UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For

the quarterly period ended

or

For the transition period from ________ to ________

Commission

File Number:

(Exact name of small business issuer as specified in its charter)

| (State or other jurisdiction of incorporation) | (I.R.S. Employer Identification Number) |

(Address of principal executive offices and zip code)

(Registrant’s telephone number, including area code)

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the last 90 days. ☒ NO ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☐ | Smaller reporting company | ||

| Emerging growth company | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO

The

number of shares of the Registrant’s common stock, $0.001 par value per share, outstanding as of August 9, 2022, was

TABLE OF CONTENTS

| Page No. | ||

| PART I. - FINANCIAL INFORMATION | ||

| Item 1. | Financial Statements | 1 |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 17 |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 24 |

| Item 4. | Controls and Procedures | 24 |

| PART II - OTHER INFORMATION | ||

| Item 1. | Legal Proceedings | 25 |

| Item 1A. | Risk Factors | 25 |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 25 |

| Item 3. | Defaults upon Senior Securities | 25 |

| Item 4. | Mine Safety Disclosures | 25 |

| Item 5. | Other Information | 25 |

| Item 6. | Exhibits | 25 |

| Signatures | 26 | |

i

PART 1 - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

TENGJUN BIOTECHNOLOGY CORP. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

| June 30, | December 31, | |||||||

| 2022 | 2021 | |||||||

| (Unaudited) | ||||||||

| Assets | ||||||||

| Current Assets | ||||||||

| Cash and cash equivalents | $ | $ | ||||||

| Advance to suppliers | ||||||||

| Inventories, net | ||||||||

| Prepaid taxes | - | |||||||

| Due from related party | - | |||||||

| Prepaid expenses and other receivable | ||||||||

| Total Current Assets | ||||||||

| Property and equipment, net | ||||||||

| Construction in progress | ||||||||

| Total Assets | $ | $ | ||||||

| Liabilities and Deficit | ||||||||

| Current Liabilities | ||||||||

| Accounts payable | $ | $ | ||||||

| Advances from customers | ||||||||

| Due to related parties | ||||||||

| Accrued liabilities and other payables | ||||||||

| Total Current Liabilities | ||||||||

| Total Liabilities | ||||||||

| Deficit | ||||||||

| Preferred stock, $ | ||||||||

| Common stock, $ | ||||||||

| Additional paid-in capital | ||||||||

| Accumulated deficit | ( | ) | ( | ) | ||||

| Accumulated other comprehensive loss | ( | ) | ||||||

| Total stockholders’ deficit | ( | ) | ( | ) | ||||

| Noncontrolling interests | ( | ) | ( | ) | ||||

| Total Deficit | ( | ) | ( | ) | ||||

| Total Liabilities and Deficit | $ | $ | ||||||

The accompanying notes are an integral part of these consolidated financial statements

1

TENGJUN BIOTECHNOLOGY CORP. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(UNAUDITED)

| For the Three Months Ended | For the Six Months Ended | |||||||||||||||

| June 30, | June 30, | |||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||

| Sales revenue, net | $ | $ | - | $ | $ | - | ||||||||||

| Cost of goods sold | - | - | ||||||||||||||

| Gross profit | - | - | ||||||||||||||

| Selling and marketing expenses | ||||||||||||||||

| General and administrative expenses | ||||||||||||||||

| Total operating expenses | ||||||||||||||||

| Loss from operations | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Interest income (expense) | ( | ) | ( | ) | ||||||||||||

| Other income (expense), net | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Loss before provision for income taxes | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Provision for income taxes | ( | ) | - | |||||||||||||

| Net loss | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Net loss attributable to noncontrolling interests | ( | ) | ( | ) | ||||||||||||

| Net loss attributable to Tengjun stockholders | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Net loss | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Other comprehensive income (loss): | ||||||||||||||||

| Foreign currency translation adjustment | ( | ) | ( | ) | ||||||||||||

| Comprehensive loss | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Comprehensive loss attributable to noncontrolling interests | ( | ) | ( | ) | ||||||||||||

| Comprehensive loss attributable to Tengjun stockholders | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ( | ) | ||||

| Net Loss Per Common Share: | ||||||||||||||||

| $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ( | ) | |||||

| Weighted average shares outstanding: | ||||||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

2

TENGJUN BIOTECHNOLOGY CORP. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN DEFICIT

(UNAUDITED)

| Accumulated | ||||||||||||||||||||||||||||

| Additional | Other | |||||||||||||||||||||||||||

| Common Stock | Paid-in | Accumulated | Comprehensive | Noncontrolling | Total | |||||||||||||||||||||||

| Shares | Amount | Capital | Deficit | Loss | Interests | Deficit | ||||||||||||||||||||||

| Balance at December 31, 2021 | $ | $ | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ( | ) | ||||||||||||||

| Net loss | - | |||||||||||||||||||||||||||

| Foreign currency translation | - | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||

| Balance at March 31, 2022 | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||||||||||||||

| Net loss | - | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||

| Foreign currency translation | - | |||||||||||||||||||||||||||

| Balance at June 30, 2022 | $ | $ | $ | ( | ) | $ | $ | ( | ) | $ | ( | ) | ||||||||||||||||

| Accumulated | ||||||||||||||||||||||||||||

| Additional | Other | |||||||||||||||||||||||||||

| Common Stock | Paid-in | Accumulated | Comprehensive | Noncontrolling | Total | |||||||||||||||||||||||

| Shares | Amount | Capital | Deficit | Loss | Interests | Deficit | ||||||||||||||||||||||

| Balance at December 31, 2020 | $ | $ | $ | ( | ) | $ | ( | ) | $ | $ | ( | ) | ||||||||||||||||

| Net loss | - | ( | ) | ( | ) | |||||||||||||||||||||||

| Foreign currency translation | - | |||||||||||||||||||||||||||

| Balance at March 31, 2021 | ( | ) | ( | ) | ( | ) | ||||||||||||||||||||||

| Net loss | - | ( | ) | ( | ) | |||||||||||||||||||||||

| Foreign currency translation | - | ( | ) | ( | ) | |||||||||||||||||||||||

| Balance at June 30, 2021 | $ | $ | $ | ( | ) | $ | ( | ) | $ | $ | ( | ) | ||||||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

3

TENGJUN BIOTECHNOLOGY CORP. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| For the Six Months Ended | ||||||||

| June 30, | ||||||||

| 2022 | 2021 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||

| Net loss | $ | ( | ) | $ | ( | ) | ||

| Adjustments to reconcile net loss to net cash provided by operating activities: | ||||||||

| Depreciation | ||||||||

| Changes in net assets and liabilities: | ||||||||

| Inventories | ||||||||

| Prepaid taxes | ( | ) | ||||||

| Prepaid expenses and other assets | ( | ) | ||||||

| Advance to suppliers | ( | ) | ||||||

| Accounts payable | ||||||||

| Taxes payable | ( | ) | ||||||

| Accrued liabilities and other payable | ( | ) | ||||||

| Net cash provided by (used in) operating activities | ( | ) | ||||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||

| Purchase of property and equipment | ( | ) | ( | ) | ||||

| Payment for construction in progress | ( | ) | ( | ) | ||||

| Net cash used in investing activities | ( | ) | ( | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||||||

| Repayment of short-term bank loan | ( | ) | ||||||

| Repayment of short-term loan from third parties | ( | ) | ||||||

| (Repayment of) proceeds from loans from related parties | ( | ) | ||||||

| Net cash (used in) provided by financing activities | ( | ) | ||||||

| EFFECT OF EXCHANGE RATE CHANGE ON CASH AND CASH EQUIVALENTS | ( | ) | ||||||

| NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | ||||||||

| CASH AND CASH EQUIVALENTS, BEGINNING BALANCE | ||||||||

| CASH AND CASH EQUIVALENTS, ENDING BALANCE | $ | $ | ||||||

| SUPPLEMENTAL DISCLOSURES: | ||||||||

| Income tax paid | $ | $ | ||||||

| Interest paid | $ | $ | ||||||

The accompanying notes are an integral part of these consolidated financial statements.

