UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

FOR THE QUARTERLY PERIOD ENDED

Commission File Number

(Exact Name of Registrant as Specified in Its Charter)

| (State or Other Jurisdiction | (I.R.S. Employer | |

| of Incorporation or Organization) | Identification No.) |

(Address of Principal Executive Offices and Issuer’s

Telephone Number, including Area Code)

1 Raffles Place, #33-02

One Raffles Place Tower One

Singapore 048616

+65 6491 7998

(Former Address of Principal Executive Offices and Issuer’s

Telephone Number, including Area Code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| N/A |

Indicate by check mark whether the registrant:

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject

to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has

submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 229.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | |

| Smaller reporting company | ||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is

a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐

As of September 27, 2021, the issuer had outstanding shares of common stock.

TABLE OF CONTENTS

| 2 |

CAUTIONARY NOTE CONCERNING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q includes "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended that are not historical facts, and involve risks and uncertainties that could cause actual results to differ materially from those expected and projected. All statements, other than statements of historical facts, included in this Form 10-Q including, without limitation, statements in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” regarding the Company’s financial position, business strategy and the plans and objectives of management for future operations, events or developments which the Company expects or anticipates will or may occur in the future, including such things as future capital expenditures (including the amount and nature thereof); expansion and growth of the Company's business and operations; and other such matters are forward-looking statements. These statements are based on certain assumptions and analyses made by the Company in light of its experience and its perception of historical trends, current conditions and expected future developments, as well as other factors it believes are appropriate under the circumstances. However, whether actual results or developments will conform with the Company's expectations and predictions is subject to a number of risks and uncertainties, including general economic, market and business conditions; the business opportunities (or lack thereof) that may be presented to and pursued by the Company; changes in laws or regulation; and other factors, most of which are beyond the control of the Company.

These forward-looking statements can be identified by the use of predictive, future-tense or forward-looking terminology, such as "believes," "anticipates," "expects," "estimates," "plans," "may," "will," or similar terms. These statements appear in a number of places in this filing and include statements regarding the intent, belief or current expectations of the Company, and its directors or its officers with respect to, among other things: (i) trends affecting the Company's financial condition or results of operations for its limited history; (ii) the Company's business and growth strategies; and, (iii) the Company's financing plans. Investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve significant risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking statements as a result of various factors. Such factors that could adversely affect actual results and performance include, but are not limited to, the Company's limited operating history, potential fluctuations in quarterly operating results and expenses, government regulation, technological change and competition. For information identifying important factors that could cause actual results to differ materially from those anticipated in the forward-looking statements, please refer to the Risk Factors section of the Company’s Current Report on Form 8-K filed with the U.S. Securities and Exchange Commission (the “SEC”) on August 8, 2018.

Consequently, all of the forward-looking statements made in this Form 10-Q are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated by the Company will be realized or, even if substantially realized, that they will have the expected consequence to or effects on the Company or its business or operations. The Company assumes no obligations to update any such forward-looking statements.

Currency and exchange rate

Unless otherwise noted, all currency figures quoted as “U.S. dollars”, “dollars” or “$” refer to the legal currency of the United States. Throughout this report, assets and liabilities of the Company’s subsidiaries are translated into U.S. dollars using the exchange rate on the balance sheet date. Revenue and expenses are translated at average rates prevailing during the period. The gains and losses resulting from translation of financial statements of foreign subsidiaries are recorded as a separate component of accumulated other comprehensive income within the statement of stockholders’ equity.

| 3 |

PART I FINANCIAL INFORMATION

ITEM 1 Financial Statements

NOBLE VICI GROUP, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

AS OF JUNE 30, 2021 AND MARCH 31, 2021

(Currency expressed in United States Dollars (“US$”), except for number of shares)

| June 30, 2021 | March 31, 2021 | |||||||

| (Unaudited) | (Audited) | |||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | $ | ||||||

| Deposits, prepayment and other receivable | ||||||||

| Accounts receivable | ||||||||

| Purchase deposits | ||||||||

| Deferred costs | ||||||||

| Inventories | ||||||||

| Total current assets | ||||||||

| Non-current assets: | ||||||||

| Intangible assets, net | ||||||||

| Property, plant and equipment, net | ||||||||

| TOTAL ASSETS | $ | $ | ||||||

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | ||||||||

| Current liabilities: | ||||||||

| Accrued liabilities and account payables | $ | $ | ||||||

| Commission liabilities | ||||||||

| Deferred revenue | ||||||||

| Amount due to a director | ||||||||

| Amount due to a related party | ||||||||

| Income tax payable | ||||||||

| Current portion of borrowings | ||||||||

| Total current liabilities | ||||||||

| Long-term liabilities: | ||||||||

| Borrowings | ||||||||

| TOTAL LIABILITIES | ||||||||

| Commitments and contingencies | ||||||||

| STOCKHOLDERS’ DEFICIT | ||||||||

| Common stock, authorized common shares of $ par value, shares issued and outstanding as of June 30, 2021 and March 31, 2021 | ||||||||

| Additional paid-in capital | ||||||||

| Accumulated other comprehensive loss | ( | ) | ( | ) | ||||

| Accumulated deficit | ( | ) | ( | ) | ||||

| Total NVGI stockholders’ deficit | ( | ) | ( | ) | ||||

| Non-controlling interest | ( | ) | ( | ) | ||||

| Total stockholders’ deficit | ( | ) | ( | ) | ||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ DEFICIT | $ | $ | ||||||

See accompanying notes to condensed consolidated financial statements.

| 4 |

NOBLE VICI GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

FOR THE THREE MONTHS ENDED JUNE 30, 2021 AND 2020

(Currency expressed in United States Dollars (“US$”))

(Unaudited)

| Three months ended June 30, | ||||||||

| 2021 | 2020 | |||||||

| REVENUE, NET | $ | $ | ||||||

| Cost of revenue | ( | ) | ( | ) | ||||

| Gross profit | ||||||||

| Operating expenses: | ||||||||

| Sales and marketing expense | ||||||||

| General and administrative expenses | ||||||||

| Total operating expenses | ||||||||

| LOSS FROM OPERATIONS | ( | ) | ( | ) | ||||

| Other (expense) income: | ||||||||

| Interest expense | ( | ) | ( | ) | ||||

| Government grant | ||||||||

| Sundry income | ||||||||

| Total other (expense) income | ( | ) | ||||||

| LOSS BEFORE INCOME TAXES | ( | ) | ( | ) | ||||

| Income tax expense | ( | ) | ||||||

| NET LOSS | $ | ( | ) | $ | ( | ) | ||

| Other comprehensive loss: | ||||||||

| – Foreign currency adjustment loss | ( | ) | ( | ) | ||||

| COMPREHENSIVE LOSS | $ | ( | ) | $ | ( | ) | ||

| Net loss per share: | ||||||||

| – Basic and diluted | $ | ( | ) | $ | ( | ) | ||

| Weighted average common shares outstanding: | ||||||||

| – Basic and diluted | ||||||||

See accompanying notes to condensed consolidated financial statements.

| 5 |

NOBLE VICI GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ DEFICIT

FOR THE THREE MONTHS ENDED JUNE 30, 2021 AND 2020

(Currency expressed in United States Dollars (“US$”))

(Unaudited)

| Common stock |

Additional paid-in | Accumulated other comprehensive income |

Accumulated |

Total stockholders’ equity |

Non- controlling |

Total equity | ||||||||||||||||||||||||||

| No. of shares | Amount | capital | (loss) | losses | (deficit) | interest | (deficit) | |||||||||||||||||||||||||

| Balance as of April 1, 2020 (audited) | $ | $ | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ( | ) | |||||||||||||||

| Foreign currency translation adjustment | – | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||||||

| Net loss for the period | – | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||||||

| Balance as of June 30, 2020 | $ | $ | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ( | ) | |||||||||||||||

| Balance as of April 1, 2021 (audited) | $ | $ | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ( | ) | |||||||||||||||

| Foreign currency translation adjustment | – | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||||||

| Net loss for the period | – | ( | ) | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||||

| Balance as of June 30, 2021 | $ | $ | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ( | ) | |||||||||||||||

