Exhibit 99.1

Unaudited Condensed Interim Consolidated Financial Statements

For the three months ended

March 31, 2024

(In United States Dollars)

enCore Energy Corp.

Condensed Interim Consolidated Statements of Financial Position

Unaudited – Prepared by Management

As at March 31, 2024 and December 31, 2023

(In USD unless otherwise noted)

| Note | March 31, 2024 $ | December 31, 2023 $ | |||||||||

| Assets | |||||||||||

| Current assets | |||||||||||

| Cash | 90,090,593 | 7,493,424 | |||||||||

| Receivables and prepaid expenses | 3,430,001 | 931,170 | |||||||||

| Marketable securities | 4 | 17,594,169 | 16,886,052 | ||||||||

| Inventory | 3 | 12,794,412 | 9,077 | ||||||||

| 123,909,175 | 25,319,723 | ||||||||||

| Non-current assets | |||||||||||

| Intangible assets | 501,466 | 513,721 | |||||||||

| Property, plant, and equipment | 5 | 16,277,181 | 14,969,860 | ||||||||

| Marketable securities | 4 | 1,250,405 | 3,046,787 | ||||||||

| Mineral properties | 7 | 271,105,464 | 267,209,138 | ||||||||

| Mining properties | 8 | 3,720,346 | 5,301,820 | ||||||||

| Reclamation deposits | 7 | - | 88,500 | ||||||||

| Right-of-use asset | 387,466 | 443,645 | |||||||||

| Restricted cash | 7,679,961 | 7,679,859 | |||||||||

| Total assets | 424,831,464 | 324,573,053 | |||||||||

Liabilities and shareholders’ equity | |||||||||||

| Current liabilities | |||||||||||

| Accounts payable and accrued liabilities | 3,487,113 | 3,576,194 | |||||||||

| Uranium loan liability | 6 | 20,282,012 | - | ||||||||

| Due to related parties | 11 | 138,880 | 2,520,594 | ||||||||

| Lease liability - current | 176,770 | 177,641 | |||||||||

| 24,084,775 | 6,274,429 | ||||||||||

| Non-current liabilities | |||||||||||

| Asset retirement obligations | 9 | 10,961,779 | 10,827,806 | ||||||||

| Convertible promissory note | 10 | - | 19,239,167 | ||||||||

| Lease liability - non-current | 240,026 | 295,147 | |||||||||

| Total liabilities | 35,286,580 | 36,636,549 | |||||||||

Shareholders’ equity | |||||||||||

| Share capital | 10 | 382,522,428 | 328,246,303 | ||||||||

| Equity portion of convertible promissory note | 10 | - | 3,813,266 | ||||||||

| Contributed surplus | 10 | 18,976,067 | 19,185,942 | ||||||||

| Accumulated other comprehensive income | 4,617,590 | 7,944,347 | |||||||||

| Equity reserves | 20,447,042 | - | |||||||||

| Non-controlling interests | 39,475,915 | - | |||||||||

| Accumulated deficit | (76,494,158 | ) | (71,253,354 | ) | |||||||

| Total shareholders’ equity | 389,544,884 | 287,936,504 | |||||||||

| Total liabilities and shareholders’ equity | 424,831,464 | 324,573,053 | |||||||||

Nature of operations and going concern | 1 | ||||||||||

| Events after the reporting period | 16 | ||||||||||

Approved on behalf of the Board of Directors on May 10, 2024:

| “William M. Sheriff” | Director | “William B. Harris” | Director |

The accompanying notes are an integral part of these condensed interim consolidated financial statements.

1

enCore Energy Corp.

Condensed Interim Consolidated Statements of Loss and Comprehensive Loss

Unaudited – Prepared by Management

(In USD unless otherwise noted)

| Three months ended | |||||||||||

| Note | March 31, 2024 $ | March 31, 2023 $ | |||||||||

| Revenue | 30,394,700 | - | |||||||||

| Cost of goods sold | 28,052,288 | - | |||||||||

| Gross Profit | 2,342,412 | - | |||||||||

| Expenses | |||||||||||

| Accretion | 9,10 | 363,457 | 497,493 | ||||||||

| Amortization and depreciation | 5,6,7 | 518,102 | 207,180 | ||||||||

| Depletion | 8 | 1,581,474 | - | ||||||||

| General administrative costs | 11 | 1,910,497 | 1,154,925 | ||||||||

| Professional fees | 11 | 1,562,633 | 2,113,048 | ||||||||

| Promotion and shareholder communication | 458,568 | 71,933 | |||||||||

| Travel | 169,445 | 143,676 | |||||||||

| Transfer agent and filing fees | 163,937 | 237,764 | |||||||||

| Staff costs | 11 | 1,942,476 | 2,441,184 | ||||||||

| Stock option expense | 10,11 | 1,118,585 | 866,483 | ||||||||

| Loss from operations | (7,446,762 | ) | (7,733,686 | ) | |||||||

| Foreign exchange gain (loss) | 2,683,358 | (3,941 | ) | ||||||||

| Gain on divestment of mineral properties | 7 | 24,240 | 24,240 | ||||||||

| Gain on sale of uranium investment | - | 1,100,500 | |||||||||

| Gain on disposal of assets | (18,028 | ) | - | ||||||||

| Interest expense | (406,567 | ) | (600,000 | ) | |||||||

| Interest income | 415,873 | 320,275 | |||||||||

| Realized gain on marketable securities | 4 | 251,476 | - | ||||||||

| Unrealized loss on marketable securities | 4 | (821,437 | ) | (581,721 | ) | ||||||

| Net loss for the period | (5,317,847 | ) | (7,474,333 | ) | |||||||

| less: net loss for the period attributable to: Non controlling interest shareholders | (77,043 | ) | - | ||||||||

| Net loss for the period attributable to: Shareholders of enCore Energy Corp | (5,240,804 | ) | (7,474,333 | ) | |||||||

| Currency translation adjustment of subsidiaries | (3,326,757 | ) | 669,480 | ||||||||

| Comprehensive loss for the period attributable to: Shareholders of enCore Energy Corp | (8,567,561 | ) | (6,804,853 | ) | |||||||

| Loss per share | |||||||||||

| Weighted average number of common shares outstanding | |||||||||||

| - basic # | 173,486,569 | 127,199,482 | |||||||||

| - diluted # | 173,486,569 | 127,199,482 | |||||||||

The accompanying notes are an integral part of these condensed interim consolidated financial statements.

2

enCore Energy Corp.

Condensed Interim Consolidated Statements of Cash Flows

Unaudited

(In USD unless otherwise noted)

| March 31, | March 31, | |||||||||||

| 2024 | 2023 | |||||||||||

| Note | $ | $ | ||||||||||

| Operating activities | ||||||||||||

| Net loss for the year | (5,317,847 | ) | (7,474,333 | ) | ||||||||

| Accretion | 7,11,12 | 363,457 | 497,493 | |||||||||

| Amortization and depreciation | 5,6,7 | 518,102 | 207,180 | |||||||||

| Depletion | 10 | 1,581,474 | - | |||||||||

| Foreign exchange (gain) loss | (2,683,358 | ) | 3,941 | |||||||||

| Stock option expense | 12,13 | 1,118,585 | 866,483 | |||||||||

| Interest income | - | (320,275 | ) | |||||||||

| Gain on divestment of mineral properties | 4,7 | (24,240 | ) | (24,240 | ) | |||||||

| Gain (loss) on marketable securities - realized | 4 | (251,476 | ) | 581,721 | ||||||||

| Gain (loss) on marketable securities - unrealized | 4 | 821,437 | - | |||||||||

| Gain on sale of uranium | 3 | - | (1,100,500 | ) | ||||||||

| Proceeds received from sale of uranium | - | 7,023,000 | ||||||||||

| Purchase of uranium | 3 | - | (14,672,500 | ) | ||||||||

| Changes in non-cash working capital items: | ||||||||||||

| Receivables | (1,191,461 | ) | (771,615 | ) | ||||||||

| Prepaids and deposits | (1,319,827 | ) | - | |||||||||

| Raw materials | (8,653 | ) | - | |||||||||

| Uranium inventory | (12,776,682 | ) | - | |||||||||

| Deposit - uranium investment | 3 | - | 2,000,000 | |||||||||

| Restricted cash | - | 47,676,777 | ||||||||||

| Uranium loan | 20,282,012 | - | ||||||||||

| Accounts payable and accrued liabilities | (558,558 | ) | 216,401 | |||||||||

| Due to related parties | 13 | (2,368,093 | ) | (345,817 | ) | |||||||

| (1,815,128 | ) | 34,363,716 | ||||||||||

| Investing activities | ||||||||||||

| Acquisition of property, plant, and equipment | 6 | (1,629,797 | ) | (462,910 | ) | |||||||

| Mineral property expenditures | 9 | (3,364,302 | ) | (1,484,328 | ) | |||||||

| Proceeds from divestment of mineral properties | 9 | - | 24,240 | |||||||||

| Proceeds from sale of minority interest in subsidiary | 10 | 60,000,000 | - | |||||||||

