As filed with the Securities and Exchange Commission on May 23, 2019

Registration No. 333-230929

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________________

AMENDMENT NO. 2

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

__________________________________________________

DelMar Pharmaceuticals, Inc.

(Exact name of registrant as specified in its charter)

__________________________________________________

|

Nevada |

2834 |

99-0360497 |

||

|

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer |

Suite 720-999 West Broadway

Vancouver, British Columbia, Canada V5Z 1K5

(604) 629-5989

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

__________________________________________________

Saiid Zarrabian

President and Chief Executive Officer

DelMar Pharmaceuticals, Inc.

Suite 720-999 West Broadway

Vancouver, British Columbia, Canada V5Z 1K5

(604) 629-5989

(Name, address, including zip code, and telephone number, including area code, of agent for service)

__________________________________________________

Copies to:

|

Michael J. Lerner, Esq. |

Barry L. Grossman, Esq. |

__________________________________________________

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. S

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

|

Large accelerated filer |

£ |

Accelerated filer |

£ |

|||||

|

Non-accelerated filer |

£ |

Smaller reporting company |

S |

|||||

|

Emerging growth company |

£ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. £

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered |

Proposed |

Amount of |

||||

|

Units consisting of shares of Series C Convertible Preferred Stock, par value $0.001 per share, and warrants to purchase shares of Common Stock, par value $0.001 per share |

$ |

8,000,000 |

$ |

969.60 |

||

|

Non-transferable Rights to purchase Units(3) |

|

— |

|

— |

||

|

Series C Convertible Preferred Stock included as part of the Units |

|

Included with Units above |

|

— |

||

|

Warrants to purchase shares of Common Stock included as part of the Units(4) |

|

|

|

— |

||

|

Common stock issuable upon conversion of the Series C Convertible Preferred Stock(5)(6) |

|

— |

|

— |

||

|

Common Stock issuable upon exercise of the Warrants(6) |

$ |

4,400,000 |

$ |

533.28 |

||

|

Total |

$ |

12,400,000 |

$ |

1,502.88 |

||

____________

(1) Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended (the “Act”).

(2) The Registrant previously paid a registration fee of $848.40 in connection with the initial filing of this Registration Statement on April 18, 2019, and the additional amount of $654.48 was paid in connection with the first amendment of this Registration Statement on May 8, 2019.

(3) Non-transferable Rights to purchase Units are being issued without consideration. Pursuant to Rule 457(g) under the Act, no separate registration fee is required for the Rights because the Rights are being registered in the same registration statement as the securities of the Registrant underlying the Rights.

(4) Pursuant to Rule 457(g) of the Act, no separate registration fee is required for the Warrants because the Warrants are being registered in the same registration statement as the Common Stock of the Registrant issuable upon exercise of the Warrants.

(5) Pursuant to Rule 457(i) of the Act, no separate registration fee is required for the common stock issuable upon conversion of the Series C Convertible Preferred Stock because no additional consideration will be received in connection with the exercise of the conversion privilege.

(6) In addition to the shares of Common Stock set forth in this table, pursuant to Rule 416 under the Act, this registration statement also registers such indeterminate number of shares of Common Stock as may become issuable upon exercise of these securities as the same may be adjusted as a result of stock splits, stock dividends, recapitalizations or other similar transactions.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Act or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS, SUBJECT TO COMPLETION, DATED MAY 23, 2019

Subscription Rights to Purchase Up to 8,000 Units

Consisting of an Aggregate of Up to 8,000 Shares of Series C Convertible Preferred Stock

and Warrants to Purchase Up to 1,000,000 Shares of Common Stock

at a Subscription Price of $1,000 Per Unit

We are distributing to holders of our common stock and certain outstanding warrants, at no charge, non-transferable subscription rights to purchase units. Each unit, which we refer to as a Unit, consists of one share of Series C Convertible Preferred Stock, which we refer to as the Preferred Stock, and 125 warrants, which we refer to as the Warrants. Each share of Preferred Stock will be convertible into shares of our common stock as described herein. Each Warrant will be exercisable for one share of our common stock. We refer to the offering that is the subject of this prospectus as the Rights Offering. In the Rights Offering, you will receive one subscription right for every share of common stock (including each share of common stock issuable upon exercise of certain outstanding warrants) owned at 5:00 p.m., Eastern Time, on May 21, 2019, the record date of the Rights Offering, or the Record Date. The Preferred Stock and the Warrants comprising the Units will separate upon the expiration of the Rights Offering and will be issued separately but may only be purchased as a Unit, and the Units will not trade as a separate security. The subscription rights will not be tradable. Holders of certain outstanding warrants as of the Record Date will also receive subscription rights pursuant to the terms of those warrants.

(Prospectus cover continued on the following page.)

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 14 of this prospectus. You should carefully consider these risk factors, as well as the information contained in this prospectus, before you invest.

Broadridge Corporate Issuer Solutions, Inc. will serve as the Subscription and Information Agent for the Rights Offering. The Subscription Agent will hold the funds we receive from subscribers until we complete, abandon or terminate the Rights Offering. If you want to participate in this Rights Offering and you are the record holder of your shares, we recommend that you submit your subscription documents to the Subscription Agent well before the deadline. If you want to participate in this Rights Offering and you hold shares or participating warrants through your broker, dealer, bank or other nominee, you should promptly contact your broker, dealer, bank or other nominee and submit your subscription documents in accordance with the instructions and within the time period provided by your broker, dealer, bank or other nominee. For a detailed discussion, see “The Rights Offering — The Subscription Rights.”

Our board of directors reserves the right to terminate the Rights Offering for any reason any time before the expiration of the Rights Offering. If we terminate the Rights Offering, all subscription payments received will be returned within 10 business days, without interest or deduction. We expect the Rights Offering to expire on or about June 12, 2019, subject to our right to extend the Rights Offering as described above, and that we would close on subscriptions within five business days of such date; provided that in no event shall such extensions extend beyond July 31, 2019.

Our common stock is listed on the Nasdaq Capital Market, or Nasdaq, under the symbol “DMPI.” On May 22, 2019, the last reported sale price of our common stock was $2.79 per share. On May 8, 2019, we effected a one-for-ten reverse stock split (the “Reverse Stock Split”) of our issued and outstanding and authorized common stock. There is no public trading market for the Preferred Stock or the Warrants and they will not be listed for trading on Nasdaq or any other securities exchange or market. The Subscription Rights are non-transferrable and will not be listed for trading on Nasdaq or any other securities exchange or market. You are urged to obtain a current price quote for our common stock before exercising your Subscription Rights.

|

Per Unit |

Total(2) |

|||||

|

Subscription price |

$ |

$ |

||||

|

Dealer-Manager fees and expenses(1) |

$ |

$ |

||||

|

Proceeds to us, before expenses |

$ |

$ |

||||

____________

(1) In connection with this Rights Offering, we have agreed to pay to Maxim Group LLC and Dawson James Securities, Inc. as the co-dealer-managers an aggregate cash fee equal to 8.0% of the gross proceeds received by us directly from exercises of the Subscription Rights. See “Plan of Distribution.”

(2) Assumes the Rights Offering is fully subscribed, but excludes proceeds from the exercise of Warrants included within the Units.

Our board of directors is making no recommendation regarding your exercise of the Subscription Rights. You should carefully consider whether to exercise your Subscription Rights before the expiration date. You may not revoke or revise any exercises of Subscription Rights once made.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

|

Co-Dealer-Managers |

||

|

Maxim Group LLC |

Dawson James Securities, Inc. |

|

The date of this Prospectus is , 2019

(Prospectus cover continued from preceding page.)

Each subscription right will entitle you to purchase one Unit, which we refer to as the Basic Subscription Right, at a subscription price per Unit of $1,000, which we refer to as the Subscription Price. Each Warrant entitles the holder to purchase one share of common stock at an exercise price of $4.40 per share from the date of issuance through its expiration five years from the date of issuance. The Warrants are subject to redemption as described in this prospectus. If you exercise your Basic Subscription Rights in full, and any portion of the Units remain available under the Rights Offering, you will be entitled to an over-subscription privilege to purchase a portion of the unsubscribed Units at the Subscription Price, subject to proration and ownership limitations, which we refer to as the Over-Subscription Privilege. Each subscription right consists of a Basic Subscription Right and an Over-Subscription Privilege, which we refer to as the Subscription Right.

The Subscription Rights will expire if they are not exercised by 5:00 p.m., Eastern Time, on June 12, 2019, unless the Rights Offering is extended or earlier terminated by the Company. If we elect to extend the Rights Offering, we will issue a press release announcing the extension no later than 9:00 a.m., Eastern Time, on the next business day after the most recently announced expiration date of the Rights Offering. We may extend the Rights Offering for additional periods in our sole discretion; provided that in no event shall such extensions extend beyond July 31, 2019. Once made, all exercises of Subscription Rights are irrevocable.

We have not entered into any standby purchase agreement or other similar arrangement in connection with the Rights Offering. The Rights Offering is being conducted on a best-efforts basis and there is no minimum amount of proceeds necessary to be received in order for us to close the Rights Offering.

We have engaged Maxim Group LLC and Dawson James Securities, Inc. to act as co-dealer-managers in the Rights Offering.

