As filed with the Securities and Exchange Commission on March 22, 2012.

Registration No. 333-168971

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

PRE-EFFECTIVE AMENDMENT NO. 2

TO

POST-EFFECTIVE AMENDMENT NO. 4

TO FORM S-11

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

APPLE REIT TEN, INC.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

Virginia |

814 East Main Street |

27-3218228 |

||

(State or other jurisdiction |

(Address. Including zip code, and |

(I.R.S. Employer |

Glade M. Knight

Chairman and Chief Executive Officer

Apple REIT Ten, Inc.

814 East Main Street

Richmond, Virginia 23219

(804) 344-8121

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Martin B. Richards, Esq.

David F. Kurzawa, Esq.

McGuireWoods LLP

901 East Cary Street, One James Center

Richmond, Virginia 23219

(804) 775-1029

(804) 775-7471

Approximate date of commencement of proposed sale to the public: As soon as possible after effectiveness of the Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. S

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

Large accelerated filer £ |

Accelerated filer £ |

Non-accelerated filer £ |

Smaller reporting company S |

Pre-Effective Amendment No. 2 to Post-Effective Amendment No. 4 to Registration Statement on Form S-11 Contents

(1)

Part I of Registration Statement

Sticker Supplement for Supplement No. 15 (b) Supplement No. 15 dated March 22, 2012 (c) Supplement No. 14 dated February 17, 2012 (cumulative, replacing all prior supplements) (d) Prospectus dated January 19, 2011

(2)

Part II of Registration Statement (3) Signature Page (4) Exhibits (see Part II, Item 36, for Exhibit Index)

(Registration No. 333-168971)

(a)

APPLE REIT TEN, INC. STICKER SUPPLEMENT TO Supplements Nos. 14 and 15 to be used with Summary of Supplements to Prospectus (See Supplements for Additional Information) Supplement No. 14 (cumulative, replacing all prior supplements) dated February 17, 2012 reports on (a) the status of our best-efforts offering of Units; (b) our purchase of 28 hotels containing a total of 3,504 guest rooms for an aggregate gross purchase price of approximately $482.6 million; (c) our

execution of certain purchase contracts that relate to 6 hotels containing a total of 745 guest rooms and that provide for an aggregate gross purchase price of approximately $101.6 million; (d) the termination of three purchase contracts; (e) the election of the board of directors included in the prospectus;

(f) the resignation of a member of our board of directors; (g) the election of a new director to our board; (h) amendments to our unit redemption program; (i) a summary of certain legal proceedings; (j) financial and operating information for all of our purchased hotels; and (k) our recent financial information

and certain additional information about us. Supplement No. 15 dated March 22, 2012 (a) reports on the status of our best-efforts offering of Units; (b) provides an update regarding our legal proceedings; and (c) provides our audited financial statements as of December 31, 2011 and for the year then ended and certain additional information

about us. As of January 27, 2011, we completed our minimum offering of 9,523,810 Units at $10.50 per Unit and raised gross proceeds of $100 million and proceeds net of selling commissions and marketing expenses of $90 million. Each Unit consists of one common share and one Series A Preferred Share.

We are continuing the offering at $11 per Unit in accordance with the prospectus. As of February 29, 2012, we had closed on the sale of 37,571,845 additional Units at $11 per Unit and from such sale we raised gross proceeds of approximately $413 million and proceeds net of selling commissions and marketing expenses of approximately $372 million. Sales of all Units at $10.50 per

Unit and $11.00 per Unit, when combined, represent gross proceeds of approximately $513 million and proceeds net of selling commissions and marketing expenses of approximately $462 million. In connection with our hotel purchases to date, we paid a total of approximately $9.7 million, representing 2% of the aggregate gross purchase price, as a commission to Apple Suites Realty Group, Inc. This entity is owned by Glade M. Knight, who is our Chairman and Chief Executive Officer.

SUPPLEMENT NO. 15 DATED MARCH 22, 2012

PROSPECTUS DATED JANUARY 19, 2011

SUPPLEMENT NO. 15 DATED MARCH 22, 2012 TO PROSPECTUS DATED JANUARY 19, 2011 APPLE REIT TEN, INC. The following information supplements the prospectus of Apple REIT Ten, Inc. dated January 19, 2011 and is part of the prospectus. This Supplement updates the information presented in the prospectus. Prospective investors should carefully review the prospectus, Supplement No. 14 (which is

cumulative and replaces all prior Supplements) and this Supplement No. 15. TABLE OF CONTENTS

S-3

S-5

S-6 Management’s Discussion and Analysis of Financial Condition and Results of Operations

S-8

S-20

S-20

F-1 Certain forward-looking statements are included in the prospectus and this supplement. These forward-looking statements may involve our plans and objectives for future operations, including future growth and availability of funds. These forward-looking statements are based on current expectations,

which are subject to numerous risks and uncertainties. Assumptions relating to these statements involve judgments with respect to, among other things, the continuation of our offering of Units, the outcome of current and future litigation, regulatory proceedings or inquiries, future economic, competitive

and market conditions and future business decisions, together with local, national and international events (including, without limitation, acts of terrorism or war, and their direct and indirect effects on travel and the economy). All of these matters are difficult or impossible to predict accurately and many

of them are beyond our control. Although we believe the assumptions relating to the forward-looking statements, and the statements themselves, are reasonable, any of the assumptions could be inaccurate and, therefore, there can be no assurance that these forward-looking statements will prove to be

accurate. In light of the significant uncertainties inherent in these forward-looking statements, the inclusion of this information should not be regarded as a representation by us or any other person that our objectives and plans, which we consider to be reasonable, will be achieved. S-1

“Courtyard by Marriott,” “Fairfield Inn,” “Fairfield Inn & Suites,” “TownePlace Suites,” “Marriott,” “SpringHill Suites” and “Residence Inn” are each a registered trademark of Marriott International, Inc. or one of its affiliates. All references below to “Marriott” mean Marriott International, Inc. and all of

its affiliates and subsidiaries, and their respective officers, directors, agents, employees, accountants and attorneys. Marriott is not responsible for the content of this prospectus supplement, whether relating to hotel information, operating information, financial information, Marriott’s relationship with Apple REIT

Ten, Inc., or otherwise. Marriott is not involved in any way, whether as an “issuer” or “underwriter” or otherwise, in the offering by Apple REIT Ten, Inc. and receives no proceeds from the offering. Marriott has not expressed any approval or disapproval regarding this prospectus supplement or the offering

related to this prospectus supplement, and the grant by Marriott of any franchise or other rights to Apple REIT Ten, Inc. shall not be construed as any expression of approval or disapproval. Marriott has not assumed, and shall not have, any liability in connection with this prospectus supplement or the offering

related to this prospectus supplement. “Hampton Inn,” “Hampton Inn & Suites,” “Homewood Suites,” “Embassy Suites,” “Hilton Garden Inn” and “Home2 Suites by Hilton” are each a registered trademark of Hilton Worldwide or one of its affiliates. All references below to “Hilton” mean Hilton Worldwide and all of its affiliates and

subsidiaries, and their respective officers, directors, agents, employees, accountants and attorneys. Hilton is not responsible for the content of this prospectus supplement, whether relating to hotel information, operating information, financial information, Hilton’s relationship with Apple REIT Ten, Inc., or

otherwise. Hilton is not involved in any way, whether as an “issuer” or “underwriter” or otherwise, in the offering by Apple REIT Ten, Inc. and receives no proceeds from the offering. Hilton has not expressed any approval or disapproval regarding this prospectus supplement or the offering related to this

prospectus supplement, and the grant by Hilton of any franchise or other rights to Apple REIT Ten, Inc. shall not be construed as any expression of approval or disapproval. Hilton has not assumed, and shall not have, any liability in connection with this prospectus supplement or the offering related to this

prospectus supplement. S-2

As of January 27, 2011, we completed our minimum offering of 9,523,810 Units at $10.50 per Unit and raised gross proceeds of $100,000,000 and proceeds net of selling commissions and marketing expenses of $90,000,000. Each Unit consists of one common share and one Series A preferred share. We

are continuing the offering at $11.00 per Unit in accordance with the prospectus. We registered to sell a total of 182,251,082 Units. As of February 29, 2012, 135,155,427 Units remain unsold. We will offer Units until January 19, 2013, unless the offering is extended, provided that the offering will be

terminated if all of the Units are sold before then. As of February 29, 2012, we had closed on the following sales of Units in the offering:

Price Per

Number of

Gross

Proceeds Net $10.50

9,523,810

$

100,000,000

$

90,000,000 $11.00

37,571,845

413,290,295

371,961,266 Total

47,095,655

$

513,290,295

$

461,961,266 Distributions Our distributions since initial capitalization through December 31, 2011 totaled approximately $23.6 million and were paid at a monthly rate of $0.06875 per common share beginning in February 2011. For the same period, our cash generated from operations was approximately $0.8 million. Due to

the inherent delay between raising capital and investing that same capital in income producing real estate, we have had significant amounts of cash earning interest at short term money market rates. As a result, a portion of distributions paid through December 31, 2011 have been funded from proceeds

from our on-going best-efforts offering of Units, and are expected to be treated as a return of capital for federal income tax purposes. The following is a summary of the distributions and net cash from (used in) operations.