| Proceeds from sale of marketable securities | 4 | 44,557 | - | |||||||||

| Asset acquisition | - | (54,556,796 | ) | |||||||||

| Interest income received | 415,873 | 320,275 | ||||||||||

| Settlement of asset retirement obligation | 11 | (156,427 | ) | (7,085 | ) | |||||||

| 55,309,904 | (56,166,604 | ) | ||||||||||

| Financing activities | ||||||||||||

| Private placement proceeds | 12 | 10,024,264 | 25,508,956 | |||||||||

| Share issue costs | 12 | (50,554 | ) | (3,423,750 | ) | |||||||

| Proceeds from the At -the-Market (ATM) sales | 12 | 2,022,169 | - | |||||||||

| Proceeds from exercise of warrants | 12 | 16,933,343 | 158,918 | |||||||||

| Proceeds from exercise of stock options | 12 | 900,806 | 287,584 | |||||||||

| Lease payments | 7 | (52,738 | ) | (31,333 | ) | |||||||

| 29,777,290 | 22,500,375 | |||||||||||

| Effect of foreign exchange on cash | (674,897 | ) | 27,156 | |||||||||

| Change in cash | 82,597,169 | 724,643 | ||||||||||

| Cash, beginning of year | 7,493,424 | 2,512,012 | ||||||||||

| Cash, end of year | 90,090,593 | 3,236,655 | ||||||||||

| Supplemental cash flow information | 15 | |||||||||||

The accompanying notes are an integral part of these condensed interim consolidated financial statements.

3

enCore Energy Corp.

Condensed Interim Consolidated Statements of Shareholders’ Equity

Unaudited

(In USD unless otherwise noted)

| Convertible | Accumulated | |||||||||||||||||||||||||||||||||||

| Share | promissory | other | Non- | Total | ||||||||||||||||||||||||||||||||

| Number of | Share | subscriptions | note | Contributed | comprehensive | Accumulated | controlling | shareholders’ | ||||||||||||||||||||||||||||

| shares | capital | received | (equity portion) | surplus | income (loss) | Deficit | interest | equity | ||||||||||||||||||||||||||||

| # | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||

| January 1, 2023 | 108,940,051 | 190,610,250 | 51,558,624 | - | 16,218,518 | 5,530,224 | (48,867,377 | ) | - | 215,050,239 | ||||||||||||||||||||||||||

| Private placement | 10,615,650 | 25,508,956 | - | - | - | - | - | - | 25,508,956 | |||||||||||||||||||||||||||

| Conversion of subscriptions to shares | 23,277,000 | 51,631,054 | (51,631,054 | ) | - | - | - | - | - | - | ||||||||||||||||||||||||||

| Share issuance costs | - | (6,487,851 | ) | - | - | 1,412,138 | - | - | - | (5,075,713 | ) | |||||||||||||||||||||||||

| Shares issued for exercise of warrants | 101,041 | 158,918 | - | - | - | - | - | - | 158,918 | |||||||||||||||||||||||||||

| Shares issued for exercise of stock options | 213,279 | 881,576 | - | - | (593,992 | ) | - | - | - | 287,584 | ||||||||||||||||||||||||||

| Shares issued for ATM | - | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||||

| Stock option expense | - | - | - | - | 866,483 | - | - | - | 866,483 | |||||||||||||||||||||||||||

| Equity portion of convertible promissory note | - | - | - | 3,813,266 | - | - | - | - | 3,813,266 | |||||||||||||||||||||||||||

| Conversion of convertible promissory note to shares | - | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||||

| Fair value of replacement options for Alta Mesa acquisition (Note 9) | - | - | - | - | 81,414 | - | - | - | 81,414 | |||||||||||||||||||||||||||

| Cumulative translation adjustment | - | - | 72,430 | - | (2,570 | ) | 669,480 | - | - | 739,340 | ||||||||||||||||||||||||||

| Loss for the year | - | - | - | - | - | - | (7,474,333 | ) | - | (7,474,333 | ) | |||||||||||||||||||||||||

| March 31, 2023 | 143,147,021 | 262,302,903 | - | 3,813,266 | 17,981,991 | 6,199,704 | (56,341,710 | ) | - | 233,956,154 | ||||||||||||||||||||||||||

| January 1, 2024 | 165,133,798 | 328,246,303 | - | 3,813,266 | 19,185,942 | 7,944,347 | (71,253,354 | ) | - | 287,936,504 | ||||||||||||||||||||||||||

| Private placement | 2,564,102 | 10,024,264 | - | - | - | - | - | - | 10,024,264 | |||||||||||||||||||||||||||

| Conversion of subscriptions to shares | - | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||||

| Share issuance costs | - | (50,554 | ) | - | - | - | - | - | - | (50,554 | ) | |||||||||||||||||||||||||

| Shares issued for exercise of warrants | 5,579,385 | 17,153,863 | - | - | (220,520 | ) | - | - | - | 16,933,343 | ||||||||||||||||||||||||||

| Shares issued for exercise of stock options | 697,754 | 2,008,746 | - | - | (1,107,940 | ) | - | - | - | 900,806 | ||||||||||||||||||||||||||

| Shares issued for ATM | 495,765 | 2,022,169 | - | - | - | - | - | - | 2,022,169 | |||||||||||||||||||||||||||

| Stock option expense | - | - | - | - | 1,118,585 | - | - | - | 1,118,585 | |||||||||||||||||||||||||||

| Equity portion of convertible promissory note | - | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||||

| Conversion of convertible promissory note to shares | 6,872,143 | 23,117,637 | - | (3,813,266 | ) | - | - | - | - | 19,304,371 | ||||||||||||||||||||||||||

| Non controlling interest | - | - | - | - | 20,447,042 | - | - | 39,475,915 | 59,922,957 | |||||||||||||||||||||||||||

| Cumulative translation adjustment | - | - | - | - | - | (3,326,757 | ) | - | - | (3,326,757 | ) | |||||||||||||||||||||||||

| Loss for the period | - | - | - | - | - | - | (5,240,804 | ) | - | (5,240,804 | ) | |||||||||||||||||||||||||

| March 31, 2024 | 181,342,947 | 382,522,428 | - | - | 39,423,109 | 4,617,590 | (76,494,158 | ) | 39,475,915 | 389,544,884 | ||||||||||||||||||||||||||

The accompanying notes are an integral part of these condensed interim consolidated financial statements.

4

enCore Energy Corp.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2024 and March 31, 2023

(In USD unless otherwise noted)

| 1. | Nature of operations and going concern |

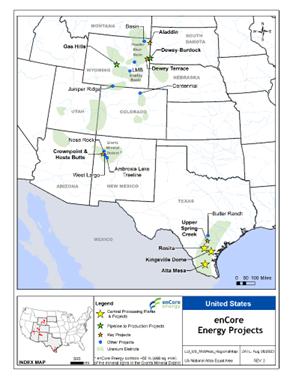

enCore Energy Corp. was incorporated under the Laws of British Columbia, Canada. enCore Energy Corp., together with its subsidiaries (collectively referred to as the “Company” or “enCore”), is principally engaged in the acquisition, exploration, and development of uranium resource properties in the United States. In Q1 2024, the Company’s Rosita project transitioned to production. On February 19, 2024, the Company completed a sale of a 30% interest in the Company’s Alta Mesa project to Boss Energy Limited (“Boss Energy’). The Company’s common shares trade on the TSX Venture Exchange and directly on a U.S. Exchange under the symbol “EU.” The Company’s corporate headquarters is located at 101 N Shoreline, Suite 560, Corpus Christi, TX 78401.

These condensed interim consolidated financial statements (the “financial statements”) have been prepared on the going concern basis which assumes that the Company will continue in operation for the foreseeable future and, accordingly, will be able to realize its assets and discharge its liabilities in the normal course of operations as they come due, under the historical cost convention except for certain financial instruments that are measured at fair value, as detailed in the Company’s accounting policies.

Geopolitical uncertainty

Geopolitical uncertainty driven by the Russian invasion of Ukraine has led many governments and utility providers to re-examine supply chains and procurement strategies reliant on nuclear fuel supplies coming out of, or through, Russia. Sanctions, restrictions, and an inability to obtain insurance on cargo have contributed to transportation and other supply chain disruptions between producers and suppliers. As a result of this and coupled with multiple years of declining uranium production globally, uranium market fundamentals are shifting from an inventory driven market to one more driven by production.

| 2. | Material accounting policy information |

Basis of preparation

These financial statements, including comparatives, have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IFRS Accounting Standards”), using the same accounting policies as detailed in the Company’s annual audited consolidated financial statements for the year ended December 31, 2023, except as stated below, and do not include all the information required for full annual financial statements in accordance with IFRS.

The principal accounting policies applied in the preparation of these financial statements are set out below. These policies have been consistently applied to all years presented unless otherwise stated.