TABLE OF CONTENTS

|

Page |

||

|

1 |

||

|

7 |

||

|

14 |

||

|

40 |

||

|

41 |

||

|

42 |

||

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

43 |

|

|

52 |

||

|

81 |

||

|

87 |

||

|

91 |

||

|

92 |

||

|

MARKET PRICE OF OUR COMMON STOCK AND RELATED STOCKHOLDER MATTERS |

93 |

|

|

93 |

||

|

94 |

||

|

102 |

||

|

112 |

||

|

118 |

||

|

121 |

||

|

121 |

||

|

121 |

||

|

F-1 |

i

ABOUT THIS PROSPECTUS

The registration statement of which this prospectus forms a part that we have filed with the Securities and Exchange Commission, or SEC, includes exhibits that provide more detail of the matters discussed in this prospectus. You should read this prospectus and the related exhibits filed with the SEC, together with the additional information described under the heading “Where You Can Find More Information” before making your investment decision.

You should rely only on the information provided in this prospectus or in a prospectus supplement or any free writing prospectuses or amendments thereto. Neither we nor the deal-managers have authorized anyone else to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. You should assume that the information in this prospectus is accurate only as of the date hereof. Our business, financial condition, results of operations and prospects may have changed since that date.

We are not, and the dealer-managers are not, offering to sell or seeking offers to purchase these securities in any jurisdiction where the offer or sale is not permitted. We and the dealer-managers have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities as to distribution of the prospectus outside of the United States.

DelMar Pharmaceuticals, Inc. and its consolidated subsidiaries are referred to herein as “DelMar,” “the Company,” “we,” “us” and “our,” unless the context indicates otherwise. Solely for convenience, trademarks and tradenames referred to in this prospectus may appear without the ® or ™ symbols, but such references are not intended to indicate in any way that we will not assert, to the fullest extent under applicable law, our rights, or that the applicable owner will not assert its rights, to these trademarks and tradenames.

ii

This summary contains basic information about us and this offering. Because it is a summary, it does not contain all of the information that you should consider before investing. Before you decide to invest in our Units, you should read this entire prospectus carefully, including the section entitled “Risk Factors” and any information incorporated by reference herein.

On May 8, 2019, we effected a one-for-ten reverse stock split (the “Reverse Stock Split”) of our issued and outstanding and authorized common stock. All per share amounts and number of shares of common stock in this prospectus reflect the Reverse Stock Split. The Reverse Stock Split does not affect our authorized preferred stock of 5,000,000 shares; except that, pursuant to the terms of the Certificate of Designations of Series B Convertible Preferred Stock for the issued and outstanding shares of our Series B Convertible Preferred Stock, par value $0.001 per share (the “Series B Preferred Stock”), the conversion price at which shares of Series B Preferred Stock may be converted into shares of common stock will be proportionately adjusted to reflect the Reverse Stock Split.

Our Business

Background

We are a clinical stage, biopharmaceutical company focused on the development and commercialization of new cancer therapies. Our mission is to benefit patients by developing and commercializing anti-cancer therapies for patients whose tumors exhibit features that make them resistant to, or unlikely to respond to, currently available therapies, particularly for orphan cancer indications where patients have failed, or are unlikely to respond to, currently available therapy.

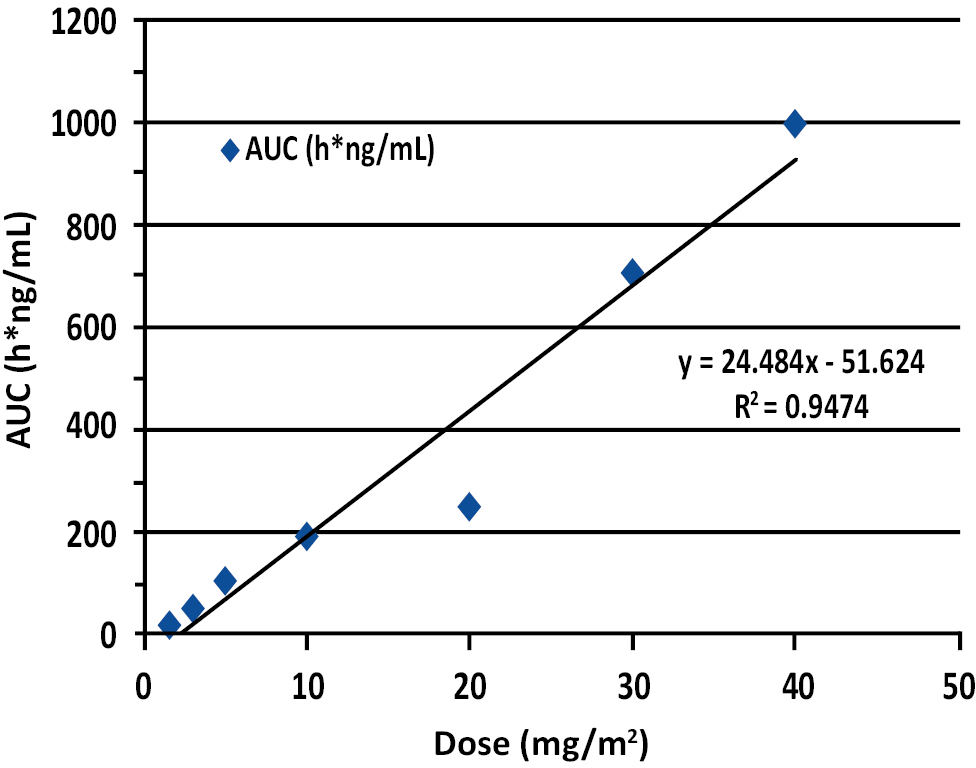

As of December 31, 2018, we have spent approximately $37.3 million of shareholder capital in developing VAL-083, a novel, validated, DNA-targeting agent, for the treatment of drug-resistant solid tumors such as glioblastoma multiforme (“GBM”) and potentially other solid tumors, including ovarian cancer, non-small cell lung cancer (“NSCLC”), and diffuse intrinsic pontine glioma (“DIPG”). VAL-083 is a first-in-class, small-molecule, DNA-targeting chemotherapeutic that demonstrated activity against a range of tumor types in prior Phase 1 and Phase 2 clinical studies sponsored by the US National Cancer Institute (“NCI”). As part of our business strategy, we leverage and build upon these prior NCI investments and data from more than 40 NCI- Phase 1 and Phase 2 clinical studies, which includes an estimated 1,000 patient safety database, with our own research to identify and target unmet medical needs in modern cancer care. DNA-targeting agents are among the most successful and widely used treatments for cancer. Their efficacy is based on the ability to bind with a cancer cell’s DNA and interfere with the process of protein production required for growth and survival of cancer cells. “First-in-class” means that VAL-083 embodies a unique molecular structure which is not an analogue or derivative of any approved product, or product under development, for the treatment of cancer.