Period

Total

Total

Net Cash From/

Net Income/ For the period Aug. 13, 2010 (initial capitalization) through Dec. 31, 2010

$

—

$

—

$

(6,000

)

$

(31,000

) 1st Quarter 2011

0.13750

1,855,000

(2,488,000

)

(2,390,000

) 2nd Quarter 2011

0.20625

5,753,000

(1,059,000

)

(1,179,000

) 3rd Quarter 2011

0.20625

7,596,000

846,000

(473,000

) 4th Quarter 2011

0.20625

8,390,000

3,522,000

(1,092,000

) Total

$

0.75625

$

23,594,000

$

815,000

$

(5,165,000

) Note for Table:

(a)

See complete consolidated statement of cash flows and consolidated statement of operations for the 12 months ending December 31, 2011 included in our most recent Form 10-K for the year ended December 31, 2011.

In February 2011, our Board of Directors established a policy for an annualized distribution rate of $0.825 per common share, payable in monthly distributions. We intend to continue paying distributions on a monthly basis, consistent with the annualized distribution rate established by our Board of

Directors. Our objective in setting a distribution rate is to project a rate that will provide consistency over our existence taking into account acquisitions and capital improvements, ramp up of new properties and varying economic cycles. To meet this objective, we may require the use of debt or offering

proceeds in addition to cash from operations. Since a portion of distributions to date have been funded with proceeds from our offering of Units, our ability to maintain our current S-3

Unit

Units Sold

Proceeds

of Selling

Commissions

and Marketing

Expense

Allowance

Distributions

Declared and

Paid per Share

Distributions

Declared and

Paid

(Used in)

Operations(a)

(Loss)(a)

intended rate of distribution will be based on our ability to fully invest our offering proceeds and thereby increase its cash generated from operations. As there can be no assurance of our ability to acquire properties that provide income at this level, or that the properties already acquired will provide

income at this level, there can be no assurance as to the classification or duration of distributions at the current rate. Proceeds of the offering which are distributed are not available for investment in properties. See “Risk Factors—We may be unable to make distributions to our shareholders,” on page 26 of

the prospectus. Net Book Value Per Share In connection with this on-going offering of Units, we are providing information about our net book value per share. Net book value per share is calculated as total book value of assets minus total liabilities. It assumes that the value of real estate assets diminishes predictably over time as shown

through the depreciation and amortization of real estate investments. Real estate values have historically risen or fallen with market conditions. Net book value does not reflect value per share upon an orderly sale or liquidation of the Company in accordance with our investment objectives. Our net book

value reflects dilution in the value of our Units from the issue price as a result of (i) operating losses, which reflect accumulated depreciation and amortization of real estate investments as well as the fees and expenses paid to acquire real estate including commissions to Apple Suites Realty Group

(“ASRG”), (ii) the funding of distributions from sources other than cash flow from operations, and (iii) fees paid in connection with our on-going best-efforts offering, including selling commissions and marketing fees. As of December 31, 2011, our net book value per share was $9.10. We calculated our

net book value by subtracting total liabilities from total assets and dividing by the total number of Units outstanding at December 31, 2011. The offering price of shares under our on-going best-efforts offering at February 29, 2012 was $11.00. Our offering price was not established on an independent basis and bears no relationship to the net book value of our assets. There is currently no established public market in which our common

shares or Units are traded, however as discussed above in the Status of the Offering section of this supplement, 37.6 million Units have been purchased at $11 per Unit. As discussed in the prospectus the Units will be illiquid for an indefinite period of time. We will continue to use the $11 per Unit price

until such time as buyers are not available, or until we have an orderly sale or liquidation in accordance with our investment objectives outlined in the prospectus. Source of Funds and Related Party Payments David Lerner Associates, Inc., ASRG and Apple Ten Advisors, Inc. earned the compensation and expense reimbursements shown below in connection with their services from inception through the period ending December 31, 2011 relating to our offering phase, acquisition phase and operations

phase. David Lerner Associates, Inc. is not related to ASRG or Apple Ten Advisors, Inc. ASRG and Apple Ten Advisors, Inc. are owned by Glade M. Knight, our Chairman and Chief Executive Officer. As described on page 10 of our prospectus under the heading “Compensation” and as shown below, we pay certain fees and expenses as they are incurred, while others accrue and will be paid in future periods, subject in some cases to the achievement of performance criteria. We did not incur any

amounts in connection with our disposition phase through December 31, 2011. S-4

Cumulative through December 31, 2011

Incurred

Paid

Accrued Offering Phase Selling commissions paid to David Lerner Associates, Inc. in connection with the offering

$

35,532,000

$

35,532,000

$

— Marketing expense allowance paid to David Lerner Associates, Inc. in connection with the offering

11,844,000

11,844,000

—

47,376,000

47,376,000

— Acquisition Phase Acquisition commission paid to Apple Suites Realty Group, Inc.

9,165,000

9,165,000

— Reimbursement of costs paid to Apple Suites Realty Group, Inc.

700,000

700,000

— Reimbursement of certain deposits to Apple Suites Realty Group, Inc.

102,500

102,500

— Operations Phase Asset management fee paid to Apple Ten Advisors, Inc.

318,000

318,000

— Reimbursement of costs paid to Apple Ten Advisors, Inc.

725,000

725,000

— Fees for Account Maintenance Services to Shareholders paid to David Lerner Associates, Inc.

171,000

131,000

40,000 The term the “Apple REIT Companies” means us, Apple REIT Six, Inc., Apple REIT Seven, Inc., Apple REIT Eight, Inc. and Apple REIT Nine, Inc. On February 17, 2012, lead plaintiffs and lead counsel in the In re Apple REITs Litigation, Civil Action No. 1:11-cv-02919-KAM-JO, filed an amended consolidated complaint in the United States District Court for the Eastern District of New York against us, Apple Suites Realty Group, Inc., Apple

Eight Advisors, Inc., Apple Nine Advisors, Inc., Apple Ten Advisors, Inc., Apple Fund Management, LLC, Apple REIT Six, Inc., Apple REIT Seven, Inc., Apple REIT Eight, Inc. and Apple REIT Nine, Inc., their directors and certain officers, David Lerner Associates, Inc. and David Lerner. The

consolidated complaint, purportedly brought on behalf of all purchasers of Units in us and the other Apple REIT Companies, or those who otherwise acquired these Units that were offered and sold to them by David Lerner Associates, Inc., or its affiliates and on behalf of subclasses of shareholders in

New Jersey, New York, Connecticut and Florida, asserts claims under Sections 11, 12 and 15 of the Securities Act of 1933. The consolidated complaint also asserts claims for breach of fiduciary duty, aiding and abetting breach of fiduciary duty, negligence, and unjust enrichment, and claims for violation

of the securities laws of Connecticut and Florida. The complaint seeks, among other things, certification of a putative nationwide class and the state subclasses, damages, rescission of share purchases and other costs and expenses. We believe that these claims against us and our officers and directors are without merit, and we intend to defend against them vigorously. At this time, we cannot reasonably predict the outcome of these proceedings or provide a reasonable estimate of the possible loss or range of loss due to these

proceedings, if any. S-5

SELECTED FINANCIAL DATA

(in thousands except per share and statistical data)

