UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

INVESTMENT COMPANY ACT FILE NUMBER 811-22467

KAYNE ANDERSON NEXTGEN ENERGY & INFRASTRUCTURE, INC.

(Exact name of registrant as specified in charter)

| 811 Main Street, 14th Floor, Houston, Texas | 77002 | |

| (Address of principal executive offices) | (Zip code) |

Jarvis V. Hollingsworth, Esq.

KA Fund Advisors, LLC, 811 Main Street, 14th Floor, Houston, Texas 77002

(Name and address of agent for service)

Registrant’s telephone number, including area code: (713) 493-2020

Date of fiscal year end: November 30, 2020

Date of reporting period: November 30, 2020

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The report of Kayne Anderson NextGen Energy & Infrastructure, Inc. (the “Registrant”) to stockholders for the fiscal year ended November 30, 2020 is attached below.

| Page | ||||

| Adoption of an Optional Delivery Method for Shareholder Reports (Rule 30e-3 Notice) |

1 | |||

| 2 | ||||

| 7 | ||||

| 8 | ||||

| 13 | ||||

| 17 | ||||

| 18 | ||||

| Statement of Changes in Net Assets Applicable to Common Stockholders |

19 | |||

| 20 | ||||

| 21 | ||||

| 25 | ||||

| 44 | ||||

| 46 | ||||

| 47 | ||||

| 52 | ||||

| 55 | ||||

| 56 | ||||

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS: This report of Kayne Anderson NextGen Energy & Infrastructure, Inc. (the “Fund”) contains “forward-looking statements” as defined under the U.S. federal securities laws. Generally, the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “will” and similar expressions identify forward-looking statements, which generally are not historical in nature. Forward-looking statements are subject to certain risks and uncertainties that could cause actual results to materially differ from the Fund’s historical experience and its present expectations or projections indicated in any forward-looking statement. These risks include, but are not limited to, changes in economic and political conditions; regulatory and legal changes; energy industry risk; leverage risk; valuation risk; interest rate risk; tax risk; and other risks discussed in the Fund’s filings with the Securities and Exchange Commission (“SEC”). You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. The Fund undertakes no obligation to publicly update or revise any forward-looking statements made herein. There is no assurance that the Fund’s investment objectives will be attained.

All investments in securities involve risks, including the possible loss of principal. The value of an investment in the Fund could be volatile, and you could suffer losses of some or a substantial portion of the amount invested. The Fund’s concentration of investments in energy infrastructure companies subjects it to the risks of the energy sector, including the risks of declines in energy and commodity prices, decreases in energy demand, adverse weather conditions, natural or other disasters, changes in government regulation, and changes in tax laws. Leverage creates risks that may adversely affect return, including the likelihood of greater volatility of net asset value and market price of common shares and fluctuations in distribution rates, which increases a stockholder’s risk of loss.

Performance data quoted in this report represent past performance and are for the stated time period only. Past performance is not a guarantee of future results. Current performance may be lower or higher than that shown based on market fluctuations from the end of the reported period.

KAYNE ANDERSON NEXTGEN ENERGY & INFRASTRUCTURE, INC.

ADOPTION OF AN OPTIONAL DELIVERY METHOD FOR SHAREHOLDER REPORTS

Rule 30e-3 Notice

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of Kayne Anderson NextGen Energy & Infrastructure, Inc.’s (the “Fund” or “KMF”) annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Fund’s website (www.kaynefunds.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund or your financial intermediary electronically by calling the Fund at 1-877-657-3863 or contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge. You can inform the Fund or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by calling the Fund at 1-877-657-3863 or contacting your financial intermediary. Your election to receive reports in paper will apply to all funds managed by KA Fund Advisors, LLC or held with your financial intermediary.

1

KAYNE ANDERSON NEXTGEN ENERGY & INFRASTRUCTURE, INC.

January 21, 2021

Dear Fellow Stockholders:

We hope that you and your families have been able to remain safe and healthy during these difficult times. Due to the global impact of the COVID-19 pandemic, the last 12 months will almost certainly be remembered as one of the most disruptive periods in modern history. A tragic number of lives have been lost and it has wreaked havoc on people’s livelihoods. The team at Kayne Anderson applauds the heroic efforts of the people on the front line of this crisis.

In response to the pandemic, nations across the globe have taken extraordinary steps to control the spread of the virus and lessen the economic fallout. Economic activity has recovered from its lows during the second quarter of 2020, and our outlook for the new year is best described as cautiously optimistic. Great progress has been made in treating those with the most severe COVID-19 symptoms, and the speed at which vaccines and therapeutics have been developed is astounding. Mass distribution of these vaccines should help the world get this health crisis under control during 2021.

As discussed in this annual letter, we are very excited about the Energy Transition and the opportunities it will create for the energy and infrastructure sectors.1 Kayne Anderson has a large, experienced team of investment professionals focused on identifying companies best positioned to benefit from this mega trend. In our opinion, KMF — with its flexible investment mandate, permanent capital base, and expertise in providing strategic capital solutions to both public and private companies — is particularly well suited to capitalize on this opportunity.

While 2020 was a very challenging year, KMF weathered the storm. Importantly, we prudently managed KMF’s balance sheet during the downturn, and the Fund exited the year on strong financial footing. Further, we transformed KMF’s portfolio during the year, positioning the Fund to benefit from the global push to use a lower carbon mix of energy resources. We acknowledge that last year was difficult for our investors, but we believe the cumulative impact of the actions taken during 2020 will accrue to our stockholders’ benefit for many years to come.

In addition to reviewing this annual letter, we encourage investors to listen to the podcasts available on our website (www.kaynefunds.com/insights). The goal of these podcasts is to provide KMF’s investors frequent updates on the Fund’s performance and insightful discussions on industry news and trends.

KMF Strategic Initiatives

In July 2020, we announced a strategic shift in the Fund’s focus to target investments in companies that are meaningfully participating in, or benefitting from, the Energy Transition. With this repositioning, KMF’s investment universe will include a more diverse portfolio of energy and infrastructure investments, including midstream companies (biased toward natural gas and LNG infrastructure), utilities (biased toward green utilities), and renewable infrastructure companies. In conjunction with this announcement, we changed KMF’s name from “Kayne Anderson Midstream/Energy Fund” to “Kayne Anderson NextGen Energy & Infrastructure, Inc.,” which we believe better reflects the Fund’s strategy and targeted investments.

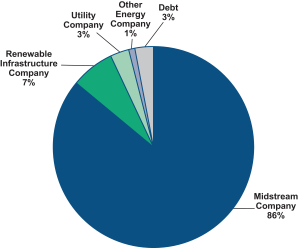

KMF made very good progress transitioning its portfolio during fiscal 2020. At the start of the year, only 10% of KMF’s portfolio was invested in renewable infrastructure companies and green utilities, while today, the Fund’s allocation to these two sub-sectors is almost 50%. Currently, over 60% of

| 1 | As defined on page 3 in the section titled “The Energy Transition”. |

2

KAYNE ANDERSON NEXTGEN ENERGY & INFRASTRUCTURE, INC.

LETTER TO STOCKHOLDERS

KMF’s portfolio is invested in NextGen Companies, which we define as companies that are participating in, or benefitting from, the Energy Transition. We are very pleased with the progress the Fund has made over the past twelve months, and we believe KMF is well positioned to capitalize on the megatrends in the energy and infrastructure sectors for decades to come.

One of the greatest challenges the world will deal with over the next decade is climate change, and nations across the globe are dedicating significant resources to tackling this problem. Over the last year, many countries announced ambitious goals to reduce emissions of carbon and other greenhouse gasses. These policies are designed to foster investments in renewable energy, electrification of vehicles, and technologies that reduce emissions. In addition to helping fight the impact of climate change, many of these policies will help stimulate local economies and provide employment opportunities for workers displaced as a result of the pandemic. Corporations are getting involved as well, with many large companies pledging to increase their use of renewable energy and reduce their carbon footprints. The industry jargon for this trend is the “Energy Transition,” which is defined as the transition away from traditional carbon-based fuels to a more sustainable mix of lower carbon and renewable energy sources. This transition is already having a meaningful impact on the energy and infrastructure sectors, and we expect it to become even more influential in the coming decades.

While events over the last few years should serve as a notice to companies in all facets of the energy industry that their businesses must adapt to this transition, the commentary about the pending obsolescence of fossil fuels — in our opinion — misses the mark. Our existing hydrocarbon-based energy system is globally interconnected and evolved into its current form over the last half-century. The use of renewable energy will rapidly grow, but fossil fuels will remain a critical piece of the puzzle for many years to come.

