SIMPSON THACHER & BARTLETT

![]()

ICBC TOWER, 35TH FLOOR

3 GARDEN ROAD

HONG KONG

(852) 2514-7600

FACSIMILE (852) 2869-7694

|

DIRECT DIAL NUMBER (852) 2514-7630 |

|

E-MAIL ADDRESS lchen@stblaw.com |

VIA EDGAR

October 26, 2012

Larry Spirgel, Assistant Director

Celeste M. Murphy, Legal Branch Chief

Kate Beukenkamp, Attorney-Advisor

Terry French, Account Branch Chief

Claire DeLabar, Staff Accountant

Division of Corporation Finance

Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

Re: Xueda Education Group

Form 20-F for Fiscal Year Ended December 31, 2011

Filed April 27, 2012

Response Dated September 7, 2012

File No. 001-34914

Dear Mr. Spirgel, Ms. Murphy, Ms. Beukenkamp, Mr. French and Ms. DeLabar:

On behalf of our client, Xueda Education Group, a company incorporated under the laws of the Cayman Islands (the “Company”), we hereby respond to the comment letter the Company received from the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”), dated October 3, 2012, with regard to the Company’s response to the Staff’s comment letter, dated July 27, 2012 (the “Prior Comments”), regarding the Company’s annual report on Form 20-F for the year ended December 31, 2011 that was filed on April 27, 2012 (the “Company’s 2011 Form 20-F”).

On behalf of the Company, we wish to thank you and the other members of the Staff for kindly granting an extension of the deadline for the Company’s response.

|

LEIMING CHEN PHILIP M.J. CULHANE DANIEL FERTIG CELIA LAM CHRIS LIN SINEAD O’SHEA JIN HYUK PARK YOUNGJIN SOHN KATHRYN KING SUDOL CHRISTOPHER WONG RESIDENT PARTNERS

SIMPSON THACHER & BARTLETT, HONG KONG IS AN AFFILIATE OF SIMPSON THACHER & BARTLETT LLP WITH OFFICES IN: | ||||||||||||||||

|

NEW YORK |

|

BEIJING |

|

HOUSTON |

|

LOS ANGELES |

|

LONDON |

|

PALO ALTO |

|

SÃO PAULO |

|

TOKYO |

|

WASHINGTON, D.C. |

The Company hereby undertakes that it will file an amendment to the Company’s 2011 Form 20-F via EDGAR immediately after the Staff’s comments are resolved. The Company also confirms that it understands its obligation to disclose to the public material information about the Company on a timely basis.

Set forth below are the Company’s response to each of the Staff’s comments contained in your October 3, 2012 letter. For convenience, we have reproduced the Staff’s comments in italicized boldface type below and keyed the Company’s response accordingly. In the response below, the Company makes references to (i) the Company’s 2011 Form 20-F, if no change to the original disclosure therein has been proposed to address a particular comment, and (ii) Proposed Amendment No. 1 to the Company’s 2011 Form 20-F, submitted to the Staff as Appendix A to the Company’s response letter dated September 7, 2012 (“Proposed Amendment No. 1”), if the Company believes that the disclosure proposed to be revised therein would address a particular comment. The other terms used in this response letter but not otherwise defined have the meanings ascribed to them in the Company’s response letter dated September 7, 2012.

General

1. Please describe to us the process to move cash from the WFOE to Xueda Education Group, including the following:

a. Describe the process for issuing a cash dividend from the WFOE to Xueda Education Group;

The process for the WFOE to issue cash dividends is as follows:

(i) As the WFOE is a company with a sole shareholder, China Xueda Corporation Limited (“Xueda Hong Kong”), the sole shareholder, needs to first make a decision on a dividend distribution.

(ii) Once a dividend decision is made by Xueda Hong Kong, the executive director of the WFOE formulates the WFOE’s dividend distribution plan and submits the plan to Xueda Hong Kong for approval.

Dividends of a wholly foreign-owned enterprise, such as the WFOE, can only be distributed out of its accumulated after-tax profits, if any, determined in accordance with PRC accounting standards and regulations and after making contributions to the mandatory reserve fund, as discussed in detail on page 23 (under the risk factor captioned “Restrictions under PRC law on our PRC subsidiary’s ability to make dividend payments and other distributions could materially and adversely affect our ability to make investments or acquisitions, pay dividends or other distributions to you, and otherwise fund and conduct our other businesses”) and page 41 (in the

first paragraph under the subsection captioned “Regulations on Dividend Distribution”) of the Company’s 2011 Form 20-F.

(iii) Xueda Hong Kong, the sole shareholder of the WFOE, reviews and approves such dividend distribution plan through a shareholder resolution.

(iv) Once the dividend distribution plan is approved by Xueda Hong Kong, the WFOE may freely convert its RMB into a foreign currency (e.g., U.S. dollar) for dividend distribution and remit the dividends, without any governmental approval, to Xueda Hong Kong outside of the PRC through a bank authorized by the SAFE to conduct foreign exchange businesses (a “designated foreign exchange bank”). This is disclosed on pages 20 and 21 (under the risk factor captioned “Restrictions on currency exchange may limit our ability to receive and use our revenue effectively”) and page 41 (in the first paragraph under the subsection captioned “Regulations on Foreign Exchange”) of the Company’s 2011 Form 20-F.

Under the Circular on Issues Concerning Outward Remittance of Profits, Dividends and Bonuses Processed by Designated Foreign Exchange Banks (1998) issued by the SAFE, as amended, the WFOE needs to present the following documents to the designated foreign exchange bank for the remittance of dividends outside of the PRC: (a) the WFOE’s tax payment certificate, tax returns and documents evidencing the WFOE’s preferential tax treatments, each as issued by local tax authorities; (b) the WFOE’s audit report for the year of the dividend distribution; (c) the shareholder resolution adopted by Xueda Hong Kong approving the dividend distribution as discussed in step (iii) above); (d) the WFOE’s Foreign Exchange Registration Certificate; (e) the WFOE’s capital verification report; and (f) other documents that may be required by the SAFE, including the tax clearance letter issued by the local tax authorities regarding the payment of withholding tax for the dividend distribution.

There are certain tax considerations (including withholding tax as discussed above) that concern the dividend distribution by the WFOE to Xueda Hong Kong, as discussed in detail on page 19 of the Company’s 2011 Form 20-F (under the risk factor captioned “There are significant uncertainties under the EIT Law relating to the withholding tax liabilities of our PRC subsidiary, and dividends payable by our PRC subsidiary to our Hong Kong subsidiary may not qualify to enjoy the treaty benefits”).

(v) Once the cash dividends (now in a foreign currency, such as U.S. dollar, as converted in the manner discussed above) are remitted by the WFOE to Xueda Hong Kong, such dividends are no longer subject to PRC laws and regulations. Xueda Hong Kong is free, upon approval by its board of

directors, to distribute such funds as dividends to its sole shareholder, the Company. Dividend distribution by a Hong Kong company, such as Xueda Hong Kong, to its shareholders does not require any governmental approval in Hong Kong.

b. Describe whether that process requires regulatory and/or SAFE approval, and if so, a description of the factors that go into such an approval;

As long as the WFOE has accumulated after-tax profits, made the required contributions to the mandatory reserve fund as discussed in the Company’s response to comment 1(e) below, met the requirements as discussed in the Company’s response to comment 1(f) below and presented the required documents to the designated foreign exchange bank as discussed in the Company’s response to comment 1(a)(iv) above — none of which is subject to any governmental authority’s approval or verification — the WFOE does not need to obtain any regulatory or SAFE approval for (i) the adoption of a cash dividend distribution plan, (ii) the conversion of RMB into a foreign currency for dividend distribution, or (iii) the remittance of the cash dividend to its sole shareholder outside of the PRC.

c. Explain whether the WFOE has issued a dividend in the past, and if not, the reasons why;

