eightk.htm

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 18, 2012

CROWN DYNAMICS CORP.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

333-169501

|

|

98-0665018

|

|

(State or other jurisdiction

|

|

(Commission File Number)

|

|

(IRS Employer

|

|

of Incorporation)

|

|

|

|

Identification Number)

|

| |

|

|

|

|

c/o Steve Aninye

5400 Laurel Springs Pkwy

Suite 107

Suwanee GA 30024

Phone number: 678.764.0355

(Address, including zip code, and telephone number, including area code,

of registrant's principal executive offices)

c/o Delaware Intercorp, Inc.

113 Barksdale Professional Center

Newark, DE 19711

Tel. 302-266-9367

(Name, address, including zip code, and telephone number,

Including area code, of agent for service)

Copy of all Communications to:

Zouvas Law Group, P.C.

2368 Second Avenue, 1st Floor

San Diego, CA 92101

Phone: 619.688.1715

Fax: 619.688.1716

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

£ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

£ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

£ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

£ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

FORWARD LOOKING STATEMENTS

This current report contains forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements relate to future events or our future results of operation or future financial performance, including, but not limited to, the following: statements relating to our ability to raise sufficient capital to finance planned operations for the next 12 months. In some cases, forward-looking statements can be identified by terminology such as “may,” “should,” “intends,” “expects,” “plans,” “anticipates,”

“believes,” “estimates,” “predicts,” “potential,” or “continue;” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors” in this current report, which may cause the Company or our industry’s actual results, levels of activity or performance to be materially different from any future results, levels of activity or performance expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, the Company cannot guarantee future results, levels of activity or performance. Do not place undue reliance on these statements, which speak only as of the date that they were made. These cautionary statements should be considered with any written or oral forward-looking statements that may be issued in the future. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward looking statements to conform these statements to reflect actual results,

later events or circumstances or to reflect the occurrence of unanticipated events.

In this report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to “common shares” refer to the common shares in the Company’s capital stock.

As used in this current report and unless otherwise indicated, the terms “we,” “us,” “our,” the “Company” and “CDDY” refer to Crown Dynamics, Corp.

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT.

On January 20th the company entered into a Technology License Agreement (the “Agreement”) with Zorah LLC (“Zorah”). The license required a one-time issuance of one million two hundred and twenty-five thousand (1,225,000) shares of restricted common stock. Thereby, the Company has exclusive rights to Zorah’s technology for development and distribution worldwide of Zorah’s technologies which include a wireless technology to remotely monitor senior citizens and special needs adults, as well as the development of a transdermal blood sugar monitoring unit, which will allow people to take their blood sugar levels without pricking themselves.

The foregoing summary description of the terms of the Agreement may not contain all information that is of interest to the reader. For further information regarding the terms and conditions of said Agreement, reference is made to the Agreement, which is filed hereto as Exhibit 10.1 and is incorporated herein by reference. Additional information about the technology of the Agreement can also be found in the Business Overview discussion of this Current Report on Form 8-k (the “Filing”).

FORM 10 DISCLOSURE

As disclosed elsewhere in this report, the Company completed a Share Exchange Agreement with Crown Dynamics Corp. (the "Transaction") and Item 2.01(f) of Form 8-K states that if the registrant was a shell company, as it was, immediately before the transaction disclosed under Item 2.01, then the registrant must disclose the information that would be required if the registrant were filing a general form for registration of securities on Form 10.

Accordingly, we are providing below the information that would be included in a Form 10 if we were to file a Form 10. Please note that the information provided below relates to the combined enterprises after the closing of the Transaction, except that information relating to periods prior to the date of the Transaction only relates to the Registrant unless otherwise specifically indicated.

ITEM 1. BUSINESS

History

We were incorporated in Delaware on June 15, 2010 and are a development stage company. On July 15, 2010, we entered into an exclusive worldwide Technology sale agreement (the "Technology Transfer and Sale Agreement ") with Illanit Appelfeld, (the “Seller”), in relation to a Technologyed technology (U.S. Technology Number: 5,799,354) (the “Technology”) for a toothbrush having a handle and a brush head, the brush head comprising two side, and one central bristle tuft bundles, each mounted to a respective separate base. The Technology and technology were transferred to us in exchange of payment to Illanit Appelfeld (the Seller) of US

$9,000 (Nine thousands United States Dollars), according to the terms and conditions specified in the Technology Transfer and Sale Agreement related to the U.S. Technology Number: 5,799,354.

Since 2010, we have migrated from dental technology to greater applications in home medical technology. On January 20th the company entered into a Technology License Agreement (the “Agreement”) with Zorah LLC (“Zorah”). Now the Company has exclusive rights to Zorah’s Technology for development and distribution worldwide of Zorah’s technologies which include a wireless technology to remotely monitor senior citizens and special needs adults, as well as the development of a transdermal blood sugar monitoring unit, which will allow people to take their blood sugar levels without pricking themselves.

Our principal offices are located at 5400 Laurel Springs Pkwy, Suite 107, Suwanee GA 30024. Our registered agent for service of process in Delaware is located at 113 Barksdale Professional Center, Newark, DE 19711, and our registered agent is Delaware Intercorp.

All references to "we," "us," "our," or similar terms used in this prospectus refer to Crown Dynamics Corp. Our fiscal year end is December 31.

Overview

The Company has acquired the rights to a developed and proprietary solution which leverages the latest in wireless technologies (GPS, Cellular, RFID and a combination of sensors), proprietary algorithms and the Internet to remotely monitor, manage and protect loved ones. While there are many markets which can take advantage of such powerful technology, the Company is initially focused on addressing the key pain points plaguing the special needs and the seniors markets.

Business Strategy

The Company’s solution will initially target the Special Needs and Senior Citizens population groups and provides: wandering detection alerts and rescue notification processes; wandering prevention capabilities; proactive emergency communications; and remote safety monitoring offerings. The Company’s solution is packaged within a wireless device worn on an individual in various form factors - that interoperates with other systems to allow the caregiver to access relevant information on the person’s condition and whereabouts. A web browser is required to access and manage the people under care.

The Company has just completed initial beta tests with prospective customers and is in the process of tweaking the solution based on lessons learned from the beta tests. Commercial rollout will commence in November 2011. The company has also signed a definitive agreement with ASA (American Seniors Association) with a membership base of 10 million.

The second phase of the Company’s product involves a proprietary solution for detecting sugar levels and other vital signs, non-invasively, for people with diabetes or at risk of diabetes. The unique invention uses a proprietary ultrasonic technique to accurately detect sugar levels transdermally, continuously, via a wristwatch worn by a person and transmits the information in real-time over the wireless network to The Company servers and designated people are notified of exceptions based on pre-configured preferences.