Energy Industry Update

Fiscal 2020 was a very strong year for the renewable infrastructure sector. Renewable infrastructure companies have seen minimal COVID-19 related financial impacts, and their cash flows proved to be very resilient, supported by fixed price contracts, preferential grid access, and strong execution on capital projects. Equity valuations benefitted from lower risk premiums, enhanced growth backlogs, lower interest rates, and increased interest from ESG-focused investors, with some of KMF’s top renewable infrastructure holdings up over 75% for the fiscal year. Despite the pandemic, growth projects have largely remained on schedule — the U.S. had a record year of wind capacity additions. Many local and federal governments enacted new greenhouse gas emission reduction targets and renewable energy goals, and many private corporations have also committed to sourcing 100% of their electricity needs from renewable energy sources. We were pleased with the industry’s performance this year and continue to be excited about the growth prospects the sector will offer over the next decade.

Like the renewable infrastructure sector, the utilities sector had very strong operational and financial performance, with very few COVID-related impacts to earnings. While U.S. power demand did see a substantial decline in the second quarter, overall demand has since largely recovered to within a few percentage points of 2019 levels. As with many sectors working to achieve net-zero 2050 targets, the power sector is working hard to reduce greenhouse gas emissions, and coal plant closures have continued to accelerate in favor of new wind and solar generation. As we look to 2021, we believe it is likely that new legislation and potential stimulus packages under the Biden administration will support investment in new renewable generation capacity and upgrades to the power grid, both of which will provide for outsized rate base growth for the sector.

3

KAYNE ANDERSON NEXTGEN ENERGY & INFRASTRUCTURE, INC.

LETTER TO STOCKHOLDERS

In contrast to the renewable infrastructure and utilities sectors, traditional hydrocarbon companies had a very tough year. The collapse in economic activity during the first and second quarters of 2020 resulted in a massive contraction in demand for energy commodities. This “demand shock” placed an enormous strain on all parts of the hydrocarbon value chain. Demand has started to recover, but it will likely take at least another 12 months before recovering to pre-pandemic levels. Domestic production, which is currently well below recent peak levels, should start to grow again later this year, albeit at a much more measured rate than the sector has seen over the past decade. This slower growth is not necessarily a bad outcome for the sector — we believe this will eventually translate into a much-improved supply/demand balance and will be supportive of more sustainable commodity prices. Despite the demand shock caused by the pandemic, operationally, midstream companies fared relatively well. For the top 10 names in the midstream sector, the impact to earnings was relatively minimal, with full year 2020 EBITDA expected to be roughly in-line with 2019 results. We remain optimistic that the resiliency of midstream earnings power, the robust free cash flow to be generated over the coming years, new share buyback programs, and a focus by management teams on instituting environmental, social & governance (typically referred to as ESG) best practices will attract investors back to the sector and be supportive of equity valuations.

KMF Performance Review

Benchmarking KMF’s performance for the year is challenging, as the Fund’s portfolio underwent a significant transformation during fiscal 2020. While we ended the fiscal year with a significant allocation to renewable infrastructure and green utilities, the Fund was predominantly weighted to midstream energy companies for most of the year. Making matters even more complicated was the huge dispersion in returns for the midstream, renewable infrastructure, and utility sub-sectors. KMF’s Net Asset Value Return was negative 33% for the year, in-line with the performance of midstream focused competitor funds.2 By comparison, the total return for the Alerian MLP Index (or the AMZ) was negative 25% and the Alerian Midstream Energy Index (or AMNA) was negative 18%. In contrast, the total return of the XLU, an ETF of domestic utilities, was up 3% for the year, and the composite total return for a group of renewable infrastructure companies that we track was 42%.3 While we are certainly disappointed by KMF’s overall performance for the fiscal year, we are happy with the Fund’s recovery since the market lows last spring, with an adjusted NAV return of over 225%, significantly outperforming the AMZ (total return of 135%), the AMNA (total return of 109%), the XLU (total return of 17%) and the aforementioned group of renewable infrastructure companies (total return of 84%). Looking forward, we believe the steps we have taken to diversify KMF’s portfolio position the Fund to generate attractive risk-adjusted returns.

Another measure of the Fund’s performance is Market Return, which was negative 41% for fiscal 2020.4 This measure is worse than our Net Asset Value Return because our stock price went from trading at a 14.7% discount to NAV at the beginning of fiscal 2020 to trading at a 25.2% discount at the end of fiscal 2020. We will continue to monitor KMF’s stock price relative to its NAV and will consider alternatives should this wider-than-normal discount persist.

| 2 | Net Asset Return is defined as the change in net asset value per share plus cash distributions paid during the period (assuming reinvestment through our dividend reinvestment plan). |

| 3 | Market-cap weighted total returns for 37 domestic and international renewable infrastructure companies. |

| 4 | Market Return is defined as the change in share price plus cash distributions paid during the period (assuming reinvestment through our dividend reinvestment plan). |

4

KAYNE ANDERSON NEXTGEN ENERGY & INFRASTRUCTURE, INC.

LETTER TO STOCKHOLDERS

KMF Distributions

During fiscal 2020 we made the difficult decision to reduce KMF’s distribution to a quarterly rate of 9 cents per share. We understand how important distributions are to our investors, but felt this reduction was the prudent financial decision.

Historically, our distributions have been funded generally by net distributable income (or NDI), which is the amount of income received by us from our portfolio investments, less operating expenses. We expect NDI to be one of several factors considered by the Fund’s Board of Directors when determining KMF’s distribution in future periods. While this may seem like a nuanced comment, we believe given the recent changes in KMF’s portfolio — it is important to consider more than just NDI. For example, KMF’s holdings of renewable infrastructure companies and green utilities tend to have lower dividend yields than most midstream companies (which reduces KMF’s NDI). Offsetting these lower yields are higher expected growth rates in earnings, cash flow, and dividends for many of these companies (which would typically result in higher rates of capital appreciation). Taking other factors into account (such as realized and unrealized gains and expected returns for portfolio investments) affords us more flexibility to meet one of our most important long-term goals — providing investors an attractive distribution.

KMF Outlook

Management is excited about what is in store for the Fund over the next decade. The last year was like none we have seen in KMF’s 10-year history. KMF navigated the downturn and, in our opinion, took the correct steps to position the Fund to thrive during the Energy Transition.

President Biden’s inauguration took place earlier this week. As we have discussed in this annual letter, addressing climate change is a clear priority of the new administration, and President Biden’s stated policy goals include some very ambitious targets for reducing carbon emissions. We expect these policies to be very beneficial for KMF’s investments in renewable infrastructure companies and green utilities. We believe both sectors are in the early stages of a period of outsized investment and growth, with over $300 billion expected to be invested annually in new solar and wind generation capacity globally for the next 30 years. For regulated utilities, massive investment in upgrading and expanding the power grid will be required to support electrification of the transport sector, which should drive outsized rate base growth for these companies. While supportive government and corporate de-carbonization policies certainly provide tailwinds for investment in renewable infrastructure companies and green utilities, technology and costs have significantly improved over the past decade, making new solar and wind generation competitive with or even cheaper than new fossil fuel generation (without the need for government subsidies).

We are also hopeful President Biden and his team will take a pragmatic approach to conventional energy and the infrastructure assets that facilitate the movement of energy-related commodities. Our outlook for midstream equities over the next 12 to 18 months is positive, and I would like to provide a few statistics to support this bullish thesis. Based on our estimates, the top 10 midstream names in KMF’s portfolio currently trade at an average of 10x enterprise value to 2021 EBITDA, below historical trading ranges of 11x to 13x. Further, those ten companies have an average dividend yield of 8%, and we estimate they will produce free cash flow yields of 10% during 2021. We expect these companies to continue to generate material amounts of free cash flow over the next five to ten years, which can be used to reduce debt, repurchase stock, and/or increase distributions.

We appreciate your investment in the Fund and look forward to executing on our investment objective of providing a high level of total return with an emphasis on making cash distributions to our

5

KAYNE ANDERSON NEXTGEN ENERGY & INFRASTRUCTURE, INC.

LETTER TO STOCKHOLDERS

stockholders. KMF’s flexible mandate within the energy and infrastructure sectors will serve it well, as will the Fund’s size and scale. I have little doubt that the next ten years will bring meaningful changes to these sectors, but our diverse team of industry experts is well positioned to capitalize on this opportunity. Please do not hesitate to contact us with any questions or comments.

Sincerely,

James C. Baker

Chairman of the Board

President and Chief Executive Officer

6

KAYNE ANDERSON NEXTGEN ENERGY & INFRASTRUCTURE, INC.

(UNAUDITED)

Portfolio of Long-Term Investments by Category(1)

| November 30, 2020 | November 30, 2019 | |

|

| |

Top 10 Holdings by Issuer

| Percent of Long Term Investments as of November 30, |

||||||||||

| Holding | Category(1) | 2020 | 2019 | |||||||

| 1. The Williams Companies, Inc. |

Midstream Company | 6.3 | % | 8.5 | % | |||||

| 2. Targa Resources Corp. |

Midstream Company | 5.4 | 4.3 | |||||||

| 3. Enterprise Products Partners |

Midstream Company | 5.0 | 5.2 | |||||||

| 4. Brookfield Renewable Partners L.P. |

Renewable Infrastructure Company | 4.9 | 2.5 | |||||||

| 5. Atlantica Sustainable Infrastructure plc |

Renewable Infrastructure Company | 4.0 | 1.7 | |||||||

| 6. Kinder Morgan, Inc. |

Midstream Company | 3.7 | 6.0 | |||||||

| 7. NextEra Energy Partners, LP |

Renewable Infrastructure Company | 3.6 | 1.7 | |||||||

| 8. Innergex Renewable Energy Inc. |

Renewable Infrastructure Company | 3.3 | 0.3 | |||||||

| 9. TC Energy Corporation |

Midstream Company | 3.1 | 5.7 | |||||||

| 10. Northland Power Inc. |

Renewable Infrastructure Company | 2.7 | 0.9 | |||||||

| (1) | See Glossary of Key Terms for definitions. |

| (2) | Includes our ownership of common units and preferred units. |

7

KAYNE ANDERSON NEXTGEN ENERGY & INFRASTRUCTURE, INC.

(UNAUDITED)

Fund Overview

Kayne Anderson NextGen Energy & Infrastructure, Inc. (the “Fund” or “KMF”) is a non-diversified, closed-end fund that commenced operations in November 2010. Our investment objective is to provide a high level of total return with an emphasis on making cash distributions to our stockholders. We seek to achieve that investment objective by investing at least 80% of our total assets in the securities of Energy Companies and Infrastructure Companies. We expect to invest the majority of our assets in securities of “NextGen” companies which we define as Energy Companies and Infrastructure Companies that are meaningfully participating in, or benefitting from, the Energy Transition. Please see the Glossary of Key Terms for a description of these investment categories and for the meaning of capitalized terms not otherwise defined herein.

As of November 30, 2020, we had total assets of $451 million, net assets applicable to our common stockholders of $331 million (net asset value of $7.02 per share), and 47.2 million shares of common stock outstanding. As of November 30, 2020, we held $440 million in equity investments and $8 million in debt investments.

Recent Events

On December 9, 2020, the Board of Directors amended and restated the KMF’s bylaws. Under the new bylaws, KMF has elected to be subject to the Maryland Control Share Acquisition Act (“MCSAA”). The MCSAA seeks to limit the ability of an acquiring person to achieve a short-term gain at the expense of the Fund’s ability to pursue its investment objective and policies and to seek long-term value for the rest of the Fund’s stockholders. The amended and restated bylaws are available in the Governance section of the Fund’s website (www.kaynefunds.com/kmf).

Results of Operations — For the Three Months Ended November 30, 2020

Investment Income. Investment income totaled $2.4 million for the quarter and consisted primarily of net dividends and distributions and interest income on our investments. We received $6.0 million of dividends and distributions, of which $3.8 million was treated as return of capital and $0.1 million was treated as distributions in excess of cost basis. Interest income was $0.3 million.

Operating Expenses. Operating expenses totaled $3.1 million, including $1.3 million of investment management fees, $0.9 million of interest expense, $0.5 million of preferred stock distributions and $0.4 million of other operating expenses. Interest expense includes $0.1 million of non-cash amortization of debt issuance costs. Preferred stock distributions include $0.05 million of non-cash amortization.

Net Investment Loss. Our net investment loss totaled $0.7 million.

Net Realized Losses. We had net realized losses of $10.5 million.

Net Change in Unrealized Gains. We had unrealized gains of $51.7 million from investments.

Net Increase in Net Assets Resulting from Operations. As a result of the above, we had a net increase in net assets resulting from operations of $40.5 million.

8

KAYNE ANDERSON NEXTGEN ENERGY & INFRASTRUCTURE, INC.

MANAGEMENT DISCUSSION

(UNAUDITED)

Results of Operations — For the Fiscal Year Ended November 30, 2020

Investment Income. Investment income totaled $12.5 million for the year and consisted primarily of net dividends and distributions and interest income on our investments. We received $34.0 million of dividends and distributions, of which $22.7 million was treated as return of capital and $0.5 million was treated as distributions in excess of cost basis. Return of capital was decreased by $0.5 million due to 2019 tax reporting information that we received in fiscal 2020. Interest income was $1.7 million.

Operating Expenses. Operating expenses totaled $19.6 million, including $6.5 million of investment management fees, $8.2 million of interest expense, $3.4 million of preferred stock distributions and $1.5 million of other operating expenses. Interest expense for the fiscal year includes $2.6 million of prepayment penalties associated with the redemptions of senior unsecured notes (“Notes”). Interest expense also includes $0.9 million of non-cash amortization and write-offs of debt issuance costs. Preferred stock distributions include $0.4 million of prepayment penalties associated with the redemption of mandatory redeemable preferred shares (“MRP Shares”) and $0.2 million of non-cash write-off, and $0.4 million of non-cash amortization and write-offs of debt issuance costs.

Net Investment Loss. Our net investment loss totaled $7.1 million.

Net Realized Losses. We had net realized losses of $167.8 million, which includes $0.2 million of net realized gains from option activity and $0.5 million of realized losses on foreign currency transactions.

Net Change in Unrealized Gains. We had a net decrease in unrealized gains of $5.2 million.

Net Decrease in Net Assets Resulting from Operations. As a result of the above, we had a decrease in net assets resulting from operations of $180.1 million.

Distributions to Common Stockholders

Net distributable income (“NDI”) is the amount of income received by us from our portfolio investments less operating expenses, subject to certain adjustments as described below. NDI is one of several items considered by our Board of Directors in setting our distribution to common stockholders. NDI is not a financial measure under the accounting principles generally accepted in the United States of America (“GAAP”). Refer to the “Reconciliation of NDI to GAAP” section below for a reconciliation of this measure to our results reported under GAAP.

Income from portfolio investments includes (a) cash dividends and distributions, (b) paid-in-kind dividends received (i.e., stock dividends), (c) interest income from debt securities and commitment fees from private investments in public equity (“PIPE investments”) and (d) net premiums received from the sale of covered calls.

Operating expenses include (a) investment management fees paid to our investment adviser, (b) other expenses (mostly comprised of fees paid to other service providers), (c) accrual for estimated excise taxes (if any) and (d) interest expense and preferred stock distributions.

9

KAYNE ANDERSON NEXTGEN ENERGY & INFRASTRUCTURE, INC.

MANAGEMENT DISCUSSION

(UNAUDITED)

Net Distributable Income (NDI)

(amounts in millions, except for per share amounts)

| Three Months Ended November 30, 2020 |

Fiscal Year Ended November 30, 2020 |

|||||||

| Distributions and Other Income from Investments |

||||||||

| Dividends |

$ | 6.0 | $ | 34.0 | ||||

| Interest Income |

0.4 | 1.8 | ||||||

|

|

|

|

|

|||||

| Total Distributions and Other Income from Investment |

6.4 | 35.8 | ||||||

| Expenses |

||||||||

| Investment Management Fee |

(1.3 | ) | (6.6 | ) | ||||

| Other Expenses |

(0.4 | ) | (1.5 | ) | ||||

| Interest Expense(1) |

(0.8 | ) | (7.4 | ) | ||||

| Preferred Stock Distributions(2) |

(0.5 | ) | (3.0 | ) | ||||

|

|

|

|

|

|||||

| Net Distributable Income (NDI) |

$ | 3.4 | $ | 17.4 | ||||

|

|

|

|

|

|||||

| Weighted Shares Outstanding |

47.2 | 47.2 | ||||||

| NDI per Weighted Share Outstanding |

$ | 0.072 | $ | 0.369 | ||||

|

|

|

|

|

|||||

| Adjusted NDI per Weighted Share Outstanding |

$ | 0.073 | (3) | $ | 0.432 | (4) | ||

|

|

|

|

|

|||||

| Distribution paid per Common Share(5) |

$ | 0.090 | $ | 0.495 | ||||

| (1) | Interest expense for the year includes $2.6 million of prepayment penalties associated with the redemption of Notes. |

| (2) | Preferred stock distributions include $0.03 million and $0.4 million of prepayment penalties associated with the redemption of MRP Shares during the quarter and year, respectively. |

| (3) | Adjusted NDI excludes amendment fees associated with the redemption of MRP Shares during the quarter ($0.03 million) |

| (4) | Adjusted NDI excludes prepayment penalties and the accelerated amortization of interest rate swap payments associated with the redemption of Notes and MRP Shares during the year ($3.0 million). |

| (5) | The distribution of $0.09 per share for the fourth quarter of fiscal 2020 was paid on December 31, 2020. Distributions for fiscal 2020 include all distributions paid during the calendar year. |

Payment of future distributions is subject to Board of Directors approval, as well as meeting the covenants on our debt agreements and terms of our preferred stock.