Year Ended

For the period Revenues: Room revenue

$

37,911

$

— Other revenue

4,180

— Total revenue

42,091

— Expenses: Hotel operating expenses

23,737

— Taxes, insurance and other

2,545

— General and administrative

3,062

28 Acquisition related costs

11,265

— Depreciation

6,009

— Interest expense, net

607

3 Total expenses

47,225

31 Net loss

$

(5,134

)

$

(31

) Per Share: Net loss per common share

$

(0.18

)

$

(3,083.50

) Distributions paid per common share

$

0.76

$

— Weighted-average common shares outstanding—basic and diluted

29,333

— Balance Sheet Data (at end of period): Cash and cash equivalents

$

7,079

$

124 Investment in real estate, net

$

452,205

$

— Total assets

$

471,222

$

992 Notes payable

$

69,636

$

400 Shareholders’ equity

$

395,915

$

17 Net book value per share

$

9.10

$

— Other Data: Cash Flow From (Used In): Operating activities

$

821

$

(6

) Investing activities

$

(393,640

)

$

— Financing activities

$

399,774

$

82 Number of hotels owned at end of period

26

— Average Daily Rate(ADR)(a)

$

110

$

— Occupancy

69

%

— Revenue Per Available Room(RevPAR)(b)

$

76

$

— Total rooms sold(c)

344,152

— Total rooms available(d)

499,089

— Modified Funds From Operations Calculation(e): Net loss

$

(5,134

)

$

(31

) Depreciation of real estate owned

6,009

— Funds from operations

875

(31

) Acquisition related costs

11,265

— Modified funds from operations

$

12,140

$

(31

) S-6

December 31,

2011

August 13, 2010

(initial capitalization)

through

December 31,

2010

(a)

Total room revenue divided by number of rooms sold. (b) ADR multiplied by occupancy percentage. (c) Represents the number of room nights sold during the period. (d) Represents the number of rooms owned by the Company multiplied by the number of nights in the period. (e) Funds from operations (FFO) is defined as net income (loss) (computed in accordance with generally accepted accounting principles—GAAP) excluding gains and losses from sales of depreciable property, plus depreciation and amortization. Modified FFO (MFFO) excludes costs associated with the

acquisition of real estate. The Company considers FFO and MFFO in evaluating property acquisitions and its operating performance and believes that FFO and MFFO should be considered along with, but not as an alternative to, net income and cash flows as a measure of the Company’s activities in

accordance with GAAP. The Company considers FFO and MFFO as supplemental measures of operating performance in the real estate industry, and along with the other financial measures included in this document, including net income, cash flow from operating activities, financing activities and

investing activities, they provide investors with an indication of the performance of the Company. The Company’s definition of FFO and MFFO are not necessarily the same as such terms that are used by other companies. FFO and MFFO are not necessarily indicative of cash available to fund cash

needs. S-7

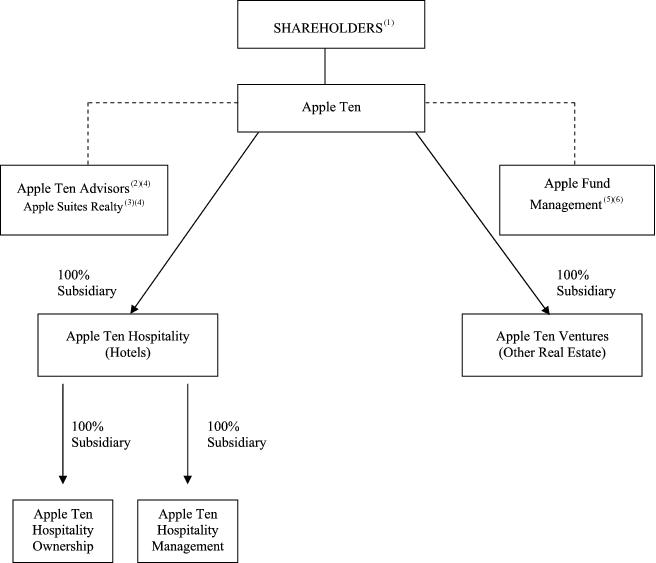

MANAGEMENT’S DISCUSSION AND ANALYSIS Overview Apple REIT Ten, Inc., together with its wholly owned subsidiaries (the “Company”) is a Virginia corporation that intends to qualify as a Real Estate Investment Trust (“REIT”) for federal income tax purposes. The Company, which has limited operating history, was formed to invest in hotels and

other income-producing real estate in selected metropolitan areas in the United States. The Company was initially capitalized on August 13, 2010, with its first investor closing on January 27, 2011. Prior to the Company’s first hotel acquisition on March 4, 2011, the Company had no revenue, exclusive of

interest income. As of December 31, 2011, the Company owned 26 hotels, all of which were purchased during 2011. Results of operations include only results from the date of ownership of the hotels. Legal Proceedings and Related Matters The term the “Apple REIT Companies” means the Company, Apple REIT Six, Inc., Apple REIT Seven, Inc., Apple REIT Eight, Inc. and Apple REIT Nine, Inc. On December 13, 2011, the United States District Court for the Eastern District of New York ordered that three putative class actions, Kronberg, et al. v. David Lerner Associates, Inc., et al., Kowalski v. Apple REIT Ten, Inc., et al., and Leff v. Apple REIT Ten, Inc., et al., be consolidated and

amended the caption of the consolidated matter to be In re Apple REITs Litigation. The District Court also appointed lead plaintiffs and lead counsel for the consolidated action and ordered lead plaintiffs to file and serve a consolidated complaint by February 17, 2012. The parties agreed to a schedule

for answering or otherwise responding to the complaint and that briefing on any motion to dismiss the complaint will be concluded by June 18, 2012. The Company was previously named as a party in all three of the abovementioned class action lawsuits. On February 17, 2012, lead plaintiffs and lead counsel in the In re Apple REITs Litigation, Civil Action No. 1:11-cv-02919-KAM-JO, filed an amended consolidated complaint in the United States District Court for the Eastern District of New York against the Company, Apple Suites Realty Group,

Inc., Apple Eight Advisors, Inc., Apple Nine Advisors, Inc., Apple Ten Advisors, Inc., Apple Fund Management, LLC, Apple REIT Six, Inc., Apple REIT Seven, Inc., Apple REIT Eight, Inc. and Apple REIT Nine, Inc., their directors and certain officers, and David Lerner Associates, Inc. and David

Lerner. The consolidated complaint, purportedly brought on behalf of all purchasers of Units in the Company and the other Apple REIT Companies, or those who otherwise acquired these Units that were offered and sold to them by David Lerner Associates, Inc., or its affiliates and on behalf of

subclasses of shareholders in New Jersey, New York, Connecticut and Florida, asserts claims under Sections 11, 12 and 15 of the Securities Act of 1933. The consolidated complaint also asserts claims for breach of fiduciary duty, aiding and abetting breach of fiduciary duty, negligence, and unjust

enrichment, and claims for violation of the securities laws of Connecticut and Florida. The complaint seeks, among other things, certification of a putative nationwide class and the state subclasses, damages, rescission of share purchases and other costs and expenses. The Company believes that any claims against it, its officers and directors and other Apple entities are without merit, and intends to defend against them vigorously. At this time, the Company cannot reasonably predict the outcome of these proceedings or provide a reasonable estimate of the

possible loss or range of loss due to these proceedings, if any. Broker Dealer On December 13, 2011, the Financial Industry Regulatory Authority (“FINRA”) amended its original complaint, filed on May 27, 2011, against David Lerner Associates, Inc., to include David Lerner, individually, as a party to this matter, as well as add additional claims related to the overall sales practices of both David

Lerner Associates, Inc. and David Lerner relative to the Company’s Units. As discussed in S-8

