xfor-20210630false2021Q20001501697--12-31100015016972021-01-012021-06-3000015016972021-04-012021-06-30xbrli:shares00015016972021-07-30iso4217:USD00015016972021-06-3000015016972020-12-310001501697xfor:RedeemableCommonStockMember2021-06-300001501697xfor:RedeemableCommonStockMember2020-12-31iso4217:USDxbrli:shares00015016972020-04-012020-06-3000015016972020-01-012020-06-300001501697us-gaap:CommonStockMember2019-12-310001501697us-gaap:AdditionalPaidInCapitalMember2019-12-310001501697us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001501697us-gaap:RetainedEarningsMember2019-12-3100015016972019-12-310001501697us-gaap:CommonStockMember2020-01-012020-03-310001501697us-gaap:AdditionalPaidInCapitalMember2020-01-012020-03-3100015016972020-01-012020-03-310001501697us-gaap:RetainedEarningsMember2020-01-012020-03-310001501697us-gaap:CommonStockMember2020-03-310001501697us-gaap:AdditionalPaidInCapitalMember2020-03-310001501697us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-03-310001501697us-gaap:RetainedEarningsMember2020-03-3100015016972020-03-310001501697us-gaap:CommonStockMember2020-04-012020-06-300001501697us-gaap:AdditionalPaidInCapitalMember2020-04-012020-06-300001501697us-gaap:RetainedEarningsMember2020-04-012020-06-3000015016972020-06-300001501697us-gaap:CommonStockMember2020-06-300001501697us-gaap:AdditionalPaidInCapitalMember2020-06-300001501697us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-06-300001501697us-gaap:RetainedEarningsMember2020-06-300001501697us-gaap:CommonStockMember2020-12-310001501697us-gaap:AdditionalPaidInCapitalMember2020-12-310001501697us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001501697us-gaap:RetainedEarningsMember2020-12-3100015016972021-01-012021-03-310001501697xfor:RedeemableCommonStockMember2021-01-012021-03-310001501697us-gaap:CommonStockMember2021-01-012021-03-310001501697us-gaap:AdditionalPaidInCapitalMember2021-01-012021-03-310001501697us-gaap:RetainedEarningsMember2021-01-012021-03-310001501697xfor:RedeemableCommonStockMember2021-03-310001501697us-gaap:CommonStockMember2021-03-310001501697us-gaap:AdditionalPaidInCapitalMember2021-03-310001501697us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-03-310001501697us-gaap:RetainedEarningsMember2021-03-3100015016972021-03-310001501697us-gaap:CommonStockMember2021-04-012021-06-300001501697us-gaap:AdditionalPaidInCapitalMember2021-04-012021-06-300001501697us-gaap:CommonStockMember2021-06-300001501697us-gaap:AdditionalPaidInCapitalMember2021-06-300001501697us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-06-300001501697us-gaap:RetainedEarningsMember2021-06-300001501697us-gaap:LetterOfCreditMemberxfor:CambridgeMAOperatingLeaseAgreementMember2021-06-300001501697us-gaap:LetterOfCreditMemberxfor:CambridgeMAOperatingLeaseAgreementMember2020-12-310001501697xfor:WalthamLeaseMemberus-gaap:LetterOfCreditMember2021-06-300001501697xfor:WalthamLeaseMemberus-gaap:LetterOfCreditMember2020-12-310001501697us-gaap:LetterOfCreditMemberxfor:ViennaLeaseAgreementMember2021-06-300001501697us-gaap:LetterOfCreditMemberxfor:ViennaLeaseAgreementMember2020-12-310001501697us-gaap:LetterOfCreditMemberxfor:AllstonLeaseAgreementMember2021-06-300001501697us-gaap:LetterOfCreditMemberxfor:AllstonLeaseAgreementMember2020-12-310001501697xfor:ResearchAndDevelopmentIncentiveProgramMember2021-06-300001501697xfor:ResearchAndDevelopmentIncentiveProgramMember2021-04-012021-06-300001501697xfor:ResearchAndDevelopmentIncentiveProgramMember2020-01-012020-06-300001501697us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2021-06-300001501697us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2021-06-300001501697us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2021-06-300001501697us-gaap:FairValueMeasurementsRecurringMember2021-06-300001501697us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001501697us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001501697us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001501697us-gaap:FairValueMeasurementsRecurringMember2020-12-310001501697us-gaap:MeasurementInputDiscountRateMember2021-06-300001501697us-gaap:LeaseholdImprovementsMember2021-06-300001501697us-gaap:LeaseholdImprovementsMember2020-12-310001501697us-gaap:FurnitureAndFixturesMember2021-06-300001501697us-gaap:FurnitureAndFixturesMember2020-12-310001501697us-gaap:ComputerEquipmentMember2021-06-300001501697us-gaap:ComputerEquipmentMember2020-12-310001501697xfor:SoftwareMember2021-06-300001501697xfor:SoftwareMember2020-12-310001501697xfor:LabEquipmentMember2021-06-300001501697xfor:LabEquipmentMember2020-12-310001501697xfor:HerculesLoanAgreementMember2018-10-012021-03-310001501697xfor:HerculesLoanAgreementMember2021-06-30xbrli:pure0001501697xfor:HerculesLoanAgreementMember2021-04-012021-06-300001501697xfor:HerculesLoanAgreementMemberus-gaap:PrimeRateMember2021-01-012021-06-300001501697srt:MaximumMemberus-gaap:DebtInstrumentRedemptionPeriodOneMemberxfor:HerculesLoanAgreementMember2021-06-300001501697srt:MaximumMemberus-gaap:DebtInstrumentRedemptionPeriodTwoMemberxfor:HerculesLoanAgreementMember2021-06-300001501697srt:MaximumMemberxfor:HerculesLoanAgreementMemberus-gaap:DebtInstrumentRedemptionPeriodThreeMember2021-06-300001501697xfor:HerculesLoanAgreementMemberus-gaap:SubsequentEventMember2022-01-012022-01-010001501697xfor:HerculesLoanAgreementMemberus-gaap:SubsequentEventMember2022-07-012022-07-010001501697xfor:HerculesLoanAgreementMemberus-gaap:SubsequentEventMember2024-07-012024-07-010001501697xfor:HerculesLoanAgreementMember2020-04-012020-06-300001501697xfor:HerculesLoanAgreementMember2021-01-012021-06-300001501697xfor:HerculesLoanAgreementMember2020-01-012020-06-30utr:sqm0001501697xfor:ViennaAustriaLeaseMember2021-01-012021-06-300001501697xfor:ViennaAustriaLeaseMember2021-06-30utr:sqft0001501697xfor:AllstonLeaseMember2019-11-112019-11-110001501697xfor:AllstonLeaseMember2019-11-110001501697xfor:AllstonLeaseMember2021-06-300001501697xfor:WalthamLeaseMember2021-01-012021-06-300001501697xfor:WalthamLeaseMember2021-06-300001501697xfor:IndemnificationAgreementsMember2020-12-310001501697xfor:IndemnificationAgreementsMember2021-06-300001501697xfor:ClassAWarrantMember2019-04-162019-04-160001501697xfor:ClassBWarrantsMember2019-11-292019-11-290001501697xfor:ClassAWarrantMember2019-04-160001501697xfor:ClassBWarrantsMember2019-11-2900015016972019-11-262019-11-260001501697xfor:ClassBWarrantsMember2021-03-230001501697xfor:PreFundedWarrantMember2019-04-162019-04-160001501697xfor:PreFundedWarrantMember2019-11-292019-11-290001501697xfor:PreFundedWarrantMember2019-04-160001501697xfor:PreFundedWarrantMember2019-11-290001501697xfor:FundedMember2021-03-2300015016972021-03-230001501697xfor:IssuanceOnOctoberTwentyFiveTwoThousandSixteenMemberxfor:LegacyWarrantsMember2021-06-300001501697xfor:IssuanceOnOctoberTwentyFiveTwoThousandSixteenMember2021-06-300001501697xfor:IssuanceOnDecemberTwentyEightTwoThousandSeventeenOneMemberxfor:LegacyWarrantsMember2021-06-300001501697xfor:IssuanceOnDecemberTwentyEightTwoThousandSeventeenOneMember2021-06-300001501697xfor:IssuanceOnSeptemberTwelveTwoThousandEighteenMemberxfor:LegacyWarrantsMember2021-06-300001501697xfor:IssuanceOnSeptemberTwelveTwoThousandEighteenMember2021-06-300001501697xfor:IssuanceOnSeptemberTwelveTwoThousandEighteenOneMemberxfor:LegacyWarrantsMember2021-06-300001501697xfor:IssuanceOnSeptemberTwelveTwoThousandEighteenOneMember2021-06-300001501697xfor:IssuanceOnOctoberNineteenTwoThousandEighteenMemberxfor:LegacyWarrantsMember2021-06-300001501697xfor:IssuanceOnOctoberNineteenTwoThousandEighteenMember2021-06-300001501697xfor:IssuanceOnMarchThirteenTwoThousandNineteenMemberxfor:LegacyWarrantsMember2021-06-300001501697xfor:IssuanceOnMarchThirteenTwoThousandNineteenMember2021-06-300001501697xfor:IssuanceOnAprilSixteenTwoThousandNineteenMemberxfor:ClassAWarrantMember2021-06-300001501697xfor:IssuanceOnAprilSixteenTwoThousandNineteenMember2021-06-300001501697xfor:ClassBWarrantsMemberxfor:IssuanceOnNovemberTwentyNineTwoThousandNineteenMember2021-06-300001501697xfor:IssuanceOnNovemberTwentyNineTwoThousandNineteenMember2021-06-300001501697xfor:PreFundedWarrantMemberxfor:IssuanceOnNovemberTwentyNineTwoThousandNineteenOneMember2021-06-300001501697xfor:IssuanceOnNovemberTwentyNineTwoThousandNineteenOneMember2021-06-300001501697xfor:PreFundedWarrantMemberxfor:IssuanceOnMarch232021Member2021-06-300001501697xfor:IssuanceOnMarch232021Member2021-06-300001501697xfor:PreFundedWarrantMember2019-11-2900015016972019-11-2900015016972021-03-232021-03-230001501697xfor:RedeemableCommonStockMember2021-04-012021-06-30xfor:vote0001501697xfor:TwoThousandNineteenEquityIncentivePlanMember2021-06-300001501697us-gaap:RestrictedStockUnitsRSUMember2020-12-310001501697us-gaap:RestrictedStockUnitsRSUMember2021-06-300001501697us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-06-300001501697us-gaap:ResearchAndDevelopmentExpenseMember2021-04-012021-06-300001501697us-gaap:ResearchAndDevelopmentExpenseMember2020-04-012020-06-300001501697us-gaap:ResearchAndDevelopmentExpenseMember2021-01-012021-06-300001501697us-gaap:ResearchAndDevelopmentExpenseMember2020-01-012020-06-300001501697us-gaap:GeneralAndAdministrativeExpenseMember2021-04-012021-06-300001501697us-gaap:GeneralAndAdministrativeExpenseMember2020-04-012020-06-300001501697us-gaap:GeneralAndAdministrativeExpenseMember2021-01-012021-06-300001501697us-gaap:GeneralAndAdministrativeExpenseMember2020-01-012020-06-300001501697xfor:RedeemableCommonStockMember2021-04-012021-06-300001501697srt:MaximumMemberxfor:PreFundedWarrantMember2021-06-300001501697us-gaap:EmployeeStockOptionMember2021-04-012021-06-300001501697us-gaap:EmployeeStockOptionMember2020-04-012020-06-300001501697us-gaap:EmployeeStockOptionMember2021-01-012021-06-300001501697us-gaap:EmployeeStockOptionMember2020-01-012020-06-300001501697us-gaap:RestrictedStockUnitsRSUMember2021-04-012021-06-300001501697us-gaap:RestrictedStockUnitsRSUMember2020-04-012020-06-300001501697us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-06-300001501697us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-06-300001501697us-gaap:WarrantMember2021-04-012021-06-300001501697us-gaap:WarrantMember2020-04-012020-06-300001501697us-gaap:WarrantMember2021-01-012021-06-300001501697us-gaap:WarrantMember2020-01-012020-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________________________________________________

