form10k.htm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

(Mark One)

|

|

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

| |

|

| |

For the fiscal year ended September 30, 2013

|

| |

|

|

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

| |

|

| |

For the transition period from __________ to __________

|

|

333-170096

|

|

Commission File Number

|

| |

|

SOLO INTERNATIONAL, INC.

|

|

(Exact name of registrant as specified in its charter)

|

| |

|

|

Nevada

|

N/A

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

| |

|

|

871 Coronado Center Dr. Ste 200, Henderson, NV

|

89052

|

|

(Address of principal executive offices)

|

(Zip Code)

|

| |

|

(702) 330-3285

|

|

(Registrant’s telephone number, including area code)

|

|

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

|

Title of each class

|

Name of each exchange on which registered

|

|

n/a

|

n/a

|

|

Securities registered pursuant to Section 12(g) of the Exchange Act:

|

|

Common Stock, $0.001 par value

|

|

Title of class

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

[ ]

|

Accelerated filer

|

[ ]

|

| |

|

|

|

|

Non-accelerated filer

|

[ ]

|

Smaller reporting company

|

[X]

|

|

(Do not check if a smaller reporting company)

|

|

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

|

The aggregate market value of voting and non-voting common stock held by non-affiliates of the registrant was approximately $573,300 (based on 88,200,000 shares held by non-affiliates and closing market price of $0.0065 per share as of March 29, 2013 (the last business day of the registrant’s most recently completed second quarter)), assuming solely for the purpose of this calculation that all directors, officers and greater than 10% stockholders of the registrant are affiliates. The determination of affiliate status for this purpose is not necessarily conclusive for any other purpose.

|

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PAST 5 YEARS:

Indicate by check mark whether the issuer has filed all documents and reports required to be filed by Section 12, 13, or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

APPLICABLE ONLY TO CORPORATE REGISTRANTS

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

| |

288,200,000 shares of common stock issued and outstanding as of December 20, 2013

|

|

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g. Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) of the Securities Act of 1933. The listed documents should be clearly described for identification purposes.

| |

|

Page

|

| |

PART I

|

|

| |

|

|

|

|

Business

|

6 |

|

|

Risk Factors

|

17 |

| Item 1B |

Unresolved Staff Comments |

23 |

|

|

Properties

|

23 |

|

|

Legal Proceedings

|

24 |

|

|

Mine Safety Disclosures

|

24 |

| |

|

|

| |

PART II

|

|

| |

|

|

|

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

25 |

|

|

Selected Financial Data

|

26 |

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

26 |

|

|

Quantitative and Qualitative Disclosures About Market Risk

|

28 |

|

|

Financial Statements and Supplementary Data

|

28 |

| |

|

|

|

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

30 |

|

|

Controls and Procedures

|

30 |

|

|

Other Information

|

31 |

| |

|

|

| |

PART III

|

|

| |

|

|

|

|

Directors, Executive Officers and Corporate Governance

|

32 |

| Item 11 |

Compensation |

35 |

|

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

37 |

|

|

Certain Relationships and Related Transactions, and Director Independence

|

37 |

|

|

Principal Accounting Fees and Services

|

39 |

| |

|

|

| |

PART IV

|

|

| |

|

|

|

|

Exhibits, Financial Statement Schedules

|

40 |

| |

|

|

| |

|

41 |

Forward Looking Statements

This Annual Report on Form 10-K (“Annual Report”) contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as "may," "should," "expects," "plans," "anticipates," "believes," "estimates," "predicts," "potential," or "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled "Risk Factors" and the risks set out below, any of which may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

These risks include, by way of example and not in limitation:

| |

·

|

the uncertainty that we will not be able to successfully identify commercially viable resources on our exploration properties;

|

| |

·

|

risks related to the large number of established and well-financed entities that are actively competing for limited resources within the mineral property exploration field;

|

| |

·

|

risks related to the failure to successfully manage or achieve growth of our business if we are successful in identify a viable mineral resource, and;

|

| |

·

|

other risks and uncertainties related to our business strategy.

|

This list is not an exhaustive list of the factors that may affect any of our forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on our forward-looking statements.

Forward looking statements are made based on management’s beliefs, estimates and opinions on the date the statements are made and we undertake no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

The safe harbors of forward-looking statements provided by Section 21E of the Exchange Act are unavailable to issuers of penny stock. As we issued securities at a price below $5.00 per share, our shares are considered penny stock and such safe harbors set forth under the Private Securities Litigation Reform Act of 1995 are unavailable to us.

Our financial statements are stated in United States dollars and are prepared in accordance with United States generally accepted accounting principles.

In this annual report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to "common stock" refer to the common shares in our capital stock.

As used in this Annual Report, the terms "we," "us," “Company,” "our" and "Solo" mean Solo International, Inc., unless otherwise indicated.

Measurement & Currency

Conversion of metric units into imperial equivalents is as follows:

|

Metric Units

|

Multiply by

|

Imperial Units

|

|

hectares

|

2.471

|

= acres

|

|

meters

|

3.281

|

= feet

|

|

kilometers

|

0.621

|

= miles (5,280 feet)

|

|

grams

|

0.032

|

= ounces (troy)

|

|

tonnes

|

1.102

|

= tons (short) (2,000 lbs)

|

|

grams/tonne

|

0.029

|

= ounces (troy)/ton

|

Cautionary Note to United States Investors

We caution U.S. investors that the Company may have materials in the public domain that may use terms that are recognized and permitted under Canadian regulations, however the U.S. Securities and Exchange Commission (“S.E.C.”) may not recognize such terms. We have detailed below the differences in the SEC regulations as compared to the Canadian Regulations under National Instrument NI 43-101.

|

S.E.C. Industry Code

|

|

National Instrument 43-101 (“NI 43-101”)

|

|

Reserve: That part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. The United States Securities and Exchange Commission requires a final or full Feasibility Study to be completed in order to support either Proven or Probable Reserves and does not recognize other classifications of mineralized deposits. Note that for industrial mineral properties, in addition to the Feasibility Study, “sales” contracts or actual sales may be required in order to prove the project’s commerciality and reserve status.

|

|

Mineral Reserve: The economically mineable part of a Measured or Indicated Mineral Resource demonstrated by at least a Preliminary Feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified.

|

|

Proven Reserves: Reserves for which a quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes, grade and/or quality are computed from the results of detailed sampling; the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, share, depth and mineral content of reserves are well established.

|

|

Proven Mineral Reserve: The economically mineable part of a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified.

|

|

Probable Reserves: Reserves for which quantity and grade and/or quality are computed from information similar to that used for proven reserves, but the sites for inspection, sampling and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation.

|

|

Probable Mineral Reserve: The economically mineable part of an indicated, and in some circumstances, a Measured Mineral Resource, demonstrated by at least a Preliminary Feasibility Study. This study must include adequate information on mining, processing, metallurgical, and economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified.

|

The address of our principal executive office is 871 Coronado Center Dr., Ste 200, Henderson, NV 89052. Our telephone number is 702-330-3285.

