Exhibit 99.1

PRESS RELEASE

Contact Information:

David R. O’Reilly

Chief Financial Officer

(214) 741-7744

The Howard Hughes Corporation® Reports Full-Year and Fourth Quarter 2019 Results

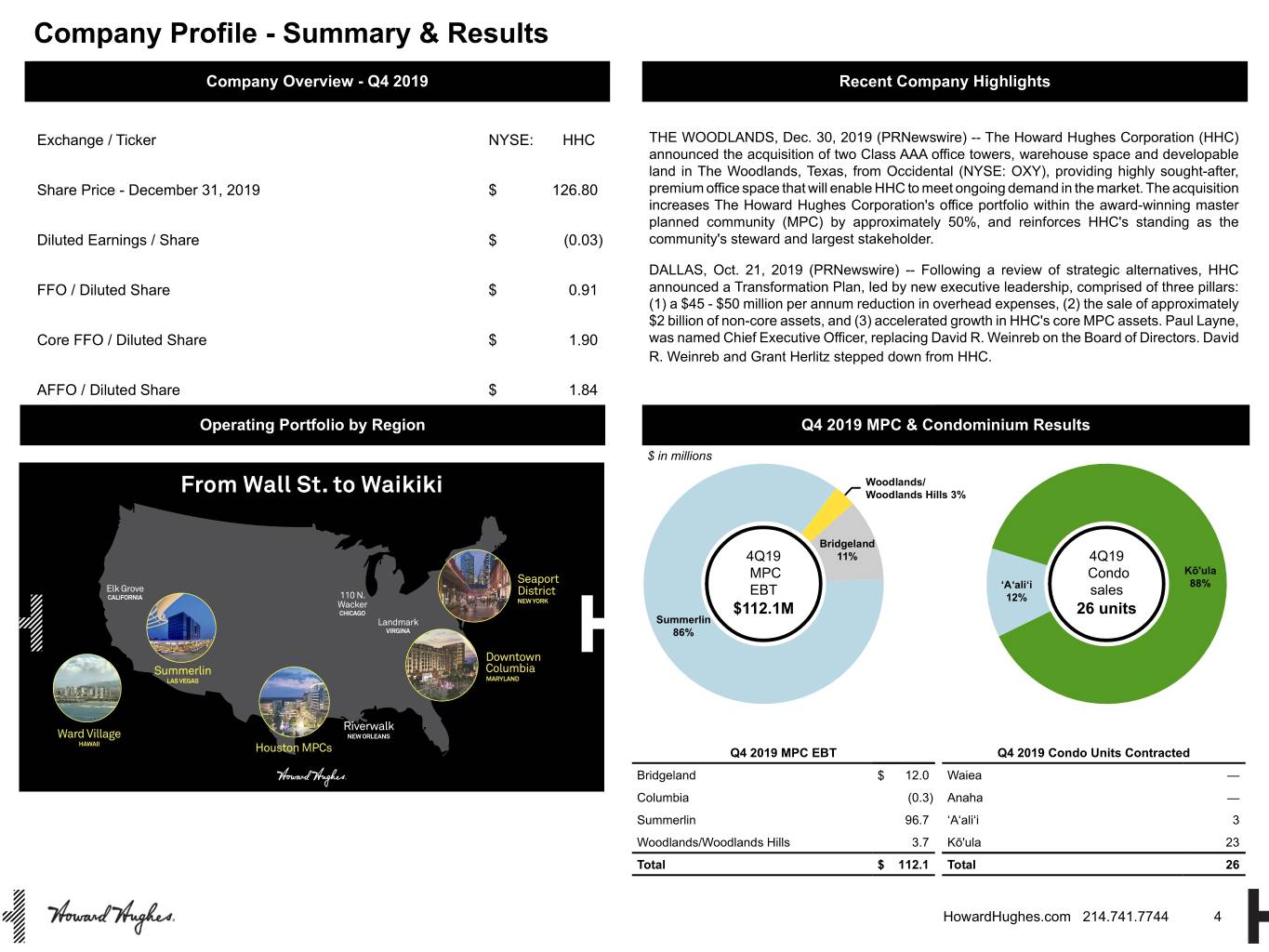

Exceptional full-year results across the Company, including 20% growth in Operating Assets NOI, record MPC land sales and meaningful progress on our Transformation Plan

Dallas, TX, February 27, 2020 – The Howard Hughes Corporation® (NYSE: HHC) (the “Company,” “HHC” or “we”) announced today operating results for the year and fourth quarter ended December 31, 2019. The financial statements, exhibits and reconciliations of non-GAAP measures in the attached Appendix and the Supplemental Information at Exhibit 99.2 provide further details of these results.

Full-Year Highlights

• | Net income attributable to common stockholders increased to $74.0 million, or $1.71 per diluted share, for the year ended December 31, 2019, compared to $57.0 million, or $1.32 per diluted share, for the year ended December 31, 2018. This increase is despite approximately $34.3 million, or $0.79 per diluted share, of one-time expenses associated with retention and severance in connection with management changes and a corporate relocation. |

• | 20% in total net operating income (“NOI”) growth from Operating Assets for the year ended December 31, 2019, over the prior year when including our share of NOI from equity investments. |

• | Experienced best year in the Company’s history in MPC segment with land sales of $330.1 million and 26.9% growth in MPC earnings before tax (“EBT”) to $257.6 million driven by a record number of acres sold and price per acre. |

• | Significant progress on announced Transformation Plan highlighted by: |

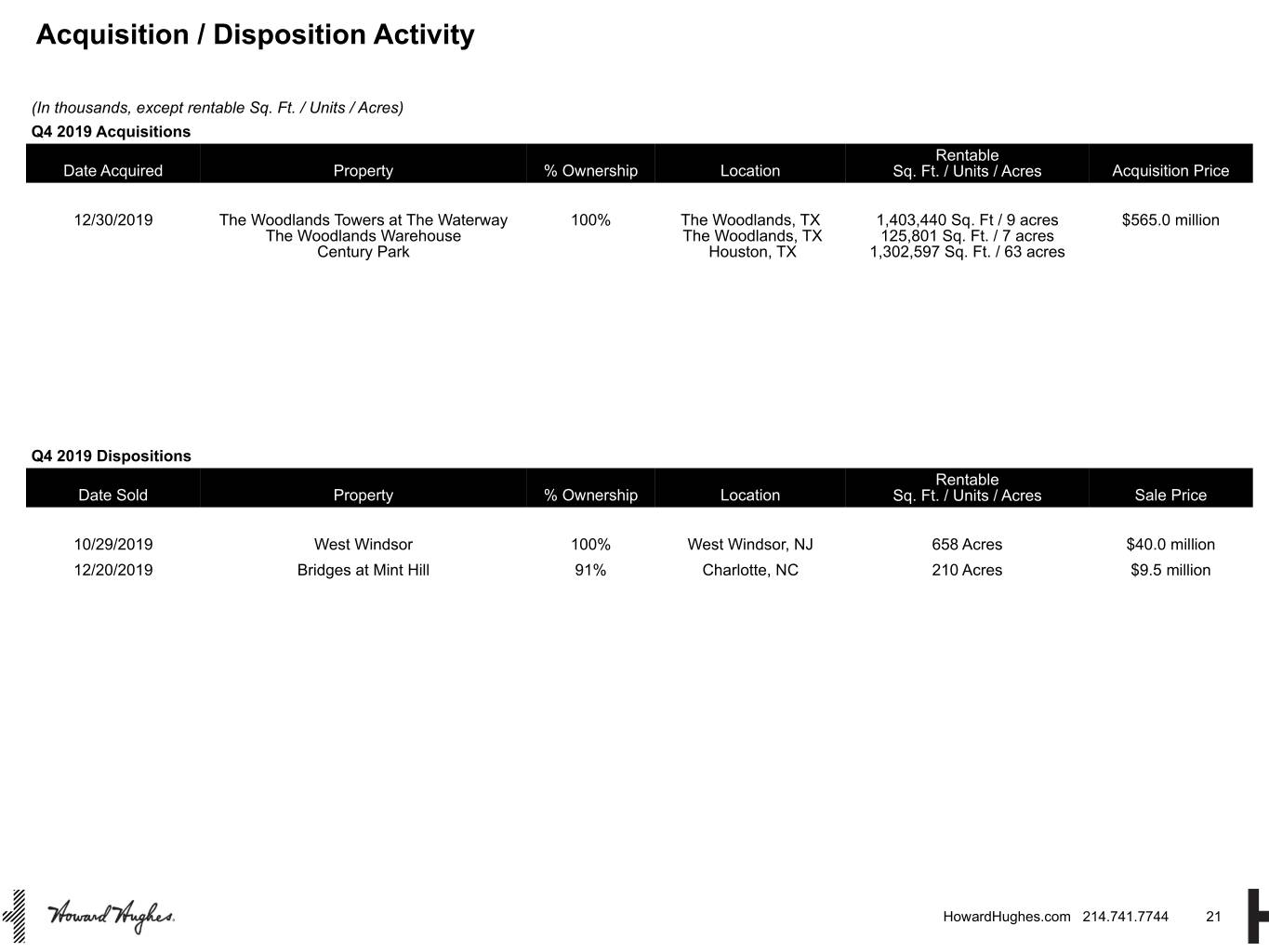

◦ | Executed sales of three non-core assets, Cottonwood Mall, West Windsor and Bridges at Mint Hill, for a total of $95.5 million and recorded a $22.4 million net gain on sale of real estate and other assets. |

◦ | Executed largest acquisition in Company history which included two Class AAA office towers with a combined 1.4 million square feet, a 125,801 square foot warehouse space and 9.3 acres of land in The Woodlands, TX, reinforcing our commitment to reinvest in our core MPCs. |

◦ | Meaningful progress reducing run-rate General and administrative expenses that will materialize throughout 2020. |

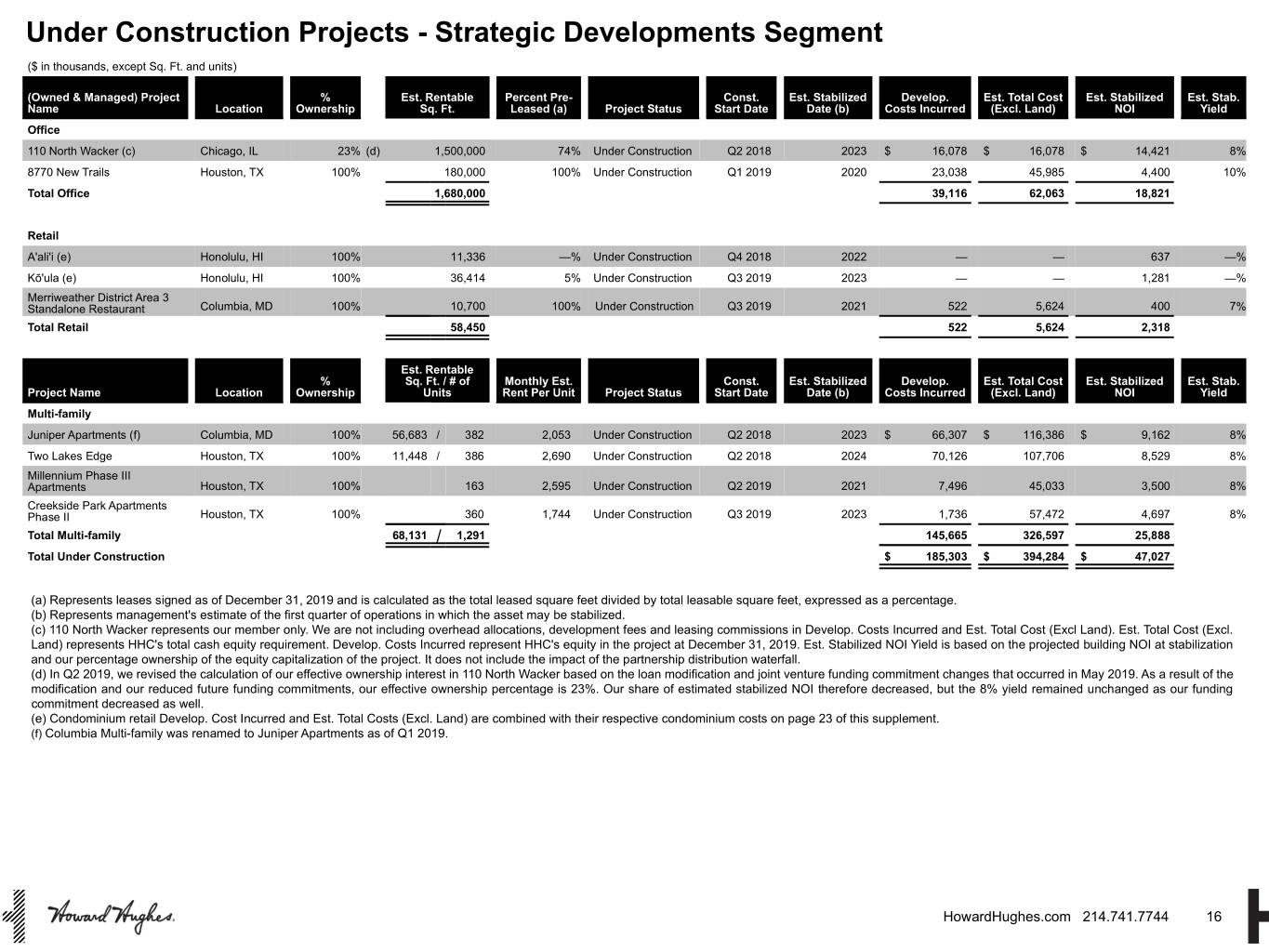

• | Commenced construction on $154.1 million of multi-family, retail and office properties which, at stabilization, are expected to contribute $14.3 million to our projected annual stabilized NOI. |

• | In Ward Village, Hawaii, we broke ground on Kō'ula, which is 74.3% pre-sold, contracted to sell 467 condominium units during the year and, subsequent to year-end, launched public pre-sales of our newest project, Victoria Place, where as of February 21, 2020, we have executed contracts for 185 condominium units, or 53.0% of total units. |

• | Increased Seaport District segment revenues by $23.0 million to $55.6 million as of December 31, 2019, compared to the prior year period due to increases in both our existing businesses and new business openings such as The Fulton and Malibu Farm, as well as sponsorship and summer concert series revenue. |

1

Highlights of our results for the years and three months ended December 31, 2019 and 2018 are summarized below. We are primarily focused on creating shareholder value by increasing our per-share net asset value. Often, the nature of our business results in short-term volatility in our Net income due to the timing of MPC land sales, recognition of condominium revenue and operating business pre-opening expenses, and, as such, we believe the following metrics are most useful in tracking our progress towards net asset value creation.

Year Ended December 31, | Three Months Ended December 31, | |||||||||||||||||||||||||||||

($ in thousands) | 2019 | 2018 | Change | % Change | 2019 | 2018 | Change | % Change | ||||||||||||||||||||||

Operating Assets NOI | ||||||||||||||||||||||||||||||

Office | $ | 85,773 | $ | 67,530 | $ | 18,243 | 27 | % | $ | 22,692 | $ | 17,394 | $ | 5,298 | 30 | % | ||||||||||||||

Retail | 62,568 | 63,846 | (1,278 | ) | (2 | )% | 14,612 | 15,290 | (678 | ) | (4 | )% | ||||||||||||||||||

Multi-family | 18,062 | 15,206 | 2,856 | 19 | % | 4,336 | 4,021 | 315 | 8 | % | ||||||||||||||||||||

Hospitality | 28,843 | 25,371 | 3,472 | 14 | % | 5,424 | 4,935 | 489 | 10 | % | ||||||||||||||||||||

Other | 10,374 | 146 | 10,228 | 7,005 | % | (788 | ) | 1,493 | (2,281 | ) | (153 | )% | ||||||||||||||||||

Company's share NOI (a) | 10,943 | 8,096 | 2,847 | 35 | % | 2,123 | 1,952 | 171 | 9 | % | ||||||||||||||||||||

Total Operating Assets NOI (b) | $ | 216,563 | $ | 180,195 | $ | 36,368 | 20 | % | $ | 48,399 | $ | 45,085 | $ | 3,314 | 7 | % | ||||||||||||||

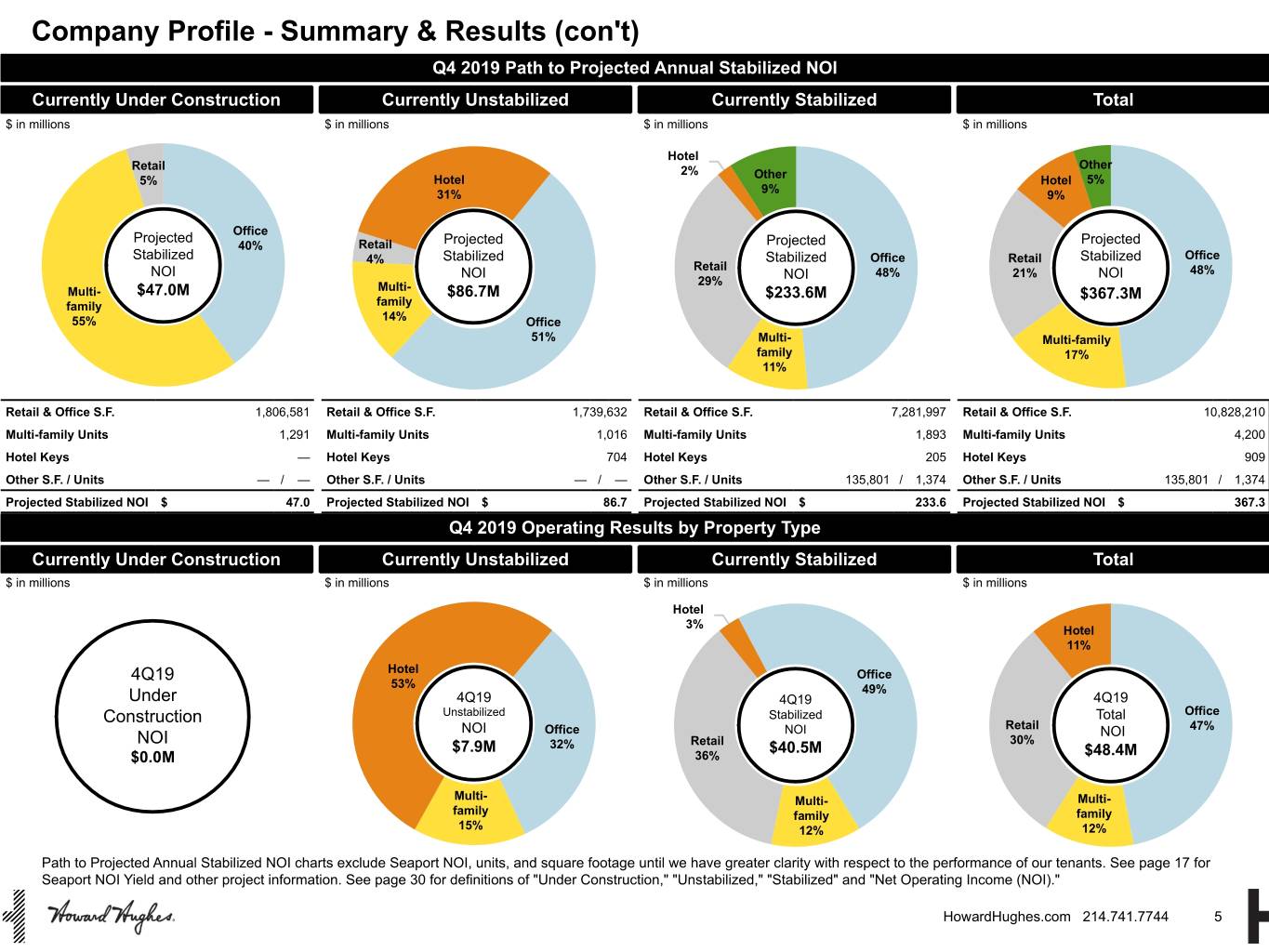

Projected stabilized NOI Operating Assets ($ in millions) | $ | 367.3 | $ | 315.9 | $ | 51.4 | 16 | % | ||||||||||||||||||||||

