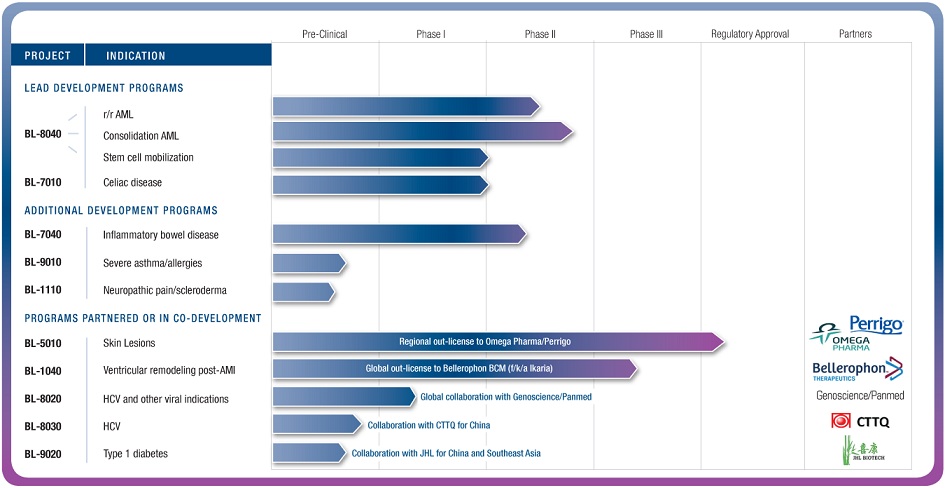

Our Product Pipeline

The table below summarizes our current pipeline of therapeutic candidates, as well as the target indication and status of each candidate.

Recent Developments

In May 2015, our shareholders approved a 1-for-10 reverse share split of our ordinary shares and a corresponding amendment of our Articles of Association. They also approved an increase in the number of our authorized ordinary shares and authorized share capital, and an amendment of our Articles of Association to reflect such increase. As a result of the foregoing changes, the number of authorized ordinary shares was increased to 150 million shares, and the number of outstanding ordinary shares is 54,654,811 million shares as of October 15, 2015. Following implementation of the reverse split, our ADSs now represent exactly one ordinary share instead of 10 ordinary shares as previously, but there was no effect on the total number of ADSs outstanding, or the number of ADSs held by any owner of ADSs. Proportional adjustments were made to all of our outstanding convertible securities. All changes were effective as of June 7, 2015.

|

The SEC allows us to incorporate by reference our publicly filed reports into this prospectus, which means that information included in those reports is considered part of this prospectus. Information that we file with the SEC after the date that we file this registration statement will automatically update and supersede the information contained in this prospectus. We incorporate by reference the following documents filed with the SEC and any future filings made with the SEC under sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”):

|

|

(1)

|

Our Annual Report on Form 20-F for the year ended December 31, 2014 filed on March 23, 2015, as amended by our amended Annual Report on Form 20-F/A filed on September 22, 2015; and

|

|

|

(2)

|

Our Current Reports on Form 6-K filed January 6, 2015, January 14, 2015, February 9, 2015, March 2, 2015, March 5, 2015, March 6, 2015, March 11, 2015, March 23, 2015, March 24, 2015, March 25, 2015, April 28, 2015, May 4, 2015, May 18, 2015, June 1, 2015, June 3, 2015, June 15, 2015, July 16, 2015, July 27, 2015, August 17, 2015, August 20, 2015, September 9, 2015 and September 10, 2015.

|

We will furnish without charge to you, on written or oral request, a copy of any or all of the above documents, other than exhibits to such documents which are not specifically incorporated by reference therein. You should direct any requests for documents to:

BioLineRx Ltd.

Modi’in Technology Park

2 HaMa’ayan Street

Modi’in 7177871, Israel

Attention: Corporate Secretary

Tel.: +972-8-642-9100

e-mail: info@BioLineRx.com

The information relating to us contained in this prospectus is not comprehensive and should be read together with the information contained in the incorporated documents. Descriptions contained in the incorporated documents as to the contents of any contract or other document may not contain all of the information which is of interest to you. You should refer to the copy of such contract or other document filed as an exhibit to our filings.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement on Form F-3 under the Securities Act of 1933, as amended (the “Securities Act”), relating to this offering of securities. This prospectus does not contain all of the information contained in the registration statement. The rules and regulations of the SEC allow us to omit certain information from this prospectus that is included in the registration statement. Statements made in this prospectus concerning the contents of any contract, agreement or other document are summaries of all material information about the documents summarized, but are not complete descriptions of all terms of these documents. If we filed any of these documents as an exhibit to the registration statement, you may read the document itself for a complete description of its terms.

In addition, we file reports with, and furnish information to, the SEC. You may read and copy the registration statement and any other documents we have filed at the SEC, including any exhibits and schedules, at the SEC’s public reference room at 100 F Street N.E., Washington, D.C. 20549. You may call the SEC at 1-800-SEC-0330 for further information on this public reference room. As a foreign private issuer, all documents which were filed after September 24, 2010 on the SEC’s EDGAR system are available for retrieval on the SEC’s website at www.sec.gov. These SEC filings are also available to the public on the Israel Securities Authority’s Magna website at www.magna.isa.gov.il and from commercial document retrieval services. We also generally make available on our own web site (www.biolinerx.com) our quarterly and year-end financial statements as well as other information.

In addition, since our ordinary shares are traded on the TASE, in the past we filed Hebrew language periodic and immediate reports with, and furnished information to, the TASE and the Israel Securities Authority, or the ISA, as required under Chapter Six of the Israel Securities Law, 1968. On August 31, 2011, our shareholders approved a transition solely to U.S. reporting standards after listing our ADSs on the Nasdaq Capital Market, in accordance with an applicable exemption under the Israel Securities Law. Copies of our SEC filings and submissions are now submitted to the ISA and the TASE. Such copies can be retrieved electronically through the MAGNA distribution site of the ISA (www.magna.isa.gov.il) and the TASE website (maya.tase.co.il).

We maintain a corporate website at www.biolinerx.com. Information contained on, or that can be accessed through, our website does not constitute a part of this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

This prospectus contains statements and information that involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. In some cases, you can identify forward-looking statements by terms including “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would,” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. You should not put undue reliance on any forward-looking statements. Unless we are required to do so under U.S. federal securities laws or other applicable laws, we do not intend to update or revise any forward-looking statements.

Factors that could cause our actual results to differ materially from those expressed or implied in such forward-looking statements include, but are not limited to:

|

|

•

|

the initiation, timing, progress and results of our preclinical studies, clinical trials, and other therapeutic candidate development efforts;

|

|

|

•

|

our ability to advance our therapeutic candidates into clinical trials or to successfully complete our preclinical studies or clinical trials;

|

|

|

•

|

our receipt of regulatory approvals for our therapeutic candidates, and the timing of other regulatory filings and approvals;

|

|

|

•

|

the clinical development, commercialization, and market acceptance of our therapeutic candidates;

|

|

|

•

|

our ability to establish and maintain corporate collaborations;

|

|

|

•

|

the interpretation of the properties and characteristics of our therapeutic candidates and of the results obtained with our therapeutic candidates in preclinical studies or clinical trials;

|

|

|

•

|

the implementation of our business model, strategic plans for our business and therapeutic candidates;

|

|

|

•

|

the scope of protection we are able to establish and maintain for intellectual property rights covering our therapeutic candidates and our ability to operate our business without infringing the intellectual property rights of others;

|

|

|

•

|

estimates of our expenses, future revenues, capital requirements and our needs for additional financing;

|

|

|

•

|

competitive companies, technologies and our industry; and

|

|

|

•

|

statements as to the impact of the political and security situation in Israel on our business.

|

Unless otherwise indicated in an accompanying prospectus supplement, the net proceeds from the sale of securities will be used for general corporate purposes.