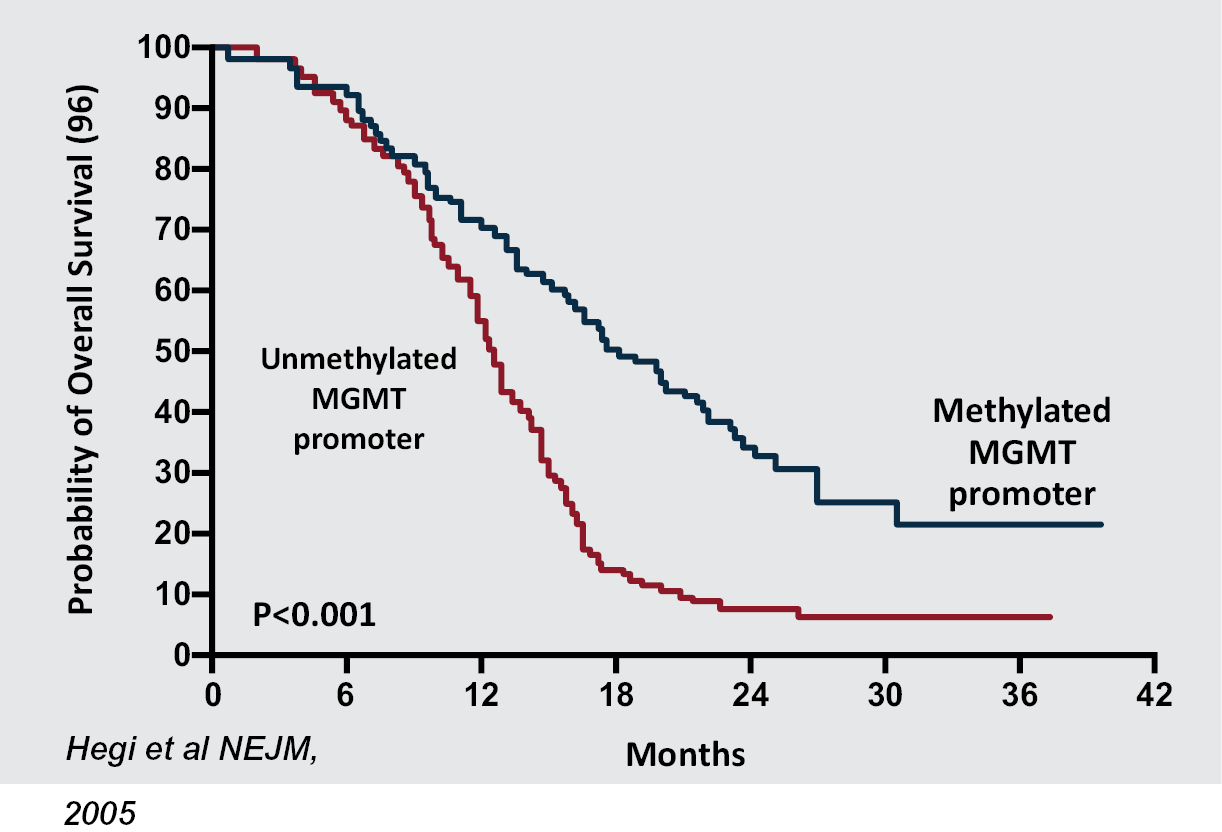

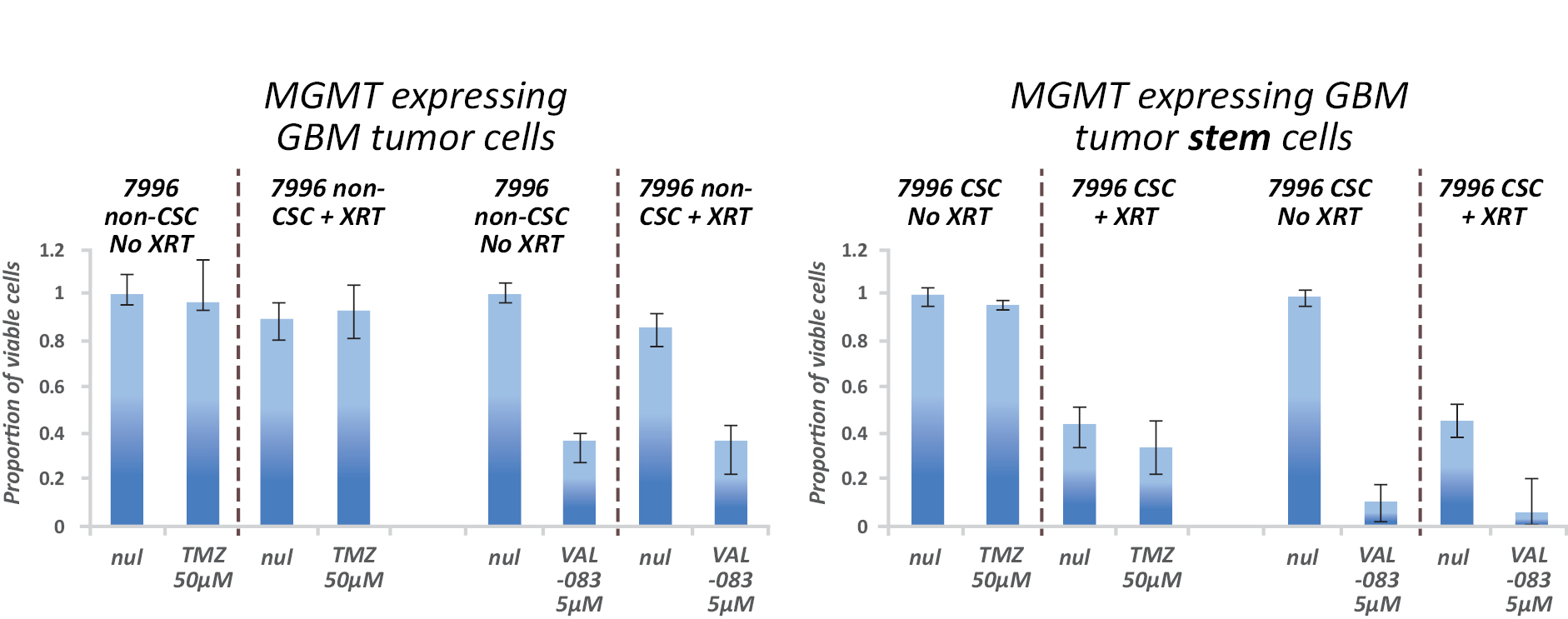

Our recent research has highlighted the opportunities afforded by VAL-083’s unique mechanism of action and its potential to address unmet medical needs by focusing our development efforts on patients whose tumors exhibit biological features that make them resistant to, or unlikely to respond to, currently available therapies. For example, our research demonstrating VAL-083’s activity in GBM independent of the O6-methyl guanine methyltransferase (“MGMT”) methylation status allows us to focus patient selection based on this important biomarker.

We are conducting two open-label, biomarker driven Phase 2 studies in MGMT-unmethylated GBM. MGMT is a DNA-repair enzyme that is associated with resistance to temozolomide, the current standard-of-care chemotherapy used in the treatment of GBM. Greater than 60% of GBM patients have MGMT-unmethylated tumors and exhibit a high expression of MGMT, which is correlated with temozolomide treatment failure and poor patient outcomes. Our research demonstrates that VAL-083’s anti-tumor activity is independent of MGMT expression. In our Phase 2 studies we are using MGMT as a biomarker to identify patients for treatment with VAL-083 in the newly-diagnosed, maintenance-stage (adjuvant) and recurrent treatment settings. If successful, the result of these studies could position VAL-083 for advancement to pivotal clinical studies as a potential replacement for temozolomide in MGMT-unmethylated GBM. We anticipate presenting data from these studies at peer reviewed scientific meetings during calendar 2019.

With respect to our STAR-3, Phase 3 study, we have finalized the decision to discontinue this clinical study due to the competitive landscape, patient enrollment rates, and potential risk of success assessment, and to allow us to focus on enrolling GBM patients in our two biomarker-driven Phase 2 studies.

We have received notice to proceed from the US Food and Drug Administration (“FDA”) for a phase 1/2, open-label, multicenter study of VAL-083 in patients with Recurrent Platinum Resistant Ovarian Cancer (“REPROVe”). Platinum-based chemotherapy is the standard-of-care in the treatment of ovarian cancer. Nearly all ovarian cancer