The preparation of consolidated financial statements in conformity with IFRS Accounting Standards requires the use of certain critical accounting estimates. It also requires management to exercise judgment in the process of applying the accounting policies. Those areas involving a higher degree of judgment and complexity or areas where assumptions and estimates are significant to the consolidated financial statements are discussed below.

These financial statements were approved for issuance by the Board of Directors on May 10, 2024.

Revenue recognition

The Company supplies uranium concentrates to its customer. Revenue is measured based on the consideration specified in a contract with a customer.

The Company recognizes revenue when it transfers control, as described below, over a good or service to a customer. Customers do not have the right to return products, except in limited circumstances. The Company’s sales arrangements with its customers are pursuant to enforceable contracts that indicate the nature and timing of satisfaction of performance obligations, including significant payment terms, where payment is usually due in 10 days. Each delivery is considered a separate performance obligation under the contract.

5

enCore Energy Corp.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2024 and March 31, 2023

(In USD unless otherwise noted)

| 2. | Material accounting policy information (continued) |

Revenue recognition (continued)

In a uranium supply arrangement, the Company is contractually obligated to provide uranium concentrates to its customers. Company-owned uranium may be physically delivered to either the customer or to conversion facilities (Converters). For deliveries to customers, terms in the sales contract specify the location of delivery. Revenue is recognized when the uranium has been delivered and accepted by the customer at that location. When uranium is delivered to Converters, the Converter will credit the Company’s account for the volume of accepted uranium. Based on delivery terms in the sales contract with its customer, the Company instructs the Converter to transfer title of a contractually specified quantity of uranium to the customer’s account at the Converter’s facility. At this point, control has been transferred and enCore recognizes revenue for the uranium supply.

Inventory

Inventories are uranium concentrates, and converted products including chemical and are measured at the lower of cost and net realizable value. The cost of inventories is based on the first in first out (FIFO) method. Cost includes direct materials, direct labor, operational overhead expenses and depreciation. Net realizable value is the estimated selling price in the ordinary course of business, less the estimated costs of completion and selling expenses. Consumable supplies and spares are valued at the lower of cost or replacement value.

Non-controlling interest

The Company applies the requirements of IFRS in accounting for non-controlling interests. A non-controlling interest represents the portion of equity in a subsidiary not attributable, directly or indirectly, to the parent company. The non-controlling interest represented in the financial statements includes the 30% interest Boss obtained in the Alta Mesa JV on February 26, 2024. The initial recognition of the interest was determined by calculating 30% of the total net assets, and the excess contribution was recorded under equity reserves. The subsequent recognition of the non-controlling interest is 30% of the net income of the Alta Mesa entity.

Basis of measurement

These financial statements have been prepared on a historical cost basis except for certain financial instruments which are measured at fair value. All dollar amounts presented are in United States Dollars (“U.S. Dollars”) unless otherwise specified. In addition, these financial statements have been prepared using the accrual basis of accounting, except for cash flow information.

Consolidation

These financial statements incorporate the financial statements of the Company and its controlled subsidiaries. Control is defined as the exposure, or rights, to variable returns from involvement with an investee and the ability to affect those returns through power over the investee. Power over an investee exists when an investor has existing rights that give it the ability to direct the activities that significantly affect the investee’s returns. This control is generally evidenced through owning more than 50% of the voting rights or currently exercisable potential voting rights of a Company’s share capital. All significant intercompany transactions and balances have been eliminated.

6

enCore Energy Corp.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2024 and March 31, 2023

(In USD unless otherwise noted)

| 2. | Material accounting policy information (continued) |

Consolidation (continued)

The Company has a 70% interest in a Joint Venture (JV) with BOSS Energy Limited (Boss). Under the JV agreement the Company retained control both before and after Boss acquired their interest. As such, the Company will continue to consolidate the operations of the JV Co. with an offsetting non-controlling interest being recorded on sub-consolidation.

These consolidated financial statements include the financial statements of the Company and its significant subsidiaries listed in the following table:

| Name of Subsidary | Place of Incorporation | Ownership Interest | Principal Activity | |||

| Tigris Uranium US Corp. | Nevada, USA | 100% | Mineral Exploration | |||

| Metamin Enterprises US Inc. | Nevada, USA | 100% | Mineral Exploration | |||

| URI, Inc. | Delaware, USA | 100% | Uranium Producer | |||

| Neutron Energy, Inc. 3 | Nevada, USA | N/A | Mineral Exploration | |||

| Uranco, Inc. | Delaware, USA | 100% | Mineral Exploration | |||

| Uranium Resources, Inc. 2 | Delaware, USA | N/A | Mineral Exploration | |||

| HRI-Churchrock, Inc. | Delaware, USA | 100% | Mineral Exploration | |||

| Hydro Restoration Corp. 1 | Delaware, USA | N/A | Mineral Exploration | |||

| Belt Line Resources, Inc.1 | Texas, USA | N/A | Mineral Exploration | |||

| enCore Energy US Corp. | Nevada, USA | 100% | Holding Company | |||

| Azarga Uranium Corp. | British Columbia, CA | 100% | Mineral Exploration | |||

| Powertech (USA) Inc. | South Dakota, USA | 100% | Mineral Exploration | |||

| URZ Energy Corp. | British Columbia, CA | 100% | Mineral Exploration | |||

| Ucolo Exploration Corp. | Utah, USA | 100% | Mineral Exploration | |||

| JV Alta Mesa LLC | Delaware, USA | 70% | Uranium Producer | |||

| enCore Alta Mesa LLC | Texas, USA | 100% | Uranium Producer | |||

| Leoncito Plant, LLC | Texas, USA | 100% | Mineral Exploration | |||

| Leoncito Restoration, LLC | Texas, USA | 100% | Mineral Exploration | |||

| Leoncito Project, LLC | Texas, USA | 100% | Mineral Exploration | |||

| Azarga Resources Limited | British Virgin Islands | 100% | Mineral Exploration | |||

| Azarga Resources (Hong Kong) Ltd.4 | Hong Kong | 100% | Mineral Exploration | |||

| Azarga Resources USA Company | Colorado, USA | 100% | Mineral Exploration | |||

| Azarga Resources Canada Ltd. | British Columbia, CA | 100% | Mineral Exploration |

| 1 | Hydro Restoration Corp. and Belt Line Resources, Inc. were divested in April 2023 (Note 4,7). |

| 2 | Uranium Resources, Inc. was dissolved in 2023. |

| 3 | Neutron Energy, Inc. was divested in July 2023 (Note 4,7). |

| 4 | Azarga Resources (Hong Kong) Ltd was later dissolved on April 29, 2024. |

7

enCore Energy Corp.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2024 and March 31, 2023

(In USD unless otherwise noted)

| 2. | Material accounting policy information (continued) |

Newly adopted accounting standards and interpretations

Effective for annual reporting periods beginning on or after January 1, 2024, the Company adopted the following amendments:

Presentation of financial statements pertaining to liabilities (IAS 1) – the amendment requires an entity to have the right to defer settlement of a liability for at least 12 months after the reporting period to be classified as non-current.

Disclosure of Accounting Policies (Amendment to IAS 7) – the amendment requires that an entity provides additional disclosures about its supplier finance arrangements relative to the Statement of Cash Flows within the liquidity risk disclosure.

Disclosure of information about international taxes (IAS 12) – the amendment introduces a temporary exception to the requirements to recognize and disclose information about deferred tax assets and liabilities related to Pillar Two income taxes and related disclosures.

The adoption of these amendments did not have a material impact on the results of its operations and financial position.

| 3. | Inventory |

Purchases of uranium is categorized in Level 1 of the fair value hierarchy as of December 31, 2023 and categorized as inventory as at March 31, 2024.

As at March 31, 2024, the Company held 125,000 pounds of purchased uranium and 34,988 pounds of produced uranium inventory (including concentrate). Costs of inventory consisted of the following:

| $ | ||||

| Balance, December 31, 2023 | - | |||

| Chemicals used in production | 17,730 | |||

| Purchased uranium | 11,712,500 | |||

| Uranium from production | 1,064,182 | |||

| Balance, March 31, 2024 | 12,794,412 | |||

| 4. | Marketable securities |

As at March 31, 2024, the company held 11,308,250 shares of American Future Fuel Corp. All of the shares held are free trading (the “Trading Shares”) or will become free trading within the next 12 months. These shares have been classified as a current asset on the consolidated statements of financial position, due to the Company’s ability to liquidate those shareholdings within the next 12 months. These shares are carried at a fair value of $3,046,103 (December 31, 2023 - $2,265,794).

8

enCore Energy Corp.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2024 and March 31, 2023

(In USD unless otherwise noted)

| 4. | Marketable securities (continued) |

In April 2023, the Company divested Belt Line Resources Inc and Hydro Restoration Corp to Nuclear Fuels Inc (“NFI”) pursuant to a Share Purchase Agreement whereby the Company received consideration in the form of 8,566,975 common shares (19.9% of the total shareholding in NFI) with a market value of $0.33 per share. The Company exercised significant judgement in the assessment of the interest in NFI specifically when considering the level of decision-making authority, the Company could exercise over NFI and concluded that NFI is an equity investment recorded and measured at fair value through profit and loss (FVTPL).