From the Company’s inception through December 31, 2014, our functional and presentation currency was the New Israeli Shekel, or NIS. Effective January 1, 2015, as a result of a number of factors, including the strategic collaboration agreement with Novartis that will be managed solely in U.S. dollars, or dollars, as well as expectations regarding a significant increase in expenses denominated in dollars relating to advanced clinical trials, our functional and presentation currency was changed to the dollar. No representation is made that NIS amounts referred to in this prospectus could have been or could be converted into dollars at any particular rate or at all.

Fluctuations in the exchange rates between the NIS and the dollar will affect the dollar amounts received by owners of our ordinary shares on payment of dividends, if any, paid in NIS.

The following table sets forth information regarding the exchange rates of NIS per dollars for the periods indicated. Average rates are those reported by the Bank of Israel for the periods presented.

|

|

|

NIS per dollar

|

|

|

Year Ended December 31,

|

|

High

|

|

|

Low

|

|

|

Average

|

|

|

Period End

|

|

|

2014

|

|

|

3.994 |

|

|

|

3.402 |

|

|

|

3.578 |

|

|

|

3.889 |

|

|

2013

|

|

|

3.791 |

|

|

|

3.471 |

|

|

|

3.611 |

|

|

|

3.471 |

|

|

2012

|

|

|

4.084 |

|

|

|

3.700 |

|

|

|

3.856 |

|

|

|

3.733 |

|

|

2011

|

|

|

3.821 |

|

|

|

3.363 |

|

|

|

3.578 |

|

|

|

3.821 |

|

|

2010

|

|

|

3.894 |

|

|

|

3.549 |

|

|

|

3.733 |

|

|

|

3.549 |

|

The following table sets forth the high and low daily representative rates for the NIS as reported by the Bank of Israel for each of the prior six months.

|

|

|

NIS per dollar

|

|

|

Month

|

|

High

|

|

|

Low

|

|

|

Average

|

|

|

Period End

|

|

| October 2015 (through October 15, 2015) |

|

|

3.923 |

|

|

|

3.821 |

|

|

|

3.863 |

|

|

|

3.821 |

|

| September 2015 |

|

|

3.949 |

|

|

|

3.863 |

|

|

|

3.913 |

|

|

|

3.923 |

|

| August 2015 |

|

|

3.930 |

|

|

|

3.772 |

|

|

|

3.845 |

|

|

|

3.930 |

|

|

July 2015

|

|

|

3.825 |

|

|

|

3.765 |

|

|

|

3.789 |

|

|

|

3.783 |

|

|

June 2015

|

|

|

3.872 |

|

|

|

3.761 |

|

|

|

3.824 |

|

|

|

3.769 |

|

|

May 2015

|

|

|

3.890 |

|

|

|

3.819 |

|

|

|

3.862 |

|

|

|

3.876 |

|

|

April 2015

|

|

|

4.014 |

|

|

|

3.861 |

|

|

|

3.938 |

|

|

|

3.861 |

|

On October 15, 2015, the representative rate was $1.00 to NIS 3.821, as reported by the Bank of Israel.

Our ADSs have been trading on the Nasdaq Capital Market under the symbol “BLRX” since July 2011.

The following table sets forth, for the periods indicated, the reported high and low closing sale prices of our ADSs on the Nasdaq Capital Market in dollars.

| |

|

In dollars

|

|

| |

|

Price Per

ADS

|

|

| |

|

High

|

|

|

Low

|

|

|

Annual:

|

|

|

|

|

|

|

|

2014

|

|

|

3.07 |

|

|

|

1.23 |

|

|

2013

|

|

|

4.75 |

|

|

|

1.58 |

|

|

2012

|

|

|

5.55 |

|

|

|

2.23 |

|

|

2011 (from July 25, 2011)

|

|

|

5.44 |

|

|

|

2.75 |

|

|

Quarterly:

|

|

|

|

|

|

|

|

|

| Third Quarter 2015 |

|

|

2.65 |

|

|

|

1.23 |

|

|

Second Quarter 2015

|

|

|

2.66 |

|

|

|

1.85 |

|

|

First Quarter 2015

|

|

|

2.84 |

|

|

|

1.71 |

|

|

Fourth Quarter 2014

|

|

|

1.83 |

|

|

|

1.23 |

|

|

Third Quarter 2014

|

|

|

2.19 |

|

|

|

1.46 |

|

|

Second Quarter 2014

|

|

|

2.27 |

|

|

|

1.94 |

|

|

First Quarter 2014

|

|

|

3.07 |

|

|

|

2.21 |

|

|

Fourth Quarter 2013

|

|

|

2.98 |

|

|

|

2.23 |

|

|

Third Quarter 2013

|

|

|

2.30 |

|

|

|

1.62 |

|

|

Second Quarter 2013

|

|

|

1.91 |

|

|

|

1.58 |

|

|

First Quarter 2013

|

|

|

4.75 |

|

|

|

1.68 |

|

|

Most Recent Six Months:

|

|

|

|

|

|

|

|

|

|

October 2015 (through October 15, 2015)

|

|

|

1.54 |

|

|

|

1.43 |

|

| September 2015 |

|

|

1.81 |

|

|

|

1.50 |

|

| August 2015 |

|

|

1.59 |

|

|

|

1.23 |

|

|

July 2015

|

|

|

2.65

|

|

|

|

1.54

|

|

|

June 2015

|

|

|

2.66 |

|

|

|

1.91 |

|

|

May 2015

|

|

|

2.04 |

|

|

|

1.85 |

|

|

April 2015

|

|

|

2.30 |

|

|

|

1.87 |

|

On October 15, 2015, the last reported sales price of our ADSs on the Nasdaq Capital Market was $1.44 per ADS. As of October 15, 2015, there was one shareholder of record of our ADSs. The number of record holders is not representative of the number of beneficial holders of our ADSs.

PRICE RANGE OF OUR ORDINARY SHARES

Our ordinary shares have been trading on the TASE under the symbol “BLRX” since February 2007.