Our common stock is quoted on the OTCBB (“Over-the-Counter- Bulletin-Board”) under the symbol "SLIO".

History of the Company

We were incorporated in the State of Nevada on April 30, 2010. Our original business plan was to operate an interior architectural design business in Poland, including programming and concept design, residential space planning, interior design, kitchen and bath design, decorating and color consultation, furniture and fixture acquisition, lighting design, start-to-finish project management. Due to a lack of revenue from our interior design services, towards the end of September 2011, we abandoned the original business plan and began seeking out potential mineral properties to acquire. We decided to enter the mining business because we were seeking out viable and feasible options to create value for our shareholders.

On October 13, 2011, the Company filed a Certificate of Change (the “Certificate of Change”) with the Nevada Secretary of State effectuating a 100 for 1 forward stock split of the issued and outstanding common stock of the Company. Additionally, as a result of the Certificate of Change, the Company increased the authorized number of common shares from seventy-five million (75,000,000) to nine hundred million (900,000,000) shares, par value $0.001 per share.

After conducting independent research on the feasibility of discovering and exploiting commercially recoverable amounts of ore, we determined that staking and exploring potential mineral claims could be an excellent long-term investment strategy that could potentially lead to lucrative business opportunities. Accordingly, we refocused the Company's business direction to include a new business plan based on the exploration of mineral claims. We are conducting business through our wholly-owned subsidiary, 9252-4768 Quebec Inc., as further described below.

Current Business

On November 15, 2011, the Company through its wholly-owned subsidiary, which was unnamed at the time (the “Optionee”), entered into a Property Option Agreement (the “Option Agreement”) with 9228-6202 Quebec Inc. (the “Optionor”), whereby the Optionee was granted the exclusive option (the “Option”) to acquire an undivided 100% right, title and interest in and to certain mineral claims located in Portland Township, Outaouais, Quebec, which consists of 2 mineral claims (CDC2261871(the “Philadelphia Claim”) and CDC2318741(an unnamed claim, the “Second Claim”)) totaling approximately 120 hectares currently staked and recorded (collectively the "Property"). On December 20, 2011, the Optionee and Optionor executed an Addendum to the Option Agreement (the “Addendum”), which incorporated all of the terms and conditions of the original Option Agreement and identified the Optionee subsidiary by its current name, 9252-4768 Quebec Inc.

To fully exercise the Option and acquire an undivided 100% right, title and interest in and to the Property, the Optionee was required to:

1) pay an aggregate sum of two hundred five thousand dollars ($205,000) to Optionor (the “Cash Payments”); 2) incur an aggregate of at least sixty-five thousand dollars ($65,000) of expenditures on or with respect to the Property (the “Expenditures”); and 3) issue to Optionor an aggregate number of restricted shares of common stock of the Company (the “Stock Issuances”) equal to twenty thousand US dollars ($20,000), as further set forth in the Option Agreement. The Cash Payments, Expenditures and Stock Issuances are herein collectively referred to as the “Option Price” and were to be paid as follows:

Cash Payments: The Optionee was required to pay the Cash Payments to Optionor in the following amounts and by the dates described below:

| i. |

|

$50,000 within 2 business days of the execution of this Option Agreement (the “First Option Payment”);

|

|

ii.

|

|

$70,000 within 30 days following the First Option Payment (the “Second Option Payment”);

|

|

iii.

|

|

$70,000 within 30 days following the Second Option Payment (the “Third Option Payment”);

|

|

iv.

|

|

$15,000 within 30 days following the Third Option Payment (the “Fourth Option Payment”);

|

Expenditures: The Optionee was required to incur Expenditures on or with respect to the Property in the following amounts and by the dates described below:

| i. |

|

Incurring exploration expenditures on the Property of not less than $65,000 prior to the first anniversary of the execution of the Option Agreement or November 15, 2012;

|

Stock Issuances: The Optionee was required to issue an aggregate number of restricted shares of common stock of the Company equal to twenty thousand US dollars ($20,000) pursuant to the terms and conditions of the Option Agreement.

Upon satisfaction of the foregoing terms and conditions, the Optionee would have fully exercised the Option and acquired an undivided 100% right, title and interest in and to the Property, subject to certain royalties reserved to Optionor per the terms of the Option Agreement, and in and to any resulting mineral permits or leases.

On November 27, 2012, the Option Agreement was further amended to revise the requirement to expend the $65,000 on exploration expenditures to read that the Optionee had earned its 100% right and interest in the Property for the payment of all expenditures to November 27, 2012 and for allowing the Optionor to utilize a portion of the expenditures expended by the Optionee to apply to certain of the Optionor’s claims.

As of the date of this Annual Report on Form 10-K, we have fulfilled all of our requirements under the Option Agreement, as amended and earned our 100% right, title and interest in and to the Property.

As of the date of this Report, we are an exploration stage company engaged in the acquisition and exploration of mineral properties, with a focus on the country of Canada. We have not acquired our first mineral Property and commenced exploration on the Property. We are currently negotiating to acquire further claims in the area. We intend to continue exploration on our already acquired Property.

At this point, we are considered an exploration or exploratory stage company because we are involved in the examination and investigation of land that we believe may contain valuable minerals for discovering the presence of these minerals, and their extent.

Our proposed exploration programs may not result in the discovery of commercially exploitable reserves of valuable minerals. Exploration for minerals is a speculative venture involving substantial risk. The probability of any mineral property ever having commercially exploitable reserves is unlikely, and it is probable that this Property may not contain any commercially exploitable reserves. If we are unable to find reserves of valuable minerals or if we cannot remove the minerals either because we do not have the capital to do so, or because it is not economically feasible to do so, then we will cease operations relating to the Property and we will attempt to seek out alternate properties. In the event that we cease operations relating to the Property, any funds received by the Company will be used to pay our working capital expenses and potential investors likely lose their investment in the Company.

Because we are an exploration stage company, there is no assurance that commercially viable mineral deposits exist on the Property, and a great deal of further exploration will be required before a final evaluation is made as to the economic viability of the Property. To date, we have no known reserves of any type of mineral on the Property and we have not discovered economically viable mineral deposits on the Property, and there is no assurance that we will discover such deposits.

If we decide to stop further exploration of the Property, we may seek to acquire other exploration properties. Any such acquisition(s) will involve due diligence costs in addition to the acquisition costs. We will also have an ongoing obligation to maintain our periodic filings with the appropriate regulatory authorities, which will involve legal and accounting costs. In the event that our available capital is insufficient to acquire an alternative resource property and sustain minimum operations, we will need to secure additional funding or else we will be compelled to discontinue our proposed business.

