UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number |

811-22482 |

Nuveen Energy MLP Total Return Fund

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Gifford R. Zimmerman

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: November 30

Date of reporting period: November 30, 2018

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

Closed-End Funds

30 November

2018

Nuveen Closed-End Funds

| JMF | Nuveen Energy MLP Total Return Fund | |

| JMLP | Nuveen All Cap Energy MLP Opportunities Fund |

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website (www.nuveen.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you have already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically anytime by contacting the financial intermediary (such as a broker-dealer or bank) through which you hold your Fund shares or, if you are a direct investor, by enrolling at www.nuveen.com/e-reports.

You may elect to receive all future shareholder reports in paper free of charge at any time by contacting your financial intermediary or, if you are a direct investor, (i) by calling 800-257-8787 and selecting option #2 or (ii) by logging into your Investor Center account at www.computershare.com/investor and clicking on “Communication Preferences.” Your election to receive reports in paper will apply to all funds held in your account with your financial intermediary or, if you are a direct investor, to all your directly held Nuveen Funds and any other directly held funds within the same group of related investment companies.

Annual Report

Life is Complex.

Nuveen makes things e-simple.

It only takes a minute to sign up for e-Reports. Once enrolled, you’ll receive an e-mail as soon as your Nuveen Fund information is ready. No more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report and save it on your computer if you wish.

Free e-Reports right to your email!

www.investordelivery.com

If you receive your Nuveen Fund distributions and statements from your financial advisor or brokerage account.

or

www.nuveen.com/client-access

If you receive your Nuveen Fund distributions and statements directly from Nuveen.

NOT FDIC INSURED MAY LOSE VALUE NO BANK GUARANTEE

| 4 | ||||

| 5 | ||||

| 10 | ||||

| 12 | ||||

| 14 | ||||

| 18 | ||||

| 19 | ||||

| 23 | ||||

| 24 | ||||

| 25 | ||||

| 26 | ||||

| 28 | ||||

| 30 | ||||

| 42 | ||||

| 43 | ||||

| 44 | ||||

| 45 | ||||

3

Chairman’s Letter to Shareholders

4

Nuveen Energy MLP Total Return Fund (JMF)

Nuveen All Cap Energy MLP Opportunities Fund (JMLP)

The Funds’ investment adviser is Nuveen Fund Advisors, LLC (NFAL), an affiliate of Nuveen, LLC. These Funds feature portfolio management by the MLP & Energy Infrastructure team of Advisory Research, Inc., which is a wholly-owned subsidiary of Piper Jaffray Companies. James J. Cunnane Jr., CFA, Managing Director and Chief Investment Officer for the MLP & Energy Infrastructure team and Quinn T. Kiley, Managing Director and Senior Portfolio Manager, manage the Funds.

Here they discuss U.S. economic and market conditions, key investment strategies and the performance of the Funds for the twelve-month reporting period ended November 30, 2018.

What factors affected the U.S. economy and financial markets during the twelve-month reporting period ended November 30, 2018?

The U.S. economy accelerated in this reporting period, with gross domestic product (GDP) growth reaching 4.2% (annualized) in the second quarter of 2018, the fastest pace since 2014, then receding to a still relatively robust 3.4% annualized rate in the third quarter of 2018, according to the Bureau of Economic Analysis “third” estimate. GDP is the value of goods and services produced by the nation’s economy less the value of the goods and services used up in production, adjusted for price changes. The boost in economic activity during the second quarter of 2018 was attributed to robust spending by consumers, businesses and the government, as well as a temporary increase in exports, as farmers rushed soybean shipments ahead of China’s retaliatory tariffs. While consumer and government spending continued to drive economic growth in the third quarter, the export contribution declined as expected and both business spending and housing investment weakened.

Consumer spending, the largest driver of the economy, remained well supported by low unemployment, wage gains and tax cuts. As reported by the Bureau of Labor Statistics, the unemployment rate fell to 3.7% in November 2018 from 4.1% in November 2017 and job gains averaged around 203,000 per month for the past twelve months. The jobs market has continued to tighten, while average hourly earnings grew at an annualized rate of 3.1% in November 2018. The Consumer Price Index (CPI) increased 2.2% over the twelve-month reporting period ended November 30, 2018 on a seasonally adjusted basis, as reported by the Bureau of Labor Statistics.

Low mortgage rates and low inventory drove home prices higher during this recovery cycle. But the price momentum slowed in recent months as mortgage rates began to drift higher and homes have become less affordable. The S&P CoreLogic Case-Shiller U.S. National Home Price Index, which covers all nine U.S. census divisions, was up 5.5% year-over-year in October 2018 (most recent data available at the time this report was prepared). The 10-City and 20-City Composites reported year-over-year increases of 4.7% and 5.0%, respectively.

This material is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy or sell securities, and is not provided in a fiduciary capacity. The information provided does not take into account the specific objectives or circumstances of any particular investor, or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with his or her advisors.

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Funds disclaim any obligation to update publicly or revise any forward-looking statements or views expressed herein.

Refer to the Glossary of Terms Used in this report for further definition of the terms used within this section.

5

Portfolio Managers’ Comments (continued)

With the U.S. economy delivering a sustainable growth rate and employment strengthening, the Federal Reserve’s (Fed) policy making committee continued to incrementally raise its main benchmark interest rate. The most recent increase, in December 2018 (subsequent to the close of the reporting period), was the fourth rate hike in 2018 and the ninth rate hike since December 2015. Fed Chair Janet Yellen’s term expired in February 2018, and the new Chairman Jerome Powell maintained the Fed’s gradual pace of interest rate hikes. However, amid signs that economic growth might have peaked, the markets’ unease about the future pace of monetary tightening, along with other factors, drove sharp volatility in the final months of 2018. Additionally, the Fed continued reducing its balance sheet by allowing a small amount of maturing Treasury and mortgage securities to roll off each month without reinvestment.

During the twelve-month reporting period, geopolitical news remained a prominent market driver. The U.S. moved forward with tariffs on imported goods from China, as well as on steel and aluminum from Canada, Mexico and Europe. These countries announced retaliatory measures in kind, intensifying concerns about a trade war, although there have been some positive developments. In July 2018, the U.S. and the European Union announced they would refrain from further tariffs while they negotiate trade terms, and in October 2018, the U.S., Mexico and Canada agreed to a new trade deal to replace the North American Free Trade Agreement. At the November 2018 G-20 summit, the U.S. and China agreed to a 90-day trade truce, although the details were murky. Brexit negotiations continued to be uncertain and Prime Minister Theresa May faced significant difficulty getting a plan approved in Parliament. Elsewhere in Europe, markets remained nervous about Italy’s new euroskeptic coalition government, immigration policy and political risk in Turkey. The U.S. Treasury issued additional sanctions on Russia in April 2018 and re-imposed sanctions on Iran following the U.S. withdrawal from the 2015 nuclear agreement. Bearish crude oil supply news, along with heightened tensions between the U.S. and Saudi Arabia after the disappearance of a Saudi journalist, drove oil price volatility. On the Korean peninsula, the leaders of South Korea and North Korea met during April 2018 and jointly announced a commitment toward peace, while the U.S.-North Korea summit yielded an agreement with few additional details.

Energy infrastructure and master limited partnership (MLP) fundamentals were very strong during the reporting period while investor returns were modest. MLPs rallied to begin 2018, up approximately 15% from November 2017 lows through January 2018. On March 15, 2018, the Federal Energy Regulatory Commission (FERC) issued a statement shifting policy on how taxes are incorporated into the regulatory tariffs pipelines are allowed to charge their customers. The FERC’s policy stated that pipelines it regulates that are owned by MLPs will not be allowed to recover tax allowances through their tariffs going forward. Although not all midstream assets are impacted and very few companies are acutely harmed, the FERC policy decision caused the entire MLP group to sell off the last two weeks of March 2018. Strong energy industry earnings in the second and third quarters of 2018 pushed MLPs higher again, while closing 2018 with weakness across the global equity and commodity markets. MLPs and energy infrastructure investments were not immune to the sell-off and surrendered most of their gains for 2018.

A significant factor in MLP performance for the reporting period was the large number of consolidations that occurred between MLPs and their parent companies. Many of these transactions resulted in distribution cuts and taxable events for investors and in the short term investors generally reacted negatively. We believe that investors will eventually focus more on the long term benefits, which include lower leverage, more stable distributions that are better covered by cash flow, growth capital that is more internally funded, and better aligned governance.

How did the Funds perform during this twelve-month reporting period ended November 30, 2018?