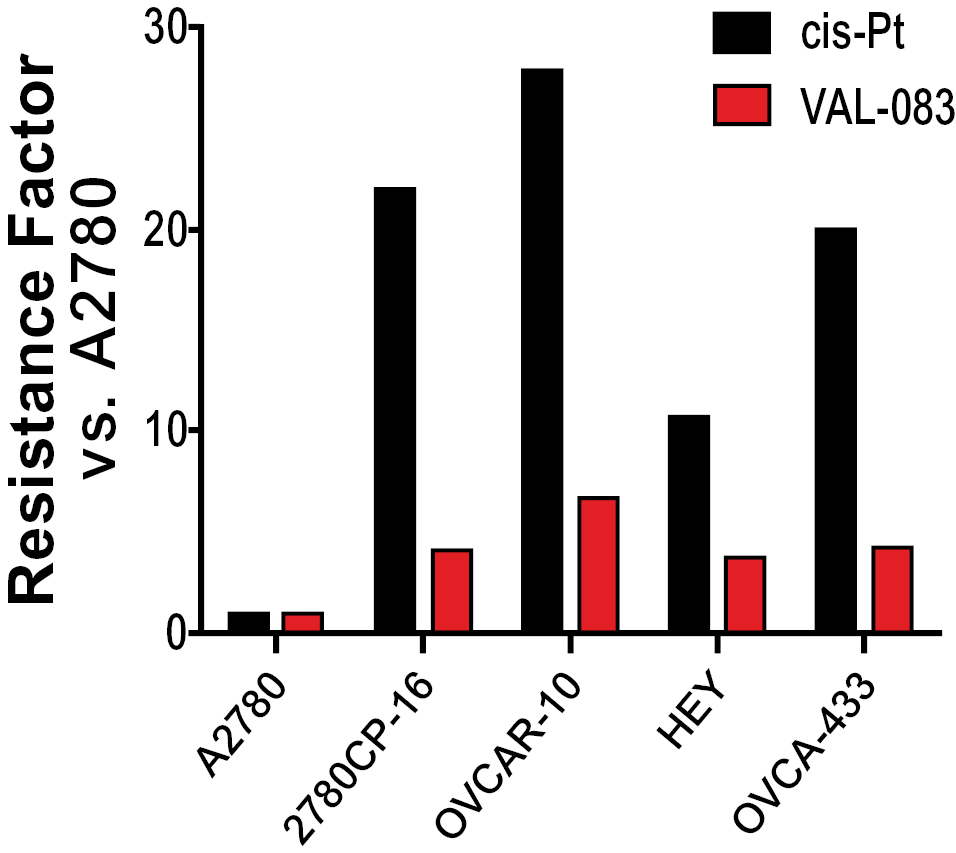

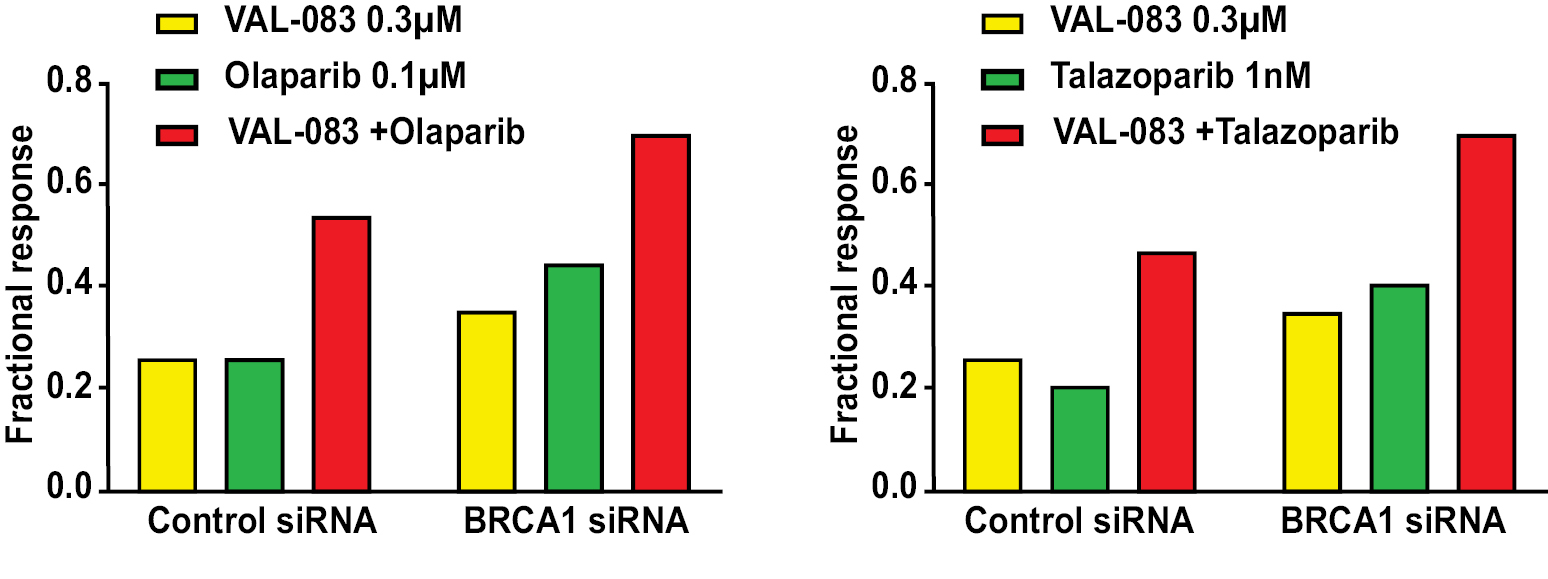

1

patients eventually become resistant to platinum (“Pt”) based chemotherapy leading to treatment failure and poor patient outcomes. We have demonstrated that VAL-083 is active against Pt-resistant ovarian cancer in vitro. However, based on ongoing evaluation and input from our ovarian cancer advisory board, we are reassessing the development of VAL-083 for the treatment of ovarian cancer. We are in the process of evaluating the best path forward in ovarian cancer and are evaluating strategic options, including the potential combination of VAL-083 with PARP inhibitors. At the American Association for Cancer Research (“AACR”) Annual Meeting in 2018 we presented preclinical data showing that VAL-083 can synergize PARP inhibitors in both a BRACA-proficient and -deficient setting.

In addition to our clinical development activities in the United States, pursuant to our collaboration with Guangxi Wuzhou Pharmaceutical (Group) Co. Ltd. (“Guangxi Wuzhou Pharmaceutical Company”), we have provided Guangxi Wuzhou Pharmaceutical Company certain commercial rights to VAL-083 in China where it is approved as a chemotherapy for the treatment of chronic myelogenous leukemia (“CML”) and lung cancer. Guangxi Wuzhou Pharmaceutical Company is the only manufacturer presently licensed by the China Food and Drug Administration (“CFDA”) to produce the product for the China market.

We have a broad patent portfolio to protect our intellectual property. Our patent applications claim composition of matter and methods of use of VAL-083 and related compounds, synthetic methods, and quality controls for the manufacturing process of VAL-083. We believe that our portfolio of intellectual property rights provides a defensible market position for the commercialization of VAL-083. In addition, VAL-083 has been granted protection under the Orphan Drug Act by the FDA and the European Medicines Agency (“EMA”) for the treatment of gliomas, including GBM. The FDA has also granted Orphan Drug protection to VAL-083 for the treatment of medulloblastoma and ovarian cancer.

Our corporate development strategy is to advance our drug candidate into multiple clinical studies and then to consider licensing, or acquiring additional product candidates, in order to establish a product pipeline and to position us for long-term sustainability and growth of shareholder value. We believe the experience of our clinical development team will position us to efficiently develop drug candidates that we may acquire, or license, in the future.

We intend to continue to evaluate options for our strategic direction. These options may include raising additional capital, the acquisition of another company and/or complementary assets, our sale, or another type of strategic partnership.

Recent Highlights

• On April 4, 2019, we announced the formation of a Scientific Advisory Board (“SAB”). Its inaugural members are Drs. Napoleone Ferrara and John de Groot. Dr. John de Groot, Chairman, ad interim of the Department of Neuro-Oncology at the MD Anderson Cancer Center is an expert in glioma biology and angiogenesis which is the key area of clinical development for VAL-083. Dr. Ferrara is a world-renowned molecular biologist whose pioneering work on the identification of VEGF, a signal protein produced by cells that stimulates the formation of blood vessels, led to the development of Genentech Inc.’s Avastin® for the treatment of certain types of cancer, including ovarian cancer and GBM. Dr. Ferrara is also a member of our Board of Directors and he will serve as the SAB’s Chairman. The SAB will work closely with our management team to optimize the development of VAL-083.

• On February 4, 2019, the Nasdaq Hearings Panel issued a decision granting our request for continued listing of our common stock on The Nasdaq Capital Market pursuant to an extension through June 25, 2019, subject to the condition that we shall have demonstrated a closing bid price of $1.00 per share or more for a minimum of ten consecutive business days by June 25, 2019. As a result of our one-for-ten reverse stock split effected on May 8, 2019, we believe we have demonstrated our compliance with the requirement. However, on May 22, 2019, the Nasdaq Staff notified us that we did not meet the stockholder equity requirements as of March 31, 2019. We expect to utilize the proceeds from this Rights Offering in order to establish compliance with such requirement.

• As of March 13, 2019, we have enrolled 47 of the planned 48 patients in our Phase 2, open-label clinical study of VAL-083 in bevacizumab (Avastin®)-naïve, recurrent glioblastoma multiforme (“rGBM”) patients with MGMT-unmethylated status. This study is being conducted at the MD Anderson Cancer Center (“MDACC”) in Houston, Texas. The study is designed to determine the impact of VAL-083 treatment on overall survival compared to historical reference control.

• On April 3, 2019, we announced that the MDACC Institutional Review Board (“IRB”) had approved the addition of up to 35 patients to our recurrent GBM study at a dose of 30 mg/m2. As previously disclosed, we had lowered the dose in this study from 40 mg/m2 to 30 mg/m2 to improve tolerance in

2

this patient population and to maximize overall exposure to VAL-083 thereby increasing the number of cycles of drug patients are able to receive. Upon completion of the initial 48 patients in this study, 13 will have had the 30 mg/m2 dose and 35 will have had the 40 mg/m2. Therefore, potentially adding an additional 35 patients at 30 mg/m2 would result in a total of 48 patients receiving the 30 mg/m2 dose. In addition, the MDACC IRB approved the addition of up to 24 patients in the pre-temozolomide (“TMZ”) maintenance setting. These patients will have had an initial cycle of temozolomide following radiation but will not have yet started subsequent cycles of temozolomide (i.e. maintenance stage TMZ patients). Subject to obtaining financing and all regulatory approvals, we are planning a new study arm that would potentially enroll up to 24 pre-TMZ maintenance stage, MGMT-unmethylated GBM patients.

• As of February 15, 2019, we have enrolled 15 of the planned up to 30 patients in our Phase 2, open-label clinical study of VAL-083 in newly-diagnosed, MGMT-unmethylated GBM patients being conducted in Guangzhou, China. This study is a single-site study being conducted at Sun Yat-sen University Cancer Center (“SYSUCC”) on newly diagnosed MGMT-unmethylated GBM patients. Patients in this study are being treated with VAL-083 in combination with radiotherapy as a potential alternative to the current standard-of-care chemo-radiation regimen.

• At the annual meeting of the AACR held March 29 to April 3, 2019, we presented clinical study updates on both of our Phase 2 studies in MGMT-unmethylated GBM patients, as well as, preclinical presentations on VAL-083 in combination with Avastin® and on the potential to overcome major challenges in the treatment of DIPG.

Risks Affecting Us

Our business is subject to numerous risks described in the section entitled “Risk Factors” and elsewhere in this prospectus. You should carefully consider these risks before making an investment. Some of these risks include:

• We have expressed substantial doubt about our ability to continue as a going concern;

• We have a limited operating history and a history of operating losses and expect to incur significant additional operating losses;

• We will need to raise additional capital;

• We are an early-stage company and may never achieve commercialization of our candidate products or profitability;

• We are currently focused on the development of a single product candidate;

• Clinical trials for our product candidate are expensive and time consuming, and their outcome is uncertain; and

• We may not receive regulatory approvals for our product candidate or there may be a delay in obtaining such approvals.

