Exhibit 99.1

Annual Information Form

For the year ended December 31, 2023

Dated as of March 28, 2024

enCore Energy Corp.

101 N. Shoreline Blvd, Suite 450

Corpus Christi, TX

78401

Phone: 361-239-5449

www.encoreuranium.com

TABLE OF CONTENTS

| PRELIMINARY NOTES |

|

1 |

| Date of Information |

|

1 |

| Documents Incorporated by Reference |

|

1 |

| Forward-looking Information |

|

2 |

| Currency |

|

3 |

| GLOSSARY OF TERMS |

|

3 |

| CORPORATE STRUCTURE |

|

8 |

| Name, Address and Incorporation |

|

8 |

| Intercorporate Relationships |

|

9 |

| GENERAL DEVELOPMENT OF THE BUSINESS |

|

11 |

| Three Year History |

|

11 |

| DESCRIPTION OF THE BUSINESS |

|

18 |

| Material Mineral Properties |

|

21 |

| Alta Mesa Uranium Project |

|

25 |

| Conclusions |

|

28 |

| Recommendations |

|

29 |

| Phase 1 – Delineation of the PAA7 and PAA8 Mineral Resource Areas: |

|

29 |

| Phase 2 – Permitting and Economic Evaluation: |

|

29 |

| Crownpoint and Hosta Butte Project |

|

30 |

| Dewey Burdock Project |

|

43 |

| Gas Hills Project |

|

53 |

| RISK FACTORS |

|

58 |

| DIVIDENDS AND DISTRIBUTIONS |

|

76 |

| CAPITAL STRUCTURE |

|

76 |

| MARKET FOR SECURITIES |

|

79 |

| Trading Price and Volume |

|

79 |

| Prior Sales |

|

80 |

| ESCROWED SECURITIES AND SECURITIES SUBJECT TO CONTRACTUAL RESTRICTION ON TRANSFER |

|

81 |

| DIRECTORS AND OFFICERS |

|

82 |

| Name, Occupation and Security Holding |

|

82 |

| Cease Trade Orders, Bankruptcies, Penalties or Sanctions |

|

84 |

| Conflicts of Interest |

|

85 |

| Audit Committee Information |

|

85 |

| LEGAL PROCEEDINGS |

|

89 |

| REGULATORY ACTIONS |

|

89 |

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS |

|

89 |

| TRANSFER AGENT AND REGISTRAR |

|

89 |

| MATERIAL CONTRACTS |

|

89 |

| INTERESTS OF EXPERTS |

|

90 |

| ADDITIONAL INFORMATION |

|

90 |

| SCHEDULE A – Audit Committee Charter |

|

91 |

PRELIMINARY NOTES

Date of Information

Unless otherwise indicated, all information contained

in this Annual Information Form (“AIF”) of enCore Energy Corp. (the “Company”) is current as of

December 31, 2023 with subsequent events disclosed to March 27, 2024.

Documents Incorporated by Reference

Incorporated by reference into this AIF are the following documents:

| ● | A report entitled “Crownpoint and Hosta Butte Uranium

Project McKinley County, New Mexico, USA Mineral Resources Technical Report” dated and with an effective date of February 25, 2022

and a revision date of March 16, 2022, prepared by Douglas L. Beahm, P.E., P.G., Carl Warren, P.E., P.G., and W. Paul Goranson, P.E.

(the “Crownpoint and Hosta Butte Technical Report”); |

| ● | A report entitled “NI 43-101 Technical Report, Preliminary

Economic Assessment, Gas Hills Uranium Project, Fremont and Natrona Counties, Wyoming, USA” dated August 10, 2021 with an effective

date of June 28, 2021 prepared by Ray Moores, P.E. of Western Water Consultants and Steve Cutler, P.G. of Roughstock Mining Services,

LLC (the “Gas Hills Technical Report”); |

| ● | A report entitled “NI 43-101 Technical Report Preliminary

Economic Assessment Dewey-Burdock Uranium ISR Project South Dakota, USA” dated December 23, 2020 and effective as of December 3,

2019 prepared by Matthew Yovich, P.E. of Woodard & Curran and Steve Cutler, P.G. of Roughstock Mining Services, LLC (the “Dewey

Burdock Project Technical Report”); and |

| ● | A report entitled “Technical Report Summary for the

Alta Mesa Uranium Project, Brooks and Jim Hogg Counties, Texas, USA” dated effective January 19, 2023 prepared by Douglas Beahm,

P.E., P.G. of BRS Inc. (the “Alta Mesa Technical Report”) |

(collectively, the “Technical

Reports”).

Copies of documents incorporated by reference

are available under the profiles of the Company and Azarga Uranium Corp. on the SEDAR website at www.sedarplus.ca.

Any statement contained in a document incorporated

or deemed to be incorporated by reference herein will be deemed to be modified or superseded for the purposes of this AIF to the extent

that a statement contained in this AIF or in any subsequently filed document that also is or is deemed to be incorporated by reference

herein modifies or supersedes such statement. Any statement so modified or superseded will not constitute a part of this AIF, except as

so modified or superseded. The modifying or superseding statement need not state that it has modified or superseded a prior statement

or include any other information set forth in the document that it modifies or supersedes. The making of such a modifying or superseding

statement will not be deemed an admission for any purpose that the modified or superseded statement, when made, constituted a misrepresentation,

an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make

a statement not misleading in light of the circumstances in which it was made.

Technical Information

Scientific or technical information contained

in this AIF or in a document incorporated or deemed to be incorporated by reference herein, other than technical information extracted

from the Technical Reports, was approved by John M. Seeley, PhD, PG, CPG, a “qualified person” for the purposes of NI 43-101

and the Manager of Geology and Exploration for the Company.

Forward-looking Information

This AIF and information

incorporated by reference herein, contains “forward-looking information” and “forward-looking statements” (referred

to together herein as “forward- looking information”). Forward-looking statements and information can generally be identified

by the use of forward-looking terminology such as “may”, “will”, “expect”, “intend”, “estimate”,

“anticipate”, “believe”, “continue”, “plans” or similar terminology. Forward-looking statements

and information are not historical facts, are made as of the date of this AIF, and include, but are not limited to, statements regarding

discussions of results from operations (including, without limitation, statements about the Company’s opportunities, strategies,

competition, expected activities and expenditures as the Company pursues its business plan, the adequacy of the Company’s available

cash resources and other statements about future events or results), performance (both operational and financial) and business prospects,

future business plans and opportunities and statements as to management’s expectations with respect to, among other things, the

activities contemplated in this AIF.

Forward-looking statements

included or incorporated by reference in this AIF include, without limitation, statements related to: the Company’s future financial

and operational performance; the sufficiency of the Company’s current working capital, anticipated cash flow or its ability to raise

necessary funds; the anticipated amount and timing of work programs; our expectations with respect to future exchange rates; the estimated

cost of and availability of funding necessary for sustaining capital; forecast capital and non-operating spending; the Company’s

plans and expectations for its property, exploration, development, production, and community relations operations; the use of available

funds; expectations regarding the process for and receipt of regulatory approvals, permits and licenses under governmental and other applicable

regulatory regimes, including U.S. government policies towards domestic uranium supply; expectations about future uranium market prices,

production costs and global uranium supply and demand; expectations regarding holding physical uranium for long-term investment; the establishment

of mineral resources on any of the Company’s current or future mineral properties (other than the Company’s properties that

currently have an established mineral resource estimates); future royalty and tax payments and rates; expectations regarding possible

impacts of litigation and regulatory actions; the completion of reclamation activities at former mine or extraction sites.

Such forward-looking statements reflect the Company’s

current views with respect to future events, based on information currently available to the Company and are subject to and involve certain

known and unknown risks, uncertainties, assumptions and other factors which may cause the actual results, performance or achievements

of the Company to be materially different from any future results, performance or achievements expressed in or implied by such forward-looking

statements. The forward-looking statements in this AIF are based on material assumptions, including the following: our budget, including

expected levels of exploration, evaluation and operations activities and costs, as well as assumptions regarding market conditions and

other factors upon which we have based our income and expenditure expectations; assumptions regarding the timing and use of our cash resources;

our ability to, and the means by which we can, raise additional capital to advance other exploration and evaluation objectives; our operations

and key suppliers are essential services, and our employees, contractors and subcontractors will be available to continue operations;

our ability to obtain all necessary regulatory approvals, permits and licenses for our planned activities under governmental and other

applicable regulatory regimes; our expectations regarding the demand for, and supply of, uranium, the outlook for long-term contracting,

changes in regulations, public perception of nuclear power, and the construction of new and ongoing operation of existing nuclear power

plants; our expectations regarding spot and long-term prices and realized prices for uranium; our expectations that our holdings of physical

uranium will be helpful in securing project financing and/or in securing long- term uranium supply agreements in the future; our expectations

regarding tax rates, currency exchange rates, and interest rates; our decommissioning and reclamation obligations and the status and ongoing

maintenance of agreements with third parties with respect thereto; our mineral resource estimates, and the assumptions upon which they

are based; our, and our contractors’, ability to comply with current and future environmental, safety and other regulatory requirements

and to obtain and maintain required regulatory approvals; and our operations are not significantly disrupted by political instability,

nationalization, terrorism, sabotage, pandemics, social or political activism, breakdown, natural disasters, governmental or political

actions, litigation or arbitration proceedings, equipment or infrastructure failure, labour shortages, transportation disruptions or accidents,

or other development or exploration risks.