If commercially marketable quantities of valuable mineral deposits exist on the Property and sufficient funds are available, we will evaluate the technical and financial risks of mineral extraction, including an evaluation of the economically recoverable portion of the deposits, market rates for the minerals, engineering concerns, infrastructure costs, finance and equity requirements, safety concerns, regulatory requirements and an analysis of the Property from initial excavation all the way through to reclamation. After we conduct this analysis and determine that a given mineral deposit is worth recovering, we will begin the development process. Development will require us to obtain a processing plant and other necessary equipment including equipment to extract, transport and store the minerals.

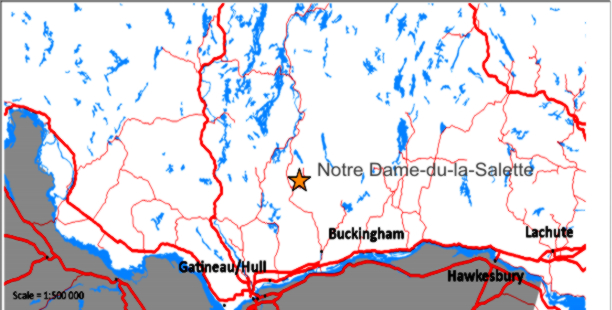

The Property

The Philadelphia Claim is a 59.96 hectare claim with no exploration restriction located 3.6 km NE of Notre Dame-de-la-Salette (45° 46’ 04”N 75° 35’ 07”W), a small village of 745 people located in the Outaouais region of Quebec, and has an easy road access as it is 170 meters off of a main road. The Philadelphia Claim is currently recorded with the Ministere of Natural Resources Quebec. The claim gives the holder an exclusive right to search for mineral substances in the public domain, except sand, gravel, clay and other loose deposits, on the land subjected to the claim.

The Philadelphia Claim was obtained by map designation, henceforth the principal method for acquiring a claim, and the Philadelphia Claim was registered on November 29, 2010. The term of a claim is two years, from the day the claim is registered and it can be renewed indefinitely providing the holder meets all the conditions set out in the Mining Act, including the obligation to invest a minimum amount required in exploration work determined by regulation. The Act includes provisions to allow any amount disbursed to perform work in excess of the prescribed requirements to be applied to subsequent terms of the claim. The Philadelphia Claim registration is set to expire on November 28, 2014. We have met our expenditure requirements on the Claim and have renewed our registration, which will expire on November 28, 2014. Recent assessments of several areas near Notre Dame-de-la-Salette indicate recoverable deposits of apatite in the Philadelphia Claim previously mined in the late 1800’s. There are several other old mines near this location: McLaren, Lac Tamo, Craft, North Star and Chapleau.

Philadelphia Claim

The region surrounding Notre Dame-de-la-Salette, including the Buckingham region is a failed rift zone (aulacogen) corridor, which is a favorable environment for the presence of carbonatite. Apatite and REE’s are associated and often concentrated in carbonatites and associated alkaline rocks. REE’s are also demonstrated by the presence of the Oka pyrochlore-rich carbonatite deposit. Such concentration of REE’s in apatite may be interpreted as an alteration of carbonatite metasomatic ore-fluids.

The Philadelphia Claim is a past apatite (phosphor) producer; the production stage was carried out from 1880 to 1884 and about 2,000 tons of rocks were extracted from the Philadelphia Claim. The main pit is 13 by 5 meters large and 30 meters deep. The apatite is found within pyroxenite, gneiss and quartzite units which are part of the Grenville Group and is in a NE-SW oriented lode. The dimensions of the prospect are unknown. The mineralization is massive and consists of green and red apatite with micas. This apatite deposit seems to originate from an alteration around a pegmatite intrusion. It seems to be caused by the dissolution of phosphor into limestone and its re-concentration in the current deposit.

The Second Claim is currently recorded with the Ministere of Natural Resources Quebec. The Second Claim was also obtained by map designation, henceforth the principal method for acquiring a claim, and the Second Claim was registered on October 19, 2011. The term of the claim is two years, from the day the claim is registered and it can be renewed indefinitely providing the holder meets all the conditions set out in the Mining Act, including the obligation to invest a minimum amount required in exploration work determined by regulation. The Act includes provisions to allow any amount disbursed to perform work in excess of the prescribed requirements to be applied to subsequent terms of the claim. We have undertaken exploration work on this claim and this Claim has been renewed, with a new expiration date of October 18, 2015.

Work done on the Property to date is presented below under “Exploration Programs” on page 12.

Glossary of Technical Geological Terms

The following defined geological terms are used in this Report:

|

Term

|

Definition

|

|

Alkali:

|

A soluble salt consisting largely of potassium or sodium carbonate.

|

|

Alkaline:

|

Having the properties of an alkali, or containing alkali; having a pH greater than 7.

|

|

Apatite:

|

A mineral consisting of calcium phosphate with some fluorine, chlorine, and other elements.

|

|

Carbonate:

|

A salt of carbonic acid, characterized by the presence of the carbonate ion.

|

|

Carbonatite:

|

Intrusive or extrusive igneous rocks defined by mineralogic composition consisting of greater than 50 percent carbonate.

|

|

Crystalline:

|

Having the structure and form of a crystal; composed of crystals.

|

|

Extrusive:

|

Relating to or denoting rock that has been extruded at the earth's surface as lava or other volcanic deposits.

|

|

Igneous Rock:

|

A rock relating to, resulting from, or suggestive of the intrusion or extrusion of magma or volcanic activity.

|

|

Intrusive:

|

Igneous rocks that crystallize below Earth's surface.

|

|

Gneiss:

|

A layered or banded crystalline metamorphic rock the grains of which are aligned or elongated into a roughly parallel arrangement.

|

|

Lode:

|

A classic vein, ledge, or other rock in place between definite walls.

|

|

Metallurgical:

|

Of or relating to metallurgy.

|

|

Metallurgy:

|

A domain of materials science and of materials engineering that studies the physical and chemical behavior of metallic elements and their mixtures, which are called alloys.

|

|

Metamorphic Rock:

|

Rock altered by pressure or heat.

|

|

Metasomatism:

|

The chemical alteration of a rock by hydrothermal and other fluids.

|

|

Mica:

|

Any of a group of chemically and physically related aluminum silicate minerals, common in igneous and metamorphic rocks.

|

|

Mineralization:

|

The concentration of metals and their chemical compounds within a body of rock.

|

|

Mafic:

|

Describes a silicate mineral or rock that is rich in magnesium and iron.