The tables in each Fund’s Performance Overview and Holding Summaries section of this report provide total returns for the one-year, five-year and since inception periods, where applicable, ended November 30, 2018. Each Fund’s total returns at net asset value (NAV) are compared with the performance of a corresponding market index. The total return at NAV for both funds underperformed both the Alerian MLP Index (“Index”) and the S&P 500® during the twelve-month reporting period.

The Funds are taxed as “C” corporations, and unlike most other investment companies, they pay taxes on their own income. Consequently, as explained more fully later in the report, the Funds’ adjustments to their assets and liabilities

6

to reflect the Funds’ projected tax payments can significantly impact Fund share performance. In the most recent twelve month reporting period, those tax adjustments had a positive impact on the share performance of JMF and no impact on the share performance of JMLP.

The Funds employ leverage. In the most recent twelve-month reporting period, this leverage had a negative impact on the Funds’ total return. You should consider the Funds’ tax adjustments and leverage when comparing each Fund’s performance to the Index and S&P 500® Index, as neither index is leveraged nor affected by the tax treatment of gains or losses. As a result, the Funds’ total return performance could differ significantly from the actual returns of its portfolio and that of the indexes, even if the pre-tax adjustment performance of the Funds’ portfolio assets and the performance of the indexes were similar.

We will divide the discussion of the various strategies used by and features of the Funds, and how each of them impacted the performance of the Funds’ shares during the twelve-month reporting period ended November 30, 2018, into the following sub-sections:

| • | Impact of portfolio management strategies on Fund share performance |

| • | Impact of tax adjustments on Fund share performance |

| • | Impact of leverage on Fund share performance |

Impact of the Funds’ primary portfolio investment strategies on Fund share performance.

Both Funds continue to invest primarily in publicly traded MLPs operating in the energy sector with the main objective of providing a tax-advantaged total return.

During the reporting period, the Funds were primarily invested in midstream MLPs that own pipelines and other infrastructure facilities. These assets provide an essential service to our economy: procuring, processing, storing and transporting the commodities and products that fuel every aspect of our lives.

JMF’s portfolio underperformed the Index for the twelve-month reporting period ended November 30, 2018. The Fund’s allocation towards high quality oil and gas pipelines owned by MLPs detracted from performance during the reporting period as the FERC decision changed the outlook for these companies. Although investors moved past the FERC decision, those MLPs directly impacted did not recover and suffered significant losses. The Fund owned TC PipeLines LP and Enbridge Energy Partners LP, both of which are potentially materially impacted by the FERC policy change. As a group, the lowest quality MLPs outperformed during the reporting period, which hurt the Funds’ relative performance. Energy Transfer Partners LP and Williams Partners LP were both acquired by their respective general partners during the reporting period and as a result were the top contributors to the Fund’s performance. The Fund no longer holds any exposure to TC PipeLines LP.

JMLP’s portfolio performance underperformed the Index for the twelve-month reporting period ended November 30, 2018. JMLP’s strategy is differentiated from JMF in the following ways: 1) JMLP will not own the top ten constituents in the Index, and 2) JMLP will not purchase securities in the bottom 30% of the universe, as defined by the sub-adviser’s “Quality Scorecard” process, which ranks each constituent of the investable MLP universe according to fundamental metrics. JMLP’s strategy did not work during the reporting period, with the investable universe underperforming the Index return which was driven by the top ten holdings in the Index. As in JMF, exposure to Enbridge Energy Partners LP detracted from performance for the Fund. Avoiding the lowest quality securities was additive to performance for JMLP. This is in contrast to the above comments on JMF, and it is due to the fact that JMLP’s mandate to own smaller capitalization MLPs requires us to look at a larger universe of securities, many of which are not in the Index.

Impact of tax adjustments on the Funds’ share performance

Each Fund is treated as a “C” Corporation for U.S. federal income tax purposes and therefore is a taxable entity, meaning that in addition to recording a current tax expense on current year earnings and realized gains, they also record

7

Portfolio Managers’ Comments (continued)

either a net deferred tax liability representing the future taxes projected to be payable on unrealized portfolio gains, or a net deferred tax asset representing the tax benefit projected to be associated with realized and unrealized portfolio losses. These tax adjustment entries on the Funds’ accounting records are intended to ensure that the Funds’ NAVs take into account the future income tax that the Funds may be liable for based on unrealized appreciation as well as the tax benefit of losses that may be used to offset future earnings. Such entries will often have a “moderating impact” on the total returns of investment of the Funds’ shares during a particular measurement period. An increase in the value of a Fund’s portfolio investments will typically trigger an increase to the deferred tax liability or a reduction to the deferred tax asset that would partially offset the portfolio value increases; in contrast, a decrease in value of the Fund’s portfolio investments will typically trigger a reduction in a deferred tax liability and/or an increase to the deferred tax asset, which again would tend to partially offset such portfolio value decreases.

During the reporting period for JMF, the projected future tax liability of the Fund decreased, resulting in a positive contribution to NAV performance.

To the extent that a Fund has a deferred tax asset, consideration is given to whether or not a valuation allowance is required that would offset the tax asset. Accounting principles dictate that the determination of such a valuation allowance is based on whether there is a more-likely-than-not probability that some portion or all of the deferred tax asset will not be realized.

At November 30, 2017, JMLP had a valuation allowance to offset the deferred tax asset. This allowance still existed at November 30, 2018. As a result, there was no impact to NAV performance associated with the deferred tax asset or liability. In light of the passage and signing into law on December 22, 2017 of the Tax Cuts and Jobs Act of 2017, JMF made adjustments on that day to the Fund’s estimate of its deferred tax liability balance. The Fund’s deferred tax liability and/ or asset balances are determined using estimates of effective tax rates expected to apply to taxable income in the years such balances are realized. The Tax Cuts and Jobs Act of 2017 reduced the statutory federal income tax rate applicable to corporations, such as JMF and JMLP, from 35% to 21%. JMF reduced the estimate of its net deferred tax liability balance to reflect this reduction in the corporate federal income tax rate; this reduced its net deferred tax liability balance as of December 22, 2017 from an amount that would have been somewhat in excess of $35 million to approximately $22 million. That adjustment in turn caused JMF’s net asset value to increase by $0.33 per common share.

JMLP, on the other hand, had a net deferred tax asset immediately prior to December 22, 2017, but that asset had a fully offsetting valuation allowance. The amount of JMLP’s net deferred tax asset decreased on December 22, 2017 due to the reduction in the income tax rate, but the valuation allowance was also reduced by the same amount, resulting in no impact to the net asset value of that Fund.

Further modifications of the Funds’ estimates or assumptions regarding its deferred tax liability and/or asset balances and any applicable valuation allowance could result in increases or decreases in the Fund’s net asset value per share, which could be material.

Impact of the Funds’ leverage strategies on performance

One important factor impacting the returns of the Funds’ common shares relative to their comparative benchmarks was the Funds’ use of leverage through bank borrowings. The Funds use leverage because our research has shown that, over time, leveraging provides opportunities for additional income and total return, particularly in the recent market environment where short-term market rates are at or near historical lows, meaning that the short-term rates the Fund has been paying on its leveraging instruments in recent years have been much lower than the interest the Fund has been earning on its portfolio securities that it has bought with the proceeds of that leverage.

However, use of leverage can expose Fund common shares to additional price volatility. When a Fund uses leverage, the Fund common shares will experience a greater increase in their net asset value if the securities acquired through the use of leverage increase in value, but will also experience a correspondingly larger decline in their net asset value if the

8

securities acquired through leverage decline in value, which will make the shares’ net asset value more volatile, and total return performance more variable, over time.

In addition, common share income in levered funds will typically decrease in comparison to unlevered funds when short-term interest rates increase and increase when short-term interest rates decrease. Over the last few quarters, short-term interest rates have indeed increased from their extended lows after the 2007-09 financial crisis. This increase has reduced common share net income, and also reduced potential for long-term total returns. Nevertheless, the ability to effectively borrow at current short-term rates is still resulting in enhanced common share income, and management believes that the advantages of continuation of leverage outweigh the associated increase in risk and volatility described above.

For the twelve-month reporting period ended November 30, 2018, leverage had a negligible impact on the total return performance of JMF and negative impact on JMLP.