See accompanying notes to condensed consolidated financial statements.

| 6 |

NOBLE VICI GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE THREE MONTHS ENDED JUNE 30, 2021 AND 2020

(Currency expressed in United States Dollars (“US$”))

(Unaudited)

| Three months ended June 30, | ||||||||

| 2021 | 2020 | |||||||

| Cash flows from operating activities: | ||||||||

| Net loss | $ | ( | ) | $ | ( | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities | ||||||||

| Amortization of intangible assets | ||||||||

| Depreciation of property, plant and equipment | ||||||||

| Change in operating assets and liabilities: | ||||||||

| Accounts receivable | ( | ) | ||||||

| Deposits, prepayment and other receivable | ( | ) | ||||||

| Deferred costs | ||||||||

| Accrued liabilities and account payables | ||||||||

| Commission liabilities | ( | ) | ||||||

| Deferred revenue | ( | ) | ||||||

| Income tax payable | ( | ) | ||||||

| Cash used in operating activities | ( | ) | ( | ) | ||||

| Cash flows from investing activities: | ||||||||

| Purchase of property, plant and equipment | ( | ) | ||||||

| Net cash used in investing activities | ( | ) | ||||||

| Cash flows from financing activities: | ||||||||

| Advances from a director | ||||||||

| Proceed from finance lease | ||||||||

| Repayment of bank loan | ( | ) | ||||||

| Repayment of finance lease | ( | ) | ( | ) | ||||

| Net cash generated from financing activities | ||||||||

| Foreign currency translation adjustment | ( | ) | ||||||

| Net change in cash and cash equivalents | ( | ) | ||||||

| BEGINNING OF PERIOD | ||||||||

| END OF PERIOD | $ | $ | ||||||

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION | ||||||||

| Cash paid for income taxes | $ | $ | ||||||

| Cash paid for interest | $ | $ | ||||||

See accompanying notes to condensed consolidated financial statements.

| 7 |

NOBLE VICI PTE LIMITED

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED JUNE 30, 2021

(Currency expressed in United States Dollars (“US$”), except for number of shares)

(Unaudited)

NOTE-1 BASIS OF PRESENTATION

The accompanying unaudited condensed consolidated financial statements have been prepared by management in accordance with both accounting principles generally accepted in the United States (“GAAP”), and the instructions to Form 10-Q and Rule 10-01 of Regulation S-X. Certain information and note disclosures normally included in audited financial statements prepared in accordance with generally accepted accounting principles have been condensed or omitted pursuant to those rules and regulations, although the Company believes that the disclosures made are adequate to make the information not misleading.

In the opinion of management, the consolidated balance sheet as of March 31, 2021 which has been derived from audited financial statements and these unaudited condensed consolidated financial statements reflect all normal and recurring adjustments considered necessary to state fairly the results for the periods presented. The results for the period ended June 30, 2021 are not necessarily indicative of the results to be expected for the entire fiscal year ending March 31, 2022 or for any future period.

NOTE-2 DESCRIPTION OF BUSINESS AND ORGANIZATION

The Company is currently engaged in the IoT, Big Data, Blockchain and E-commerce business.

Description of subsidiaries

| Name |

Place of incorporation and kind of legal entity |

Principal activities and place of operation |

Particulars of issued/ registered share capital |

Effective interest held | ||||

|

|

||||||||

| N/A | ||||||||

The Company and its subsidiaries are hereinafter referred to as (the “Company”).

| 8 |

NOBLE VICI PTE LIMITED

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED JUNE 30, 2021

(Currency expressed in United States Dollars (“US$”), except for number of shares)

(Unaudited)

NOTE-3 GOING CONCERN UNCERTAINTIES

The accompanying condensed consolidated financial statements have been prepared using the going concern basis of accounting, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business.

As of June 30, 2021, the Company suffered from an accumulated deficit

of $

These and other factors raise substantial doubt about the Company’s ability to continue as a going concern. These condensed consolidated financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets and liabilities that may result in the Company not being able to continue as a going concern.

NOTE-4 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The accompanying condensed consolidated financial statements reflect the application of certain significant accounting policies as described in this note and elsewhere in the accompanying condensed consolidated financial statements and notes.

| l | Basis of presentation |

These accompanying condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America (“US GAAP”).

| l | Basis of consolidation |

The condensed consolidated financial statements include the accounts of the Company and its subsidiaries. All significant inter-company balances and transactions within the Company have been eliminated upon consolidation.

| l | Use of estimates and assumptions |

In preparing these condensed consolidated financial statements, management makes estimates and assumptions that affect the reported amounts of assets and liabilities in the balance sheet and revenues and expenses during the periods reported. Actual results may differ from these estimates.

| l | Cash and cash equivalents |

Cash and cash equivalents are carried at cost and represent cash on hand, demand deposits placed with banks or other financial institutions and all highly liquid investments with an original maturity of three months or less as of the purchase date of such investments.

| 9 |

NOBLE VICI PTE LIMITED

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED JUNE 30, 2021

(Currency expressed in United States Dollars (“US$”), except for number of shares)

(Unaudited)

| l | Intangible assets |

Intangible assets represented the acquired game

right from a related party, which are stated at acquisition cost, less accumulated amortization. The Company amortizes its intangible

assets with definite lives over their estimated useful lives and reviews these assets for impairment when an indicator for potential impairment

exists. The Company is currently amortizing its intangible assets with definite lives over periods of

| l | Property, plant and equipment |

Property, plant and equipment are stated at cost less accumulated depreciation and accumulated impairment losses, if any. Depreciation is calculated on the straight-line basis over the following expected useful lives from the date on which they become fully operational:

| Expected useful lives | ||

| Building | ||

| Leasehold improvements | ||

| Furniture and fittings | ||

| Office equipment and computers | ||

| Motor vehicle |

Expenditures for repairs and maintenance are expensed as incurred. When assets have been retired or sold, the cost and related accumulated depreciation are removed from the accounts and any resulting gain or loss is recognized in the results of operations.

Depreciation expense for the three months ended

June 30, 2021 and 2020 were $

| l | Impairment of long-lived assets |

In accordance with Accounting Standards Codification

("ASC") Topic 360-10-5, “Impairment or Disposal of Long-Lived Assets”, the Company reviews its long-lived

assets, including property, plant and equipment, as well as intangible assets for impairment whenever events or changes in circumstances

indicate that the carrying amount of the assets may not be fully recoverable or that useful lives are no longer appropriate. If the total

of the expected undiscounted future net cash flows is less than the carrying amount of the asset, a loss is recognized for the difference

between the fair value and carrying amount of the asset. There has been

| l | Revenue recognition |

Revenue is recognized when it is realized or realizable and earned, in accordance with ASC 605 Revenue Recognition (“ASC 605”). Revenue from the sale of products is recognised when all of the following criteria are met: (1) persuasive evidence of an arrangement exists; (2) delivery has occurred or services have been performed; (3) the seller’s price to the buyer is fixed or determinable; and (4) collectability is reasonably assured. Product sales are recorded net of good and service taxes and product returns.