FORM 10-Q

_____________________________________________________________________________________

(Mark One) | | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2021

or | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________

Commission File Number: 001-38295

_____________________________________________________________________________________

X4 PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

_____________________________________________________________________________________ | | | | | |

Delaware (State or other jurisdiction of incorporation or organization) | 27-3181608 (I.R.S. Employer Identification No.) |

| |

61 North Beacon Street, 4th Floor Boston, Massachusetts (Address of principal executive offices) | 02134 (Zip Code) |

(857) 529-8300

(Registrant’s telephone number, including area code)

____________________________________________________________________________

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock | | XFOR | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. | | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | | Smaller reporting company | ☒ |

| | | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of July 30, 2021, the registrant had 24,851,648 shares of common stock outstanding.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, that relate to future events or to our future operations or financial performance. All statements, other than statements of historical facts, contained in this Quarterly Report on Form 10-Q, including statements regarding our strategy, future operations, future financial position, future revenues, projected costs, prospects, plans and objectives of management, are forward-looking statements. These statements may be identified by such forward-looking terminology as “may,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue” or the negative of these terms or other comparable terminology. Our forward-looking statements are based on a series of expectations, assumptions, estimates and projections about our company, are not guarantees of future results or performance and involve substantial risks and uncertainty. We may not actually achieve the plans, intentions or expectations disclosed in these forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in these forward-looking statements. These forward-looking statements are subject to a number of known and unknown risks, uncertainties and assumptions, including risks described in the section titled “Risk Factors” and elsewhere in this report, regarding, among other things:

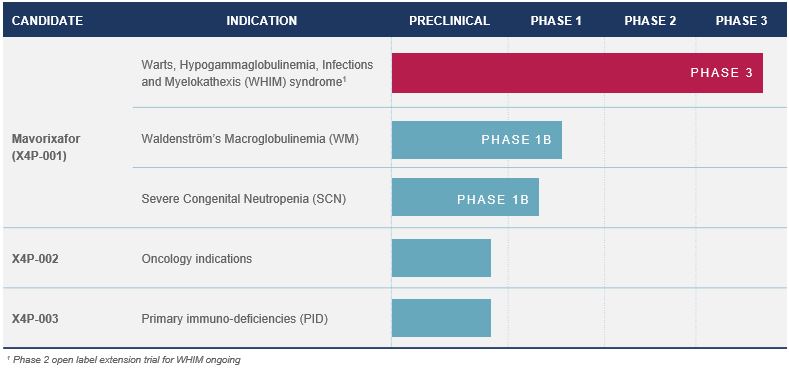

•the timing, progress and reporting of results of our current trials of mavorixafor, including our global Phase 3 clinical trial in patients with Warts, Hypogammaglobulinemia, Infections, and Myelokathexis, or WHIM, syndrome, our Phase 1b clinical trial in combination with ibrutinib in patients with Waldenström’s macroglobulinemia, or Waldenström’s, and our Phase 1b clinical trial as monotherapy in patients with Severe Congenital Neutropenia, or SCN;

•the initiation, timing, design, progress and results of our current and future preclinical studies and clinical trials of X4P-002 and X4P-003 or any of our other product candidates or our research and development programs that we pursue;

•our expectations regarding the impact of the ongoing COVID-19 pandemic, included the expected duration of disruption and immediate and long-term impact and effect on our business and operations;

•the diversion of healthcare resources away from the conduct of clinical trials as a result of the ongoing COVID-19 pandemic, including the diversion of hospitals serving as our clinical trial sites and of hospital staff or independent physicians supporting the conduct of our clinical trials;

•the interruption of key clinical trial activities, such as clinical trial site monitoring, due to limitations on travel, quarantines or social distancing protocols imposed or recommended by federal or state governments, employers and others in connection with the ongoing COVID-19 pandemic;

•the potential benefits that may be derived from any of our product candidates;

•the timing of and our ability to obtain and maintain regulatory approval of our existing product candidates or any product candidates that we may develop in the future, and any related restrictions, limitations, or warnings in the label of any approved product candidates;

•our plans to research, develop, manufacture and commercialize our product candidates;

•the timing of our regulatory filings for our product candidates, along with regulatory developments in the United States and other foreign countries;

•the size and growth potential of the markets for our product candidates, if approved, and the rate and degree of market acceptance of our product candidates, including reimbursement that may be received from payors;

•the benefits of U.S. Food and Drug Administration, or FDA, and European Commission designations, including, without limitation, Fast Track, Orphan Drug and Breakthrough Therapy;

•our commercialization, marketing and manufacturing capabilities and strategy;

•our ability to attract and retain qualified employees and key personnel;

•our competitive position;

•our expectations regarding our ability to obtain and maintain intellectual property protection;

•the success of competing therapies that are or may become available;

•our estimates and expectations regarding future operations, financial position, revenues, costs, expenses, uses of cash, capital requirements or our need for additional financing;

•our ability to raise additional capital; and

•our strategies, prospects, plans, expectations or objectives.