The following table sets forth, for the periods indicated, the reported high and low closing sale prices of our ordinary shares on the TASE in NIS and dollars. All prices quoted below give effect to the 1-for-10 reverse share split of our ordinary shares, which became effective June 7, 2015.

| |

|

NIS

|

|

|

Dollars

|

|

| |

|

Price Per

Ordinary Share

|

|

|

Price Per

Ordinary Share

|

|

| |

|

High

|

|

|

Low

|

|

|

High

|

|

|

Low

|

|

|

Annual:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2014

|

|

|

10.49 |

|

|

|

4.76 |

|

|

|

3.01 |

|

|

|

1.24 |

|

|

2013

|

|

|

17.99 |

|

|

|

5.90 |

|

|

|

4.89 |

|

|

|

1.62 |

|

|

2012

|

|

|

21.15 |

|

|

|

8.92 |

|

|

|

5.58 |

|

|

|

2.32 |

|

|

2011

|

|

|

32.40 |

|

|

|

11.27 |

|

|

|

9.12 |

|

|

|

3.03 |

|

|

2010

|

|

|

47.50 |

|

|

|

28.60 |

|

|

|

12.60 |

|

|

|

7.96 |

|

|

Quarterly:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Third Quarter 2015

|

|

|

10.21 |

|

|

|

4.94 |

|

|

|

2.70 |

|

|

|

1.27 |

|

|

Second Quarter 2015

|

|

|

9.83 |

|

|

|

7.36 |

|

|

|

2.61 |

|

|

|

1.92 |

|

|

First Quarter 2015

|

|

|

10.23 |

|

|

|

6.70 |

|

|

|

2.57 |

|

|

|

1.72 |

|

|

Fourth Quarter 2014

|

|

|

7.11 |

|

|

|

4.76 |

|

|

|

1.81 |

|

|

|

1.24 |

|

|

Third Quarter 2014

|

|

|

7.33 |

|

|

|

5.69 |

|

|

|

2.14 |

|

|

|

1.56 |

|

|

Second Quarter 2014

|

|

|

8.02 |

|

|

|

6.76 |

|

|

|

2.31 |

|

|

|

1.95 |

|

|

First Quarter 2014

|

|

|

10.49 |

|

|

|

7.70 |

|

|

|

3.01 |

|

|

|

2.21 |

|

|

Fourth Quarter 2013

|

|

|

10.76 |

|

|

|

8.03 |

|

|

|

3.02 |

|

|

|

2.27 |

|

|

Third Quarter 2013

|

|

|

8.53 |

|

|

|

5.99 |

|

|

|

2.37 |

|

|

|

1.65 |

|

|

Second Quarter 2013

|

|

|

7.31 |

|

|

|

5.90 |

|

|

|

2.01 |

|

|

|

1.62 |

|

|

First Quarter 2013

|

|

|

17.99 |

|

|

|

6.25 |

|

|

|

4.89 |

|

|

|

1.72 |

|

|

Most Recent Six Months:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

October 2015 (through October 15, 2015)

|

|

|

6.05 |

|

|

|

5.76 |

|

|

|

1.56 |

|

|

|

1.51 |

|

|

September 2015

|

|

|

7.25 |

|

|

|

5.78 |

|

|

|

1.85 |

|

|

|

1.47 |

|

|

August 2015

|

|

|

6.21 |

|

|

|

4.94 |

|

|

|

1.65 |

|

|

|

1.27 |

|

|

July 2015

|

|

|

10.21

|

|

|

|

6.13

|

|

|

|

2.70

|

|

|

|

1.62

|

|

|

June 2015

|

|

|

9.83 |

|

|

|

7.36 |

|

|

|

2.61 |

|

|

|

1.92 |

|

|

May 2015

|

|

|

8.13 |

|

|

|

7.46 |

|

|

|

2.10 |

|

|

|

1.93 |

|

|

April 2015

|

|

|

9.11 |

|

|

|

7.61 |

|

|

|

2.31 |

|

|

|

1.97 |

|

|

March 2015

|

|

|

10.23 |

|

|

|

7.66 |

|

|

|

2.57 |

|

|

|

1.91 |

|

|

February 2015

|

|

|

9.15 |

|

|

|

7.11 |

|

|

|

2.37 |

|

|

|

1.83 |

|

|

January 2015

|

|

|

8.44 |

|

|

|

6.70 |

|

|

|

2.13 |

|

|

|

1.72 |

|

On October 15, 2015, the last reported sales price of our ordinary shares on the TASE was NIS 5.76 per share, or $1.51 per share (based on the exchange rate reported by the Bank of Israel for such date). On October 15, 2015, the exchange rate of the NIS to the dollar was $1.00 = NIS 3.821, as reported by the Bank of Israel. As of October 15, 2015, there were two shareholders of record of our ordinary shares. The number of record holders is not representative of the number of beneficial holders of our ordinary shares.

RATIO OF EARNINGS TO FIXED CHARGES

The table below presents our consolidated ratio of earnings to fixed charges for each of the periods indicated. Where the ratio indicates coverage of less than a 1:1 ratio, we have disclosed the amount (in thousands of USD) of the deficiency, i.e., the additional earnings required to achieve a 1:1 ratio. We computed these ratios by dividing earnings by fixed charges. For this purpose, earnings consist of earnings before income taxes and non-controlling interests plus fixed charges. Fixed charges consist of interest expense, whether capitalized or expensed.

|

Year Ended December 31,*

|

|

Six Months Ended

June 30,

|

|

2010

|

|

2011

|

|

2012

|

|

2013

|

|

2014

|

|

2015

|

|

24.58x

|

|

(12,611)

|

|

(19,163)

|

|

(15,437)

|

|

(9,955)

|

|

(9,121)

|

*Effective January 1, 2015, we changed our functional currency to the dollar from the NIS. All amounts and calculations herein for the years 2010 through 2014 have been translated at the June 30, 2015 exchange rate of NIS 3.769 to one USD.

The following description of our share capital and provisions of our Articles of Association are summaries and do not purport to be complete.

Ordinary Shares

At October 15, 2015, our authorized share capital consists of 150 million ordinary shares, par value NIS 0.10 per share, of which 54,654,811 shares are issued and outstanding as of October 15, 2015.

All of our outstanding ordinary shares will be validly issued, fully paid and non-assessable. Our ordinary shares are not redeemable and do not have any preemptive rights. Pursuant to Israeli securities laws, a company whose shares are traded on the TASE may not have more than one class of shares (subject to an exception which is not applicable to us), and all outstanding shares must be validly issued and fully paid. Shares and convertible securities may not be issued without the consent of the Israeli Securities Authority and all outstanding shares must be registered for trading on the TASE.

Registration Number and Purposes of the Company

Our number with the Israeli Registrar of Companies is 513398750. Our purpose appears in our Articles of Association and includes every lawful purpose.

Transfer of Shares

Our ordinary shares that are fully paid for are issued in registered form and may be freely transferred under our Articles of Association, unless the transfer is restricted or prohibited by applicable law or the rules of a stock exchange on which the shares are traded. The ownership or voting of our ordinary shares by non-residents of Israel is not restricted in any way by our Articles of Association or the laws of the State of Israel, except for ownership by nationals of some countries that are, or have been, in a state of war with Israel.

Election of Directors

Our ordinary shares do not have cumulative voting rights in the election of directors. As a result, the holders of a majority of the voting power represented at a shareholders meeting have the power to elect all of our directors, subject to the special approval requirements for external directors.

Pursuant to our Articles of Association, other than the external directors, for whom special election requirements apply under the Israeli Companies Law, our directors are elected at a general or special meeting of our shareholders and serve on the Board of Directors until they are removed by the majority of our shareholders at a general or special meeting of our shareholders or upon the occurrence of certain events, in accordance with the Israeli Companies Law and our Articles of Association. In addition, our Articles of Association allow our Board of Directors to appoint directors to fill vacancies on the Board of Directors to serve until the next general meeting or special meeting, or earlier if required by our Articles of Association or applicable law. We have held elections for each of our non-external directors at each annual meeting of our shareholders since our initial public offering in Israel. External directors are elected for an initial term of three years and may be removed from office pursuant to the terms of the Israeli Companies Law.

