UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10

Amendment No. 1

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or 12(g) of the Securities Exchange Act of 1934

MAN AHL FUTURESACCESS LLC

(Exact name of registrant as specified in its charter)

|

DELAWARE

(State or other jurisdiction of

incorporation or organization)

|

27-2365025

(I.R.S. Employer

Identification No.)

|

c/o MERRILL LYNCH ALTERNATIVE INVESTMENTS LLC

4 World Financial Center

250 Vesey Street, 10th Floor

New York, NY 10080

Barbra E. Kocsis

Merrill Lynch Alternative Investments LLC

1200 Merrill Lynch Drive (1B)

Pennington, NJ 08534

(609) 274-5838

__________________________

Copies to:

Mark Borrelli

Sidley Austin LLP

One South Dearborn

Chicago, Illinois 60603

Securities to be registered pursuant to Section 12(b) of the Act: NONE

Securities to be registered pursuant to Section 12(g) of the Act: Units of Limited Liability Company Interest

(Title of Class)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ___ | Accelerated filer ___ | ||

| Non-accelerated filer ___ | Smaller reporting company X |

TABLE OF CONTENTS

|

Item 1:

|

Business

|

1

|

|

Item 1A:

|

Risk Factors

|

24

|

|

Item 2:

|

Financial Information

|

24

|

|

Item 3:

|

Properties

|

24

|

|

Item 4:

|

Security Ownership of Certain Beneficial Owners and Management

|

25

|

|

Item 5:

|

Directors and Executive Officers

|

25

|

|

Item 6:

|

Executive Compensation

|

28

|

|

Item 7:

|

Certain Relationships and Related Transactions, and Director Independence

|

28

|

|

Item 8:

|

Legal Proceedings

|

29

|

|

Item 9:

|

Market Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters

|

29

|

|

Item 10:

|

Recent Sales of Unregistered Securities

|

30

|

|

Item 11:

|

Description of Registrant’s Securities to be Registered

|

30

|

|

Item 12:

|

Indemnification of Directors and Officers

|

35

|

|

Item 13:

|

Financial Statements and Supplementary Data

|

36

|

|

Item 14:

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

36

|

|

Item 15:

|

Financial Statements and Exhibits

|

36

|

-i-

Item 1: BUSINESS

|

(a)

|

General Development of Business

|

Man AHL FuturesAccess LLC (the “Fund”) is a Delaware limited liability company, formed on April 1, 2010, that retains a single professional commodity trading advisor (“CTA”) to manage the Fund’s speculative trading of commodity futures and forward contracts, other commodity interests and options on each of the foregoing. Merrill Lynch Alternative Investments LLC, a Delaware limited liability company (the “Sponsor”), is the sponsor of the Fund. Man-AHL (USA) Ltd. (the “Trading Advisor”) is the CTA of the Fund, and is not affiliated with the Sponsor or the Fund.

The Fund is part of the Merrill Lynch FuturesAccessSM Program (“FuturesAccess”), which has been sponsored and designed by the Sponsor to make available to eligible investors different futures funds, including the Fund (“FuturesAccess Funds”), for direct investment or investment through a fund of funds.

The Fund will file annual, quarterly and current reports and certain other information with the Securities and Exchange Commission (“SEC”). Persons may read and copy any documents the Fund files at the SEC’s public reference room at 100 F Street, NE, Washington D.C. 20549 on official business days between the hours of 10 a.m. and 3 p.m. You may obtain information on the operation at the public reference room by calling the SEC at 1-800-SEC-0330. The SEC maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov. A copy of any such filings will be provided free of charge to any investor in the Fund (“Investor”) upon written request to the Fund at its business address, c/o Merrill Lynch Alternative Investments LLC, 4 World Financial Center 250 Vesey Street, 10th Floor New York, NY 10080.

Plan of Operation

The Fund commenced trading on August 2, 2010. The Fund’s objective is to capitalize on price movements in a diversified portfolio of highly liquid stock index, interest rate, metal, energy and agricultural futures, as well as over-the-counter dealer and interbank currency contracts.

Under its limited liability company operating agreement (the “Operating Agreement”), the Fund has delegated the exclusive management of all aspects of the business and administration of the Fund to the Sponsor. The Sponsor is registered with the Commodity Futures Trading Commission (“CFTC”) as a commodity pool operator (“CPO”) and as a CTA and is a member of the National Futures Association (“NFA”) in such capacities. The Sponsor is also registered with the SEC as an investment adviser.

The Fund’s disclosure document was prepared in accordance with applicable CFTC rules and has been filed with and reviewed by NFA prior to its distribution to potential investors. The Fund’s units of limited liability company interest (“Units”) are privately offered pursuant to Rule 506 under Regulation D of the Securities Act of 1933, as amended (the “Securities Act”).

The Fund’s assets may be used to engage in the trading of commodity futures and forward contracts, including currency forward contracts, other commodity interests and options on each of the foregoing pursuant to the investment methodology of the Trading Advisor. The Sponsor was responsible for selecting and will be responsible for monitoring the Trading Advisor, and it may replace the Trading Advisor or terminate the Fund in the future, in its sole discretion. The Sponsor selected the Trading Advisor based on the Sponsor’s diligence on the Trading Advisor, the markets in which the Trading Advisor is active and the Trading Advisor’s past performance. The Sponsor may add replacement or additional trading advisors, but is unlikely to do so absent removal or resignation of the current Trading Advisor.

The Trading Advisor attempts to achieve for the Fund the investment objective of its trading model, the Man-AHL Diversified Program, subject to any differences resulting from restrictions placed on the Fund’s trading portfolio due to the Sponsor’s disapproving or delaying its approval of an instrument pursuant to the process set out in the advisory agreement with the Trading Advisor (the “Trading Program”), and further described below under Item 1(c) “Narrative Description of Business ─ The Trading Advisor.” The Trading Program employs a systematic, statistically-based investment strategy that is designed to identify and capitalize on price movements and inefficiencies in markets around the world. A stable and robust trading and implementation infrastructure is then employed to capitalize on these trading opportunities. Two other accounts managed by the Trading Advisor currently use the Trading Program. The Trading Advisor believes that its management of such other accounts will not adversely affect the number of such opportunities available to the Fund. The trading systems are quantitative and primarily directional in nature, meaning that investment decisions are entirely driven by mathematical models based on market trends and other historic relationships. Trading takes place around the clock and real-time price information is used to respond to price moves across a diverse range of global markets. The Trading Advisor invests in a diversified portfolio of instruments which may include futures, options on futures, forward contracts, swaps and other financial derivatives, both on and off exchange. The interests underlying the investments in which the Trading Advisor invests include, without limitation, stock indices, bonds, currencies, short-term interest rates, energies, metals and agriculturals.

When a futures or options on futures position is established, “initial margin” is deposited. On most exchanges, at the close of each trading day “variation margin,” representing the unrealized gain or loss on the open positions, is either credited to or debited from a trader’s account. If “variation margin” payments cause a trader’s “initial margin” to fall below “maintenance margin” levels, a “margin call” is made, requiring the trader to deposit additional margin or have its position closed out. Margin is also required to be posted with counterparties when making investments through forward, swaps or other over-the-counter instruments. In general, approximately 10% to 20% of the Fund’s assets are expected to be committed as margin for futures or options on futures positions at any one time and 5% to 10% to be committed as margin for forward, swaps or other over-the-counter positions, although these amounts could occasionally be substantially higher. Fund assets not committed to margin will be held in cash or cash equivalents and will earn interest as further described below under Item 1(c) “Narrative Description of Business ─ Use of Proceeds and Cash Management Income.” The Fund is not required to invest any minimum percentage of its assets in its account with the Trading Advisor,

2

although the Sponsor intends to invest all of the Fund’s assets in the Fund’s account with the Trading Advisor except for any amount the Sponsor determines is necessary or advisable to pay expenses or redemptions or to use for other operating purposes.

In addition to emphasizing sector and market diversification, the Trading Program has been constructed to achieve diversification by combining various systems. The systems are driven by powerful computerized processes or trading algorithms, most of which work by sampling prices in real time and measuring price momentum and breakouts. In aggregate, the systems run more than 3,000 price samples each day spread across the 100 or so markets traded. The trading algorithms aim mainly to capture price trends and close out positions when there is a high probability of a different trend developing, although the Trading Program may include algorithmic systems based on certain forms of quantitative fundamental data that can be captured efficiently, such as interest rate data.

Another important aspect of diversification is the fact that the various systems generate signals across different timeframes, ranging from two to three days to several months, which is designed to reduce the risk of the Trading Program. In line with the principle of diversification, the approach to portfolio construction and asset allocation is premised on the importance of deploying investment capital across the full range of sectors and markets. Particular attention is paid to correlation of markets and sectors, expected returns, trading costs and market liquidity. Portfolios are regularly reviewed and, when necessary, adjusted to reflect changes in these factors. The Trading Advisor also has a process for adjusting its market risk exposure in real time to reflect changes in the volatility of individual markets.

The Trading Advisor’s trading signals are generated 100% systematically and therefore have no discretionary trading during drawdowns or other time periods.

The Trading Program is the product of continuing research and development performed by the Trading Advisor.

The Fund’s fiscal year ends on December 31.

As the Fund trades primarily in commodity interests rather than securities, the Fund qualifies for an exclusion from the definition of, and is not registered as, an investment company under the Investment Company Act of 1940 (the “Company Act”). Consequently, Investors will not have the benefit of the investor protection provisions afforded by the Company Act.

|

(b)

|

Financial Information about Segments

|

The Fund’s business constitutes only one segment: a speculative “commodity pool.” The Fund does not engage in sales of goods or services.

3

|

(c)

|

Narrative Description of Business

|

General

The Fund will trade in highly liquid stock index, interest rate, metal, energy and agricultural futures, as well as over-the-counter dealer and interbank currency contracts. One of the aims of the Fund is to provide diversification for Investors’ portfolios by offering access to an investment field that has often had a low degree of performance correlation with traditional stock and bond holdings. However, investment in the Fund is only appropriate for a limited portion of that segment of an Investor’s portfolio which is intended to be invested in investments that bear a high level of risk. Traditional portfolios invested in stocks, bonds and cash equivalents can be diversified by allocating a portion of their assets to non-traditional investments such as managed futures.

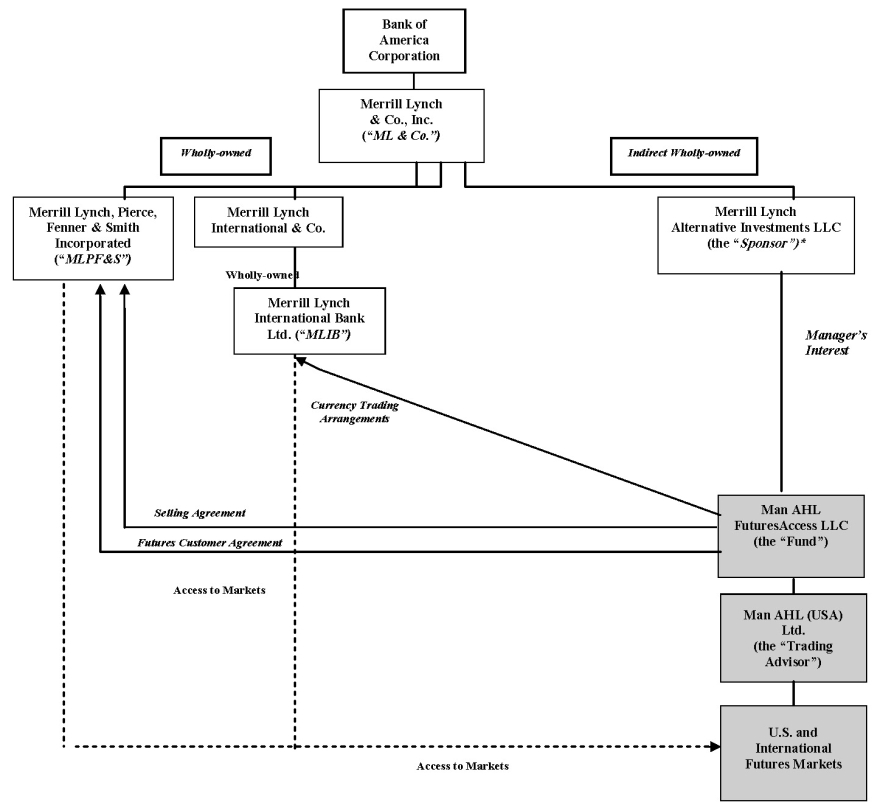

The potential non-correlation with the performance of stocks and bonds means that managed futures can help to improve long-term returns and reduce portfolio volatility, although there can be no assurance that the Fund will achieve these objectives or avoid substantial losses. Below is a chart showing the relationships between the Fund, the Sponsor and several of the major service providers to the Fund.

4

*The Sponsor sponsors and manages a variety of alternative investment funds, including the Fund, other FuturesAccess Funds, other commodity pools and funds which trade primarily in securities rather than commodities, including hedge funds, funds of funds and private equity funds.

5

The Sponsor

The Sponsor is a wholly-owned subsidiary of Merrill Lynch Investment Managers, L.P. (“MLIM”), which, in turn, is 99% owned by MLIM Administration, L.P. and 1% owned by its general partner, Princeton Services, Inc. MLIM Administration, L.P. is 99% owned by Merrill Lynch & Co., Inc. (“ML & Co.”) and 1% owned by its general partner, Princeton Services, Inc. ML & Co. is a wholly-owned subsidiary of Bank of America Corporation. For convenience, ML & Co. and its affiliated entities are sometimes collectively referred to as “Merrill Lynch.”

The Sponsor sponsors and manages a variety of alternative investments, including hedge funds, funds of funds, managed futures and private equity funds. The Sponsor’s capabilities in this field of investment date back as far as 1986 through its predecessor organizations. The Sponsor’s affiliates also act as general partner, sponsor or investment manager for a number of hedge funds, single manager feeder funds, funds of funds, managed futures and private equity funds. One of these fund of funds included within FuturesAccess, ML Trend-Following Futures Fund L.P. (the “Trend-Following Fund”), is the sole investor in certain Units of the Fund; however there are additional investors in the other classes of Units. Further, another one of the Sponsor’s fund of funds, ML Systematic Momentum FuturesAccess LLC (“Systematic Momentum”), may invest in certain Units of the Fund in the future.

The Trading Advisor

The Trading Advisor, a United Kingdom (“UK”) company, became registered as a commodity trading advisor with the CFTC in May 2003 and is a member of NFA. The Trading Advisor also is registered with The UK Financial Services Authority (the “FSA”) in England.

The Trading Advisor is a wholly-owned subsidiary of Man Investments Holdings Limited, a UK holding company that is part of the Man Group of companies (the “Man Group”). The Trading Advisor uses the same trading approaches and has common personnel as its affiliate, Man Investments Ltd. (“MIL”), a UK company organized to act as an investment and commodity advisor to non-U.S. persons. The main business address of the Trading Advisor is Sugar Quay, Lower Thames Street, London EC3R 6DU, England.

The Fund and the Sponsor have entered into an advisory agreement with the Trading Advisor whereby the Trading Advisor will trade in the international futures and forwards markets pursuant to the Trading Program. In the Trading Program, which the Trading Advisor has traded since January 2005, the Trading Advisor applies a systematic, trend-following strategy.

The Fund accesses the Trading Program by placing funds allocated to trading all or substantially all of its assets in a CFTC-regulated managed account held by Merrill Lynch, Pierce, Fenner & Smith Incorporated (“MLPF&S”), the Fund’s commodity broker. Funds are also held at MLPF&S in London and foreign currency forwards are processed through Merrill Lynch International Bank Ltd. (“MLIB”). The Fund also utilizes custody accounts with The Bank of New York Mellon.

6

The Trading Advisor will agree in writing with the Sponsor or the Fund to the list of commodity interests that the Trading Advisor intends to trade on the Fund’s behalf or may in the future trade on the Fund’s behalf other than regulated futures contracts and options on regulated futures contracts traded on a qualified board of trade or exchange. The addition of commodity interests other than spot and forward contracts on foreign currencies to this list requires the prior written consent of the Fund or the Sponsor. The addition of spot and forward contracts on foreign currencies to the list requires prior written notice to, but not consent of, the Fund or the Sponsor.

