Exhibit 99.1

|

| THOMSON REUTERS STREETEVENTS |

| EDITED TRANSCRIPT |

| ASNA - Ascena Retail Group, Inc. at ICR XChange Conference |

| EVENT DATE/TIME: JANUARY 16, 2013 / 07:50PM GMT |

|

|

| THOMSON

REUTERS STREETEVENTS | www.streetevents.com | Contact Us |

|

| JANUARY 16, 2013 / 07:50PM GMT, ASNA - Ascena Retail Group, Inc. at ICR XChange Conference |

CORPORATE PARTICIPANTS

David Jaffe Ascena Retail Group, Inc. - President, CEO

CONFERENCE CALL PARTICIPANTS

Edward Yruma KeyBanc Capital Markets - Analyst

PRESENTATION

Edward Yruma - KeyBanc Capital Markets - Analyst

My name is Edward Yruma. I am KeyBanc's senior softlines and specialty retail analyst.

Next up, we are proud to have Ascena Retail Group, one of the leading specialty retailers. The Company recently acquired Charming Shoppes, so a very, very interesting story. The Company is clearly invested in their shared services model, which I think creates a very unique value proposition within specialty retail.

From the Company, we have David Jaffe, CEO. We also have Dirk Montgomery, the new CFO. And then, obviously, you are all familiar with Armand Correia, the outgoing CFO. So with that, David.

David Jaffe - Ascena Retail Group, Inc. - President, CEO

A little video to warm up the audience here.

(Video plays)

(Video ends)

All right. Well, while everybody's reading the forward-looking statement, I just want to take a moment and thank Armand. Armand has been with dressbarn for 22 years. This is his last ICR. And he's transitioning, and Dirk Montgomery has just joined us. This is his first ICR, so it is an interesting transition.

Armand has been with dressbarn in the CFO role since 22 years ago, and really has been my partner in developing the Ascena Retail Group as we know it. So eight or nine years ago when I walked into his office and said, hey, I think I've got this idea about an acquisition, we hadn't done any acquisitions, and it was the start of something that has become really bigger than both of us.

And clearly without his help, we never would have gotten here. So I'm going to be sorry to see him go and I just want to thank him publicly for all his help over the last 22 years.

So let me go high level and I'm going to go really quickly. All these slides are available on our website. But our vision is to serve shareholders and create value by becoming a family of leading retail concepts with $10 billion in sales and top-tier profitability.

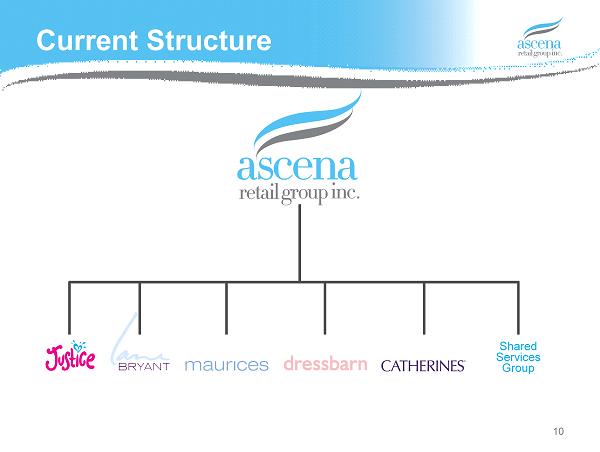

So five brands, we're certainly on our way to creating a family of brands. We've got -- this year, we're projecting just under $5 billion of sales, so we're certainly on that way, on that direction. And the top-tier profitability, we're working on. Some of it's at the brands, and we'll talk a little bit about that. