UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended August 31, 2013

o TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT

For the transition period from _________ to ________

Commission file number : 000-54577

LAREDO RESOURCES CORP

(Exact name of registrant as specified in its charter)

| Nevada | 90-0822497 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

|

300 Jameson House

838 West Hastings Street

Vancouver, B.C., Canada

|

V6C 0A6 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number: (604) 669-9000

Securities registered under Section 12(b) of the Exchange Act:

| Title of each class | Name of each exchange on which registered | |

| none | not applicable |

Securities registered under Section 12(g) of the Exchange Act:

Title of class

none

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o Accelerated filer o Non-accelerated filer o Smaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. n/a

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date: 178,500,000 shares as of October 28, 2013.

TABLE OF CONTENTS

| Page | |||||

| PART I | |||||

| Item 1. |

Business

|

3 | |||

| Item 2. |

Properties

|

3 | |||

| Item 3. |

Legal Proceedings

|

4 | |||

| Item 4. |

Mine Safety Disclosures

|

4 | |||

| PART II | |||||

| Item 5. |

Market for Registrant’s Common Equity and Related Stockholder Matters and Issuer Purchases of Equity Securities

|

5 | |||

| Item 6. |

Selected Financial Data

|

6 | |||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

7 | |||

| Item 7A. |

Quantitative and Qualitative Disclosures About Market Risk

|

8 | |||

| Item 8. |

Financial Statements and Supplementary Data

|

9 | |||

| Item 9. |

Changes In and Disagreements With Accountants on Accounting and Financial Disclosure

|

11 | |||

| Item 9A(T). |

Controls and Procedures

|

11 | |||

| Item 9B. |

Other Information

|

11 | |||

|

|

|||||

| PART III | |||||

| Item 10. |

Directors, Executive Officers and Corporate Governance

|

12 | |||

| Item 11. |

Executive Compensation

|

14 | |||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

16 | |||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence

|

16 | |||

| Item 14. |

Principal Accountant Fees and Services

|

16 | |||

| PART IV | |||||

| Item 15. |

Exhibits, Financial Statement Schedules

|

17 | |||

2

PART I

Item 1. Business

Company Overview

We were incorporated on August 17, 2010, under the laws of the state of Nevada. The Company originally engaged in the exploration of certain mineral claims located in Elko County, Nevada. On September 10, 2012, we entered into an Agreement of Conveyance, Transfer and Assignment of Membership Interests and Assumption of Obligations (the “Agreement”) with our former sole officer and director, Ruth Cruz Santos. Pursuant to the Agreement, we transferred all membership interests in our operating subsidiary, LRE Exploration LLC, to Ms. Santos. In exchange for this assignment of membership interests, Ms. Santos agreed to assume and cancel all liabilities relating to our former business of exploring certain mining claims located in Elko County, Nevada. In addition, Ms. Santos agreed to release all liability under certain promissory notes due and owing to her. As a result of the Agreement, we are no longer pursuing the mineral exploration opportunities located in Elko County, Nevada.

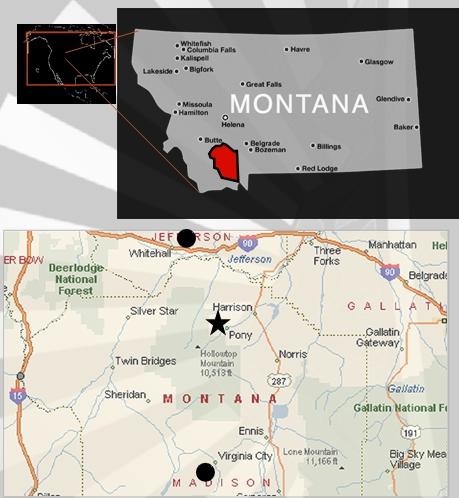

On November 2, 2012, we entered into a letter agreement with Magna Management Ltd. (“Magna”) under which we have been granted the exclusive right, for a period of sixty (60) days, to negotiate for the purchase of all rights held by Magna in the mineral property known as Pony Mountain Gold, located in the Mineral Hills District (commonly called the Pony District) in southwestern Montana.

On September 6, 2013, the Company memorialized the previous November 2, 2012, MOU agreement with Magna under which we have been granted the rights afforded to Magna as the denoted Buyer pursuant to the CONTRACT FOR DEED FOR SALE AND PURCHASE OF MINING PROPERTY agreement, entered into between Magna and the Sellers on August 1, 2013, regarding the Pony Mountain Gold mineral property.

The Pony Mountain Gold property is comprised of an approximately 4000-acre package of properties, assembled over the years by a local family and local geologist. The property contains several previously-mined, underground hard-rock vein systems, such as the Mountain Cliff, Strawberry-Keystone, Amy, and Atlantic-Pacific (A-P) mines. Historically, the Pony Mountain Gold property has been productive, and we believe it has potential for new productivity.

Item 2. Properties

On September 6, 2013, the Company memorialized the previous November 2, 2012, MOU agreement with Magna under which we have been granted the rights afforded to Magna as the denoted Buyer pursuant to the CONTRACT FOR DEED FOR SALE AND PURCHASE OF MINING PROPERTY agreement, entered into between Magna and the Sellers on August 1, 2013, regarding the Pony Mountain Gold mineral property.

The Pony Mountain Gold property is comprised of an approximately 4000-acre package of properties, assembled over the years by a local family and local geologist. The property contains several previously-mined, underground hard-rock vein systems, such as the Mountain Cliff, Strawberry-Keystone, Amy, and Atlantic-Pacific (A-P) mines. Historically, the Pony Mountain Gold property has been productive, and we believe it has potential for new productivity.

3

Item 3. Legal Proceedings

We are not a party to any pending legal proceeding. We are not aware of any pending legal proceeding to which any of our officers, directors, or any beneficial holders of 5% or more of our voting securities are adverse to us or have a material interest adverse to us.

Item 4. Mine Safety Disclosures

Not applicable.

4

PART II

Item 5. Market for Registrant’s Common Equity and Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

Our common stock is quoted under the symbol “LRDR” on the OTCBB operated by the Financial Industry Regulatory Authority, Inc. (“FINRA”) and the OTCQB operated by OTC Markets Group, Inc. Few market makers continue to participate in the OTCBB system because of high fees charged by FINRA. Consequently, market makers that once quoted our shares on the OTCBB system may no longer be posting a quotation for our shares. As of the date of this report, however, our shares are quoted by several market makers on the OTCQB. The criteria for listing on either the OTCBB or OTCQB are similar and include that we remain current in our SEC reporting. Our reporting is presently current and, since inception, we have filed our SEC reports on time.

A trading market for our securities did not begin to develop until after the fiscal year ended August 31, 2012.

