Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark One) | ||

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2011 |

||

OR |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission file number: 001-35113

GNC Holdings, Inc.

(Exact name of registrant as specified in its charter)

| DELAWARE (state or other jurisdiction of Incorporation or organization) |

20-8536244 (I.R.S. Employer Identification No.) |

|

300 Sixth Avenue Pittsburgh, Pennsylvania (Address of principal executive offices) |

15222 (Zip Code) |

Registrant's telephone number, including area code: (412) 288-4600

Securities registered pursuant to section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

|---|---|---|

| Class A common stock, par value $0.001 per share | New York Stock Exchange |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

As of February 15, 2012, the number of outstanding shares of Class A common stock, par value $0.001 per share (the "Class A common stock"), and the number of shares outstanding of Class B common stock, par value $0.001 per share (the "Class B common stock" and together with the Class A common stock, the "common stock"), of GNC Holdings, Inc. were 103,832,767 shares and 2,060,178 shares, respectively.

2

This Annual Report on Form 10-K (this "Annual Report") contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to our financial condition, results of operations and business. Forward-looking statements include statements that may relate to our plans, objectives, goals, strategies, future events, future revenues or performance, capital expenditures, financing needs and other information that is not historical information. Discussions containing such forward-looking statements may be found in Items 1, 2, 3, 7 and 7A hereof, as well as within this report generally. Forward-looking statements can often be identified by the use of terminology such as "subject to," "believe," "anticipate," "plan," "expect," "intend," "estimate," "project," "may," "will," "should," "would," "could," "can," the negatives thereof, variations thereon and similar expressions, or by discussions of strategy.

All forward-looking statements, including, without limitation, our examination of historical operating trends, are based upon our current expectations and various assumptions. We believe there is a reasonable basis for our expectations and beliefs, but they are inherently uncertain. We may not realize our expectations and our beliefs may not prove correct. Actual results could differ materially from those described or implied by such forward-looking statements. The following uncertainties and factors, among others (including those set forth under "Risk Factors"), could affect future performance and cause actual results to differ materially from those matters expressed in or implied by forward-looking statements:

- •

- significant competition in our industry;

- •

- unfavorable publicity or consumer perception of our products;

- •

- increases in the cost of borrowings and limitations on availability of additional debt or equity capital;

- •

- our debt levels and restrictions in our debt agreements;

- •

- the incurrence of material product liability and product recall costs;

- •

- loss or retirement of key members of management;

- •

- costs of compliance and our failure to comply with new and existing governmental regulations including, but not limited

to, tax regulations;

- •

- costs of litigation and the failure to successfully defend lawsuits and other claims against us;

- •

- the failure of our franchisees to conduct their operations profitably and limitations on our ability to terminate or

replace under-performing franchisees;

- •

- economic, political and other risks associated with our international operations;

- •

- our failure to keep pace with the demands of our customers for new products and services;

- •

- disruptions in our manufacturing system or losses of manufacturing certifications;

- •

- disruptions in our distribution network;

- •

- the lack of long-term experience with human consumption of ingredients in some of our products;

- •

- increases in the frequency and severity of insurance claims, particularly claims for which we are

self-insured;

- •

- the failure to adequately protect or enforce our intellectual property rights against competitors;

- •

- changes in raw material costs and pricing of our products;

3

- •

- failure to successfully execute our growth strategy, including any delays in our planned future growth, any inability to

expand our franchise operations or attract new franchisees, or any inability to expand our company-owned retail operations;

- •

- changes in applicable laws relating to our franchise operations;

- •

- damage or interruption to our information systems;

- •

- the impact of current economic conditions on our business;

- •

- natural disasters, unusually adverse weather conditions, pandemic outbreaks, boycotts and geo-political

events; and

- •

- our failure to maintain effective internal controls.

Consequently, forward-looking statements should be regarded solely as our current plans, estimates and beliefs. You should not place undue reliance on forward-looking statements. We cannot guarantee future results, events, levels of activity, performance or achievements. We do not undertake and specifically decline any obligation to update, republish or revise forward-looking statements to reflect future events or circumstances or to reflect the occurrences of unanticipated events.

Throughout this Annual Report, we use market data and industry forecasts and projections that were obtained from surveys and studies conducted by third parties, including the Nutrition Business Journal, and from publicly available industry and general publications. Although we believe that the sources are reliable, and that the information contained in such surveys and studies conducted by third parties is accurate and reliable, we have not independently verified the information contained therein. We note that estimates, in particular as they relate to general expectations concerning our industry, involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading "Risk Factors" in this Annual Report.

PART I

GNC Holdings, Inc. ("Holdings") is headquartered in Pittsburgh, Pennsylvania and the Class A common stock trades on the New York Stock Exchange (the "NYSE") under the symbol "GNC." Based on our worldwide network of more than 7,600 locations and our online channels, we believe we are the leading global specialty retailer of health and wellness products, including vitamins, minerals and herbal supplement products ("VMHS"), sports nutrition products and diet products. Our diversified, multi-channel business model derives revenue from product sales through company-owned domestic retail stores, domestic and international franchise activities, third-party contract manufacturing, e-commerce and corporate partnerships. We believe that the strength of our GNC brand, which is distinctively associated with health and wellness, combined with our stores and online channels, give us broad access to consumers and uniquely position us to benefit from the favorable trends driving growth in the nutritional supplements industry and the broader health and wellness sector. Our broad and deep product mix, which is focused on high-margin, premium, value-added nutritional products, is sold under our GNC proprietary brands, including Mega Men®, Ultra Mega®, GNC Total Lean, Pro Performance® and Pro Performance® AMP, and under nationally recognized third-party brands.

Based on the information we compiled from the public securities filings of our primary competitors, our network of domestic retail locations is approximately eleven times larger than the next largest U.S. specialty retailer of nutritional supplements and provides a leading platform for our vendors to distribute their products to their target consumers. Our close relationships with our vendor partners have enabled us to negotiate first-to-market opportunities. In addition, our in-house product development capabilities enable us to offer our customers proprietary merchandise that can only be purchased through our locations or through GNC.com. Since the nutritional supplement consumer often requires knowledgeable customer

4

service, we also differentiate ourselves from mass and drug retailers with our well-trained sales associates who are aided by in-store technology. We believe that our expansive retail network, differentiated merchandise offering and quality customer service result in a unique shopping experience that is distinct from that of our competitors.

Our principal executive office is located at 300 Sixth Avenue, Pittsburgh, Pennsylvania 15222, and our telephone number is (412) 288-4600. We maintain and make available on GNC.com, free of charge, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports as soon as reasonably practical after we electronically file or furnish them to the U.S. Securities and Exchange Commission (the "SEC").

In this Annual Report, unless the context requires otherwise, references to "we," "us," "our," "Company" or "GNC" refer collectively to Holdings and its subsidiaries.

Corporate History

Our business was founded in 1935 by David Shakarian who opened our first health food store in Pittsburgh, Pennsylvania. Since that time, the number of stores has continued to grow, and we began producing our own vitamin and mineral supplements as well as foods, beverages and cosmetics.