As disclosed on page 19 (under the risk factor captioned “There are significant uncertainties under the EIT Law relating to the withholding tax liabilities of our PRC subsidiary, and dividends payable by our PRC subsidiary to our Hong Kong subsidiary may not qualify to enjoy the treaty benefits”) and pages 20 and 21 (under the risk factor captioned “Restrictions under PRC law on our PRC subsidiary’s ability to make dividend payments and other distributions could materially and adversely affect our ability to make investments or acquisitions, pay dividends or other distributions to you, and otherwise fund and conduct our other businesses”) of the Company’s 2011 Form 20-F, the WFOE has never declared or issued any dividend in the past. This reflects a decision made by the WFOE and the Company that the WFOE’s accumulated earnings would be reinvested to expand the WFOE’s business operations and to meet the anticipated increasing demand for private tutoring services in China. In addition, the Company has been holding sufficient cash (excluding the cash held by the WFOE) for its own anticipated cash needs. Therefore, even though the WFOE would have sufficient earnings to distribute dividends, the Company has never requested (through Xueda Hong Kong) the WFOE to make any dividend distribution.

d. Describe your policy related to dividends being issued from the WFOE;

As discussed above and disclosed on page F-34 (in Note 10) of the Company’s 2011 Form 20-F, the Company and the WFOE have decided to use the WFOE’s accumulated earnings to expand the WFOE’s business and to meet the anticipated increasing demand for private tutoring services in China. The Company does not have any current plan for the WFOE to distribute any dividends in the near future.

e. We understand there are restrictions on statutory reserves that impact ability to dividend. Describe those requirements and whether the WFOE has met the requirements to execute a cash dividend;

As disclosed on pages 41 and 42 of Proposed Amendment No. 1 (in the subsection captioned “Regulations on Dividend Distribution”) and as discussed in the Company’s response to comment 1(a) above, the WFOE’s ability to distribute dividends is subject to certain restrictions.

Under the PRC Wholly Foreign-Owned Enterprise Law (1986), as amended, and the Implementing Rules of the Wholly Foreign-Owned Enterprise Law (1990), as amended, a wholly foreign-owned enterprise, such as the WFOE,

(a) may distribute dividends only out of its accumulated after-tax profits, if any, determined in accordance with PRC accounting standards and regulations; and

(b) is required to contribute at least 10% of its annual after-tax profits, if any, determined in accordance with PRC accounting standards, to its general reserves fund, until the cumulative amount in the reserve fund reaches 50% of such enterprise’s registered capital.

The above mandatory reserve fund can only be used for the specified purposes and cannot be transferred to the wholly foreign-owned enterprise’s shareholders in the form of loans, advances, dividends or otherwise.

The WFOE has met the above requirements, and therefore may distribute dividends if Xueda Hong Kong (as the sole shareholder of WFOE) so decides.

f. Tell us whether there any barriers other than the statutory reserves to executing a cash dividend;

The only potential barriers for the WFOE to distribute dividends other than the mandatory reserve fund as discussed in the Company’s response to comment 1(e) above would be the following: (i) Article 5 of the Circular on Issues Concerning Outward Remittance of Profits, Dividends and Bonuses Processed by Designated

Foreign Exchange Banks (1998), as amended, provides that a foreign-invested enterprise is prohibited from remitting any dividends abroad until the registered capital is paid in as required by the entity’s articles of association; and (ii) Article 58 of the Implementing Rules of the Wholly Foreign-Owned Enterprise Law (1990), as amended, provides that a foreign-invested enterprise may not distribute dividends before its cumulative losses from prior fiscal years are made up.

As the WFOE’s registered capital has been contributed in accordance with relevant PRC laws and regulations as well as the WFOE’s articles of association, and the WFOE’s cumulative losses in prior years have all been made up, the above restrictions do not apply to the WFOE. Neither the Company nor its PRC counsel is aware of any other barriers to executing a cash dividend by the WFOE.

g. Tell us other ways outside of a dividend, and potential barriers for those other ways, that the WFOE could transfer value to Xueda Education Group.

The Company is aware of only two other possible approaches that the WFOE could transfer value (in the broad sense of this term) to the Company: (i) through one or more service agreements between the WFOE and one or more of the Company’s overseas subsidiaries under which the Company’s overseas subsidiaries provide services to and receive service fees from the WFOE; or (ii) through the distribution of residual properties, if any, to Xueda Hong Kong (as the WFOE’s sole shareholder) upon the WFOE’s dissolution — Xueda Hong Kong could then distribute the properties it has received from the WFOE to the Company without any barrier.

In the first approach, the service arrangements, as transactions between related parties, may be subject to the PRC tax authorities’ scrutiny, potentially resulting in a significant increase to the WFOE’s tax liabilities. In addition, the service fees the Company receives from the WFOE under such service arrangements would be subject to business tax or value-added tax and enterprise income tax in China. These tax implications may constitute significant barriers to the proposed value transfer.

In the second approach, the dissolution of the WFOE (except as a result of the expiration of the WFOE’s business term) would need approval, as a matter of formality and without substantive review, by the commerce authorities that approved the establishment of the WFOE. To obtain such approval, the WFOE would need to provide certain required documents to the commerce authorities. As the Company relies on the WFOE (through the WFOE’s contractual arrangements with the VIE and the VIE’s shareholders) for its business operations,

a dissolution of the WFOE would cause the termination of the Company’s business, making this approach not viable.

2. Please tell us how the board of directors was appointed of Xueda Education Group and how members of the board can be terminated and appointed, and how the officers of Xueda Education Group are hired, fired, and compensated. Please tell us whether the board votes on termination of a board member and whether the board member subject to that vote is entitled to vote.

Appointment and Removal of the Company’s Directors

The Company appoints its directors in accordance with its articles of association, as amended and restated from time to time. The Company’s board of directors (the “Board”), up to the time of the Company’s initial public offering and listing of its American depositary shares on the New York Stock Exchange in early November 2010, was duly elected by the Company’s shareholders under the Company’s then effective articles of association. Since then, two directors (namely, Gongquan Wang and Jun Wang) have resigned, and the vacancies resulted from their resignations were filled with another two individuals (namely, William Hsu and Cheung Kin Au-Yueng) by the affirmative vote of the Board in accordance with Article 82(d) of the Company’s currently effective third amended and restated articles of association (the “Current Articles of Association”). Currently, the Board consists of eight directors: three are independent directors (as discussed on pages 72 and 73 of the Company’s 2011 Form 20-F under “Item 6.A. Directors and Senior Management”), two are representatives of the Company’s principal shareholders (namely, William Hsu, representing the investor that controls CDH Xueda Limited, and Cheung Lun Julian Cheng, representing the investor that controls WP X Investments IV Ltd.), and the remaining three (namely, Rubin Li, Xin Jin and Jinbo Yao) are the Company’s founders (and shareholders) who have served as the Company’s directors since before the Company’s initial public offering.

The Board does not have the power to remove a director under the Company’s Current Articles of Association. A director can only be removed by the Company’s shareholders. Under Article 83 of the Company’s Current Articles of Association, a director may be removed from office with or without cause by a simple majority of the Company’s shareholders voting at a general meeting. The director to be removed is entitled to attend the general meeting convened to remove him or her and be heard on the motion for his or her removal. If the subject director is also a shareholder, he or she is entitled to vote on the matter at the general meeting.

In order for the shareholders to remove a director, a general meeting needs to be called. Under the Company’s Current Articles of Association, a general meeting may be called in two scenarios:

(i) By the Company’s Board, which requires resolutions adopted by a simple majority of the directors present at a Board meeting with a quorum present (i.e., a majority of the directors) that call a general meeting and propose the matters for approval by the shareholders (such as the removal of any director) — as the Company currently has eight directors, such resolutions can be adopted by a minimum of three directors at a Board meeting attended by five directors.

(ii) Through a shareholder requisition (i.e., any one or more shareholders holding no less than 10% of the Company’s issued and outstanding shares may request the Board to call a general meeting to approve the matters proposed by such shareholders). If the Board fails to convene a general meeting within 21 days of the requisition, the requisitioning shareholders (or any of them representing more than one-half of the total voting rights of all the requisitioning shareholders) may send a seven-day prior meeting notice to all shareholders of the Company and convene a general meeting within three months after the expiration of the above-mentioned 21-day period to review proposals made by the requisitioning shareholders, including but not limited to, proposals on removing any of the directors.