MPC | ||||||||||||||||||||||||||||||

Acres Sold - Residential | 571 | 456 | 115 | 25 | % | 234 | 72 | 162 | 225 | % | ||||||||||||||||||||

Acres Sold - Commercial | — | 10 | (10 | ) | (100 | )% | — | 6 | (6 | ) | (100 | )% | ||||||||||||||||||

Price Per Acre - Residential | $ | 571 | $ | 515 | $ | 56 | 11 | % | $ | 610 | $ | 418 | $ | 192 | 46 | % | ||||||||||||||

Price Per Acre - Commercial | $ | — | $ | 517 | $ | (517 | ) | (100 | )% | $ | — | $ | 399 | $ | (399 | ) | (100 | )% | ||||||||||||

MPC EBT | $ | 257,586 | $ | 202,955 | $ | 54,631 | 27 | % | $ | 112,117 | $ | 30,617 | $ | 81,500 | 266 | % | ||||||||||||||

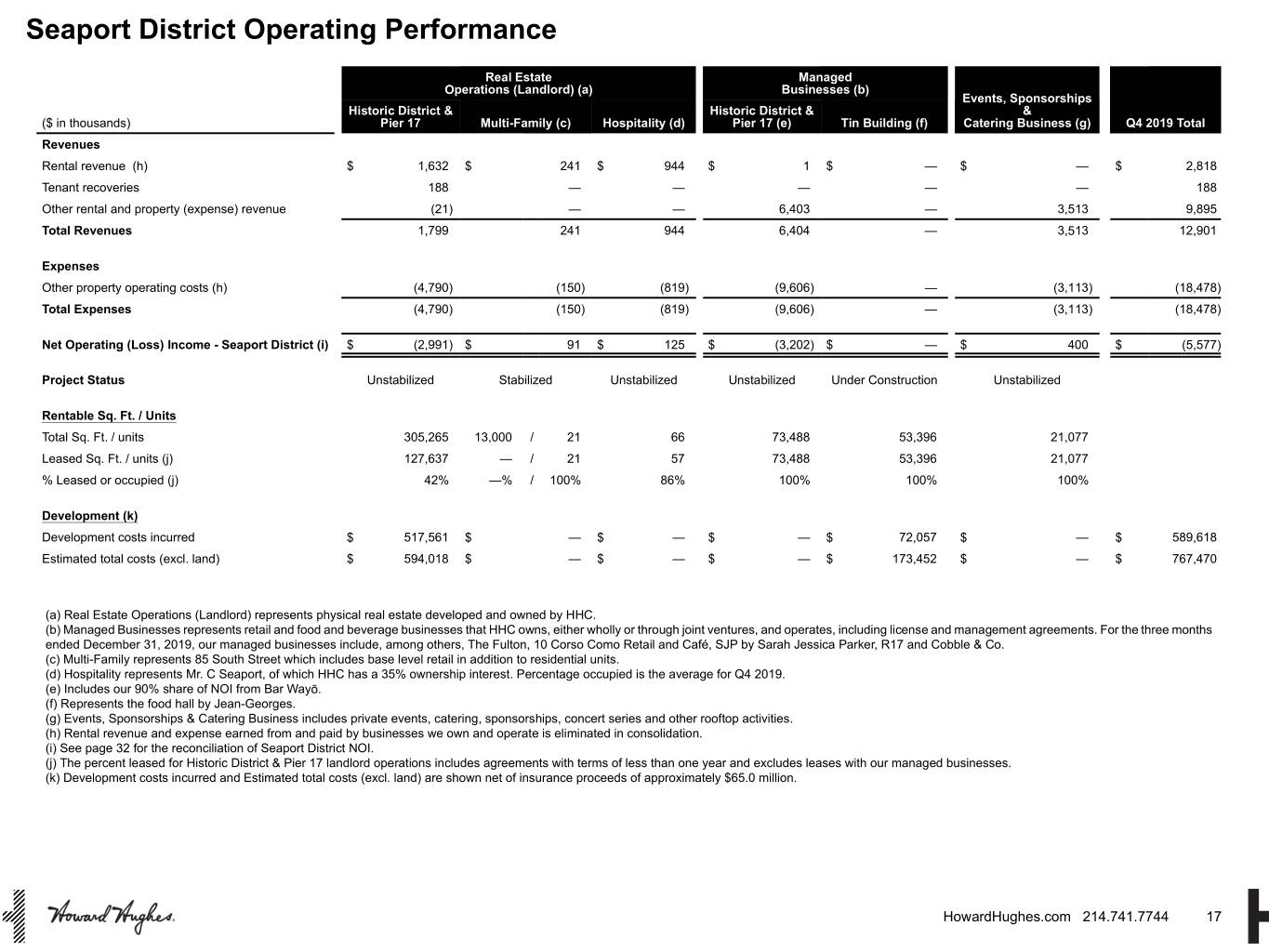

Seaport District NOI | ||||||||||||||||||||||||||||||

Historic District & Pier 17 - Landlord | $ | (8,147 | ) | $ | (2,039 | ) | $ | (6,108 | ) | (300 | )% | $ | (2,991 | ) | $ | 707 | $ | (3,698 | ) | 523 | % | |||||||||

Multi-Family | 394 | 553 | (159 | ) | (29 | )% | 91 | 190 | (99 | ) | (52 | )% | ||||||||||||||||||

Hospitality | 41 | 143 | (102 | ) | (71 | )% | — | 73 | (73 | ) | (100 | )% | ||||||||||||||||||

Historic District & Pier 17 - Managed Businesses | (7,172 | ) | (4,985 | ) | (2,187 | ) | (44 | )% | (2,752 | ) | (4,457 | ) | 1,705 | 38 | % | |||||||||||||||

Events, Sponsorships & Catering Business | (136 | ) | 850 | (986 | ) | (116 | )% | 400 | (28 | ) | 428 | (1,529 | )% | |||||||||||||||||

Company's share NOI (a) | (710 | ) | (713 | ) | 3 | — | % | (325 | ) | (134 | ) | (191 | ) | (143 | )% | |||||||||||||||

Total Seaport District NOI | $ | (15,730 | ) | $ | (6,191 | ) | $ | (9,539 | ) | 154 | % | $ | (5,577 | ) | $ | (3,649 | ) | $ | (1,928 | ) | 53 | % | ||||||||

Strategic Developments | ||||||||||||||||||||||||||||||

Condominium units contracted to sell (c) | 108 | 103 | 5 | 5 | % | 26 | 54 | (28 | ) | (52 | )% | |||||||||||||||||||

(a) | Includes Company’s share of NOI from non-consolidated assets |

(b) | Excludes properties sold or in redevelopment |

(c) | Includes units at our buildings that are open or under construction as of December 31, 2019 |

“Our final quarter of 2019 was marked by significant progress on our transformation plan commitments to sell non-core properties and to focus resources into the growth of our core MPC business. Our acquisition of The Woodlands Towers at The Waterway increases our office portfolio within the award-winning The Woodlands MPC by approximately 50% and reinforces our standing as the community’s steward and largest stakeholder. Overall, our MPCs continue to rank among the top-selling communities in the country with Summerlin and Bridgeland again being ranked by RCLCO as the third and 12th highest selling master planned communities in the nation for 2019. Home sales, a leading indicator

2

of future land purchases by home builders, are up 15% for the year across all our MPCs, and we had a 25% increase in residential acres sold this year over 2018 across our MPC segment.

“Further, we have made meaningful progress towards our goal of having rental NOI comfortably cover interest expense and steady-state corporate costs by realizing 20% growth in Operating Assets NOI over 2018 and making substantial progress in the reduction in our run rate general and administrative costs that will be realized throughout 2020.

“In Honolulu, we continued our momentum at Ward Village by delivering Ke Kilohana and beginning construction on Kō'ula, which was 74% pre-sold at year end. Demand to live in our community remains high as evidenced by sales at Kō'ula, and in January 2020, we began public pre-sales on Victoria Place, our seventh condominium project, which as of February 21st is already 53.0% presold.

“In New York, we continue to make substantial progress in accomplishing our vision for the Seaport District and have celebrated the openings of multiple retail and restaurant attractions throughout the year, including the critically acclaimed The Fulton, by Jean Georges. We remain confident in our vision for the Seaport District and the lasting impact it will make for years to come,” said Paul H. Layne, Chief Executive Officer.

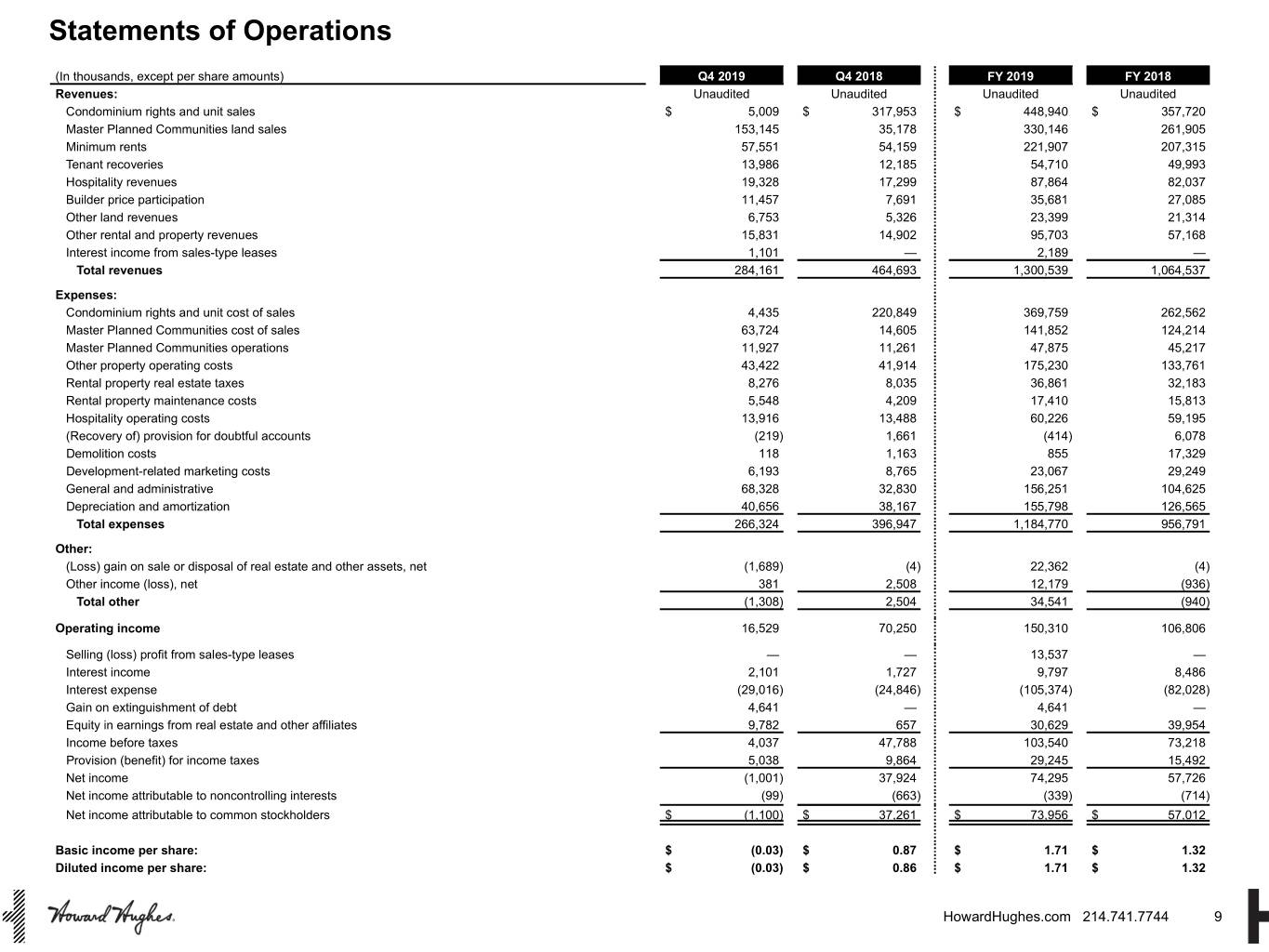

Financial Results

Net income attributable to common stockholders increased to $74.0 million, or $1.71 per diluted share, and decreased to $(1.1) million, or $(0.03) per diluted share, for the year and three months ended December 31, 2019, respectively, compared to $57.0 million, or $1.32 per diluted share, and $37.3 million, or $0.86 per diluted share, for the year and three months ended December 31, 2018, respectively. The increase for the year ended December 31, 2019, is primarily attributable to higher MPC land sales; the increase in the Gain (loss) on sale or disposal of real estate and other assets, net due to the sales of non-core assets; higher Minimum rental and Selling profit from sales-type leases revenues in the Operating Assets segment and higher Other rental and property revenues in the Operating Assets and Seaport District segments. These increases are partially offset by higher operating expenses at all four segments; higher Interest expense at the Seaport District due to interest incurred on the 250 Water Street and Seaport District debt facilities and higher Depreciation and amortization expense as a result of properties being placed into service. The higher operating expenses at the Seaport District are primarily due to start-up costs associated with opening new businesses. The decrease in Net income attributable to common stockholders for the three months ended December 31, 2019, compared to the same period in 2018, is due to lower Condominium rights and units sales, net of costs due to the timing of closings and an increase in General and administrative expenses due to corporate restructuring costs and consulting fees for technology and data integration projects. The decrease was partially offset by higher Master Planned Communities land sales.

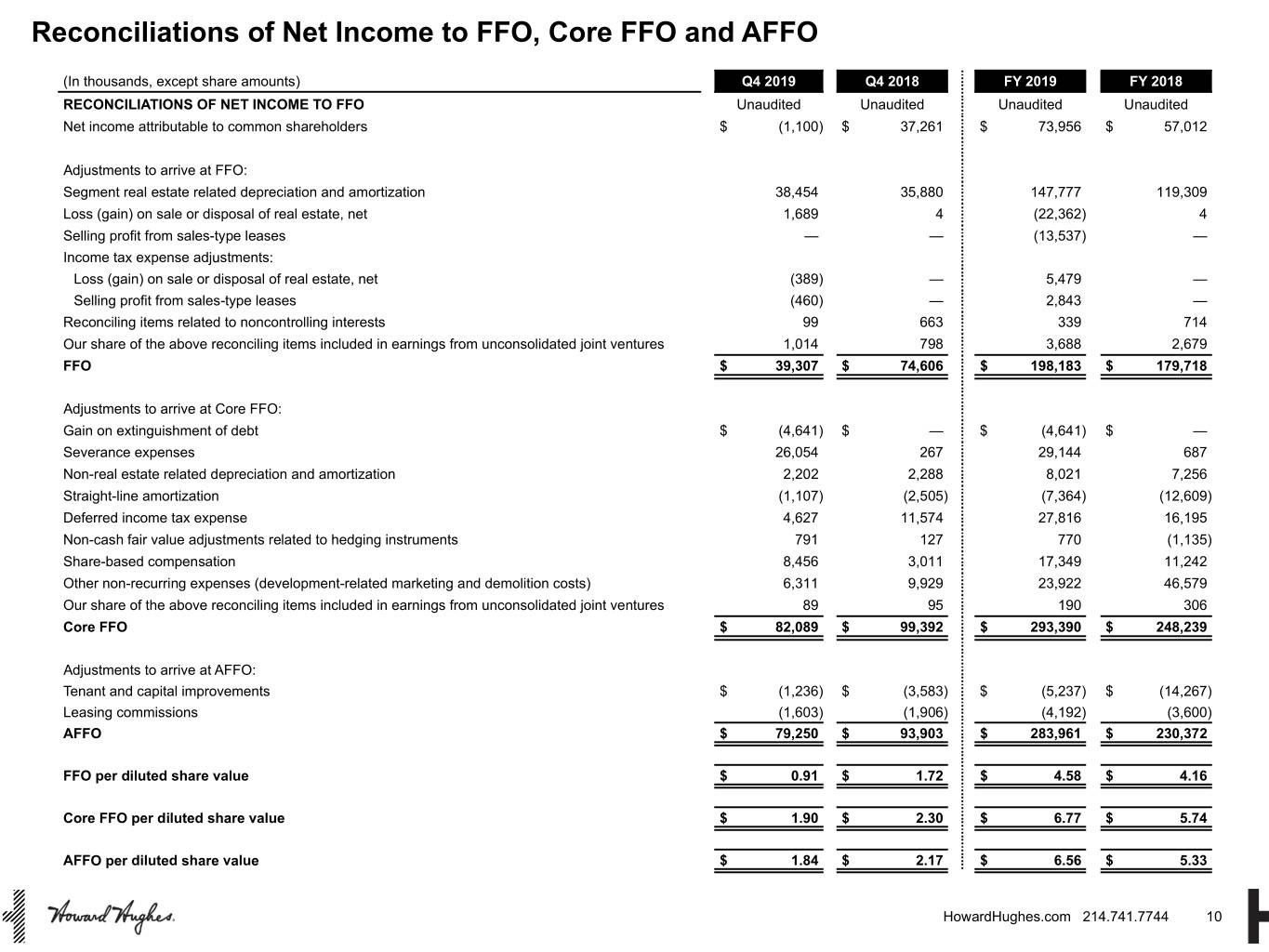

Key factors impacting our Funds from operations (“FFO”), Core funds from operations (“Core FFO”) and Adjusted FFO (“AFFO”) are discussed below.

Year Ended December 31, | Three Months Ended December 31, | ||||||||||||||||

(In thousands, except per share amounts) | 2019 | 2018 | 2019 | 2018 | |||||||||||||

Net income attributable to common stockholders | $ | 73,956 | $ | 57,012 | $ | (1,100 | ) | $ | 37,261 | ||||||||

Basic income per share: | $ | 1.71 | $ | 1.32 | $ | (0.03 | ) | $ | 0.87 | ||||||||

Diluted income per share: | $ | 1.71 | $ | 1.32 | $ | (0.03 | ) | $ | 0.86 | ||||||||

Funds from operations | $ | 198,183 | $ | 179,718 | $ | 39,307 | $ | 74,606 | |||||||||

FFO per weighted-average diluted share | $ | 4.58 | $ | 4.16 | $ | 0.91 | $ | 1.72 | |||||||||

Core FFO | $ | 293,390 | $ | 248,239 | $ | 82,089 | $ | 99,392 | |||||||||

Core FFO per weighted-average diluted share | $ | 6.77 | $ | 5.74 | $ | 1.90 | $ | 2.30 | |||||||||

AFFO | $ | 283,961 | $ | 230,372 | $ | 79,250 | $ | 93,903 | |||||||||

AFFO per weighted-average diluted share | $ | 6.56 | $ | 5.33 | $ | 1.84 | $ | 2.17 | |||||||||

3

FFO increased $18.5 million, or $0.42 per diluted share, for the year ended December 31, 2019, and decreased $35.3 million, or $0.81 per diluted share, for the three months ended December 31, 2019, compared to the same periods in 2018. The changes between periods are primarily attributable to the factors impacting net income discussed above.

Core FFO, our FFO adjusted to exclude the impact of certain non-cash and/or nonrecurring income and expense items, increased $45.2 million, or $1.03 per diluted share, for the year ended December 31, 2019, and decreased $17.3 million, or $0.40 per diluted share, for the three months ended December 31, 2019, compared to the same periods in 2018. Core FFO reflects the results of our core operations during these periods, as it is adjusted to exclude one-time costs such as Severance expense and Share-based compensation expense, both of which negatively impacted net income in 2019.

AFFO, our Core FFO adjusted to exclude recurring capital improvements and leasing commissions, increased $53.6 million, or $1.23 per diluted share, for the year ended December 31, 2019, and decreased $14.7 million, or $0.33 per diluted share, for the three months ended December 31, 2019, compared to the same periods in 2018, primarily due to the items mentioned in the FFO and Core FFO discussions above. Both periods were also impacted by lower tenant and capital improvements. Please reference FFO, Core FFO and AFFO as defined and reconciled to the closest GAAP measure in the Appendix to this release and the reasons why we believe these non-GAAP measures are meaningful to investors and a better indication of our overall performance.