During the year ended December 31, 2023, NFI was acquired by Uravan Minerals Inc., who renamed themselves Nuclear Fuels Inc. As a result of this transaction the Company received 696,825 additional shares related to a contractual top up right for a total aggregate ownership of 9,327,800 shares (19.9% of the total shareholding in NFI). The cost base of the Company’s shareholdings of NFI is $2,802,030.

In January 2024, the Company purchased an additional 1,716,260 units of NFI at a price of C$0.60 per unit. Each unit is comprised of 1 common share and one half of a warrant. This investment maintained the Company’s ownership level at 19.9%.

As at March 31, 2024, 6,846,550 of the shares held in NFI are free trading or will become free trading within the next 12 months. These shares have been classified as a current asset on the consolidated statements of financial position, due to the Company’s ability to liquidate those shareholdings within the next 12 months. As at March 31, 2024, 4,197,510 of the shares have been classified as a non-current asset on the consolidated statements of financial position, due to the Company’s inability to liquidate those shareholdings within the next 12 months. The fair value of the 11,044,060 NFI shares at March 31, 2024 is $3,137,949 (December 31, 2023 - $5,077,980).

In July 2023, the Company divested of Neutron Energy Inc. to Anfield Energy Inc. (“Anfield”) pursuant to a Share Purchase Agreement whereby the Company received consideration of C$5,000,000 and 185,000,000 common shares (19.56% of the total shareholding in Anfield). During the three months ended March 31, 2024, the Company sold 15,000,000 of the shares for gross proceeds of C$1,097,950. The remaining shares were classified as a current asset on the consolidated statements of financial position, due to the Company’s ability to liquidate those shareholdings within the next 12 months. These shares are carried at a fair value of $12,546,000 (December 31, 2023 - $12,589,065).

In accordance with the Company’s accounting policy, each of these common shares is classified as FVTPL, with gains/losses being recognized to the consolidated statements of loss and comprehensive loss.

The following table summarizes the fair value of the Company’s marketable securities at March 31, 2024:

| Marketable securities | ||||||||||||||||||||

| current | non-current | Total | ||||||||||||||||||

| Volume | $ | $ | Warrants | $ | ||||||||||||||||

| Balance, December 31, 2022 | 11,388,250 | 3,162,361 | 784,831 | - | 3,947,192 | |||||||||||||||

| Additions | 194,247,800 | 7,022,600 | 2,792,500 | - | 9,815,100 | |||||||||||||||

| Reclass from non-current to current | - | 787,559 | (787,559 | ) | - | - | ||||||||||||||

| Change in fair value | - | 5,732,355 | 185,480 | - | 5,917,835 | |||||||||||||||

| Foreign exchange translation | - | 181,177 | 71,535 | - | 252,712 | |||||||||||||||

| Balance, December 31, 2023 | 205,636,050 | 16,886,052 | 3,046,787 | - | 19,932,839 | |||||||||||||||

| Additions | 1,716,260 | 763,564 | - | 763,564 | ||||||||||||||||

| Disposals | (15,000,000 | ) | (556,125 | ) | - | (556,125 | ) | |||||||||||||

| Reclass from non-current to current | - | 746,989 | (746,989 | ) | - | - | ||||||||||||||

| Change in fair value | - | 48,128 | (984,630 | ) | 115,065 | (821,437 | ) | |||||||||||||

| Foreign exchange translation | - | (408,961 | ) | (64,763 | ) | (543 | ) | (474,267 | ) | |||||||||||

| Balance, March 31, 2024 | 192,352,310 | 17,479,647 | 1,250,405 | 114,522 | 18,844,574 | |||||||||||||||

9

enCore Energy Corp.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2024 and March 31, 2023

(In USD unless otherwise noted)

| 4. | Marketable securities (continued) |

The realized gain on marketable securities for the three months ended March 31, 2024 was $251,476 (three months ended March 31, 2023 – nil). The unrealized loss on marketable securities for the three months ended March 31, 2024 was $821,437 (three months ended March 31, 2023 – $581,721).

| 5. | Property, plant, and equipment |

In February 2023, through its asset acquisition of Alta Mesa, the Company acquired a variety of property, plant, and equipment assets (Note 8).

In May 2023, the Company acquired proprietary Prompt Fission Neutron (“PFN”) technology and equipment in the amount of $3,100,000 included within “Other property and equipment”. The PFN is amortized over its expected useful economic life of 10 years.

| Uranium plants | Other property and equipment | Furniture | Buildings | Software | Total | |||||||||||||||||||

| $ | $ | $ | $ | $ | $ | |||||||||||||||||||

| Balance, December 31, 2023 | 10,405,924 | 4,119,189 | 84,297 | 353,055 | 7,395 | 14,969,860 | ||||||||||||||||||

| Additions | 1,241,804 | 163,303 | - | 295,050 | - | 1,700,157 | ||||||||||||||||||

| Disposals | ||||||||||||||||||||||||

| Depreciation | (178,412 | ) | (188,382 | ) | (8,597 | ) | (8,891 | ) | (7,252 | ) | (391,534 | ) | ||||||||||||

| Currency translation adjustment | - | (490 | ) | (669 | ) | - | (143 | ) | (1,302 | ) | ||||||||||||||

| Balance, March 31, 2024 | 11,469,316 | 4,093,620 | 75,031 | 639,214 | - | 16,277,181 | ||||||||||||||||||

| 6. | Asset acquisition and disposition |

Alta Mesa acquisition

On February 14, 2023, the Company acquired the Alta Mesa in-Situ Recovery uranium project (“Alta Mesa”).The aggregate amount of the total consideration was $120,574,541 which consisted of a cash payment of $60,000,000, the issuance of a $60,000,000 secured vendor takeback convertible promissory note and 44,681 enCore stock options (the “Replacement Options”) for options held by Energy Fuels option holders, valued at $81,414 using the Black-Scholes option pricing model, and total transaction costs of $493,127 associated with the Arrangement.

The transaction did not qualify as a business combination according to the definition in IFRS 3 Business Combinations. It has been accounted for as an asset acquisition with the purchase price allocated based on the estimated fair value of the assets and liabilities summarized as follows:

| Consideration | $ | |||

| Cash | 60,000,000 | |||

| Convertible promissory note | 60,000,000 | |||

| Fair value of replacement options | 81,414 | |||

| Transaction costs | 493,127 | |||

| Total consideration value | 120,574,541 | |||

| Net assets acquired | $ | |||

| Prepaids | 42,374 | |||

| Property, plant, and equipment | 6,111,000 | |||

| Mineral properties | 120,196,484 | |||

| Asset retirement obligations | (5,488,969 | ) | ||

| Accounts payable and accrued liabilities | (286,348 | ) | ||

| Total net assets acquired | 120,574,541 |

10

enCore Energy Corp.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2024 and March 31, 2023

(In USD unless otherwise noted)

| 6. | Asset acquisition and disposition (continued) |

Alta Mesa acquisition (continued)

The value of the replacement options has been derived using the Black-Scholes option pricing model. The weighted average assumptions used in the Black-Scholes option pricing model are as follows:

| Weighted Average | ||||

| Exercise Price | $ | 3.10 | ||

| Share price | $ | 3.20 | ||

| Discount Rate | 3.39 | % | ||

| Expected life (years) | 5.00 | |||

| Volatility | 99.48 | % | ||

| Fair value of replacement options (CAD per option): | $ | 2.43 | ||

The fair value of the Replacement Options is based on the issuance of 44,681 options with a fair value of $81,414 (C$108,636).

Alta Mesa joint venture

On December 5, 2023, the Company entered into a Master Transaction Agreement (the “MT Agreement”) with Boss Energy Limited (“Boss Energy”), a public company domiciled in Australia. Pursuant to the MT Agreement, Boss Energy was assigned the right to acquire a 30% interest in the Alta Mesa assets.

On February 26, 2024, pursuant to the terms of a MT Agreement, Boss Energy acquired a 30% equity interest in a new limited liability company (the “JV Company”) that was formed to hold the Alta Mesa project, in exchange for a payment of $60 million. The company holds 70% equity in the JV Company.

Upon closing of the Transaction, the parties entered into a joint venture agreement (the “JV Agreement”) which will govern the JV Company. Pursuant to the JV Agreement, the company will act as manager of the JV Company and will be entitled to a management fee.

Concurrently with the establishment of the JV Company, the parties entered into a uranium loan agreement providing for up to 200,000 pounds of uranium to be lent by Boss Energy to the Company. The loan will bear interest of 9% and be repayable in 12 months in cash or uranium at the election of Boss Energy. After 6 months, the Company can elect to pay off the loan plus $200,000. At March 31, 2024, the Company recorded a deemed value of $20,108,000 for the borrowed uranium along with $174,012 of associated interest.