|

|

Mineralized Material:

|

Projection of mineralization in rock based on geological evidence and assumed continuity.

|

|

Ore:

|

A type of rock that contains minerals with important elements including metals. The ores are extracted through mining; these are then refined to extract the valuable element(s).

|

|

Pegmatite:

|

A coarsely crystalline granite or other igneous rock with crystals several centimeters in length.

|

|

Pyroxene:

|

Any of a large class of rock-forming silicate minerals, generally containing calcium, magnesium, and iron.

|

|

Pyroxenite:

|

Ultramafic igneous rock consisting essentially of minerals of the pyroxene group.

|

|

Quartz:

|

A very hard mineral composed of silica, SiO2, found worldwide in many different types of rocks, including sandstone and granite.

|

|

Quartzite:

|

An extremely compact, hard, granular rock consisting essentially of quartz.

|

|

Reserve:

|

(For the purposes of this Report): That part of a mineral deposit, which could be economically and legally extracted or produced. Reserves consist of:

Proven (Measured) Reserves: Reserves for which: (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; (b) grade and/or quality are computed from the results of detailed sampling; and (c) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well-defined that size, shape, depth and mineral content of reserves are well-established.

Probable (Indicated) Reserves: Reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven (measured) reserves, is high enough to assume continuity between points of observation.

|

|

Rift Zone:

|

A large area of the earth in which plates of the earth's crust are moving away from each other, forming an extensive system of fractures and faults.

|

|

Silica:

|

A hard, unreactive, colorless compound, SiO2, that occurs as the mineral quartz and as a principal constituent of sandstone and other rocks.

|

|

Silicate:

|

Any of numerous compounds containing silicon, oxygen, and one or more metals.

|

|

Ultramafic:

|

Relating to or denoting igneous rocks composed chiefly of mafic minerals.

|

|

Vein:

|

A fracture that has been filled with mineral material.

|

|

Volcanic:

|

Characteristic of, pertaining to, situated in or upon, formed in, or derived from volcanoes.

|

Exploration Programs:

Phase I

The Company completed Phase 1 during the month of September, 2012, which was its initial survey consisting of prospecting and locating historic apatite mine sites and sampling of the mine sites located. The Company’s consulting geologist recommended commencing Phase II of the Company’s planned exploration program. The objective of the initial phase of exploration was to locate the historic mine site on the claims and sample the site to evaluate its REE content. Further the objective was to try to define if there is any zoning between heavy and light REE in the skarns. This initial phase was carried on between September 18 and 21, 2012 by a geologist and a technician. The crew was able to locate the old mine site, along with 2 other small open pits and many outcrops in the immediate surroundings. The site is easily accessible by main roads and a small walk through a clear bush road. 26 samples were taken on the main mine site, 11 blocks were sampled and 5 other samples were taken on other outcrops and pits. The samples were bagged on site and then sent to Val D'Or Minerals Lab for preparation by crushing (Split off 1kg and pulverize split to better than 85% passing 75 microns) and REE assaying by inductively coupled plasma mass spectrometry (ICP-MS). Apatite minerals found on site were sent to the University of Quebec's mineral lab to evaluate their REE contents with a scanning electron microscope.

Phase II

The second phase exploration program started on the 16th day of October, 2012. The exploration team was comprised of a senior geophysicist and a technician. Their objective was to find new mining pits in the surrounding area of the main historical pit site and to sample the new sites for REE. The team will also undertake a geophysical reconnaissance survey. A beep mat will be brought on the property to verify the geophysical signals of the skarns zones at surface, which is the host rock of apatite and REE. A Beep Mat BM4+ was used to evaluate if there are any electro magnetism and magnetism signals which will allow us to separate skarns zones and their surroundings close to the surface.

While the Company has received results it does not yet have a NI43-101 compliant report which will allow it to release the results in Canada as the Company is a reporting issuer in both Canada and the U.S. The Company finalized its NI43-101 report on May 9, 2013.

Plan of Operation

We have implemented our initial exploration program and completed our Phase I and Phase II exploration programs. We plan to continue to conduct mineral exploration activities on the Property to assess whether the Property contains mineral reserves capable of commercial extraction. To date, we have not identified any commercially exploitable reserves of minerals on the Property.

Phase III and Phase IV

A Phase III ground geophysical survey should be able to generate drilling targets for apatite in any skarn zones identified or elsewhere on the property. Phase IV will then either drill or mechanically strip the geophysical anomalies. Both third and fourth phases can be done even if the ground is frozen or if snow is present. We expect to begin these phases (Phase III and Phase IV) of the program on the second calendar quarter of 2014, assuming we have adequate funds to continue our operations. Phase III will consist of retaining a consultant(s) to conduct core sampling and analysis. Core sampling is the process of drilling holes to a depth of up to 100 feet in order to extract a sample of earth. Depending on the availability of funds, we intend to drill a minimum of 16 holes to a depth of 100 feet each (totaling 1,600 linear feet) and a maximum of 32 holes to a depth of 100 feet each (totaling 3,200 linear feet). We anticipate that it will take between one to three months to drill 16-32 holes to a depth of 100 feet each. Our estimated costs for drilling is approximately $20.00 per foot; thus to drill 16 holes to a depth of 100 feet, it will cost approximately $31,000 and to drill 32 holes to a depth of 100 feet, it will cost approximately $64,000. Additionally, we will pay a consultant(s) up to a maximum of $5,000 per month for his or her services during Phase III. We anticipate that it will take between one to three months to conduct Phase III; thus, we will pay the consultant(s) a minimum of $5,000 and a maximum of $15,000.

As part of Phase IIII, after core sampling, the consultant(s) will analyze the samples collected from the core drilling. The total estimated cost for analyzing the core samples is $3,500, and we estimate this process will take approximately 30 days. The core samples will be tested to determine if mineralized material is located on the Property. We intend to take our core samples to analytical chemists, geochemists and registered assayers located in Outaouais, Quebec. We have not selected any such persons as of the date of this Report. Based upon the tests of the core samples, we will determine if we will terminate operations, proceed with additional exploration of the Property, or develop the Property. If we do not find mineralized material or we cannot remove mineralized material, either because we do not have the funds or because it is not economically feasible to proceed, we will cease operations.