4

TENGJUN BIOTECHNOLOGY CORP. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

NOTE 1. ORGANIZATION AND NATURE OF BUSINESS

Tengjun Biotechnology Corp. (formerly known as China Herb Group Holdings Corporation, the “Company”) was incorporated under the name “Island Radio, Inc.” under the laws of the State of Nevada on June 28, 2010. On December 9, 2019, the Company changed its corporate name to Tengjun Biotechnology Corp. (“Tengjun”).

Tengjunxiang Biotechnology Ltd. (“Tengjunxiang”) is a holding company incorporated in the Cayman Islands on July 19, 2021. On August 5, 2021, Tengjunxiang formed a wholly-owned subsidiary, Tengjunxiang Biotechnology HK Limited (“Tengjunxiang HK”), under the laws of Hong Kong. Shandong Minfu Biology Science and Technology Co., Ltd. (“Shandong Minfu”) is a company incorporated under the laws of the People’s Republic of China (the “PRC”) on August 29, 2021. Tengjunxiang HK owns all of the equity interests in Shandong Minfu, a wholly-foreign owned entity formed (“WFOE”) under the laws of PRC.

Shandong Tengjunxiang Biotechnology Co., Ltd (“Shandong Tengjunxiang”) was incorporated under the laws of PRC on June 27, 2014. Jinxiang County Kanglong Water Purification Equipment Co., Ltd (“Jinxiang Kanglong”), a wholly-owned subsidiary of Shandong Tengjunxiang, was formed under the laws of the PRC on January 6, 2015. Shangdong Tengjunxiang and Jinxiang Kanglong have been under common control. Shandong Tengjunxiang and its subsidiary, Jinxiang Kanglong are primarily engaged in processing, packaging, distribution and sale of dandelion teas, and producing and sale of water purifiers in China, and plans to increase its tea processing and water purifier production lines, and expand its sales channels in the next one to two years.

On December 15, 2021, all shareholders

and the Board of Shandong Tengjunxiang agreed to increase its registered capital to RMB

All of the entities of the Restructuring Transaction are under common control of Mr. Xianchang Ma, the controlling shareholder of Tengjunxiang, before and after the Restructuring Transaction, which results in the consolidation of Tengjunxiang and its subsidiaries and has been accounted for as a reorganization of entities under common control at carrying value and for accounting purpose, the reorganization was accounted for as a recapitalization. The consolidated financial statements are prepared on the basis as if the Restructuring Transaction became effective as of the beginning of the first period presented in the accompanying consolidated financial statements.

On

December 23, 2021,

In connection with the acquisition of Tengjunxiang pursuant to the Share Exchange Agreement, the Company with its subsidiaries commenced its business operations in processing, packaging, distribution and sale of dandelion teas, producing and sale of water purifiers in China through Tengjunxiang and its subsidiaries in the People’s Republic of China. The acquisition of Tengjunxiang is treated as a reverse acquisition (the “Reverse Acquisition”).

5

COVID-19

A novel strain of coronavirus, or COVID-19, was first identified in China in December 2019, and subsequently declared a pandemic on March 11, 2020 by the World Health Organization. As a result of the COVID-19 pandemic, all travels had been severely curtailed to protect the health of the Company’s employees and comply with local government guidelines. The COVID-19 pandemic has had an adverse effect on the Company’s business. Although China has already begun to recover from the outbreak of COVID-19 and the Company’s business has gone back to normal, the epidemic continues to spread on a global scale and there is a risk of the epidemic returning to China in the future, thereby causing further business interruption. The full impact of the pandemic on the Company’s business, operations and financial results depends on various factors that continue to evolve, which the Company may not be able to accurately predict for now.

NOTE 2. GOING CONCERN

These

consolidated financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the settlement

of liabilities and commitments in the normal course of business. As reflected in the Company’s accompanying consolidated financial

statements, the Company had an accumulated deficit of $

If the Company is unable to successfully commence its business operations in a short period of time, or unable to raise additional capital or secure additional lending, the Company may need to curtail or cease its operations. The Company believes that these matters raise substantial doubt about the Company’s ability to continue as a going concern. The accompanying consolidated financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

In order to continue as a going concern, the Company will need, among other things, additional capital resources. Management plans to obtain such resources for the Company include obtaining capital from the sale of its equity, and short-term and long-term borrowings from banks, stockholders or other related parties. However, management cannot provide any assurance that the Company will be successful in accomplishing any of its plans.

NOTE 3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Accounting

The consolidated financial statements and accompanying notes are prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”).

Principles of consolidation

The

consolidated financial statements include the financial statements of Tengjun Biotechnology Corp., Tengjunxiang and its

Use of Estimates

The preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the amount of revenues and expenses during the reporting periods. Management makes these estimates using the best information available at the time the estimates are made. However, actual results could differ materially from those results.

6

Reclassification

Certain classifications have been made to the prior year financial statements to conform to the current year presentation. The reclassification had no impact on previously reported net loss or accumulated deficit.

Cash and Cash Equivalents

The Company considers all cash on hand and in banks, certificates of deposit with banks and other highly-liquid investments with maturities of three months or less, when purchased, to be cash and cash equivalents. The Company has not experienced any losses in such accounts and believes it is not exposed to any significant risks on its cash in bank accounts.

Advance to suppliers

The

Company makes advances to certain vendors for construction and purchase of equipment. The Company had advance to suppliers of $

Inventories

The Company’s inventories primarily consist of dandelion teas and water purifiers. Inventories are valued at the lower of cost (determined on a weighted average basis) and net realizable value. Inventories mainly consist of raw materials, goods in process, and finished goods. The Company reviews its inventories regularly for possible obsolete goods and establishes reserves when determined necessary. No reserve for inventory was established as of June 30, 2022 and December 31, 2021.

Property and Equipment

Property and equipment are recorded at cost less accumulated depreciation. Gains or losses on disposals are reflected as gain or loss in the period of disposal. All ordinary repair and maintenance costs are expensed as incurred.

Depreciation for financial reporting purposes is provided using the straight-line method over the estimated useful lives of the assets:

| Estimated Useful Life | ||

| Buildings and improvements | ||

| Machinery and equipment | ||

| Office furniture and equipment | ||

| Vehicles |

Costs incurred in constructing new facilities, including progress payments and other costs related to construction, are capitalized and transferred to property, plant and equipment on completion, at which time depreciation commences.

Construction in Progress

Construction

in progress represents direct costs of construction, interest and design fees incurred. No interest was capitalized for the six months

ended June 30, 2022 and 2021. Capitalization of these costs ceases and the construction in progress is transferred to property, plant,

and equipment when substantially all the activities necessary to prepare the assets for their intended use are completed. No depreciation

is recognized until it is completed and ready for intended use. Construction in progress as of June 30, 2022 and December 31, 2021 was

$

Impairment of Long-lived Assets

The Company evaluates long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable through the estimated undiscounted cash flows expected to result from the use and eventual disposition of the assets. Whenever any such impairment exists, an impairment loss will be recognized for the amount by which the carrying value exceeds the fair value. There was no impairment for the six months ended June 30, 2022 and 2021 based on management’s evaluation.

