UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 10-Q

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2019

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE EXCHANGE ACT

For the transition period from _________ to _________

Commission File No. 000-54394

ONLINE DISRUPTIVE TECHNOLOGIES,

INC.

(Exact name of registrant as specified in its

charter)

| Nevada | 27-1404923 |

| (State or other jurisdiction | (I.R.S. Employer |

| of incorporation or | Identification No.) |

| organization) |

P.O. Box 1080, 10 Stevens Street, Andover, MA

01810-3572

(Address of principal executive offices) (zip code)

978-886-1071

(Registrant’s telephone number,

including area code)

_______________________________________________________________

(Former

name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (§232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files).

Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

| (Do not check if a smaller reporting company) | Emerging growth company [ ] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ]

No [X]

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY

PROCEEDINGS

DURING THE PRECEDING FIVE YEARS

Indicate by check mark whether the registrant has filed all

documents and reports required to be filed by Section 12, 13 or 15(d) of the

Securities and Exchange Act of 1933 subsequent to the distribution of securities

under a plan confirmed by a court.

Yes [ ] No [

]

APPLICABLE ONLY TO CORPORATE ISSUERS

State the number of shares outstanding of each of the issuer’s classes of common equity as of the latest practicable date: As of June 10, 2019, there were 127,240,587 shares of common stock, par value $0.001, outstanding.

TABLE OF CONTENTS

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

ONLINE DISRUPTIVE TECHNOLOGIES, INC.

CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

FOR THE QUARTER ENDED MARCH 31, 2019

(Unaudited)

Online Disruptive Technologies, Inc.

Condensed

Interim Consolidated Balance Sheets

(U.S.

Dollars)

(Unaudited)

| March 31, 2019 | December 31, 2018 | |||||

| $ | $ | |||||

| ASSETS | ||||||

| Current Assets | ||||||

| Cash and Cash Equivalents | 60,932 | 120,245 | ||||

| Restricted Cash (Note 12(3)) | 30,118 | 29,185 | ||||

| Prepaid Expenses | 19,486 | 23,467 | ||||

| VAT Receivable | 12,979 | 20,141 | ||||

| Total Current Assets | 123,515 | 193,038 | ||||

| Fixed Assets (Note 4) | 42,532 | 45,274 | ||||

| Right-of-use Assets (Note 3) | 89,799 | - | ||||

| Total Assets | 255,846 | 238,312 | ||||

| LIABILITIES | ||||||

| Current Liabilities | ||||||

| Accounts Payable | 149,283 | 194,400 | ||||

| Accrued Liabilities | 224,705 | 196,316 | ||||

| Promissory Note (Note 7) | 41,547 | 50,000 | ||||

| Current Portion of Lease Liability (Note 3) | 56,142 | - | ||||

| Total Current Liabilities | 471,677 | 440,716 | ||||

| Convertible Debentures (Note 8) | 2,061,388 | 2,061,388 | ||||

| Convertible Loan (Note 9) | 537,000 | 537,000 | ||||

| Lease Liabilities (Note 3) | 34,210 | - | ||||

| Total Liabilities | 3,104,275 | 3,039,104 | ||||

| DEFICIT | ||||||

| Authorized: 20,000,000 Preferred Shares, par value $0.001 500,000,000 Common Shares, par value $0.001 Issued and outstanding: Nil Preferred Shares 125,865,122 Common Shares (December 31, 2018: 124,063,122 Common Shares) |

125,865 | 124,063 | ||||

| Shares Subscription Received | 45,797 | - | ||||

| Additional Paid-in Capital | 12,793,579 | 12,340,094 | ||||

| Accumulated Other Comprehensive Loss | 35,968 | 80,946 | ||||

| Deficit | (15,706,997 | ) | (15,255,866 | ) | ||

| Deficit Attributable to Shareholders of the Company | (2,705,788 | ) | (2,710,763 | ) | ||

| Non-Controlling Interests | (142,641 | ) | (90,029 | ) | ||

| Total Deficit | (2,848,429 | ) | (2,800,792 | ) | ||

| Total Liabilities and Deficit | 255,846 | 238,312 |

The accompanying notes are an integral part of these condensed interim consolidated financial statements.

Online Disruptive Technologies, Inc.

Condensed Interim Consolidated Statements of Operations and

Comprehensive Loss

(U.S. Dollars)

(Unaudited)

| Three months ended | Three months ended | |||||

| March 31, 2019 | March 31, 2018 | |||||

| $ | $ | |||||

| General and Administrative Expenses | ||||||

| Accounting Fees | 7,500 | 7,500 | ||||

| Audit & Tax Fees | 10,451 | 14,564 | ||||

| Bank Fees | 110 | 136 | ||||

| Consulting Fees | 91,701 | 112,152 | ||||

| Depreciation – Right-of-use Assets (Note 12) | 13,374 | - | ||||

| Filing and Transfer Agent Fees | 1,550 | 90 | ||||

| Insurance Expense | 5,840 | 13,217 | ||||

| Marketing Expense | 1,098 | - | ||||

| Legal Fees | 4,964 | 3,665 | ||||

| Office and Miscellaneous Expense | 2,802 | 2,970 | ||||

| Payroll Expense | 8,916 | 9,382 | ||||

| Rent Expense | 1,890 | 984 | ||||

| Research and Development Expense (Note 2l, 5) | 384,747 | 266,822 | ||||

| Travel Expenses | 2,450 | 3,667 | ||||

| 537,393 | 435,149 | |||||

| Other Expenses | ||||||

| Capital Lease Interest Expense (Note 3) | 1,175 | - | ||||

| Fair Value Through Profit and Loss on Loan | - | 34,978 | ||||

| Interest Accretion | - | 122,745 | ||||

| Interest Expense | 1,330 | 56 | ||||

| Foreign Currency (Gain)Loss | (39,168 | ) | 2,524 | |||

| Net Loss and Comprehensive Loss for the period | (500,730 | ) | (595,452 | ) | ||

| Other Comprehensive Income | ||||||

| Currency Translation Adjustments | (44,978 | ) | - | |||

| Comprehensive Loss for the period | (545,708 | ) | (595,452 | ) | ||

| Net Loss Attributable to: | ||||||

| Common Stockholders | (451,131 | ) | (556,809 | ) | ||

| Non-Controlling Interests | (49,599 | ) | (38,643 | ) | ||

| (500,730 | ) | (595,452 | ) | |||

| Net Comprehensive Loss Attributable to: | ||||||

| Common Stockholders | (491,653 | ) | (556,809 | ) | ||

| Non-Controlling Interests | (54,055 | ) | (38,643 | ) | ||

| (545,708 | ) | (595,452 | ) | |||

| Basic and Diluted Net Loss per Common Share | (0.00 | ) | (0.00 | ) | ||

| Weighted Average Number of Common Shares Outstanding

– Basic and Diluted |

124,618,189 | 118,009,579 |

The accompanying notes are an integral part of these condensed interim consolidated financial statements.

Online Disruptive Technologies, Inc.

Condensed

Interim Consolidated Statements of Cash Flows

(U.S.

Dollars)

(Unaudited)

| Three months | Three months | |||||

| ended March | ended March | |||||

| 31, 2019 | 31, 2018 | |||||

| $ | $ | |||||

| Cash flow from Operating Activities | ||||||

| Net loss for the period | (500,730 | ) | (595,452 | ) | ||

| Adjustment for items not involving cash: | ||||||

| Capital lease interest expense | 1,175 | - | ||||

| Stock-based compensation | 199,886 | 74,023 | ||||

| Foreign exchange (gain) loss | (39,168 | ) | 2,524 | |||

| Fair value through profit and loss on loan | - | 34,978 | ||||

| Depreciation – Fixed assets | 4,188 | 11,803 | ||||

| Depreciation – Right-of-use Assets | 13,374 | - | ||||

| Interest accrued | 1,204 | 122,745 | ||||

| Changes in non-cash working capital items: | ||||||

| Decrease in VAT receivable | 7,805 | 7,788 | ||||

| Decrease in prepaid expense | 4,227 | 1,487 | ||||

| (Decrease) Increase in accounts payable and accrued liabilities | (25,099 | ) | 85,760 | |||

| Net cash used in operating activities | (333,138 | ) | (254,344 | ) | ||

| Cash flow from financing activities | ||||||

| Common shares issued, net of issuance costs | 255,400 | - | ||||

| Share subscription received | 45,797 | 8,145 | ||||

| Convertible loan issued | - | 350,000 | ||||

| Term loan repayment | (10,000 | ) | - | |||

| Net cash provided by financing activities | 291,197 | 358,145 | ||||

| Cash flow from investing activities | - | - | ||||

| Net cash used in investing activities | - | - | ||||

| Effects of exchange rate changes on cash and cash equivalents | (16,439 | ) | (921 | ) | ||

| Net decrease in cash, cash equivalents, and restricted cash | (58,380 | ) | 102,880 | |||

| Cash, cash equivalents, and restricted cash, beginning of period | 149,430 | 232,247 | ||||

| Cash, cash equivalents, and restricted cash, end of period | 91,050 | 335,127 | ||||

| Supplementary Information | ||||||

| Interest Paid | - | - | ||||

| Income Taxes Paid | - | - |

The accompanying notes are an integral part of these condensed interim consolidated financial statements.

| Online Disruptive Technologies, Inc. |

| Notes to the Condensed Interim Consolidated Financial Statements |

| March 31, 2019 |

| (Unaudited) |

Note 1 - Nature of Operations and Going Concern

Online Disruptive Technologies, Inc. (“ODT” or the “Company”) was incorporated on November 16, 2009 in the State of Nevada, U.S.A. The Company was in the business of operating websites with advertising revenue platforms. However, as described below, the Company changed its primary business focus to the development and commercialization of a biotechnology platform. The Company has limited operations that has had no revenues from inception to date. The Company has a December 31 year-end.

