EXHIBIT 99.1

ANNUAL INFORMATION FORM

Year ended December 31, 2017

March 14, 2018

- i -

|

FORWARD-LOOKING STATEMENTS |

2 |

|

MINERAL RESERVE AND RESOURCE ESTIMATES AND NOTICE TO U.S. READERS |

3 |

|

SHARE CONSOLIDATION |

3 |

|

CURRENCY AND EXCHANGE RATES |

4 |

|

CORPORATE STRUCTURE |

4 |

|

REORGANIZATION |

13 |

|

RISK FACTORS |

14 |

|

MINERAL PROPERTIES |

24 |

|

San Francisco Property |

24 |

|

Introduction and Technical Information |

24 |

|

Property Description and Location |

25 |

|

Accessibility, Climate, Physiography, Local Resources and Infrastructure |

26 |

|

History |

26 |

|

Geological Setting and Mineralization |

27 |

|

Exploration Programs |

28 |

|

Sampling, Analysis and Data Verification |

29 |

|

Mineral Resource and Reserve Estimates |

30 |

|

Operational Data |

35 |

|

Processing |

37 |

|

Capital and Cash Costs |

38 |

|

Economic Analysis |

39 |

|

Conclusions and Recommendations |

40 |

|

Ana Paula Property |

41 |

|

Summary |

41 |

|

Introduction and Technical Information |

41 |

|

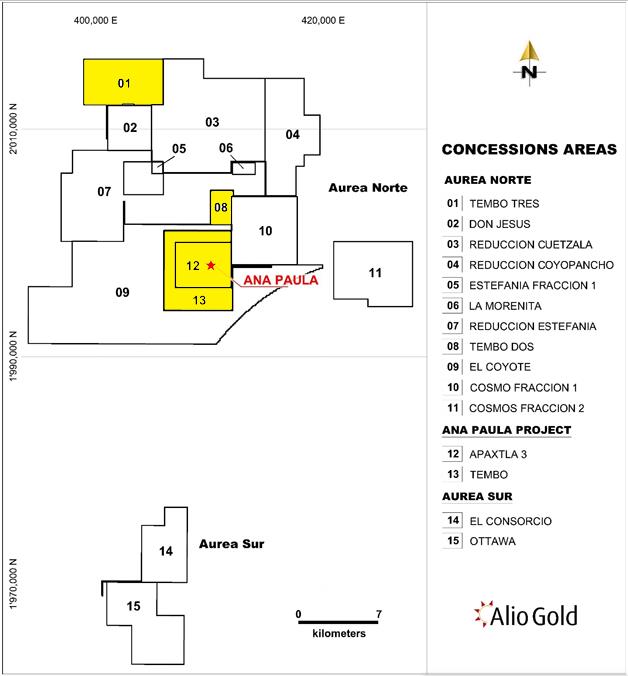

Property Description and Location |

41 |

|

History |

44 |

|

Geology and Mineralization |

45 |

|

Exploration and Drilling |

46 |

|

Sampling, Analysis and Data Verification |

47 |

|

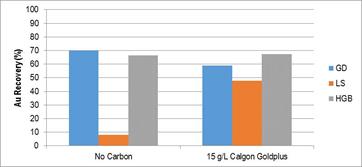

Metallurgy |

49 |

|

Mineral Resource Estimate |

53 |

|

Mineral Reserve Estimate |

55 |

|

Mining |

55 |

|

Mine Rock Management |

56 |

|

Recovery Methods |

57 |

|

Project Infrastructure |

59 |

|

Environmental Considerations and Permitting |

61 |

|

Capital Costs |

61 |

|

Operating Costs |

62 |

|

Economic Analysis |

62 |

|

Conclusions |

64 |

|

Recommendations |

64 |

|

DIVIDENDS |

65 |

|

CAPITAL STRUCTURE |

66 |

|

MARKET FOR SECURITIES |

67 |

|

ESCROWED SECURITIES |

67 |

|

DIRECTORS AND OFFICERS |

68 |

|

Director and Officer Information |

68 |

|

Shareholdings of Directors and Officers |

69 |

|

Corporate Cease Trade Orders or Bankruptcies |

70 |

|

Penalties or Sanctions |

70 |

|

Conflicts of Interest |

71 |

|

LEGAL PROCEEDINGS AND REGULATORY ACTIONS |

71 |

|

INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS |

71 |

|

REGISTRAR AND TRANSFER AGENT |

71 |

|

MATERIAL CONTRACTS |

72 |

|

TECHNICAL INFORMATION |

72 |

|

INTEREST OF EXPERTS |

72 |

|

AUDIT COMMITTEE INFORMATION |

73 |

|

ADDITIONAL INFORMATION |

75 |

|

APPENDIX 1 |

A-1 |

- i -

2

Unless otherwise stated or the context requires otherwise, references in this Annual Information Form (“AIF”) to the “Company”, “Alio Gold”, “Alio”, “we”, “us” or “our” refer to Alio Gold Inc. and its subsidiaries on a consolidated basis.

Certain statements contained in this AIF may constitute “forward-looking statements” or “forward-looking information” (collectively, “forward-looking statements”) and are made pursuant to the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 and Canadian securities laws. Forward-looking statements are statements which relate to future events. Such statements include estimates, forecasts and statements with respect to project development risks and estimated future production and cash costs, future trends, plans, strategies, objectives and expectations, including with respect to costs, capital requirements, availability of financing, production, exploration and reserves and resources, projected production at the Company’s San Francisco Property (as defined below) and Ana Paula Project (as defined below), including estimated internal rate of return and projected production, exploitation activities and potential, future operations, projected operational updates to the Ana Paula Project (as defined below), expectations regarding environmental studies at the Ana Paula Project (as defined below), expectations regarding permitting at the Ana Paula Project (as defined below) and expectations regarding the payment of dividends on the Company’s common shares. Information inferred from the interpretation of drilling results and information concerning mineral resource estimates may also be deemed to be forward-looking statements, as it constitutes a prediction of what might be found to be present when, and if, a project is developed. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans, “anticipates”, believes”, “estimates”, “predicts”, “potential”, or “continue” or the negative of these terms or other comparable terminology. All statements and information other than statements of historical fact may be forward-looking statements.

These forward-looking statements are based on a number of assumptions, including: the successful completion of development projects, planned expansions or other projects within the timelines anticipated and at anticipated production levels; the accuracy of reserve and resource, grade, mine life, cash cost, net present value and internal rate of return estimates and other assumptions, projections and estimates made in the technical reports for the San Francisco Property and the Ana Paula Project; that mineral resources can be developed as planned; interest and exchange rates; that required financing and permits will be obtained; general economic conditions; that labor disputes, flooding, ground instability, fire, failure of plant, equipment or processes to operate are as anticipated and other risks of the mining industry will not be encountered; the price of gold, silver and other metals; competitive conditions in the mining industry; title to mineral properties; and changes in laws, rules and regulations applicable to the Company.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements, or industry results, to differ materially from those anticipated in such forward-looking statements. The Company believes the expectations reflected in such forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct and readers are cautioned not to place undue reliance on forward-looking statements due to the inherent uncertainty thereof. Some of the risks and other factors which could cause actual results to differ materially from those expressed in the forward-looking statements contained in this AIF include, but are not limited to: decreases in the price of gold; competition with other companies with greater financial and human resources and technical facilities; risks associated with doing business in Mexico; maintaining compliance with governmental regulations and expenses associated with such compliance; ability to hire, train, deploy and manage qualified personnel in a timely manner; ability to obtain or renew required government permits; failure to discover new reserves, maintain or enhance existing reserves or develop new operations; risks and hazards associated with exploration and mining operations; accessibility and reliability of existing local infrastructure and availability of adequate infrastructures in the future; environmental regulation; land reclamation requirements; ownership of, or control over, the properties on which the Company operates; maintaining existing property rights or obtaining new rights; inherent uncertainties in the process of estimating mineral reserves and resources; reported reserves and resources may not accurately reflect the economic viability of the Company’s properties; uncertainties in estimating future mine production and related costs; risks associated with expansion and development of mining properties; currency exchange rate fluctuations; directors’ and officers’ conflicts of interest; inability to access additional capital; problems integrating new acquisitions and other problems with strategic transactions; legal proceedings; uncertainties related to the repatriation of funds from foreign subsidiaries; no dividend

3

payments; volatile share price; negative research reports or analyst’s downgrades and dilution; and other factors contained in the section entitled “Risk Factors” in this AIF.

