Table of Contents

As filed with the Securities and Exchange Commission on September 23, 2013

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Adecoagro S.A.

(Exact name of registrant as specified in its charter)

| Grand Duchy of Luxembourg | Not Applicable | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

Adecoagro S.A.

Société anonyme

13-15 Avenue de la Liberté

L-1931 Luxembourg

R.C.S. Luxembourg B 153 681

+352 2689-8213

(Address and telephone number of registrant’s principal executive offices)

Corporation Service Company

1180 Avenue of the Americas, Suite 210

New York, NY 10036

(800) 927-9801

(Name, address and telephone number of agent for service)

Copies to:

Frank Vivero, Esq.

Haynes and Boone, LLP

30 Rockefeller Plaza

26th Floor

New York, NY 10112

(212) 659-4970

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Securities and Exchange Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of each class of securities to be registered |

Amount to be |

Proposed maximum aggregate offering price per share(2) |

Proposed maximum offering price(2) |

Amount of registration fee | ||||

| Common shares, par value $1.50 per share |

55,821,281 | $7.26 | $405,262,500 | $55,278 | ||||

|

| ||||||||

|

| ||||||||

| (1) | The registration statement also includes an indeterminate number of the Registrant’s common shares that may become offered, issuable or sold to prevent dilution resulting from stock splits, stock dividends and similar transactions, which shall be deemed to be included pursuant to Rule 416 under the Securities Act of 1933, as amended. |

| (2) | Estimated solely for the purpose of computing the amount of the registration fee in accordance with Rule 457(c) under the Securities Act of 1933, on the basis of the average of the high and the low prices ($7.13 and $7.38, respectively) of the Registrant’s common shares as quoted on the New York Stock Exchange on September 16, 2013. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PROSPECTUS (subject to completion)

Issued September 23, 2013

Adecoagro S.A.

55,821,281 COMMON SHARES

Offered by Selling Shareholders

This prospectus relates to up to 55,821,281 common shares that the selling shareholders to be named in a prospectus supplement may offer from time to time.

The selling shareholders may sell all or a portion of our common shares beneficially owned by them in one or more offerings from time to time underwritten and/or managed by an investment banking firm or broker-dealer in open market transactions, privately negotiated transactions, ordinary brokerage transactions or any other method permitted by applicable law, at market prices prevailing at the time of sale, prices related to prevailing market prices or privately negotiated prices.

In the prospectus supplement relating to any sales by the selling shareholders, we will, among other things, set forth the number of shares that such shareholders will be selling.

We will not receive any of the proceeds from the sale by the selling shareholders of the common shares offered by this prospectus.

Our common shares are listed on the New York Stock Exchange under the symbol “AGRO.” On September 20, 2013, the closing price of our common stock on the New York Stock Exchange was $7.44.

Investing in our common shares involves risks. See “Risk Factors” beginning on page 9.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

, 2013

Table of Contents

i

Table of Contents

This prospectus is part of a registration statement that we have filed with the Securities and Exchange Commission, or the Commission, using a “shelf” registration process. Under this shelf registration process, the selling shareholders may, from time to time, offer and sell up to 55,821,281 common shares. This prospectus provides you with a general description of the securities the selling shareholders may offer. Each time the selling shareholders offer the securities described in this prospectus, we will provide a prospectus supplement, or information that is incorporated by reference into this prospectus, identifying the selling shareholders and containing more specific information about the terms of the offering. We may also authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings. We may also add, update or change in the prospectus supplement any of the information contained in this prospectus or in the documents that we have incorporated by reference into this prospectus, including without limitation, a discussion of any risk factors or other special considerations that apply to these offerings or securities or the specific plan of distribution. If there is any inconsistency between the information in this prospectus and a prospectus supplement or information incorporated by reference having a later date, you should rely on the information in that prospectus supplement or incorporated information having a later date. We urge you to read carefully this prospectus, any applicable prospectus supplement and any related free writing prospectus, together with the information incorporated herein by reference as described under the heading “Where You Can Find More Information; Incorporation of Certain Information by Reference,” before buying any of the securities being offered.

We have not authorized anyone to provide any information other than that contained or incorporated by reference in this prospectus or any prospectus supplement or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are not making an offer in any state or jurisdiction or under any circumstances where the offer is not permitted. You should assume that the information in this prospectus or any prospectus supplement or amendment prepared by us is accurate only as of the date on their cover pages and that any information we have incorporated by reference is accurate only as of the date of the document incorporated by reference.

In this prospectus, unless otherwise specified or if the context so requires:

| • | References to the terms “Adecoagro S.A.,” “Adecoagro,” “we,” “us,” “our,” “our company” and “the company” refer to the registrant, Adecoagro S.A., a corporation organized under the form of a société anonyme under the laws of the Grand Duchy of Luxembourg, and its subsidiaries. |

| • | References to “IFH” and “IFH LP” mean International Farmland Holdings, LP, a limited partnership organized under the laws of Delaware, and its subsidiaries. |

| • | References to “Adecoagro LP” mean Adecoagro, LP, a limited partnership organized under the laws of Delaware, and its subsidiaries. |

| • | References to “$,” “$,” “U.S. dollars,” “dollars” and “USD” are to U.S. dollars. |

| • | References to “Argentine Pesos,” “Pesos,” “Ps.” or “ARS” are to Argentine Pesos, the official currency of Argentina. |

| • | References to “Brazilian Real,” “Real,” “Reais” or “R$” are to the Brazilian Real, the official currency of Brazil. |

| • | Unless stated otherwise, references to “sales” are to the combined sales of manufactured products and services rendered plus sales of agricultural produce and biological assets. |

1

Table of Contents

WHERE YOU CAN FIND MORE INFORMATION;

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

We file annual and special reports and other information with the Commission (File Number 001-35052). These filings contain important information which does not appear in this prospectus. For further information about us, you may read and copy these filings at the Commission’s public reference room at 100 F Street, N.E, Washington, D.C. 20549. You may obtain information on the operation of the public reference room by calling the SEC at 1-800-SEC-0330. The Commission also maintains an internet site that contains reports, information statements, and other information regarding issuers that file electronically with the Commission, which you may access at http://www.sec.gov.

The Commission allows us to “incorporate by reference” information into this prospectus, which means that we can disclose important information to you by referring you to other documents which we have filed or will file with the Commission. We are incorporating by reference in this prospectus the documents listed below and all amendments or supplements we may file to such documents, as well as any future filings we may make with the Commission on Form 20-F under the Exchange Act after the date of the initial registration statement and prior to the effectiveness of the registration statement, and after the date of this prospectus and prior to the time that all of the securities offered by this prospectus have been sold or de-registered.

| • | Our Annual Report on Form 20-F for the fiscal year ended December 31, 2012, filed with the Commission on April 29, 2013 (“Annual Report on Form 20-F”); |

| • | The report on Form 6-K containing our unaudited condensed consolidated interim financial statements as of June 30, 2013 and for the six-months ended June 30, 2013 and 2012 furnished to the Commission on August 14, 2013 (the “Unaudited Interim Consolidated Financial Statements”); |

| • | The report on Form 6-K containing our audited consolidated financial statements as of December 31, 2012 and 2011 and for the years ended December 31, 2012, 2011 and 2010 (the “Audited Annual Consolidated Financial Statements”) filed with the Commission on September 6, 2013; and |

| • | The description of our common shares contained in our Registration Statement on Form 8-A (File No. 001-35052) filed with the Commission pursuant to Section 12(g) of the Securities Exchange Act of 1934, as amended, on January 24, 2011. |

In addition, we may incorporate by reference into this prospectus our reports on Form 6-K filed after the date of this prospectus (and before the time that all of the securities offered by this prospectus have been sold or de-registered) if we specifically identify in the report that it is being incorporated by reference in this prospectus.