Together with our wholly owned subsidiary GNC Acquisition Inc. ("GNC Acquisition"), we entered into an Agreement and Plan of Merger (the "Merger Agreement") with GNC Parent Corporation on February 8, 2007. Pursuant to the Merger Agreement, and on March 16, 2007, GNC Acquisition was merged with and into GNC Parent Corporation, with GNC Parent Corporation as the surviving corporation and our direct wholly owned subsidiary (the "Merger"). As a result of the Merger, Holdings became the sole equity holder of GNC Parent Corporation and the indirect parent company of GNC Corporation and our operating subsidiary, General Nutrition Centers, Inc. ("Centers").

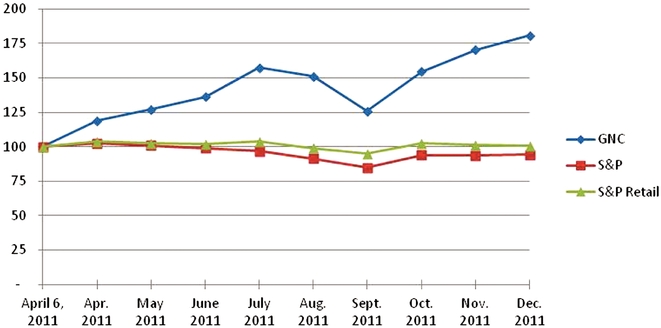

On April 6, 2011, we completed an initial public offering (the "IPO") pursuant to which 25.875 million shares of Class A common stock were sold at a price of $16.00 per share. Holdings issued and sold 16 million shares and certain of Holdings' stockholders sold 9.875 million shares in the IPO. During the fourth quarter of 2011, we completed a secondary offering (the "Secondary Offering") pursuant to which certain of Holdings' stockholders sold 23.0 million shares of Class A common stock at a price of $24.75 per share.

Holdings is a holding company and all of its operations are conducted through its operating subsidiaries.

Our Growth Strategy

We plan to execute several strategies in the future to promote growth in revenue and operating income, and capture market share, including:

- •

- Growing company-owned domestic retail earnings. We believe

growth in our domestic retail business will be supported by continued same store sales growth and positive operating leverage. Our existing store base and the supporting infrastructure enable us to

convert a high percentage of our incremental sales volume into operating income, providing the opportunity to further expand our company-owned retail operating income margin.

- •

- Growing company-owned domestic retail square footage. We

believe that (i) the expansion of our store base will allow us to increase our market share and our appeal to a wider range of consumers as we enter new markets and grow within existing

markets, and (ii) the U.S. market can support a significant number of additional GNC stores.

- •

- Growing our international footprint. Our international business has been a key driver of growth in recent years. We expect to continue capitalizing on international revenue growth opportunities

5

- •

- Expanding our e-commerce business. We believe

GNC.com is well-positioned to continue capturing market share online, which represents one of the fastest growing channels of distribution in the U.S. nutritional supplements industry. We

intend to continue to capitalize on the growth of GNC.com and may explore opportunities to acquire additional web banners to expand our online market share, as with our acquisition of

LuckyVitamin.com.

- •

- Further leveraging of the GNC brand. As with our Rite Aid, Sam's Club and PetSmart partnerships, we believe we have the opportunity to create additional streams of revenue and grow our customer base by leveraging the GNC brand through corporate partnerships outside of our existing distribution channels.

through additions of franchise stores in existing markets, expansion into new high growth markets and the growth of product distribution in both existing and new markets.

Competitive Strengths

We believe we are well-positioned to capitalize on favorable industry trends as a result of the following competitive strengths:

- •

- Highly-valued and iconic brand. We believe our broad

portfolio of proprietary products, which are available in our locations or on GNC.com, advances GNC's brand presence and our general reputation as a leading retailer of health and wellness products.

We recently modernized the GNC brand in an effort to further advance its positioning. We have launched enhanced advertising campaigns, in-store signage and product packaging with a focus

on engaging our customers, building the brand and reinforcing GNC's credibility with consumers.

- •

- Attractive, loyal customer base. Our large customer base

includes approximately 4.9 million active Gold Card members in the United States and Canada who account for over 50% of company-owned retail sales and spend on average two times more than other

GNC customers. We believe that our customer base is attractive as our shoppers tend to be gender balanced, relatively young, well-educated and affluent. Recent surveys, commissioned by us,

reflect a high satisfaction rate among our shoppers with respect to selection, product innovation, quality and overall experience.

- •

- Commanding market position in an attractive and growing

industry. Based on our broad global footprint of more than 7,600 locations in the United States and 53 international countries

(including distribution centers where retail sales are made), and on GNC.com, we believe we are the leading global specialty retailer of health and wellness products within a fragmented industry. With

a presence in all 50 states and the District of Columbia, our domestic retail network is approximately eleven times larger than the next largest U.S. specialty retailer of nutritional supplements,

based on the information we compiled from the public securities filings of our primary competitors.

- •

- Unique product offerings and robust innovation

capabilities. Product innovation is critical to our growth, brand image superiority and competitive advantage. We have internal product

development teams located in our corporate headquarters in Pittsburgh, Pennsylvania and our manufacturing facility in Greenville, South Carolina, which collaborate on the development and formulation

of proprietary nutritional supplements with a focus on high growth categories. We seek to maintain the pace of GNC's proprietary product innovation to stay ahead of our competitors and provide

consumers with unique reasons to shop at our stores. Our in-house product development teams and vertically integrated infrastructure enable us to quickly take a concept for a new product

from the idea stage, to product development, to testing and trials and ultimately to the shelf to be sold to our customers.

- •

- Diversified business model. Our multi-channel approach is unlike many other specialty retailers as we derive revenues across a number of distribution channels in multiple geographies, including retail sales from company-owned retail stores (including 136 stores on U.S. military bases), retail

6

- •

- Vertically integrated operations that underpin our business

strategy. To support our company-owned and franchise store bases, we have developed sophisticated manufacturing, warehousing and

distribution facilities. These consist of a manufacturing facility in Greenville, South Carolina, distribution facilities in Leetsdale, Pennsylvania, Anderson, South Carolina, and Phoenix, Arizona,

and a transportation fleet of over 100 delivery trucks and trailers. Our vertically integrated business model allows us to control the production and timing of new product introductions, control

costs, maintain high standards of product quality, monitor delivery times, manage inventory levels and enhance profitability.

- •

- Differentiated service model that fosters a "selling" culture and an exceptional customer

experience. We believe we distinguish ourselves from mass and drug retailers with our well-trained sales associates, who offer educated service and trusted advice.

We invest considerable capital and human resources in providing comprehensive associate training. We believe that our expansive retail network, differentiated merchandise offering and

high- quality customer service result in a unique shopping experience.

- •

- World-class management team with a proven track record. Our highly experienced and talented management team has a unique combination of leadership and experience across the retail industry. Our team has successfully executed on key growth initiatives while effectively managing the business in a difficult economic environment.

sales from GNC.com, royalties, wholesale sales and fees from both domestic and international franchisees, revenue from third-party contract manufacturing, wholesale revenue and fees from our Rite Aid store-within-a-store locations, and wholesale revenues from Sam's Club and PetSmart. Our business is further diversified by our broad merchandise assortment. Our retail stores generally offer over 1,800 SKUs across multiple product categories.