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

(for the year ended December 31, 2011)

its prospectus, dated January 19, 2011, the Company is offering its Units for sale through David Lerner Associates, Inc. as the managing dealer for its best efforts offering. A copy of FINRA’s original complaint can be found at: http://www.finra.org/Newsroom/NewsReleases/2011/P123738; and FINRA’s amended complaint can

be found at: http://disciplinaryactions.finra.org/viewdocument.aspx?DocNB=29068. David Lerner Associates, Inc. was also the sole distributor (managing dealer) of Apple REIT Six, Inc., Apple REIT Seven, Inc., Apple REIT Eight, Inc., and Apple REIT Nine, Inc. The Company is unaffiliated with David Lerner Associates,

Inc. or David Lerner; however, it does rely upon David Lerner Associates, Inc. for the offer and sale and administration of the Company’s Units. The Apple REIT Companies take these allegations against David Lerner Associates, Inc. and David Lerner very seriously, and the Apple REIT Companies intend to cooperate

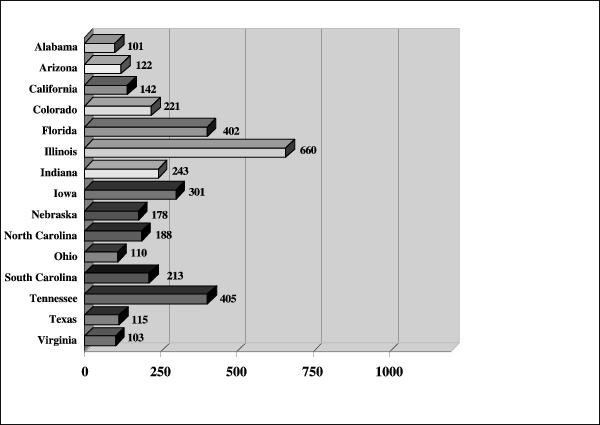

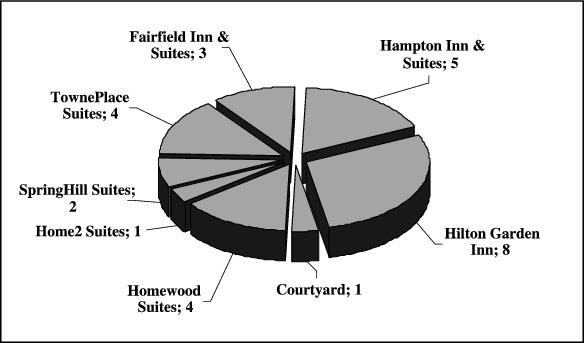

with any and all regulatory or governmental inquiries. Hotels Owned As noted above, the Company commenced operations in March 2011 upon the purchase of its first hotel property. The following table summarizes the location, brand, manager, date acquired, number of rooms and gross purchase price for each of the 26 hotels the Company owned as of December 31,

2011. All dollar amounts are in thousands.

City

State

Brand

Manager

Date

Rooms

Gross Denver

CO

Hilton Garden Inn

Stonebridge

3/4/2011

221

$

58,500 Winston-Salem

NC

Hampton Inn & Suites

McKibbon

3/15/2011

94

11,000 Matthews

NC

Fairfield Inn & Suites

Newport

3/25/2011

94

10,000 Columbia

SC

TownePlace Suites

Newport

3/25/2011

91

10,500 Mobile

AL

Hampton Inn & Suites

McKibbon

6/2/2011

101

13,000 Gainesville

FL

Hilton Garden Inn

McKibbon

6/2/2011

104

12,500 Pensacola

FL

TownePlace Suites

McKibbon

6/2/2011

98

11,500 Knoxville

TN

SpringHill Suites

McKibbon

6/2/2011

103

14,500 Richmond

VA

SpringHill Suites

McKibbon

6/2/2011

103

11,000 Cedar Rapids

IA

Hampton Inn & Suites

Schulte

6/8/2011

103

13,000 Cedar Rapids

IA

Homewood Suites

Schulte

6/8/2011

95

13,000 Hoffman Estates

IL

Hilton Garden Inn

Schulte

6/10/2011

184

10,000 Davenport

IA

Hampton Inn & Suites

Schulte

7/19/2011

103

13,000 Knoxville

TN

Homewood Suites

McKibbon

7/19/2011

103

15,000 Knoxville

TN

TownePlace Suites

McKibbon

8/9/2011

98

9,000 Mason

OH

Hilton Garden Inn

Schulte

9/1/2011

110

14,825 Omaha

NE

Hilton Garden Inn

White

9/1/2011

178

30,018 Des Plaines

IL

Hilton Garden Inn

Raymond

9/20/2011

251

38,000 Merillville

IN

Hilton Garden Inn

Schulte

9/30/2011

124

14,825 Austin/Round Rock

TX

Homewood Suites

Vista

10/3/2011

115

15,500 Scottsdale

AZ

Hilton Garden Inn

White

10/3/2011

122

16,300 South Bend

IN

Fairfield Inn & Suites

White

11/1/2011

119

17,500 Charleston

SC

Home2 Suites

LBA

11/10/2011

122

13,908 Oceanside

CA

Courtyard

Marriott

11/28/2011

142

30,500 Skokie

IL

Hampton Inn & Suites

Raymond

12/19/2011

225

32,000 Tallahassee

FL

Fairfield Inn & Suites

LBA

12/30/2011

97

9,355

Total

3,300

$

458,231 The purchase price for these properties, net of debt assumed, was funded primarily by the Company’s on-going best-efforts offering of Units. The Company assumed approximately $69.4 million of debt secured by five of its hotel properties. The following table summarizes the hotel location, interest

rate, maturity date and principal amount assumed associated with each note payable. All dollar amounts are in thousands. S-9

Acquired

Purchase

Price

Location Brand

Interest

Acquisition

Maturity

Principal

Outstanding Knoxville, TN Homewood Suites

6.30

%

7/19/2011

10/8/2016

$

11,499

$

11,428 Knoxville, TN TownePlace Suites

5.45

%

8/9/2011

12/11/2015

7,392

7,306 Des Plaines, IL Hilton Garden Inn

5.99

%

9/20/2011

8/1/2016

20,838

20,749 Scottsdale, AZ Hilton Garden Inn

6.07

%

10/3/2011

2/1/2017

10,585

10,558 Skokie, IL Hampton Inn & Suites

6.15

%

12/19/2011

7/1/2016

19,092

19,092

$

69,406

$

69,133

(1)

At acquisition, the Company adjusted the interest rates on these loans to market rates and is amortizing the adjustments to interest expense over the life of the loan.

The Company leases all of its hotels to its wholly-owned taxable REIT subsidiary (or a subsidiary thereof) under master hotel lease agreements. The Company also used the proceeds of its on-going best-efforts offering to pay approximately $9.2 million, representing 2% of the gross purchase price for

these hotels, as a brokerage commission to Apple Suites Realty Group, Inc. (“ASRG”), 100% owned by Glade M. Knight, the Company’s Chairman and Chief Executive Officer. No goodwill was recorded in connection with any of the acquisitions. Management and Franchise Agreements Each of the Company’s 26 hotels are operated and managed, under separate management agreements, by affiliates of one of the following companies: LBAM Investor Group, L.L.C. (“LBA”), Marriott International (“Marriott”), MHH Management, LLC (“McKibbon”), Newport Hospitality Group,

Inc. (“Newport”), Raymond Management Company, Inc. (“Raymond”), Schulte Hospitality Group, Inc. (“Schulte”), Stonebridge Realty Advisors, Inc. (“Stonebridge”), Vista Host, Inc. (“Vista”), or White Lodging Services Corporation (“White”). The agreements provide for initial terms of 5 to 30 years.