Certain statements in and portions of this prospectus update and replace information in the above listed documents incorporated by reference. Likewise, statements in or portions of a future document incorporated by reference in this prospectus may update and replace statements in and portions of this prospectus or the above listed documents.

We will provide you without charge, upon your written or oral request, a copy of any of the documents incorporated by reference in this prospectus, other than exhibits to such documents that are not specifically incorporated by reference into such documents. Please direct your written or telephone requests to 13-15 Avenue de la Liberté, L-1931, Luxembourg, Grand Duchy of Luxembourg, Attn: General Counsel; telephone number (+352) 2689-8213. You may also obtain information about us by visiting our website at www.adecoagro.com. The reference to our website is intended to be an inactive textual reference and the contents of our website are not intended to be incorporated into this prospectus.

We are a société anonyme under the laws of the Grand Duchy of Luxembourg and are a “foreign private issuer” as defined in Rule 3b-4 under the Securities Exchange Act of 1934, or Exchange Act. As a result, our proxy solicitations are not subject to the disclosure and procedural requirements of Regulation 14A under the Exchange Act, transactions in our equity securities by our officers, directors and principal shareholders are exempt from Section 16 of the Exchange Act; and we are not required under the Exchange Act to file periodic reports and financial statements as frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act.

2

Table of Contents

NOTICE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated in it by reference, including our Annual Report on Form 20-F, contain forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995, that involve risks and uncertainties. These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements.

In some cases, you can identify forward-looking statements by terms such as “may,” “might,” “should,” “could,” “would,” “expect,” “plan,” “believe,” “intend,” “anticipate,” “estimate,” “predict,” “potential,” “project,” “outlook,” “target,” “estimate,” “assume,” as well as variations of these terms, and similar expressions intended to identify forward-looking statements. These statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. The forward-looking statements included in this prospectus and the documents incorporated in it by reference relate to, among others:

| • | our business prospects and future results of operations; |

| • | weather and other natural phenomena; |

| • | developments in, or changes to the laws, regulations and governmental policies governing our business, including limitations on ownership of farmland by foreign entities in certain jurisdiction in which we operate, environmental laws and regulations; |

| • | the implementation of our business strategy, including our development of the Ivinhema mill and other current projects; |

| • | our plans relating to acquisitions, joint ventures, strategic alliances or divestitures; |

| • | the implementation of our financing strategy and capital expenditure plan; |

| • | the maintenance of our relationships with customers; |

| • | the competitive nature of the industries in which we operate; |

| • | the cost and availability of financing; |

| • | future demand for the commodities we produce; |

| • | international prices for commodities; |

| • | the condition of our land holdings; |

| • | the development of the logistics and infrastructure for transportation of our products in the countries where we operate; |

| • | the performance of the South American and world economies; |

| • | the relative value of the Brazilian Real, the Argentine Peso, and the Uruguayan Peso compared to other currencies; and |

| • | the factors discussed under the “Risk Factors” in this prospectus and the documents incorporated by reference. |

Given these uncertainties, you should be cautioned that these statements may, and often do, vary from actual results. Therefore, you should not place undue reliance on these forward-looking statements. There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from those expressed or implied by the forward-looking statements. In particular, you should consider the risks listed under the caption “Risk Factors” of this prospectus and in Item 3 of our Annual Report on Form 20-F, which is incorporated herein by reference.

3

Table of Contents

Although we believe that our expectations expressed in these forward-looking statements are reasonable, our expectations may turn out to be incorrect. Our actual results could be materially different from our expectations. In light of the risks and uncertainties described above, the estimates and forward-looking statements discussed in this prospectus and the documents incorporated in it by reference might not occur, and our future results and our performance may differ materially from those expressed in these forward-looking statements due to, inclusive, but not limited to, the factors mentioned above. Because of these uncertainties, you should not make any investment decision based on these estimates and forward-looking statements. We undertake no obligation to update any of the forward-looking statements after the date of the prospectus to conform those statements to reflect the occurrence of unanticipated events, except as required by applicable law.

4

Table of Contents

You should read the following summary together with the more detailed information about us, the common shares that may be sold from time to time, and our financial statements and the notes to them, all of which appear elsewhere in this prospectus or in the documents incorporated by reference in this prospectus.

About Adecoagro S.A.

We are a leading agricultural company in South America, with operations in Argentina, Brazil and Uruguay. We are currently involved in a broad range of businesses, including farming crops and other agricultural products, cattle and dairy operations, sugar, ethanol and energy production and land transformation. Our sustainable business model is focused on (i) a low-cost production model that leverages growing or producing each of our agricultural products in regions where we believe we have competitive advantages, (ii) reducing the volatility of our returns through product and geographic diversification and use of advanced technology, (iii) benefiting from vertical integration in key segments of the agro-industrial chain, (iv) acquiring and transforming land to improve its productivity and realizing land appreciation through strategic dispositions, and (v) promoting sustainable agricultural production and development.

As of June 30, 2013, we owned a total of 278,336 hectares, comprised of 23 farms in Argentina, 11 farms in Brazil and one farm in Uruguay. In addition we own and operate several agro-industrial production facilities including three sugar and ethanol mills in Brazil with a sugarcane crushing capacity of 7.2 million tons, four rice processing facilities in Argentina, a dairy operation with approximately 7,500 milking cows in Argentina, and 12 grain and rice conditioning and storage plants in Argentina.

We believe that we are:

Ÿ one of the largest owners of productive farmland in South America, with more than 225,427 owned hectares as of June 30, 2013 used in productive activities (excluding 52,907 hectares of legal land reserves pursuant to local regulations and other land reserves) located in Argentina, Brazil and Uruguay, producing a wide range of agricultural products. Our productive farmland is composed of 136,181 hectares suitable to grow crops and rice, 9,145 hectares suitable to grow sugarcane, 67,794 hectares suitable for raising beef cattle which are mostly leased to a third party beef processor and 12,308 hectares of potentially croppable land which is being evaluated for transformation.

Ÿ a leading producer of agricultural commodities in South America. During the 2011/2012 harvest year, we harvested 199,418 hectares (including 55,754 leased hectares and 48,286 second crop hectares) and produced 564,800 tons of grains, including soybeans, corn, wheat, sunflower and cotton. During the 2012/2013 harvest year we planted 181,629 hectares, out of which 166,523 had been harvested as of June 30, 2013, producing a total of 426,833 tons of grains.

Ÿ one of the largest producers of rough (unprocessed) rice in the world. During the 2012/2013 harvest year we harvested 35,249 hectares and produced 200,367 tons of rice, which accounted for 15% of the total Argentine production according to the Asociacion Correntina de Plantadores de Arroz (Corrientes Rice Planters Association). We are also a large processor and exporter of white rice in Argentina, accounting for 18% of total white rice production capacity in Argentina and 21% of total Argentine white rice exports during 2012, according to the Camara de Industriales Arroceros de Entre Rios (Entre Rios Rice Industrial Chamber) and the Federacion de Entidades Arroceras (Entities Rice Federation), respectively.