Reconciliation of NDI to GAAP

The difference between distributions and other income from investments in the NDI calculation and total investment income as reported in our Statement of Operations is reconciled as follows:

| • | A significant portion of the cash distributions received from our investments is characterized as return of capital. For GAAP purposes, return of capital distributions are excluded from investment income, whereas the NDI calculation includes the return of capital portion of such distributions. |

10

KAYNE ANDERSON NEXTGEN ENERGY & INFRASTRUCTURE, INC.

MANAGEMENT DISCUSSION

(UNAUDITED)

| • | GAAP recognizes distributions received from our investments that exceed the cost basis of our securities to be realized gains and are therefore excluded from investment income, whereas the NDI calculation includes these distributions. |

| • | NDI includes the value of paid-in-kind dividends and distributions whereas such amounts are not included as investment income for GAAP purposes, but rather are recorded as unrealized gains upon receipt. |

| • | NDI includes commitment fees from PIPE investments, whereas such amounts are generally not included in investment income for GAAP purposes, but rather are recorded as a reduction to the cost of the investment. |

| • | Certain of our investments in debt securities were purchased at a discount or premium to the par value of such security. When making such investments, we consider the security’s yield to maturity, which factors in the impact of such discount (or premium). Interest income reported under GAAP includes the non-cash accretion of the discount (or amortization of the premium) based on the effective interest method. When we calculate interest income for purposes of determining NDI, in order to better reflect the yield to maturity, the accretion of the discount (or amortization of the premium) is calculated on a straight-line basis to the earlier of the expected call date or the maturity date of the debt security. |

| • | We may sell covered call option contracts to generate income or to reduce our ownership of certain securities that we hold. In some cases, we are able to repurchase these call option contracts at a price less than the call premium that we received, thereby generating a profit. The premium we receive from selling call options, less (i) the amount that we pay to repurchase such call option contracts and (ii) the amount by which the market price of an underlying security is above the strike price at the time a new call option is written (if any), is included in NDI. For GAAP purposes, premiums received from call option contracts sold are not included in investment income. See Note 2 — Significant Accounting Policies for a full discussion of the GAAP treatment of option contracts. |

The treatment of expenses included in NDI also differs from what is reported in the Statement of Operations as follows:

| • | The non-cash amortization or write-offs of capitalized debt issuance costs and preferred stock offering costs related to our financings is included in interest expense and distributions on preferred stock for GAAP purposes, but is excluded from our calculation of NDI. |

| • | NDI also includes recurring payments (or receipts) on interest rate swap contracts or the amortization of termination payments on interest rate swap contracts entered into in anticipation of an offering of Notes and MRP Shares. The termination payments on interest rate swap contracts are amortized over the term of the Notes or MRP Shares issued. For GAAP purposes, these amounts are included in the realized gains/losses section of the Statement of Operations in the period in which the termination payments were incurred. |

| • | Under GAAP, excise taxes are accrued when probable and estimable. For NDI, we exclude excise tax that is unrelated to the current fiscal period. |

| • | For GAAP purposes, offering costs incurred related to the issuance of common stock reduce paid-in capital when stock is issued. Certain costs related to registration statements or shelf offerings may be written off once the registration statement or prospectus’ usefulness has expired. The non-cash amortization or write-off of these offering costs is included in operating expense for GAAP purposes, but is excluded from our calculation of NDI. |

11

KAYNE ANDERSON NEXTGEN ENERGY & INFRASTRUCTURE, INC.

MANAGEMENT DISCUSSION

(UNAUDITED)

Liquidity and Capital Resources

At November 30, 2020, we had total leverage outstanding of $116 million, which represented 26% of total assets. Total leverage was comprised of $85 million of Notes, $28 million of MRP Shares and $4 million of borrowings outstanding under our unsecured revolving credit facility (the “Credit Facility”). At such date, we had $0.2 million of cash and cash equivalents. As of January 21, 2021, we had $17 million borrowings outstanding under our Credit Facility and we had $2 million of cash.

Our Credit Facility has a total commitment of $75 million and matures on February 8, 2021. The interest rate on borrowings under the Credit Facility may vary between LIBOR plus 1.30% and LIBOR plus 2.15%, depending on our asset coverage ratios. We pay a fee of 0.20% per annum on any unused amounts of the Credit Facility. We have launched a process to renew this facility and expect to complete this renewal process in early February 2021.

At November 30, 2020, we had $85 million of Notes outstanding that mature between 2022 and 2025 and we had $28 million of MRP Shares outstanding that are subject to mandatory redemption between 2021 and 2024. We expect to refinance the MRP Shares that mature in 2021 prior to their redemption dates.

At November 30, 2020, our asset coverage ratios under the Investment Company Act of 1940, as amended (“1940 Act”), were 505% for debt and 385% for total leverage (debt plus preferred stock). As of January 21, 2021, our asset coverage ratios were 506% for debt and 398% for total leverage. As of January 21, 2021, we were in compliance with all covenants of our debt agreements and the terms of our preferred stock.

Our target asset coverage ratio with respect to our debt is 480% and our target total leverage asset coverage is 360%. At times we may be above or below this target depending on market conditions as well as certain other factors.

As of November 30, 2020, our total leverage consisted 97% of fixed rate obligations and 3% of floating rate obligations. At such date, the weighted average interest/dividend rate on our total leverage was 3.66%.

12

KAYNE ANDERSON NEXTGEN ENERGY & INFRASTRUCTURE, INC.

NOVEMBER 30, 2020

(amounts in 000’s)

| Description |

No. of Shares/Units |

Value | ||||||

| Long-Term Investments — 135.4% |

||||||||

| Equity Investments(1) — 132.9% |

||||||||

| United States — 81.9% |

||||||||

| Midstream Company(2) — 59.0% |

||||||||

| Antero Midstream Corporation |

1,178 | $ | 7,943 | |||||

| BP Midstream Partners LP(3) |

251 | 2,844 | ||||||

| Cheniere Energy, Inc.(4)(5) |

140 | 7,948 | ||||||

| Cheniere Energy Partners, L.P.(3)(5) |

74 | 2,819 | ||||||

| DCP Midstream, LP — Series A Preferred Units(3)(6) |

6,005 | 4,406 | ||||||

| Energy Transfer LP(3) |

1,235 | 7,634 | ||||||

| EnLink Midstream Partners, LP, — Series C Preferred Units(7) |

8,605 | 4,733 | ||||||

| Enterprise Products Partners L.P.(3) |

485 | 9,417 | ||||||

| Enterprise Products Partners L.P. — Convertible Preferred Units(3)(8)(9)(10) |

13 | 12,805 | ||||||

| Equitrans Midstream Corporation(5) |

163 | 1,328 | ||||||

| Equitrans Midstream Corporation — Convertible Preferred Shares(5)(8)(9)(11) |

238 | 4,589 | ||||||

| Kinder Morgan, Inc.(5) |

1,158 | 16,657 | ||||||

| KNOT Offshore Partners LP(12) |

297 | 4,339 | ||||||

| ONEOK, Inc. |

269 | 9,659 | ||||||

| Magellan Midstream Partners, L.P.(3) |

156 | 6,419 | ||||||

| MPLX LP(3) |

548 | 11,538 | ||||||

| Phillips 66 Partners LP(3) |

126 | 3,387 | ||||||

| Plains GP Holdings, L.P.(13)(14) |

695 | 5,509 | ||||||

| Plains GP Holdings, L.P. — Plains AAP, L.P.(8)(12)(13)(14) |

690 | 5,475 | ||||||

| Rattler Midstream LP(12) |

421 | 3,489 | ||||||

| Shell Midstream Partners, L.P.(3) |

333 | 3,418 | ||||||

| Targa Resources Corp. |

1,025 | 24,098 | ||||||

| TC PipeLines, LP(3)(5)(15) |

217 | 6,696 | ||||||

| The Williams Companies, Inc.(5) |

1,347 | 28,266 | ||||||

|

|

|

|||||||

| 195,416 | ||||||||

|

|

|

|||||||

| Renewable Infrastructure Company(2)(5) — 10.8% |

||||||||

| Clearway Energy, Inc. — Class A |

231 | 6,259 | ||||||

| Clearway Energy, Inc. — Class C |

102 | 2,988 | ||||||

| Enviva Partners, LP(3) |

231 | 10,302 | ||||||

| NextEra Energy Partners, LP |

257 | 16,299 | ||||||

|

|

|

|||||||

| 35,848 | ||||||||

|

|

|

|||||||

| Utility Company(2)(5) — 10.5% |

||||||||

| Dominion Energy, Inc. |

67 | 5,251 | ||||||

| Duke Energy Corporation |

32 | 2,993 | ||||||

| Eversource Energy |

48 | 4,218 | ||||||

| NextEra Energy, Inc. |

156 | 11,509 | ||||||

| Sempra Energy |

52 | 6,654 | ||||||

| Xcel Energy Inc. |

64 | 4,298 | ||||||

|

|

|

|||||||

| 34,923 | ||||||||

|

|

|

|||||||

See accompanying notes to financial statements.