Effective March 24, 2010, the Company acquired 100% of the issued and outstanding shares of RelationshipScoreboard.com Entertainment Inc. (“RS” or “RelationshipScoreboard.com”), a company incorporated on November 16, 2009 in the state of Nevada, U.S.A. in exchange for 16,000,000 shares of the Company’s common stock. Upon the completion of the acquisition, the former sole shareholder of RS held 89% of the Company’s issued and outstanding common stock. As a result, the transaction was accounted for as a reverse takeover transaction (“RTO”) for accounting purpose, as RS was deemed to be the acquirer, and these condensed interim consolidated financial statements are a continuation of the financial statements of RS. On January 28, 2013, RelationshipScoreboard.com was closed and dissolved. The Company sold the website assets for $10 to an arm’s length individual and wrote off all supplier payables in the amount of $430.

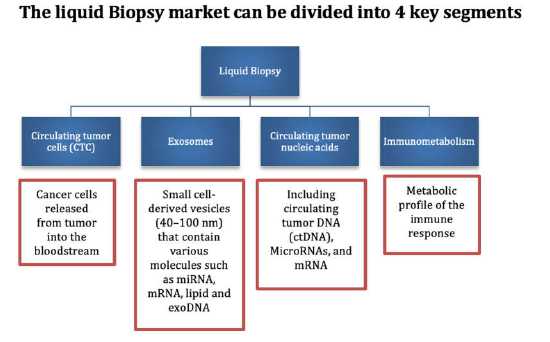

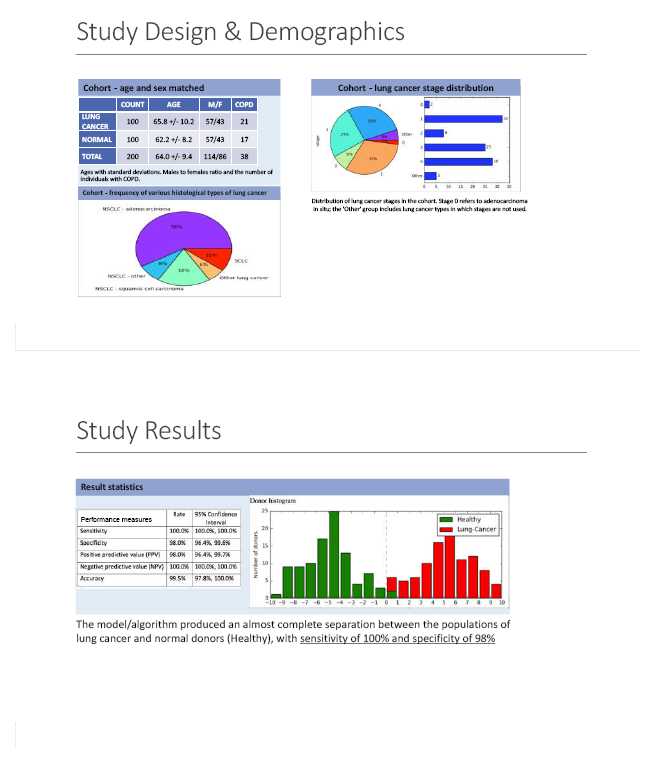

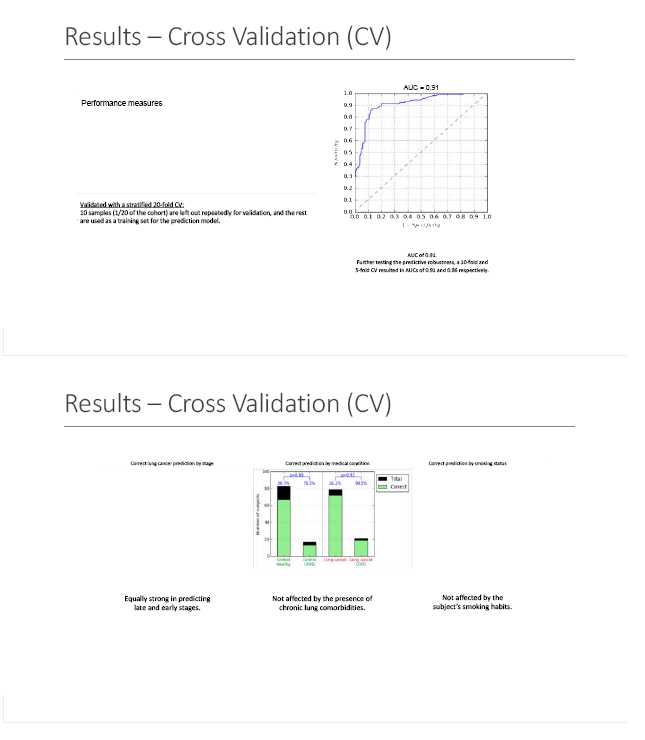

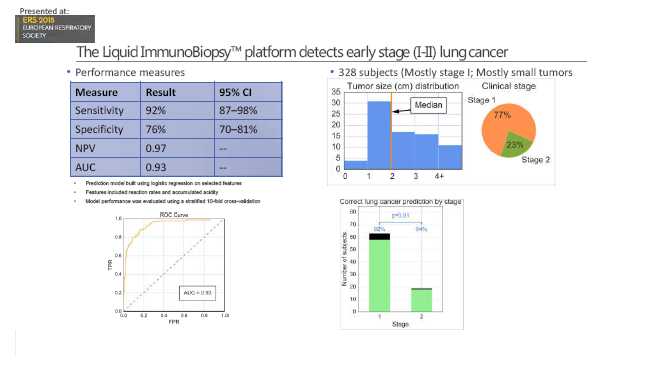

On April 23, 2012, the Company established an Israeli subsidiary named Savicell Diagnostic Ltd. (“Savicell”) with the intention of exploring business ventures in the biotechnology sector. On July 25, 2012, Savicell entered into a definitive licensing agreement with a division of the Tel Aviv University for the purpose of developing and commercializing a new technology relative to the early detection of various forms of disease. With the consummation of this transaction, the Company is now entirely focused on its biotechnology efforts.

These condensed interim consolidated financial statements have been prepared with the ongoing assumption that the Company will be able to realize its assets and discharge its liabilities in the normal course of business. The Company has a working capital deficit balance of $348,162 as at March 31, 2019 (working capital deficiency balance December 2018 – $247,678) and an accumulated deficit of $15,706,997. Furthermore, additional future losses are anticipated which raise substantial doubt about the Company’s ability to continue as a going concern. These condensed interim consolidated financial statements do not include any adjustments to the amounts and classification of assets and liabilities that might be necessary should the Company be unable to continue as a going concern.

The operations of the Company have primarily been funded by the sale of common shares and loans received. Continued operations of the Company are dependent on the Company’s ability to complete equity financings or to generate profitable operations in the future. Management’s plan in this regard is to secure additional funds through future equity financings. Such financings may not be available or may not be available on reasonable terms to the Company. Failure to obtain the ongoing support of its equity financings and creditors may make the going concern basis of accounting inappropriate, in which case the Company’s assets and liabilities would need to be recognized at their liquidation values. These condensed interim consolidated financial statements do not include any adjustments relating to the recoverability and classification of recorded assets amounts and classification of liabilities that might arise from this uncertainty.

| Online Disruptive Technologies, Inc. |

| Notes to the Condensed Interim Consolidated Financial Statements |

| March 31, 2019 |

| (Unaudited) |

Note 2 - Significant Accounting Policies

a) Basis of

Presentation

These condensed interim consolidated financial statements

have been prepared for interim financial reporting in conformity with generally

accepted accounting principles in the United States of America (“US GAAP”), and

are expressed in United States dollars, unless otherwise noted. All adjustments

considered necessary for a fair presentation of financial position, results of

operations and cash flows for the three months ended March 31, 2019 have been

included.

b) Principles of

Consolidation

These condensed interim consolidated financial statements

include the accounts of the Company and its 87.81% (December 31, 2018 – 87.81%)

interest in Savicell. All significant intercompany accounts and transactions

have been eliminated upon consolidation.

c) Use of

Estimates

The preparation of condensed interim consolidated financial

statements in conformity with US GAAP requires management to make estimates and

assumptions that affect the reported amounts of assets and liabilities and

disclosures of contingent assets and liabilities at the date of the financial

statements, and the reported amounts of revenues and expenses during the

reporting period. Actual results could differ from those estimates.