7

Business Overview

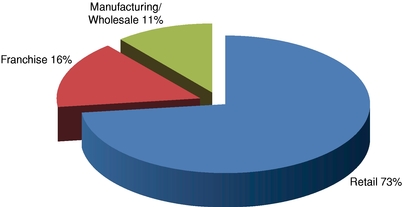

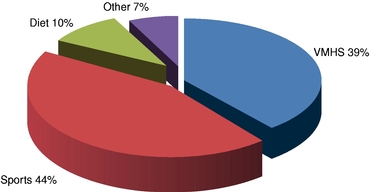

The following charts illustrate the percentage of our net revenue generated by our three segments and the percentage of our net U.S. retail nutritional supplements revenue generated by our product categories for the year ended December 31, 2011:

U.S. Retail Revenue by Product*

- *

- includes domestic retail and GNC.com

In 2011, we did not have a material concentration of sales from any single product or product line.

Segments

We generate revenues from our three segments, Retail, Franchise and Manufacturing/Wholesale. The following chart outlines our segments and the historical contribution to our consolidated revenues by those segments, after intercompany eliminations. For a description of operating income (loss) by segment, our total assets by segment, total revenues by geographic area, and total assets by geographic area, see Note 16, "Segments," to our audited consolidated financial statements included in this Annual Report.

8

| |

Year ended December 31, | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2011 | 2010 | 2009 | ||||||||||||||||

| |

(dollars in millions) |

||||||||||||||||||

Retail |

$ | 1,518.5 | 73.3 | % | $ | 1,344.4 | 73.8 | % | $ | 1,256.3 | 73.6 | % | |||||||

Franchise |

334.8 | 16.1 | % | 293.6 | 16.1 | % | 264.2 | 15.5 | % | ||||||||||

Manufacturing/Wholesale (Third Party) |

218.9 | 10.6 | % | 184.2 | 10.1 | % | 186.5 | 10.9 | % | ||||||||||

Total |

$ | 2,072.2 | 100.0 | % | $ | 1,822.2 | 100.0 | % | $ | 1,707.0 | 100.0 | % | |||||||

Although we believe that our retail and franchise businesses are not seasonal in nature, historically we have experienced, and expect to continue to experience, a variation in our net sales and operating results from quarter to quarter.

Retail

Our Retail segment generates revenues primarily from sales of products to customers at our company-owned stores in the United States, Canada and Puerto Rico and through our websites, GNC.com and LuckyVitamin.com.

Locations

As of December 31, 2011, we operated 3,046 company-owned stores across all 50 states and in the District of Columbia and in Canada and Puerto Rico. Most of our U.S. company owned stores are between 1,000 and 2,000 square feet and are located primarily in shopping malls and strip shopping centers. Traditional shopping mall and strip shopping center locations generate a large percentage of our total retail sales. With the exception of our downtown stores, virtually all of our company-owned stores follow one of two consistent formats, one for mall locations and one for strip shopping center locations.

We periodically redesign our store graphics to better identify with our GNC customers and provide product information to allow these customers to make educated decisions regarding product purchases and usage. Our product labeling is consistent within our product lines and the stores are designed to present a unified approach to packaging with emphasis on added information for the customer. As an ongoing practice, we continue to reset and upgrade all of our company-owned stores to maintain a more modern and customer-friendly layout, while promoting our GNC Live Well® theme.

Websites

Our website, GNC.com, which we re-launched in 2009, has become an increasingly significant part of our business. Some of the products offered on our website may not be available at our retail locations, enabling us to broaden the assortment of products available to our customers. The ability to purchase our products through the internet also offers a convenient method for repeat customers to evaluate and purchase new and existing products. This additional sales channel has enabled us to market and sell our products in regions where we have limited or no retail operations. Internet purchases are fulfilled and shipped directly from our distribution centers to our consumers using a third-party courier service. To date, we believe that most of the sales generated by our website are incremental to the revenues from our retail locations.

In August 2011, we acquired S&G Properties, LLC d/b/a LuckyVitamin.com and What's the Big Deal?, Inc. d/b/a Gary's "World of Wellness" (collectively referred to as "LuckyVitamin.com"), an online retailer of health and wellness products.

9

Franchise

Our Franchise segment is comprised of our domestic and international franchise operations, and generates revenues from franchise activities primarily through product sales to franchisees, royalties on franchise retail sales and franchise fees.

As of December 31, 2011, there were 2,514 franchise stores operating, including 924 stores in the United States and 1,590 international franchise stores operating in 53 international countries (including distribution centers where retail sales are made). Our franchise stores in the United States are typically between 1,000 and 2,000 square feet, and approximately 90% are located in strip mall centers. The international franchise stores are typically smaller and, depending upon the country and cultural preferences, are located in mall, strip center, street or store-within-a-store locations. In addition, some international franchisees sell on the internet in their respective countries. Typically, our international stores have a store format and signage similar to our U.S. franchise stores. We believe that our franchise program enhances our brand awareness and market presence and will enable us to continue to expand our store base internationally with limited capital expenditures. We believe we have good relationships with our franchisees, as evidenced by our domestic franchisee renewal rate of 92% between 2006 and 2011. We do not rely heavily on any single franchise operator in the United States, since the largest franchisee owns and/or operates 12 store locations.

All of our franchise stores in the United States offer both our proprietary products and third-party products, with a product selection similar to that of our company-owned stores. Our international franchise stores are offered a more limited product selection than our franchise stores in the United States with the product selection heavily weighted toward proprietary products.

Franchises in the United States

Revenues from our franchisees in the United States accounted for approximately 62% of our total franchise revenues for the year ended December 31, 2011. New franchisees in the United States are generally required to pay an initial fee of $40,000 for a franchise license. Existing GNC franchise operators may purchase an additional franchise license for a $30,000 fee. We typically offer limited financing to qualified franchisees in the United States for terms of up to five years. Once a store begins operations, franchisees are required to pay us a continuing royalty of 6% of sales and contribute 3% of sales to a national advertising fund. Our standard franchise agreements for the United States are effective for an initial ten-year period with two five-year renewal options. At the end of the initial term and each of the renewal periods, the renewal fee is generally 33% of the franchisee fee that is then in effect. The franchisee renewal option is generally at our election. Franchisees must meet certain conditions to exercise the franchisee renewal option. Our franchisees in the United States receive limited geographical exclusivity and are required to utilize the standard GNC store format.

Generally, we enter into a five-year lease with one five-year renewal option with landlords for our franchise locations in the United States. This allows us to secure locations at more cost-effective rates, which we sublease to our franchisees at cost. Franchisees must meet certain minimum standards and duties prescribed by our franchise operations manual, and we conduct periodic field visit reports to ensure our minimum standards are maintained. If a franchisee does not meet specified performance and appearance criteria, we are permitted to terminate the franchise agreement. In these situations, we may take possession of the location, inventory and equipment, and operate the store as a company-owned store or re-franchise the location. In 2011, we terminated four franchise agreements, all of which were converted into company-owned stores.