7

Value added tax (“VAT”)

All

China-based enterprises are subject to a VAT imposed by the PRC government on their domestic product sales and services. The Company’s

subsidiaries in the PRC are subject to VAT at rates ranged from

Advances from customers

Payments received before all the relevant criteria for revenue recognition are satisfied are recorded as advance from customers. When all revenue recognition criteria are met, the advances from customers are recognized as revenue.

Revenue Recognition

The Company recognizes revenue in accordance with ASC Topic 606, Revenue from Contracts with Customers. To determine the revenue to be recognized, the Company applies the following five-step model:

| ● | identify arrangements with customers; |

| ● | identify performance obligations; |

| ● | determine transaction price; |

| ● | allocate transaction price to the separate performance obligations in the arrangement, if more than one exists; and |

| ● | recognize revenue as performance obligations are satisfied. |

The Company generates revenues mainly from sales of packaged dandelion teas and water purifiers. During the three and six months ended June 30, 2022, the Company also engaged in the sale of certain nutritional products and water treatment accessories. Revenue from the sales of goods is recognized when the control over the promised goods is transferred to customers.

Cash payments received or due from customers before revenue recognized are recorded as advances from customers. The advance from customers is recognized as revenue when the Company’s performance obligation is completed.

Cost of goods sold

Cost of goods sold consists primarily of cost of goods purchased, direct raw material cost, direct labor cost, and cost of manufacturing overheads including the depreciation of production equipment.

Selling and marketing expenses

Selling and marketing expenses primarily consist of advertising costs, agency fees, costs for promotional materials, and commission costs made to sales force.

Advertising

expenses are charged to the consolidated statements of operations and comprehensive loss in the period incurred. The amounts of advertising

expenses incurred were $

Commission

expense primarily consists of commission costs made to independent sales force. The amount of commission expense incurred were $

8

General and administrative expenses

General and administrative expenses primarily consist of payroll and benefit costs for corporate employees, legal, consulting, professional expenses, rental expenses and other corporate overhead costs.

Concentration of Credit Risk

The operations of the Company are primarily in the PRC. Accordingly, the Company’s business, financial condition, and results of operations may be influenced by the political, economic, and legal environments in the PRC, and by the general state of the PRC economy.

The

Company has cash on hand and demand deposits in accounts maintained with state-owned banks within the PRC. Cash in state-owned banks

is covered by insurance up to RMB

The

Company generated total revenue of $

During the three months ended June 30, 2022, the Company had two major supplier that accounted for over 10% of its total purchases.

| Supplier | Net purchase for the three months ended June 30, 2022 | % of total purchase | ||||||

| A | $ | % | ||||||

| B | % | |||||||

During the six months ended June 30, 2022, the Company had two major supplier that accounted for over 10% of its total purchases.

| Supplier | Net purchase for the six months ended June 30, 2022 |

%

of total purchase |

||||||

| A | $ | % | ||||||

| B | % | |||||||

No

supplier accounted for over

Income Taxes

The Company accounts for income taxes using an asset and liability approach which allows for the recognition and measurement of deferred tax assets based upon the likelihood of realization of tax benefits in future years. Under the asset and liability approach, deferred taxes are provided for the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. A valuation allowance is provided for deferred tax assets if it is more likely than not these items will either expire before the Company is able to realize their benefits, or that future deductibility is uncertain.

Under ASC 740, a tax position is recognized as a benefit only if it is “more likely than not” that the tax position would be sustained in a tax examination, with a tax examination being presumed to occur. The evaluation of a tax position is a two-step process. The first step is to determine whether it is more-likely-than-not that a tax position will be sustained upon examination, including the resolution of any related appeals or litigations based on the technical merits of that position. The second step is to measure a tax position that meets the more-likely-than-not threshold to determine the amount of benefit to be recognized in the financial statements. A tax position is measured at the largest amount of benefit that is greater than 50 percent likely of being realized upon ultimate settlement. Tax positions that previously failed to meet the more-likely-than-not recognition threshold should be recognized in the first subsequent period in which the threshold is met. Previously recognized tax positions that no longer meet the more-likely-than-not criteria should be de-recognized in the first subsequent financial reporting period in which the threshold is no longer met. Penalties and interest incurred related to underpayment of income tax are classified as income tax expense in the year incurred.

9

Related parties

The Company follows ASC 850, “Related Party Disclosures,” for the identification of related parties and disclosure of related party transactions. Parties are related if one party has the ability, directly or indirectly, to control the other party or exercise significant influence over the other party in making financial and operating decisions. Parties are also considered to be related if they are subject to common control or significant influence, such as a family member or relative, shareholder, or a related corporation.

Foreign Currency Translation

The Company uses the United States dollar (“U.S. dollars”) for financial reporting purposes. The functional currency of the Company and its subsidiaries is the Chinese Yuan or Renminbi (“RMB”). The Company’s subsidiaries maintain their books and records in their functional currency, being the primary currency of the economic environment in which their operations are conducted. For the Company and its subsidiaries whose functional currencies are other than the U.S. dollar, all asset and liability accounts were translated at the exchange rate on the balance sheet date; stockholders’ equity is translated at the historical rates and items in the income statement and cash flow statements are translated at the average rate in each applicable period. Translation adjustments resulting from this process are included in accumulated other comprehensive income in the statement of shareholders’ equity. The resulting translation gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations as incurred.

Fair Values of Financial Instruments

ASC 820 defines fair value as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. ASC 820 also establishes a fair value hierarchy, which requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. ASC 820 describes three levels of inputs that may be used to measure fair value:

Level 1 – quoted prices in active markets for identical assets or liabilities.

Level 2 – quoted prices for similar assets and liabilities in active markets or inputs that are observable

Level 3 – inputs that are unobservable

The Company’s financial instruments primarily consist of cash and cash equivalents, advances to suppliers, prepaid expenses, other receivable, accounts payable, accrued expenses, other payables, and related party borrowings. As of the balance sheet dates, the estimated fair values of the financial instruments were not materially different from their carrying values as presented on the balance sheets. This is attributed to the short maturities of the instruments and that interest rates on the borrowings approximate those that would have been available for loans of similar remaining maturity and risk profile at respective balance sheet dates.

Lease

The Company adopted FASB Accounting Standards Codification, Topic 842, Leases (“ASC 842”) using the modified retrospective approach, electing the practical expedient that allows the Company not to restate its comparative periods prior to the adoption of the standard on January 1, 2019.

10

The new leasing standard requires recognition of leases on the consolidated balance sheets as right-of-use (“ROU”) assets and lease liabilities. ROU assets represent the Company’s right to use underlying assets for the lease terms and lease liabilities represent the Company’s obligation to make lease payments arising from the leases. Operating lease ROU assets and operating lease liabilities are recognized based on the present value and future minimum lease payments over the lease term at commencement date. The Company’s future minimum based payments used to determine the Company’s lease liabilities mainly include minimum based rent payments. As most of the Company’s leases do not provide an implicit rate, the Company uses its estimated incremental borrowing rate based on the information available at commencement date in determining the present value of lease payments.

The adoption of ASC 842 had no material impact on the Company’s consolidated balance sheets, results of operations or cash flows. In addition, the adoption of ASC 842 did not result in a cumulative-effect adjustment to the opening balance of retained earnings (accumulated deficit). Operating lease cost is recognized as a single lease cost on a straight-line basis over the lease term and is recorded in selling, general and administrative expenses. Variable lease payments for common area maintenance, property taxes and other operating expenses are recognized as expense in the period when the changes in facts and circumstances on which the variable lease payments are based occur.

Segment Reporting

ASC Topic 280, “Segment Reporting,” requires use of the “management approach” model for segment reporting. The management approach model is based on the way a company’s chief operating decision maker organizes segments within the Company for making operating decisions assessing performance and allocating resources. Reportable segments are based on products and services, geography, legal structure, management structure, or any other manner in which management disaggregates a company.