Potential revenues recur on a monthly basis and are comprised of the following: $299 for the purchase of the device; a monthly service fee of $49.00 for Special Needs customer use; and a monthly service fee of $19.00 for Senior Population customer use. Additional fees will be charged for add-on modules. Devices sold to OEM distribution channels will be priced at $9.00 per month per device.

Business Plan

The Company is initially focused on two markets; the Special Needs and the Senior markets. Both population groups would benefit from The Company’s solution that prevents wandering; detects if wandering happens; optimizes the rescue process of people that wander through The Company’s proprietary Watchtower technology; and effectively monitors people to manage and protect them while at home. The company will launch the second phase of their product in 2012, which is focused on transdermally detecting the chemical constitution of the blood, non-invasively and in real-time. The system utilizes the information to determine the medication that may be present in the person, there enabling very

effective medication compliance management. The same technology will be utilized in Phase 2 to determine sugar levels in real-time which brings an unprecedented level of effectiveness in managing the sugar level problem for people with diabetes or at risk of diabetes. A few key considerations relating to the three markets are provided below:

Special Needs Market:

|

§

|

Approximately seven million people in the U.S. suffer from dementia with approximately two-thirds of total diagnosed with Alzheimer’s.

|

|

§

|

As of 2010, the fastest growing segment of U.S. population was seniors over the age of 65; estimated that 50% of this group is at risk for developing dementia.

|

|

§

|

Estimates of 66% to 95% of dementia people are cared for at home.

|

|

§

|

Approximately 60% of dementia people will wander from home; 51% of those that wander at life risk if not found within 24 hours.

|

|

§

|

Alzheimer’s considered third most expensive disease to treat.

|

|

§

|

Global report by Alzheimer’s Disease International (ADI) predicts dementia sufferers to double in ten years

|

|

§

|

Additional market of 6 million people in the U.S. with other special needs (autism, injury impaired etc.)

|

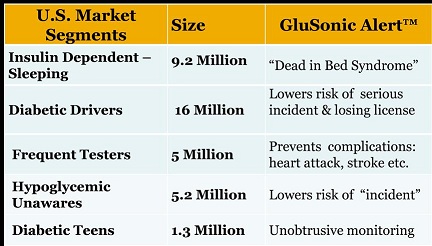

Diabetes Market

Products

The Company provides technology solutions to help protect people with special needs when their personal safety matters. The Company’s temporary name for the product is the “Solution” which is the next generation of Personal Emergency Response System (PERS) that enables mobility and safety by following the person anywhere through state of the art wireless technology. The Solution is the only GPS based product that locates indoors, and works outdoors as well.

Wandering Detection and Rescue

This is focused on detecting when a person leaves a perimeter when they are not supposed to. The care givers, and other designated people are notified in real-time and the person’s location and movement can be viewed on a phone, web browser, etc., to determine if safety is at risk and then take necessary action. The solution provides proprietary workflows to expedite the return process using the Technology pending the Company’s SafetyNet Technology. The solution accounts for situations where the person leaves home legitimately, for example, for a doctor’s visit, shopping, therapy, etc., thereby ensuring that false alerts are not sent to the care givers and rescuers.

Wandering Prevention

This adds optional capabilities to the system to help prevent wandering from happening at all. The system interacts with electronic door locks to lock a door when the person comes too close to a door leading outside. Should wandering occur, however, the wandering detection and return processes kick in.

Current Capabilities include:

|

2.

|

Optimize the process of returning someone that wanders

|

|

3.

|

Panic button (SOS) – more like the traditional PERS

|

|

4.

|

Emergency outbound and inbound phone calls to predetermined phones numbers

|

|

5.

|

Automatic fall detection

|

|

6.

|

Automatic alerts sent to designated people, allowing caregivers to remotely care for, manage and protect people with special needs and seniors, when they are at home or outdoors.

|

|

7.

|

Real Time location, automatic and manual check in

|

|

8.

|

Automatic notifications to caregivers are via cell, text or email and the Watchtower software determines which predetermined responder is located closest for the quickest action.

|

|

9.

|

Product includes voice-to-voice response (without having to answer) to remotely listen in and talk to the person in distress

|

|

10.

|

Product also can be used for a simple 3 button preassigned cell phone to send and receive calls.

|

|

11.

|

Product provides a 24/7 monitoring center

|

Thus far, the Company’s technology is the only comprehensive solution that;

|

1.

|

Automates the process of wandering management

|

|

2.

|

Provides remote monitoring with special alert notification

|

|

3.

|

Enables proactive management of a person’s vital status and

|

|

4.

|

Automates wandering detection and return

|

|

5.

|

Works indoors and outdoors without requiring visibility to satellites for location

|

|

6.

|

Product has the longest battery life (rechargeable with an alert) in the industry

|

|

7.

|

Calls preassigned phone numbers

|

|

8.

|

Receives phone calls without the confusion of having to answer – you just talk and the person can hear you and you hear them

|

|

9.

|

Provides real time continuous location of the person Detects movement and lack of movement

|

|

10.

|

Provides automatic schedule management with a detailed audit trail (who did what when)

|

With the individual wearing or carrying a simple device, the caregiver can determine if the person is safe and accounted for. This non-invasive solution enables caregivers to remotely determine the vital status of the person being monitored, in real-time.

The Company will allow other companies to brand label its software platform and use it in their markets of interest outside the healthcare space. The Company is currently in discussions with some companies that want to OEM the product. The Company will also allow a few companies outside the United States to OEM the solution and sell into the dementia and elder care markets overseas, particularly Asia.

Pictured: Product Sample

Marketing

The Company’s technology is technically superior to the 1.8 million Personal Emergency Response systems (PERS) installed in the US. This market is growing at a rate of 30% per year and is plagued with the transition of phones in the home to cellular and digital service. Over 30% of US homes no longer have the traditional analog phone service of just 5 years ago. These PERS systems are in effect obsolete for 30% of the market and this positions The Company to capture not only the imbedded base but the growth as well. Note this only addresses the wireless advantage.

With 7 million people in the USA diagnosed with dementia, and 6 million with other types of special needs, establishing a monthly monitoring rate of $49 per person yields a market potential of $7.7 billion per year and an additional 6.8 billion per year for the seniors market at $19 per month per person.

Initially, the company will focus on the dementia and special needs space within the United States. The business model is focused on selling directly to institutions that deal with people with dementia and getting endorsements that influence others.

The product will be sold as follows:

|

1.

|

Sell to caregiver agencies and companies

|

|

2.

|

Sell to government agencies, especially states

|

|

3.

|

Sell to home safety monitoring companies

|

|

4.

|

Sell through agent relationships and distributors

|

|

5.

|

Acquire relevant endorsements from the Alzheimer’s Association, American Neurological Association of Doctors, and similar organizations

|

The revenue is based on a recurring annuity model. Customers pay $199.00 to purchase the device and a monthly service fee of $19.95 to $49.95 per month. Additional fees will be charged for the add-on modules and for return incidents. The OEM product is estimated at $9 per month per device, thus allowing a profit motivation for these businesses.

