UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

| | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

OR

| | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number

CONTANGO ORE, INC.

(Exact name of registrant as specified in its charter)

| |

| |

| (State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) |

| (Address of principal executive offices) | (Zip code) |

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| | | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” or “emerging growth company” in Rule 12b-2 of the Exchange Act.:

| Large accelerated filer ☐ |

| Accelerated filer ☐ |

| |

| Smaller reporting company | Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

The total number of shares of common stock, par value $0.01 per share, outstanding as of February 10, 2022 was

CONTANGO ORE, INC.

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

Page |

|

|

|

PART I – FINANCIAL INFORMATION |

||

| Item 1. |

Financial Statements |

|

|

|

|

Condensed Consolidated Balance Sheets as of December 31, 2021 and June 30, 2021 (unaudited) |

3 |

|

|

|

Condensed Consolidated Statements of Operations for the three and six months ended December 31, 2021 and 2020 (unaudited) |

4 |

|

|

|

Condensed Consolidated Statements of Cash Flows for the six months ended December 31, 2021 and 2020 (unaudited) |

5 |

|

|

|

Condensed Consolidated Statement of Shareholders’ Equity for the three and six months ended December 31, 2021 and 2020 (unaudited) |

6 |

|

|

|

Notes to the Unaudited Condensed Consolidated Financial Statements |

7 |

|

| Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

19 |

|

| Item 3. |

Quantitative and Qualitative Disclosures about Market Risk |

41 |

|

| Item 4. |

Controls and Procedures |

41 |

|

|

|

PART II – OTHER INFORMATION |

|

|

| Item 1. |

Legal Proceedings |

42 | |

| Item 1A. |

Risk Factors |

42 | |

| Item 2. |

Unregistered Sales of Equity Securities and Use of Proceeds |

43 | |

| Item 4. |

Mine Safety Disclosures |

43 | |

| Item 5. |

Other Information |

43 |

|

| Item 6. |

Exhibits |

44 |

|

All references in this Form 10-Q to the “Company”, “CORE”, “we”, “us” or “our” are to Contango ORE, Inc.

CONTANGO ORE, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

Item 1 - Financial Statements

| December 31, 2021 | June 30, 2021 | |||||||

| ASSETS | ||||||||

| CURRENT ASSETS: | ||||||||

| Cash | $ | $ | ||||||

| Restricted cash | ||||||||

| Prepaid expenses and other | ||||||||

| Income tax receivable | ||||||||

| Total current assets | ||||||||

| LONG-TERM ASSETS: | ||||||||

| Investment in Peak Gold (Note 4) | ||||||||

| Property & equipment, net | ||||||||

| Total long-term assets | ||||||||

| TOTAL ASSETS | $ | $ | ||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||

| CURRENT LIABILITIES: | ||||||||

| Accounts payable | $ | $ | ||||||

| Accrued liabilities | ||||||||

| Note payable | ||||||||

| Total current liabilities | ||||||||

| NON-CURRENT LIABILITIES: | ||||||||

| Advance royalty reimbursement | ||||||||

| Asset retirement obligations | ||||||||

| Contingent consideration liability | ||||||||

| Total non-current liabilities | ||||||||

| TOTAL LIABILITIES | ||||||||

| COMMITMENTS AND CONTINGENCIES (NOTE 13) | ||||||||

| SHAREHOLDERS’ EQUITY: | ||||||||

| Common Stock, $ par value, shares authorized; shares issued and outstanding at December 31, 2021; shares issued and outstanding at June 30, 2021 | ||||||||

| Additional paid-in capital | ||||||||

| Treasury stock at cost ( shares at December 31, 2021; and at June 30, 2021) | ( | ) | ||||||

| Accumulated deficit | ( | ) | ( | ) | ||||

| TOTAL SHAREHOLDERS’ EQUITY | ||||||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | $ | ||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

CONTANGO ORE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

|

Three Months Ended December 31, |

Six Months Ended December 31, |

|||||||||||||||

|

2021 |

2020 |

2021 |

2020 |

|||||||||||||

| EXPENSES: |

||||||||||||||||

| Claim rental expense | $ | ( |

) | $ | ( |

) | $ | ( |

) | $ | ( |

) | ||||

| Exploration expense |

( |

) |

( |

) | ( |

) |

( |

) | ||||||||

| Depreciation expense | ( |

) | ( |

) | ||||||||||||

| Accretion expense | ( |

) | ( |

) | ||||||||||||

| General and administrative expense |

( |

) |

( |

) | ( |

) |

( |

) |

||||||||

| Total expenses |

( |

) |

( |

) |

( |

) |

( |

) |

||||||||

| OTHER INCOME/(EXPENSE): |

||||||||||||||||

| Interest income |

||||||||||||||||

| Interest expense | ( |

) | ||||||||||||||

| Loss from equity investment in Peak Gold, LLC (Note 4) |

( |

) |

( |

) | ( |

) |

( |

) |

||||||||

| Gain on sale of a portion of the equity investment in Peak Gold, LLC |

— | — | — | |||||||||||||

| Total other income/(expense) |

) | ( |

) |

( |

) | |||||||||||

| INCOME/(LOSS) BEFORE TAXES |

( |

) |

( |

) |

( |

) | ||||||||||

| Income tax (expense)/benefit |

— | ( |

) | |||||||||||||

| NET INCOME/(LOSS) |

$ | ( |

) |

$ | ( |

) | $ | ( |

) | $ | ||||||

| NET INCOME/(LOSS) PER SHARE |

||||||||||||||||

| Basic and diluted |

$ | ( |

) |

$ | ( |

) |

$ | ( |

) | $ | ||||||

| WEIGHTED AVERAGE COMMON SHARES OUTSTANDING |

||||||||||||||||

| Basic and diluted |

|

|||||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

CONTANGO ORE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| Six Months Ended December 31, | ||||||||

| 2021 | 2020 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Net income/(loss) | $ | ( | ) | $ | ||||

| Adjustments to reconcile net income/(loss) to net cash used in operating activities: | ||||||||

| Stock-based compensation | ||||||||

| Depreciation expense | ||||||||

| Accretion expense | ||||||||

| Loss from equity investment in Peak Gold, LLC | ||||||||

| Gain on sale of a portion of the equity investment in Peak Gold, LLC | ( | ) | ||||||

| Changes in operating assets and liabilities net of assets and liabilities acquired: | ||||||||

| Increase in prepaid expenses and other | ( | ) | ||||||

| Increase (decrease) in accounts payable and accrued liabilities | ( | ) | ||||||

| Decrease (increase) in income tax receivable | ( | ) | ||||||

| Increase in advance royalty reimbursement | ||||||||

| Net cash used in operating activities | ( | ) | ( | ) | ||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||

| Cash invested in Peak Gold, LLC | ( | ) | ( | ) | ||||

| Acquisition of property and equipment | ( | ) | ||||||

| Cash paid for acquisition of Alaska Gold Torrent, LLC, net of cash received | ( | ) | ||||||

| Cash proceeds from the sale of a portion of the equity investment in Peak Gold, LLC | ||||||||

| Net cash provided/(used) by investing activities | ( | ) | ||||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

| Cash paid for shares withheld from employees for payroll tax withholding | ( | ) | ||||||

| Cash proceeds from capital raise, net | ( | ) | ||||||

| Net cash provided/(used) by financing activities | ( | ) | ||||||

| NET INCREASE/(DECREASE) IN CASH | ( | ) | ||||||

| CASH, BEGINNING OF PERIOD | ||||||||

| CASH AND RESTRICTED CASH, END OF PERIOD | $ | $ | ||||||

| Supplemental disclosure of cash flow information | ||||||||

| Cash paid for: | ||||||||

| Income taxes | $ | $ | ||||||

| Non-cash investing activities | ||||||||

| Note payable issued for acquisition of Alaska Gold Torrent, LLC | ||||||||

| Direct transaction costs for acquisition of Alaska Gold Torrent, LLC financed in accounts payable | ||||||||

| Asset retirement obligations | — | |||||||

| Contingent liability for acquisition of Alaska Gold Torrent, LLC | ||||||||

| Total non-cash investing activities | $ | $ | ||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

CONTANGO ORE, INC.