Dividend and Liquidation Rights

We may declare a dividend to be paid to the holders of our ordinary shares in proportion to their respective shareholdings. Under the Israeli Companies Law, dividend distributions are determined by the board of directors and do not require the approval of the shareholders of a company unless the company’s articles of association provide otherwise. Our Articles of Association do not require shareholder approval of a dividend distribution and provide that dividend distributions may be determined by our Board of Directors.

Pursuant to the Israeli Companies Law, we may only distribute dividends from our profits accrued over the previous two years or the overall balance of the profits, whichever is greater, all as defined in the Israeli Companies Law, according to our then last reviewed or audited financial reports, provided that the date of the financial reports is not more than six months prior to the date of distribution, or we may distribute dividends with court approval. In each case, we are only permitted to pay a dividend if there is no reasonable concern that payment of the dividend will prevent us from satisfying our existing and foreseeable obligations as they become due.

In the event of our liquidation, after satisfaction of liabilities to creditors, our assets will be distributed to the holders of our ordinary shares in proportion to their shareholdings. This right, as well as the right to receive dividends, may be affected by the grant of preferential dividend or distribution rights to the holders of a class of shares with preferential rights that may be authorized in the future.

Shareholder Meetings

Under Israeli law, we are required to hold an annual general meeting of our shareholders once every calendar year that must be no later than 15 months after the date of the previous annual general meeting. All meetings other than the annual general meeting of shareholders are referred to as special meetings. Our Board of Directors may call special meetings whenever it sees fit, at such time and place, within or outside of Israel, as it may determine. In addition, the Israeli Companies Law and our Articles of Association provide that our Board of Directors is required to convene a special meeting upon the written request of (a) any two of our directors or one quarter of our Board of Directors or (b) one or more shareholders holding, in the aggregate, either (1) 5% of our outstanding shares and 1% of our outstanding voting power or (2) 5% of our outstanding voting power.

Subject to the provisions of the Israeli Companies Law and the regulations promulgated thereunder, shareholders entitled to participate and vote at general meetings are the shareholders of record on a date to be decided by the board of directors, which may be between four and 40 days prior to the date of the meeting. Furthermore, the Israeli Companies Law and our Articles of Association require that resolutions regarding the following matters must be passed at a general meeting of our shareholders:

|

|

•

|

amendments to our Articles of Association;

|

|

|

•

|

appointment or termination of our auditors;

|

|

|

•

|

appointment of directors and appointment and dismissal of external directors;

|

|

|

•

|

approval of acts and transactions requiring general meeting approval pursuant to the Israeli Companies Law;

|

|

|

•

|

approval of our compensation policy for directors and office holders;

|

|

|

•

|

compensation of directors and/or the principal executive officer, indemnification and change of the principal executive officer;

|

|

|

•

|

increases or reductions of our authorized share capital;

|

|

|

•

|

the exercise of our Board of Director’s powers by a general meeting, if our Board of Directors is unable to exercise its powers and the exercise of any of its powers is required for our proper management.

|

The Israeli Companies Law requires that a notice of any annual or special shareholders meeting be provided at least 21 days prior to the meeting and if the agenda of the meeting includes the appointment or removal of directors, the approval of transactions with office holders or interested or related parties, or an approval of a merger, notice must be provided at least 35 days prior to the meeting.

The Israeli Companies Law does not allow shareholders of publicly traded companies to approve corporate matters by written consent. Consequently, our Articles of Association does not allow shareholders to approve corporate matters by written consent.

Voting Rights

Quorum Requirements

Pursuant to our Articles of Association, holders of our ordinary shares have one vote for each ordinary share held on all matters submitted to a vote before the shareholders at a general meeting. The quorum required for our general meetings of shareholders consists of at least two shareholders present in person, by proxy or written ballot who hold or represent between them at least 25% of the total outstanding voting rights. A meeting adjourned for lack of a quorum is adjourned to the same day in the following week at the same time and place or on a later date if so specified in the summons or notice of the meeting. At the reconvened meeting, any number of our shareholders present in person or by proxy shall constitute a lawful quorum.

Vote Requirements

Our Articles of Association provide that all resolutions of our shareholders require a simple majority vote, unless otherwise required by applicable law.

Israeli law provides that a shareholder of a public company may vote in a meeting and in a class meeting by means of a written ballot in which the shareholder indicates how he or she votes on resolutions relating to the following matters:

|

|

•

|

an appointment or removal of directors;

|

|

|

•

|

an approval of transactions with office holders or interested or related parties;

|

|

|

•

|

an approval of a merger or any other matter in respect of which there is a provision in the articles of association providing that decisions of the general meeting may also be passed by written ballot;

|

|

|

•

|

authorizing the chairman of the board of directors or his relative to act as the company’s chief executive officer or act with such authority; or authorize the company’s chief executive officer or his relative to act as the chairman of the board of directors or act with such authority; and

|

|

|

•

|

other matters which may be prescribed by Israel’s Minister of Justice.

|

The provision allowing the vote by written ballot does not apply where the voting power of the controlling shareholder is sufficient to determine the vote. Our Articles of Association provides that our Board of Directors may prevent voting by means of a written ballot and this determination is required to be stated in the notice convening the general meeting.

On June 17, 2015, the ISA launched an electronic voting system and, as of this date, shareholders may vote in a meeting or in a class meeting by using this electronic voting system (in addition to other existing methods of voting).

The Israeli Companies Law provides that a shareholder, in exercising his or her rights and performing his or her obligations toward the company and its other shareholders, must act in good faith and in a customary manner, and avoid abusing his or her power. This is required when voting at general meetings on matters such as changes to the articles of association, increasing the company’s registered capital, mergers and approval of related party transactions. A shareholder also has a general duty to refrain from depriving any other shareholder of its rights as a shareholder. In addition, any controlling shareholder, any shareholder who knows that its vote can determine the outcome of a shareholder vote and any shareholder who, under the company’s articles of association, can appoint or prevent the appointment of an office holder, is required to act with fairness towards the company. The Israeli Companies Law does not describe the substance of this duty except to state that the remedies generally available upon a breach of contract will also apply to a breach of the duty to act with fairness, and, to the best of our knowledge, there is no binding case law that addresses this subject directly.

Resolutions

Unless otherwise stated under the Israeli Companies Law, or provided in a company’s articles of association, a resolution at a shareholders meeting requires approval by a simple majority of the voting rights represented at the meeting, in person, by proxy or written ballot, and voting on the resolution. As mentioned above, as of June 17, 2015, voting is also possible by using the ISA electronic voting system. Under the Israeli Companies Law, unless otherwise provided in a company’s articles of association or under applicable law, all resolutions of the shareholders of a company require a simple majority. A resolution for the voluntary winding up of the company requires the approval of holders of 75% of the voting rights represented at the meeting, in person, by proxy or by written ballot and voting on the resolution.