In addition, the Company will explore strategic partnerships interested in using the software platform for other target markets. The Company is in confidential OEM discussions with several major parties interested in brand labeling the Company Software.

Technology Platform

The Company’s proprietary technology is focused on Inter-operability, which is built into the core of the software architecture, via web services, making it very easy to inter-operate with other systems to bring in relevant information in context. The application is deployed on a hosted model. All the caregiver needs is a web browser to access and manage the people under their care. There is nothing to deploy other than strapping the device on the person to be managed. This platform allows the company to protect the uniqueness of the Company design, as we refine our Technology protection.

Competition

The Company has conducted an in-depth analysis of the competitive landscape and has determined that its offering is far superior, will supplant the current technologies and expand the current market. Management believes that the Solution addresses and resolves the shortfalls of the solutions currently available. The current offerings come from a handful of manufacturers.

|

1.

|

Care Trak – Requires a home unit to be installed and the person wears a transmitter. Range is limited in the house and should wandering occur, there is no wide-area tracking capability. All you know is that the person has left but you don’t know where the person is.

|

|

2.

|

Return - The primary solution available today to locate wanderers; requires the police to deploy helicopters with special equipment mounted to search suspected areas in a limited geographic grid pattern; Very intrusive, limited effectiveness and costly to implement.

|

|

3.

|

Nametag – As part of the Alzheimer’s endorsed Safe Return program, the person wears a name plate with a phone number and other information imprinted on it. When the person is found somewhere, disoriented, and the number on the plate is called, help will be sent to rescue the wanderer. The success rate of this option is very limited.

|

|

4.

|

Panic Pendant - There are a number of companies that provide alerts should a patient push a panic button if they fall or are in distress. Pre-programmed emergency contact phone numbers are automatically dialed until someone is reached. These products place the burden on the patient to activate an alert and provide no capabilities to prevent wandering, remote management or locating someone who is lost. They are marketed more heavily to the elder care market.

|

|

5.

|

Linear and Philips and a few others providing the wired PERS systems that have been on the market for decades.

|

None of these competitor’s solutions help detect and manage the vital status of the person.

Insurance

We do not maintain any insurance, but does intend to maintain insurance in the future. Because it does not have any insurance, if we are made a party to a liability action, it may not have sufficient funds to defend the litigation. If that occurs, a judgment could be rendered against the Company that could cause us to cease operations.

Intellectual Property

We have an exclusive license to the Zorah Technology as described in Section 1.01 of this Filing and incorporated herein.

Employees

Currently company has one employee. Additionally, third-parties are instrumental to keep the development of projects on time and on budget. Management expects to continue to use consultants, attorneys, and accountants as necessary.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. The Company’s reports or other filings made with the SEC may be read or photocopied at the SEC’s Public Reference Room, located at 100 F Street, N.W., Washington, DC 20549. Information on the operation of the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330. These reports and other filings may be accessed electronically on the SEC’s web site, www.sec.gov.

ITEM 1A. RISK FACTORS

RISKS RELATING TO OUR COMPANY

|

We are a development stage company with no operating history and may never be able to carry out our business plan or achieve any revenues or profitability; at this stage of our business, even with our good faith efforts, potential investors have a high probability of losing their entire investment.

|

We are subject to all of the risks inherent in the establishment of a new business enterprise. We were established on June 15, 2010, for the purpose of engaging in the development, manufacture, and sale of a toothbrush having a handle and a brush head (the brush head comprising two side, and one central bristle tuft bundles, each mounted to a respective separate base) intended to attain a non-longitudinal movement by normal longitudinal movement of the brush over teeth. We have not generated any revenues nor have we realized a profit from our operations to date, and there is little likelihood that we will generate any revenues or realize any profits in the short term. Any profitability in the future from our business

will be dependent upon the successful marketing and licensing of our technology to one or more third party design and manufacturing companies that would develop and sell a specially-designed medical devices based on our technology. Our business plan is subject to numerous industry-related risk factors as set forth herein. We may not be able to successfully carry out our business. There can be no assurance that we will ever achieve any revenues or profitability. Accordingly, our prospects must be considered in light of the risks, expenses, and difficulties frequently encountered in establishing a new business in our industry, and our Company is a highly speculative venture involving significant financial risk.

|

We expect to incur operating losses in the next twelve months because we have no plan to generate revenues unless and until we successfully find a buyer for our medical technology devices.

|

We have never generated revenues. We intend to market our medical device technology and bring it to market worldwide. We own the right to exploit the technology and Technology for the new invention. However, we have not developed or manufactured any finalized devices based on our technology. We intend to develop our product and market it to third-party sellers. We expect to incur operating losses over the next twelve months because we have no source of revenues unless and until we are successful marketing of our product to one or more third parties. We cannot guarantee that we will ever be successful in marketing our product or in generating revenues in the future. We recognize that if we are unable to

generate revenues, we will not be able to earn profits or continue operations. We can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations.

|

We do not have sufficient cash to fund our operating expenses for the next twelve months, and we will require additional funds through the sale of our common stock, which requires favorable market conditions and interest in our activities by investors. We may not be able to sell our common stock and funding may not be available for continued operations.

|

There is not enough cash on hand to fund our administrative expenses and operating expenses or our proposed marketing and promotion campaign for the next twelve months. Because we do not expect to have any cash flow from operations within the next twelve months, we will need to raise additional capital, which may be in the form of loans from current stockholders and/or from public and private equity offerings. Our ability to access capital will depend on our success in implementing our business plan. It will also depend upon the status of the capital markets at the time such capital is sought. Should sufficient capital not be available, the implementation of our business plan could be delayed and, accordingly, the

implementation of our business strategy would be adversely affected. If we are unable to raise additional funds in the future, we may have to cease all substantive operations. In such event it would not be likely that investors would obtain a profitable return on their investment or a return of their investment at all.

|

Our auditors have expressed substantial doubt about our ability to continue as a going concern, and if we do not raise net proceeds of at least $53,500 from our offering, we may have to suspend or cease operations within twelve months.

|

Our audited financial statements for the period from June 15, 2010, through December 31, 2010, were prepared using the assumption that we will continue our operations as a going concern. We were incorporated on June 15, 2010, and do not have a history of earnings. As a result, our independent accountants in their audit report have expressed substantial doubt about our ability to continue as a going concern. Continued operations are dependent on our ability to complete equity or debt financing activities or to generate profitable operations. Such capital formation activities may not be available or may not be available on reasonable terms. Our financial statements do not include any adjustments that may result from

the outcome of this uncertainty. We believe that if we do not raise net proceeds of at least $53,500 from our offering, we may have to suspend or cease operations within twelve months. Therefore, we may be unable to continue operations in the future as a going concern. If we cannot continue as a viable entity, our stockholders may lose some or all of their investment in the Company.