You should refer to the section titled “Risk Factors" in this Quarterly Report for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. As a result of these factors, we cannot assure you that the forward-looking statements in this Quarterly Report will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. You should, therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this Quarterly Report.

SUMMARY OF SELECTED RISKS ASSOCIATED WITH OUR BUSINESS

Our business faces significant risks and uncertainties. If any of the following risks are realized, our business, financial condition and results of operations could be materially and adversely affected. You should carefully review and consider the full discussion of our risk factors in the section titled “Risk Factors” in Part I, Item 1A of this Quarterly Report. Some of the more significant risks include the following:

•We have incurred significant losses and have not generated revenue from product sales since our inception. We expect to continue to incur losses for the foreseeable future, and we may never achieve or maintain profitability.

•We will require substantial additional funding. If we are unable to raise capital when needed, we could be forced to delay, reduce or eliminate any product development programs or commercialization efforts.

•Raising additional capital may cause dilution to our investors, restrict our operations or require us to relinquish rights to our technologies or product candidates. Future debt obligations may expose us to risks that could adversely affect our business, operating results and financial condition and may result in further dilution to our stockholders.

•We depend almost entirely on the success of our lead product candidate, mavorixafor, which we are developing initially for the treatment of WHIM syndrome, for the treatment of SCN, for the treatment of Waldenström’s, and contingent on a potential strategic partner, for the treatment of clear cell renal cell carcinoma, or ccRCC. We cannot be certain that we will be able to obtain regulatory approval for, or successfully commercialize, mavorixafor or any other product candidate.

•We expect to develop mavorixafor, and potentially future product candidates, in combination with other therapies, which exposes us to additional risks.

•The regulatory review and approval processes of the FDA and comparable foreign regulatory authorities are lengthy, time-consuming and inherently unpredictable, and if we are ultimately unable to obtain regulatory approval for our product candidates, including mavorixafor, our business will be substantially harmed.

•We depend on license agreements with Genzyme, Beth Israel Deaconess Medical Center, Dana-Farber Cancer Institute, and Georgetown University to permit us to use patents and patent applications. Termination of these rights or the failure to comply with obligations under these agreements could materially harm our business and prevent us from developing or commercializing our product candidates.

•The results of clinical trials may not support our product candidate claims.

•We may fail to enroll a sufficient number of patients in our clinical trials in a timely manner, which could delay or prevent clinical trials of our product candidates.

•The commercial opportunity in WHIM syndrome, SCN or Waldenström’s could be smaller than we anticipate; therefore, our potential future revenue from mavorixafor for the treatment of any of the diseases may be adversely affected and our business may suffer.

•If we experience any of a number of possible unforeseen events in connection with our clinical trials, potential marketing approval or commercialization of our product candidates, or our entry into licensing, collaboration or similar arrangements, could be delayed or prevented.

•Interim top-line and preliminary data from our clinical trials that we announce or publish from time to time may change as more patient data become available and are subject to audit and verification procedures that could result in material changes in the final data.

•A breakthrough therapy designation or Fast Track designation by the FDA for our product candidates may not lead to a faster development or regulatory review or approval process, and neither of these designations increases the likelihood that our product candidates will receive marketing approval.

•Product candidates may cause undesirable side effects that could delay or prevent their marketing approval, limit the commercial profile of an approved label, or result in significant negative consequences following marketing approval, if any, including marketing withdrawal.

•If, in the future, we are unable to establish sales and marketing capabilities or to selectively enter into agreements with third parties to sell and market our product candidates, we may not be successful in commercializing our product candidates if and when they are approved.

•We face substantial competition, which may result in others discovering, developing or commercializing products before or more successfully than we do.

•Even if we obtain and maintain approval for our product candidates from the FDA, we may never obtain approval for our product candidates outside of the United States, which would limit our market opportunities and could harm our business.

•Even if we are able to commercialize mavorixafor or any other product candidate that we develop, the product may become subject to unfavorable pricing regulations, third-party reimbursement practices or healthcare reform initiatives, which would harm our business.

•We have minimal experience manufacturing our product candidates on a large clinical or commercial scale and have no manufacturing facility. We are currently dependent on a single third party manufacturer for the manufacture of mavorixafor, the active pharmaceutical ingredient, or API, and a single manufacturer of mavorixafor finished drug product capsules. If we experience problems with these third parties, the manufacturing of mavorixafor could be delayed, which could harm our results of operations.

•We rely on third-party clinical research organizations, or CROs, to conduct our preclinical studies and clinical trials. If these CROs do not successfully carry out their contractual duties or meet expected deadlines, we may not be able to obtain regulatory approval for or commercialize our product candidates and our business could be substantially harmed.

•Disruptions in our supply chain could delay the commercial launch of our product candidates.

•Our employees, principal investigators, CROs and consultants may engage in misconduct or other improper activities, including noncompliance with regulatory standards and requirements, which could have a material adverse effect on our business.

•We may depend on such collaborations for the development and commercialization of our product candidates. If those collaborations are not successful, we may not be able to capitalize on the market potential of our product candidates.

•We may engage in future acquisitions or in-licenses of technology that could disrupt our business, cause dilution to our stockholders and harm our financial condition and operating results.

•If we are unable to protect our intellectual property rights, our competitive position could be harmed.

•Third parties may initiate legal proceedings alleging that we are infringing their intellectual property rights, the outcome of which would be uncertain and could have a material adverse effect on the success of our business.

•The global COVID-19 pandemic is adversely affecting, and is expected to continue to adversely affect, our business, including our clinical trials and preclinical studies.

•Our future success depends on our ability to retain executives and to attract, retain and motivate key personnel in a competitive environment for skilled biotechnology personnel.

•We will need to grow the size of our organization, and we may experience difficulties in managing this growth.

•Our stock price is expected to continue to be volatile.

•We are an “emerging growth company,” and a “smaller reporting company” and as a result of the reduced disclosure requirements applicable to emerging growth companies and smaller reporting companies, our common stock may be less attractive to investors.

PART I FINANCIAL INFORMATION

Item 1. FINANCIAL STATEMENTS.

X4 PHARMACEUTICALS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except share and per share amounts)

(Unaudited) | | | | | | | | | | | |

| June 30, 2021 | | December 31, 2020 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 95,161 | | | $ | 78,708 | |

| Research and development incentive receivable | 1,053 | | | 917 | |

| Prepaid expenses and other current assets | 5,157 | | | 3,682 | |

| Total current assets | 101,371 | | | 83,307 | |

| Property and equipment, net | 1,745 | | | 1,237 | |

| Goodwill | 27,109 | | | 27,109 | |

| Right-of-use assets | 9,430 | | | 7,960 | |

| Other assets | 2,004 | | | 3,258 | |

| Total assets | $ | 141,659 | | | $ | 122,871 | |

Liabilities, Redeemable Common Stock and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 2,528 | | | $ | 3,144 | |

| Accrued expenses | 9,607 | | | 8,018 | |

| Current portion of lease liability | 985 | | | 786 | |

| Total current liabilities | 13,120 | | | 11,948 | |

| Long-term debt, including accretion, net of discount | 33,542 | | | 33,178 | |

| Lease liabilities | 5,350 | | | 4,484 | |

| Other liabilities | 434 | | | 462 | |

| Total liabilities | 52,446 | | | 50,072 | |

| Commitments and contingencies (Note 9) | | | |

Redeemable common stock, 229,885 and zero issued and outstanding at June 30, 2021 and December 31, 2020, respectively (Note 11) | 1,875 | | | 0 |

| Stockholders’ equity: | | | |

Common stock, $0.001 par value, 125,000,000 shares authorized as of each of June 30, 2021 and December 31, 2020; 24,584,858 and 16,305,731 shares issued and outstanding as of June 30, 2021 and December 31, 2020, respectively | 25 | | | 16 | |

| Additional paid-in capital | 319,921 | | | 267,077 | |

| Accumulated other comprehensive loss | (119) | | | (119) | |

| Accumulated deficit | (232,489) | | | (194,175) | |

| Total stockholders’ equity | 87,338 | | | 72,799 | |

Total liabilities, redeemable common stock and stockholders’ equity | $ | 141,659 | | | $ | 122,871 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