Fees associated with the agreements generally include the payment of base management fees, incentive management fees, accounting fees, and other fees for centralized services which are allocated among all of the hotels that receive the benefit of such services. Base management fees are calculated as a

percentage of gross revenues. Incentive management fees are calculated as a percentage of operating profit in excess of a priority return to the Company, as defined in the management agreements. The Company has the option to terminate the management agreements if specified performance thresholds

are not satisfied. For the year ended December 31, 2011 the Company incurred approximately $1.3 million in management fees. LBA, McKibbon, Newport, Raymond, Schulte, Stonebridge, Vista and White are not affiliated with either Marriott or Hilton, and as a result, the hotels they manage were required to obtain separate franchise agreements with each respective franchisor. The Hilton franchise agreements generally

provide for a term of 10 to 21 years. Fees associated with the agreements generally include the payment of royalty fees and program fees. The Marriott franchise agreements generally provide for initial terms of 15 to 20 years. Fees associated with the agreements generally include the payment of royalty

fees, marketing fees, reservation fees and a communications support fee based on room revenues. For the year ended December 31, 2011 the Company incurred approximately $1.8 million in franchise fees. Results of Operations During the period from the Company’s initial capitalization on August 13, 2010 to March 3, 2011, the Company owned no properties, had no revenue, exclusive of interest income and was primarily engaged in capital formation activities. During this period, the Company incurred miscellaneous start-

up costs and interest expense related to an unsecured line of credit. The Company’s first investor closing under its on-going best-efforts offering occurred on January 27, 2011 and the Company began operations on March 4, 2011 when it purchased its first hotel. During the S-10

Rate(1)

Date

Date

Assumed

balance as of

December 31, 2011

remainder of 2011, the Company purchased an additional 25 hotel properties. As a result, a comparison of 2011 operating results to prior year results is not meaningful. Hotel performance is impacted by many factors including local competition, local and general economic conditions in the United States and the performance of individual managers assigned to each hotel. Performance of the hotels as compared to other hotels in their respective local markets in

general has met the Company’s expectations for the period owned. In evaluating financial condition and operating performance, the most important indicators on which the Company focuses are revenue measurements, such as average occupancy, average daily rate (“ADR”), revenue per available room

(“RevPAR”) and market yield, which compares an individual hotel’s results to others in its local market, and expenses, such as hotel operating expenses, general and administrative and other expenses as described below. Revenues The Company’s principal source of revenue is hotel revenue, consisting of room and other related revenue. For the year ended December 31, 2011, the Company had total revenue of approximately $42.1 million. This revenue reflects hotel operations for the 26 hotels acquired through December 31,

2011 for their respective periods of ownership by the Company. For the period from acquisition through December 31, 2011, the hotels achieved combined average occupancy of approximately 69%, ADR of $110 and RevPAR of $76. ADR is calculated as room revenue divided by the number of rooms

sold, and RevPAR is calculated as occupancy multiplied by ADR. These rates are consistent with industry and brand averages for the period owned. The average Market Yield for these hotels in 2011 was 130. The Market Yield is a measure of each hotel’s RevPAR compared to the average in the

market, with 100 being the average (the index excludes hotels under renovation or open less than two years) and is provided by Smith Travel Research, Inc.®, an independent company that tracks historical hotel performance in most markets throughout the world. The Company will continue to pursue

market opportunities to improve revenue. With continued modest improvement in the economy in the United States, the hotel industry and the Company anticipate revenue growth in the mid-single digits in 2012 as compared to 2011 for comparable properties. Expenses Hotel operating expenses relate to the 26 hotels acquired through December 31, 2011 for their respective periods owned and consist of direct room expenses, hotel administrative expense, sales and marketing expense, utilities expense, repair and maintenance expense, franchise fees and management

fees. For the year ended December 31, 2011, hotel operating expenses totaled approximately $23.7 million or 56% of total revenue. Nine of the hotels acquired by the Company opened within the past two years. As a result, although operating expenses will increase with a full year of ownership for all

properties, it is anticipated that expense as a percentage of revenue for the properties owned at December 31, 2011 will decline as new properties establish themselves within their respective markets. Taxes, insurance, and other expenses for the year ended December 31, 2011 were approximately $2.5 million or 6% of total revenue. For comparable hotels, taxes will likely increase if the economy continues to improve and localities reassess property values accordingly. Also, for comparable hotels,

2012 insurance rates have increased due to property and casualty carriers’ losses world-wide in the past year. General and administrative expense for the year ended December 31, 2011 was approximately $3.1 million. The principal components of general and administrative expense are advisory fees and reimbursable expenses, legal fees, accounting fees and reporting expense. The Company incurred

approximately $0.5 million in legal costs in 2011 due to the legal and related matters discussed above. The Company anticipates it will continue to incur significant legal costs at least during the first half of 2012. S-11

Acquisition related costs for the year ended December 31, 2011 were approximately $11.3 million. The Company has expensed as incurred all transaction costs associated with the acquisitions of existing businesses, including title, legal, accounting and other related costs, as well as the brokerage

commission paid to ASRG. Depreciation expense for the year ended December 31, 2011 was approximately $6.0 million. Depreciation expense represents expense of the Company’s 26 hotel buildings and related improvements, and associated personal property (furniture, fixtures, and equipment) for their respective periods

owned. For the year ended December 31, 2011, the Company recognized interest income of approximately $0.4 million. Interest income represents earnings on excess cash invested in short term money market instruments. Interest expense for the year ended December 31, 2011 totaled approximately $1.0

million and primarily represents interest expense incurred from debt assumed with the acquisition of five of the Company’s hotels. Related Parties The Company has, and is expected to continue to engage in, significant transactions with related parties. These transactions cannot be construed to be at arm’s length and the results of the Company’s operations may be different if these transactions were conducted with non-related parties. The

Company’s independent members of the Board of Directors oversee and annually review the Company’s related party relationships (which include the relationships discussed in this section) and are required to approve any significant modifications to the contracts, as well as any new significant related

party transactions. The Board of Directors is not required to approve each individual transaction that falls under the related party relationships. However, under the direction of the Board of Directors, at least one member of the Company’s senior management team approves each related party

transaction. The Company has a contract with ASRG, to acquire and dispose of real estate assets for the Company. A fee of 2% of the gross purchase price or gross sale price in addition to certain reimbursable expenses is paid to ASRG for these services. As of December 31, 2011, payments to ASRG for fees

under the terms of this contract have totaled approximately $9.2 million since inception, all of which was incurred in 2011 and is included in acquisition related costs in the Company’s consolidated statements of operations. The Company is party to an advisory agreement with A10A, pursuant to which A10A provides management services to the Company. A10A provides these management services through an affiliate called Apple Fund Management LLC (“AFM”), which is a subsidiary of Apple REIT Six, Inc. An

annual fee ranging from 0.1% to 0.25% of total equity proceeds received by the Company, in addition to certain reimbursable expenses, are payable to A10A for these management services. Total advisory fees incurred by the Company under the advisory agreement are included in general and

administrative expenses and totaled approximately $318,000 for the year ended December 31, 2011. No advisory fees were incurred by the Company prior to 2011. In addition to the fees payable to ASRG and A10A, the Company reimbursed A10A or ASRG or paid directly to AFM on behalf of A10A or ASRG approximately $1.4 million and $25,000 for the years ended December 31, 2011 and 2010. The expenses reimbursed were approximately $700,000 and

$0, respectively, for costs reimbursed under the contract with ASRG and approximately $700,000 and $25,000, respectively, for costs reimbursed under the contract with A10A. The costs are included in general and administrative expenses and are for the Company’s proportionate share of the staffing and

related costs provided by AFM at the direction of A10A. AFM is an affiliate of Apple Six Advisors, Inc., Apple Seven Advisors, Inc., Apple Eight Advisors, Inc., Apple Nine Advisors, Inc., Apple Ten Advisors, Inc., ASRG and Apple Six Realty Group, Inc., (collectively the “Advisors” which are wholly owned by Glade M. Knight). As such, the Advisors

provide management services through the use of AFM to, respectively, Apple REIT Six, Inc., Apple REIT Seven, Inc., Apple REIT Eight, Inc., Apple REIT Nine, Inc. and Apple REIT Ten, Inc. (collectively the “Apple REIT Entities”). Although there is a potential conflict on time S-12

allocation of employees due to the fact that a senior manager, officer or staff member will provide services to more than one company, the Company believes that the executives and staff compensation sharing arrangement described more fully below allows the companies to share costs yet attract and

retain superior executives and staff. The cost sharing structure also allows each entity to maintain a much more cost effective structure than having separate staffing arrangements. Amounts reimbursed to AFM include both compensation for personnel and “overhead” (office rent, utilities, benefits, office