The following tables set forth the range of high and low prices for our common stock for the each of the periods indicated as reported by the OTCQB. These quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

| Fiscal Year Ending August 31, 2013 | ||||||||

|

Quarter Ended

|

High $

|

Low $

|

||||||

|

August 31, 2013

|

$ | 0.105 | $ | 0.015 | ||||

|

May 31, 2013

|

$ | 0.84 | $ | 0.111 | ||||

|

February 28, 2013

|

$ | 0.54 | $ | 0.30 | ||||

|

November 30, 2012

|

$ | 0.54 | $ | 0.0030 | ||||

| Fiscal Year Ending August 31, 2012 | ||||||||

|

Quarter Ended

|

High $

|

Low $

|

||||||

|

August 31, 2012

|

N/A | N/A | ||||||

|

May 31, 2012

|

N/A | N/A | ||||||

|

February 29, 2012

|

N/A | N/A | ||||||

|

November 30, 2011

|

N/A | N/A | ||||||

5

Penny Stock

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a market price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the SEC, that: (a) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; (b) contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation of such duties or other requirements of the securities laws; (c) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; (d) contains a toll-free telephone number for inquiries on disciplinary actions; (e) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and (f) contains such other information and is in such form, including language, type size and format, as the SEC shall require by rule or regulation.

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with (a) bid and offer quotations for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) a monthly account statement showing the market value of each penny stock held in the customer's account.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written acknowledgment of the receipt of a risk disclosure statement, a written agreement as to transactions involving penny stocks, and a signed and dated copy of a written suitability statement.

These disclosure requirements may have the effect of reducing the trading activity for our common stock. Therefore, stockholders may have difficulty selling our securities.

Holders of Our Common Stock

As of October 28, 2013, we had 178,500,000 shares of our common stock issued and outstanding, held by seventy-seven (77) shareholders of record.

Dividends

There are no restrictions in our articles of incorporation or bylaws that prevent us from declaring dividends. The Nevada Revised Statutes, however, do prohibit us from declaring dividends where after giving effect to the distribution of the dividend:

|

1.

|

we would not be able to pay our debts as they become due in the usual course of business, or;

|

|

2.

|

our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights ofshareholders who have preferential rights superior to those receiving the distribution.

|

We have not declared any dividends and we do not plan to declare any dividends in the foreseeable future.

Item 6. Selected Financial Data

A smaller reporting company is not required to provide the information required by this Item.

6

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Statements

Certain statements, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives, and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements.” These forward-looking statements generally are identified by the words “believes,” “project,” “expects,” “anticipates,” “estimates,” “intends,” “strategy,” “plan,” “may,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse affect on our operations and future prospects on a consolidated basis include, but are not limited to: changes in economic conditions, legislative/regulatory changes, availability of capital, interest rates, competition, and generally accepted accounting principles. These risks and uncertainties should also be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements.

Results of Operations for the Years Ended August 31, 2013 and August 31, 2012, and the Period From Inception (August 17, 2010) to August 31, 2013

We have had no revenue for the years ended August 31, 2013 and August 31, 2012, or for the period from Inception (August 17, 2010) through August 31, 2013. Our total expenses and net loss for the year ended August 31, 2013 were $222,077, and consisted of accounting and audit fees of $29,584, a loss on foreign exchange of $5, legal fees of $39,249 and transfer and filing fees of $27,784. By comparison, our total expenses and net loss for the year ended August 31, 2012 were $56,356, and consisted of audit and accounting fees of $19,314, a gain on foreign exchange of $4, legal fees of $11,225, mineral exploration costs of $0, transfer and filing fees of $5,092, and interest expense of $4,384. Our total expenses and net loss for the period from Inception (August 17, 2010) through August 31, 2013 were $356,345.

Liquidity and Capital Resources

As of August 31, 2013, we had total current assets of $1,692 consisting of $692 of cash and $1,000 of pre-paid assets. Our total current liabilities as of August 31, 2013 were $250,457, and consisted of advances from a related party of $105,901, a related party note payable of $20,000, accrued interest due to a related party of $1,156, and accounts payable of $123,400. We had a working capital deficit of $248,765 as of August 31, 2013.

Operating activities used $3,176 in net cash during the fiscal year ended August 31, 2013. Operating activities used $48,674 in net cash during the fiscal year ended August 31, 2012. From Inception (August 17, 2010) through August 31, 2013, operating activities used a total of $107,293 in net cash. Our net losses during these periods were the primary negative components of our operating cash flows. Financing activities generated cash of $20,000 during the fiscal year ended August 31, 2013, as against $47,500 during the fiscal year ended August 31, 2012 and $134,485 from inception (August 17, 2010) through August 31, 2013. The source of this cash was the proceeds of related party notes payable.

Also, on September 10, 2012, we received new financing in the amount of $20,000 from Gardner and Associates, under the terms of a Promissory Note. The promissory note is unsecured, bears interest at 6% per annum, and matures on September 30, 2014.

7

As discussed above, we will require financing in the amount of $3,000,000 to complete our planned acquisition of the Pony Mountain Gold property. Also, significant additional financing may be required in order to commence the active production of precious metals on those mining claims. We intend to fund our acquisition of the Pony Mountain Gold property rights, as well as our initial operations, through debt and/or equity financing arrangements.

On September 6, 2013 the Company entered into an agreement with Magna Management Ltd. (“Magna”) to increase the number of authorized shares to 2 billion shares and constitute a class of convertible preferred shares to be solely issued to Magna. This is exchange for paying $240,000 on behalf of the Company toward the purchase price of property mining rights associated with property located near Pony, Montana.

Off Balance Sheet Arrangements

As of August 31, 2013, there were no off balance sheet arrangements.

Going Concern

We have yet to achieve profitable operations, have accumulated losses of $356,345 since our inception and expect to incur further losses in the development of our business, all of which casts substantial doubt about our ability to continue as a going concern. Our ability to continue as a going concern is dependent upon our ability to generate future profitable operations and/or to obtain the necessary financing from shareholders or other sources to meet its obligations and repay its liabilities arising from normal business operations when they come due. Management has no formal plan in place to address this concern but considers that we will be able to obtain additional funds by equity financing and/or related party advances, however there is no assurance of additional funding being available or on acceptable terms, if at all.

Critical Accounting Policies

In December 2001, the SEC requested that all registrants list their most “critical accounting polices” in the Management Discussion and Analysis. The SEC indicated that a “critical accounting policy” is one which is both important to the portrayal of a company’s financial condition and results, and requires management’s most difficult, subjective or complex judgments, often as a result of the need to make estimates about the effect of matters that are inherently uncertain. At this time, management does not believe that any of our accounting policies fit this definition.

Recently Issued Accounting Pronouncements

The Company has reviewed issued accounting pronouncements and plans to adopt those that are applicable to it. The Company does not expect the adoption of any other pronouncements to have an impact on its results of operations or financial position.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

A smaller reporting company is not required to provide the information required by this Item.

8

Item 8. Financial Statements and Supplementary Data

Index to Financial Statements Required by Article 8 of Regulation S-X:

Audited Financial Statements:

|

F-1

|

Report of Independent Registered Public Accounting Firm

|

|

F-2

|

Consolidated Balance Sheets as of August 31, 2013 and 2012;

|

|

F-3

|

Consolidated Statements of Operations for the years ended August 31, 2013 and August 31, 2012, and for the period from Inception (August 17, 2010) through August 31, 2013;

|

|

F-4

|

Consolidated Statement of Stockholders’ Equity (Deficit) from Inception (August 17, 2010) to August 31, 2013;

|

|

F-5

|

Consolidated Statements of Cash Flows for the years ended August 31, 2013 and August 31, 2012, and for the period from Inception (August 17, 2010) through August 31, 2013;

|

|

F-6

|

Notes to Financial Statements

|

9

LAREDO RESOURCES CORP.