The Trading Advisor has the sole and exclusive authority and responsibility for directing the Fund’s trading, subject to the Sponsor’s fiduciary obligation to intervene to overrule or unwind trades if the Sponsor deems that doing so is necessary or reasonably advisable for the protection of the Fund. The Fund or the Sponsor may also override the trading instructions of the Trading Advisor to the extent necessary: (i) to fund any distributions or redemptions of Units to be made by the Fund; (ii) to pay the Fund’s expenses; and/or (iii) to comply with speculative position limits imposed by the CFTC or a particular market on which instruments traded by the Trading Advisor for the Fund are listed or traded; provided that the Fund and the Sponsor will permit the Trading Advisor three days in which to liquidate positions for the purposes set forth in clauses (i)-(iii) prior to exercising its override authority. The Sponsor has agreed that any exercise of its override authority will be effected solely by the Sponsor or a Sponsor affiliate or, at the Sponsor’s request, the Trading Advisor. The Trading Advisor will have no liability for the results of any of the Sponsor’s interventions under (i)-(ii) above effected by the Sponsor or Sponsor affiliate nor under (iii) if the Sponsor’s intervention is proven to be an error and the Trading Advisor was in fact in compliance with speculative position limits imposed by the CFTC or the relevant market.

The advisory agreement will continue in effect until the calendar year end following the five-year anniversary of the effective date of the agreement. Thereafter, the advisory agreement will be automatically renewed for successive one-year periods, on the same terms. The advisory agreement may, however, be terminated at any time pursuant to any of the following: (i) in its discretion, the Sponsor may terminate the advisory agreement at any time; (ii) if at any time after 90 days of the effective date of the advisory agreement the Fund does not have a capitalization of at least $50 million, the Trading Advisor may terminate the advisory agreement upon 30 days’ prior written notice and if at any time after eighteen months of the effective date of the advisory agreement the Fund does not have a capitalization of at least $100 million, the Trading Advisor may terminate the advisory agreement upon 30 days’ prior written notice; (iii) the Trading Advisor may terminate the advisory agreement upon 30 days’ prior written notice if the Fund does not have a capitalization of at least $700 million as of the third anniversary of the effective date of the advisory agreement, provided that such termination must be effective no later than three months following the third anniversary of the effective date of the advisory agreement; (iv) the Trading Advisor may terminate the advisory agreement upon 30 days’ prior written notice, if, in the opinion of a reputable law firm reasonably acceptable to the Sponsor, there occurs a change in law or regulation of general application that would result in material legal, regulatory, tax or financial harm to the global AHL business of which the Trading Advisor is part due to the Trading Advisor’s continued engagement by the Fund; (v) the Trading Advisor may terminate the advisory agreement upon notice to the Fund no later than 90 days before the expiration of the

7

then-current term; and (vi) the Fund and/or the Sponsor, on the one hand, or the Trading Advisor, on the other, may terminate the advisory agreement as a result of a material breach of the advisory agreement by the other party, after due notice and an opportunity to cure.

Upon the dissolution of the Fund, the Sponsor (or, if the Sponsor has withdrawn, such other liquidator as the Investors may, by vote of more than 50% of the outstanding Units, by net asset value then held by Investors, select) will wind up the Fund’s affairs and, in connection therewith, will distribute the Fund’s assets pursuant to the Fund’s Operating Agreement. While there are no separate fees related to terminating the agreement, if there is a performance fee owed to the Trading Advisor on the date of termination, such performance fee is due on the termination of the advisory agreement.

The advisory agreement provides that the Fund and the Sponsor will each severally indemnify, defend and hold harmless the Trading Advisor and certain affiliated parties from and against any and all losses, claims, damages, liabilities, costs and expenses (including any reasonable investigatory, legal and other expenses incurred in connection with, and any amounts paid in, any settlement; provided that, as applicable, the Fund or the Sponsor will have approved such settlement) resulting from a demand, claim, lawsuit, action or proceeding relating to any of the Fund’s or the Sponsor’s actions or capacities, respectively, relating to the business or activities of the Fund pursuant to the advisory agreement; provided that the conduct of such person which was the subject of the demand, claim, lawsuit, action or proceeding did not constitute negligence, willful misconduct or a material breach of the advisory agreement or of any fiduciary obligation to the Fund and was done in good faith and in a manner such person reasonably believed to be in, or not opposed to, the best interests of the Fund. The termination of any demand, claim, lawsuit, action or proceeding by settlement will not, in itself, create a presumption that the conduct in question was not undertaken in good faith and in a manner reasonably believed to be in, or not opposed to, the best interests of the Fund.

Use of Proceeds and Cash Management Income

Subscription Proceeds

The Fund’s cash will be used as security for the Fund’s trading activity and to pay the Fund’s trading losses, offset by trading gains, if any, as well as its expenses and redemptions. The primary use of the proceeds of the sale of the Units is to permit the Trading Advisor to trade on a speculative basis in a wide range of different futures and forwards markets on behalf of the Fund, the range of which may be limited from time to time by the specific focus of the Trading Program. While being used for this purpose, the Fund’s assets also generally will be available for cash management.

8

Markets Traded

The Fund engages in speculative trading in the U.S. and non-U.S. futures and forward markets.

The Fund’s commitments to different types of markets — U.S. and non-U.S., regulated and non-regulated — differ substantially from time to time, as well as over time. The Fund has no policy restricting its relative commitment to any of these different types of markets.

Custody of Assets

Certain of the Fund’s cash is held by MLPF&S in customer segregated accounts and primarily invested in CFTC-permitted investments, including, without limitation, commercial paper, U.S. government and government agency securities, prime non-U.S. government securities, corporate notes and money market funds.

Interest

The Fund generally will earn interest, as described below, on its cash, which is deemed to include, in addition to actual cash held by the Fund, its “open trade equity” i.e., equity attributable to unrealized gain and loss marked to market daily on open positions. Cash is held primarily in U.S. dollars, and to a lesser extent in foreign currencies. Cash does not include, and the Fund does not earn interest income on, the Fund’s gains or losses on its open forward, commodity option and certain non-U.S. futures positions since these gains and losses are not collected or paid until such positions are closed out.

The Fund’s cash may be greater than, less than or equal to the Fund’s net asset value (on which the redemption value of the Units is based) primarily because net asset value reflects all gains and losses on open positions as well as accrued but unpaid expenses.

MLPF&S intends to pay interest on the Fund’s cash, irrespective of how such cash is held or invested, at the most favorable rate payable by MLPF&S to accounts of Merrill Lynch affiliates, which will consist of the current federal funds rate of interest minus a spread based on the currency held. MLPF&S will receive the amount of the spread, in addition to any amounts it receives over the federal funds rate due to its investing activities, as well as any amounts it, or its affiliates, receive in brokerage commissions as described herein. The Fund receives interest on its cash held in excess of margin. MLPF&S retains the additional economic benefit derived from possession of the Fund’s cash, which includes the ability to invest such cash throughout MLPF&S’s cash management programs, which may include investments in vehicles managed or sponsored by MLPF&S or its affiliates.

MLPF&S, in the course of acting as commodity broker for the Fund, may lend certain currencies to, and borrow certain currencies from, the Fund. In the course of doing so, MLPF&S both retains certain amounts of interest and receives other economic benefits. In doing so, MLPF&S follows its standard procedures for paying interest on the assets of the commodity pools sponsored by the Sponsor and other MLPF&S affiliates and traded through MLPF&S.

9

Net Asset Value

The Fund will calculate the net asset value per Unit of each Class as of the close of business on the last business day of each calendar month and such other dates as the Sponsor may determine in its discretion. On a monthly basis, the Sponsor, pursuant to applicable CFTC regulations, sends to each Investor summary financial information for the Fund for the prior month, including relevant net asset values. The Fund’s net asset value as of any date will generally equal the value of the Fund’s account under the management of the Trading Advisor as of such date, plus any other assets held by the Fund, minus accrued brokerage commissions, Sponsor’s, Management and Performance Fees (all as defined below), trading liabilities, organizational expense amortization and any operating costs and other liabilities of the Fund. The net asset value of each Class as of any date will generally equal the net asset value of the Fund attributable to such Class, after the deduction of all transaction costs and operating expenses, but prior to accrual of the Management, Performance and Sponsor’s Fees, less the Management, Performance and Sponsor’s Fees charged specifically to that Class. The net asset value of each Class is then divided equally among all Units of such Class in order to calculate the net asset value per Unit. As a result, all Units of the same Class will have the same net asset value.