The Company records revenues from the sales of third-party products on a “gross” basis pursuant to ASC 605-45 Revenue Recognition - Principal Agent Considerations, when we are the primary obligor in the arrangement with the end customer and have the risks and rewards as principal in the transaction, such as responsibility for fulfillment, retaining the risk for collection, and establishing the price of the products. If these indicators have not been met, or if indicators of net revenue reporting specified in ASC 605-45 are present in the arrangement, revenue is recognized net of related direct costs.

| 10 |

NOBLE VICI PTE LIMITED

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED JUNE 30, 2021

(Currency expressed in United States Dollars (“US$”), except for number of shares)

(Unaudited)

| l | Commission credits |

The Company maintains a membership program, whereby certain members earn commission credits, based on the sales volume of certain other members who are sponsored directly or indirectly by the member. Commission credits are redeemable on future spending of the products purchased or playing online games. Commission credits are recorded and classified as operating expense when the products are delivered and revenue is recognized. The estimated liability for unredeemed commission credit is included in commission liability on the accompanying balance sheets. Management reviews the adequacy for the accrual for unredeemed commission credits by periodically evaluating the historical redemption and projected trends.

| l | Income taxes |

The Company adopted the ASC 740 Income tax provisions of paragraph 740-10-25-13, which addresses the determination of whether tax benefits claimed or expected to be claimed on a tax return should be recorded in the consolidated financial statements. Under paragraph 740-10-25-13, the Company may recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in the consolidated financial statements from such a position should be measured based on the largest benefit that has a greater than fifty percent (50%) likelihood of being realized upon ultimate settlement. Paragraph 740-10-25-13 also provides guidance on de-recognition, classification, interest and penalties on income taxes, accounting in interim periods and requires increased disclosures. The Company had no material adjustments to its liabilities for unrecognized income tax benefits according to the provisions of paragraph 740-10-25-13.

The estimated future tax effects of temporary differences between the tax basis of assets and liabilities are reported in the accompanying balance sheets, as well as tax credit carry-backs and carry-forwards. The Company periodically reviews the recoverability of deferred tax assets recorded on its balance sheets and provides valuation allowances as management deems necessary.

| l | Uncertain tax positions |

The Company did not take any uncertain tax positions

and had

| l | Leases |

Under Topic 842, Leases (“ASC 842”), the Company determines if an arrangement is a lease at inception. Operating leases are included in operating lease right-of-use (“ROU”) assets, other current liabilities, and operating lease liabilities in the condensed consolidated balance sheets. Finance leases are included in property and equipment, other current liabilities, and other long-term liabilities in the condensed consolidated balance sheets.

ROU assets represent the right to use an underlying asset for the lease term and lease liabilities represent our obligation to make lease payments arising from the lease. Operating lease ROU assets and liabilities are recognized at commencement date based on the present value of lease payments over the lease term. As most of the Company’s leases do not provide an implicit rate, the Company generally use the incremental borrowing rate based on the estimated rate of interest for collateralized borrowing over a similar term of the lease payments at commencement date. The operating lease ROU asset also includes any lease payments made and excludes lease incentives. The lease terms may include options to extend or terminate the lease when it is reasonably certain that we will exercise that option. Lease expense for lease payments is recognized on a straight-line basis over the lease term.

| 11 |

NOBLE VICI PTE LIMITED

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED JUNE 30, 2021

(Currency expressed in United States Dollars (“US$”), except for number of shares)

(Unaudited)

| l | Foreign currencies translation |

Transactions denominated in currencies other than the functional currency are translated into the functional currency at the exchange rates prevailing at the dates of the transaction. Monetary assets and liabilities denominated in currencies other than the functional currency are translated into the functional currency using the applicable exchange rates at the balance sheet dates. The resulting exchange differences are recorded in the condensed consolidated statement of operations.

The reporting currency of the Company is United States Dollar ("US$") and the accompanying condensed consolidated financial statements have been expressed in US$. In addition, the Company’s operating subsidiaries in Singapore and Seychelles maintain their books and record in its local currency, Singapore Dollars (“S$”), which is a functional currency as being the primary currency of the economic environment in which their operations are conducted. In general, for consolidation purposes, assets and liabilities of its subsidiaries whose functional currency is not US$ are translated into US$, in accordance with ASC Topic 830-30, “Translation of Financial Statement”, using the exchange rate on the balance sheet date. Revenues and expenses are translated at average rates prevailing during the year. The gains and losses resulting from translation of financial statements of foreign subsidiaries are recorded as a separate component of accumulated other comprehensive income within the statements of changes in stockholder’s equity.

Translation of amounts from S$ into US$1 has been made at the following exchange rates for the three months ended June 30, 2021 and 2020:

| June 30, 2021 | June 30, 2020 | |||||||

| Period-end S$:US$1 exchange rate | ||||||||

| Annual average S$:US$1 exchange rate | ||||||||

| l | Comprehensive income |

ASC Topic 220, “Comprehensive Income”, establishes standards for reporting and display of comprehensive income, its components and accumulated balances. Comprehensive income as defined includes all changes in equity during a period from non-owner sources. Accumulated other comprehensive income, as presented in the accompanying condensed consolidated statements of changes in stockholders’ equity, consists of changes in unrealized gains and losses on foreign currency translation. This comprehensive income is not included in the computation of income tax expense or benefit.

| l | Segment reporting |

ASC Topic 280, “Segment Reporting” establishes standards for reporting information about operating segments on a basis consistent with the Company’s internal organization structure as well as information about geographical areas, business segments and major customers in condensed consolidated financial statements. For the three months ended June 30, 2021 and 2020, the Company operates in one reportable operating segment in Singapore and Asian Region.

| l | Related parties |

The Company follows the ASC 850-10, Related Party for the identification of related parties and disclosure of related party transactions.

| 12 |

NOBLE VICI PTE LIMITED

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED JUNE 30, 2021

(Currency expressed in United States Dollars (“US$”), except for number of shares)

(Unaudited)

Pursuant to section 850-10-20 the related parties include a) affiliates of the Company; b) entities for which investments in their equity securities would be required, absent the election of the fair value option under the Fair Value Option Subsection of section 825–10–15, to be accounted for by the equity method by the investing entity; c) trusts for the benefit of employees, such as pension and Income-sharing trusts that are managed by or under the trusteeship of management; d) principal owners of the Company; e) management of the Company; f) other parties with which the Company may deal if one party controls or can significantly influence the management or operating policies of the other to an extent that one of the transacting parties might be prevented from fully pursuing its own separate interests; and g) other parties that can significantly influence the management or operating policies of the transacting parties or that have an ownership interest in one of the transacting parties and can significantly influence the other to an extent that one or more of the transacting parties might be prevented from fully pursuing its own separate interests.

The consolidated financial statements shall include disclosures of material related party transactions, other than compensation arrangements, expense allowances, and other similar items in the ordinary course of business. However, disclosure of transactions that are eliminated in the preparation of consolidated or combined financial statements is not required in those statements. The disclosures shall include: a) the nature of the relationship(s) involved; b) a description of the transactions, including transactions to which no amounts or nominal amounts were ascribed, for each of the periods for which income statements are presented, and such other information deemed necessary to an understanding of the effects of the transactions on the consolidated financial statements; c) the dollar amounts of transactions for each of the periods for which income statements are presented and the effects of any change in the method of establishing the terms from that used in the preceding period; and d) amount due from or to related parties as of the date of each balance sheet presented and, if not otherwise apparent, the terms and manner of settlement.

| l | Commitments and contingencies |

The Company follows the ASC 450-20, Commitments to report accounting for contingencies. Certain conditions may exist as of the date the financial statements are issued, which may result in a loss to the Company but which will only be resolved when one or more future events occur or fail to occur. The Company assesses such contingent liabilities, and such assessment inherently involves an exercise of judgment. In assessing loss contingencies related to legal proceedings that are pending against the Company or un-asserted claims that may result in such proceedings, the Company evaluates the perceived merits of any legal proceedings or un-asserted claims as well as the perceived merits of the amount of relief sought or expected to be sought therein.