Total maximum expenditures for the exploration of the Property over the next 12 months are expected to range from approximately $100,000 to $300,000. If sufficient funds are available we will continue with Phase III and Phase IV until funds are no longer available. In the event we have enough money to begin but not to complete one of the Phases, we will cease operations until we raise more money. If we cannot or do not raise sufficient money to complete our planned Phases, or if our exploration activities are not successful, we will discontinue exploration of the Property and any funds spent on exploration will likely be lost.

|

Phase

|

Exploration Activities

|

Anticipated Timeframe

|

|

Cost

|

|

|

Phase III & Phase IV

|

Retention of consultant(s) to conduct: Core sampling and analysis of samples derived from core sampling.

|

Expected to begin in the first calendar quarter of 2013 (dependent on funding).

|

|

$100,000 - $3000,000

(dependent on the number of holes drilled and the duration

of consultant’s services)

|

|

|

TOTAL

|

|

|

|

$ |

100,000 – 300,000 |

|

Quality Assurance/Quality Control

The data obtained from our exploration program will consist of survey data, sampling data, and assay results. Quality Assurance / Quality Control (QA/QC) protocols will be in place at the mining site and at the laboratory to test the sampling and analysis procedures.

The Company will utilize statistical methodologies to calculate mineral reserves based on interpolation between and projection beyond sample points. Interpolation and projection are limited by certain factors including geologic boundaries, economic considerations and constraints to safe mining practices. Sample points will consist of variably spaced drill core intervals obtained from drill sites located on the surface and in underground development workings. Results from all sample points within the mineral reserve area will be evaluated and applied in determining the mineral reserves.

Samples will be sent to a laboratory for analyses. The samples will be under a strict monitoring and tracking system from log-in to completion. Samples will be logged-in immediately upon receipt and carefully checked for any special handling that may be needed. All analytical procedures, sample handling, and preservation techniques used will strictly adhere to those approved by the Canadian Environmental Protection Act Environmental Registry (“CEPA Registry”), where applicable. To test assay accuracy and reproducibility, pulps from core samples will be submitted and then resubmitted for analysis and compared. To test for sample errors or cross-contamination, blank core (waste core) samples will be submitted with the mineralized samples and compared. Reference samples from the CEPA Registry or from private sources will also be tested with every set of samples to provide an additional measure of accuracy.

The QA/QC protocols will be practiced on both resource development and production samples. The data will be entered into a 3-dimensional modeling software package and analyzed to produce a 3-dimensional solid block model of the resource. The assay values will be further analyzed by a geostatistical modeling technique to establish a grade distribution within the 3-dimensional block model. Dilution will then be applied to the model and a diluted tonnage and grade will be calculated for each block. Mineral and waste tons, contained ounces and grade will then be calculated and summed for all blocks. A percent mineable factor based on historic geologic unit values will be applied and the final proven reserve tons and grade will be calculated.

The Company will review its methodology for calculating mineral reserves on an annual and as-needed basis. Conversion, an indicator of the success in upgrading probable mineral reserves to proven mineral reserves, will be evaluated as part of the reserve process. The review will examine the effect of new geologic information, changes implemented or planned in mining practices and mine economics on factors used for the estimation of probable mineral reserves. The review will include an evaluation of the Company’s rate of conversion of probable reserves to proven reserves.

The Industry

Quebec has what may be large deposits of apatite, the parent mineral for rare earth elements (“REE”). REE’s are a collection of seventeen (17) chemical elements in the periodic table, namely scandium, yttrium and the fifteen (15) lanthanides. They are commonly used for high tech applications, alternative energy technologies, and defense technologies. For example, REE’s are used in wind power generation, fuel cells, rechargeable batteries, hydrogen storage, radar deflection, stealth detection, night vision and permanent magnets used in electric and electric-hybrid vehicles. Generally, REE’s cannot be replaced by an alternative, making them virtually essential to our technological world. Deposits of REE’s in high concentrations are relatively rare.

REE’s are moderately abundant in the earth’s crust, some even more abundant than copper, lead, gold, and platinum. While more abundant than many other minerals, REE’s are not concentrated enough to make them easily exploitable economically. China is the current global leader in supplying REE’s.

World Mine Production and Reserves

|

Country

|

Mine Production

|

Reserves

|

| |

2011

|

2012

|

|

|

United States

|

-

|

7,000

|

13,000,000

|

|

Australia

|

2,200

|

4,000

|

1,600,000

|

|

Brazil

|

250

|

300

|

36,000

|

|

China

|

105,000

|

95,000

|

55,000,000

|

|

India

|

2,800

|

2,800

|

3,100,000

|

|

Malaysia

|

280

|

350

|

30,000

|

|

Other countries

|

N/A

|

N/A

|

41,000,000

|

|

World Total

|

111,000

|

110,000

|

110,000,000

|

Source: U.S. Department of the Interior, Mineral Commodity Summaries, USGS, January 2013.

|

1.

|

Reserve Base is defined by the USGS to include reserves (both economic and marginally economic) plus some subeconomic resources (i.e., those that may have potential for becoming economic reserves).

|

China*

China, the predominant supplier. announced regulations on exports and a crackdown on smuggling. On September 1, 2009, China announced plans to reduce its export quota to 35,000 tons per year in 2010–2015, ostensibly to conserve scarce resources and protect the environment. On October 19, 2010 China Daily, citing an unnamed Ministry of Commerce official, reported that China will "further reduce quotas for rare earth exports by 30 percent at most next year to protect the precious metals from over-exploitation". At the end of 2010 China announced that the first round of export quotas in 2011 for rare earths would be 14,446 tons which was a 35% decrease from the previous first round of quotas in 2010. China announced further export quotas on 14 July 2011 for the second half of the year with total allocation at 30,184 tons with total production capped at 93,800 tonnes. In September 2011 China announced the halt in production of three of its eight major rare earth mines, responsible for almost 40% of China's total rare earth production. In March 2012, the U.S., E.U., and Japan confronted China at WTO about these export and production restrictions. China responded with claims that the restrictions had environmental protection in mind. In August 2012, China announced a further 20% reduction in production. These restrictions have damaged industries in other countries and forced producers of rare earth products to relocate their operations to China. The Chinese restrictions on supply failed in 2012 as prices dropped in response to the opening of other sources.

Outside of China*

As a result of the increased demand and tightening restrictions on exports of the metals from China, some countries are stockpiling rare earth resources. Searches for alternative sources in Australia, Brazil, Canada, South Africa, Tanzania, Greenland, and the United States are ongoing. Mines in these countries were closed when China undercut world prices in the 1990s, and it will take a few years to restart production as there are many barriers to entry. One example is the Mountain Pass mine in California, that announced its resumption of operations on a start-up basis on August 27, 2012. Other significant sites under development outside of China include the Nolans Project in Central Australia, the remote Hoidas Lake project in northern Canada, and the Mount Weld project in Australia. The Hoidas Lake project has the potential to supply about 10% of the $1 billion of REE consumption that occurs in North America every year. Vietnam signed an agreement in October 2010 to supply Japan with rare earths from its northwestern Lai Châu Province.