Company Information

We are a Nevada corporation formed on June 24, 2009 under the name Berry Only Inc. On January 25, 2013, we entered into and closed an exchange agreement (the “Exchange Agreement”), with Del Mar Pharmaceuticals (BC) Ltd. (“Del Mar (BC)”), 0959454 B.C. Ltd. (“Callco”), and 0959456 B.C. Ltd. (“Exchangeco”) and the security holders of Del Mar (BC). Upon completion of the Exchange Agreement, Del Mar (BC) became a wholly-owned subsidiary of ours (the “Reverse Acquisition”).

We are the parent company of Del Mar (BC), a British Columbia, Canada corporation incorporated on April 6, 2010, which is a clinical stage company with a focus on the development of drugs for the treatment of cancer. We are also the parent company to Callco and Exchangeco which are British Columbia, Canada corporations. Callco and Exchangeco were formed to facilitate the Reverse Acquisition.

Our principal executive offices are located at Suite 720-999 West Broadway, Vancouver, British Columbia, Canada V5Z 1K5 and our telephone number is (604) 629-5989. We maintain an internet website at www.delmarpharma.com. We do not incorporate the information on our website into this prospectus and you should not consider it part of this prospectus.

3

Summary of the Rights Offering

|

Securities to be Offered |

We are distributing to you, at no charge, one non-transferable Subscription Right to purchase one Unit for every share of our common stock (or share of common stock issuable upon exercise of our certain outstanding warrants) that you owned on the Record Date. Each Unit consists of one share of our Preferred Stock and 125 Warrants. |

|

|

Size of Offering |

8,000 Units. |

|

|

Subscription Price |

$1,000 per Unit. |

|

|

Series C Convertible Preferred Stock |

Each share of Preferred Stock will be convertible, at our option at any time on or after the first anniversary of the expiration of the rights offering or at the option of the holder at any time, into the number of shares of our common stock determined by dividing the $1,000 stated value per share of the Preferred Stock by a conversion price of $4.00 per share, subject to adjustment. The Preferred Stock has certain conversion rights and dividend rights. |

|

|

Warrants |

Each Warrant entitles the holder to purchase one share of our common stock at an exercise price of $4.40 per share, subject to adjustment, from the date of issuance through its expiration five years from the date of issuance. The Warrants will be exercisable for cash, or, during any period when a registration statement for the exercise of the Warrants is not in effect, on a cashless basis, at any time and from time to time after the date of issuance. In addition, if on any trading day after 90 days after the closing date of the Rights Offering the daily volume weighted average price of our common stock fails to exceed the exercise price of the Warrants, the Warrants will be exercisable on a cashless basis at any time and from time to time after such occurrence, with each Warrant to purchase one share of common stock being exchanged for 0.9 of a share of common stock. There is no public trading market for the Warrants and they will not be listed for trading on Nasdaq or any other securities exchange or market. We may redeem the Warrants for $0.001 per Warrant if our common stock closes above $13.20 per share for ten consecutive trading days and on each such day the dollar trading volume exceeds $250,000, provided that we may not do so prior to the first anniversary of expiration of the Rights Offering. |

|

|

Record Date |

5:00 p.m., Eastern Time, May 21, 2019. |

|

|

Basic Subscription Rights |

Your Basic Subscription Right will entitle you to purchase one Unit at the Subscription Price. |

|

|

Over-Subscription Privilege |

If you exercise your Basic Subscription Rights in full, you may also choose to purchase a portion of any Units that are not purchased by our other stockholders or warrant holders through the exercise of their Basic Subscription Rights, subject to proration and stock ownership limitations described elsewhere in this prospectus. |

|

|

Expiration Date |

The Subscription Rights will expire at 5:00 p.m., Eastern Time, on June 12, 2019. |

4

|

Procedure for Exercising Subscription Rights |

|

|

If as of the Record Date you are a beneficial owner of shares or participating warrants that are registered in the name of a broker, dealer, bank or other nominee, you should instruct your broker, dealer, bank or other nominee to exercise your Subscription Rights on your behalf. Please follow the instructions of your nominee, who may require that you meet a deadline earlier than 5:00 p.m., Eastern Time, on June 12, 2019. |

||

|

Delivery of Shares and Warrants |

As soon as practicable after the expiration of the Rights Offering, and within five business days thereof, we expect to close on subscriptions and for the Subscription Agent to arrange for the issuance of the shares of Preferred Stock and Warrants purchased pursuant to the Rights Offering. All shares and Warrants that are purchased in the Rights Offering will be issued in book-entry, or uncertificated, form meaning that you will receive a direct registration, or DRS, account statement from our transfer agent reflecting ownership of these securities if you are a holder of record. If you hold your shares or participating warrants in the name of a bank, broker, dealer, or other nominee, DTC will credit your account with your nominee with the securities you purchased in the Rights Offering. |

|

|

Non-transferability of Subscription Rights |

|

|

|

Transferability of Warrants |

The Warrants will be separately transferable following their issuance and through their expiration five years from the date of issuance. |

|

|

No Board Recommendation |

Our board of directors is not making a recommendation regarding your exercise of the Subscription Rights. You are urged to make your decision to invest based on your own assessment of our business and financial condition, our prospects for the future, the terms of the Rights Offering, the information in this prospectus and other information relevant to your circumstances. Please see “Risk Factors” for a discussion of some of the risks involved in investing in our securities. |

|

|

No Revocation |

All exercises of Subscription Rights are irrevocable, even if you later learn of information that you consider to be unfavorable to the exercise of your Subscription Rights. |

5

|

Use of Proceeds |

Assuming the exercise of Subscription Rights to purchase all Units of the Rights Offering, after deducting fees and expenses and excluding any proceeds received upon exercise of any Warrants, we estimate the net proceeds of the Rights Offering will be approximately $6.9 million. We intend to use the net proceeds from the exercise of Subscription Rights for our clinical trials and for general corporate purposes, which may include working capital, capital expenditures, research and development and other commercial expenditures. In addition, we may use the net proceeds from this offering for investments in businesses, products or technologies that are complementary to our business. See “Use of Proceeds.” |

|

|

Material U.S. Federal Income Tax Consequences |

|

|

Extension and Termination |

Although we do not presently intend to do so, we may extend the Rights Offering for additional time in our sole discretion; provided that in no event shall such extensions extend beyond July 31, 2019. Our board of directors may for any reason terminate the Rights Offering at any time before the expiration of the Rights Offering. |

|

|

Subscription and Information Agent Questions |

|

|

|

Market for Common Stock |

Our common stock is listed on Nasdaq under the symbol “DMPI.” |

|

|

Dealer-Managers |

Maxim Group LLC and Dawson James Securities, Inc. will act as co-dealer-managers for the Rights Offering. |

On May 8, 2019, we effected a one-for-ten reverse stock split (the “Reverse Stock Split”) of our issued and outstanding and authorized common stock. All per share amounts and number of shares of common stock in this prospectus reflect the Reverse Stock Split. The Reverse Stock Split does not affect our authorized preferred stock of 5,000,000 shares; except that, pursuant to the terms of the Certificate of Designations of Series B Convertible Preferred Stock for the issued and outstanding shares of our Series B Convertible Preferred Stock, par value $0.001 per share (the “Series B Preferred Stock”), the conversion price at which shares of Series B Preferred Stock may be converted into shares of common stock will be proportionately adjusted to reflect the Reverse Stock Split.

6

QUESTIONS AND ANSWERS RELATING TO THE RIGHTS OFFERING

The following are examples of what we anticipate will be common questions about this Rights Offering. The answers are based on selected information included elsewhere in this prospectus. The following questions and answers do not contain all of the information that may be important to you and may not address all of the questions that you may have about the Rights Offering. This prospectus and the documents incorporated by reference into this prospectus contain more detailed descriptions of the terms and conditions of the Rights Offering and provides additional information about us and our business, including potential risks related to the Rights Offering, the Units offered hereby, and our business. We urge you to read this entire prospectus and the documents incorporated by reference into this prospectus.

Why are we conducting the Rights Offering?

We are conducting the Rights Offering to raise additional capital for general corporate purposes and to fund ongoing operations.

What is the Rights Offering?

We are distributing, at no charge, to holders of our common stock and holders of our certain outstanding warrants as of the Record Date, non-transferable Subscription Rights to purchase Units at a price of $1,000 per Unit. The Subscription Rights will not be tradable. Each Unit consists of one share of our Preferred Stock and 125 Warrants. See “Are there risks in exercising my Subscription Rights?” below. Each Warrant will be exercisable for one share of our common stock. Upon expiration of the Rights Offering, the Preferred Stock and Warrants will immediately separate. There is no public trading market for the Preferred Stock or the Warrants and they will not be listed for trading on Nasdaq or any other securities exchange or market. The common stock to be issued upon conversion of the Preferred Stock or exercise of the Warrants, like our existing shares of common stock, will be traded on the NASDAQ Capital Market under the symbol “DMPI.” You will receive one Subscription Right for every share of common stock (including each share of common stock issuable upon exercise of certain outstanding warrants) that you owned as of 5:00 p.m., Eastern Time, on the Record Date. Each Subscription Right entitles the record holder to a Basic Subscription Right and an Over-Subscription Privilege. The Subscription Rights will expire if they are not exercised by 5:00 p.m., Eastern Time, on June 12, 2019, unless we extend or earlier terminate the Rights Offering.