CONDENSED CONSOLIDATED STATEMENT OF SHAREHOLDERS’ EQUITY

(Unaudited)

| Common Stock |

Additional

Paid-In

|

Treasury | Accumulated |

Total

Shareholders’

|

||||||||||||||||||||

| Shares |

Amount |

Capital |

Stock | Deficit |

Equity |

|||||||||||||||||||

| Balance at June 30, 2021 |

|

$ |

|

$ | $ | $ |

(

|

) |

$ | |||||||||||||||

| Stock-based compensation |

—

|

—

|

— |

—

|

||||||||||||||||||||

| Cost of common stock issuance | — | — | ( |

) | — | — | ( |

) | ||||||||||||||||

| Restricted stock activity | ( |

) | ||||||||||||||||||||||

| Net loss for the period | — | ( |

) | ( |

) | |||||||||||||||||||

| Balance at September 30, 2021 | $ | $ | $ | $ | ( |

) | $ | |||||||||||||||||

| Stock-based compensation | — | |||||||||||||||||||||||

| Restricted stock activity | ( |

) | ||||||||||||||||||||||

| Treasury shares withheld for employee taxes | — | ( |

) | ( |

) | |||||||||||||||||||

| Net loss for the period | — | ( |

) | ( |

) | |||||||||||||||||||

| Balance at December 31, 2021 | $ | $ | $ | ( |

) | $ | ( |

) | $ | |||||||||||||||

|

Common Stock |

Additional

Paid-In

|

Treasury |

Accumulated |

Total

Shareholders’

|

||||||||||||||||||||

| Shares |

Amount |

Capital |

Stock |

Deficit |

Equity |

|||||||||||||||||||

| Balance at June 30, 2020 |

|

$ |

|

$ | $ |

(

|

) | $ |

(

|

) |

$ |

|

||||||||||||

| Stock-based compensation |

—

|

—

|

|

—

|

—

|

|||||||||||||||||||

| Issuance of common stock | — | |||||||||||||||||||||||

|

Cost of common stock issuance

|

— | — | ( |

)

|

—

|

—

|

|

|||||||||||||||||

|

Shares received from the partial sale of the investment in Peak Gold, LLC and retired

|

(

|

) |

(

|

) |

(

|

) | — |

|

—

|

( |

)

|

|||||||||||||

| Net income for the period | — | |||||||||||||||||||||||

| Balance at September 30, 2020 | $ | $ | $ | $ | ( |

) | $ | |||||||||||||||||

| Stock-based compensation | — | |||||||||||||||||||||||

| Restricted stock activity | ( |

) | ||||||||||||||||||||||

| Net loss for the period | — | ( |

) | ( |

) | |||||||||||||||||||

| Balance at December 31, 2020 | $ | $ | $ | $ | ( |

) | $ | |||||||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

CONTANGO ORE, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

1. Organization and Business

Contango ORE, Inc. (“CORE” or the “Company”) engages in exploration for gold ore and associated minerals in Alaska. The Company conducts its operations through three primary means:

| ● |

a |

| ● |

its wholly-owned subsidiary, Alaska Gold Torrent, LLC, an Alaska limited liability company (“AGT”), which leases the mineral rights to approximately |

| ● |

its wholly-owned subsidiary, Contango Minerals Alaska, LLC (“Contango Minerals”), which separately owns the mineral rights to approximately |

The Lucky Shot Property and the Minerals Property are collectively referred to in these Notes to Unaudited Condensed Consolidated Financial Statements as the “Contango Properties”.

The Company is in an exploration stage. The Company’s fiscal year end is June 30.

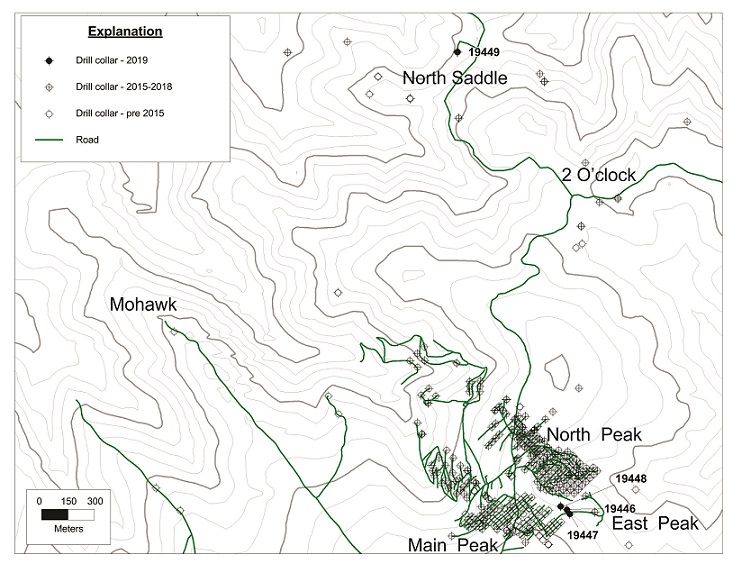

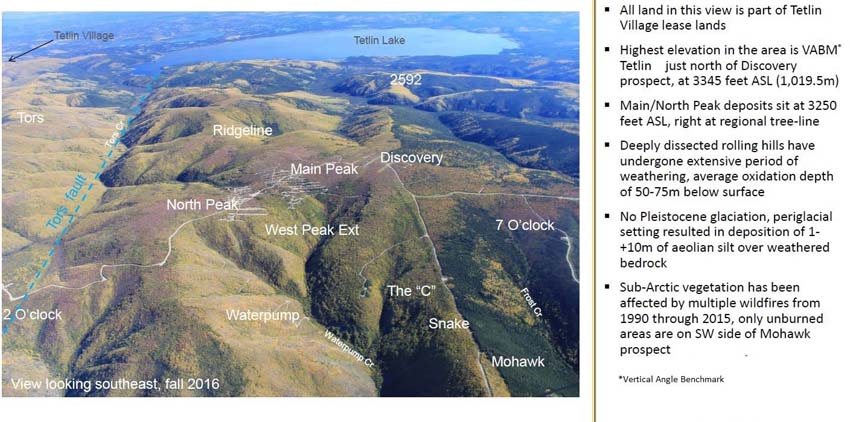

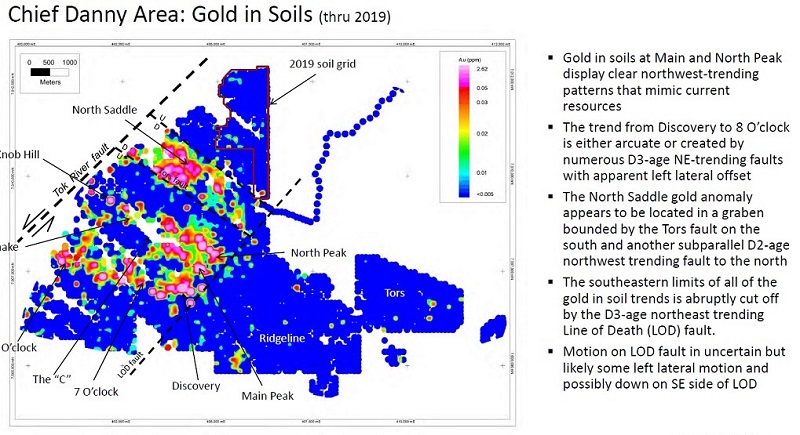

The Company has been involved in the exploration on the Manh Choh Project for twelve years, which has resulted in identifying two mineral deposits (Peak and North Peak) and several other gold, silver, and copper prospects. The Peak Gold JV plans to mine ore from the Peak and North Peak deposits and then process the ore at the existing Fort Knox mining and milling complex located approximately 250 miles away. The use of the Fort Knox mill is expected to accelerate the development of the Peak Gold JV Property and result in significantly reduced upfront capital development costs, smaller environmental footprint, a shorter permitting and development timeline and less overall execution risk for the Peak Gold JV to advance the Peak and North Peak deposits to a production decision. ThePeak Gold JV will be charged a toll for using the Fort Knox facilities. A toll milling agreement will be finalized once a feasibility study has been completed.

The Peak Gold JV spent approximately $

At the Lucky Shot Property, the Company has engaged a mining contractor (Atkinson Construction) to execute the planned 2022 exploration/development program to advance the Enserch Tunnel to the footwall of the Lucky Shot vein and drift 1500ft. parallel to the vein and set up drill stations every 75 feet. The Company plans to be ready to drill by late summer 2022, with a plan to drill approximately 3200 meters (~10,000 feet) from underground into the down-dip projection of the Lucky Shot vein. The Company is currently securing a drilling contractor to conduct the underground drilling.

On the Shamrock Property, the company conducted soil and surface rock chip sampling during 2021. Follow up trenching and detailed geologic mapping is planned for the summer of 2022. At the Eagle/Hona Property, the Company carried out a detailed reconnaissance of the northern and eastern portions of the large claim block that had not previously been detail sampled. Due to the steep topography, a helicopter was used to execute the program safely. Follow up geologic mapping and sampling is planned for the summer of 2022.

Background Information

The Company was formed on September 1, 2010 as a Delaware corporation for the purpose of engaging in the exploration in the State of Alaska for gold ore and associated minerals.

On January 8, 2015, the Company's wholly owned subsidiary, CORE Alaska, LLC (“CORE Alaska”), and a subsidiary of Royal Gold, Inc. (“Royal Gold”) formed the Peak Gold JV. On September 30, 2020, CORE Alaska sold a

Concurrently with the CORE Transactions, KG Mining, in a separate transaction, acquired

2. Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“US GAAP”) for interim financial information, pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”), including instructions to Form 10-Q and Article 8 of Regulation S-X. Accordingly, they do not include all the information and footnotes required by US GAAP for complete annual consolidated financial statements. In the opinion of management, all adjustments considered necessary for a fair presentation of the consolidated financial statements have been included. All such adjustments are of a normal recurring nature. The consolidated financial statements should be read in conjunction with the consolidated audited financial statements and notes included in the Company’s Form 10-K for the fiscal year ended June 30,2021. The results of operations for the three and six months ended December 31, 2021 are not necessarily indicative of the results that may be expected for the fiscal year ending June 30,2022.

3. Summary of Significant Accounting Policies

The Company’s significant accounting policies are described below.

