As filed with the Securities and Exchange Commission on July 22, 2022

Registration No.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

(Exact name of registrant as specified in its charter)

| 333-169397 | 27-3042462 | |||

| (State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification Number) |

East Jinze

Road and South Huimin Road, Food Industry Economic and Technology Development District,

Jianxiang County, Jining City, Shandong Province, China

(86) 0537-8711599

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Xianchang Ma

Chief Executive Officer

East Jinze Road and South Huimin Road,

Food Industry

Economic and Technology Development District,

Jianxiang County, Jining City, Shandong Province, China

(86) 0537-8711599

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Huan Lou, Esq.

Sichenzia Ross Ference LLP

1185 Avenue of the Americas

New York, NY 10036

(212) 930-9700

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☐ | Smaller reporting company | ||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.☐

You should rely only on the information contained in this prospectus. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant will file a further amendment which specifically states that this registration statement will thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement will become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED JULY 22, 2022 |

Minimum Offering: [ ] Shares of

Common Stock

Maximum Offering: [ ] Shares of

Common Stock

TENGJUN BIOTECHNOLOGY CORP.

Tengjun Biotechnology Corp. (“Tengjun”), a Nevada corporation, is offering a minimum of [ ] and a maximum of [ ] shares of common stock, par value $0.001 per share. We are in the sector of consumer retail business, with focuses on traditional Chinese dandelion teas, water purifiers and dietary supplements.

This is a “best efforts” public offering of shares of the common stock, par value $0.001 per share (the “Common Stock”), conducted by the Company without any investment bank, although we reserve the right to engage a broker-dealer. We may engage a placement agent for this offering in the future. We expect the net proceeds from the sale of Common Stock offered pursuant to this prospectus to be a maximum of $10,000,000 and a minimum of $5,000,000, before deducting the estimated offering expenses, based on an assumed public offering price of $[ ] per share. This offering will terminate 180 days from the date of this prospectus, unless the offering is fully subscribed before that date or we decide to terminate the offering prior to that date. In either event, the offering may be closed without further notice to you. Any and all funds for securities purchased in the offering will be transmitted directly to us for our immediate use.

This is a self-underwritten offering. This prospectus is part of a registration statement that permits our officers and directors to sell the shares directly to the public with no commission or other remuneration payable to them for any shares that are sold by them. Our officers and directors will sell the shares and intend to offer them to friends, family members, and business acquaintances. In offering the securities on our behalf, our directors and officers will rely on the safe harbor from broker dealer registration set out in Rule 3a4-1 under the Securities Exchange Act of 1934. Our officers, directors, control persons and affiliates may purchase shares in this offering.

We may also engage registered broker-dealers to offer and sell the shares of our Common Stock (each a “Placement Agent” and collectively, the “Placement Agents”). We may pay any such registered persons who make such sales a commission of up to a certain percentage of the aggregate purchase price of the shares sold by such Placement Agent in this offering and issue to the Placement Agent a warrant to purchase such number of shares of our Common Stock in an amount not to exceed certain percentage of the number of shares of Common Stock sold by such Placement Agent in this offering, subject to the compliance with the maximum allowable fees under applicable, rules and regulations including the rules of the Financial Industry Regulatory Authority (“FINRA”) and the foreign equivalent agencies where the Placement Agent is regulated. However, we have not entered into any underwriting or agent agreement, arrangement or understanding for the sale of the securities being offered pursuant to this prospectus. This offering is intended to be made solely by the delivery of this prospectus and the accompanying subscription agreements to prospective investors. Any Placement Agent engaged by us for this offering would only be compensated based on the aggregate purchase price of the shares of Common Stock sold by such Placement Agent in this offering.

Our Common Stock is quoted on the OTCQB tier of the OTC Markets under the symbol “TJBH.” On July 21, 2022, the last reported sale price per share of our Common Stock was $3.00. The recent market price of our Common Stock set forth herein will not be used to determine the offering price of our Common Stock. There is no active public market for the Common Stock and the prices quoted on the OTCQB tier of the OTC Markets may not be indicative of the market price of our Common Stock. The offering price of the Common Stock will be arbitrarily determined and will not necessarily bear any relationship to our assets, results of operations, or book value, or to any other generally accepted criteria of valuation. The offering price is determined through negotiations with the Company and investors. The investors and the Company have set $[ ] per share for the offering price, which will be finalized prior to closing of the offering. In the near future, we may apply to list our Common Stock on a national stock exchange; however, there is no assurance that in the event we do apply to list our Common Stock, our application will be approved.

We do not intend to close our offering unless we sell at least a minimum number of the shares of common stock at the price per share set forth above. The Company’s offering may close or terminate, as the case may be, on the earlier of (i) any time after the minimum offering amount is raised, (ii) one hundred and eighty (180) days from the effective date of this prospectus, or the expiration date, (iii) the date on which this offering is terminated by the Company in its sole discretion prior to the expiration date, or (iv) upon raising the maximum offering amount. If we can successfully raise the minimum offering amount within the offering period, the proceeds from our offering will be released to us after deducting certain escrow fees. Until the offering terminates or is consummated, the proceeds of the offering will be payable to a third party’s escrow account (the “Escrow Account”) maintained solely for the purposes of this offering at [ ] until the minimum offering amount is raised.

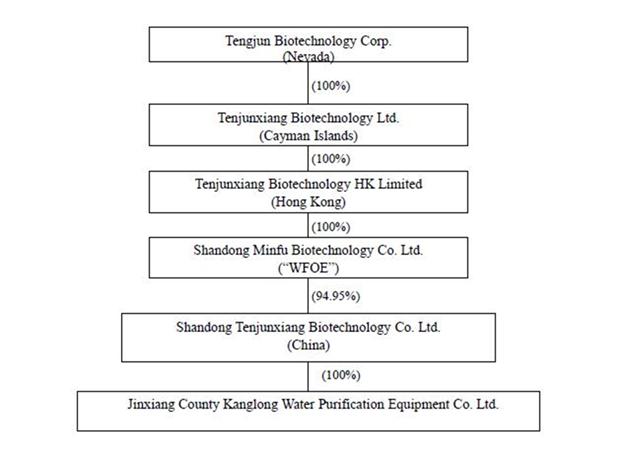

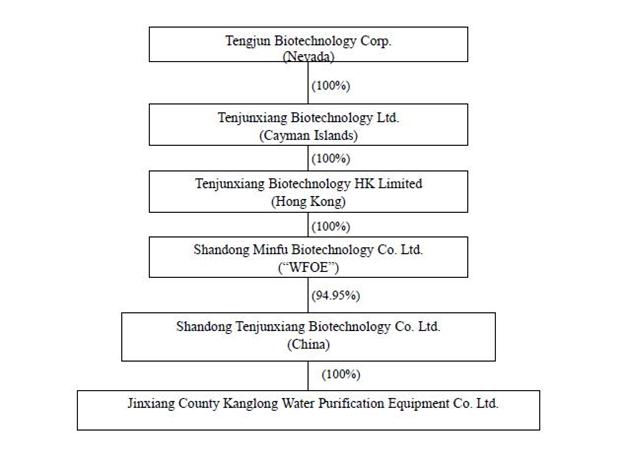

Investors in our Common Stock should be aware that they are not permitted to directly hold equity interests in the Chinese operating entities, Shandong Tengjunxiang Biotechnology Co., Ltd. (“TJX”) and Jinxiang County Kanglong Water Purification Equipment Co., Ltd. (“KL Water”). Investors can only purchase equity solely in Tengjun, our Nevada corporation, which indirectly owns majority equity interests in the subsidiaries as described in details below.