X4 PHARMACEUTICALS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(In thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2021 | | 2020 | | 2021 | | 2020 |

| License revenue | $ | — | | | $ | — | | | $ | — | | | $ | 3,000 | |

| Operating expenses: | | | | | | | |

| Research and development | 13,193 | | | 9,342 | | | 25,297 | | | 18,253 | |

| General and administrative | 5,804 | | | 5,316 | | | 11,636 | | | 9,986 | |

| Total operating expenses | 18,997 | | | 14,658 | | | 36,933 | | | 28,239 | |

| Loss from operations | (18,997) | | | (14,658) | | | (36,933) | | | (25,239) | |

| Other income (expense): | | | | | | | |

| Interest income | 3 | | | 7 | | | 5 | | | 303 | |

| Interest expense | (905) | | | (687) | | | (1,797) | | | (1,271) | |

| Change in fair value of derivative liability | 57 | | | — | | | 26 | | | — | |

| Other income, net | 210 | | | 194 | | | 397 | | | 235 | |

| Loss on extinguishment of debt | — | | | — | | | — | | | (162) | |

| Total other expense, net | (635) | | | (486) | | | (1,369) | | | (895) | |

| Loss before provision for income taxes | (19,632) | | | (15,144) | | | (38,302) | | | (26,134) | |

| Provision for income taxes | 6 | | | — | | | 12 | | | 148 | |

| Net loss and comprehensive loss | (19,638) | | | (15,144) | | | (38,314) | | | (26,282) | |

| Deemed dividend on Class B Warrant price reset | — | | | — | | | (8,239) | | | — | |

| Net loss attributable to common stockholders | $ | (19,638) | | | $ | (15,144) | | | $ | (46,553) | | | $ | (26,282) | |

Net loss per share attributable to common stockholders—basic and diluted | $ | (0.74) | | | $ | (0.76) | | | $ | (1.97) | | | $ | (1.31) | |

Weighted average common shares outstanding—basic and diluted | 26,527 | | | 20,032 | | | 23,655 | | | 20,016 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

X4 PHARMACEUTICALS, INC.

CONDENSED CONSOLIDATED STATEMENT OF REDEEMABLE COMMON STOCK AND STOCKHOLDERS’ EQUITY

(In thousands, except share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional

Paid-In

Capital | | Accumulated Other Comprehensive

Loss | | Accumulated

Deficit | | Total

Stockholders’

Equity |

| Shares | | Amount | |

| Balance at December 31, 2019 | 16,128,862 | | | $ | 16 | | | $ | 261,367 | | | $ | (119) | | | $ | (132,044) | | | $ | 129,220 | |

| Exercise of stock options | 13,006 | | | — | | | 96 | | | | | | | 96 | |

| Stock-based compensation expense | | | | | 613 | | | | | | | 613 | |

| Net loss | | | | | | | | | (11,138) | | | (11,138) | |

| Balance at March 31, 2020 | 16,141,868 | | | $ | 16 | | | $ | 262,076 | | | $ | (119) | | | $ | (143,182) | | | $ | 118,791 | |

| Exercise of stock options | 407 | | | — | | | 2 | | | | | | | 2 | |

| Issuance of shares under employee stock purchase plan | 10,057 | | | — | | | 76 | | | | | | | 76 | |

| Vesting of restricted stock units, less shares withheld and retired to satisfy tax obligations | 23,822 | | | | | (14) | | | | | | | (14) | |

| Stock-based compensation expense | | | | | 1,173 | | | | | | | 1,173 | |

| Net loss | | | | | | | | | (15,144) | | | (15,144) | |

| Balance at June 30, 2020 | 16,176,154 | | | $ | 16 | | | $ | 263,313 | | | $ | (119) | | | $ | (158,326) | | | $ | 104,884 | |

X4 PHARMACEUTICALS, INC.

CONDENSED CONSOLIDATED STATEMENT OF REDEEMABLE COMMON STOCK AND STOCKHOLDERS’ EQUITY

(In thousands, except share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Redeemable Common Stock | | Common Stock | | Additional

Paid-In

Capital | | Accumulated Other Comprehensive

Loss | | Accumulated

Deficit | | Total

Stockholders’ Equity |

| Shares | | Amount | | Shares | | Amount |

| Balance at December 31, 2020 | — | | | — | | | 16,305,731 | | | $ | 16 | | | $ | 267,077 | | | $ | (119) | | | $ | (194,175) | | | $ | 72,799 | |

Issuance of common stock, redeemable common stock and prefunded warrants for the purchase of common stock, net of issuance costs of $3.5 million | 229,885 | | | 1,875 | | | 6,041,951 | | | 7 | | | 49,633 | | | | | | | 49,640 | |

| Exercise of stock options | | | | | 5,860 | | | | | 40 | | | | | | | 40 | |

| Exercise of prefunded warrants | | | | | 1,072,887 | | | 1 | | | | | | | | | 1 | |

| Stock-based compensation | | | | | | | | | 1,258 | | | | | | | 1,258 | |

| Net loss | | | | | | | | | | | | | (18,676) | | | (18,676) | |

| Balance at March 31, 2021 | 229,885 | | | 1,875 | | | 23,426,429 | | | 24 | | | 318,008 | | | (119) | | | (212,851) | | | 105,062 | |

| Issuance of common stock under employee stock purchase plan | | | | | 20,232 | | | — | | | 116 | | | | | | | 116 | |

| Exercise of prefunded warrants | | | | | 1,056,881 | | | 1 | | | | | | | | | 1 | |

| Vesting of restricted stock units | | | | | 81,316 | | | | | | | | | | | — | |

| Stock-based compensation | | | | | | | | | 1,797 | | | | | | | 1,797 | |

| Net loss | | | | | | | | | | | | | (19,638) | | | (19,638) | |

| Balance at June 30, 2021 | 229,885 | | | $ | 1,875 | | | 24,584,858 | | | $ | 25 | | | $ | 319,921 | | | $ | (119) | | | $ | (232,489) | | | $ | 87,338 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

X4 PHARMACEUTICALS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited) | | | | | | | | | | | |

| Six Months Ended June 30, |

| 2021 | | 2020 |

| Cash flows from operating activities: | | | |

| Net loss | $ | (38,314) | | | $ | (26,282) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Stock-based compensation expense | 3,055 | | | 1,786 | |

| Depreciation and amortization expense | 235 | | | 102 | |

| Non-cash lease expense | 672 | | | 320 | |

| Accretion of debt discount | 364 | | | 252 | |

| Loss on extinguishment of debt | — | | | 162 | |

| Other | 19 | | | (31) | |

| Changes in operating assets and liabilities: | | | |

| Prepaid expenses, other current assets and research and development incentive receivable | (1,888) | | | (4,201) | |

| Accounts payable | (592) | | | (211) | |

| Accrued expenses | (853) | | | 1,542 | |

| Lease liabilities | (280) | | | (425) | |

| Operating lease right-of-use asset, net of non-cash portion | (59) | | | — | |

| Net cash used in operating activities | (37,641) | | | (26,986) | |

| Cash flows from investing activities: | | | |

| Acquisition of property, equipment and intangible assets | (582) | | | (564) | |

| Net cash used in investing activities | (582) | | | (564) | |

| Cash flows from financing activities: | | | |

| Proceeds from exercise of stock options and prefunded warrants and issuance of shares under employee stock purchase plan | 157 | | | 175 | |

| Employee taxes paid related to net share settlement of vested restricted stock units | — | | | (14) | |

| Proceeds from borrowings under loan and security agreements, net of issuance costs | — | | | 4,888 | |

| Proceeds from sale of common stock, redeemable common stock and prefunded warrants | 53,960 | | | — | |

| | | |

| | | |

| Net cash provided by financing activities | 54,117 | | | 5,049 | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (103) | | | 60 | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | 15,791 | | | (22,441) | |

| Cash, cash equivalents and restricted cash at beginning of period | 80,702 | | | 128,086 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 96,493 | | | $ | 105,645 | |

| Supplemental disclosure of non-cash investing and financing activities: | | | |

| | | |

| | | |

| Acquisition of right-of-use asset financed by lease liabilities | $ | 1,343 | | | $ | — | |

| Issuance costs not yet paid related to sale of common stock, redeemable common stock and prefunded warrants | $ | 2,442 | | | $ | — | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