Significant areas requiring the use of management estimates include assumptions and estimates relating to share-based payments, valuation allowances for deferred tax assets and assessment of lease.

d) Foreign

Currency Translation

The Company’s functional currency is the U.S.

dollar. Transactions in other currencies are recorded in U.S. dollars at the

rates of exchange prevailing when the transactions occur. Monetary assets and

liabilities denominated in other currencies are translated into U.S. dollars at

rates of exchange in effect at the balance sheet dates. Exchange gains and

losses are recorded in the statements of operations.

Results of operations are translated into the Company’s presentation currency, U.S. dollars, at an appropriate average rate of exchange during the year. Net assets and liabilities are translated to U.S. dollars for presentation purposes at rates of exchange in effect at the end of the period. Gains or losses arising on translation are recognized in other comprehensive income (loss) as foreign currency translation adjustments.

e) Cash and Cash

Equivalents

Cash and cash equivalents consist entirely of readily

available cash balances. There were no cash equivalents as of March 31, 2019 and

December 31, 2018.

| Online Disruptive Technologies, Inc. |

| Notes to the Condensed Interim Consolidated Financial Statements |

| March 31, 2019 |

| (Unaudited) |

Note 2 - Significant Accounting Policies (Continued)

f)

Stock-based Compensation

The Company accounts for its stock-based

compensation awards in accordance with ASC Topic 718, Compensation—Stock

Compensation (“ASC 718”). ASC 718 requires all stock-based payments to employees

and non-employees including grants of stock options, to be recognized as expense

in the statements of operations based on their grant date fair values. The

Company estimates the grant date fair value of each option award using the

Black-Scholes option-pricing model. The use of the Black-Scholes option-pricing

model requires management to make assumptions with respect to the expected term

of the option, the expected volatility of the common stock consistent with the

expected life of the option, risk-free interest rates and expected dividend

yields of the common stock.

g) Stock for

Services

The Company periodically issues common stock, warrants and

common stock options to consultants for various services. Costs of these

transactions are measured at the fair value of the service received or the fair

value of the equity instruments issued, whichever is more reliably measurable.

The value of the common stock is measured at the earlier of (i) the date at

which a firm commitment for performance by the counterparty to earn the equity

instruments is reached or (ii) the date at which the counterparty’s performance

is complete.

h) Income

Taxes

Income taxes are accounted for under the liability method of

accounting for income taxes. Under the liability method, deferred tax

liabilities and assets are recognized for the estimated future tax consequences

attributable to differences between the amounts reported in the financial

statement carrying amounts of existing assets and liabilities and their

respective tax bases. Deferred tax assets and liabilities are measured using

enacted income tax rates expected to apply when the asset is realized or the

liability is settled. The effect of a change in income tax rates on deferred tax

liabilities and assets is recognized in income in the period in which the change

occurs. Deferred tax assets are recognized to the extent that they are

considered more likely than not to be realized.

Per FASB ASC 740 “Income taxes” under the liability method, it is the Company’s policy to provide for uncertain tax positions and the related interest and penalties based upon management’s assessment of whether a tax benefit is more likely than not to be sustained upon examination by tax authorities. At March 31, 2019, the Company believes it has appropriately accounted for any unrecognized tax benefits. To the extent the Company prevails in matters for which a liability for an unrecognized benefit is established or is required to pay amounts in excess of the liability, the Company’s effective tax rate in a given financial statement period may be affected. Interest and penalties associated with the Company’s tax positions are recorded as Interest Expense.

| Online Disruptive Technologies, Inc. |

| Notes to the Condensed Interim Consolidated Financial Statements |

| March 31, 2019 |

| (Unaudited) |

Note 2 - Significant Accounting Policies (Continued)

i) Comprehensive

Income (Loss)

The Company accounts for comprehensive income under the

provisions of ASC Topic 220-10, Comprehensive Income - Overall, which

establishes standards for reporting and display of comprehensive income, its

components and accumulated balances. The Company is disclosing this information

on its Statements of Operations and Comprehensive Loss.

j) Earnings (Loss)

Per Share

Basic loss per share is computed on the basis of the weighted

average number of common shares outstanding during each period.

Diluted loss per share is computed on the basis of the weighted average number of common shares and dilutive securities outstanding. Stock options are considered to be common stock equivalents and were not included in the net loss per share calculation for the quarter ended March 31, 2019 and 2018 because the inclusion of such underlying shares would have had an anti-dilutive effect.

k) Financial

Instruments and Fair Value of Financial Instruments

Fair Value of

Financial Instruments – the Company adopted SFAS ASC 820-10-50, “Fair Value

Measurements”. This guidance defines fair value, establishes a three-level

valuation hierarchy for disclosures of fair value measurement and enhances

disclosure requirements for fair value measures. The three levels are defined as

follows:

| • |

Level 1 inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets. | |

|

| ||

| • |

Level 2 inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the financial instrument. | |

|

| ||

| • |

Level 3 inputs to valuation methodology are unobservable and significant to the fair measurement. |

As at March 31, 2019, the fair value of cash and cash equivalents was measured using Level 1 inputs, and the fair value of convertible debentures was measured using Level 2 inputs.

The Company’s financial instruments are cash and cash equivalents, restricted cash, accounts payable, accrued liabilities, promissory note, convertible debentures and convertible loans. The recorded values of our financial instruments approximate their current fair values because of their nature and respective maturity dates or durations.

| Online Disruptive Technologies, Inc. |

| Notes to the Condensed Interim Consolidated Financial Statements |

| March 31, 2019 |

| (Unaudited) |

Note 2 - Significant Accounting Policies (Continued)

l) Research and

Development Expenses

In the quarter ended March 31, 2019, all research

and development costs are charged to expense as incurred. The majority of these

costs are in-house expenses related to consulting fees, materials, salaries of

employees working on the R&D projects, rent and legal expenses related to

patents. A breakdown of the R&D costs is as follows:

| Three months ended | Three months ended | |||||

| March 31, 2019 | March 31, 2018 | |||||

| $ | $ | |||||

| Research and Development Expenses | ||||||

| Consulting fees | 3,699 | 9,458 | ||||

| Legal fees | 4,702 | 717 | ||||

| Office and Miscellaneous Expense | 1,457 | 5,204 | ||||

| Payroll expense | 165,233 | 154,098 | ||||

| R&D materials and supplies | 8,344 | 14,463 | ||||

| Rent | 1,426 | 8,859 | ||||

| Share-based compensation | 199,886 | 74,023 | ||||

| Total | 384,747 | 266,822 |

Savicell’s financing commitment related to the License and Research Funding Agreement (as defined in Note 4 below) entered into with Ramot at Tel Aviv University was completely fulfilled by December 31, 2015.

m) Fixed

Assets

The depreciation rates applicable to each category of fixed assets

are as follows:

| Class of Properties | Depreciation Rate |

| Furniture and Fixtures | 15-year; straight-line basis |

| Computer Equipment | 3 to 4-year; straight-line basis |

| Lab Equipment | 3 to 15-year; straight-line basis |

n) Convertible

Debentures

Convertible debentures, for which the embedded conversion

feature does not qualify for derivative treatment, is evaluated to determine if

the effective or actual rate of conversion per the terms of the convertible note

agreement is below market value. In these instances, the Company accounts for

the value of the beneficial conversion feature as a debt discount, which is then

accreted to interest expense over the life of the related debt using the

effective interest method.

o) Convertible

Loans

Convertible loans are accounted for in accordance with ASC 470-20.

The Company has determined that the embedded conversion options in the

convertible loans are not required to be separately accounted for as a

derivative under GAAP.

| Online Disruptive Technologies, Inc. |

| Notes to the Condensed Interim Consolidated Financial Statements |

| March 31, 2019 |

| (Unaudited) |

Note 2 - Significant Accounting Policies (Continued)

p) Modifications

to Debt

The Company evaluates any modifications to its debt in accordance

with the applicable guidance in ASC 470-50, Debt-Modifications and

Extinguishments. If the debt instruments are substantially modified, the

modification is accounted for in the same manner as a debt extinguishment (i.e.,

a major modification) and the fees paid are recognized as expense at the time of

the modification. Otherwise, such fees are deferred and amortized as an

adjustment of interest expense over the remaining term of the modified debt

instrument using the interest method.

q) Recently

Adopted Accounting Pronouncements

In July 2017, the FASB issued ASU

2017-11“Earnings Per Share (Topic 260); Distinguishing Liabilities from Equity

(Topic 480); Derivatives and Hedging (Topic 815): (Part I) Accounting for

Certain Financial Instruments with Down Round Features; (Part II) Replacement of

the Indefinite Deferral for Mandatorily Redeemable Financial Instruments of

Certain Nonpublic Entities and Certain Mandatorily Redeemable Noncontrolling

Interests with a Scope Exception” (“ASU 2017-11”). ASU 2017-11 allows companies

to exclude a down round feature when determining whether a financial instrument

(or embedded conversion feature) is considered indexed to the entity’s own

stock. As a result, financial instruments (or embedded conversion features) with

down round features may no longer be required to be accounted for as derivative

liabilities. A company will recognize the value of a down round feature only

when it is triggered, and the strike price has been adjusted downward. For

equity-classified freestanding financial instruments, an entity will treat the

value of the effect of the down round as a dividend and a reduction of income

available to Common Stock holders in computing basic earnings per share. For

convertible instruments with embedded conversion features containing down round

provisions, entities will recognize the value of the down round as a beneficial

conversion discount to be amortized to earnings. ASU 2017-11 is effective for

fiscal years beginning after December 15, 2018, and interim periods within those

fiscal years. Early adoption is permitted. The Company has early adopted the

methodologies prescribed by this ASU for the year ended December 31, 2018 and

there is no material impact on the Company’s condensed interim consolidated

financial statements.