International Franchises

Revenues from our international franchisees accounted for approximately 38% of our total franchise revenues for the year ended December 31, 2011. In 2011, new international franchisees were required to

10

pay an initial fee of approximately $25,000 for a franchise license for each full size store and continuing royalty fees that vary depending on the country and the store type. Our international franchise program has enabled us to expand into international markets with limited capital expenditures. We expanded our international presence from 961 international franchise locations at the end of 2006 to 1,590 international locations (including distribution centers where retail sales are made) as of December 31, 2011. We typically generate less revenue from franchises outside the United States due to lower international royalty rates and the franchisees purchasing a smaller percentage of products from us compared to our domestic franchisees.

We enter into development agreements with international franchisees for either full-size stores, store-within-a-store locations, wholesale distribution center operations or internet distribution rights. The development agreement grants the franchisee the right to develop a specific number of stores in a territory, often the entire country. The franchisee then enters into a franchise agreement for each location. The full-size store franchise agreement has an initial ten-year term with two five-year renewal options. At the end of the initial term and renewal periods, the franchisee typically has the option to renew the agreement at 33% of the franchise fee that is then in effect. Franchise agreements for international store-within-a-store locations have an initial term of five years, with two five-year renewal options. At the end of the initial term and each of the renewal periods, the franchisee has the option to renew the agreement for up to a maximum of 50% of the franchise fee that is then in effect. Our international franchisees often receive exclusive franchising rights to the entire country franchise, excluding U.S. military bases. Our international franchisees must meet minimum standards and duties similar to our U.S. franchisees.

Manufacturing/Wholesale

Our Manufacturing/Wholesale segment is comprised of our manufacturing operations in South Carolina and our wholesale sales business. This segment supplies our Retail and Franchise segments as well as various third parties with finished products. Our Manufacturing/Wholesale segment generates revenues through sales of manufactured products to third parties, and the sale of our proprietary and third-party brand products to Rite Aid, Sam's Club, PetSmart and www.drugstore.com. Our wholesale operations are supported primarily by our Anderson, South Carolina distribution center.

Manufacturing

Our sophisticated manufacturing and warehousing facilities provide finished products to our Retail and Franchise segments and enable us to control the production and distribution of our proprietary products, better control costs, protect product quality, monitor delivery times and maintain appropriate inventory levels. Our unique combination of in-house development of products, vertically integrated infrastructure and innovation capabilities support our business strategy and enable the rapid development of proprietary products.

We operate two main manufacturing facilities in the United States: one in Greenville, South Carolina and one in Anderson, South Carolina. We utilize our plants primarily for the production of proprietary products. Our manufacturing operations are designed to ensure low-cost production of a variety of products of different quantities, sizes and packaging configurations while maintaining strict levels of quality control. Our manufacturing procedures are designed to promote consistency and quality in our finished goods. We conduct sample testing on raw materials and finished products, including weight, purity and micro bacterial testing. Our manufacturing facilities also service our wholesale operations, including the manufacture and supply of our proprietary and third-party brand products to Rite Aid, Sam's Club, PetSmart and www.drugstore.com. We use our available capacity at these facilities to produce products for sale to third-party customers.

The principal raw materials used in the manufacturing process are natural and synthetic vitamins, herbs, minerals and gelatin. We maintain multiple sources for the majority of our raw materials, with the

11

remaining being single-sourced due to the uniqueness of the material. In 2011, no one vendor supplied more than 10% of our raw materials. Our distribution fleet delivers raw materials and components to our manufacturing facilities and also delivers our finished goods and third-party products to our distribution centers.

Wholesale

Franchise Store-Within-a-Store Locations. To increase brand awareness and promote access to customers who may not frequent specialty nutrition stores, we entered into a strategic alliance with Rite Aid in December 1998 to open GNC franchise store-within-a-store locations. As of December 31, 2011, we had 2,125 Rite Aid store-within-a-store locations. Through this strategic alliance, we generate revenues from sales to Rite Aid of our products at wholesale prices, the manufacture of Rite Aid private label products, retail sales of certain consigned inventory and license fees. We are Rite Aid's sole supplier for the PharmAssure vitamin brand and a number of Rite Aid private label supplements. In May 2007, we extended our alliance with Rite Aid through 2014 with a five year option. At December 31, 2011, Rite Aid had opened 975 of an additional 1,125 stores that Rite Aid has committed to open by December 31, 2014.

Products

We offer a wide range of high-quality nutritional supplements sold under our GNC proprietary brand names, including Mega Men®, Ultra Mega®, GNC Total Lean, Pro Performance® and Pro Performance® AMP and under nationally recognized third-party brand names. We report our sales in four major nutritional supplement categories: VMHS, sports nutrition, diet and other wellness. In addition, our retail sales offer an extensive mix of brands, including over 1,800 SKUs across multiple categories and products. Through our online channels, GNC.com and LuckyVitamin.com, we offer additional SKUs to online customers. This variety is designed to provide our customers with a vast selection of products to fit their specific needs and to generate a high number of transactions with purchases from multiple product categories. Sales of our proprietary brands at our company-owned stores represented approximately 56% of our net retail product revenues for the years ended 2011, 2010 and 2009. We have arrangements with our vendors to provide third-party products on an as needed basis. We are not dependent on any one vendor for a material amount of our third-party products.

Consumers may purchase a GNC Gold Card in any U.S. GNC store or at GNC.com for $15.00. A Gold Card allows a consumer to save 20% on all store and online purchases on the day the card is purchased and during the first seven days of every month for a year. Gold Card members also receive personalized mailings and e-mails with product news, nutritional information, and exclusive offers.

Products are delivered to our retail stores through our distribution centers located in Leetsdale, Pennsylvania, Anderson, South Carolina and Phoenix, Arizona. Our distribution centers support our company-owned stores as well as franchise stores and Rite Aid locations. Our distribution fleet delivers our finished goods and third-party products through our distribution centers to our company-owned and domestic franchise stores on a weekly or biweekly basis depending on the sales volume of the store. LuckyVitamin.com is supported by a new, separate distribution center in Leetsdale, Pennsylvania that began operating in December 2011. Each of our distribution centers has a quality control department that monitors products received from our vendors to ensure they meet our quality standards.

12

Based on data collected from our point of sales systems in our GNC stores and from GNC.com, below is a comparison of our company-owned domestic retail product sales by major product category, and the percentages of our company-owned domestic retail product sales for the years shown:

| |

December 31, | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

U.S Retail Product Categories:

|

2011 | 2010 | 2009 | ||||||||||||||||

| |

($ in millions) |

||||||||||||||||||

VMHS |

$ | 542.6 | 38.7 | % | $ | 496.1 | 39.9 | % | $ | 496.4 | 42.7 | % | |||||||

Sports Nutrition Products |

621.8 | 44.3 | % | 531.3 | 42.7 | % | 443.4 | 38.2 | % | ||||||||||

Diet Products |

139.6 | 9.9 | % | 122.3 | 9.8 | % | 128.0 | 11.0 | % | ||||||||||

Other Wellness Products |

99.7 | 7.1 | % | 93.5 | 7.6 | % | 94.3 | 8.1 | % | ||||||||||

Total U.S. Retail revenues |

$ | 1,403.7 | 100.0 | % | $ | 1,243.2 | 100.0 | % | $ | 1,162.1 | 100.0 | % | |||||||

The data above represents the revenue reported for the domestic portion of our retail segment, and excludes additional revenue, primarily wholesale sales revenue to our military commissary locations, revenue from LuckyVitamin.com, which is not on our point of sales system, and certain revenue adjustments that are recorded to ensure conformity with generally accepted accounting principles in the United States, including deferral of our Gold Card revenue to match the twelve month discount period of the card, and a reserve for customer returns. These excluded amounts were $16.7 million for 2011 (including $14.5 million related to LuckyVitamin.com), $6.5 million for 2010 and $5.7 million for 2009. These items are recurring in nature, and we expect to record similar adjustments in the future.