The risks, uncertainties, assumptions and other

factors that could cause actual results to differ materially from any future results expressed in or implied by the forward-looking statements

in this AIF include, but are not limited to, the following factors: exploration and development risks; changes in commodity prices; access

to skilled mining personnel; results of exploration and development activities; uninsured risks; regulatory risks; defects in title; availability

of materials and equipment, timeliness of government approvals and unanticipated environmental impacts on operations; risks posed by the

economic and political environments in which the Company operates and intends to operate; the potential for losses arising from the expansion

of operations into new markets; increased competition; assumptions regarding market trends and the expected demand and desires for the

Company’s products and proposed products; reliance on industry manufacturers, suppliers and others; the failure to adequately protect

intellectual property; the failure to adequately manage future growth; adverse market conditions; and the failure to satisfy ongoing regulatory

requirements. In addition, the risks, assumptions, and other factors set out herein and in the Company’s public filings, including

the most recent Management Discussion and Analysis (“MD&A”) for the year ended December 31, 2023, could cause actual

results to differ materially from any future results expressed in or implied by the forward-looking statements in this AIF. Should one

or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect,

actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. These

risks, uncertainties, assumptions and other factors should be considered carefully, and prospective investors and readers should not place

undue reliance on the forward-looking statements.

Any forward-looking statement speaks only as of

the date on which such statement is made, and the Company undertakes no obligation to update any forward-looking statement or information

or statements to reflect information, events, results, circumstances or otherwise after the date on which such statement is made or to

reflect the occurrence of unanticipated events, except as required by applicable laws. New factors emerge from time to time, and it is

not possible for management to predict all of such factors and to assess in advance the impact of each such fact on the Company’s

business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained

in any forward-looking statements or information. All of the forward-looking statements contained or incorporated into this AIF are qualified

by the foregoing cautionary statements.

Currency

All dollar amounts in this AIF are expressed in

U.S. dollars unless otherwise indicated.

GLOSSARY OF TERMS

For ease of

reference, the following factors for converting metric measurements into imperial equivalents are as follows:

| Metric Units |

|

Multiply By |

|

Imperial Units |

| Hectares |

|

2.471 |

|

= acres |

| Meters |

|

3.281 |

|

= feet |

| Kilometers |

|

0.621 |

|

= miles (5,280 feet) |

| Grams |

|

0.032 |

|

= ounces (troy) |

| Tonnes |

|

1.102 |

|

= tons (short) (2,000 lbs) |

| grams/tonne |

|

0.029 |

|

= ounces (troy)/ton |

Abbreviations

In this AIF, the abbreviations set forth below have the following meanings:

| $ |

U.S. dollar |

|

km2 |

square kilometer |

| ° |

degrees |

|

kv |

kilovolt |

| % |

percent |

|

m |

meter |

| C$ |

Canadian dollar |

|

m2 |

square meter |

| ft |

feet |

|

lb |

pound |

| g/t |

metric gam per metric tonne |

|

U3O8 |

tri-uranium octo-oxide |

| kg |

kilogram |

|

ppm |

parts per million |

| kg/t |

kilograms per tonne |

|

U |

uranium |

| kl/t |

kilo liters per tonne |

|

ac |

acres |

In this AIF,

the following terms have the meanings set forth herein:

“Acquisition

Agreement” means the membership interest purchase agreement dated November 13, 2022, and as amended

on December 28, 2022 and on February 13, 2023, entered into among the Company, EFR White Canyon, and enCore Energy US for the Alta Mesa

Acquisition;

“Agents”

mean the Lead Agents, Canaccord Genuity Corp., Canaccord Genuity LLC, Haywood Securities Inc., PI Financial Corp., and Jett Capital Advisors,

LLC;

“AGM”

means the Company’s annual general meeting of shareholders held on June 21, 2023;

“AIF”

means this annual information form of the Company for the year ended December 31, 2023;

“Alta Mesa Acquisition” means

the Company’s acquisition of the Alta Mesa Uranium Project from EFR White Canyon for the Alta Mesa Consideration;

“Alta Mesa Consideration” means

the total consideration of US$120 million for the Alta Mesa Acquisition, consisting of US$60 million in cash and the Note;

“Alta

Mesa Entities” means enCore Alta Mesa LLC, Leoncito Plant, LLC and Leoncito Project, LLC;

“Alta Mesa Technical Report”

means the technical report entitled “Technical Report Summary for the Alta Mesa Uranium Project,

Brooks and Jim Hogg Counties, Texas, USA” dated effective January 19, 2023 prepared by Douglas Beahm, P.E., P.G. of BRS Inc.;

“Alta

Mesa Uranium Project” means the fully licensed and constructed in-situ recovery (ISR) mining project

and central processing facility currently on standby, located on almost 200,000 acres of private land in the State of Texas, as further

described in Material Mineral Properties – Alta Mesa Uranium Project;

“Anfield”

means Anfield Energy Inc.;

“ATM

Offering” means the “at-the-market” offering of the Company pursuant to the Sales

Agreement for proceeds of up to US$70,000,000;

“Audit

Committee” means the Company’s audit committee of the Board of Directors;

“Azarga”

means Azarga Uranium Corp.;

“BCBCA”

means the Business Corporations Act (British Columbia), as amended and supplemented from time to time;

“Board

of Directors” means the board of directors of the Company;

“Boss

Energy” means Boss Energy Limited;

“Cebolleta”

means the Cebolleta Uranium Project;

“CEO”

means the Chief Executive Officer of the Company;

“CFO”

means the Chief Financial Officer of the Company;

“Cibola”

means Cibola Resources, LLC;

“Common

Shares” means the common shares without par value in the capital of the Company;

“CRC”

means Core Research Center;

“Crownpoint and Hosta Butte Project”

means the Company’s 100% interest in McKinley properties and a 60% - 100% interest in the adjacent Crownpoint and Hosta Butte properties,

all of which are located in McKinley County, New Mexico, as further described in Material Mineral Properties – Crownpoint and

Hosta Butte Project;

“Crownpoint

and Hosta Butte Technical Report” means the technical report entitled “Crownpoint and Hosta

Butte Uranium Project McKinley County, New Mexico, USA” dated February 25, 2022, with an effective date of February 25, 2022 and

a revision date of March 16, 2022, prepared by Douglas L. Beahm, P.E., P.G., Carl Warren, P.E., P.G., and W. Paul Goranson, P.E.;

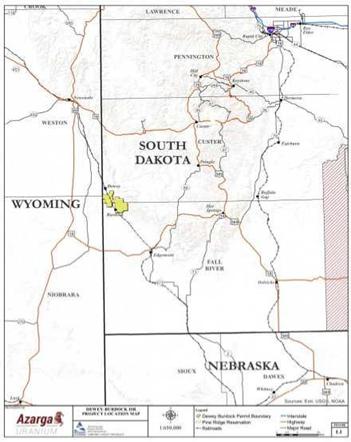

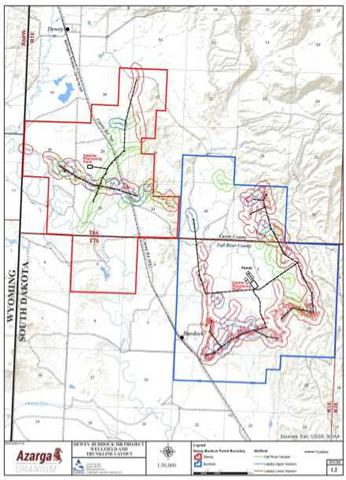

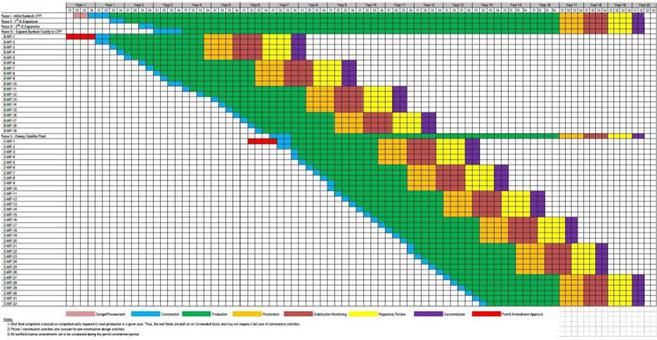

“Dewey

Burdock Project” means the Company’s advanced-stage uranium exploration project located

in South Dakota and is solely controlled by Powertech USA, Inc., a wholly-owned subsidiary of the Company, as further described in Material

Mineral Properties – Dewey Burdock Project;

“Dewey

Burdock Technical Report” means the technical report entitled “NI 43-101 Technical Report

Preliminary Economic Assessment Dewey-Burdock Uranium ISR Project South Dakota, USA” dated December 23, 2020 and effective as of

December 3, 2019 prepared by Matthew Yovich, P.E. of Woodard & Curran and Steve Cutler, P.G. of Roughstock Mining Services, LLC;