In July 2018, the FASB issued ASU 2018-10, Codification Improvements to Topic 842, Leases. For entities that early adopted Topic 842, the amendments are effective upon issuance of ASU 2018-10, and the transition requirements are the same as those in Topic 842. For entities that have not adopted Topic 842, the effective date and transition requirements will be the same as the effective date and transition requirements in Topic 842. ASU 2018-10 will be effective for use for fiscal years beginning after December 15, 2018. The Company has adopted the methodologies prescribed by this ASU on January 1, 2019 and there is no material impact on the Company’s condensed interim consolidated financial statements.

In June 2018, the FASB issued ASU 2018-07, Compensation-Stock Compensation (Topic 718): Improvements to Nonemployee Share-Based Payment Accounting. These amendments expand the scope of Topic 718, Compensation—Stock Compensation (which currently only includes share-based payments to employees) to include share-based payments issued to nonemployees for goods or services. Consequently, the accounting for share-based payments to nonemployees and employees will be substantially aligned. The ASU supersedes Subtopic 505-50, Equity—Equity-Based Payments to Non-Employees. This standard is effective for fiscal years beginning after December 15, 2018, including interim periods within that fiscal year.

| Online Disruptive Technologies, Inc. |

| Notes to the Condensed Interim Consolidated Financial Statements |

| March 31, 2019 |

| (Unaudited) |

Note 2 - Significant Accounting Policies (Continued)

q) Recently Adopted Accounting Pronouncements (continued)

The Company has adopted the methodologies prescribed by this ASU on January 1, 2019 and there is no material impact on the Company’s condensed interim consolidated financial statements.

In February 2016, the Financial Accounting Standards Board (“FASB”) issued ASC 842 which requires lessees to recognize a right-of-use (“ROU”) asset and lease liability on the balance sheet for virtually all leases. From a lessee perspective, ASC 842 retains a dual model requiring leases to be classified as either operating or finance leases for the income statement. Operating leases will result in straight-line expense, and financing leases will have a front-loaded expense pattern with an interest expense component. On January 1, 2019, the Company adopted ASC 842 and all related amendments using the prospective transition approach. The comparative information has not been restated and continues to be reported under the accounting standards in effect for those periods. Adoption of the new standard resulted in the recording of lease ROU assets and lease liabilities of approximately $100,069 as of January 1, 2019. In accordance with ASC 842, the Company determines if an arrangement is a lease at inception based on whether there is an identified asset, whether the Company has the right to obtain substantially all of the economic benefits from the use of the asset and whether the Company has the right to direct the use of the asset. Currently, the Company only has operating leases and does not have any financing leases. Operating lease ROU assets and operating lease liabilities are recognized based on the present value of the future minimum lease payments over the lease term. Lease expense for minimum lease payments is recognized on a straight-line basis over the lease term. See note 3, Leases, for further disclosures and detail regarding our operating leases.

r) Recently Issued

Accounting Pronouncements Not Yet Adopted

In August 2018, the FASB issued

ASU 2018-13, Fair Value Measurement (Topic 820): Disclosure Framework—Changes to

the Disclosure Requirements for Fair Value Measurement. For all entities,

amendments are effective for fiscal years, and interim periods within those

fiscal years, beginning after December 15, 2019. The amendments on changes in

unrealized gains and losses, the range and weighted average of significant

unobservable inputs used to develop Level 3 fair value measurements, and the

narrative description of measurement uncertainty should be applied prospectively

for only the most recent interim or annual period presented in the initial

fiscal year of adoption. All other amendments should be applied retrospectively

to all periods presented upon their effective date. Early adoption is permitted.

An entity is permitted to early adopt any removed or modified disclosures upon

issuance of ASU No. 2018-13 and delay adoption of the additional disclosures

until their effective date. The Company is currently evaluating the potential

impact this guidance will have on the condensed interim consolidated financial

statements, if any.

Note 3 – Adoption of ASC 842, Leases

On January 1, 2019, the Company adopted ASC 842 using the prospective transition approach, which applies the provisions of the new guidance at the effective date without adjusting the comparative periods presented. The adoption of the lease standard did not result in a cumulative-effect adjustment to opening equity. Results for reporting periods beginning after January 1, 2019 are presented under ASC 842 while prior period amounts are not adjusted and continue to be reported in accordance with the Company’s historic accounting under ASC 840, “Leases,” (“ASC 840”).

| Online Disruptive Technologies, Inc. |

| Notes to the Condensed Interim Consolidated Financial Statements |

| March 31, 2019 |

| (Unaudited) |

Note 3 - Adoption of ASC 842, Leases (Continued)

The Company leases office space. For leases with terms greater than 12 months, the Company records the related right-of-use (“ROU”) asset and lease obligation at the present value of lease payments over the term. Leases may include fixed rental escalation clauses, renewal options and / or termination options that are factored into the determination of lease payments when appropriate. The Company’s leases do not usually provide a readily determinable implicit rate; therefore, an estimate of the Company’s incremental borrowing rate is used to discount the lease payments based on information available at the lease commencement date. The discount rate used was 5%.

Operating lease costs during the three months ended March 31, 2019 were $13,997.

The adoption of ASC 842 resulted in the recognition of ROU assets and lease liabilities of approximately $100,069 as of January 1, 2019. As at March 31, 2019, ROU Asset is $89,799, current portion and long term portion of these lease liabilities are $56,142 and $34,210 respectively. The standard did not materially impact the Company’s condensed interim consolidated statement of operations or its condensed interim consolidated statement of cash flows for the three months ended March 31, 2019. See below for the Company’s updated lease policy and the required disclosures under ASC 842. The Company is a lessee in a rental lease that has expiry dates within the next 2 years.

The table below summarizes the remaining expected lease payments under our operating leases as of March 31, 2019.

| Future Lease Payments | March 31, | ||

| 2019 | |||

| 2019 | $ | 41,992 | |

| 2020 | 42,315 | ||

| 2021 | 9,654 | ||

| Less: imputed interest | (3,709 | ) | |

| Present value of operating lease liabilities | $ | 90,352 |

Update to Lease Policy

Accounting and reporting guidance for leases requires that leases be evaluated and classified as either operating or finance leases by the lessee and as either operating, sales-type or direct financing leases by the lessor. The Company’s operating leases are included in ROU assets, lease liabilities-current portion and lease liability-less current portion in the accompanying consolidated balance sheets. ROU assets represent the Company’s right to use an underlying asset for the lease term, and lease liabilities represent the obligation to make lease payments arising from the lease.

| Online Disruptive Technologies, Inc. |

| Notes to the Condensed Interim Consolidated Financial Statements |

| March 31, 2019 |

| (Unaudited) |

Note 4 – Fixed Assets

As of March 31, 2019, the fixed assets balance on the consolidated financial statement consist of the following:

| Furniture and | Computer | ||||||||||||

| Cost: | Fixtures | Equipment | Lab Equipment | Total | |||||||||

| December 31, 2017 | $ | 3,871 | $ | 29,325 | $ | 49,191 | $ | 82,387 | |||||

| Additions | - | 9,933 | 10,897 | 20,830 | |||||||||

| Exchange difference | (286 | ) | (2,580 | ) | (4,089 | ) | (6,955 | ) | |||||

| December 31, 2018 | $ | 3,585 | $ | 36,678 | $ | 55,999 | $ | 96,262 | |||||

| Additions | - | - | - | - | |||||||||

| Exchange difference | 114 | 1171 | 1,789 | 3,074 | |||||||||

| March 31, 2019 | $ | 3,699 | $ | 37,849 | $ | 57,788 | $ | 99,336 |

| Furniture and | Computer | Lab | |||||||||||

| Amortization: | Fixtures | Equipment | Equipment | Total | |||||||||

| December 31, 2017 | $ | 887 | $ | 19,497 | $ | 14,868 | $ | 35,252 | |||||

| Additions | 137 | 6,692 | 12,311 | 19,140 | |||||||||

| Exchange difference | (65 | ) | (1,440 | ) | (1,899 | ) | (3,404 | ) | |||||

| December 31, 2018 | $ | 959 | $ | 24,749 | $ | 25,280 | $ | 50,988 | |||||

| Additions | 45 | 1,093 | 3,050 | 4,188 | |||||||||

| Exchange difference | 926 | 348 | 354 | 1,628 | |||||||||

| March 31, 2019 | $ | 1,930 | $ | 26,190 | $ | 28,684 | $ | 56,804 |

| Furniture and | Computer | Lab | |||||||||||

| Net Book Value: | Fixtures | Equipment | Equipment | Total | |||||||||

| December 31, 2017 | $ | 2,984 | $ | 9,828 | $ | 34,323 | $ | 47,135 | |||||

| December 31, 2018 | $ | 2,626 | $ | 11,929 | $ | 30,719 | $ | 45,274 | |||||

| March 31, 2019 | $ | 1,769 | $ | 11,659 | $ | 29,104 | $ | 42,532 |

The Company recorded depreciation in R&D materials and supplies in Research and Development expenses as disclosed in Note 2 l).

| Online Disruptive Technologies, Inc. |

| Notes to the Condensed Interim Consolidated Financial Statements |

| March 31, 2019 |

| (Unaudited) |

Note 5 – License and Research Funding Agreement

On July 25, 2012, the Company’s subsidiary Savicell entered into a License and Research Funding Agreement (“R&D Agreement”) with Ramot at Tel Aviv University (“Ramot”) pursuant to which:

- In the course of research performed at Tel-Aviv University ("TAU"), Prof. Fernando Patolsky has developed technology relating to early detection of diseases by measuring metabolic activity in the immune system;

- Savicell wishes to fund further research at TAU relating to such technology; and

- Savicell wishes to obtain a license from Ramot with respect to such technology and the results of such further funded research in order to develop and commercialize products in the diagnostics space, and Ramot wishes to grant the Company such license, all in accordance with the terms and conditions of this R&D Agreement.