Boss Energy also acquired 2,564,102 common shares of the Company issued from treasury at a price of $3.90 per share for total proceeds to the Company of $10 million.

Finally, the parties also entered into a strategic collaboration agreement for the collaboration and research to develop the Company’s PFN technology, to be financed equally by each party.

The terms of the JV Agreement and the disposal of a 30% interest in the JV Co. support that control was retained both before and after Boss Energy acquired their interest, and that joint control is not present. As such, Company will continue to consolidate the operations of the JV Co. with an offsetting non-controlling interest being recorded.

The table below is a summary of the accounting for recognition of the initial Non-Controlling Interest on Boss Energy acquiring 30% interest in the JV Company.

| February 26, 2024 | ||||

| Boss Energy Initial NCI | $ | |||

| Cash | 60,000,000.00 | |||

| Equity Reserves | (20,447,042.00 | ) | ||

| Non-controlling interest | (39,552,958.00 | ) | ||

11

enCore Energy Corp.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2024 and March 31, 2023

(In USD unless otherwise noted)

| 7. | Mineral Properties |

| Arizona | Colorado | New Mexico | South Dakota | Texas | Utah | Wyoming | Total | ||||||||||||||||||

| $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||

| Balance, December 31, 2022 | 775,754 | 578,243 | 4,905,348 | 86,220,848 | 9,144,069 | 1,840,362 | 41,754,462 | 145,219,086 | |||||||||||||||||

| Exploration costs: | |||||||||||||||||||||||||

| Drilling | - | - | - | - | 7,300 | - | - | 7,300 | |||||||||||||||||

| Acquisition, maintenance and lease fees | 99,415 | 4,544 | 49,370 | 312,927 | 121,414,182 | 49,910 | 296,298 | 122,226,646 | |||||||||||||||||

| Consulting | 141 | 4,566 | 138 | 4,742 | 96,937 | 552 | 38,511 | 145,587 | |||||||||||||||||

| Personnel | - | 8,069 | - | 174,850 | 426,773 | - | 75,317 | 685,009 | |||||||||||||||||

| Impairment | - | - | - | - | (1,537,168 | ) | (658 | ) | - | (1,537,826 | ) | ||||||||||||||

| Divestment: | |||||||||||||||||||||||||

| Divestment of mineral interest | (358,969 | ) | - | (2,433,353 | ) | - | - | - | (376,039 | ) | (3,168,361 | ) | |||||||||||||

| Assets held for sale | 358,969 | - | - | - | - | - | 369,913 | 728,882 | |||||||||||||||||

| Project development costs: | |||||||||||||||||||||||||

| Construction of wellfields | - | - | - | - | 1,060,260 | - | - | 1,060,260 | |||||||||||||||||

| Drilling | - | - | - | - | 5,898,856 | - | - | 5,898,856 | |||||||||||||||||

| Personnel | - | - | - | - | 1,245,519 | - | - | 1,245,519 | |||||||||||||||||

| Reclassification | |||||||||||||||||||||||||

| Reclassification to Mining properties | - | - | - | - | (5,301,820 | ) | - | - | (5,301,820 | ) | |||||||||||||||

| Balance, December 31, 2023 | 875,310 | 595,422 | 2,521,503 | 86,713,367 | 132,454,908 | 1,890,166 | 42,158,462 | 267,209,138 | |||||||||||||||||

| Exploration costs: | |||||||||||||||||||||||||

| Drilling | - | ||||||||||||||||||||||||

| Acquisition, maintenance and lease fees | 1,440 | 335,014 | 7,247 | 92,241 | 435,942 | ||||||||||||||||||||

| Consulting | 455 | 2,714 | 37,000 | 13,082 | 28 | 11,294 | 64,573 | ||||||||||||||||||

| Personnel | 6,796 | 50,540 | 18,597 | 33,730 | 109,663 | ||||||||||||||||||||

| Project development costs: | |||||||||||||||||||||||||

| Construction of wellfields | 2,816,207 | 2,816,207 | |||||||||||||||||||||||

| Personnel | 469,941 | 469,941 | |||||||||||||||||||||||

| Balance, March 31, 2024 | 875,765 | 604,932 | 2,521,503 | 86,802,347 | 136,107,749 | 1,897,441 | 42,295,727 | 271,105,464 | |||||||||||||||||

12

enCore Energy Corp.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2024 and March 31, 2023

(In USD unless otherwise noted)

| 7. | Mineral properties (continued) |

Arizona

The Company owns or controls several Arizona State mineral leases and unpatented federal lode mining claims covering acreage in northern Arizona strip district.

At March 31, 2024, the Company held cash bonds for $nil (December 31, 2023 - $85,500) with the Bureau of Land Management. In February, 2024, the bond was released and funds have been returned to the Company.

New Mexico

On July 20, 2023, the Company divested its subsidiary Neutron Energy, Inc, including its holding of the Marquez-Juan Tafoya Uranium Project to Anfield Energy, Inc. Pursuant to a Share Purchase Agreement, the Company received cash consideration of $3,796,000 (C$5,000,000) and 500,000,000 shares of Anfield with a fair value of $7,022,600. (Note 4). The net book value of the subsidiary was $2,433,353 at the transaction date, transaction costs of $423,387 were incurred and $32,826 in currency exchange effect was recognized resulting in a gain on divestment of subsidiary of $7,994,688.

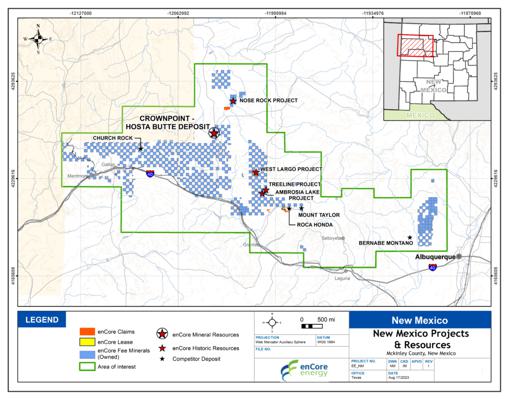

Nose Rock

The Nose Rock Project is located in McKinley County, New Mexico.

Treeline

The Treeline project is located in McKinley and Cibola Counties, Grants Uranium District, New Mexico.

McKinley, Crownpoint and Hosta Butte

The Company owns a 100% interest in the McKinley properties and a 60 - 100% interest in the adjacent Crownpoint and Hosta Butte properties, all of which are located in McKinley County, New Mexico. The Company holds a 60% interest in a portion of a certain section at Crownpoint. The Company owns a 100% interest in the rest of the Crownpoint and Hosta Butte project area, subject to a 3% gross profit royalty on uranium produced.

West Largo

The West Largo Project is near the Grants Mineral Belt in McKinley County, New Mexico.

Other New Mexico Properties

The Company holds mineral properties in an area located primarily in McKinley County in northwestern New Mexico.

Under the agreement, Ambrosia retained the right to acquire the uranium mineral rights associated with the property by quit claim deed to be furnished by the Company. In 2023, the Company received an additional payment of $24,240 to extend the option through January 14, 2024 which was recorded on the Company’s consolidated statements of loss and comprehensive loss. In January 2024, Ambrosia exercised its final option to complete the purchase of these rights and the Company received an additional payment of $24,240.

13

enCore Energy Corp.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2024 and March 31, 2023

(In USD unless otherwise noted)

| 7. | Mineral properties (continued) |

Other New Mexico Properties (continued)

Related to a 2021 agreement, Wildcat Solar Power Plant, LLC exercised its option to acquire rights to certain mineral interests in September 2023. $16,000 was received in consideration. The asset having no net book value at the transaction date, resulted in a gain on disposal of the mineral interests of $16,000 recorded on the Company’s consolidated statement of comprehensive loss.

Texas

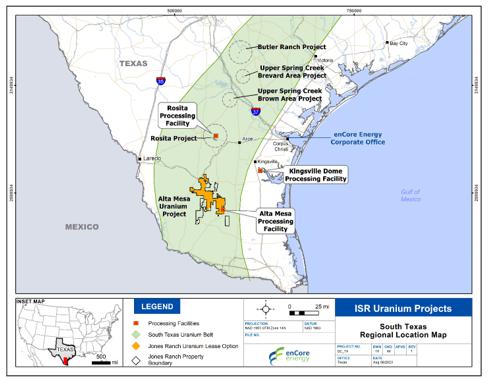

Rosita

The Rosita Project is located in Duval County, Texas on land owned by the Company.

At December 31, 2023, in accordance with its material accounting policy for mineral properties, the Company assessed its Rosita South Extension mineral property assets for impairment and found that the asset at a carrying value of $6,757,297 and a recoverable value of $5,301,822, resulting in an impairment charge of $1,455,475 on the Company’s consolidation statement of loss and comprehensive loss. Subsequent to recording impairment, the asset was reclassified as a Mining property asset (Note 8).