Ÿ a leading dairy producer in South America in terms of our cutting-edge technology, productivity per cow and grain conversion efficiencies, producing over 55.0 million liters of raw milk during 2012.

Ÿ a growing producer of sugar, ethanol and energy in Brazil, where we are in the process of building what we believe will be one of the most cost-efficient sugarcane crushing clusters in Brazil. We currently own three mills with a total nominal sugarcane crushing capacity of 7.2 million tons per year, including: (i) Usina Monte Alegre,

5

Table of Contents

located in Minas Gerais, with a total crushing capacity of 1.2 million tons per year, (ii) Angelica, located in Mato Grosso do Sul, with a total crushing capacity of 4.0 million, and (iii) Ivinhema, located in Mato Grosso do Sul, with a current crushing capacity of 2.0 million tons. Our operation is highly integrated, meaning that over 96% of the sugarcane crushed at our mills is supplied from our own plantations. As of June 30, 2013, our sugarcane plantation consisted of 94,214 hectares.

Ÿ we are currently in the process of expanding the capacity of the Ivinhema mill. The mill is expected to reach 4.0 million tons of sugarcane crushing capacity by 2015 and 6.0 million tons by 2017. Once the construction of Ivinhema is completed, when combined with the Angelica mill, will form a cluster of 10.0 million tons of crushing capacity, which we believe will allow us to become one of the lowest-cost producers of sugar, ethanol and energy from sugarcane in Brazil. By 2017, our aggregate sugarcane crushing capacity is expected to reach 11.2 million tons per year;

Ÿ each of our mills is equipped with state-of-the-art technology, including full cogeneration capacity (the generation of electricity from sugarcane bagasse, the fiber that remains after the sugarcane is crushed), high flexibility to adjust production between sugar and ethanol, ability to transform by-products and effluents into bio-fertilizers which are applied to our sugarcane plantation, and mechanized agricultural operations, among others;

Ÿ one of the leading companies in South America involved in the acquisition and transformation of undermanaged land to more productive uses, generating higher cash yields. During the last seven fiscal years, we have consistently sold a portion of our fully mature farms every year. As of June 30, 2013, we have sold 13 farms generating capital gains of over $138 million.

Corporate Information

Adecoagro S.A. is a Luxembourg société anonyme (a public company limited by shares). The Company’s legal name is “Adecoagro S.A.” Adecoagro S.A. was incorporated on June 11, 2010.

Adecoagro S.A. is registered with the Luxembourg Registry of Trade and Companies under number B153681. Adecoagro S.A. has its registered office at 13-15 Avenue de la Liberté, L-1931, Luxembourg, Grand Duchy of Luxembourg. Our telephone number is (+352) 2689-8213

Recent Developments

Sale of Santa Regina

On December 27, 2012, we completed the sale and lease back of 51% of the “Santa Regina” farm, located in General Villegas, province of Buenos Aires, Argentina. Under the terms of the agreement, Adecoagro sold 51% of the outstanding shares of Santa Regina S.A., a company whose main asset is the Santa Regina farm, for a total consideration of $13.0 million (equivalent to $7,058 per hectare and 11% above Cushman & Wakefield’s independent appraisal dated September 2012), and granted an option to the buyer to acquire on or before June 2014 the remaining 49% interest for $13.1 million). On June 14, 2013, the buyer exercised its option to acquire the remaining 49% interest and we received $13.1 million in total consideration in the transaction (equivalent to $7,370 per hectare, 16% above Cushman & Wakefield’s independent appraisal dated September 2012).

Santa Regina is a 3,618 hectare farm that was purchased by Adecoagro in 2002 for a total of $2.3 million, or $625 per hectare. The farm has 3,200 hectares of croppable land that have been transformed and are currently used to produce corn, soybean and wheat. During the last ten years, we have operated Santa Regina under a sustainable production model focused on no-till farming, crop rotation, balanced fertilization and other best practices, which have enhanced productivity and soil quality. Considering the purchase price, transformation capital expenditures, operating cash flows and exit price, this investment generated an internal rate of return of 34.2%. The book value of Santa Regina in our balance sheet was $3.1 million. In connection with the sale of Santa Regina (i) we recorded a $9.3 million gain in the fourth quarter of 2012 corresponding to the sale of 51% stake of Santa Regina S.A., and (ii) we recorded a $1.2 million gain in the second quarter of 2013.

6

Table of Contents

Sale of Mimoso and Lagoa de Oeste farms and Coffee assets

During May 2013, Adecoagro entered into an agreement to sell the Mimoso farm and Lagoa do Oeste farm located in Luis Eduardo Magalhaes, Bahia, Brazil. The farms have a total area of 3,834 hectares of which 904 hectares are planted with coffee trees. In addition, we entered into an agreement whereby the buyer will operate and make use of 728 hectares of existing coffee trees in our Rio de Janeiro farm during an 8-year period. The total consideration of this operation was $24 million, of which $4.0 million were collected as of June 30, 2013 and the balance in three annual installments. Pursuant to the terms of the agreement, we will retain property to these coffee trees, which will still have an estimate useful life of 10 years upon the expiration of the agreement.

Sale of La Lacteo

On June 6, 2013, we acquired the remaining 50% interest in our dairy joint venture La Lacteo S.A. (“La Lacteo”) for a nominal consideration, and collected $5.1 million associated with the acquisition and the termination of the joint venture. On July 31, 2013, we sold our 100% interest in La Lacteo for nominal consideration. In addition, the Milk Supply Offer Agreement between La Lacteo and Adeco Agropecuaria S.A. was terminated without penalties and amounts payable by La Lacteo to Adeco Agropecuraria S.A. under the Milk Supply Offer Agreement were refinanced under a separate agreement.

We have accounted for the disposition of our interest in La Lacteo S.A. as discontinued operations. The net effects of the above-described transactions resulted in a gain of $ 2.9 million, recorded in the statement of income within “Profit of the period from discontinued operations.”(See note 28) to our Unaudited Interim Financial Statements).

Sale of San Martin Farm

On September 13, 2013, we entered into a sale agreement, pursuant to which we agreed to sell the San Martin farm for a total price of $8.0 million, equivalent to $2,294 per hectare, representing a 15% premium over the Cushman & Wakefield independent appraisal dated September 30, 2012. San Martin is a 3,502 hectare farm located in the province of Corrientes, Argentina. The farm is used for cattle grazing activities and is a subdivision of the Ita Caabo farm acquired by Adecoagro in 2007. This transaction will generate approximately $6.5 million of operating profit in the third quarter of 2013.

Share Repurchase Program

On September 12, 2013, our Board of Directors authorized a share repurchase program for up to 5% of our outstanding shares. We expect the repurchase program to commence on or about September 24, 2013 and will be reviewed by the Board of Directors after a 12-month period.