Access to Corporate Records

Under the Israeli Companies Law, all shareholders of a company generally have the right to review minutes of the company’s general meetings, its shareholders register and principal shareholders register, articles of association, financial statements and any document it is required by law to file publicly with the Israeli Companies Registrar and the Israeli Securities Authority. Any of our shareholders may request access to review any document in our possession that relates to any action or transaction with a related party, interested party or office holder that requires shareholder approval under the Israeli Companies Law. We may deny a request to review a document if we determine that the request was not made in good faith, that the document contains a commercial secret or a patent or that the document’s disclosure may otherwise prejudice our interests.

Modification of Class Rights

The rights attached to any class of share, such as voting, liquidation and dividend rights, may be amended by unanimous written consent of the holders of the issued shares of that class, or by adoption of a resolution by the holders of a majority of the shares of that class present at a separate class meeting.

Acquisitions under Israeli Law

Full Tender Offer

A person wishing to acquire shares of a public Israeli company and who would as a result hold over 90% of the target company’s issued and outstanding share capital is required by the Israeli Companies Law to make a tender offer to all of the company’s shareholders for the purchase of all of the issued and outstanding shares of the company. A person wishing to acquire shares of a public Israeli company and who would as a result hold over 90% of the issued and outstanding share capital of a certain class of shares is required to make a tender offer to all of the shareholders who hold shares of the same class for the purchase of all of the issued and outstanding shares of the same class. If the shareholders who do not accept the offer hold less than 5% of the issued and outstanding share capital of the company or of the applicable class, all of the shares that the acquirer offered to purchase will be transferred to the acquirer by operation of law (provided that a majority of the offerees that do not have a personal interest in such tender offer shall have approved the tender offer, except that if the total votes to reject the tender offer represent less than 2% of the company’s issued and outstanding share capital, in the aggregate, approval by a majority of the offerees that do not have a personal interest in such tender offer is not required to complete the tender offer). However, a shareholder that had its shares so transferred may petition the court within six months from the date of acceptance of the full tender offer, whether or not such shareholder agreed to the tender, to determine whether the tender offer was for less than fair value and whether the fair value should be paid as determined by the court unless the acquirer stipulated in the tender offer that a shareholder that accepts the offer may not seek appraisal rights. If the shareholders who did not accept the tender offer hold 5% or more of the issued and outstanding share capital of the company or of the applicable class, the acquirer may not acquire shares of the company that will increase its holdings to more than 90% of the company’s issued and outstanding share capital or of the applicable class from shareholders who accepted the tender offer.

Special Tender Offer

The Israeli Companies Law provides that an acquisition of shares of a public Israeli company must be made by means of a special tender offer if as a result of the acquisition the purchaser would become a holder of 25% or more of the voting rights in the company, unless one of the exemptions in the Israeli Companies Law is met. This rule does not apply if there is already another holder of at least 25% of the voting rights in the company. Similarly, the Israeli Companies Law provides that an acquisition of shares in a public company must be made by means of a tender offer if as a result of the acquisition the purchaser would become a holder of 45% or more of the voting rights in the company, if there is no other shareholder of the company who holds 45% or more of the voting rights in the company, unless one of the exemptions in the Israeli Companies Law is met.

A special tender offer must be extended to all shareholders of a company but the offeror is not required to purchase shares representing more than 5% of the voting power attached to the company’s outstanding shares, regardless of how many shares are tendered by shareholders. A special tender offer may be consummated only if (i) at least 5% of the voting power attached to the company’s outstanding shares will be acquired by the offeror and (ii) the number of shares tendered in the offer exceeds the number of shares whose holders objected to the offer.

If a special tender offer is accepted, then the purchaser or any person or entity controlling it or under common control with the purchaser or such controlling person or entity may not make a subsequent tender offer for the purchase of shares of the target company and may not enter into a merger with the target company for a period of one year from the date of the offer, unless the purchaser or such person or entity undertook to effect such an offer or merger in the initial special tender offer.

Merger

The Israeli Companies Law permits merger transactions if approved by each party’s board of directors and, unless certain requirements described under the Israeli Companies Law are met, a majority of each party’s shares voted on the proposed merger at a Shareholders’ meeting called with at least 35 days’ prior notice.

For purposes of the shareholder vote, unless a court rules otherwise, the merger will not be deemed approved if a majority of the shares represented at the shareholders meeting that are held by parties other than the other party to the merger, or by any person who holds 25% or more of the outstanding shares or the right to appoint 25% or more of the directors of the other party, vote against the merger. If the transaction would have been approved but for the separate approval of each class or the exclusion of the votes of certain shareholders as provided above, a court may still approve the merger upon the request of holders of at least 25% of the voting rights of a company, if the court holds that the merger is fair and reasonable, taking into account the value of the parties to the merger and the consideration offered to the shareholders.

Upon the request of a creditor of either party to the proposed merger, the court may delay or prevent the merger if it concludes that there exists a reasonable concern that, as a result of the merger, the surviving company will be unable to satisfy the obligations of any of the parties to the merger, and may further give instructions to secure the rights of creditors.

In addition, a merger may not be completed unless at least 50 days have passed from the date that a proposal for approval of the merger was filed by each party with the Israeli Registrar of Companies and 30 days have passed from the date the merger was approved by the shareholders of each party.

Anti-Takeover Measures under Israeli Law

The Israeli Companies Law allows us to create and issue shares having rights different from those attached to our ordinary shares, including shares providing certain preferred rights, distributions or other matters and shares having preemptive rights. As of the date of this prospectus, we do not have any authorized or issued shares other than our ordinary shares. In the future, if we do create and issue a class of shares other than ordinary shares, such class of shares, depending on the specific rights that may be attached to them, may delay or prevent a takeover or otherwise prevent our shareholders from realizing a potential premium over the market value of their ordinary shares. The authorization of a new class of shares will require an amendment to our Articles of Association which requires the prior approval of the holders of a majority of our shares at a general meeting. In addition, the rules and regulations of the TASE also limit the terms permitted with respect to a new class of shares and prohibit any such new class of shares from having voting rights. Shareholders voting in such meeting will be subject to the restrictions provided in the Israeli Companies Law as described above in “—Voting Rights.”

Borrowing Powers

Pursuant to the Israeli Companies Law and our Articles of Association, our Board of Directors may exercise all powers and take all actions that are not required under law or under our Articles of Association to be exercised or taken by our shareholders, including the power to borrow money for company purposes.

Changes in Capital

Our Articles of Association enable us to increase or reduce our share capital. Any such changes are subject to the provisions of the Israeli Companies Law and must be approved by a resolution duly passed by our shareholders at a general or special meeting by voting on such change in the capital. In addition, transactions that have the effect of reducing capital, such as the declaration and payment of dividends in the absence of sufficient retained earnings and profits and an issuance of shares for less than their nominal value, require a resolution of our Board of Directors and court approval.

Transfer Agent and Registrar

Until now, the transfer agent and registrar for our ordinary shares in Israel has been Bank Leumi Nominee Company Ltd. (Hevra Le-Rishumim of Bank Leumi Le-Israel Ltd.). However, in May 2015, the transfer agent announced that as of July 25, 2015, it would be ceasing its activities and terminating its agreements with issuers. Therefore, we have entered into an arrangement with Mizrahi Tefahot Hevra Lerishumim Ltd. as the new transfer agent and registrar for our ordinary shares. The Depositary and Registrar for the ADSs is The Bank of New York Mellon.

Each ADS represents one ordinary share. Our ADSs trade on the Nasdaq Capital Market.