Although the Company has attempted to identify important factors that could cause actual results or events to differ materially from those described in the forward-looking statements, you are cautioned that this list is not exhaustive and there may be other factors that the Company has not identified. Furthermore, the Company undertakes no obligation to update or revise any forward-looking statements included in this AIF if these beliefs, estimates and opinions or other circumstances should change, except as otherwise required by applicable law.

MINERAL RESERVE AND RESOURCE ESTIMATES AND NOTICE TO U.S. READERS

The Company is subject to the reporting requirements of the applicable Canadian securities laws, and as a result reports mineral reserves and resources according to Canadian standards. Canadian reporting requirements for disclosure of mineral properties are governed by National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”). The definitions of NI 43-101 are adopted from those given by the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”). U.S. reporting requirements are governed by Industry Guide 7 (“Guide 7”) of the Securities and Exchange Commission (the “Commission”). These reporting standards have similar goals in terms of conveying an appropriate level of confidence in the disclosures being reported, but embody different approaches and definitions. For example, under Industry Guide 7, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. We report “resources” in accordance with NI 43-101. While the terms “Mineral Resource,” “Measured Mineral Resource,” “Indicated Mineral Resource” and “Inferred Mineral Resource” are recognized and required by Canadian regulations, they are not defined terms under standards of the Commission and generally, U.S. companies are not permitted to report resources in documents filed with the Commission. As such, certain information contained in this AIF concerning descriptions of mineralization and resources under Canadian standards is not comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of the Commission. In addition, an Inferred Mineral Resource are conceptual in nature, and are estimated based on limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity. While an Inferred Resources has a lower level of confidence than that applying to an Indicated Mineral Resource, it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to a Indicated Mineral Resources with continued exploration. Inferred Mineral Resource cannot be converted to Mineral Reserve and are not used in Pre-feasibility and Feasibility level studies. In addition, the definitions of “Proven Mineral Reserves” and “Probable Mineral Reserves” under CIM standards differ in certain respects from the standards of the Commission.

On May 12, 2017, the Company effected a consolidation of its outstanding shares on a 10:1 basis. In this AIF, unless otherwise stated, capital balances prior to May 12, 2017, are stated on a pre-consolidation basis. All other capital balances are stated on a post consolidation basis.

4

All dollar amounts in this AIF are expressed in United States dollars, unless otherwise indicated. References in this AIF to “dollars” or “$” are to United States dollars. References in this AIF to “C$” are to Canadian dollars. The following table sets forth the value of the Canadian dollar expressed in United States dollars on December 31 of each year and the average, high and low exchange rates during the year indicated based on the noon and daily average rate of exchange, as applicable, as reported by the Bank of Canada:

|

|

Twelve Months Ended December 31 |

||

|

|

2017 |

2016 |

2015 |

|

Average rate for period |

0.7701 |

0.7550 |

0.7821 |

|

Rate at end of period |

0.7971 |

0.7448 |

0.7225 |

|

High for period |

0.8245 |

0.7977 |

0.8511 |

|

Low for period |

0.7276 |

0.6869 |

0.7161 |

The daily average rate of exchange on March 14, 2018, as reported by the Bank of Canada for the conversion of Canadian dollars into United States dollars was C$1.00 equals $0.7726.

Name, Address and Incorporation

The Company was incorporated pursuant to the Business Corporations Act (British Columbia) on March 17, 2005. On May 12, 2017, the Company changed its name from “Timmins Gold Corp.” to “Alio Gold Inc.”

The Company’s head office is located at Suite 507 – 700 West Pender Street, Vancouver, British Columbia, V6C 1G8. The Company’s registered and records office is located at Blake, Cassels & Graydon LLP, 595 Burrard Street, Suite 2600, Vancouver, BC V7X 1L3. The Company’s subsidiary office in Mexico is located at Blvd. Solidaridad #335 A, Local 3, Col Las Palmas, Hermosillo, Sonora, Mexico, 83270. The subsidiary also maintains a field office at the San Francisco Property (as defined under “General Development of the Business – Overview” below), near Estacion Llano, Sonora.

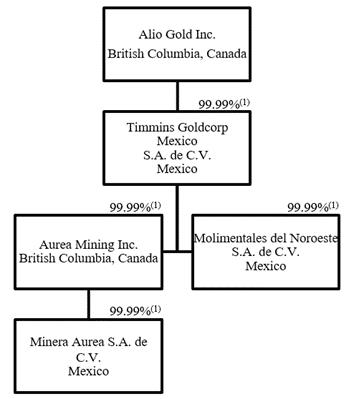

Intercorporate Relationships

The Company had five subsidiaries: Timmins Goldcorp Mexico, S.A. de C.V. (“Timmins Mexico”), Molimentales del Noroeste, S.A. de C.V. (“Molimentales”), Newstrike Capital Inc. (“Newstrike”), Aurea Mining Inc. (“Aurea”) and Minera Aurea, S.A. de C.V. (“Minera Aurea”). All subsidiaries are wholly owned except for nominal shareholders holding one share in each of the Mexican subsidiaries. Timmins Mexico was incorporated pursuant to the laws of Mexico on March 23, 2005 and is the entity through which the Company conducts its Mexican operations, except for its operations in Guerrero, Mexico. Molimentales was acquired on March 20, 2007, and was incorporated pursuant to the laws of Mexico for the principal purpose of holding the mineral concessions and infrastructure that constitute the San Francisco Mine (as defined below). In May 2015 the Company acquired all of the outstanding shares of Newstrike. Newstrike was incorporated pursuant to the Business Corporations Act (Alberta) on November 7, 2000 under the name “Erez Inc.”. The name was changed to MCS Global Corp. on June 20, 2003. On April 21, 2006 MCS Global Corp. continued to British Columbia under the Business Corporations Act (British Columbia) and changed its name to “Newstrike Capital Inc.” on May 5, 2006. In 2008 Newstrike, acquired all of the outstanding shares of Aurea. Aurea was incorporated pursuant to the Business Corporations Act (British Columbia). Aurea holds all but one of the outstanding shares of Minera Aurea which was incorporated pursuant to the laws of Mexico on March 22, 2004. Minera Aurea owns the Ana Paula gold project in Guerrero, Mexico.