VMHS

We sell vitamins and minerals in single vitamin and multi vitamin form and in different potency levels. Our vitamin and mineral products are available in liquid, tablets, soft gelatin, hard-shell capsules and powder forms, and are available in traditional bottle packaging form or in customized daily packet form ("Vitapak®"). Many of our special vitamin and mineral formulations, such as Mega Men®, Ultra Mega® and Triple Strength Fish Oil are available at GNC locations and on GNC.com. In addition to our selection of VMHS products with unique formulations, we also offer the full range of standard "alphabet" vitamins. We sell herbal supplements in various solid dosage and soft gelatin capsules, tea and liquid forms. We have consolidated our traditional herbal offerings under a single umbrella brand, Herbal Plus®. In addition to the Herbal Plus® line, we offer a full line of whole food-based supplements and herb and natural remedy products.

We also offer a variety of specialty products in our GNC and Preventive Nutrition® product lines. These products emphasize third-party research and literature regarding the positive benefits from certain ingredients. These offerings include products designed to provide nutritional support to specific areas of the body, such as joints, the heart and blood vessels and the digestive system. Overall, GNC-branded proprietary products constituted approximately 82% of our VMHS sales in 2011.

Sports Nutrition Products

Sports nutrition products are designed to be taken in conjunction with an exercise and fitness regimen. We typically offer a broad selection of sports nutrition products, such as protein and weight gain powders, sports drinks, sports bars and high potency vitamin formulations, including GNC brands such as Pro Performance®, Pro Performance® AMP and Beyond Raw®, and popular third-party products. Our GNC-branded proprietary products, including Pro Performance® branded products, represented approximately 37% of our sports nutrition product sales in 2011, and are available only at our locations, select wholesale partner locations and on GNC.com. With a broad array of products and our vast retail footprint, we believe we are recognized as one of the leading retailers of sports nutrition products.

13

Diet Products

Our wide variety of diet products consist of various formulas designed to supplement the diet and exercise plans of weight conscious consumers. We typically offer a variety of diet products, including pills, meal replacements, shakes, diet bars, energy tablets and cleansing products. Our retail stores offer our proprietary and third-party brand products suitable for different diet and weight management approaches, including products designed to increase thermogenesis (a change in the body's metabolic rate measured in terms of calories) and metabolism. The diet category is cyclical with new products generating short-term sales growth before generally declining over time, making sales trends within this category less predictable than in our other product categories. We derive the majority of our diet sales from third-party products. Our GNC proprietary line, Total Lean™, is more focused on meal replacement and represents a more stable line of business. Over time, we have reduced our exposure to the diet category. In 2011, company-owned retail sales from diet products accounted for approximately 10% of sales, down significantly from 27% of sales in 2001. Overall, we estimate that GNC-branded proprietary products constituted approximately 31% of our diet product sales in 2011.

Other Wellness Products

Other wellness products represent a comprehensive category that consists of sales of our Gold Card preferred membership and sales of other nonsupplement products, including cosmetics, food items, health management products, books, DVDs and equipment.

Product Development

We believe that introduction of innovative, high quality, clinically proven, superior performing products is a key driver of our business. Customers widely credit us as being a leader in offering premium health products and rate the availability of a wide variety of products as one of our biggest strengths. We identify shifting consumer trends through market research and through interactions with our customers and leading industry vendors to assist in the development, manufacturing and marketing of our new products. Our dedicated innovation team independently drives the development of proprietary products by collaborating with vendors to provide raw materials, clinical and product development for proprietary GNC-branded products. Average development time for products is four to seven months, or six to 18 months when development involves clinical trials. We also work with our vendors to ensure a steady flow of third-party products with preferred distribution rights are made available to us for a limited period of time. In 2011, we targeted our product development efforts on specialty vitamins, women's nutrition, sports nutrition and condition specific products, resulting in the introduction of the GNC Total LeanTM, Sport Vitapaks and Beyond Raw®. In 2011, we estimate that GNC-branded products generated more than $975 million of retail sales across company-owned retail, domestic franchise locations, GNC.com and Rite Aid store-within-a-store locations.

Research and Development

We have an internal research and development group that performs scientific research on potential new products and enhancements to existing products, in part to assist our product development team in creating new products, and in part to support claims that may be made as to the purpose and function of the product.

Employees

As of December 31, 2011, we had approximately 5,800 full-time and 8,000 part-time employees, of whom approximately 11,000 were employed in the domestic portion of our Retail segment, 40 were employed in our Franchise segment, 1,550 were employed in our Manufacturing/Wholesale segment, 525 were employed in corporate support functions, 750 were employed in Canada and 75 were employed at

14

LuckyVitamin.com. None of our employees belongs to a union or is a party to any collective bargaining or similar agreement. We consider our relationship with our employees to be good.

Competition

The U.S. nutritional supplements retail industry is a large, highly fragmented and growing industry, with no single industry participant accounting for a majority of total industry retail sales. Competition is based on price, quality and assortment of products, customer service, marketing support and availability of new products. In addition, the market is highly sensitive to the introduction of new products.

We compete with both publicly and privately owned companies, which are highly fragmented in terms of geographical market coverage and product categories. We also compete with other specialty retailers, supermarkets, drugstores, mass merchants, multi-level marketing organizations, mail-order companies, other internet sites and a variety of other smaller participants. We believe that the market is highly sensitive to the introduction of new products. In the United States, many of our competitors have national brands that are heavily advertised and are manufactured by large pharmaceutical and food companies and other retailers. Most supermarkets, drugstores and mass merchants have narrow product offerings limited primarily to simple vitamins, herbs and popular third-party diet products. Our international competitors also include large international pharmacy chains and major international supermarket chains, as well as other large U.S.-based companies with international operations. Our wholesale and manufacturing operations compete with other wholesalers and manufacturers of third-party nutritional supplements.

Trademarks and Other Intellectual Property

We believe trademark protection is particularly important to the maintenance of the recognized brand names under which we market our products. We own or have rights to material trademarks or trade names that we use in conjunction with the sale of our products, including the GNC brand name. We also rely upon trade secrets, know-how, continuing technological innovations and licensing opportunities to develop and maintain our competitive position. We protect our intellectual property rights through a variety of methods, including trademark, patent and trade secret laws, as well as confidentiality agreements and proprietary information agreements with vendors, employees, consultants and others who have access to our proprietary information. Protection of our intellectual property often affords us the opportunity to enhance our position in the marketplace by precluding our competitors from using or otherwise exploiting our technology and brands. We are also a party to several intellectual property license agreements relating to certain of our products. The duration of our trademark registrations is generally 10, 15 or 20 years, depending on the country in which the marks are registered, and the registrations can be renewed by us. The scope and duration of our intellectual property protection varies throughout the world by jurisdiction and by individual product.