The Company will need to raise an additional amount of approximately $15,000 in addition to the net proceeds of $53,500 from the offering, either thru additional equity financing or from additional loans from its directors, in order to pay its existing liabilities (other than the Director loans and the offering costs) and hence alleviate the necessity to file for protection under bankruptcy laws.

|

We have no track record that would provide a basis for assessing our ability to conduct successful business activities. We may not be successful in carrying out our business objectives.

|

The revenue and income potential of our proposed business and operations are unproven as the lack of operating history makes it difficult to evaluate the future prospects of our business. There is nothing at this time on which to base an assumption that our business operations will prove to be successful or that we will ever be able to operate profitably. Accordingly, we have no track record of successful business activities, strategic decision-making by management, fund-raising ability, and other factors that would allow an investor to assess the likelihood that we will be successful in licensing our technology for the development, manufacture and sale of a product based on our Technology. There is a

substantial risk that we will not be successful in implementing our business plan, or if initially successful, in thereafter generating any operating revenues or in achieving profitable operations.

|

Because we are not making provisions for a refund to investors, you may lose your entire investment.

|

Even though our business plan is based upon the complete subscription of the shares offered through this offering, the offering makes no provisions for refund to an investor. We will utilize all amounts received from newly issued common stock purchased through this offering even if the amount obtained through this offering is not sufficient to enable us to go forward with our planned operations. Any funds received from the sale of newly issued stock will be placed into our corporate bank account. We do not intend to escrow any funds received through this offering. Once funds are received as the result of a completed sale of common stock being issued by us, those funds will be placed into our corporate bank account

and may be used at the discretion of management.

|

As a development stage company, we may experience substantial cost overruns in marketing our technology and in locating and negotiating a license agreement with a third party for the licensing of our Technology and the manufacture of a product based on our Product.

|

We may experience substantial cost overruns in marketing our technology and in locating and negotiating a license agreement with a third party for the licensing of our Technology and the manufacture of a product based on our Product. We may not have sufficient capital to successfully implement and complete our project. We may not be able to find a third party manufacturer willing to license our technology and manufacture a product based on our Technology because of industry conditions, general economic conditions, and/or competition from potential manufacturers and distributors of competing products. In addition, the commercial success of any product is often dependent upon factors beyond the control of

the company attempting to market the product, including, but not limited to, market acceptance of the product and whether or not third parties promote the products through prominent marketing channels and/or other methods of promotion. Even if we do succeed in raising the capital to locate and negotiate a license agreement with a third party for the licensing of our Technology and the manufacture of a product based on our Technology, we cannot ensure that the final cost for producing this product will be found to be warranted and reasonable, and therefore we cannot ensure that the product, if developed, will actually find popularity and acceptance.

| |

We will rely on a third party to resell our product based on our technology

|

We will rely on third parties to help us to develop, manufacture, and market a product based on our technology. If we are unable to enter into satisfactory agreements, or if such third parties’ manufacturing and distribution plans are not satisfactory, we may not be able to commercialize products based on our technology as planned. We may not be able to contract with third parties to manufacture products based on our technology in an economical manner. Furthermore, third-party manufacturers may not adequately perform their obligations, which may impair our competitive position. If a manufacturer fails to perform, we could experience significant time delays or we may be unable to

commercialize specialized medical devices based on our Technology, which would result in losses of sales and goodwill.

| |

We are a small company with limited resources compared to some of our current and potential competitors, and the third party licensees to whom we will license our technology may not be able to compete effectively and increase market share.

|

Specially-designed medical devices are part of an industry that is competitive, and although we believe our technology offers unique developments, we cannot guarantee that these unique features are enough to effectively capture a significant enough market share to successfully launch and sustain a product based on our Technology. Based on our company’s initial research through both the Internet and trade journals, as well as through an extensive search through existing Technologies, we believe there is no one in the industry that has successfully brought a product like ours to market; nonetheless, our current and potential competitors have longer operating histories, significantly greater resources

and name recognition, and a larger base of distributors and customers than we have. In addition, any third parties with whom we will eventually sign license agreements may not be able to successfully compete with current companies in the field. These competitors may have greater name credibility than our future third party licensees with our potential distributors and customers. These competitors also may be able to adopt more aggressive pricing policies and devote greater resources to the development, promotion, and sale of their products and services than our third party licensees can to products based on our Technology. To be competitive, our third party licensees will have to continue to invest significant resources in research and development, sales and marketing, and customer support. They may not have sufficient resources to make

these investments or to develop the technological advances necessary to be competitive, which in turn will cause our business to suffer and restrict our profitability potential.

|

Changing consumer preferences may negatively impact our business.

|

The Company's success is dependent upon the ongoing need and appeal for a specially-designed medical devices. Consumer preferences with respect to such devices are continuously changing and are difficult to predict. As a result of changing consumer preferences, we cannot assure you that a product based on our Technology will achieve customer acceptance, or that it will continue to be popular with consumers for any significant period of time, or that new products will achieve an acceptable degree of market acceptance, or that if such acceptance is achieved, it will be maintained for any significant period of time. Our success is dependent upon our third party licensees’ ability to develop, introduce, and gain

customer acceptance, and on consumer willingness to continue on a long term basis to adapt their current practices to include the use of a specialized medical device. The failure of a product based on our Technology to achieve and sustain market acceptance and to produce acceptable margins could have a material adverse effect on our financial condition and results of operations.

|

Our Directors own 100% of the outstanding shares of our common stock, and may be able to influence control of the company or decision making by management of the Company.

|

Our Directors presently own 100% of our outstanding common stock. If all of the 2,500,000 shares of our common stock being offered hereby are sold, the shares held by our Directors will constitute approximately 55% of our outstanding common stock. After sale of all stock, the current Directors will still have a majority control and will still have a majority of the voting power for all business decisions.

|

If our intellectual property protection is inadequate, competitors may gain access to our technology and undermine our competitive position.

|

We regard our current and future intellectual property as important to our success, and we rely on Technology law to protect our proprietary rights. Despite our precautions, unauthorized third parties may copy certain portions of products based on our Technology or reverse engineer or obtain and use information that we regard as proprietary. We have been granted one Technology in the United States and we may seek additional Technologies in the future. We do not know if any future Technology application will be issued with the scope of the claims we seek, if at all or whether any Technologies we receive will be challenged or invalidated. Thus, we cannot assure you that our intellectual property rights can be

successfully asserted in the future or that they will not be invalidated, circumvented or challenged. In addition, the laws of some foreign countries do not protect proprietary rights to the same extent as do the laws of the United States. Our means of protecting our proprietary rights in the United States or abroad may not be adequate and competitors may independently develop a similar technology. Any failure to protect our proprietary information and any successful intellectual property challenges or infringement proceedings against us could have a material adverse effect on our business, financial condition, or results of operations.