If the assessment of a contingency indicates that it is probable that a material loss has been incurred and the amount of the liability can be estimated, then the estimated liability would be accrued in the Company’s financial statements. If the assessment indicates that a potentially material loss contingency is not probable but is reasonably possible, or is probable but cannot be estimated, then the nature of the contingent liability, and an estimate of the range of possible losses, if determinable and material, would be disclosed.

Loss contingencies considered remote are generally not disclosed unless they involve guarantees, in which case the guarantees would be disclosed. Management does not believe, based upon information available at this time that these matters will have a material adverse effect on the Company’s financial position, results of operations or cash flows. However, there is no assurance that such matters will not materially and adversely affect the Company’s business, financial position, and results of operations or cash flows.

| l | Fair value of financial instruments |

The Company follows paragraph 825-10-50-10 of the FASB Accounting Standards Codification for disclosures about fair value of its financial instruments and has adopted paragraph 820-10-35-37 of the FASB Accounting Standards Codification (“Paragraph 820-10-35-37”) to measure the fair value of its financial instruments. Paragraph 820-10-35-37 of the FASB Accounting Standards Codification establishes a framework for measuring fair value in generally accepted accounting principles (GAAP), and expands disclosures about fair value measurements. To increase consistency and comparability in fair value measurements and related disclosures, paragraph 820-10-35-37 of the FASB Accounting Standards Codification establishes a fair value hierarchy which prioritizes the inputs to valuation techniques used to measure fair value into three (3) broad levels. The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities and the lowest priority to unobservable inputs. The three (3) levels of fair value hierarchy defined by paragraph 820-10-35-37 of the FASB Accounting Standards Codification are described below:

| Level 1 | Quoted market prices available in active markets for identical assets or liabilities as of the reporting date. | |

| Level 2 | Pricing inputs other than quoted prices in active markets included in Level 1, which are either directly or indirectly observable as of the reporting date. | |

| Level 3 | Pricing inputs that are generally observable inputs and not corroborated by market data. |

| 13 |

NOBLE VICI PTE LIMITED

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED JUNE 30, 2021

(Currency expressed in United States Dollars (“US$”), except for number of shares)

(Unaudited)

Financial assets are considered Level 3 when their fair values are determined using pricing models, discounted cash flow methodologies or similar techniques and at least one significant model assumption or input is unobservable.

The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities and the lowest priority to unobservable inputs. If the inputs used to measure the financial assets and liabilities fall within more than one level described above, the categorization is based on the lowest level input that is significant to the fair value measurement of the instrument.

The carrying amounts of the Company’s financial assets and liabilities, such as cash and cash equivalents, approximate their fair values because of the short maturity of these instruments.

| l | Recent accounting pronouncements |

The Company has reviewed all recently issued, but not yet effective, accounting pronouncements and do not believe the future adoption of any such pronouncements may be expected to cause a material impact on its financial condition or the results of its operations.

NOTE-5 INTANGIBLE ASSETS

| June 30, 2021 | March 31, 2021 | |||||||

| (Audited) | ||||||||

| Gaming right and software | ||||||||

| Gross carrying value | $ | $ | ||||||

| Less: accumulated amortization | ( | ) | ( | ) | ||||

| Intangible assets, net | $ | $ | ||||||

Amortization expense for the three months ended

June 30, 2020 and 2020 were $

The following table outlines the annual amortization expense for the next five years:

| Years ending June 30: | ||||

| 2022 | ||||

| 2023 | ||||

| Total | $ | |||

| 14 |

NOBLE VICI PTE LIMITED

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED JUNE 30, 2021

(Currency expressed in United States Dollars (“US$”), except for number of shares)

(Unaudited)

NOTE-6 AMOUNT DUE TO A DIRECTOR

As of June 30, 2021, amount due to a director of the Company, Mr. TANG Wai Chong Eldee, which was unsecured, interest-free and had no fixed terms of repayment. Imputed interest from related party loan is not significant.

NOTE-7 AMOUNT DUE TO A RELATED PARTY

As of June 30, 2021, the Company owed the amount

of $

NOTE-8 BORROWINGS

| June 30, 2021 | March 31, 2021 | |||||||

| (Audited) | ||||||||

| Current portion | ||||||||

| Loan | $ | $ | ||||||

| Lease liabilities | ||||||||

| Total current borrowings | ||||||||

| Non-current portion | ||||||||

| Loan | ||||||||

| Lease liabilities | ||||||||

| Total noncurrent borrowings | ||||||||

| Total borrowings | $ | $ | ||||||

The loans are secured by a mortgage over leasehold

building. During the three months ended June 30, 2021, the Company re-financed and obtained a new short-term loan facility up to $

As of June 30, 2021, the loan bears interest rate

at

The Company financed its motor vehicles, office

premises and office equipment under finance lease agreements with the effective interest rate ranging from

| 15 |

NOBLE VICI PTE LIMITED

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED JUNE 30, 2021

(Currency expressed in United States Dollars (“US$”), except for number of shares)

(Unaudited)

Right of use assets are included in the condensed consolidated balance sheet are as follows:

| June 30, 2021 | March 31, 2021 | |||||||

| Non-current assets | ||||||||

| Right-of-use assets, net of amortization (included in property, plant and equipment) | $ | $ | ||||||

The maturities of lease liabilities are as follows:

| Lease liabilities | Loan | |||||||

| Years ending June 30: | ||||||||

| 2022 | $ | $ | ||||||

| 2023 | ||||||||

| 2024 | ||||||||

| 2025 | ||||||||

| 2026 | ||||||||

| Total lease payments | ||||||||

| Less: Imputed interest | ( | ) | ( | ) | ||||

Present value of lease liabilities | $ | $ | ||||||

NOTE-9 INCOME TAX

The Company generated an operating loss for the three months ended June 30, 2021 and 2020 and did not record income tax expense. The Company has operations in various countries and is subject to tax in the jurisdictions in which they operate, as follows:

United States of America

NVGI is registered in the State of Delaware and is subject to United States of America tax law. No provision for income taxes have been made as NVGI has generated no taxable income for the periods presented. The Company’s policy is to recognize accrued interest and penalties related to unrecognized tax benefits in its income tax provision. The Company has not accrued or paid interest or penalties which were not material to its results of operations for the period presented.

As of June 30, 2021, the Company incurred $

| 16 |

NOBLE VICI PTE LIMITED

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED JUNE 30, 2021

(Currency expressed in United States Dollars (“US$”), except for number of shares)

(Unaudited)

Republic of Singapore

The Company’s operating subsidiaries are

registered in Republic of Singapore and are subject to the Singapore corporate income tax at a standard income tax rate of

The Company’s subsidiary in Republic of Seychelles is also subject to the Singapore corporate income tax regime.

The reconciliation of income tax rate to the effective income tax rate based on income before income taxes for the three months ended June 30, 2021 and 2020 are as follows:

| Three months ended June 30, | ||||||||

| 2021 | 2020 | |||||||

| (Loss)/Income before income taxes | $ | ( | ) | $ | ( | ) | ||

| Statutory income tax rate | ||||||||

| Income tax expense at statutory rate | ( | ) | ( | ) | ||||

| Tax effect of non-taxable income | ( | ) | ||||||

| Tax loss not recognized as deferred tax | ||||||||

| Income tax expense | $ | $ | ||||||

NOTE-10 RELATED PARTY TRANSACTIONS

From time to time, the stockholder and director of the Company advanced funds to the Company for working capital purpose. Those advances are unsecured, non-interest bearing and due on demand. The imputed interest on the loan from a related party was not significant.

Royalty charges and marketing expenses paid to

a related company totaled $

Apart from the transactions and balances detailed elsewhere in these accompanying consolidated financial statements, the Company has no other significant or material related party transactions during the periods presented.