The Company believes that these provisions under its Current Articles of Associations provide two mechanisms for the directors and shareholders who hold a substantial stake in the Company to call a general meeting to remove directors from office. At a general meeting called in either way discussed above and attended by holders of at least one-third of the Company’s then issued and outstanding shares in person or by proxy, the shareholders present at the meeting in person or by proxy can, by a simple majority vote, approve the removal of any director as proposed by the Board or the requisitioning shareholders, as the case may be. To date, the Company’s shareholders have not removed any of its directors.

Appointment, Removal and Compensation of the Company’s Officers

The Company’s officers may be appointed in two ways:

First, under Article 91 of the Company’s Current Articles of Association, the Board has the right to appoint officers of the Company as the Board may think necessary for the administration of the Company. In connection with this power granted to the Board, Article 118(a) of the Company’s Current Articles of Association further provides that, the appointment of either of the Company’s chief executive officer or chief financial officer requires the approval of a supermajority of at least two-thirds of the vote of all directors. The other Board-appointed officers of the Company, if any, are to be appointed with the approval of a simple majority of all directors. All Board-appointed officers are to be removed by the Board with the same vote as required for their appointment. A director to be appointed as an officer is required to declare his or her interest and participate in the directors’ vote on his or her appointment. The Company’s incumbent chief executive officer and chief financial officer were both appointed by the Board in this manner. The compensation of all Board-appointed officers is determined by a simple majority vote of the Board.

Second, officers may also be appointed and removed by the Company’s management team, led by the chief executive officer, if they are not Board-appointed. The compensation of such other officers is also determined by the Company’s management team.

3. Please identify for us the officers of the WFOE and the VIE and tell us how they can be removed or replaced.

Officers of the WFOE

The officers of the WFOE are: Xin Jin (President), Junfeng Gao (Vice President, who is also the WFOE’s principal accounting officer), Wei Zhang (Vice President), Wenbin Xu (Senior Director, Service Management), Jun Li (Senior Director, Consulting Management), Haodong Yan (General Manager, Elite Class Division), Hui Jin (Senior Director, Human Resources), Hong Zheng (Senior Director, Development and Construction), Zhe Li (Senior Director, Marketing), Yao Chen (Senior Director, Administration; Senior Director, Government Relations), Di Zhang (Assistant to President; Board Secretary), Huibin Qi (Senior Director, Technology) and Jianxin Miao (Senior Consultant to President).

Under the WFOE’s articles of association, the president of the WFOE is appointed and removed by the WFOE’s sole executive director (namely, William Hsu, who is also a director of the Company but not a shareholder or director of the VIE); the WFOE’s vice presidents and principal accounting officer are appointed and removed by the WFOE’s sole executive director on the basis of the president’s recommendation; the other officers of the WFOE are appointed and removed by the WFOE’s president.

The WFOE’s sole executive director is appointed and removed through a resolution by the WFOE’s sole shareholder, Xueda Hong Kong, which is a wholly-owned subsidiary of the Company and controlled by the Company’s Board.

Officers of the VIE

The officers of the VIE are: Rubin Li (President), and all of the officers of the WFOE as discussed above (except Xin Jin) are also officers of the VIE holding the same positions. Under the VIE’s articles of association, the president of the VIE is appointed and removed by the VIE’s board of directors (consisting of Rubin Li, Xin Jin, Jinbo Yao, Junhong Piao and Yafei Wang) by a simple majority vote of the directors; the VIE’s vice presidents and chief accounting officer are appointed and removed by the VIE’s board of directors by a simple majority vote of the directors on the basis of the president’s recommendation; the other officers of the VIE are appointed and removed by the VIE’s president.

The Company notes that, as discussed on page 49 of Proposed Amendment No. 1 (in the subsection captioned “Powers of Attorney”) and in the Company’s response to Prior Comments 33 and 38(d), the VIE’s shareholders have granted, under the Powers of Attorney, to the WFOE the power to nominate and appoint the chairperson of the board of directors, directors and executive directors of the VIE. With this power to appoint and remove the VIE’s board of directors (the process of which is discussed in greater detail in

the Company’s response to comment 4 below), the WFOE has effective control over the appointment and removal of the president and all of the other officers of the VIE. All powers granted by the VIE’s shareholders under the Powers of Attorney to the WFOE are to be exercised by its sole executive director acting as its legal representative, who, as discussed above, is controlled by the Company’s Board (through its control over Xueda Hong Kong).

4. Please tell us how the VIE board of directors was appointed and how the directors can be removed or appointed and how decisions are made.

According to the VIE’s articles of association, the VIE’s directors are appointed and removed by the VIE’s shareholders. The incumbent directors of the VIE were all appointed by the VIE’s shareholders before the contractual arrangements with the WFOE were formed.

The Company notes that, as discussed on page 49 of Proposed Amendment No. 1 (in the subsection captioned “Powers of Attorney”) and in the Company’s response to Prior Comments 33 and 38(d), the VIE’s shareholders have granted, under the Powers of Attorney, to the WFOE (to be exercised by its sole executive director acting as its legal representative as discussed in the Company’s response to comment 3 above) the power to exercise all of the VIE’s shareholders rights with respect to their equity interest in the VIE, including but not limited to nominating and appointing the VIE’s chairperson of the board of directors, directors and executive directors. With this power, the WFOE’s sole executive director may decide to convene general meetings for the VIE and adopt shareholders’ resolutions to appoint or remove any of the VIE’s directors on behalf of all the VIE’s shareholders.

5. Please tell us whether there are any relationships between the equity holders of Xueda Education Group and/or the equity holders of the VIE. We would like to understand whether certain shareholders may, in substance or contractually, control another shareholder’s vote.

As disclosed on page 14 of Proposed Amendment No. 1 (under the risk factor captioned “Certain shareholders of our VIE may have potential conflicts of interest with us, which may harm our business and financial condition”), certain shareholders of the VIE, namely Xin Jin, Rubin Li, Jinbo Yao, Qiang Deng, Yafei Wang, Chaoming Chai and CDH Xueda Limited (through Junhong Piao, its designated holder) are also beneficial owners of the Company.

The table below sets forth the beneficial ownership or equity interest each of the Company’s principal shareholders holds in the Company and the VIE, respectively, as of December 31, 2011.

|

Name |

|

Beneficial Ownership |

|

Equity Interest |

|

|

Xin Jin |

|

20.5 |

|

27.0 |

|

|

Rubin Li |

|

15.6 |

|

23.5 |

|

|

Jinbo Yao |

|

10.0 |

|

15.7 |

|

|

Qiang Deng |

|

* |

|

2.1 |

|

|

Yafei Wang |

|

2.7 |

|

3.5 |

|

|

Chaoming Chai |

|

* |

|

2.3 |

|

|

CDH Xueda Limited |

|

16.4 |

|

20.0 |

|

|

WP X Investments IV Ltd. |

|

11.1 |

|

— |

|

|

Total |

|

76.9 |

|

94.1 |

|

* Beneficial ownership less than 1%.

The Company is not aware of any relationship or arrangement between or among any of the above parties that would enable any of them to control, in substance or contractually, any other party’s vote in the Company or in the VIE.

6. Please tell us who has control based on the accounting model that would apply, such as the voting interest entity or variable interest entity, over Xueda Education Technology Co., Ltd, Beijing Century Hui Ce Investment Consultancy Co., Ltd and CDH Xueda Education Limited. In addition, identify for us the officers of these companies and the process by which those in power may be removed or reappointed.

Xueda Education Technology Co., Ltd.