(An Exploration Stage Company)

CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2013 and 2012

10

| Office Locations

Las Vegas, NV

New York, NY

Pune, India

Beijing, China

|

|

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders

Laredo Resources Corp.

We have audited the accompanying balance sheets of Laredo Resources Corp. (An Exploration Stage Company) (the “Company”) as of August 31, 2013 and 2012 and the related statements of operations, stockholders’ equity (deficit) and cash flows for each of the years then ended and for the period from inception (August 17, 2010) through August 31, 2013. Laredo Resources Corp.’s management is responsible for these financial statements. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Laredo Resources Corp. (An Exploration Stage Company) as of August 31, 2013 and 2012 and the results of its operations and its cash flows for each of the years then ended and for the period from inception (August 17, 2010) through August 31, 2013 in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming the Company will continue as a going concern. As discussed in Note 2 to the financial statements, the Company has suffered losses from operations, which raise substantial doubt about its ability to continue as a going concern. Management’s plans in regard to these matters are also described in Note 2. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ De Joya Griffith, LLC

Henderson, Nevada

December 9, 2013

|

De Joya Griffith, LLC ● 2580 Anthem Village Dr. ● Henderson, NV ● 89052

Telephone (702) 563-1600 ● Facsimile (702) 920-8049

www.dejoyagriffith.com

|

Member of:

|

|

F-1

Laredo Resources Corp.

(An Exploration Stage Company)

Consolidated Balance Sheets

|

August 31,

|

||||||||

|

2013

|

2012

|

|||||||

|

ASSETS

|

||||||||

|

Current Assets

|

||||||||

|

Cash

|

$ | 692 | $ | 368 | ||||

|

Prepaid assets

|

1,000 |

‐

|

||||||

|

Total Current Assets

|

1,692 | 368 | ||||||

|

Intangible asset, net of accumulated

|

||||||||

|

amortization of $3,209 and $0, respectively

|

13,291 |

‐

|

||||||

|

TOTAL ASSETS

|

$ | 14,983 | $ | 368 | ||||

|

LIABILITIES AND STOCKHOLDERS' DEFICIT

|

||||||||

|

Current Liabilities

|

||||||||

|

Accounts payable and accrued liabilities

|

$ | 123,400 | $ | 558 | ||||

|

Advances from related party

|

105,901 | - | ||||||

|

Accrued interest, related party

|

1,156 | 3,998 | ||||||

|

Note payable, related party

|

20,000 | 86,500 | ||||||

|

Total Current Liabilities

|

250,457 | 91,056 | ||||||

|

Stockholders' Deficit

|

||||||||

|

Preferred stock: $.001 par value, 10,000,000 shares

|

||||||||

|

authorized, none issued or outstanding

|

- |

‐

|

||||||

|

Common stock: $.001 par value, 4,500,000,000 shares authorized,

|

||||||||

|

178,500,000 shares issued and outstanding

|

178,500 | 178,500 | ||||||

|

Additional paid in capital

|

92,886 | 1,797 | ||||||

|

Deficit accumulated during the exploration stage

|

(506,860 | ) | (270,985 | ) | ||||

|

Total Stockholders' Deficit

|

(235,474 | ) | (90,688 | ) | ||||

| TOTAL LIABILITIES AND STOCKHOLDERS' DEFICIT | $ | 14,983 | $ | 368 | ||||

F-2

Laredo Resources Corp.

(An Exploration Stage Company)

Consolidated Statements of Operations

|

From

|

||||||||||||

|

Inception

|

||||||||||||

|

(August 17,

|

||||||||||||

|

For the Years Ended

|

2010) to

|

|||||||||||

|

August 31,

|

August 31,

|

|||||||||||

|

2013

|

2012

|

2013

|

||||||||||

| Revenues | $ | - | $ | - | $ | - | ||||||

|

Operating Expenses

|

||||||||||||

|

Amortization expense

|

3,209 | - | 3,209 | |||||||||

|

Accounting and audit

|

29,584 | 19,314 | 64,226 | |||||||||

|

Foreign exchange (gain) loss

|

5 | 4 | 790 | |||||||||

|

Legal fees

|

39,249 | 11,225 | 82,798 | |||||||||

|

General and administrative

|

112,246 | 6,337 | 125,213 | |||||||||

|

Mineral property exploration costs

|

10,000 | - | 14,500 | |||||||||

|

Transfer and filing fees

|

27,784 | 5,092 | 36,016 | |||||||||

|

Impairment of mineral property option

|

- | 20,000 | 20,000 | |||||||||

|

Total operating expenses

|

222,077 | 61,972 | 346,752 | |||||||||

|

Net loss from operations

|

(222,077 | ) | (61,972 | ) | (346,752 | ) | ||||||

|

Other income (expense)

|

||||||||||||

|

Forgiveness of debt

|

- | 10,000 | 10,000 | |||||||||

|

Interest and financing expense

|

(13,798 | ) | (4,384 | ) | (19,593 | ) | ||||||

|

Net other income (expense)

|

(13,798 | ) | 5,616 | (9,593 | ) | |||||||

|

Net Loss

|

$ | (235,875 | ) | $ | (56,356 | ) | $ | (356,345 | ) | |||

|

Basic and diluted loss per share

|

$ | - | $ | - | ||||||||

|

Weighted average number of shares outstanding

|

178,500,000 | 178,500,000 | ||||||||||

F-3

Laredo Resources Corp.

(An Exploration Stage Company)

Consolidated Statement of Stockholders' Deficit

For the Period from Inception (August 17, 2010) to August 31, 2013

| Deficit | ||||||||||||||||||||||||||||

|

Accumulated

|

||||||||||||||||||||||||||||

| Additional | During the | |||||||||||||||||||||||||||

|

Preferred Shares

|

Common Stock

|

Paid in |

Exploration

|

|||||||||||||||||||||||||

|

Shares

|

Amount | Shares | Amount | Capital | Stage |

Total

|

||||||||||||||||||||||

|

Balance, inception (August 17, 2010)

|

$ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||||||

| Capital stock issued to founder for | ||||||||||||||||||||||||||||

| cash | - | 100,000,000 | 100,000 | - | (84,375 | ) | 15,625 | |||||||||||||||||||||

| Capital stock issued for cash, net of | ||||||||||||||||||||||||||||

| commission | - | 78,500,000 | 78,500 | - | (66,140 | ) | 12,360 | |||||||||||||||||||||

| Net loss | - | - | - | - | (7,325 | ) | (7,325 | ) | ||||||||||||||||||||

| Balance as of August 31, 2010 | - | 178,500,000 | 178,500 | - | (157,840 | ) | 20,660 | |||||||||||||||||||||