The form of the deposit agreement for the ADS and the form of American Depositary Receipt (ADR) that represents an ADS have been incorporated by reference as exhibits to this registration statement on Form F-3. Copies of the deposit agreement are available for inspection at the principal office of The Bank of New York Mellon, located at 101 Barclay Street, New York, New York 10286, and at the principal office of our custodians, Bank Leumi Le-Israel, 34 Yehuda Halevi St., Tel-Aviv 65546, Israel and Bank Hapoalim B.M., 104 Hayarkon Street, Tel Aviv 63432, Israel.

Dividends, Other Distributions and Rights

Amounts distributed to ADS holders will be reduced by any taxes or other governmental charges required to be withheld by the custodian or the Depositary. If the Depositary determines that any distribution in cash or property is subject to any tax or governmental charges that the Depositary or the custodian is obligated to withhold, the Depositary may use the cash or sell or otherwise dispose of all or a portion of that property to pay the taxes or governmental charges. The Depositary will then distribute the balance of the cash and/or property to the ADS holders entitled to the distribution, in proportion to their holdings.

Cash dividends and cash distributions

The Depositary will convert into dollars all cash dividends and other cash distributions that it or the custodian receives in a foreign currency. The Depositary will distribute to the ADS holders the amount it receives, after deducting any currency conversion expenses. If the Depositary determines that any foreign currency it receives cannot be converted and transferred on a reasonable basis, it may distribute the foreign currency (or an appropriate document evidencing the right to receive the currency), or hold that foreign currency uninvested, without liability for interest, for the accounts of the ADS holders entitled to receive it.

Distributions of ordinary shares

If we distribute ordinary shares as a dividend or free distribution, the Depositary may, with our approval, and will, at our request, distribute to ADS holders new ADSs representing the ordinary shares. The Depositary will distribute only whole ADSs. It will sell the ordinary shares that would have required it to use fractional ADSs and then distribute the proceeds in the same way it distributes cash. If the Depositary deposits the ordinary shares but does not distribute additional ADSs, the existing ADSs will also represent the new ordinary shares.

If holders of ordinary shares have the option of receiving a dividend in cash or in shares, we may also grant that option to ADS holders.

Other distributions

If the Depositary or the custodian receives a distribution of anything other than cash or shares, the Depositary will distribute the property or securities to the ADS holder, in proportion to such holder’s holdings. If the Depositary determines that it cannot distribute the property or securities in this manner or that it is not feasible to do so, then, after consultation with us, it may distribute the property or securities by any means it thinks is equitable and practical, or it may sell the property or securities and distribute the net proceeds of the sale to the ADS holders.

Rights to subscribe for additional ordinary shares and other rights

If we offer our holders of ordinary shares any rights to subscribe for additional ordinary shares or any other rights, the Depositary will, if requested by us:

|

|

•

|

make the rights available to all or certain holders of ADSs, by means of warrants or otherwise, if lawful and practically feasible; or

|

|

|

•

|

if it is not lawful or practically feasible to make the rights available, attempt to sell those rights or warrants or other instruments.

|

In that case, the Depositary will allocate the net proceeds of the sales to the account of the ADS holders entitled to the rights. The allocation will be made on an averaged or other practicable basis without regard to any distinctions among holders.

If registration under the Securities Act is required in order to offer or sell to the ADS holders the securities represented by any rights, the Depositary will not make the rights available to ADS holders unless a registration statement is in effect or such securities are exempt from registration. We do not, however, have any obligation to file a registration statement or to have a registration statement declared effective. If the Depositary cannot make any rights available to ADS holders and cannot dispose of the rights and make the net proceeds available to ADS holders, then it will allow the rights to lapse, and the ADS holders will not receive any value for them.

Voting of the underlying shares

Under the deposit agreement, an ADS holder is entitled, subject to any applicable provisions of Israeli law, our articles of association and bylaws and the deposited securities, to exercise voting rights pertaining to the shares represented by its ADSs. The Depositary will send to ADS holders such information as is contained in the notice of meeting that the Depositary receives from us, as well as a statement that holders of as the close of business on the specified record date will be entitled to instruct the Depositary as to the exercise of voting rights and a statement as to the manner in which the such instructions may be given. Under the deposit agreement, the Depositary will endeavor (insofar as is practicable and in accordance with the applicable law and our articles of association) to vote or cause to be voted the number of ordinary shares represented by ADSs in accordance with the instructions provided by the holders of ADSs to the Depositary. If no instructions are received by the Depositary from any holder of ADSs with respect to any of the ordinary shares represented by the ADSs evidenced by such holder’s receipts on or before the date established by the Depositary for such purpose, the Depositary will deem the holder of the ordinary shares to have instructed the Depositary to give a discretionary proxy to a person designated by us with respect to the ordinary shares represented by such ADSs, and the Depositary will give such instruction.

Changes affecting deposited securities.

If there is any change in nominal value or any split - up, consolidation, cancellation or other reclassification of deposited securities, or any recapitalization, reorganization, business combination or consolidation or sale of assets involving us, then any securities that the Depositary receives in respect of deposited securities will become new deposited securities. Each ADS will automatically represent its share of the new deposited securities, unless the Depositary delivers new ADSs as described in the following sentence. The Depositary may, with our approval, and will, at our request, distribute new ADSs or ask ADS holders to surrender their outstanding ADSs in exchange for new ADSs describing the new deposited securities.

Amendment of the deposit agreement

The Depositary and we may agree to amend the form of the ADSs and the deposit agreement at any time, without the consent of the ADS holders. If the amendment adds or increases any fees or charges (other than taxes or other governmental charges) or prejudices an important right of ADS holders, it will not take effect as to outstanding ADSs until three months after the Depositary has sent the ADS holders a notice of the amendment. At the expiration of that three-month period, each ADS holder will be considered by continuing to hold its ADSs to agree to the amendment and to be bound by the deposit agreement as so amended. The Depositary and we may not amend the deposit agreement or the form of ADSs to impair the ADS holder’s right to surrender its ADSs and receive the ordinary shares and any other property represented by the ADSs, except to comply with mandatory provisions of applicable law.

Termination of the deposit agreement

The Depositary will terminate the deposit agreement if we ask it to do so and will notify the ADS holders at least 30 days before the date of termination. The Depositary may also terminate the deposit agreement if it resigns and a successor depositary has not been appointed by us and accepted its appointment within 60 days after the Depositary has given us notice of its resignation. After termination of the deposit agreement, the Depositary will no longer register transfers of ADSs, distribute dividends to the ADS holders, accept deposits of ordinary shares, give any notices, or perform any other acts under the deposit agreement whatsoever, except that the Depositary will continue to:

|

|

•

|

collect dividends and other distributions pertaining to deposited securities;

|

|

|

•

|

sell rights as described under the heading “Dividends, other distributions and rights — Rights to subscribe for additional shares and other rights” above; and

|

|

|

•

|

deliver deposited securities, together with any dividends or other distributions received with respect thereto and the net proceeds of the sale of any rights or other property, in exchange for surrendered ADSs.

|

Four months after termination, the Depositary may sell the deposited securities and hold the proceeds of the sale, together with any other cash then held by it, for the pro rata benefit of ADS holders that have not surrendered their ADSs. The Depositary will not have liability for interest on the sale proceeds or any cash it holds.