The Bank of New York Mellon, which acts as the Fund’s administrator, values the Fund’s managed futures positions. The liquidating value of a commodity futures contract or option traded on a U.S. commodity exchange is based upon the settlement price on the commodity exchange on which the particular commodity futures contract or option is traded; provided that, if a contract or option cannot be liquidated on the day with respect to which net asset value is being determined, the basis for determining the liquidating value of such contract or option shall be such value as the Sponsor may deem fair and reasonable.

The liquidating value of a futures, forward or options contract not traded on a U.S. exchange is determined based upon policies established by the Sponsor, on a basis consistently applied for each different variety of contract.

The Sponsor is authorized to make all net asset value determinations including, without limitation, for purposes of determining redemption payments and calculating Sponsor’s Fees, on the basis of estimated numbers. The Sponsor will not, unless the Sponsor otherwise determines, make retroactive adjustments in order to reflect the difference between estimated and final numbers, but rather reflects such difference including, for purposes of calculating redemption payments and Sponsor’s Fees, in the accounting period when such differences are determined.

The Fund may suspend the calculation of the net asset value of the Fund’s Units during any period for which the Sponsor is unable to value a material portion of the Fund’s positions. The Fund will give notice of any such suspension to all Investors.

Charges

The Fund will offer four classes (“Classes”) of Units to outside investors: Class A, Class C, Class I and Class D. Each Class participates on equal terms in the profits and losses of the Fund and has equal ownership rights in the equity thereof. Classes are differentiated only by the fees

10

paid by each and the type of investor eligible to invest in each. Class eligibility is determined on the basis of an Investor’s total investment in all FuturesAccess Funds, HedgeAccess Funds (defined below) and certain other funds or programs sponsored by the Sponsor or its affiliates (“Total Investment”). A separate class of Units, the Class DT Units, is not open to investment except by the Trend-Following Fund and is subject to different fees and terms. Other classes may be offered from time to time, including a class, the Class DS Units, for investment only by Systematic Momentum, with such terms as determined by the Sponsor in its sole discretion.

Although the Sponsor uses the term “Class” to distinguish the four types of units of limited liability company interest, and while the four types have different fees and investment minimums, they have the same rights, preferences and privileges, and the Sponsor therefore does not believe that different fees and investment minimums are sufficient differences to make them four separate “classes” under Section 12(g) of the Securities Exchange Act of 1934 (the “Exchange Act”).

No minimum Total Investment is required to invest in Class A or Class C Units, other than the minimum subscription amounts required to invest in the Fund. As described in more detail below, Class A Units are subject to a one-time, upfront sales commission (“sales commission”) of between 1.0% and 2.5%, depending on the size of the subscription, and Class C Units are not subject to a sales commission but pay a higher Sponsor’s Fee (as defined below) than the Class A Units. Investors with a Total Investment of $5,000,000 or more are eligible to purchase Class I Units. Investors with investments in the Fund of $5,000,000 or more or a Total Investment of $15,000,000 or more are eligible to purchase Class D Units.

11

Description of Current Charges

|

Recipient

|

Nature of Payment

|

Amount of Payment

|

|

MLPF&S

|

Sales Commission

|

Sales commissions are based on gross subscription amounts, i.e., the total subscription prior to deduction of the sales commission.

Class A

1.00% – 2.50%

The initial sales commission applicable to subscriptions for Class A Units are as follows:

Total Investment of less than $1,000,000 2.5%

Total Investment of at least $1,000,000,

less than $2,000,000 2.0%

Total Investment of at least $2,000,000,

less than $3,000,000 1.5%

Total Investment of at least $3,000,000,

less than $5,000,000 1.0%

Class C

None

Class I

Up to 0.50%, subject to negotiation by individual Investors, but not to exceed 0.50% in any case

Class D

Up to 0.50%, subject to negotiation by individual Investors, but not to exceed 0.50% in any case

The Sponsor may waive or reduce sales commissions for certain Investors without entitling any other Investor to such waiver or reduction.

|

12

|

Recipient

|

Nature of Payment

|

Amount of Payment

|

|

The Sponsor

|

Sponsor’s Fees (asset-based)

|

Class A Units (which pay a sales commission) pay the Sponsor a monthly Sponsor’s Fee of 1/12 of 1.5% of their month-end net asset value.

Class C Units (which pay no sales commissions) pay the Sponsor a monthly Sponsor’s Fee of 1/12 of 2.5% of their month-end net asset value.

Class I Units (which pay a sales commission) pay the Sponsor a monthly Sponsor’s Fee of 1/12 of 1.1% of their month-end net asset value.

Class D Units (which pay a sales commission) pay no Sponsor’s Fees.

Net asset value, for purposes of calculating the Sponsor’s Fee, is calculated prior to reduction for the Sponsor’s Fee being calculated.

The Sponsor may waive, reduce or rebate Sponsor’s Fees for certain Investors without entitling any other Investor to a waiver or reduction.

|

|

The Trading Advisor

|

Management Fees (asset-based)

|

As of the last business day of each calendar month, the Fund will pay the Trading Advisor a Management Fee equal to 1/12 of 2.0% (a 2.0% annual rate) of the average month-end net asset value of each Investor’s Units, prior to reduction for any accrued Performance Fees, as described below, the Management Fee being calculated or the accrued Sponsor’s Fees. The Management Fee will be pro rated in the case of partial calendar months, but will not be subject to rebate once paid. The Sponsor receives approximately 50% of the 2.0% annual Management Fee payable by the Fund to the Trading Advisor.

|

13

|

Recipient

|

Nature of Payment

|

Amount of Payment

|

|

The Trading Advisor

|

Performance Fees

|

The Fund will pay to the Trading Advisor, as of each December 31 (“Performance Fee Calculation Date”), a Performance Fee equal to 20% of the New Trading Profit (defined below) allocated to the Class D, Class DT and Class DS Units (if any) of the Fund (collectively, the “20% Classes”) and 25% of the New Trading Profit allocated to the Class A, Class C and Class I Units of the Fund (collectively, the “25% Classes”) as of the Performance Fee Calculation Date. Performance Fees are calculated with respect to the 20% Classes as a whole on the one hand and the 25% Classes as a whole on the other hand, irrespective of the performance of different Investor’s Units in such Classes. When there is an accrued Performance Fee at the time any net capital withdrawal is made from the Fund’s account with the Trading Advisor (a “capital withdrawal”), the Performance Fee attributable to such withdrawal will be paid. The Performance Fee is determined by multiplying the Performance Fee that would have been paid had the date of the capital withdrawal been a Performance Fee Calculation Date by a fraction, the numerator of which is the amount of the capital withdrawal attributable to the 20% Classes or the 25% Classes, as applicable, and the denominator of which is the aggregate net asset value of the 20% Classes or the 25% Classes, respectively, immediately before the capital withdrawal. The Performance Fee will be paid from and reduce the amount of the capital withdrawal.

|

|

“New Trading Profit” is calculated separately with respect to the 25% Classes and the 20% Classes and equals any increase in the aggregate net asset value (prior to reduction for the Sponsor’s Fees discussed above and excluding any interest income) of the 20% Classes or the 25% Classes, as applicable, as of the current Performance Fee Calculation Date over the High Water Mark attributable to the applicable group of Classes. The High Water Mark attributable to each of the 20% Classes and the 25% Classes is equal to the highest aggregate net asset value of the 20% Classes or the 25% Classes, respectively, after reduction for the Performance Fee then paid, as of any preceding Performance Fee Calculation Date over the life of the Fund. The High Water Mark will be increased dollar-for-dollar by new subscriptions and decreased proportionately when capital withdrawals are made with respect to the 20% Classes or the 25% Classes. The proportionate High Water Mark reduction made as a result of capital withdrawals shall be calculated by multiplying the High Water

|

14

| Recipient | Nature of Payment | Amount of Payment |

|

Mark in effect immediately prior to such capital withdrawal by a fraction, the numerator of which is the aggregate net asset value of the 20% Classes or 25% Classes, as applicable, immediately following such capital withdrawal and the denominator of which is the net asset value of such group of Classes immediately before such capital withdrawal, in each case prior to reduction for any accrued Performance Fee. New Trading Profit is calculated prior to the reduction for any Performance Fees or Sponsor’s Fees of the applicable group of Classes being calculated as of such Performance Fee Calculation Date. In addition, net asset value for purposes of calculating the Performance Fee will not include any interest income earned by the Fund and will not be reduced by the Sponsor’s Fees, although such interest income will increase, and such Sponsor’s Fees will decrease, net asset value for purposes of determining the value of the Units.