In addition, as we are based in and having significant of our operations in China, we are subject to legal and operational risks associated with having substantially all of our operations in China, including risks related to the legal, political and economic policies of the Chinese government, the relations between China and the United States, and changes in Chinese laws and regulations, which could result in a material change in our operations and/or cause the value of our shares to significantly decline or become worthless and affect our ability to offer or continue to offer securities to investors. Recently, the PRC government initiated a series of regulatory actions and made a number of public statements on the regulation of business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas, adopting new measures to extend the scope of cybersecurity reviews, and expanding efforts in anti-monopoly enforcement. On December 28, 2021, thirteen governmental departments of the PRC, including the Cyberspace Administration of China (the “CAC”), issued the Cybersecurity Review Measures, which became effective on February 15, 2022. The Cybersecurity Review Measures provide that an online platform operator, which possesses personal information of at least one million users, must apply for a cybersecurity review by the CAC if it intends to be listed in foreign countries. Because our current operations do not possess personal information from more than one million users at this moment, we do not believe that we are subject to the cybersecurity review by the CAC. In addition, as of the date of this prospectus, we have not been involved in any investigations on cybersecurity review initiated by any PRC regulatory authority, nor have we received any inquiry, notice, or sanction related to cybersecurity review under the Cybersecurity Review Measures. As of the date of this prospectus, no relevant laws or regulations in the PRC explicitly require us to seek approval from the China Securities Regulatory Commission (the “CSRC”) or any other PRC governmental authorities for our overseas securities offering plan, nor have we received any inquiry, notice, warning or sanctions regarding our planned offering from the CSRC or any other PRC governmental authorities. Also as of the date of this prospectus, we do not believe we are in a monopolistic position in the consumer retail industry. In summary, the recent statements and regulatory actions by China’s government related to the data security or antimonopoly concerns, have not affected our ability to conduct our business, accept foreign investments, or being quoted by the OTCQB. However, since these statements and regulatory actions by the PRC government are newly published and official guidance and related implementation rules have not been issued, it is highly uncertain what the potential impact such modified or new laws and regulations will have on our daily business operation, the ability to accept foreign investments and trading our shares of Common stock on the OTCQB. The Standing Committee of the National People’s Congress (the “SCNPC”) or other PRC regulatory authorities may in the future promulgate laws, regulations or implementing rules that would require Tengjun or any of its subsidiaries to obtain regulatory approval from Chinese authorities before consummation of this offering in the U.S. and China. See “Risk Factors - Risks Relating to Doing Business in China” and “Risk Factors - Risks Related to Our Common stock and This Offering.”

Our shares of Common stock may be prohibited from trading on a national exchange or “over-the-counter” markets under the Holding Foreign Companies Accountable Act (the “HFCAA”) if the Public Company Accounting Oversight Board (“PCAOB”) determines that it is unable to inspect or fully investigate our auditor and as a result the exchange where our securities are traded may delist our securities. Furthermore, on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act (the “AHFCAA”), which, if signed into law, would amend the HFCAA and require the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three consecutive years. Pursuant to the HFCAA, the PCAOB issued a Determination Report on December 16, 2021, which found that the PCAOB was unable to inspect or investigate completely certain named registered public accounting firms headquartered in mainland China and Hong Kong. Our independent registered public accounting firm is headquartered in the State of California and has been inspected by the PCAOB on a regular basis and as such, it is not affected by or subject to the PCAOB’s Determination Report. Notwithstanding the foregoing, in the future, if there is any regulatory change or step taken by PRC regulators that does not permit our auditor to provide audit documentations located in China or Hong Kong to the PCAOB for inspection or investigation, you may be deprived of the benefits of such inspection which could result in limitation or restriction to our access to the U.S. capital markets and trading of our securities, including trading on the national exchange and trading on “over-the-counter” markets, may be prohibited under the HFCA Act . See “Risk Factors - Risks Relating to Doing Business in China.”

Unless otherwise stated, “Tengjun” refers to Tengjun Biotechnology Corp., a Nevada corporation.

Unless otherwise stated “Tengjunxiang Cayman” refers to Tengjunxiang Biotechnology Ltd., a Cayman Island company.

Unless otherwise stated “Tengjunxiang HK” refers to Tengjunxiang Biotechnology HK Ltd., a company formed under the laws of Hong Kong.

Unless otherwise stated, “Shandong Minfu” or “WFOE” refers to Shandong Minfu Biotechnology Co. Ltd., a company formed under the PRC laws.

Unless otherwise stated, “Shandong Tengjunxiang” or “TJX” refers to Shandong Tengjunxiang Biotechnology Co. Ltd., a China corporation.

Unless otherwise stated “KL Water” refers to Jinxiang County Kanglong Water Purification Equipment Co. Ltd., a company formed under the PRC laws.

You should read this prospectus, together with additional information described under the headings “Incorporation of Certain Information by Reference” and “Where You Can Find More Information”, carefully before you invest in any of our securities.

Our Common stock is presently quoted on the OTCQB tier of the OTC Markets under the symbol “TJBH,” and has had limited trading to date.

Investing in our securities is highly speculative and involves a high degree of risk. See “Risk Factors” beginning on page 12 of this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is July 22, 2022

TABLE OF CONTENTS

i

You should rely only on the information contained in this prospectus or in any free writing prospectus that we may specifically authorize to be delivered or made available to you. We have not authorized anyone to provide you with any information other than that contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus may only be used where it is legal to offer and sell our securities. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our Common stock. Our business, financial condition, results of operations and prospects may have changed since that date. We are not making an offer of these securities in any jurisdiction where the offer is not permitted.

For investors outside the United States: We have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of Common stock and the distribution of this prospectus outside the United States.

GENERAL MATTERS

Unless otherwise indicated, all references to “dollars,” “US$,” or “$” in this prospectus are to United States dollars.

Unless otherwise indicated or the context requires otherwise, references in this prospectus to:

“China” or the “PRC” are to the People’s Republic of China, excluding Taiwan and the special administrative regions of Hong Kong and Macau for the purposes of this prospectus only;

“Common Stock” are to our shares of Common Stock, par value US$0.001 per share;

“we”, “us”, the “Company” or the “Group” are to and the subsidiaries set forth in Exhibit 21.1, as a group.

Unless otherwise stated, “Tengjun” refers to Tengjun Biotechnology Corp., a Nevada corporation.

Unless otherwise stated “Tengjunxiang Cayman” refers to Tengjunxiang Biotechnology Ltd., a Cayman Island company.

Unless otherwise stated “Tengjunxiang HK” refers to Tengjunxiang Biotechnology HK Ltd., a company formed under the laws of Hong Kong.

Unless otherwise stated, “Shandong Minfu” or “WFOE” refers to Shandong Minfu Biotechnology Co. Ltd., a company formed under the PRC laws.

Unless otherwise stated, “Shandong Tengjunxiang” or “TJX” refers to Shandong Tengjunxiang Biotechnology Co. Ltd., a China corporation.

Unless otherwise stated “KL Water” refers to Jinxiang County Kanglong Water Purification Equipment Co. Ltd., a company formed under the PRC laws.

This prospectus contains various company names, product names, trade names, trademarks and service marks, all of which are the properties of their respective owners.