Insurance and Risk Management

We purchase insurance to cover standard risks in the nutritional supplements industry, including policies to cover general products liability, workers' compensation, auto liability and other casualty and property risks. Our insurance rates are dependent upon our safety record as well as trends in the insurance industry. We also maintain workers' compensation insurance and auto insurance policies that are retrospective in that the cost per year will vary depending on the frequency and severity of claims in the policy year.

We face an inherent risk of exposure to product liability claims in the event that, among other things, the use of products sold by us results in injury. With respect to product liability coverage, we carry insurance coverage typical of our industry and product lines. Our coverage involves self-insured retentions with primary and excess liability coverage above the retention amount. We have the ability to refer claims to most of our vendors and their insurers to pay the costs associated with any claims arising from such

15

vendors' products. In most cases, our insurance covers such claims that are not adequately covered by a vendor's insurance and provides for excess secondary coverage above the limits provided by our product vendors.

We self-insure certain property and casualty risks due to our analysis of the risk, the frequency and severity of a loss and the cost of insurance for the risk. We believe that the amount of self-insurance is not significant and will not have an adverse impact on our performance. In addition, we may from time to time self-insure liability with respect to specific ingredients in products that we may sell.

Government Regulation

Product Regulation

Domestic

The processing, formulation, safety, manufacturing, packaging, labeling, advertising and distribution of our products are subject to regulation by one or more federal agencies, including the Federal Drug Administration (the "FDA"), the Federal Trade Commission (the "FTC"), the Consumer Product Safety Commission (the "CPSC"), the United States Department of Agriculture (the "USDA") and the Environmental Protection Agency (the "EPA"), and by various agencies of the states and localities in which our products are sold.

The Dietary Supplement Health and Education Act of 1994 ("DSHEA") amended the Federal Food, Drug, and Cosmetic Act (the "FDC Act") to establish a new framework governing the composition, safety, labeling, manufacturing and marketing of dietary supplements. Generally, under the FDC Act, dietary ingredients that were marketed in the United States prior to October 15, 1994 may be used in dietary supplements without notifying the FDA. "New" dietary ingredients (i.e., dietary ingredients that were "not marketed in the United States before October 15, 1994") must be the subject of a new dietary ingredient notification submitted to the FDA unless the ingredient has been "present in the food supply as an article used for food" without being "chemically altered." A new dietary ingredient notification must provide the FDA evidence of a "history of use or other evidence of safety" establishing that use of the dietary ingredient "will reasonably be expected to be safe." A new dietary ingredient notification must be submitted to the FDA at least 75 days before the initial marketing of the new dietary ingredient. The FDA may determine that a new dietary ingredient notification does not provide an adequate basis to conclude that a dietary ingredient is reasonably expected to be safe. Such a determination could prevent the marketing of such dietary ingredient. The FDA recently issued draft guidance governing the notification of new dietary ingredients. Although FDA guidance is not mandatory, and companies are free to use an alternative approach if the approach satisfies the requirements of applicable laws and regulations, FDA guidance is a strong indication of the FDA's "current thinking" on the topic discussed in the guidance, including its position on enforcement. At this time, it is difficult to determine whether the draft guidance, if finalized, would have a material impact on our operations. However, if the FDA were to enforce the applicable statutes and regulations in accordance with the draft guidance as written, such enforcement could require us to incur additional expenses, which could be significant, and negatively impact our business in several ways, including, but not limited to, enjoining the manufacturing of our products until the FDA determines that we are in compliance and can resume manufacturing, increasing our liability and reducing our growth prospects.

The Dietary Supplement Labeling Act of 2011, which was introduced in July 2011 (S1310), would amend the FDC Act to, among other things, (i) require dietary supplement manufacturers to register the dietary supplements that they manufacture with the FDA (and provide a list of the ingredients in and copies of the labels and labeling of the supplements), (ii) mandate the FDA and the Institute of Medicine to identify dietary ingredients that cause potentially serious adverse effects and (iii) require warning statements for dietary supplements containing potentially unsafe ingredients. If the bill is reintroduced and enacted, it could restrict the number of dietary supplements available for sale, increase our costs, liabilities

16

and potential penalties associated with manufacturing and selling dietary supplements, and reduce our growth prospects.

The Dietary Supplement Safety Act (S 3002), introduced in February 2010, would repeal the provision of DSHEA that permits the sale of all dietary ingredients sold in dietary supplements marketed in the United States prior to October 15, 1994, and instead permit the sale of only those dietary ingredients included on a list of Accepted Dietary Ingredients to be issued and maintained by the FDA. The bill also would allow the FDA to: impose a fine of twice the gross profits earned by a distributor on sales of any dietary supplement found to violate the law; require a distributor to submit a yearly report on all non-serious Adverse Event Reports ("AERs") received during the year to the FDA; and allow the FDA to recall any dietary supplement it determines with "a reasonable probability" would cause serious adverse health consequences or is adulterated or misbranded. The bill also would require any dietary supplement distributor to register with the FDA and submit a list of the ingredients in and copies of the labels of its dietary supplements to the FDA and thereafter update such disclosures yearly and submit any new dietary supplement product labels to the FDA before marketing any dietary supplement product. If this bill is reintroduced and enacted, it could severely restrict the number of dietary supplements available for sale and increase our costs and potential penalties associated with selling dietary supplements.

The FDA or other agencies could take actions against products or product ingredients that in its determination present an unreasonable health risk to consumers that would make it illegal for us to sell such products. In addition, the FDA could issue consumer warnings with respect to the products or ingredients in such products that are sold in our stores. Such actions or warnings could be based on information received through FDC Act-mandated reporting of serious adverse events. For example, the FDC Act requires that reports of serious adverse events be submitted to the FDA, and based in part on such reports, in May 2009, the FDA warned consumers to stop using Hydroxycut diet products, which are produced by Iovate Health Sciences, Inc. ("Iovate") and were sold in our stores. Iovate issued a voluntary recall, with which we fully complied. Sales of the recalled Hydroxycut products amounted to approximately $57.8 million, or 4.7% of our retail sales in 2008, and $18.8 million, or 4.2% of our retail sales in the first four months of 2009. Through December 31, 2011, we estimate that we had refunded approximately $3.5 million to our retail customers and approximately $1.6 million to our wholesale customers for Hydroxycut product returns.

As is common in our industry, we rely on our third-party vendors to ensure that the products they manufacture and sell to us comply with all applicable regulatory and legislative requirements. In general, we seek representations and warranties, indemnification and/or insurance from our vendors. However, even with adequate insurance and indemnification, any claims of non-compliance could significantly damage our reputation and consumer confidence in our products. In addition, the failure of such products to comply with applicable regulatory and legislative requirements could prevent us from marketing the products or require us to recall or remove such products from the market, which in certain cases could materially and adversely affect our business, financial condition and results of operations. For example, we sell products manufactured by third parties that contain DMAA (as defined below). Although we have received representations from our third-party vendors that these products comply with applicable regulatory and legislative requirements, recent media articles have suggested that DMAA may not comply with the FDC Act. In December 2011, the U.S. military asked us to temporarily remove products containing DMAA from our stores on its bases pending the outcome of a precautionary review. That review is still pending. If it is determined that DMAA does not comply with applicable regulatory and legislative requirements, we could be required to recall or remove from the market all products containing DMAA and we could become subject to lawsuits related to any alleged non-compliance, any of which could materially and adversely affect our business, financial condition and results of operations. In the past, we have attempted to offset any losses related to recalls and removals with reformulated or alternative products; however, there can be no assurance that we would be able to offset all or any portion of losses related to any future removal or recall.