Also under consideration for mining are sites such as Thor Lake in the Northwest Territories, various locations in Vietnam,[14][20][39] and a site in southeast Nebraska in the US, where Quantum Rare Earth Development, a Canadian company, is currently conducting test drilling and economic feasibility studies toward opening a niobium mine. Additionally, a large deposit of rare earth minerals was recently discovered in Kvanefjeld in southern Greenland. Pre-feasibility drilling at this site has confirmed significant quantities of black lujavrite, which contains about 1% rare earth oxides (REO). The European Union has urged Greenland to restrict Chinese development of rare-earth projects there, but as of early 2013, the government of Greenland has said that it has no plans to impose such restrictions. Many Danish politicians have expressed concerns that other nations, including China, could gain influence in thinly populated Greenland, given the number of foreign workers and investment that could come from Chinese companies in the near future because of the law passed December 2012.

Adding to potential mine sites, ASX listed Peak Resources announced in February 2012, that their Tanzanian based Ngualla project contained not only the 6th largest deposit by tonnage outside of China, but also the highest grade of rare earth elements of the 6.

*Source – Wikipedia (http://en.wikipedia.org/wiki/Rare_earth_element)

Current Trends and Information:

China’s virtual monopoly on rare earth elements used in high-technology applications has been loosened, decreasing the risk that supplies to U.S. defense contractors could be disrupted, according to the Pentagon’s latest assessment of the nation’s industrial base.

“Global market forces are leading to positive changes in rare earth supply chains, and a sufficient supply of most of these materials likely will be available to the defense industrial base,” said the Pentagon report by Elana Broitman, the Defense Department’s top official on the U.S. industrial base. “Prices for most rare earth oxides and metals have declined approximately 60 percent from their peaks in the summer of 2011.”

Rare earths are 17 chemically similar elements used in products from Apple Inc.’s iPads and hybrid-electric cars to smart bombs and Tomahawk cruise missiles made by Raytheon Co.

“An increase in supply of material from outside of China” and the substitution of other substances have reduced reliance on China since 2011, when it controlled 95 percent of the world’s supply and imposed export restrictions, said the report, which was sent to Congress last week.

Congress in 2011 required the Pentagon to examine the use of rare earth materials in defense applications, determine if non-U.S. supplies might be disrupted, and suggest ways to ensure long-term availability, as well as secure an assured source of supply by 2015.

Defense Research

The Defense Department is “conducting research in cooperation with a domestic producer to develop an economic and environmentally superior process for producing rare earth metals,” according to the report, which said that defense requirements generally are a small percentage of demand for the materials.

“These conclusions are wishful thinking, not a defense strategy,” Jeff Green, president of J.A. Green & Co. in Washington, who represents miners and users of the elements, said in an e-mailed statement.

“We still have no producers of the more defense-critical heavy rare earths, and significant gaps remain in the domestic production of metal, alloy and magnets, all found in our most critical weapons, with no appreciable investment planned to solve the production problem,” he said.

*Source – Bloomberg Businessweek – December 18, 2013.

Identification of Certain Significant Employees

We have no significant employees other than our sole officer and director described below under “Directors and Executive Officers”. We intend to retain independent geologists and consultants on a contract basis to conduct the work programs on the Property in order to carry our plan of operations.

Government Regulation

We will be required to comply with all regulations, rules and directives of governmental authorities and agencies applicable to the exploration of minerals in Portland Township, Outaouais, Quebec in Canada, including those which govern prospecting, mineral exploration, drilling, mining, production, mineral extraction, transportation of minerals, taxes, labor standards, occupational health, waste disposal, protection of the environment, mine safety, hazardous substances and several other matters. We believe that we are in compliance in all material respects with applicable mining, health, safety and environmental statutes and the regulations promulgated by Quebec and the Canadian Federal Government. Currently, there are no costs associated with our compliance with such regulations and laws. There is presently no need for any government approval of our business or our anticipated mineral products.

Additional approvals and authorizations may be required from other government agencies, depending upon the nature and scope of the proposed exploration program. The amount of these costs is not known as we do not know the size, quality of any resource or reserve at this time. It is impossible to assess the impact of any capital expenditures on earnings or our competitive position.

Environmental Regulations

Our exploration activities are also subject to various federal and local laws and regulations governing protection of the environment. These laws are continually changing and, as a general matter, are becoming more restrictive. Our policy is to conduct business in a way that safeguards public health and the environment and in material compliance with applicable environmental laws and regulations. Changes to current local or federal laws and regulations in the jurisdictions where we operate could require additional capital expenditures and increased operating costs. Although we are unable to predict what additional legislation and the associated costs of such legislation, if any, might be proposed or enacted, additional regulatory requirements could render certain exploration activities uneconomic.

Insurance

We do not maintain any insurance and do not intend to maintain insurance in the future. Because we do not have any insurance, if we are made a party of a legal action, we may not have sufficient funds to defend the litigation. If that occurs a judgment could be rendered against us that could cause us to cease operations.

Competition

We are a junior mineral resource exploration company. We compete with other mineral resource exploration companies for financing and for the acquisition of new mineral properties. Many of the mineral resource exploration companies with whom we compete have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford more geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration and development. This competition could adversely impact our ability to achieve the financing necessary for us to conduct further exploration of our mineral properties.

We will also compete with other junior mineral exploration companies for financing from a limited number of investors that are prepared to make investments in junior mineral exploration companies. The presence of competing junior mineral exploration companies may impact our ability to raise additional capital in order to fund our exploration programs if investors are of the view that investments in competitors are more attractive based on the merit of the mineral properties under investigation and the price of the investment offered to investors.

We will also compete with other junior and senior mineral companies for available resources, including, but not limited to, professional geologists, camp staff, helicopter or float planes, mineral exploration supplies and drill rigs.

Subsidiaries

We have one wholly-owned subsidiary incorporated in Quebec, Canada named 9252-4768 Quebec Inc., and we are currently conducting our business through this subsidiary.

Patents and Trademarks

We do not own, either legally or beneficially, any patents or trademarks.

Research and Development Expenditures

We have not incurred any research or development expenditures since our incorporation.

WHERE YOU CAN GET ADDITIONAL INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy our reports or other filings made with the SEC at the SEC’s Public Reference Room, located at 100 F Street, N.E., Washington, DC 20549. You can obtain information on the operations of the Public Reference Room by calling the SEC at 1-800-SEC-0330. You can also access these reports and other filings electronically on the SEC’s web site, www.sec.gov.

RISKS RELATING TO OUR COMPANY

We are an exploration stage company and may never be able to carry out our proposed business or achieve any revenues or profitability; at this stage of our business, even with our good faith efforts, potential investors have a high probability of losing their entire investment.