supplies, etc.) used by the companies. Since the employees of AFM perform services for the Apple REIT Entities and Advisors at the direction of the Advisors, individuals, including executive officers, receive their compensation at the direction of the Advisors and may receive consideration directly from

the Advisors. The Advisors and Apple REIT Entities allocate all of the costs of AFM among the Apple REIT Entities and the Advisors. The allocation of costs from AFM is reviewed at least annually by the Compensation Committees of the Apple REIT Entities. In making the allocation, management of each of

the entities and their Compensation Committee consider all relevant facts related to each Company’s level of business activity and the extent to which each Company requires the services of particular personnel of AFM. Such payments are based on the actual costs of the services and are not based on

formal record keeping regarding the time these personnel devote to the Company, but are based on a good faith estimate by the employee and/or his or her supervisor of the time devoted by the employee to the Company. As part of this arrangement, the day to day transactions may result in amounts

due to or from the Apple REIT Entities. To efficiently manage cash disbursements, an individual Apple REIT Entity may make payments for any or all of the related companies. The amounts due to or from the related Apple REIT Entity are reimbursed or collected and are not significant in amount. ASRG and A10A are 100% owned by Glade M. Knight, Chairman and Chief Executive Officer of the Company. Mr. Knight is also Chairman and Chief Executive Officer of Apple REIT Six, Inc., Apple REIT Seven, Inc., Apple REIT Eight, Inc. and Apple REIT Nine, Inc. Another member of the

Company’s Board of Directors is also on the Board of Directors of Apple REIT Seven, Inc. and Apple REIT Eight, Inc. During the first quarter of 2011, the Company entered into an assignment of contract with ASRG to become the purchaser of a Home2 Suites by Hilton under construction in Charleston, South Carolina for a total purchase price of $13.9 million. ASRG entered into the assigned contract on

November 5, 2010. Under the terms and conditions of the contract, ASRG assigned to the Company all of its rights and obligations under the purchase contract. There was no consideration paid to ASRG for this assignment, other than the reimbursement of the deposit previously made by ASRG totaling

$100,000. There was no profit for ASRG in the assignment. The Company purchased this hotel on November 10, 2011, the same day the hotel opened for business. During the fourth quarter of 2011, the Company entered into an assignment of contract with ASRG to become the purchaser of all of the ownership interests in a limited liability company, Sunbelt-FTH, LLC, which owned a Fairfield Inn & Suites by Marriott located in Tallahassee, Florida for a total

purchase price of $9.4 million. The hotel is newly constructed and opened on December 15, 2011. ASRG entered into the assigned contract on July 8, 2010. Under the terms and conditions of the contract, ASRG assigned to the Company all of its rights and obligations under the purchase contract. There

was no consideration paid to ASRG for this assignment, other than the reimbursement of the deposit previously made by ASRG totaling $2,500. There was no profit for ASRG in the assignment. The Company closed on the purchase of the limited liability company on December 30, 2011. The Company has incurred legal fees associated with the Legal Proceedings and Related Matters discussed herein. The Company also incurs other professional fees such as accounting, auditing and reporting. These fees are included in general and administrative expense in the Company’s consolidated

statements of operations. To be cost effective, these services received by the Company are shared as applicable across the other Apple REIT Entities. The professionals cannot always specifically identify their fees for one company and therefore management allocates these costs across the companies that

benefit from the services. S-13

On occasion, the Company uses, for acquisition, renovation and asset management purposes, a Learjet owned by Apple Air Holding, LLC, which is jointly owned by Apple REIT Six, Inc., Apple REIT Seven, Inc., Apple REIT Eight, Inc., and Apple REIT Nine, Inc. Total costs paid for the usage of

the aircraft in 2011 were $216 thousand. Series B Convertible Preferred Stock The Company has issued 480,000 Series B convertible preferred shares to Glade M. Knight, Chairman and Chief Executive Officer of the Company, in exchange for the payment by him of $0.10 per Series B convertible preferred share, or an aggregate of $48,000. The Series B convertible preferred

shares are convertible into common shares pursuant to the formula and on the terms and conditions set forth below. There are no dividends payable on the Series B convertible preferred shares. Holders of more than two-thirds of the Series B convertible preferred shares must approve any proposed amendment to the articles of incorporation that would adversely affect the Series B convertible preferred shares. Upon the Company’s liquidation, the holder of the Series B convertible preferred shares is entitled to a priority liquidation payment before any distribution of liquidation proceeds to the holders of the common shares. However, the priority liquidation payment of the holder of the Series B

convertible preferred shares is junior to the holders of the Series A preferred shares’ distribution rights. The holder of a Series B convertible preferred share is entitled to a liquidation payment of $11 per number of common shares each Series B convertible preferred share would be convertible into

according to the formula described below. In the event that the liquidation of the Company’s assets results in proceeds that exceed the distribution rights of the Series A preferred shares and the Series B convertible preferred shares, the remaining proceeds will be distributed between the common shares

and the Series B convertible preferred shares, on an as converted basis. Each holder of outstanding Series B convertible preferred shares shall have the right to convert any of such shares into common shares of the Company upon and for 180 days following the occurrence of any of the following events:

substantially all of the Company’s assets, stock or business is sold or transferred through exchange, merger, consolidation, lease, share exchange, sale or otherwise, other than a sale of assets in liquidation, dissolution or winding up of the Company; (2) the termination or expiration without renewal of the advisory agreement with A10A, or if the Company ceases to use ASRG to provide property acquisition and disposition services; or (3) the Company’s common shares are listed on any securities exchange or quotation system or in any established market. S-14

(1)

Upon the occurrence of any conversion event, each Series B convertible preferred share may be converted into a number of common shares based upon the gross proceeds raised through the date of conversion in the Company’s $2 billion offering according to the following table: Gross Proceeds Raised from Sales of

Number of Common Shares $400 million

4.83721 $500 million

6.11068 $600 million

7.29150 $700 million

8.49719 $800 million

9.70287 $900 million

10.90855 $1 billion

12.11423 $1.1 billion

13.31991 $1.2 billion

14.52559 $1.3 billion

15.73128 $1.4 billion

16.93696 $1.5 billion

18.14264 $1.6 billion

19.34832 $1.7 billion

20.55400 $1.8 billion

21.75968 $1.9 billion

22.96537 $2 billion

24.17104 In the event that after raising gross proceeds of $2 billion, the Company raises additional gross proceeds in a subsequent public offering, each Series B convertible preferred share may be converted into an additional number of common shares based on the additional gross proceeds raised through the

date of conversion in a subsequent public offering according to the following formula: (X/100 million) x 1.20568, where X is the additional gross proceeds rounded down to the nearest $100 million. No additional consideration is due upon the conversion of the Series B convertible preferred shares. The conversion into common shares of the Series B convertible preferred shares will result in dilution of the shareholders’ interests and the termination of the Series A preferred shares. Expense related to the issuance of 480,000 Series B convertible preferred shares to Mr. Knight will be recognized at such time when the number of common shares to be issued for conversion of the Series B shares can be reasonably estimated and the event triggering the conversion of the Series B

shares to common shares occurs. The expense will be measured as the difference between the fair value of the common stock for which the Series B shares can be converted and the amounts paid for the Series B shares. Although the fair market value cannot be determined at this time, expense if the

maximum offering is achieved could range from $0 to in excess of $127 million (assumes $11 per unit fair market value). Based on equity raised through December 31, 2011, if a triggering event had occurred, expense would have ranged from $0 to $25.5 million (assumes $11 per unit fair market value)

and approximately 2.3 million common shares would have been issued. Liquidity and Capital Resources The following is a summary of the Company’s significant contractual obligations as of December 31, 2011:

(000’s)

Total

Amount of Commitments Expiring per Period

Less than 1

2-3 Years

4-5 Years

Over 5 Property Purchase Commitments

$

116,137

$

26,550

$

89,587

$

—

$

— Debt (including interest of $19.0 million)