| Capital contribution by president | - | - | - | 895 | - | 895 | ||||||||||||||||||||||

| Net loss | - | - | - | - | (56,789 | ) | (56,789 | ) | ||||||||||||||||||||

| Balance as of August 31, 2011 | - | - | 178,500,000 | 178,500 | 895 | (214,629 | ) | (35,234 | ) | |||||||||||||||||||

| Capital contribution by president | - | - | - | - | 902 | - | 902 | |||||||||||||||||||||

| Net loss | - | - | - | - | (56,356 | ) | (56,356 | ) | ||||||||||||||||||||

| Balance as of August 31, 2012 | - | - | 178,500,000 | 178,500 | 1,797 | (270,985 | ) | (90,688 | ) | |||||||||||||||||||

| Capital contribution by president | - | - | - | - | 25 | - | 25 | |||||||||||||||||||||

| Sale of subsidiary | - | - | - | - | 91,064 | - | 91,064 | |||||||||||||||||||||

| Net loss | - | - | - | - | - | (235,875 | ) | (235,875 | ) | |||||||||||||||||||

|

Balance as of August 31, 2013

|

$ | - | $ | - | 178,500,000 | $ | 178,500 | $ | 92,886 | $ | (506,860 | ) | $ | (235,474 | ) | |||||||||||||

F-4

Laredo Resources Corp.

(An Exploration Stage Company)

Consolidated Statements of Cash Flows

|

For the Years Ended

August 31, |

From Inception

(August 17, 2010) |

|||||||||||

| 2013 | 2012 | 2013 | ||||||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

||||||||||||

|

Net loss

|

$ | (235,875 | ) | $ | (56,356 | ) | $ | (356,345 | ) | |||

|

Adjustment to reconcile Net loss to net

|

||||||||||||

|

cash used by operating activities:

|

||||||||||||

|

Non cash interest expense - capital contribution

|

25 | 902 | 1,822 | |||||||||

|

Forgiveness of debt

|

- | (10,000 | ) | (10,000 | ) | |||||||

|

Write off of property option

|

- | 20,000 | 20,000 | |||||||||

|

Amortization expense

|

3,209 | - | 3,209 | |||||||||

|

Changes in assets and liabilities:

|

||||||||||||

|

Prepaid expenses

|

(1,000 | ) | 3,000 | (1,000 | ) | |||||||

|

Accrued interest, related party

|

1,272 | 3,482 | 5,270 | |||||||||

|

Accounts payable and accrued liabilities

|

123,292 | (9,702 | ) | 123,850 | ||||||||

|

Advances from related party

|

105,901 | - | 105,901 | |||||||||

|

Net Cash Used in Operating Activities

|

(3,176 | ) | (48,674 | ) | (107,293 | ) | ||||||

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

||||||||||||

|

Acquisition of intangibles

|

(16,500 | ) | - | (26,500 | ) | |||||||

|

Net Cash Used in Investing Activities

|

(16,500 | ) | - | (26,500 | ) | |||||||

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

||||||||||||

|

Capital stock issued

|

- | - | 27,985 | |||||||||

|

Notes payable, related party

|

20,000 | 47,500 | 106,500 | |||||||||

|

Net Cash Provided by Financing Activates

|

20,000 | 47,500 | 134,485 | |||||||||

|

Net change in cash and cash equivalents

|

324 | (1,174 | ) | 692 | ||||||||

|

Cash and cash equivalents, beginning of period

|

368 | 1,542 | - | |||||||||

|

Cash and cash equivalents, end of period

|

$ | 692 | $ | 368 | $ | 692 | ||||||

|

Supplemental cash flow information:

|

||||||||||||

|

Cash paid for interest

|

$ | - | $ | - | $ | - | ||||||

|

Cash paid for taxes

|

$ | - | $ | - | $ | - | ||||||

|

Non-cash transactions:

|

||||||||||||

|

Accrual of mineral property

|

$ | - | $ | 10,000 | $ | 10,000 | ||||||

|

Accounts payable settled in connection with sale of subsidiary

|

$ | 450 | $ | - | $ | 450 | ||||||

|

Accrued interest, related party, settled in connection with sale of subsidiary

|

$ | 4,114 | $ | - | $ | 4,114 | ||||||

|

Note payable, related party, settled in connection with sale of subsidiary

|

$ | 86,500 | $ | - | $ | 86,500 | ||||||

|

Gain from foreign exchange

|

$ | 2,324 | $ | - | $ | 2,324 | ||||||

F-5

LAREDO RESOURCES CORP.

(An Exploration Stage Company)

Notes to Consolidated Financial Statements

August 31, 2013 and 2012

Note 1 - Nature of Operations and Ability to Continue as a Going Concern

The Company was incorporated in the state of Nevada, United States of America on August 17, 2010. The Company’s year-end is August 31.

On August 31, 2010, the Company incorporated a wholly-owned subsidiary, LRE Exploration LLC, (“LRE”) in the State of Nevada, United States of America (“USA”) for the purpose of mineral exploration in the USA. This subsidiary was sold in September 2012. See Note 9 for details.

On November 30, 2010, LRE began its operations by entering into a property option agreement with Arbutus Minerals LLC. (“Arbutus”) whereby the Company was granted an option to earn up to a 100% interest in 20 mineral claims (the “ABR Claims”) located approximately 15 miles north of Elko, Nevada. During the year ended August 31, 2012, the Company abandoned the property.

Effective October 30, 2012, the Company increased the number of authorized common shares of the Company from 90,000,000 to 4,500,000,000 shares per director’s resolution dated October 30, 2012. The Company also conducted a fifty to one forward stock split of the Company’s issued and outstanding common shares per director’s resolution. Following this stock split, the number of outstanding shares of the Company’s common stock increased from 3,570,000 shares to 178,500,000 shares. All share and per share information in these financial statements has been retro-actively restated for all periods presented to give effect of this stock split.

These financial statements have been prepared in accordance with generally accepted accounting principles applicable to a going concern, which assumes that the Company will be able to meet its obligations and continue its operations for its next fiscal year. Realization values may be substantially different from carrying values as shown and these financial statements do not give effect to adjustments that would be necessary to the carrying values and classification of assets and liabilities should the Company be unable to continue as a going concern. The Company has yet to achieve profitable operations, has accumulated losses of $506,860 since its inception and expects to incur further losses in the development of its business, all of which casts substantial doubt about the Company’s ability to continue as a going concern.

The Company’s ability to continue as a going concern is dependent upon its ability to generate future profitable operations and/or to obtain the necessary financing from shareholders or other sources to meet its obligations and repay its liabilities arising from normal business operations when they become due. Management has no formal plan in place to address this concern but considers that the Company will be able to obtain additional funds by equity financing and/or related party advances, however there is no assurance of additional funding being available or on acceptable terms, if at all. The financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts of and classification of liabilities that might be necessary in the event the company cannot continue in existence.

Note 2 - Summary of Significant Accounting Policies

Use of Estimates

The consolidated financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and are stated in US dollars. The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of expense during the reporting period. Actual results could differ from those estimates.

F-6

LAREDO RESOURCES CORP.

(An Exploration Stage Company)

Notes to Consolidated Financial Statements

August 31, 2013 and 2012

Note 2 - Summary of Significant Accounting Policies (continued)

Principles of Consolidation

These financial statements include the accounts of the Company and LRE Exploration LLC (LRE), until LRE was disposed of by sale to the former president on September 10, 2012. Accordingly, the statements of operations and cash flows presented include the results of LRE from September 1, 2011 to September 10, 2012, and the balance sheet presented at August 31, 2013 is solely that of Laredo Resources Corp. The balance sheet presented at August 31, 2012 comprises Laredo Resources Corp. and its wholly owned subsidiary LRE. All significant inter-company transactions and balances have been eliminated.

Exploration Stage Company

The Company is an exploration stage company. All losses accumulated since inception are considered part of the Company’s exploration stage activities.

Cash and cash equivalents

The Company considers all highly liquid instruments purchased with a maturity of three months or less to be cash equivalents. There were $692 cash equivalents at August 31, 2013 and $368 at August 31, 2012.

The Company minimizes its credit risk associated with cash by periodically evaluating the credit quality of its primary financial institution. The balance at times may exceed federally insured limits. At August 31, 2013 and 2012, the balance did not exceed the federally insured limit.

Intangible Asset

The Company has applied the provision of ASC topic 350 - Intangible - goodwill and other, in accounting for its intangible asset. The intangible asset is being amortized by the straight line method on the basis of a useful life of 3 years. The intangible asset consists of website development costs. The balance at August 31, 2013 was $13,291, net of accumulated amortization of $3,209.

Mineral Property

The Company is primarily engaged in the acquisition, exploration and development of mineral properties.

Mineral property acquisition costs are capitalized in accordance with FASB ASC 930, “Extractive Activities-Mining,” when management has determined that probable future benefits consisting of a contribution to future cash inflows have been identified and adequate financial resources are available or are expected to be available as required to meet the terms of property acquisition and budgeted exploration and development expenditures. Mineral property acquisition costs are expensed as incurred if the criteria for capitalization are not met.

In the event that mineral property acquisition costs are paid with Company shares, those shares are recorded at the estimated fair value at the time the shares are due in accordance with the terms of the property agreements.

Mineral property exploration costs are expensed as incurred.

When it has been determined that a mineral property can be economically developed as a result of establishing proven and probable reserves and pre-feasibility, the costs incurred to develop such property are capitalized.

F-7

LAREDO RESOURCES CORP.

(An Exploration Stage Company)

Notes to Consolidated Financial Statements

August 31, 2013 and 2012

Mineral Property (continued)

Estimated future removal and site restoration costs, when determinable are provided over the life of proven reserves on a units-of-production basis. Costs, which include production equipment removal and environmental remediation, are estimated each period by management based on current regulations, actual expenses incurred, and technology and industry standards. Any charge is included in exploration expense or the provision for depletion and depreciation during the period and the actual restoration expenditures are charged to the accumulated provision amounts as incurred.

To date the Company has not established any proven or probable reserves on its mineral properties.

Asset Retirement Obligations

Asset retirement obligations (“ARO”) associated with the retirement of a tangible long-lived asset, are recognized as liabilities in the period in which it is incurred and becomes determinable, with an offsetting increase in the carrying amount of the associated assets. The cost of tangible long-lived assets, including the initially recognized ARO, is amortized, such that the cost of the ARO is recognized over the useful life of the assets. The ARO is recorded at fair value, and accretion expense is recognized over time as the discounted fair value is accreted to the expected settlement value.

The fair value of the ARO is measured using expected future cash flow, discounted at the Company’s credit-adjusted risk-free interest rate. As of August 31, 2013 and 2012, the Company has determined no provision for ARO’s is required.

Impairment of Long- Lived Assets

The Company reviews and evaluates long-lived assets for impairment when events or changes in circumstances indicate that the related carrying amounts may not be recoverable. The assets are subject to impairment consideration under FASB ASC 360-10-35-17 if events or circumstances indicate that their carrying amount might not be recoverable. When the Company determines that an impairment analysis should be done, the analysis will be performed using the rules of FASB ASC 930-360-35, Asset Impairment, and 360- 0 through 15-5, Impairment or Disposal of Long- Lived Assets.

Foreign Currency Translation

The Company’s functional currency is the United States dollar as substantially all of the Company’s operations are in the USA. The Company uses the United States dollar as its reporting currency for consistency with registrants of the Securities and Exchange Commission (“SEC”).

Assets and liabilities denominated in a foreign currency are translated at the exchange rate in effect at the balance sheet date and capital accounts are translated at historical rates. Income statement accounts are translated at the average rates of exchange prevailing during the period.

Translation adjustments from the use of different exchange rates from period to period are included in the Accumulated Other Comprehensive Income account in Stockholders’ Equity, if applicable.

Transactions undertaken in currencies other than the functional currency of the entity are translated using the exchange rate in effect as of the transaction date. Any exchange gains and losses are included in the consolidated statements of operations.

F-8

LAREDO RESOURCES CORP.

(An Exploration Stage Company)

Notes to Consolidated Financial Statements

August 31, 2013 and 2012

Earnings per share

In accordance with accounting guidance now codified as FASB ASC Topic 260, “Earnings per Share,” basic earnings per share (“EPS”) is computed by dividing net loss available to common stockholders by the weighted average number of common shares outstanding during the period, excluding the effects of any potentially dilutive securities. Diluted EPS gives effect to all dilutive potential of shares of common stock outstanding during the period including stock options or warrants, using the treasury stock method (by using the average stock price for the period to determine the number of shares assumed to be purchased from the exercise of stock options or warrants), and convertible debt or convertible preferred stock, using the if-converted method. Diluted EPS excludes all dilutive potential of shares of common stock if their effect is anti-dilutive. As there are no common stock equivalents outstanding, diluted and basic loss per share are the same.

Income Taxes

The Company uses the asset and liability method of accounting for income taxes. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to temporary differences between the financial statements carrying amounts of existing assets and liabilities and loss carry-forwards and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled.

The effect of a change in tax rules on deferred tax assets and liabilities is recognized in operations in the year of change. A valuation allowance is recorded when it is “more likely-than-not” that a deferred tax asset will not be realized.

Stock-based Compensation

The Company is required to record compensation expense, based on the fair value of the awards, for all awards granted after the date of the adoption.

Comprehensive Income

The Company is required to report comprehensive income, which includes net loss as well as changes in equity from non-owner sources.

Reclassifications

Certain reclassifications have been made to prior year financial statements in order for them to be in conformity with the current year presentation. The reclassifications had no impact on change in net assets.

Newly Issued Accounting Pronouncements

The Company feels there are no newly issued accounting pronouncements that will materially impact its financial position, cash flows or results of operations.

F-9

LAREDO RESOURCES CORP.

(An Exploration Stage Company)

Notes to Consolidated Financial Statements

August 31, 2013 and 2012

Note 3 - Financial Instruments

Fair value is defined as the price that would be received upon sale of an asset or paid upon transfer of a liability in an orderly transaction between market participants at the measurement date and in the principal or most advantageous market for that asset or liability.