We are subject to all of the risks inherent in the establishment of a new business enterprise. We have just begun the initial stages of exploration of the Property, and thus have no way to evaluate the likelihood that our business will be successful. We were incorporated on April 30, 2010 and after refocusing our operations to mining, we currently have been involved primarily in organizational activities and the acquisition of our mineral claim interests. We have earned no revenues as of the date of this Report. Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates.

There is nothing at this time on which to base an assumption that our proposed business operations will prove to be successful or that we will ever be able to operate profitably. We anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. We may not be able to successfully effectuate our business. There can be no assurance that we will ever achieve any revenues or profitability. The revenue and income potential of our proposed business and operations is unproven as the lack of operating history makes it difficult to evaluate the future prospects of our business.

We expect to incur operating losses in the future because we have no revenue.

Since our inception through September 30, 2013, the Company has earned no revenue and has incurred a net loss of $960,853. We do not anticipate earning revenues until such time as we enter into commercial production of the Property. We expect to incur operating losses in future periods. We cannot guarantee that we will ever be successful in generating revenues in the future. We recognize that if we are unable to generate revenues, we will not be able to earn profits or continue operations which will have a significant negative impact on the Company's operations.

Key management personnel may leave the Company, which could adversely affect the ability of the Company to continue operations.

The Company is entirely dependent on the efforts of its President because of the time and effort that he devotes to the Company. Mr. Michael Cooper Smith currently devotes between 5 and 10 hours per week to our business and any additional time when required. He is in charge of supervising all exploration programs that we carry out including supervision of any consultants or contractors that we engage to assist in exploration. The loss of Mr. Cooper Smith could have a material adverse effect on the business and its prospects and there is no guarantee that replacement personnel, if any, will help the Company to operate profitably. The Company does not maintain key person life insurance on its President.

Because our sole director and officer has no experience in mineral exploration and does not have formal training specific to the technicalities of mineral exploration, there is a higher risk our business will fail.

Our sole director and officer has no experience in mineral exploration and does not have formal training as a geologist or in the technical aspects of management of a mineral exploration company. As a result of his inexperience, there is a higher risk of our being unable to complete our business plan for the exploration of the Property. In addition, we will have to rely on the technical services of others with expertise in geological exploration in order for us to carry out our planned exploration program. If we are unable to contract for the services of such individuals, it will make it difficult and maybe impossible to pursue our business plan. There is thus a higher risk that our operations, earnings and ultimate financial success could suffer irreparable harm and our business will likely fail and you will lose your entire investment in our common stock.

Because our sole director and officer has other business interests, he may not be able or willing to devote a sufficient amount of time to our business operation, causing our business to fail.

Our sole director and officer currently devotes between 5 and 10 hours per week to our business. While he presently possesses adequate time to attend to our interests, it is possible that the demands on him from other obligations could increase with the result that he would no longer be able to devote sufficient time to the management of our business. This could negatively impact our business development.

We may not be able to attract and maintain key management personnel to manage the Company or geological consultants to carry out our proposed business operations, which could have a material adverse effect on our business.

Our ability to develop our business depends in large part, on our ability to attract and maintain qualified key management personnel to manage the Company and geological consultants to carry out our exploration activities. Competition for such persons is intense, and we cannot assure you that we will be able to attract and retain them. Our development now and in the future will depend on the efforts of these people, including our sole officer and director, Mr. Plante and the loss or inability to attract these people could have a material adverse effect on our business.

If we are not able to obtain further financing, our proposed business operations may fail.

We do not expect to generate substantial revenues to fund our ongoing operations in the foreseeable future. Accordingly, we will require additional funds, either from equity or debt financing, to maintain our daily operations and to develop the Property. Obtaining additional financing is subject to a number of factors, including market prices for minerals and investor acceptance of our proposed activities. Financing, therefore, may not be available on acceptable terms, if at all. The most likely source of future funds presently available to us is through the sale of equity capital. Any sale of share capital, however, will result in dilution to existing shareholders. If we are unable to raise additional funds when required, we may be forced to delay our plan of operations and our entire business may fail.

Our business could be impaired if we fail to comply with applicable regulations.

Failure to comply with government regulations could subject us to civil and criminal penalties, require us to forfeit our rights to the Property, and affect the value of our assets. We may also be required to take corrective actions for failure to comply with applicable regulations, which could require substantial capital expenditures. We could also be required to indemnify our officers and directors in connection with any expenses or liabilities that they may incur individually in connection with regulatory action against them for non-compliance. As a result, our future business prospects could deteriorate due to regulatory constraints, and our profitability could be impaired by our obligation to provide such indemnification to our employees.

Our Articles of Incorporation exculpate our officers and directors from any liability to our Company or our stockholders.

Our Articles of Incorporation contain a provision limiting the liability of our officers and directors for their acts or failures to act, except for acts involving intentional misconduct, fraud or a knowing violation of law. This limitation on liability may reduce the likelihood of derivative litigation against our officers and directors and may discourage or deter our stockholders from suing our officers and directors based upon breaches of their duties to our Company.

Because we do not have an audit or compensation committee, shareholders will have to rely on our sole officer and director, who is not independent, to perform these functions.

We do not have an audit or compensation committee. The functions of such committees are performed by our sole officer and director, who is not independent. Thus, there is a potential conflict of interest in that our sole officer and director has the authority to determine issues concerning management compensation and audit issues that may affect management decisions.

We have a “going concern” opinion from our auditors, indicating the possibility that we may not be able to continue to operate.

Our independent registered public accountants have expressed substantial doubt about our ability to continue as a going concern. This opinion could materially limit our ability to raise additional funds by issuing new debt or equity securities or otherwise. If we fail to raise sufficient capital when needed, we will not be able to complete our proposed business. As a result we may have to liquidate our business and investors may lose their investments. The ability of the Company to continue as a going concern is dependent upon its ability to successfully accomplish its plan of operations described herein and eventually attain profitable operations. You should consider our independent registered public accountant’s comments when determining if an investment in the Company is suitable.

RISKS ASSOCIATED WITH OUR PROPOSED BUSINESS

Our exploration activities may not be commercially successful, which could lead us to abandon our plans to develop the mineral Property and our investments in exploration.

Our long-term success depends on our ability to establish commercially recoverable quantities of minerals on the Property. Mineral exploration is highly speculative in nature, involves many risks and is frequently non-productive. Substantial expenditures are required to establish proven and probable reserves through drilling and analysis, to develop metallurgical processes to extract metal, and to develop the mining and processing facilities and infrastructure at any site chosen for mining. Whether a mineral deposit will be commercially viable depends on a number of factors, which include, without limitation, the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices, which fluctuate widely; and government regulations, including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection.