“EFR

White Canyon” means EFR White Canyon Corp.;

“Elephant

Capital” means Elephant Capital Corp.;

“enCore”

or “Company” means enCore Energy Corp.;

“enCore

Energy US” means enCore Energy US Corp., a wholly-owned subsidiary of the Company;

“Energy

Fuels” means Energy Fuels Inc.;

“Exchange

Ratio” means the exchange ratio of the Arrangement, being 0.375 enCore shares for each common

share of Azarga;

“Gas

Hills Project” means the Company’s Gas Hills Uranium Project located approximately 45 miles

east of Riverton, Wyoming in the historic Gas Hills Uranium District, as further described in Material Mineral Properties – Gas

Hills Project;

“Gas

Hills Technical Report” means the technical report entitled “NI 43-101 Technical Report,

Preliminary Economic Assessment, Gas Hills Uranium Project, Fremont And Natrona Counties, Wyoming, USA” dated August 10, 2021 with

an effective date of June 28, 2021 prepared by Ray Moores, P.E. of Western Water Consultants Inc. and Steve Cutler, P.G. of Roughstock

Mining Services, LLC;

“historical

estimate” means an estimate of the quantity, grade, or metal or mineral content of a deposit that

an issuer has not verified as a current mineral resource or mineral reserve, and which was prepared before the issuer acquiring, or entering

into an agreement to acquire, an interest in the property that contains the deposit;

“JV

Agreement” means the limited liability company agreement which governs JV Alta Mesa, entered into

between enCore Energy US Corp. and Boss Energy (US) LLC as of February 13, 2024, and as amended and restated on February 26, 2024;

“JV

Alta Mesa” means JV Alta Mesa LLC, a Delaware limited liability company formed to hold the Alta

Mesa Uranium Project;

“Lead

Agents” mean Cantor Fitzgerald Canada Corporation and Cantor Fitzgerald & Co.;

“Marquez-Juan Technical Report”

means the technical report entitled “MARQUEZ-JUAN TAFOYA URANIUM PROJECT” dated and with an effective date of June 9, 2021

prepared by Douglas L. Beahm, P.E., P.G., BRS Inc. and Terence P. McNulty, PE, PHD, McNulty and Associates;

“Marquez-Juan Project” means the

Marquez-Juan Tafoya Uranium Project which consists of private mineral leases located in McKinley and Sandoval counties of New Mexico,

on the eastern end of the Grants Uranium District in northern New Mexico;

“Master Agreement” means the

master transaction agreement dated December 5, 2023 among the Company, enCore Energy US, and Boss Energy;

“MEUS” means Metamin Enterprises

US Inc., a wholly-owned subsidiary of enCore Energy US;

“mineral reserve” means the

economically mineable part of a measured and/or indicated mineral resource. It includes diluting materials and allowances for losses,

which may occur when the material is mined or extracted and is defined by studies at pre-feasibility or feasibility level as appropriate

that include application of modifying factors;

“mineral resources” means a

concentration or occurrence of solid material of economic interest in or on the Earth’s crust in such form, grade or quality and

quantity that there are reasonable prospects for economic extraction. The location, quantity, grade or quality, continuity and other geological

characteristics of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge, including sampling.

Mineral resources are sub-divided, in order of increasing geological confidence, into inferred, indicated and measured categories;

“mineralization” means in exploration,

a reference to a notable concentration of metals and their associated mineral compounds, or a specific mineral, within a body of rock;

“Nasdaq” means Nasdaq Stock

Market LLC;

“Neutron Energy” means Neutron

Energy, Inc.;

“NI 43-101” means National

Instrument 43-101 Standards of Disclosure for Mineral Projects;

“NI

52-110” means National Instrument 52-110 Audit Committees;

“Note” means

the $60 million secured convertible promissory note with EFR White Canyon;

“NRC”

means US Nuclear Regulatory Commission;

“Nuclear

Fuels” means Nuclear Fuels Inc. (formerly, Uravan Minerals Inc.)

“NYSE

American” means NYSE American LLC;

“NZ”

means The NZ Land Company;

“NZU”

means NZ Uranium LLC;

“Offering”

means the public offering of Units for aggregate gross proceeds of C$34,500,862.50 closed on February 8, 2023;

“Offering

Prospectus” means the short form prospectus of the Company dated February 3, 2023 and filed in

connection with the Offering;

“OTCQB” means OTCQB Venture

Market;

“Prospectus Supplement” means

the prospectus supplement dated June 26, 2023 to the Company’s short form base shelf prospectus dated June 20, 2023;

“Red Cloud” means Red Cloud

Securities Inc. and Red Cloud Financial Services Inc.;

“Registration Statement” means

the registration statement on Form F-10 (including such Offering Prospectus) filed with the SEC for the Offering;

“Rosita Project” means the

Company’s uranium processing plant and associated well fields located in Duval County, Texas, as further described in General

Development of the Business;

“Sales Agreement” means the

Controlled Equity OfferingSM Sales Agreement dated as of June 26, 2023 entered into among the Company and the Agents;

“SEC” means the U.S. Securities

and Exchange Commission;

“SEDAR”

means SEDAR+, the System for Electronic Document Analysis and Retrieval;

“Share

Consolidation” means the share consolidation of the Common Shares on the basis of one (1) post-consolidation

Common Share for every three (3) pre-consolidation Common Shares;

“Stock

Option Plan” means the Company’s stock option plan, as further amended from time to time;

“Technical

Reports” means the Crownpoint and Hosta Butte Technical Report, the Dewey Burdock Technical Report,

the Gas Hills Technical Report, and the Alta Mesa Technical Report;

“Tigris”

means Tigris Uranium US Corp.;

“TSX-V”

means the TSX Venture Exchange;

“Units”

means a unit of the Company, consisting of one Unit Share and one-half of one Warrant, issued under the Offering;

“Unit

Share” means a Common Share underlying the Units;

“URI” means URI, Inc.;

“U.S. Securities Act” means

the United States Securities Act of 1933, as amended;

“USGS” means United States

Geological Survey;

“Vane” means VANE Minerals

(US) LLC;

“Warrants” means the Common

Share purchase warrants underlying the Units, with each Warrant exercisable into a Warrant Share at a price of $4.05 for a period of 36

months following the closing of the Offering;

“Warrant Share” means the Common

Shares issuable upon exercise of the Warrants; and

“Westwater” means Westwater

Resources Inc.

CORPORATE STRUCTURE

Name, Address and Incorporation

enCore was incorporated on October 30, 2009 under

the Business Corporations Act (British Columbia) (the “BCBCA”) under the name “Dauntless Capital Corp.”

The company’s name was changed to “Tigris Uranium Corp.” on September 2, 2010, and changed to “Wolfpack Gold Corp.”

on May 15, 2013. On August 15, 2014, the company’s name was changed to “enCore Energy Corp.”

The Company is a reporting issuer in all the provinces

and territories of Canada. The Company’s Common Shares are listed for trading on the TSX-V and on Nasdaq under the symbol “EU”.

The principal offices of the Company are located

at Suite 450, 101 N. Shoreline Blvd, Corpus Christi, Texas 78401, United States of America. The Company’s registered and records

office is located at Suite 1200, 750 West Pender Street, Vancouver, British Columbia, V6C 2T8.

Intercorporate Relationships

enCore has the following subsidiaries as at the

date of this AIF:

| Name of Subsidiary |

|

Jurisdiction of Incorporation |

|

Percentage of Voting Shares/Interests beneficially owned directly or indirectly by enCore |

| Azarga Uranium Corp. |

|

British Columbia |

|

100% directly |

| Powertech (USA) Inc. |

|

South Dakota |

|

100% indirectly through Azarga Uranium Corp. |

| URZ Energy Corp. |

|

British Columbia |

|

100% indirectly through Azarga Uranium Corp. |

| Ucolo Exploration Corp. |

|

Utah |

|

100% indirectly through URZ Energy Corp. |

| Azarga Resources Limited |

|

British Virgin Islands |

|

100% indirectly through Azarga Uranium Corp. |

| Azarga Resources (Hong Kong) Ltd. |

|

Hong Kong |

|

100% indirectly through Azarga Resources Limited |

| Azarga Resources Canada Ltd. |

|

British Columbia |

|

100% indirectly through Azarga Resources (Hong Kong) Limited |

| Azarga Resources USA Company |

|

Colorado |

|

100% indirectly through Azarga Resources Canada Ltd. |

| enCore Energy US Corp. |

|

Nevada |

|

100% directly |

| HRI-Churchrock, Inc. |

|

Delaware |

|

100% indirectly through enCore Energy US Corp. |

| Metamin Enterprises US Inc. |

|

Nevada |

|

100% indirectly through enCore Energy US Corp. |

| Tigris Uranium US Corp. |

|

Nevada |

|

100% indirectly through enCore Energy US Corp. |

| Uranco, Inc. |

|

Delaware |

|

100% indirectly through enCore Energy US Corp. |

| URI, Inc. |

|

Delaware |

|

100% indirectly through enCore Energy US Corp. |

| JV Alta Mesa LLC |

|

Delaware |

|

70% indirectly through enCore Energy US Corp. |

| enCore Alta Mesa LLC |

|

Texas |

|

100% indirectly through JV Alta Mesa LLC |

| Leoncito Plant, LLC |

|

Texas |

|

100% indirectly through JV Alta Mesa LLC |

| Leoncito Project, LLC |

|

Texas |

|

100% indirectly through JV Alta Mesa LLC |

| Leoncito Restoration, LLC |

|

Texas |

|

100% indirectly through Leoncito Project, LLC |

The following organizational chart illustrates enCore’s principal

subsidiaries as at the date of this AIF:

Notes:

| * | POI = Place of incorporation or legal organization |

| * | PPB= Principal place of business |

GENERAL DEVELOPMENT OF THE BUSINESS

Three Year History

The following provides an overview of events during

the three year period prior to the date of this AIF.