The Funds employ regulatory leverage through the use of bank borrowings. As of November 30, 2018, the Funds had outstanding bank borrowings as shown in the accompanying table.

| JMF | JMLP | |||||||

| Bank Borrowings |

$ | 170,400,000 | $ | 37,750,000 | ||||

As of November 30, 2018, the Funds’ leverage, expressed as a percentage of total managed assets, were as shown in the accompanying table.

| JMF | JMLP | |||||||

| Effective Leverage* |

29.51 | % | 28.78 | % | ||||

| Regulatory Leverage* |

29.51 | % | 28.78 | % | ||||

| * | Effective Leverage is a Fund’s effective economic leverage, and includes both regulatory leverage and the leverage effects of certain derivative and other investments in a Fund’s portfolio that increase the Fund’s investment exposure. Regulatory leverage consists of preferred shares issued or borrowings of a Fund. Both of these are part of a Fund’s capital structure. A Fund, however, may from time to time borrow on a typically transient basis in connection with its day-to-day operations, primarily in connection with the need to settle portfolio trades. Such incidental borrowings are excluded from the calculation of a Fund’s effective leverage ratio. Regulatory leverage is subject to asset coverage limits set forth in the Investment Company Act of 1940. |

Bank Borrowings

As noted above, the Funds employ leverage through the use of bank borrowings.

The Funds operate under established leverage guidelines. During the current reporting period, volatility in the MLP market caused the Funds to periodically reduce and increase the amount of their outstanding borrowings in order to maintain levels consistent with these guidelines. The Funds’ bank borrowing activities are as shown in the accompanying table.

| Current Reporting Period | Subsequent to the Close of the Reporting Period |

|||||||||||||||||||||||||||||||||||

| Fund | December 1, 2017 | Draws | Paydowns | November 30, 2018 | Average Balance Outstanding |

Draws | Paydowns | January 25, 2019 | ||||||||||||||||||||||||||||

| JMF |

$ | 175,000,000 | $ | 7,000,000 | $ | (11,600,000 | ) | $ | 170,400,000 | $ | 169,768,493 | $ | — | $ | (14,300,000 | ) | $ | 156,100,000 | ||||||||||||||||||

| JMLP |

$ | 41,500,000 | $ | 1,600,000 | $ | (5,350,000 | ) | $ | 37,750,000 | $ | 39,077,945 | $ | — | $ | (4,650,000 | ) | $ | 33,100,000 | ||||||||||||||||||

Refer to Notes to Financial Statements, Note 7 – Borrowing Arrangements for further details.

During the reporting period, JMF and JMLP continued to utilize forward interest rate swap contracts to hedge the future interest expense of its leverage. During the reporting period, these swaps had a positive impact on the Funds’ overall performance.

9

Information

DISTRIBUTION INFORMATION

The following information regarding the Funds’ distributions is current as of November 30, 2018, the Funds’ fiscal and tax year end, and may differ from previously issued distribution notifications.

The Funds have a cash flow-based distribution program. Under this program, each Fund seeks to maintain an attractive and stable regular distribution based on the Fund’s net cash flow received from its portfolio investments. Fund distributions are not intended to include expected portfolio appreciation; however, each Fund invests in securities that make payments which ultimately may be fully or partially treated as gains or return of capital for tax purposes. This tax treatment will generally “flow through” to the Fund’s distributions, but the specific tax treatment is often not known with certainty until after the end of the Fund’s tax year. As a result, regular distributions throughout the year are likely to be re-characterized for tax purposes as either long-term gains (both realized and unrealized), or as a non-taxable return of capital.

The figures in the table below provide the sources (for tax purposes) of each Fund’s distributions as of November 30, 2018. These source estimates include amounts currently estimated to be attributable to realized gains and/or returns of capital. The Funds attribute these non-income sources equally to each regular distribution throughout the fiscal year. The information shown below is for the distributions paid on common shares for all prior months in the current fiscal year. These amounts should not be used for tax reporting purposes, and the distribution sources may differ for financial reporting than for tax reporting. The final determination of the tax characteristics of all distributions paid in 2018 will be made in early 2019 and reported to you on Form 1099-DIV. More details about the tax characteristics of each Fund’s distributions are available on www.nuveen.com/CEFdistributions.

Data as of November 30, 2018

| Fiscal YTD | Fiscal YTD | |||||||||||||||||||||||||||||||

| Percentage of the Distribution | Per Share Amounts | |||||||||||||||||||||||||||||||

| Fund | Net Investment Income(1) |

Realized Gains |

Return of Capital(2) |

Total Distributions |

Net Investment Income(1) |

Realized Gains |

Return of Capital(2) |

|||||||||||||||||||||||||

| JMF (FYE 11/30) |

47.24 | % | 0.00 | % | 52.76 | % | $ | 1.1000 | $ | 0.5200 | $ | 0.0000 | $ | 0.5800 | ||||||||||||||||||

| JMLP (FYE 11/30) |

0.00 | % | 0.00 | % | 100 | % | $ | 0.8250 | $ | 0.0000 | $ | 0.0000 | $ | 0.8250 | ||||||||||||||||||

| (1) | NII is Net Investment Income. The funds may have current fiscal year earnings and profits, and if so, a portion or all of the distributions may be treated as ordinary dividend income. |

| (2) | Return of Capital may represent unrealized gains, return of shareholders’ principal, or both. |

The following table provides information regarding fund distributions and total return performance over various time periods. This information is intended to help you better understand whether fund returns for the specified time periods were sufficient to meet fund distributions.

Data as of November 30, 2018

| Annualized | Cumulative | |||||||||||||||||||||||||||||||||||

| Fund | Inception Date |

Latest Quarterly Per Share Distribution |

Current Distribution on NAV |

1-Year Return on NAV |

Since Inception Return on NAV |

Calendar YTD Distributions on NAV |

Calendar YTD Return on NAV |

|||||||||||||||||||||||||||||

| JMF (FYE 11/30) |

2/23/2011 | $0.2500 | 10.02 | % | 0.83 | % | (0.05) | % | 11.02 | % | (5.58) | % | ||||||||||||||||||||||||

| JMLP (FYE 11/30) |

3/26/2014 | $0.1875 | 10.84 | % | (6.91) | % | (10.44) | % | 11.92 | % | (11.44) | % | ||||||||||||||||||||||||

10

EQUITY SHELF PROGRAM

During the current reporting period, the Funds were authorized by the Securities and Exchange Commission (SEC) to issue additional shares through an equity shelf program (Shelf Offering). Under these programs, the Funds, subject to market conditions, may raise additional capital from time to time in varying amounts and offering methods at a net price at or above each Fund’s NAV per share. Under the Shelf Offerings, each Fund is authorized to issue additional shares as shown in the accompanying table.

| JMF | JMLP | |||||||

| Additional authorized shares |

9,800,000 | 3,100,000 | ||||||

During the current reporting period, the Funds sold shares through their Shelf Offering at a weighted average premium to their NAV per share as shown in the accompanying table.

| JMF | JMLP | |||||||

| Shares sold through Shelf Offering |

688,792 | 337,500 | ||||||

| Weighted average premium to NAV per share sold |

1.63 | % | 1.57 | % | ||||

Refer to Notes to Financial Statements, Note 4 – Fund Shares, Equity Shelf Programs and Offering Costs for further details of Shelf Offerings and each Fund’s respective transactions.

SHARE REPURCHASES

During August 2018, the Funds’ Board of Trustees reauthorized an open-market share repurchase program, allowing each Fund to repurchase an aggregate of up to approximately 10% of its outstanding shares.

As of November 30, 2018, and since the inception of the Funds’ repurchase programs, the Funds have cumulatively repurchased and retired their outstanding shares as shown in the accompanying table.

| JMF | JMLP | |||||||

| Shares cumulatively repurchased and retired |

— | — | ||||||

| Shares authorized for repurchase |

4,080,000 | 1,350,000 | ||||||

OTHER SHARE INFORMATION

As of November 30, 2018, and during the current reporting period, the Funds’ share prices were trading at a premium/(discount) to their NAVs as shown in the accompanying table.

| JMF | JMLP | |||||||

| NAV |

$ | 9.98 | $ | 6.92 | ||||

| Share price |

$ | 9.19 | $ | 6.24 | ||||

| Premium/(Discount) to NAV |

(7.92 | )% | (9.83 | )% | ||||

| 12-month average premium/(discount) to NAV |

(4.59 | )% | (3.69 | )% | ||||

11

Considerations

Fund shares are not guaranteed or endorsed by any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation.

Nuveen Energy MLP Total Return Fund (JMF)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to their net asset value. MLP Units are subject to energy sector concentration risk, limited voting rights, and heightened tax risk. Common stock returns often have experienced significant volatility. Leverage increases return volatility and magnifies the Fund’s potential return and its risks; there is no guarantee a fund’s leverage strategy will be successful. For these and other risks such as tax risk, please see the Fund’s web page at www.nuveen.com/JMF.