Repurchases of shares under the program will be made from time to time in open market transactions in compliance with the trading conditions of Rule l0b-18 under the U.S. Securities Exchange Act of 1934, as amended, and applicable rules and regulations. The share repurchase program does not require Adecoagro to acquire any specific number or amount of shares and may be modified, suspended, reinstated or terminated at any time in the Company’s discretion and without prior notice. The size and the timing of repurchases will depend upon market conditions, applicable legal requirements and other factors.

7

Table of Contents

The Offering

| Common shares offered by the selling shareholders: | 55,821,281 common shares. | |

| New York Stock Exchange Symbol: | “AGRO” | |

| Use of proceeds: | We will not receive any proceeds from the sale of the common shares offered by the selling shareholders. | |

| Common shares outstanding before and after the offering: | 122,381,390 common shares. | |

| Risk factors: | Before deciding to invest in our common shares, you should carefully consider the risks related to our business, the offering and our common shares. See “Risk Factors” beginning on page 9 of this prospectus. | |

The number of outstanding common shares is based on the common shares outstanding as of June 30, 2013, and excludes:

Ÿ 4,078,996 common shares issuable upon the exercise of outstanding share options under our existing Stock Option plans exercisable at a weighted average exercise price of $9.78 per share; and

Ÿ 686,599 common shares issuable pursuant to the Restricted Unit Plan subject to vesting restrictions.

8

Table of Contents

Investing in our common shares involves a high degree of risk. Before making an investment decision, you should carefully consider the information contained in this prospectus or in any applicable prospectus supplement and incorporated by reference herein as well as the risks described below, as well as in our consolidated financial statements and accompanying notes. Our business activities, cash flow, financial condition and results of operations could be materially and adversely affected by any of these risks. The market price of our common shares may decrease due to any of these risks or other factors, and you may lose all or part of your investment. The risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business operations.

Risks Related to Our Business

Unpredictable weather conditions, pest infestations and diseases may have an adverse impact on agricultural production and may reduce the volume and sucrose content of sugarcane that we can cultivate and purchase in a given harvest.

The occurrence of severe adverse weather conditions, especially droughts, hail, floods or frost or diseases are unpredictable and may have a potentially devastating impact on agricultural production and may otherwise adversely affect the supply and price of the agricultural commodities that we sell and use in our business. Adverse weather conditions may be exacerbated by the effects of climate change. The effects of severe adverse weather conditions may reduce yields of our agricultural activities. Additionally, higher than average temperatures and rainfall can contribute to an increased presence of insects. Commencing during the middle of 2008 and lasting until the middle of 2009, the areas in which we operate suffered one of the worst droughts of the last 50 to 70 years, which resulted in a reduction of approximately 15% to 40% of our agricultural production per hectare, depending on the affected commodity, compared with our historical averages.

We experienced drought conditions during the last months of 2011 affecting some of our farms in Argentina and Uruguay. As a result, for the year 2012, actual yields were lower than originally expected and generated a negative impact of $ 27.3 million in our Profit from Operations Before Financing and Taxation for 2012.

The occurrence and effects of disease and plagues can be unpredictable and devastating to agricultural products, potentially rendering all or a substantial portion of the affected harvests unsuitable for sale. Our agricultural products are also susceptible to fungus and bacteria that are associated with excessively moist conditions. Even when only a portion of the production is damaged, our results of operations could be adversely affected because all or a substantial portion of the production costs have been incurred. Although some diseases are treatable, the cost of treatment is high, and we cannot assure you that such events in the future will not adversely affect our operating results and financial condition. Furthermore, if we fail to control a given plague or disease and our production is threatened, we may be unable to supply our main customers, which could affect our results of operations and financial condition.

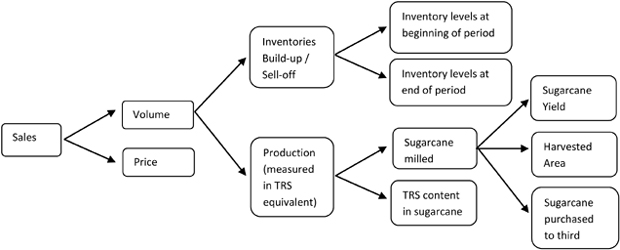

Our sugar production depends on the volume and sucrose content of the sugarcane that we cultivate or that is supplied to us by growers located in the vicinity of our mills. Both sugarcane yields and sucrose content depend primarily on weather conditions such as rainfall and temperature, which vary. Weather conditions have historically caused volatility in the ethanol and sugar industries. Future weather patterns may reduce the amount of sugarcane that we can harvest or purchase, or the sucrose content in such sugarcane, and, consequently, the amount of sugar we can recover in any given harvest. Any reduction in the volume of sugar recovered could have a material adverse effect on our operating results and financial condition.

As a result, we cannot assure you that future severe adverse weather conditions or pest infestations will not adversely affect our operating results and financial condition.

Fluctuation in market prices for our products could adversely affect our financial condition and results of operations.

Prices for agricultural products and by-products, including, among others, sugar, ethanol, and grains, like those of other commodities, have historically been cyclical and sensitive to domestic and international changes in supply and demand and can be expected to fluctuate significantly. In addition, the agricultural products and by-

9

Table of Contents

products we produce are traded on commodities and futures exchanges and thus are subject to speculative trading, which may adversely affect us. The prices that we are able to obtain for our agricultural products and by-products depend on many factors beyond our control including:

| • | prevailing world commodity prices, which historically have been subject to significant fluctuations over relatively short periods of time, depending on worldwide demand and supply; |

| • | changes in the agricultural subsidy levels of certain important producers (mainly the U.S. and the European Union (“E.U.”) and the adoption of other government policies affecting industry market conditions and prices; |

| • | changes to trade barriers of certain important consumer markets (including China, India, the U.S. and the E.U.) and the adoption of other governmental policies affecting industry market conditions and prices; |

| • | changes in government policies for biofuels; |

| • | world inventory levels, i.e., the supply of commodities carried over from year to year; |

| • | climatic conditions and natural disasters in areas where agricultural products are cultivated; |

| • | the production capacity of our competitors; and |

| • | demand for and supply of competing commodities and substitutes. |

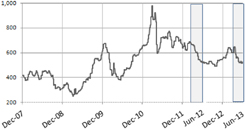

For example, we reported a loss of $23 million for 2012 compared to a gain of $31.9 million for 2011 for our sugarcane business segment in the line item “Initial recognition and Changes in Fair Value of Biological Assets and Agricultural produce.” This loss was generated mainly by a decrease in price estimates used in the discounted cash flow (“DCF”) model to determine the fair value of our sugarcane plantations. In the DCF model, the price of future harvested sugarcane is calculated based on estimates of sugar price derived from the No. 11 futures contract (“NY11”) quoted on the ICE-NY. Sugar price estimates decreased due to lower sugar market prices. See “Item 5. Operating and Financial Review and Prospects—A. Operating Results—Year ended December 31, 2012 as compared to year ended December 31, 2011” in our Annual Report on Form 20-F.

Further, because we intentionally do not hedge 100% of the price risk on our agricultural products, we are unable to have minimum price guarantees for all of our production and are, therefore, exposed to risks associated with the prices of agricultural products and their volatility. We are subject to fluctuations in prices of agricultural products that could result in our receiving lower prices for our agricultural products than our production costs.