|

||

|

The Performance Fee is calculated by taking the applicable percentage of New Trading Profit as of the Performance Fee Calculation Date. For example, if the 25% Classes had a High Water Mark of $20,000, and the Units of such Classes had an aggregate value (prior to reduction for the fees discussed above and excluding any interest income) of $19,000 at the beginning of the period for which the Performance Fee is being calculated and an aggregate value (as similarly adjusted) of $22,000 at the end, the Performance Fee would equal 25% of $2,000, or $500, and the new High Water Mark of the 25% Classes would equal $21,500.

|

||

|

MLPF&S

|

Brokerage Commissions

|

The principal operating costs of the Fund are the per-trade brokerage commissions paid to MLPF&S (a portion of which is paid to the Fund’s executing brokers, which may or may not include MLPF&S, as commissions for their execution services) and the currency forward contract (“F/X”) dealer spreads paid to MLIB and others (described below).

The Fund’s brokerage commissions are paid on the completion or liquidation of a trade and are referred to as “round-turn” commissions, which cover both the initial purchase (or sale) and the subsequent offsetting sale (or purchase) of a single commodity futures contract. If 100 contracts are included in a single trade, 100 round-turn commissions are charged. The brokerage commission rate charged in respect of the Trading Advisor may vary based on the frequency of its trading. If the Trading Advisor has faster turnover, the Trading Advisor may be charged a lower

|

15

| Recipient | Nature of Payment | Amount of Payment |

| per trade rate in an attempt to maintain the overall brokerage costs of the different FuturesAccess Funds at generally comparable levels. However, the commission expenses of the different FuturesAccess Funds, both in the aggregate and on a “round-turn” basis, will vary, perhaps materially.

The “round-turn” commissions paid by the Fund on futures exchanges are expected to be approximately $15 per round-turn plus fees, except in the case of certain non-U.S. contracts on which the rates may be as high as $100 per round-turn plus fees due, in part, to the large size of the contracts traded. In general, the Sponsor estimates that aggregate brokerage commission charges (including F/X spreads) will equal approximately 0.50% per annum.

|

||

|

Various Banks and Dealers, including Merrill Lynch International Bank

|

Currency (F/X) Dealer Spreads

|

The Fund’s currency trades may be executed in the spot and forward foreign exchange markets (the “F/X Markets”) in which there are no direct execution costs. Instead, the banks and dealers in the F/X Markets, including MLIB, take a “spread” between the prices at which they are prepared to buy and sell a particular currency, and such spreads are built into the pricing of the spot or forward contracts with the Fund. A significant portion of the Fund’s foreign currency trades are likely to be executed through MLIB, an affiliate of the Sponsor.

Should the Fund engage in exchange of futures for physical (“EFP”) trading, the Fund would acquire cash currency positions through banks and dealers, including Merrill Lynch. The Fund would pay a spread when it exchanges these positions for futures. This spread would reflect, in part, the different settlement dates of the cash and the futures contracts, as well as prevailing interest rates, but also would include a pricing spread in favor of the dealer, which will often be Merrill Lynch.

|

|

Service Providers, including Merrill Lynch Entities

|

Operating Costs

|

The Fund pays, in addition to the other expenses described above, its operating costs — including, without limitation: ongoing offering expenses; execution and clearing brokerage commissions (as described above); forward and other over-the-counter trading spreads (as described above); administrative, transfer, exchange and redemption processing, legal, regulatory, reporting, filing, tax, audit, escrow, accounting and printing fees and expenses — as well as extraordinary expenses. Operating costs are allocated pro rata among the Fund’s Classes of Units based on their respective net asset values.

|

16

| Recipient | Nature of Payment | Amount of Payment |

|

The Sponsor retains outside service providers to supply certain services to FuturesAccess, including, without limitation, legal, tax reporting, custody, accounting, administrative and escrow services. Operating costs include the Fund’s allocable share of the fees and expenses of these outside service providers, as well as the fees and expenses of any Merrill Lynch entity or other service providers which may be retained to provide such (or other) services in the future. Certain other costs related to FuturesAccess as a whole including, for example, additional third party service providers and costs related to improvements over the entire platform, such as a consultant brought in to improve processes platform wide, are allocated pro rata among all FuturesAccess Funds, including the Fund. Such costs will vary significantly from period to period.

|

||

|

The Sponsor

|

Organizational and Initial Offering Costs

|

The Fund charges the costs associated with the organization and initial offering of the Fund to investors by amortizing the amount over a 60-month straight line basis for purposes of calculating the trading net asset value of the fund. These costs are amortized for U.S. generally accepted accounting principles (“GAAP”) purposes over a 12-month period for financial reporting purposes on the annual audit and for any regulatory filings. The Fund ultimately pays for all of these costs and will reimburse the Manager for any such costs that it advanced on behalf of the Fund.

|

|

N/A

|

Ongoing Offering Expenses

|

The Fund will pay its own ongoing offering expenses, which are allocated pro rata among each Class of Units in accordance with their respective net asset values. The ongoing offering expenses payable by the Fund are not expected to exceed $100,000 per year, although these expenses could exceed this estimate during any given year.

|

Conflicts of Interest

Merrill Lynch-Affiliated Entities

Other than the Trading Advisor and certain executing brokers utilized by the Trading Advisor, all parties involved in the operations of the Fund are affiliated with Merrill Lynch. Consequently, many of the business terms of the Fund have not been negotiated at arm’s-length. Were Investors to seek redress from Merrill Lynch for damages relating to the offering of the Units or the operations of the Fund, they (i) would be unlikely to have recourse against any

17

Merrill Lynch entity, such as ML & Co. and Merrill Lynch International & Co., which is not a direct party to an agreement with the Fund, and (ii) would be likely to have recourse even in the case of a direct party only on a derivative basis, suing not individually but in the right of the Fund.

MLPF&S and MLIB

MLPF&S executes, and MLIB acts as counterparty to, trades for many different clients in the same markets at the same time. Consequently, other clients may receive better prices on the same trades than the Fund, causing the Fund to pay higher prices for its positions.

Many MLPF&S clients pay lower brokerage rates, and many MLIB clients pay lower bid-ask spreads, than the Fund. Brokerage commissions and bid-ask spreads have a major impact on the Fund’s performance, and the cumulative effect of the higher rates paid by the Fund is material.

MLPF&S and MLIB each must allocate their resources among many different clients. They have financial incentives to favor certain accounts over the Fund, including by devoting more business time to such other accounts or by providing lower brokerage commissions to accounts with higher trading volume than the Fund. Because of the competitive nature of the markets in which the Fund trades, to the extent that either of MLPF&S or MLIB prefers other clients over the Fund, the Fund is likely to incur losses.

MLPF&S and MLIB do not have to compete to provide services to the Fund; consequently, there is no independent check on the quality of their services.

The Sponsor

Use of Merrill Lynch Affiliates

The Sponsor and its affiliates are the Fund’s primary service providers, other than the Trading Advisor and certain executing brokers utilized by the Fund, and will remain so even if using other firms would be more advantageous for the Fund. Because the Fund’s primary service providers are the Sponsor or its affiliates, the principals or key employees of the Sponsor may be associated persons of such primary service providers.

Proprietary Investments

From time to time, the Sponsor or Merrill Lynch may have substantial proprietary investments with the Trading Advisor. The Sponsor and Merrill Lynch have a conflict of interest in allocating capital to the Trading Advisor, and the terms of the Sponsor’s or Merrill Lynch’s proprietary investment with the Trading Advisor may have substantially different terms than those the Sponsor or Merrill Lynch would receive by investing into the Fund, including the potential for more advantageous fees and liquidity than are offered to Investors.