Pursuant to the above noted R&D Agreement, Savicell funded research expenditures amounting to a total of $1,600,000 (paid in prior years).

- $81,000 within 5 business days of the R&D Agreement (paid)

- Before October 2012; $359,500 plus VAT as applicable (paid)

- Before January 3, 2013; $359,500 plus VAT as applicable (paid)

- Before April 3, 2013; $400,000 plus VAT as applicable (paid)

The payments originally due on April 3, 2013 and July 3, 2013 were postponed by the parties until such time as the funds were actually required in furtherance of the joint research and development initiatives. As of December 31, 2015, Savicell’s entire financing commitment has been met and no more expenditures are mandated by the R&D Agreement on behalf of Ramot. Savicell is continuing the clinical research within its own laboratory situated in Haifa, Israel.

In addition, during fiscal year 2013, Savicell agreed to issue to Ramot warrants (the “Warrants”) to purchase a number of ordinary shares of Savicell which shall together comprise 15% of issued shares of Savicell on an as-converted, fully diluted basis (equivalent to 1,765 Warrant Shares of Savicell). The Warrants shall be exercisable at an exercise price equal to the par value of the Warrant Shares, at any time and from time to time before Savicell completes a deemed liquidity event or the first underwritten offering of the Savicell's ordinary shares to the general public. The fair value of the Warrant Shares has been estimated at $1,698.97 per Warrant Share which is equivalent to the price at which Savicell has issued shares to third parties, for a total of $2,998,682 which has been included in research and development costs. As the exercise price inherent in the warrant certificate to purchase 1,765 common shares of Savicell is at nominal value, the warrant certificate is valued at the price of the subsequent equity issuance by Savicell ($1,698.97 per share) and the related common shares are considered to be issued and outstanding.

Upon successful development and commercialization of the technology, and in recognition of the rights and licenses granted to Savicell pursuant to this R&D Agreement, Savicell will be subject to (a) royalties based on the worldwide sales related to the technology; and (b) minimum annual royalties with respect to any calendar year following the first commercial sales as follows. The minimum annual royalties are subject to increases for each successive year.

During the quarter ended March 31, 2019, Savicell incurred research and development costs of $384,747 (March 31, 2018 -$266,822) which were included in the consolidated statements of operations and comprehensive loss.

| Online Disruptive Technologies, Inc. |

| Notes to the Condensed Interim Consolidated Financial Statements |

| March 31, 2019 |

| (Unaudited) |

Note 6 – Related Party Transactions

The Company completed the following related party transactions:

During the quarter ended March 31, 2019, the Company incurred consulting fees and salaries of $127,506 (for the quarter ended March 31, 2018 - $140,785) payable to its directors and officers.

As at March 31, 2019, there was $71,782 (December 31, 2018 – $94,045) payable to current officers and directors of the Company.

As at March 31, 2019, included in convertible debentures are amounts of $2,061,388 (December 31, 2018 - $2,061,388) that was entered into with two directors, one consultant, and one key management personnel of the Company (Note 8).

Note 7 – Promissory Note

During the year ended December 31, 2018, the Company issued a promissory note to the spouse of a consultant and former director of the Company for $50,000. The note bears interest at the rate of 10% per annum with an initial maturity date of the earlier of February 28, 2019 or the closing by the Company of an equity financing of at least $250,000. Interest incurred during the three months ended March 31, 2019 is $1,204 (for the quarter ended March 31, 2018 - $nil).

During the quarter ended the Company has repaid $10,000. The remaining balance is due on demand.

Note 8 – Convertible Debentures

On April 15, 2015, the Company entered into debt conversion option agreements with two directors, one consultant and one employee of the Company pursuant to which the Company collectively settled debts in the aggregate amount of $852,418. Pursuant to the agreements, these individuals may convert a portion or all of the debt amounts into common shares of the Company at a price per share of $0.055 over a seven year term.

On December 31, 2015, the Company entered into debt conversion option agreements with two directors, one consultant and one employee of the Company pursuant to which the Company collectively settled debts in the aggregate amount of $188,085 with an unsecured and non-interest bearing convertible debenture. Pursuant to the agreements, these individuals may convert a portion or all of the debt amounts into common shares of the Company at a price per share of $0.20 over a seven year term.

On December 31, 2016, the Company entered into debt conversion option agreements with two directors, one consultant and one employee of the Company pursuant to which the Company collectively settled debts in the aggregate amount of $172,895 with an unsecured and non-interest bearing convertible debenture. Pursuant to the agreements, these individuals may convert a portion or all of the debt amounts into common shares of the Company at a price per share of $0.20 over a seven-year term.

On December 31, 2018, the Company entered into debt conversion option agreements with two directors, one consultant and one employee of the Company pursuant to which the Company collectively settled debts in the aggregate amount of $843,266 with an unsecured and non- interest bearing convertible debenture. Pursuant to the agreements, these individuals may convert a portion or all of the debt amounts into common shares of the Company at a price per share of $0.20 over a ten-year term.

| Online Disruptive Technologies, Inc. |

| Notes to the Condensed Interim Consolidated Financial Statements |

| March 31, 2019 |

| (Unaudited) |

Note 8 – Convertible Debentures (continued)

The Company evaluated these convertible debentures for derivatives and determined that they do not qualify for derivative treatment. The Company then evaluated the debenture for beneficial conversion features and determined that the convertible debenture issued on April 15, 2015 does contain beneficial conversion features.

The aggregate intrinsic value of the beneficial conversion features was determined to be $852,418. This amount was recorded as a debt discount on April 15, 2015 that is being amortized over the life of the debenture at effective interest rate of 71%. The total debt discount amortization of $852,418 was fully recognised as of December 31, 2018.

| December 31, 2018 | Additions | March 31, 2019 | |||||||

| Giora Davidovits | $ | 860,293 | $ | - | $ | 860,293 | |||

| Eyal Davidovits | 402,861 | - | 402,861 | ||||||

| Irit Arbel | 355,746 | - | 355,746 | ||||||

| Robbie Manis | 437,763 | - | 437,763 | ||||||

| Total | $ | 2,056,663 | $ | - | $ | 2,056,663 |

| December 31, 2018 | Additions | March 31, 2019 | |||||||

| Convertible debentures | $ | 2,056,663 | $ | - | $ | 2,056,663 | |||

| Convertible discount | (852,418 | ) | - | (852,418 | ) | ||||

| Net convertible debentures | 1,204,245 | - | 1,204,245 | ||||||

| Interest accretion | 852,418 | - | 852,418 | ||||||

| Exchange difference | 4,725 | - | 4,725 | ||||||

| Balance | $ | 2,061,388 | $ | - | $ | 2,061,388 |

Note 9 – Convertible Loan

On March 8, 2018, the Company issued one convertible loan in the face amount of $350,000 to two current shareholders. The convertible loan matures after two years and bears interest at a rate of 10% per annum. The convertible loan may be converted into common shares of the Company at the earlier of fifteen days after the maturity date and the date the Company raises gross proceeds of $5,000,000 through private placements or files a registration statement with the Securities and Exchange Commission in the United States. The conversion price is $0.20 per share or such lesser price that the Company may issue additional shares to third parties, and, on conversion or repayment of the convertible loan, the Company will issue warrants in a number that is equal to the amount of the loan divided by the conversion price, exercisable at the funding price. In addition, the Company will reset the prior investment price issuable to each Lender for the amount equal to the lower of the prior investment made by such lenders and the amount invested by such lenders under this loan agreement. Such lower amount is referred to as “ Covered Investment”. The incremental number of common shares to be issued to the lenders by the Company is the Covered Investment divided by the reduced share price less the number of common shares previously issued by the Company in respect of the Covered Investment.

| Online Disruptive Technologies, Inc. |

| Notes to the Condensed Interim Consolidated Financial Statements |

| March 31, 2019 |

| (Unaudited) |

Note 9 – Convertible Loan (continued)

During the year ended December 31, 2018, the Company issued four convertible loans in the aggregate amount of $187,000 to four individual lenders. The debentures are interest bearing and have a term to maturity of two years. The loans are convertible into common shares of the Company at the lower of $0.20 per share and the price of a future financing initiative. Moreover, warrants will be granted to the lenders upon the earlier of repayment of the loans or conversion thereof, in a number that is equal to the amount of the convertible loans divided by the conversion price, exercisable at the funding price.