NOTE-11 CONCENTRATIONS OF RISK

The Company is exposed to the following concentrations of risk:

(a) Major customers

For the three months ended June 30, 2021 and 2020, there is no single customer exceeding 10% of the Company’s revenue, respectively.

| 17 |

NOBLE VICI PTE LIMITED

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED JUNE 30, 2021

(Currency expressed in United States Dollars (“US$”), except for number of shares)

(Unaudited)

(b) Major vendors

For the three months ended June 30, 2021 and 2020, there is no single vendor representing more than 10% of the Company’s purchase, respectively.

| (c) | Interest rate risk |

As the Company has no significant interest-bearing assets, the Company’s income and operating cash flows are substantially independent of changes in market interest rates.

The Company’s interest-rate risk arises from borrowings under finance lease. The Company manages interest rate risk by varying the issuance and maturity dates variable rate debt, limiting the amount of variable rate debt, and continually monitoring the effects of market changes in interest rates. As of June 30, 2021, borrowing under finance lease was at fixed rates.

| (d) | Economic and political risk |

The Company’s major operations are conducted in Republic of Singapore. Accordingly, the political, economic, and legal environments in Singapore, as well as the general state of Singapore’s economy may influence the Company’s business, financial condition, and results of operations.

| (e) | Exchange rate risk |

The Company cannot guarantee that the current exchange rate will remain steady; therefore there is a possibility that the Company could post the same amount of profit for two comparable periods and because of the fluctuating exchange rate actually post higher or lower profit depending on exchange rate of S$ converted to US$ on that date. The exchange rate could fluctuate depending on changes in political and economic environments without notice.

NOTE-12 COMMITMENTS AND CONTINGENCIES

As of June 30, 2021, the Company has

NOTE-13 SUBSEQUENT EVENTS

In accordance with ASC Topic 855, “Subsequent Events”, which establishes general standards of accounting for and disclosure of events that occur after the balance sheet date but before condensed consolidated financial statements are issued, the Company has evaluated all events or transactions that occurred after June 30, 2021, up through the date the Company issued the unaudited condensed consolidated financial statements. During the period, the Company did not have any material recognizable subsequent events.

| 18 |

ITEM 2 Management’s Discussion and Analysis of Financial Condition and Results of Operations

Overview

We were incorporated under the laws of the State of Delaware on July 6, 2010 under the name “Advanced Ventures Corp.” Effective January 6, 2014, we changed our name to “Gold Union Inc.” Effective March 26, 2018, we changed our name to Noble Vici Group, Inc. and our trading symbol was changed to NVGI. On August 8, 2018, we consummated the acquisition of Noble Vici Private Limited, a corporation organized under the laws of Singapore (“NVPL”), which was wholly owned by Eldee Tang, our sole director and Chief Executive Officer. NVPL is engaged in the IoT, Big Data, Blockchain and E-commerce business. As a result of our acquisition of NVPL, we entered into the IoT, Big Data, Blockchain and E-commerce business. We are headquartered in Singapore and operate a branch office in Taiwan. Certain of our resellers are operating “V-More” branded satellite offices in Shenzhen, China.

History

As Advanced Ventures Corp., we acquired a patent (U.S. Patent Number: 6,743,209) (the “Patent”), for a catheter with a integral anchoring mechanism. During the second fiscal quarter of 2014, we elected to discontinue our business of exploiting the Patent and began to consider other business opportunities that may bring quicker and greater value to our stockholders. We initially considered entering into the business of trading precious metal bullion primarily in the Asia Pacific region. Therefore, effective January 6, 2014, we changed our name to “Gold Union Inc.” to more adequately reflect our initial intended business operations.

Effective March 7, 2012, we increased the number of our authorized shares of common stock to three billion shares (3,000,000,000) and engaged in a forward stock split of its common shares whereby each one share of our common stock was split into fifteen shares of our common stock.

On December 31, 2015, we consummated a Share Exchange Agreement with G.U. International Limited, a limited company incorporated under the laws of the Republic of Seychelles and our wholly owned subsidiary (“GUI”), and Kao Wei-Chen, an individual representing herself and 8 other individuals (collectively, the “Golden Corridor Shareholders”), which agreement was amended several times to extend the closing date of the acquisition (collectively, the “Share Exchange Agreement”). Pursuant to the Share Exchange Agreement, we, through GUI, purchased 480 shares of Phnom Penh Golden Corridor Trading Co. Limited (the “GC Shares”), from 9 private Golden Corridor Shareholders, representing 48% of the issued and outstanding shares of common stock of Golden Corridor. As consideration, we issued to the Golden Corridor Shareholders 2,500,000,000 shares of our common stock, at a value of US $0.002 per share, for an aggregate value of US $5,000,000.

As a result of our acquisition of the GC Shares, we ceased our metal bullion trading business and entered into the real estate development and rental business located in the Kingdom of Cambodia. Golden Corridor owns three parcels of land located at National Road 44, Phum Phkung, Chbarmorn Commune, Chbarmorn District, Kampong Speu Province, Kingdom of Cambodia, measuring an aggregate of 172,510 square meters (collectively, the “Properties”). We intended to develop the Properties into an industrial park for rental income.

Due to difficulties in entering the real estate development and rental business, on February 2, 2018, we engaged in a corporate reorganization and distributed the GC Shares to our shareholders. On March 18, 2018, our subsidiary, G.U. Asia Limited was dissolved.

Change in Control

On January 29, 2018, Eldee Tang entered into Share Sale Agreements with four shareholders and former affiliates of the Company to purchase up to 1,675,000,000 shares of the Company’s common stock at a per share purchase price of US$0.00008, for an aggregate price of US$134,000. On June 15, 2018, the Company effectuated a 1 for 1,000 reverse stock split whereby every 1,000 shares of the Company’s common stock were reduced to one share. The parties effectuated Mr. Tang’s purchase of 750,000 shares such securities (expressed on a post reverse split basis) effective June 15, 2018. Mr. Tang hopes to purchase the balance of the 925,000 shares from Kao Wei-Chen, a former affiliate of the Company, in the near future. The foregoing description of the Share Sale Agreement with Kao Wei-Chen is qualified in its entirety by reference to such agreement which is filed as Exhibit 10.2 to this Quarterly Report and is incorporated herein by reference.

| 19 |

In connection with the contemplated change in control, on March 27, 2018, Lim Yew Chuan, the director, Chief Executive Officer, Chief Financial Officer and Secretary of Noble Vici Group, Inc. (the “Company”), resigned from all of his positions as director, Chief Executive Officer, Chief Financial Officer and Secretary of the Company. Concurrently, Eldee Tang was appointed to serve as the Chief Executive Officer and Director of the Company, together with other members of the new management team.

Effective June 15, 2018, we:

| 1. | Increased the Company’s authorized capital from 3,000,000,000 shares of common stock, par value $0.0001 (the “Common Stock”), to 3,050,000,000 shares, consisting of 3,000,000,000 shares of Common Stock and 50,000,000 shares of undesignated preferred stock, par value $0.0001 (the “Preferred Stock”); | |

| 2. | Effected a 1-for-1000 reverse stock split of our issued and outstanding Common Stock (the “Reverse Stock Split”); | |

| 3. | Elected not to be governed by Section 203 of the Delaware General Corporation Law; | |

| 4. | Changed the Company’s fiscal year end from December 31st to March 31st, for all purposes (including tax and financial accounting); | |

| 5. | Adopted Amended and Restated Certificate of Incorporation for the purpose of consolidating the amendments to the Company’s Certificate of Incorporation; and | |

| 6. | Adopted the Amended and Restated Bylaws of the Company. |

Acquisition of NVPL, TDA and NDA

On August 8, 2018, we consummated the acquisition of Noble Vici Private Limited, a corporation organized under the laws of Singapore (“NVPL”), in accordance with the terms of a Share Exchange Agreement. NVPL is wholly owned by Eldee Tang, our Chief Executive Officer and Director. Pursuant to the Share Exchange Agreement, we purchased One Million and One (1,000,001) shares of NVPL (the “NVPL Shares”), representing all of the issued and outstanding shares of common stock of NVPL, in consideration of One Hundred Forty Million (140,000,000) shares of our common stock, at a value of US $1.70 per share, for an aggregate value of US $238,000,000. It is our understanding that Mr. Tang is not a U.S. Person within the meaning of Regulations S. Accordingly, the Shares are being sold pursuant to the exemption provided by Section 4(a)(2) of the Securities Act of 1933, as amended, Regulation D and Regulation S promulgated thereunder. As a result of our acquisition of NVPL, we entered into the IoT, Big Data, Blockchain and E-commerce business.