Alta Mesa Project

The Alta Mesa Project is located in Brooks County, Texas.

In February 2024, the Company completed several transactions under a master transaction agreement with an unrelated company Boss Energy Ltd. The completion of this transaction resulted in the Company holding a 70% interest in the project while also remaining as the project manager. Boss Energy Ltd. holds a 30% interest in the project (Note 8).

| 8. | Mining properties |

In December 2023, in accordance with its material accounting policy for mineral properties, the Company reclassified its Rosita Extension mineral property to a producing mining property.

Significant judgment was used to determine the recoverable value in use of the Rosita Extension asset. Recoverability is dependent upon assumptions and judgments in pricing for future uranium sales, costs of production, and mineral reserves. Other assumptions used in the calculation of recoverable amounts are discount rates, future cash flows and profit margins. A 10% change in these assumptions could impact the potential impairment of this asset.

The mining property’s balance at March 31, 2024 and December 31, 2023 consists of:

| Rosita | ||||||||

| Extension | Total | |||||||

| $ | $ | |||||||

| Balance, December 31, 2022 | - | - | ||||||

| Reclassification from mineral properties | 5,301,820 | 5,301,820 | ||||||

| Depletion | - | - | ||||||

| Balance, December 31, 2023 | 5,301,820 | 5,301,820 | ||||||

| Additions | - | - | ||||||

| Depletion | (1,581,474 | ) | (1,581,474 | ) | ||||

| Balance, March 31, 2024 | 3,720,346 | 3,720,346 | ||||||

14

enCore Energy Corp.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2024 and March 31, 2023

(In USD unless otherwise noted)

| 9. | Asset retirement obligations |

The Company is obligated by various federal and state mining laws and regulations which require the Company to reclaim surface areas and restore underground water quality for certain assets in Texas, Wyoming, Utah and Colorado. These projects must be returned to the pre-existing or background average quality after completion of mining.

The Company updates these reclamation provisions based on cash flow estimates, and changes in regulatory requirements and settlements annually. The Company used an inflation factor of 2.5% per year and a discount rate of 11% in estimating the present value of its future cash flows.

The asset retirement obligations balance by project is as follows:

| March 31, | December 31, | |||||||

| 2024 | 2023 | |||||||

| $ | $ | |||||||

| Kingsville | 2,500,354 | 2,458,564 | ||||||

| Rosita | 1,444,412 | 1,485,560 | ||||||

| Vasquez | 42,021 | 40,896 | ||||||

| Alta Mesa | 6,707,186 | 6,574,980 | ||||||

| Centennial | 168,806 | 168,806 | ||||||

| Gas Hills | 63,000 | 63,000 | ||||||

| Ticaboo | 36,000 | 36,000 | ||||||

| Asset retirement obligations | 10,961,779 | 10,827,806 | ||||||

The asset retirement obligations continuity summary is as follows:

| Asset retirement obligation | $ | |||

| Balance, December 31, 2022 | 4,752,352 | |||

| Additions (Note 6) | 5,488,969 | |||

| Accretion | 1,099,119 | |||

| Settlement | (291,449 | ) | ||

| Change in estimates | (221,185 | ) | ||

| Balance, December 31, 2023 | 10,827,806 | |||

| Accretion | 290,401 | |||

| Settlement | (156,428 | ) | ||

| Balance, March 31, 2024 | 10,961,779 | |||

| 10. | Share capital |

The authorized share capital of the Company consists of an unlimited number of common and preferred shares without par value.

During the three months ended March 31, 2024, the Company issued:

| i) | 2,564,102 units to Boss Energy Limited. for a private placement at a price of $3.90 per unit for gross proceeds of $10,024,264 (C$13,518,900). |

| ii) | 6,872,143 common shares were issued to extinguish the convertible note with a carrying value of $23,117,637 |

15

enCore Energy Corp.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2024 and March 31, 2023

(In USD unless otherwise noted)

| 10. | Share capital (continued) |

| iii) | 5,579,385 common shares were issued on the exercise of warrants, for gross proceeds of $17,153,863. |

| iv) | 697,754 common shares were issued on the exercise of stock options, for gross proceeds of $900,806. In connection with the stock options exercised, the Company reclassified $1,107,940 from contributed surplus to share capital. |

| v) | In June 2023 the Company filed a Canadian short form base shelf prospectus of $140 million and U.S. registration statement on Form F-10. The Company also filed a prospectus supplement, pursuant to which the Company may, at its discretion and from time-to-time, sell common shares of the Company for aggregate gross proceeds of up to $70.0 million. The sale of common shares is to be made through “at-the-market distributions” (“ATM”), as defined in the Canadian Securities Administrators’ National Instrument 44-102 Shelf Distributions, directly on a U.S. Exchange. At March 31, 2024, 495,765 common shares were sold in accordance with the Company’s ATM program for gross proceeds of $2,022,169. |

During the year ended December 31, 2023, the Company issued:

| i) | 10,615,650 units for a public offering at a price of C$3.25 per unit for gross proceeds of $25,561,689 (C$34,500,863). Each unit consisted of one common share and one-half share purchase warrant. Each whole warrant entitles the holder to purchase one additional share at a price of C$4.05 for a period of three years. The Company paid commissions of $1,504,047 (C$2,030,012) and other cash issuance costs of $391,939 (C$529,000). |

| ii) | 23,277,000 subscription receipts issued December 6, 2022 at a price of C$3.00 per Subscription Receipt were converted into units for gross proceeds of $51,737,788 (C$69,831,000). Each unit is comprised of one common share of enCore and one share purchase warrant. Each warrant entitles the holder to purchase one additional share at a price of C$3.75 for a period of three years. The Company paid commissions of $3,018,893 (C$4,074,600), other cash issuance costs of $171,365 (C$231,291) and issued 1,350,000 finders’ warrants with a fair value of $1,415,067 (C$1,909,916). 1,066,500 of the finder’s warrants are exercisable into one common share of the Company at a price of C$3.91 for 27 months from closing; 283,500 of the finder’s warrants are exercisable into one common share of the Company at a price of C$3.25 for 27 months from closing. The value of the finders’ warrants was derived using the Black-Scholes option pricing model as follows: |

| Weighted Average | ||||||||

| Quantity | 1,066,500 | 263,500 | ||||||

| Exercise Price | $ | 3.91 | $ | 3.25 | ||||

| Share price | $ | 3.20 | $ | 3.20 | ||||

| Discount Rate | 4.19 | % | 4.19 | % | ||||

| Expected life (years) | 2.25 | 2.25 | ||||||

| Volatility | 81.81 | % | 81.81 | % | ||||

| Fair value of finders’ warrants (CAD per option): | $ | 1.38 | $ | 1.54 | ||||

| iii) | 6,034,478 common shares were issued on the exercise of warrants, for gross proceeds of $16,995,629. |

| iv) | 575,676 common shares were issued on the exercise of stock options, for gross proceeds of $557,465. In connection with the stock options exercised, the Company reclassified $1,041,239 from contributed surplus to share capital. |

| v) | In June 2023 the Company filed a Canadian short form base shelf prospectus of $140 million and U.S. registration statement on Form F-10. The Company also filed a prospectus supplement, pursuant to which the Company may, at its discretion and from time-to-time, sell common shares of the Company for aggregate gross proceeds of up to $70.0 million. The sale of common shares is to be made through “at-the-market distributions” (“ATM”), as defined in the Canadian Securities Administrators’ National Instrument 44-102 Shelf Distributions, directly on a U.S. Exchange. At December 31, 2023, 15,690,943 common shares were sold in accordance with the Company’s ATM program for gross proceeds of $49,444,256. |

16

enCore Energy Corp.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2024 and March 31, 2023

(In USD unless otherwise noted)

| 10. | Share capital (continued) |

Stock options

The Company adopted a Stock Option Plan (the “Plan”) under which it is authorized to grant options to Officers, Directors, employees and consultants enabling them to acquire common shares of the Company. The number of shares reserved for issuance under the Plan cannot exceed 10% of the outstanding common shares at the time of the grant. The options can be granted for a maximum of five years and vest as determined by the Board of Directors.