Unless otherwise indicated, all references to “GAAP” in this prospectus are to United States generally accepted accounting principles.

Through and including, 2022, all dealers effecting transactions in shares of our Common stock, whether or not participating in this offering, may be required to deliver a prospectus.

ii

USE OF MARKET AND INDUSTRY DATA

This prospectus includes market and industry data that has been obtained from third party sources, including industry publications, as well as industry data prepared by our management on the basis of its knowledge of and experience in the industries in which we operate (including our management’s estimates and assumptions relating to those industries based on that knowledge). Management’s knowledge of such industries has been developed through its experience and participation in those industries. Although our management believes such information to be reliable, neither we nor our management have independently verified any of the data from third party sources referred to in this prospectus or ascertained the underlying economic assumptions relied upon by such sources. In addition, the agents have not independently verified any of the industry data prepared by management or ascertained the underlying estimates and assumptions relied upon by management. Furthermore, references in this prospectus to any publications, reports, surveys or articles prepared by third parties should not be construed as depicting the complete findings of the entire publication, report, survey or article. The information in any such publication, report survey or article is not incorporated by reference in this prospectus.

TRADEMARKS

We, including our subsidiaries, own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our business. This prospectus may also contain trademarks, service marks and trade names of third parties, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks and trade names or products in this prospectus is not intended to, and does not imply a relationship with, or endorsement or sponsorship by us. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus may appear without the ®, TM or SM symbols, but the omission of such references is not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable owner of these trademarks, service marks and trade names.

iii

PROSPECTUS SUMMARY

This summary highlights selected information that is presented in greater detail elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our Common Stock. You should read this entire prospectus carefully, including the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes included elsewhere in this prospectus, before making an investment decision. Unless the context otherwise requires, the terms “the company,” “we,” “us” and “our” in this prospectus refer to Tengjun Biotechnology Corp. and its consolidated subsidiaries.

COMPANY OVERVIEW

Overview

We are in the consumer retail industry, producing, distributing and marketing featured dandelion teas and water purifiers in the PRC with the planned expansion in the nutraceutical products in the U.S. market. We cultivate, harvest and process dandelion plants to make black and green dandelion teas in the PRC and our in-house marketing and sales team and outside marketing partners distribute and sell our teas in the PRC. In addition, based on our interactions with a lot of tea drinkers, we realized that a large portion of tea drinkers would prefer using purified water to make their tea. As a result of such observation, our subsidiary KL Water manufactures household water purifiers and leverage our existing marketing and sales team to distribute its various models of water purifiers starting in 2022. In addition, we have contracted a New York-based company to produce a type of dietary supplement with nicotinamide mononucleotide as one of the key active ingredients, which have been recognized possessing certain health benefits to people in the general scientific communities as described in details. See the “Business” section on page 41. As of July 1, 2022, we have established and expanded our marketing teams to twenty-three (23) provinces and the cities of Beijing, Shanghai, Tianjin, and Chongqing in the PRC.

Our executive offices are located at East Jinze Road and South Huimin Road, Food Industry Economic and Technology Development District, Jinxiang County, Jining City, Shandong Province, China.

Corporate History and Structure

Tengjun was incorporated on June 28, 2010 in the State of Nevada under the name “Island Radio, Inc.” and changed our name to “China Herb Group Holdings Corporation” effective July 17, 2012. On December 9, 2019, the Company changed its corporate name to “Tengjun Biotechnology Corp.”

On June 27, 2012, Eric R. Boyer and Nina Edstrom (collectively, the “Sellers”), who were then the major shareholders of the Company, entered into a Share Purchase Agreement with Chin Yung Kong, Qiuping Lu and Fumin Feng (collectively, the “Purchasers”), pursuant to which the Sellers sold to the Purchasers an aggregate 4,000,000 shares of the common stock of the Company, which represented approximately 93% of the then total issued and outstanding stock of the Company, for a total purchase price of $159,970 (the “Change in Control”). As result of this share purchase transaction, Chin Yung Kong, Qiuping Lu and Fumin Feng became the controlling shareholders of the Company.

The Company’s original business plan was to become a commercial FM radio broadcaster. Subsequently, following the Change in Control, the Company changed its business plan and intended to become a medical and spa company with a focus on Asia. However, after consultation with its professional and business advisors in the United States and the PRC, the Company’s management decided during the third quarter of 2014 that this would no longer be its plan of operations.

Effective on December 23, 2021 (the “Closing Date”), pursuant to the Share Exchange Agreement, Tengjunxiang Cayman became a wholly-owned subsidiary of Tengjun. The acquisition of TJX (the “Acquisition”) is treated as a reverse acquisition, and the business of TJX became the business of the Company. At the time of the Acquisition, Tengjun was not engaged in any active business. As a result of the consummation of the Acquisition on December 23, 2021 as discussed above, TJX became a wholly-owned subsidiary of Tengjun and the business of TJX became the business of Tengjun.

TJX was incorporated on July 19, 2021 under the laws of the Cayman Islands. The authorized capital stock of TJX is 500,000,000 ordinary shares, all of which were issued and outstanding prior to the closing of the Acquisition. Shangdong Tengjunxiang, our operating company, was formed on June 27, 2014, under the laws of China.

1

The diagram below illustrates our corporate structure following the Acquisition:

Business Strategy

Compared with other teas, dandelion teas enjoy the reputation of having health benefits in China. It is a household concept in China that drinking dandelion teas may clean the consumers’ livers and purifying their digestion system. TJX intends to leverage that deep-rooted concept to market its products to the Chinese consumers.

As of July 1, 2022, TJX produced two types of teas, green dandelion tea and black dandelion tea with another line of business of manufacturing and selling consumer water purifiers. TJX’s tea products are focused on not only their taste but also their aesthetic presentation and health benefits. In the first quarter of 2022, Tengjun restarted the official marketing and distribution of its consumer products as the COVID-19 related restrictions were alleviated in most parts of PRC during that period. In 2022, Tengjun has been offering TJX’s products and selected consumer products in China through regional representatives, online stores and wechat marketing.

2

TJX has devoted substantial resources to establish the entire dandelion production chain, from research and development, plant cultivation, tea leaves selection, processing, to storing and distributing to the market. Shandong Tengjunxiang was founded in 2014 and has used the seven years to cultivate the dandelion farms, construct its tea manufacturing factory, research and development center and office buildings. Shandong Tengjunxiang has a wholly-owned subsidiary, KL Water, which is in the business of design, develop, and manufacture consumer water purifiers. In addition, Tengjun has been implementing its business development plan in the U.S. to market and distribute nicotinamide mononucleotide related nutraceutical products.

Our goal is to become a leading consumer retail company distributing household brands of dandelion tea, water purifiers and nutraceutical supplements in each city where we operate, by selling the finest quality consumer products and providing customers with premium post-sales services.

Principal Products

|

|

|

|

TJX’s main products are Mincheng Black Dandelion Tea and Mincheng Green Dandelion Tea, of various packages and sizes. TJX’s subsidiary KL Water focuses on designing, developing and manufacturing consumer water purifiers in Shandong Province and other provinces in China.

In addition to the featured dandelion teas, TJX also is trying to market and distribute Ejiao (donkey hide gelatin candies), other tea products (including “Puxichun” tea), packed multigrain porridge, and other nutraceutical products all over China.