What are the Basic Subscription Rights?

For every share you owned (including each share of common stock issuable upon exercise of certain outstanding warrants) as of the Record Date, you will receive one Basic Subscription Right, which gives you the opportunity to purchase one Unit, consisting of one share of our Preferred Stock and 125 Warrants, for a price of $1,000 per Unit. For example, if you owned 100 shares of common stock as of the Record Date, you will receive Subscription Rights and will have the right to purchase 100 shares of our Preferred Stock and Warrants to purchase 12,500 shares of our common stock for $1,000 per Unit (or a total payment of $100,000). You may exercise all or a portion of your Basic Subscription Rights or you may choose not to exercise any Basic Subscription Rights at all.

If you are a record holder of our common stock or certain outstanding warrants, the number of shares you may purchase pursuant to your Basic Subscription Rights is indicated on the enclosed Rights Certificate. If you hold your shares or participating warrants in the name of a broker, dealer, bank or other nominee who uses the services of the Depository Trust Company, or DTC, you will not receive a Rights Certificate. Instead, DTC will issue one Subscription Right to your nominee record holder for each share of our common stock (including each share of common stock issuable upon exercise of certain outstanding warrants) that you beneficially own as of the Record Date. If you are not contacted by your nominee, you should contact your nominee as soon as possible.

What is the Over-Subscription Privilege?

If you exercise your Basic Subscription Rights in full, you may also choose to exercise your Over-Subscription Privilege to purchase a portion of any Units that are not purchased by other holders of common stock or participating warrant holders and remain available under the Rights Offering. You should indicate on your Rights Certificate, or the form provided by your nominee if your shares are held in the name of a nominee, how many additional Units you would like to purchase pursuant to your Over-Subscription Privilege, which we refer to as your Over-Subscription Request.

Subject to stock ownership limitations, if sufficient Units are available, we will seek to honor your Over-Subscription Request in full. If Over-Subscription Requests exceed the number of Units available, however, we will allocate the

7

available Units pro-rata among the stockholders and warrant holders exercising the Over-Subscription Privilege in proportion to the number of shares of our common stock (including each share of common stock issuable upon exercise of certain outstanding warrants) each of those stockholders and warrant holders owned on the Record Date, relative to the number of shares (including each share of common stock issuable upon exercise of certain outstanding warrants) owned on the Record Date by all record holders exercising the Over-Subscription Privilege. If this pro-rata allocation results in any stockholders or warrant holders receiving a greater number of Units than the stockholder or warrant holders subscribed for pursuant to the exercise of the Over-Subscription Privilege, then such stockholder or warrant holder will be allocated only that number of Units for which the stockholder or warrant holder oversubscribed, and the remaining Units will be allocated among all other stockholders and warrant holders exercising the Over-Subscription Privilege on the same pro rata basis described above. The proration process will be repeated until all Units have been allocated. See “The Rights Offering-Limitation on the Purchase of Units” for a description of certain stock ownership limitations.

To properly exercise your Over-Subscription Privilege, you must deliver to the Subscription Agent the subscription payment related to your Over-Subscription Privilege before the Rights Offering expires. Because we will not know the total number of unsubscribed units before the expiration of the rights offering, if you wish to maximize the number of units you purchase pursuant to your over-subscription privilege, you will need to deliver payment in an amount equal to the aggregate Subscription Price for the maximum number of units available, assuming that no stockholder or warrant holders other than you has purchased any units pursuant to such stockholder’s or warrant holder’s basic Subscription Right and over-subscription privilege. See “The Rights Offering-The Subscription Rights-Over-Subscription Privilege.” To the extent you properly exercise your Over-Subscription Privilege for an amount of Units that exceeds the number of unsubscribed Units available to you, any excess subscription payments will be returned to you within 10 business days after the expiration of the Rights Offering, without interest or deduction.

Broadridge Corporate Issuer Solutions, Inc., our Subscription Agent for the Rights Offering, will determine the allocation of Over-Subscription Requests based on the formula described above.

May the Subscription Rights that I exercise be reduced for any reason?

Yes. While we are distributing to holders of our common stock and holders of our certain outstanding warrants one Subscription Right for every share of common stock (including each share of common stock issuable upon exercise of certain outstanding warrants) owned on the Record Date, we are only seeking to raise $8.0 million dollars in gross proceeds in this Rights Offering. As a result, based on 2,610,970 shares of common stock outstanding as of March 31, 2019 and 585,626 shares of common stock issuable upon exercise of certain outstanding warrants, we would grant Subscription Rights to acquire 3,196,596 Units but will only accept subscriptions for 8,000 Units. Accordingly, sufficient Units may not be available to honor your subscription in full. If exercises of Basic Subscription Rights exceed the number of Units available in the Rights Offering, we will allocate the available Units pro-rata among the record holders exercising the Basic Subscription Rights in proportion to the number of shares of our common stock (including each share of common stock issuable upon exercise of warrants issued certain outstanding warrants) each of those record holders owned on the Record Date, relative to the number of shares (including each share of common stock issuable upon exercise of certain outstanding warrants) owned on the Record Date by all record holders exercising the Basic Subscription Right. If this pro-rata allocation results in any record holders receiving a greater number of Units than the record holder subscribed for pursuant to the exercise of the Basic Subscription Rights, then such record holder will be allocated only that number of Units for which the record holder subscribed, and the remaining Units will be allocated among all other record holders exercising their Basic Subscription Rights on the same pro rata basis described above. The proration process will be repeated until all Units have been allocated. Accordingly, sufficient Units may not be available to honor your subscription in full, and we will allocate the available Units pro-rata among the record holders exercising the Basic Subscription Rights in proportion to the number of shares of our common stock (including each share of common stock issuable upon exercise of certain outstanding warrants) each of those record holders owned on the Record Date, relative to the number of shares (including each share of common stock issuable upon exercise of certain outstanding warrants) owned on the Record Date by all record holders exercising the Basic Subscription Right. Please also see the discussion under “The Rights Offering-The Subscription Rights-Over-Subscription Privilege” and “The Rights Offering-Limitation on the Purchase of Units” for a description potential proration as to the Over-Subscription Privilege and certain stock ownership limitations.

If for any reason the amount of Units allocated to you is less than you have subscribed for, then the excess funds held by the Subscription Agent on your behalf will be returned to you, without interest, as soon as practicable after the

8

Rights Offering has expired and all prorating calculations and reductions contemplated by the terms of the Rights Offering have been effected, and we will have no further obligations to you.

What are the terms of the Series C Convertible Preferred Stock?

Each share of Preferred Stock will be convertible, at our option at any time on or after the first anniversary of the expiration of the rights offering or at the option of the holder at any time, into the number of shares of our common stock determined by dividing the $1,000 stated value per share of the Preferred Stock by a conversion price of $4.00 per share, subject to adjustment. The Preferred Stock has certain conversion rights and dividend rights as described in more detail herein.

What are the terms of the Warrants?

Each Warrant entitles the holder to purchase one share of our common stock at an exercise price of $4.40 per share from the date of issuance through its expiration five years from the date of issuance. The Warrants will be exercisable for cash, or, during any period when a registration statement for the exercise of the Warrants is not in effect, on a cashless basis. In addition, if on any trading day after 90 days after the closing date of the Rights Offering the daily volume weighted average price of our common stock fails to exceed the exercise price of the Warrants, the Warrants will be exercisable on a cashless basis at any time and from time to time after such occurrence, with each Warrant to purchase one share of common stock being exchanged for 0.9 of a share of common stock. We may redeem the Warrants for $0.001 per Warrant if our common stock closes above $13.20 per share for ten consecutive trading days and on each such day the dollar trading volume exceeds $250,000, provided that we may not do so prior to the first anniversary of expiration of the Rights Offering.

Are the Preferred Stock or Warrants listed?

There is no public trading market for the Preferred Stock or Warrants and they will not be listed for trading on Nasdaq or any other securities exchange or market. The Warrants will be issued in registered form under a warrant agent agreement with Mountain Share Transfer, Inc. as warrant agent.

Will fractional shares be issued upon exercise of Subscription Rights, the conversion of Preferred Stock, or the exercise of Warrants?

No. We will not issue fractional shares of common stock in the Rights Offering. We will only distribute Subscription Rights to acquire whole Units, rounded down to the nearest whole number of underlying common shares giving rise to such Subscription Rights. Any excess subscription payments received by the Subscription Agent will be returned within 10 business days after expiration of the Rights Offering, without interest or deduction. Additionally, no fractional shares of common stock will be issued as a result of the conversion of shares of Preferred Stock or the exercise of Warrants. Instead, for any such fractional share that would otherwise have been issuable upon conversion of shares of Preferred Stock, the Company will round down to the next whole share, and for any such fractional share that would have otherwise been issued upon exercise of Warrants, the Company will round up such fraction to the next whole share.

What effect will the Rights Offering have on our outstanding common stock?