5

In September 2017, the Company began a process of restructuring its subsidiaries to simplify the Company’s corporate organizational structure. The Company and its subsidiaries completed the following series of transactions in October 2017:

|

|

(a) |

A new, wholly-owned, Canadian subsidiary of the Company was formed (“NewCo”); |

|

|

(b) |

The Company then sold all of the issued and outstanding common shares of Newstrike to NewCo, resulting in Newstrike becoming a wholly-owned subsidiary of NewCo; |

|

|

(c) |

Aurea amalgamated with its parent company, Newstrike, with the effect that the two companies continued as one company, except that the legal existence of Aurea did not cease, and Aurea was deemed to have survived the amalgamation, becoming a wholly-owned subsidiary of NewCo; |

|

|

(d) |

Aurea then performed a similar amalgamation with its subsequent parent company, NewCo, with the effect that the two companies continued as one company, except that the legal existence of Aurea did not cease, and Aurea was deemed to have survived the amalgamation, becoming a wholly-owned subsidiary of Alio Gold; and, |

|

|

(e) |

The Company then sold all but one of the issued and outstanding common shares of Aurea to Timmins Mexico. |

The reorganization did not involve any change in the Company’s business, management, Board, facilities, assets or liabilities and there were no dispositions or transfers of title of Aurea’s assets. The Company’s current corporate structure is included below:

|

|

(1) |

The Company is the registered owner of 99.99% of the shares. The remaining 0.01% of the shares are held by nominal shareholders. |

6

GENERAL DEVELOPMENT OF THE BUSINESS

Overview

The Company is a publicly traded gold producer engaged in the operation, development, exploration and acquisition of resource properties, primarily in Mexico. The Company owns and operates the San Francisco open pit gold mine (the “San Francisco Mine”), which together with the associated La Chicharra open pit gold mine, and additional exploration claims in and around the mines (collectively, the “San Francisco Property”) consists of approximately 53,380 hectares of surface area in the state of Sonora, Mexico. The term San Francisco Project refers to the area within the exploitation or mining concessions controlled by the Company (the “San Francisco Project”). In addition, the Company is developing the Ana Paula property in the state of Guerrero, Mexico (the “Ana Paula Project”). The Company’s goal is to become an intermediate gold producer through developing and/or acquiring assets.

Locations of the Company’s Assets

7

Recent Developments

On May 12, 2017, the Company effected a consolidation of its outstanding shares on a 10:1 basis. In this AIF, unless otherwise stated, capital balances prior to May 12, 2017, are stated on a pre-consolidation basis. All other capital balances are stated on a post consolidation basis.

2015

On May 26, 2015, the Company completed a plan of arrangement (“Arrangement”) with Newstrike, owner of the Ana Paula Project, pursuant to which the Company acquired all of the issued and outstanding common shares of Newstrike by way of a court approved plan of arrangement. Under the terms of the Arrangement, Newstrike shareholders received 0.9 of a common share (“Exchange Ratio”) and C$0.0001 in cash for each Newstrike common share (a “Newstrike Share”). In addition, each outstanding option to purchase a Newstrike Share was exchanged for an option to purchase a common share of the Company, based upon the Exchange Ratio.

In July 2015, the Company commenced a drill program at its Ana Paula Project designed to confirm the drilling of previous owners and carry out select infill drilling. The program consisted of 2,000 m in ten core holes. The results of this drilling were consistent with those from previous drill programs and helped to increase the confidence of the block model via increased drill density at the core of the deposit.

In July 2015, the Company drifted into underground veins parallel to the south wall of the San Francisco pit. The drift was part of a pilot phase designed to test mining and processing of the underground ore. Previous drilling had delineated three mineralized veins near the south wall of the San Francisco pit located within 50 to 100 m of the current south pit wall. The pilot phase involved drifting 90 m into the south wall of the pit to access the veins followed by 200 m of lateral drifting to extract a bulk sample of ore. The pilot phase allowed the Company to test ground conditions, mining costs, grade and metallurgical recovery of the underground ore. The program was put on hold during the third quarter of 2015 due to the depressed gold price. The program provided useful information. The Company continues to evaluate the underground potential at the San Francisco Property, however it is not a priority at this time.

On October 6, 2015, the Company’s employment agreement with Bruce Bragagnolo ended. Mr. Bragagnolo resigned as a director of the Company and was replaced by Mark Backens as Interim CEO.

On November 2, 2015, the Company acquired a process plant and select auxiliary equipment (“Plant”) used by Goldcorp Inc. (“Goldcorp”) in the operation of its El Sauzal Mine in Chihuahua, Mexico (“Plant Acquisition”). The El Sauzal Mine was operational until December 2014 when Goldcorp began its closure. The Plant was acquired by the Company for future use at the Ana Paula Project.

The total purchase price of C$8.0 million consisted of the following:

|

|

(a) |

C$1.0 million in cash paid on closing; |

|

|

(b) |

C$3.0 million which was satisfied by the issuance of 10 million shares in the capital of the Company at a price of C$0.30 per share on closing; and |

|

|

(c) |

C$4.0 million in cash payable to Goldcorp one year from closing. |

8

The closing of the Plant Acquisition was subject to, among other things, the completion of a C$6.0 million investment by Goldcorp in the Company by way of a non-brokered private placement of 20 million units of the Company (“Private Placement”) at a price of C$0.30 per unit. Each unit consisted of one share and one half of a warrant, each whole warrant being exercisable for a term of 24 months into a common share of the Company at a price of C$0.35 per share. The warrants are subject to an accelerated exercise period of 10 days if the Company's closing share price meets or exceeds C$0.60 per share for 20 consecutive trading days. As a result of the Plant Acquisition and Private Placement, Goldcorp, upon closing of both transactions, held approximately 9.9% of the Company’s issued and outstanding common shares on an undiluted basis. During the fourth quarter of 2015 the demobilization of the El Sauzal Mine began and approximately 15% of the total demobilization was complete by December 31, 2015.

On November 2, 2015, the Company announced that, assuming the gold price retained in its then current range of approximately $1,000 per gold ounce over the next year, open pit operations would cease at the San Francisco Mine in the second half of 2016, at which point the mine would be placed on care and maintenance. Heap leach operations would continue through early 2017. Full operations could then resume if and when gold prices returned to higher levels. The focus of the 2016 mine-out was to mine the highest margin ounces to maximize free cash flow during that period.

On December 31, 2015, the Company announced that it had agreed to an extension to January 31, 2016, of its existing $10.2 million credit facility with Sprott Resource Lending Partnership (“Sprott”) and Morgan Stanley Capital Group Inc. In consideration of the extension, the Company paid a fee to Sprott as administrative agent in the amount of $150,000. On January 26, 2016, the credit facility was amended to replace Morgan Stanley Capital Group Inc. with Goldcorp (together with Sprott, the “Lenders”) and to extend the maturity date to June 30, 2016. Interest was payable monthly at the rate of 12% per annum. In consideration of the re-financing the Company paid a $408,901 bonus to the Lenders. The bonus was payable in cash or shares at the option of each Lender, in relation to its proportion of the credit facility, on the earlier of the repayment and June 30, 2016.

2016

In June 2016, the Company repaid its $10.2 million credit facility with the Lenders. A cash bonus of $204,450 was paid to Sprott and a cash bonus of $70,416 was paid and 550,000 common shares were issued to Goldcorp pursuant to the terms of the credit agreement.

The Company repaid its C$2.0 million loan from Zebra Holdings and Investments S.à.r.l. and Lorito Holdings S.à.r.l. in June 2016.

In June 2016, the Company completed the demobilization of the El Sauzal Mine acquired in September 2015. The final C$4.0 million payment to Goldcorp was made in October 2016 in accordance with the terms of the agreement.

Darren Prins resigned as Chief Financial Officer of the Company in June 2016.

On July 20, 2016, the Company completed the sale of the Caballo Blanco Project in Veracruz, Mexico (which the Company originally acquired in December 2014) to Candelaria Mining Corp. Consideration for the sale was $12.5 million cash and the assumption of the $5.0 million contingent payment.

In August 2016, the Company announced a new mine plan for its San Francisco Mine which included extended operations into 2023.

In August 2016, the Company announced the commencement of pre-construction activities at the Ana Paula Project including feasibility work, infill drilling, metallurgical test-work and environmental baseline and permitting activities.

9

The estimated budget for the pre-construction program is approximately $9.2 million and includes:

|

|

(a) |

$2.2 million - Drilling, including soil sampling and trenching; 10,000 meters of core drilling for resource definition, 2,000 meters of core drilling for geotechnical work, and 4,000 meters of reverse circulation (“RC”) drilling for condemnation; |

|

|

(b) |

$3.4 million - Feasibility work program; and |

|

|

(c) |

$3.6 million - Environmental studies and construction permits. |

On November 30, 2016, the Company closed a bought deal offering of 36,400,000 units of the Company (the “Units”), at a price C$0.55 per Unit for gross proceeds to the Company of approximately C$20.0 million. The Units were issued in a public offering in all of the provinces of Canada, other than Québec, pursuant to a short form prospectus dated November 28, 2016. The financing was underwritten by a syndicate of underwriters led by National Bank Financial Inc. and RBC Capital Markets and included BMO Nesbitt Burns Inc., PI Financial Inc., Scotia Capital Inc. and TD Securities Inc. Each Unit consists of one common share of the Company and one-half of one common share purchase warrant (each whole common share purchase warrant, a “Warrant”). Each Warrant entitles the holder to acquire one common share at a price of C$0.70 at any time prior to May 30, 2018. The proceeds of the offering are intended to be used for exploration and preconstruction activities at the Ana Paula Project and for working capital purposes.

2017

Effective February 1, 2017, Greg McCunn was appointed Chief Executive Officer of the Company replacing Interim Chief Executive Officer Mark Backens. Mr. McCunn also joined the Company’s board of directors.

On April 10, 2017, the Company received authorization of the Environmental Impact Assessment for the Ana Paula Project from the Mexican regulator, the Secretaría de Medio Ambiente y Recursos Naturales (“SEMARNAT”).

On April 25, 2017, the Company announced additional changes to its management team, as follows:

|

|

• |

Colette Rustad was appointed as Executive Vice President and Chief Financial Officer; |

|

|

• |

Jose Hector Figueroa was appointed as Vice President of Operations; |

|

|

• |

Paul Hosford was appointed as Vice President of Project Development; |

|

|

• |

Jason Gregg was appointed as Executive Vice President of Human Resources; |

|

|

• |

Miguel Bonilla was promoted to Country Manager Mexico; and, |

|

|

• |

Arturo Bonillas resigned as President of the Company. |

On May 11, 2017, the Company announced the revitalization plan for the San Francisco Property, and subsequently filed the updated San Francisco Report (as defined below) on May 26, 2017. On May 16, 2017, the Company announced the results of a preliminary feasibility study on its Ana Paula Project, and subsequently filed the updated Ana Paula Report (as defined below) on May 26, 2017, and a further revised version of the Ana Paula Report on June 12, 2017, which incorporated non-material changes to the previously filed version. In July 2017, a definitive feasibility study (“DFS”) in respect of the Ana Paula Project commenced.

On May 12, 2017, the Company changed its name to Alio Gold Inc. (the “Name Change”) and effected a consolidation of its outstanding shares on a 10:1 basis (the “Consolidation”). Following the Consolidation, the number of outstanding common shares of the Company was approximately 35,562,860. The common shares commenced trading on a post-Consolidation basis on the TSX and NYSE AMERICAN on May 16, 2017 under the ticker symbol ALO.

10

During the second half of 2017, steps were undertaken to revitalize the San Francisco Property. A waste stripping campaign was undertaken to open-up the main pit in phase 5 and 6 which has resulted in increased mining flexibility and the ability to deliver consistent ore feed to the leach pads. The main pit is now open across multiple mining faces as the ramp-up of pre-stripping reached sustainable and planned levels toward the end of 2017.

On July 6, 2017, the company also announced the appointment of Lynette Gould as Vice President of Investor Relations of the Company effective July 5, 2017.

On July 20, 2017, the Company closed a bought deal offering of 8,062,000 units of the Company (the “2017 Units”), at a price C$6.25 per 2017 Unit for gross proceeds to the Company of approximately C$50.4 million. The 2017 Units were issued in a public offering in all of the provinces of Canada, other than Québec, pursuant to a short form prospectus dated July 12, 2017. The financing was underwritten by a syndicate of underwriters led by Cormark Securities Inc., and Clarus Securities Inc., and included Raymond James Ltd., and BMO Nesbitt Burns Inc. Each Unit consists of one common share of the Company and one-half of one common share purchase warrant (each whole common share purchase warrant, a “2017 Warrant”). Each 2017 Warrant entitles the holder to acquire one common share at a price of C$8.00 at any time prior to July 20, 2018. The net proceeds of the offering are intended to be used by the Company to advance the Ana Paula project and for general corporate purposes.

On September 1, 2017, Anthony Hawkshaw retired from the board of directors.

On September 18, 2017, the Company announced that the board of directors of the Company had formally approved and underground exploration decline and exploration program at its Ana Paula Project. The Company also received authorization to start construction of the decline from Mexico’s Secretary of Environment and Natural Resources. The Company also initiated a regional exploration program for the remainder of 2017 on a 56,000-hectare land package in the Guerrero Gold Belt.

On September 21, 2017, the Company received its Change of Land Use Approval for the Ana Paula Project. This approval covers the 370 hectares required for the proposed open pit mine, waste storage, process plant and the tailings storage facility.

On October 19, 2017, the Company announced that Goldcorp exercised its warrants that expire on October 19, 2017, for total proceeds of C$3.5 million. The Company has also exercised a buyback right from Goldcorp of a 1% net smelter royalty of its Ana Paula Project for US$2.9 million.

On October 26, 2017, the Company announced that it had awarded the contract for developing the underground decline at the Ana Paula Project. The Company has engaged JDS Energy and Mining to manage the contract and underground mining operation.

On December 4, 2017, the Company provided an exploration update from the Ana Paula Project and announced the completion of the 2,000 metre drill program to twin previous drill holes within the pre-feasibility pit for metallurgical test work samples. The Company also announced that it initiated a surface drill program to target the high-grade breccia below the pre-feasibility pit. Drilling, consisting of six drill holes of 600 to 700 meters each is currently being undertaken on a 24x7 basis with one drill rig. This extension will be further tested from drilling underground, which is expected to commence in the third quarter of 2018, consisting of 55 diamond drill holes (12,000 meters), including geochemical sampling and assaying. Construction of the decline commenced in December, 2017, with the mine portal site prepared and under construction. The decline is expected to reach the mineralized area during the third quarter of 2018, in time for drilling. The drill program is expected to confirm the continuity and shape of the high-gold mineralization below the proposed pit that is hosted in the breccia and it will also explore the gold mineralization indications at depth hosted in hornfels skarn, typical of the Guerrero Gold Belt. The explosives magazine site has been completed and surface infrastructure including offices and workshops have been installed to support mining. A 100 person camp was ordered in December 2017 and is currently being fabricated off-site. The permit for the camp site was received in February 2018 and the camp is expected to be fully-functional in April 2018.

11

In addition to exploration at the Ana Paula Project, the Company continued to advance its DFS during 2017. The DFS is using the same group of consultants for continuity, and will be based on the updated mineral resource estimate and mine plan as well as additional metallurgical testing.