We may invest significant capital and resources in exploration activities and abandon such investments if they are unable to identify commercially exploitable mineral reserves. The decision to abandon a project may reduce the price of our common stock which is currently quoted on the OTC Bulletin Board, and impair our ability to raise future financing. We cannot provide any assurance to investors that we will discover or acquire any mineralized material in sufficient quantities underlying the Property to justify commercial operations. Further, we will not be able to recover the funds that we spend on exploration if we are not able to establish commercially recoverable quantities of mineral on the Property.

Since we do not have a backup program, if results from our initial work program are negative, anyone purchasing our stock will likely lose their entire investment.

If the results from the initial phase of work are negative and do not warrant additional phases of exploration work, we will need to seek other mineral exploration opportunities. We cannot guarantee that we will have enough funds to purchase an additional property, have a geological report prepared, and complete exploration work on the Property. If the results from the initial phase of work on the Property are negative and we cannot find another feasible exploration opportunity, anyone purchasing our stock will likely lose their entire investment.

Because the probability of an individual mineral claim ever having reserves is extremely remote, any funds spent on exploration will probably be lost.

The probability of an individual mineral claim ever having reserves is extremely remote. Accordingly, if the Property does not contain reserves, we will likely have to cease operations and as a result, our business may fail. As such, any funds spent on exploration will probably be lost, which could result in a loss of your entire investment.

As we undertake exploration of the land underlying the Property, we will be subject to compliance with government regulation that may increase the anticipated time and cost of our exploration program.

We will be subject to the mining laws and regulations of the country of Canada as we carry out our exploration program. We may be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these regulations. While our planned exploration program budgets for regulatory compliance, there is a risk that new regulations could increase our time and costs of doing business and prevent us from carrying out our exploration program.

We are subject to risks inherent in the mining industry, and at present we do not have any insurance against such risks. Any losses we may incur that are associated with such risks may cause us to incur substantial costs which will have a material adverse effect upon our results of operations.

Any mining operations that we may undertake in the future will be subject to risks normally encountered in the mining business. Mining for valuable minerals is generally subject to a number of risks and hazards, including environmental hazards, industrial accidents, labor disputes, unusual or unexpected geological conditions, pressures, cave-ins, changes in the regulatory environment and natural phenomena such as inclement weather conditions. At the present time, we do not intend to obtain insurance coverage and even if we were to do so, no assurance can be given that such insurance will continue to be available or that it will be available at economically feasible premiums. Additionally, insurance coverage may not be adequate to cover any resulting liability. Moreover, insurance against risks such as environmental pollution or other hazards as a result of exploration and production is not generally available to companies in the mining industry on acceptable terms. We might also become subject to liability for pollution or other hazards, which may not be insured against or which we may elect not to insure against because of premium costs or other reasons. Losses from these events may cause us to incur significant costs that could have a material adverse effect upon our financial performance and results of operations. Such costs could potentially exceed our asset value and cause us to liquidate all of our assets, resulting in the loss of your entire investment in our common stock.

Estimates of mineralized material are subject to evaluation uncertainties that could result in project failure.

Our exploration and future mining operations, if any, will be subject to risks associated with being able to accurately predict the quantity and quality of mineralized material within the earth using statistical sampling techniques. Estimates of any mineralized material on the Property would be made using samples obtained from appropriately placed underground workings and intelligently designed drilling. There is an inherent variability of assays between check and duplicate samples taken adjacent to each other and between sampling points that cannot be reasonably eliminated. Additionally, there also may be unknown geologic details that have not been identified or correctly appreciated at the current level of accumulated knowledge about the Property. This could result in uncertainties that cannot be reasonably eliminated from the process of estimating mineralized material. If these estimates were to prove to be unreliable, we could implement an exploration plan that may not lead to commercially viable operations in the future.

Because of the fiercely competitive nature of the mining industry, we may be unable to maintain or acquire attractive mining properties on acceptable terms, which will materially affect our financial condition.

The mining industry is competitive in all of its phases. We face strong competition from other mining companies in connection with the acquisition of properties producing, or capable of producing, precious and base metals. Many of these companies have greater financial resources, operational experience and technical capabilities. As a result of this competition, we may be unable to maintain or acquire attractive mining properties on terms we consider acceptable or at all. Consequently, our revenues, operations and financial condition could be materially adversely affected.

We may not be able to obtain, renew or continue to comply with all of the permits necessary to develop and operate the Property, which would force us to discontinue development or operations.

Pursuant to Canadian law, we must obtain various approvals, licenses or permits in connection with the development and operations of the Property including environmental protection and the use of water resources. In addition to requiring permits for the development of and production at the Property, we may need to obtain other permits and approvals during the life of any exploration projects we undertake on the Property. Obtaining, renewing and continuing to comply with the necessary governmental permits and approvals can be a complex, costly, time-consuming process. The failure to obtain or renew the necessary permits or licenses or continue to meet their requirements could delay development, increase our costs or, in some cases, require us to discontinue mining operations.

Our activities are subject to complex laws, significant government regulations and accounting standards that may delay or prevent operations at the Property and can adversely affect our operating and development costs, the timing of our operations, our ability to operate and our financial results.

Our proposed business, mining operations and exploration and development activities are subject to extensive Canadian, United States, and other foreign, federal, state, provincial, territorial and local laws and regulations and also exploration, development, production, exports, taxes, labor standards, waste disposal, protection of the environment, reclamation, historic and cultural resource preservation, mine safety and occupational health, reporting and other matters, as well as accounting standards. Compliance with these laws, regulations and standards or the imposition of new such requirements could adversely affect our operating and development costs, the timing of our operations, our ability to operate and our financial results. These laws and regulations governing various matters include:

|

1.

|

environmental protection;

|

|

2.

|

management of natural resources;

|

|

3.

|

exploration, development of mines, production and post-closure reclamation;

|

|

6.

|

labor standards and occupational health and safety, including mine safety;

|

|

7.

|

historic and cultural preservation; and

|

|

8.

|

general accepted accounting principles.

|

The costs associated with compliance with these laws and regulations may be substantial and possible future laws and regulations, or more stringent enforcement of current laws and regulations by governmental authorities, could cause additional expense, capital expenditures, restrictions on or suspensions of our operations and delays in the development of the Property. These laws and regulations may allow governmental authorities and private parties to bring lawsuits based upon damages to property and injury to persons resulting from the environmental, health and safety impacts of our future operations, and could lead to the imposition of substantial fines, penalties or other civil or criminal sanctions. In addition, our failure to comply strictly with applicable laws, regulations and local practices relating to permitting applications or reporting requirements could result in loss, reduction or expropriation of entitlements, or the imposition of additional local or foreign parties as joint venture partners. Any such loss, reduction, expropriation or imposition of partners could have a materially adverse effect on our operations or business.

If we do not find a joint venture participant for the development of the Property, we may not be able to advance exploration work.