As disclosed on pages 29 and 30 of the Company’s 2011 Form 20-F (under “Item 4.A. History and Development of the Company”), Xueda Education Technology Co, Ltd. (“Xueda Technology”) was established prior to the incorporation of the Company. Since the establishment of the VIE in 2009, the business, assets, liabilities and personnel of Xueda Technology have been completely transferred to and assumed by the VIE. As disclosed on page F-11 of the Company’s 2011 Form 20-F (under “History of the Group and corporate reorganization” in Note 1), the restructuring was carried out between Xueda Technology and the VIE, which were ultimately owned by identical beneficial shareholders as of then. Therefore, the Company accounted for the restructuring as a recapitalization with no change in the basis of the assets and liabilities transferred from Xueda Technology, and the consolidated financial statements of the Company for the period prior to its incorporation comprised those of Xueda Technology as if the Company had always possessed the assets, liabilities and business transferred from Xueda Technology.

Xueda Technology is not consolidated in the Company’s financial statements, nor is it controlled by the Company. The Company has had no equity interest or variable interest in Xueda Technology. To the Company’s knowledge, (i) Xueda Technology continues to be owned by the same shareholders as before the restructuring (namely, Rubin Li, Xin Jin, Jinbo Yao, Changyong Zhu, Qiang Deng, Beijing Century Hui Ce Investment Consultancy Co., Ltd and CDH Xueda Education Limited, as disclosed on page F-10 of the Company’s 2011 Form 20-F under the subsection captioned “History of the Group and corporate reorganization”), (ii) it has no active business operations, and (iii) it does not have any officers.

Beijing Century Hui Ce Investment Consultancy Co., Ltd and CDH Xueda Education Limited

As disclosed on page 29 of Proposed Amendment No. 1 (under “Item 4.A. History and Development of the Company”) and on page F-41 (in Note 15, “Convertible Redeemable Preferred Shares”) of the Company’s 2011 Form 20-F, Beijing Century Hui Ce Investment Consultancy Co., Ltd and CDH Xueda Education Limited were two of the shareholders of its prior operating entity (i.e., Xueda Technology), and CDH Xueda Education Limited’s beneficial owner (i.e., CDH Xueda Limited, as disclosed on page F-41 of the Company’s 2011 Form 20-F in Note 15) is one of the Company’s existing shareholders.

The Company has had no equity interest or variable interest in, or any control over, any of these entities, nor does the Company consolidate any of these entities or have any information on the identities of their officers or the process by which those in power of these entities may be removed or reappointed.

7. Please describe Rubin Li and Xin Jin’s involvement in the purpose and design of the VIE as it was formed, as well as how they can be removed as officers and board members of Xueda Education Group, the WFOE and/or the VIE.

Rubin Li and Xin Jin were founders and primary owners of the Company’s business which adopted the name of Xueda Technology in 2007. Xueda Technology was the Company’s primary operating entity until the restructuring in 2009 and 2010. As disclosed in detail on pages 29 and 30 of Proposed Amendment No. 1 (under “Item 4.A. History and Development of the Company”) and in the Company’s response to Prior Comment 31, the purposes of the restructuring were to address and preempt certain compliance issues that arose from Xueda Technology’s status as a foreign-invested enterprise. As a result of the restructuring, the VIE (a PRC domestic company) was established to conduct the Company’s private tutoring business. Rubin Li and Xin Jin led the restructuring and subsequently became two of the shareholders of the VIE.

Currently, Rubin Li is (i) chairman of the board of directors and president of the VIE and (ii) chairman of the Company’s Board. Rubin Li does not serve as a director or an officer of the WFOE, nor does he serve as an officer of the Company. Xin Jin is (i) a director of the VIE, (ii) president of the WFOE and (iii) a director and the chief executive officer of the Company. Xin Jin does not serve as an officer of the VIE, nor does he serve as a director of the WFOE.

For the process on how Rubin Li and Xin Jin can be removed as a director and/or officer of the VIE, the Company refers to its response to comments 3 and 4 above. As discussed there, they can be removed by the WFOE’s sole executive director (who is controlled by the Company’s Board).

For the process on how Xin Jin can be removed as an officer of the WFOE, the Company refers to its response to comment 3 above. As discussed there, he can be removed as president of the WFOE by the WFOE’s sole executive director (who is controlled by the Company’s Board).

For the process on how they can be removed as a director and/or officer of the Company, the Company refers to its response to comment 2 above. As discussed there, Rubin Li (as chairman of the Company’s Board) and Xin Jin (as a director) can be removed by simple majority vote of the shareholders at a general meeting that can be called either by the Board or holders of at least 10 % of the Company’s issued and outstanding shares. Xin Jin, as the Company’s chief executive officer, can be removed with a supermajority of at least two-thirds of the vote of the eight-member Board.

In each of the above scenarios, the Company’s Board has the power to remove Rubin Li and Xin Jin from each of their positions held in the Company, the WFOE or the VIE.

8. Please tell us whether there are relationships that Rubin Lin or Xin Jin have with vendors, employees, and/or the government or others that would significantly impact the VIE operations if one or both of them were not involved. Please tell us whether there is a suitable replacement for these individuals.

As disclosed on pages 31 (in the subsection captioned “Overview”) and 35 (in the subsection captioned “Our Service Network”) of the Company’s 2011 Form 20-F, the Company had a total of 295 learning centers located in 63 cities in 28 provinces in China as of December 31, 2011. Due to the large number and geographic dispersion of the Company’s learning centers and the nature of the Company’s business, there have not been any individual or small groups of vendors, employees or government contacts that are significant to the VIE’s business operations as a whole. In addition, none of Rubin Li, Xin Jin or any other officers of the Company or the VIE controls or maintains relationships with any individual or small groups of vendors, employees or government contacts the termination of which would significantly impact the VIE’s operations if any or all of Rubin Li, Xin Jin or other officers of the Company or the VIE were no longer involved in the VIE’s business. Therefore, the termination or removal of Rubin Li, Xin Jin or any other officers of the VIE would not result in any significant adverse impact on the VIE’s relationships with its vendors, employees or government authorities. For the same reason, if Rubin Li, Xin Jin or any other officers of the VIE, individually or collectively, were no longer involved in the VIE’s operations, the Company would not have any significant difficulty in finding suitable replacements for these individuals for the purpose of maintaining relationships with the VIE’s vendors, employees or government contacts.

As disclosed on page 5 of Proposed Amendment No. 1 (under the risk factor captioned “Our business depends on the continuing efforts of our senior management team, local management teams and other key personnel, and our business may be harmed if we lose their services”), the Company depends heavily upon the continuing services of the members of its senior management team, particularly, the Company’s chief executive officer and chief financial officer. The Company wishes to note that it values and relies on its senior management team members’ leadership skills, business experience and vision, not on their relationships with any vendors, employees or government contacts.

9. We note from your response letter dated September 7, 2012 your descriptions of the contractual rights granted to the board of directors of the WFOE. Please describe what would happen if the VIE shareholders collectively or individually (such as Rubin Li or Xin Jin) disagree with the actions of the board of directors of Xueda Education Group. In this regard, help us understand in substance what the VIE shareholders could do that the board of Xueda Education Group cannot prevent.

The Company believes that by design, the VIE structure effectively prevents the VIE’s shareholders from acting in disagreement with the actions or decisions of the Company.

In this regard, the Company refers to its response to Prior Comments 33 and 43, where the Company describes:

(i) the exclusive right irrevocably granted by each of the VIE’s shareholders to the WFOE under the Exclusive Purchase Right Contract — this exclusive right enables the WFOE (or the Company, as the Company controls the WFOE through its ownership of the entire equity interest in the WFOE) to unilaterally appoint one or more PRC individuals or entities as nominee shareholders of its choice to replace any of the existing shareholders of the VIE at any time, including at a time any shareholder of the VIE shall disagree with the WFOE or the Company; and

(ii) the power granted by each of the VIE’s shareholders to the WFOE under the Powers of Attorney that enables the WFOE to sign transfer agreements on behalf of the VIE’s shareholders and to enforce the Pledge Agreement and the Exclusive Purchase Right Contract — this power enables the WFOE to unilaterally appoint nominee shareholders to take over the equity interest in the VIE.