During 2017, the DFS was advanced significantly to derisk the project in the last half of 2017, including:

|

|

(a) |

Additional metallurgical testwork. The testwork indicates that a significant amount of arsenic is leached in the ambient oxidization process. Arsenic removal technology has been identified and tested. Comminution and flotation optimization testwork has also been completed, which indicated that the ore hardness is similar to that indicated in the Ana Paula Report (defined below). |

|

|

(b) |

A field program of geological mapping, borehole drilling and seismic evaluation to characterize the ground conditions for the tailings, waste dump and plant site areas. The geotechnical program identified that the ground conditions in the area of the proposed Ana Paula Report (defined below) tailings dam embankment and the plant site areas are not favourable and a number of trade-off studies were initiated to investigate new locations or configurations for these facilities. Additional trade-off studies were also initiated to evaluate a number of tailings storage options to cost effectively manage arsenic bearing tailings material to meet water quality criteria. These studies and subsequent water balance and quality modelling are in progress and further drilling is needed to confirm the hydrogeology at the tailings site. |

|

|

(c) |

Offsite infrastructure development. A System Impact Study and a Facilities Study are underway to confirm the point of connection to grid power and the costs of connection, respectively. The access road was upgraded to improve road conditions and travel time, and a route accessing the project site via existing roads from the north has been delineated. Minor upgrades were completed on the northern route to allow access to site for the underground mining equipment, camp and support facilities. Further road widening is underway and it is expected that construction of bypass roads will be required for permanent operation. |

The initial scope of the DFS was initially contemplated to be similar to the Ana Paula Report (defined below) in that it contemplated an open-pit mine with a processing plant producing approximately 116,000 ounces of gold per year for 8 years. The Company announced on February 21, 2018 that it is currently evaluating a change in scope to the DFS which would include an underground mine component, and will incorporate results from the underground exploration drilling. The addition of the underground mine has the potential to enhance the Ana Paula Project for several reasons:

|

|

(a) |

Previous drilling has confirmed that the mineralization extents approximately 300 meters below the proposed pit. Increased drilling has the potential to add further Mineral Resources below the proposed pit. |

|

|

(b) |

The processing plant that is expected to be used for processing ore at the Ana Paula Project previously operated at 6,000 tonnes per day. The basis for the Ana Paula Report for the project is 5,000 tonnes per day of ore being mined from an open pit mine as the geometry of the pit limits ore production. If additional ore can be provided from the underground mine, the production profile and the unit costs of production could be enhanced. |

|

|

(c) |

The current open pit design envisions three distinct phases, with the final phase involving a significant push-back of the pit walls to allow deeper mining from surface. It is likely that the third phase of the proposed pit could be more efficiently mined from underground, improving the economics of the project by a reduction in waste movement from surface. |

|

|

(d) |

An underground mining operation could also enhance the project by allowing for the tailings from the ambient oxidation process to be stored underground as back-fill. This would eliminate the need for additional surface tailings facilities and allowing the inert flotation tailings to be stored on surface in an unlined tailings storage facility. |

12

The Company anticipates that, upon completion of the DFS, the DFS will provide a higher level of confidence in the project economics than the Ana Paula Report (defined below) and allow the Company to make an investment decision whether to proceed with construction of the project as well as provide technical support for potential debt financing. The Company has commenced discussions on financing alternatives for the Ana Paula Project, and a number of proposals were received and reviewed. The Company will pursue a financing package with a balance of the lowest overall cost, the least restrictive covenants and the flexibility to allow the Company to pursue its growth strategy. In the fourth quarter of 2017, opportunities to reduce capital expenditures envisioned in the revitalization plan for the San Francisco Project were investigated. In particular, crushing improvements which targeted improved metallurgical recovery were put on hold to evaluate improvements in recovery obtainable by improvements in blasting in open pit.

In December 2017, a dual cut-off strategy was implemented at the San Francisco Project which involves trucking lower grade run-of-mine ore to old heap leach pads while higher cut off grade material is fed to the crusher. Run-of-mine ore was placed under leach in January 2018 and approximately 10% of the San Francisco production is expected to come from run of mine leaching in 2018. As at February 28, 2018, approximately 788,000 tonnes of run of mine ore grading an average of 0.16 g/t gold had been stacked on historical leach pads 1 and 2, and stacking is continuing at a rate of 15,000-20,000 tonnes per day. Recovery of gold from run of mine ore is estimated to be 30% during the first 120 days, with 40% as the expected long-term recovery rate. It is expected that all ore mining activity will be in the main pit during 2018, with ore production from La Chicharra Phase 2 expected to commence in 2019.

In addition, the power upgrade project which commenced in the third quarter of 2017 was put on hold while discussions with power authorities (“CFE”) were undertaken. During the fourth quarter of 2017, the CFE requested the Company pay for additional infrastructure not contemplated in the original scope of work. While dialogue continues, the project has been put on hold.

On January 30, 2018, the company announced gold production guidance for its San Francisco Mine of between 90,000 and 100,000 ounces at all-in sustaining costs between $1,000 and $1,100 per ounce and total capital and mine site exploration spending between $2.5 and $3.0 million.

In preparation for the departure of Miguel Soto, Vice President Exploration for Alio at the end of February 2018, the exploration function at the San Francisco Mine has been transferred to the mine site under the direction of the General Manager. At the Ana Paula Project, the Company has engaged Ms. Gillian Kearvell as a consultant to oversee the current exploration program.

In the fourth quarter of 2017, the Company appointed Joe Campbell as General Manager of the San Francisco Mine and Jorge Lozano as Manager, Mining. Jose Hector Figueroa, VP Operations, completed a handover to the new mine management team and left the Company at the end of February 2018.

Gold Sales

The Company delivers gold and silver in doré form to an international precious metal refinery in North America where the doré may, at the Company’s option, be converted into London Good Delivery metal, or alternatively, be sold to the refiner. Gold is delivered to the refinery by armoured, insured carriers. If the metal is returned to the Company, it is sold to international bullion dealers.

Metal Revenues

In 2017, the Company sold 83,211 gold ounces at an average realized gold price of $1,256 per ounce, compared to sales of 100,480 gold ounces at an average realized gold price of $1,234 per ounce during 2016. This represents a decrease of 17% in gold ounces sold and an increase of 2% in realized gold price over 2016.

Total metal revenues from mining operations in 2017 were $105.2 million compared to $123.9 million during 2016, due to lower gold ounces sold.

13

The Company holds open option contracts whereby the Company purchased the option to sell gold ounces at a set price (“put option”) and financed the purchase price of this put option by selling the right to a third party to purchase a number of the Company’s gold ounces at a set price (“call option”).

At December 31, 2017, the Company held 25,000 of these option contracts. Subsequent to December 31, 2017, the Company acquired an additional 35,000 options contracts. At March 14, 2018, 10,000 contracts had expired. Open contracts have a put price of $1,250 per ounce and call prices between $1,387 and $1,469 per ounce.

Environmental Protection Requirements

Mining, exploration and development activities are subject to various levels of federal, provincial, state and local laws and regulations relating to the protection of the environment, including requirements for closure and reclamation of mining properties.

The Company’s total liability for reclamation and closure cost obligations at December 31, 2017, was $4.1 million and was calculated using an effective weighted discount rate of 7.5%. The undiscounted value of this liability is $5.3 million, calculated using an effective weighted inflation rate assumption of 3.5%. Reclamation expenditures for the year ended December 31, 2017, were nil.

Environmental Policies

The Company implemented an environmental policy in August 2017 (the “Environmental Policy”). The Environmental Policy affirms the Company’s belief that effective environmental management is paramount to a successful future. To promote its commitment to environmental management, the Company has committed to develop and maintain a comprehensive environmental management system with environmental targets for each project and promote employee commitment to environmental performance through appropriate training and periodic evaluations. Furthermore, the Company has committed to conduct business in a manner that attempts to minimize any potential environmental impacts, foster mutually beneficial environmental partnerships with host communities and maintain open and transparent communication with stakeholders that may be impacted by its operations. Finally, the Company has committed to identify and protect sites of environmental or cultural significance, provide for the reclamation and rehabilitation of areas impacted by its operations and maintain a culture where environmental, social, cultural and economic considerations are integrated into all planning and decision-making processes.

Employees

As of December 31, 2017, the Company had 11 full-time employees or contractors at its head office in Vancouver, Canada. In addition, the Company had 16 full-time employees at its office in Hermosillo, Mexico, and 55 full-time employees and 43 contractors at the Ana Paula Project. At its San Francisco Project the Company had 274 employees and 194 skilled mining personnel provided by a mining contractor.

In September 2017, the Company began a restructuring process to simplify its corporate structure and completed a series of transactions to this effect in October 2017. See “Corporate Structure”.

14

Risk Factors Relating to the Company’s Business

The Company’s revenue is derived primarily from the sale of gold, and therefore decreases in the price of gold may cause the Company’s revenue to decrease substantially.