The Company evaluated these convertible loans for derivatives and determined that they do not qualify for derivative treatment.

Note 10 – Equity

Common Shares

On April 17, 2018, stock options previously granted by the Company were exercised, resulting in the issuance of 481,179 common shares at $0.01 per share for total proceeds of $4,812.

On June 20, 2018, the Company issued 117,660 shares at $0.20 per share for an aggregate amount of $23,532 in exchange for consulting services rendered during the year ended December 31, 2018.

On August 24, 2018, the Company issued 16,665 common shares at $0.20 per share for total proceeds of $3,333 for stock options that were exercised during the year ended December 31, 2018.

On August 27, 2018, stock options previously granted by the Company to a consultant were exercised resulting in the issuance of 800,000 common shares at $0.01 per share. The Company will receive consulting services from this consultant in 2019 in lieu of receiving cash proceeds from this issuance.

On September 7, 2018, the Company issued an aggregate of 2,300,000 units at a price of $0.20 per unit for gross proceeds of $460,000. Each unit is comprised of one common share of the Company and one non-transferable common share purchase warrant with each warrant being exercisable into one additional share at an exercise price of $0.20 per warrant share for a period of two years after the closing of the financing.

On December 18, 2018, the Company issued 78,625 shares at $0.20 per share for an aggregate amount of $15,725 in respect of future consulting services to be rendered up from January 1, 2019 to December 31, 2019.

On December 19, 2018, the Company issued an aggregate of 605,585 units at a price of $0.20 per unit. The total proceeds consist of $95,000 which was previously recorded as a share subscription received on the balance sheet with the remaining gross proceed of $26,117 received in 2018. Each unit comprises one share and one non-transferable common stock share purchase warrant. Each warrant entitles the holder to acquire one additional share of common stock at a price of $0.20 per share until December 19, 2020.On December 19, 2018, the Company issued an aggregate of 500,000 units at a price of $0.20 per unit for total proceeds of $100,000. Each unit comprises one share and one non-transferable common stock share purchase warrant. Each warrant entitles the holder to acquire of $0.20 per share until December 19, 2020.

| Online Disruptive Technologies, Inc. |

| Notes to the Condensed Interim Consolidated Financial Statements |

| March 31, 2019 |

| (Unaudited) |

Note 10 – Equity (continued)

Common Shares (continued)

On March 4, 2019, the Company issued an aggregate of 1,252,000 common shares at a price of $0.20 per share for gross proceeds of $250,400.

On March 4, 2019, the Company issued 50,000 shares at $0.20 per share for an aggregate amount of $10,000, for proceeds received in previous year.

On March 4, 2019, an employee exercised 500,000 options and accordingly received 500,000 common shares at an exercise price of $0.01 per share for aggregate consideration of $5,000.

As at March 31, 2019, the Company has 125,865,122 common shares (December 31, 2018 – 124,063,122) issued and outstanding.

Warrants

A summary of warrants as at March 31, 2019 and December 31, 2018 is as follows:

| Warrant Outstanding | ||||||

| Weighted Average | ||||||

| Number of warrant | Exercise Price | |||||

| Balance, December 31, 2018 | 5,186,835 | $ | 0.20 | |||

| Issued | - | 0.20 | ||||

| Balance, March 31, 2019 | 5,186,835 | $ | 0.20 |

| Number Outstanding | Weighted Average | Expiry Date | Weighted Average |

| Exercise Price | Remaining Life | ||

| 1,693,750 | $0.20 | April 3, 2019 | 0.00 |

| 2,300,000 | $0.20 | September 7, 2020 | 1.44 |

| 87,500 | $0.20 | September 17, 2021 | 2.47 |

| 1,105,585 | $0.20 | December 19, 2020 | 1.72 |

| 5,186,835 | $0.20 | 1.05 |

Preferred Shares

The Company has authorized 20,000,000 preferred shares at a par value of $0.001 per share. No preferred shares have been issued by the Company and accordingly none are outstanding.

Stock Options

In August 2015 the Company granted a total of 1,730,000 stock options to four advisors of the Company. The stock options are exercisable at an exercise price of $0.20 per share and may be exercised for six-seven years. One third of the options will vest at end of each completed year for which the consultant provides the services. The options were valued based on the Black Scholes model. For quarter ended March 31, 2019, the Company recorded stock based compensation of nil (2018: $9,382) for such options.

| Online Disruptive Technologies, Inc. |

| Notes to the Condensed Interim Consolidated Financial Statements |

| March 31, 2019 |

| (Unaudited) |

Note 10 – Equity (Continued)

Stock Options (continued)

On November 22, 2015 the Company granted a total of 50,000 stock options to an employee. The stock options are exercisable at an exercise price of $0.20 per share and may be exercised for seven years. One third of the options will vest at the grant date of each of November 22, 2016, November 22, 2017 and November 22, 2018 that the employee remains an employee of the Company or its subsidiaries. The options were valued based on the Black Scholes model. For quarter ended March 31, 2019, the Company recorded stock based compensation of nil (2018: $3,392) for such options.

On December 1, 2015 the Company granted a total of 125,000 stock options to an employee. The stock options are exercisable at an exercise price of $0.20 per share and may be exercised for seven years. One third of the options will vest at the grant date of each of December 1, 2016, December 1, 2017 and December 1, 2018 that the employee remains an employee of the Company or its subsidiaries. The options were valued based on the Black Scholes model. For quarter ended March 31, 2019, the Company recorded stock based compensation of nil (2018: $1,987) for such options.

On December 6, 2015 the Company granted a total of 100,000 stock options to an employee. The stock options are exercisable at an exercise price of $0.20 per share and may be exercised for seven years. One third of the options will vest at the grant date of each of December 6, 2016, December 6, 2017 and December 6, 2018 that the employee remains an employee of the Company or its subsidiaries. The options were valued based on the Black Scholes model. For quarter ended March 31, 2019, the Company recorded stock based compensation of nil (2018: $1,658) for such options.

On February 15, 2016 the Company granted a total of 50,000 stock options to an employee. The stock options are exercisable at an exercise price of $0.20 per share and may be exercised for seven years. One third of the options will vest on each of the first, second and third anniversaries of the date of grant provided the employee remains an employee of the Company or its subsidiaries. The options were valued based on the Black Scholes model. During the quarter ended March 31, 2018, 16,667 options were exercised at $0.20 per share resulting in total proceeds of $3,333. The remainder options 33,333 were cancelled and no stock based compensation was recorded for the quarter.

On March 7, 2016 the Company granted a total of 75,000 stock options to two employees. The stock options are exercisable at an exercise price of $0.20 per share and may be exercised for seven years. One third of the options will vest on each of the first, second and third anniversaries of the date of grant provided the employee remains an employee of the Company or its subsidiaries. The options were valued based on the Black Scholes model. For year quarter ended March 31, 2019, the Company recorded stock based compensation of $126 (2018: $843) for such options.

On May 5, 2016 the Company granted a total of 150,000 stock options to an consultant. The stock options are exercisable at an exercise price of $0.20 per share and may be exercised for ten years. One third of the options will vest on each of the first, second and third anniversaries of the date of grant provided the employee remains an employee of the Company or its subsidiaries. The options were valued based on the Black Scholes model. For the quarter ended March 31, 2019 the Company recorded stock based compensation of $456 (2018: $2,086) for such options.

| Online Disruptive Technologies, Inc. |

| Notes to the Condensed Interim Consolidated Financial Statements |

| March 31, 2019 |

| (Unaudited) |

Note 10 – Equity (Continued)

Stock Options (continued)

On June 6, 2016 the Company granted a total of 800,000 stock options to a consultant. The stock options are exercisable at the exercise price of $0.20 per share and may be exercised for five years. 480,000 of the options so granted will vest as to one quarter of such options at the end of each completed year that the consultant provides the services. The remaining 320,000 options will be fully vested when the consultant has completed the provision of a minimum of 600 blood samples of lung cancer and control patients during the 4 years following June 6, 2016. One twelfth of these options will vest upon each 50 blood samples having been delivered by the consultant to the Company. The options were valued based on the Black Scholes model. For the quarter ended March 31, 2019, 533,337 option vested and the Company recorded stock based compensation of $5,454 (2018: $12,434) for such options.

On November 1, 2016, the Company granted a total of 360,000 stock options to an employee. The stock options are exercisable at an exercise price of $0.20 per share and may be exercised for seven years. One half of the options will vest immediately and one-half shall vest on the on the first anniversary date of grant provided the grantee remains a board member of the Company or its subsidiaries. The options were valued based on the Black Scholes model. For the quarter ended March 31, 2019, the Company recorded stock based compensation of nil (2017: $21,491).