Nuveen All Cap Energy MLP Opportunities Fund (JMLP)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to their net asset value. MLP Units are subject to energy sector concentration risk, limited voting rights, and heightened tax risk. Common stock returns often have experienced significant volatility. Leverage increases return volatility and magnifies the Fund’s potential return and its risks; there is no guarantee a fund’s leverage strategy will be successful. For these and other risks, including tax risk and small capitalization risk, please see the Fund’s web page at www.nuveen.com/JMLP.

12

THIS PAGE INTENTIONALLY LEFT BLANK

13

| JMF | Nuveen Energy MLP Total Return Fund Performance Overview and Holding Summaries as of November 30, 2018 |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Average Annual Total Returns as of November 30, 2018

| Average Annual | ||||||||||||

| 1-Year | 5-Year | Since Inception |

||||||||||

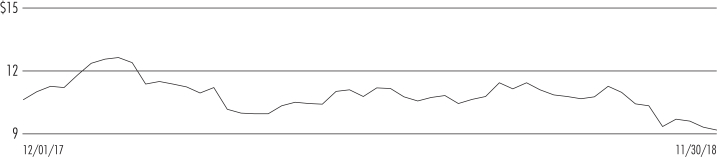

| JMF at NAV | 0.83% | (4.91)% | (0.05)% | |||||||||

| JMF at Share Price | (3.98)% | (5.09)% | (1.28)% | |||||||||

| Alerian MLP Index | 1.21% | (5.16)% | 1.23% | |||||||||

| S&P 500® Index | 6.27% | 11.12% | 12.44% | |||||||||

Since inception returns are from 2/23/11. Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

Share Price Performance — Weekly Closing Price

14

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

15

| JMLP | Nuveen All Cap Energy MLP Opportunities Fund Performance Overview and Holding Summaries as of November 30, 2018 |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Average Annual Total Returns as of November 30, 2018

| Average Annual | ||||||||

| 1-Year | Since Inception |

|||||||

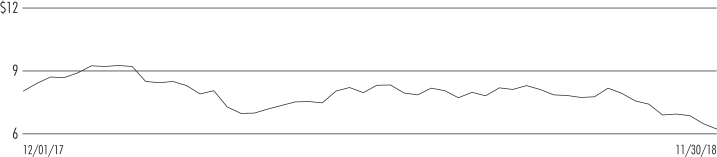

| JMLP at NAV | (6.91)% | (10.44)% | ||||||

| JMLP at Share Price | (13.77)% | (13.14)% | ||||||

| Alerian MLP Index | 1.21% | (5.86)% | ||||||

| S&P 500® Index | 6.27% | 11.16% | ||||||

Since inception returns are from 3/26/14. Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

Share Price Performance — Weekly Closing Price

16

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

17

Report of Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of

Nuveen Energy MLP Total Return Fund

Nuveen All Cap Energy MLP Opportunities Fund:

Opinions on the Financial Statements

We have audited the accompanying statements of assets and liabilities, including the portfolios of investments, of Nuveen Energy MLP Total Return Fund and Nuveen All Cap Energy MLP Opportunities Fund (hereafter collectively referred to as the “Funds”) as of November 30, 2018, the related statements of operations and cash flows for the year ended November 30, 2018, the statements of changes in net assets for each of the two years in the period ended November 30, 2018, including the related notes, and the financial highlights for each of the periods indicated therein (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of each of the Funds as of November 30, 2018, the results of each of their operations and each of their cash flows for the year then ended, the changes in each of their net assets for each of the two years in the period ended November 30, 2018 and each of the financial highlights for each of the periods indicated therein in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinions

These financial statements are the responsibility of the Funds’ management. Our responsibility is to express an opinion on the Funds’ financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Funds in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of November 30, 2018 by correspondence with the custodian. We believe that our audits provide a reasonable basis for our opinions.

PricewaterhouseCoopers LLP

Chicago, Illinois

January 25, 2019

We have served as the auditor of one or more investment companies in Nuveen Funds since 2002.

18

| JMF | Nuveen Energy MLP Total Return Fund

|

| Shares/Units | Description (1) | Value | ||||||||||||||

| LONG-TERM INVESTMENTS – 143.5% (99.0% of Total Investments) |

| |||||||||||||||

| MASTER LIMITED PARTNERSHIPS & MLP AFFILIATES – 126.7% (87.4% of Total Investments) |

| |||||||||||||||

| Oil, Gas & Consumable Fuels – 126.7% (87.4% of Total Investments) | ||||||||||||||||

| 949,467 | Andeavor Logistics LP |

$ | 35,434,108 | |||||||||||||

| 877,229 | Crestwood Equity Partners LP |

26,053,701 | ||||||||||||||

| 1,451,565 | DCP Midstream LP |

49,469,335 | ||||||||||||||

| 589,088 | Delek Logistics Partners LP |

17,955,402 | ||||||||||||||

| 2,001,365 | Enable Midstream Partners LP |

26,698,209 | ||||||||||||||

| 1,068,223 | Enbridge Energy Management LLC, (2) |

11,643,631 | ||||||||||||||

| 1,488,940 | Enbridge Energy Partners LP |

16,184,778 | ||||||||||||||

| 4,388,853 | Energy Transfer LP |

63,945,588 | ||||||||||||||

| 3,456,765 | EnLink Midstream Partners LP |

45,733,001 | ||||||||||||||

| 818,834 | Enterprise Products Partners LP |

21,494,393 | ||||||||||||||

| 1,095,257 | Genesis Energy LP |

24,150,417 | ||||||||||||||

| 642,250 | KNOT Offshore Partners LP, (3) |

12,870,690 | ||||||||||||||

| 224,025 | Martin Midstream Partners LP |

2,376,905 | ||||||||||||||

| 863,415 | MPLX LP |

28,604,939 | ||||||||||||||

| 2,498,135 | NGL Energy Partners LP |

23,182,693 | ||||||||||||||

| 547,100 | PBF Logistics LP |

10,985,768 | ||||||||||||||

| 1,270,678 | Plains All American Pipeline LP |

29,263,714 | ||||||||||||||

| 132,855 | Sunoco LP |

3,714,626 | ||||||||||||||

| 1,020,255 | Tallgrass Energy LP |

21,792,647 | ||||||||||||||

| 980,540 | USD Partners LP |

10,285,865 | ||||||||||||||

| 760,895 | Western Gas Partners LP |

33,814,174 | ||||||||||||||

| Total Oil, Gas & Consumable Fuels |

|

515,654,584 | ||||||||||||||

| Total Master Limited Partnerships & MLP Affiliates (cost $498,553,373) |

|

515,654,584 | ||||||||||||||

| Shares | Description (1) | Value | ||||||||||||||

| COMMON STOCKS – 16.8% (11.6% of Total Investments) |

| |||||||||||||||

| Diversified Financial Services – 1.3% (0.9% of Total Investments) | ||||||||||||||||

| 699,900 | Altus Midstream Company, (4), (5), (6) |

$ | 5,245,536 | |||||||||||||

| Energy Equipment & Services – 0.7% (0.5% of Total Investments) | ||||||||||||||||

| 263,822 | Archrock Inc. |

2,690,984 | ||||||||||||||

| Oil, Gas & Consumable Fuels – 14.8% (10.2% of Total Investments) | ||||||||||||||||

| 499,208 | ONEOK, Inc., (3) |

|

30,666,347 | |||||||||||||

| 664,005 | Targa Resources Corp. |

|

29,634,543 | |||||||||||||

| Total Oil, Gas & Consumable Fuels |

|

60,300,890 | ||||||||||||||

| Total Common Stocks (cost $49,277,187) |

|

68,237,410 | ||||||||||||||

| Total Long-Term Investments (cost $547,830,560) |

|

583,891,994 | ||||||||||||||

| Principal Amount (000) |

Description (1) | Coupon | Maturity | Value | ||||||||||||

| SHORT-TERM INVESTMENTS – 1.4% (1.0% of Total Investments) |

| |||||||||||||||

| REPURCHASE AGREEMENTS – 1.4% (1.0% of Total Investments) | ||||||||||||||||

| $ | 5,877 | Repurchase Agreement with Fixed Income Clearing Corporation, dated 11/30/18, repurchase price $5,878,011, collateralized by $5,990,000 U.S. Treasury Notes, 2.750%, due 2/15/24, value $5,996,739 |