On September 17, 2018, we consummated the acquisition of a 51% controlling interest in The Digital Agency Private Limited, a private limited company organized under the laws of Singapore (“TDA”), and a start-up digital marketing company, in accordance with the terms of that certain Share Exchange Agreement by and among the Company, NIApplications Private Limited (formerly, “Noble Infotech Applications Private Limited”), a private limited company organized under the laws of Singapore and our wholly owned subsidiary (“NIA”), TDA and Mok Jo Han (“the “TDA Share Exchange Agreement”). Pursuant to the terms of the TDA Share Exchange Agreement, we acquired 51 ordinary shares of TDA, representing approximately fifty-one percent (51%) of the issued and outstanding ordinary shares of TDA, in exchange for 510,000 shares of common stock of the Company, par value $0.0001 (the “TDA Shares”), representing an exchange ratio of ONE (1) ordinary share of TDA for Ten Thousand (10,000) shares of common stock of the Company, at a valuation of $2.00 per share of the Company, for an aggregate value of $1,020,000. It is our understanding that Mr. Mok is not a U.S. Person within the meaning of Regulations S. The TDA Shares were sold pursuant to the exemption provided by Section 4(a)(2) of the Securities Act of 1933, as amended, and Regulation S promulgated thereunder.

On September 17, 2018, we consummated the acquisition of a 51% controlling interest in Noble Digital Apps Sendirian Berhad, a private limited company organized under the laws of Malaysia (“NDA”), and a start-up digital apps and big data company in accordance with the terms of that certain Share Exchange Agreement by and among the Company, NIA, NDA, Cheng Bok Woon, Tan Yew Fui, and Yong Swee Sun (“the “NDA Share Exchange Agreement”). Pursuant to the terms of the NDA Share Exchange Agreement, we acquired 510 ordinary shares of NDA, representing approximately fifty-one percent (51%) of the issued and outstanding ordinary shares of NDA, in exchange for 510,000 shares of common stock of the Company, par value $0.0001 (the “NDA Shares”), representing an exchange ratio of ONE (1) ordinary share of NDA for One Thousand (1,000) shares of common stock of the Company, at a valuation of $2.00 per share of the Company, for an aggregate value of $1,020,000. It is our understanding that Mr. Cheng, Mr. Tan and Mr. Yong are not U.S. Person within the meaning of Regulations S. The NDA Shares were sold pursuant to the exemption provided by Section 4(a)(2) of the Securities Act of 1933, as amended, and Regulation S promulgated thereunder.

| 20 |

Issuance of shares to sales affiliates

On September 17, 2018, and September 25, 2018, we approved the issuance of Nine Million One Hundred Thirty Five Thousand Seven Hundred Ninety Four (9,135,794) shares and Five Hundred Sixty Seven Thousand Sixty-Four (567,064) shares of our common stock, par value $0.0001, respectively, representing a total of approximately 6.3% of our issued and outstanding common stock, at a per share price of One Dollars and Ninety Nine Cents (US $1.99), to approximately 460 sales associates for prior sales and marketing services provided to us and our subsidiaries and affiliates. As a condition of receipt of such securities, each recipient executed a Stockholder Representation Letters, which contained, among other things, restrictions prohibiting the transfer of such securities for a minimum period of 18 months up to a maximum period of 66 months after the execution of such letter. For ease of administration, the recipients appointed Noble Infotech Limited (“NIL”) as nominee to hold, manage, administer and effectuate the distribution of such securities upon the expiration of the applicable restricted periods. The shares were issued on October 18, 2018 to NIL. The securities were issued pursuant to the exemption provided by Regulation S promulgated under the Securities Act of 1933, as amended. The foregoing description of the Stockholder Representation Letters are qualified in its entirety by reference to such agreements which are filed as Exhibit 10.3 to this Quarterly Report and are incorporated herein by reference.

On December 3, 2018, we approved the issuance of up to an aggregate of Ten Million Eight Hundred Thirty Eight Thousand One Hundred Forty One (10,838,141) shares of our common stock, par value $0.0001, representing approximately 7.1% of our issued and outstanding common stock, at a per share price of Two Dollars (US $2.00), to about 690 sales associates for prior sales and marketing services provided to us and our subsidiaries and affiliates. As a condition of receipt of such securities, each recipient was required to execute one of two standard forms of Stockholder Representation Letters, which contained, among other things, restrictions prohibiting the transfer of such securities for a minimum period of 18 or 24 months up to a maximum period of 72 months after the execution of such letter. For ease of administration, the recipients appointed Venvici Partners Limited (“VVP”) as nominee to hold, manage, administer and effectuate the distribution of such securities upon the expiration of the applicable restricted periods. The shares were issued on January 4, 2019 to VVP. The securities were issued pursuant to the exemption provided Regulation S promulgated under the Securities Act of 1933, as amended. The foregoing description of the Stockholder Representation Letters and the appointment of VVP as trustee are qualified in its entirety by reference to such agreements which are filed as Exhibits 10.4 and 10.5 to this Quarterly Report and are incorporated herein by reference.

On March 11, 2019, our Board of Directors, approved the issuance of up to an aggregate of Fifteen Million (15,000,000) shares of our common stock, par value $0.0001, representing approximately 8.4% of our issued and outstanding common stock (collectively, the “Shares”), at a per share price of Two Dollars (US $2.00), to about 700 sales associates for prior sales and marketing services provided to us and our subsidiaries and affiliates. As a condition of receipt of such securities, each recipient was required to execute one of two standard forms of Stockholder Representation Letters, which contained, among other things, restrictions prohibiting the transfer of such securities for a minimum period of 18 months up to a maximum period of 66 months after the execution of such letter. For ease of administration, the recipients appointed Venvici Partners Limited (“VVP”) as nominee to hold, manage, administer and effectuate the distribution of the Shares upon the expiration of the applicable restricted periods. For so long as VVP is the stockholder of record of the Shares, VVP shall serve as the attorney in fact to vote such Shares at any annual, special or other meeting of the stockholders of the Company, and at any adjournment or adjournments thereof, or pursuant to any consent in lieu of a meeting or otherwise, with respect to any matter that may be submitted for a vote of stockholders of the Company. The securities will be issued pursuant to the exemption provided by Regulation S promulgated under the Securities Act of 1933, as amended. The foregoing description of the Stockholder Representation Letters and the appointment of VVP as trustee are qualified in its entirety by reference to such agreements which are filed as Exhibits 10.6 and 10.7 to this Quarterly Report and are incorporated herein by reference.