Business Segment Operating Results

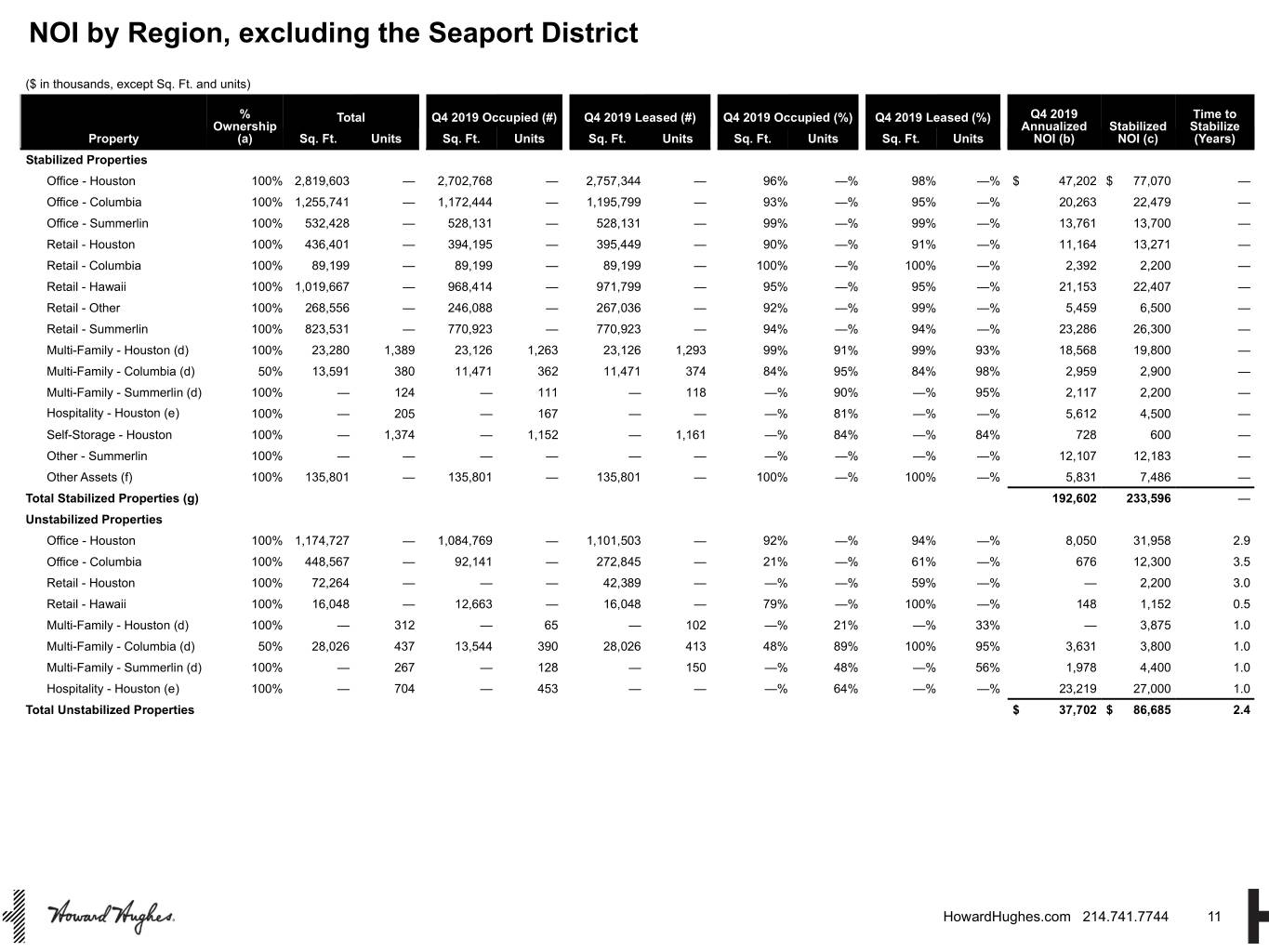

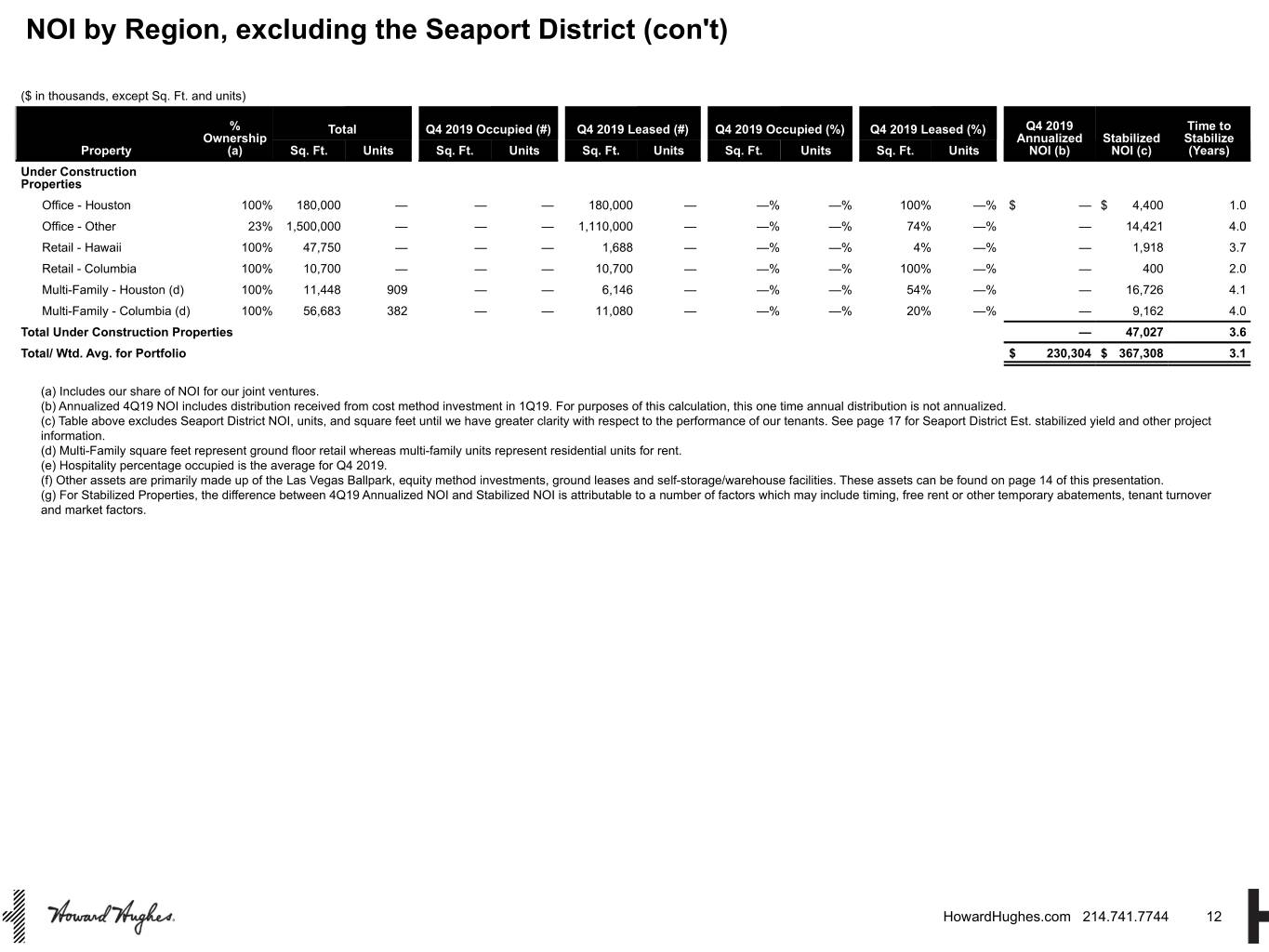

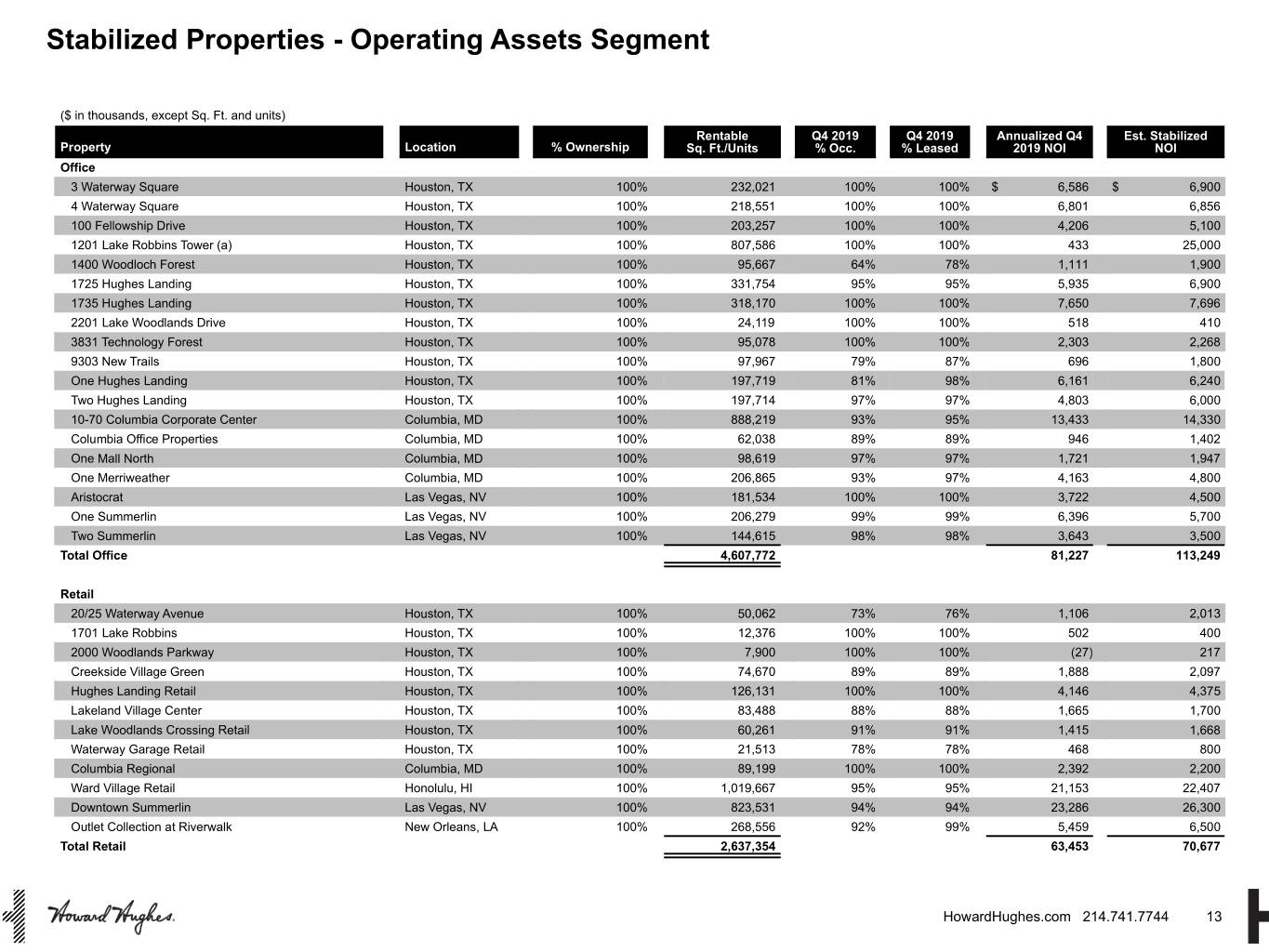

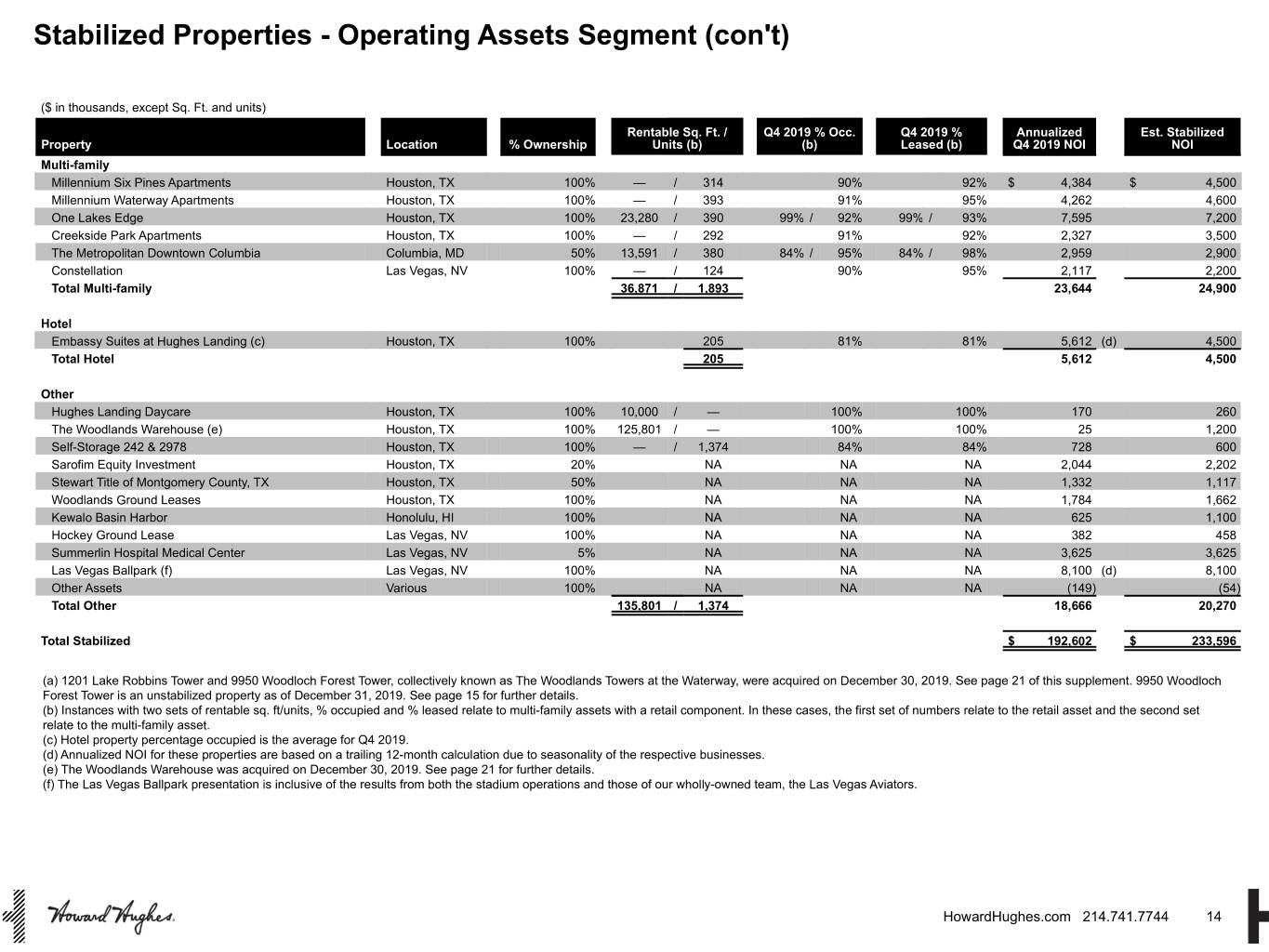

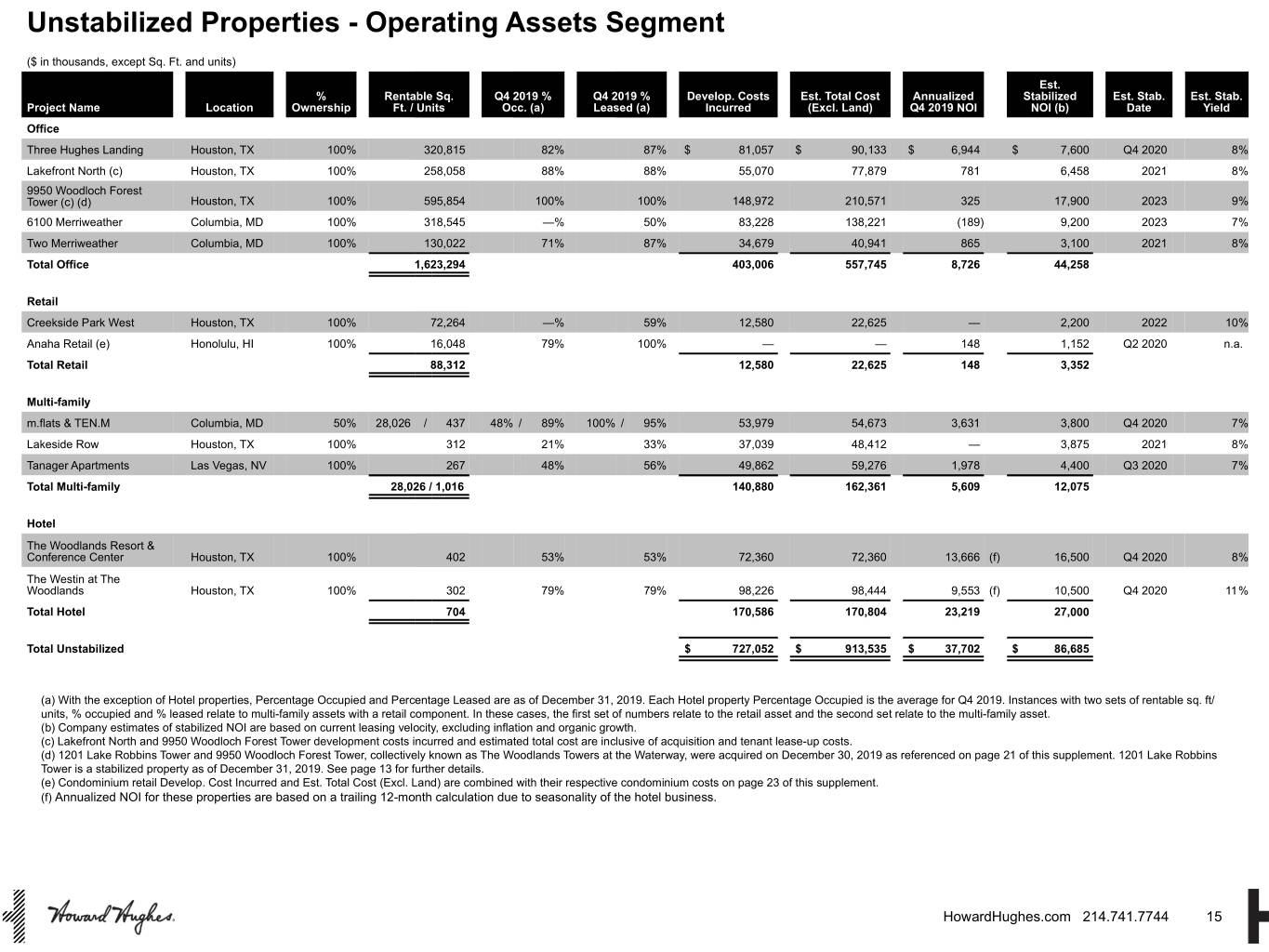

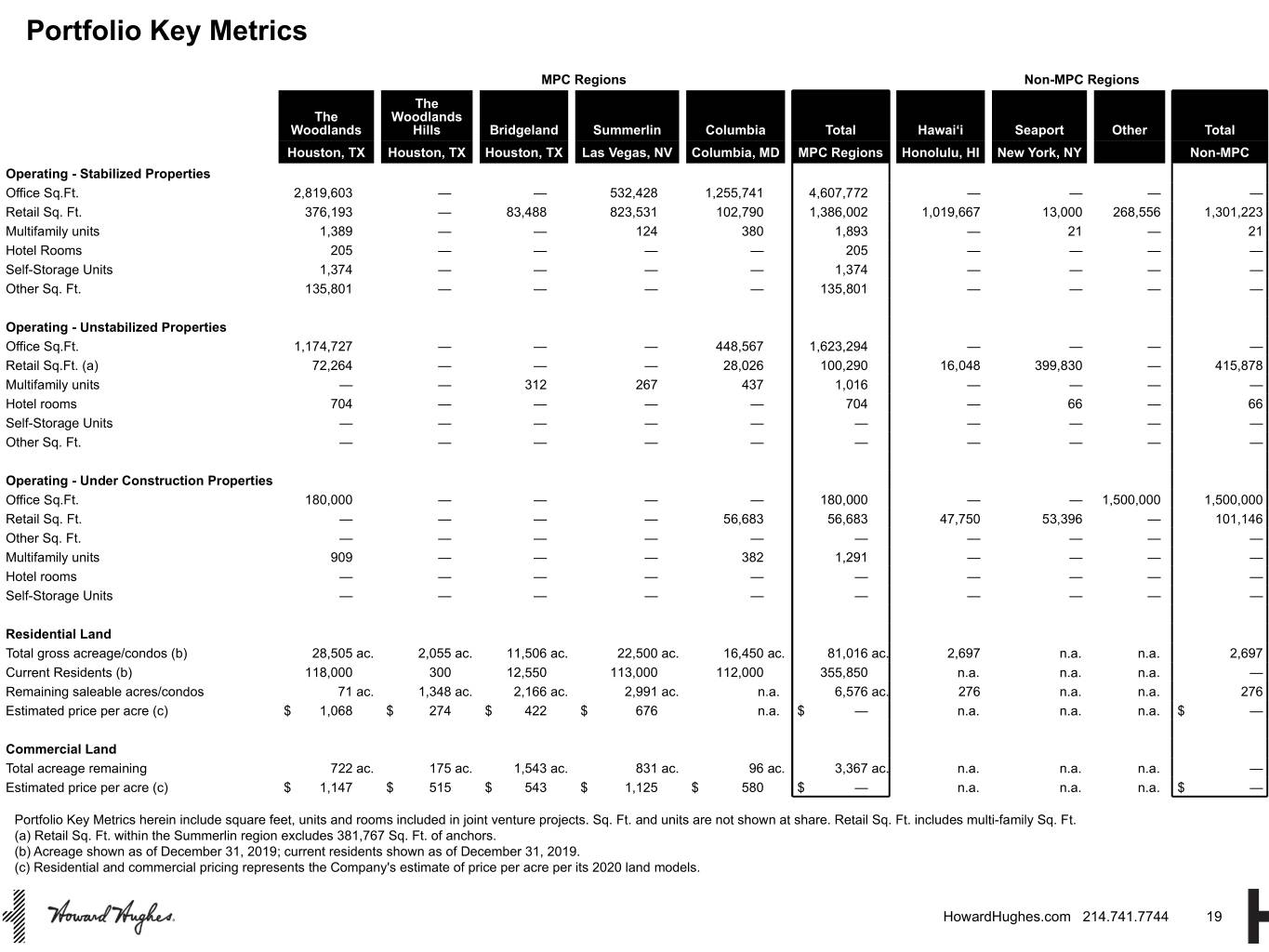

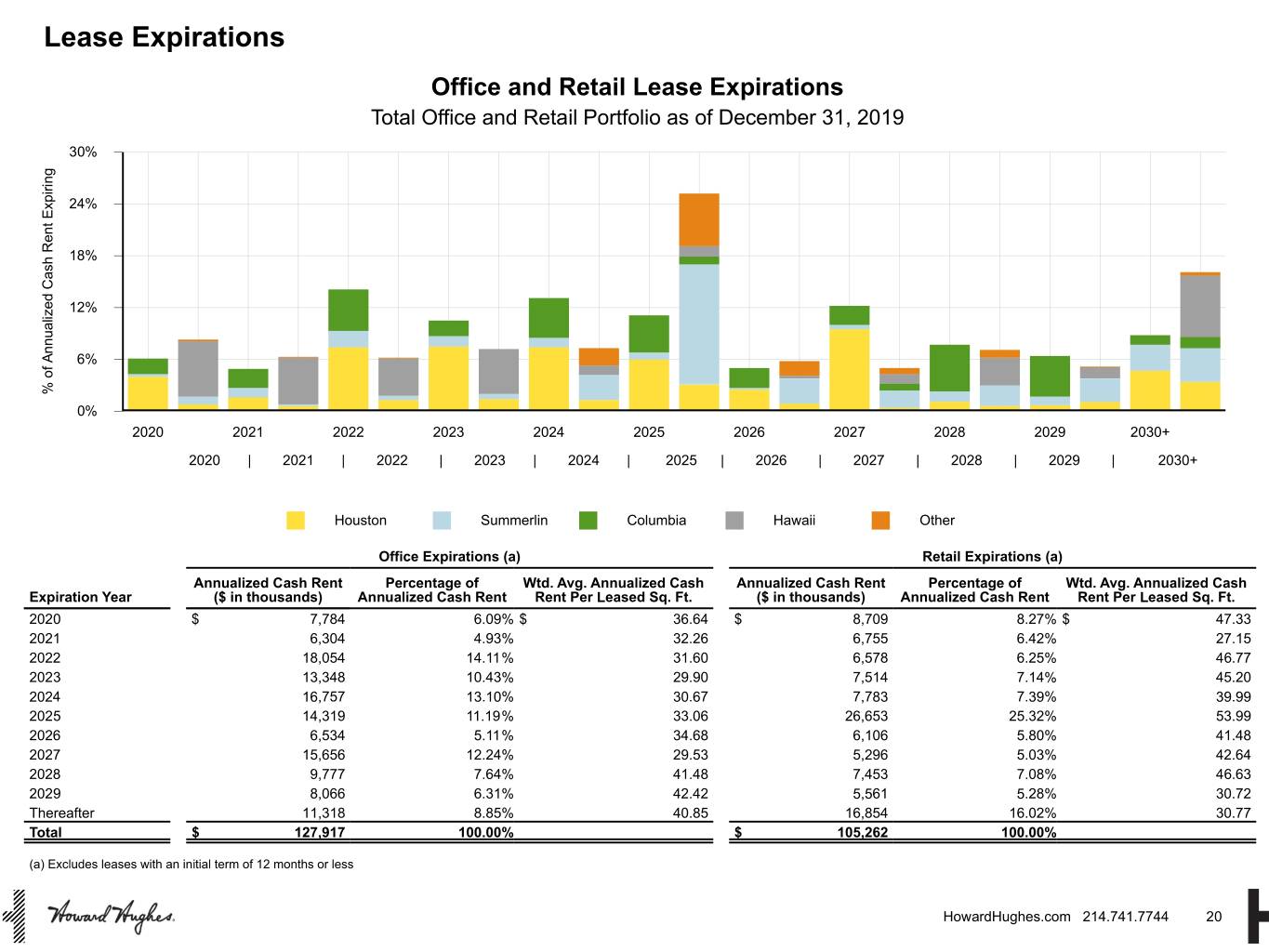

Operating Assets

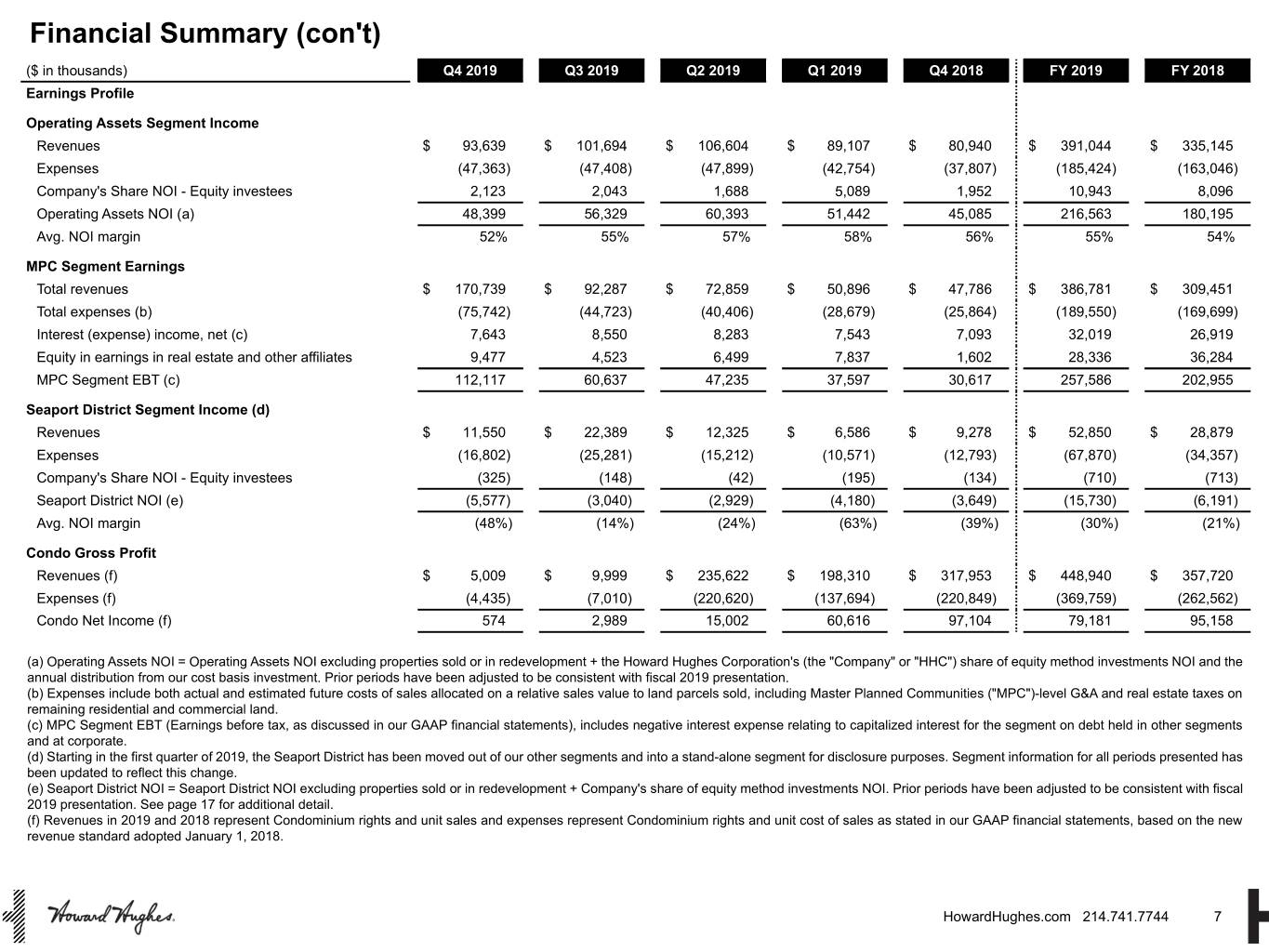

In our Operating Assets segment, we increased NOI, including our share of NOI from equity investees and excluding properties sold or in redevelopment, by $36.4 million, or 20.2%, to $216.6 million in the year ended December 31, 2019, and by $3.3 million, or 7.4%, to $48.4 million in the three months ended December 31, 2019, compared to the same periods in 2018. The increases in NOI for the year and three months ended December 31, 2019, are primarily driven by increases of $18.2 million and $5.3 million in our office properties and $3.5 million and $0.5 million in our hospitality properties. The increases in our office and hospitality properties for the year and three months ended December 31, 2019, are mainly the result of increased occupancy as well as NOI generated from assets placed into service in 2019 and late 2018. Our other properties category also contributed $10.2 million to the increase in NOI for the year ended December 31, 2019, due to placing the Las Vegas Ballpark, the home of our Triple-A baseball team the Las Vegas Aviators, into service in March 2019. The increase in the three months ended December 31, 2019, compared to the same periods in 2018 was partially offset by a decrease of $2.3 million in our other properties category which is primarily attributable to ending the baseball season, leading to reduced ticket and concession revenue, while continuing to incur recurring operating expenses such as salaries and benefits which were not incurred in the prior year since the Las Vegas Ballpark was not yet placed in service.