However, as discussed on page 14 of Proposed Amendment No. 1 (under the risk factor captioned “Certain shareholders of our VIE may have potential conflicts of interest with us, which may harm our business and financial condition”), if the five of the VIE’s shareholders who are also the Company’s directors (i.e., Rubin Li, Xin Jin, Jinbo Yao, Yafei Wang and the director appointed by CDH Xueda Limited) were to disagree with the WFOE or the Company, they could take advantage of the majority seats they hold on the Company’s eight-member Board and make decisions on behalf of the Company which the other directors or shareholders of the Company cannot prevent, such as transfer or sale of the VIE’s significant business or assets, or prevent the WFOE from exercising its purchase right under the Exclusive Purchase Right Contract, the powers granted to it under the Powers of Attorney and other rights under the contractual arrangements against the VIE and its shareholders. In these situations, also as discussed under the same risk factor, the other directors and shareholders of the Company will have to resort to the laws of the Cayman Islands — which provide that a company’s directors and officers owe a fiduciary duty to such company and requires them to act in good faith and in the best interests of the company and not to use their positions for personal gain — to prevent those shareholders of the VIE who are also the Company’s directors from taking any actions against the Company’s interest. To receive the remedies for breach of fiduciary duties under the Cayman Islands law, the other directors and shareholders of the Company may have to rely on legal proceedings and face significantly uncertainties as to the outcome of such legal proceedings.

10. Please describe what rights Rubin Li has as the legal representative of the VIE and whether he has any unilateral rights over the significant activities of the VIE.

The rights of the VIE’s legal representative are defined under the VIE’s articles of association, which provides that the legal representative of the VIE is the chairman of the board of the directors who may exercise the following functions and powers: (i) convening and holding shareholders’ meetings; (ii) monitoring the implementation of the resolutions adopted by the shareholders and reporting to the shareholders’ meeting; (iii) signing documents on behalf of the VIE; and (vi) under emergent circumstances, such as war or extreme natural disasters, exercising discretion and disposition rights over the VIE’s affairs, provided that such discretion and disposition shall be in the interests of the VIE and shall be subsequently reported to the shareholders’ meeting. In addition, at any time deemed necessary, the VIE’s shareholders may appoint the president of the VIE to replace the chairman as the legal representative of the VIE.

Rubin Li, as the legal representative of the VIE, does not have any unilateral rights over any significant activities of the VIE. As discussed on page 49 of Proposed Amendment No. 1 (in the subsection captioned “Powers of Attorney”) and in the Company’s response to Prior Comments 33 and 38(d), the VIE’s shareholders have granted, under the Powers of Attorney, to the WFOE the power to nominate and appoint the legal representative of the VIE. With this power, the WFOE has the effective control over the legal representative of the VIE. In addition, as discussed in the Company’s response to Prior Comments 33 and 35, the Company (through the WFOE’s contractual arrangements with the VIE and its shareholders) controls all significant decisions of the VIE and its subsidiaries and schools through its control over (i) the management team and finance and accounting department of each of the VIE and its subsidiaries and schools, and (ii) the cash collection and expenditure management of the VIE and its subsidiaries and schools.

11. We note from your response to comment 3 of our letter dated July 27, 2012 that the VIE established and operates learning centers. Please provide us an accounting analysis that supports the consolidation conclusion of the schools/learning centers into the VIE or the WFOE, including which accounting model has been applied, such as the voting interest entity model, variable interest entity model, lease model, and or asset model as well as the details and judgments of the accounting analysis. We understand from this response that there are two structures you use, which may or may not include an entity. Please describe this analysis for each type of structure.

In response to the Staff’s comment, the Company has prepared a memorandum (the “Consolidation Analysis Memo”) to discuss the basis for the consolidation of the VIE’s schools/learning centers into the financial statements of the Company. This Consolidation Analysis Memo is attached as Annex I to this response letter.

12. Please tell us other models that were considered and rejected and whether they could result in a non-consolidation accounting conclusion.

The Company refers to paragraphs 30 through 32 of the Consolidation Analysis Memo attached as Annex I to this response letter.

13. Please tell us if the schools/learning centers were not consolidated on the VIE’s financial statements, whether the alternative accounting result of accounting for the arrangements would result in a material difference to the financial statements.

Even if the schools/learning centers were not consolidated on the VIE’s financial statements, the Company believes that they would still be consolidated into the Company’s financial statements. This alternative result of accounting would not result in any difference to the Company’s consolidated financial statements. To support this position, the Company refers to the Consolidation Analysis Memo attached as Annex I to this response letter, particularly paragraphs 51 through 55, 65 and 66.

14. Please provide an analysis of the arrangements, including the terms such as expiration, cancellation provisions, etc., between the VIE and/or WOFE and the government and/or entity that holds the schools and explain an overview of how control and economics work. For example, please ensure the following are addressed:

Relationship between the VIE and its schools

The Company wishes to clarify that, as discussed in the Company’s response to the third bullet point of Prior Comment 3 and shown on the organizational chart on page 47 of Proposed Amendment No. 1, each school of the VIE was established by its “sponsor”, which is either (i) the VIE itself, (ii) one of the three nominees who established three schools on behalf of the VIE under the nominee agreements, as disclosed in the Company’s response to Prior Comment 1, or (iii) one of the VIE’s wholly-owned subsidiaries in China, upon such sponsor’s obtaining of a school permit from the government’s education authorities. In other words, there is no “entity” other than the VIE itself or one of its nominees or subsidiaries, as the case may be, that holds any school. As the sole sponsor of each school, the VIE (or one of its nominees or subsidiaries, as the case may be) controls such school through appointing and controlling such school’s decision-making body, i.e., the executive council or the board of directors.

Of the above relationships, the nominee agreements between the VIE and the three individuals are the only “contractual arrangements” that convey the entire sponsorship rights and interests and economic returns in the schools established under the nominee agreements to the VIE. There are no other contractual arrangements between the VIE and the schools or their sponsors that are not the VIE itself.

The Company refers to the additional discussions in paragraphs 9 through 11 of the Consolidated Analysis Memo attached as Annex I on how the private schools are controlled by their sponsors.

Relationship between the WFOE and the VIE’s school

As discussed in detail on pages 48 and 49 of Proposed Amendment No. 1 (in the subsection captioned “Organizational Structure”) and in the Company’s response to Prior Comments 1, 39 and 45 and paragraph 5(b) of the Consolidation Analysis Memo attached as Annex I, the WFOE provides certain technology consulting and

management services to the VIE, covering all of the VIE’s schools, under the Exclusive Service Agreement. In addition, as discussed in the Company’s response to Prior Comment 1 and paragraph 5(c) of the Consolidation Analysis Memo attached as Annex I, the WFOE also has entered into four service agreements with four schools of the VIE as required by local tax authorities, under which the WFOE agrees to provide certain services to these schools that are within the scope of the services to be provided under the Exclusive Service Agreement. The WFOE also controls all of the VIE’s schools through its control over the VIE. There is no other arrangement between the WFOE and any of the VIE’s schools.

Relationship between the government and a school

The Company notes that the government’s education authorities are merely the approval authorities. As such, no governmental authority is involved in any arrangement that enables such government authorities to control, or receive or derive any economic benefit from, any of the VIE’s schools.

a. Please describe whether an entity is involved in the structure and if so what capacity, what type of entity, own owns the entity, purpose and design, etc.

As discussed in the Company’s response to this comment above, each school has a sponsor which is either (i) the VIE itself, (ii) one of the three nominees, or (iii) one of the VIE’s wholly-owned subsidiaries in China. A private school is not a corporate entity under the PRC Company Law; the action of establishing a private school is referred to as “sponsoring” a school, and the party who establishes the school is referred to as the “sponsor” of the school which holds “sponsorship interest” in such school. As discussed on pages 38 to 40 of Proposed Amendment No. 1 (in the subsection captioned “Regulations on Private Education”) and in paragraphs 6 through 18 of the Consolidated Analysis Memo attached as Annex I, the economic substance of “sponsorship” of a private school is substantially similar to that of ownership of a corporate entity with respect to legal, regulatory and tax matters.

b. Did the VIE make an upfront contribution to receive the sponsorship agreement, or does the VIE makes payments to the government over time?