Charges of Depositary

We will pay the fees, reasonable expenses and out-of-pocket charges of the Depositary and those of any registrar only in accordance with agreements in writing entered into between us and the Depositary from time to time. The following charges shall be incurred by any party depositing or withdrawing ordinary shares or by any party surrendering ADSs or to whom ADSs are issued (including, without limitation, issuance pursuant to a stock dividend or stock split declared by us or an exchange of stock regarding the ADSs or deposited ordinary shares or a distribution of ADSs pursuant to the terms of the deposit agreement):

|

|

•

|

taxes and other governmental charges;

|

|

|

•

|

any applicable transfer or registration fees;

|

|

|

•

|

certain cable, telex and facsimile transmission charges as provided in the Deposit Agreement;

|

|

|

•

|

any expenses incurred in the conversion of foreign currency;

|

|

|

•

|

a fee of $5.00 or less per 100 ADSs (or a portion thereof) for the execution and delivery of ADSs and the surrender of ADSs;

|

|

|

•

|

a fee of $.05 or less per ADS (or portion thereof) for any cash distribution made pursuant to the Deposit Agreement;

|

|

|

•

|

a fee for the distribution of securities pursuant to the Deposit Agreement;

|

|

|

•

|

in addition to any fee charged under clause 6, a fee of $.05 or less per ADS (or portion thereof) per annum for depositary services, which will be payable as provided in clause 10 below;

|

|

|

•

|

a fee for the distribution of proceeds of rights that the Depositary sells pursuant to the Deposit Agreement; and

|

|

|

•

|

any other charges payable by the Depositary, any of the Depositary’s agents, or the agents of the Depositary’s agents in connection with the servicing of Shares or other Deposited Securities.

|

The Depositary may own and deal in our securities and in our ADSs.

Liability of Holders for Taxes, Duties or Other Charges

Any tax or other governmental charge with respect to ADSs or any deposited ordinary shares represented by any ADR shall be payable by the holder of such ADR to the Depositary. The Depositary may refuse to effect transfer of such ADR or any withdrawal of deposited ordinary shares represented by such ADR until such payment is made, and may withhold any dividends or other distributions or may sell for the account of the holder any part or all of the deposited ordinary shares represented by such ADR and may apply such dividends or distributions or the proceeds of any such sale in payment of any such tax or other governmental charge and the holder of such ADR shall remain liable for any deficiency.

We may issue debt securities in one or more series. The specific terms of each series of debt securities will be described in the applicable prospectus supplement relating to that series. The prospectus supplement may or may not modify the general terms found in this prospectus and will be filed with the SEC. For a complete description of the terms of a particular series of debt securities, you should read both this prospectus and the prospectus supplement relating to that particular series.

As required by federal law for all bonds and notes of companies that are publicly offered, the debt securities are governed by a document called an “indenture.” An indenture is a contract between us and a financial institution, acting as trustee on your behalf, and is subject to and governed by the Trust Indenture Act of 1939, as amended. We have entered into an indenture between us and The Bank of New York Mellon, to act as trustee, pursuant to which we may issue multiple series of debt securities from time to time. The trustee has two main roles. First, the trustee can enforce your rights against us if we default. There are some limitations on the extent to which the trustee acts on your behalf, described in the second paragraph under “Events of Default — Remedies if an Event of Default Occurs.” Second, the trustee performs certain administrative duties for us.

Because this section is a summary, it does not describe every aspect of the debt securities and the indenture. We urge you to read the indenture because it, and not this description, defines your rights as a holder of debt securities. A copy of the indenture is attached as an exhibit to the registration statement of which this prospectus is a part. We will file a supplemental indenture with the SEC prior to the commencement of any debt offering, at which time the supplemental indenture would be publicly available.

The prospectus supplement, which will accompany this prospectus, will describe the particular series of debt securities being offered by including:

|

|

•

|

the designation or title of the series of debt securities;

|

|

|

•

|

the total principal amount of the series of debt securities;

|

|

|

•

|

the percentage of the principal amount at which the series of debt securities will be offered;

|

|

|

•

|

the date or dates on which principal will be payable;

|

|

|

•

|

the rate or rates (which may be either fixed or variable) and/or the method of determining such rate or rates of interest, if any;

|

|

|

•

|

the date or dates from which any interest will accrue, or the method of determining such date or dates, and the date or dates on which any interest will be payable;

|

|

|

•

|

whether any interest may be paid by issuing additional securities of the same series in lieu of cash (and the terms upon which any such interest may be paid by issuing additional securities);

|

|

|

•

|

the terms for redemption, extension or early repayment, if any;

|

|

|

•

|

the currencies in which the series of debt securities are issued and payable;

|

|

|

•

|

whether the amount of payments of principal, premium or interest, if any, on a series of debt securities will be determined with reference to an index, formula or other method (which could be based on one or more currencies, commodities, equity indices or other indices) and how these amounts will be determined;

|

|

|

•

|

the place or places, if any, other than or in addition to the Borough of Manhattan in the City of New York, of payment, transfer, conversion and/or exchange of the debt securities;

|

|

|

•

|

the denominations in which the offered debt securities will be issued (if other than $1,000 and any integral multiple thereof for registered securities);

|

|

|

•

|

the provision for any sinking fund;

|

|

|

•

|

any restrictive covenants;

|

|

|

•

|

whether the series of debt securities are issuable in certificated form;

|

|

|

•

|

any provisions for defeasance or covenant defeasance;

|

|

|

•

|

any provisions regarding any future changes or modifications of the terms of the series of debt securities in light of the requirements under applicable law for effecting such changes or modifications;

|

|

|

•

|

any special Israeli and/or U.S. federal income tax implications, including, if applicable, Israeli and/or U.S. federal income tax considerations relating to original issue discount;

|

|

|

•

|

whether and under what circumstances we will pay additional amounts in respect of any tax, assessment or governmental charge and, if so, whether we will have the option to redeem the debt securities rather than pay the additional amounts (and the terms of this option);

|

|

|

•

|

any provisions for convertibility or exchangeability of the debt securities into or for any other securities;

|

|

|

•

|

whether the debt securities are subject to subordination and the terms of such subordination;

|

|

|

•

|

whether the debt securities are secured or unsecured and the terms of any security interests;

|

|

|

•

|

the listing, if any, on a securities exchange; and

|

General

The indenture provides that any debt securities proposed to be sold under this prospectus and the accompanying prospectus supplement (“offered debt securities”) may be issued under the indenture in one or more series.

For purposes of this prospectus, any reference to the payment of principal of or premium or interest, if any, on debt securities will include additional amounts if required by the terms of the debt securities.

The indenture does not limit the amount of debt securities that may be issued thereunder from time to time. Debt securities issued under the indenture, when a single trustee is acting for all debt securities issued under the indenture, are called the “indenture securities”. The indenture also provides that there may be more than one trustee thereunder, each with respect to one or more different series of indenture securities. See “Resignation of Trustee” below. At a time when two or more trustees are acting under the indenture, each with respect to only certain series, the term “indenture securities” means the one or more series of debt securities with respect to which each respective trustee is acting. In the event that there is more than one trustee under the indenture, the powers and trust obligations of each trustee described in this prospectus will extend only to the one or more series of indenture securities for which it is trustee. If two or more trustees are acting under the indenture, then the indenture securities for which each trustee is acting would be treated as if issued under separate indentures.