The fair value should be calculated based on assumptions that market participants would use in pricing the asset or liability, not on assumptions specific to the entity. In addition, the fair value of liabilities should include consideration of non-performance risk including our own credit risk.

In addition to defining fair value, the standard expands the disclosure requirements around fair value and establishes a fair value hierarchy for valuation inputs. The hierarchy prioritizes the inputs into three levels based on the extent to which inputs used in measuring fair value are observable in the market. Each fair value measurement is reported in one of the three levels which is determined by the lowest level input that is significant to the fair value measurement in its entirety. These levels are:

Level 1 - inputs are based upon unadjusted quoted prices for identical instruments traded in active markets.

Level 2 - inputs are based upon significant observable inputs other than quoted prices included in Level 1, such as quoted prices for identical or similar instruments in markets that are not active, and model-based valuation techniques for which all significant assumptions are observable in the market or can be corroborated by observable market data for substantially the full term of the assets or liabilities.

Level 3 - inputs are generally unobservable and typically reflect management’s estimates of assumptions that market participants would use in pricing the asset or liability. The fair values are therefore determined using model-based techniques that include option pricing models, discounted cash flow models, and similar techniques.

The carrying value of the Company’s financial assets and liabilities which consist of cash, accounts payable and accrued liabilities, and notes payable in management’s opinion approximates fair value due to the short maturity of such instruments. These financial assets and liabilities are valued using level 3 inputs, except for cash which is at level 1. Unless otherwise noted, it is management’s opinion that the Company is not exposed to significant interest, exchange or credit risks arising from these financial instruments.

Note 4 - Related Party Transactions

On September 10, 2012, the Company assigned all membership units of LRE to the former President of the Company and received as consideration the release and discharge of all liabilities under all the promissory notes and accrued interest to the date of the transaction. As at August 31, 2012, this amount aggregated $90,688.

On September 10, 2012, the Company issued a promissory note in the amount of $20,000 to a Company controlled by the Company’s newly appointed president and received $20,000 cash in exchange. The promissory note is unsecured, bears interest at 6% per annum, and matures on September 10, 2013. During the year ended August 31, 2013, the Company accrued $1,156 of interest expense with respect to this note payable.

In addition, during the year ended August 31, 2013, the Company CEO paid various vendor invoices on behalf of the Company. These are shown on the consolidated balance sheet as Advances from related party and amount to $105,901. $76,300 of this is management fees and is included in general and administrative expenses on the consolidated statement of operations.

F-10

LAREDO RESOURCES CORP.

(An Exploration Stage Company)

Notes to Consolidated Financial Statements

August 31, 2013 and 2012

Note 5 - Note Payable

On September 10, 2012, the Company CEO loaned $20,000 to the Company. See Note 4 for details.

Note 6 - Capital Stock

The Company has 10,000,000 shares of authorized preferred stock with a par value of $0.001 per share. There were zero shares of preferred stock issued and outstanding as of August 31, 2013 and 2012.

Effective October 30, 2012, the Company increased the number of authorized common shares of the Company from 90,000,000 to 4,500,000,000 shares per a director’s resolution dated October 30, 2012.

The Company also conducted a fifty to one forward stock split of the Company’s issued and outstanding common shares per a director’s resolution. Following this stock split, the number of outstanding shares of the Company’s stock increased from 3,570,000 shares to 178,500,000 shares. All shares and per share information in these financial statements have been retro-actively restated for all periods presented to give effect of this stock split.

Note 7 - Forgiveness of Debt

On November 30, 2010, LRE entered into a property option agreement (amended April 3, 2012) with Arbutus Minerals LLC (“Arbutus”) whereby the Company was granted an option to earn up to a 100% interest in 20 mineral claims (the “ABR Claims”) located approximately 15 miles north of Elko, Nevada. Arbutus holds only the mineral rights to the ABR Claims as the ABR Claims are on Bureau of Land Management managed land. Consideration for the option consists of cash payments to Arbutus totaling $90,000, and aggregate exploration expenditures of $295,000.

As of August 31, 2012, the Company had incurred $10,000 in acquisition costs and accrued an additional $10,000 in the form of option payments to Arbutus per the option agreement. During August 2012, the Company abandoned the property and all property option costs incurred were written off. The Company also negotiated the forgiveness of $10,000 which was due pursuant to the property option agreement on November 30, 2012.

Note 8 - Income Taxes

A reconciliation of the income tax provision computed at statutory rates to the reported tax provision is as follows:

|

Year Ended August 31,

|

||||||||

|

2013

|

2012

|

|||||||

|

Basic statutory and state income tax rate

|

35.0 | % | 35.0 | % | ||||

|

Approximate loss before income taxes

|

$ | 235,875 | $ | 56,356 | ||||

|

Expected approximate tax recovery on net loss, before income tax

|

$ | 83,000 | $ | 19,700 | ||||

|

Valuation allowance

|

(83,000 | ) | (19,700 | ) | ||||

|

Deferred income tax recovery

|

$ | - | $ | - | ||||

F-11

LAREDO RESOURCES CORP.

(An Exploration Stage Company)

Notes to Consolidated Financial Statements

August 31, 2013 and 2012

Note 8 - Income Taxes (continued)

Significant components of the Company’s deferred tax assets and liabilities are as follows:

|

Year Ended

August 31,

2013

|

Year Ended

August 31,

2012

|

|||||||

|

Deferred income tax assets

|

||||||||

|

Non-capital losses carried forward

|

$ | 125,200 | $ | 42,200 | ||||

|

Less: valuation allowance

|

(125,200 | ) | (42,200 | ) | ||||

|

Deferred income tax assets

|

$ | - | $ | - | ||||

At August 31, 2013, the Company has incurred accumulated net operating losses in the United States of America totaling approximately $356,345 which are available to reduce taxable income in future years.

These losses expire as follows:

|

Year of Expiration

|

Amount

|

|||

|

2030

|

$ | 7,325 | ||

|

2031

|

56,789 | |||

|

2032

|

56,356 | |||

|

2033

|

235,875 | |||

| $ | 356,345 | |||

The amount taken into income as deferred tax assets must reflect that portion of the income tax loss carry forwards that is more-likely-than-not to be realized from future operations. The Company has chosen to provide an allowance of 100% against all available income tax loss carry forwards, regardless of their time of expiry.

F-12

LAREDO RESOURCES CORP.

(An Exploration Stage Company)

Notes to Consolidated Financial Statements

August 31, 2013 and 2012

Note 9 - Sale of Subsidiary

On September 10, 2012, the Company assigned all membership units of LRE to the former President of the Company and received as consideration the release and discharge of all liabilities under all promissory notes and accrued interest entered into prior to August 31, 2012.