3

Recent Development

As the COVID-19 related restrictions gradually reduced in the PRC and U.S., we have fully resumed the production of our tea products and our marketing and sales department has assembled a significant sales contractors of over 1.3 million sales representatives throughout twenty-three (23) provinces and the cities of Beijing, Shanghai, Tianjin, and Chongqing in the PRC. Our sales network reached the following provinces and direct administered municipalities: Zhejiang Province (approximately 80,000 sales representatives), Jiangsu Province (approximately 100,000 sales representatives), Guangdong Province (approximately 100,000 sales representatives), Sichuan Province (approximately 50,000 sales representatives), Henan Province (approximately 80,000 sales representatives), Hubei Province (approximately 50,000 sales representatives), Fujian Province (approximately 70,000 sales representatives), Hunan Province (approximately 60,000 sales representatives), Shanghai (approximately 30,000 sales representatives), Shanxi Province (approximately 30,000 sales representatives), Hebei Province (approximately 50,000 sales representatives), Beijing (approximately 50,000 sales representatives), Anhui Province (approximately 60,000 sales representatives), Liaoning Province (approximately 20,000 sales representatives), Chongqing (approximately 60,000 sales representatives), Jiangxi Province (approximately 40,000 sales representatives), Yunnan Province (approximately 10,000 sales representatives), Jilin Province (approximately 20,000 sales representatives), Tianjin (approximately 30,000 sales representatives), Heilongjiang Province (approximately 15,000 sales representatives), Gansu Province (approximately 17,000 sales representatives), Xinjiang Uygur Autonomous Region (approximately 15,000 sales representatives), Guizhou Province (approximately 13,000 sales representatives), Hainan Province (approximately 7,000 sales representatives), Ningxia Hui Autonomous Region (approximately 12,000 sales representatives), Inner Mongolia Autonomous Region (approximately 10,000 sales representatives), and Shandong Province (approximately 300,000 sales representatives).

Given the swift establishment of our sales network in 2022, we have achieved $4.3 million in gross sales revenue during the first quarter of 2022 as compared to no revenue in the three months ended March 31, 2021.

4

In addition, the Company is implementing its plans to market and distribute dietary supplements featured nicotinamide mononucleotide as one of the key ingredients. Nicotinamide Mononucleotide (“NMN”) is a nucleotide derived from ribose and nicotinamide. Nicotinamide is a form of vitamin B3, Niacin, and is often used as a dietary supplement and medication. NMN research has found that it may be a productive anti-aging agent. On May 13, 2022, Tengjun engaged We Do Private Label LLC (“WDPL”), a manufacturing company in New York, for the production of the dietary supplements featured NMN.

Summary of Risk Factors

An investment in our Common stock is subject to a number of risks, including risks related to our business and industry, risks related to our corporate structure, risks related to doing business in China, and risks related to our Common stock in this offering. You should carefully consider all of the information in this prospectus before making an investment in our Common stock. The following list summarizes some, but not all, of these risks. Please read the information in the section entitled “Risk Factors”, beginning on page 12, for a more thorough description of these and other risks.

Risks Relating to Our Tea and Water Purifier Businesses

| - | We may not be able to successfully implement our growth strategy on a timely basis or at all, which could harm our results of operations. |

| - | Our limited operating experience and limited brand recognition in other regions may limit our expansion strategy and cause our business and growth to suffer. |

| - | We face significant competition from other specialty tea and beverage retailers and retailers of grocery products, which could adversely affect us and our growth plans. |

| - | If we are unable to maintain sufficient levels of cash flow, we may not meet our growth expectations. |

| - | Because our tea business is highly concentrated on a single, discretionary product category, dandelion teas, we are vulnerable to changes in consumer preferences and in economic conditions affecting disposable income that could harm our financial results. |

| - | Our success depends, in part, on our ability to source, develop and market new varieties of teas and tea blends, tea accessories and other tea-related merchandise that meet our high standards and customer preferences. |

| - | We may experience negative effects to our brand and reputation from real or perceived quality or safety issues with our tea products, which could have an adverse effect on our operating results. |

| - | Use of social media may adversely impact our reputation or subject us to fines or other penalties. |

| - | A shortage in the supply, a decrease in the quality or an increase in the price of tea as a result of weather conditions, earthquakes, crop disease, pests or other natural or manmade causes could impose significant costs and losses on our business. |

| - | We rely significantly on information technology systems and any failure, inadequacy, interruption or security failure of those systems could harm our ability to operate our business effectively. |

| - | Data security breaches and attempts thereof could negatively affect our reputation, credibility and business. |

| - | Our business, results of operations and financial condition may be adversely affected by global public health epidemics, including the strain of coronavirus known as COVID-19. |

| - | Litigation may adversely affect our business, financial condition, results of operations or liquidity. |

| - | Our failure to comply with existing or new regulations in the PRC, or an adverse action regarding product claims or advertising could have a material adverse effect on our results of operations and financial condition. |

| - | We may not be able to protect our intellectual property adequately, which could harm the value of our brand and adversely affect our business. |

| - | Continued innovation and the successful development and timely launch of new products are critical to our financial results and achievement of our growth strategy. |

| - | Due to the seasonality of the water purifier products and other factors such as adverse weather conditions, our operating results are subject to fluctuations. |

| - | Changes in the beverage environment and retail landscape could impact our financial results. |

| - | Price increases may not be sufficient to offset cost increases and maintain profitability or may result in sales volume declines. |

| - | Our failure to accurately forecast customer demand for our products, or to quickly adjust to forecast changes, could adversely affect our business and financial results. |

| - | Incidents involving tampering, adulteration, contamination or mislabeling of our dandelion tea, whether or not accurate, as well as adverse public or medical opinions about the health effects of consuming our dandelion products, could harm our business. |

5

Risks Relating to Doing Business in the PRC

| - | Changes in China’s economic, political, or social conditions or government policies could have a material adverse effect on our business and operations. |

| - | Changes in the policies of the PRC government could have a significant impact upon our ability to operate profitably in the PRC. |

| - | PRC laws and regulations governing our current business operations are sometimes vague and uncertain and any changes in such laws and regulations may impair our ability to operate profitably. Changes and uncertainty in PRC laws and interpretation may materially and adversely affect our business performance and impede our operations in China. |

| - | Because our business is conducted in Chinese dollars or RMB and the price of our common stock is quoted in United States dollars, changes in currency conversion rates may affect the amount of proceeds we will receive after the currency exchange from U.S. dollars to RMB. |

| - | If we become subject to the scrutiny, criticism and negative publicity involving U.S.-listed Chinese companies, we may have to expend significant resources to investigate and resolve such matters, which could harm our business operations, stock price and reputation. |

| - | Increases in labor costs in the PRC may adversely affect our business and our profitability. |

| - | Failure to make adequate contributions to various employee benefits plans as required by PRC regulations may subject us to penalties. |

| - | Regulation and censorship of information disseminated over the internet in China may adversely affect our business and reputation and subject us to liability for information displayed on our website. |

| - | The Chinese government exerts substantial influence over the manner in which we must conduct our business activities. We are currently not required to obtain approval from any Chinese authority to quote our common shares on the OTCQB tier of the OTC Markets. However, if we were required to obtain any type of securities listing approval from the PRC government in the future and were denied such permission, we would not be able to continue being quoted on the OTCQB tier of the OTC Markets or offering securities to investors, and therefore our share price would significantly depreciate. |

| - | In light of recent events indicating greater oversight by the Cyberspace Administration of China (the “CAC”) over data security, we may be subject to a variety of PRC laws and other obligations regarding cybersecurity and data protection, and any failure to comply with applicable laws and obligations could have a material adverse effect on our business, our quotation on the OTCQB tier of the OTC Markets, financial condition, results of operations, and the offering. |