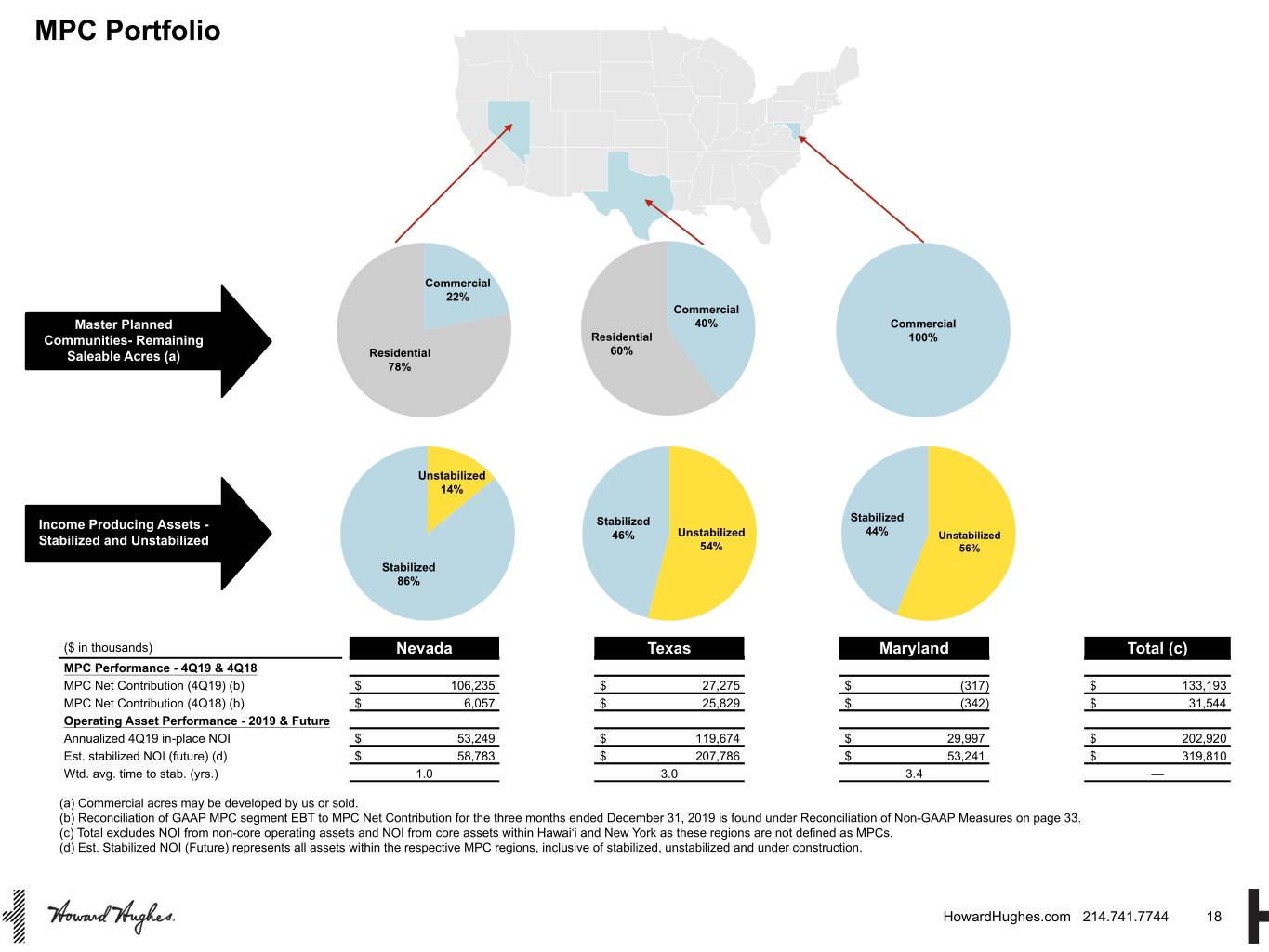

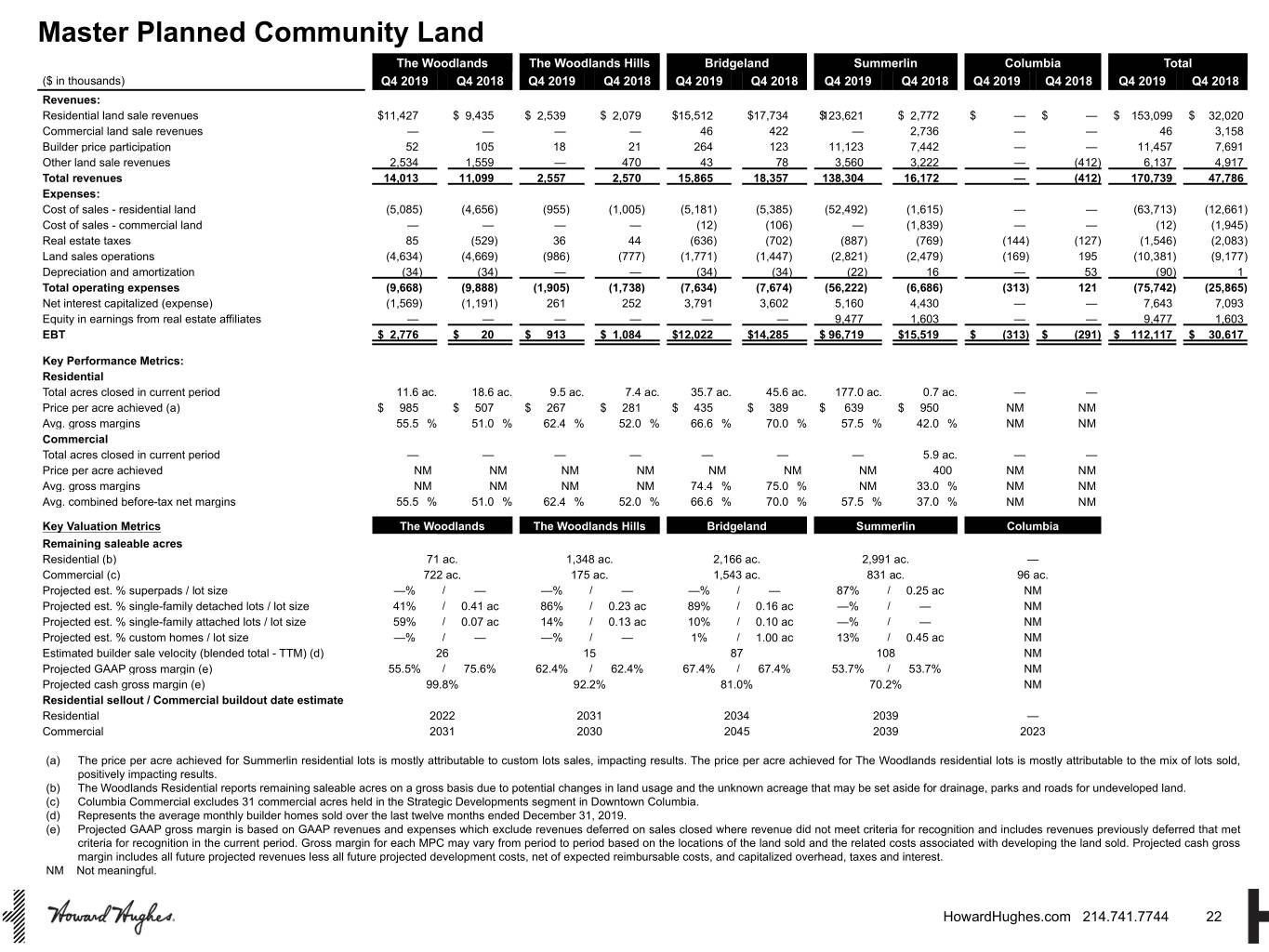

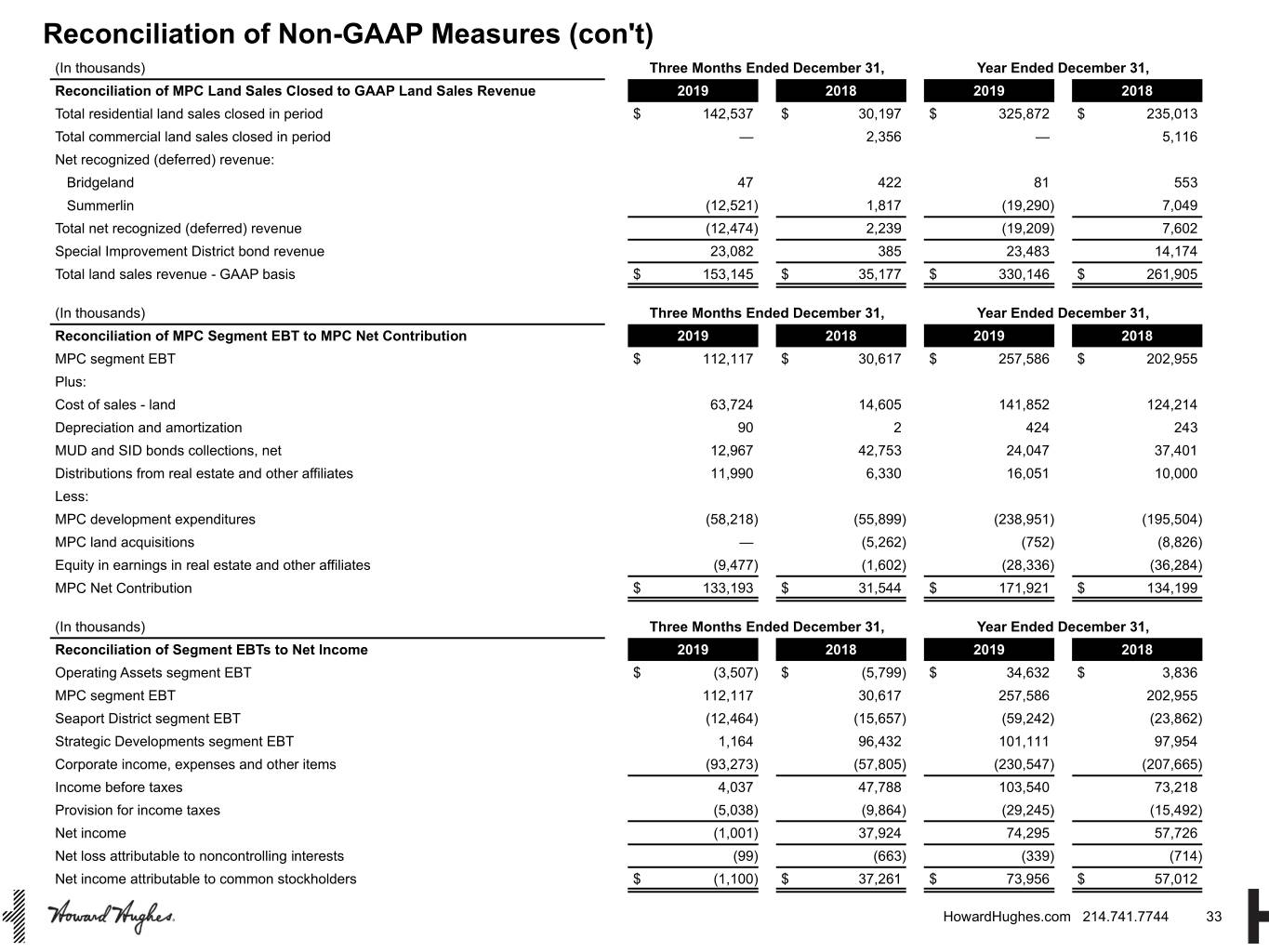

Master Planned Communities

Our MPC segment revenues fluctuate each quarter given the nature of development and sale of land in these large-scale, long-term communities. As a result of this fluctuation, we believe full-year results are a better measurement of performance than quarterly results. During the year and three months ended December 31, 2019, our MPC segment EBT was $257.6 million and $112.1 million compared to $203.0 million and $30.6 million during the same periods in 2018, increases of 26.9% and 266.2%, respectively. The primary drivers of these changes are discussed below.

The $54.6 million increase in EBT for the year ended December 31, 2019, compared to the prior year period, was primarily attributable to an increase in superpad sales at Summerlin as well as increased single-family lot sales at Bridgeland, The Woodlands and The Woodlands Hills. Summerlin’s superpad sales totaled 316 acres for the year ended December 31, 2019, compared to 241 acres in the prior year. Summerlin’s superpads achieved a $648,000 price per acre for the year ended December 31, 2019, with the custom lots yielding $1,701,000 per acre, compared to $566,000 in the prior year period. Bridgeland’s single-family lot sales totaled 773 for the year ended December 31, 2019, an

4

increase of 24.7% over the prior year, and it achieved a $408,000 price per acre, compared to $385,000 in the prior year. Single-family lot sales at The Woodlands totaled 171 for the year ended December 31, 2019, compared to 146 for the same period in the prior year. Single-family price per acre at The Woodlands increased 11.5% to $689,000 for the year ended December 31, 2019, compared to the prior year period. Land sales revenues at The Woodlands Hills increased $2.2 million, or 24.9%, for the year ended December 31, 2019, compared to 2018. Residential acres sold increased to 40.2 acres in 2019 from 32.4 acres sold in 2018.

The $81.5 million increase in EBT for the three months ended December 31, 2019, compared to the prior year period was primarily driven by increased superpad sales at Summerlin and increased residential land sales at The Woodlands, partially offset by lower residential land sales at Bridgeland. Land sales revenues at Summerlin increased to $120.8 million, or 176.3 residential acres, compared $2.8 million, or 0.7 residential acres, in the prior year period. While The Woodlands sold fewer acres in the fourth quarter of 2019 compared to the prior year, the overall increase in land sales revenues was driven by a $985,000 residential price per acre for the three months ended December 31, 2019, an increase of $478,000 per acre from the prior year period primarily due to product mix and continuing demand. While Bridgeland also increased its residential price per acre by $46,000 per acre, or 12%, over the prior year period, the decrease in land sales revenues at Bridgeland was driven by fewer lots sold for the three months ended December 31, 2019, compared to the prior year period. Land sales revenues at The Woodlands Hills increased $0.5 million due to a higher quantity and change in the mix of lots sold for the three months ended December 31, 2019, compared to the prior year period. However, EBT at The Woodlands Hills decreased primarily due to lower Other land sales revenues due to funds received for a construction easement in 2018 that did not recur in 2019 and higher operating expenses.

Although they do not directly impact our results of operations, we believe ongoing strong underlying home sales will continue to drive demand for land in our MPCs. The rate of home sales at The Woodlands Hills, which commenced sales in the second quarter of 2018, increased 245.7% and 1,750.0% for the year and three months ended December 31, 2019, respectively, over the prior year periods. Bridgeland’s home sales increased 49.3% and 70.7% for the year and three months ended December 31, 2019, respectively, over the prior year periods. We believe that the acceleration at both The Woodlands Hills and Bridgeland speak to their respective maturation as master planned communities as well as their thoughtful approach to conservation, recreation and transportation. While home sales decreased 7.0% and 17.9% in The Woodlands for the year and three months ended December 31, 2019, respectively, compared to the prior periods, home sales at Summerlin have increased 1.3% and 31.7% for the year and three months ended December 31, 2019, compared to the prior year period, evidencing continued strength.

Our MPCs have won numerous awards for design excellence and for community contribution. Summerlin and Bridgeland were again ranked by RCLCO, capturing third and 12th highest-selling master planned communities in the nation, respectively, for the year ended December 31, 2019. Summerlin was also recognized as “Master Planned Community of the Year” from the National Association of Homebuilders for 2019. The following summarizes home sales in our MPCs during the year and three months ended December 31, 2019.

Net New Home Sales | |||||||||||||||||||||||

Year Ended December 31, | Three Months Ended December 31, | ||||||||||||||||||||||

2019 | 2018 | Change | % Change | 2019 | 2018 | Change | % Change | ||||||||||||||||

The Woodlands | 319 | 343 | (24 | ) | (7.0 | )% | 64 | 78 | (14 | ) | (17.9 | )% | |||||||||||

The Woodlands Hills | 121 | 35 | 86 | 245.7 | % | 37 | 2 | 35 | 1,750.0 | % | |||||||||||||

Bridgeland | 739 | 495 | 244 | 49.3 | % | 198 | 116 | 82 | 70.7 | % | |||||||||||||

Summerlin | 1,292 | 1,276 | 16 | 1.3 | % | 303 | 230 | 73 | 31.7 | % | |||||||||||||

Total | 2,471 | 2,149 | 322 | 15.0 | % | 602 | 426 | 176 | 41.3 | % | |||||||||||||

The Seaport District

In the Seaport District, we celebrated the openings of Seaport News, Fellow Barber, the catering kitchen that will service Pier 17, The Fulton by Jean-Georges, Garden Bar, Bar Wayō, Malibu Farm and The Lookout on Pier 17. We

5

also sold out 30 concerts for the 2019 Summer Concert Series on The Rooftop at Pier 17®. In the fourth quarter, we opened Pier 17 Winterland for the second year in a row. Attendance and sales for Winterland skating were up approximately 68% and 137%, respectively, from the prior year. The increase in foot traffic and accompanying increase in revenue, as discussed in more detail below, demonstrates that the Seaport District is becoming recognized as a new culinary and entertainment destination in lower Manhattan.

Seaport District segment revenues increased by $23.0 million to $55.6 million and $2.6 million to $12.6 million for the year and three months ended December 31, 2019, respectively, compared to the same periods in 2018. The increases are due to both our existing businesses as well as new business openings. The increase in the twelve-month period was driven by Cobble & Co., Garden Bar, 10 Corso Como Retail and Café, The Fulton, the summer concert series and sponsorships. The increase in the three-month period was driven by The Fulton, Malibu Farm, Winterland and our catering businesses.

In the Seaport District segment, NOI, including our share of NOI from equity investees, decreased by $9.5 million to a net operating loss of $15.7 million and decreased by $1.9 million to a net operating loss of $5.6 million for the year and three months ended December 31, 2019, respectively, compared to the same periods in 2018. The decrease in NOI in the year-end period was driven by continued investment in the development of the Seaport District, particularly as it relates to funding start-up costs related to the retail, food and beverage and other operating businesses. Decreases of $6.1 million, $2.2 million and $1.0 million, in landlord operations, managed businesses, and events and sponsorships, respectively, compared to the prior year period were primary contributors to the decrease in NOI for the year ended December 31, 2019. The decrease for the three-month period compared to the prior year period was primarily attributable to a decrease of $3.7 million in landlord operations, partially offset by an increase of $1.7 million in our managed businesses for the three months ended December 31, 2019. Our landlord operations business represents physical real estate developed, owned and leased to third parties by HHC. We expect to continue to incur operating expenses in excess of rental revenues while the remaining available space is in lease-up. Our managed businesses include retail and food and beverage entities that we operate and own, either directly, through license agreements or in joint ventures. Our event and sponsorship businesses include our concert series; Winterland skating and bar; event catering; private events; and sponsorships from 11 partners. We expect to incur operating losses for our event and sponsorship, landlord operations and managed business entities until the Seaport District reaches its critical mass of offerings.

The Seaport District is part non-stabilized operating asset, part development project and part operating business. As such, the Seaport District has a greater range of possible outcomes than our other projects. The greater uncertainty is largely the result of (i) business operating risks, (ii) seasonality, (iii) potential sponsorship revenue and (iv) event revenue. We operate and own, either directly, through license agreements or in joint ventures, many of the tenants in the Seaport District, including retail stores such as 10 Corso Como and SJP by Sarah Jessica Parker and restaurants such as The Fulton by Jean-Georges, Bar Wayō, Malibu Farm, two concepts by Andrew Carmellini, R17 and the food hall operated by Jean-Georges. As a result, the revenues and expenses of these businesses, as well as the underlying market conditions affecting these types of businesses, will directly impact the NOI of the Seaport District. This is in contrast to our other retail properties where we primarily receive lease payments and are not as directly impacted by the operating performance of the underlying businesses. This causes the quarterly results and eventual stabilized yield of the Seaport District to be less predictable than our other operating real estate assets with traditional lease structures. Further, as we open new operating businesses, either owned entirely or in joint venture, we expect to incur pre-opening expenses and operating losses until those businesses stabilize, which likely will not happen until the Seaport District reaches its critical mass of offerings. We expect the time to stabilize the Seaport District will be primarily driven by the construction, interior finish work and stabilization to occur at the Jean-Georges food hall in the Tin Building. Construction is expected to be substantially complete in early 2021 with an expected opening by summer 2021, assuming that we receive the necessary approvals timely. We expect stabilization to occur approximately 12 to 18 months after opening. Given the factors and uncertainties listed above combined with our operating experience during this past summer as we opened multiple new venues, we will no longer provide guidance on our expected NOI yield and stabilization date for the Seaport District for the next several quarters. We will continue all other aspects of our disclosure for the Seaport District segment including revenues, expenses, NOI and EBITDA. As we move closer to opening a critical mass of offerings at the Seaport District, we will re-establish goals for yield on costs and stabilization dates when the uncertainties and range of possible outcomes are more clear.

6

Strategic Developments

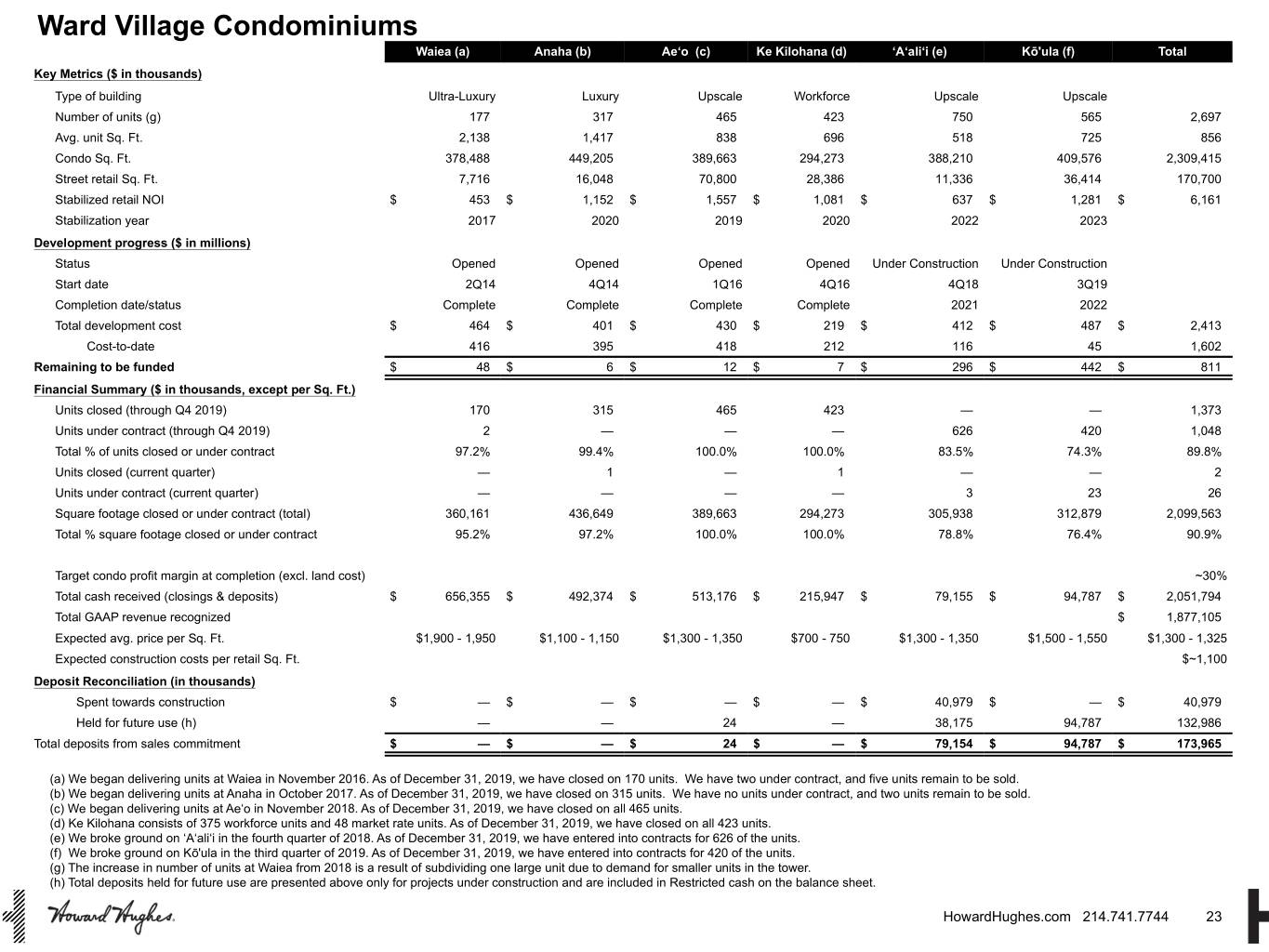

In our Strategic Developments segment, we experienced another strong year, including robust sales of condominium units at Ward Village. Strong sales momentum continued at ‘A‘ali‘i and Kō'ula, which are 83.5% and 74.3% pre-sold, respectively, as of December 31, 2019. We launched public sales of our newest project, Kō'ula, in January 2019 and broke ground in July 2019. Kō'ula was 75.4% presold as of February 21, 2020. Our most recent sales continue to support our ability to maintain a 30% blended profit margin, excluding land, across Ward Village. Given the strong sales momentum at ‘A‘ali‘i and Kō'ula, which we expect to complete in 2021 and 2022, respectively, along with Ward Village’s reputation and scale, we launched public pre-sales of Victoria Place, our newest 349-unit mixed-use condominium project in January 2020. As of February 21, 2020, have entered into contracts for 185 units, or 53.0%, of Victoria Place’s total units.

For the year and three months ended December 31, 2019, we reported revenues of $448.9 million and $5.0 million, respectively, from Condominium rights and unit sales for homes that actually closed escrow at our four delivered buildings (Waiea, Anaha, Ae‘o and Ke Kilohana) in Ward Village compared to $357.7 million and $318.0 million for the prior year periods, respectively. The cause of the increase in revenue in the twelve-month period compared to prior year is increased closings. The decrease for the three months ended December 31, 2019, is due to $309.0 million of condominium revenue due to closings at Ae‘o in 2018 which did not recur in the current period. Condominium revenue is recognized when construction of the condominium tower is complete and unit sales close, leading to greater variability in revenue recognized between periods. We closed on 596 condominium units during the year ended December 31, 2019, compared to 315 during the prior year period. With approximately 90% of our homes sold across our six towers that are either delivered or under construction, we feel that we have found the combination of product and price that resonate in the market. Further, these sales continue to demonstrate the desirability of our community and the high-quality product that we are developing in Honolulu. As noted above, the current increased pace of pre-sales gives us the opportunity to modestly accelerate the pace under which we launch new towers.

We also increased our projected annual stabilized NOI target by $51.4 million from $315.9 million at December 31, 2018, to $367.3 million at December 31, 2019, excluding the redevelopment of the Seaport District. This increase is primarily attributable to the acquisitions of The Woodlands Towers at the Waterway and The Woodlands Warehouse as well as the commencement of construction of 8770 New Trails, Millennium Phase III Apartments, Creekside Park Apartments Phase II and Merriweather District Area 3 Standalone Restaurant.

Segment EBT increased $3.2 million for the year ended December 31, 2019, primarily due to the net gain recognized for the sales of Cottonwood Mall, West Windsor and Bridges at Mint Hill, partially offset by lower Condominium rights and unit sales, net of costs, primarily due to the lower profit margin at Ke Kilohana, which is in line with our expectation given the concentration of workforce housing units in this tower. Segment EBT decreased $95.3 million for the three months ended December 31, 2019, compared to the same period in 2018, primarily due to a decrease in the Condominium rights and unit sales, net of costs, due to 2018 closings at Ae‘o that did not recur in 2019.