|

We may be subject to intellectual property litigation, such as Technology infringement claims, which could adversely affect our business.

|

Our success will also depend in part on our ability to locate one or more third party licensees to develop a commercially viable product without infringing the proprietary rights of others. Although we have not been notified of any infringement claims, other Technologies could be filed which would prohibit or limit our third party licensees’ ability to develop and market specialized medical devices based on our license in the future. In the event of an intellectual property dispute, we may be forced to litigate. Intellectual property litigation would divert management's attention from developing our product and would force us to incur substantial costs regardless of whether or not we are successful. An adverse

outcome could subject us to significant liabilities to third parties, and force us to cease operations.

|

If and when products based on our technology are sold, we may be liable for product liability claims and we presently do not maintain product liability insurance.

|

The specially-designed medical devices may expose us to potential liability from personal injury or property damage claims by end-users of the product. We currently have no product liability insurance to protect us against the risk that in the future a product liability claim or product recall could materially and adversely affect our business. Inability to obtain sufficient insurance coverage at an acceptable cost or otherwise to protect against potential product liability claims could prevent or inhibit the commercialization of our product. We cannot assure you that when our third party licensees commence distribution of a product based on our Technology that we will be able to obtain or maintain adequate coverage

on acceptable terms, or that such insurance will provide adequate coverage against all potential claims. Moreover, even if we maintain adequate insurance, any successful claim could materially and adversely affect our reputation and prospects, and divert management’s time and attention. If we are sued for any injury allegedly caused by future products based on our Technology, our liability could exceed our total assets and our ability to pay the liability.

|

We did not conduct due diligence regarding the inventors’ experience nor regarding what was involved in designing and Technologizing the technology.

|

We did not conduct due diligence regarding the inventor’s experience in the dental field nor regarding what was involved in designing and Technologizing the technology that underlies the Technology. We do not know whether the inventor had experience in the dental field or whether he properly designed the technology. Neither can we assure you that we will be able to develop the Technologized technology into a product. Any failure in the design of the Technologized technology could have a material adverse effect on our business, financial condition, or results of operations.

RISKS ASSOCIATED WITH OUR BUSINESS

Since we do not have an alternative plan of operations, if results from our initial work program are negative, anyone purchasing our stock will likely lose their entire investment.

If the results from the initial phase of our development program are negative and do not warrant additional phases of production work, we will need to seek other product development opportunities. We cannot assure that we will have enough funds to purchase or develop additional products or licenses. If the results from the initial phase of work on our products are negative and we cannot find other feasible development opportunities, anyone purchasing our stock will likely lose their entire investment.

We operate in a highly technical and competitive environment.

We operate in a highly-competitive business environment. Accordingly, demand for our products and services is largely dependent on our ability to provide leading-edge, technology-based solutions that reduce the operator’s overall cost of living and medical expenses. If competitive or other market conditions impact our ability to continue providing superior-performing product offerings, our financial condition, results of operations or cash flows could be adversely impacted.

Our businesses are subject to a variety of governmental regulations.

We are exposed to a variety of federal, state, local and international laws and regulations relating to matters such as environmental, health and safety, labor and employment, import/export control, currency exchange, bribery and corruption and taxation. These laws and regulations are complex, change frequently and have tended to become more stringent over time. In the event the scope of these laws and regulations expand in the future, the incremental cost of compliance could adversely impact our financial condition, results of operations or cash flows.

Our industry is experiencing more litigation involving claims of infringement of intellectual property rights.

Over the past few years, our industry has experienced increased litigation related to the infringement of intellectual property rights. Although no material matters are pending or threatened at this time, we, as well as certain of our competitors, have been named as defendants in various intellectual property matters in the past. These types of claims are typically costly to defend, involve monetary judgments that, in certain circumstances, are subject to being enhanced and are often brought in venues which have proved to be favorable to plaintiffs. If we are served with an intellectual property claim which we are unsuccessful in defending, it could adversely impact our results of

operations and cash flows.

The loss of strategic relationships used in the development of our products and technology could impede our ability to complete our products and result in a material adverse effect causing the business to suffer.

We may rely on strategic relationships with technology development partners to provide technology. A loss of these relationships for any reason could cause us to experience difficulties in completing the development of our product and implementing our business strategy. There can be no assurance that we could establish other relationships of adequate expertise in a timely manner or at all.

RISKS RELATING TO OUR COMMON STOCK

|

We may in the future issue additional shares of our common stock which would reduce investors’ ownership interests in the Company and which may dilute our share value. We do not need stockholder approval to issue additional shares.

|

Our certificate of incorporation authorizes the issuance of 200,000,000 shares of common stock, par value $0.0001 per share. The future issuance of all or part of our remaining authorized common stock may result in substantial dilution in the percentage of our common stock held by our then existing stockholders. We may value any common stock issued in the future on an arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common stock.

|

Our common stock is subject to the "penny stock" rules of the SEC and the trading market in our securities is limited, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

|

The Securities and Exchange Commission has adopted Rule 15g-9 which establishes the definition of a "penny stock," for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require: (i) that a broker or dealer approve a person's account for transactions in penny stocks; and (ii) the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. In order to approve a person's account for transactions in penny

stocks, the broker or dealer must: (i) obtain financial information and investment experience objectives of the person; and (ii) make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the Security and Exchange Commission relating to the penny stock market, which, in highlight form: (i) sets forth the basis on which the broker or dealer made the suitability determination; and (ii) that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

Generally, brokers may be less willing to execute transactions in securities subject to the "penny stock" rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

|

We do not intend to pay cash dividends on our shares of common stock but rather, we intend to finance the development and expansion of our business, delaying or perhaps preventing investors from receiving a return on their shares.

|

Because we do not intend to pay any cash dividends on our shares of common stock, our stockholders will not be able to receive a return on their shares unless they sell them.