Risks Relating to this Offering and Our Securities

| - | You may experience dilution of your ownership interests because of the future issuance of additional common stock of the Company. |

| - | There is not an active liquid trading market for the Company’s Common Stock. |

| - | We together with TJX will incur additional costs as a result of becoming a public company, and the new management will be required to devote substantial time to compliance initiatives. |

6

THE OFFERING

| Securities offered | Tengjun is offering a minimum of [ ] shares of Common stock and up to a maximum of [ ] shares of Common stock at an anticipated offering price of $[ ] per share. If we do not raise the aggregate minimum offering amount of $5,000,000, we will not conduct a closing of our offering and will return to investors all amounts previously deposited by them in the Escrow Account, without interest or deduction. Prior to the closing of our offering, all funds delivered as payment for the securities offering hereby shall be held in escrow by a third party, independent escrow agent. | |

| Public offering price | The assumed public offering price is $[ ] per share of Common stock. | |

| Common Stock outstanding before this offering: | 65,309,169 shares as of June 20, 2022 | |

| Common Stock to be outstanding immediately after this offering | [ ] shares at minimum and [ ] shares at maximum(1) | |

| Use of proceeds | See “Use of Proceeds” on page 29 for a complete description of the intended use of proceeds from this offering. | |

| Dividend Policy | Holders of Common stock are entitled to receive ratably such dividends, if any, as may be declared by our board of directors, or the Board, out of funds legally available. We have not paid any dividends since our inception, and we presently anticipate that all earnings, if any, will be retained for development of our business. Any future disposition of dividends will be at the discretion of our Board and will depend upon, among other things, our future earnings, operating and financial condition, capital requirements, and other factors. | |

| Voting Rights | Each share of Common stock will entitle its holder to one vote on all matters to be voted on by stockholders. See “Description of Securities.” | |

| Risk Factors: | Investing in our securities is highly speculative and involves a high degree of risk. You should carefully consider the information set forth in this prospectus and, in particular, the specific factors set forth in the “Risk Factors” section beginning on page 12 of this prospectus before deciding whether or not to invest in our securities | |

| Quotation: | Our shares of Common stock are currently quoted on the OTCQB under the ticker symbol “TJBH”. | |

| Gross Proceeds: | $10,000,000 at a maximum (the “Maximum Offering Amount”), and $5,000,000 at a minimum (the “Minimum Offering Amount”), before deducting any applicable fees, commissions, and expenses | |

| Transfer Agent: | Securities Transfer Corporation | |

| Risk Factors: | Investing in our securities is highly speculative and involves a high degree of risk. You should carefully consider the information set forth in this prospectus and, in particular, the specific factors set forth in the “Risk Factors” section beginning on page 12 of this prospectus before deciding whether or not to invest in our securities. |

7

SUMMARY CONSOLIDATED FINANCIAL AND OTHER DATA

The following historical statements of operations for the fiscal years ended December 31, 2021 and 2020, and three months ended March 31, 2021 and 2020, and balance sheet data as of December 31, 2021 and 2020, and three months ended March 31, 2021 and 2020, which have been derived from our audited financial statements for those periods. Our historical results are not necessarily indicative of the results that may be expected in the future. You should read this data together with our consolidated financial statements and related notes appearing elsewhere in this prospectus as well as “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” appearing elsewhere in the prospectus.

SELECTED CONSOLIDATED FINANCIAL INFORMATION:

Summary of Consolidated Balance Sheets Data As of December 31, 2021 and 2020

| December 31, | December 31, | |||||

| 2021 | 2020 | |||||

| Assets | ||||||

| Current Assets | ||||||

| Cash and cash equivalents | $ | 285,568 | $ | 6,238 | ||

| Advance to suppliers | 564,846 | 377,088 | ||||

| Inventories, net | 3,084,157 | 2,797,060 | ||||

| Prepaid taxes | 688,272 | 653,479 | ||||

| Other receivable | 5,688 | 882 | ||||

| Total Current Assets | 4,628,531 | 3,834,747 | ||||

| Property and equipment, net | 675,556 | 906,845 | ||||

| Construction in progress | 8,726,299 | 8,283,595 | ||||

| Operating lease right-of-use assets | - | 2,827 | ||||

| Total Assets | $ | 14,030,386 | $ | 13,028,014 | ||

| Liabilities and Deficit | ||||||

| Current Liabilities | ||||||

| Short-term loan | $ | - | $ | 459,770 | ||

| Accounts payable | 263,891 | 256,234 | ||||

| Advances from customers | 14,123 | 13,793 | ||||

| Operating lease liabilities - current | - | 2,827 | ||||

| Due to related parties | 15,531,258 | 12,789,537 | ||||

| Loan from third parties | - | 459,770 | ||||

| Accrued liabilities and other payables | 506,844 | 224,198 | ||||

| Total Current Liabilities | 16,316,116 | 14,206,129 | ||||

| Total Liabilities | 16,316,116 | 14,206,129 | ||||

| Deficit | ||||||

| Preferred stock, $.001 par value; 5,000,000 shares authorized; 0 shares issued and outstanding | ||||||

| Common stock, $.001 par value; 70,000,000 shares authorized; 65,309,169 and 19,285,714 shares issued and outstanding as of December 31, 2021 and 2020, respectively | 65,309 | 19,286 | ||||

| Additional paid-in capital | 1,099,599 | 1,549,018 | ||||

| Accumulated deficit | (3,187,804 | ) | (2,605,211 | ) | ||

| Accumulated other comprehensive loss | (168,535 | ) | (141,208 | ) | ||

| Total stockholders’ deficit | (2,191,431 | ) | (1,178,115 | ) | ||

| Noncontrolling interests | (94,299 | ) | - | |||

| Total Deficit | (2,285,730 | ) | (1,178,115 | ) | ||

| Total Liabilities and Deficit | $ | 14,030,386 | $ | 13,028,014 | ||

The accompanying notes are an integral part of these consolidated financial statements

8

Summary of Consolidated Statements of Operations and Comprehensive Loss Data

For the Years Ended December 31, 2021 and 2020

| For the Years Ended | ||||||

| December 31, | ||||||

| 2021 | 2020 | |||||

| Sales revenue, net | $ | - | $ | 290 | ||

| Cost of goods sold | - | 58 | ||||

| Gross profit | - | 232 | ||||

| Selling and marketing expenses | 28,499 | 68,804 | ||||

| General and administrative expenses | 709,735 | 597,873 | ||||

| Total operating expenses | 738,234 | 666,677 | ||||

| Loss from operations | (738,234 | ) | (666,445 | ) | ||

| Interest expense | (4,970 | ) | (15,102 | ) | ||

| Other (expense) income, net | (4,321 | ) | (9,339 | ) | ||

| Loss before provision for income taxes | (747,525 | ) | (690,886 | ) | ||

| Provision for income taxes | - | - | ||||

| Net loss | $ | (747,525 | ) | $ | (690,886 | ) |

| Net loss | $ | (747,525 | ) | $ | (690,886 | ) |

| Other comprehensive income (loss): | ||||||

| Foreign currency translation loss | (36,291 | ) | (68,201 | ) | ||

| Comprehensive loss | $ | (783,816 | ) | $ | (759,087 | ) |

| Net Loss Per Common Share: | ||||||

| Net loss per common share - basic and diluted | $ | (0.04 | ) | $ | (0.04 | ) |

| Weighted average shares outstanding: | ||||||

| Basic and diluted | 20,294,447 | 19,285,714 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