Balance Sheet Fourth-Quarter Activity and Subsequent Events

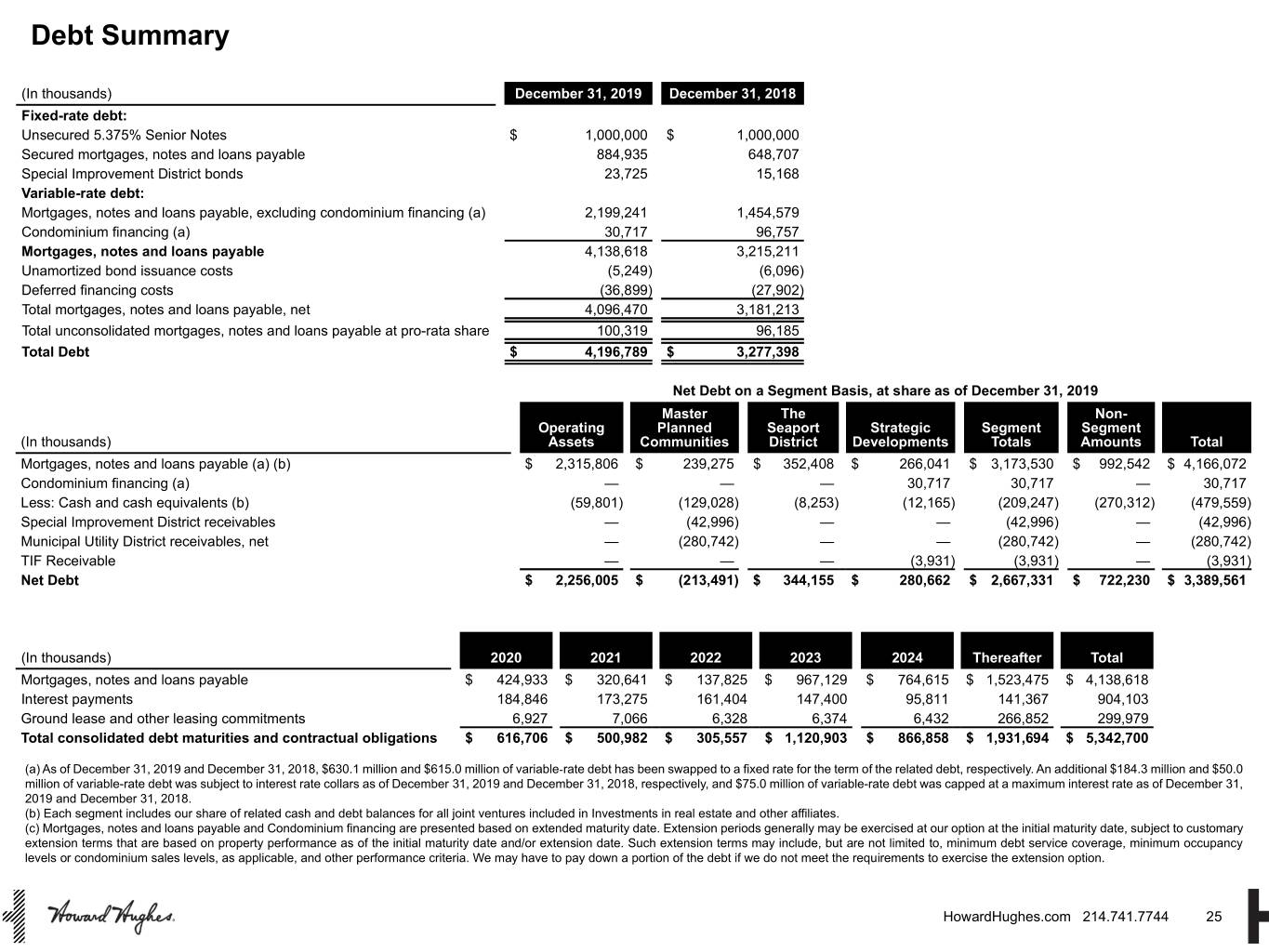

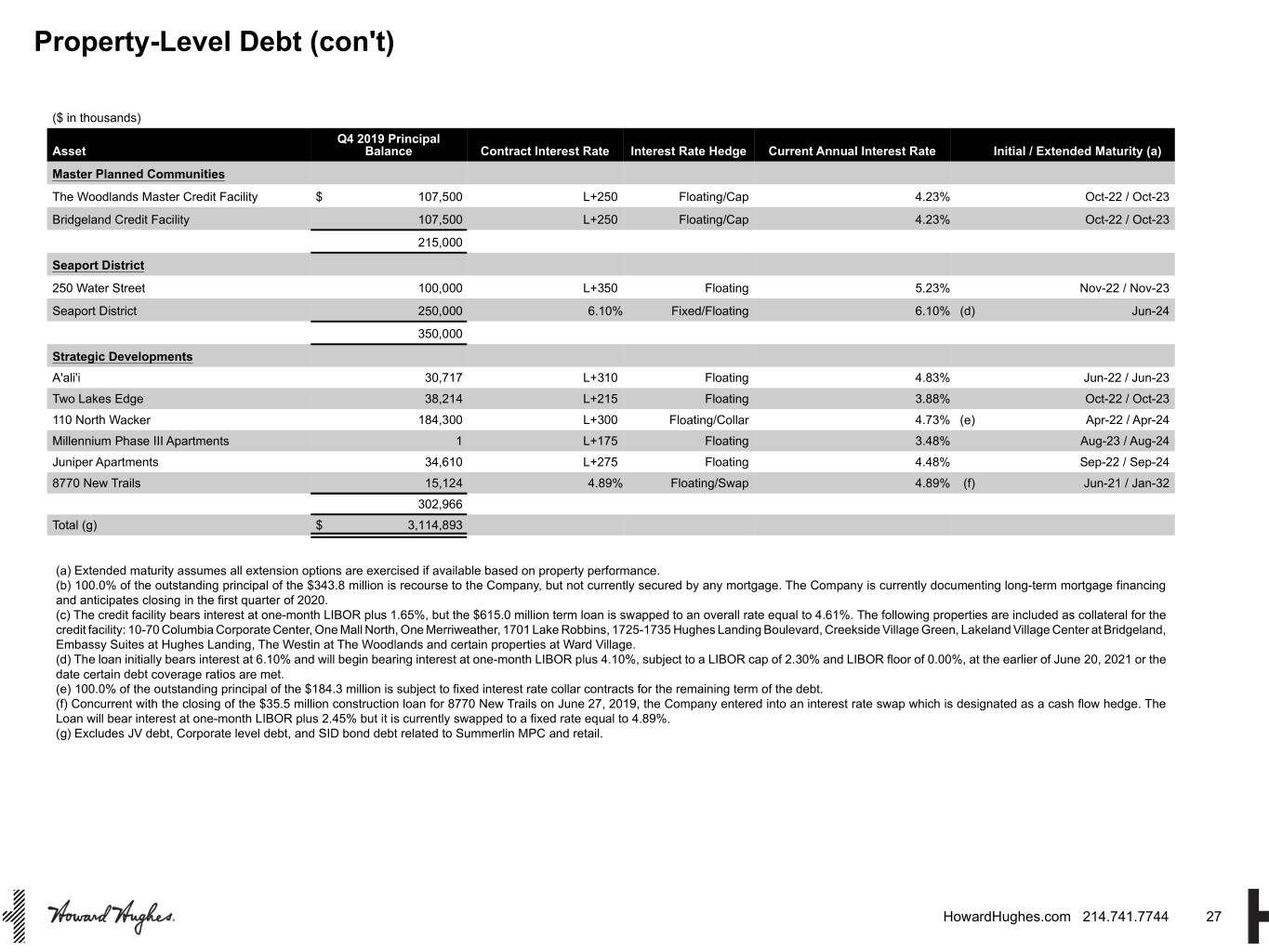

On January 7, 2020, we closed on a $43.4 million construction loan for the development of Creekside Park Apartments Phase II. The loan bears interest at one-month London Interbank Offered Rate (“LIBOR”) plus 1.75% with an initial maturity date of January 7, 2024 and a one-year extension option.

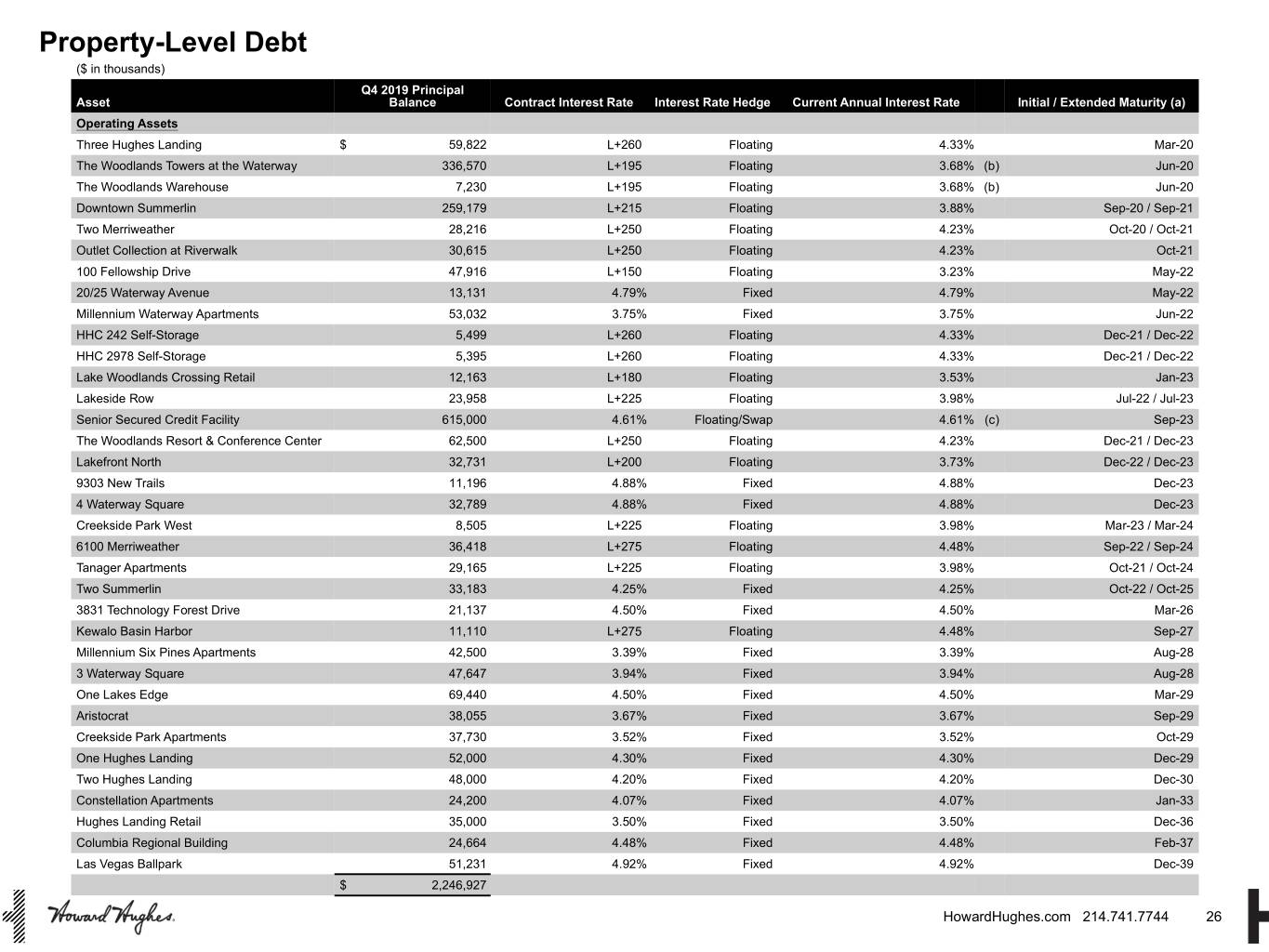

On December 30, 2019, we closed on a $343.8 million bridge loan for the acquisitions of The Woodlands Towers at the Waterway and The Woodlands Warehouse. The loan bears interest at one-month LIBOR plus 1.95% with a maturity of June 30, 2020. We are currently documenting long-term mortgage financing and anticipate closing in the first quarter of 2020.

7

On December 5, 2019, we modified and extended the $61.2 million loan for Three Hughes Landing. The loan bears interest at one-month LIBOR plus 2.60% and the extended maturity date is now March 5, 2020, at which point we anticipate Three Hughes Landing will be added to the Senior Secured Credit Facility.

On November 19, 2019, we closed on a $100.0 million note payable for 250 Water Street. The note bears interest at one-month LIBOR plus 3.50% with an initial maturity date of November 18, 2022 and a one-year extension option. We extinguished the previous note on the property at a $4.9 million discount in the fourth quarter of 2019.

On October 24, 2019, we modified and extended the $47.9 million loan for Outlet Collection at Riverwalk. The total commitment was reduced to $30.9 million, including the required paydown of $15.0 million. The loan bears interest at one-month LIBOR plus 2.50% and matures October 24, 2021.

On October 17, 2019, we closed on a $250.0 million credit facility secured by land and certain other collateral in The Woodlands and Bridgeland MPCs. The loan bears interest at one-month LIBOR plus 2.50% with an initial maturity of October 17, 2022 and two one-year extension options. The new loan refinanced The Woodlands Master Credit Facility and Bridgeland Credit Facility with a combined principal balance of $215.0 million and a weighted-average interest rate of one-month LIBOR plus 2.87%.

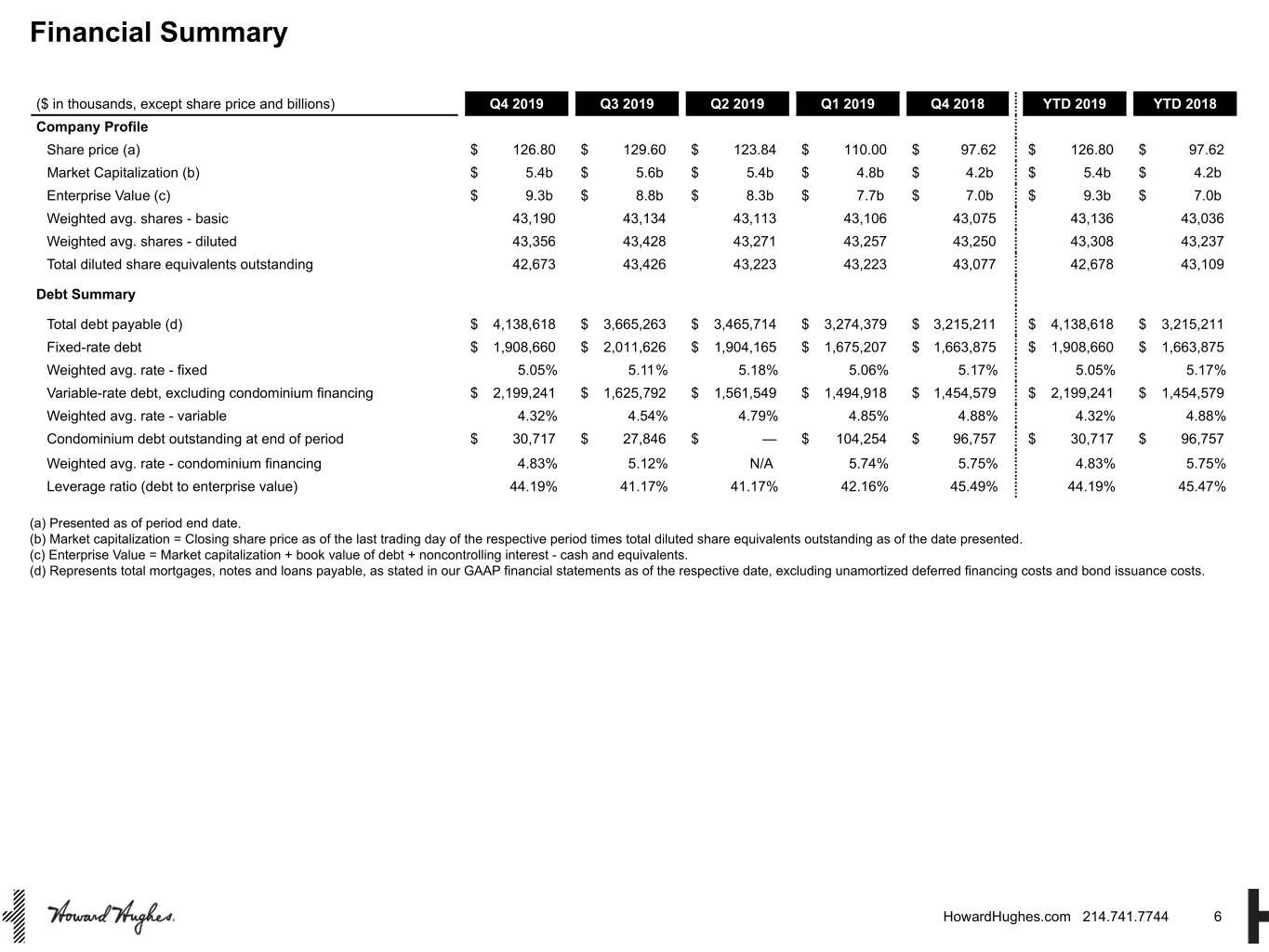

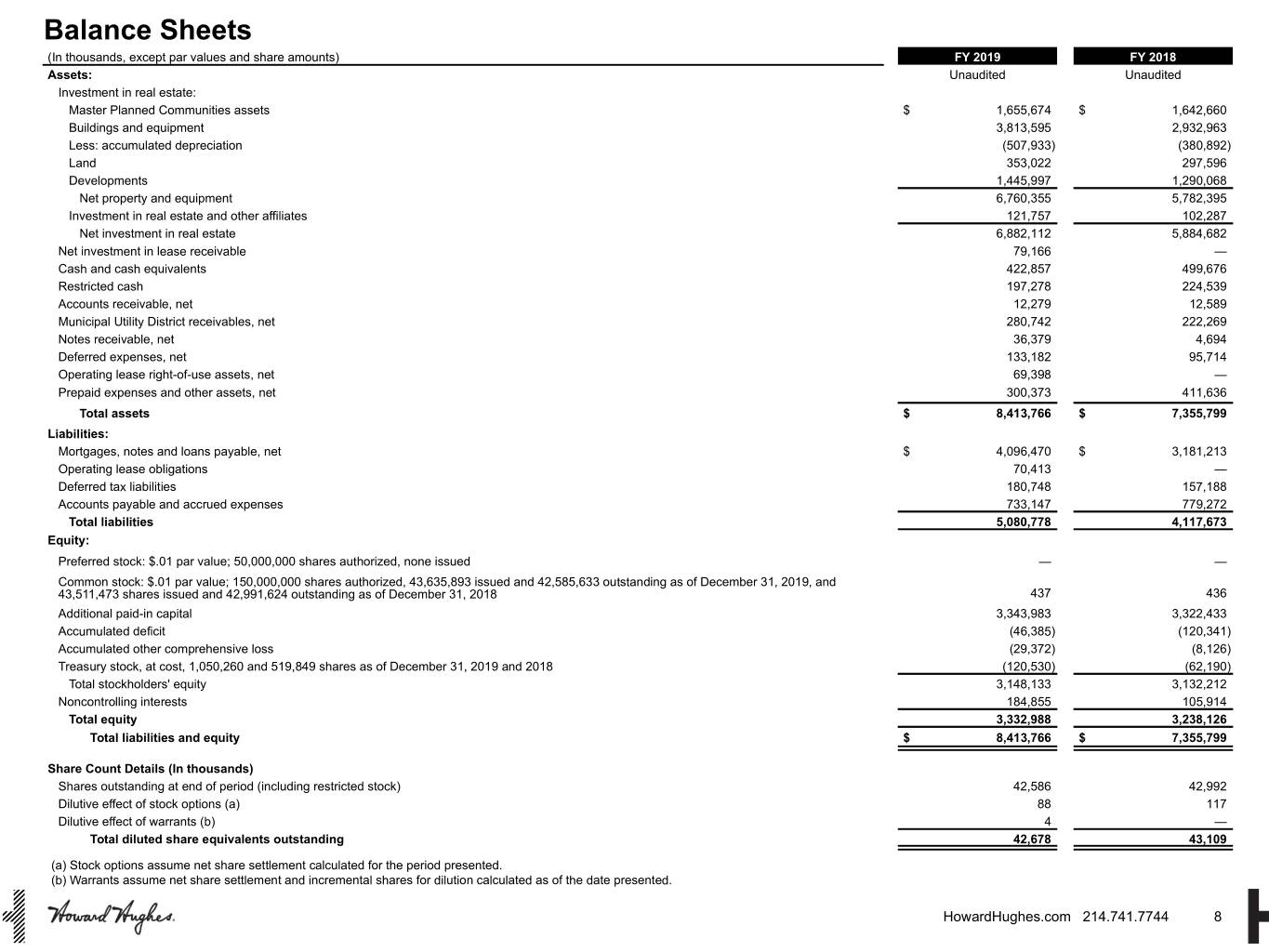

As of December 31, 2019, our total consolidated debt equaled approximately 48.7% of our total assets and our leverage ratio (debt to enterprise value, as defined in the Supplemental Information) was 44.2%. We believe our low leverage, with a focus on project-specific financing, reduces our exposure to potential downturns and provides us with the ability to evaluate new opportunities. As of December 31, 2019, we had $422.9 million of cash and cash equivalents.