The Company manages its business as two operating segments, dandelion teas and water purifier, all of which are located in the PRC. All of its revenues are derived in the PRC. All long-lived assets are located in PRC.

The following table shows the Company’s operations by business segment for the three and six months ended June 30, 2022 and 2021:

| For the | For the | |||||||||||||||

| Three Months Ended | Six Months Ended | |||||||||||||||

| June 30, | June 30, | June 30, | June 30, | |||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||

| Net revenue | ||||||||||||||||

| Dandelion teas | $ | $ | $ | $ | ||||||||||||

| Water purifier | ( | ) | ||||||||||||||

| Total revenues, net | $ | $ | $ | $ | ||||||||||||

| Cost of goods sold | ||||||||||||||||

| Dandelion teas | $ | $ | $ | $ | ||||||||||||

| Water purifier | ( | ) | ||||||||||||||

| Total cost of goods sold | $ | $ | $ | $ | ||||||||||||

| Gross profit | ||||||||||||||||

| Dandelion teas | $ | $ | $ | $ | ||||||||||||

| Water purifier | ( | ) | ||||||||||||||

| Gross profit | $ | $ | $ | $ | ||||||||||||

| Operating expenses | ||||||||||||||||

| Dandelion teas | $ | $ | $ | $ | ||||||||||||

| Water purifier | ( | ) | ||||||||||||||

| Total operating expenses | $ | $ | $ | $ | ||||||||||||

| Loss from operations | ||||||||||||||||

| Dandelion teas | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ( | ) | ||||

| Water purifier | ( | ) | ( | ) | ||||||||||||

| Loss from operations | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ( | ) | ||||

11

| As of June 30, | As of December 31, | |||||||

| Segment assets | 2022 | 2021 | ||||||

| Dandelion teas | $ | $ | ||||||

| Water purifier | ||||||||

| Total assets | $ | $ | ||||||

Income (Loss) per Share Calculation

Basic net income (loss) per common share is computed by dividing the net loss attributable to common stockholders by the weighted-average number of common shares outstanding for the period. Diluted earnings (loss) per shares is computed similar to basic earnings (loss) per share except that the denominator is increased to include the number of additional common shares that would have been outstanding if the potential common shares had been issued and if the additional common shares were dilutive.

Recent Accounting Pronouncements

In June 2016, the FASB issued ASU No. 2016-13, Financial Instruments-Credit Losses (Topic 326), which requires entities to measure all expected credit losses for financial assets held at the reporting date based on historical experience, current conditions, and reasonable and supportable forecasts. This replaces the existing incurred loss model and is applicable to the measurement of credit losses on financial assets measured at amortized cost. This guidance is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2022. Early application will be permitted for all entities for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2018. The Company is currently evaluating the impact that the standard will have on its consolidated financial statements.

In March 2020, the FASB issued ASU 2020-04, Reference Rate Reform (Topic 848) (“ASU 2020-04”). ASU 2020-04 contains practical expedients for reference rate reform related activities that impact debt, leases, derivatives and other contracts. The guidance in ASU 2020-04 is optional and may be elected over time as reference rate reform activities occur. The Company continues to evaluate the impact of the guidance and may apply the elections as applicable as changes in the market occur.

NOTE 4. INVENTORIES, NET

Inventories consisted of the following:

| June 30, | December 31, | |||||||

| 2022 | 2021 | |||||||

| Raw materials | $ | $ | ||||||

| Work in process | ||||||||

| Finished goods | ||||||||

| Less: allowance for obsolete inventories | ||||||||

| Inventories, net | $ | $ | ||||||

12

NOTE 5. PROPERTY, PLANT, AND EQUIPMENT, NET

Property, plant, and equipment consisted of the following:

| June 30, | December 31, | |||||||

| 2022 | 2021 | |||||||

| Buildings | $ | $ | ||||||

| Machinery and equipment | ||||||||

| Office equipment | ||||||||

| Vehicles | ||||||||

| Less: Accumulated depreciation | ( | ) | ( | ) | ||||

| Property and equipment, net | $ | $ | ||||||

Depreciation

expense for the three months ended June 30, 2022 and 2021 were $

NOTE 6. PREPAID TAXES

Prepaid

taxes as of June 30 2022 and December 31, 2021, primarily consist of prepaid VAT in the amount of $

NOTE 7. SHORT-TERM LOAN

On

March 17, 2020, Shandong Tengjunxiang and China Construction Bank entered into a one-year bank loan agreement in an amount of RMB

During

the three months ended June 30, 2022 and 2021, the Company recorded interest expense of $

NOTE 8. ACCRUED LIABILITIES AND OTHER PAYABLES

Accrued liabilities and other payables consisted of the following at June 30, 2022 and December 31, 2021:

| June 30, 2022 | December 31, 2021 | |||||||

| Accrued local taxes | $ | $ | ||||||

| Advance from employees | ||||||||

| Payable for construction and improvements | ||||||||

| Payable for machinery and equipment | ||||||||

| Accrued payroll | ||||||||

| Accrued professional fees | ||||||||

| Other | ||||||||

| Total | $ | $ | ||||||

NOTE 9. INCOME TAX

United States

The

Company was incorporated in the United States of America and is subject to United States federal taxation. The U.S. Tax Cuts and Jobs

Act (the “Act”) was enacted on December 22, 2017. Effective in 2018, the Tax Act reduces the U.S. statutory tax rate from

13

Cayman Islands

Under the current laws of the Cayman Islands, the Company is not subject to tax on income or capital gain. Additionally, upon payments of dividends to the shareholders, no Cayman Islands withholding tax will be imposed.

Hong Kong

Tengjunxiang

HK is incorporated in Hong Kong and is subject to Hong Kong Profits Tax on the taxable income as reported in its statutory financial

statements adjusted in accordance with relevant Hong Kong tax laws. The applicable tax rate is

PRC

Effective

on January 1, 2008, the PRC Enterprise Income Tax Law, EIT Law, and Implementing Rules impose an unified enterprise income tax rate of

Provision for income tax expense (benefit) consists of the following:

| For the Six Months Ended June 30, | ||||||||

| 2022 | 2021 | |||||||

| Current | ||||||||

| USA | $ | $ | ||||||

| China | ||||||||

| Deferred | ||||||||

| USA | ||||||||

| China | ||||||||

| Total provision for income tax expense (benefit) | $ | $ | ||||||

The following is a reconciliation of the statutory tax rate to the effective tax rate:

| For the Six Months Ended | ||||||||

| June 30, | ||||||||

| 2022 | 2021 | |||||||

| U.S. federal statutory income tax (benefit) | ( | )% | ( | )% | ||||

| Foreign tax rate differential | ( | )% | ( | )% | ||||

| Change in valuation allowances | % | % | ||||||

| Effective income tax rate | % | - | % | |||||

The Company periodically evaluates the likelihood of the realization of deferred tax assets, and adjusts the carrying amount of the deferred tax assets by the valuation allowance to the extent that the future realization of the deferred tax assets is not judged to be more likely than not. The Company considers many factors when assessing the likelihood of future realization of its deferred tax assets, including its recent cumulative earnings experience by taxing jurisdiction, expectations of future taxable income or loss, the carryforward periods available to the Company for tax reporting purposes, and other relevant factors.