18

Other Funds Sponsored by the Sponsor

The Sponsor might be able to add more value to the Fund if certain Sponsor personnel were to focus exclusively on managing the Fund, but none do so. The Sponsor is a registered investment adviser and commodity pool operator and operates trading accounts other than the Fund because such accounts generate significant revenues for it, and also diversify the Sponsor’s exposure to one or more of such accounts performing poorly. The amount of time the Sponsor will devote to managing the Fund will vary significantly over time and is very difficult to quantify, but the Sponsor believes that the time it devotes to the Fund will be sufficient for the Sponsor to manage the Fund in accordance with its obligations and duties to the Fund.

The Sponsor sponsors or manages a total of 137 funds other than the Fund, including 15 other FuturesAccess Funds, 2 commodity pools not included in FuturesAccess and 120 funds which trade primarily in securities rather than commodities, including hedge funds, funds of funds and private equity funds. These funds are generally privately offered and may compete with or take positions opposite the Fund. The Sponsor does not attempt to ensure any consistency of trading results across the pools it sponsors. Each of these funds presents a potential conflict for the time and services of the Sponsor’s personnel and the Sponsor may have financial incentives to favor certain of such funds over the Fund, such as in cases where these other funds pay higher fees or attract more subscriptions than the Fund.

Certain clients of the Sponsor pay materially lower brokerage rates than does the Fund. In particular, certain institutional clients of Merrill Lynch receive, as a result of arm’s-length negotiations, better commission rates than the Fund.

There is, in general, a shortage of qualified futures trading advisors available to manage customer assets. The Sponsor has a conflict of interest in selecting the Trading Advisor for the Fund and for other accounts sponsored by the Sponsor.

Per-Trade Revenues

Because the FuturesAccess Funds, including the Fund, pay brokerage commissions and forward trading spreads to MLPF&S and MLIB on a per trade basis, the Sponsor may have an incentive to select trading advisors for FuturesAccess, including the Trading Advisor, which trade in higher volume, generating more revenue for MLPF&S and MLIB.

The Trading Advisor

Other Clients and Business Activities of the Trading Advisor

The Fund might benefit significantly from an exclusive focus by the Trading Advisor on the Fund rather than on its other accounts, including accounts owned by its principals. The Fund could be adversely affected by the fact that the Trading Advisor trades other accounts at the same time that it is managing the Fund’s account. The Trading Advisor has numerous different clients and financial incentives to favor certain of such clients over the Fund. The amount of time the

19

Trading Advisor will devote to managing the account of the Fund will vary significantly over time and is very difficult to quantify, but the Sponsor believes will be sufficient for the Trading Advisor to discharge its duties to the Fund.

Other client accounts managed by the Trading Advisor may significantly outperform the Fund.

The Trading Advisor and its principals devote a substantial portion of their business time to ventures and accounts other than managing the Fund, including, in some cases, ventures that are unrelated to futures trading.

The Trading Advisor acts, or may in the future act, as sponsor of its own single- or multi-advisor futures funds. Such funds may, from time to time, be in direct competition with the Fund for positions in the market. The Trading Advisor currently advises three accounts or funds that trade the same or substantially the same strategy as the Fund and which may be in competition for the same positions in the market.

Brokers and Dealers Selected by Trading Advisor

The Trading Advisor may require, as a condition of its managing the Fund’s account, that such account trade through certain non-Merrill Lynch brokers with which the Trading Advisor has ongoing business dealings, even though Merrill Lynch remains the clearing broker for the Fund. The Trading Advisor may have a conflict of interest between insisting on the use of such brokers and using the brokers most advantageous for the Fund.

The Trading Advisor executes a large number of its trades for the Fund’s account through executing brokers affiliated with the Trading Advisor.

Performance Fees

The fact that the Trading Advisor is eligible to receive Performance Fees may cause it to trade in a more speculative fashion than it otherwise would.

Financial Advisors

“Financial Advisors” are the individual Merrill Lynch brokers who deal directly with Merrill Lynch clients. Financial Advisors are compensated, in part, on the basis of the amount of securities commissions which they generate from client transactions. Financial Advisors receive ongoing compensation and, in certain cases, initial selling commissions on the Units they sell and have a financial incentive to encourage Investors to purchase and not to redeem their Units.

Proprietary Trading

The Sponsor, MLPF&S and the Trading Advisor, and their respective affiliates, principals, key employees and related persons may trade in the commodity markets for their own accounts as well as for the accounts of their clients. Records of this trading will not be available for inspection by Investors. These persons may take positions which are the same as or opposite to those held by the Fund. As a result of a neutral allocation system, testing a new trading system,

20

trading their proprietary accounts more aggressively or other actions not in violation of their fiduciary or other duties, these persons may from time to time take positions in their proprietary accounts ahead of the positions taken for the Fund. In addition, on occasion orders may be filled more advantageously for the account of one or more such persons than for the Fund’s account.

Direct and Indirect Investors

Investors will be permitted to invest directly in the Fund, and the Fund also will be an underlying fund for the Trend-Following Fund, and potentially may be an underlying fund for Systematic Momentum or other funds of funds managed by the Sponsor in the future. Under certain circumstances, the potentially disparate interests of the direct Investors and the relevant fund(s) of funds could materially adversely affect one or both groups of investors. For example, the Sponsor, in managing the relevant multi-advisor fund(s) of funds, has a conflict of interest when reallocating capital away from one underlying fund to another between acting in the best interests of such fund of funds Investors and of the direct Investors. As a result, the Sponsor may not make allocations that it would otherwise have considered in the best interest of the relevant fund(s) of funds. Further, the Sponsor may allocate additional fund of fund capital to an underlying fund, such as the Fund, even though doing so prevents the direct Investors from themselves investing more due to capacity constraints.

Permitting different sets of Investors to participate in the same underlying portfolios increases both the conflicts of interest and the potential risks to which such Investors are subject.

Transactions Between Merrill Lynch and the Fund

Certain of the service providers to the Fund, other than the Trading Advisor, the Fund’s independent registered public accounting firm and outside counsel to Merrill Lynch, the Fund’s Administrator, various print and service vendors and certain financial institutions, are affiliates of Merrill Lynch, including the exclusive clearing broker for the Fund, MLPF&S. Merrill Lynch negotiated with the Trading Advisor regarding the level of its Management Fee and Performance Fee and certain other terms of its advisory agreement. However, the fees paid by the Fund to any Merrill Lynch parties were established by such parties based on rates charged to similarly-situated customers rather than being negotiated, and they are higher than would have been obtained in arm’s-length bargaining.

The Fund pays Merrill Lynch substantial brokerage commissions as well as bid-ask spreads on forward currency trades. The Fund also will pay MLPF&S interest on short-term loans extended by MLPF&S to cover losses on foreign currency positions. Merrill Lynch retains certain economic benefits from possession of the Fund’s capital.

In the case of EFP transactions with MLIB, Merrill Lynch recognizes certain incremental profits from the “differential” at which the Fund’s cash currency positions are exchanged for futures. Consequently, the Sponsor may have a financial incentive to encourage the Trading Advisor to trade EFPs to a greater extent than it otherwise might.

21

Certain entities in the Merrill Lynch organization, including, but not limited to, MLPF&S and MLIB, are the beneficiary of certain of the revenues generated from the Fund. The Sponsor controls the management of the Fund and serves as its sponsor. Although the Sponsor has not sold any assets, directly or indirectly, to the Fund, the Sponsor makes substantial profits from the Fund due to the foregoing revenues.

To the extent that cash is placed with affiliates of Merrill Lynch, Merrill Lynch indirectly receives certain economic benefits and therefore has a conflict of interest in selecting such third parties. For example, Merrill Lynch may invest in money market funds managed by BlackRock, Inc. or its affiliates (“BlackRock”). Merrill Lynch is a substantial stockholder in BlackRock and, therefore, potentially benefits from its economic interest in BlackRock whenever BlackRock receives compensation for managing cash invested in money market investment funds managed by BlackRock.

No loans have been, are or will be outstanding between the Sponsor or any of its principals and the Fund.