We intend to retain any future earnings to finance the development and expansion of our business. We do not anticipate paying any cash dividends on our common stock in the foreseeable future. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless they sell them at a price higher than that which they initially paid for such shares.

|

The investors may sustain a loss of their investment based on the offering price of our common stock.

|

The price of our common stock in this offering has not been determined by any independent financial evaluation, market mechanism or by our auditors, and is therefore, arbitrary. Because we have no significant operating history and have not generated any revenues to date, the price of our common stock is not based on past earnings, nor is the price of our common stock indicative of the current market value of the assets owned by us. As a result, the price of the common stock in this offering may not reflect how the stock is received on the market. There can be no assurance that the shares offered hereby are worth the price for which they are offered and investors may therefore lose a portion or

all of their investment.

| |

State securities laws may limit secondary trading, which may restrict the states in which you may sell the shares offered by this prospectus.

|

If you purchase shares of our common stock sold in this offering, you may not be able to resell the shares in any state unless and until the shares of our common stock are qualified for secondary trading under the applicable securities laws of such state or there is confirmation that an exemption, such as listing in certain recognized securities manuals, is available for secondary trading in such state. Thirty-three states have what is commonly referred to as a “manual exemption” for secondary trading of securities such as those to be resold by selling stockholders under this registration statement. In these states, so long as the issuer obtains and maintains a listing in Mergent, Inc. or Standard and

Poor’s Corporate Manual, secondary trading of common stock can occur without any filing, review or approval by state regulatory authorities in these states. These states are: Alaska, Arizona, Arkansas, Colorado, Connecticut, District of Columbia, Florida, Hawaii, Idaho, Indiana, Iowa, Kansas, Maine, Maryland, Massachusetts, Michigan, Mississippi, Missouri, Nebraska, New Jersey, New Mexico, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Rhode Island, South Carolina, Texas, Utah, Washington, West Virginia, and Wyoming. Ten states provide for an exemption for non-issuer transactions in outstanding securities affected through a registered broker-dealer when the securities are subject to registration under Section 12 of the Securities Exchange Act of 1934 for at least 90 days (180 days in Alabama). These states are: Alabama, Colorado, District of Columbia, Illinois, Kansas,

Missouri, New Jersey, New Mexico, Oklahoma, and Rhode Island.

We currently do not intend to register or qualify our stock in any state or seek coverage in one of the recognized securities manuals. Because the shares of our common stock registered hereunder have not been registered for resale under the blue sky laws of any state, and we have no current plans to register or qualify our shares in any state, the holders of such shares and persons who desire to purchase such shares in any trading market that might develop in the future should be aware that there may be significant state blue sky restrictions upon the ability of investors to purchase and sell such shares. In this regard, each state's statutes and regulations must be reviewed before engaging in any securities sales

activities in a state to determine what is permitted, or not permitted, in a particular state. Furthermore, even in those states that do not require registration or qualification for the resale of registered securities, such states may require the filing of notices or place additional conditions on the availability of exemptions. Accordingly, since many states continue to restrict the resale of securities that have not been qualified for resale, investors should consider any potential secondary market for our securities to be a limited one.

In addition, at this time we do not know in which states, if any, we will be selling the offered securities or whether our securities will be registered or exempt from registration under the laws of such state. Our officers reside outside of the United States, and initially they intend to sell the offered securities to foreign investors. Should they be unsuccessful in selling all of the offered securities to foreign investors, they may seek to locate investors in the United States, in which case, we will then address all applicable state law registration requirements. In addition, in connection with our intent to have our securities listed on the OTCBB, a determination regarding state

law registration requirements will be made in conjunction with those market makers, if any, who agree to serve as market makers for our common stock. We have not yet applied to have our securities registered in any state, and we will not do so until we receive expressions of interest from investors resident in specific states after they have reviewed our Registration Statement. We will comply with the relevant blue-sky laws of any state in which we decide to sell our securities

|

Our directors do not have experience with the FDA approval and are not equipped to manage the FDA approval process and therefore will need to condition the granting of a license agreement for our technology based on the feasibility of the third party licensing company to manage this process.

|

| |

The Directors of Crown Dynamics Corp. have no experience with the FDA approval process, from the premarket approval application requirement stage, through the duration of the approval process, and all other stages, including registration and listing requirements, labeling requirements, quality system regulation and manufacturing of the device, post-market reporting and record keeping requirements, import and export requirements and remedies for non-compliance. While our Directors do have business and accounting backgrounds, the Company will seek third party licensing partners that have experience with getting FDA approval and are familiar with what is required during each phase. If we are unable to find a third party

with FDA approval experience interested in licensing our technology, we may not be able to complete the plan of operations as detailed in this document and/or we may need to hire consultants at additional cost, which may require additional funds, that we do not have at this time.

ITEM 2. FINANCIAL INFORMATION

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following summarizes the factors affecting the operating results and financial condition of Crown Dynamics Corp. This discussion should be read together with the financial statements of Crown Dynamics Corp. and the notes to financial statements included elsewhere in this current report. In addition to historical financial information, the following discussion and analysis contain forward-looking statements that involve risks, uncertainties and assumptions. Our actual results and timing of selected events may differ materially from those anticipated in these forward-looking statements as a result of many factors, including those discussed

under “Risk Factors” and elsewhere in this report. We encourage you to review our “Cautionary Note Regarding Forward-Looking Statements and Industry Data” at the front of this current report, and our “Risk Factors” set forth above.

PLAN OF OPERATION

We are a development stage company that has acquired the technology to develop two new home medical devices. The Solution will initially target the Special Needs and Senior Citizens population groups and provides: wandering detection alerts and rescue notification processes; wandering prevention capabilities; proactive emergency communications; and remote safety monitoring offerings. The Company’s solution is packaged within a wireless device worn on an individual in various form factors - that interoperates with other systems to allow the caregiver to access relevant information on the person’s condition and whereabouts. A web browser is required to access and manage the people

under care.

The Company has just completed initial beta tests with prospective customers and is in the process of tweaking the solution based on lessons learned from the beta tests. Commercial rollout will commence in November 2011. The company has also signed a definitive agreement with ASA (American Seniors Association) with a membership base of 10 million.

The second phase of the Company’s product involves a proprietary solution for detecting sugar levels and other vital signs, non-invasively, for people with diabetes or at risk of diabetes. The unique invention uses a proprietary ultrasonic technique to accurately detect sugar levels transdermally, continuously, via a wristwatch worn by a person and transmits the information in real-time over the wireless network to The Company servers and designated people are notified of exceptions based on pre-configured preferences.

Potential revenues recur on a monthly basis and are comprised of the following: $299 for the purchase of the device; a monthly service fee of $49.00 for Special Needs customer use; and a monthly service fee of $19.00 for Senior Population customer use. Additional fees will be charged for add-on modules. Devices sold to OEM distribution channels will be priced at $9.00 per month per device.

RESULTS OF OPERATIONS

Nine Months Ended September 30, 2011 Compared with Nine Months Ended September 30, 2010

Revenues

During the Nine Months ended September 30, 2011, we have generated no revenues and have not generated revenues since its inception. We anticipate that we will generate revenues in the first half of 2012.

Expenses

The operating expenses and net loss for the nine months ended September 30, 2011 amounted to $26,363. In comparison, the operating expenses for the nine months ending September 30, 2010 amounted to $15,472

The significant increase in total expenses in fiscal 2011 resulted primarily from the significant increase in professional fees.