About The Howard Hughes Corporation®

The Howard Hughes Corporation owns, manages and develops commercial, residential and mixed-use real estate throughout the U.S. Its award-winning assets include the country’s preeminent portfolio of master planned communities, as well as operating properties and development opportunities including: the Seaport District in New York; Columbia, Maryland; The Woodlands®, The Woodlands Hills, and Bridgeland® in the Greater Houston, Texas area; Summerlin®, Las Vegas; and Ward Village® in Honolulu, Hawai‘i. The Howard Hughes Corporation’s portfolio is strategically positioned to meet and accelerate development based on market demand, resulting in one of the strongest real estate platforms in the country. Dedicated to innovative place making, the Company is recognized for its ongoing commitment to design excellence and to the cultural life of its communities. The Howard Hughes Corporation is traded on the New York Stock Exchange as HHC. For additional information visit www.howardhughes.com.

The Howard Hughes Corporation has partnered with Say, the fintech startup reimagining shareholder communications, to allow investors to submit and upvote questions they would like to see addressed on the Company’s fourth quarter earnings call. Say verifies all shareholder positions and provides permission to participate on the February 28th call, during which the Company’s leadership will be answering top questions. Utilizing the Say platform, The Howard Hughes Corporation elevates its capabilities for responding to Company shareholders, making its investor relations Q&A more transparent and engaging.

In addition to dial-in options, institutional and retail shareholders can participate by going to app.saytechnologies.com/howardhughes. Shareholders can email hello@saytechnologies.com for any support inquiries.

Safe Harbor Statement

We may make forward-looking statements in this press release and in other reports and presentations that we file or furnish with the Securities and Exchange Commission. In addition, our management may make forward-looking statements orally to analysts, investors, creditors, the media and others. Forward-looking statements include:

8

• | announcement of certain changes, which we refer to as our “Transformation Plan”, including new executive leadership, reduction in our overhead expenses, the proposed sale of our non-core assets and accelerated growth in our core MPC assets; |

• | expected performance of our stabilized, income-producing properties and the performance and stabilization timing of properties that we have recently placed into service or are under construction; |

• | capital required for our operations and development opportunities for the properties in our Operating Assets, Seaport District and Strategic Developments segments; |

• | expected commencement and completion for property developments and timing of sales or rentals of certain properties; |

• | expected performance of our MPC segment; |

• | forecasts of our future economic performance; and |

• | future liquidity, finance opportunities, development opportunities, development spending and management plans. |

These statements involve known and unknown risks, uncertainties and other factors that may have a material impact on any future results, performance and achievements expressed or implied by such forward-looking statements. These risk factors are described in our Annual Report on Form 10-K, which has been filed with the Securities and Exchange Commission on February 27, 2020. Any factor could, by itself, or together with one or more other factors, adversely affect our business, results of operations or financial condition. There may be other factors currently unknown to us that we have not described in our Annual Report that could cause results to differ from our expectations. These forward-looking statements present our estimates and assumptions as of the date of this press release. Except as may be required by law, we undertake no obligation to modify or revise any forward-looking statements to reflect events or circumstances occurring after the date of this release.

Our Financial Presentation

As discussed throughout this release, we use certain non-GAAP performance measures, in addition to the required GAAP presentations, as we believe these measures improve the understanding of our operational results and make comparisons of operating results among peer companies more meaningful. Management continually evaluates the usefulness, relevance, limitations and calculation of the Company’s reported non-GAAP performance measures to determine how best to provide relevant information to the public, and thus such reported measures could change. The non-GAAP financial measures used throughout this release are Net operating income, Funds from operations, Core funds from operations, and Adjusted funds from operations. We provide a more detailed discussion about these non-GAAP measures in our reconciliation of non-GAAP measures provided in this earnings release.

9

THE HOWARD HUGHES CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

UNAUDITED

Year Ended December 31, | Three Months Ended December 31, | |||||||||||||||

(In thousands, except per share amounts) | 2019 | 2018 | 2019 | 2018 | ||||||||||||

Revenues: | ||||||||||||||||

Condominium rights and unit sales | $ | 448,940 | $ | 357,720 | $ | 5,009 | $ | 317,953 | ||||||||

Master Planned Communities land sales | 330,146 | 261,905 | 153,145 | 35,178 | ||||||||||||

Minimum rents | 221,907 | 207,315 | 57,551 | 54,159 | ||||||||||||

Tenant recoveries | 54,710 | 49,993 | 13,986 | 12,185 | ||||||||||||

Hospitality revenues | 87,864 | 82,037 | 19,328 | 17,299 | ||||||||||||

Builder price participation | 35,681 | 27,085 | 11,457 | 7,691 | ||||||||||||

Other land revenues | 23,399 | 21,314 | 6,753 | 5,326 | ||||||||||||

Other rental and property revenues | 95,703 | 57,168 | 15,831 | 14,902 | ||||||||||||

Interest income from sales-type leases | 2,189 | — | 1,101 | — | ||||||||||||

Total revenues | 1,300,539 | 1,064,537 | 284,161 | 464,693 | ||||||||||||

Expenses: | ||||||||||||||||

Condominium rights and unit cost of sales | 369,759 | 262,562 | 4,435 | 220,849 | ||||||||||||

Master Planned Communities cost of sales | 141,852 | 124,214 | 63,724 | 14,605 | ||||||||||||

Master Planned Communities operations | 47,875 | 45,217 | 11,927 | 11,261 | ||||||||||||

Other property operating costs | 175,230 | 133,761 | 43,422 | 41,914 | ||||||||||||

Rental property real estate taxes | 36,861 | 32,183 | 8,276 | 8,035 | ||||||||||||

Rental property maintenance costs | 17,410 | 15,813 | 5,548 | 4,209 | ||||||||||||

Hospitality operating costs | 60,226 | 59,195 | 13,916 | 13,488 | ||||||||||||

(Recovery of) provision for doubtful accounts | (414 | ) | 6,078 | (219 | ) | 1,661 | ||||||||||

Demolition costs | 855 | 17,329 | 118 | 1,163 | ||||||||||||

Development-related marketing costs | 23,067 | 29,249 | 6,193 | 8,765 | ||||||||||||

General and administrative | 156,251 | 104,625 | 68,328 | 32,830 | ||||||||||||

Depreciation and amortization | 155,798 | 126,565 | 40,656 | 38,167 | ||||||||||||

Total expenses | 1,184,770 | 956,791 | 266,324 | 396,947 | ||||||||||||

Other: | ||||||||||||||||

Gain (loss) on sale or disposal of real estate and other assets, net | 22,362 | (4 | ) | (1,689 | ) | (4 | ) | |||||||||

Other income (loss), net | 12,179 | (936 | ) | 381 | 2,508 | |||||||||||

Total other | 34,541 | (940 | ) | (1,308 | ) | 2,504 | ||||||||||

Operating income | 150,310 | 106,806 | 16,529 | 70,250 | ||||||||||||

Selling (loss) profit from sales-type leases | 13,537 | — | — | — | ||||||||||||

Interest income | 9,797 | 8,486 | 2,101 | 1,727 | ||||||||||||

Interest expense | (105,374 | ) | (82,028 | ) | (29,016 | ) | (24,846 | ) | ||||||||

Gain on extinguishment of debt | 4,641 | — | 4,641 | — | ||||||||||||

Equity in earnings from real estate and other affiliates | 30,629 | 39,954 | 9,782 | 657 | ||||||||||||

Income before taxes | 103,540 | 73,218 | 4,037 | 47,788 | ||||||||||||

Provision (benefit) for income taxes | 29,245 | 15,492 | 5,038 | 9,864 | ||||||||||||

Net income | 74,295 | 57,726 | (1,001 | ) | 37,924 | |||||||||||

Net income attributable to noncontrolling interests | (339 | ) | (714 | ) | (99 | ) | (663 | ) | ||||||||

Net income attributable to common stockholders | $ | 73,956 | $ | 57,012 | $ | (1,100 | ) | $ | 37,261 | |||||||

Basic income per share: | $ | 1.71 | $ | 1.32 | $ | (0.03 | ) | $ | 0.87 | |||||||

Diluted income per share: | $ | 1.71 | $ | 1.32 | $ | (0.03 | ) | $ | 0.86 | |||||||

10

THE HOWARD HUGHES CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

UNAUDITED

December 31, | ||||||||

(In thousands, except par values and share amounts) | 2019 | 2018 | ||||||

Assets: | ||||||||

Investment in real estate: | ||||||||

Master Planned Communities assets | $ | 1,655,674 | $ | 1,642,660 | ||||

Buildings and equipment | 3,813,595 | 2,932,963 | ||||||

Less: accumulated depreciation | (507,933 | ) | (380,892 | ) | ||||

Land | 353,022 | 297,596 | ||||||

Developments | 1,445,997 | 1,290,068 | ||||||

Net property and equipment | 6,760,355 | 5,782,395 | ||||||

Investment in real estate and other affiliates | 121,757 | 102,287 | ||||||

Net investment in real estate | 6,882,112 | 5,884,682 | ||||||

Net investment in lease receivable | 79,166 | — | ||||||

Cash and cash equivalents | 422,857 | 499,676 | ||||||

Restricted cash | 197,278 | 224,539 | ||||||

Accounts receivable, net | 12,279 | 12,589 | ||||||

Municipal Utility District receivables, net | 280,742 | 222,269 | ||||||

Notes receivable, net | 36,379 | 4,694 | ||||||

Deferred expenses, net | 133,182 | 95,714 | ||||||

Operating lease right-of-use assets, net | 69,398 | — | ||||||

Prepaid expenses and other assets, net | 300,373 | 411,636 | ||||||

Total assets | $ | 8,413,766 | $ | 7,355,799 | ||||

Liabilities: | ||||||||

Mortgages, notes and loans payable, net | $ | 4,096,470 | $ | 3,181,213 | ||||

Operating lease obligations | 70,413 | — | ||||||

Deferred tax liabilities | 180,748 | 157,188 | ||||||

Accounts payable and accrued expenses | 733,147 | 779,272 | ||||||

Total liabilities | 5,080,778 | 4,117,673 | ||||||

Equity: | ||||||||

Preferred stock: $.01 par value; 50,000,000 shares authorized, none issued | — | — | ||||||

Common stock: $.01 par value; 150,000,000 shares authorized, 43,635,893 issued and 42,585,633 outstanding as of December 31, 2019, and 43,511,473 shares issued and 42,991,624 outstanding as of December 31, 2018 | 437 | 436 | ||||||

Additional paid-in capital | 3,343,983 | 3,322,433 | ||||||

Accumulated deficit | (46,385 | ) | (120,341 | ) | ||||

Accumulated other comprehensive loss | (29,372 | ) | (8,126 | ) | ||||

Treasury stock, at cost, 1,050,260 and 519,849 shares as of December 31, 2019 and 2018 | (120,530) | (62,190) | ||||||

Total stockholders' equity | 3,148,133 | 3,132,212 | ||||||

Noncontrolling interests | 184,855 | 105,914 | ||||||

Total equity | 3,332,988 | 3,238,126 | ||||||

Total liabilities and equity | $ | 8,413,766 | $ | 7,355,799 | ||||

11

Appendix – Reconciliations of Non-GAAP Measures

As of and for the Year and Three Months Ended December 31, 2019

We use certain non-GAAP performance measures, in addition to the required GAAP presentations, as we believe these measures improve the understanding of our operational results and make comparisons of operating results among peer companies more meaningful. Management continually evaluates the usefulness, relevance, limitations and calculation of the Company’s reported non-GAAP performance measures to determine how best to provide relevant information to the public, and thus such reported measures could change. The non-GAAP financial measures used herein are Net operating income (“NOI”), Funds from operations (“FFO”), Core funds from operations (“Core FFO”) and Adjusted funds from operations (“AFFO”).

As a result of our four segments, Operating Assets, Master Planned Communities (“MPC”), Seaport District and Strategic Developments, being managed separately, we use different operating measures to assess operating results and allocate resources among these four segments. The one common operating measure used to assess operating results for our business segments is earnings before tax (“EBT”). EBT, as it relates to each business segment, represents the revenues less expenses of each segment, including interest income, interest expense and Equity in earnings of real estate and other affiliates. EBT excludes corporate expenses and other items that are not allocable to the segments. We present EBT because we use this measure, among others, internally to assess the core operating performance of our assets. However, EBT should not be considered as an alternative to GAAP net income.

Effective January 1, 2019, the Company moved the Seaport District out of the Operating Assets and Strategic Development segments and into a stand-alone segment for disclosure purposes. As applicable, we have adjusted our performance measures in all periods reported to reflect this change.

Year Ended December 31, | Three Months Ended December 31, | |||||||||||||||||||||||

(In thousands) | 2019 | 2018 | $ Change | 2019 | 2018 | $ Change | ||||||||||||||||||

Operating Assets Segment EBT | ||||||||||||||||||||||||

Total revenues | $ | 400,131 | $ | 348,242 | $ | 51,889 | $ | 94,736 | $ | 84,225 | $ | 10,511 | ||||||||||||

Total operating expenses | (187,322 | ) | (164,445 | ) | (22,877 | ) | (47,733 | ) | (38,073 | ) | (9,660 | ) | ||||||||||||

Segment operating income | 212,809 | 183,797 | 29,012 | 47,003 | 46,152 | 851 | ||||||||||||||||||

Depreciation and amortization | (115,499 | ) | (103,293 | ) | (12,206 | ) | (30,609 | ) | (29,265 | ) | (1,344 | ) | ||||||||||||

Provision for impairment | — | — | — | — | — | — | ||||||||||||||||||

Interest expense, net | (81,029 | ) | (71,551 | ) | (9,478 | ) | (20,334 | ) | (18,665 | ) | (1,669 | ) | ||||||||||||

Other income (loss), net | 1,142 | (7,107 | ) | 8,249 | (44 | ) | (4,504 | ) | 4,460 | |||||||||||||||

Equity in earnings from real estate and other affiliates | 3,672 | 1,994 | 1,678 | 477 | 487 | (10 | ) | |||||||||||||||||

(Loss) gain on sale or disposal of real estate and other assets, net | — | (4 | ) | 4 | — | (4 | ) | 4 | ||||||||||||||||

Selling profit from sales-type leases | 13,537 | — | 13,537 | — | — | — | ||||||||||||||||||

Operating Assets segment EBT | 34,632 | 3,836 | 30,796 | (3,507 | ) | (5,799 | ) | 2,292 | ||||||||||||||||

Master Planned Communities Segment EBT | ||||||||||||||||||||||||

Total revenues | 386,781 | 309,451 | 77,330 | 170,739 | 47,786 | 122,953 | ||||||||||||||||||

Total operating expenses | (189,727 | ) | (169,474 | ) | (20,253 | ) | (75,652 | ) | (25,866 | ) | (49,786 | ) | ||||||||||||

Segment operating income | 197,054 | 139,977 | 57,077 | 95,087 | 21,920 | 73,167 | ||||||||||||||||||

Depreciation and amortization | (424 | ) | (243 | ) | (181 | ) | (90 | ) | 2 | (92 | ) | |||||||||||||

Interest income, net | 32,019 | 26,919 | 5,100 | 7,643 | 7,093 | 550 | ||||||||||||||||||

Other income, net | 601 | 18 | 583 | — | — | — | ||||||||||||||||||

Equity in earnings from real estate and other affiliates | 28,336 | 36,284 | (7,948 | ) | 9,477 | 1,602 | 7,875 | |||||||||||||||||

MPC segment EBT | 257,586 | 202,955 | 54,631 | 112,117 | 30,617 | 81,500 | ||||||||||||||||||

12

Year Ended December 31, | Three Months Ended December 31, | |||||||||||||||||||||||

(In thousands) | 2019 | 2018 | $ Change | 2019 | 2018 | $ Change | ||||||||||||||||||

Seaport District Segment EBT | ||||||||||||||||||||||||

Total revenues | 55,645 | 32,632 | 23,013 | 12,594 | 10,020 | 2,574 | ||||||||||||||||||

Total operating expenses | (77,872 | ) | (49,716 | ) | (28,156 | ) | (18,137 | ) | (17,751 | ) | (386 | ) | ||||||||||||

Segment operating income | (22,227 | ) | (17,084 | ) | (5,143 | ) | (5,543 | ) | (7,731 | ) | 2,188 | |||||||||||||

Depreciation and amortization | (26,381 | ) | (12,466 | ) | (13,915 | ) | (6,668 | ) | (5,960 | ) | (708 | ) | ||||||||||||

Interest (expense) income, net | (12,865 | ) | 6,291 | (19,156 | ) | (4,425 | ) | (2,175 | ) | (2,250 | ) | |||||||||||||

Other (loss) income, net | (22 | ) | 102 | (124 | ) | 125 | 222 | (97 | ) | |||||||||||||||

Equity in losses from real estate and other affiliates | (2,592 | ) | (705 | ) | (1,887 | ) | (804 | ) | (13 | ) | (791 | ) | ||||||||||||

Loss on sale or disposal of real estate and other assets | (6 | ) | — | (6 | ) | — | — | — | ||||||||||||||||

Gain on extinguishment of debt | 4,851 | — | 4,851 | 4,851 | — | 4,851 | ||||||||||||||||||

Seaport District segment EBT | (59,242 | ) | (23,862 | ) | (35,380 | ) | (12,464 | ) | (15,657 | ) | 3,193 | |||||||||||||

Strategic Developments Segment EBT | ||||||||||||||||||||||||

Total revenues | 457,948 | 374,212 | 83,736 | 6,075 | 322,662 | (316,587 | ) | |||||||||||||||||

Total operating expenses | (391,848 | ) | (290,806 | ) | (101,042 | ) | (9,507 | ) | (229,914 | ) | 220,407 | |||||||||||||

Segment operating income | 66,100 | 83,406 | (17,306 | ) | (3,432 | ) | 92,748 | (96,180 | ) | |||||||||||||||

Depreciation and amortization | (5,473 | ) | (3,307 | ) | (2,166 | ) | (1,087 | ) | (657 | ) | (430 | ) | ||||||||||||

Interest income, net | 11,321 | 12,476 | (1,155 | ) | 1,822 | 2,682 | (860 | ) | ||||||||||||||||

Other income, net | 831 | 3,015 | (2,184 | ) | 167 | 3,092 | (2,925 | ) | ||||||||||||||||

Equity in earnings (losses) from real estate and other affiliates | 1,213 | 2,364 | (1,151 | ) | 632 | (1,433 | ) | 2,065 | ||||||||||||||||

Gain on sale or disposal of real estate and other assets, net | 27,119 | — | 27,119 | 3,062 | — | 3,062 | ||||||||||||||||||

Strategic Developments EBT | 101,111 | 97,954 | 3,157 | 1,164 | 96,432 | (95,268 | ) | |||||||||||||||||

Consolidated Segment EBT | ||||||||||||||||||||||||

Total revenues | 1,300,505 | 1,064,537 | 235,968 | 284,144 | 464,693 | (180,549 | ) | |||||||||||||||||

Total operating expenses | (846,769 | ) | (674,441 | ) | (172,328 | ) | (151,029 | ) | (311,604 | ) | 160,575 | |||||||||||||

Segment operating income | 453,736 | 390,096 | 63,640 | 133,115 | 153,089 | (19,974 | ) | |||||||||||||||||