1.050% | 12/03/18 | $ | 5,877,497 | ||||||||||

| Total Short-Term Investments (cost $5,877,497) |

5,877,497 | |||||||||||||||

| Total Investments (cost $553,708,057) – 144.9% |

|

589,769,491 | ||||||||||||||

| Borrowings – (41.9)% (7), (8) |

|

(170,400,000 | ) | |||||||||||||

| Deferred Tax Liability, net – (3.7)% |

|

(15,278,080 | ) | |||||||||||||

| Other Assets Less Liabilities – 0.7% (9) |

|

2,916,764 | ||||||||||||||

| Net Assets – 100% |

|

$ | 407,008,175 | |||||||||||||

19

| JMF | Nuveen Energy MLP Total Return Fund (continued) | |

| Portfolio of Investments November 30, 2018 |

Investments in Derivatives

Interest Rate Swaps – OTC Uncleared

| Counterparty | Notional Amount |

Fund Pay/Receive Floating Rate |

Floating Rate Index | Fixed Rate (Annualized) |

Fixed Rate Payment Frequency |

Effective Date (10) |

Optional Termination Date |

Maturity Date |

Value | Unrealized Appreciation (Depreciation) |

||||||||||||||||||||||||||||||

| JPMorgan Chase Bank, N.A. |

$ | 94,500,000 | Receive | 1-Month LIBOR | 1.969 | % | Monthly | 6/01/18 | 7/01/25 | 7/01/27 | $ | 4,449,268 | $ | 4,449,268 | ||||||||||||||||||||||||||

For Fund portfolio compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications into sectors for reporting ease.

| (1) | All percentages shown in the Portfolio of Investments are based on net assets unless otherwise noted. |

| (2) | Payment-in-kind (“PIK”) security. Depending on the terms of the security, distributions may be received in the form of cash, securities, or a combination of both. |

| (3) | Distribution designated as ordinary income which is recognized as “Dividends” on the Statement of Operations. |

| (4) | Non-income producing; issuer has not declared a dividend within the past twelve months. |

| (5) | Investment valued at fair value using methods determined in good faith by, or at the discretion of, the Board. For fair value measurement disclosure purposes, investment classified as Level 3. See Notes to Financial Statements, Note 2 – Investment Valuation and Fair Value Measurements for more information. |

| (6) | Security is restricted and may be resold only in transactions exempt from registration, normally to qualified institutional buyers. |

| (7) | The Fund segregates 100% of its eligible investments (excluding any investments separately pledged as collateral for specific investments in derivatives, when applicable) in the Portfolio Investments as collateral for borrowings. As of the end of the reporting period, investments with a value of $440,344,253 have been pledged as collateral for borrowings. |

| (8) | Borrowings as a percentage of Total Investments is 28.9%. |

| (9) | Other assets less liabilities includes the unrealized appreciation (depreciation) of certain over-the-counter (“OTC”) derivatives as presented on the Statement of Assets and Liabilities, when applicable. The unrealized appreciation (depreciation) of OTC cleared and exchange-traded derivatives is recognized as part of the cash collateral at brokers and/or the receivable or payable for variation margin as presented on the Statement of Assets and Liabilities, when applicable. |

| (10) | Effective date represents the date on which both the Fund and counterparty commence interest payment accruals on each contract. |

| LIBOR | London Inter-Bank Offered Rate |

See accompanying notes to financial statements.

20

| JMLP | Nuveen All Cap Energy

Portfolio of Investments November 30, 2018 |

| Shares/Units | Description (1) | Value | ||||||||||||||

| LONG-TERM INVESTMENTS – 138.9% (99.4% of Total Investments) |

| |||||||||||||||

| MASTER LIMITED PARTNERSHIPS & MLP AFFILIATES – 127.0% (90.8% of Total Investments) |

| |||||||||||||||

| Gas Utilities – 3.4% (2.4% of Total Investments) | ||||||||||||||||

| 84,049 | AmeriGas Partners LP |

$ | 3,123,261 | |||||||||||||

| Oil, Gas & Consumable Fuels – 123.6% (88.4% of Total Investments) | ||||||||||||||||

| 301,794 | Crestwood Equity Partners LP |

8,963,282 | ||||||||||||||

| 343,048 | DCP Midstream LP |

11,691,076 | ||||||||||||||

| 146,150 | Delek Logistics Partners LP |

4,454,652 | ||||||||||||||

| 799,975 | Enable Midstream Partners LP |

10,671,666 | ||||||||||||||

| 214,905 | Enbridge Energy Management LLC, (2) |

2,342,464 | ||||||||||||||

| 368,305 | Enbridge Energy Partners LP |

4,003,475 | ||||||||||||||

| 355,975 | Energy Transfer LP |

5,186,556 | ||||||||||||||

| 775,365 | EnLink Midstream Partners LP |

10,258,079 | ||||||||||||||

| 229,710 | Genesis Energy LP |

5,065,105 | ||||||||||||||

| 264,695 | Global Partners LP |

4,573,930 | ||||||||||||||

| 265,885 | Hoegh LNG Partners LP, (3) |

4,559,928 | ||||||||||||||

| 173,590 | Holly Energy Partners LP |

4,883,087 | ||||||||||||||

| 410,190 | KNOT Offshore Partners LP, (3) |

8,220,208 | ||||||||||||||

| 124,795 | Martin Midstream Partners LP |

1,324,075 | ||||||||||||||

| 597,868 | NGL Energy Partners LP |

5,548,215 | ||||||||||||||

| 227,100 | NuStar Energy LP |

5,489,007 | ||||||||||||||

| 200,000 | Oasis Midstream Partners LP |

4,030,000 | ||||||||||||||

| 141,340 | PBF Logistics LP |

2,838,107 | ||||||||||||||

| 279,950 | Summit Midstream Partners LP |

3,440,586 | ||||||||||||||

| 217,770 | Tallgrass Energy LP |

4,651,567 | ||||||||||||||

| 314,902 | USD Partners LP |

3,303,322 | ||||||||||||||

| Total Oil, Gas & Consumable Fuels |

|

115,498,387 | ||||||||||||||

| Total Master Limited Partnerships & MLP Affiliates (cost $116,225,044) |

|

118,621,648 | ||||||||||||||

| Shares | Description (1) | Value | ||||||||||||||

| COMMON STOCKS – 11.9% (8.6% of Total Investments) |

| |||||||||||||||

| Diversified Financial Services – 1.2% (0.9% of Total Investments) | ||||||||||||||||

| 153,500 | Altus Midstream Company, (4), (5), (6) |

$ | 1,150,435 | |||||||||||||

| Oil, Gas & Consumable Fuels – 10.7% (7.7% of Total Investments) | ||||||||||||||||

| 57,055 | ONEOK, Inc., (3) |

3,504,889 | ||||||||||||||

| 145,645 | Targa Resources Corp. |

6,500,136 | ||||||||||||||

| Total Oil, Gas & Consumable Fuels |

|

10,005,025 | ||||||||||||||

| Total Common Stocks (cost $11,839,159) |

|

11,155,460 | ||||||||||||||

| Total Long-Term Investments (cost $128,064,203) |

|

129,777,108 | ||||||||||||||

| Principal Amount (000) |

Description (1) | Coupon | Maturity | Value | ||||||||||||

| SHORT-TERM INVESTMENTS – 0.9% (0.6% of Total Investments) |

| |||||||||||||||

| REPURCHASE AGREEMENTS – 0.9% (0.6% of Total Investments) | ||||||||||||||||

| $ | 821 | Repurchase Agreement with Fixed Income Clearing Corporation, dated 11/30/18, repurchase price $821,523, collateralized by $845,000 U.S. Treasury Notes, 2.875%, due 5/31/25, value $841,666 |

1.050% | 12/03/18 | $ | 821,451 | ||||||||||

| Total Short-Term Investments (cost $821,451) |

821,451 | |||||||||||||||

| Total Investments (cost $128,885,654) – 139.8% |

|

130,598,559 | ||||||||||||||

| Borrowings – (40.4)% (7), (8) |

|

(37,750,000 | ) | |||||||||||||

| Other Assets Less Liabilities – 0.6% (9) |

|

567,368 | ||||||||||||||

| Net Assets – 100% |

|

$ | 93,415,927 | |||||||||||||

21

| JMLP | Nuveen All Cap Energy MLP Opportunities Fund (continued) | |

| Portfolio of Investments November 30, 2018 |

Investments in Derivatives

Interest Rate Swaps – OTC Uncleared

| Counterparty | Notional Amount |

Fund Pay/Receive Floating Rate |

Floating Rate Index |

Fixed Rate (Annualized) |

Fixed Rate Payment Frequency |

Effective Date (10) |

Optional Termination Date |

Maturity Date |

Value | Unrealized Appreciation (Depreciation) |

||||||||||||||||||||||||||||||

| Morgan Stanley Capital Services LLC |

$ | 21,000,000 | Receive | 1-Month LIBOR | 2.042 | % | Monthly | 6/01/18 | 7/01/25 | 7/01/27 | $ | 888,178 | $ | 888,178 | ||||||||||||||||||||||||||