Yes, the sponsor of each school, i.e., the VIE or its relevant nominee or subsidiary, as the case may be, is required to make an upfront capital contribution when sponsoring (i.e., establishing) the school. Such capital contribution is made to the school and is equivalent to the capital contribution required to be made by a shareholder under the PRC Company Law to a corporate entity upon incorporation. A school sponsor is not required to make any capital contribution or other payments to any government authorities, nor does it receive any “sponsorship agreement” from any government authorities or from the school it sponsors. A private school does not have a “sponsorship agreement.” In return of

the capital contribution to the school, the sponsor receives sponsorship interest in the school (equivalent to the equity interest that a shareholder receives in a corporate entity upon making capital contribution to such entity). The relationship between a private school and its sponsor is evidenced in the school’s articles of association and school permit issued by the education authorities.

c. Describe the substance of the rights conveyed to the VIE through the contractual arrangements.

As discussed above, the nominee agreements between the VIE and the three individual nominees are the only contractual arrangements between the VIE and school sponsors that are not the VIE itself. Under these nominee agreements, the nominees conveyed the entire sponsorship rights and interests and economic benefits in the schools established under the nominee agreements to the VIE. Please refer to its response to Prior Comment 1 for the details of the nominee agreements.

d. Has the service fee between the schools/learning centers and the WFOE been paid or is there an unpaid balance? If there is an unpaid balance, please describe why.

As discussed above, all the services provided by the WFOE to the VIE’s schools/learning centers are within the scope of the services provided under the Exclusive Service Agreement between the WFOE and the VIE. As discussed on page 49 of Proposed Amendment No. 1 (in the subsection captioned “Exclusive Technology Consulting and Management Services Agreement”) and in the Company’s response to Prior Comment 40, all service fees recognized by the WFOE for those services (including to the VIE’s schools/learning centers) in 2010 and 2011 under the Exclusive Service Agreement had been paid to the WFOE as of June 30, 2012.

e. Describe any barriers or restrictions to the rights or economics conveyed through the contractual arrangements.

As discussed above, the nominee agreements between the VIE and the three individual nominees are the only contractual arrangements between the VIE and school sponsors that are not the VIE itself. Under these nominee agreements, the nominees conveyed the entire sponsorship rights and interests and economic benefits in the schools established under the nominee agreements to the VIE. Please refer to its response to Prior Comment 1 for the details of the nominee agreements. There are no barriers or restrictions to the rights or economic returns conveyed by the nominees to the VIE under the nominee agreements.

15. Please describe any legal restrictions that prevent the VIE from receiving economics. We understand that the WFOE has service contracts with the schools/learning centers that are not subject to the “reasonable return” restrictions for sponsorship agreements. We also understand that the VIE has sponsorship agreements with the schools/learning centers that are subject to the “reasonable returns”. Tell us whether there are any other legal restrictions. In addition, address the following:

The Company wishes to clarify that as discussed in the Company’s response to comment 14(b) above, a private school does not have a “sponsorship agreement” and the

relationship between the VIE’s private schools and the VIE (or one of the VIE’s nominees or subsidiaries, as the case may be) as the sponsor is evidenced in the school’s articles of association and school permit issued by the education authorities, not by a sponsorship agreement.

The VIE (or one of its relevant nominees or wholly-owned subsidiaries, as the case may be), in the capacity of sole sponsor of the relevant school, may receive economics (in the broad sense of this term) from its schools in the following forms: (i) residual properties distributed upon such school’s liquidation; and (ii) economic returns from such school.

Distribution of Residual Properties

To date, there have been no relevant national laws or regulations addressing the distribution of residual properties upon termination and liquidation of a private school. As analyzed in the Company’s response to Prior Comment 15, the Company and its PRC counsel believe that the residual properties of a private school solely funded by private sponsors without any government or donated funds should be distributed to its sponsors. However, as a result of the lack of national laws and regulations in China on the distribution of residual properties upon termination and liquidation of a private school, the potential legal restrictions for the VIE to receive economics from its schools in this manner are unclear.

Economic Returns

Under the Law for Promoting Private Education and the PE Implementation Rules, the sponsor of a private school is subject to the following legal restrictions when receiving returns from their schools.

First, there remain uncertainties as to the sponsor’s right to economic returns in a private school. In the case of RRR schools, the Law for Promoting Private Education and the PE Implementation Rules provide that an RRR school may determine the percentage of the school’s net income that can be distributed as reasonable returns to its sponsor(s) after considering several factors (discussed below). However, none of the current PRC laws and regulations provides a formula for or clear guidelines on determining what constitutes reasonable returns. In the case of NRRR schools, none of the current PRC laws or regulations sets forth what rights a sponsor has to economic returns.

Second, the amount of economic returns (if any) to the sponsors are subject to the allocation of development funds. Each private school (regardless of its status as an RRR school or an NRRR school) is required to allocate at the end of each fiscal year a certain amount to its development fund for the construction or maintenance of the school or procurement or upgrade of educational equipment. In the case of an RRR school, this amount must be at least 25% of the annual net income of the school, if any, as determined in accordance with generally accepted accounting principles in the PRC. In the case of

an NRRR school, this amount must be at least 25% of the annual increase in the net assets of the school, if any, as determined in accordance with generally accepted accounting principles in the PRC.

Third, the amount of economic returns to the sponsor(s) of an RRR school is also subject to certain other considerations. When determining the percentage of the school’s annual net income that can be distributed as reasonable returns, an RRR school needs to take into consideration the following factors: (i) the school’s tuition and fees, (ii) the ratio of the school’s expenses used for educational activities and improvement of the educational conditions to the total tuition and fees collected; and (iii) the admission standards and educational quality. Certain information relating to the factors discussed above is required to be publicly disclosed before the school may determine the amount of reasonable returns for distribution. Such information and the decision to distribute reasonable returns are also required to be filed with the approval authorities within 15 days of the board’s decision.

The VIE or its relevant nominees or subsidiaries, in their roles as sponsors of the relevant schools, are subject to these restrictions. The Company notes that the above discussion has been included on page 15 (under the risk factor captioned “Our VIE and its subsidiaries may be subject to significant limitations on their ability to distribute economic returns of their private tutoring schools or otherwise be materially and adversely affected by changes in PRC laws and regulations”) and on pages 39 and 40 (under “Economic rights” and “Allocation of development funds”) of Proposed Amendment No. 1.

a. Please tell us what impact the “reasonable returns” restrictions for sponsorship agreements have on the accounting analysis.

As discussed in the Consolidation Analysis Memo attached as Annex I, the Company notes that all its private schools are appropriately consolidated in the Company’s consolidated financial statements. In reaching this conclusion, the Company considered and discussed “reasonable returns” in paragraphs 12, 13, 36, 37 and 53(c) of the Consolidation Analysis Memo attached as Annex I.

b. Please tell us what happens if the school is liquidated, and whether the VIE is legally or contractually restricted in the return it can receive. Explain to us the impact, if any, such a restriction has on the accounting analysis.

Distribution upon Termination/Liquidation

Regardless of whether an RRR school or an NRRR school, the Law for Promoting Private Education provides that upon termination and liquidation of a private school, its properties shall be distributed in the following order: (1) refunding tuition, incidental expenses and other fees received from students; (2) paying outstanding salaries of faculty and staff and outstanding social insurance, if any; and (3) repaying other debts; afterwards, the residual properties shall be

distributed in accordance with relevant laws and regulations. However, to date, there have been no relevant national laws or regulations addressing the distribution of residual properties upon termination and liquidation of a private school. As analyzed in the Company’s response to Prior Comment 15, the Company and its PRC counsel believe that the residual properties of a private school solely funded by private sponsors without any government or donated funds should be distributed to its sponsors.

Assuming that upon liquidation, a private school’s residual properties are indeed distributed to its sponsors as analyzed, the Company notes that such distribution of residual properties (i) would not be subject to any additional legal or contractual restrictions, and (ii) would not be deemed “returns” as such term is used in the context of an RRR school or subject to the requirements for “reasonable returns.”