In addition, there is a strong relationship between the value of our land holdings and market prices of the commodities we produce, which are affected by global economic conditions. A decline in the prices of grains, sugar, ethanol, or related by-products below their current levels for a sustained period of time could significantly reduce the value of our land holdings and materially and adversely affect our financial condition and results of operations.

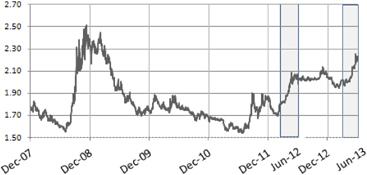

Ethanol prices are correlated to the price of sugar and are becoming closely correlated to the price of oil, so that a decline in the price of sugar will adversely affect both our ethanol and sugar businesses, and a decline in the price of oil may adversely affect our ethanol business.

A vast majority of ethanol in Brazil is produced at sugarcane mills that produce both ethanol and sugar. Because sugarcane millers are able to alter their product mix in response to the relative prices of ethanol and sugar, this results in the prices of both products being directly correlated, and the correlation between ethanol and sugar may increase over time. In addition, sugar prices in Brazil are determined by prices in the world market, so that there is a strong correlation between Brazilian ethanol prices and world sugar prices.

Because flex-fuel vehicles, which have become popular in Brazil, allow consumers to choose between gasoline and ethanol at the pump rather than in the showroom, ethanol prices are now becoming increasingly correlated to gasoline prices and, consequently, oil prices. We believe that the correlation among the three products will increase over time. Accordingly, a decline in sugar prices would have an adverse effect on the financial performance of our ethanol and sugar businesses, and a decline in oil prices might have an adverse effect on that of our ethanol business.

10

Table of Contents

The expansion of our business through acquisitions poses risks that may reduce the benefits we anticipate from these transactions.

As part of our business strategy, we have grown through acquisitions. We plan to continue growing by acquiring other farms and production facilities throughout South America. We believe that the agricultural industry and agricultural activity in the region are highly fragmented and that our future consolidation opportunities will continue to be significant to our growth. However, our management is unable to predict whether or when any prospective acquisitions or strategic alliances will occur, or the likelihood of a certain transaction being completed on favorable terms and conditions. In addition, we are unable to predict the effect that changes in Argentine or Brazilian legislation regarding foreign ownership of rural properties could have in our business. See “—Risks Related to Argentina— Argentine law concerning foreign ownership of rural properties may adversely affect our results of operations and future investments in rural properties in Argentina” and “—Risks Related to Brazil— Recent changes in Brazilian rules concerning foreign investment in rural properties may adversely affect our investments.” Our ability to continue to expand our business successfully through acquisitions depends on many factors, including our ability to identify acquisitions or access capital markets at an acceptable cost and negotiate favorable transaction terms. Even if we are able to identify acquisition targets and obtain the necessary financing to make these acquisitions, we could financially overextend ourselves, especially if an acquisition is followed by a period of lower than projected prices for our products.

Acquisitions also expose us to the risk of successor liability relating to actions involving an acquired company, its management or contingent liabilities incurred before the acquisition. The due diligence we conduct in connection with an acquisition, and any contractual guarantees or indemnities that we receive from the sellers of acquired companies, may not be sufficient to protect us from, or compensate us for, actual liabilities. Any material liability associated with an acquisition could adversely affect our reputation and results of operations and reduce the benefits of the acquisition.

To support the acquisitions we hope to make, we may need to implement new or upgraded strategies, systems, procedures and controls for our operations and will face risks, including diversion of management time and focus and challenges associated with integrating new managers and employees. Our failure to integrate new businesses successfully could adversely affect our business and financial performance.

Adverse conditions may create delays in or the suspension of the construction of our Ivinhema mill and/or significantly increase the amount of our expected investments.

As part of our strategy to increase our production and increase our competitiveness through economies of scale, we are in the process of constructing the second phase of the Ivinhema mill, adding a nominal crushing capacity of 2.0 million tons per year, which is expected to commence commercial operations during the second quarter of 2015 See “Item 4. Information on the Company—B. Business Overview.” As of June 30, 2013 we have incurred $342 million for the acquisition and assembly of industrial equipment manufacturing costs, agricultural equipment and sugarcane planting expenses. We estimate that we will need to invest an additional $362 million to complete the construction of the Ivinhema mill, which is expected to be financed with proceeds from a loan from the BNDES (“Banco Nacional de Desenvolvimento”) dated December 27, 2012, and the cash flow generated from the Angelica and UMA mill operations. See “Item 4. Information on the Company—B. Business Overview” in our Annual Report on Form 20-F. The completion of the Ivinhema project involves various risks, including engineering, construction and regulatory risks, such as obtaining necessary permits and licenses as well as other significant challenges that can suspend the construction of the Ivinhema mill, hinder or delay the project’s scheduled completion date and successful operation or that can result in significant cost increases as well as foreign exchange risks associated with incurring costs in Brazilian Reais. In addition, the Ivinhema mill may not operate at projected capacity or may incur higher operating costs than estimated, and we may not be able to sell the ethanol and sugar produced by the Ivinhema mill at competitive prices. If (i) construction is delayed or suspended, (ii) we are required to invest more than the budgeted amount to complete the project, (iii) we fail to operate the mill or operate it at a lower capacity than we anticipate or (iv) we are unable to sell all of the ethanol and sugar produced by the mill, our results of operations and financial condition will be materially adversely affected.

11

Table of Contents

A significant increase in the price of raw materials we use in our operations, or the shortage of such raw materials, could adversely affect our results of operations.

Our production process requires various raw materials, including primarily fertilizer, pesticides and seeds, which we acquire from local and international suppliers. We do not have long-term supply contracts for most of these raw materials. A significant increase in the cost of these raw materials, especially fertilizer and agrochemicals, a shortage of raw materials or the unavailability of these raw materials entirely could reduce our profit margin, reduce our production and/or interrupt the production of some of our products, in all cases adversely affecting the results of our operations and our financial condition.

For example, we rely on fertilizers and agrochemicals, many of which are petro-chemical based. For the year ended December 31, 2012, in our farming business, fertilizers and agrochemicals constituted approximately 21.6% of our cost of production for the 2011/2012harvest year. In our Sugar, Ethanol and Energy business, fertilizers and agrochemicals constituted 13.5% of our cost of production for 2012. On a consolidated basis, fertilizers and agrochemicals constituted 17.0% of our cost of production for 2012. Worldwide production of agricultural products has increased significantly in recent years, increasing the demand for agrochemicals and fertilizers. This has resulted, among other things, in increased prices for agrochemicals and fertilizers.

Increased energy prices and frequent interruptions of energy supply could adversely affect our business.

We require substantial amounts of fuel oil and other resources for our harvest activities and transport of our agricultural products. For the year ended December 31, 2012, fuel constituted 10.3% of the cost of production of our farming business during the 2011/2012 harvest year. In our Sugar, Ethanol and Energy business, fuel constituted 9.3% of our cost of production for 2012. On a consolidated basis, fuel constituted 9.7% of our cost of production for 2012 . We rely upon third parties for our supply of energy resources used in our operations. The prices for and availability of energy resources may be subject to change or curtailment, respectively, due to, among other things, new laws or regulations, imposition of new taxes or tariffs, interruptions in production by suppliers, imposition of restrictions on energy supply by government, worldwide price levels and market conditions. Over the last few years, the Argentine government has taken certain measures in order to reduce the use of energy during peak months of the year by frequently cutting energy supply to industrial facilities and large consumers to ensure adequate supply for residential buildings. For example, certain of our industrial facilities have been subject to a quota system whereby electricity cuts occur on a work shift basis, resulting in our facilities being shut down during certain work shifts. While some of our facilities utilize different sources of energy, such as firewood and liquefied natural gas, and have attempted to stock their required supplies ahead of higher demand periods, we cannot assure you that we will be able to procure the required energy inputs at acceptable prices. If energy supply is cut for an extended period of time and we are unable to find replacement sources at comparable prices, or at all, our business and results of operations could be adversely affected.