Year Ended December 31, 2010 Compared with Inception

Revenues

During the year ended December 31, 2010, we have generated no revenues and have not generated revenues since its inception.

Expenses

During the fiscal year ended December 31, 2010 Total expenses were $15,472 which included $1500 in filing fees, $2472 in transfer agent fees, professional fees of $1000 and patent expenses of $9000. This compares to our total expenses of $49,475 incurred since inception, which included $30,879 in professional’s fee and total filing fees of $5,624.

The significant decrease in total expenses in fiscal 2010 resulted primarily from the professional fees that were paid out in 2011.

LIQUIDITY AND CAPITAL RESOURCES

Liquidity and Capital Resources

Our balance sheet as September 30, 2011 reflects $300 in cash and cash equivalents. Cash from inception to date have been sufficient to provide the operating capital necessary to operate to date (funded by loans from the Directors). The operating expenses and net loss for the nine months ended September 30, 2011 amounted to $26,363.

We intend to raise the balance of our cash requirements for the next 12 months (approximately $2,000,000) from private placements or a registered public offering (either self-underwritten or through a broker-dealer). If we are unsuccessful in raising enough money through future capital-raising efforts, we may review other financing possibilities such as bank loans. At this time, our Company does not have a commitment from any broker/dealer to provide financing. There is no assurance that any financing will be available or if available, on terms that will be acceptable.

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Uses of estimates in the preparation of financial statements

The preparation of financial statements in conformity with accounting principles generally accepted in the United States ("GAAP") requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Estimates are used for the valuation of the Company’s stock, as the Company’s stock is not currently trading and the valuation of equity and equity-linked instruments such as options using the Black-Sholes model.

Cash and cash equivalents

Cash and cash equivalents consist of all cash balances and highly liquid investments with an original maturity of three months or less. Because of the short maturity of these investments, the carrying amounts approximate their fair value. Cash and cash equivalents are invested in a highly liquid money market fund. Restricted cash is excluded from cash and cash equivalents and is included in other current and long-term assets.

Fair Value of Financial Instrument

The Company’s financial instruments consisted of cash, accounts payable and accounts receivables. Unless otherwise noted, it is management’s opinion that the Company is not exposed to significant interest, currency or credit risks arising from these financial instruments. Because of the short maturity of such assets and liabilities, the fair value of these financial instruments approximate their carrying values, unless otherwise noted.

Property and equipment

Expenditures for new facilities or equipment and expenditures that extend the useful lives or expand the production capacity of existing facilities or equipment are capitalized and depreciated using the straight-line or units of production method at rates sufficient to depreciate such costs over the estimated productive lives of such facilities based on proven and probable reserves.

Impairment of long-lived assets

The Company reviews and evaluates its long-lived assets for impairment annually and at interim periods if events or changes in circumstances indicate that the related carrying amounts may not be recoverable. An impairment is determined to exist if the total estimated future cash flows on an undiscounted basis are less than the carrying amount of the assets. An impairment loss is measured and recorded based on discounted estimated future cash flows. Future cash flows are estimated based on quantities of development of the technologies that the Company has acquired.

Revenue recognition

We are an exploration stage company and have not yet achieved any revenues. We will recognize revenue on the development and sale of our technologies when the product can be placed for purchase and the development is complete.

Income Taxes

The Company accounts for income taxes using the liability method, recognizing certain temporary differences between the financial reporting basis of the Company’s liabilities and assets and the related income tax basis for such liabilities and assets. This method generates either a net deferred income tax liability or asset for the Company, as measured by the statutory tax rates in effect. The Company derives its deferred income tax charge or benefit by recording the change in either the net deferred income tax liability or asset balance for the year.

The Company’s deferred income tax assets include certain future tax benefits. The Company records a valuation allowance against any portion of those deferred income tax assets when it believes, based on the weight of available evidence, it is more likely than not that some portion or all of the deferred income tax asset will not be realized.

OFF-BALANCE SHEET ARRANGEMENTS

We have no off-balance sheet arrangements.

RECENT ACCOUNTING PRONOUNCEMENTS

In August 2009, FASB issued an amendment to the accounting standards related to the measurement of liabilities that are recognized or disclosed at fair value on a recurring basis. This standard clarifies how a company should measure the fair value of liabilities and that restrictions preventing the transfer of a liability should not be considered as a factor in the measurement of liabilities within the scope of this standard. This standard is effective for the Company on October 1, 2009. The adoption of this amendment did not have a material effect on the Company’s consolidated financial statements.

In October 2009, FASB issued an amendment to the accounting standards related to the accounting for revenue in arrangements with multiple deliverables including how the arrangement consideration is allocated among delivered and undelivered items of the arrangement. Among the amendments, this standard eliminated the use of the residual method for allocating arrangement considerations and requires an entity to allocate the overall consideration to each deliverable based on an estimated selling price of each individual deliverable in the arrangement in the absence of having vendor-specific objective evidence or other third-party evidence of fair value of the undelivered items. This standard

also provides further guidance on how to determine a separate unit of accounting in a multiple-deliverable revenue arrangement and expands the disclosure requirements about the judgments made in applying the estimated selling price method and how those judgments affect the timing or amount of revenue recognition. This standard, for which the Company is currently assessing the impact, will become effective on January 1, 2011.

In October 2009, the FASB issued an amendment to the accounting standards related to certain revenue arrangements that include software elements. This standard clarifies the existing accounting guidance such that tangible products that contain both software and non-software components that function together to deliver the product’s essential functionality, shall be excluded from the scope of the software revenue recognition accounting standards. Accordingly, sales of these products may fall within the scope of other revenue recognition standards or may now be within the scope of this standard and may require an allocation of the arrangement consideration for each element of the

arrangement. This standard, for which the Company is currently assessing the impact, will become effective on January 1, 2011.

In January 2010, the FASB issued an amendment to ASC 505, Equity, where entities that declare dividends to shareholders that may be paid in cash or shares at the election of the shareholders are considered to be a share issuance that is reflected prospectively in EPS, and is not accounted for as a stock dividend. This standard is effective for interim and annual periods ending on or after December 15, 2009 and is to be applied on a retrospective basis. The adoption of this standard is not expected to have a significant impact on the Company’s financial statements.

In January 2010, the FASB issued an amendment to ASC 820, Fair Value Measurements and Disclosure, to require reporting entities to separately disclose the amounts and business rationale for significant transfers in and out of Level 1 and Level 2 fair value measurements and separately present information regarding purchase, sale, issuance, and settlement of Level 3 fair value measures on a gross basis. This standard, for which the Company is currently assessing the impact, is effective for interim and annual reporting periods beginning after December 15, 2009, with the exception of disclosures regarding the purchase, sale, issuance, and settlement of Level 3 fair value measures which are effective for fiscal

years beginning after December 15, 2010.