13

KAYNE ANDERSON NEXTGEN ENERGY & INFRASTRUCTURE, INC.

SCHEDULE OF INVESTMENTS

NOVEMBER 30, 2020

(amounts in 000’s)

| Description |

No. of Shares/Units |

Value | ||||||

| Other Energy Company(2) — 1.6% |

||||||||

| Phillips 66 |

86 | $ | 5,192 | |||||

|

|

|

|||||||

| Total United States (Cost — $337,082) |

|

271,379 | ||||||

|

|

|

|||||||

| Canada — 33.7% |

||||||||

| Renewable Infrastructure Company(2)(5) — 18.9% |

||||||||

| Brookfield Renewable Partners L.P. |

343 | 21,792 | ||||||

| Brookfield Renewable Corporation — Class A |

134 | 10,637 | ||||||

| Innergex Renewable Energy Inc. |

750 | 14,839 | ||||||

| Northland Power Inc. |

349 | 11,950 | ||||||

| TransAlta Renewables Inc. |

242 | 3,340 | ||||||

|

|

|

|||||||

| 62,558 | ||||||||

|

|

|

|||||||

| Midstream Company(2) — 10.6% |

||||||||

| AltaGas Ltd.(5) |

130 | 1,866 | ||||||

| Enbridge Inc. |

305 | 9,508 | ||||||

| Pembina Pipeline Corporation |

389 | 9,916 | ||||||

| TC Energy Corporation(5)(15) |

313 | 13,749 | ||||||

|

|

|

|||||||

| 35,039 | ||||||||

|

|

|

|||||||

| Utility Company(2)(5) — 3.0% |

||||||||

| Algonquin Power & Utilities Corp. |

641 | 10,043 | ||||||

|

|

|

|||||||

| Other Energy Company(2) — 1.2% |

||||||||

| Jupiter Resources Inc.(4)(8)(16) |

1,229 | 4,042 | ||||||

|

|

|

|||||||

| Total Canada (Cost — $96,867) |

|

111,682 | ||||||

|

|

|

|||||||

| United Kingdom — 6.9% |

||||||||

| Renewable Infrastructure Company(2)(5) — 5.4% |

||||||||

| Atlantica Sustainable Infrastructure plc |

520 | 17,879 | ||||||

|

|

|

|||||||

| Utility Company(2)(5) — 1.5% |

||||||||

| SSE plc |

283 | 5,058 | ||||||

|

|

|

|||||||

| Total United Kingdom (Cost — $15,293) |

|

22,937 | ||||||

|

|

|

|||||||

| Spain — 2.6% |

||||||||

| Utility Company(2)(5) — 1.8% |

||||||||

| Iberdrola, S.A. |

433 | 5,910 | ||||||

|

|

|

|||||||

| Renewable Infrastructure Company(2)(5) — 0.8% |

||||||||

| EDP Renováveis, S.A. |

129 | 2,738 | ||||||

|

|

|

|||||||

| Total Spain (Cost — $6,938) |

|

8,648 | ||||||

|

|

|

|||||||

| Italy — 1.9% |

||||||||

| Utility Company(2)(5) — 1.9% |

||||||||

| Enel — Società per Azioni (Cost — $5,361) |

642 | 6,407 | ||||||

|

|

|

|||||||

See accompanying notes to financial statements.

14

KAYNE ANDERSON NEXTGEN ENERGY & INFRASTRUCTURE, INC.

SCHEDULE OF INVESTMENTS

NOVEMBER 30, 2020

(amounts in 000’s)

| Description |

No. of Shares/Units |

Value | ||||||||||||||||||

| Greece — 1.8% |

||||||||||||||||||||

| Renewable Infrastructure Company(2)(5) — 1.8% |

|

|||||||||||||||||||

| Terna Energy S.A. (Cost — $4,938) |

|

379 | $ | 5,866 | ||||||||||||||||

|

|

|

|||||||||||||||||||

| Denmark — 1.4% |

||||||||||||||||||||

| Renewable Infrastructure Company(2)(5) — 1.4% |

|

|||||||||||||||||||

| Orsted A/S (Cost — $3,231) |

|

25 | 4,557 | |||||||||||||||||

|

|

|

|||||||||||||||||||

| Portugal — 1.1% |

||||||||||||||||||||

| Utility Company(2)(5) — 1.1% |

|

|||||||||||||||||||

| EDP — Energias de Portugal, S.A. (Cost — $3,373) |

|

673 | 3,581 | |||||||||||||||||

|

|

|

|||||||||||||||||||

| Switzerland — 0.9% |

||||||||||||||||||||

| Infrastructure Company(2) — 0.9% |

||||||||||||||||||||

| Flughafen Zurich AG (Cost — $2,037) |

|

17 | 2,877 | |||||||||||||||||

|

|

|

|||||||||||||||||||

| Lithuania — 0.7% |

||||||||||||||||||||

| Utility Company(2)(5) — 0.7% |

||||||||||||||||||||

| AB Ignitis Grupe(4) (Cost — $2,477) |

|

94 | 2,241 | |||||||||||||||||

|

|

|

|||||||||||||||||||

| Total Equity Investments (Cost — $477,597) |

|

440,175 | ||||||||||||||||||

|

|

|

|||||||||||||||||||

| Interest Rate |

Maturity Date |

Principal Amount |

||||||||||||||||||

| Debt Instruments — 2.5% |

||||||||||||||||||||

| United States — 2.5% |

||||||||||||||||||||

| Midstream Company(2) — 2.5% |

||||||||||||||||||||

| Buckeye Partners, L.P. |

6.375 | % | 1/22/78 | $ | 6,040 | 4,107 | ||||||||||||||

| Crestwood Holdings LLC(8) |

(17 | ) | 3/6/23 | 6,677 | 4,290 | |||||||||||||||

|

|

|

|||||||||||||||||||

| Total Debt Investments (Cost — $11,205) |

|

8,397 | ||||||||||||||||||

|

|

|

|||||||||||||||||||

| Total Long-Term Investments — 135.4% (Cost — $488,802) |

|

448,572 | ||||||||||||||||||

|

|

|

|||||||||||||||||||

| Debt |

|

(88,515 | ) | |||||||||||||||||

| Mandatory Redeemable Preferred Stock at Liquidation Value |

|

(27,542 | ) | |||||||||||||||||

| Other Liabilities in Excess of Other Assets |

|

(1,288 | ) | |||||||||||||||||

|

|

|

|||||||||||||||||||

| Net Assets Applicable to Common Stockholders |

|

$ | 331,227 | |||||||||||||||||

|

|

|

|||||||||||||||||||

| (1) | Unless otherwise noted, equity investments are common units/common shares. |

| (2) | Refer to the “Glossary of Key Terms” for the definitions. |

| (3) | Securities are treated as a qualified publicly-traded partnership for RIC qualification purposes. To qualify as a RIC for tax purposes, the Fund may directly invest up to 25% of its total assets in equity and debt securities of entities treated as qualified publicly-traded partnerships. The Fund had 18.1% of its total assets invested in qualified publicly-traded partnerships at November 30, 2020. It is the Fund’s intention to be treated as a RIC for tax purposes. |

| (4) | Security is non-income producing. |

| (5) | For the purposes of the Fund’s investment policies, it considers NextGen companies to be Energy Companies and Infrastructure Companies that are meaningfully participating in, or benefitting from, the Energy Transition. For these purposes we include Renewable Infrastructure Companies, Green Utilities and Midstream Companies that primarily own and/or operate Midstream Assets related to natural gas or liquefied natural gas. |

| (6) | Series A Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Units. Distributions are payable at a rate of 7.375% per annum through December 15, 2022. On and after |

See accompanying notes to financial statements.

15

KAYNE ANDERSON NEXTGEN ENERGY & INFRASTRUCTURE, INC.