For Fund portfolio compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications into sectors for reporting ease.

| (1) | All percentages shown in the Portfolio of Investments are based on net assets unless otherwise noted. |

| (2) | Payment-in-kind (“PIK”) security. Depending on the terms of the security, distributions may be received in the form of cash, securities, or a combination of both. |

| (3) | Distribution designated as ordinary income which is recognized as “Dividends” on the Statement of Operations. |

| (4) | Non-income producing; issuer has not declared a dividend within the past twelve months. |

| (5) | Investment valued at fair value using methods determined in good faith by, or at the discretion of, the Board. For fair value measurement disclosure purposes, investment classified as Level 3. See Notes to Financial Statements, Note 2 – Investment Valuation and Fair Value Measurements for more information. |

| (6) | Security is restricted and may be resold only in transactions exempt from registration, normally to qualified institutional buyers. |

| (7) | The Fund segregates 100% of its eligible investments (excluding any investments separately pledged as collateral for specific investments in derivatives, when applicable) in the Portfolio Investments as collateral for borrowings. As of the end of the reporting period, investments with a value of $96,499,124 have been pledged as collateral for borrowings. |

| (8) | Borrowings as a percentage of Total Investments is 28.9%. |

| (9) | Other assets less liabilities includes the unrealized appreciation (depreciation) of certain over-the-counter (“OTC”) derivatives as presented on the Statement of Assets and Liabilities, when applicable. The unrealized appreciation (depreciation) of OTC cleared and exchange-traded derivatives is recognized as part of the cash collateral at brokers and/or the receivable or payable for variation margin as presented on the Statement of Assets and Liabilities, when applicable. |

| (10) | Effective date represents the date on which both the Fund and counterparty commence interest payment accruals on each contract. |

| LIBOR | London Inter-Bank Offered Rate |

See accompanying notes to financial statements.

22

Statement of Assets and Liabilities

November 30, 2018

| JMF | JMLP | |||||||

| Assets |

||||||||

| Long-term investments, at value (cost $547,830,560 and $128,064,203, respectively) |

$ | 583,891,994 | $ | 129,777,108 | ||||

| Short-term investments, at value (cost approximates value) |

5,877,497 | 821,451 | ||||||

| Unrealized appreciation on interest rate swaps |

4,449,268 | 888,178 | ||||||

| Receivable for interest |

171 | 24 | ||||||

| Other assets |

71,448 | 13,782 | ||||||

| Total assets |

594,290,378 | 131,500,543 | ||||||

| Liabilities |

||||||||

| Cash overdraft |

1,683 | 1,704 | ||||||

| Borrowings |

170,400,000 | 37,750,000 | ||||||

| Payable for: |

||||||||

| Interest |

439,465 | 97,946 | ||||||

| State income tax |

262,652 | 8,989 | ||||||

| Deferred tax liability, net |

15,278,080 | — | ||||||

| Accrued expenses: |

||||||||

| State franchise tax |

27,314 | 3,476 | ||||||

| Management fees |

513,774 | 119,974 | ||||||

| Trustees fees |

72,084 | 11,423 | ||||||

| Other |

287,151 | 91,104 | ||||||

| Total liabilities |

187,282,203 | 38,084,616 | ||||||

| Net assets |

$ | 407,008,175 | $ | 93,415,927 | ||||

| Shares outstanding |

40,786,741 | 13,500,221 | ||||||

| Net asset value (“NAV”) per share outstanding |

$ | 9.98 | $ | 6.92 | ||||

| Net assets consist of: |

||||||||

| Shares, $0.01 par value per share |

$ | 407,867 | $ | 135,002 | ||||

| Paid-in surplus |

370,312,518 | 184,953,711 | ||||||

| Total distributable earnings, net of tax |

36,287,790 | (91,672,786 | ) | |||||

| Net assets |

$ | 407,008,175 | $ | 93,415,927 | ||||

| Authorized shares |

Unlimited | Unlimited | ||||||

See accompanying notes to financial statements.

23

Year Ended November 30, 2018

| JMF | JMLP | |||||||

| Investment Income |

||||||||

| Distributions from Master Limited Partnerships (“MLPs”) |

$ | 52,162,544 | $ | 11,534,258 | ||||

| Less: Return of capital on distributions from MLPs |

(52,162,544 | ) | (11,534,258 | ) | ||||

| Dividends(1) |

1,965,882 | 710,871 | ||||||

| Interest |

35,231 | 6,893 | ||||||

| Total investment income |

2,001,113 | 717,764 | ||||||

| Expenses |

||||||||

| Management fees |

(6,646,250 | ) | (1,585,170 | ) | ||||

| Interest expense on borrowings |

(4,613,998 | ) | (1,055,581 | ) | ||||

| Custodian fees |

(63,388 | ) | (29,814 | ) | ||||

| Trustees fees |

(40,349 | ) | (9,530 | ) | ||||

| Professional fees |

(167,617 | ) | (139,759 | ) | ||||

| Shareholder reporting expenses |

(103,031 | ) | (50,652 | ) | ||||

| Shareholder servicing agent fees |

(1,587 | ) | (218 | ) | ||||

| Stock exchange listing fees |

(11,149 | ) | (8,411 | ) | ||||

| Investor relations expenses |

(27,252 | ) | (6,527 | ) | ||||

| Franchise tax expenses |

(35,053 | ) | (32,502 | ) | ||||

| Shelf offering expenses |

— | (158,061 | ) | |||||

| Other |

(80,529 | ) | (87,868 | ) | ||||

| Total expenses |

(11,790,203 | ) | (3,164,093 | ) | ||||

| Net investment income (loss) before taxes |

(9,789,090 | ) | (2,446,329 | ) | ||||

| Deferred tax benefit |

25,494,850 | — | ||||||

| Current tax (expense)/benefit |

(4,147 | ) | — | |||||

| Net investment income (loss) |

15,701,613 | (2,446,329 | ) | |||||

| Realized and Unrealized Gain (Loss) |

||||||||

| Net realized gain (loss) from: |

||||||||

| Investments before taxes |

12,318,695 | (11,291,525 | ) | |||||

| Swaps before taxes |

68,212 | 9,147 | ||||||

| Deferred tax (expense)/benefit |

(32,260,643 | ) | — | |||||

| Net realized gain (loss) from investments |

(19,873,736 | ) | (11,282,378 | ) | ||||

| Change in net unrealized appreciation (depreciation) of: |

||||||||

| Investments before taxes |

(10,395,353 | ) | 6,642,195 | |||||

| Swaps before taxes |

3,318,282 | 746,546 | ||||||

| Deferred tax (expense)/benefit |

18,431,625 | — | ||||||

| Change in net unrealized appreciation (depreciation) of investments |

11,354,554 | 7,388,741 | ||||||

| Net realized and unrealized gain (loss) |

(8,519,182 | ) | (3,893,637 | ) | ||||

| Net increase (decrease) in net assets from operations |

$ | 7,182,431 | $ | (6,339,966 | ) | |||

| (1) | See Notes to Financial Statements, Note 1 – General Information and Significant Accounting Policies, Investment Income for more information. |

See accompanying notes to financial statements.