X4 PHARMACEUTICALS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. NATURE OF THE BUSINESS AND BASIS OF PRESENTATION

X4 Pharmaceuticals, Inc. (together with its subsidiaries, the “Company”) is a late-stage clinical biopharmaceutical company focused on the research, development and commercialization of novel therapeutics for the treatment of rare diseases. The Company’s lead product candidate, mavorixafor, is a potential first-in-class, once-daily, oral inhibitor of CXCR4 and is currently in a Phase 3 clinical trial for the treatment of Warts, Hypogammaglobulinemia, Infections, and Myelokathexis (“WHIM”) syndrome, a rare, inherited, primary immunodeficiency disease caused by genetic mutations in the CXCR4 receptor gene. The Company is also conducting a 14-day, proof-of-concept Phase 1b clinical trial of mavorixafor in patients with severe congenital neutropenia (“SCN”) and a Phase 1b clinical trial of mavorixafor in combination with ibrutinib in Waldenström’s macroglobulinemia (“Waldenström’s”).

Going Concern Assessment—The Company has evaluated whether there are certain conditions and events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern within one year after the date that these condensed consolidated financial statements are issued. As of June 30, 2021, the Company had $95.2 million of cash and cash equivalents. Based on its current operating plan, the Company believes that its existing cash and cash equivalents will be sufficient to fund its operating expense and capital expenditure requirements into the fourth quarter of 2022. However, as further discussed in Note 7, the Company has a covenant under its loan agreement with Hercules Capital Inc. (“Hercules”) that requires that the Company maintain a minimum level of cash, as defined, beginning on April 1, 2022, which date is extended if the Company meets certain financial milestones related to third party funding. Based on its current financial projections, the Company believes it would be in violation of this covenant in the second quarter of 2022. If the Company is in violation of this covenant, Hercules could require the repayment of all outstanding debt.

As a result, the Company believes that, in the aggregate, these conditions raise substantial doubt about the Company’s ability to continue as a going concern within one year after the date that these condensed consolidated financial statements are issued. Nevertheless, the accompanying condensed consolidated financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. In order to fund its operations beyond 2021, the Company is seeking to raise funds potentially through a combination of equity offerings, debt financings, other third-party funding, marketing and distribution arrangements and other collaborations and strategic alliances. If the Company is unable to obtain future funding when needed, the Company may be forced to delay, reduce or eliminate some or all of its research and development programs, product portfolio expansion or pre-commercialization efforts, which could adversely affect its business prospects, or the Company may be unable to continue operations. There is no assurance that the Company will be successful in obtaining sufficient funding on terms acceptable to the Company to fund continuing operations, if at all.

Impact of the COVID-19 Pandemic— The impact of the COVID-19 pandemic continues to be extensive in many aspects of society, which has resulted in and will likely continue to result in significant disruptions to the global economy, as well as businesses and capital markets around the world. Impacts to the Company’s business have included temporary closures or postponements of activation of its clinical trial sites or facilities, disruptions or restrictions on its employees’ ability to travel, disruptions to or delays in ongoing clinical trials, including patient enrollment at a slower pace than initially projected and the diversion of healthcare resources away from the conduct of the Company’s clinical trials as a result of the ongoing COVID-19 pandemic, including the diversion of hospitals serving as the Company’s clinical trial sites and hospital staff supporting the conduct of the Company’s clinical trials.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Significant Accounting Policies—The Company’s significant accounting policies are disclosed in the audited consolidated financial statements and the notes thereto in the Company’s Annual Report on Form 10-K for the year ended December 31, 2020 filed with the SEC on March 19, 2021 (the “2020 Annual Report”). Since the date of those consolidated financial statements, there have been no material changes to the Company’s significant accounting policies.

Risks and Uncertainties—The impact of the COVID-19 pandemic has been and, notwithstanding the recent commencement of vaccination efforts, is expected to continue to be extensive in many aspects of society, which has resulted in and will likely continue to result in significant disruptions to the global economy, as well as businesses and capital markets around the world. Impacts to the Company’s business have included temporary closures or postponements of activation of its clinical trial sites or

X4 PHARMACEUTICALS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

facilities, disruptions or restrictions on its employees’ ability to travel, disruptions to or delays in ongoing clinical trials, including patient enrollment at a slower pace than initially projected and the diversion of healthcare resources away from the conduct of the Company’s clinical trials as a result of the ongoing COVID-19 pandemic, including the diversion of hospitals serving as the Company’s clinical trial sites and hospital staff supporting the conduct of the Company’s clinical trials.

In addition, the Company is subject to other challenges and risks specific to its business and its ability to execute on its business plan and strategy, as well as risks and uncertainties common to companies in the biotechnology industry with research and development operations, including, without limitation, risks and uncertainties associated with: obtaining regulatory approval of its product candidates; delays or problems in obtaining clinical supply, loss of single source suppliers or failure to comply with manufacturing regulations; identifying, acquiring or in-licensing additional products or product candidates; product development and the inherent uncertainty of clinical success; and the challenges of protecting and enhancing its intellectual property rights; and the challenges of complying with applicable regulatory requirements. In addition, to the extent the ongoing COVID-19 pandemic adversely affects the Company’s business and results of operations, it is expected also to have the effect of heightening many of the other risks and uncertainties discussed above.

Principles of Consolidation— The condensed consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries, including X4 Pharmaceuticals (Austria) GmbH, which is incorporated in Vienna, Austria (“X4 Austria”), and X4 Therapeutics, Inc. All significant intercompany accounts and transactions have been eliminated.

Unaudited Interim Condensed Consolidated Financial Statements— The condensed consolidated balance sheet at December 31, 2020 that is presented in these interim condensed consolidated financial statements was derived from audited financial statements but does not include all disclosures required by accounting principles generally accepted in the United States of America (“GAAP”). The accompanying condensed consolidated financial statements are unaudited. The accompanying unaudited interim condensed consolidated financial statements have been prepared by the Company pursuant to the rules and regulations of the SEC for interim financial statements. Accordingly, certain information and footnote disclosures normally included in financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to such rules and regulations. However, the Company believes that the disclosures are adequate to make the information presented not misleading. These unaudited interim condensed consolidated financial statements should be read in conjunction with the Company’s audited financial statements and the notes thereto for the year ended December 31, 2020 included in the 2020 Annual Report. In the opinion of management, all adjustments, consisting only of normal recurring adjustments as necessary, for the fair statement of the Company’s condensed financial position, condensed results of its operations and cash flows have been made. The results of operations for the three and six months ended June 30, 2021 are not necessarily indicative of the results of operations that may be expected for the year ending December 31, 2021.

Use of Estimates— The preparation of the Company’s condensed consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the condensed consolidated financial statements, and the reported amounts of expenses during the reporting period. Significant estimates and assumptions reflected in these condensed consolidated financial statements include, but are not limited to, the accrual of research and development expenses, the impairment or lack of impairment of long-lived assets including operating lease right-of-use assets and goodwill, and the constraint of variable consideration from contracts with customers. The Company bases its estimates on historical experience, known trends and other market-specific or other relevant factors that it believes to be reasonable under the circumstances. On an ongoing basis, management evaluates its estimates when there are changes in circumstances, facts and experience. Changes in estimates are recorded in the period in which they become known. The COVID-19 pandemic has impacted and is expected to continue to impact the clinical development timelines for certain of the Company's clinical programs. As of the date of issuance of these condensed consolidated financial statements, the Company is not aware of any specific event or circumstance that would require the Company to update its estimates, assumptions and judgments or revise the carrying value of its assets or liabilities. Actual results could differ from those estimates, and any such differences may be material to the Company’s condensed consolidated financial statements.

Cash and Cash Equivalents— The Company considers all highly liquid investments with maturities of three months or less at the date of purchase to be cash equivalents. Cash equivalents consisted of money market funds as of June 30, 2021 and December 31, 2020.