The majority of the Company’s revenue is derived from the sale of gold, and therefore fluctuations in the price of gold represent one of the most significant factors affecting the Company’s operations and profitability. To a lesser extent, the Company also generates revenue from other by-product or co-product metals, such as silver. The prices of gold and other commodities have fluctuated widely in recent years and are affected by numerous factors beyond the Company’s control, including:

|

|

• |

levels of supply and demand; |

|

|

• |

global or regional consumptive patterns; |

|

|

• |

sales by government holders; |

|

|

• |

metal stock levels maintained by producers and others; |

|

|

• |

increased production due to new mine developments and improved mining and production methods; |

|

|

• |

speculative activities; |

|

|

• |

inventory carrying costs; |

|

|

• |

availability and costs of metal substitutes; |

|

|

• |

international economic and political conditions; |

|

|

• |

interest rates; |

|

|

• |

currency values; and |

|

|

• |

inflation or deflation. |

The market prices of gold and other metals may decline from current levels. Declining market prices for gold or other metals could materially adversely affect the Company’s operations and profitability. Further, a decline in the market price of gold may also require the Company to write-down its mineral reserves or resources, which would have a material adverse effect on its earnings and profitability.

The Company operates in a highly competitive industry with many large competitors, and it expects that competition may intensify in the future.

The gold mining industry is intensely competitive, and the Company competes with other companies that have greater financial and human resources and technical facilities. Competition is primarily for mineral-rich properties which can be developed and produced economically; the technical expertise to find, develop, and produce such properties; the labor and equipment to operate such properties; and the capital to finance the development of such properties. Many of the Company’s competitors not only explore for and mine precious metals, but conduct refining and marketing operations on a worldwide basis and have far greater financial and technical resources than the Company. Such competition may result in the Company being unable to acquire desired properties, recruit or retain qualified employees or acquire the capital necessary to fund its operations and develop its properties, which could have an adverse effect on results.

15

The Company is subject to particular risks associated with doing business in Mexico, any of which could result in additional costs to the Company and cause its operating results to suffer.

The Company’s only operating mine and all of its exploration and development properties are located in Mexico. In the past, Mexico has been subject to a number of risks and uncertainties, including:

|

|

• |

terrorism and hostage taking; |

|

|

• |

expropriation or nationalization without adequate compensation; |

|

|

• |

difficulties enforcing judgments obtained in Canadian or United States courts against assets located outside of those jurisdictions; |

|

|

• |

high rates of inflation; |

|

|

• |

changes to royalty and tax regimes; |

|

|

• |

substantial fluctuations in currency exchange rates; |

|

|

• |

volatile local political and economic developments; |

|

|

• |

difficulty understanding and complying with the regulatory and legal framework respecting the ownership and maintenance of mineral properties, mines and mining operations; |

|

|

• |

as the price of fuel is set by the federal government the fuel component of cost structure is not necessarily determined by market forces; and |

|

|

• |

difficulty obtaining key equipment and components for equipment. |

Criminal activities in the State of Guerrero, where the Company’s Ana Paula Project is located, or the perception that criminal activities are likely, may disrupt operations, hamper the ability to hire and keep qualified personnel and impair access to sources of capital. Risks associated with conducting business in the region include risks related to personnel safety and asset security. Risks may include, but are not limited to: kidnappings of employees and contractors, exposure of employees and contractors to local crime related activity and disturbances, exposure of employees and contractors to drug trade activity, and damage or theft including future gold shipments, if any. These risks could result in serious adverse consequences including personal injuries or death, property damage or theft, limiting or disrupting operations, restricting the movement of funds, impairing contractual rights and causing the Company to shut down operations, all of which may expose the Company to costs as well as potential liability. Such events could have a material adverse effect on the Company’s cash flows, earnings, results of operations and financial condition and make it more difficult for the Company to obtain required financing. Although the Company intends to develop procedures regarding these risks, due to the unpredictable nature of criminal activities, there is no assurance that the Company’s efforts will effectively mitigate risks and safeguard personnel and Company property.

Any of these factors, among others, may cause changes in the existing business or regulatory environment in Mexico with respect to mineral exploration and mining activities, which could result in additional costs to the Company and thereby cause its operating results to suffer. In addition, the enforcement by the Company of its legal rights to exploit its properties may not be recognized by the government of Mexico or by its court system. These risks, along with any variation from the current regulatory, economic and political climate may limit or disrupt the Company’s operations, restrict the movement of funds or result in the deprivation of contractual rights. The Company obtains insurance coverage to partially mitigate risk; however, there is no assurance that adequate insurance will be available to cover all risks or if insurance coverage is available the cost of coverage might be prohibitive.

16

The Company’s business is subject to various governmental regulations, and compliance with these regulations may cause the Company to incur significant expenses. If the Company fails to maintain compliance with applicable regulations, it may be forced to pay fines, be subject to civil penalties or be forced to temporarily halt or cease operations.

The Company’s business is subject to a variety of federal, state, provincial and local laws and regulations in Mexico and Canada, including:

|

|

• |

environmental protection; |

|

|

• |

management and use of toxic substances and explosives; |

|

|

• |

management of natural resources; |

|

|

• |

exploration, development, production and post-closure reclamation of mines; |

|

|

• |

imports and exports; |

|

|

• |

price controls or production restrictions; |

|

|

• |

taxation; |

|

|

• |

mining royalties; |

|

|

• |

labour standards and occupational health and safety, including mine safety; and |

|

|

• |

historical and cultural preservation. |

The Company’s activities relating to the San Francisco Property are subject to, among other things, regulations promulgated by SEMARNAT, Mexico’s environmental protection agency; DGM, the Mexican Department of Economy—Director General of Mines; and the regulations of CONAGUA, the Comisión Nacional del Agua with respect to water rights. Mexican regulators have broad authority to shut down or levy fines against facilities that do not comply with regulations or standards.

The costs associated with compliance with these laws and regulations are substantial and possible future laws and regulations, changes to existing laws and regulations or more stringent enforcement of current laws and regulations by governmental authorities, could cause additional expense, capital expenditures, restrictions on or suspensions of the Company’s operations and delays in the development of its properties. Moreover, these laws and regulations may allow governmental authorities and private parties to bring lawsuits based upon damages to property and injury to persons resulting from the environmental, health and safety impacts of the Company’s past and current operations, or possibly even those actions of parties from whom the Company acquired its properties, and could lead to the imposition of substantial fines, penalties or other civil or criminal sanctions. It is difficult to strictly comply with all regulations imposed on the Company, and even with the application of considerable care the Company may inadvertently fail to comply with certain laws. Such events can lead to fines, penalties, loss, reduction or expropriation of entitlements, the imposition of additional local or foreign parties as joint venture partners and other material negative impacts on the Company.

If the Company is unable to hire, train, deploy and manage qualified personnel in a timely manner, particularly in Mexico, its ability to manage and grow its business will be impaired.

Recruiting and retaining qualified personnel is critical to the Company’s success. The Company is dependent on the services of key executives including our President and Chief Executive Officer and other highly skilled and experienced executives and personnel focused on managing the Company’s interests. The number of persons skilled in acquisition, exploration and development of mining properties is limited and competition for such persons is intense. As the Company’s business activity grows, the Company will require additional key financial, administrative and mining personnel as well as additional operations staff, particularly in Mexico. The Company may not be successful in attracting, training and retaining qualified personnel as competition for persons with these skill sets increases. If the Company is not successful in attracting, training and retaining qualified personnel, the efficiency of its operations could be impaired, which could have an adverse impact on its future cash flows, earnings, results of operations and financial condition.

17

It may be particularly difficult to find or hire qualified personnel in the mining industry who are situated in Mexico, to obtain all of the necessary services or expertise in Mexico, or to conduct operations on the Company’s projects at reasonable rates. If qualified personnel cannot be obtained in Mexico, the Company may need to obtain those services outside of Mexico, which will require work permits and compliance with applicable laws and could result in delays and higher costs to the Company.