V-More Merchant Acquisition Agreements

On March 19, 2019, we entered into a V-More Merchant Acquisition Agreement with each of the Consultants pursuant to which each Consultant agreed to provide certain services related to the identification, due diligence, acquisition and retention of potential merchants in certain designated territories for inclusion in our V-More platform. As consideration for these services, each Consultant received up to an aggregate of Fourteen Million Three Hundred Twenty Thousand (14,320,000) shares of our common stock, for an aggregate of up to Forty-Two Million Nine Hundred Sixty Thousand (42,960,000) shares of our common stock, subject to the achievement of certain performance milestones and certain clawback rights. We registered Twenty-One Million Four Hundred Eighty Thousand (21,480,000) shares of the amount of shares issuable under the V-More Merchant Acquisition Agreement on a Registration Statement on Form S-8 filed with the Securities and Exchange Commission on March 19, 2019. The foregoing description of the V-More Merchant Acquisition Agreements is qualified in its entirety by reference to the V-More Merchant Acquisition Agreements dated March 19, 2019, which are filed as Exhibits 10.8, 10.9 and 10.10 to this Quarterly Report and incorporated herein by reference.

| 21 |

Consulting Agreement

During the period from March 19, 2019 till December 31, 2019, one of V-More’s merchants and vendors, Fame Reserve Limited, a subcontractor of Ms. Sukullayanee Suwunnavid (the “Digital Consultant”), which distributes digital vouchers, ran a promotion through V-More platform to promote and sell their digital vouchers (the “Promotion”). As a consideration for purchasing these vouchers for the promotion, the Board approved the issuance of up to an aggregate of Ten Million (10,000,000) shares of our common stock, par value $0.0001, of our issued and outstanding common stock, at a per share price of Two Dollars (US$2.00).

In connection to the Promotion, we entered into a Consulting Agreement with pursuant to which the Digital Consultant agreed to supply certain digital offerings and services to our customers, including without limitation, order fulfilment services with respect to orders from our customers received through the Digital Consultant’s online platform and its related digital offerings. We issued Ten Million (10,000,000) shares of the Corporation’s Common Stock, par value $0.0001 (the “Shares”), at a per share price of US$2.00, as payment in full for the Services and the satisfaction of all of our obligations to the Digital Consultant with respect to such services. These securities were registered on a Registration Statement on Form S-8 filed with the Securities and Exchange Commission on March 19, 2019. The foregoing description of the Consulting Agreement is qualified in its entirety by reference to the V-Consulting Agreement dated March 19, 2019, which is filed as Exhibit 10.11 to this Quarterly Report and incorporated herein by reference.

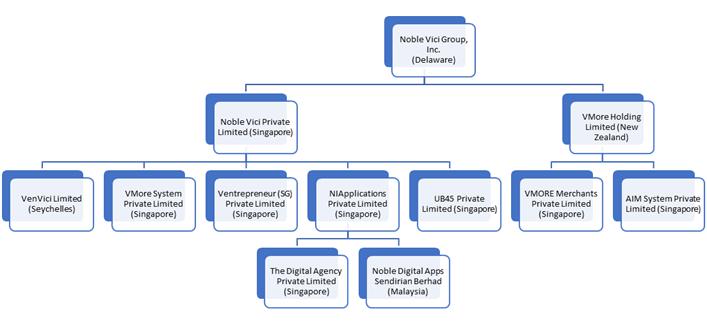

Our current corporate structure is as below:

| 22 |

Our Operations and Future Plans

Ecommerce Platform

We are focused on providing users with innovative tools to live and interact in the modern mobile world through our ecosystem of IoT, Big Data, Blockchain and E-commerce products and services. We integrate blockchain technology with our E-commerce platform to connect consumers and merchants in a dynamic global marketplace via blockchain transactions. We onboard users, consumers and referrers through our Affiliate Incentivized Marketing to Advertising Dollar Sharing (formerly known as Affiliate Incentivized Marketing (AIM)) model while merchants are onboarded via our Merchant Incentivized Marketing (MIM) model. Some products and services offered in our ecosystem include procurement of discounted goods and services, referral reward system, mobile games and digital marketing, financial markets apps and a “Business Centre” within the same app. Our E-commerce platform not only offers users the ability to make online purchases, but also the convenience of an O2O (Online to Offline) platform whereby consumers can transact at a discount online while goods and services are distributed at a physical location. This drives traffic to the already weakened retail industry. The Business Centre within our ecosystem is offered through a mobile app and allows users to create their own referral platform within our ecosystem.

Advertising Dollar Sharing (ADS)

We have rebranded our Affiliate Incentivized Marketing to Advertising Dollar Sharing. Similar to the AIM model, the ADS business model also involves driving online and physical traffic and increasing sales and marketing of targeted products and services. Its enhanced function includes distribution of advertising dollars via ADS system to agencies, affiliate marketers, advertiser, users and referrals.

Sale and Distribution of IoT Smart Devices / VMore System Private Limited

In addition to the E-commerce platform, we intend to focus on the sales and distribution of IoT smart devices and appliances. In September, 2019, we began to sell our first IoT appliance, our smart coffee dispensing machines (the V-More Express (“VX”)). Our initial plans of beginning machine distribution on or about the third calendar quarter of 2020 were delayed by the COVID-19 pandemic. We are currently monitoring the situation and hope to begin machine distribution and their progressive operation in Singapore once the economy begins to return to normalcy. We hope to derive income from sales of our VX IoT hardware, the core consumables in VX and the advertising services we provide to our customers in connection with the VX.

Features of the VX; Revenue Sources:

Machine Capacity: The VX offers 9 types of beverage, holds 60 litres of distilled water tank and is able to produce 400 cups of beverages. VX currently offers barista-grade coffee in 9 different varieties in both hot and ice options. VX can be modified to allow for other offerings to be sold. We expect to adopt regional pricing for core products sales, aligning to each specific market’s demand and supply.

AdTech: In addition to sales of core products, we expect to rely on advertisements placed through the VX to drive revenue. We intend to seek advertisers that are proximate to each specific VX to display their advertisements through our smart machine. We believe that the use of local advertisements (Proximate Location Ads, or PLA) will drive relevant traffic to nearby physical merchants as well as online merchants. Advertisements can be static or dynamic and may be interactive, allowing user interaction. We expect to provide services to advertisers to assist them in creating and placing effective ads in the VX.

Smart Technology: The VX features a 42 inch touch screen with Smart Digital Panel Advertising Technology (“SDPAT”) that allows users to interact with advertisements via its interactive touch screen. Through the VX, we hope to capture users’ spending behaviour, advertisement interactions and other quantitative data, while developing our Big Data analytics. Data from our machines can be integrated with our ecommerce platform to facilitate the offering of discounts, rewards or other products and services across our e-commerce platform. We believe that additional data will allow us to: (i) deliver and improve our offerings and services of our online VMore E-commerce platform; (ii) improve synergy with offline merchants; (iii) improve the efficacy of our advertising services; and (iv) improve sales of products offered by the VX.

| 23 |

VX Operations

Our VX business operations are segregated into the following core functions to address the needs of our advertisers, VX IoT hardware purchasers and consumers.

Sales and Marketing Team. Our team will focus on the sale of the VX IoT hardware. Its targeted industries are primarily from real estate and property owners such as commercial offices, retails and buildings, where the VX will be installed. In addition to the sale of VX, the team will also create brand awareness of the VX and its core offerings in the VX.

Advertiser Onboarding Team. Once an advertiser engages us online to have its advertisement placed in VX, a member of our advertiser onboarding team will initiate the first of several communications with the merchant to introduce the advertiser to the technology involved in our PLA ecosystem. Before the advertisement goes live on the VX, the team will work with the advertiser to build and create the advertisement. We will provide tools such as an app to ensure the advertisement traffic monitoring and management are aligned. All advertisements will be proximate locality based, ensuring relevance for targeted traffic to be driven.

Operation and Maintenance Team(O&M). Once the VX are deployed, O&M team will monitor the performance of each VX deployed for its ingredients supply, hardware status and data collection efficiency. Maintenance of the hardware for performance to prevent downtime and refilling the ingredients into the VX will be undertaken by the O&M team.

Customer/User Service Representatives. Our customer service representatives will be reachable via the app or email 24 hours a day, seven days a week. The customer service team will also work with our technology team to improve the experience of VX owners, consumers and advertisers on the mobile application based on their feedback.