17

The FDC Act permits "statements of nutritional support" to be included in labeling for dietary supplements without FDA pre-market approval. Such statements must be submitted to the FDA within 30 days of marketing. Such statements may describe how a particular dietary ingredient affects the structure, function or general well-being of the body, or the mechanism of action by which a dietary ingredient may affect body structure, function or well-being, but may not expressly or implicitly represent that a dietary supplement will diagnose, cure, mitigate, treat or prevent a disease. A company that uses a statement of nutritional support in labeling must possess scientific evidence substantiating that the statement is truthful and not misleading. If the FDA determines that a particular statement of nutritional support is an unacceptable drug claim, conventional food claim or an unauthorized version of a "health claim," or, if the FDA determines that a particular claim is not adequately supported by existing scientific data or is false or misleading, we would be prevented from using the claim.

In addition, DSHEA provides that so-called "third-party literature," e.g., a reprint of a peer-reviewed scientific publication linking a particular dietary ingredient with health benefits, may be used "in connection with the sale of a dietary supplement to consumers" without the literature being subject to regulation as labeling. The literature: (1) must not be false or misleading; (2) may not "promote" a particular manufacturer or brand of dietary supplement; (3) must present a balanced view of the available scientific information on the subject matter; (4) if displayed in an establishment, must be physically separate from the dietary supplements; and (5) should not have appended to it any information by sticker or any other method. If the literature fails to satisfy each of these requirements, we may be prevented from disseminating such literature with our products, and any dissemination could subject our product to regulatory action as an illegal drug.

In June 2007, pursuant to the authority granted by the FDC Act as amended by DSHEA, the FDA published detailed current Good Manufacturing Practice ("cGMP") regulations that govern the manufacturing, packaging, labeling and holding operations of dietary supplement manufacturers. The cGMP regulations, among other things, impose significant recordkeeping requirements on manufacturers. The cGMP requirements are in effect for all manufacturers, and the FDA is conducting inspections of dietary supplement manufacturers pursuant to these requirements. There remains considerable uncertainty with respect to the FDA's interpretation of the regulations and their actual implementation in manufacturing facilities. In addition, the FDA's interpretation of the regulations will likely change over time as the agency becomes more familiar with the industry and the regulations. The failure of a manufacturing facility to comply with the cGMP regulations renders products manufactured in such facility "adulterated," and subjects such products and the manufacturer to a variety of potential FDA enforcement actions. In addition, under the Food Safety Modernization Act ("FSMA"), which was enacted on January 2, 2011, the manufacturing of dietary ingredients contained in dietary supplements will be subject to similar or even more burdensome manufacturing requirements, which will likely increase the costs of dietary ingredients and will subject suppliers of such ingredients to more rigorous inspections and enforcement. The FSMA will also require importers of food, including dietary supplements and dietary ingredients, to conduct verification activities to ensure that the food they might import meets applicable domestic requirements.

The FDA has broad authority to enforce the provisions of federal law applicable to dietary supplements, including powers to issue a public warning or notice of violation letter to a company, publicize information about illegal products, detain products intended for import, require the reporting of serious adverse events, require a recall of illegal or unsafe products from the market, and request the Department of Justice to initiate a seizure action, an injunction action or a criminal prosecution in the U.S. courts. The FSMA expands the reach and regulatory powers of the FDA with respect to the production and importation of food, including dietary supplements. The expanded reach and regulatory powers include the FDA's ability to order mandatory recalls, administratively detain domestic products, require certification of compliance with domestic requirements for imported foods associated with safety issues and administratively revoke manufacturing facility registrations, effectively enjoining manufacturing of

18

dietary ingredients and dietary supplements without judicial process. The regulation of dietary supplements may increase or become more restrictive in the future.

The FTC exercises jurisdiction over the advertising of dietary supplements and over-the-counter drugs. In recent years, the FTC has instituted numerous enforcement actions against dietary supplement companies for failure to have adequate substantiation for claims made in advertising or for the use of false or misleading advertising claims. We continue to be subject to three consent orders issued by the FTC. In 1984, the FTC instituted an investigation of General Nutrition, Incorporated ("GNI"), one of our then existing subsidiaries, alleging deceptive acts and practices in connection with the advertising and marketing of certain of its products. GNI accepted a proposed consent order, under which it agreed to refrain from, among other things, making certain claims with respect to certain of its products unless the claims are based on and substantiated by competent and reliable scientific evidence. We also entered into a consent order in 1970 with the FTC, which generally addressed "iron deficiency anemia" type products. As a result of routine monitoring by the FTC, disputes arose concerning our compliance with these orders and with regard to advertising for certain hair care products. While we believe that GNI, at all times, operated in material compliance with the orders, it entered into a settlement in 1994 with the FTC to avoid protracted litigation. As a part of this settlement, GNI entered into a consent decree and paid, without admitting liability, a civil penalty in the amount of $2.4 million and agreed to adhere to the terms of the 1970 and 1989 consent orders and to abide by the provisions of the settlement document concerning hair care products. We do not believe that future compliance with the outstanding consent decrees will materially affect our business operations.

The FTC continues to monitor our advertising and, from time to time, requests substantiation with respect to such advertising to assess compliance with the various outstanding consent decrees and with the Federal Trade Commission Act. Our policy is to use advertising that complies with the consent decrees and applicable regulations. Nevertheless, there can be no assurance that inadvertent failures to comply with the consent decrees and applicable regulations will not occur.

Some of the products sold by franchise stores are purchased by franchisees directly from other vendors and these products do not flow through our distribution centers. Although franchise contracts contain strict requirements for store operations, including compliance with federal, state and local laws and regulations, we cannot exercise the same degree of control over franchisees as we do over our company-owned stores.

As a result of our efforts to comply with applicable statutes and regulations, we have from time to time reformulated, eliminated or relabeled certain of our products and revised certain provisions of our sales and marketing program.

Foreign

Our products sold in foreign countries are also subject to regulation under various national, local and international laws that include provisions governing, among other things, the formulation, manufacturing, packaging, labeling, advertising and distribution of dietary supplements and over-the-counter drugs. Government regulations in foreign countries may prevent or delay the introduction, or require the reformulation, of certain of our products.