9

Summary of Consolidated Balance Sheets Data As of March 31, 2022

| March 31, | December 31, | |||||

| 2022 | 2021 | |||||

| (Unaudited) | ||||||

| Assets | ||||||

| Current Assets | ||||||

| Cash and cash equivalents | $ | 1,690,839 | $ | 285,568 | ||

| Advance to suppliers | 534,388 | 564,846 | ||||

| Inventories, net | 2,841,174 | 3,084,157 | ||||

| Prepaid taxes | 176,822 | 688,272 | ||||

| Other receivable | 34,148 | 5,688 | ||||

| Total Current Assets | 5,277,371 | 4,628,531 | ||||

| Property and equipment, net | 597,268 | 675,556 | ||||

| Construction in progress | 8,818,289 | 8,726,299 | ||||

| Total Assets | $ | 14,692,928 | $ | 14,030,386 | ||

| Liabilities and Deficit | ||||||

| Current Liabilities | ||||||

| Accounts payable | $ | 264,538 | $ | 263,891 | ||

| Advances from customers | 14,197 | 14,123 | ||||

| Due to related parties | 15,800,481 | 15,531,258 | ||||

| Accrued liabilities and other payables | 676,073 | 506,844 | ||||

| Total Current Liabilities | 16,755,289 | 16,316,116 | ||||

| Total Liabilities | 16,755,289 | 16,316,116 | ||||

| Deficit | ||||||

| Preferred stock, $.001 par value; 5,000,000 shares authorized; 0 shares issued and outstanding | - | - | ||||

| Common stock, $.001 par value; 70,000,000 shares authorized; 65,309,169 and 65,309,169 shares issued and outstanding as of March 31, 2022 and December 31, 2021, respectively | 65,309 | 65,309 | ||||

| Additional paid-in capital | 1,099,599 | 1,099,599 | ||||

| Accumulated deficit | (2,968,981 | ) | (3,187,804 | ) | ||

| Accumulated other comprehensive loss | (177,496 | ) | (168,535 | ) | ||

| Total stockholders’ deficit | (1,981,569 | ) | (2,191,431 | ) | ||

| Noncontrolling interests | (80,792 | ) | (94,299 | ) | ||

| Total Deficit | (2,062,361 | ) | (2,285,730 | ) | ||

| Total Liabilities and Deficit | $ | 14,692,928 | $ | 14,030,386 | ||

The accompanying notes are an integral part of these consolidated financial statements.

10

Summary of Consolidated Statements of Operations and Comprehensive Loss Data

For the Three Months ended March 31, 2022 and 2021

(UNAUDITED)

| For the Three Months Ended | ||||||

| March 31, | ||||||

| 2022 | 2021 | |||||

| Sales revenue, net | $ | 4,284,114 | $ | - | ||

| Cost of goods sold | 370,064 | - | ||||

| Gross profit | 3,914,050 | - | ||||

| Selling and marketing expenses | 3,357,973 | 3,459 | ||||

| General and administrative expenses | 230,339 | 157,667 | ||||

| Total operating expenses | 3,588,312 | 161,126 | ||||

| Income (loss) from operations | 325,738 | (161,126 | ) | |||

| Interest expense | - | (4,973 | ) | |||

| Interest income | 24 | - | ||||

| Income (loss) before provision for income taxes | 325,762 | (166,099 | ) | |||

| Provision for income taxes | 92,955 | - | ||||

| Net income (loss) | 232,807 | (166,099 | ) | |||

| Net income attributable to noncontrolling interests | 13,984 | - | ||||

| Net income (loss) attributable to Tengjun stockholders | 218,823 | (166,099 | ) | |||

| Net income (loss) | 232,807 | (166,099 | ) | |||

| Other comprehensive income (loss): | ||||||

| Foreign currency translation adjustment | (9,438 | ) | 6,597 | |||

| Comprehensive income (loss) | 223,369 | (159,502 | ) | |||

| Comprehensive income attributable to noncontrolling interests | 13,507 | - | ||||

| Comprehensive income (loss) attributable to Tengjun stockholders | $ | 209,862 | $ | (159,502 | ) | |

| Net (income) loss per common share: | ||||||

| Net income (loss) per common share - basic and diluted | $ | 0.00 | $ | (0.01 | ) | |

| Weighted average shares outstanding: | ||||||

| Basic and diluted | 65,309,169 | 19,285,714 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

11

RISK FACTORS

An investment in Tengjun’s Common stock involves a high degree of risks. In determining whether to purchase the Company’s Common stock, an investor should carefully consider all of the material risks described below, together with the other information contained in this report before making a decision to purchase Tengjun’s securities. An investor should only purchase Tengjun’s securities if he or she can afford to suffer the loss of his or her entire investment.

Risks Relating to Our Tea and Ancillary Businesses

We may not be able to successfully implement our growth strategy on a timely basis or at all, which could harm our results of operations.

We are at the development stage. Our ability to successfully scale the tea and consumer water purification businesses depends on many factors, including:

| ● | Our ability to increase brand awareness in the PRC and to increase tea consumption; |

| ● | our ability to educate the consumers in general about the health benefits potentially associated with dandelion teas; |

| ● | the negotiation of acceptable terms with our suppliers; |

| ● | the maintenance of adequate distribution capacity, information systems and other operational system capabilities; |

| ● | buying, distribution and other support operations; |

| ● | the hiring, training and retention of management and other skilled personnel; |

| ● | expanding our store presence and enhancing the internet traffic to our tea products; |

| ● | assimilating new store employees into our corporate culture; |

| ● | the effective sourcing and management of inventory to meet the needs on a timely basis; |

| ● | the availability of sufficient levels of cash flow and financing to support our expansion; and |

| ● | the short-term and long-term effects of COVID-19 on the food services industry in the PRC. |

Our limited operating experience and limited brand recognition in other regions may limit our expansion strategy and cause our business and growth to suffer.

Our future growth depends, to a considerable extent, on our expansion efforts into regions of the PRC outside Shandong Province. We have a limited number of customers and limited experience in operating outside our current areas. We also have limited experience with market practices outside of our current areas and cannot guarantee that we will be able to penetrate or successfully operate in any market outside of our current region, Shandong Province. We may also encounter difficulty expanding in other regions’ markets because of limited brand recognition. In particular, we have no assurance that our marketing efforts will prove successful outside of the narrow geographic regions in which they have been used. The expansion into other regions may also present competitive, merchandising, forecasting and distribution challenges that are different from or more severe than those we currently face. Failure to develop new markets outside our current areas or disappointing growth may harm our business and results of operations.

12

We face significant competition from other specialty tea and beverage retailers and retailers of grocery products, which could adversely affect us and our growth plans.

The Chinese tea market is highly fragmented. We compete directly with a large number of relatively small independently owned tea retailers and a number of regional and national tea retailers, as well as retailers of grocery products, including loose-leaf tea and tea bags and other beverages. We compete with these retailers on the basis of taste, quality and price of product offered, store atmosphere, location, customer service and overall customer experience. We must spend considerable resources to differentiate our customer experience. Some of our competitors may have greater financial, marketing and operating resources than we do. Therefore, despite our efforts, our competitors may be more successful than us in attracting customers. In addition, as we continue to drive growth in Shandong Province, our success, combined with relatively low barriers to entry, may encourage new competitors to enter the market. As we continue to expand geographically, we expect to encounter additional regional and local competitors.