Technology. We employ technology to improve the experience we offer to VX owners, users and advertisers, increase the rate at which our users use our V-More Pro platform and enhance the efficiency of our business operations. A component of our strategy is to continue developing and refining our technology. With the future use of blockchain technology for recording and collecting data, we believe the security of transactional records will be increased, protecting the accuracy of data held by VX owners, advertisers and users. We believe that basing transactional data on a private blockchain network will facilitate a smoother and faster transaction completion.

We expect to use an algorithm to analyze data collected through our VX ecosystem. As the volume of transactions grow organically through increased deployment of VXs, we expect to increase the amount of data that we can collect and analyze. We believe that such data will allow us to continue to improve the experience of our VX owners, advertisers and consumers which, in turn, will help us improve the way the ecosystem flows.

Cybersecurity. We have integrated our technology with encryption algorithm “SHA3-256” & RSA Public/Private-Key, which is designed to withstand timing attacks. It also accepts any 32-byte string as a valid public key and does not require validation. We believe that the security of transaction records within our current system is adequate.

Advertising Dollar Sharing (ADS). We believe our ADS model will allow users and advertisers to benefit from reduced costs to consumers and higher traffic for advertisers. We expect users to benefit from discounts and advertising dollar rebates offered through our PLA ecosystem from online and offline merchants, referrals, and internal marketing efforts, with advertisers benefitting from increased retail sales volume offline or online.

Core Product/User Scale. We hope to include other products from mass market merchants, such as food and other beverages, as part of our product and service offerings. We believe that outreach to the mass market will be more effective to drive traffic for the advertisers/merchants where simple to complex transactions can be achieved through adoption of an incentivized model.

Brand. A substantial portion of our VX owners, advertisers and users are acquired through agencies, word-of-mouth & social network/platforms. We believe that relying on the referral process, in turn, will improve the quality of our user base, advertisers and VX owners as well as brand awareness. We expect that higher confidence in our brand will facilitate acquiring more users, advertisers and VX owners for our ecosystem.

| 24 |

We operate our IoT Smart Device business through VMore System Private Limited (“VSPL”), our wholly owned subsidiary. VMSPL was incorporated in Singapore on July 22, 2019, and operates with our subsidiary AIM System Private Limited (“ASPL”), a Singapore private limited corporation incorporated on April 1, 2019, as described below:

| · | VSPL – engages in sales and marketing of VX and barista grade coffee to owners and consumers, operates and maintains the VX including support, both technical and non-technical; | |

| · | ASPL – engages in VX software technology integration; Proximate Location Ads (“PLA”) activities such as advertisement sales, build, create and deploy its proprietary software technology (“PropST”); distribute advertising dollars via an Advertising Dollar Sharing (“ADS”) system to agencies, affiliate marketers, advertisers, users and referrals; provide technical and non-technical support in relation to PLA; and engages in brand management, marketing, promotions and media engagement activities. |

VX vendor

We expect to rely on Barista Uno Private Limited (“BUPL”) to provide VSPL with VX IoT hardware and coffee sourcing, distribution, and logistical upstream and downstream fulfilment services. Eldee Tang, our Chief Executive Officer, Interim Chief Financial Officer, Interim Secretary and Director owns 31% of BUPL. As a result of the Covid-19 pandemic, Singapore has enacted heightened measures since April 7, 2020, that have restricted movement in people, goods and services for most businesses in Singapore. As a result, we our sales operations for VX related offerings were materially and adversely impacted. Our expected recovery timeline will depend on the policies of the Singapore Government moving forward, such as lifting of the movement restriction measures. We expect such impact to continue at least throughout the balance of calendar year 2021.

Trends, Markets and Regions

Advertisement Spending

*It is estimated that advertising spending worldwide will surpass 560 billion U.S. dollars in 2019, representing a growth of roughly four percent compared with the previous year. North America is expected to remain the largest regional ad market, closely followed by Asia Pacific. Western Europe ranks third, with ad spends amounting to approximately half of these of North America. (*Source: https://www.statista.com/statistics/ 236943/global-advertising-spending/) **Meanwhile, digital advertising spending worldwide – which includes both desktop and laptop computers as well as mobile devices – stood at an estimate at 194.6 billion U.S. dollars in 2016. This figure is forecast to constantly increase in the coming years, reaching a total of 335 billion U.S. dollars by 2020. (**Source: https://www.statista.com/statistics/237974/online-advertising-spending-worldwide/)

In addition to the advertising spending study, we examined various consumer models such as cashback models for direct compensation to affiliate marketing (e.g., https://www.shopback.sg), discounted coupons sales model (e.g. https://www.groupon.com) and incentivized reward model (e.g. https://www.dollarshaveclub.com).

We believe that advertising spending, including digital advertising spending will continue to increase in the near future. We intend to innovate the way advertisement is used in the marketplace through digital advertisements and effective channeling relevant traffic.

Market and Region: Bank and Unbanked in Southeast Asia

*With a population of 570 million and a booming GDP expected to reach $4.7 trillion by 2025, the six largest countries in Southeast Asia represent one of the world’s largest and fastest-growing regions. Within the region, we believe that the financial services industry holds tremendous if fundamental underlying challenges are addressed. For example, cash is still the primary means of transaction. More than 70% of the adult population is either “underbanked” or “unbanked,” with limited access to financial services. (*Source: https://www.bain.com/insights/fufilling-its-promise/)

*Currently, only 50% of adults in ASEAN have an account at a financial institution. ASEAN is discussing a specific financial inclusion target for 2020. There is a consensus to set the target at around 70% for 2020. Rates of financial “exclusion” are higher among the poor, those living in rural areas, and those who are less-educated. Interestingly, neither gender nor age are relevant factors that explain financial exclusion in ASEAN countries. In ASEAN countries, only 29% of workers reported receiving their monthly salaries through an account from a financial institution, while the remaining 71% is paid in cash by their employers. (Source: http://blogs.worldbank.org/eastasiapacific/how-to-scale-up-financial-inclusion-in-asean-countries).

| 25 |

We believe the unbanked population in the ASEAN region represents an untapped opportunity, as individuals without accounts at financial institutions are limited in their ability to shop or engage in other financial transactions online. We intend to focus on the ASEAN region, especially the unbanked market which is generally not the main focus of many large corporations. We believe that our model of converting VX spending into reward incentives and rebates that are redeemable on our platform allows the unbanked market to access our online platform for new and additional spending experiences without the requirement of having an account at a financial institution.

Other Initiatives

We are generally pursuing a plan of expansion and hope to achieve revenue growth through mass adoption by users and merchants of our platform/ecosystem. We seek to increase our user and merchant base through user incentive programs and brand awareness marketing programs, among other things. We expect to focus on users and merchants located in China and the Asia Pacific region in the foreseeable future. There can be no assurance, however, that we will be able to successfully grow our revenues in the future, if ever.

Effective May 27, 2021, we granted Accell Technologies, Inc. (“ATI”) an exclusive license to use, market and sell our E-commerce Aggregator, Reward, AIM and AdTech system (“System”) in North America and South America for a period of 10 years (the “ATI License Agreement”). Pursuant to the terms of the ATI License Agreement, ATI is obligated to pay a royalty fee of 10% of gross revenues, not to exceed 20% of EBITDA on a per country basis in addition to other set up and software maintenance fees. ATI completed its evaluation of our System, and we expect ATI to complete the general software requirements specification (“SRS”) submission during the calendar quarter ended September 30, 2021. However due to the Covid 19 pandemic situation and restrictions, ATI faces delay in completing the SRS. ATI hopes to complete the SRS by the end of calendar quarter ended December 31, 2021. The foregoing description of the ATI License Agreement is qualified in its entirety by reference to such agreement which is filed as Exhibit 10.15 to this Quarterly Report.