2021:

Project Developments, Acquisitions and Dispositions

In June 2021, the Company announced the results

of a Preliminary Economic Assessment for the Company’s recently consolidated Juan Tafoya and Marquez projects located in the Grant’s

Uranium District in northwest New Mexico.

On August 27, 2021, the Company entered into a

Share Purchase Agreement with Elephant Capital Corp. (“Elephant Capital”) to sell all of the outstanding share capital

of Cibola Resources, LLC (“Cibola”), held by the Company’s wholly-owned subsidiary, Neutron Energy, Inc., to

Elephant Capital. Cibola which itself controls the rights to a lease of a mineral property comprising approximately 6,700 acres of mineral

rights and 5,700 acres of surface rights located in west-central New Mexico and commonly referred to as the “Cebolleta Uranium Project”

(“Cebolleta”). On October 29, 2021, Evolving Gold Corp. announced that it was acquiring Elephant Capital.

On December 31, 2021, the Company completed the

acquisition of all of the issued and outstanding common shares of Azarga in exchange for 95,419,852 Common Shares of the Company. Outstanding

and unexercised warrants and options to purchase common shares of Azarga were deemed to be exchanged for options and warrants to purchase

Common Shares of the Company on an adjusted basis. The Arrangement consolidated a pipeline of exploration and development staged in-situ

recovery (“ISR”) focused uranium projects located in the United States, including the licensed Rosita Project and Kingsville

Dome past producing uranium production facilities in South Texas, the advanced stage Dewey Burdock development project in South Dakota,

which has been issued its key federal permits, the PEA-staged Gas Hills Project located in Wyoming, and a portfolio of resource staged

projects throughout the United States. In connection with the Arrangement, the U.S. Nuclear Regulatory Commission (“NRC”)

approved the change of control over the Dewey Burdock Source and By-Product Materials License, which enables the Company to receive, acquire,

possess, and transfer natural uranium and byproduct material in any form without restriction on quantity, at the Dewey-Burdock Project

in Fall River and Custer Counties, South Dakota.

Financing and Corporate Developments

In March 2021, enCore completed a private placement

of 15,000,000 units at a price of C$1.00 per unit for gross proceeds of C$15,000,000. Each unit was comprised of one Common Share and

one-half of one common share purchase warrant. Each whole warrant entitles the holder thereof to purchase one common share at an exercise

price of $1.30 until March 9, 2024.

Uranium Contract Developments

In April 2021, the Company acquired 200,000 pounds

of U3O8 for a purchase price of C$37.12 per pound ($29.65 per pound) or C$7,423,767 and another 100,000 of U3O8

for a purchase price of C$37.58 per pound ($30.80 per pound) or C$3,757,600.

In July 2021, the Company entered into a uranium

supply contract with UG USA, Inc. Pursuant to the agreement, UG USA, Inc. will purchase U3O8 from the Company for

up to two million pounds from 2023 through 2027. The sales price under the agreement will be tied to spot market pricing with terms that

are more representative of current market conditions and practices. In August 2021, the Company and UG USA, Inc. agreed to terminate a

previous sales agreement which was entered into prior to the July 2021 contract (as referenced above), acquired by the Company in the

asset acquisition with Westwater Resources Inc. (“Westwater”) in December 2020 for a cancellation fee of $2,750,000.

In September, the Company sold 200,000 pounds

U3O8 to two different buyers for an average sales price of C$34.88 per pound U3O8. The Company

realized revenue from these sales of C$6,975,000.

In December, the Company secured a second uranium

purchase agreement with a Fortune 150 United States utility. The uranium purchase agreement, which represents the second purchase agreement

executed by enCore, is a four-year agreement commencing in 2024, and it covers up to 1.3 million pounds U3O8 based

on market pricing with a ceiling price significantly higher than the current uranium spot market price at the time of the announcement.

2022:

Project Developments, Acquisitions and Dispositions

In April, the Company announced positive results

from its on-going uranium delineation and exploration drill programs at the Rosita Project. Highlights of the Rosita South uranium delineation

and exploration drill programs include: (a) 32 drill holes reported for a total of ~11,000 feet including 20 delineation drill holes and

12 exploration drill holes; (b) the exploration drilling has identified 8 mineralized sands plus an additional 4 potentially mineralized

sands, all within 800 feet of the surface, which provide opportunities for discovery of future uranium resources across the entire Rosita

project; and (c) Delineation drill results established an extension of mineralization in the Production Area which supports the start-up

of the Rosita Plant expected next year.

The Company also announced that the refurbishment

of the Rosita Project is 90% complete, and the Company intends to commence commissioning work once the modernization and refurbishment

project is complete. Following commissioning work the Rosita Project will be ready to start receiving loaded resin. Monitor well installation,

baseline water quality analysis, and hydrological testing will be completed as part of the Production Area Authorization (PAA) process

with the Texas Commission on Environmental Quality. (TCEQ). wellfield installation will begin immediately following the submittal of the

PAA data package to the TCEQ. All activities are on track and on budget for a projected 2023 production start.

In May, the Company completed the sale of Cibola,

including its holding of Ceboletta, to Elephant Capital pursuant to the Share Purchase Agreement with Elephant Capital dated August 27,

2021. Subsequently on May 24, 2022, the Company acquired 11,308,250 common shares of American Future Fuel Corporation (formerly Evolving

Gold Corp), representing approximately 15.90% on an undiluted basis of the outstanding shares of American Future Fuel Corporation, and

a cash payment of $250,000 in exchange for common shares of Elephant Capital previously held by the Company.

On November 13, 2022, the Company entered into

the Acquisition Agreement to acquire the Alta Mesa Uranium Project, a uranium project from EFR White Canyon for total Alta Mesa Consideration

of $120 million. The Alta Mesa Uranium Project is a fully licensed and constructed ISR project and central processing facility currently

on standby, located on almost 200,000 acres of private land in the state of Texas. Total operating capacity is 1.5 million lbs U3O8

per year. The Alta Mesa Uranium Project historically produced nearly 5 million lbs U3O8 between 2005 and 2013, when

full production was curtailed as a result of low uranium prices at the time. The Alta Mesa Uranium Project has not been in commercial

production since 2013. enCore intends to immediately pursue the resumption of operations following completion of the Alta Mesa Acquisition.

Pursuant to the terms of the Acquisition

Agreement, the Company, through its wholly owned subsidiary enCore Energy US Corp. (“enCore Energy US”), acquired

all of the limited liability company membership interests in each of the three Texas limited liability companies which collectively

own and control the Project, being enCore Alta Mesa LLC, Leoncito Plant, LLC and Leoncito Project, LLC (collectively, the

“Alta Mesa Entities”) from EFR White Canyon, a wholly owned subsidiary of Energy Fuels. The Company also assumed

the reclamation obligations and obtained replacement surety bonds associated with the Project. The Alta Mesa Consideration payable

to Energy Fuels consists of $60 million in cash and a $60 million secured convertible promissory note (the

“Note”) with EFR White Canyon. The obligations under the Note were secured by the assets of the Alta Mesa

Entities and a pledge of the equity interests of the Alta Mesa Entities. In addition, the Company provided to EFR white Canyon a

parent guarantee of the obligations under the Note. The Note had a two (2) year term with interest at a rate of 8% per

annum payable on June 30th and December 31st of each year during the term. The Note was convertible at the

election of the holder, to acquire Common Shares of the Company at a price equal to a 20% premium to the volume weighted average

price of the Common Shares for the 10 consecutive trading days immediately prior to the closing of the Alta Mesa Acquisition. The Note was retired in February of 2024 (See “Subsequent Events” below).

Financing and Corporate Developments

In March, 2022, the Company completed a “bought

deal” prospectus offering pursuant to which the Company sold an aggregate of 19,607,842 units of the Company at a price of C$1.53

per unit for aggregate gross proceeds of C$29,999,998.26. Each unit was comprised of one Common Share and one-half of one common share

purchase warrant of the Company. Each whole warrant entitles the holder thereof to purchase one Common Share at an exercise price of C$2.00

until March 25, 2024. The Company paid the underwriters a cash commission of C$1,612,499.93 and issued an aggregate of 1,053,922 compensation

options of the Company. Each compensation option is exercisable to acquire one Common Share at an exercise price of C$1.53 per share until

March 25, 2024. The Company planned to use the net proceeds to maintain and advance the Company’s material properties, acquire properties,

plant upgrades, maintenance and refurbishment, and for general corporate and working capital purposes.