Regulation

The Sponsor is registered with the CFTC as a CPO and a CTA and is a member of NFA in such capacities. The Trading Advisor is registered with the CFTC as a CTA and is a member of NFA. The Trading Advisor also is registered with the FSA in England. MLPF&S is registered with the CFTC as a futures commission merchant and is a member of NFA in this capacity. MLPF&S is a clearing member of the Chicago Mercantile Exchange, and is either a clearing member or member of all other principal U.S. futures and futures options exchanges. Other than in respect of requirements arising from the registration of the Fund’s securities under Section 12(g) of the Exchange Act, the Fund is generally not subject to regulation by the SEC. In particular, as the Fund trades primarily in commodity interests rather than securities, the Fund qualifies for an exclusion from the definition of, and is not registered as, an “investment company” under the Company Act. Consequently, Investors will not have the benefit of the investor protection provisions afforded by the Company Act. However, the Sponsor itself is registered as an “investment adviser” under the Investment Advisers Act of 1940. MLPF&S is also regulated by the SEC and the Financial Industry Regulatory Authority, Inc.

Registered CPOs and CTAs are subject to significant disclosure, reporting and recordkeeping requirements under CFTC regulations. Although compliance with these requirements afford investors certain benefits, they also increase administrative burdens and expenses. The CPO, MLPF&S and the Fund are also subject to anti-money laundering regulations and offering restrictions with respect to the sale of the Units pursuant to Rule 506 under Regulation D of the Securities Act. These restrictions limit the type of investor that may purchase Units.

In addition, the CFTC and the U.S. commodities exchanges have established limits referred to as “speculative position limits” on the maximum net long or net short speculative positions that any person may hold or control in any particular futures or options contracts traded on U.S. commodities exchanges. All commodity accounts controlled by the Trading Advisor are combined for speculative position limit purposes. The Trading Advisor could be required to

22

liquidate positions held for the Fund, or may not be able to fully implement trading instructions generated by its trading models, in order to comply with such limits. Any such liquidation or limited implementation could result in substantial costs to the Fund. Additionally, most U. S. exchanges also limit the maximum change in some, but not all, futures prices during any single trading day. These price limits may have an impact on the Fund’s trading method because once the price limit has been reached, it becomes very difficult to execute trades in the same direction the market has moved. These price limits apply on a day-to-day basis, and therefore do not limit ultimate losses, but may reduce or temporarily eliminate liquidity.

CFTC regulations also prohibit trading advisors from trading certain instruments for accounts of U.S. persons such as the Fund. As a result, certain instruments that may be traded by the Trading Advisor for its non-U.S. accounts may not be traded for the Fund.

Pursuant to CFTC regulations, MLPF&S, as the Fund’s futures commission merchant, is required to segregate assets for on-exchange futures and options trading. If the assets of the Fund were not so segregated by MLPF&S, the Fund would be subject to the risk of the failure of MLPF&S. Even given proper segregation, in the event of the insolvency of MLPF&S, the Fund may be subject to a risk of loss of its funds and would be able to recover only a pro rata share of assets, such as U.S. Treasury bills, specifically traceable to the commodity customers of MLPF&S such as the Fund.

The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Reform Act”) was enacted in July 2010. The Reform Act includes provisions that comprehensively regulate the over-the-counter derivatives markets for the first time. The Reform Act requires that a substantial portion of over-the-counter derivatives be executed in regulated markets and submitted for clearing to regulated clearinghouses. Those over-the-counter derivatives may include over-the-counter foreign exchange forwards and swaps which are traded by the Fund, although the U.S. Treasury has the discretion to exclude foreign exchange forwards and swaps from certain of the new regulatory requirements. If these forwards and swaps are not so excluded, the Reform Act may require them to be cleared and may subject the Fund, the Trading Advisor, the Sponsor and/or the Fund’s counterparties to additional regulatory requirements including minimum initial and variation margin requirements, minimum capital requirements, registration with the SEC and/or the CFTC, new business conduct standards, disclosure requirements, reporting and recordkeeping requirements, transparency requirements, position limits, limitations on conflicts of interest and other regulatory burdens. Some or all of these requirements may apply even if forwards and swaps are not excluded by the U.S. Treasury. These new regulatory burdens would further increase the dealers’ costs, which costs are expected to be passed through to other market participants such as the Fund in the form of higher fees and less favorable dealer marks. They may also render certain strategies in which the Trading Advisor might otherwise engage impossible, or so costly that they will no longer be economical, to implement.

Additionally, the Reform Act, under what is commonly referred to as the “Volcker Rule,” may restrict banking entities or their affiliates, such as the Sponsor, and certain other financial entities, from (i) purchasing units or other ownership interests in, or sponsoring, hedge funds or private equity funds (such as the Fund), with the exception of maintaining a de minimis

23

investment, subject to certain other conditions and/or exceptions, (ii) engaging in proprietary trading and (iii) certain transactions involving conflicts of interest. The regulations and interpretations with respect to the Reform Act have yet to be issued, and the full import of the Reform Act is not yet clear. Once such regulations are issued and become effective, the Sponsor may take certain actions that it determines, in its sole discretion, to be necessary or advisable to comply with the Reform Act. Such changes may include, but are not limited to, the complete or partial redemption or transfer of any Units held by the Sponsor and/or the compulsory redemption of U.S. persons from the Fund. These actions may have a material adverse effect on the Fund and Investors.

The requirements of Reg. S-K Item (h)(4)(i) through (xi) and (h)(5) are not applicable. The Fund has no employees of its own.

|

(d)

|

Financial Information about Geographic Areas

|

The Fund has no operations in foreign countries, although it trades on non-U.S. exchanges and other non-U.S. markets and the Trading Advisor is located in the United Kingdom. The Fund does not engage in sales of goods or services.

|

(e)

|

Available Information

|

Not applicable.

|

(f)

|

Reports to Investors

|

Not applicable.

|

(g)

|

Enforceability of Civil Liabilities Against Foreign Persons

|

Not applicable.

ITEM 1A: RISK FACTORS

Not applicable, the Fund is a smaller reporting company.

ITEM 2: FINANCIAL INFORMATION

|

(h)

|

Selected Financial Data

|

The Fund has only recently been organized and, as of September 30, 2010, has no meaningful performance history.

ITEM 3: PROPERTIES

The Fund does not own or use any physical properties in the conduct of its business. The Sponsor or an affiliate performs administrative services for the Fund from the Sponsor’s office, but the Sponsor bears its own overhead costs, including the costs of the Sponsor’s facilities.

24

ITEM 4: SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

(a)

|

Security Ownership of Certain Beneficial Owners

|

Not applicable.

|

(b)

|

Security Ownership of Management

|

The Fund has no officers or directors. Under the terms of the Operating Agreement, the Fund’s affairs are managed by the Sponsor, which has discretionary authority over the Fund’s trading (although delegated to the Trading Advisor). As of September 1, 2010, the Sponsor and the principals of the Sponsor did not own any Units.

|

(c)

|

Changes in Control

|

None.

ITEM 5: DIRECTORS AND EXECUTIVE OFFICERS

(a) and (b) Identification of Directors and Executive Officers.

The Fund itself has no officers or directors, but is managed by the Sponsor. Accordingly, Investors do not receive the benefit of a direct fiduciary relationship with the officers and managers of the Sponsor. The Sponsor has a board of managers rather than a board of directors. In each case below, the managers and officers of the Sponsor are not independent and are employed for an indefinite term, subject to removal by the Sponsor.

The principal officers and managers of the Sponsor and their business backgrounds as of September 30, 2010 were as follows:

|

Name

|

Title

|

Age

|

|

JAMES COSTABILE

|

Vice President and Manager

|

34

|

|

JUSTIN FERRI

|

Chief Executive Officer, President, and Manager

|

34

|

|

PAUL HARRIS

|

Vice President and Manager

|

40

|

|

DEANN MORGAN

|

Vice President and Manager

|

40

|

|

COLLEEN RUSCH

|

Vice President and Manager

|

42

|

|

BARBRA E. KOCSIS

|

Chief Financial Officer

|

42

|

JamesL. Costabile has been a Vice President of the Sponsor and a Managing Director within Global Investment Solutions group (“GIS”) responsible for alternative investment distribution for Merrill Lynch since June 2007 and US Trust since January 2009. As part of the Sponsor’s management team, Mr. Costabile oversees a team of specialists responsible for supporting hedge funds, private equity and real asset offerings. Prior to joining Merrill Lynch in 2007, Mr. Costabile spent ten years with Citigroup Inc., most recently as a Managing Director for Citigroup Alternative Investments responsible for co-heading Smith Barney Alternative Investment

25

Distribution from February 2005 to June 2007. Prior to that, Mr. Costabile held a number of positions involving sales, marketing, product management and financial advisor training within different divisions of Citigroup, Inc. including: Citigroup Alternative Investments from May 2003 to February 2005 (sales manager for hedge funds, private equity funds, structured products and exchange funds); the Private Capital Group from February 2001 to May 2003 (sales desk manager for alternative funds for Smith Barney and Citi Private Bank); Salomon Smith Barney Alternative Investment Group from February 1999 to February 2001 (producing sales desk manager for alternative investment funds); Smith Barney Alternative Investments from March 1998 to February 1999 (sales desk supervisor for alternative investment funds) and Smith Barney Capital Management from November 1997 to March 1998 (participating in sales, marketing and product management). Mr. Costabile received a B.S. from Fordham University and holds the Chartered Alternative Investment Analyst designation.