We depend on international trade and economic and other conditions in key export markets for our products.

Our operating results depend largely on economic conditions and regulatory policies for our products in major export markets. The ability of our products to compete effectively in these export markets may be adversely affected by a number of factors that are beyond our control, including the deterioration of macroeconomic conditions, volatility of exchange rates, the imposition of greater tariffs or other trade barriers or other factors in those markets, such as regulations relating to chemical content of products and safety requirements. Due to the growing participation in the worldwide agricultural commodities markets by commodities produced in South America, South American growers, including us, are increasingly affected by the measures taken by importing countries in order to protect their local producers. Measures such as the limitation on imports adopted in a particular country or region may affect the sector’s export volume significantly and, consequently, our operating results.

The European Union limits the import of genetically modified organisms, or “GMOs”. See “Some of the agricultural commodities and food products that we produce contain genetically modified organisms. If the sale of our products into a particular importing country is adversely affected by trade barriers or by any of the factors mentioned above, the relocation of our products to other consumers on terms equally favorable could be impaired, and our business, financial condition and operating results may be adversely affected.

12

Table of Contents

A worldwide economic downturn could weaken demand for our products or lower prices.

The demand for the products we sell may be affected by international, national and local economic conditions. Adverse changes in the perceived or actual economic climate, such as higher fuel prices, higher interest rates, stock and real estate market declines and/or volatility, more restrictive credit markets, higher taxes, and changes in governmental policies could reduce the level of demand or prices of the products we produce. We cannot predict the duration or magnitude of this downturn or the timing or strength of economic recovery. If the downturn continues for an extended period of time or worsens, we could experience a prolonged period of decreased demand and price. In addition, the economic downturn has and may continue to adversely impact our suppliers, which can result in disruptions in service and financial losses.

Our business is seasonal, and our results may fluctuate significantly depending on the growing cycle of our crops.

As with any agricultural business enterprise, our business operations are predominantly seasonal in nature. The harvest of corn, soybean and rice generally occurs from January to May. Wheat is harvested from December to January. Cotton is harvested from June to August, but requires processing which takes approximately two to three months. Our operations and sales are affected by the growing cycle of the crops we process and the timing of our harvest sales. In addition, our sugar and ethanol business is subject to seasonal trends based on the sugarcane growing cycle in the center-south region of Brazil. The annual sugarcane harvesting period in the center-south region of Brazil begins in April and ends in November/December. This creates fluctuations in our inventory, usually peaking in December to cover sales between crop harvests (i.e., January through April), and a degree of seasonality in our gross profit. Seasonality could have a material adverse effect on our business and financial performance. In addition, our quarterly results may vary as a result of the effects of fluctuations in commodities prices, production yields and costs. Therefore, our results of operations have varied significantly from period to period and are likely to continue to vary, due to seasonal factors.

Our dairy and beef cattle are vulnerable to diseases.

Diseases among our cattle herds, such as mastitis, tuberculosis, brucellosis and foot-and-mouth disease, can have an adverse effect on the productivity of our dairy cows. Outbreaks of cattle diseases may also result in the closure of certain important markets to our cattle-derived products. Although we abide by national veterinary health guidelines, including laboratory analyses and vaccination, to control diseases among our herds, especially foot-and-mouth disease, we cannot assure you that future outbreaks of cattle diseases will not occur. A future outbreak of diseases among our cattle herds could adversely affect our milk sales and operating results and financial condition.

Our current insurance coverage may not be sufficient to cover our potential losses.

Our production is, in general, subject to different risks and hazards, including adverse weather conditions, fires, diseases and pest infestations, other natural phenomena, industrial accidents, labor disputes, changes in the legal and regulatory framework applicable to us, environmental contingencies and other natural phenomena. Our insurance currently covers only part of the losses we may incur and does not cover losses on crops due to hail storms, fires or similar risks. Furthermore, although we maintain insurance at levels that are customary in our industry, certain types of risks may not be covered by the policies we have for our industrial facilities. Additionally, we cannot guarantee that the indemnification paid by the insurer due to the occurrence of a casualty covered by our policies will be sufficient to entirely compensate us for the damages suffered. Moreover, we may not be able to maintain or obtain insurance of the type and amount desired at reasonable costs. If we were to incur significant liability for which we were not fully insured, it could have a materially adverse effect on our business, financial condition and results of operations.

A reduction in market demand for ethanol or a change in governmental policies reducing the amount of ethanol required to be added to gasoline may adversely affect our business.

Government authorities of several countries, including Brazil and certain states of the United States, currently require the use of ethanol as an additive to gasoline. Since 1997, the Sugar and Alcohol Interministerial Council of Brazil (Conselho Interministerial do Açúcar e Álcool) has set the required blend of anhydrous ethanol to gasoline (currently, which by law may vary between 18% and 25%). Since October 1, 2011, the required blend has been set at 20%, pursuant to Ministry of Agriculture Ordinance Rule No. 678/2011 (Portaria MAPA no. 67812011).

13

Table of Contents

Approximately 45% of all fuel ethanol in Brazil is consumed in the form of anhydrous ethanol blended with gasoline; the remaining 68.6% of fuel ethanol is consumed in the form of hydrous ethanol, which is mostly used to power flex-fuel vehicles. Flex-fuel vehicles have the flexibility to run either on gasoline (blended with anhydrous ethanol) or hydrous ethanol. In the United States, almost all gasoline sold contains 10% ethanol. The European Union aims for 10% of the energy used in the transport sector to derive from renewable energy sources by 2020, without specific targets for certain renewable energy sources and without intermediate targets, to be determined by each Member State. As an example, in Sweden the ethanol blending ratio is 5%, which is the same mandate for other non-European countries, such as Argentina, Canada and the India. Other countries in the world such as Colombia, South Africa, Thailand and China have a 10% biofuel blending mandate. In addition, flex-fuel vehicles in Brazil have a tax benefit in the form of a lower tax rate on manufactured products (Imposto sobre Produtos Industrializados) and therefore are currently taxed at lower levels than gasoline-only vehicles, which has contributed to the increase in production and sale of flex-fuel vehicles. For example, from May 2012 to June 2013 (subject to further extension) flex-fuel vehicles are being taxed at a reduced industrial products tax rate. Many of these policies and incentives stem from, and are mostly driven by, climate change concerns and the positive perceptions regarding the use of ethanol as a solution to the climate change problem. If such concerns or perception were to change, the legal framework and incentive structure promoting the use of ethanol may be revised, leading to a reduction in the demand for ethanol. In addition, any reduction in the percentage of ethanol required in fuel blended with gasoline or increase in the levels at which flex-fuel vehicles are taxed in Brazil, or any growth in the demand for natural gas and other fuels as an alternative to ethanol, lower gasoline prices or an increase in gasoline consumption (versus ethanol), may cause demand for ethanol to decline and affect our business.