The Company announced some changes in its executive

offices. On May 3, 2022, the Company appointed Mr. Peter Luthiger as Chief Operating Officer, and on July 15, 2022, the Company appointed

Gregory Zerzan as Chief Administrative Officer and General Counsel. Mr. Luthiger is responsible for the commissioning and operation of

the Rosita Uranium Processing Plant in South Texas.

In June, the Company appointed Susan Hoxie-Key,

MSc, P.E., as a director of the Company. Ms. Hoxie-Key brings over 40 years of engineering experience in the nuclear fuel industry.

The Company consolidated the Common Shares in

September, on the basis of one (1) post-consolidation Common Share for every three (3) pre-consolidation Common Shares (the “Share

Consolidation”). The exercise price and the number of Common Shares issuable under any of the outstanding warrants, stock options

or other convertible securities issued prior to the Share Consolidation was proportionately adjusted.

In December, in connection with the Alta Mesa

Acquisition, the Company completed a brokered private placement (the “Subscription Receipt Brokered Offering”) and

issued an aggregate of 23,000,000 subscription receipts of the Company (“Subscription Receipts”) at a price of C$3.00

per Subscription Receipt for aggregate gross proceeds of C$69 million, including the full exercise of the underwriters’ option.

Concurrently, the Company completed a non-brokered private placement of 277,000 Subscription Receipts for gross proceeds of C$831,000

(the “Subscription Receipt Concurrent Offering”, and together with the Subscription Receipt Brokered Offering, the

“Subscription Receipt Offering”). The Subscription Receipt Brokered Offering was completed pursuant to an underwriting

agreement entered into among the Company, Canaccord Genuity Corp., Haywood Securities Inc., Cantor Fitzgerald Canada Corporation, PI Financial

Corp., Clarus Securities Inc., and Red Cloud Securities Inc. (together with the Lead Underwriter, the “Subscription Receipt Underwriters”).

The Subscription Receipts were issued pursuant to the terms of a subscription receipt agreement (the “Subscription Receipt Agreement”)

dated December 6, 2022 among the Company, Computershare Trust Company of Canada, as subscription receipt agent (the “Subscription

Receipt Escrow Agent”), and Canaccord Genuity Corp. Upon satisfaction of the escrow release conditions included in the Subscription

Receipt Agreement (the “Escrow Release Conditions”): (i) each of the Subscription Receipts will automatically convert

into one unit of the Company (a “Subscription Receipt Unit”); and (ii) the net proceeds of the Subscription Receipt

Offering will be released from escrow and used to fund the cash portion of the Alta Mesa Consideration payable by the Company pursuant

to the Acquisition Agreement to acquire the Project from EFR White Canyon, and for working capital purposes.

Each Subscription Receipt Unit was comprised of

one Common Share (each, a “Subscription Receipt Share”) and one Common Share purchase warrant (each, a “Subscription

Receipt Warrant”), with each Subscription Receipt Warrant entitling the holder thereof to acquire one Common Share at a price

of C$3.75 for a period of 3 years following satisfaction of the Escrow Release Conditions.

Uranium Contract Developments

In February, the Company entered into an agreement

to forward purchase 200,000 pounds U3O8 from a third party. The agreement allows the Company to acquire the uranium

in 2023 at a fixed price, and the Company has prepaid a portion of the forward purchase price to secure the purchase agreement.

In June, the Company secured a uranium purchase

sales agreement with a United States based nuclear power company. The agreement is a multi-year agreement commencing in 2025 and covers

up to 600,000 pounds of U3O8 based on market pricing with a floor price that assures the Company’s cost of

product are met. The agreement includes an inflation adjusted ceiling price higher than the current uranium spot market pricing providing

the U.S. nuclear power plant assurance of cost certainty.

In December, 2022, the Company was awarded a contract

to sell 100,000 pounds of natural uranium concentrates (U3O8) to the United States government, at a price of $70.50/pound,

under the new Uranium Reserve Program. The uranium purchase will help the United States Government establish a strategic uranium reserve

and represents the first uranium purchase by the United States government in 40 years. The U.S. National Nuclear Security Administration,

an office within the U.S. Department of Energy, is the agency tasked with purchasing domestic U3O8 and conversion

services for the Uranium Reserve Program. The Uranium Reserve is intended to be a backup source of supply for domestic nuclear power plants

in the event of a significant market disruption and provide support for restarting uranium production in the United States. The Company

is one of five qualified United States based operators, with existing licensed facilities, that is approved to sell domestically sourced

natural uranium to the United States Government’s Uranium Reserve Program.

2023:

Project Developments, Acquisitions and Dispositions

On February 15, 2023, the Company closed the Alta

Mesa Acquisition for $60 million in cash and the Note. The Note has a two (2) year term and bears interest at a rate of 8% per annum payable

on June 30th and December 31st of each year during the term. The Note is convertible at the election of the holder,

to acquire common shares of enCore at a price of $2.9103 per share. Energy Fuels agreed not to transact with the common shares of enCore

received on conversion of the Note, including hedging and short sales, with exceptions for sale transactions of up to $10 million in value

in any 30-day period, block trades and underwritten distributions. In addition, Energy Fuels agreed to standard standstill provisions

restricting additional acquisitions of enCore securities.

In connection with the closing of the Alta Mesa

Acquisition, 23,277,000 Subscription Receipts were automatically converted into units comprised of one Subscription Receipt Share and

one Subscription Receipt Warrant, with each warrant entitling the holder thereof to acquire one Subscription Receipt Warrant Share at

a price of $3.75 for a period of 3 years until February 14, 2026. The net proceeds from the Subscription Receipt Offering of approximately

$66 million, after deduction of fees and commissions, have been released from escrow to the Company, and were applied to fund the cash

portion of the consideration payable by the Company pursuant to the Alta Mesa Acquisition.

In March, the Company made a formal production

decision for the resumption of uranium production from the Alta Mesa processing plant in early 2024. Alta Mesa was the Company’s

second producing location following resumption of uranium production at the South Texas Rosita Uranium Processing Plant scheduled for

2023.

Also in March, the NRC license became final and

fully effective. The challenger to the NRC granting of a source materials license to the Company’s wholly-owned subsidiary, Powertech

(USA) Inc., declined to seek review by the U.S. Supreme Court.

In May, the Company acquired all of the proprietary

Prompt Fission Neutron (“PFN”) technology and equipment, including related exclusive intellectual property, and global

licensing rights from Energy Fuels for $3.1 million. The use and ownership of PFN technology provides enCore with a clear competitive

advantage by providing close to real time assays for uranium that cannot be achieved using conventional coring and assay methods.

On

June 5, 2023, the Company entered into a share purchase agreement with its wholly-owned indirect subsidiary, Neutron Energy, Inc. (“Neutron

Energy”) and Anfield Energy Inc. (“Anfield”) whereby Anfield will acquire all of the issued and outstanding

shares of Neutron Energy which holds the Marquez-Juan Tafoya Uranium Project located in New Mexico as its sole asset, in exchange for

C$5,000,000 in cash and 185,000,000 common shares of Anfield. Pursuant to the Anfield Agreement, on closing of the transaction,

enCore has the right to one seat on the board of directors of Anfield, which will be ongoing for so long as enCore holds at least

10% of the issued shares of Anfield. The Company will have the right to maintain its percentage equity interest in Anfield in

subsequent share issuances as long as it holds at least 10% of the issued shares of Anfield. Red Cloud Securities Inc. acted as an advisor

in connection with the transaction. The transaction closed on July 19,

2023, and on closing, C$4 million of the consideration payment was made, with the balance on September 25, 2023. Eugene Spiering was appointed

to the board of directors of the Anfield as the initial nominee of enCore.

In July 2023, the Company

acquired 9,263,800 common shares of Nuclear Fuels Inc. (“Nuclear Fuels”) following the completion of a business combination

transaction completed by Nuclear Fuels. The shares acquired by the Company represented approximately 19.9% of the then issued and outstanding

common shares of Nuclear Fuels.

In October of 2023, the

Company repaid $20 million of the $60 million Alta Mesa debt, to Energy Fuels Inc., reducing the debt to $40 million. Funds for repayment

of the debt to Energy Fuels Inc. were made through sales from the At-the-Market (ATM) equity offering program.

In November 2023, the

Company received renewed license approval from the executive director of the Texas Commission on Environmental Quality (TCEQ) for the

Company’s combined South Texas in situ recovery (ISR) uranium central processing plants (CPPs) at its Rosita, Kingsville Dome and

Vasquez uranium projects. The renewed license allows for the addition of two remote ion exchange (RIX) units at the Rosita CPP and wellfield.

In November, the Company

commenced uranium production at the South Texas Rosita in situ recovery uranium central processing plant. The restart of the previously

producing Rosita CPP is the first step in enCore’s South Texas production pipeline strategy utilizing the in situ recovery production

process.

In December, the Company

entered into a master transaction agreement (the “Master Agreement”) among enCore Energy US, and Boss Energy Ltd. (“Boss

Energy”) which, upon completion, will result in the sale of a 30% ownership interest in the Alta Mesa Uranium Project to Boss

Energy for $60 million, an investment of $10 million into enCore common shares by Boss Energy, a loan of up to 200,000 pounds U3O8

(triuranium octoxide) for enCore’s commercial use over the next year, and the formation of a strategic collaboration on the use

and joint development of enCore’s PFN technology for uranium exploration and production.