Fair Value Measurement. Accounting guidelines for measuring fair value establish a three-level valuation hierarchy for disclosure of fair value measurements. The valuation hierarchy categorizes assets and liabilities measured at fair value into one of three different levels depending on the observability of the inputs employed in the measurement.

The three levels are defined as follows:

Level 1 – Observable inputs such as quoted prices in active markets at the measurement date for identical, unrestricted assets or liabilities.

Level 2 – Other inputs that are observable directly or indirectly, such as quoted prices in markets that are not active or inputs, which are observable, either directly or indirectly, for substantially the full term of the asset or liability.

Level 3 – Unobservable inputs for which there are little or no market data and which the Company makes its own assumptions about how market participants would price the assets and liabilities.

Business Combinations. In determining whether an acquisition should be accounted for as a business combination or asset acquisition, the Company first determines whether substantially all of the fair value of the gross assets acquired is concentrated in a single identifiable asset or a group of similar identifiable assets. If this is the case, the single identifiable asset or the group of similar assets is not deemed to be a business, and is instead deemed to be an asset. If this is not the case, the Company then further evaluates whether the single identifiable asset or group of similar identifiable assets and activities includes, at a minimum, an input and a substantive process that together significantly contribute to the ability to create outputs. If so, the Company concludes that the single identifiable asset or group of similar identifiable assets and activities is a business. The Company accounts for business combinations using the acquisition method of accounting. Application of this method of accounting requires that (i) identifiable assets acquired (including identifiable intangible assets) and liabilities assumed generally be measured and recognized at fair value as of the acquisition date and (ii) the excess of the purchase price over the net fair value of identifiable assets acquired and liabilities assumed be recognized as goodwill, which is not amortized for accounting purposes but is subject to testing for impairment at least annually. The Company measures and recognizes asset acquisitions that are not deemed to be business combinations based on the cost to acquire the assets, which includes transaction costs. Goodwill is not recognized in asset acquisitions. Contingent consideration in asset acquisitions payable in the form of cash is recognized when payment becomes probable and reasonably estimable, unless the contingent consideration meets the definition of a derivative, in which case the amount becomes part of the asset acquisition cost when acquired. Contingent consideration payable in the form of a fixed number of the Company’s own shares is measured at fair value as of the acquisition date and recognized when the issuance of the shares becomes probable. Upon recognition of the contingent consideration payment, the amount is included in the cost of the acquired asset or group of assets.

The Company purchased

Recently Issued Accounting Pronouncements. In February 2016, the Financial Accounting Standards Board “FASB” issued Accounting Standards Update “ASU” 2016-02, Leases (Topic 842), which requires recognition of right-of-use assets and lease payment liabilities on the balance sheet by lessees for all leases with terms greater than twelve months. Classification of leases as either a finance or operating lease will determine the recognition, measurement and presentation of expenses. ASU 2016-02 also requires certain quantitative and qualitative disclosures about leasing arrangements. The Peak Gold JV owns the Tetlin lease and any impact of the new standard related to that lease will be evaluated at the Peak Gold JV level. The new standard was adopted in July 2019. The Company acquired two new leases with the acquisition of AGT. Neither of the leases acquired require capitalization on the balance sheet.

In January 2020, the FASB issued ASU 2020-01, Investments—Equity Securities (Topic 321), Investments— Equity Method and Joint Ventures (Topic 323), and Derivatives and Hedging (Topic 815), which clarifies the interaction between the three standards. For public business entities, the amendments in this update are effective for fiscal years beginning after December 15, 2020, and interim periods within those fiscal years. The Company accounts for the Peak Gold JV under the equity method of accounting. The adoption of this standard did not have an impact on the financial statements.

The Company has evaluated all other recent accounting pronouncements and believes that none of them will have a significant effect on the Company’s consolidated financial statements.

4. Investment in the Peak Gold JV

The Company initially recorded its investment at the historical book value of the assets contributed to the Peak Gold JV, which was approximately $

The following table is a roll-forward of the Company's investment in the Peak Gold JV from January 8, 2015 (inception) to December 31, 2021:

| Investment | ||||

| in Peak Gold, LLC | ||||

| Investment balance at June 30, 2014 | $ | |||

| Investment in Peak Gold, LLC, at inception January 8, 2015 | ||||

| Loss from equity investment in Peak Gold, LLC | ( | ) | ||

| Investment balance at June 30, 2015 | $ | |||

| Investment in Peak Gold, LLC | ||||

| Loss from equity investment in Peak Gold, LLC | ||||

| Investment balance at June 30, 2016 | $ | |||

| Investment in Peak Gold, LLC | ||||

| Loss from equity investment in Peak Gold, LLC | ||||

| Investment balance at June 30, 2017 | $ | |||

| Investment in Peak Gold, LLC | ||||

| Loss from equity investment in Peak Gold, LLC | ( | ) | ||

| Investment balance as June 30, 2018 | $ | |||

| Investment in Peak Gold, LLC | ||||

| Loss from equity investment in Peak Gold, LLC | ( | ) | ||

| Investment balance at June 30, 2019 | $ | |||

| Investment in Peak Gold, LLC | ||||

| Loss from equity investment in Peak Gold, LLC | ( | ) | ||

| Investment balance at June 30, 2020 | $ | |||

| Investment in Peak Gold, LLC | ||||

| Loss from equity investment in Peak Gold, LLC | ( | ) | ||

| Investment balance at June 30, 2021 | $ | |||

| Investment in Peak Gold, LLC | ||||

| Loss from equity investment in Peak Gold, LLC | ( | ) | ||

| Investment balance at December 31, 2021 | $ | |||

In conjunction with the CORE Transactions, and Kinross assuming the role of manager of the Peak Gold JV, the Peak Gold JV converted its method of accounting from US GAAP to International Financial Reporting Standards (“IFRS”) and changed its fiscal year end from June 30 to December 31, effective for the quarter ended December 31, 2020. The condensed unaudited financial statements presented below have been converted from IFRS to US GAAP for presentation purposes. The following table presents the condensed unaudited results of operations for the Peak Gold JV for the three and six month periods ended December 31, 2021 and 2020, and for the period from inception through December 31, 2021 in accordance with US GAAP:

| Three Months Ended | Three Months Ended | Six Months Ended | Six Months Ended | Period from Inception January 8, 2015 to | ||||||||||||||||

| December 31, 2021 | December 31, 2020 | December 31, 2021 | December 31, 2020 | December 31, 2021 | ||||||||||||||||

| EXPENSES: | ||||||||||||||||||||

| Exploration expense | $ | $ | $ | $ | $ | |||||||||||||||

| General and administrative | ||||||||||||||||||||

| Total expenses | ||||||||||||||||||||

| NET LOSS | $ | $ | $ | $ | $ | |||||||||||||||

The Company’s share of the Peak Gold JV’s results of operations for the three and six months ended December 31, 2021 was a loss of approximately $

5. Prepaid Expenses and other assets

The Company has prepaid expenses and other assets of $

6. Net Income/(Loss) Per Share

A reconciliation of the components of basic and diluted net income/(loss) per share of Common Stock is presented below:

| Three Months Ended December 31, | ||||||||||||||||||||||||

| 2021 | 2020 | |||||||||||||||||||||||

| Net Loss | Weighted Average Shares | Loss Per Share | Net Loss | Weighted Average Shares | Loss Per | |||||||||||||||||||

| Basic Net Income/(Loss) per Share: | ||||||||||||||||||||||||

| Net loss attributable to common stock | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ( | ) | ||||||||||||

| Diluted Net Income/(Loss) per Share: | ||||||||||||||||||||||||

| Net loss attributable to common stock | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ( | ) | ||||||||||||

| Six Months Ended December 31, | ||||||||||||||||||||||||||||

| 2021 | 2020 | |||||||||||||||||||||||||||

| Net Loss | Weighted Average Shares | Loss Per Share | Net Income | Weighted Average Shares | Income Per Share | |||||||||||||||||||||||

| Basic Net Income/(Loss) per Share: | ||||||||||||||||||||||||||||

| Net income/(loss) attributable to common stock | $ | ( | ) | | $ | ( | ) | $ | |

| | $ | |

| ||||||||||||||

| Diluted Net Income/(Loss) per Share: | ||||||||||||||||||||||||||||

| Net income/(loss) attributable to common stock | $ | ( | ) | | $ | ( | ) | $ | |

| | $ | |

| ||||||||||||||

Options to purchase

7. Shareholders’ Equity

On December 11, 2020, at the Annual Meeting, the Company’s stockholders approved a proposal to amend the Company’s Certificate of Incorporation to increase the number of authorized shares of its Common Stock from

The Company entered into Stock Purchase Agreements dated as of June 14, and June 17, 2021 (the “Purchase Agreements”) for the sale of an aggregate of

On September 23, 2020, the Company completed the issuance and sale of an aggregate of

Rights Plan Termination and Rights Agreement

On December 19, 2012, the Company adopted a Rights Plan, which was amended on March 21, 2013, September 29, 2014, December 18, 2014, November 11, 2015, April 22, 2018, and November 20, 2019. The Board adopted an amendment to accelerate the expiration date of its prior stockholder rights agreement to September 23, 2020, such that, at the close of business on September 23, 2020, the purchase rights thereunder expired and the prior stockholder rights agreement was no longer in force and effect. On September 23, 2020, the Company adopted a limited duration stockholder rights agreement (the “Rights Agreement”) to replace the Company’s prior stockholder Rights Plan, which has been terminated.