88,128

5,453

10,906

62,074

9,695 Ground Leases

107

2

4

4

97

$

204,372

$

32,005

$

100,497

$

62,078

$

9,792 S-15

Units through Date of Conversion

through Conversion of

One Series B Convertible Preferred Share

Year

Years

The Company was initially capitalized on August 13, 2010, with its first investor closing on January 27, 2011. The Company’s principal sources of liquidity are cash on hand, the proceeds of its on-going best-efforts offering and the cash flow generated from properties the Company has or will acquire

and any short term investments. In addition, the Company may borrow funds, subject to the approval of the Company’s Board of Directors. The Company anticipates that cash flow from operations, and cash on hand, will be adequate to meet its anticipated liquidity requirements, including debt service, capital improvements, required distributions to shareholders to qualify as a REIT and planned Unit redemptions. The Company intends to

use the proceeds from the Company’s on-going best-efforts offering, cash on hand and assumed secured debt to purchase the hotels under contract if a closing occurs, however, it may use debt if necessary to complete the acquisitions. To maintain its REIT status the Company is required to distribute at least 90% of its ordinary income. Distributions during 2011 totaled approximately $23.6 million and were paid at a monthly rate of $0.06875 per common share beginning in February 2011. For the same period, the Company’s cash

generated from operations was approximately $0.8 million. Due to the inherent delay between raising capital and investing that same capital in income producing real estate, the Company has had significant amounts of cash earning interest at short term money market rates. As a result, a portion of

distributions paid through December 31, 2011 have been funded from proceeds from the on-going best-efforts offering of Units, and are expected to be treated as a return of capital for federal income tax purposes. In February 2011, the Company’s Board of Directors established a policy for an annualized

distribution rate of $0.825 per common share, payable in monthly distributions. The Company intends to continue paying distributions on a monthly basis, consistent with the annualized distribution rate established by its Board of Directors. The Company’s Board of Directors, upon the recommendation of

the Audit Committee, may amend or establish a new annualized distribution rate and may change the timing of when distributions are paid. The Company’s objective in setting a distribution rate is to project a rate that will provide consistency over the life of the Company taking into account acquisitions

and capital improvements, ramp up of new properties and varying economic cycles. To meet this objective, the Company may require the use of debt or offering proceeds in addition to cash from operations. Since a portion of distributions to date have been funded with proceeds from the offering of

Units, the Company’s ability to maintain its current intended rate of distribution will be based on its ability to fully invest its offering proceeds and thereby increase its cash generated from operations. As there can be no assurance of the Company’s ability to acquire properties that provide income at this

level, or that the properties already acquired will provide income at this level, there can be no assurance as to the classification or duration of distributions at the current rate. Proceeds of the offering which are distributed are not available for investment in properties. The Company is raising capital through a best-efforts offering of Units (each Unit consists of one common share and one Series A preferred share) by David Lerner Associates, Inc., the managing dealer, which receives selling commissions and a marketing expense allowance based on proceeds of the

Units sold. The minimum offering of 9,523,810 Units at $10.50 per Unit was sold as of January 27, 2011, with proceeds net of commissions and marketing expenses totaling $90 million. Subsequent to the minimum offering and through December 31, 2011, an additional 34.0 million Units, at $11 per Unit,

were sold, with the Company receiving proceeds, net of commissions, marketing expenses and other offering costs of approximately $334.6 million. The Company is continuing its offering at $11.00 per Unit. The Company will offer Units until January 19, 2013, unless the offering is extended, or terminated

if all of the Units are sold before then. As of December 31, 2011, 138,748,819 Units remained unsold. The Company’s Board of Directors has approved a Unit Redemption Program to provide limited interim liquidity to its shareholders who have held their Units for at least one year. Shareholders may request redemption of Units for a purchase price equal to 92.5% of the price paid per Unit if the

Units have been owned for less than five years, or 100% of the price paid per Unit if the Units have been owned more than five years. The maximum number of Units that may be redeemed in any given year is three percent of the weighted average number of Units outstanding during the 12-month

period immediately prior to the date of redemption. The Company reserves the S-16

right to change the purchase price of redemptions, reject any request for redemption, or otherwise amend the terms of, suspend, or terminate the Unit Redemption Program. If the total redemption requests exceed the authorized amount of redemptions, the Board of Directors may limit the amount of

redemptions as it deems prudent. If requests exceed the authorized amount, redemptions will be made on a pro-rata basis. Redemptions will be made quarterly and the Company may use proceeds from its on-going best-efforts offering to redeem Units. Prior to the commencement of the Company’s on-going best-efforts offering, the Company obtained an unsecured note payable in a principal amount of $400,000 to fund certain start-up costs and offering expenses. The note was fully paid during January 2011 with net proceeds from the Company’s

on-going best-efforts offering. The Company has on-going capital commitments to fund its capital improvements. The Company is required, under all of the hotel management agreements and certain loan agreements, to make available, for the repair, replacement, refurbishing of furniture, fixtures, and equipment, a percentage of

gross revenues provided that such amount may be used for the Company’s capital expenditures with respect to the hotels. The Company expects that this amount will be adequate to fund required repair, replacement, and refurbishments and to maintain the Company’s hotels in a competitive condition.

As of December 31, 2011, the Company held approximately $5.2 million in reserves for capital expenditures. During 2011, the Company spent approximately $1.7 million in capital expenditures and anticipates spending $12 million during 2012 on properties owned at December 31, 2011. The Company

does not currently have any existing or planned projects for development. As of December 31, 2011, the Company had outstanding contracts for the potential purchase of seven additional hotels for a total purchase price of approximately $116.1 million. Of these seven hotels, six are under construction and should be completed over the next 3 to 18 months from December

31, 2011. Closing on these six hotels is expected upon completion of construction. The existing hotel is expected to close within the next three months. Although the Company is working towards acquiring these hotels, there are many conditions to closing that have not yet been satisfied and there can be

no assurance that closings will occur under the outstanding purchase contracts. It is anticipated that the purchase price (less any debt assumed) for the outstanding contracts will be funded from the proceeds of the Company’s on-going best-efforts offering of Units and cash on hand if a closing occurs. Impact of Inflation Operators of hotels, in general, possess the ability to adjust room rates daily to reflect the effects of inflation. Competitive pressures may, however, limit the operators’ ability to raise room rates. Currently the Company is not experiencing any material impact from inflation. Business Interruption Being in the real estate industry, the Company is exposed to natural disasters on both a local and national scale. Although management believes there is adequate insurance to cover this exposure, there can be no assurance that such events will not have a material adverse effect on the Company’s

financial position or results of operations. Seasonality The hotel industry historically has been seasonal in nature. Seasonal variations in occupancy at the Company’s hotels may cause quarterly fluctuations in its revenues. To the extent that cash flow from operations is insufficient during any quarter, due to temporary or seasonal fluctuations in revenue,

the Company expects to utilize cash on hand or, if necessary, any available other financing sources to make distributions. S-17

Critical Accounting Policies The following contains a discussion of what the Company believes to be critical accounting policies. These items should be read to gain a further understanding of the principles used to prepare the Company’s financial statements. These principles include application of judgment; therefore, changes in

judgments may have a significant impact on the Company’s reported results of operations and financial condition. Investment Policy Upon acquisition of real estate properties, the Company estimates the fair value of acquired tangible assets (consisting of land, land improvements, buildings and improvements) and identified intangible assets and liabilities, in-place leases and assumed debt based on evaluation of information and

estimates available at that date. Generally, the Company does not acquire hotel properties that have significant in-place leases as lease terms for hotel properties are very short term in nature. The Company has not assigned any value to intangible assets such as management contracts and franchise

agreements as such contracts are generally at current market rates and any other value attributable to these contracts is not considered material. The Company has expensed as incurred all transaction costs associated with the acquisitions of existing businesses, including title, legal, accounting and other

related costs, as well as the brokerage commission paid to ASRG. Capitalization Policy The Company considers expenditures to be capital in nature based on the following criteria: (1) for a single asset, the cost must be at least $500, including all normal and necessary costs to place the asset in service, and the useful life must be at least one year; (2) for group purchases of 10 or more

identical assets, the unit cost for each asset must be at least $50, including all normal and necessary costs to place the asset in service, and the useful life must be at least one year; (3) for major repairs to a single asset, the repair must be at least $2,500 and the useful life of the asset must be substantially

extended. Impairment Losses Policy The Company records impairment losses on hotel properties used in operations if indicators of impairment are present, and the sum of the undiscounted cash flows estimated to be generated by the respective properties over their estimated remaining useful life, based on historical and industry data, is

less than the properties’ carrying amount. Indicators of impairment include a property with current or potential losses from operations, when it becomes more likely than not that a property will be sold before the end of its previously estimated useful life or when events, trends, contingencies or changes

in circumstances indicate that a triggering event has occurred and an asset’s carrying value may not be recoverable. The Company monitors its properties on an ongoing basis by analytically reviewing financial performance and considers each property individually for purposes of reviewing for indicators of

impairment. As many indicators of impairment are subjective, such as general economic and market declines, the Company also prepares an annual recoverability analysis for each of its properties to assist with its evaluation of impairment indicators. The analysis compares each property’s net book value

to each property’s estimated operating income using current operating results for each stabilized property and projected stabilized operating results based on the property’s market for properties that recently opened, were recently renovated or experienced other short-term business disruption. Since the