On May 31, 2017, the Company granted a total of 875,000 stock options to six employees. The stock options are exercisable at an exercise price of $0.20 per share and may be exercised for seven years. One third of the options will vest on each of the first, second and third anniversaries of the date of grant provided the employee remains an employee of the Company or its subsidiaries. The options were valued based on the Black Scholes model. For the quarter ended March 31, 2019, the Company recorded stock based compensation of $7,918 (2018: $47,930) for such options.

On July 2, 2017, the Company granted a total of 150,000 stock options to an employee. The stock options are exercisable at an exercise price of $0.20 per share and may be exercised for seven years. One third of the options will vest on each of the first, second and third anniversaries of the grant date provided the provided the employee remains an employee of the Company or its subsidiaries. The options were valued based on the Black Scholes model. For the quarter ended March 31, 2019, the Company recorded stock based compensation of $1,408 (2018: $9,144) for such options.

On July 12, 2017, the Company granted a total of 260,000 stock options to an employee. The stock options are exercisable at an exercise price of $0.20 per share and may be exercised for ten years. 50,000 options vested on grant date. Off the remaining 210,000, one third of the options will vest on each of the first, second and third anniversaries of the grant date provided the employee remains a consultant of the Company or its subsidiaries. The options were valued based on the Black Scholes model. For the quarter ended March 31, 2019, the Company recorded stock based compensation of $2,075 (2018: $12,314) for such options.

| Online Disruptive Technologies, Inc. |

| Notes to the Condensed Interim Consolidated Financial Statements |

| March 31, 2019 |

| (Unaudited) |

Note 10 – Equity (Continued)

Stock Options (continued)

On February 13, 2018, the Company granted a total of 231,250 stock options to a consultant. The stock options vest immediately and are exercisable at an exercise price of $0.20 per share and may be exercised over five years. The options were valued based on the Black Scholes model. For the quarter ended March 31, 2019, the Company recorded stock based compensation of nil (2018: $26,317) for such options.

On June 22, 2018, the Company granted a total of 4,100,000 stock options to a group of employees. The stock options are exercisable at an exercise price of $0.20 per share and may be exercised for seven years. One third of the options will vest on each of the first, second and third anniversaries of the date of grant, namely June 22, 2019, June 22, 2020 and June 22, 2021 provided the employees remains an employee of the Company or its subsidiaries. The options were valued based on the Black Scholes model. For the quarter ended March 31, 2019, the Company recorded stock based compensation of $85,968 (2018: $182,608) for such options.

On June 22, 2018, the Company granted a total of 1,500,000 stock options to an employee. The stock options are exercisable at an exercise price of $0.20 per share and may be exercised for seven years. One quarter of the options will vest immediately. The remaining 1,125,000 options will vest in equal amounts on each of June 22, 2019, June 22, 2020 and June 22, 2021 provided the employee remains an employee of the Company or its subsidiaries. The options were valued based on the Black Scholes model. For the quarter ended March 31, 2019, the Company recorded stock based compensation of $23,487 (2018; $102,090) for such options.

On June 22, 2018, the Company granted a total of 200,000 stock options to a consultant. The stock options are exercisable at an exercise price of $0.20 per share and may be exercised for seven years. One third of the options will vest on each of June 22, 2019, June 22, 2020 and June 22, 2021. The options were valued based on the Black Scholes model. For the quarter ended March 31, 2019, the Company recorded stock based compensation of $3,953 (2018: $8,432) for such options.

On June 22, 2018, the Company granted a total of 4,000,000 stock options to a consultant. The stock options are exercisable at an exercise price of $0.20 per share and may be exercised for seven years. One quarter of the options vest on the date of grant, and a further quarter will vest on each of June 22, 2019, June 22, 2020 and June 22, 2021. The options were valued based on the Black Scholes model. For the quarter ended March 31, 2019, the Company recorded stock based compensation of $59,288 (2018: $265,751) for such options.

On June 22, 2018, the Company granted a total of 4,600,000 stock options to a group of employees, consultants and directors. The stock options are exercisable at an exercise price of $0.20 per share and may be exercised for seven years. The options vest immediately on grant date. The options were valued based on the Black Scholes model. For the quarter ended March 31, 2019, the Company recorded stock based compensation of nil (2018: $640,896) for such options.

On July 18, 2018, the Company granted a total of 360,000 stock options to a consultant. The stock options are exercisable at an exercise price of $0.20 per share and may be exercised for ten years. 150,000 of the options vest on the date of grant, and one third of the options will vest at the end of each year of service as at July 18, 2019, 2020 and 2021. The options were valued based on the Black Scholes model. For the quarter ended March 31, 2019, the Company recorded stock based compensation of $5,025 (2018: $34,548) for such options.

| Online Disruptive Technologies, Inc. |

| Notes to the Condensed Interim Consolidated Financial Statements |

| March 31, 2019 |

| (Unaudited) |

Note 10 – Equity (Continued)

Stock Options (continued)

On September 12, 2018, the Company granted a total of 150,000 stock options to a consultant. The stock options are exercisable at an exercise price of $0.20 per share and may be exercised for ten years. 30,000 of the options vest on the date of grant, and 40,000 of the options will vest at the end of each year of service as at September 12, 2019, 2020 and 2021. The options were valued based on the Black Scholes model. For the quarter ended March 31, 2019, the Company recorded stock based compensation of $2,966 (2018: $8,710) for such options.

On September 14, 2018, the Company granted a total of 105,000 stock options to a consultant. The stock options are exercisable at an exercise price of $0.20 per share and expired on April 25, 2023. 15,000 options vested at the end of each 7 months of services. The options were valued based on the Black Scholes model. For the quarter ended March 31, 2019, the Company recorded stock based compensation of $1,727 (2018: $2,072) for such options.

On November 22, 2018, the Company granted a total of 250,000 stock options to a consultant. The stock options vest immediately and are exercisable at an exercise price of $0.20 per share and may be exercised over seven years. The options were valued based on the Black Scholes model. For the quarter ended March 31, 2019, the Company recorded stock based compensation of nil (2018: $212,893) for such options.

The fair value of each option grant is calculated using the following assumptions:

| 2019 | 2018 | |

| Expected life – year | 5-10 | 5-10 |

| Interest rate | 1.53% - 2.86% | 1.53% - 2.86% |

| Volatility | 55.54% - 77.08% | 65.68% - 94.22% |

| Dividend yield | --% | --% |

| Forfeiture rate | --% | --% |

| Weighted average fair value of options granted | $0.13 | $0.13 |

| Online Disruptive Technologies, Inc. |

| Notes to the Condensed Interim Consolidated Financial Statements |

| March 31, 2019 |

| (Unaudited) |

Note 10 – Equity (Continued)

Stock Options (continued)

| Number of Options | Weighted | Expire date | ||||||||

| Average Exercise | ||||||||||

| Price | ||||||||||

| Balance, December 31, 2016 | 17,345,896 | $ | 0.05 | |||||||

| Granted, on May 31, 2017 | 875,000 | 0.20 | May 31, 2024 | |||||||

| Expired, July 1, 2017 | (75,000 | ) | 0.20 | July 1, 20177 | ||||||

| Granted, on July 2, 2017 | 150,000 | 0.20 | July 2, 2024 | |||||||

| Granted, on July 12, 2017 | 260,000 | 0.200 | July 12, 2027 | |||||||

| Exercised, on September 25, 2017 | (150,000 | ) | 0.01 | September 25, 2017 | ||||||

| Balance, December 31, 2017 | 18,405,896 | $ | 0.04 | |||||||

| Granted, on February 13, 2018 | 231,250 | 0.20 | February 13, 2023 | |||||||

| Exercised, on January 28, 2018 | (16,665 | ) | 0.20 | |||||||

| Cancelled, on January 28 2018 | (33,335 | ) | 0.20 | |||||||

| Exercised, on March 20, 2018 | (481,179 | ) | 0.001 | |||||||

| Granted, on June 22, 2018 | 14,400,000 | 0.20 | June 22, 2025 | |||||||

| Granted, on July 18, 2018 | 360,000 | 0.20 | July 18, 2028 | |||||||

| Exercised, on August 14, 2018 | (800,000 | ) | 0.01 | |||||||

| Granted, on September 12, 2018 | 150,000 | 0.20 | September 12, 2028 | |||||||

| Granted, on September 14, 2018 | 105,000 | 0.20 | April 25, 2023 | |||||||

| Expired, on September 28, 2018 | (25,000 | ) | 0.20 | |||||||

| Granted, on November 22, 2018 | 250,000 | 0.20 | November 22, 2025 | |||||||

| Balance, December 31, 2018 | 32,545,967 | $ | 0.13 | |||||||

| Exercised on March 04, 2019 | (500,000 | ) | 0.20 | |||||||

| Balance, March 31, 2019 | 32,045,967 | $ | 0.13 |

| Online Disruptive Technologies, Inc. |

| Notes to the Condensed Interim Consolidated Financial Statements |

| March 31, 2019 |

| (Unaudited) |

Note 10 – Equity (Continued)