The Company may be unable to obtain or renew required government permits, or may only be able to do so at significant expense, which may harm its operating results.

In the ordinary course of business, the Company is required to obtain and renew governmental permits and licenses for the operation and expansion of existing operations or for the development, construction and commencement of new operations. Obtaining or renewing the necessary governmental permits and licenses is a complex and time-consuming process, often involving public hearings and costly undertakings on the Company’s part.

The duration and success of the Company’s efforts to obtain and renew permits and licenses are contingent upon many variables not within its control, including the interpretation of applicable requirements implemented by the permitting authority. The Company may not be able to obtain or renew permits or licenses that are necessary to its operations, or the cost to obtain or renew permits or licenses may exceed what the Company believes it can recover from a given property once in production. Any unexpected delays or costs associated with the permitting and licensing process, including challenges to the terms of such permits or licenses, whether successful or unsuccessful, could delay the development or impede the operation of a mine, which could adversely affect the Company’s operations and profitability.

For the Company to carry out its mining activities, its exploitation licenses must be kept current. There is no guarantee that the Company’s exploitation licenses will be extended or that new exploitation licenses will be granted. In addition, such exploitation licenses could be changed and applications to renew existing licenses may not be approved. The Company may also be required to contribute to the cost of providing the required infrastructure to facilitate the development of its properties. The Company will also be required to obtain and comply with permits and licenses that may contain specific conditions concerning operating procedures, water use, waste disposal, spills, environmental studies, abandonment and restoration plans and financial assurances. The Company may not be able to comply with any such conditions.

Failure to discover new reserves, maintain or enhance existing reserves or develop new operations could negatively affect the Company’s future results and financial condition.

The long-term operation of the Company’s business and its profitability is dependent, in part, on the cost and success of its exploration and development programs. Many of the Company’s properties are in the exploration and development stages and only the San Francisco Property and Ana Paula Project have mineralization considered a mineral reserve pursuant to CIM standards. Mineral exploration and development involves a high degree of risk and few properties that are explored are ultimately developed into producing mines. The Company’s mineral exploration and development programs may not result in any discoveries of bodies of commercially viable mineralization, and even if commercial quantities of mineralization are discovered, the Company may not be able to bring the mineral property into commercial production. Development of the Company’s mineral properties will follow only upon obtaining satisfactory exploration results. Discovery of mineral deposits is dependent upon a number of factors, not the least of which is the technical skill of the exploration personnel involved. The commercial viability of a mineral deposit once discovered is also dependent upon a number of factors, some of which are the particular attributes of the deposit (such as size, grade and proximity to infrastructure), metal prices, permitting, anticipated capital and operating costs and government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals and environmental protection. Most of the above factors are beyond the Company’s control. As a result, the Company’s acquisition, exploration and development programs may not yield new reserves to replace or expand current reserves. Unsuccessful exploration or development programs could have a material adverse affect on the Company’s operations and profitability.

18

In addition, the Company’s ability to sustain its present levels of gold production is dependent upon the identification of additional reserves at the San Francisco Mine. If the Company is unable to develop new ore bodies, it may not be able to sustain or increase present production levels. Reduced production would have a material and adverse affect on future cash flows, results of operations and financial condition.

The Company is subject to various operating risks and hazards associated with its exploration and mining operations, any of which could cause it to incur substantial expenses or affect the economic feasibility of its projects. The Company may be unable to insure against such risks, or to insure against such risks at a reasonable cost.

The ownership, operation and development of a mine or mineral property involves many risks which even a combination of experience, knowledge and careful evaluation may not be able to overcome. These risks include:

|

|

• |

environmental hazards; |

|

|

• |

industrial accidents, explosions and third party accidents; |

|

|

• |

the encountering of unusual or unexpected geological formations; |

|

|

• |

ground falls, rock bursts, cave-ins and seismic activity including earthquakes; |

|

|

• |

fires and flooding; |

|

|

• |

metallurgical and other processing problems, including the availability and costs of processing and refining facilities; |

|

|

• |

availability of economic sources of power; |

|

|

• |

variations in grade, deposit size, density and other geological problems; |

|

|

• |

unanticipated adverse geotechnical conditions; |

|

|

• |

incorrect data on which engineering assumptions are made; |

|

|

• |

mechanical equipment performance problems; |

|

|

• |

unavailability or significant changes in the cost of materials and equipment including fuel; |

|

|

• |

labour force or local community disruptions; |

|

|

• |

title claims, including aboriginal land claims; |

|

|

• |

unanticipated transportation costs; and |

|

|

• |

periodic interruptions due to inclement or hazardous weather conditions. |

These occurrences could result in:

|

|

• |

environmental damage and liabilities; |

|

|

• |

work stoppages, delayed production and resultant losses; |

|

|

• |

increased production costs; |

|

|

• |

damage to, or destruction of, mineral properties or production facilities and resultant losses; |

|

|

• |

asset write downs; |

|

|

• |

monetary losses; |

|

|

• |

claims for compensation of loss of life or damages in connection with accidents that occur on company property, and punitive awards in connection with those claims; and |

|

|

• |

other liabilities. |

These factors, among others, may cause anticipated capital and operating costs, production and economic returns, or other estimates to differ significantly from the Company’s actual capital and operating costs. It is not always possible to fully insure against such risks and the Company may decide not to insure against such risks due to high premiums or for other reasons. Should any such uninsured liabilities arise, they could adversely impact the Company’s profitability.

19

The Company’s operations are dependent on the accessibility and reliability of existing local infrastructure, and its exploration or exploitation activities are dependent upon adequate infrastructure being available in the future.

Mining, processing, development and exploration activities depend, to some degree, on adequate infrastructure. Reliable roads, bridges, power sources and water supply are important determinants, which affect capital and operating costs. The lack of availability on acceptable terms or the delay in the availability of any one or more of these items could prevent or delay exploitation or development of the Company’s projects. If adequate infrastructure is not available in a timely manner, the exploitation or development of the Company’s projects may not be commenced or completed on a timely basis, if at all. In addition, the resulting operations may not achieve the anticipated production volume, or the construction costs and ongoing operating costs associated with the exploitation and/or development of the Company’s advanced projects will be higher than anticipated. Unusual or infrequent weather phenomena, sabotage, government or other interference in the maintenance or provision of such infrastructure could adversely affect the Company’s operations and profitability.

The Company is subject to extensive environmental regulation, and any failure of compliance could result in fines or government sanctions, civil liabilities and damage to its reputation.

All phases of the Company’s operations are subject to environmental laws and regulations. These laws and regulations set certain standards regarding health and environmental quality, and provide for penalties and other liabilities for violations, as well as obligations to rehabilitate current and former properties in certain circumstances. Furthermore, operating permits could be temporarily withdrawn where there is evidence of serious breaches of health and safety, or even permanently, in the case of extreme breaches. Significant liabilities could be imposed on the Company for damages, clean-up costs or penalties in the event of certain discharges into the environment, environmental damage caused by previous owners of acquired properties or noncompliance with environmental laws. In addition, environmental legislation in Mexico is generally evolving in a manner which will require stricter standards and will be subject to increased enforcement, fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. Such changes in environmental regulation, if any, may adversely impact the Company’s operations and profitability.

Land reclamation requirements may be burdensome.

Land reclamation requirements are generally imposed on companies with mining operations in order to minimize the long term effects of land disturbance, and the Company is subject to such requirements at its mineral properties. Reclamation obligations include requirements to:

|

|

• |

control dispersion of potentially harmful effluents; and |

|

|

• |

reasonably re-establish pre-disturbance land forms and vegetation. |

To carry out reclamation obligations arising from exploration and development activities, the Company must allocate financial resources that might otherwise be spent on further exploration and development programs. If the Company is required to carry out unanticipated reclamation work, its financial position could be adversely affected.