24

Statement of Changes in Net Assets

| JMF | JMLP | |||||||||||||||

| Year Ended 11/30/18 |

Year Ended(1) 11/30/17 |

Year Ended 11/30/18 |

Year Ended(1) 11/30/17 |

|||||||||||||

| Operations |

||||||||||||||||

| Net investment income (loss) |

$ | 15,701,613 | $ | (5,258,603 | ) | $ | (2,446,329 | ) | $ | (928,988 | ) | |||||

| Net realized gain (loss) from: |

||||||||||||||||

| Investments |

(19,941,948 | ) | 15,318,442 | (11,291,525 | ) | (11,465,552 | ) | |||||||||

| Swaps |

68,212 | (7,220,235 | ) | 9,147 | — | |||||||||||

| Change in net unrealized appreciation (depreciation) of: |

||||||||||||||||

| Investments |

8,036,272 | (58,471,713 | ) | 6,642,195 | 7,700,171 | |||||||||||

| Swaps |

3,318,282 | 9,413,579 | 746,546 | 141,632 | ||||||||||||

| Net increase (decrease) in net assets from operations |

7,182,431 | (46,218,530 | ) | (6,339,966 | ) | (4,552,737 | ) | |||||||||

| Distributions to Shareholders(2) |

||||||||||||||||

| Dividends(3) |

(21,108,108 | ) | (7,093,871 | ) | — | — | ||||||||||

| Return of capital |

(23,571,772 | ) | (46,224,336 | ) | (11,086,585 | ) | (12,646,074 | ) | ||||||||

| Decrease in net assets from distributions to shareholders |

(44,679,880 | ) | (53,318,207 | ) | (11,086,585 | ) | (12,646,074 | ) | ||||||||

| Fund Share Transactions |

||||||||||||||||

| Proceeds from shelf offering, net of offering costs |

7,353,662 | 4,819,170 | 2,713,917 | 3,479,922 | ||||||||||||

| Proceeds from shares issued to shareholders due to reinvestment of distributions |

— | 1,737,280 | — | 24,162 | ||||||||||||

| Net increase (decrease) in net assets from Fund share transactions |

7,353,662 | 6,556,450 | 2,713,917 | 3,504,084 | ||||||||||||

| Net increase (decrease) in net assets |

(30,143,787 | ) | (92,980,287 | ) | (14,712,634 | ) | (13,694,727 | ) | ||||||||

| Net assets at the beginning of period |

437,151,962 | 530,132,249 | 108,128,561 | 121,823,288 | ||||||||||||

| Net assets at the end of period |

$ | 407,008,175 | $ | 437,151,962 | $ | 93,415,927 | $ | 108,128,561 | ||||||||

| (1) | Prior period amounts have been conformed to current year presentation. See Notes to Financial Statements, Note 8 – New Accounting Pronouncements for further details. |

| (2) | The composition and per share amounts of the Funds’ distributions are presented in the Financial Highlights. The distribution information for the Fund as of its most recent tax year end is presented within the Notes to Financial Statements, Note 1 – Income Taxes. |

| (3) | For the fiscal year ended November 30, 2017 the Fund’s distributions to shareholders were paid from net investment income. |

See accompanying notes to financial statements.

25

Year Ended November 30, 2018

| JMF | JMLP | |||||||

| Cash Flows from Operating Activities: |

||||||||

| Net Increase (Decrease) in Net Assets from Operations |

$ | 7,182,431 | $ | (6,339,966 | ) | |||

| Adjustments to reconcile the net increase (decrease) in net assets from operations to net cash provided by (used in) operating activities: |

||||||||

| Purchases of investments |

(148,230,391 | ) | (34,989,751 | ) | ||||

| Proceeds from sales of investments |

152,579,132 | 36,981,001 | ||||||

| Proceeds from (Purchases of) short-term investments, net |

(4,699,075 | ) | 789,411 | |||||

| Return of capital distributions from MLPs |

52,162,544 | 11,534,258 | ||||||

| (Increase) Decrease in: |

||||||||

| Receivable for interest |

(171 | ) | (24 | ) | ||||

| Other assets |

(9,677 | ) | (3,641 | ) | ||||

| Increase (Decrease) in: |

||||||||

| Deferred tax liability, net |

(11,665,832 | ) | — | |||||

| Payable for interest |

130,933 | 40,682 | ||||||

| Payable for interest rate swaps purchased |

(210,079 | ) | — | |||||

| Payable for state income tax |

4,147 | — | ||||||

| Accrued state franchise tax expense |

(13,695 | ) | (2,760 | ) | ||||

| Accrued management fees |

(15,035 | ) | (10,983 | ) | ||||

| Accrued Trustees fees |

10,702 | 2,316 | ||||||

| Accrued other expenses |

(58,089 | ) | (15,017 | ) | ||||

| Net realized (gain) loss from investments before taxes |

(12,318,695 | ) | 11,291,525 | |||||

| Change in net unrealized appreciation (depreciation) of: |

||||||||

| Investments before taxes |

10,395,353 | (6,642,195 | ) | |||||

| Swaps before taxes |

(3,318,282 | ) | (746,546 | ) | ||||

| Net cash provided by (used in) operating activities |

41,926,221 | 11,888,310 | ||||||

| Cash Flows from Financing Activities |

||||||||

| Proceeds from borrowings |

7,000,000 | 1,600,000 | ||||||

| Repayments of borrowings |

(11,600,000 | ) | (5,350,000 | ) | ||||

| Proceeds from shelf offering, net of offering costs |

7,353,662 | 2,767,119 | ||||||

| Increase (Decrease) in cash overdraft |

(3 | ) | 71 | |||||

| Cash distributions paid to shareholders |

(44,679,880 | ) | (11,086,585 | ) | ||||

| (Payments for) deferred offering costs |

— | 181,085 | ||||||

| Net cash provided by (used in) financing activities |

(41,926,221 | ) | (11,888,310 | ) | ||||

| Net Increase (Decrease) in Cash |

— | — | ||||||

| Cash at the beginning of period |

— | — | ||||||

| Cash at the end of period |

$ | — | $ | — | ||||

| Supplemental Disclosures of Cash Flow Information | JMF | JMLP | ||||||

| Cash paid for interest on borrowings (excluding borrowing costs) |

$ | 4,483,065 | $ | 1,014,899 | ||||

| Net cash paid (received) for taxes |

48,748 | 35,262 | ||||||

See accompanying notes to financial statements.

26

THIS PAGE INTENTIONALLY LEFT BLANK

27

Selected data for a share outstanding throughout each period:

| Investment Operations | Less Distributions | |||||||||||||||||||||||||||||||||||||||||||

| Beginning NAV |

Net Investment Income (Loss)(a) |

Net Realized/ Unrealized Gain (Loss) |

Total | From Net Investment Income |

Return of Capital |

Total | Offering Costs |

Premium from Shares Sold through Shelf Offering |

Ending NAV |

Ending Share Price |

||||||||||||||||||||||||||||||||||

| JMF |

| |||||||||||||||||||||||||||||||||||||||||||

| Year Ended 11/30: |

| |||||||||||||||||||||||||||||||||||||||||||

| 2018 |

$ | 10.90 | $ | 0.39 | $ | (0.21 | ) | $ | 0.18 | $ | (0.52 | ) | $ | (0.58 | ) | $ | (1.10 | ) | $ | — | $ | — | $ | 9.98 | $ | 9.19 | ||||||||||||||||||

| 2017 |

13.42 | (0.13 | ) | (1.04 | ) | (1.17 | ) | (0.18 | ) | (1.17 | ) | (1.35 | ) | — | — | ** | 10.90 | 10.57 | ||||||||||||||||||||||||||

| 2016 |

13.45 | (0.12 | ) | 1.44 | 1.32 | — | (1.35 | ) | (1.35 | ) | — | — | 13.42 | 13.32 | ||||||||||||||||||||||||||||||

| 2015 |

22.10 | (0.08 | ) | (7.23 | ) | (7.31 | ) | — | (1.34 | ) | (1.34 | ) | — | — | 13.45 | 11.91 | ||||||||||||||||||||||||||||

| 2014 |

20.22 | (0.32 | ) | 3.48 | 3.16 | (0.12 | ) | (1.16 | ) | (1.28 | ) | — | — | 22.10 | 20.72 | |||||||||||||||||||||||||||||

| JMLP |

| |||||||||||||||||||||||||||||||||||||||||||

| Year Ended 11/30: |

| |||||||||||||||||||||||||||||||||||||||||||

| 2018 |

8.21 | (0.18 | ) | (0.28 | ) | (0.46 | ) | — | (0.83 | ) | (0.83 | ) | — | — | 6.92 | 6.24 | ||||||||||||||||||||||||||||

| 2017 |

9.55 | (0.07 | ) | (0.29 | ) | (0.36 | ) | — | (0.98 | ) | (0.98 | ) | — | — | ** | 8.21 | 8.02 | |||||||||||||||||||||||||||

| 2016 |

8.94 | (0.05 | ) | 1.69 | 1.64 | — | (1.03 | ) | (1.03 | ) | — | — | 9.55 | 9.80 | ||||||||||||||||||||||||||||||

| 2015 |

18.52 | (0.12 | ) | (8.09 | ) | (8.21 | ) | — | (1.37 | ) | (1.37 | ) | — | — | 8.94 | 8.35 | ||||||||||||||||||||||||||||

| 2014(g) |

19.10 | (0.27 | ) | 0.73 | 0.46 | (0.21 | ) | (0.79 | ) | (1.00 | ) | (0.04 | ) | — | 18.52 | 16.35 | ||||||||||||||||||||||||||||

| Borrowings at the End of Period | ||||||||

| Aggregate Amount Outstanding (000) |

Asset Coverage Per $1,000 |

|||||||

| JMF |

| |||||||

| Year Ended 11/30: |

| |||||||

| 2018 |

$ | 170,400 | $ | 3,389 | ||||

| 2017 |

175,000 | 3,498 | ||||||

| 2016 |

185,550 | 3,857 | ||||||

| 2015 |

199,000 | 3,666 | ||||||

| 2014 |

315,000 | 3,768 | ||||||

| JMLP |

| |||||||

| Year Ended 11/30: |

| |||||||

| 2018 |

37,750 | 3,475 | ||||||

| 2017 |

41,500 | 3,606 | ||||||

| 2016 |

39,000 | 4,124 | ||||||

| 2015 |

41,800 | 3,727 | ||||||

| 2014(g) |

85,000 | 3,780 | ||||||

| (a) | Per share Net Investment Income (Loss) is calculated using the average daily shares method. |

| (b) | Total Return Based on NAV is the combination of changes in NAV, reinvested dividend income at NAV and reinvested capital gains distributions at NAV, if any. The last dividend declared in the period, which is typically paid on the first business day of the following month, is assumed to be reinvested at the ending NAV. The actual reinvest price for the last dividend declared in the period may often be based on the Fund’s market price (and not its NAV), and therefore may be different from the price used in the calculation. Total returns are not annualized. |