Stock Options (continued)

| Outstanding March 31, 2019 | Exercisable as at March 31, 2019 | ||||||||||||||||||||

| 30, 2015 | Weighted | Weighted | |||||||||||||||||||

| Weighted | Average | Weighted | Average | ||||||||||||||||||

| Average | Remaining | Average | Remaining | ||||||||||||||||||

| Exercise | Number of | Exercise | Contractual | Number of | Exercise | Contractual | |||||||||||||||

| Price | Options | Price | Life (years) | Options | Price | Life (years) | |||||||||||||||

| $ | 0.01 | 9,750,000 | $ | 0.01 | 3.42 | 9,750,000 | $ | 0.01 | 3.42 | ||||||||||||

| 0.01 | 1,924,717 | 0.01 | 1.62 | 1,924,717 | 0.01 | 1.62 | |||||||||||||||

| 0.20 | 150,000 | 0.20 | 2.10 | 150,000 | 0.20 | 1.07 | |||||||||||||||

| 0.20 | 120,000 | 0.20 | 3.41 | 120,000 | 0.20 | 2.41 | |||||||||||||||

| 0.20 | 1,610,000 | 0.20 | 3.36 | 1,610,000 | 0.20 | 3.37 | |||||||||||||||

| 0.20 | 75,000 | 0.20 | 3.42 | 75,000 | 0.20 | 3.42 | |||||||||||||||

| 0.20 | 50,000 | 0.20 | 3.65 | 50,000 | 0.20 | 3.65 | |||||||||||||||

| 0.20 | 125,000 | 0.20 | 3.67 | 125,000 | 0.20 | 3.67 | |||||||||||||||

| 0.20 | 100,000 | 0.20 | 3.69 | 100,000 | 0.20 | 3.69 | |||||||||||||||

| 0.20 | 75,000 | 0.20 | 3.94 | 75,000 | 0.20 | 3.94 | |||||||||||||||

| 0.20 | 150,000 | 0.20 | 7.10 | 110,000 | 0.20 | 7.10 | |||||||||||||||

| 0.20 | 800,000 | 0.20 | 2.19 | 480,000 | 0.20 | 2.19 | |||||||||||||||

| 0.20 | 360,000 | 0.20 | 4.59 | 360,000 | 0.20 | 4.59 | |||||||||||||||

| 0.20 | 850,000 | 0.20 | 5.17 | 283,333 | 0.20 | 5.17 | |||||||||||||||

| 0.20 | 150,000 | 0.20 | 5.21 | 50,000 | 0.20 | 5.26 | |||||||||||||||

| 0.20 | 260,000 | 0.20 | 8.23 | 120,000 | 0.20 | 8.29 | |||||||||||||||

| 0.20 | 231,250 | 0.20 | 3.88 | 231,250 | 0.20 | 3.88 | |||||||||||||||

| 0.20 | 4,100,000 | 0.20 | 6.23 | - | - | 6.23 | |||||||||||||||

| 0.20 | 1,500,000 | 0.20 | 6.24 | 375,000 | 0.20 | 6.23 | |||||||||||||||

| 0.20 | 200,000 | 0.20 | 6.24 | - | - | 6.23 | |||||||||||||||

| 0.20 | 4,000,000 | 0.20 | 6.24 | 1,000,000 | 0.20 | 6.23 | |||||||||||||||

| 0.20 | 4,600,000 | 0.20 | 6.24 | 4,600,000 | 0.20 | 6.23 | |||||||||||||||

| 0.20 | 360,000 | 0.20 | 9.31 | 150,000 | 0.20 | 9.31 | |||||||||||||||

| 0.20 | 105,000 | 0.20 | 4.07 | 15,000 | 0.20 | 4.07 | |||||||||||||||

| 0.20 | 150,000 | 0.20 | 9.46 | 30,000 | 0.20 | 9.46 | |||||||||||||||

| 0.20 | 250,000 | 0.20 | 6.65 | 250,000 | 0.20 | 6.65 | |||||||||||||||

| 32,045,967 | $ | 0.13 | 4.78 | 22,034,300 | $ | 0.10 | 4.16 | ||||||||||||||

| Online Disruptive Technologies, Inc. |

| Notes to the Condensed Interim Consolidated Financial Statements |

| March 31, 2019 |

| (Unaudited) |

Note 10 – Equity (Continued)

Non-Controlling Interests

The Company’s subsidiary, Savicell, granted a third party a warrant certificate to purchase 1,765 common shares of Savicell that initially represented 15% of the underlying common equity of Savicell. In the course of its initial equity issuances up to October 30, 2012 (the “Initial Closing”), Savicell issued a total of 592 ordinary shares at $1,698.97 per share to the non-related third party representing approximately 4.79% of the fully diluted common equity of Savicell for aggregate proceeds of $1,005,795. The Savicell investors are entitled to convert their Savicell shares into common shares of ODT (1:10,625) at a price equal to 80% of the per share pricing of the first completed ODT financing of over $500,000 conducted after July 1, 2012 (the “Financing Price”) provided that for purposes of such conversion, the deemed maximum Financing Price shall be the per share price of the common shares of ODT based on (a) an aggregate ODT equity valuation of $30,000,000; and (b) the number of common shares of ODT outstanding at the time of the financing. Savicell continued its equity issuances following the Initial Closing.

As at December 31, 2012, Savicell had issued a total of 684 shares at $1,698.97 per share representing approximately 5.11% of the fully diluted common equity of Savicell for aggregate proceeds of $1,162,192.

During the year ended December 31, 2013, Savicell issued a total of 760 shares at $1,700 per share representing approximately 5.68% of the fully diluted common equity of Savicell for aggregate proceeds of $1,292,000.

During the year ended December 31, 2014, Savicell issued a total of 183 shares at $1,699 per share representing approximately 1.37% of the fully diluted common equity of Savicell for aggregate proceeds of $310,977.

During the year ended December 31, 2015, Savicell issued a total of 417 shares at $1,700 per share to third parties for aggregate proceeds of $709,087. As at December 31, 2015, Savicell also issued 516 shares at $1,700 to ODT, which of $532,084 has not been received as at December 31, 2015. In addition, Savicell investors exchanged 588 Savicell shares for 6,248,672 of ODT common shares with ODT receiving the Savicell shares so exchanged.

During the year ended December 31, 2016, Savicell investors exchanged 1,132 Savicell shares for 12,026,654 of ODT common shares with ODT receiving the Savicell shares so exchanged. As at December 31, 2016, Savicell received $1,786,656 from ODT and issued 1,051 shares to ODT in return.

During the year ended December 31, 2017, Savicell investors exchanged 27 Savicell shares for 288,830 of ODT common shares with ODT receiving the Savicell shares so exchanged. Savicell issued 387 shares to settle inter-company debts with ODT.

During the year ended December 31, 2018, Savicell issued 1,467 shares to settle inter-company debts with ODT. The Company, the Warrant holder and the Savicell investors held underlying interests in the equity of Savicell of 87.81%, 10.43% and 1.76%, respectively (December 31, 2017 - 86.65%, 11.42% and 1.93%).

| Online Disruptive Technologies, Inc. |

| Notes to the Condensed Interim Consolidated Financial Statements |

| March 31, 2019 |

| (Unaudited) |

Note 10 – Equity (Continued)

Non-Controlling Interests (continued)

As at March 31, 2019, The Company, the Warrant holder and the Savicell investors held underlying interests in the equity of Savicell of 87.81%, 10.43% and 1.76%, respectively (December 31, 2018 – 87.81%, 10.43% and 1.76%).

Savicell’s Common Shares

| Number | Amount | |||||

| of Shares | ||||||

| Balance, December 31, 2016 | 15,063 | 5,606,110 | ||||

| Shares issued to settle inter-company debts | 387 | 658,711 | ||||

| Balance, December 31, 2017 | 15,450 | 6,264,821 | ||||

| Shares issued to settle inter-company debts | 1,467 | 2,494,219 | ||||

| Balance, March 31, 2019 and December 31, 2018 | 16,917 | 8,759,040 |

As the exercise price inherent in the warrant certificate to purchase 1,765 common shares of Savicell is at nominal value, the warrant certificate is valued at the price of the subsequent equity issuance by Savicell ($1,698.97 per share) and the related common shares are considered to be issued and outstanding.

Note 11 – Loss per Share

We present both basic and diluted income per share on the face of our consolidated statements of operations. Basic and diluted income per share are calculated as follows:

| March 31, 2019 | December 31, | |||||

| 2018 | ||||||

| Net loss | $ | (505,771 | ) | $ | (3,587,653 | ) |

| Weighted average common shares outstanding: | ||||||

| Basic and diluted | 124,618,189 | 120,542,611 | ||||

| Net loss per common share: | ||||||

| Basic and diluted | $ | (0.00 | ) | $ | (0.03 | ) |

Certain stock options whose terms and conditions are described in Note 10, “Stock Options” could potentially dilute basic and dilute loss per share in the future, but were not included in the computation of diluted loss per share because to do so would have been anti-dilutive. Those anti-dilutive options are as follows.

| March 31, 2019 | December 31, 2018 | |||||

| Anti-dilutive options | 22,034,300 | 22,570,970 |

| Online Disruptive Technologies, Inc. |

| Notes to the Condensed Interim Consolidated Financial Statements |

| March 31, 2019 |

| (Unaudited) |

Note 12 – Commitments and Guarantees

The Company was not a guarantor to any parties as at March 31, 2019.

| 1. |