The following table summarized the identifiable assets and liabilities of LRE that were disposed of, the consideration received, and the loss of LRE for the period from September 1, 2012 to September 10, 2012.

|

September 10,

|

||||

|

2012

|

||||

|

Identifiable Assets and Liabilities

|

||||

|

Account payable

|

$ | (450 | ) | |

|

A mount owed to Laredo Resources Corp.

|

(17,550 | ) | ||

|

Net liabilities of LRE

|

(18,000 | ) | ||

|

Consideration Received

|

||||

|

Settlement of accounts payable, promissory notes, and accrued interest

|

91,064 | |||

|

Elimination of accumulated losses of LRE

|

18,000 | |||

| 109,064 | ||||

|

Sale of subsidiary - related party

|

$ | 91,064 | ||

Note 10 - Subsequent Events

On September 1, 2013 the Company entered into an agreement with Magna Management Ltd. (“Magna”) to increase the number of authorized shares to 2 billion shares and constitute a class of convertible preferred shares to be solely issued to Magna. This is exchange for paying $240,000 on behalf of the Company toward the purchase price of property mining rights associated with property located near Pony, Montana.

In addition, on September 1, 2013, the Company entered into a convertible note payable for $240,000 with an interest rate of ten percent per annum with Magna.

F-13

Item 9. Changes In and Disagreements with Accountants on Accounting and Financial Disclosure

None.

Item 9A. Controls and Procedures

As required by Rule 13a-15 under the Securities Exchange Act of 1934, we have carried out an evaluation of the effectiveness of our disclosure controls and procedures as of the end of the period covered by this annual report, being August 31, 2013. This evaluation was carried out under the supervision and with the participation of our management, including our Chief Executive Officer and Chief Financial Officer.

Disclosure controls and procedures are controls and other procedures that are designed to ensure that information required to be disclosed in our reports filed or submitted under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported, within the time periods specified in the Securities and Exchange Commission’s rules and forms. Disclosure controls and procedures include controls and procedures designed to ensure that information required to be disclosed in our company’s reports filed under the Securities Exchange Act of 1934 is accumulated and communicated to management, including our Chief Executive Officer and Chief Financial Officer, to allow timely decisions regarding required disclosure.

Based upon that evaluation, including our Chief Executive Officer and Chief Financial Officer, we have concluded that our disclosure controls and procedures were ineffective as of the end of the period covered by this annual report.

Management’s Report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting (as defined in Rule 13a-15(f) under the Securities Exchange Act of 1934). Management has assessed the effectiveness of our internal control over financial reporting as of August 31, 2013 based on criteria established in Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. As a result of this assessment, management concluded that, as of August 31, 2013, our internal control over financial reporting was not effective. Our management identified the following material weaknesses in our internal control over financial reporting, which are indicative of many small companies with small staff: (i) inadequate segregation of duties and effective risk assessment; and (ii) insufficient written policies and procedures for accounting and financial reporting with respect to the requirements and application of both US GAAP and SEC guidelines.

We plan to take steps to enhance and improve the design of our internal control over financial reporting. During the period covered by this annual report on Form 10-K, we have not been able to remediate the material weaknesses identified above. To remediate such weaknesses, we hope to implement the following changes during our fiscal year ending August 31, 2013: (i) appoint additional qualified personnel to address inadequate segregation of duties and ineffective risk management; and (ii) adopt sufficient written policies and procedures for accounting and financial reporting. The remediation efforts set out in (i) and (ii) are largely dependent upon our securing additional financing to cover the costs of implementing the changes required. If we are unsuccessful in securing such funds, remediation efforts may be adversely affected in a material manner.

This annual report does not include an attestation report of our registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by our registered public accounting firm pursuant to an exemption for non-accelerated filers set forth in Section 989G of the Dodd-Frank Wall Street Reform and Consumer Protection Act.

Item 9B. Other Information

None.

11

PART III

Item 10. Directors, Executive Officers and Corporate Governance

Our sole executive officer and director is as follows:

| Name | Age | Position(s) and Office(s) Held | ||

| Robert Gardner | 74 | President, Chief Executive Officer, Chief Financial Officer, and Director |

Set forth below is a brief description of the background and business experience of each of our current executive officers and directors.

Robert Gardner was appointed President, Chief Executive Officer, Chief Financial Officer, Secretary, Treasurer, and Director on September 10, 2012. He is the Proprietor and Principal of Gardner & Associates in Vancouver. He is a Barrister and Solicitor in the Province of British Columbia where he was called and admitted in 1966. He is currently President of Q-Gold Resources Ltd., a position he has held since approximately July of 2010. Formerly, he was Chairman of Viridis Energy, Inc. from approximately December 2009 until April 2011. He also served as President, CFO and Secretary of First Star Resources, Inc. from November 2010 through approximately December 2011. He was a member of the Board and Chairman of Stealth Energy from approximately 2006 until his resignation in approximately July 2011. He was Chairman and a member of the Board of Genco Resources (now Silvermex Resources, Inc.) from approximately February 2003 until his resignation in May 2010. During his time at Genco Resources, he also served as acting CEO from January 2009 to February 2010. He was a Director for Kootenay Gold, Inc. from June 2003 until his resignation in March 2009. He served as Chairman of Andover Resources from December 2006 until his resignation in September 2008. He was on the Board of Chief Consolidated Mining as an U.S.-associated company to Andover from March 2008 until his resignation in 2010. He was a Director for Atlas Technology Group from August 2005 until his resignation in February 2009. He served as Chairman of Bolero Resources Corp. from February 2006 until his resignation in February 2008. He was on the Board of Directors of Getty Copper from approximately 2003 until his resignation in November 2004. He was a director of Triple Dragon Resources, Inc. from February 23, 2006 to June 4, 2007.

Mr. Gardner was called to the Bar of England and Wales in 1964 and called and admitted in British Columbia in 1966. He is a member of the Honourable Society of the Inner Temple (London). He graduated from Cambridge University in 1961 with a BA, in 1962 with an LLB, in 1965 with an MA, and in 1995 with an LLM. He was made a Queens Counsel in 1989.

Term of Office

Our Directors are appointed for a one year term to hold office until the next annual general meeting of our shareholders or until removed from office in accordance with our bylaws. Our officers are appointed by our board of directors and hold office until removed by the board.

Family Relationships

There are no family relationships between or among the directors, executive officers or persons nominated or chosen by us to become directors or executive officers.

12

Involvement in Certain Legal Proceedings

To the best of our knowledge, during the past ten years, none of the following occurred with respect to a present or former director, executive officer, or employee: (1) any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; (2) any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); (3) being subject to any order, judgment or decree, not subsequently reversed, suspended, vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his or her involvement in any type of business, securities or banking activities; and (4) being found by a court of competent jurisdiction (in a civil action), the SEC or the Commodities Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended or vacated.

Committees of the Board

We do not currently have a compensation committee, executive committee, or stock plan committee.

Audit Committee

We do not have a separately-designated standing audit committee. The entire Board of Directors performs the functions of an audit committee, but no written charter governs the actions of the Board when performing the functions of what would generally be performed by an audit committee. The Board approves the selection of our independent accountants and meets and interacts with the independent accountants to discuss issues related to financial reporting. In addition, the Board reviews the scope and results of the audit with the independent accountants, reviews with management and the independent accountants our annual operating results, considers the adequacy of our internal accounting procedures and considers other auditing and accounting matters including fees to be paid to the independent auditor and the performance of the independent auditor. Our Board of Directors, which performs the functions of an audit committee, does not have a member who would qualify as an “audit committee financial expert” within the definition of Item 407(d)(5)(ii) of Regulation S-K. We believe that, at our current size and stage of development, the addition of a special audit committee financial expert to the Board is not necessary.