SCHEDULE OF INVESTMENTS

NOVEMBER 30, 2020

(amounts in 000’s)

| December 15, 2022, distributions on the Series A Preferred Units will be payable at a rate equal to the three-month LIBOR plus 5.148% per annum. |

| (7) | Series C Preferred Units are cumulative redeemable perpetual units. Distributions on the Series C Preferred Units are payable at a rate of 6.0% per annum through December 15, 2022. On and after December 15, 2022, the rate will be based on three-month LIBOR, determined quarterly, plus 4.11%. |

| (8) | The Fund’s ability to sell this security is subject to certain legal or contractual restrictions. As of November 30, 2020, the aggregate value of restricted securities held by the Fund was $31,201 (6.9% of total assets), which included $13,807 of Level 2 securities and $17,394 of Level 3 securities. See Note 7 — Restricted Securities. |

| (9) | Fair valued security. See Notes 2 and 3 in Notes to Financial Statements. |

| (10) | On September 30, 2020, the Fund purchased, Series A Cumulative Convertible Preferred Units (“EPD Convertible Preferred Units”) from Enterprise Products Partners, L.P. (“EPD”). The EPD Convertible Preferred Units are senior to the common units in terms of liquidation preference and priority of distributions, and pay a distribution of 7.25% per annum. The EPD Convertible Preferred Units are convertible into EPD common units at anytime after September 29, 2025 at the liquidation preference amount divided by 92.5% of the 5-day volume weighted average price of the EPD’s common units at such time. |

| (11) | The Equitrans Midstream Corporation (“ETRN”) Convertible Preferred Shares are convertible on a one-for-one basis into common shares of ETRN after April 10, 2021. The ETRN Convertible Preferred Shares pay quarterly cash distributions based on an annual rate of (a) 9.75% through March 31, 2024 and (b) the greater of (i) 10.5% or (ii) LIBOR plus 8.15% thereafter. |

| (12) | This company is structured like an MLP, but is not treated as a qualified publicly-traded partnership for regulated investment company (“RIC”) qualification purposes. |

| (13) | The Fund believes that it is an affiliate of Plains AAP, L.P. (“PAGP-AAP”) and Plains GP Holdings, L.P. (“PAGP”). See Note 5 — Agreements and Affiliations. |

| (14) | The Fund’s ownership of PAGP-AAP is exchangeable on a one-for-one basis into either PAGP shares or Plains All American Pipeline, L.P. (“PAA”) units at the Fund’s option. The Fund values its PAGP-AAP investment on an “as exchanged” basis based on the higher public market value of either PAGP or PAA. As of November 30, 2020, the Fund’s PAGP-AAP investment is valued at PAA’s closing price. See Note 7 — Restricted Securities. |

| (15) | On December 15, 2020, TC Energy Corporation (“TRP”) and TC Pipelines, LP (“TCP”) announced an agreement under which TRP will acquire all TCP common units in a stock-for-unit merger. Under the terms of the agreement, TCP unitholders will receive 0.70 TRP common shares for each TCP common unit held. |

| (16) | On November 4, 2020 Tourmaline Oil (“TOU”) announced the definitive agreement to acquire Jupiter Resources Inc. (“Jupiter”). Under the terms of the agreement, each share of Jupiter will be exchanged for 0.2365 shares of TOU. The acquisition was completed on December 18, 2020. As of November 30, 2020, the Fund valued its investment in Jupiter on an “as-exchanged” basis based on the value of TOU shares to be received. |

| (17) | Floating rate first lien senior secured term loan. Security pays interest at a rate of LIBOR + 750 basis points (7.66% as of November 30, 2020). |

See accompanying notes to financial statements.

16

KAYNE ANDERSON NEXTGEN ENERGY & INFRASTRUCTURE, INC.

STATEMENT OF ASSETS AND LIABILITIES

NOVEMBER 30, 2020

(amounts in 000’s, except share and per share amounts)

| ASSETS |

||||

| Investments, at fair value: |

||||

| Non-affiliated (Cost — $447,205) |

$ | 437,588 | ||

| Affiliated (Cost — $41,597) |

10,984 | |||

| Cash |

158 | |||

| Deposits with brokers |

247 | |||

| Interest, dividends and distributions receivable (Cost — $1,501) |

1,503 | |||

| Deferred credit facility offering costs and other assets |

317 | |||

|

|

|

|||

| Total Assets |

450,797 | |||

|

|

|

|||

| LIABILITIES |

||||

| Payable for securities purchased |

1,998 | |||

| Investment management fee payable |

429 | |||

| Accrued directors’ fees |

77 | |||

| Accrued expenses and other liabilities |

1,576 | |||

| Credit facility |

4,000 | |||

| Notes |

84,515 | |||

| Unamortized notes issuance costs |

(343 | ) | ||

| Mandatory redeemable preferred stock, $25.00 liquidation value per share (1,101,690 shares issued and outstanding) |

27,542 | |||

| Unamortized mandatory redeemable preferred stock issuance costs |

(224 | ) | ||

|

|

|

|||

| Total Liabilities |

119,570 | |||

|

|

|

|||

| NET ASSETS APPLICABLE TO COMMON STOCKHOLDERS |

$ | 331,227 | ||

|

|

|

|||

| NET ASSETS APPLICABLE TO COMMON STOCKHOLDERS CONSIST OF |

||||

| Common stock, $0.001 par value |

$ | 47 | ||

| Paid-in capital |

816,368 | |||

| Total distributable earnings (loss) |

(485,188 | ) | ||

|

|

|

|||

| NET ASSETS APPLICABLE TO COMMON STOCKHOLDERS |

$ | 331,227 | ||

|

|

|

|||

| NET ASSET VALUE PER COMMON SHARE |

$ | 7.02 | ||

|

|

|

|||

See accompanying notes to financial statements.

17

KAYNE ANDERSON NEXTGEN ENERGY & INFRASTRUCTURE, INC.

FOR THE FISCAL YEAR ENDED NOVEMBER 30, 2020

(amounts in 000’s)

| INVESTMENT INCOME |

||||

| Income |

||||

| Dividends and distributions: |

||||

| Non-affiliated investments |

$ | 31,782 | ||

| Affiliated investments |

2,111 | |||

| Money market mutual funds |

125 | |||

|

|

|

|||

| Total dividends and distributions (after foreign taxes withheld of $933) |

34,018 | |||

| Return of capital |

(22,723 | ) | ||

| Distributions in excess of cost basis |

(482 | ) | ||

|

|

|

|||

| Net dividends and distributions |

10,813 | |||

| Interest income |

1,682 | |||

|

|

|

|||

| Total Investment Income |

12,495 | |||

|

|

|

|||

| Expenses |

||||

| Investment management fees |

6,556 | |||

| Professional fees |

407 | |||

| Directors’ fees |

313 | |||

| Administration fees |

251 | |||

| Insurance |

143 | |||

| Reports to stockholders |

151 | |||

| Custodian fees |

78 | |||

| Other expenses |

201 | |||

|

|

|

|||

| Total Expenses — before interest expense and preferred distributions |

8,100 | |||

| Interest expense including amortization of offering costs |

8,153 | |||

| Distributions on mandatory redeemable preferred stock including amortization of offering costs |

3,376 | |||

|

|

|

|||

| Total Expenses |

19,629 | |||

|

|

|

|||

| Net Investment Loss |

(7,134 | ) | ||

|

|

|

|||

| REALIZED AND UNREALIZED GAINS (LOSSES) |

||||

| Net Realized Gains (Losses) |

||||

| Investments — non-affiliated |

(134,449 | ) | ||

| Investments — affiliated |

(32,964 | ) | ||

| Foreign currency transactions |

(480 | ) | ||

| Options |

149 | |||

|

|

|

|||

| Net Realized Loss |

(167,744 | ) | ||

|

|

|

|||

| Net Change in Unrealized Gains (Losses) |

||||

| Investments — non-affiliated |

(13,716 | ) | ||

| Investments — affiliated |

8,539 | |||

| Foreign currency translations |

11 | |||

| Options |

(31 | ) | ||

|

|

|

|||

| Net Change in Unrealized Losses |

(5,197 | ) | ||

|

|

|

|||

| Net Realized and Unrealized Losses |

(172,941 | ) | ||

|

|

|

|||

| NET DECREASE IN NET ASSETS APPLICABLE TO COMMON STOCKHOLDERS RESULTING FROM OPERATIONS |

$ | (180,075) | ||

|

|

|

See accompanying notes to financial statements.

18

KAYNE ANDERSON NEXTGEN ENERGY & INFRASTRUCTURE, INC.