Financing and Corporate Developments

On January 23, 2023, the Common Shares commenced

trading on the NYSE American under the symbol “EU.”

In February, the Company completed the Subscription

Receipt Offering, in connection with the Alta Mesa Acquisition. Pursuant to the Offering, the Company issued a total of 10,615,650 units

at a price of C$3.25 per Unit for aggregate gross proceeds of C$34,500,862.50, including the full exercise of the over-allotment option

granted to the underwriters under the Offering. In connection with the Offering, the Company filed a short form prospectus dated February

3, 2023 with the securities commissions in each of the provinces of Canada except Quebec. A Registration Statement on Form F-10 (including

such prospectus) was also filed with the SEC for the Offering.

In June, the Company

entered into a Controlled Equity OfferingSM Sales Agreement (the “Sales Agreement”) with Cantor Fitzgerald

Canada Corporation and Cantor Fitzgerald & Co. (together, the “Lead Agents”), and Canaccord Genuity Corp., Canaccord

Genuity LLC, Haywood Securities Inc., PI Financial Corp., and Jett Capital Advisors, LLC (together with the Lead Agents, the “Agents”).

Pursuant to the Sales Agreement, the Company will be entitled, at its discretion from time-to-time during the term of the Sales Agreement,

to sell, through the Lead Agents, such number of Common Shares that would result in aggregate gross proceeds to the Company of up to $70,000,000

(the “ATM Offering”). The ATM Offering was made by way of a prospectus supplement dated June 26, 2023 (the “Prospectus

Supplement”) to the Company’s existing Canadian short form base shelf prospectus of $140 million and a U.S.

registration statement on Form F-10, as amended (File No. 333-272609), dated June 12, 2023 and June 20, 2023, respectively.

Net proceeds from the ATM Offering will be used for corporate purposes as described in the Prospectus Supplement. As at December 31, 2023,

the Company has issued a total of 15,690,943 common shares for gross proceeds of $49,294,106 and paid commission of $1,197,354 to the

Agents under the ATM Offering.

On June 29, 2023, the

Company appointed Dain McCoig has Director of Technical Services. Mr. McCoig is responsible for engineering and technical support on all

projects within the Company’s production pipeline.

in November 14, 2023,

the Company reduced the remaining principal balance of the Note to $20 million.

Uranium Contract Developments

On February 21, 2023, the Company secured its

fourth uranium sales agreement with the addition of a purchase sales agreement with a Fortune 500-listed United States utility. The uranium

sales agreement is a multiyear agreement commencing in 2027. It covers firm deliveries of 650,000 pounds of U308,

with an option to acquire up to 400,000 pounds U308 under a two-year extended term, if exercised. The sales agreement

is based on market pricing with a floor price well above the company’s current projected costs of production and an inflation-adjusted

ceiling price significantly higher than the current uranium spot market pricing providing the U.S. with assurance of domestic supply along

with cost certainty.

In May, the Company made its first delivery into

one of the Company’s four contracted uranium sales agreements. This delivery of 200,000 pounds U3O8 represented

the first portion of the annual deliveries into the 5-year agreement (announced on August 4, 2021) which covers 2 million pounds

U3O8 of uranium with significant delivery flexibility for market related pricing. The Company successfully

acquired uranium under favorable pricing terms in 2022 from a third party and delivered it into this agreement using current spot market

pricing indicators to establish the sales price.

On December 23, 2023,

Carrie Mierkey stepped down as Chief Financial Officer of the Company, and Dr. Dennis Stover agreed to act as interim Chief Financial

Officer.

Subsequent Events

The following provides a summary of events involving

the Company subsequent to the financial year ended December 31, 2023.

On January 2, 2024, the Company transferred its

stock exchange listing to the Nasdaq Capital Market from the NYSE American LLC. The Company continues to trade on Nasdaq Capital Market

under the symbol “EU”.

On January 17, 2024, the Company provided an update

on its South Texas operations which are advancing on schedule and providing exceptional drilling results to support future planned production.

Highlights include:

| ● | The Alta Mesa in situ recovery

(ISR) uranium central processing plant (CPP) upgrades and refurbishments are advancing on schedule for the planned early 2024 resumption

of uranium production. |

| ● | The Alta Mesa project wellfield

drilling is providing increasingly positive high-grade results from the wellfield delineation drill program. |

| ● | Uranium production from the

Rosita CPP which commenced Nov. 21, 2023, continues to meet projected start-up production levels. |

In February 2024, the Company appointed Robert

Willette as Chief Legal Officer of the Company, as well as Shona Wilson as Chief Financial Officer of the Company.

On February 7, 2024, the full outstanding principal

amount of the Note in the amount of $20 million was converted into 6,872,143 common shares of the Company.

On February 26, 2024, the Company completed the

transactions under the Master Agreement with Boss Energy.

Transactions highlight include:

| ● | enCore

receiving $60 million in full payment for Boss Energy’s 30% share of JV Alta Mesa; |

| ● | enCore

received an additional $10 million from Boss Energy as payment for a private placement of 2,564,102 common shares of enCore at a price

of $3.90 per share; and |

| ● | The

formation of a joint venture company owning Alta Mesa Uranium Project with enCore holding a 70% joint venture interest and remaining

the project manager, and Boss Energy holding a 30% joint venture interest. |

Pursuant to the terms of the Master Agreement,

Boss Energy acquired a 30% equity interest in a new limited liability company (the “JV Alta Mesa”) that was formed

to hold the Alta Mesa Uranium Project, in exchange for a payment to enCore of $60 million. enCore holds 70% equity in JV Alta Mesa. In

connection with the formation of JV Alta Mesa, enCore Energy US and a subsidiary of Boss Energy, Boss Energy (US) LLC, entered into a

limited liability company agreement dated February 13, 2024, and as amended and restated on February 26, 2024 (the “JV Agreement”)

which will govern JV Alta Mesa. Pursuant to the JV Agreement, enCore Energy US will act as manager of JV Alta Mesa and will be entitled

to a management fee. JV Alta Mesa will distribute uranium from production at Alta Mesa on a pro rata basis according to enCore and Boss

Energy’s ownership interest. In the event a party’s interest falls below 10%, the other party shall have a right to either

acquire that interest, or elect to have the interest converted into a 1% production royalty at Alta Mesa.

Concurrently with the establishment of JV Alta

Mesa, the parties entered into a uranium loan agreement providing for up to 200,000 pounds of uranium to be lent by Boss Energy to enCore.

The loan will bear interest of 9% and be repayable in 12 months in cash or uranium at the election of Boss Energy.

The parties also entered into a strategic collaboration

agreement for the joint collaboration and research to develop the Company’s PFN technology, to be financed equally by each party.

DESCRIPTION OF THE BUSINESS

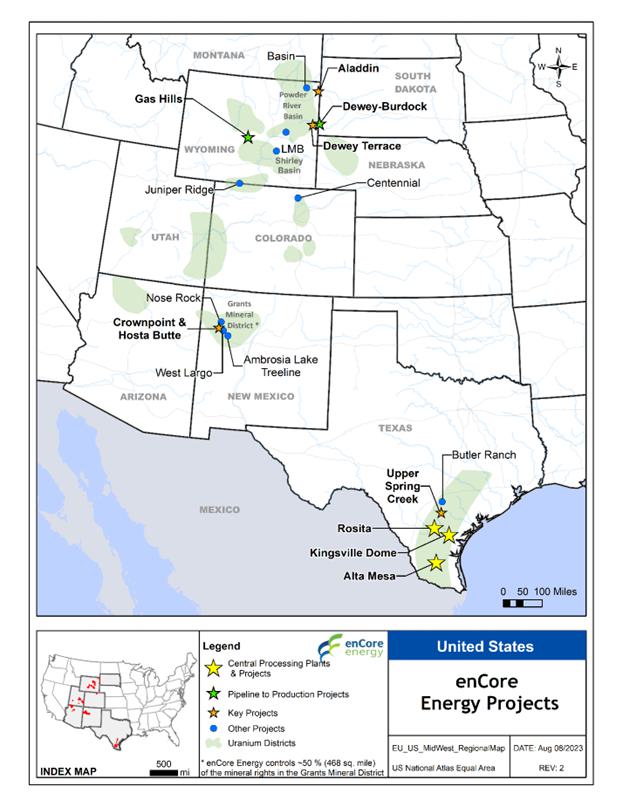

enCore holds a portfolio of uranium assets located

in New Mexico, South Dakota, Wyoming, Texas, Utah, Colorado, and Arizona in the USA, and is advancing its properties with a focus on utilizing

in-situ recovery.

enCore’s material properties and projects

are the Rosita Project located in Texas, the Alta Mesa Uranium Project in Texas, the Crownpoint and Hosta Butte Uranium Project located

in New Mexico, the Dewey Burdock Project located in South Dakota, and the Gas Hills Project located in Wyoming.