Total Return Based on Share Price is the combination of changes in the market price per share and the effect of reinvested dividend income and reinvested capital gains distributions, if any, at the average price paid per share at the time of reinvestment. The last dividend declared in the period, which is typically paid on the first business day of the following month, is assumed to be reinvested at the ending market price. The actual reinvestment for the last dividend declared in the period may take place over several days, and in some instances may not be based on the market price, so the actual reinvestment price may be different from the price used in the calculation. Total returns are not annualized.

28

| Ratios/Supplemental Data | ||||||||||||||||||||||||||||||||||

| Total Returns | Ratios to Average Net Assets Before Reimbursement/ Income Taxes/ Tax Benefit (Expense)(e) |

Ratios to Average Net Assets After Reimbursement/ Income Taxes/ Tax Benefit (Expense)(d)(e) |

Ratios to Average Net Assets |

|||||||||||||||||||||||||||||||

| Based on NAV(b) |

Based on Share Price(b) |

Ending Net Assets (000) |

Expenses | Net Investment Income (Loss) |

Expenses | Net Investment Income (Loss) |

Current and Deferred Tax Benefit (Expense) |

Portfolio Turnover Rate(f) |

||||||||||||||||||||||||||

| 0.83 | % | (3.98 | )% | $ | 407,008 | (2.56 | )% | (2.12 | )% | (0.03 | )% | 3.41 | % | 2.53 | % | 23 | % | |||||||||||||||||

| (9.44 | ) | (11.44 | ) | 437,152 | (2.23 | ) | (1.67 | ) | 3.45 | (1.05 | ) | 5.68 | 12 | |||||||||||||||||||||

| 12.27 | 27.51 | 530,132 | (1.99 | ) | (1.46 | ) | (8.10 | ) | (1.05 | ) | (6.11 | ) | 28 | |||||||||||||||||||||

| (34.43 | ) | (37.51 | ) | 530,525 | (1.95 | ) | (0.68 | ) | 22.29 | (c) | (0.42 | )(c) | 24.23 | 18 | ||||||||||||||||||||

| 15.67 | 13.67 | 871,905 | (1.84 | ) | (1.45 | ) | (10.38 | ) | (1.47 | ) | (8.54 | ) | 6 | |||||||||||||||||||||

| (6.91 | ) | (13.77 | ) | 93,416 | (2.86 | ) | (2.21 | ) | (2.86 | ) | (2.21 | ) | 0.00 | 24 | ||||||||||||||||||||

| (4.22 | ) | (8.91 | ) | 108,129 | (2.32 | ) | (0.76 | ) | (2.33 | ) | (0.77 | ) | (0.01 | ) | 24 | |||||||||||||||||||

| 22.62 | 34.48 | 121,823 | (2.15 | ) | (0.59 | ) | (2.14 | ) | (0.58 | ) | 0.01 | 37 | ||||||||||||||||||||||

| (46.47 | ) | (43.24 | ) | 114,004 | (2.02 | ) | (1.42 | ) | (0.16 | ) | (0.85 | ) | 1.86 | 37 | ||||||||||||||||||||

| 1.97 | (13.76 | ) | 236,281 | (1.77 | )* | (1.40 | )* | (3.13 | )* | (1.82 | )* | (1.36 | ) | 25 | ||||||||||||||||||||

| (c) | During the fiscal year ended November 30, 2015, the Adviser voluntarily reimbursed the Fund for certain expenses incurred in connection with an equity shelf program. As a result, the Expenses and Net Investment Income (Loss) Ratios to Average Net Assets reflect this voluntary expense reimbursement from Adviser. The Expenses and Net Investment Income (Loss) Ratios to Average Net Assets excluding this expense reimbursement after income taxes/tax benefit (expenses) from the Adviser were as follows: |

| Ratios to Average Net Assets | ||||||||

| JMF | Expenses | Net Investment Income (Loss) |

||||||

| Year Ended 11/30: |

||||||||

| 2015 |

22.27 | % | (0.44 | )% | ||||

| (d) | Expense ratios include the current and deferred tax benefit (expense) allocated to net investment income (loss) and the deferred tax benefit (expense) allocated to realized and unrealized gain (loss). Net Investment Income (Loss) ratios exclude the deferred tax benefit (expense) allocated to realized and unrealized gain (loss). |

| (e) • | Net Investment Income (Loss) ratios reflect income earned and expenses incurred on assets attributable to borrowings, as described in Note 7 – Borrowing Arrangements. |

| • | Each ratio includes the effect of all interest expense paid and other costs related to borrowings as follows: |

| (f) | Portfolio Turnover Rate is calculated based on the lesser of long-term purchases or sales (as disclosed in Note 5 – Investment Transactions) divided by the average long-term market value during the period. |

| (g) | For the period March 26, 2014 (commencement of operations) through November 30, 2014. |

| * | Annualized. |

| ** | Rounds to less than $0.01. |

See accompanying notes to financial statements.

29

Financial Statements

1. General Information and Significant Accounting Policies

General Information

Fund Information

The funds covered in this report and their corresponding New York Stock Exchange (“NYSE”) symbols are as follows (each a “Fund” and collectively, the “Funds”):

| • | Nuveen Energy MLP Total Return Fund (JMF) |

| • | Nuveen All Cap Energy MLP Opportunities Fund (JMLP) |

The Funds are registered under the Investment Company Act of 1940, as amended, as non-diversified closed-end management investment companies. JMF and JMLP were each organized as a Massachusetts business trust on September 27, 2010 and July 25, 2013, respectively.

The end of the reporting period for the Funds is November 30, 2018, and the period covered by these Notes to Financial Statements is the fiscal year ended November 30, 2018 (the “current fiscal period”).

Investment Adviser

The Funds’ investment adviser is Nuveen Fund Advisors, LLC (the “Adviser”), a subsidiary of Nuveen, LLC (“Nuveen”). Nuveen is the investment management arm of Teachers Insurance and Annuity Association of America (TIAA). The Adviser has overall responsibility for management of the Funds, oversees the management of the Funds’ portfolios, manages the Funds’ business affairs and provides certain clerical, bookkeeping and other administrative services, and, if necessary, asset allocation decisions. The Adviser has entered into sub-advisory agreements with Advisory Research Inc., (the “Sub-Adviser”), a wholly-owned subsidiary of Piper Jaffray Companies, under which the Sub-Adviser’s MLP & Energy Infrastructure team manages the investment portfolios of the Funds.

Investment Objectives and Principal Investment Strategies

JMF’s investment objective is to provide tax-advantaged total return. The Fund seeks to achieve its investment objective by investing primarily in a portfolio of master limited partnerships (“MLPs”) in the energy sector. Under normal market circumstances, the Fund will invest at least 80% of its managed assets (as defined in Note 6 – Management Fees and Other Transactions with Affiliates) in MLPs in the energy sector. The Fund considers investments in MLPs to include investments that offer economic exposure to publicly traded and private MLPs in the form of equity securities of MLPs, securities of entities holding primarily general partner or managing member interests in MLPs, securities that are derivatives of interests in MLPs and debt securities of MLPs. Further, the Fund considers an entity to be part of the energy sector if it derives at least 50% of its revenues from the business of exploring, developing, producing, gathering, transporting, processing, storing, refining, distributing, mining or marketing natural gas, natural gas liquids, crude oil, refined petroleum products or coal.