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

Not required.

ITEM 3. PROPERTIES

Our principal executive office consists of approximately 1,200 square feet of space located 5400 Laurel Springs Pkwy, Suite 107, Suwanee GA 30024, rented on a month-to-month basis. The telephone number is 678.764.0355. The space is adequate for our Company’s immediate needs. Additional space may be required as operations expand.

ITEM 4. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of January 17, 2012, the beneficial ownership of the outstanding common stock by: (i) any holder of more than five (5%) percent; (ii) each of our executive officers and directors; and (iii) our directors and executive officers as a group. Unless otherwise indicated, each of the stockholders named in the table below has sole voting and dispositive power with respect to such shares of common stock. As of the date of this Current Report, there are 16,500,000 shares of common stock issued and outstanding.

| |

|

|

|

Name and Address of Beneficial Owner

|

Amount and Nature of Beneficial Ownership

|

Percentage of Beneficial Ownership

|

|

Directors and Officers:

|

|

|

| |

|

|

|

Steve Aninye

5400 Laurel Springs Pkwy

Suite 107

Suwanee GA 30024

|

9,000,000

|

54.54%

|

Exemption From Registration. The shares of Common Stock referenced herein were issued in reliance upon the exemption from securities registration afforded by the provisions of Section 4(2) of the Securities Act of 1933, as amended, (“Securities Act”), and/or Regulation D, as promulgated by the U.S. Securities and Exchange Commission under the Securities Act, based upon the following: (a) each of the persons to whom the shares of Common Stock were issued (each such person, an “Investor”) confirmed to the Company that it or he is an “accredited investor,” as defined in Rule 501 of Regulation D promulgated under the Securities Act and has such background,

education and experience in financial and business matters as to be able to evaluate the merits and risks of an investment in the securities, (b) there was no public offering or general solicitation with respect to the offering of such shares, (c) each Investor was provided with certain disclosure materials and all other information requested with respect to the Company, (d) each Investor acknowledged that all securities being acquired were being acquired for investment intent and were “restricted securities” for purposes of the Securities Act, and agreed to transfer such securities only in a transaction registered under the Securities Act or exempt from registration under the Securities Act and (e) a legend has been, or will be, placed on the certificates representing each such security stating that it was restricted and could only be transferred if subsequently registered

under the Securities Act or transferred in a transaction exempt from registration under the Securities Act.

ITEM 5. DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth the names and ages of our current directors and executive officers. Our Board of Directors appoints our executive officers. Directors serve until the earlier occurrence of the election of his or her successor at the next meeting of stockholders, death, resignation or removal by the Board of Directors. There are no family relationships among our directors, executive officers, or director nominees.

| Name |

Age |

Position |

|

Steve Aninye

5400 Laurel Springs Pkwy

Suite 107

Suwanee GA 30024

|

|

CEO and Chairman of Board of Director

|

STEVE ANINYE Mr. Aninye was CEO and founder of Omnilink Systems (“Omnilink”); a technology solution provider that offers a product used in enforcing accountability and compliance with offenders in alternative sanction programs. Mr. Aninye conceived, designed and built both the Omnilink hardware and software platform and was also responsible for raising over $18 million in start-up funding. Omnilink was recognized by Frost & Sullivan and nominated for the company’s Mobile Vital Status Services Award.

Prior to his tenure at Omnilink, Mr. Aninye was Executive Vice President and CTO at InfoImage Corporation (“InfoImage”), a leading provider of enterprise portal software systems. Mr. Aninye was part of the InfoImage team that raised $65 million in capital for ongoing development, research and capital expenditures. Microsoft invested $10 million in InfoImage. Mr. Aninye also led the engineering team at Manhattan Associates, a leading supply chain software provider and, prior to that, served in senior technical management positions at Compaq and Eaton Corporation. At Eaton, Mr. Aninye led the team that developed an innovative approach for a much more

profitable ion implanter system that continues to be an Eaton’s flagship product.

Mr. Aninye holds a BSEE in electronic engineering and an MBA from the University of Wisconsin.

Directors

Each director serves until our next annual meeting of the stockholders or unless they resign earlier. The Board of Directors elects officers and their terms of office are at the discretion of the Board of Directors. Each of our directors serves until his or her successor is elected and qualified. Each of our officers is elected by the Board of Directors to a term of one (1) year and serves until his or her successor is duly elected and qualified, or until he or she is removed from office. At the present time, members of the Board of Directors are not compensated in cash for their services to the Board.

Compliance with Section 16(a) of the Securities Exchange Act of 1934

Section 16(a) of the Securities Exchange Act of 1934 requires our executive officers and directors, and persons who beneficially own more than 10% of our equity securities, to file reports of ownership and changes in ownership with the Securities and Exchange Commission. Officers, directors and greater than 10% shareholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file.

Audit Committee

The Company intends to establish an audit committee of the Board of Directors, which will consist of soon-to-be-nominated independent directors. The audit committee’s duties would be to recommend to the Company’s Board of Directors the engagement of an independent registered public accounting firm to audit the Company’s financial statements and to review the Company’s accounting and auditing principles. The audit committee would review the scope, timing and fees for the annual audit and the results of audit examinations performed by the internal auditors and independent registered public accounting firm, including their recommendations to

improve the system of accounting and internal controls. The audit committee would, at all times, be composed exclusively of directors who are, in the opinion of the Company’s Board of Directors, free from any relationship which would interfere with the exercise of independent judgment as a committee member and who possess an understanding of financial statements and generally accepted accounting principles.

Compensation Committee

The Company intends to establish a compensation committee of the Board of Directors. The compensation committee would review and approve the Company’s salary and benefits policies, including compensation of executive officers.

Security Holders Recommendations to Board of Directors

Our Company does not currently have a process for security holders to send communications to the Board of Directors. However, we welcome comments and questions from our shareholders. Shareholders can direct communications to Chief Executive Officer Steve Aninye at the executive offices.

While we appreciate all comments from shareholders, we may not be able to individually respond to all communications. Our Company does attempt to address shareholder questions and concerns in press releases and documents filed with the SEC so that all shareholders have access to information at the same time. Mr. Aninye collects and evaluates all shareholder communications. If the communication is directed to the Board of Directors generally or to a specific director, Mr. Aninye will disseminate the communications to the appropriate party at the next scheduled Board of Directors meeting. If the communication requires a more urgent response, Mr. Aninye will direct that

communication to the appropriate executive officer. All communications addressed to our directors and executive officers will be reviewed by those parties unless the communication is clearly frivolous.

ITEM 6. EXECUTIVE COMPENSATION

Compensation of Officers

A summary of cash and other compensation paid in accordance with management consulting contracts for our Principal Executive Officer and other executives for the most recent three years is as follows:

|

Name and Principal Position