Company’s planned initial hold period for each property is 39 years the Company’s ongoing analysis and annual recoverability analysis have not identified any impairment losses and no impairment losses have been recorded to date. If events or circumstances change such as the Company’s intended hold

period for a property or if the operating performance of a property declines substantially for an extended period of time, the Company’s carrying value for a particular property may not be recoverable and an impairment loss will be recorded. Impairment losses are measured as the difference between the

asset’s fair value and its carrying value. S-18

Subsequent Events In January 2012, the Company declared and paid approximately $3.0 million in dividend distributions to its common shareholders, or $0.06875 per outstanding common share. The Company also closed on the issuance of approximately 1.7 million Units through its on-going best-efforts offering,

representing gross proceeds to the Company of approximately $18.7 million and proceeds net of selling and marketing costs of approximately $16.8 million. In January 2012, the Company entered into an assignment of contract with ASRG to become the purchaser of all of the ownership interests in a limited liability company, which owns a TownePlace Suites by Marriott (under construction) in Nashville, Tennessee for a total purchase price of $9.8

million. ASRG entered into the assigned contract on July 8, 2010. Under the terms and conditions of the contract, ASRG assigned to the Company all of its rights and obligations under the purchase contract. There was no consideration paid to ASRG for this assignment, other than the reimbursement of

the deposit previously made by ASRG totaling $2,500. There was no profit for ASRG in the assignment. The Company purchased this hotel on January 31, 2012, the same day the hotel opened for business. In January 2012, the Company closed on the purchase of a Homewood Suites located in Gainesville, Florida. The gross purchase price for this hotel, which contains 103 guest rooms, was $14.6 million. The Company assumed approximately $13.1 million of mortgage debt associated with this hotel. The

loan provides for monthly payments of principal and interest on an amortized basis. In February 2012, the Company declared and paid approximately $3.1 million in dividend distributions to its common shareholders, or $0.06875 per outstanding common share. The Company also closed on the issuance of approximately 1.9 million Units through its on-going best-efforts offering,

representing gross proceeds to the Company of approximately $20.8 million and proceeds net of selling and marketing costs of approximately $18.7 million. S-19

The audited consolidated financial statements and financial statement schedule of the Company as of December 31, 2011 and 2010, and the related consolidated statements of operations, shareholders’ equity, and cash flows for the year ended December 31, 2011 and for the period August 13, 2010

(initial capitalization) through December 31, 2010, appearing in this Prospectus and the Registration Statement have been audited by Ernst & Young LLP, independent registered public accounting firm, as set forth in their report thereon appearing elsewhere herein, and are included in reliance upon such

report given on the authority of such firm as experts in accounting and auditing. The tables following this introduction set forth information with respect to certain of the prior real estate programs sponsored by Glade M. Knight, who is sometimes referred to as the “prior program sponsor.” These tables provide information for use in evaluating the programs, the results of the

operations of the programs, and compensation paid by the programs. Information in the tables is current as of December 31, 2011. The tables are furnished solely to provide prospective investors with information concerning the past performance of entities formed by Glade M. Knight. Regulatory filings

and annual reports of Apple REIT Nine, Apple REIT Eight, Apple REIT Seven, Apple REIT Six, Apple Hospitality Five and Apple Hospitality Two will be provided upon request for no cost (except for exhibits, for which there is a minimal charge). In addition, Table VI of this Supplement contains

detailed information on the property acquisitions of Apple REIT Nine and is available without charge upon request of any investor or prospective investor. Please send all requests to Apple REIT Ten, Inc., 814 East Main Street, Richmond, VA 23219, Attn: Kelly Clarke; telephone: 804-344-8121. In the five years ending December 31, 2011, Glade M. Knight sponsored only Apple Hospitality Two, Apple Hospitality Five, Apple REIT Six, Apple REIT Seven, Apple REIT Eight and Apple REIT Nine, which have investment objectives similar to ours. Apple Hospitality Two, Apple Hospitality

Five, Apple REIT Six, Apple REIT Seven, Apple REIT Eight and Apple REIT Nine were formed to invest in existing residential rental properties and/or extended-stay and select-service hotels and possibly other properties for the purpose of providing regular monthly or quarterly distributions to

shareholders and the possibility of long-term appreciation in the value of properties and shares. On May 23, 2007, Apple Hospitality Two merged with and into an affiliate managed by ING Clarion Partners, LLC. Pursuant to the terms and conditions of the Agreement and Plan of Merger, dated as of February 15, 2007, upon the completion of the merger, the separate corporate existence of

Apple Hospitality Two ceased. Each shareholder of Apple Hospitality Two received approximately $11.20 for each outstanding unit (consisting of one common share together with one Series A preferred share). On October 5, 2007, Apple Hospitality Five merged with and into a subsidiary of Inland American Real Estate Trust, Inc. Pursuant to the terms and conditions of the Agreement and Plan of Merger, dated as of July 25, 2007, upon the completion of the merger, the separate corporate existence of

Apple Hospitality Five ceased. Each shareholder of Apple Hospitality Five received approximately $14.05 for each outstanding unit (consisting of one common share together with one Series A preferred share). The information in the following tables should not be considered as indicative of our capitalization or operations. Also past performance of prior programs is not necessarily indicative of our future results. Purchasers of units offered by our offering will not have any interest in the entities referred to

in the following tables or in any of the properties owned by those entities as a result of the acquisition of Units in us. Apple REIT Six, Apple REIT Seven, Apple REIT Eight and Apple REIT Nine have existing Unit Redemption Programs that are similar to our Unit Redemption Program. Currently, the prior companies’ programs redemption requests exceed the redemptions granted. Thus, for the most recent

redemption date (January 2012), the percentage of requested redemptions that were honored was as S-20

follows: Apple REIT Six, approximately 4%; Apple REIT Seven, approximately 4%; Apple REIT Eight, approximately 2% and Apple REIT Nine, approximately 14%. As with our program, each of these companies’ Board of Directors approved its Unit Redemption Program to provide only limited interim liquidity to its shareholders who have held their Units for at least one year. Investments in these companies as well as Apple REIT Ten, Inc. are, and are

intended to be, illiquid investments until a liquidity event occurs. See, “Apple Ten Advisors and Apple Suites Realty—Prior Performance of Programs Sponsored by Glade M. Knight” in the prospectus for additional information on certain prior real estate programs sponsored by Mr. Knight, including a description of the investment objectives which are deemed by

Mr. Knight to be similar and dissimilar to ours. The following tables use certain financial terms. The following paragraphs briefly describe the meanings of these terms.

•

“Acquisition Costs” means fees related to the purchase of property, cash down payments, acquisition fees, and legal and other costs related to property acquisitions. • “Cash Generated From Operations” means the excess (or the deficiency in the case of a negative number) of operating cash receipts, including interest on investments, over operating cash expenditures, including debt service payments. • “GAAP” refers to “Generally Accepted Accounting Principles” in the United States. • “Recapture” means the portion of taxable income from property sales or other dispositions that is taxed as ordinary income. • “Reserves” refers to offering proceeds designated for repairs and renovations to properties and offering proceeds not committed for expenditure and held for potential unforeseen cash requirements. • “Return of Capital” refers to distributions to investors in excess of net income. S-21