The Company’s production and exploration depend on its ownership of, or control over, the properties on which it operates, and maintaining existing property rights or obtaining new rights is a highly competitive and costly process.

The Company’s ability to carry out successful mining activities will depend in part on its ability to obtain tenure to its properties to the satisfaction of international lending institutions. The issue of any such licenses must be in accordance with Mexican law and relevant mining legislation. The validity of mining or exploration titles or claims or rights, which constitute most of the Company’s property holdings, can be uncertain and may be contested. The Company has used reasonable commercial efforts to investigate its title or claims to its various properties and, to its knowledge, except where it has otherwise identified, those titles or claims to material properties are in good standing. However, the Company has not conducted surveys of all the claims in which it holds direct or indirect interests and therefore, the precise area and location of such claims may be in doubt. The Company’s properties may also be subject to prior

20

unregistered liens, agreements or transfers, native land claims or undetected title defects. The Mexican government may revoke or significantly alter the conditions of the applicable exploration and mining titles or claims, and such exploration and mining titles or claims may be challenged or impugned by third parties, which could materially impact the Company’s rights to its various properties or interests. Title insurance is generally not available for mining properties, and the Company’s ability to ensure that it has obtained secure claims to individual mineral properties or mining concessions may be severely constrained.

Mines have limited lives and, as a result, the Company continually seeks to replace and expand reserves through the acquisition of new properties. In addition, there is a limited supply of desirable mineral lands available in areas where the Company would consider conducting exploration, development or production activities. Because the Company faces strong competition for new properties from other mining companies, some of which have greater financial resources than it does, the Company may be unable to acquire attractive new mining properties on terms that it considers acceptable. Competition in the mining business for limited sources of capital could adversely impact the Company’s ability to acquire and develop suitable mines, developmental projects or properties having significant exploration potential. As a result, the Company’s acquisition, exploration and development programs may not yield new mineral reserves to replace or expand current mineral reserves.

The process of estimating mineral reserves and resources is subject to inherent uncertainties, and reported reserves and resources may not accurately reflect the economic viability of the Company’s properties.

There is a degree of uncertainty attributable to the estimation of mineral reserves and mineral resources. Until mineral reserves or mineral resources are actually mined and processed, the quantity of mineral and reserve grades must be considered as estimates only. Levels of metals indicated by such mineral reserves or mineral resources may not be produced, and the Company may not receive the price assumed in determining its reserves. These estimates are expressions of judgment based on knowledge, mining experience, analysis of drilling results and industry practices. Valid estimates made at a given time may significantly change when new information becomes available. While the Company believes that its reserve and resource estimates are well established and reflect management’s best estimates, by their nature reserve and resource estimates are imprecise and depend, to a certain extent, upon analysis of drilling results and statistical inferences that may ultimately prove unreliable.

Furthermore, fluctuations in the market price of metals, as well as increased capital or production costs or reduced recovery rates may render ore reserves uneconomic and may ultimately result in a reduction of reserves. The extent to which resources may ultimately be reclassified as proven or probable reserves is dependent upon the demonstration of their profitable recovery. The evaluation of reserves or resources is always influenced by economic and technological factors, which may change over time. Resource estimates may not ultimately be reclassified as proven or probable reserves. If the Company’s reserve or resource figures are inaccurate or are reduced in the future, this could have an adverse affect on its future cash flows, earnings, results of operations and financial condition.

In estimating its reserves and resources, the Company relies on laboratory-based recovery models to project estimated recoveries by ore type at optimal crush sizes. Actual gold recoveries in a commercial heap leach operation may exceed or fall short of projected laboratory test results. In addition, the grade of mineralization ultimately mined may differ from the one indicated by the drilling results and the difference may be material. Production can be affected by such factors as permitting regulations and requirements, weather, environmental factors, unforeseen technical difficulties, unusual or unexpected geological formations, inaccurate or incorrect geological, metallurgical or engineering work and work interruptions, among other things. Short term factors, such as the need for an orderly development of deposits or the processing of new or different grades, may have an adverse effect on mining operations or the results of those operations. Minerals recovered in small scale laboratory tests may not be duplicated in large scale tests under on-site conditions or in production-scale operations. Material changes in proven and probable reserves or resources, grades, waste-to-ore ratios or recovery rates may affect the economic viability of projects. The estimated proven and probable reserves and resources the Company discloses should not be interpreted as assurances of mine life or of the profitability of future operations.

21

The Company has engaged expert independent technical consultants to advise it on, among other things, mineral reserves and resources and project engineering at the Mine. The Company believes these experts are competent and that they have and will carry out their work in accordance with internationally recognized industry standards. If, however, the work conducted and to be conducted by these experts is ultimately found to be incorrect or inadequate in any material respect, the Company may experience delays and increased costs.

The process of estimating future mine production and related costs are subject to inherent uncertainties, and actual results may differ materially from such estimates.

The Company periodically prepares estimates of future mine production and future production costs for the San Francisco Mine. There can be no assurance that the Company will achieve these production estimates. These production estimates are dependent on, among other things, the accuracy of underlying mineral reserve estimates; the accuracy of assumptions regarding ore grades and recovery rates, ground conditions and physical characteristics of ores; equipment and mechanical availability; labour availability; facilities and infrastructure; having sufficient materials and supplies on hand; and the accuracy of estimated rates and costs of mining and processing. Failure to achieve production estimates could have a material and adverse effect on any or all of the Company’s future cash flows, results of operations and financial condition.

The Company’s actual production and costs may vary from its estimates for a variety of reasons, including actual ore mined varying from estimates of grade, tonnage, dilution and metallurgical and other characteristics; short-term operating factors, such as the need for sequential development of ore bodies and the processing of new or different ore grades from those planned; and the risks and hazards associated with mining described throughout these “Risk Factors Relating to the Company’s Business”. In addition, metal recoveries in small scale laboratory tests may not be duplicated in larger scale tests under on-site conditions or during production, and known and experienced recoveries may not continue. Costs of production may also be affected by changing stripping ratios, ore grade metallurgy, labour costs, costs of supplies and services (such as, for example, fuel and power), general inflationary pressures and currency exchange rates. Failure to achieve cost estimates could have a material and adverse effect on any or all of the Company’s future cash flows, results of operations and financial condition.

The expansion and development of the Company’s mining properties is uncertain and subject to risk.

The development of the Company’s properties that are found to be economically feasible will require the expansion and improvement of existing mining operations, as well as the construction and operation of additional mines, processing plants and related infrastructure. As a result, the Company is subject to all of the risks associated with establishing and expanding mining operations and business enterprises including:

|

|

• |

the timing and cost, which will be considerable, of the construction of additional mining and processing facilities; |

|

|

• |

the availability and costs of skilled labour, power, water, transportation and mining equipment; |

|

|

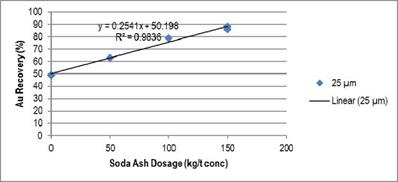

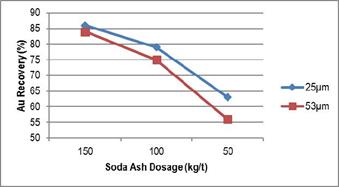

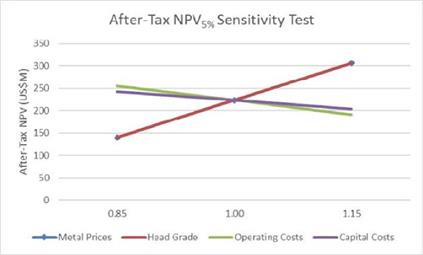

• |