X4 PHARMACEUTICALS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Restricted Cash | | | | | | | | | | | |

| (in thousands) | As of June 30, 2021 | | As of December 31, 2020 |

| Letter of credit security: Cambridge lease | $ | — | | | $ | 264 | |

| Letter of credit security: Waltham lease | 250 | | | 250 | |

| Letter of credit security: Vienna Austria lease | 227 | | | 336 | |

| Letter of credit security: Boston lease | 855 | | | 1,144 | |

| Total restricted cash | $ | 1,332 | | | $ | 1,994 | |

| Restricted cash included in prepaid expenses and other current assets | $ | — | | | $ | 264 | |

| Restricted cash included in other assets | $ | 1,332 | | | $ | 1,730 | |

In connection with the Company’s lease agreements for its facilities in Massachusetts and Austria, the Company maintains letters of credit, which are secured by restricted cash, for the benefit of the respective landlord.

The following table provides a reconciliation of cash, cash equivalents, and restricted cash reported within the condensed consolidated balance sheets to the sum of the total of amounts shown in the Company’s condensed consolidated statements of cash flows as of June 30, 2021, December 31, 2020, June 30, 2020 and December 31, 2019: | | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands) | June 30, 2021 | | December 31, 2020 | | June 30, 2020 | | December 31, 2019 |

| Cash and cash equivalents | $ | 95,161 | | | $ | 78,708 | | | $ | 103,744 | | | $ | 126,184 | |

| Restricted cash, current portion | — | | | 264 | | | — | | | — | |

| Restricted cash, non-current | 1,332 | | | 1,730 | | | 1,901 | | | 1,902 | |

| Total cash, cash equivalents and restricted cash | $ | 96,493 | | | $ | 80,702 | | | $ | 105,645 | | | $ | 128,086 | |

Goodwill— Goodwill is tested for impairment at the reporting unit level annually in the fourth quarter, or more frequently when events or changes in circumstances indicate that the asset might be impaired. Examples of such events or circumstances include, but are not limited to, a significant adverse change in legal or business climate, an adverse regulatory action or unanticipated competition. The Company has determined that it operates in a single operating segment and has a single reporting unit.

The Company assesses qualitative factors to determine whether the existence of events or circumstances would indicate that it is more likely than not that the fair value of the reporting unit is less than its carrying amount. If after assessing the totality of events or circumstances, the Company were to determine that it is more likely than not that the fair value of the reporting unit is less than its carrying amount, then the Company would perform an interim quantitative impairment test, whereby the Company compares the fair value of the reporting unit to its carrying value. If the fair value of the reporting unit exceeds the carrying value of its net assets, goodwill is not impaired, and no further testing is required. If the fair value of the reporting unit is less than its carrying value, the Company measures the amount of impairment loss, if any, as the excess of the carrying value over the fair value of the reporting unit. There were no triggering events during the six months ended June 30, 2021 that necessitated an interim impairment test of goodwill.

Recently Adopted Accounting Pronouncements

In August 2020, the Financial Accounting Standards Board (“FASB”) issued ASU 2020-06, Debt, Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging—Contracts in Entity’s Own Equity (Subtopic 815-40). ASU 2020-06 was issued to reduce the complexity of accounting for financial instruments having characteristics of both debt and equity. For example, the new standard modifies the scope exception to derivative accounting under ASC 815-40, Derivatives and Hedging---Contracts in an Entity’s Own Equity, by eliminating certain required settlement criteria, such as the requirement that common shares issued upon exercise of a warrant not require an active registration statement. The Company adopted ASU 2020-06 on January 1, 2021 and the adoption of this guidance did not have an impact on its condensed consolidated financial statements and related disclosures.

In December 2019, the FASB issued ASU 2019-12, Simplifying the Accounting for Income Taxes (“ASU 2019-12”). ASU

2019-12 simplifies the accounting for income taxes, including the methodology for calculating income taxes in an interim period and the recognition of deferred tax liabilities for outside basis differences. ASU 2019-12 is effective for fiscal years

X4 PHARMACEUTICALS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

beginning after December 15, 2020, including interim periods within those fiscal years. The Company adopted ASU 2019-12 on January 1, 2021 and the adoption of this guidance did not have a material impact on its condensed consolidated financial statements and related disclosures.

Recently Issued Accounting Standards Not Yet Adopted

In June 2016, the FASB issued ASU 2016-13, Credit Losses (Topic 326) Measurement of Credit Losses on Financial Instruments (“ASU 2016-13"), as amended. ASU 2016-13 requires that financial assets measured at amortized cost, such as trade receivables, be presented net of expected credit losses, which may be estimated based on relevant information such as historical experience, current conditions, and future expectation for each pool of similar financial asset. The new guidance requires enhanced disclosures related to trade receivables and associated credit losses. In accordance with ASU 2019-10, Financial Instruments-Credit Losses (Topic 326), Derivative and Hedging (Topic 815), and Leases (Topic 842)- Effective Dates, as the Company meets the definition of a “smaller reporting company”, the Company has elected to defer the adoption of ASU 2016-13 until January 1, 2023. The Company expects that the adoption of ASU 2016-13 may accelerate the timing and could increase the level of credit loss expense in the consolidated statement of operations and will likely require an increased level of disclosure in the notes to the consolidated financial statements.

3. LICENSE, COLLABORATION AND FUNDING AGREEMENTS

Research and Development Incentive Program

The Company participates in a research and development incentive program provided by the Austrian government whereby the Company is entitled to reimbursement by the Austrian government for a percentage of qualifying research and development expenses and capital expenditures incurred by the Company’s subsidiary in Austria. As of June 30, 2021, the amount due under the program is $1.1 million, which amount was included in research and development incentive receivable in the condensed consolidated balance sheet. During the six months ended June 30, 2021 and 2020, the Company recorded $546 thousand and $171 thousand of income related to the program within the condensed consolidated statements of operations as other income.

License and Collaboration Agreements

There were no material modifications of the Company’s license or collaboration agreements during the three months ended June 30, 2021.

4. FAIR VALUE OF FINANCIAL ASSETS AND LIABILITIES

The following tables present information about the Company’s financial assets and liabilities measured at fair value on a recurring basis and indicate the level of the fair value hierarchy used to determine such fair values: | | | | | | | | | | | | | | | | | | | | | | | |

| Fair Value Measurements as of June 30, 2021 Using: |

| (in thousands) | Level 1 | | Level 2 | | Level 3 | | Total |

| Assets: | | | | | | | |

| Cash equivalents—money market funds | $ | 14,816 | | | $ | 27,897 | | | $ | — | | | $ | 42,713 | |

| $ | 14,816 | | | $ | 27,897 | | | $ | — | | | $ | 42,713 | |

| Liabilities: | | | | | | | |

| Embedded derivative liability | $ | — | | | $ | — | | | $ | 428 | | | $ | 428 | |

| $ | — | | | $ | — | | | $ | 428 | | | $ | 428 | |

X4 PHARMACEUTICALS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Fair Value Measurements as of December 31, 2020 Using: |

| (in thousands) | Level 1 | | Level 2 | | Level 3 | | Total |

| Assets: | | | | | | | |

| Cash equivalents—money market funds | $ | 16,816 | | | $ | 28,018 | | | $ | — | | | $ | 44,834 | |

| $ | 16,816 | | | $ | 28,018 | | | $ | — | | | $ | 44,834 | |

| Liabilities: | | | | | | | |

| Embedded derivative liability | $ | — | | | $ | — | | | $ | 455 | | | $ | 455 | |

| $ | — | | | $ | — | | | $ | 455 | | | $ | 455 | |

The Company’s cash equivalents consisted of money market funds invested in U.S. Treasury securities. The money market funds were valued based on reported market pricing for the identical assets, which represents a Level 1 measurement, or by using inputs observable in active markets for similar securities, which represents a Level 2 measurement.

The following table provides a roll-forward of the aggregate fair values financial instruments for which fair values are determined using Level 3 inputs:

| | | | | | | |

| (in thousands) | Embedded Derivative Liability | | |

| Balance as of December 31, 2020 | $ | 455 | | | |

| Change in fair value | (27) | | | |

| Balance as of June 30, 2021 | $ | 428 | | | |

Embedded Derivative Liability— The fair value of the embedded derivative liability recognized in connection with the Company’s loan agreement with Hercules (Note 7), which is associated with additional fees due to Hercules upon events of default, was determined based on significant inputs not observable in the market, which represents a Level 3 measurement within the fair value hierarchy. The fair value of this embedded derivative liability, which is reported within other non-current liabilities on the condensed consolidated balance sheets, is estimated by the Company at each reporting date based, in part, on the results of third party valuations, which are prepared based on a discounted cash flow model that considers the timing and probability of occurrence of a redemption upon an event of default, the potential amount of prepayment fees or contingent interest upon an event of default and the Company’s risk-adjusted discount rate of 14%.