Pursuant to the Rights Agreement, the Board declared a dividend of

On September 21, 2021, the Board of Directors of the Company approved an amendment to the Rights Agreement (as amended, the “Rights Plan”), extending the Rights Plan by an additional year to September 22, 2022.

8. Sales Transaction with KG Mining

On September 29, 2020, the Company, CORE Alaska, LLC and KG Mining, entered into the CORE Purchase Agreement pursuant to which CORE Alaska sold a

Concurrently with the Purchase Agreement, KG Mining, in a separate transaction, acquired from Royal Gold (i)

The Company recorded the $

The Company recorded a non-current liability totaling $

Prior to the Kinross Transactions, the Peak Gold JV, Contango Minerals, the Company, CORE Alaska, Royal Gold and Royal Alaska entered into a Separation and Distribution Agreement, dated as of September 29, 2020 (the “Separation Agreement”). Pursuant to the Separation Agreement, the Peak Gold JV completed the formation of Contango Minerals, and contributed approximately

The distribution of the Alaska state mining claims to Contango Minerals meets the definition of a non-reciprocal nonmonetary transfer as defined in Accounting Standards Codification (“ASC”) 845 and would generally be recorded at fair value to the extent fair value is determinable. However, to date, the Peak Gold JV's gold exploration has concentrated on the Tetlin Lease (which was retained by the Peak Gold JV), with only a limited amount of work performed on the State of Alaska mining claims. The Company has concluded that the fair value of the state claims is not determinable within reasonable limits, and therefore has recorded the distribution at historical book value. The Peak Gold JV’s historical book value associated with the Alaska state mining claims is zero as of the date of the CORE Transactions because the costs associated with exploration performed on these claims were expensed when incurred. Therefore, the Company's balance sheet has a net book value of zero for these claims as of the date of the CORE Transactions.

In connection with the Separation Agreement, the Peak Gold JV and Contango Minerals entered into the Option Agreement. Under the Option Agreement, Contango Minerals granted the Peak Gold JV an option, subject to certain conditions contained in the Option Agreement, to purchase approximately

Prior to the CORE Transactions, the Peak Gold JV was a variable interest entity as defined by FASB ASU No. 2015-02, Consolidation (Topic 810): Amendments to the Consolidation Analysis. The Company was not the primary beneficiary since it did not have the power to direct the activities of the Peak Gold JV. The Company’s ownership interest in the Peak Gold JV has therefore historically applied the equity method of accounting for its investment. After the Kinross Transactions, the Company retained a

9. Acquisition of Lucky Shot Property

On August 24, 2021, the Company completed the purchase of all outstanding membership interests (the “Interests”) of AGT from CRH Funding II PTE. LTD, a Singapore private limited corporation (“CRH”) (the “Lucky Shot Transaction”). AGT holds rights to the Lucky Shot Property. The Company agreed to purchase the Interests for a total purchase price of up to $

In addition to the cash at closing and the Promissory Note, the Company will be obligated to pay CRH additional consideration if production on the Lucky Shot Property meets two separate milestone payment thresholds. If the first threshold of (1) an aggregate “mineral resource” equal to

The Company also agreed to make $

The Company evaluated this acquisition under ASC 805, Business Combinations. ASC 805 requires that an acquirer determine whether it has acquired a business. If the criteria of ASC 805 are met, a transaction would be accounted for as a business combination and the purchase price is allocated to the respective net assets assumed based on their fair values and a determination is made whether any goodwill results from the transaction. In evaluating the criteria outlined by this standard, the Company concluded that the acquired set of assets did not meet the US GAAP definition of a business (the assembled workforce does not currently perform a substantive process). Therefore, the Company accounted for the purchase as an asset acquisition, and allocated the total consideration transferred on the date of the acquisition, approximately $

10. Property & Equipment

The table below sets forth the book value by type of fixed asset as well as the estimated useful life:

| Asset Type | Estimated Useful Life | December 31, 2021 | June 30, 2021 | |||||||

| Mineral properties | N/A - Units of Production | $ | $ | |||||||

| Land | Not Depreciated |

| |

| ||||||

| Buildings and improvements | 20-39 years | | ||||||||

| Machinery and equipment | 3 - 10 years | | ||||||||

| Vehicles | | | ||||||||

| Computer and office equipment | | | ||||||||

| Furniture & fixtures | ||||||||||

| Less: Accumulated depreciation and amortization | ( | ) | — |

| ||||||

| Property & Equipment, net | $ | | $ | | ||||||

11. Related Party Transactions

Mr. Brad Juneau, who served as the Company’s Chairman, President and Chief Executive Officer until January 6, 2020, and the Company’s Executive Chairman until November 11, 2021, and now serves as the Company's Chairman is also the sole manager of Juneau Exploration, L.P. (“JEX”), a private company involved in the exploration and production of oil and natural gas. On December 11, 2020, the Company entered into a Second Amended and Restated Management Services Agreement (the “A&R MSA”) with JEX, which amends and restates the Amended and Restated Management Services Agreement between the Company and JEX dated as of November 20, 2019. Pursuant to the A&R MSA, JEX will continue, subject to direction of the board of directors of the Company (the “Board”), to provide certain facilities, equipment and services used in the conduct of the business and affairs of the Company and management of its membership interest in the Peak Gold JV. Pursuant to the A&R MSA, JEX will provide to the Company office space and office equipment, and certain related services. The A&R MSA will be effective for one year beginning December 1, 2020 and will renew automatically on a monthly basis as of December 1, 2021 unless terminated upon ninety days’ prior notice by either the Company or JEX. Pursuant to the A&R MSA, the Company will pay to JEX a monthly fee of $

The Company entered into Stock Purchase Agreements dated as of June 14, and June 17, 2021 for the sale of an aggregate of

On September 23, 2020, the Company completed the issuance and sale of an aggregate of

On September 30, 2020, in a series of related transactions, Kinross, through its wholly owned subsidiary, acquired all of the interest in the Peak Gold JV held by Royal Gold and an additional

In addition, on September 29, 2020, the Peak Gold JV entered into an Omnibus Second Amendment and Restatement of Royalty Deeds and Grant of Additional Royalty (the “JV Royalty Agreement”) with Royal Gold. Pursuant to the JV Royalty Agreement, the Peak Gold JV (i) granted to Royal Gold a

The Company will be required to fund any royalty payments the Peak Gold JV is obligated to make to Royal Gold under the JV Royalty Agreement in proportion to its membership interests in the Peak Gold JV. The Company’s proportionate share of the additional royalty granted to Royal Gold pursuant to the JV Royalty Agreement has been partially offset by a cash payment of $

On April 16, 2018, Royal Gold filed a Schedule 13D with the Securities and Exchange Commission to reflect Royal Gold’s acquisition from an existing stockholder of

12. Stock-Based Compensation

On September 15, 2010, the Board adopted the Contango ORE, Inc. Equity Compensation Plan (the “2010 Plan”). On November 14, 2017, the Stockholders of the Company approved and adopted the Contango ORE, Inc. Amended and Restated 2010 Equity Compensation Plan (the “Amended Equity Plan”). The amendments to the 2010 Plan included (a) increasing the number of shares of Common Stock that the Company may issue under the plan by

On November 13, 2019, the stockholders of the Company approved and adopted the First Amendment (the “Amendment”) to the Amended Equity Plan (as amended, the “Equity Plan”) which increased the number of shares of Common Stock that the Company may issue under the Equity Plan by 500,000 shares. Under the Equity Plan, the Board may issue up to

On December 11, 2020, the Board, upon recommendation of the Compensation Committee of the Board (the “Compensation Committee”), adopted the Second Amendment to the Equity Plan to increase the maximum aggregate number of shares of Common Stock of the Company with respect to which award grants may be made under the Equity Plan to any individual during a calendar year from

As of December 31, 2021, there were

Restricted Stock. In November 2019, the Company granted

In connection with the appointment of Rick Van Nieuwenhuyse as the President and Chief Executive Officer of the Company, on January 9, 2020, the Company issued

On December 1, 2020, the Company granted an aggregate

On August 16, 2021, the Company granted

On November 11, 2021, the Company granted

As of December 31, 2021, the total compensation cost related to unvested awards not yet recognized was $

Stock options. In connection with the appointment of Rick Van Nieuwenhuyse as the President and Chief Executive Officer of the Company, on January 6, 2020, the Company granted to Mr. Van Nieuwenhuyse options to purchase

There were

A summary of the status of stock options granted under the Equity Plan as of December 31, 2021 and changes during the six months then ended, is presented in the table below:

| Six Months Ended | ||||||

| December 31, 2021 | ||||||

| Shares Under Options | Weighted Average Exercise Price | |||||

| Outstanding as of June 30, 2021 | $ | |||||

| Granted | ||||||

| Exercised | ||||||

| Forfeited | ||||||

| Outstanding at the end of the period | $ | |||||

| Aggregate intrinsic value | $ | |||||

| Exercisable, end of the period | ||||||

| Aggregate intrinsic value | $ | |||||

| Available for grant, end of period | ||||||

| Weighted average fair value per share of options granted during the period | $ | |||||

13. Commitments and Contingencies

Tetlin Lease. The Tetlin Lease had an initial ten-year term beginning July 2008 which was extended for an additional ten years to July 15, 2028, and for so long thereafter as the Peak Gold JV initiates and continues to conduct mining operations on the Tetlin Lease.