If we are unable to maintain sufficient levels of cash flow, we may not meet our growth expectations.

We may be unable to obtain any necessary financing on commercially reasonable terms to pursue or maintain our growth strategy. If we are unable to pursue or maintain our growth strategy, the market price of our Common stock could decline and our results of operations and profitability could suffer.

Because our tea business is highly concentrated on a single, discretionary product category, dandelion teas, we are vulnerable to changes in consumer preferences and in economic conditions affecting disposable income that could harm our financial results.

Our tea business is not diversified and consists primarily of developing, sourcing, producing, marketing and selling dandelion tea. Consumer preferences often change rapidly and without warning, moving from one trend to another among many retail concepts. Therefore, our business is substantially dependent on our ability to educate consumers on the many positive attributes of tea and anticipate shifts in consumer tastes. Any future shifts in consumer preferences away from the consumption of tea beverages or dandelion tea would also have a material adverse effect on our results of operations. In particular, there has been an increasing focus on health and wellness by consumers, which we believe has increased demand for products, such as our teas, that are perceived to be healthier than other beverage alternatives. If such consumer preference trends change, or if our dandelion teas are not perceived to be healthier than other beverage alternatives, our financial results could be adversely affected.

Consumer purchases of specialty retail products, including our products, are historically affected by economic conditions such as changes in employment, salary and wage levels, the availability of consumer credit, inflation, interest rates, tax rates, fuel prices and the level of consumer confidence in prevailing and future economic conditions. These discretionary consumer purchases may decline during recessionary periods or at other times when disposable income is lower. Our financial performance may become susceptible to economic and other conditions in regions or states where we have a significant number of stores. Our continued success will depend, in part, on our ability to anticipate, identify and respond quickly to changing consumer preferences and economic conditions.

Our success depends, in part, on our ability to source, develop and market new varieties of teas and tea blends, tea accessories and other tea-related merchandise that meet our high standards and customer preferences.

We currently only offer black and green dandelion teas under the brand name Mincheng Dandelion. Our success depends in part on our ability to continually innovate, develop, source and market new varieties of tea beverages, tea accessories and other tea-related merchandise that both meet our standards for quality and appeal to customers’ preferences. Failure to innovate, develop, source and market new varieties of tea beverages, tea accessories and other tea-related merchandise that consumers want to buy could lead to a decrease in our sales and profitability.

We may experience negative effects to our brand and reputation from real or perceived quality or safety issues with our tea products, which could have an adverse effect on our operating results.

We believe our customers rely on us to provide them with high-quality tea products. Concerns regarding the safety of our tea products or the safety and quality of our supply chain could cause consumers to avoid purchasing certain products from us or to seek alternative sources of tea, even if the basis for the concern has been addressed or is outside of our control. Adverse publicity about these concerns, whether or not ultimately based on fact, and whether or not involving our tea products, could discourage consumers from buying our tea and have an adverse effect on our brand, reputation and operating results.

13

Furthermore, the sale of our tea entails a risk of product liability claims and the resulting negative publicity. For example, tea leaves supplied to us may contain contaminants that, if not detected by us, could result in illness or death upon their consumption. We cannot assure you that product liability claims will not be asserted against us or that we will not be obligated to perform product recalls in the future.

Any loss of confidence on the part of our customers in the safety and quality of our tea products would be difficult and costly to overcome. Any such adverse effect could be exacerbated by our position in the market as a purveyor of quality tea and could significantly reduce our brand value. Issues regarding the safety of any teas sold by us, regardless of the cause, could have a substantial and adverse effect on our sales and operating results.

Use of social media may adversely impact our reputation or subject us to fines or other penalties.

There has been a substantial increase in the use of social media platforms and similar devices, including blogs, social media websites, and other forms of Internet-based communications, which allow individuals access to a broad audience of consumers and other interested persons. As laws and regulations rapidly evolve to govern the use of these platforms and devices, the failure by us, our employees or third parties acting at our direction to abide by applicable laws and regulations in the use of these platforms and devices could adversely affect our reputation or subject us to fines or other penalties.

Consumers value readily available information concerning retailers and their goods and services and often act on such information without further investigation and without regard to its accuracy. Information concerning us may be posted on social media platforms and similar devices by unaffiliated third parties, whether seeking to pass themselves off as us or not, at any time, which may be adverse to our reputation or business. The harm may be immediate without affording us an opportunity for redress or correction.

A shortage in the supply, a decrease in the quality or an increase in the price of tea as a result of weather conditions, earthquakes, crop disease, pests or other natural or manmade causes could impose significant costs and losses on our business.

Although we have our own dandelion farm, we also purchase dandelion leaves from local farms which have contracts with us. The supply and price of tea is subject to fluctuation, depending on demand and other factors outside of our control. The supply, quality and price of our teas can be affected by multiple factors, including political and economic conditions, civil and labor unrest, adverse weather conditions, including floods, drought and temperature extremes, earthquakes, tsunamis, and other natural disasters and related occurrences. In extreme cases, entire tea harvests from both our own farms and contract farms, may be lost or may be negatively impacted in some geographic areas. These factors can increase costs and decrease sales, which may have a material adverse effect on our business, results of operations and financial condition.

Dandelion tea may be vulnerable to crop disease and pests, which may vary in severity and effect. The costs to control disease and pest damage vary depending on the severity of the damage and the extent of the plantings affected. Moreover, there can be no assurance that available technologies to control such conditions will continue to be effective. These conditions can increase costs and decrease sales, which may have a material adverse effect on our business, results of operations and financial condition.

We rely significantly on information technology systems and any failure, inadequacy, interruption or security failure of those systems could harm our ability to operate our business effectively.

We rely on our information technology systems to effectively manage our business data, tea production lines, communications, point-of-sale, supply chain, order entry and fulfillment, inventory and distribution centers and other business processes. The failure of our systems to perform as we anticipate could disrupt our business and result in transaction errors, processing inefficiencies and the loss of sales, causing our business to suffer. Despite any precautions we may take, our information technology systems may be vulnerable to damage or interruption from circumstances beyond our control, including fire, natural disasters, systems failures, power outages, viruses, security breaches, cyber-attacks and terrorism, including breaches of our transaction processing or other systems that could result in the compromise of confidential company, customer or employee data. Any such damage or interruption could have a material adverse effect on our business, cause us to face significant fines, customer notice obligations or costly litigation, harm our reputation with our customers, require us to expend significant time and expense developing, maintaining or upgrading our information technology systems or prevent us from paying our vendors or employees, receiving payments from our customers or performing other information technology, administrative or outsourcing services on a timely basis. Furthermore, our ability to conduct our website operations may be affected by changes in foreign, state, provincial and federal privacy laws and we could incur significant costs in complying with the multitude of foreign, state, provincial and federal laws regarding the unauthorized disclosure of personal information. Although we carry business interruption insurance, our coverage may not be sufficient to compensate us for potentially significant losses in connection with the risks described above.

14

Data security breaches and attempts thereof could negatively affect our reputation, credibility and business.