New Legislation or Regulation

Legislation may be introduced which, if passed, would impose substantial new regulatory requirements on dietary supplements. For example, although not yet reintroduced in this session of Congress, bills have been repeatedly proposed in past sessions of Congress which would subject the dietary ingredient dehydroepiandrosterone ("DHEA") to the requirements of the Controlled Substances Act, which would prevent the sale of products containing DHEA. In March 2009, the General Accounting Office (the "GAO") issued a report that made four recommendations to enhance the FDA's oversight of

19

dietary supplements. The GAO recommended that the Secretary of the Department of Health and Human Services direct the Commissioner of the FDA to: (1) request authority to require dietary supplement companies to identify themselves as a dietary supplement company and update this information annually, provide a list of all dietary supplement products they sell and a copy of the labels and update this information annually, and report all adverse events related to dietary supplements, not just serious adverse events; (2) issue guidance to clarify when an ingredient is considered a new dietary ingredient, the evidence needed to document the safety of new dietary ingredients, and appropriate methods for establishing ingredient identity; (3) provide guidance to industry to clarify when products should be marketed as either dietary supplements or conventional foods formulated with added dietary ingredients; and (4) coordinate with stakeholder groups involved in consumer outreach to identify additional mechanisms for educating consumers about the safety, efficacy, and labeling of dietary supplements, implement these mechanisms, and assess their effectiveness. These recommendations could lead to increased regulation by the FDA or future legislation concerning dietary supplements.

We cannot determine what effect additional domestic or international governmental legislation, regulations, or administrative orders, when and if promulgated, would have on our business in the future. New legislation or regulations may require the reformulation of certain products to meet new standards, require the recall or discontinuance of certain products not capable of reformulation, impose additional record keeping or require expanded documentation of the properties of certain products, expanded or different labeling or scientific substantiation.

Franchise Regulation

We must comply with regulations adopted by the FTC and with the laws of several states that regulate the offer and sale of franchises. The FTC's Trade Regulation Rule on Franchising and certain state laws require that we furnish prospective franchisees with a franchise offering circular containing information prescribed by the Trade Regulation Rule on Franchising and applicable state laws and regulations.

We also must comply with a number of state laws that regulate some substantive aspects of the franchisor-franchisee relationship. These laws may limit a franchisor's business practices in a number of ways, including limiting the ability to:

- •

- terminate or not renew a franchise without good cause;

- •

- interfere with the right of free association among franchisees;

- •

- disapprove the transfer of a franchise;

- •

- discriminate among franchisees with regard to franchise terms and charges, royalties and other fees; and

- •

- place new stores near existing franchises.

To date, these laws have not precluded us from seeking franchisees in any given area and have not had a material adverse effect on our operations. Bills concerning the regulation of certain aspects of franchise relationships have been introduced into Congress on several occasions during the last decade, but none have been enacted. Revisions to the FTC rule have also been proposed by the FTC and currently are in the comment stage of the rulemaking process.

Our international franchise agreements and franchise operations are regulated by various foreign laws, rules and regulations. These laws may limit a franchisor's business practices in a number of ways. To date, these laws have not precluded us from seeking franchisees in any given area and have not had a material adverse effect on our operations.

20

Environmental Compliance

In March 2008, the South Carolina Department of Health and Environmental Control ("DHEC") requested that we investigate contamination associated with historical activities at one of our South Carolina facilities. This investigation has identified chlorinated solvent impacts in soils and groundwater that extend offsite from our facility. We are awaiting DHEC approval of the scope of additional investigations in order to understand the extent of these impacts and develop appropriate remedial measures for DHEC approval. At this state of the investigation, however, it is not possible to estimate the timing and extent of any remedial action that may be required, the ultimate cost of remediation, or the amount of our potential liability.

In addition to the foregoing, we are subject to numerous federal, state, local and foreign environmental and health and safety laws and regulations governing its operations, including the handling, transportation and disposal of our non-hazardous and hazardous substances and wastes, as well as emissions and discharges from its operations into the environment, including discharges to air, surface water and groundwater. Failure to comply with such laws and regulations could result in costs for remedial actions, penalties or the imposition of other liabilities. New laws, changes in existing laws or the interpretation thereof, or the development of new facts or changes in their processes could also cause us to incur additional capital and operating expenditures to maintain compliance with environmental laws and regulations and environmental permits. We are also subject to laws and regulations that impose liability and cleanup responsibility for releases of hazardous substances into the environment without regard to fault or knowledge about the condition or action causing the liability. Under certain of these laws and regulations, such liabilities can be imposed for cleanup of previously owned or operated properties, or for properties to which substances or wastes that were sent in connection with current or former operations at its facilities. The presence of contamination from such substances or wastes could also adversely affect our ability to sell or lease our properties, or to use them as collateral for financing. From time to time, we have incurred costs and obligations for correcting environmental and health and safety noncompliance matters and for remediation at or relating to certain of our properties or properties at which our waste has been disposed. However, compliance with the provisions of national, state and local environmental laws and regulations has not had a material effect upon our capital expenditures, earnings, financial position, liquidity or competitive position. We believe we are currently in compliance with our environmental obligations pursuant to environmental and health and safety laws and regulations in all material respects, and that any liabilities for noncompliance will not have a material adverse effect on our business or financial performance.

The following risk factors could cause our financial performance to differ significantly from the goals, plans, objectives, intentions and expectations expressed in this Annual Report. If any of the following risks and uncertainties actually occur, our business, financial condition, results of operations or cash flows could be materially and adversely affected.

Risks Relating to Our Business and Industry

We may not effectively manage our growth, which could materially harm our business.

We expect that our business will continue to grow, which may place a significant strain on our management, personnel, systems and resources. We must continue to improve our operational and financial systems and managerial controls and procedures, and we will need to continue to expand, train and manage our technology and workforce. We must also maintain close coordination among our technology, compliance, accounting, finance, marketing and sales organizations. We cannot assure you that we will manage our growth effectively. If we fail to do so, our business could be materially harmed.

21

Our continued growth will require an increased investment by us in technology, facilities, personnel and financial and management systems and controls. It also will require expansion of our procedures for monitoring and assuring our compliance with applicable regulations, and we will need to integrate, train and manage a growing employee base. The expansion of our existing businesses, any expansion into new businesses and the resulting growth of our employee base will increase our need for internal audit and monitoring processes that are more extensive and broader in scope than those we have historically required. We may not be successful in identifying or implementing all of the processes that are necessary. Further, unless our growth results in an increase in our revenues that is proportionate to the increase in our costs associated with this growth, our operating margins and profitability will be adversely affected.

We operate in a highly competitive industry. Our failure to compete effectively could adversely affect our market share, revenues and growth prospects.

The U.S. nutritional supplements retail industry is large and highly fragmented. Participants include specialty retailers, supermarkets, drugstores, mass merchants, multi-level marketing organizations, on-line merchants, mail-order companies and a variety of other smaller participants. We believe that the market is also highly sensitive to the introduction of new products, which may rapidly capture a significant share of the market. In the United States, we also compete for sales with heavily advertised national brands manufactured by large pharmaceutical and food companies, as well as other retailers. In addition, as some products become more mainstream, we experience increased price competition for those products as more participants enter the market. Our international competitors include large international pharmacy chains, major international supermarket chains and other large U.S.-based companies with international operations. Our wholesale and manufacturing operations compete with other wholesalers and manufacturers of third-party nutritional supplements. We may not be able to compete effectively and our attempts to do so may require us to reduce our prices, which may result in lower margins. Failure to effectively compete could adversely affect our market share, revenues and growth prospects.

Unfavorable publicity or consumer perception of our products, the ingredients they contain and any similar products distributed by other companies could cause fluctuations in our operating results and could have a material adverse effect on our reputation, the demand for our products and our ability to generate revenues and the market price of the Class A common stock.