14

As

of June 30, 2022 and December 31, 2021, based on the weight of available evidence, including cumulative losses in recent years and expectations

of future taxable income, the Company determined that it was more likely than not that its deferred tax assets would not be realized

and have a

NOTE 10. RELATED PARTY TRANSACTIONS AND BALANCES

The related party of the company with whom transactions are reported in these financial statements are as follows:

| Name of Individual | Relationship with the Company | |

| Xianchang Ma | ||

| Liuhong Liu | ||

| Pan Shi | ||

| Jin Tian | ||

| Qiuping Lu |

Due from related party:

| June 30, | December 31, | |||||||

| 2022 | 2021 | |||||||

| Pan Shi | ||||||||

| $ | $ | |||||||

Due to related parties:

| June 30, | December 31, | |||||||

| 2022 | 2021 | |||||||

| Xianchang Ma | $ | $ | ||||||

| Qiuping Lu | ||||||||

| Liuhong Liu | - | |||||||

| Pan Shi | ||||||||

| Jin Tian | ||||||||

| $ | $ | |||||||

Due to related parties represent advances from its related parties for the Company’s payment for construction, purchase of equipment, and daily operating expenses. The balances are unsecured, non-interest bearing, and payable on demand.

NOTE 11. LEASE

The

Company leased a facility under an operating lease arrangement. The lease has initial lease term of

The following provides details of the Company’s lease expenses:

Three Months Ended June 30, | ||||||||

| 2022 | 2021 | |||||||

| Operating lease expenses | $ | $ | ||||||

15

Six Months Ended June 30, | ||||||||

| 2022 | 2021 | |||||||

| Operating lease expenses | $ | $ | ||||||

Other information related to leases is presented below:

| Six Months Ended June 30, | ||||||||

| 2022 | 2021 | |||||||

| Cash Paid For Amounts Included In Measurement of Liabilities: | ||||||||

| Operating cash flows from operating leases | $ | $ | ||||||

| Weighted Average Remaining Lease Term: | ||||||||

| Operating leases | | |||||||

| Weighted Average Discount Rate: | ||||||||

| Operating leases | % | % | ||||||

NOTE 12. EQUITY

Preferred Stock

The

total number of preferred shares authorized that may be issued by the Company is

As

of June 30, 2022 and December 31, 2021, the Company had

Common Stock

The

total number of common shares authorized that may be issued by the Company is

Common Stock Issued for Reverse Merger

On

December 23, 2021, the Company issued

NOTE 13. SUBSEQUENT EVENTS

Management has evaluated subsequent events through the date which the financial statements are available to be issued. All subsequent events requiring recognition as of June 30, 2022 have been incorporated into these financial statements and there are no subsequent events that require disclosure in accordance with FASB ASC Topic 855, “Subsequent Events.”

16

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion of the results of operations and financial condition should be read in conjunction with our condensed consolidated financial statements and notes thereto included in Item 1 of this part. This report, including the information incorporated by reference, contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. The use of any of the words “believe,” “expect,” “anticipate,” “plan,” “estimate,” and similar expressions are intended to identify such statements. Forward-looking statements include statements concerning our possible or assumed future results. The actual results that we achieve may differ materially from those discussed in such forward-looking statements due to the risks and uncertainties described in the Risk Factors section of this report, in Management’s Discussion and Analysis of Financial Condition and Results of Operations, and in other sections of this report, as well as in our annual report on Form 10-K. We undertake no obligation to update any forward-looking statements.

Overview

Corporate History and Structure

We were incorporated on June 28, 2010 in the State of Nevada under the name “Island Radio, Inc.” and changed our name to “China Herb Group Holdings Corporation” effective July 17, 2012. On December 9, 2019, the Company changed its corporate name to “Tengjun Biotechnology Corp.”

On June 27, 2012, Eric R. Boyer and Nina Edstrom (collectively, the “Sellers”), who were then the major shareholders of the Company, entered into a Share Purchase Agreement with Chin Yung Kong, Qiuping Lu and Fumin Feng (collectively, the “Purchasers”), pursuant to which the Sellers sold to the Purchasers an aggregate 4,000,000 shares of the common stock of the Company, which represented approximately 93% of the then total issued and outstanding stock of the Company, for a total purchase price of $159,970 (the “Change in Control”). As result of this share purchase transaction, Chin Yung Kong, Qiuping Lu and Fumin Feng became the controlling shareholders of the Company.

Acquisitions/Business Combinations

On December 23, 2021, the Company entered into a Share Purchase/Exchange Agreement (the “Share Exchange Agreement”) with Tengjunxiang Biotechnology Ltd. (the “Target”), a Cayman Islands corporation, and the Target’s eleven shareholders (the “Selling Shareholders”): Min Xing Biotechnolgy Ltd, Pastoral Technology Co., Ltd., Shu Zhilin Trading Co., Ltd., Teng Rui Xiang Bio-Tech Ltd., Aihua Trading Co., Ltd, Rock Climbing Technology, Langtaosha Trading Co., Ltd., Min Cheng Biotechnology Ltd, Kangfan Technology Co., Ltd., Chaorong Technology Co., Ltd., and Shengrui Biotechnology Co., Ltd. In accordance with the Share Exchange Agreement, on December 23, 2021, the Selling Shareholders collectively sold and transferred 500,000,000 ordinary shares of the Target, constituting one hundred percent (100%) of the issued and outstanding share capital of the Target, to the Company in exchange for 19,285,714 shares of Company’s common stock, par value $0.001 per share (the “Tengjun Shares”), at an agreed price of $0.19 per share of the Company’s common stock (the “Common Stock”) for a total valuation of $3,675,000 of the Target.

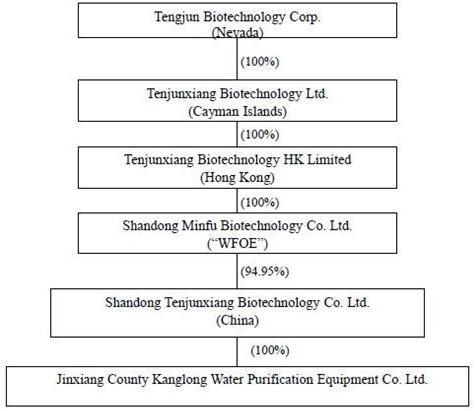

In connection with the acquisition of the Target pursuant to the Share Exchange Agreement, the Company is entering into the Chinese tea and water purifier business through its newly acquired subsidiary the Target Company, which owns four corporate entities: (i) Tengjunxiang Biotechnology HK Limited (“Tengjun HK”), a company formed in Hong Kong and wholly owned by the Target, (ii) Shandong Minfu Biotechnology Co., Ltd. (“WFOE”), a wholly foreign owned entity formed under the laws of China and wholly owned by Tengjun HK, (iii) Shandong Tengjunxiang Biotechnology Co., Ltd. (“Shangdong Tengjunxiang”), a company formed under the laws of China and 94.95% owned by WFOE, and (iv) Jinxiang County Kanglong Water Purification Equipment Co. Ltd. (“Kanglong”), a company formed under the laws of China and wholly-owned subsidiary of Shandong Tengjunxiang. The parties to this Agreement closed the transaction contemplated therein on December 23, 2021.

The Target was incorporated on July 19, 2021 under the laws of the Cayman Islands. The authorized capital stock of the Target is 500,000,000 ordinary shares, all of which were issued and outstanding prior to the closing of the Acquisition. Shangdong Tengjunxiang, our operating company, was formed on June 27, 2014, under the laws of China. Promptly after the Closing, the Target shall update the shareholder registration of the Target to effect the Share Exchange Agreement. The Share Exchange Agreement was signed and agreed by and among all of the shareholders and/or beneficial owners of the Target, the Target and the Company.

As a result of the consummation of the Acquisition on December 23, 2021 as discussed above, the Target became a wholly-owned subsidiary of the Company and the business of the Target became the business of the Company.