Pursuant to the terms of the Tetlin Lease, the Peak Gold JV was required to spend $

Gold Exploration. The Company’s Triple Z, Eagle/Hona, Shamrock, Willow, and Lucky Shot claims are all located on State of Alaska lands. The Company released its Bush and West Fork claims in November 2020. The annual claim rentals on these projects vary based on the age of the claims, and are due and payable in full by November 30 of each year. Annual claims rentals for the 2021-2022 assessment year totaled $

Lucky Shot Acquisition. With regard to the Lucky Shot Acquisition, in addition to the cash at closing and the Promissory Note, the Company will be obligated to pay CRH additional consideration if production on the Lucky Shot Property meets two separate milestone payment thresholds. If the first threshold of (1) an aggregate “mineral resource” equal to

Royal Gold Royalties. Initially, the Peak Gold JV was obligated to pay Royal Gold (i) an overriding royalty of

Retention Agreements. In February 2019, the Company entered into Retention Agreements with its then Chief Executive Officer, Brad Juneau, its Chief Financial Officer, Leah Gaines, and one other employee providing for payments in an aggregate amount of $

Short Term Incentive Plan. The Compensation Committee of the Board of Directors of the Company (the “Compensation Committee”) adopted a Short-Term Incentive Plan (the “STIP”) effective as of June 10, 2020, for the benefit of Mr. Van Nieuwenhuyse. Pursuant to the terms of the STIP, the Compensation Committee will establish performance goals each year and evaluate the extent to which, if any, Mr. Van Nieuwenhuyse meets such goals. The STIP provides for a payout equal to

14. Income Taxes

The Company recognized a full valuation allowance on its deferred tax asset as of December 31, 2021 and June 30, 2021 and has recognized

On March 27, 2020, the Coronavirus Aid, Relief, and Economic Security Act (“the CARES Act”) was enacted which is aimed at providing emergency assistance due to the impact of the COVID-19 pandemic. The CARES Act includes several tax incentives. Among them are an increase to the IRC Section 163(j) limitation, temporary relief from the 80% limitation on net operating losses (“NOLs”), an ability to carry back NOLs, as well as some technical corrections related to the Act. As of December 31, 2021, the Company does not expect the CARES Act to have a material impact.

15. Subsequent Events

In conjunction with the STIP plan, in January 2022, Mr. Van Nieuwenhuyse received a $

On January 1, 2022, the four non-executive directors realized a vesting of

Available Information

General information about the Company can be found on the Company’s website at www.contangoore.com. Our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, as well as any amendments and exhibits to those reports, are available free of charge through our website as soon as reasonably practicable after the Company files or furnishes them to the Securities and Exchange Commission (“SEC”).

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with the consolidated financial statements and the accompanying notes and other information included elsewhere in this Form 10-Q and in our Form 10-K for the fiscal year ended June 30, 2021, previously filed with the SEC.

Notice Regarding Mineral Disclosure

In October 2018, the Securities and Exchange Commission (the “SEC”) adopted amendments to its current disclosure rules to modernize the mineral property disclosure requirements for mining registrants. The amendments include the adoption of a new subpart 1300 of Regulation S-K, which will govern disclosure for mining registrants (the “SEC Mining Modernization Rules”). The SEC Mining Modernization Rules replace the historical property disclosure requirements for mining registrants that were included in the SEC’s Industry Guide 7 and better align disclosure with international industry and regulatory practices, including the Canadian National Instrument 43-101—Standards of Disclosure for Mineral Projects. The Company must comply with the SEC Mining Modernization Rules as of the Company’s fiscal year beginning on or after January 1, 2021, which began on July 1, 2021.

The Technical Report summary for the Peak Gold JV Property (as defined below) has been prepared in accordance with the SEC Mining Modernization Rules and is included as Exhibit 96.1 to this Form 10-Q.

These disclosures differ in material respects from the requirements set forth in Industry Guide 7, which remains applicable to U.S. companies subject to the reporting and disclosure requirements of the SEC that have not early adopted the SEC Mining Modernization Rules. These standards differ significantly from the disclosure requirements of Industry Guide 7 in that mineral resource information contained herein may not be comparable to similar information disclosed by U.S. companies that have not early adopted the SEC Mining Modernization Rules.

The financial statements, notes thereto and audits for the fiscal year ended June 30, 2021 were prepared in compliance with Industry Guide 7. The accounting and definitions used in the notes to the financial statements for the Company’s fiscal year ended June 30, 2021 were prepared in compliance with Industry Guide 7 since the SEC Mining Modernization Rules were not applicable during these periods. However, since there are disclosures made in this Form 10-Q that are made to be current as of December 31, 2021, the disclosure made in certain Items that is not solely based on an historical presentation for periods prior to July 1, 2021 has been made in compliance with the SEC Mining Modernization Rules.

The Company has no known reserves as defined under Industry Guide 7 or the SEC Mining Modernization Rules. There are significant differences in the definitions and in the disclosure required under the SEC Mining Modernization Rules and under Industry Guide 7. Under Industry Guide 7, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Industry Guide 7 does not define and the SEC’s disclosure standards normally do not permit the inclusion of information concerning “measured mineral resources”, “indicated mineral resources” or “inferred mineral resources” or other descriptions of the amount of mineralization in mineral deposits that do not constitute “reserves” by U.S. standards in documents filed with the SEC. U.S. investors should also understand that “inferred mineral resources” have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. An inferred mineral resource has a lower level of confidence than that applying to an indicated mineral resource and must not be converted to a mineral reserve.

Therefore, the reader should be aware that the notes to the financial statements were prepared in compliance with Industry Guide 7, and the balance of this Item 2 to Form 10-Q was prepared in compliance with the SEC Mining Modernization Rules. Therefore, those terms that have specific definitions in the SEC Mining Modernization Rules have those meanings ascribed to them by the regulation.

Cautionary Statement about Forward-Looking Statements

Some of the statements made in this report may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The words and phrases “should be”, “will be”, “believe”, “expect”, “anticipate”, “estimate”, “forecast”, “goal” and similar expressions identify forward-looking statements and express our expectations about future events. Any statement that is not historical fact is a forward -looking statement. These include such matters as:

| • |

The Company’s financial position; |

| • |

Business strategy, including outsourcing; |

| • |

Meeting Company forecasts and budgets; |

| • |

Anticipated capital expenditures and availability of future financings; |

| • |

Prices of gold and associated minerals; |

| • |

Timing and amount of future discoveries (if any) and production of natural resources on the Contango Properties and the Peak Gold JV Property; |

| • |

Operating costs and other expenses; |

| • |

Cash flow and anticipated liquidity; |

| • | The Company’s ability to fund its business with current cash reserves based on currently planned activities; | |

| • |

Prospect development; |

| • | Operating and legal risks; and | |

| • |

New governmental laws and regulations. |

Although the Company believes the expectations reflected in such forward-looking statements are reasonable, such expectations may not occur. These forward-looking statements involve known and unknown risks, uncertainties and other factors, many of which are outside of our control, that may cause our actual results, performance or achievements to be materially different from future results expressed or implied by the forward-looking statements. In addition to the risk factors described in Part II, Item 1A. Risk Factors, of this report and Part I, Item 1A. Risk Factors, in our Annual Report on Form 10-K for the year ended June 30, 2021, these factors include among others:

| • |

Ability to raise capital to fund capital expenditures; |

| • | Ability to retain or maintain our relative ownership interest in the Peak Gold JV; | |

| • | Ability to influence management of the Peak Gold JV; | |

| • | Ability to realize the anticipated benefits of the Kinross Transactions, including ability to process ore mined from the Peak Gold JV Property at the existing Fort Knox mining and milling complex; | |

| • | Disruption from the Kinross Transactions and transition of the Peak Gold JV’s management to Kinross, including as it relates to maintenance of business and operational relationships potential delays or changes in plans with respect to exploration or development projects or capital expenditures; | |

| • |

Operational constraints and delays; |

| • |

The risks associated with exploring in the mining industry; |

| • |

The timing and successful discovery of natural resources; |

| • |

Availability of capital and the ability to repay indebtedness when due; |

| • |

Declines and variations in the price of gold and associated minerals; |

| • |

Price volatility for natural resources; |

| • |

Availability of operating equipment; |

| • |

Operating hazards attendant to the mining industry; |

| • |

Weather; |

| • |

The ability to find and retain skilled personnel; |

| • |

Restrictions on mining activities; |

| • |

Legislation that may regulate mining activities; |

| • | Changes in applicable tax rates and other regulatory changes; | |

| • |

Impact of new and potential legislative and regulatory changes (including commitments to international agreements) on mining operating and safety standards.; |

| • |

Uncertainties of any estimates and projections relating to any future production, costs and expenses (including changes in the cost of fuel, power, materials, and supplies); |

| • |

Timely and full receipt of sale proceeds from the sale of any of our mined products (if any); |

| • |

Stock price and interest rate volatility; |

| • |

Federal and state regulatory developments and approvals; |

| • |

Availability and cost of material and equipment; |

| • |

Actions or inactions of third-parties; |

| • |

Potential mechanical failure or under-performance of facilities and equipment; |

| • |

Environmental and regulatory, health and safety risks; |

| • |

Strength and financial resources of competitors; |

| • |

Worldwide economic conditions; |

| • | Impact of pandemics, such as the worldwide COVID-19 outbreak, which could impact the Company's or the Peak Gold JV’s exploration schedule; | |

| • |

Expanded rigorous monitoring and testing requirements; |

| • |

Ability to obtain insurance coverage on commercially reasonable terms; |

| • |

Competition generally and the increasing competitive nature of the mining industry; |

|

| • | Risks related to title to properties; and | |

| • | Ability to consummate strategic transactions. |

You should not unduly rely on these forward-looking statements in this report, as they speak only as of the date of this report. Except as required by law, the Company undertakes no obligation to publicly release any revisions to these forward-looking statements to reflect events or circumstances occurring after the date of this report or to reflect the occurrence of unanticipated events. All forward-looking statements included herein are expressly qualified in their entirety by the cautionary statements contained or referred to in this section.