X4 PHARMACEUTICALS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

5. PROPERTY AND EQUIPMENT, NET

Property and equipment, net consisted of the following: | | | | | | | | | | | |

| (in thousands) | June 30, 2021 | | December 31, 2020 |

| Leasehold improvements | $ | 228 | | | $ | 228 | |

| Furniture and fixtures | 1,268 | | | 910 | |

| Computer equipment | 152 | | | 47 | |

| Software | 33 | | | 33 | |

| Lab equipment | 573 | | | 293 | |

| 2,254 | | | 1,511 | |

| Less: Accumulated depreciation and amortization | (509) | | | (274) | |

| $ | 1,745 | | | $ | 1,237 | |

Depreciation and amortization expense related to property and equipment was $235 thousand and $102 thousand for the six months ended June 30, 2021 and 2020 respectively.

6. ACCRUED EXPENSES

Accrued expenses consisted of the following: | | | | | | | | | | | |

| (in thousands) | June 30,

2021 | | December 31,

2020 |

| Accrued employee compensation and benefits | $ | 3,022 | | | 3,756 | |

| Accrued external research and development expenses | 2,656 | | | 3,150 | |

| Accrued professional fees | 931 | | | 627 | |

| Accrued issuance costs for private placement equity offering (Note 11) | 2,442 | | | — | |

| Other | 556 | | | 485 | |

| $ | 9,607 | | | $ | 8,018 | |

7. LONG-TERM DEBT

Long-term debt consisted of the following: | | | | | | | | | | | |

| (in thousands) | June 30,

2021 | | December 31,

2020 |

| Principal amount of long-term debt | $ | 32,500 | | | $ | 32,500 | |

| | | |

| | | |

| Debt discount, net of accretion | 253 | | | 223 | |

| Cumulative accretion of final payment due at maturity | 789 | | | 455 | |

| Long-term debt, including accretion | $ | 33,542 | | | $ | 33,178 | |

Hercules Loan Agreement, As Amended

In October 2018, the Company entered into a Loan and Security Agreement (the “Hercules Loan Agreement”), as amended in December 2019, June 2019, March 2020 and December 2020, with Hercules, under which the Company has borrowed an aggregate of $32.5 million of term loans to date. The Hercules Loan Agreement provides for maximum borrowings of up to $50.0 million, which include (i) subject to the achievement of certain performance milestones and conditions, a right of the Company to request that Hercules make additional term loan advances in an aggregate amount of up to $7.5 million through June 30, 2022 and (ii) subject to Hercules investment committee’s sole discretion, a right of the Company to request that Hercules make additional term loan advances in an aggregate amount of up to $10.0 million through December 31, 2022. Borrowings under the Hercules Loan Agreement accrues interest at a variable rate equal to the greater of (i) 8.75% or (ii) 8.75%

X4 PHARMACEUTICALS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

plus The Wall Street Journal prime rate minus 6.0%. In an event of default and until such event is no longer continuing, the interest rate applicable to borrowings would be increased by 4.0%.

Borrowings under the Hercules Loan Agreement are repayable in monthly interest-only payments through January 1, 2023, and in equal monthly payments of principal and accrued interest from February 1, 2023 until the maturity date of the loan, which is July 1, 2024. The Company may prepay all, but not less than all, of the outstanding borrowings, subject to a prepayment premium of up to 2.0%, 1.0% or 0.5% of the principal amount outstanding as of the date of repayment, in each case depending on when such repayment is made. In addition, the Hercules Loan Agreement provides for payments of $0.8 million, $1.3 million, and $0.8 million payable on January 1, 2022, July 1, 2023 and July 1, 2024, respectively, which payments are accelerated upon the prepayment of the borrowings upon the Company’s election on upon default of the loan.

Borrowings under the Hercules Loan Agreement are collateralized by substantially all of the Company’s personal property and other assets except for their intellectual property (but including rights to payment and proceeds from the sale, licensing or disposition of the intellectual property).

Pursuant to the Hercules Loan Agreement, effective as of the earlier of (a) certain specified events impacting the Company’s Phase III trial of mavorixafor for the treatment of WHIM syndrome and (b) April 1, 2022 (which date is extended if the Company meets certain financial milestones related to third party funding), the Company at all times thereafter must maintain cash in an account or accounts in which Hercules has a first priority security interest, in an aggregate amount greater than or equal to the greater of (i) $30.0 million or (ii) 6 multiplied by a metric based on prior months’ cash expenditures; provided, however, that from and after the Company’s achievement of certain performance milestones, the required level shall be reduced to the greater of (x) $20.0 million, or (y) 3 multiplied by the current cash expenditures metric; and provided further, that subject to the achievement of certain milestones, this covenant will be extinguished. The Hercules Loan Agreement also restricts the Company’s ability to incur additional indebtedness, pay dividends, encumber its intellectual property, or engage in certain fundamental business transactions, such as mergers or acquisitions of other businesses, with certain exceptions.

The Company recognized interest expense under the Hercules Loan Agreement as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| (dollars in thousands) | For the three months ended June 30, | | For the six months ended June 30, |

| 2021 | | 2020 | | 2021 | | 2020 |

| Total interest expense | $ | 905 | | | $ | 686 | | | $ | 1,796 | | | $ | 1,271 | |

| Non-cash interest expense | $ | 186 | | | $ | 133 | | | $ | 364 | | | $ | 252 | |

The annual effective interest rate of the Hercules Loan Agreement as of June 30, 2021 is 10.7%. There were no principal payments due or paid under the Hercules Loan Agreement during the six months ended June 30, 2021.

As of June 30, 2021, future principal payments and the final payment due under the Hercules Loan Agreement were as follows (in thousands):

| | | | | |

| Year Ending December 31, | Total |

| 2021 | $ | — | |

| 2022 | — | |

| 2023 | 21,185 | |

| 2024 | 11,315 | |

| |

| Long-term debt | $ | 32,500 | |

X4 PHARMACEUTICALS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

8. LEASES

The Company has lease agreements for its facilities in Boston, Massachusetts, which is the Company’s principal executive office; Vienna, Austria, which is the Company’s research and development center; and Waltham, Massachusetts, which the Company has sublet to a third party. There are no restrictions or financial covenants associated with any of the lease agreements.

Vienna Austria Leases— The Company had an operating lease, as amended, for approximately 400 square meters of laboratory and office space in Vienna, Austria, which commenced on March 1, 2019, as amended, for a term of approximately 2 years terminating in April 2021. The annual base rent for the previous lease was approximately $154 thousand. In September 2020, the Company entered into a new operating lease for approximately 1,200 square meters of laboratory and office space in Vienna, Austria (“Vienna Lease”), which commenced in February 2021 following construction of laboratory and office space for a term of 7 years. The Company contributed $709 thousand to building improvements, which are classified as part of the right-of-use asset. The Company recorded a right-of-use asset and associated lease liabilities upon the commencement of the Vienna Lease in the first quarter of 2021. The annual base rent for the Vienna Lease, following a 6-month rent free period, will be approximately $300 thousand.

Boston Lease— The Company leases approximately 28,000 square feet of office space in Boston, Massachusetts (“Boston Lease”), which serves as the Company’s headquarters. Base rental payments are approximately $1.0 million annually, plus certain operating expenses. The term of the Boston Lease will continue until November 2026, unless earlier terminated. The Company has the right to sublease the premises, subject to landlord consent and also has the right to renew the Boston Lease for an additional five years at the then prevailing effective market rental rate. The Company is required to maintain a security deposit in the form of a letter of credit for $1.1 million for the benefit of the landlord.

Waltham Lease— The Company leases approximately 6,000 square feet of office space in Waltham, Massachusetts (“Waltham Lease”). The Waltham Lease, as amended, commenced on January 1, 2019, and expires approximately five years from the commencement date. The base rent is approximately $262 thousand annually. In addition to the base rent, the Company is also responsible for its share of operating expenses, electricity and real estate taxes, which costs are not included in the determination of the leases’ right-of-use assets or lease liabilities. The Company is subleasing the space to a third party for the duration of the lease. The right-of-use asset is being amortized to rent expense over the five-year term of the lease.