Impact on Accounting Analysis

As discussed in the Consolidation Analysis Memo attached as Annex I, the Company notes that all its private schools are appropriately consolidated in the Company’s consolidated financial statements. In reaching this conclusion, the Company considered and discussed the liquidation of schools in paragraphs 15, 40 and 42 of the Consolidation Analysis Memo attached as Annex I.

Risk Factors, page 4

Restrictions on currency exchange may limit our ability to receive and use our..., page 24

16. We note your disclosure under this risk factor heading discussing restrictions on currency exchange limitations on your ability to use net income generated in RMB to fund any business activities we may have outside China in the future. In future filings, please revise this risk factor to include a reference to the new rules and restrictions, their purpose and impact on your ability to transfer funds.

The Staff’s comment is noted and the requested additional references and disclosure have been included on pages 22 and 23 (under the risk factor captioned “PRC regulation of loans and direct investment by offshore holding companies to PRC entities may delay or prevent us from using the proceeds we received from our initial public offering, which could materially and adversely affect our liquidity and our ability to fund and expand our business”) and 42 (in the subsection captioned “Regulation on Foreign Exchange”) of Proposed Amendment No. 1. The Company will also include the requested reference and discussion in its future filings.

* * * * * *

In responding to the Staff’s comments, the Company acknowledges that:

· the Company is responsible for the adequacy and accuracy of the disclosure in the filing;

· Staff comments or any changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filing; and

· the Company may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities law of the United States.

Should you have any question regarding this response letter or Proposed Amendment No. 1, please contact me by phone at (+852) 2514-7630 (office) or (+852) 9032-1314 (cell) or by email at lchen@stblaw.com or my colleague Kevin Zhang by phone at (+852) 2514-7610 (office) or (+852) 6396-8173 (cell) or by email at kzhang@stblaw.com.

|

|

Very truly yours, |

|

|

|

|

|

/s/ Leiming Chen |

|

|

Leiming Chen |

cc: Xin Jin, Chief Executive Director

Junfeng Gao, Chief Financial Officer

Xueda Education Group

Kevin Zhang

Simpson Thacher & Bartlett

Taylor Lam, Partner

Li Lin, Partner

Deloitte Touche Tohmatsu CPA Ltd.

ANNEX I

CONSOLIDATION ANALYSIS

I. INTRODUCTION

I-A Structure of operating entities

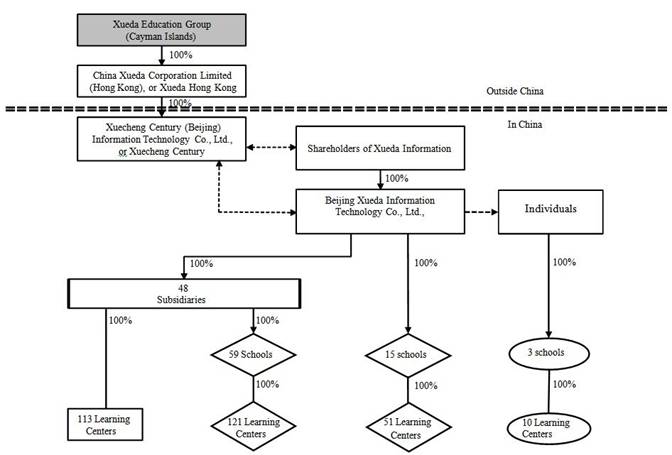

1. As disclosed in the Company’s 2011 Form 20-F, the Company, through Xuecheng Century (Beijing) Information Technology Co., Ltd. (“Xuecheng Century”), consolidates Beijing Xueda Information Technology Co., Ltd. ’s (“Xueda Information”) financial results of operations, assets and liabilities into the Company’s consolidated financial statements. As of December 31, 2011, Xueda Information had 48 subsidiaries and 77 private schools (including 295 learning centers established and operated by these subsidiaries and schools). These subsidiaries and private schools (including their learning centers) operate under the following structures (please refer to Annex A for a structure chart of the Company and its consolidated entities):

· 48 subsidiaries established and wholly owned by Xueda Information, of which:

· 36 subsidiaries directly established and operated 113 learning centers; and

· 32 subsidiaries sponsored and established 59 private schools which then established and operated 121 learning centers.

(Note: 20 of the 48 subsidiaries both (i) directly established and operated learning centers and (ii) sponsored and established private schools (which then established learning centers).)

· 15 private schools sponsored and established by Xueda Information — these private schools established and operated 51 learning centers; and

· 3 private schools established by three individuals on behalf of Xueda Information under nominee agreements between Xueda Information and these three individuals — these private schools established and operated 10 learning centers.

I-B Establishment of subsidiaries, schools and learning centers

2. The 48 subsidiaries were established by Xueda Information as limited liability companies under PRC Company Law. Xueda Information has registered each subsidiary with the relevant industry and commerce administration authorities of China and funded the registered capital of all these subsidiaries. Xueda Information owns 100% equity interest in each of these subsidiaries.

3. As disclosed on page 39 of Proposed Amendment No. 1, entities and individuals who establish private schools are commonly referred to as “sponsors” as opposed to “owners” or “shareholders.” Accordingly, a sponsor holds “sponsorship interest” in a

private school, as opposed to “equity interest” a shareholder holds in a company. Please refer to paragraphs 6 through 18 for a discussion of private school sponsors’ rights. To establish a private school, the sponsors shall submit an application form together with certain other required documents, including the proposed articles of association, a list of sponsors and evidence of teaching premises, to obtain (i) an education permit from the local education bureau, which is the primary regulatory authorization required for a school, and (ii) registration certificate from the local civil administration bureau, which can be obtained as a matter of formality. The sponsors are also required to make an upfront capital contribution to the private school. The sponsorship interest is evidenced by entering the sponsor’s name into the private school’s articles of association and education permit. The sponsors are not required to make any payment to any government authorities for sponsoring a private school. As discussed in the Company’s response to the first bullet point of Prior Comment 3 and shown on the organizational chart on page 47 of Proposed Amendment No. 1, the private schools of the Company are sponsored by (i) Xueda Information, (ii) one of Xueda Information’s wholly owned subsidiaries, or (iii) one of the individuals nominated by Xueda Information. As explained in greater detail below, Xueda Information is viewed as the owner of each of the private schools which Xueda Information sponsors directly or indirectly, i.e., through one of its wholly-owned subsidiaries.

4. The Company’s learning centers were established by (i) Xueda Information’s subsidiaries or (ii) one of the private schools. These learning centers are not separate legal entities, as defined in the Glossary of ASC 810-10-20; rather, they are merely physical operating locations and integral parts of the subsidiaries or private schools that established these learning centers. These learning centers are not independent legal persons or taxable entities under PRC laws and regulations. Accordingly students enter into service agreements with Xueda Information’s subsidiaries or private schools, not with these learning centers. For the above reasons, there is no distinction between learning centers established and operated by Xueda Information’s wholly owned subsidiaries and those established and operated by the private schools. The financial results of operations, assets and liabilities of a learning center belong to the subsidiary or private school that established such learning center.