Overview

The Company engages in exploration for gold ore and associated minerals in Alaska. The Company conducts its operations through three primary means:

| ● |

a 30.0% membership interest in Peak Gold, LLC (the “Peak Gold JV”), which leases approximately 675,000 acres from the Tetlin Tribal Council and holds approximately 13,000 additional acres of State of Alaska mining claims (such combined acreage, the “Peak Gold JV Property”) for exploration and development, including in connection with the Peak Gold JV's plan to mine ore from the Peak and North Peak deposits within the Peak Gold JV Property (the “Manh Choh Project”); |

| ● |

its wholly-owned subsidiary, Alaska Gold Torrent, LLC, an Alaska limited liability company (“AGT”), which leases the mineral rights to approximately 8,600 acres of State of Alaska and patented mining claims for exploration from Alaska Hard Rock, Inc., located in three former producing gold mines located on the patented claims in the Willow Mining District about 75 miles north of Anchorage, Alaska (the “Lucky Shot Property”) (See Note 9 - Acquisition of Lucky Shot Property); and |

| ● |

its wholly-owned subsidiary, Contango Minerals Alaska, LLC (“Contango Minerals”), which separately owns the mineral rights to approximately 214,600 acres of State of Alaska mining claims for exploration, including (i) approximately 139,100 acres located immediately northwest of the Peak Gold JV Property (the “Eagle/Hona Property”), (ii) approximately 14,800 acres located northeast of the Peak Gold JV Property (the “Triple Z Property”), (iii) approximately 52,700 acres of new property in the Richardson district of Alaska staked by the Company in the first quarter of 2021 (the “Shamrock Property”) and (iv) approximately 8,000 acres located to the north and east of the Lucky Shot Property (the “Willow Property” and, together with the Shamrock Property, the Eagle/Hona Property and the Triple Z Property, collectively the “Minerals Property”). |

The Lucky Shot Property and the Minerals Property are collectively referred to in this Quarterly Report on Form 10-Q as the “Contango Properties”.

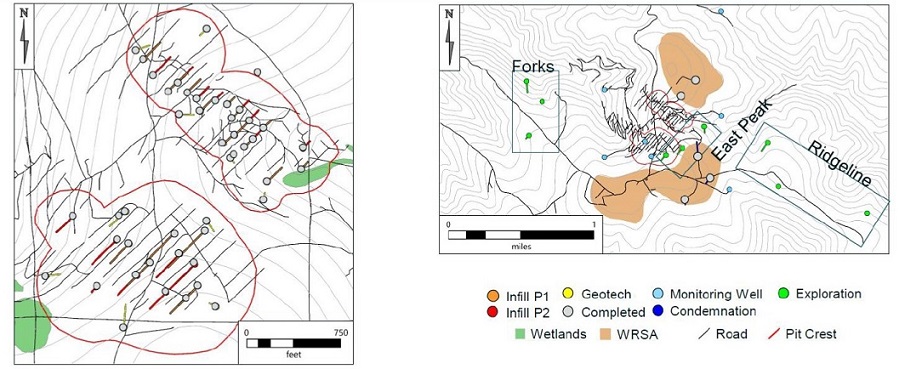

At the Lucky Shot Property, the Company has engaged a mining contractor (Atkinson Construction) to execute the planned 2022 exploration/development program to advance the Enserch Tunnel to the footwall of the Lucky Shot vein and drift 1500ft. parallel to the vein and set up drill stations every 75 feet. The Company plans to be ready to drill by late summer 2022, with a plan to drill approximately 3200 meters (~10,000 feet) from underground into the down-dip projection of the Lucky Shot vein. The Company is currently securing a drilling contractor to conduct the underground drilling.

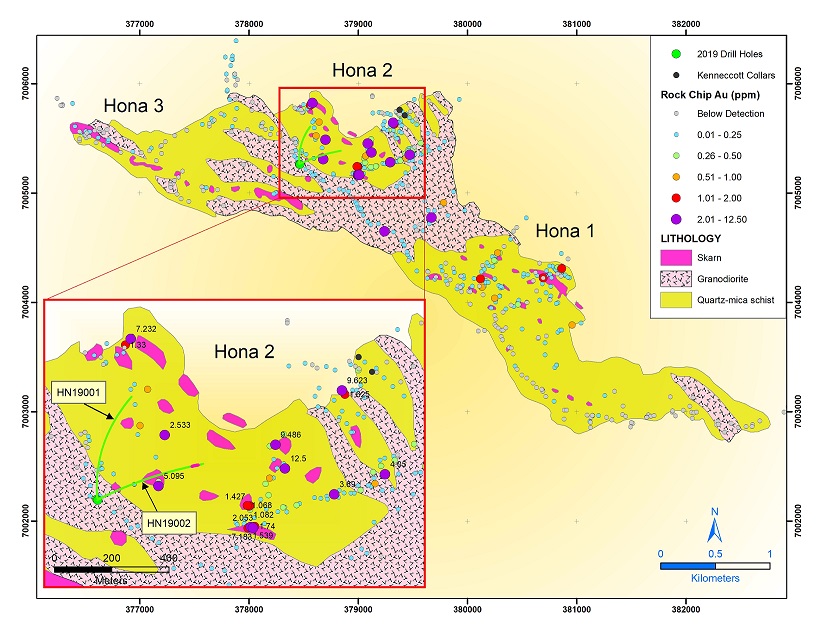

On the Shamrock Property, the company conducted soil and surface rock chip sampling during 2021. Follow up trenching and detailed geologic mapping is planned for the summer of 2022. At the Eagle/Hona Property, the Company carried out a detailed reconnaissance of the northern and eastern portions of the large claim block that had not previously been detail sampled. Due to the steep topography, a helicopter was used to execute the program safely. Follow up geologic mapping and sampling is planned for the summer of 2022.

Background

Contango ORE, Inc. was formed on September 1, 2010 as a Delaware corporation for the purpose of engaging in the exploration in the State of Alaska for gold ore and associated minerals. On January 8, 2015, the Company and a subsidiary of Royal Gold, Inc. (“Royal Gold”) formed the Peak Gold JV. The Company contributed a 100% leasehold interest in an estimated 675,000 acres (the “Tetlin Lease”) from the Tetlin Tribal Council, the council formed by the governing body for the Native Village of Tetlin, an Alaska Native Tribe (the “Tetlin Tribal Council”); and State of Alaska mining claims near Tok, Alaska (together with other property, formerly the “Peak Gold Joint Venture Property”), and Royal Gold made an initial investment into the Peak Gold JV of $5.0 million. By September 29, 2020, Royal Gold had contributed approximately $37.1 million to the Peak Gold JV and earned a cumulative economic interest of 40.0%. The proceeds from the investments were used for exploration of the Peak Gold Joint Venture Property. Royal Gold served as the manager of the Peak Gold JV and managed, directed, and controlled operations of the Peak Gold JV until the Kinross Transactions (described below).

Kinross Transaction

On September 29, 2020, the Company, CORE Alaska, LLC and KG Mining (Alaska), Inc. (“KG Mining”), an indirect wholly-owned subsidiary of Kinross Gold Corporation, a corporation formed under the laws of Ontario, Canada (“Kinross”), entered into a Purchase Agreement (the “CORE Purchase Agreement”), pursuant to which CORE Alaska sold a 30.0% membership interest (the “CORE JV Interest”) in the Peak Gold JV, to KG Mining (the “CORE Transactions”). The CORE Transactions closed on September 30, 2020. In consideration for the CORE JV Interest, the Company received $32.4 million in cash and 809,744 shares of the Company’s common stock, par value $0.01 per share (the “Common Stock”). The 809,744 shares of Common Stock were acquired by KG Mining from Royal Gold, as part of the Royal Gold Transactions (described below) and were subsequently canceled by the Company. Of the $32.4 million cash consideration, $1.2 million constituted a reimbursement prepayment to the Company by KG Mining of amounts relating to CORE Alaska’s proportionate share of certain silver royalty payments that the Peak Gold JV may be obligated to pay to Royal Gold, with the understanding that as a result of such reimbursements, KG Mining would bear the entire economic impact of those silver royalty payments due from the Peak Gold JV. Concurrently with the CORE Purchase Agreement, KG Mining, in a separate transaction, acquired from Royal Gold (i) 100% of the equity of Royal Alaska, LLC (“Royal Alaska”), which held a 40.0% membership interest in the Peak Gold JV (the “Royal Gold Transactions” and, together with the CORE Transactions, the “Kinross Transactions”). Therefore, as of December 31, 2021, the Company holds a 30.0% membership interest in the Peak Gold JV, and KG Mining holds a 70.0% membership interest in the Peak Gold JV and serves as the manager and operator of the Peak Gold JV. KG Mining and CORE Alaska entered into the Amended and Restated Limited Liability Company Agreement of the Peak Gold JV (the “A&R JV LLCA”) on October 1, 2020 to address the new ownership arrangements and to incorporate additional terms that will permit the Peak Gold JV to further develop and produce from its properties.