The Company’s stock options outstanding at March 31, 2024 and December 31, 2023, and associated changes, are as follows:

| Three months ended | Year ended | |||||||||||||||

| March 31, 2024 | December 31, 2023 | |||||||||||||||

| Weighted average | Weighted average | |||||||||||||||

| Options | exercise price | Options | exercise price | |||||||||||||

| # | CAD $ | # | CAD $ | |||||||||||||

| Options outstanding, beginning of period/year | 8,412,882 | 2.63 | 7,235,648 | 2.52 | ||||||||||||

| Granted | 425,000 | 6.11 | 2,670,181 | 2.85 | ||||||||||||

| Exercised | (697,754 | ) | 1.74 | (575,676 | ) | 1.31 | ||||||||||

| Forfeited/expired | (81,043 | ) | 3.33 | (917,271 | ) | 3.20 | ||||||||||

| Options outstanding | 8,059,085 | $ | 2.88 | 8,412,882 | $ | 2.63 | ||||||||||

| Options exercisable | 5,842,418 | $ | 2.69 | 5,921,267 | $ | 2.39 | ||||||||||

As at March 31, 2024, stock options outstanding were as follows:

| Options Outstanding | Options Exercisable | |||||||||||||||||||||

| March 31, 2024 | March 31, 2024 | |||||||||||||||||||||

| Weighted average | Weighted average | Weighted average | ||||||||||||||||||||

| Option price | Options | remaining life | exercise price | Options | exercise price | |||||||||||||||||

| per share | # | (years) | CAD $ | # | CAD $ | |||||||||||||||||

| $ | 0.18 - 1.92 | 2,307,164 | 0.25 | $ | 0.73 | 2,307,164 | $ | 0.73 | ||||||||||||||

| $ | 2.40 - 3.79 | 2,796,087 | 1.36 | $ | 2.91 | 985,253 | $ | 2.98 | ||||||||||||||

| $ | 4.20 - 6.45 | 2,955,834 | 1.11 | $ | 4.55 | 2,550,001 | $ | 4.35 | ||||||||||||||

| 8,059,085 | 2.71 | $ | 2.88 | 5,842,418 | $ | 2.69 | ||||||||||||||||

During the three months ended March 31, 2024, the Company granted an aggregate of 425,000 stock options to Directors, Officers, employees, and an accounting advisory consultant of the Company. A fair value of C$1,805,429 was calculated for these options as measured at the grant date using the Black-Scholes option pricing model.

During the year ended December 31, 2023, the Company granted an aggregate of 2,670,181 stock options to Directors, Officers, employees, and an accounting advisory consultant of the Company. A fair value of C$5,616,767 was calculated for these options as measured at the grant date using the Black-Scholes option pricing model.

The Company’s standard stock option vesting schedule calls for 25% every six months commencing six months after the grant date.

During the three months ended March 31, 2024, the Company recognized stock option expense of $1,118,585 (year ended December 31, 2023 - $4,538,747) for the vested portion of the stock options.

17

enCore Energy Corp.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2024 and March 31, 2023

(In USD unless otherwise noted)

| 10. | Share capital (continued) |

Stock options (continued)

The fair value of all compensatory options granted is estimated on the grant date using the Black-Scholes option pricing model. The weighted average assumptions used in calculating the fair values are as follows:

| March 31, | December 31, | |||||

| 2024 | 2023 | |||||

| Risk-free interest rate | 3.56% | 3.34% | ||||

| Expected life of option | 5.0 years | 5.0 years | ||||

| Expected dividend yield | 0% | 0% | ||||

| Expected stock price volatility | 86.81% | 95.43% | ||||

| Fair value per option | C$4.25 | C$2.10 |

Share purchase warrants

A summary of the status of the Company’s warrants as of March 31, 2024, and December 31, 2023, and changes during the period/year then ended is as follows:

| Three months ended | Year ended | |||||||||||||||

| March 31, 2024 | December 31, 2023 | |||||||||||||||

| Weighted | Weighted | |||||||||||||||

| average | average | |||||||||||||||

| Warrants | exercise price | Warrants | exercise price | |||||||||||||

| # | CAD $ | # | CAD $ | |||||||||||||

| Warrants outstanding, beginning of year | 31,461,804 | 4.04 | 7,494,506 | 4.43 | ||||||||||||

| Granted | 500 | 3.90 | 30,013,783 | 3.80 | ||||||||||||

| Exercised | (5,579,385 | ) | 4.09 | (6,034,479 | ) | 3.35 | ||||||||||

| Expired | (2,746,235 | ) | 5.95 | (12,006 | ) | 2.02 | ||||||||||

| Warrants outstanding, end of period/year | 23,136,684 | 3.80 | 31,461,804 | 4.04 | ||||||||||||

As of March 31, 2024, share purchase warrants outstanding were as follows:

| Warrants Outstanding | ||||||||||||||

| March 31, 2024 | ||||||||||||||

| Warrant price per share | Warrants # | Weighted average remaining life (years) | Weighted average exercise price CAD $ | |||||||||||

| $ | 3.00 - 4.05 | 23,136,684 | 1.87 | $ | 3.80 | |||||||||

Convertible promissory note

On February 14, 2023, the Company issued a secured convertible promissory note (the “Note”) in connection with the Alta Mesa acquisition (Note 6) with a principal value of $60,000,000. The note had a two-year term bearing interest at 8% per annum.

During the year ended December 31, 2023, the Company paid $40,000,000 of the principal balance off, reducing the outstanding principal balance at that date to $20,000,000. In February 2024, the balance was converted by issuance of 6,872,143 common shares to the debt holder.

18

enCore Energy Corp.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2024 and March 31, 2023

(In USD unless otherwise noted)

| 10. | Share capital (continued) |

Convertible promissory note (continued)

A reconciliation of the convertible debenture components is as follows:

| Liability | Equity | Total | ||||||||||

| $ | $ | $ | ||||||||||

| Balance, December 31, 2023 | 19,239,167 | 3,813,266 | 23,052,433 | |||||||||

| Issuance of promissory note | - | - | - | |||||||||

| Accretion expense | 65,204 | - | 65,204 | |||||||||

| Conversion of promissory note to shares | (19,304,371 | ) | (3,813,266 | ) | (23,117,637 | ) | ||||||

| Accrued interest, not yet paid | - | - | - | |||||||||

| Balance, March 31, 2024 | - | - | - | |||||||||

| Liabilities: | ||||||||||||

| Current portion - convertible debenture (accrued interest) | - | - | - | |||||||||

| Long term portion - convertible debenture | - | - | - | |||||||||

| Balance, March 31, 2024 | - | - | - | |||||||||

| 11. | Related party transactions and balances |

Related parties include key management of the Company and any entities controlled by these individuals as well as other entities providing key management services to the Company. Key management personnel consist of Directors and senior management including the Executive Chairman, Chief Executive Officer, Chief Financial Officer, Chief Operating Officer, and Chief Legal Officer.

The amounts paid to key management or entities providing similar services are as follows:

| March 31, | March 31, | |||||||||

| 2024 | 2023 | |||||||||

| $ | $ | |||||||||

| Consulting | (1) | 309,280 | 37,774 | |||||||

| Directors’ fees | (2) | 69,000 | 27,000 | |||||||

| Staff costs | 409,161 | 1,504,754 | ||||||||

| Stock option expense | 651,160 | 660,962 | ||||||||

| Total key management compensation | 1,438,601 | 2,230,490 | ||||||||

| (1) | During the three months ended March 31, 2024, the Company incurred communications & community engagement consulting fees of $42,000 (December 31, 2023 - $147,529) according to a contract with 5 Spot Corporation in 2024 and Tintina Holdings, Ltd., in 2023. In July 2023, the Tintina Holdings, Ltd contract was reassigned to 5 Spot Corporation, a new Company owned by the spouse of the Company’s Executive Chairman. The Company also incurred finance and accounting consulting fees of $267,280 (December 31, 2023 – $7,000) according to a contract with Hovan Ventures LLC, a Company owned and operated by the former CFO for the Company. |

| (2) | Directors’ Fees are included in staff costs on the consolidated statements of loss and comprehensive loss. |

During the three months ended March 31, 2024, the Company granted 250,000 (March 31, 2023 – nil) options to key management, with a fair value of $496,565.

19

enCore Energy Corp.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2024 and March 31, 2023

(In USD unless otherwise noted)

| 11. | Related party transactions and balances (continued) |

As of March 31, 2024 and December 31, 2023, the following amounts were owed to related parties:

| March 31, | December 31, | |||||||

| 2024 | 2023 | |||||||

| $ | $ | |||||||

| 5-Spot Corporation | 14,000 | 12,000 | ||||||

| Hovan Ventures LLC | 30,100 | 7,000 | ||||||

| Officers and Board Members | 94,780 | 2,501,594 | ||||||

| Total key management compensation | 138,880 | 2,520,594 | ||||||

| 12. | Management of capital |

The Company’s objectives when managing capital are to safeguard its ability to continue as a going concern in order to support the exploration, evaluation, and development of its mineral properties and to maintain a flexible capital structure that optimizes the cost of capital within a framework of acceptable risk. The Company manages the capital structure and makes adjustments to it in light of changes in economic conditions and the risk characteristics of the underlying assets. To maintain or adjust its capital structure, the Company may issue new shares, issue debt, and acquire or dispose of assets.

The Company is dependent on the capital markets as its primary source of operating capital and the Company’s capital resources are largely determined by the strength of the junior resource markets, the status of the Company’s projects in relation to these markets, and its ability to compete for investor support of its projects.

The Company considers the components of shareholders’ equity as capital.