17

The diagram below illustrates our corporate structure following the Acquisition:

We had limited operations and generated limited revenues from our business operations before the quarter ended June 30, 2022. Our independent registered public accounting firm has issued a going concern opinion for the year ended December 31, 2021. This means that our auditors believe there is substantial doubt that we can continue as an on-going business for the next 12 months. Accordingly, we may have to raise additional cash from various sources, including operations, controlling shareholders’ investments and debt and equity financing from third party investors.

Results of Operations

Results of Operations – Three Months Ended June 30, 2022 Compared to Three Months Ended June 30, 2021.

The following table sets forth information from our statements of comprehensive income for the three months ended June 30, 2022 and 2021:

| Three Months Ended | ||||||||||||||||

| June 30, | Change | |||||||||||||||

| 2022 | 2021 | (Amount) | (Percent) | |||||||||||||

| Sales revenue | $ | 51,290,462 | $ | - | $ | 51,290,462 | * | % | ||||||||

| Cost of Goods Sold | (3,438,949 | ) | - | (3,438,949 | ) | * | % | |||||||||

| Gross Profit | 47,851,513 | - | 47,851,513 | * | % | |||||||||||

| Operating Expenses | (51,341,188 | ) | (219,420 | ) | (51,121,768 | ) | 23,299 | % | ||||||||

| Operating Income (Loss) | (3,489,675 | ) | (219,420 | ) | (3,270,255 | ) | 1,490 | % | ||||||||

| Interest Income (Expense) | 7,397 | (4 | ) | 7,401 | (185,025 | )% | ||||||||||

| Other Income (Expense) | (74 | ) | (2,657 | ) | 2,583 | (97 | )% | |||||||||

| Income Tax Provision (Benefit) | (53,366 | ) | - | (53,366 | ) | * | % | |||||||||

| Net Income (Loss) | (3,428,986 | ) | (222,081 | ) | (3,206,905 | ) | 1,444 | % | ||||||||

| Comprehensive Income (loss) | $ | (3,228,216 | ) | $ | (241,974 | ) | $ | (2,986,242 | ) | 1,234 | % | |||||

18

Revenues

We generated $51,290,462 and $0 in revenues for the three months ended June 30, 2022 and 2021, respectively. The Company did not generate any revenue during the three months ended June 30, 2021 due to the impact of COVID-19.

During the three months ended June 30, 2022, sales of dandelion teas, certain nutritional products, and water treatment accessories generated $51,444,665 in revenue, constituting approximately 100% of the total revenue for that quarter, and sales of water purifiers generated negative revenue of $154,203 due to sales returns, representing approximately 0% of the total revenue for such quarter.

The following is the sales breakdown by segment during the three months ended June 30, 2022 and 2021:

| For the three months ended | ||||||||||||||

| June 30, | ||||||||||||||

| 2022 | 2021 | |||||||||||||

| Dandelion teas | $ | 51,444,665 | 100 | % | $ | - | -% | |||||||

| Water purifier | (154,203 | ) | (0 | )% | - | -% | ||||||||

| Total | $ | 51,290,462 | 100 | % | $ | - | -% | |||||||

Cost of Goods Sold

Our cost of goods sold was $3,438,949 and $0 for the three months ended June 30, 2022 and 2021, respectively. During the three months ended June 30, 2022, cost of sales of dandelion teas, certain nutritional products, and water treatment accessories was $3,456,644, constituting approximately 101% of the total cost of goods sold, and cost of sales of water purifiers was $(17,695), representing approximately negative 1% of the total cost of goods sold due to the cost adjustment in connection with the sales returns. The Company did not incur any cost in the three months ended June 30, 2021 because there were no sales during the second quarter of 2021.

The following is the cost of goods sold breakdown by segment during the three months ended June 30, 2022 and 2021:

| For the three months ended | ||||||||||||||

| June 30, | ||||||||||||||

| 2022 | 2021 | |||||||||||||

| Dandelion teas | $ | 3,456,644 | 101 | % | $ | - | - | % | ||||||

| Water purifier | (17,695 | ) | (1 | )% | - | - | % | |||||||

| Total | $ | 3,438,949 | 100 | % | $ | - | - | % | ||||||

Gross Margin

Our gross margin was $47,851,513 and $0 for the three months ended June 30, 2022 and 2021, respectively. The gross profit as a percentage of net revenue for the Dandelion teas was 100% for the three months ended June 30, 2022. The gross profit as a percentage of net revenue for water purifiers was approximately 0% for the three months ended June 30, 2022.

The following table presents gross margin by segment for three months ended June 30, 2022 and 2021:

| For the three months ended | ||||||||||||||

| June 30, | ||||||||||||||

| 2022 | 2021 | |||||||||||||

| Dandelion teas | $ | 47,988,021 | 100 | % | $ | - | - | % | ||||||

| Water purifier | (136,508 | ) | (0 | )% | - | - | % | |||||||

| Total | $ | 47,851,513 | 100 | % | $ | - | - | % | ||||||

Selling and Marketing Expenses

Our selling and marketing expenses primarily consist of sales commission, advertising and product promotion expenses.

Our selling and marketing expenses were $51,072,254 for the three months ended June 30, 2022 as compared to $13,419 for the three months ended June 30, 2021. Our total selling and marketing expenses increased by $51,058,835 or 380,497% during the three months ended June 30, 2022, compared to the same period in 2021. Such increase in selling and marketing expenses was mainly due to the significant increase in sales commission.

19

General and administrative expenses

Our general and administrative expenses primarily consist of payroll and benefit costs for corporate employees, legal, consulting, professional expenses, rental expenses and other corporate overhead costs.

The general and administrative expenses was $268,934 for the three months ended June 30, 2022 as compared to $206,001 for the three months ended June 30, 2021. Our general and administrative expenses increased by $62,933 or 31% during the three months ended June 30, 2022, compared to the same period in 2021. Such increase in general and administrative expenses was mainly due to the increase in legal, accounting, printing, and stock transfer agent fees that were associated with the Company’s merger and acquisition activities and SEC filings.

Interest income (expense)

Interest income (expense) was $7,397 for the three months ended June 30, 2022 as compared to $(4) for the three months ended June 30, 2021. Our total interest income increased by $7,401 or 185,025% during the three months ended June 30, 2022, compared to the same period in 2021. The increase in interest income was primarily due to the interest earned from the Company’s bank savings accounts.

Net Income (Loss)

Our net loss was $3,428,986 for the three months ended June 30, 2022 as compared to net loss of $222,081 for the three months ended June 30, 2021, increased by $3,206,905 or 1,444 % as a result of the above factors.

Foreign Currency Translation Loss

We had $200,770 in foreign currency translation gain during the three months ended June 30, 2022 as compared to $(19,893) in foreign currency translation loss during the three months ended June 30, 2021, reflecting a change of $220,663 or 1,109%. Such increase in foreign currency translation gain was primarily caused by the currency exchange rate fluctuation.

Results of Operations – Six Months Ended June 30, 2022 Compared to Six Months Ended June 30, 2021.

The following table sets forth information from our statements of comprehensive income for the six months ended June 30, 2022 and 2021:

| Six Months Ended | ||||||||||||||||

| June 30, | Change | |||||||||||||||

| 2022 | 2021 | (Amount) | (Percent) | |||||||||||||

| Sales revenue | $ | 55,574,576 | $ | - | $ | 55,574,576 | * | % | ||||||||

| Cost of Goods Sold | (3,809,013 | ) | - | (3,809,013 | ) | * | % | |||||||||

| Gross Profit | 51,765,563 | - | 51,765,563 | * | % | |||||||||||

| Operating Expenses | (54,929,500 | ) | (380,546 | ) | (54,548,954 | ) | 14,334 | % | ||||||||

| Operating Income (Loss) | (3,163,937 | ) | (380,546 | ) | (2,783,391 | ) | 731 | % | ||||||||

| Interest Income (Expense) | 7,421 | (4,977 | ) | 12,398 | (249 | )% | ||||||||||

| Other Income (Expense) | (74 | ) | (2,657 | ) | 2,583 | (97 | )% | |||||||||

| Income Tax Provision | 39,589 | - | 39,589 | * | % | |||||||||||

| Net Income (Loss) | (3,196,179 | ) | (388,180 | ) | (2,807,999 | ) | 723 | % | ||||||||

| Comprehensive Income (loss) | $ | (3,004,847 | ) | $ | (401,476 | ) | $ | (2,603,371 | ) | 648 | % | |||||

Revenue

We generated $55,574,576 and $0 in revenues for the six months ended June 30, 2022 and 2021, respectively. The Company did not generate any revenue during the six months ended June 30, 2021 due to the impact of COVID-19.