We collect and store personal information relating to our customers and employees, including their personally identifiable information, and rely on third parties for the operation of the various social media tools and websites we use as part of our marketing strategy. Consumers are increasingly concerned over the security of personal information transmitted over the Internet (or through other mechanisms), consumer identity theft and user privacy. Any perceived, attempted or actual unauthorized disclosure of personally identifiable information regarding our employees or customers could harm our reputation and credibility, reduce our ability to attract and retain customers and could result in litigation against us or the imposition of significant fines or penalties. We cannot assure you that any of our third-party service providers with access to such personally identifiable information will maintain policies and practices regarding data privacy and security in compliance with all applicable laws, or that they will not experience data security breaches or attempts thereof which could have a corresponding adverse effect on our business.

Recently, data security breaches suffered by well-known companies and institutions have attracted a substantial amount of media attention, prompting new foreign legislative proposals addressing data privacy and security, as well as increased data protection obligations imposed on merchants by credit card issuers. As a result, we may become subject to more extensive requirements in the future to protect the customer information that we process in connection with the purchase of our products, resulting in increased compliance costs.

Our business, results of operations and financial condition have been and may in the future be adversely affected by global public health epidemics, including the strain of coronavirus known as COVID-19.

In December 2019, a novel strain of coronavirus causing respiratory illness, or COVID-19, has surfaced in Wuhan, China, spreading at a fast rate in January and February of 2020, and confirmed cases were also reported in other parts of the world. In reaction to this outbreak, an increasing number of countries imposed travel suspensions to and from China following the World Health Organization’s “public health emergency of international concern” (PHEIC) announcement on January 30, 2020. Since this outbreak, business activities in China and many other countries including U.S. have been disrupted by a series of emergency quarantine measures taken by the government.

Since the outbreak of COVID-19 in China, our employees and contractors in Shandong province were not allowed to leave their residences due to the temporary PRC restrictions for more than two months in early 2020, which in turn practically led to zero production and sales of dandelion teas and water purifiers during such period. Then in 2021, we faced a second round of COVID-19 in Shandong province. Due to the restrictions on travel and in-person meetings in our region by which the local government attempted to contain the spread of COVID-19, our marketing and sales team and independent sales representatives could not sell any tea products or water purifiers in 2021, which were stored in our warehouse during the year of 2021. As COVID-19 has subdued in the past few months, we have resumed regular business operations since first quarter 2022.

However, there is no guarantee that COVID-19 will not return to Shandong province where our main business operations are. The extent to which COVID-19 negatively impacts our business is highly uncertain and cannot be accurately predicted. We believe that the coronavirus outbreak and the measures taken to control it may have a significant negative impact on not only our business, but economic activities globally. The magnitude of this negative effect on the continuity of our business operation in China and U.S. remains uncertain. These uncertainties impede our ability to conduct our daily operations and could materially and adversely affect our business, financial condition and results of operations, and as a result affect our share price and create more volatility.

15

Litigation may adversely affect our business, financial condition, results of operations or liquidity.

Our business is subject to the risk of litigation by employees, consumers, vendors, competitors, intellectual property rights holders, shareholders, government agencies and others through private actions, class actions, administrative proceedings, regulatory actions or other litigation. The outcome of litigation, particularly class action lawsuits, regulatory actions and intellectual property claims, is inherently difficult to assess or quantify. Plaintiffs in these types of lawsuits may seek recovery of very large or indeterminate amounts, and the magnitude of the potential loss relating to these lawsuits may remain unknown for substantial periods of time. In addition, certain of these lawsuits, if decided adversely to us or settled by us, may result in liability material to our financial statements as a whole or may negatively affect our operating results if changes to our business operation are required. Regardless of the outcome or merit, the cost to defend future litigation may be significant and result in the diversion of management and other company resources. There also may be adverse publicity associated with litigation that could negatively affect customer perception of our business, regardless of whether the allegations are valid or whether we are ultimately found liable. As a result, litigation may adversely affect our business, financial condition, results of operations or liquidity.

Our failure to comply with existing or new regulations in the PRC, or an adverse action regarding product claims or advertising could have a material adverse effect on our results of operations and financial condition.

Our business operations, including farming, food processing, labeling, packaging, advertising, sourcing, distribution and sale of our products, are subject to the Food and Drug Safety Law and Product Quality Law of the PRC and the applicable regulations. From time to time, we may be subject to challenges to our marketing, advertising or product claims in litigation or governmental, administrative or other regulatory proceedings. Failure to comply with applicable regulations or withstand such challenges could result in changes in our supply chain, product labeling, packaging or advertising, loss of market acceptance of the product by consumers, additional recordkeeping requirements, injunctions, product withdrawals, recalls, product seizures, fines, monetary settlements or criminal prosecution. Any of these actions could have a material adverse effect on our results of operations and financial condition.

In addition, consumers who allege that they were deceived by any statements that were made in advertising or labeling could bring a lawsuit against us under consumer protection laws. If we were subject to any such claims, while we would defend ourselves against such claims, we may ultimately be unsuccessful in our defense. Defending ourselves against such claims, regardless of their merit and ultimate outcome, would likely result in a significant distraction for management, be lengthy and costly and could adversely affect our results of operations and financial condition. In addition, the negative publicity surrounding any such claims could harm our reputation and brand image.

We may not be able to protect our intellectual property adequately, which could harm the value of our brand and adversely affect our business.

We believe that our intellectual property, including the trademark and patents, has substantial value and has contributed significantly to the success of our business. In particular, our trademarks, and the unregistered names of a significant number of the varieties of tea beverages that we sell, are valuable assets that reinforce the distinctiveness of our brand and our customers’ favorable perception of our stores.

We also strive to protect our intellectual property rights by relying on PRC laws, as well as contractual restrictions with our employees, contractors (including those who develop, source, manufacture, store and distribute our tea beverages, light meals, baked goods, tea accessories and other tea-related merchandise), vendors and other third parties. However, we may not enter into confidentiality and/or invention assignment agreements with every employee, contractor and service provider to protect our proprietary information and intellectual property ownership rights. Those agreements that we do execute may be breached, resulting in the unauthorized use or disclosure of our proprietary information. Individuals not subject to invention assignments agreements may make adverse ownership claims to our current and future intellectual property, and even the existence of executed confidentiality agreements may not deter independent development of similar intellectual property by others. Unauthorized disclosure of or claims to our intellectual property or confidential information may adversely affect our business.

16

From time to time, third parties may sell our products using our name without our consent, and, we believe, may infringe or misappropriate our intellectual property rights. We will respond to these actions on a case-by-case basis and where appropriate may commence litigation to protect our intellectual property rights. However, we may not be able to detect unauthorized use of our intellectual property or to take appropriate steps to enforce, defend and assert our intellectual property in all instances.

Effective trade secret, patent, copyright, trademark and domain name protection is expensive to obtain, develop and maintain, both in terms of initial and ongoing registration or prosecution requirements and expenses and the costs of defending our rights. Our trademark and patent rights and related registrations may be challenged in the future and could be opposed, canceled or narrowed. Our failure to register or protect our trademarks could prevent us in the future from using our trademarks or challenging third parties who use names and logos similar to our trademarks, which may in turn cause customer confusion, impede our marketing efforts, negatively affect customers’ perception of our brand, stores and products, and adversely affect our sales and profitability. Moreover, intellectual property proceedings and infringement claims brought by or against us could result in substantial costs and a significant distraction for management and have a negative impact on our business. We cannot assure you that we are not infringing or violating, and have not infringed or violated, any third-party intellectual property rights, or that we will not be accused of doing so in the future.