STATEMENT OF CHANGES IN NET ASSETS APPLICABLE TO COMMON STOCKHOLDERS

(amounts in 000’s, except share amounts)

| For the Fiscal Year Ended November 30, |

||||||||

| 2020 | 2019 | |||||||

| OPERATIONS |

||||||||

| Net investment loss(1) |

$ | (7,134 | ) | $ | (4,606 | ) | ||

| Net realized gains (losses) |

(167,744 | ) | 9,078 | |||||

| Net change in unrealized losses |

(5,197 | ) | (20,784 | ) | ||||

|

|

|

|

|

|||||

| Net Decrease in Net Assets Resulting from Operations |

(180,075 | ) | (16,312 | ) | ||||

|

|

|

|

|

|||||

| DIVIDENDS AND DISTRIBUTIONS TO COMMON STOCKHOLDERS(1)(2) |

||||||||

| Dividends |

(22,129 | ) | — | |||||

| Distributions — return of capital |

(526 | ) | (44,335 | ) | ||||

|

|

|

|

|

|||||

| Dividends and Distributions to Common Stockholders |

(22,655 | ) | (44,335 | ) | ||||

|

|

|

|

|

|||||

| CAPITAL STOCK TRANSACTIONS |

||||||||

| Common stock purchased under the share repurchase program (1,681,037 shares) |

— | (19,999 | ) | |||||

|

|

|

|

|

|||||

| Total Decrease in Net Assets Applicable to Common Stockholders |

(202,730 | ) | (80,646 | ) | ||||

|

|

|

|

|

|||||

| NET ASSETS APPLICABLE TO COMMON STOCKHOLDERS |

||||||||

| Beginning of year |

533,957 | 614,603 | ||||||

|

|

|

|

|

|||||

| End of year |

$ | 331,227 | $ | 533,957 | ||||

|

|

|

|

|

|||||

| (1) | Distributions on the Fund’s mandatory redeemable preferred stock (“MRP Shares”) are treated as an operating expense under GAAP and are included in the calculation of net investment loss. See Note 2 — Significant Accounting Policies. |

| (2) | Distributions paid to common stockholders for the fiscal years ended November 30, 2020 and 2019 were characterized as either dividends (a portion of which was eligible to be treated as qualified dividend income) or distributions (return of capital). This characterization is based on the Fund’s earnings and profits. |

See accompanying notes to financial statements.

19

KAYNE ANDERSON NEXTGEN ENERGY & INFRASTRUCTURE, INC.

FOR THE FISCAL YEAR ENDED NOVEMBER 30, 2020

(amounts in 000’s)

| CASH FLOWS FROM OPERATING ACTIVITIES |

||||

| Net decrease in net assets resulting from operations |

$ | (180,075) | ||

| Adjustments to reconcile net decrease in net assets resulting from operations to net cash provided by operating activities: |

||||

| Return of capital distributions |

22,723 | |||

| Distributions in excess of cost basis |

482 | |||

| Net realized losses (excluding foreign currency transactions) |

167,264 | |||

| Net change in unrealized losses (excluding foreign currency translations) |

5,208 | |||

| Accretion of bond discounts, net |

(256 | ) | ||

| Purchase of long-term investments |

(260,685 | ) | ||

| Proceeds from sale of long-term investments |

390,651 | |||

| Proceeds from sale of short-term investments, net |

34,230 | |||

| Decrease in deposits with brokers |

34 | |||

| Decrease in interest, dividends and distributions receivable |

568 | |||

| Amortization of deferred debt offering costs |

872 | |||

| Amortization of mandatory redeemable preferred stock offering costs |

420 | |||

| Decrease in other assets |

1 | |||

| Increase in payable for securities purchased |

1,998 | |||

| Decrease in investment management fee payable |

(411 | ) | ||

| Decrease in premiums received on call option contracts written |

(125 | ) | ||

| Increase in accrued directors’ fees |

11 | |||

| Decrease in accrued expenses and other liabilities |

(1,547 | ) | ||

|

|

|

|||

| Net Cash Provided by Operating Activities |

181,363 | |||

|

|

|

|||

| CASH FLOWS FROM FINANCING ACTIVITIES |

||||

| Increase in borrowings under credit facility |

4,000 | |||

| Redemption of notes |

(116,408 | ) | ||

| Redemption of mandatory redeemable preferred stock |

(47,458 | ) | ||

| Costs associated with mandatory redeemable preferred stock |

(139 | ) | ||

| Costs associated with notes |

(261 | ) | ||

| Costs associated with renewal of credit facility |

(439 | ) | ||

| Cash distributions paid to common stockholders |

(22,655 | ) | ||

|

|

|

|||

| Net Cash Used in Financing Activities |

(183,360 | ) | ||

|

|

|

|||

| NET CHANGE IN CASH |

(1,997 | ) | ||

| CASH — BEGINNING OF YEAR |

2,155 | |||

|

|

|

|||

| CASH — END OF YEAR |

$ | 158 | ||

|

|

|

|||

Supplemental disclosure of cash flow information:

During the fiscal year ended November 30, 2020, interest paid related to debt obligations was $8,434.

See accompanying notes to financial statements.

20

KAYNE ANDERSON NEXTGEN ENERGY & INFRASTRUCTURE, INC.

(amounts in 000’s, except share and per share amounts)

| For the Fiscal Year Ended November 30, | ||||||||||||||||

| 2020 | 2019 | 2018 | 2017 | |||||||||||||

| Per Share of Common Stock(1) |

||||||||||||||||

| Net asset value, beginning of period |

$ | 11.31 | $ | 12.57 | $ | 14.15 | $ | 17.41 | ||||||||

| Net investment income (loss)(2) |

(0.15 | ) | (0.10 | ) | (0.18 | ) | 0.14 | |||||||||

| Net realized and unrealized gains (losses) |

(3.66 | ) | (0.29 | ) | (0.19 | ) | (2.10 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total income (loss) from operations |

(3.81 | ) | (0.39 | ) | (0.37 | ) | (1.96 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Common dividends — dividend income(3) |

(0.47 | ) | — | (0.10 | ) | (0.03 | ) | |||||||||

| Common distributions — long-term capital gains(3) |

— | — | — | — | ||||||||||||

| Common distributions — return of capital(3) |

(0.01 | ) | (0.93 | ) | (1.10 | ) | (1.27 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total dividends and distributions — common |

(0.48 | ) | (0.93 | ) | (1.20 | ) | (1.30 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Offering expenses associated with the issuance of common stock |

— | — | (0.01 | )(5) | — | |||||||||||

| Effect of shares issued in reinvestment of distributions |

— | — | — | — | ||||||||||||

| Effect of issuance of common stock |

— | — | — | — | ||||||||||||

| Effect of common stock repurchased |

— | 0.06 | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net asset value, end of period |

$ | 7.02 | $ | 11.31 | $ | 12.57 | $ | 14.15 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Market value per share of common stock, end of period |

$ | 5.25 | $ | 9.65 | $ | 10.96 | $ | 12.88 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total investment return based on common stock market value(6) |

(41.0 | )% | (4.2 | )% | (6.7 | )% | (8.7 | )% | ||||||||

| Total investment return based on net asset value(7) |

(32.7 | )% | (2.1 | )% | (2.6 | )% | (11.7 | )% | ||||||||

| Supplemental Data and Ratios(8) |

||||||||||||||||

| Net assets applicable to common stockholders, end of period |

$ | 331,227 | $ | 533,957 | $ | 614,603 | $ | 311,843 | ||||||||

| Ratio of expenses to average net assets |

||||||||||||||||

| Management fees(9) |

1.9 | % | 1.8 | % | 1.8 | % | 1.7 | % | ||||||||

| Other expenses |

0.4 | 0.3 | 0.4 | 0.4 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Subtotal |

2.3 | 2.1 | 2.2 | 2.1 | ||||||||||||

| Interest expense and distributions on mandatory redeemable preferred |

3.2 | 1.9 | 1.8 | 1.7 | ||||||||||||

| Management fee waiver |

— | — | — | — | ||||||||||||

| Excise taxes |

— | — | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total expenses |

5.5 | % | 4.0 | % | 4.0 | % | 3.8 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Ratio of net investment income (loss) to average net assets(2) |

(2.0 | )% | (0.8 | )% | (1.1 | )% | 0.9 | % | ||||||||

| Net increase (decrease) in net assets applicable to common stockholders resulting from operations to average net assets |

(50.7 | )% | (2.7 | )% | (16.1 | )% | (11.9 | )% | ||||||||

| Portfolio turnover rate |

51.8 | % | 30.0 | % | 21.9 | % | 25.5 | % | ||||||||

| Average net assets |

$ | 354,957 | $ | 604,030 | $ | 420,605 | $ | 360,869 | ||||||||

| Notes outstanding, end of period(10) |

$ | 84,515 | $ | 200,923 | $ | 200,923 | $ | 91,000 | ||||||||

| Credit facility outstanding, end of period(10) |

4,000 | $ | — | $ | 24,000 | $ | — | |||||||||

| Term loan outstanding, end of period(10) |

— | $ | — | $ | — | $ | — | |||||||||

| Mandatory redeemable preferred stock, end of period(10) |

$ | 27,542 | $ | 75,000 | $ | 75,000 | $ | 35,000 | ||||||||

| Average shares of common stock outstanding |

47,197,462 | 47,903,748 | 30,639,065 | 22,034,170 | ||||||||||||

| Asset coverage of total debt(11) |

505.3 | % | 403.1 | % | 406.6 | % | 481.1 | % | ||||||||

| Asset coverage of total leverage (debt and preferred stock)(12) |

385.4 | % | 293.5 | % | 304.9 | % | 347.5 | % | ||||||||

| Average amount of borrowings per share of common stock during the period(1) |

$ | 2.67 | $ | 4.25 | $ | 4.39 | $ | 5.16 | ||||||||

See accompanying notes to financial statements.