Nomination Committee

Our Board of Directors does not maintain a nominating committee. As a result, no written charter governs the director nomination process. Our size and the size of our Board, at this time, do not require a separate nominating committee.

When evaluating director nominees, our directors consider the following factors:

- The appropriate size of our Board of Directors;

- Our needs with respect to the particular talents and experience of our directors;

- The knowledge, skills and experience of nominees, including experience in finance, administration or public service, in light of prevailing business conditions and the knowledge, skills and experience already possessed by other members of the Board;

- Experience in political affairs;

- Experience with accounting rules and practices; and

- The desire to balance the benefit of continuity with the periodic injection of the fresh perspective provided by new Board members.

Our goal is to assemble a Board that brings together a variety of perspectives and skills derived from high quality business and professional experience. In doing so, the Board will also consider candidates with appropriate non-business backgrounds.

13

Other than the foregoing, there are no stated minimum criteria for director nominees, although the Board may also consider such other factors as it may deem are in our best interests as well as our stockholders. In addition, the Board identifies nominees by first evaluating the current members of the Board willing to continue in service. Current members of the Board with skills and experience that are relevant to our business and who are willing to continue in service are considered for re-nomination. If any member of the Board does not wish to continue in service or if the Board decides not to re-nominate a member for re-election, the Board then identifies the desired skills and experience of a new nominee in light of the criteria above. Current members of the Board are polled for suggestions as to individuals meeting the criteria described above. The Board may also engage in research to identify qualified individuals. To date, we have not engaged third parties to identify or evaluate or assist in identifying potential nominees, although we reserve the right in the future to retain a third party search firm, if necessary. The Board does not typically consider shareholder nominees because it believes that its current nomination process is sufficient to identify directors who serve our best interests.

Code of Ethics

As of August 31, 2013, we had not adopted a Code of Ethics for Financial Executives, which would include our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions.

Item 11. Executive Compensation

Compensation Discussion and Analysis

We do not currently pay compensation to our sole officer and director, Robert Gardner. Our sole executive officer holds substantial ownership in the company and is generally motivated by a strong entrepreneurial interest in expanding our operations and revenue base to the best of his ability.

Summary Compensation Table

The table below summarizes all compensation awarded to, earned by, or paid to our former or current executive officers for the fiscal years ended 2013 and 2012.

SUMMARY COMPENSATION TABLE

|

Stock

|

Option

|

Non-Equity

Incentive Plan |

Nonqualified

Deferred |

All Other

|

|||||||||||||||||||||||||||||

|

Name and

|

Salary

|

Bonus

|

Awards

|

Awards

|

Compensation

|

Compensation

|

Compensation

|

Total

|

|||||||||||||||||||||||||

|

principal position

|

Year

|

($)

|

($)

|

($)

|

($)

|

($)

|

Earnings ($)

|

($)

|

($)

|

||||||||||||||||||||||||

|

Robert Gardner,

|

2013

|

$ | n/a | $ | n/a | $ | n/a | $ | n/a | $ | n/a | $ | n/a | $ | n/a | $ | n/a | ||||||||||||||||

|

President, CEO, and CFO

|

2012

|

$ | n/a | $ | n/a | $ | n/a | $ | n/a | $ | n/a | $ | n/a | $ | n/a | $ | n/a | ||||||||||||||||

|

Ruth Cruz Santos, former officer

|

2012

|

$ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | ||||||||||||||||

Narrative Disclosure to the Summary Compensation Table

We have not entered into any employment agreement or consulting agreement with our executive officers. There are no arrangements or plans in which we provide pension, retirement, or similar benefits for executive officers.

Although we do not currently compensate our officers, we reserve the right to provide compensation at some time in the future. Our decision to compensate officers depends on the availability of our cash resources with respect to the need for cash to further our business purposes.

14

Outstanding Equity Awards at Fiscal Year-End

The table below summarizes all unexercised options, stock that has not vested, and equity incentive plan awards for each named executive officer as of August 31, 2013.

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

|

OPTION AWARDS

|

STOCK AWARDS

|

||||||||

| Name |

Number of

Securities

Underlying

Unexercised

Options

(#)

Exercisable

|

Number of

Securities

Underlying

Unexercised

Options

(#)

Unexercisable

|

Equity

Incentive

Plan

Awards:

Number of

Securities

Underlying

Unexercised

Unearned

Options

(#)

|

Option

Exercise

Price

($)

|

Option

Expiration

Date

|

Number

of

Shares

or Shares

of

Stock

That

Have

Not

Vested

(#)

|

Market

Value

of

Shares

or

Shares

of

Stock

That

Have

Not

Vested

($)

|

Equity

Incentive

Plan

Awards:

Number

of

Unearned

Shares,

Shares or

Other

Rights

That Have

Not

Vested

(#)

|

Equity

Incentive

Plan

Awards:

Market or

Payout

Value of

Unearned

Shares,

Shares or

Other

Rights

That

Have Not

Vested

(#)

|

| Robert Gardner | - | - |

-

|

-

|

-

|

-

|

-

|

-

|

-

|

Director Compensation

The table below summarizes all compensation of our directors for the year ended August 31, 2013.

| DIRECTOR COMPENSATION | |||||||

|

Fees Earned

or

|

Non-Equity

Incentive |

Non-Qualified

Deferred

|

All

|

||||

|

Paid in

|

Stock

|

Option

|

Plan

|

Compensation

|

Other

|

||

|

Name

|

Cash

|

Awards

|

Awards

|

Compensation

|

Earnings

|

Compensation

|

Total

|

|

Robert Gardner

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

Narrative Disclosure to the Director Compensation Table

We do not compensate our directors for their service at this time.

15

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

The following table sets forth, as of December 05, 2013, the beneficial ownership of our common stock by each executive officer and director, by each person known by us to beneficially own more than 5% of the our common stock and by the executive officers and directors as a group:

| Title of class | Name and address of beneficial owner (1) | Amount of beneficial ownership | Percent of class* | |||

| Executive Officers & Directors: | ||||||

| Common | Robert Gardner | 100,000,000 | 56.02% | |||

| 300 Jameson House

838 West Hastings Street

Vancouver, B.C. V6C 0A6

Canada

|

||||||

| Common | Total all executive officers and directors | 100,000,000 | 56.02% | |||

| Common | 5% Shareholders | None |

|

(1)

|

As used in this table, "beneficial ownership" means the sole or shared power to vote, or to direct the voting of, a security, or the sole or shared investment power with respect to a security (i.e., the power to dispose of, or to direct the disposition of, a security). In addition, for purposes of this table, a person is deemed, as of any date, to have "beneficial ownership" of any security that such person has the right to acquire within 60 days after such date.

|

Item 13. Certain Relationships and Related Transactions, and Director Independence