During the six months ended June 30, 2022, sales of dandelion teas, certain nutritional products, and water treatment accessories generated $54,908,343 in revenue, constituting approximately 99% of the total revenue for that period, and sales of water purifiers generated $666,233 in revenue, representing approximately 1% of the total revenue for such period.

The following is the sales breakdown by segment during the six months ended June 30, 2022 and 2021:

| For the six months ended | ||||||||||||

| June 30, | ||||||||||||

| 2022 | 2021 | |||||||||||

| Dandelion teas | $ | 54,908,343 | 99 | % | $ | - | -% | |||||

| Water purifier | 666,233 | 1 | % | - | -% | |||||||

| Total | $ | 55,574,576 | 100 | % | $ | - | -% | |||||

20

Cost of Goods Sold

Our cost of goods sold was $3,809,013 and $0 for the six months ended June 30, 2022 and 2021, respectively. During the six months ended June 30, 2022, cost of sales of dandelion teas, certain nutritional products, and water treatment accessories was $3,730,491, constituting approximately 98% of the total cost of goods sold, and cost of sales of water purifiers was $78,522, representing approximately 2% of the total cost of goods sold. The Company did not incur any cost in the six months ended June 30, 2021 because there were no sales during the same period of 2021.

The following is the cost of goods sold breakdown by segment during the six months ended June 30, 2022 and 2021:

| For the six months ended | ||||||||||||||

| June 30, | ||||||||||||||

| 2022 | 2021 | |||||||||||||

| Dandelion teas | $ | 3,730,491 | 98 | % | $ | - | - | % | ||||||

| Water purifier | 78,522 | 2 | % | - | - | % | ||||||||

| Total | $ | 3,809,013 | 100 | % | $ | - | - | % | ||||||

Gross Margin

Our gross margin was $51,765,563 and $0 for the six months ended June 30, 2022 and 2021, respectively. The gross profit as a percentage of net revenue for the Dandelion teas was 99% for the six months ended June 30, 2022. The gross profit as a percentage of net revenue for water purifiers was approximately 1% for the six months ended June 30, 2022.

The following table presents gross margin by segment for six months ended June 30, 2022 and 2021:

| For the six months ended | ||||||||||||||

| June 30, | ||||||||||||||

| 2022 | 2021 | |||||||||||||

| Dandelion teas | $ | 51,177,852 | 99 | % | $ | - | - | % | ||||||

| Water purifier | 587,711 | 1 | % | - | - | % | ||||||||

| Total | $ | 51,765,563 | 100 | % | $ | - | - | % | ||||||

Selling and Marketing Expenses

Our selling and marketing expenses primarily consist of sales commission, advertising and product promotion expenses.

Our selling and marketing expenses were $54,430,227 for the six months ended June 30, 2022 as compared to $16,878 for the six months ended June 30, 2021. Our total selling and marketing expenses increased by $54,413,349 or 322,392% during the six months ended June 30, 2022, compared to the same period in 2021. Such increase in selling and marketing expenses was mainly due to the significant increase in sales commission.

General and administrative expenses

Our general and administrative expenses primarily consist of payroll and benefit costs for corporate employees, legal, consulting, professional expenses, rental expenses and other corporate overhead costs.

The general and administrative expenses was $499,273 for the six months ended June 30, 2022 as compared to $363,668 for the six months ended June 30, 2021. Our general and administrative expenses increased by $135,605 or 37% during the six months ended June 30, 2022, compared to the same period in 2021. Such increase in general and administrative expenses was mainly due to the increase in legal, accounting, printing, and stock transfer agent fees that were associated with the Company’s merger and acquisition activities and SEC filings.

Interest income (expense)

Interest income (expense) was $7,421 for the six months ended June 30, 2022 as compared to $(4,977) for the six months ended June 30, 2021, representing an increase from interest expense to interest income by $12,398, or 249% during the six months ended June 30, 2022, compared to the same period in 2021, primarily due to the repayment of a short-term bank loan on March 17, 2021 and the interest earned from Company’s bank savings accounts.

21

Net Income (Loss)

Our net loss was $3,196,179 for the six months ended June 30, 2022 as compared to net loss of $388,180 for the six months ended June 30, 2021, increased by $2,807,999 or 723 % as a result of the above factors.

Foreign Currency Translation Loss

We had $191,332 in foreign currency translation gain during the six months ended June 30, 2022 as compared to $(13,296) in foreign currency translation loss during the six months ended June 30, 2021, reflecting a change of $204,628 or 1,539%. Such increase in foreign currency translation gain was primarily caused by the currency exchange rate fluctuation.

Liquidity and Capital Resources

Working Capital

| June 30, | December 31, | Change | ||||||||||||||

| 2022 | 2021 | (Amount) | (Percent) | |||||||||||||

| Current Assets | $ | 8,530,209 | $ | 4,628,531 | 3,901,678 | 84 | % | |||||||||

| Current Liabilities | $ | 22,813,084 | $ | 16,316,116 | 6,496,968 | 40 | % | |||||||||

| Working Capital (deficit) | $ | (14,282,875 | ) | $ | (11,687,585 | ) | (2,595,290 | ) | 22 | % | ||||||

Our working capital deficit was $14,282,875 as of June 30, 2022 as compared to $11,687,585 as of December 31, 2021, an increase of $2,595,290 or 22%. The increase in working capital deficiency is primarily due to the increase in the liabilities related to our operating activities during the six months ended June 30, 2022.

Cash Flow from Operating Activities

Our net cash provided by operating activities were $7,691,850 for the six months ended June 30, 2022 as compared to $141,967 of net cash used in operating activities for the six months ended June 30, 2021, reflecting an increase of $7,833,817 or 5518%. The increase was primarily due to the decrease in inventories, prepaid taxes, and increase in accounts payable and taxes payable during the six months ended June 30, 2022 compared to the six months ended June 30, 2021.

Cash Flow from Investing Activities

Our net cash used in investing activities was $212,875 for the six months ended June 30, 2022 as compared to that of $271,331 for the six months ended June 30, 2021, reflecting a decrease of $58,456 or 22%. The decrease in net cash used in investing activities was primarily due to the decrease in payment for construction in progress and acquisition of equipment during the six months ended June 30, 2022 as compared to those items in the six months ended June 30, 2021.

Cash Flow from Financing Activities

Our net cash used in financing activities were $776,804 for the six months ended June 30, 2022 as compared to $593,382 of net cash provided by financing activities for the six months ended June 30, 2021, representing a decrease of $1,370,186 or 231%. The decrease was primarily due to the decreased cash inflow from loans from related parties during the six months ended June 30, 2022.

Off-Balance Sheet Arrangements

As of June 30, 2022, we did not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures, or capital resources that is material to investors.