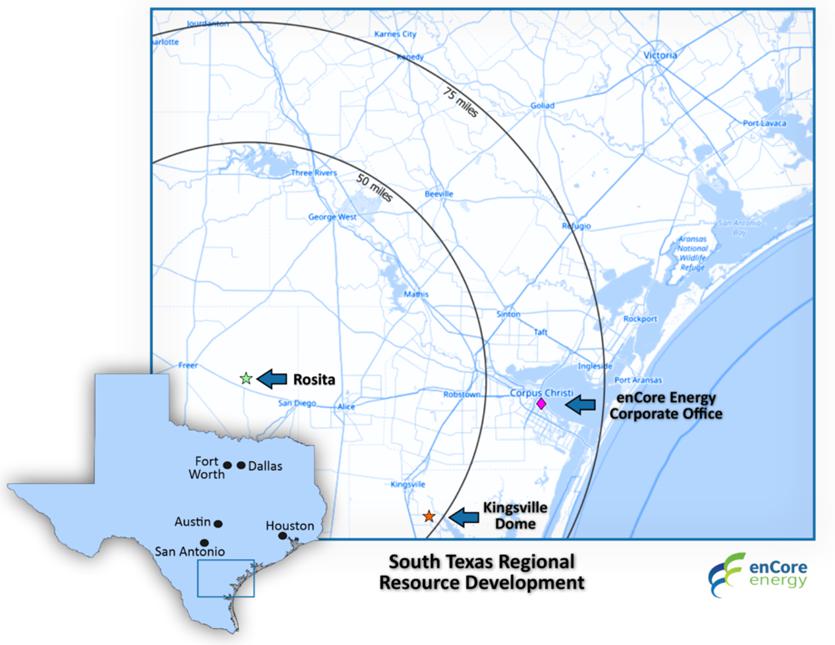

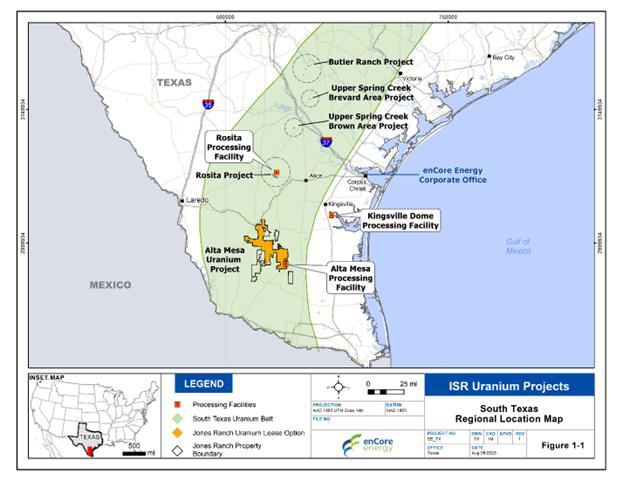

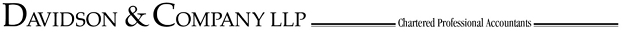

Rosita Project, Texas

The Rosita uranium processing plant and associated

well fields (the “Rosita Project”) are located in Duval County, Texas on a 200-acre tract of land owned by the Company.

The facility is located within the South Texas uranium province, about 22 miles west of the town of Alice. The Rosita plant was constructed

in 1990 and was originally designed and constructed to operate as an up-flow extraction facility. The Rosita property holdings consist

of mineral leases from private landowners covering approximately 3,475 gross and net acres of mineral rights.

Alta Mesa Uranium Project, Texas

The Alta Mesa Uranium Project is a fully licensed

and constructed ISR project and central processing facility currently on standby, located on over 203,000 acres of private land in the

state of Texas. Total operating capacity is 1.5 million lbs U3O8 per year. Alta Mesa historically produced nearly

5 million lbs of U3O8 between 2005 and 2013, when full production was curtailed as a result of low uranium prices

at the time.

Crownpoint and Hosta Butte Uranium Project,

New Mexico

The Company owns a 100% interest in McKinley properties

and a 60% - 100% interest in the adjacent Crownpoint and Hosta Butte properties, all of which are located in McKinley County, New Mexico.

The Company holds a 60% interest in a portion of a certain section at Crownpoint. The Company owns a 100% interest in the rest of the

Crownpoint and Hosta Butte Uranium Project area, subject to a 3% gross profit royalty on uranium produced.

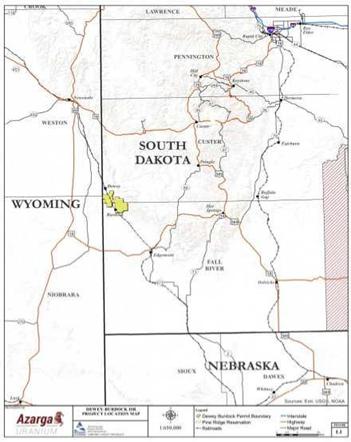

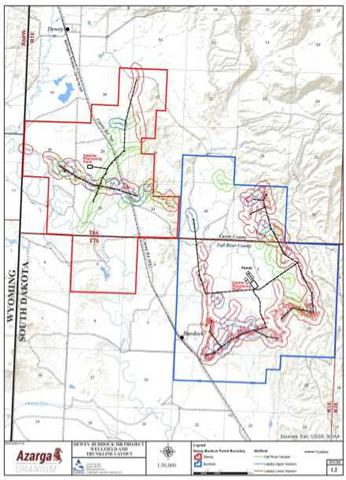

Dewey Burdock Project, South Dakota

The Dewey Burdock Project is an advanced-stage

uranium exploration project located in southwest South Dakota and forms part of the northwestern extension of the Edgemont Uranium Mining

District. The Dewey Burdock Project includes federal claims, private mineral rights and private surface rights controlling the entire

area within the licensed project permit boundary as well as surrounding areas. The Company currently controls approximately 16,962 acres

of net mineral rights and 12,613 acres of surface rights. The net result of the royalty and rental payments results in a cumulative 4.85

percent surface and mineral royalty.

Gas Hills Project, Wyoming

The Company’s owns a 100% interest in the

Gas Hills Project located in the historic Gas Hills uranium district situated 45 miles east of Riverton, Wyoming. The Gas Hills Project

consists of approximately 1,280 surface acres and 12,960 net mineral acres of unpatented lode mining claims, a State of Wyoming mineral

lease, and private mineral leases, within a brownfield site which has experienced extensive development including mine and mill site production.

Additional Properties

enCore holds the following additional non-principal

properties and projects:

| (i) | Nose Rock, New Mexico. The Nose Rock project is located in McKinley County New Mexico, USA on the

northern edge of the Grants Uranium District, approximately 10 miles north-northeast of the Crownpoint and Hosta Butte Uranium Project.

The Nose Rock property consists of 42 owned unpatented lode mining claims comprising over 800 acres (approximately 335 hectares). |

| (ii) | Metamin Properties, Arizona, Utah and Wyoming. Through its subsidiary Metamin Enterprises US Inc.

(“MEUS”), the Company holds various prospective uranium mining properties located in the States of Arizona, Utah and

Wyoming, USA, along with drill core, geophysical data, drilling data and equipment related to the properties. |

| (iii) | West Largo, New Mexico. The West Largo project consist of approximately 3,840 acres (i.e. six square

miles) in McKinley County, New Mexico, along the north-central edge of the Grants Uranium District, approximately 25 miles north of Grants.

The majority of the property is held through deeded mineral rights and also includes 75 unpatented lode claims. |

| (iv) | Ambrosia Lake-Treeline, New Mexico. The Ambrosia Lake – Treeline Property consists of deeded

mineral rights totaling 24,555 acres and a mining lease along with certain unpatented mining claims covering approximately 1,700 acres.

The project is located approximately 115 miles west-northwest of Albuquerque, in McKinley and Cibola Counties, Grants Uranium District,

New Mexico. The project is situated within the boundaries of the Ambrosia Lake mining district, which is the largest uranium mining area

(in terms of pounds of U3O8 production) in the United States. |

| (v) | Checkerboard Mineral Rights, New Mexico. The land position covers approximately 300,000 acres of

deeded ‘checkerboard’ mineral rights, also known as the Frisco and Santa Fe railroad grants. They are located within a large

area of about 75 miles long by 25 miles wide along trend of the Grants Uranium District. The properties are located primarily in McKinley

County which lies in northwestern New Mexico. The properties are approximately 125 miles northwest of Albuquerque, and as close as 4 miles

from the town of Crownpoint. |

| (vi) | Kingsville Dome, Texas. The Kingsville Dome property is located in Kleberg County, Texas and is

situated on several tracts of land leased from third parties. The property is situated approximately eight miles southeast of the city

of Kingsville, Texas. The project is comprised of numerous mineral leases from private landowners, covering an area of approximately 2,434

gross and 2,227 net acres of mineral rights. The Kingsville Dome Central Processing Facility (the “Kingsville Dome Facility”)

is a licensed ISR production facility located on the property. The Company intends to initiate review and refurbishment of the Kingsville

Dome Facility for future production capacity. |

| (vii) | Vasquez Project, Texas. The Vasquez project is located in Duval County, Texas, a short distance

northwest of the town of Hebbronville. The project is situated on a leased tract of land that is being held until final restoration has

been completed. The Vasquez property consists of a mineral lease on 1,023 gross and net acres. |

| (viii) | Butler Ranch Project, Texas. The Butler Ranch project is comprised of non-contiguous fee leases

that cover an area of about 438 acres of mineral rights. The Butler Ranch project is located in the southwestern end of Karnes County,