The Peak Gold JV had also historically held certain State of Alaska unpatented mining claims for the exploration of gold ore and associated minerals. Prior to the Kinross Transactions, the Peak Gold JV, Contango Minerals Alaska, LLC, an Alaska limited liability company formed by the Peak Gold JV (“Contango Minerals”), the Company, CORE Alaska, Royal Gold and Royal Alaska entered into a Separation and Distribution Agreement, dated as of September 29, 2020 (the “Separation Agreement”). Pursuant to the Separation Agreement, the Peak Gold JV formed Contango Minerals, contributed approximately 167,000 acres of Alaska State mining claims to it, subject to the Option Agreement (described below), and retained an additional 1.0% net smelter returns royalty interest on certain of the Alaska state mining claims that were contributed. After the formation and contribution to Contango Minerals, the Peak Gold JV made simultaneous distributions to Royal Alaska and CORE Alaska by (i) granting a new 28.0% net smelter returns silver royalty on all silver produced from a defined area within the Tetlin Lease and transferring the additional 1.0% net smelter returns royalty described above to Royal Gold and (ii) assigning 100.0% of the membership interests in Contango Minerals to CORE Alaska, which were in turn distributed to the Company, resulting in Contango Minerals becoming a wholly-owned subsidiary of the Company. The Separation Agreement contains customary representations, warranties and covenants.

In connection with the Separation Agreement, the Peak Gold JV and Contango Minerals entered into an Option Agreement, dated as of September 29, 2020 (the “Option Agreement”). Under the Option Agreement, Contango Minerals granted the Peak Gold JV an option, subject to certain conditions contained in the Option Agreement, to purchase approximately 13,000 acres of the Alaska state mining claims which were contributed to Contango Minerals pursuant to the Separation Agreement, together with all extralateral rights, water and water rights, and easements and rights of way in connection therewith, that are held by Contango Minerals. Subject to the conditions in the Option Agreement, the Peak Gold JV had the right to exercise the option to purchase the Alaska state mining claims, in whole or in part, at an exercise price of $50,000. The Peak Gold JV exercised this option in whole in June 2021 and paid the Company $50,000.

Kinross is a large gold producer with a diverse global portfolio and extensive operating experience in Alaska. The Peak Gold JV plans to mine ore from the Peak and North Peak deposits and then process ore at the existing Fort Knox mining and milling complex located approximately 250 miles away. The use of the Fort Knox mill is expected to accelerate the development of the Peak Gold JV Property and result in significantly reduced upfront capital development costs, smaller environmental footprint, a shorter permitting and development timeline and less overall risk for Peak Gold JV Property.

Acquisition of Lucky Shot Property

On August 24, 2021 the Company completed the purchase of all outstanding membership interests (the “Interests”) of AGT from CRH Funding II PTE. LTD, a Singapore private limited corporation (“CRH”) (the “Lucky Shot Transaction”). AGT holds rights to the Lucky Shot Property. The Company agreed to purchase the Interests for a total purchase price of up to $30 million. The purchase price includes an initial payment at closing of $5 million in cash and a promissory note in the original principal amount of $6.25 million, payable by the Company to CRH (the “Promissory Note”), with a maturity date of February 28, 2022 (the “Maturity Date”). The Promissory Note is secured by the Interests. If the Company completes an offering and obtains a listing of its shares on the NYSE American prior to the Maturity Date, the Company will pay the Promissory Note through the issuance to CRH of shares of the Company's common stock. The common stock will be valued at the per share price in the offering, if available, or (y) the per share price representing a 10% discount to the 30-day volume-weighted average share price as of the Maturity Date. In November 2021, the Company's common stock commenced listing on the NYSE American. In the event the Company does not complete a public offering on or before the Maturity Date, the Company will pay the Promissory Note in cash.

In addition to the cash at closing and the Promissory Note, the Company will be obligated to pay CRH additional consideration if production on the Lucky Shot Property meets two separate milestone payment thresholds. If the first threshold of (1) an aggregate “mineral resource” equal to 500,000 ounces of gold or (2) production and receipt by the Company of an aggregate of 30,000 ounces of gold (including any silver based on a 1:65 gold:silver ratio) is met, then the Company will pay CRH $5 million in cash and $3.75 million in newly issued shares of CORE common stock. If the second threshold of (1) an aggregate “mineral resource” equal to 1,000,000 ounces of gold or (2) production and receipt by the Company of an aggregate of 60,000 ounces of gold (including any silver based on a 1:65 gold:silver ratio) is met, then the Company will pay CRH $5 million in cash and $5 million in newly issued shares of CORE common stock. If payable, the additional share consideration will be issued based on the 30-day volume weighted average price for each of the thirty trading days immediately prior to the satisfaction of the relevant production goal.

The Company also agreed to make $10,000,000 in expenditures during the 36-month period following closing toward the existence, location, quantity, quality or commercial value of mineral deposits in, under and upon the Lucky Shot Property. On August 16, 2021, the Company hired Chris Kennedy, who has prior experience in underground mine operations management, to serve as the Company's Mine General Manager. In his role, Mr. Kennedy will manage the Company's underground exploration and development program on the Lucky Shot Property.

app

Properties

Overview

On January 8, 2015, the Company and a subsidiary of Royal Gold, Inc. (“Royal Gold”) formed Peak Gold, LLC (the “Peak Gold JV”), and the Company contributed its leasehold interest in a mineral lease with the Native Village of Tetlin whose governmental entity is the Tetlin Tribal Council (“Tetlin Tribal Council”) for the exploration of minerals near Tok, Alaska on a currently estimated 675,000 acres (the “Tetlin Lease”) to the Peak Gold JV. In addition to the Tetlin Lease, the Peak Gold JV also holds approximately 13,000 additional acres of State of Alaska mining claims for the exploration of gold and associated minerals (together with the Tetlin Lease, the “Peak Gold JV Property”). As of December 31, 2021, the Company held a 30.0% membership interest, and KG Mining held a 70.0% membership interest, in the Peak Gold JV.

The Company also separately owns the mineral rights to approximately 223,200 acres of State of Alaska and patented mining claims for exploration through its wholly-owned subsidiaries AGT (consisting of the Lucky Shot Property) and Contango Minerals (consisting of the Eagle/Hona, Triple Z, and Shamrock prospects and additional state mining claims in the Willow Mining District), and has begun allocating more annual resources to exploration of those properties and other new opportunities.

The Company believes that it and the Peak Gold JV hold good title to their respective properties, in accordance with standards generally accepted in the mineral industry. As is customary in the mineral industry, the Company conducted only a preliminary title examination at the time it entered into the Tetlin Lease. The Peak Gold JV conducted a title examination prior to the assignment of the Tetlin Lease to the Peak Gold JV and performed certain curative title work. Before the Company or the Peak Gold JV begins any mine development work, however, the Company or the Peak Gold JV, as applicable, expects to conduct a full title review and perform curative work on any defects that it deems significant. A significant amount of additional work is likely required in the exploration of the Peak Gold JV Property and the Contango Properties before any determination as to the economic feasibility of a mining venture can be made.