There were no changes in the Company’s approach to capital management during the three months ended March 31, 2024, and the Company is not subject to any externally imposed capital requirements.

| 13. | Financial instruments |

Financial instruments include cash, receivables and marketable securities and any contract that gives rise to a financial asset to one party and a financial liability or equity instrument to another party. Financial assets and liabilities measured at fair value are classified in the fair value hierarchy according to the lowest level of input that is significant to the fair value measurement. Assessment of the significance of a particular input to the fair value measurement requires judgement and may affect placement within the fair value hierarchy levels. The hierarchy is as follows:

| 1. | Level 1 fair value measurements are those derived from quoted prices in active markets for identical assets or liabilities. |

| 2. | Level 2 fair value measurements are those derived from inputs other than quoted prices included within Level 1, that are observable either directly or indirectly. |

| 3. | Level 3 fair value measurements are those derived from valuation techniques that include inputs that are not based on observable market data. |

Marketable securities are measured at Level 1 of the fair value hierarchy. The Company classifies these investments as financial assets whose value is derived from quoted prices in active markets and carries them at FVTPL.

The Company classifies its cash, restricted cash and receivables as financial assets measured at amortized cost. Accounts payable, lease liability, due to related parties, and convertible promissory note are classified as financial liabilities measured at amortized cost. The carrying amounts of receivables, accounts payable, and amounts due to related parties approximate their fair values due to the short-term nature of the financial instruments. The carrying value of the Company’s convertible promissory note, and lease liabilities approximates fair value as they bear a rate of interest commensurate with market rates.

20

enCore Energy Corp.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2024 and March 31, 2023

(In USD unless otherwise noted)

| 13. | Financial instruments (continued) |

Currency risk

Foreign currency exchange risk is the risk that future cash flows, net income and comprehensive income will fluctuate as a result of changes in foreign exchange rates. As the Company’s operations are conducted internationally, operations and capital activity may be transacted in currencies other than the functional currency of the entity party to the transaction.

The Company’s objective in managing its foreign currency risk is to minimize its net exposures to foreign currency cash flows by obtaining most of its estimated annual U.S. cash requirements and holding the remaining currency in Canadian dollars. The Company monitors and forecasts the values of net foreign currency cash flow and consolidated statement of financial position exposures and from time to time could authorize the use of derivative financial instruments such as forward foreign exchange contracts to economically hedge a portion of foreign currency fluctuations.

The following table provides an indication of the Company’s foreign currency exposures during the period/year ended March 31, 2024, and December 31, 2023:

| March 31, | December 31, | |||||||

| 2024 | 2023 | |||||||

| C$ | C$ | |||||||

| Cash | 2,333,327 | 5,120,718 | ||||||

| Marketable Securities - Current | 23,840,337 | 22,333,093 | ||||||

| Accounts payable and accrued liabilities | (331,929 | ) | (351,193 | ) | ||||

| 25,841,735 | 27,102,618 | |||||||

A 10% change in Canadian/US foreign exchange rate at period end would have changed the net loss of the Company, assuming that all other variables remained constant, by $1,907,120 for the period/year ended March 31, 2024 (December 31, 2023 - $2,049,192).

The Company has not, to the date of these financial statements, entered into derivative instruments to offset the impact of foreign currency fluctuations.

Credit risk

Credit risk arises from cash held by banks and financial institutions and receivables. The maximum exposure to credit risk is equal to the carrying value of these financial assets. Some of the Company’s cash is held by a Canadian bank.

Market risk

The Company is exposed to market risk because of the fluctuating value of its marketable securities (Note 4). The Company has no control over these fluctuations and does not hedge its investments. Based on the March 31, 2024 value of marketable securities every 10% change in the share price of these holdings would have impacted loss for the period/year, by approximately $1,760,000 (December 31, 2023 - $1,689,000) before income taxes.

Further, the Company still has a significant amount of projects still in the exploration stage. Fluctuations in commodity prices may influence financial markets and may indirectly affect the Company’s ability to raise capital to fund exploration.

21

enCore Energy Corp.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2024 and March 31, 2023

(In USD unless otherwise noted)

| 13. | Financial instruments (continued) |

Interest rate risk

Interest rate risk mainly arises from the Company’s cash, which receives interest based on market interest rates. The interest rate risk on cash is not considered significant.

Liquidity risk

The Company is primarily engaged in the acquisition, exploration, and development of uranium resource properties in the United States which is subject to significant inherent risk. Declines in the market prices of uranium and delays in the production, changes in the regulatory environment and adverse changes in other inherent risks can significantly and negatively impact the Company’s operations and cash flows and its ability to maintain sufficient liquidity to meet its financial obligations. Adverse changes to the factors mentioned above have impacted the recoverability of the Company’s mineral properties property, mining properties, and plant and equipment, which may result in impairment losses being recorded.

The Company’s current operating budget and future estimated cash flows indicate that the Company will generate positive cash flow in excess of the Company’s cash commitments within the twelve-month period following the date these consolidated financial statements were authorized for issuance.

The Company may be required to raise additional funds from external sources to meet these requirements. There is no assurance that the Company will be able to raise such additional funds on acceptable terms, if at all.

If the Company raises additional funds by issuing securities, existing shareholders may be diluted. If the Company is unable to obtain financing from external sources or issuing securities the Company may have difficulty meeting its payment obligations.

| 14. | Segmented information |

The Company operates in a single segment: the acquisition, exploration, and development of mineral properties in the United States.

The table below provides a breakdown of the Company’s long-term assets by geographic segment:

| South Dakota | Texas | New Mexico | Wyoming | Other States | Total | |||||||||||||||||||

| $ | $ | $ | $ | $ | $ | |||||||||||||||||||

| Intangible assets | - | 122,399 | 216,340 | - | 174,982 | 513,721 | ||||||||||||||||||

| Property, plant and equipment | 208,619 | 14,761,241 | - | - | - | 14,969,860 | ||||||||||||||||||

| Mineral properties | 86,713,367 | 132,454,909 | 2,521,503 | 42,158,462 | 3,360,897 | 267,209,138 | ||||||||||||||||||

| Mining properties | - | 5,301,820 | - | - | - | 5,301,820 | ||||||||||||||||||

| Right-of-use assets | - | 443,645 | - | - | - | 443,645 | ||||||||||||||||||

| Balance, December 31, 2023 | 86,921,986 | 153,084,014 | 2,737,843 | 42,158,462 | 3,535,879 | 288,438,184 | ||||||||||||||||||

| Intangible assets | - | 119,468 | 215,949 | - | 166,049 | 501,466 | ||||||||||||||||||

| Property, plant and equipment | 207,092 | 16,070,089 | - | - | - | 16,277,181 | ||||||||||||||||||

| Mineral properties | 86,802,347 | 136,107,751 | 2,521,503 | 42,295,727 | 3,378,136 | 271,105,464 | ||||||||||||||||||

| Mining properties | - | 5,301,820 | - | - | - | 5,301,820 | ||||||||||||||||||

| Right-of-use assets | - | 387,466 | - | - | - | 387,466 | ||||||||||||||||||

| Balance, March 31, 2024 | 87,009,439 | 157,986,594 | 2,737,452 | 42,295,727 | 3,544,185 | 293,573,397 | ||||||||||||||||||

22

enCore Energy Corp.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2024 and March 31, 2023

(In USD unless otherwise noted)

| 15. | Supplemental cash flows |

The Company incurred non-cash financing and investing activities as follows:

| March 31, | December 31, | |||||||

| 2024 | 2023 | |||||||

| $ | $ | |||||||

| Non-cash financing activities: | ||||||||

| Share issue costs on finders' warrants issued | - | 1,415,057 | ||||||

| Deferred financing costs remaining in accounts payable and accrued liabilities | - | - | ||||||

| - | 1,415,057 | |||||||

| Non-cash investing activities: | ||||||||

| Mineral property costs included in accounts payable and accrued liabilities | 532,024 | 327,607 | ||||||

| Property, plant, and equipment additions included in accounts payable and accrued liabilities | 107,961 | 187,834 | ||||||

| Reclamation Settlements remaining in Accounts Payable | - | 9,651 | ||||||

| Conversion of convertible note to shares | 23,117,637 | - | ||||||

| Convertible promissory note issued for asset acquisition (Note 10) | - | 60,000,000 | ||||||

| Marketable securities received on divestitures | - | 9,815,100 | ||||||

| 23,757,622 | 70,340,192 | |||||||

There were no amounts paid for income taxes during the period/year ended March 31, 2024, and December 31, 2023.

| 16. | Events after the reporting period |

Subsequent to March 31, 2024, the following reportable events were completed:

| a) | On April 4, 2024, the Company suspended its ATM Program with a remaining balance of approximately US$18.7 million of common shares available for sale. The Company does not anticipate further sales under the ATM program in light of its current cash on hand of approximately US$90 million. |

| b) | On April 29, 2024 the Company executed all liquidation documents and effectively completed the process to dissolve Azarga Resources (Hong Kong) Ltd. |

23