The indenture does not contain any provisions that give you protection in the event we issue a large amount of debt or we are acquired by another entity.

We refer you to the particular prospectus supplement for information with respect to any deletions from, modifications of or additions to the Events of Default or our covenants that are described below, including any addition of a covenant or other provision providing event risk or similar protection.

We have the ability to issue indenture securities with terms different from those of indenture securities previously issued and, without the consent of the holders thereof, to reopen a previous issue of a series of indenture securities and issue additional indenture securities of that series unless the reopening was restricted when that series was created.

Conversion and Exchange

If any debt securities are convertible into or exchangeable for other securities, the applicable prospectus supplement will explain the terms and conditions of the conversion or exchange, including the conversion price or exchange ratio (or the calculation method), the conversion or exchange period (or how the period will be determined), if conversion or exchange will be mandatory or at the option of the holder or us, provisions for adjusting the conversion price or the exchange ratio and provisions affecting conversion or exchange in the event of the redemption of the underlying debt securities. These terms may also include provisions under which the number or amount of other securities to be received by the holders of the debt securities upon conversion or exchange would be calculated according to the market price of the other securities as of a time stated in the applicable prospectus supplement.

Issuance of Securities in Registered Form

We may issue the debt securities in registered form, in which case we may issue them either in book-entry form only or in “certificated” form. Debt securities issued in book-entry form will be represented by global securities. We expect that we will usually issue debt securities in book-entry only form represented by global securities.

Book-Entry Holders

We will issue registered debt securities in book-entry form only, unless we specify otherwise in the applicable prospectus supplement. This means debt securities will be represented by one or more global securities registered in the name of a depositary that will hold them on behalf of financial institutions that participate in the depositary’s book-entry system. These participating institutions, in turn, hold beneficial interests in the debt securities held by the depositary or its nominee. These institutions may hold these interests on behalf of themselves or customers.

Under the indenture, only the person in whose name a debt security is registered is recognized as the holder of that debt security. Consequently, for debt securities issued in book-entry form, we will recognize only the depositary as the holder of the debt securities and we will make all payments on the debt securities to the depositary. The depositary will then pass along the payments it receives to its participants, which in turn will pass the payments along to their customers who are the beneficial owners. The depositary and its participants do so under agreements they have made with one another or with their customers; they are not obligated to do so under the terms of the debt securities.

As a result, investors will not own debt securities directly. Instead, they will own beneficial interests in a global security, through a bank, broker or other financial institution that participates in the depositary’s book-entry system or holds an interest through a participant. As long as the debt securities are represented by one or more global securities, investors will be indirect holders, and not holders, of the debt securities.

Street Name Holders

In the future, we may issue debt securities in certificated form or terminate a global security. In these cases, investors may choose to hold their debt securities in their own names or in “street name.” Debt securities held in street name are registered in the name of a bank, broker or other financial institution chosen by the investor, and the investor would hold a beneficial interest in those debt securities through the account he or she maintains at that institution.

For debt securities held in street name, we will recognize only the intermediary banks, brokers and other financial institutions in whose names the debt securities are registered as the holders of those debt securities and we will make all payments on those debt securities to them. These institutions will pass along the payments they receive to their customers who are the beneficial owners, but only because they agree to do so in their customer agreements or because they are legally required to do so. Investors who hold debt securities in street name will be indirect holders, and not holders, of the debt securities.

Legal Holders

Our obligations, as well as the obligations of the applicable trustee and those of any third parties employed by us or the applicable trustee, run only to the legal holders of the debt securities. We do not have obligations to investors who hold beneficial interests in global securities, in street name or by any other indirect means. This will be the case whether an investor chooses to be an indirect holder of a debt security or has no choice because we are issuing the debt securities only in book-entry form.

For example, once we make a payment or give a notice to the holder, we have no further responsibility for the payment or notice even if that holder is required, under agreements with depositary participants or customers or by law, to pass it along to the indirect holders but does not do so. Similarly, if we want to obtain the approval of the holders for any purpose (for example, to amend an indenture or to relieve us of the consequences of a default or of our obligation to comply with a particular provision of an indenture), we would seek the approval only from the holders, and not the indirect holders, of the debt securities. Whether and how the holders contact the indirect holders is up to the holders.

When we refer to you, we mean those who invest in the debt securities being offered by this prospectus, whether they are the holders or only indirect holders of those debt securities. When we refer to your debt securities, we mean the debt securities in which you hold a direct or indirect interest.

Special Considerations for Indirect Holders

If you hold debt securities through a bank, broker or other financial institution, either in book-entry form or in street name, we urge you to check with that institution to find out:

|

|

•

|

how it handles securities payments and notices;

|

|

|

•

|

whether it imposes fees or charges;

|

|

|

•

|

how it would handle a request for the holders’ consent, if ever required;

|

|

|

•

|

whether and how you can instruct it to send you debt securities registered in your own name so you can be a holder, if that is permitted in the future for a particular series of debt securities;

|

|

|

•

|

how it would exercise rights under the debt securities if there were a default or other event triggering the need for holders to act to protect their interests; and

|

|

|

•

|

if the debt securities are in book-entry form, how the depositary’s rules and procedures will affect these matters.

|

Global Securities

As noted above, we usually will issue debt securities as registered securities in book-entry form only. A global security represents one or any other number of individual debt securities. Generally, all debt securities represented by the same global securities will have the same terms.

Each debt security issued in book-entry form will be represented by a global security that we deposit with and register in the name of a financial institution or its nominee that we select. The financial institution that we select for this purpose is called the depositary. Unless we specify otherwise in the applicable prospectus supplement, The Depository Trust Company, New York, New York, known as DTC, will be the depositary for all debt securities issued in book-entry form.

A global security may not be transferred to or registered in the name of anyone other than the depositary or its nominee, unless special termination situations arise. We describe those situations below under “Special Situations when a Global Security will be Terminated.” As a result of these arrangements, the depositary, or its nominee, will be the sole registered owner and holder of all debt securities represented by a global security, and investors will be permitted to own only beneficial interests in a global security. Beneficial interests must be held by means of an account with a broker, bank or other financial institution that in turn has an account with the depositary or with another institution that has an account with the depositary. Thus, an investor whose security is represented by a global security will not be a holder of the debt security, but only an indirect holder of a beneficial interest in the global security.

Special Considerations for Global Securities

As an indirect holder, an investor’s rights relating to a global security will be governed by the account rules of the investor’s financial institution and of the depositary, as well as general laws relating to securities transfers. The depositary that holds the global security will be considered the holder of the debt securities represented by the global security.

If debt securities are issued only in the form of a global security, an investor should be aware of the following:

|

|

•

|

An investor cannot cause the debt securities to be registered in his or her name, and cannot obtain certificates for his or her interest in the debt securities, except in the special situations we describe below.

|

|

|

•

|

An investor will be an indirect holder and must look to his or her own bank or broker for payments on the debt securities and protection of his or her legal rights relating to the debt securities, as we describe under “Issuance of Securities in Registered Form” above.

|

|

|

•

|

An investor may not be able to sell interests in the debt securities to some insurance companies and other institutions that are required by law to own their securities in non-book-entry form.

|

|

|

•

|