Property Summary

The following table outlines the land ownership of the three legal entities that own mineral rights in Alaska: the Company's 30% ownership of the Peak Gold JV (through CORE Alaska, LLC, the Company's wholly-owned subsidiary); AGT; and Contango Minerals; each as of December 31, 2021:

| Property |

Location |

Commodities |

Claims |

Estimated Acres |

Type |

||||||

| Peak Gold JV (30.0% Interest): |

|||||||||||

| Tetlin Lease |

Eastern Interior |

Gold, Copper, Silver |

- |

675,000 |

Lease |

||||||

| Tetlin-Tok |

Eastern Interior |

Gold, Copper, Silver |

129 |

10,400 |

State Mining Claims |

||||||

| Eagle |

Eastern Interior |

Gold, Copper, Silver |

30 |

2,600 |

State Mining Claims |

||||||

| 159 |

688,000 |

||||||||||

| AGT (Leased from Alaska Hard Rock Inc.) (100% Interest): |

|||||||||||

| Lucky Shot |

South Central |

Gold |

58 |

7,900 |

State Mining Claims |

||||||

| Lucky Shot |

South Central |

Gold |

43 |

700 |

Patented Mining Claims |

||||||

| 101 |

8,600 |

||||||||||

| Contango Minerals (100% Interest): |

|||||||||||

| Eagle |

Eastern Interior |

Gold, Copper, Silver |

396 |

64,800 |

State Mining Claims |

||||||

| Triple Z |

Eastern Interior |

Gold, Copper, Silver |

95 |

14,800 |

State Mining Claims |

||||||

| Hona |

Eastern Interior |

Gold, Copper, Silver |

482 |

74,300 |

State Mining Claims |

||||||

| Shamrock |

Eastern Interior |

Gold, Copper, Silver |

361 |

52,700 |

State Mining Claims |

||||||

| Willow |

South Central |

Gold |

69 |

8,000 |

State Mining Claims |

||||||

| 1,403 |

214,600 |

||||||||||

| TOTALS: |

1,663 |

911,200 |

|||||||||

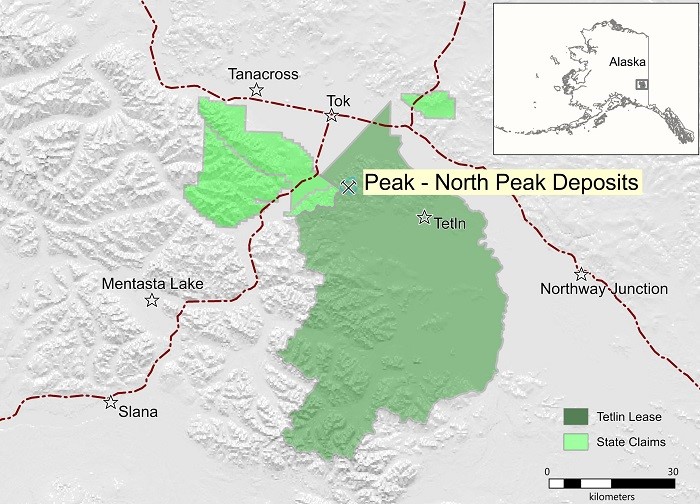

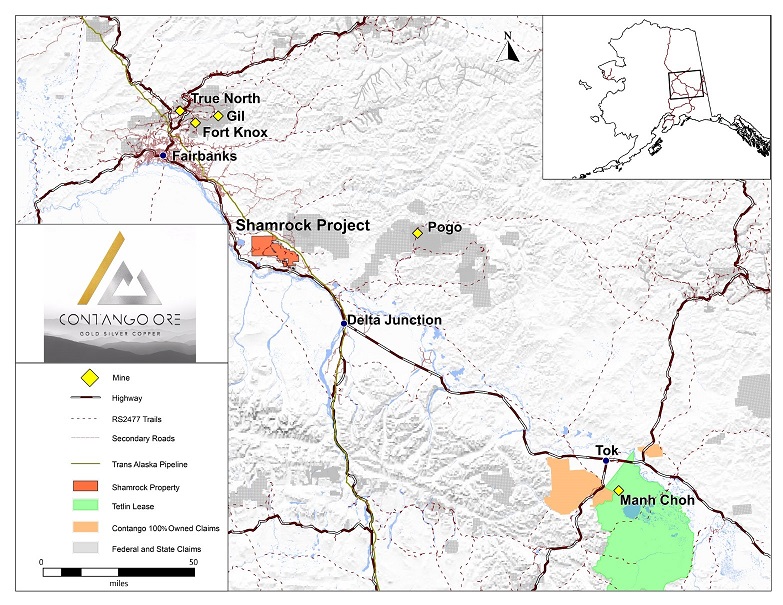

Below is a map showing the location of the Peak Gold JV Property and the Contango Properties, including the ownership percentage for the rights associated with each property held by the Peak Gold JV or the Company, as applicable, and the nature of each interest:

The Peak Gold JV Property and the Contango Properties are all currently in the exploration stage. The Peak Gold JV Property and the Contango Properties are not currently producing, have not had mineral production during any of the three most recently completed fiscal years of the Company, and are not currently known to host proven or provable mineral reserves as defined by the SEC Mining Modernization Rules.

Acquisition of Exploration and Mining Rights

Exploration and mining rights in Alaska may be acquired in the following manners: public lands, private fee lands, unpatented Federal or State of Alaska mining claims, patented mining claims, and tribal lands. The primary sources for acquisition of these lands are the United States government, through the Bureau of Land Management and the United States Forest Service, the Alaskan state government, tribal governments, and individuals or entities who currently hold title to or lease government and private lands.

Tribal lands are those lands that are under control by sovereign Native American tribes. Areas that show promise for exploration and mining can be leased from or joint ventured with the tribe controlling the land, including land constituting the Tetlin Lease.

The State of Alaska government owns public lands. Mineral resource exploration, development and production are administered primarily by the State Department of Natural Resources. Ownership of the subsurface mineral estate, including alluvial and lode mineral rights, can be acquired by staking a 40-acre or 160-acre mining claim, which right is granted under Alaska Statute Sec. 38.05.185 to 38.05.275, as amended. The State of Alaska government continues to own the surface estate, subject to certain rights of ingress and egress owned by the claimant, even though the subsurface can be controlled by a claimant with a right to extract through claim staking. A mining claim is subject to annual assessment work requirements, the payment of annual rental fees and royalties due to the State of Alaska after commencement of commercial production. Both private fee-land and unpatented mining claims and related rights, including rights to use the surface, are subject to permitting requirements of federal, state, tribal and local governments.

Mine Types

Other than the former-producing mines located on the Lucky Shot Property (described below), which are not currently active, there are no existing mines on either the Peak Gold JV Property or any of the Contango Properties. Because the Peak Gold JV Property and the Contango Properties are all currently in the exploration stage, the Company has not determined the type of mine that may be established in the future in connection with any possible mineral production.

Peak Gold JV Property

The Peak Gold JV Property is located in the Tetlin Hills and Mentasta Mountains of eastern interior Alaska, 300 kilometers southeast of the city of Fairbanks and 20 kilometers southeast of Tok, Alaska. The Tetlin Lease covers an area measuring approximately 80 kilometers north-south by 60 kilometers east-west in eastern Interior Alaska. The project is located 15 kilometers from the Alaska Highway and 400 kilometers from the Fort Knox Milling Complex.

The Peak Gold JV Property is accessible via road connected to the Alaska Highway and via helicopter and via road. The 23-mile long Tetlin Village Road is an all-weather gravel road connecting the village with the town of Tok on the Alaska Highway. The majority of our Peak Gold JV Property is accessible only via helicopter, although many winter trails exist in the Tetlin Hills and Mentasta Mountains in the northern and southwestern parts of the properties, respectively. Winter trails link Tetlin Village to the village of Old Tetlin and continue south to the Tetlin River airstrip, a 1,500 foot long unmaintained gravel strip located in the Tetlin River Valley. Winter trails also provide access to the Tuck Creek valley from the village of Mentasta on the Tok Cutoff Highway.

Two seasonal dirt roads have been permitted and constructed to allow surface access to the Chief Danny gold-copper-silver prospect in the northern Tetlin Hills. Both of these roads begin along the Tetlin Village Road and extend to the Chief Danny project and access to both roads is controlled by gates at their junction with the Tetlin Village Road.

The paved Alaska Highway passes near the northern edge of the Peak Gold JV Property as does the southern terminus of the Taylor Highway where it joins the Alaska Highway at Tetlin Junction. The 23-mile long Tetlin Village Road provides year-round access to the northern Tetlin Hills, linking Tetlin Village to the Alaska Highway. Buried electrical and fiber-optic communications cables follow this road corridor and link Tetlin Village to the Tok power and communications grid. The Tok public electric facility is capable of generating up to 2 megawatts of power, and the nearest high capacity public electric facilities to the Peak Gold JV Property are in Delta Junction, 107 road miles northwest of the Peak Gold JV Property and Glennallen, 138 road miles southwest of the Peak Gold JV Property. The Company does not have any plant or equipment at the Peak Gold JV Property, and relies on contractors for the Peak Gold JV to perform work. The Company does not believe the Peak Gold JV Property was explored for minerals prior to exploration activities of the Company and the Peak Gold JV.

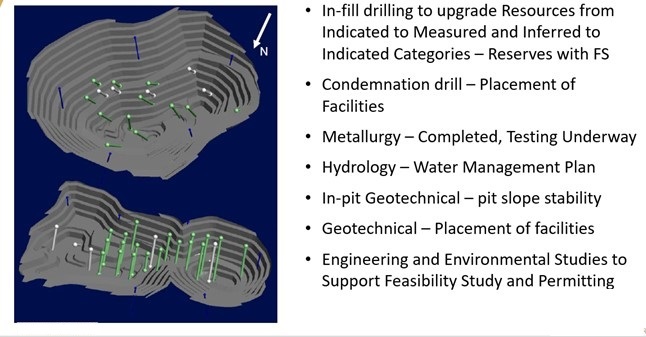

The map below depicts the Peak Gold JV Property and the State of Alaska mining claims owned by the Company:

Tetlin Lease

Juneau Exploration, L.P. (“JEX”) entered into the Tetlin Lease with the Tetlin Tribal Council, effective as of July 15, 2008. In November 2010, the Tetlin Lease was assigned to the Company and in January 2015, the Tetlin Lease was assigned to the Peak Gold JV. The Tetlin Lease’s current term extends to July 5, 2028, and for so long thereafter as the Peak Gold JV continues conducting exploration or mining operations on the Tetlin Lease.