Texas, about 45 miles southeast of the city of San Antonio, and 12 miles northwest of the town of Kenedy. The project is situated in the

southwestern end of the Karnes County uranium mining district, which was one of the largest uranium production areas in Texas. |

| (ix) | Upper Spring Creek Project, Texas. The Company holds mineral properties located in South Texas

described generally as the Upper Spring Creek Project area. The property is currently comprised of non-contiguous fee leases that cover

an area of about 90.32 acres of surface and 66.49 acres of net mineral rights, and the Company is actively acquiring additional mineral

properties to this project. This project area includes mineral properties that were identified in the Signal Equities LLC database that

the Company acquired in December 2020. These properties are intended to be developed as satellite ion-exchange plants that will provide

loaded resin to the central processing plant located at the Rosita Project. |

| (x) | VANE Dataset and ROFR, Arizona and Utah. During the year ended December 31, 2018, the Company entered

into an agreement with VANE granting the Company exclusive access to certain VANE uranium exploration data and information as well as

a first right of refusal covering seven of VANE’s current uranium projects in Arizona and Utah. In exchange, the Company issued

3,000,000 common shares of the Company and granted VANE certain back-in rights for any projects developed from the use of the data. The

primary term of the agreement is five years and may be renewed by the Company by written notice for three successive renewal periods of

three years each (a total of 14 years). |

| (xi) | Dewey Terrace Project, Wyoming. This project consists of approximately 1,874 acres of surface rights

and approximately 7,514 acres of net mineral rights. The Dewey Terrace Project is located adjacent to the Dewey Burdock Project. |

| (xii) | Juniper Ridge Project, Wyoming. The Juniper Ridge project in Carbon County, Wyoming, consists of

approximately 640 surface acres and 3,240 net mineral acres of unpatented lode mining claims and a State of Wyoming mineral lease and

is located within a brownfield site which has experienced extensive exploration, development, and mine production. |

| (xiii) | Centennial Project, Colorado. The Centennial Project in Weld County, Colorado, is comprised of

approximately 1,365 acres of surface rights and 6,238 acres of net mineral rights. |

| (xiv) | Aladdin Project, Wyoming. The Aladdin Project in Wyoming is comprised of private leases that cover

approximately 5,166 acres of surface rights and 4,712 acres of net mineral rights located in Wyoming. The Aladdin Project is 80 miles

northwest of the Dewey Burdock Project. |

| (xv) | Other Properties: The Company holds the Shirley Basin Project in Wyoming the JB Project in Colorado

and Utah, and the Ticaboo project in Utah. |

Material Mineral Properties

Rosita Plant

Property Description and Location

The Rosita Project is a uranium processing plant

and associated well fields located on a 200-acre tract of land owned by enCore in north-central Duval County Texas, about 14 miles southeast

of the town of Freer and 60 miles west-northwest of the city of Corpus Christi.

The Rosita property holdings consist of mineral

leases from private landowners covering approximately 2,759 gross and net acres of mineral rights. All of the leases for the Rosita area

provide for payment of sliding scale royalties based on the price of uranium, ranging from 6.25% to 18.25% of uranium sales produced from

the leased lands. Under the terms of the leases the lands can be held after the expiration of their primary term and secondary terms,

if restoration and reclamation activities remain ongoing. The leases initially had primary and secondary terms ranging from 2012 to 2016,

with provisions to extend the leases beyond the initial terms. enCore holds these leases by payment of annual property rental fees ranging

from $10 to $30 per acre.

Project Highlights:

| ● | Licensed ISR production facility with 800,000 pounds of U3O8 per year capacity |

| | | |

| | ● | Designed to process feed from multiple satellite operations,

current facility refurbishment and upgrade work projected for completion by Q2 2022 |

| ● | Previous production of 2.65 million pounds of U3O8 from ISR methods |

| | | |

| ● | Centrally located within the South Texas Uranium Belt, which hosts an estimated ~60 million pounds of

unmined U3O8 |

The Rosita Central Processing Facility (“CPP”)

is located in Duval County, Texas about 14 miles southeast of the town of Freer and 60 miles west-northwest of the city of Corpus Christi

on a 200-acre tract of land owned by the Company.

Access to the Rosita project and process facility

is good, including an improved company-owned private drive that connects to a maintained county road to Texas Farm to Market Road 3196

about 1 mile northeast of the intersection of State Highway 44 and FM 3196 in Duval County. Electrical power for the Rosita project is

readily available with an industrial-scale power line extending to the Rosita CPP.

In addition to the 200-acre tract of land owned

by the Company for the Rosita CPP, additional property holdings consist of mineral leases from private landowners covering approximately

3,377 acres of mineral rights. The nearby Rosita South property consists of mineral leases from private landowners covering approximately

1,479 acres of mineral rights.

Property History

Initial production of uranium utilizing the ISR

process commenced in 1990 and continued until July 1999. During that time approximately 2.64 million pounds of U3O8 were

produced. Resin was processed at the Rosita plant, and the recovered uranium was precipitated into a slurry, which was then transported

to Kingsville Dome for final purification, drying and packaging. Production was halted in July of 1999 due to depressed uranium prices.

In the 2007-2008 period upgrades were made to

the processing equipment and additions to the facility were installed, including revisions to the elution and precipitation circuits,

and the addition of a full drying system. Additional facility refurbishment and upgrade work is underway projected for completion by Q2

2022.

Production from a new wellfield, in production

area 3, at the Rosita project began in June 2008. However, technical difficulties that raised the cost of production coupled with a sharp

decline in uranium prices led to the decision to shut-in this wellfield in October 2008, after the production of 10,200 pounds of U3O8.

URI has had no production from the Rosita project since that time.

enCore’s satellite well field and an ion

exchange system are in place at the Rosita project, but only operated for a short period of time in 2008. A total of 10,200 pounds of

uranium were produced between June and October 2008.

URI’s capital expenditures at the Rosita

Project were approximately $13,000 and $9,000 in 2013 and 2012, respectively.

It is anticipated that

future production from the centrally located Rosita CPP would be primarily sourced from multiple satellite operations. There are an estimated

47 deposits with approximately 60 million pounds U3O8 of unmined in-situ amenable mineralization within the

South Texas Uranium Belt. The USGS also estimates that there is the potential to discover an additional 220 million pounds U3O8

(“Assessment of Undiscovered Sandstone-Hosted Uranium Resources in the Texas Coastal Plain, 2015”, November 2015, Susan M.

Hall and Mark J. Mihalasky, USGS, Domestic Uranium Assessment).

Geological Setting and Mineralization

Uranium mineralization

at the Rosita project occurs as roll-front-type deposits hosted in porous and permeable sandstones of the Goliad Formation (of Pliocene

age), at depths ranging from 125 to 350 feet below the surface. The sandstones of the Goliad Formation occur in a deltaic to marginal

marine environment of the Texas Gulf Coastal Plain which dip gently easterly into the Gulf of Mexico. Rosita’s classic C-shaped

roll-front deposits comprise highly sinuous mineralized zones occurring at the interface of oxidized and reduced sediments located in

the easterly part of the Rosita Property shown on the map below.

Licenses and Permits

In Texas, the Texas Commission on Environmental

Quality (“TCEQ”) regulates uranium mining and issues the necessary licenses and permits. A Radioactive Material

License issued by TCEQ covers the Rosita, Kingsville Dome and Vasquez projects and it is in timely renewal. Each site also has class I

non-hazardous injection permits for operation of waste disposal wells on site, which are regulated by the TCEQ as well. All permits for

the disposal wells are active. A renewal of a Class III Underground Injection Control Permit was issued on October 20, 2014.

The Rosita Project includes four TCEQ production

area authorizations (“PAA”) that could allow for low cost and accelerated timeline to production. Production areas

1 and 2 are depleted, and groundwater restoration has been completed to regulatory standards. Production areas 3 and 4 contain uranium

reserves that have yet to be produced. Production areas 1 and 2 consist of seven wellfields whose groundwater has been restored by the

circulation and processing of approximately 1.3 billion gallons of reverse osmosis treated water. In 2013, enCore completed the final

phase of TCEQ required stabilization in production areas 1 and 2. Wells in production areas 1 and 2 were plugged and abandoned in 2014.

A radioactive material license and an underground

injection control permit has been issued for the Rosita Project. On August 30, 2012, enCore filed the requisite application for

renewal of the underground injection control permit. Production could resume in areas already included in existing PAA. As new areas

are proposed for production, additional authorizations under the permit will be required.

Mineral Resources

On March 27, 2014, URI

reported an estimated In-Place Proven Reserve for the Rosita Project (Form 10K for December 31, 2013, US Security and Exchange Commission).

Table 1 – Historical

In-Place Proven Reserve* Estimate for the Rosita Project

| Category | |

Tonnes | | |

Grade eU3O8% | | |

U3O8 (lbs) | |

| In-Place Reserves | |

| 370,000 | | |

| 0.082 | | |

| 614,000 | |