22

Critical Accounting Policies and Estimates

We prepare our financial statements in conformity with Generally Accepted Accounting Principles (“GAAP”) of the United States, which requires management to make certain estimates and apply judgments. We base our estimates and judgments on historical experience, current trends and other factors that management believes to be important at the time the financial statements are prepared. On a regular basis, we review our accounting policies and how they are applied and disclosed in our financial statements.

While we believe that the historical experience, current trends and other factors considered support the preparation of our financial statements in conformity with GAAP, actual results could differ from our estimates and such differences could be material.

Inventories

Our inventories primarily consist of dandelion teas and water purifiers. Inventories are valued at the lower of cost (determined on a weighted average basis) and net realizable value. Inventories consist of raw materials, goods in process, and finished goods. We review our inventories regularly for possible obsolete goods and establishes reserves when determined necessary. As of June 30, 2022 and December 31, 2021, the allowance for obsolete inventories was $0 and $0, respectively.

Construction in Progress

Construction in progress represents direct costs of construction, interest and design fees incurred. No interest was capitalized for the three months ended June 30, 2022 and 2021. Capitalization of these costs ceases and the construction in progress is transferred to property, plant, and equipment when substantially all the activities necessary to prepare the assets for their intended use are completed. No depreciation is recognized until it is completed and ready for intended use. Construction in progress as of June 30, 2022 and December 31, 2021 was $8,506,821 and $8,726,299, respectively.

Revenue Recognition

The Company recognizes revenue in accordance with ASC Topic 606, Revenue from Contracts with Customers. To determine the revenue to be recognized, the Company applies the following five-step model:

| ● | identify arrangements with customers; | |

| ● | identify performance obligations; | |

| ● | determine transaction price; | |

| ● | allocate transaction price to the separate performance obligations in the arrangement, if more than one exists; and | |

| ● | recognize revenue as performance obligations are satisfied. |

The Company generates revenues mainly from sales of packaged dandelion teas and water purifiers. During the three and six months ended June 30, 2022, the Company also engaged in the sale of certain nutritional products and water treatment accessories. Revenue from the sales of goods is recognized when the control over the promised goods is transferred to customers.

Cash payments received or due from customers before revenue recognized are recorded as advances from customers. The advance from customers is recognized as revenue when the Company’s performance obligation is completed.

Related parties

The Company follows ASC 850, “Related Party Disclosures,” for the identification of related parties and disclosure of related party transactions. Parties are related if one party has the ability, directly or indirectly, to control the other party or exercise significant influence over the other party in making financial and operating decisions. Parties are also considered to be related if they are subject to common control or significant influence, such as a family member or relative, shareholder, or a related corporation.

Recent Accounting Pronouncements

See Note 3 to our unaudited consolidated financial statements for the three and six months ending June 30, 2022 and 2021.

23

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not applicable.

ITEM 4. CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures.

As of the end of the period covered by this report, we conducted an evaluation under the supervision and with the participation of our chief (principal) executive officer and chief (principal) accounting officer of our disclosure controls and procedures (as defined in Rule 13a-15(e) and 15d-15(e) of the Exchange Act).

A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be presented or detected on a timely basis.

Based on management’s assessment, we have concluded that, as of June 30, 2022, our disclosure controls and procedures were not effective in timely alerting management to the material information relating to us required to be included in our annual and interim filings with the SEC.

Our chief executive officer and principal financial officer have concluded that our disclosure controls and procedures had the following material weaknesses:

| ● | We were unable to maintain any segregation of duties within our financial operations due to our reliance on limited personnel in the finance function. While this control deficiency did not result in any audit adjustments to our 2021 interim or annual financial statements, it could have resulted in a material misstatement that might have been prevented or detected by a segregation of duties; |

| ● | We lack sufficient resources to perform the internal audit function and does not have an Audit Committee; |

| ● | Documentation of all proper accounting procedures is not yet complete; and |

| ● | We have no formal control process related to the identification and approval of related party transactions. |

These weaknesses were identified in our Annual Report on Form 10-K for the year ended December 31, 2021. These weaknesses have existed since our inception on June 28, 2010 and, as of June 30, 2022, have not been remediated.

To the extent reasonably possible given our limited financial and personnel resources, we intend to take measures to cure the aforementioned material weaknesses, including, but not limited to, the following:

| ● | Consider the engagement of consultants to assist in ensuring that accounting policies and procedures are consistent across the organization and that we have adequate control over financial statement disclosures; |

| ● | Hire additional qualified financial personnel, including a Chief Financial Officer, on a full-time basis; |

| ● | Expand our board of directors to include additional independent individuals willing to perform directorial functions; and |

| ● | Increase our workforce in preparation for commencing revenue producing operations. |

Since the recited remedial actions will require that we hire or engage additional personnel, these material weaknesses may not be overcome in the near-term due to our limited financial resources. Until such remedial actions can be realized, we will continue to rely on the limited advice of outside professionals and consultants.

Changes in Controls and Procedures

There have been no changes in our internal control over financial reporting that occurred during the period covered by this report that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

24

PART II - OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS

We are not currently a party to any lawsuit or proceeding which, in the opinion of management, is likely to have a material adverse effect on us or our business.

ITEM 1A. RISK FACTORS

Not applicable for smaller reporting companies.

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

On July 7, 2022, the Company and nine non-U.S. investors entered into the securities purchase agreements (the “Securities Purchase Agreements”), pursuant to which the Company issued and sold an aggregate of 25,000,000 shares of its common stock (the “Private Offering”), par value $0.001 per share, at a price of $0.10 per share, to such nine investors. The shares of common stock were sold to such non-U.S. investors in reliance upon the exemption pursuant to Section 4(a)(2) of the Securities Act of 1933 (the “Act”) and Regulation S promulgated under the Act. The Company did not engage any placement agent with respect to the Private Offering. As of July 31, 2022, the Company received the gross proceeds of $2,500,000 as a result of the Private Offering.

The foregoing description of the Securities Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the entire Agreement, which is filed as Exhibit 10.1 hereto, and incorporated herein by reference.

ITEM 3. DEFAULTS UPON SENIOR SECURITIES

None.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

ITEM 5. OTHER INFORMATION

None.

ITEM 6. EXHIBITS

| Exhibit Number |

Description | |

| 10.1 | Form of Securities Purchase Agreement dated July 7, 2022 | |

| 31.1* | Certification of Chief Executive Officer and Chief Financial Officer pursuant to Rule 13a-14(a) of the Securities Exchange Act of 1934 | |

| 32.1** | Certification of the Chief Executive Officer and Chief Financial Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 | |

| 101.INS* | INLINE XBRL INSTANCE DOCUMENT | |

| 101.SCH* | INLINE XBRL TAXONOMY EXTENSION SCHEMA DOCUMENT | |

| 101.CAL* | INLINE XBRL TAXONOMY EXTENSION CALCULATION LINKBASE DOCUMENT | |

| 101.DEF* | INLINE XBRL TAXONOMY EXTENSION DEFINITION LINKBASE DOCUMENT | |

| 101.LAB* | INLINE XBRL TAXONOMY EXTENSION LABEL LINKBASE DOCUMENT | |

| 101.PRE* | INLINE XBRL TAXONOMY EXTENSION PRESENTATION LINKBASE DOCUMENT | |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101). |

| * | Filed along with this document |

| ** | The certification attached as Exhibit 32.1 accompanying this quarterly report on Form 10-Q pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, shall not be deemed “filed” by the Registrant for purposes of Section 18 of the Securities Exchange Act of 1934, as amended. |

25

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Tengjun Biotechnology Corp. | ||

| Date: August 15, 2022 | By: | /s/ Xianchang Ma |

| Name: | Xianchang Ma | |

| Title: | Chief Executive Officer and Chief Financial Officer | |

| (Principal Executive Officer, Principal Financial and Accounting Officer) | ||

26