I-C Agreements entered into amongst the various legal entities within the Company’s structure

5. As discussed in the Company’s response to Prior Comment 1, the following agreements involve Xuecheng Century, Xueda Information, Xueda Information’s shareholders, Xueda Information’s subsidiaries, certain schools and certain school sponsors:

a. As disclosed in detail on pages 48 through 50 of Proposed Amendment No.1, Xuecheng Century and Xueda Information or Xueda Information’s shareholders entered into the Exclusive Service Agreement, the Pledge Agreement, the Exclusive Purchase Right Contract and the Powers of Attorney. As a result of these

contractual arrangements, Xuecheng Century has the power to control Xueda Information and the right to receive benefit from Xueda Information, and therefore has appropriately consolidated Xueda Information.

b. As discussed in the Company’s response to Prior Comment 1, the Exclusive Service Agreement is between Xuecheng Century and Xueda Information. Even though there are no separate contractual arrangements that directly connect Xueda Information’s private schools and subsidiaries with Xuecheng Century, these private schools and subsidiaries are deemed parties to the Exclusive Service Agreement as analyzed below. As discussed in paragraphs 9 through 11, Xueda Information has control, through its rights as the sponsor, over the schools it sponsors directly and indirectly (i.e., through its wholly owned subsidiaries or Nominee Holders — as defined below). In addition, as discussed in paragraph 20, Xueda Information has control over its wholly owned subsidiaries. Furthermore, as discussed in the Company’s response to Prior Comments 33 and 34, Xuecheng Century has control over Xueda Information. Given such “chain of command,” the Exclusive Services Agreement is in substance between Xuecheng Century and each of Xueda Information’s private school or wholly-owned subsidiary by extension through Xueda Information. The private schools and wholly owned subsidiaries would not be able to negotiate pricing for the services or obtain services from another vendor without ultimately obtaining Xuecheng Century’s approval. In practice, Xuecheng Century directly provides services and charges the private schools and wholly owned subsidiaries (rather than charging Xueda Information) services fees for services provided to them under the Exclusive Service Agreement.

c. As discussed in the Company’s response to Prior Comment 1, Xuecheng Century entered into ten service agreements with six wholly-owned subsidiaries and four private schools of Xueda Information located in four different cities, under which Xuecheng Century agreed to grant a license for the use of certain computer software and to provide technological support services for 20% of annual net revenue of the subsidiaries or schools. The fees are subject to adjustments agreed by both parties. The agreements’ initial terms are five years and can be renewed based on mutual agreement. To clarify, as discussed in paragraph 5(b), the Exclusive Service Agreement entered into between Xuecheng Century and Xueda Information effectively covers all of Xueda Information’s wholly owned subsidiaries and private schools including the aforementioned six wholly owned subsidiaries and four private schools, and in practice, Xuecheng Century directly charges the subsidiaries and private schools services fees for services provided to them under the Exclusive Service Agreement. Xuecheng Century does not provide any services that are not within the scope of the services to be provided by it under the Exclusive Service Agreement. These additional ten service agreements were requested by the local tax authorities in the cities where the subsidiaries or schools are located for the sole purpose of establishing a contract that directly connects Xuecheng Century with each of these subsidiaries and schools, so as to support the service fees recorded and paid by these subsidiaries and schools to Xuecheng

Century for income tax assessment purposes. The Company does not view these service agreements as evidence of any additional business activities beyond the services provided by Xuecheng Century to Xueda Information and its subsidiaries and private schools under the Exclusive Service Agreement.

d. As discussed in the Company’s response to Prior Comments 1 and 14 and on pages 47 and 48 of Proposed Amendment No. 1, because of certain policies maintained by certain district-level education authorities in three cities which require that the sponsor of a private school be an individual (not an entity) or be a local individual resident, three private schools (which established and operated 10 learning centers) are held by Rubin Li, chairman of the Company’s board of directors, Xin Jin, the Company’s chief executive officer, and another individual who is a manager of one of Xueda Information’s wholly owned subsidiaries (collectively referred to as the “Nominee Holders”), respectively, on behalf of Xueda Information under three nominee agreements. These three schools were established with the initial capital provided by Xueda Information in the form of loans made by Xueda Information to the Nominee Holders which are not required to be repaid. Each of the nominee agreements provides that (i) Xueda Information is the sole beneficiary of the sponsorship interest and any other rights and interests derived from the sponsorship interest, including the rights to the private school’s economic returns and residual properties upon termination and dissolution; (ii) the Nominee Holders will exercise all rights relating to the sponsorship interest at the instruction of Xueda Information and may not take any action without the Xueda Information’s express instruction and consent; (iii) the Nominee Holders will transfer the sponsorship interest of the private school they hold to Xueda Information immediately upon the Xueda Information’s request; and (iv) the nominee agreement will terminate after the Nominee Holders fully transfer the sponsorship interest in the private schools to Xueda Information and complete the approval and registration procedure for such transfer.

I-D Ownership and restriction on distribution of school assets to the sponsor of a school 1

6. As analyzed below, the Company and its PRC counsel believe that under current PRC law, the “sponsorship interest” that a sponsor holds in a private school is, for all practical purpose, substantially equivalent to the “equity interest” a shareholder holds in a company.

1 Note that this applies to both schools that require reasonable returns (“RRR schools”) and schools that do not require reasonable returns (“NRRR schools”) unless otherwise stated. All the Company’s private schools had applied for the status of an RRR school. However, in certain districts or cities, whether to grant the status of an RRR school is at the discretion of the local education authorities. As disclosed on page 48 of Proposed Amendment No. 1, two schools that were not granted an RRR school status are the only two NRRR schools, which operate severn learning centers and contributed an aggregate of 3.4% of the Company’s consolidated net revenues in 2011. A private school has the right to amend the school’s articles of association to change itself from an NRRR school to an RRR school, or vice versa. A change of a school’s articles of association requires the approval of the local education authorities, which approval, for most of locations in China, is perfunctory in nature because there are no limitations or restrictions for a school to elect to be an NRRR or an RRR school.

7. Under Article 71 of the General Principles of the Civil Law, “property ownership” means the owner’s rights to lawfully possess, utilize, profit from and dispose of the property. Based on this definition, the Company believes that the sponsorship interest in a private school is substantially equivalent to equity interest that a shareholder holds in a company, because a sponsor has the rights to lawfully (1) possess, (2) utilize, (3) profit from, and (4) dispose of the sponsorship interest in the private school as discussed below.

“Possession”

8. The Company and its PRC counsel believe that a sponsor “possesses” the sponsorship interest in a private school in the same way as a shareholder of a PRC company “possesses” equity interest in the company. A shareholder’s “possession” of equity interest in a PRC company is evidenced by the company’s articles of association and corporate records filed with the relevant government authorities, as provided by Articles 25 and 33 of the PRC Company Law. Similarly, a sponsor’s “possession” of sponsorship interest in a private school is evidenced by the schools’ articles of association and education permit, pursuant to Article 14 of the Implementation Rules for Promoting Private Education.

“Utilization”

9. A sponsor’s right to “utilize” its sponsorship interest in a private school is supported by PRC laws and regulations that provide the sponsor with the rights to exercise ultimate control over the private school by becoming the member of and controlling the composition of the school’s decision-making body.

10. Under Article 9 of the Implementation Rules for Promoting Private Education, a private school’s sponsor has the statutory right to appoint the initial director(s) of the school, subject only to the requirement under Article 20 of the Law for Promoting Private Education, which provides that the board of a school should consist of the sponsor or its representative(s), the school principal and school employee representative(s). In addition, Article 12 and 14 of the Law for Promoting Private Education and Article 9 of the Implementation Rules for Promoting Private Education provide the sponsor with the power to prepare the applicable documents for the establishment of the private school and formulate the school’s initial articles of association in which the procedures governing subsequent changes to the board of directors of the school are stipulated. Furthermore, Article 21 of the Law for Promoting Private Education and Articles 20 and 21 of the Implementation Rules for Promoting Private Education stipulate that a private school’s board of directors is responsible for making major decisions that affect the school.

11. By controlling a private school’s board of directors as discussed above, the sponsor possesses ultimate control over decisions concerning the private school’s operations, which, according to Article 21 of the Law for Promoting Private Education, include

appointment and dismissal of the school principal, formulation of rules and regulations of the school, adoption of development plans and approval of annual work plans, raising funds for school operations and adoption of budgets and final financial statements, making decisions on the number and compensation of the employees, and making decisions on the division, merger or termination of the school.

“Profiting from”

12. Under Article 51 of the Law for Promoting Private Education, investors of an RRR school may choose to receive “reasonable returns” after the allocation of no less than 25% of the school’s annual net profit to its development fund as well as the allocation for mandatory expenses as required by applicable laws and regulations. The decision-making body of the school has the power to determine the amount to be distributed to its sponsors as reasonable returns. However, none of the current PRC laws and regulations provides a formula or guidelines for determining “reasonable returns.” In the case of NRRR schools, none of the current PRC laws or regulations sets forth what rights a sponsor has to economic returns. However, the Company believes that the absence of such rights a sponsor has to economic rights does not prevent the sponsor from profiting from the schools as analyzed in paragraph 13.