21

KAYNE ANDERSON NEXTGEN ENERGY & INFRASTRUCTURE, INC.

FINANCIAL HIGHLIGHTS

(amounts in 000’s, except share and per share amounts)

| For the Fiscal Year Ended November 30, | ||||||||||||

| 2016 | 2015 | 2014 | ||||||||||

| Per Share of Common Stock(1) |

||||||||||||

| Net asset value, beginning of period |

$ | 17.56 | $ | 39.51 | $ | 35.75 | ||||||

| Net investment income (loss)(2) |

(0.07 | ) | 0.30 | (0.01 | ) | |||||||

| Net realized and unrealized gains (losses) |

1.43 | (18.42 | ) | 5.61 | ||||||||

|

|

|

|

|

|

|

|||||||

| Total income (loss) from operations |

1.36 | (18.12 | ) | 5.60 | ||||||||

|

|

|

|

|

|

|

|||||||

| Common dividends — dividend income(3) |

(1.50 | ) | (1.68 | ) | (1.57 | ) | ||||||

| Common distributions — long-term capital gains(3) |

— | (2.14 | ) | (0.34 | ) | |||||||

| Common distributions — return of capital(3) |

— | — | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Total dividends and distributions — common |

(1.50 | ) | (3.82 | )(4) | (1.91 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Offering expenses associated with the issuance of common stock |

— | — | — | |||||||||

| Effect of shares issued in reinvestment of distributions |

(0.01 | ) | (0.01 | ) | (0.02 | ) | ||||||

| Effect of issuance of common stock |

— | — | — | |||||||||

| Effect of common stock repurchased |

— | — | 0.09 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net asset value, end of period |

$ | 17.41 | $ | 17.56 | $ | 39.51 | ||||||

|

|

|

|

|

|

|

|||||||

| Market value per share of common stock, end of period |

$ | 15.33 | $ | 15.46 | $ | 35.82 | ||||||

|

|

|

|

|

|

|

|||||||

| Total investment return based on common stock market value(6) |

12.7 | % | (50.2 | )% | 15.3 | % | ||||||

| Total investment return based on net asset value(7) |

12.7 | % | (48.7 | )% | 16.4 | % | ||||||

| Supplemental Data and Ratios(8) |

||||||||||||

| Net assets applicable to common stockholders, end of period |

$ | 383,557 | $ | 380,478 | $ | 854,257 | ||||||

| Ratio of expenses to average net assets |

||||||||||||

| Management fees(9) |

1.8 | % | 1.9 | % | 1.7 | % | ||||||

| Other expenses |

0.5 | 0.2 | 0.2 | |||||||||

|

|

|

|

|

|

|

|||||||

| Subtotal |

2.3 | 2.1 | 1.9 | |||||||||

| Interest expense and distributions on mandatory redeemable preferred stock(2) |

3.8 | 2.5 | 1.7 | |||||||||

| Management fee waiver |

— | — | — | |||||||||

| Excise taxes |

— | 0.4 | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Total expenses |

6.1 | % | 5.0 | % | 3.6 | % | ||||||

|

|

|

|

|

|

|

|||||||

| Ratio of net investment income (loss) to average net assets(2) |

(0.5 | )% | 1.0 | % | (0.0 | )% | ||||||

| Net increase (decrease) in net assets applicable to common stockholders resulting from operations to average net assets |

10.3 | % | (58.3 | )% | 14.0 | % | ||||||

| Portfolio turnover rate |

48.2 | % | 45.3 | % | 45.3 | % | ||||||

| Average net assets |

$ | 314,015 | $ | 672,534 | $ | 887,585 | ||||||

| Notes outstanding, end of period(10) |

$ | 91,000 | $ | 185,000 | $ | 235,000 | ||||||

| Credit facility outstanding, end of period(10) |

$ | — | $ | — | $ | — | ||||||

| Term loan outstanding, end of period(10) |

$ | 27,000 | $ | — | $ | 46,000 | ||||||

| Mandatory redeemable preferred stock, end of period(10) |

$ | 35,000 | $ | 70,000 | $ | 105,000 | ||||||

| Average shares of common stock outstanding |

21,975,582 | 21,657,943 | 21,897,671 | |||||||||

| Asset coverage of total debt(11) |

454.7 | % | 343.5 | % | 441.4 | % | ||||||

| Asset coverage of total leverage (debt and preferred stock)(12) |

350.7 | % | 249.2 | % | 321.3 | % | ||||||

| Average amount of borrowings per share of common stock during the period(1) |

$ | 4.86 | $ | 11.16 | $ | 12.84 | ||||||

See accompanying notes to financial statements.

22

KAYNE ANDERSON NEXTGEN ENERGY & INFRASTRUCTURE, INC.

FINANCIAL HIGHLIGHTS

(amounts in 000’s, except share and per share amounts)

| For the Fiscal Year

Ended November 30, |

||||||||||||

| 2013 | 2012 | 2011 | ||||||||||

| Per Share of Common Stock(1) |

||||||||||||

| Net asset value, beginning of period |

$ | 29.01 | $ | 25.94 | $ | 23.80 | ||||||

| Net investment income (loss)(2) |

(0.06 | ) | 0.17 | 0.29 | ||||||||

| Net realized and unrealized gains (losses) |

8.61 | 4.64 | 3.12 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total income (loss) from operations |

8.55 | 4.81 | 3.41 | |||||||||

|

|

|

|

|

|

|

|||||||

| Common dividends — dividend income(3) |

(1.15 | ) | (1.30 | ) | (1.20 | ) | ||||||

| Common distributions — long-term capital gains(3) |

(0.66 | ) | (0.41 | ) | — | |||||||

| Common distributions — return of capital(3) |

— | — | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Total dividends and distributions — common |

(1.81 | ) | (1.71 | ) | (1.20 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Offering expenses associated with the issuance of common stock |

— | — | — | |||||||||

| Effect of shares issued in reinvestment of distributions |

— | (0.03 | ) | (0.04 | ) | |||||||

| Effect of issuance of common stock |

— | — | (0.03 | ) | ||||||||

| Effect of common stock repurchased |

— | — | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Net asset value, end of period |

$ | 35.75 | $ | 29.01 | $ | 25.94 | ||||||

|

|

|

|

|

|

|

|||||||

| Market value per share of common stock, end of period |

$ | 32.71 | $ | 28.04 | $ | 22.46 | ||||||

|

|

|

|

|

|

|

|||||||

| Total investment return based on common stock market value(6) |

23.5 | % | 33.3 | % | (5.5 | )% | ||||||

| Total investment return based on net asset value(7) |

30.5 | % | 19.4 | % | 14.7 | % | ||||||

| Supplemental Data and Ratios(8) |

||||||||||||

| Net assets applicable to common stockholders, end of period |

$ | 788,057 | $ | 635,226 | $ | 562,044 | ||||||

| Ratio of expenses to average net assets |

||||||||||||

| Management fees(9) |

1.8 | % | 1.7 | % | 1.6 | % | ||||||

| Other expenses |

0.2 | 0.3 | 0.3 | |||||||||

|

|

|

|

|

|

|

|||||||

| Subtotal |

2.0 | 2.0 | 1.9 | |||||||||

| Interest expense and distributions on mandatory redeemable preferred stock(2) |

1.8 | 1.8 | 1.3 | |||||||||

| Management fee waiver |

— | — | (0.3 | ) | ||||||||

| Excise taxes |

0.1 | — | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Total expenses |

3.9 | % | 3.8 | % | 2.9 | % | ||||||

|

|

|

|

|

|

|

|||||||

| Ratio of net investment income (loss) to average net assets(2) |

(0.2 | )% | 0.6 | % | 1.1 | % | ||||||