Justin Ferri has been the Chief Executive Officer and President of the Sponsor since August 2009. He also serves as Managing Director within the Merrill Lynch Global Wealth & Investment Management group (“GWIM”) and GIS, responsible for heading GWIM’s Alternative Investments business. In addition, Mr. Ferri serves as Vice President of IQ Investment Advisors LLC (“IQ”), an indirect, wholly-owned investment adviser subsidiary of Merrill Lynch & Co., and serves as President of each of IQ’s publicly traded closed-end mutual fund companies. Prior to his role in GIS, Mr. Ferri was a Director in the MLPF&S Global Private Client Market Investments & Origination group, and before that, he served as a Vice President and head of the MLPF&S Global Private Client Rampart Equity Derivatives team. Prior to joining Merrill Lynch in 2002, Mr. Ferri was a Vice President within the Quantitative Development group of mPower Advisors LLC from 1999 to 2002, and prior to that, he worked in the Private Client division of J.P. Morgan & Co. He holds a B.A. degree from Loyola College in Maryland.

Paul D. Harris has been a Vice President of the Sponsor and a Managing Director and head of Strategy and Marketing in the Alternative Investment group within GIS since December 2009. Mr. Harris is responsible for leading Strategy, Marketing and Information Management functional teams in developing alternative investment solutions, including hedge funds, managed futures, private equity and real assets investments for financial advisors. Prior to joining Merrill Lynch in December 2009, Mr. Harris was a Managing Director at PH Investment Group, LLC, and before that a Director at Bridgewater Associates. Mr. Harris was also a Director at Citigroup Alternative Investments and the Strategy and M&A team at Citigroup’s investment bank from January 2003 to January 2007. In addition, Mr. Harris worked in strategic consulting as a Project Leader at the Boston Consulting Group from September 1999 to January 2002. Mr. Harris began his career with Barclays Capital and Goldman Sachs in investment banking and capital markets in September 1992. Mr. Harris holds an MBA from Harvard Business School and a BA in Economics and Politics from Essex University, UK.

Deann Morgan has been a Vice President of the Sponsor and Managing Director of GIS since March 2008. As Managing Director of GIS, Ms. Morgan heads Alternative Investments Origination. From April 2006 until March 2008, Ms. Morgan was a Director for Merrill Lynch’s Investments, Wealth Management & Insurance group, where she was responsible for origination

26

of private equity and listed alternative investments. Between August 2004 and April 2006, Ms. Morgan worked for Merrill Lynch’s Investment Banking Group covering Asian corporate clients. She received her M.B.A. from the University of Chicago and her B.B.A. from University of Michigan.

Colleen R. Rusch has been a Vice President of the Sponsor and a Director within GIS responsible for overseeing GWIM’S Alternative Investments product and trading platform since 2007. In addition, Ms. Rusch serves as Chief Administrative Officer and Vice President of IQ and serves as Vice President and Secretary of each of IQ’s publicly-traded closed-end mutual funds. Prior to her role in GIS, Ms. Rusch was a Director in the MLPF&S Global Private Client — Market Investment & Origination Group (“MIO”) from July 2005 to 2007. Prior to her role as a Director in MIO, Ms. Rusch was a Director of Merrill Lynch Investment Managers from January 2005 to July 2005 and a Vice President from 1998 to December 2004. Ms. Rusch holds a B.S. degree in Business Administration from Saint Peter’s College in New Jersey.

Barbra E. Kocsis is the Chief Financial Officer for the Sponsor, and is a Director within GWIM, positions she has held since October 2006. Prior to serving in her current roles, she was the Fund Controller of the Sponsor from May 1999 to September 2006. Before joining the Sponsor, Ms. Kocsis held various accounting and tax positions at Derivatives Portfolio Management LLC from May 1992 until May 1999, at which time she held the position of accounting director. Prior to that, she was an associate at Coopers & Lybrand in both the audit and tax practices from September 1988 to February 1992. She graduated cum laude from Monmouth College with a Bachelor of Science in Business Administration - Accounting.

(c) Identification of Certain Significant Employees

None.

(d) Family Relationships

None.

(e) Business Experience

See Item 5 (a) and (b) above.

(f) Involvement in Certain Legal Proceedings

None.

27

(g) Promoters and Control Persons.

On July 31, 2007, the CFTC issued an order against the Sponsor and its affiliate MLIM, to which the Sponsor and MLIM consented, containing findings, which the Sponsor and MLIM neither admitted nor denied, that the Sponsor and MLIM filed with the NFA a number of annual reports for commodity pools for which they acted as CPOs after the deadline established by the CFTC’s regulations, in violation of CFTC Regulation 4.22(c). MLIM and the Sponsor were ordered to cease and desist from violating Regulation 4.22(c) and to pay a civil penalty in the amount of $500,000.

ITEM 6: EXECUTIVE COMPENSATION

The officers of the Sponsor are remunerated by Merrill Lynch in their respective positions. The Fund does not itself have any officers, directors or employees. None of the principals, officers or employees of the Sponsor receives compensation from the Fund. All persons serving in the capacity of officers or executives of the Sponsor are compensated by the Sponsor or an affiliate in respect of their respective positions with the Sponsor, which involve numerous duties unrelated to the operation of the Fund. The Sponsor receives a monthly Sponsor’s Fee from the Class A Units (which pay a sales commission) equal to 1/12 of 1.5% of their month-end net asset value. Class C Units (which pay no sales commissions) pay the Sponsor a monthly Sponsor’s Fee of 1/12 of 2.5% of their month-end net asset value. Class I Units (which pay a sales commission) pay the Sponsor a monthly Sponsor’s Fee of 1/12 of 1.1% of their month-end net asset value. MLPF&S will receive brokerage commissions and other compensation related to the Fund’s cash accounts as described elsewhere in this Form 10.

There are no compensation plans or arrangements relating to a change in control of either the Fund or the Sponsor.

ITEM 7: CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

|

(d)

|

Transactions Between Merrill Lynch and the Fund

|

Many of the service providers to the Fund are affiliates of Merrill Lynch, although the Trading Advisor is not an affiliate of Merrill Lynch. The Sponsor negotiated with the Trading Advisor regarding the level of its Management Fee and Performance Fee and certain other terms of its advisory agreement. However, the fees paid by the Fund to any Merrill Lynch parties were established by such parties based on rates charged to similarly-situated customers rather than being negotiated, and they are higher than would have been obtained in arm’s-length bargaining.

As noted above, the Fund pays Merrill Lynch substantial brokerage commissions as well as bid-ask spreads on forward currency trades. Bid-ask spreads are not a quantifiable expense of the Fund but do represent a profit margin to the dealer for making a market in currency. The Fund cannot quantify the amount of dealer profit that is embedded in a price quoted by a dealer but believes that the Fund will effect currency transactions at prevailing market prices. Dealer profit from the Fund’s currency trading may, over time, be substantial. The Fund also pays Merrill

28

Lynch interest on short-term loans extended by Merrill Lynch to cover losses on foreign currency positions, and Merrill Lynch retains certain economic benefits from possession of the Fund’s capital.

Certain entities in the Merrill Lynch organization are the beneficiaries of certain of the revenues generated from the Fund. The Sponsor controls the management of the Fund and serves as its sponsor. Although the Sponsor has not sold any assets, directly or indirectly, to the Fund, the Sponsor makes substantial profits from the Fund due to the foregoing revenues.