As the Company’s leases do not provide an implicit rate, the Company estimated the incremental borrowing rate in calculating the present value of the lease payments. The Company utilizes its incremental borrowing rates, which are the rates incurred to borrow on a collateralized basis over a similar term and amount equal to the lease payments in a similar economic environment.

The components of lease expense for the three and six months ended June 30, 2021 and 2020 were as follows: | | | | | | | | | | | | | | | | | | | | | | | |

| (dollars in thousands) | For the Three Months Ended June 30, | | For the Six Months Ended June 30, |

| Lease Cost | 2021 | | 2020 | | 2021 | | 2020 |

| Fixed operating lease cost | $ | 541 | | $ | 216 | | | $ | 1,017 | | | $ | 434 | |

| Short-term lease costs | — | | 38 | | | 42 | | | 76 | |

| Total lease expense | $ | 541 | | $ | 254 | | | $ | 1,059 | | | $ | 510 | |

| Other information | | | | | | | |

| Right-of-use asset obtained in exchange for operating lease liabilities | $ | — | | | | | $ | 1,343 | | | |

| Operating cash flows from operating leases | $ | 280 | | | $ | 242 | | | $ | 603 | | | $ | 484 | |

| Sublease income | $ | 49 | | | $ | 48 | | | $ | 98 | | | $ | 97 | |

| Weighted-average remaining lease term—operating leases | 5.4 years | | | | | | |

| Weighted-average discount rate—operating leases | 11.3 | % | | | | | | |

X4 PHARMACEUTICALS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Maturities of lease liabilities due under lease agreements that have commenced as of June 30, 2021 are as follows (in thousands)

| | | | | |

| Maturity of lease liabilities | Operating

Leases |

| 2021 (remainder of the year) | $ | 767 | |

| 2022 | 1,611 | |

| 2023 | 1,639 | |

| 2024 | 1,405 | |

| 2025 | 1,432 | |

| Thereafter | 1,725 | |

| Total lease payments | 8,579 | |

| Less: interest | (2,244) | |

| Total operating lease liabilities as of June 30, 2021 | $ | 6,335 | |

9. COMMITMENTS AND CONTINGENCIES

The Company has agreements with CROs pursuant to which the Company and the CROs are conducting clinical trials of mavorixafor for the treatment of WHIM syndrome, Waldenström’s and SCN. The Company may terminate these agreements by providing notice pursuant to the contractual provisions of such agreements and would incur early termination fees. The Company also has agreements with contract manufacturing organizations (“CMOs”) for the production of mavorixafor for use in clinical trials.

Indemnification Agreements— In the ordinary course of business, the Company may provide indemnification of varying scope and terms to vendors, lessors, business partners and other parties with respect to certain matters including, but not limited to, losses arising out of breach of such agreements or from intellectual property infringement claims made by third parties. In addition, the Company has entered into indemnification agreements with members of its board of directors and its executive officers that will require the Company to, among other things, indemnify them against certain liabilities that may arise by reason of their status or service as directors or officers. The maximum potential amount of future payments the Company could be required to make under these indemnification agreements is, in many cases, unlimited. To date, the Company has not incurred any material costs as a result of such indemnification obligations. The Company is not currently aware of any indemnification claims and has not accrued any liabilities related to such obligations in its condensed consolidated financial statements as of June 30, 2021 or December 31, 2020.

Legal Proceedings— The Company is not a party to any litigation and does not have contingency reserves established for any litigation liabilities. At each reporting date, the Company evaluates whether or not a potential loss amount or a potential range of loss is probable and reasonably estimable under the provisions of the authoritative guidance that addresses accounting for contingencies. The Company expenses as incurred the costs related to any legal proceedings.

Redeemable Common Stock— See Notes 11 and 15 related to the Company’s redeemable common stock.

10. COMMON STOCK WARRANTS

In connection with its issuance of common stock in public offerings that closed on April 16, 2019 and November 29, 2019, the Company issued 3,900,000 Class A warrants, which are exercisable for the Company’s common stock, and 5,416,667 Class B warrants, which are exercisable for shares of the Company’s common stock or prefunded warrants to purchase shares of the Company's common stock. The Class A warrants have an exercise price of $13.20 per share, expire on April 15, 2024 and were immediately exercisable. The Class B warrants were immediately exercisable upon issuance, had an initial exercise price of $15.00 per share and expire on a date that is the earlier of (a) the date that is 30 calendar days from the date on which the

X4 PHARMACEUTICALS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Company issues a press release announcing top-line data from its Phase 3 clinical trial of mavorixafor for the treatment of patients with WHIM syndrome (or, if such date is not a business day, the next business day) and (b) November 28, 2024. The Class B warrants have a contingent price adjustment feature pursuant to which the exercise price of the Class B warrants is adjusted to the lowest weighted average offering price at which the Company sells its common stock or certain securities convertible into or exercisable for the Company's common stock in one or more subsequent offerings, if the weighted average offering price for such offering is below $15.00. On March 23, 2021, the Company completed a private placement sale of its common stock priced at $8.70. Accordingly, the exercise price of the Class B warrants was adjusted to $8.70.

In addition, in connection with the April 16, 2019, November 29, 2019 and March 23, 2021 equity offerings, the Company issued 2,130,000, 1,750,000 and 50,000 prefunded warrants, respectively, for proceeds of $10.999, $11.999 and $8.69 per share, respectively. Each of the prefunded warrants is exercisable into one share of the Company's common stock and was immediately exercisable upon issuance. The April 2019 and November 2019 pre-funded warrants have a remaining exercise price of $0.001 per share and the March 2021 pre-funded warrants have a remaining exercise price of $0.01 per share.

The following table provides a roll forward of outstanding warrants for the six month period ended June 30, 2021: | | | | | | | | | | | | | | | | | | | | |

| | Number of warrants | | Weighted Average Exercise Price | | Weighted Average Contractual Term (Years) |

| Outstanding and exercisable warrants to purchase common shares as of December 31, 2020 | | 13,354,403 | | | $13.52 | | 3.70 |

| Issued | | 50,000 | | | | | |

| Exercised | | (2,130,000) | | | | | |

| | | | | | |

| Outstanding and exercisable warrants to purchase common shares as of June 30, 2021 | | 11,274,403 | | | $10.94 | | 3.21 |

As of June 30, 2021, the Company’s outstanding warrants to purchase shares of common stock consisted of the following: | | | | | | | | | | | | | | | | | | | | |

| Issuance Date | | Number of

Shares of

Common

Stock Issuable | | Exercise

Price | | Expiration Date |

| October 25, 2016 | | 5,155 | | | $ | 19.78 | | | October 24, 2026 |

| December 28, 2017 | | 115,916 | | | $ | 19.78 | | | December 28, 2027 |

| September 12, 2018 | | 25,275 | | | $ | 19.78 | | | September 12, 2021 |

| September 12, 2018 | | 20,220 | | | $ | 19.78 | | | September 12, 2028 |

| October 19, 2018 | | 20,016 | | | $ | 19.78 | | | October 19, 2028 |

| March 13, 2019 | | 5,000 | | | $ | 19.78 | | | March 12, 2029 |

| April 16, 2019 | | 3,866,154 | | | $ | 13.20 | | | April 15, 2024 |

| November 29, 2019 | | 5,416,667 | | | $ | 8.70 | | | November 28, 2024 |

| November 29, 2019 | | 1,750,000 | | | $ | 12.00 | | (a) | n/a |

| March 23, 2021 | | 50,000 | | | $ | 8.70 | | (b) | n/a |

| | 11,274,403 | | | | | |

(a) In November 2019, the Company received $11.999 per pre-funded warrant, or $21.0 million in aggregate proceeds. Each prefunded

warrant may be exercised for an additional $0.001 per pre-funded warrant.

(b) In March 2021, the Company received $8.69 per pre-funded warrant, or $435 thousand in aggregate proceeds. Each prefunded warrant may be exercised for an additional $0.01 per pre-funded warrant.

X4 PHARMACEUTICALS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

11. COMMON STOCK AND REDEEMABLE COMMON STOCK