Assuming no other transactions by us involving our capital stock prior to the expiration of the Rights Offering, and if the Rights Offering is fully subscribed, upon consummation of the Rights Offering we will have 2,610,970 shares of common stock issued and outstanding, 8,000 shares of Convertible Series C Preferred Stock issued and outstanding, which will be convertible into 2,000,000 shares of common stock, 278,530 shares of Series A Preferred Stock, 841,113 shares of Series B Preferred and one share of Special Voting Preferred Stock issued and outstanding, 9,063 shares of common stock issuable upon exchange of Exchangeable Shares of 0959456 B.C. Ltd., a British Columbia corporation (“Exchangeco”) (which shares are recognized on an as-exchanged for common stock basis for financial statement purposes), and Warrants to purchase an additional 1,862,503 shares of our common stock issued and outstanding, based on, as of March 31, 2019, 2,610,970 shares of our common stock issued and outstanding, 278,530 shares of Series A Preferred Stock, 841,113 shares of Series B Preferred and one share of Special Voting Preferred Stock issued and outstanding, 9,063 shares of common stock issuable upon exchange of Exchangeable Shares of Exchangeco and outstanding warrants to purchase 862,503 shares of common stock. The exact number of shares of Preferred Stock and Warrants that we will issue in this offering will depend on the number of Units that are subscribed for in the Rights Offering.

9

How was the Subscription Price determined?

In determining the Subscription Price, the directors considered, among other things, the following factors:

• the current and historical trading prices of our common stock;

• the price at which stockholders might be willing to participate in the Rights Offering;

• the value of the common stock issuable upon conversion of the Preferred Stock being issued as a component of the Unit;

• the value of the Warrant being issued as a component of the Unit;

• our need for additional capital and liquidity;

• the cost of capital from other sources; and

• comparable precedent transactions, including the percentage of shares offered, the terms of the Subscription Rights being offered, the subscription price and the discount that the subscription price represented to the immediately prevailing closing prices for those offerings.

In conjunction with the review of these factors, the board of directors also reviewed our history and prospects, including our past and present earnings and cash requirements, our prospects for the future, the outlook for our industry and our current financial condition. The board of directors also believed that the Subscription Price should be designed to provide an incentive to our current stockholders to participate in the Rights Offering and exercise their Basic Subscription Right and their Over-Subscription Privilege.

The Subscription Price does not necessarily bear any relationship to any established criteria for value. You should not consider the Subscription Price as an indication of actual value of our company or our common stock. The market price of our common stock may decline during or after the Rights Offering. You should obtain a current price quote for our common stock and perform an independent assessment of our Preferred Stock and Warrants before exercising your Subscription Rights and make your own assessment of our business and financial condition, our prospects for the future, the terms of the Rights Offering, the information in this prospectus and the other considerations relevant to your circumstances. Once made, all exercises of Subscription Rights are irrevocable. In addition, there is no established trading market for the Preferred Stock or the Warrants to be issued pursuant to this offering, and the Preferred Stock and the Warrants may not be widely distributed.

Am I required to exercise all of the Basic Subscription Rights I receive in the Rights Offering?

No. You may exercise any number of your Basic Subscription Rights, or you may choose not to exercise any Basic Subscription Rights. If you do not exercise any Basic Subscription Rights, the number of shares of our common stock you own will not change. However, if you choose to not exercise your Basic Subscription Rights in full and other holders of Subscription Rights do exercise, your proportionate ownership interest in our company will decrease. If you do not exercise your Basic Subscription Rights in full, you will not be entitled to exercise your Over-Subscription Privilege.

How soon must I act to exercise my Subscription Rights?

If you received a Rights Certificate and elect to exercise any or all of your Subscription Rights, the Subscription Agent must receive your completed and signed Rights Certificate and payment for both your Basic Subscription Rights and any Over-Subscription Privilege you elect to exercise before the Rights Offering expires on June 12, 2019, at 5:00 p.m., Eastern Time, unless we extend or earlier terminate the Rights Offering; provided that in no event shall such extensions extend beyond July 31, 2019. If you hold your shares or participating warrants in the name of a broker, dealer, bank or other nominee, your nominee may establish a deadline before the expiration of the Rights Offering by which you must provide it with your instructions to exercise your Subscription Rights, along with the required subscription payment.

May I transfer my Subscription Rights?

No. The Subscription Rights may be exercised only by the stockholders and warrant holders to whom they are distributed, and they may not be sold, transferred, assigned or given away to anyone else, other than by operation

10

of law. As a result, Rights Certificates may be completed only by the stockholder or warrant holder who receives the certificate. We do not intend to apply for the listing of the Subscription Rights on any securities exchange or recognized trading market.

Will our directors and executive officers participate in the Rights Offering?

To the extent they hold common stock on the record date or certain outstanding warrants as of the Record Date, our directors and executive officers will be entitled to participate in the Rights Offering on the same terms and conditions applicable to other Rights holders.

Are we requiring a minimum subscription to complete the rights offering?

There is no aggregate minimum we must receive to complete the rights offering.

Has the board of directors made a recommendation to stockholders regarding the Rights Offering?

No. Our board of directors is making no recommendation regarding your exercise of the Subscription Rights. Rights holders who exercise Subscription Rights will incur investment risk on new money invested. We cannot predict the price at which our shares of common stock will trade after the Rights Offering. On May 22, 2019, the last reported sale price of our common stock on Nasdaq was $2.79 per share. You should make your decision based on your assessment of our business and financial condition, our prospects for the future, the terms of the Rights Offering, the information contained in this prospectus and other considerations relevant to your circumstances. See “Risk Factors” for discussion of some of the risks involved in investing in our securities.

How do I exercise my Subscription Rights?

If you are a stockholder or warrant holder of record (meaning you hold your shares of our common stock or participating warrants in your name and not through a broker, dealer, bank or other nominee) and you wish to participate in the Rights Offering, you must deliver a properly completed and signed Rights Certificate, together with payment of the Subscription Price for both your Basic Subscription Rights and any Over-Subscription Privilege you elect to exercise, to the Subscription Agent before 5:00 p.m., Eastern Time, on June 12, 2019. If you are exercising your Subscription Rights through your broker, dealer, bank or other nominee, you should promptly contact your broker, dealer, bank or other nominee and submit your subscription documents and payment for the Units subscribed for in accordance with the instructions and within the time period provided by your broker, dealer, bank or other nominee.

What if my shares are held in “street name”?

If you hold your shares of our common stock or participating warrants in the name of a broker, dealer, bank or other nominee, then your broker, dealer, bank or other nominee is the record holder of the shares you beneficially own. The record holder must exercise the Subscription Rights on your behalf. Therefore, you will need to have your record holder act for you.

If you wish to participate in this Rights Offering and purchase Units, please promptly contact the record holder of your shares or participating warrants. We will ask the record holder of your shares or participating warrants, who may be your broker, dealer, bank or other nominee, to notify you of this Rights Offering.

What form of payment is required?

You must timely pay the full Subscription Price for the full number of Units you wish to acquire pursuant to the exercise of Subscription Rights by delivering to the Subscription Agent a:

• personal check drawn on a U.S. bank;

• certified check drawn on a U.S. bank;

• U.S. Postal money order; or

• wire transfer.

11

If you send payment by personal uncertified check, payment will not be deemed to have been delivered to the Subscription Agent until the check has cleared. As such, any payments made by personal check should be delivered to the Subscription Agent no fewer than three business days prior to the expiration date.

If you send a payment that is insufficient to purchase the number of Units you requested, or if the number of Units you requested is not specified in the forms, the payment received will be applied to exercise your Subscription Rights to the fullest extent possible based on the amount of the payment received.

When will I receive my new shares of Preferred Stock and Warrants?

As soon as practicable after the expiration of the Rights Offering, and within five business days thereof, we expect to close on subscriptions and for the Subscription Agent to arrange for the issuance of the shares of Preferred Stock and Warrants purchased in the Rights Offering. At closing, all prorating calculations and reductions contemplated by the terms of the Rights Offering will have been effected and payment to us for the subscribed-for Units will have cleared. All shares and Warrants that you purchase in the Rights Offering will be issued in book-entry, or uncertificated, form meaning that you will receive a direct registration, or DRS, account statement from our transfer agent reflecting ownership of these securities if you are a holder of record. If you hold your shares or participating warrants in the name of a broker, dealer, bank or other nominee, DTC will credit your account with your nominee with the securities you purchase in the Rights Offering. Mountain Share Transfer, Inc. is acting as the warrant agent in this offering.

After I send in my payment and Rights Certificate to the Subscription Agent, may I cancel my exercise of Subscription Rights?

No. Exercises of Subscription Rights are irrevocable, even if you later learn information that you consider to be unfavorable to the exercise of your Subscription Rights. You should not exercise your Subscription Rights unless you are certain that you wish to purchase Units at the Subscription Price.

How much will our company receive from the Rights Offering?

Assuming that all Units are sold in the Rights Offering, we estimate that the net proceeds from the Rights Offering will be approximately $6.9 million, based on the Subscription Price of $1,000 per Unit, after deducting fees and expenses payable to the dealer-managers, and after deducting other estimated expenses payable by us and excluding any proceeds received upon exercise of any Warrants. If all Warrants included in the Units are exercised for cash at the exercise price of $4.40 per share, we will receive an additional $4.4 million. We intend to use the net proceeds for general corporate purposes and to fund ongoing operations. See “Use of Proceeds.”