Growth in the sale and distribution of ethanol depends in part on infrastructure improvements, which may not occur on a timely basis, if at all.

In contrast to the well-established logistical operations and infrastructure supporting sugar exports, ethanol exports inherently demand much more complex preparation and means of distribution, including outlets from our facilities to ports and shipping to other countries. Substantial infrastructure development by persons and entities outside our control is required for our operations, and the ethanol industry generally, to grow. Areas requiring expansion include, but are not limited to, additional rail capacity, additional storage facilities for ethanol, increases in truck fleets capable of transporting ethanol within localized markets, expansion of refining and blending facilities to handle ethanol, growth in service stations equipped to handle ethanol fuels, and growth in the fleet of flex-fuel vehicles. Specifically, with respect to ethanol exports, improvements in consumer markets abroad are needed in the number and capacity of ethanol blending industrial plants, the distribution channels of gasoline-ethanol blends and the chains of distribution stations capable of handling fuel ethanol as an additive to gasoline. Substantial investments required for these infrastructure changes and expansions may not be made or they may not be made on a timely basis. Any delay or failure in making the changes in or expansion of infrastructure may hurt the demand for or prices of our products, prevent our products’ delivery, impose additional costs on us or otherwise have a serious adverse effect on our business, operating results or financial status. Our business relies on the continuing availability of infrastructure, and any infrastructure disruptions may have a material adverse effect on our business, financial condition and operating results.

We may be harmed by competition from alternative fuels, products and production methods.

Ethanol competes in the biofuel market with other, established fuels such as biodiesel, as well as fuels that are still in the development phase, including methanol and butanol from biomass. Alternative fuels could become more successful than ethanol in the biofuels market over the medium or long term due, for example, to lower production costs, greater environmental benefits or other more favorable product characteristics. In addition, alternative fuels may also benefit from tax incentives or other favorable governmental treatment, from which they may benefit at the expense of ethanol. Furthermore, our success depends on early identification of new developments relating to products and production methods and continuous expansion and preservation of our existing expertise in order to ensure that our product range keeps pace with technological change. Competitors may gain an advantage over us by, for example, developing or using new products and production methods, introducing new products to the market sooner than we do, or securing exclusive rights to new technologies, thereby significantly harming our competitive position.

14

Table of Contents

A substantial portion of our assets is farmland that is highly illiquid.

We have been successful in partially rotating and monetizing a portion of our investments in farmland. During the last eleven years, we have executed transactions for the purchase and disposition of land for over $542 million. Ownership of a significant portion of the land we operate is a key part of our business model. However, agricultural real estate is generally an illiquid asset. Moreover, the adoption of laws and regulations that impose limitations on ownership of rural land by foreigners in the jurisdictions in which we operate may also limit the liquidity of our farmland holdings. See “—Risks Related to Argentina—Argentine law concerning foreign ownership of rural properties may adversely affect our results of operations and future investments in rural properties in Argentina” and “—Risks Related to Brazil— Recent changes in Brazilian rules concerning foreign investment in rural properties may adversely affect our investments.” As a result, it is unlikely that we will be able to adjust our owned agricultural real estate portfolio promptly in response to changes in economic, business or regulatory conditions. Illiquidity in local market conditions may adversely affect our ability to complete dispositions, to receive proceeds generated from any such sales or to repatriate any such proceeds.

We have agriculture partnerships relating to a significant portion of our sugarcane plantations.

As of December 31, 2012, approximately 89% of our sugarcane plantations were leased through agriculture partnership agreements, for periods of an average of six to twelve years. We cannot guarantee that these agriculture partnerships will be renewed after their respective terms. Even if we are able to renew these agreements, we cannot guarantee that such renewals will be on terms and conditions satisfactory to us. Any failure to renew the agriculture partnerships or obtain land suitable for sugarcane planting in sufficient quantity and at reasonable prices to develop our activities could adversely affect our results of operations, increase our costs or force us to seek alternative properties, which may not be available or be available only at higher prices.

We may be subject to labor disputes from time to time that may adversely affect us.

Our employees are represented by unions or equivalent bodies and are covered by collective bargaining or similar agreements which are subject to periodic renegotiation. We may not successfully conclude our labor negotiations on satisfactory terms, which may result in a significant increase in the cost of labor or may result in work stoppages or labor disturbances that disrupt our operations. Cost increases, work stoppages or disturbances that result in substantial amounts of raw product not being processed could have a material and adverse effect on our business, results of operations and financial condition.

We may not possess all of the permits and licenses required to operate our business, or we may fail to maintain the licenses and permits we currently hold. This could subject us to fines and other penalties, which could materially adversely affect our results of operations.

We are required to hold a variety of permits and licenses to conduct our farming and industrial operations, including but not limited to permits and licenses concerning land development, agricultural and harvesting activities, seed production, labor standards, occupational health and safety, land use, water use and other matters. We may not possess all of the permits and licenses required for each of our business segments. In addition, the approvals, permits or licenses required by governmental agencies may change without substantial advance notice, and we could fail to obtain the approvals, permits or licenses required to expand our business. If we fail to obtain or to maintain such permits or licenses, or if renewals are granted with onerous conditions, we could be subject to fines and other penalties and be limited in the number or the quality of the products that we could offer. As a result, our business, results of operations and financial condition could be adversely affected

We are subject to extensive environmental regulation, and concerns regarding climate change may subject us to even stricter environmental regulations.

Our activities are subject to a broad set of laws and regulations relating to the protection of the environment. Such laws include compulsory maintenance of certain preserved areas within our properties, management of pesticides and associated hazardous waste and the acquisition of permits for water use and effluents disposal. In addition, the storage and processing of our products may create hazardous conditions. We could be exposed to criminal and administrative penalties in addition to the obligation to remedy the adverse affects of our operations on the environment and to indemnify third parties for damages. Environmental laws and their enforcement are becoming more stringent in Argentina and Brazil increasing the risk of and penalties associated with violations,

15

Table of Contents

which could impair or suspend our operations or projects (e.g., Ivinhema in respect ofalleged environmental damage on the lvinhema river), and our operations expose us to potentially adverse environmental legislation and regulation. Failure to comply with past, present or future laws could result in the imposition of fines, third party claims, and investigation by environmental authorities and the relevant public attorney office. For example, the perceived effects of climate change may result in additional legal and regulatory requirements to reduce or mitigate the effects of our industrial facilities’ emissions. Such requirements, if enacted, could increase our capital expenditures and expenses for environmental compliance in the future, which may have a material and adverse effect on our business, results of operations and financial condition. Moreover, the denial of any permit that we have requested, or the revocation of any of the permits that we have already obtained, may have an adverse effect on our results of operations.

Some of the agricultural commodities and food products that we produce contain genetically modified organisms.