Depreciation and amortization | (147,777 | ) | (119,309 | ) | (28,468 | ) | (38,454 | ) | (35,880 | ) | (2,574 | ) | ||||||||||||

Provision for impairment | — | — | — | — | — | — | ||||||||||||||||||

Interest expense, net | (50,554 | ) | (25,865 | ) | (24,689 | ) | (15,294 | ) | (11,065 | ) | (4,229 | ) | ||||||||||||

Other income (loss), net | 2,552 | (3,972 | ) | 6,524 | 248 | (1,190 | ) | 1,438 | ||||||||||||||||

Equity in earnings from real estate and other affiliates | 30,629 | 39,937 | (9,308 | ) | 9,782 | 643 | 9,139 | |||||||||||||||||

Gain (loss) on sale or disposal of real estate and other assets, net | 27,113 | (4 | ) | 27,117 | 3,062 | (4 | ) | 3,066 | ||||||||||||||||

Selling profit from sales-type leases | 13,537 | — | 13,537 | — | — | — | ||||||||||||||||||

Gain on extinguishment of debt | 4,851 | — | 4,851 | 4,851 | — | 4,851 | ||||||||||||||||||

Consolidated segment EBT | 334,087 | 280,883 | 53,204 | 97,310 | 105,593 | (8,283 | ) | |||||||||||||||||

Corporate income, expenses and other items | (259,792 | ) | (223,157 | ) | (36,635 | ) | (98,311 | ) | (67,669 | ) | (30,642 | ) | ||||||||||||

Net income | 74,295 | 57,726 | 16,569 | (1,001 | ) | 37,924 | (38,925 | ) | ||||||||||||||||

Net (income) loss attributable to noncontrolling interests | (339 | ) | (714 | ) | 375 | (99 | ) | (663 | ) | 564 | ||||||||||||||

Net income attributable to common stockholders | $ | 73,956 | $ | 57,012 | $ | 16,944 | $ | (1,100 | ) | $ | 37,261 | $ | (38,361 | ) | ||||||||||

13

NOI

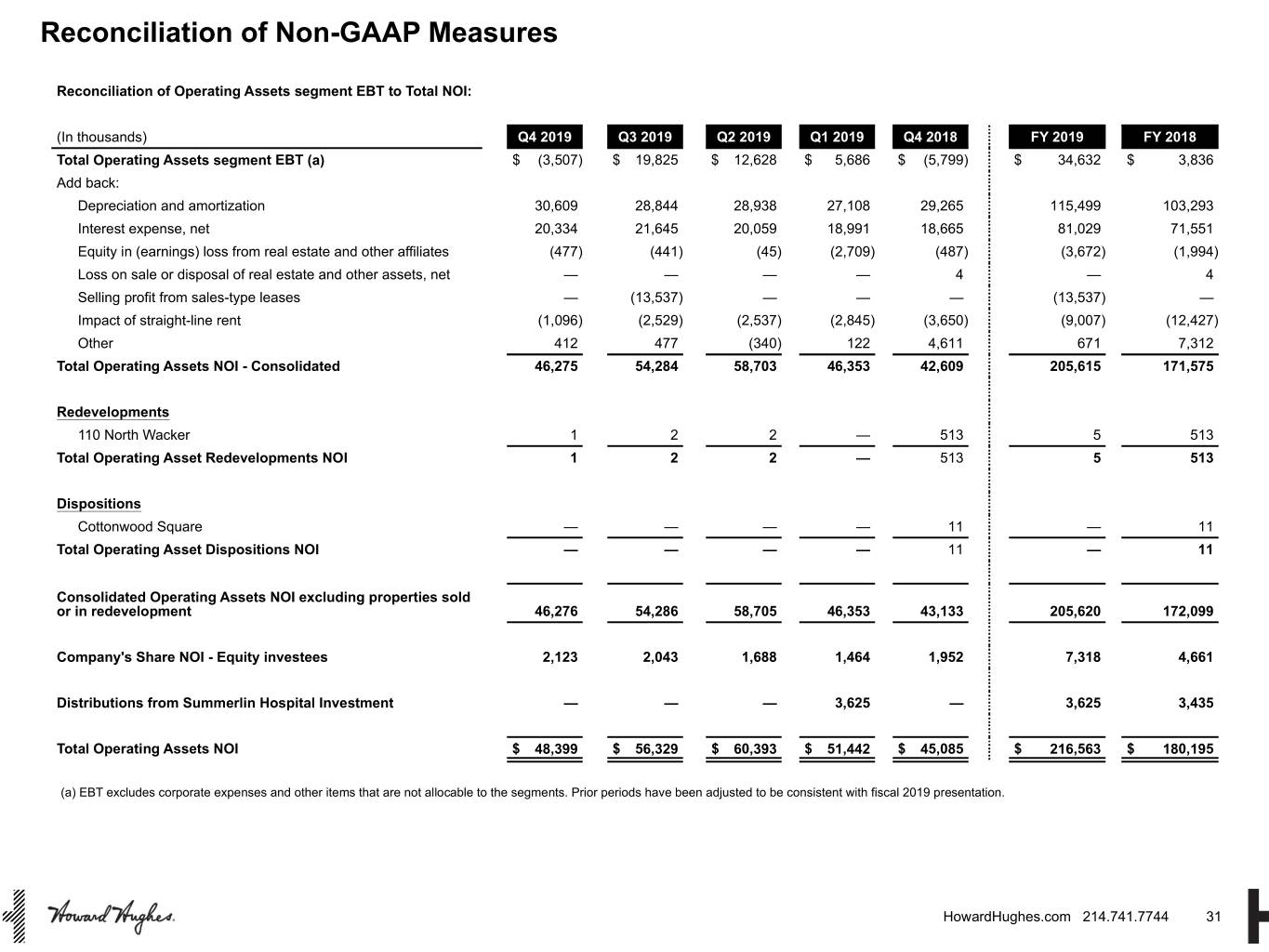

We believe that NOI is a useful supplemental measure of the performance of our Operating Assets and Seaport District portfolio because it provides a performance measure that, when compared year over year, reflects the revenues and expenses directly associated with owning and operating real estate properties and the impact on operations from trends in rental and occupancy rates and operating costs. We define NOI as operating revenues (rental income, tenant recoveries and other revenue) less operating expenses (real estate taxes, repairs and maintenance, marketing and other property expenses, including our share of NOI from equity investees). NOI excludes straight-line rents and amortization of tenant incentives, net interest expense, ground rent amortization, demolition costs, other (loss) income, amortization, depreciation and development-related marketing. All management fees have been eliminated for all internally-managed properties. We use NOI to evaluate our operating performance on a property-by-property basis because NOI allows us to evaluate the impact that property-specific factors such as lease structure, lease rates and tenant base have on our operating results, gross margins and investment returns. Variances between years in NOI typically result from changes in rental rates, occupancy, tenant mix and operating expenses. Although we believe that NOI provides useful information to investors about the performance of our Operating Assets and Seaport District assets, due to the exclusions noted above, NOI should only be used as an additional measure of the financial performance of the assets of this segment of our business and not as an alternative to GAAP Net income (loss). For reference, and as an aid in understanding our computation of NOI, a reconciliation of EBT to NOI for Operating Assets and Seaport District has been presented in the tables below.

Year Ended December 31, | Three Months Ended December 31, | |||||||||||||||

(In thousands) | 2019 | 2018 | 2019 | 2018 | ||||||||||||

Total Operating Assets segment EBT (a) | $ | 34,632 | $ | 3,836 | $ | (3,507 | ) | $ | (5,799 | ) | ||||||

Add back: | ||||||||||||||||

Depreciation and amortization | 115,499 | 103,293 | 30,609 | 29,265 | ||||||||||||

Interest expense, net | 81,029 | 71,551 | 20,334 | 18,665 | ||||||||||||

Equity in (earnings) loss from real estate and other affiliates | (3,672 | ) | (1,994 | ) | (477 | ) | (487 | ) | ||||||||

Loss on sale or disposal of real estate and other assets, net | — | 4 | — | 4 | ||||||||||||

Selling profit from sales-type leases | (13,537 | ) | — | — | — | |||||||||||

Impact of straight-line rent | (9,007 | ) | (12,427 | ) | (1,096 | ) | (3,650 | ) | ||||||||

Other | 671 | 7,312 | 412 | 4,611 | ||||||||||||

Total Operating Assets NOI - Consolidated | 205,615 | 171,575 | 46,275 | 42,609 | ||||||||||||

Redevelopments | ||||||||||||||||

110 North Wacker | 5 | 513 | 1 | 513 | ||||||||||||

Total Operating Asset Redevelopments NOI | 5 | 513 | 1 | 513 | ||||||||||||

Dispositions | ||||||||||||||||

Cottonwood Square | — | 11 | — | 11 | ||||||||||||

Total Operating Asset Dispositions NOI | — | 11 | — | 11 | ||||||||||||

Consolidated Operating Assets NOI excluding properties sold or in redevelopment | 205,620 | 172,099 | 46,276 | 43,133 | ||||||||||||

Company's Share NOI - Equity investees | 7,318 | 4,661 | 2,123 | 1,952 | ||||||||||||

Distributions from Summerlin Hospital Investment | 3,625 | 3,435 | — | — | ||||||||||||

Total Operating Assets NOI | $ | 216,563 | $ | 180,195 | $ | 48,399 | $ | 45,085 | ||||||||

(a) EBT excludes corporate income, expenses and other items that are not allocable to the segments.

14

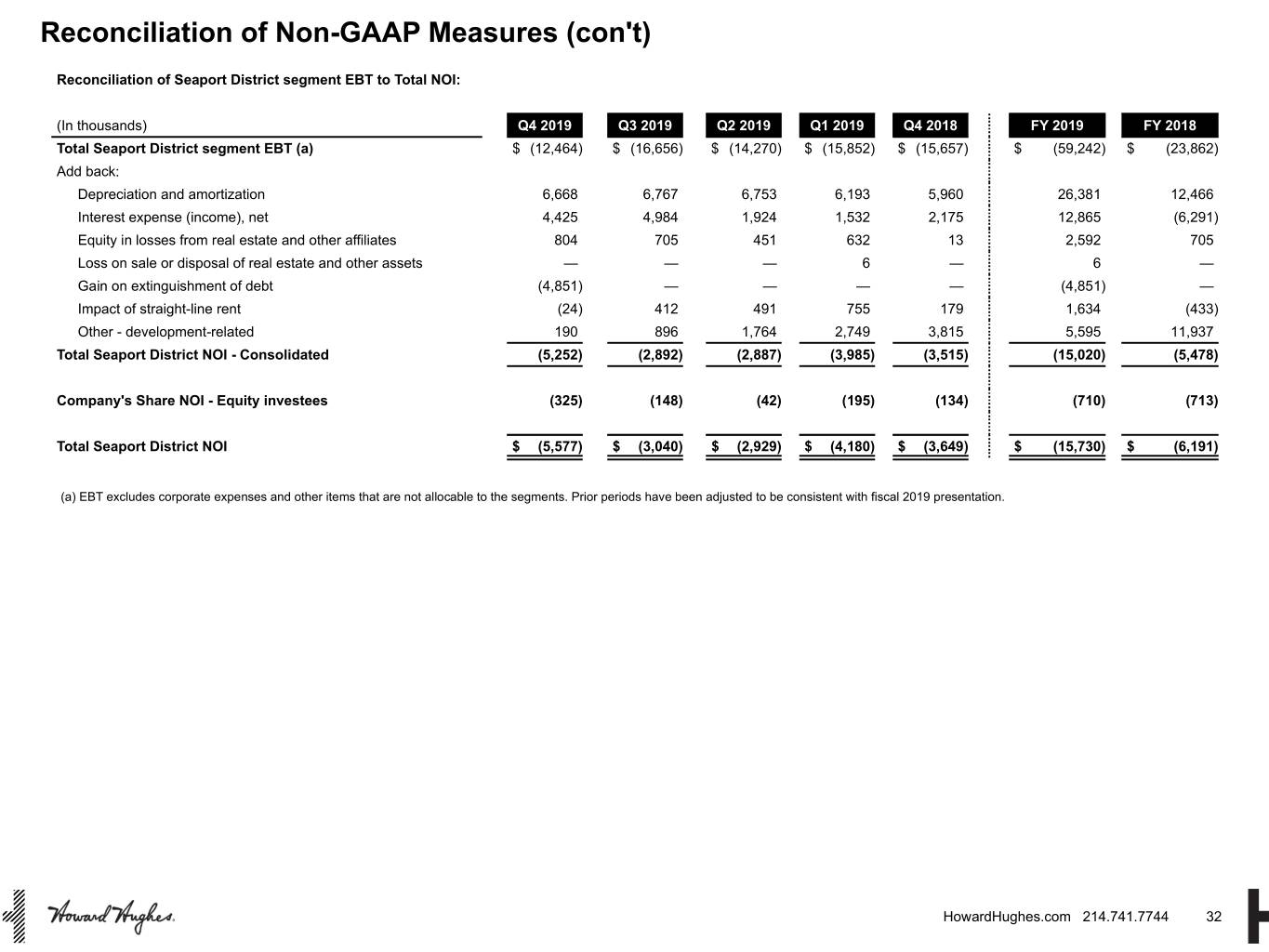

Year Ended December 31, | Three Months Ended December 31, | |||||||||||||||

(In thousands) | 2019 | 2018 | 2019 | 2018 | ||||||||||||

Total Seaport District segment EBT (a) | $ | (59,242 | ) | $ | (23,862 | ) | $ | (12,464 | ) | $ | (15,657 | ) | ||||

Add back: | ||||||||||||||||

Depreciation and amortization | 26,381 | 12,466 | 6,668 | 5,960 | ||||||||||||

Interest expense (income), net | 12,865 | (6,291) | 4,425 | 2,175 | ||||||||||||

Equity in losses from real estate and other affiliates | 2,592 | 705 | 804 | 13 | ||||||||||||

Impact of straight-line rent | 1,634 | (433) | (24 | ) | 179 | |||||||||||

Loss on sale or disposal of real estate and other assets | 6 | — | — | — | ||||||||||||

Gain on extinguishment of debt | (4,851) | — | (4,851 | ) | — | |||||||||||

Other - development-related | 5,595 | 11,937 | 190 | 3,815 | ||||||||||||

Total Seaport District NOI - Consolidated | (15,020) | (5,478) | (5,252 | ) | (3,515 | ) | ||||||||||

Company's Share NOI - Equity investees | (710) | (713) | (325 | ) | (134 | ) | ||||||||||

Total Seaport District NOI | (15,730) | (6,191) | $ | (5,577 | ) | $ | (3,649 | ) | ||||||||

(a) EBT excludes corporate income, expenses and other items that are not allocable to the segments.

FFO, Core FFO and AFFO

FFO is defined by the National Association of Real Estate Investment Trusts (“NAREIT”) as net income calculated in accordance with GAAP, excluding gains or losses from real estate dispositions, as well as real estate depreciation and amortization and impairment charges all of which we believe are not indicative of the performance of our operating portfolio. We calculate FFO in accordance with NAREIT’s definition. Since FFO excludes depreciation and amortization, as well as gains and losses from depreciable property, dispositions and impairments, it can provide a performance measure that, when compared year over year, reflects the impact on operations from trends in land sales prices, occupancy rates, rental rates, operating costs, acquisition and development activities, and financing costs. This provides a perspective of our financial performance not immediately apparent from net income determined in accordance with GAAP. Core FFO is calculated by adjusting FFO to exclude the impact of certain non-cash and/or nonrecurring income and expense items, as set forth in the calculation below. These items can vary greatly from period to period, depending upon the volume of our acquisition activity and debt retirements, among other factors. We believe that by excluding these items, Core FFO serves as a useful, supplementary measure of the ongoing operating performance of our core operations, and we believe it is used by investors in a similar manner. Finally, AFFO adjusts our Core FFO operating measure to deduct cash spent on recurring tenant improvements and capital expenditures of a routine nature as well as leasing commissions to present an adjusted measure of Core FFO. Core FFO and AFFO are non-GAAP and non-standardized measures and may be calculated differently by other peer companies.

While FFO, Core FFO, AFFO and NOI are relevant and widely used measures of operating performance of real estate companies, they do not represent cash flows from operations or net income as defined by GAAP and should not be considered an alternative to those measures in evaluating our liquidity or operating performance. FFO, Core FFO, AFFO and NOI do not purport to be indicative of cash available to fund our future cash requirements. Further, our computations of FFO, Core FFO, AFFO and NOI may not be comparable to those reported by other real estate companies. We have included a reconciliation of FFO, Core FFO and AFFO to GAAP net income below. Non-GAAP financial measures should not be considered independently, or as a substitute, for financial information presented in accordance with GAAP.

15

Year Ended December 31, | Three Months Ended December 31, | |||||||||||||||

(In thousands, except share amounts) | 2019 | 2018 | 2019 | 2018 | ||||||||||||

Net income attributable to common shareholders | $ | 73,956 | $ | 57,012 | $ | (1,100 | ) | $ | 37,261 | |||||||

Adjustments to arrive at FFO: | ||||||||||||||||

Segment real estate related depreciation and amortization | 147,777 | 119,309 | 38,454 | 35,880 | ||||||||||||

(Gain) loss on sale or disposal of real estate, net | (22,362 | ) | 4 | 1,689 | 4 | |||||||||||

Selling profit from sales-type leases | (13,537 | ) | — | — | — | |||||||||||

Income tax expense adjustments: | ||||||||||||||||

(Gain) loss on sale or disposal of real estate, net | 5,479 | — | (389 | ) | — | |||||||||||

Selling profit from sales-type leases | 2,843 | — | (460 | ) | — | |||||||||||

Reconciling items related to noncontrolling interests | 339 | 714 | 99 | 663 | ||||||||||||

Our share of the above reconciling items included in earnings from unconsolidated joint ventures | 3,688 | 2,679 | 1,014 | 798 | ||||||||||||

FFO | $ | 198,183 | $ | 179,718 | $ | 39,307 | $ | 74,606 | ||||||||

Adjustments to arrive at Core FFO: | ||||||||||||||||

Gain on extinguishment of debt | $ | (4,641 | ) | $ | — | $ | (4,641 | ) | $ | — | ||||||

Severance expenses | 29,144 | 687 | 26,054 | 267 | ||||||||||||

Non-real estate related depreciation and amortization | 8,021 | 7,256 | 2,202 | 2,288 | ||||||||||||

Straight-line amortization | (7,364 | ) | (12,609 | ) | (1,107 | ) | (2,505 | ) | ||||||||

Deferred income tax expense | 27,816 | 16,195 | 4,627 | 11,574 | ||||||||||||

Non-cash fair value adjustments related to hedging instruments | 770 | (1,135 | ) | 791 | 127 | |||||||||||

Share-based compensation | 17,349 | 11,242 | 8,456 | 3,011 | ||||||||||||

Other non-recurring expenses (development-related marketing and demolition costs) | 23,922 | 46,579 | 6,311 | 9,929 | ||||||||||||

Our share of the above reconciling items included in earnings from unconsolidated joint ventures | 190 | 306 | 89 | 95 | ||||||||||||

Core FFO | $ | 293,390 | $ | 248,239 | $ | 82,089 | $ | 99,392 | ||||||||

Adjustments to arrive at AFFO: | ||||||||||||||||

Tenant and capital improvements | $ | (5,237 | ) | $ | (14,267 | ) | $ | (1,236 | ) | $ | (3,583 | ) | ||||

Leasing commissions | (4,192 | ) | (3,600 | ) | (1,603 | ) | (1,906 | ) | ||||||||

AFFO | $ | 283,961 | $ | 230,372 | $ | 79,250 | $ | 93,903 | ||||||||

FFO per diluted share value | $ | 4.58 | $ | 4.16 | $ | 0.91 | $ | 1.72 | ||||||||

Core FFO per diluted share value | $ | 6.77 | $ | 5.74 | $ | 1.90 | $ | 2.30 | ||||||||

AFFO per diluted share value | $ | 6.56 | $ | 5.33 | $ | 1.84 | $ | 2.17 | ||||||||

16