Are there risks in exercising my Subscription Rights?

Yes. The exercise of your Subscription Rights involves risks. Exercising your Subscription Rights involves the purchase of shares of our common stock and Warrants to purchase common stock and you should consider this investment as carefully as you would consider any other investment. In addition, our Warrants will not be listed on Nasdaq and a market for the Warrants does not exist. See “Risk Factors” for discussion of additional risks involved in investing in our securities.

Can the board of directors terminate or extend the Rights Offering?

Yes. Our board of directors may decide to terminate the Rights Offering at any time and for any reason before the expiration of the Rights Offering. We also have the right to extend the Rights Offering for additional periods in our sole discretion; provided that in no event shall such extensions extend beyond July 31, 2019. We do not presently intend to extend the Rights Offering. We will notify stockholders and the public if the Rights Offering is terminated or extended by issuing a press release announcing the extension no later than 9:00 a.m., Eastern Time, on the next business day after the most recently announced expiration date of the Rights Offering.

If the Rights Offering is not completed or is terminated, will my subscription payment be refunded to me?

Yes. The Subscription Agent will hold all funds it receives in a segregated bank account until completion of the Rights Offering. If we do not complete the Rights Offering, all subscription payments received by the Subscription Agent will be returned within 10 business days after the termination or expiration of the Rights Offering, without

12

interest or deduction. If you own shares in “street name,” it may take longer for you to receive your subscription payment because the Subscription Agent will return payments through the record holder of your shares.

How do I exercise my Rights if I live outside the United States?

The Subscription Agent will hold Rights Certificates for stockholders having addresses outside the United States. To exercise Subscription Rights, foreign stockholders must notify the Subscription Agent and timely follow other procedures described in the section entitled “The Rights Offering - Foreign Stockholders.”

What fees or charges apply if I purchase shares in the Rights Offering?

We are not charging any fee or sales commission to issue Subscription Rights to you or to issue shares of Preferred Stock or Warrants to you if you exercise your Subscription Rights. If you exercise your Subscription Rights through a broker, dealer, bank or other nominee, you are responsible for paying any fees your broker, dealer, bank or other nominee may charge you.

What are the U.S. federal income tax consequences of receiving and/or exercising my Subscription Rights?

For U.S. federal income tax purposes, we do not believe you should recognize income or loss in connection with the receipt or exercise of Subscription Rights in the Rights Offering, but the receipt and exercise of the Subscription Rights is unclear in certain respects. You should consult your tax advisor as to your particular tax consequences resulting from the receipt and exercise of Subscription Rights, including the receipt, ownership and disposition of our Preferred Stock, Warrants, and common stock received upon the conversion of Preferred Stock or the exercise of Warrants. For further information, see “Material U.S. Federal Income Tax Consequences.”

To whom should I send my forms and payment?

If your shares or participating warrants are held in the name of a broker, dealer, bank or other nominee, then you should send your subscription documents and subscription payment to that broker, dealer, bank or other nominee. If you are the record holder, then you should send your subscription documents, Rights Certificate, and subscription payment to the Subscription Agent by hand delivery, first class mail or courier service to:

|

By mail: |

By hand or overnight courier: |

|||||

|

Broadridge Corporate Issuer Solutions, Inc. |

Broadridge Corporate Issuer Solutions, Inc. |

You or, if applicable, your nominee are solely responsible for completing delivery to the Subscription Agent of your subscription documents, Rights Certificate and payment. You should allow sufficient time for delivery of your subscription materials to the Subscription Agent and clearance of payment before the expiration of the Rights Offering at 5:00 p.m. Eastern Time on June 12, 2019.

Whom should I contact if I have other questions?

If you have other questions or need assistance, please contact the Information Agent: Broadridge Corporate Issuer Solutions, Inc., toll free at (855) 793-5068, or by mail at Broadridge Corporate Issuer Solutions, Inc., Attn: BCIS Re-Organization Dept., P.O. Box 1317, Brentwood, New York, 11717-0693.

Who are the dealer-managers?

Maxim Group LLC and Dawson James Securities, Inc. will act as co-dealer-managers for the Rights Offering. Under the terms and subject to the conditions contained in the dealer-manager agreement, the dealer-managers will use their best efforts to solicit the exercise of Subscription Rights. We have agreed to pay the dealer-managers certain fees for acting as dealer-managers and to reimburse the dealer-managers for certain out-of-pocket expenses incurred in connection with this offering. The dealer-managers are not underwriting or placing any of the Subscription Rights or the shares of our Preferred Stock or Warrants being issued in the Rights Offering and are not making any recommendation with respect to such Subscription Rights (including with respect to the exercise or expiration of such Subscription Rights), shares of Preferred Stock or Warrants.

13

Investing in our securities involves a high degree of risk. In determining whether to purchase our common stock, an investor should carefully consider all of the material risks described below, together with the other information contained in this report before making a decision to purchase our securities. An investor should only purchase our securities if he or she can afford to suffer the loss of his or her entire investment.

Risks Related to Our Business

We have expressed substantial doubt about our ability to continue as a going concern.

As discussed in Note 1 to the consolidated financial statements for the year ended June 30, 2018, our audited financial statements for the fiscal year ended June 30, 2018, include an explanatory paragraph that such financial statements were prepared assuming that we will continue as a going concern. A going concern basis assumes that we will continue our operations for the foreseeable future and contemplates the realization of assets and the settlement of liabilities in the normal course of business.

For the year ended June 30, 2018 and the nine months ended March 31, 2019, we reported a loss of $11,138,312 and $5,465,486, respectively, and a negative cash flow from operations of $9,850,850 and $4,514,674, respectively. We had an accumulated deficit of $57,988,567 as at March 31, 2019. As at March 31, 2019, we had cash and cash equivalents on hand of $2,152,233. We are in the development stage and have not generated any revenues to date. We do not have the prospect of achieving revenues until such time that our product candidate is commercialized, or partnered, which may not ever occur. In the near future, we will require additional funding to maintain our clinical studies, research and development projects, and for general operations. These circumstances indicate substantial doubt exists about our ability to continue as a going concern.

Consequently, management is pursuing various financing alternatives to fund our operations, including this Rights Offering, so it can continue as a going concern. Management plans to secure the necessary financing through the issue of new equity and/or the entering into of strategic partnership arrangements. We may tailor our drug candidate development program based on the amount of funding we are able to raise in the future. Nevertheless, there is no assurance that these initiatives will be successful.

The financial statements do not give effect to any adjustments to the amounts and classification of assets and liabilities that may be necessary should we be unable to continue as a going concern. Such adjustments could be material.

We have a limited operating history and a history of operating losses and expect to incur significant additional operating losses.

We are an early stage company and there is limited historical financial information upon which to base an evaluation of our performance. Our prospects must be considered in light of the uncertainties, risks, expenses, and difficulties frequently encountered by companies in their early stages of operations. We expect to incur substantial additional net expenses over the next several years as our research, development and commercial activities increase. The amount of future losses and when, if ever, we will achieve profitability are uncertain. Our ability to generate revenue and achieve profitability will depend on, among other things, successful completion of the preclinical and clinical development of our product candidate; obtaining necessary regulatory approvals from the FDA and international regulatory agencies; successful manufacturing, sales and marketing arrangements; and raising sufficient funds to finance our activities. If we are unsuccessful at some or all of these undertakings, our business, prospects and results of operations may be materially adversely affected.

We will need to raise additional capital, which may cause dilution to our stockholders, restrict our operations or require us to relinquish rights to technologies or product candidates.

Until such time, if ever, as we can generate substantial product revenues, we expect to finance our cash needs through a combination of public or private equity offerings, debt financings and/or license and development agreements with collaboration partners. As of March 31, 2019, we had cash and cash equivalents to fund operations into the middle of calendar 2019. We expect the net proceeds from this Right Offering to be $6.9 million assuming all of the securities are sold, which we expect to fund our operations until the middle of calendar 2020. We will also

14

need to raise additional capital to fund our operations. We do not have any committed external source of funds. To the extent that we raise additional capital through the sale of equity or convertible debt securities, then-existing stockholders’ interests may be materially diluted, and the terms of such securities could include liquidation or other preferences that adversely affect their rights as common stockholders. Debt financing and preferred equity financing, if available, may involve agreements that include restrictive covenants that limit our ability to take specified actions, such as incurring additional debt, making capital expenditures or declaring dividends. In addition, debt financing would result in fixed payment obligations.

In addition, we have retained Oppenheimer & Co. Inc. as a financial advisor to assist us in our evaluation of a broad range of strategic alternatives to enhance stockholder value, including additional capital raising transactions, an acquisition, merger, business combination, licensing and/or other strategic transaction involving us. There is no assurance that the review of strategic alternatives will result in us changing our business plan, pursuing any particular transaction, or, if we pursue any such transaction, that it will be completed. We do not expect to make further public comment regarding the strategic review until our Board of Directors has approved a specific transaction or otherwise deems disclosure of significant developments is appropriate.