Our soybean, corn and cotton products contain GMOs in varying proportions depending on the year and the country of production. The use of GMOs in food has been met with varying degrees of acceptance in the markets in which we operate. The United States, Argentina and Brazil, for example, have approved the use of GMOs in food products, and GMO and non-GMO grain in those countries is produced and frequently commingled during the grain origination process. Elsewhere, adverse publicity about genetically modified food has led to governmental regulation limiting sales of GMO products in some of the markets in which our customers sell our products, including the European Union. It is possible that new restrictions on GMO products will be imposed in major markets for some of our products or that our customers will decide to purchase fewer GMO products or not buy GMO products at all, which could have a material adverse effect on our business, results of operations, financial condition or prospects.

If our products become contaminated, we may be subject to product liability claims, product recalls and restrictions on exports that would adversely affect our business.

The sale of food products for human consumption involves the risk of injury to consumers. These injuries may result from tampering by third parties, bioterrorism, product contamination or spoilage, including the presence of bacteria, pathogens, foreign objects, substances, chemicals, other agents, or residues introduced during the growing, storage, handling or transportation phases.

We cannot be sure that consumption of our products will not cause a health-related illness in the future or that we will not be subject to claims or lawsuits relating to such matters. Even if a product liability claim is unsuccessful or is not fully pursued, the negative publicity surrounding any assertion that our products caused illness or injury could adversely affect our reputation with existing and potential customers and our corporate and brand image, and we could also incur significant legal expenses. Moreover, claims or liabilities of this nature might not be covered by any rights of indemnity or contribution that we may have against others, which could have a material adverse effect on our business, results of operations or financial condition.

Our principal shareholders have the ability to direct our business and affairs, and their interests could conflict with yours

As of the date of this prospectus, our principal shareholders were the beneficial owners of approximately 45.5% of our common shares. As a result of this significant influence over us, our principal shareholders may be able to elect a majority of the members of our board of directors, direct our management and determine the result of substantially all resolutions that require shareholders’ approval, including fundamental corporate transactions and the payment of dividends by us. The interests of our principal shareholders may differ from, and could conflict with, those of our other shareholders.

IFRS accounting standards related to biological assets require us to make numerous estimates in the preparation of our financial statements and therefore limit the comparability of our financial statements to similar issuers using U.S. GAAP

IAS 41 “Biological Assets” requires that we measure our biological assets and agriculture produce at the point of harvest at fair value. Therefore, we are required to make assumptions and estimates relating to, among other things, future agricultural commodity yields, prices, and production costs extrapolated through a discounted cash flow method. For example, the value of our biological assets with a production cycle lasting more than one year (i.e., sugarcane, coffee, dairy and cattle) generated initial recognition and changes in fair value of biological assets

16

Table of Contents

amounting to 25.3 million loss in 2012, $38.7 million gain in 2011and $78.8 million loss in 2010. The assumptions and estimates used to determine the fair value of biological assets, and any changes to such prior estimates, directly affect our reported results of operations. If actual market conditions differ from our estimates and assumptions, there could be material adjustments to our results of operations. In addition, the use of such discounted cash flow method utilizing these future estimated metrics differs from generally accepted accounting principles in the United States (“U.S. GAAP”). As a result, our financial statements and reported earnings are not directly comparable to those of similar companies in the United States.

Certain of our subsidiaries have substantial indebtedness which could impair their financial condition and decrease the amount of dividends we receive.

Certain of our subsidiaries in Argentina and Brazil have a substantial amount of debt, which requires significant principal and interest payments. As of June 30, 2013, we had 605.8 million of debt outstanding on a consolidated basis, all of which was incurred by our subsidiaries and not guaranteed by Adecoagro. Such indebtedness could affect our subsidiaries’ future operations, for example, by requiring a substantial portion of their cash flows from operations to be dedicated to the payment of principal and interest on indebtedness instead of funding working capital and other business purposes, making it more difficult for them to satisfy all of their debt obligations, increasing their cost of borrowing to satisfy business needs and limiting their ability to obtain additional financing.

The substantial level of indebtedness borne by certain of our subsidiaries also affects the amount of cash available to them to pay as dividends, increasing our vulnerability to economic downturns or other adverse developments relative to competitors with less leverage; and limiting our ability to obtain additional financing on their behalf for working capital, capital expenditures, acquisitions or other corporate purposes in the future. Moreover, by reducing the level of dividends we may receive, such indebtedness places limits on our ability to make acquisitions or needed capital expenditures or to pay dividends to our shareholders. See “Item 5. – Operating and Financial Review and Prospects – Liquidity and Capital Resources—Indebtedness and Financial Instruments” in our Annual Report on Form 20-F.

The terms of the indebtedness of, and past breaches of financial ratio covenants by, certain of our subsidiaries impose significant restrictions on their operating and financial flexibility.

The debt instruments of certain of our subsidiaries contain customary covenants including limitations on their ability to, among other things, incur or guarantee additional indebtedness; make restricted payments, including dividends and prepaying indebtedness; create or permit certain liens; enter into business combinations and asset sale transactions; make investments, including capital expenditures; and enter into new businesses. Certain of these debt instruments are also secured by various collateral including mortgages on certain farms, pledges of subsidiary stock and liens on certain facilities, equipment and accounts. Certain of these debt instruments also contain cross-default provisions, where a default on one loan by one subsidiary could result in lenders of otherwise performing loans declaring a default on the otherwise performing loans. For more information regarding the covenants, collateral, and cross-default provisions of our subsidiaries’ indebtedness, see “Item 5. Operating and Financial Review and Prospects—B. Liquidity and Capital Resources—Indebtedness and Financial Instruments” in our Annual Report on Form 20-F. These restrictions could limit our subsidiaries’ ability to obtain future financing, withstand a future downturn in business or the economy in general, conduct operations or otherwise take advantage of business opportunities that may arise. Moreover, by reducing the level of dividends we may receive, such indebtedness places limits on our ability to make acquisitions or needed capital expenditures or to pay dividends to our shareholders.

The terms of certain of our subsidiaries’ debt instruments contain financial ratio covenants, limitations on their levels of debt and capital expenditures and requirements on maintaining various levels of EBITDA. During 2009 and 2010, certain of our operating subsidiaries in Argentina and Brazil breached certain financial ratio covenants under their debt instruments, and subsequently entered with the lenders into amendments to redefine the terms of such financial ratio covenants. The financial ratio covenants we are currently required to meet, some of which are measured on a combined basis aggregating results of the borrowing subsidiaries and others which are measured on an individual debtor basis, include, among others, debt service coverage, minimum liquidity and leverage ratios. For detailed information regarding the financial ratio covenants, limitations on levels of debt and capital expenditures and requirements on EBITDA, see “Item 5. Operating and Financial Review and Prospects—B. Liquidity and Capital Resources—Indebtedness and Financial Instruments” in our Annual Report on Form 20-F.

17

Table of Contents

The failure by our subsidiaries to maintain applicable financial ratios, in certain circumstances, would prevent them from borrowing additional amounts and could result in a default under such indebtedness. If we or our subsidiaries are unable to repay those amounts, the affected lenders could initiate bankruptcy-related proceedings or enforce their rights to the collateral securing such indebtedness, which would have a material and adverse effect on our business, results of operations and financial condition. For detailed information regarding the terms of our subsidiaries’ indebtedness, see “Item 5. Operating and Financial Review and Prospects—B. Liquidity and Capital Resources—Indebtedness and Financial Instruments” in our Annual Report on Form 20-F.

Fluctuations in interest rates could have a significant impact on our results of operations, indebtedness and cash flow.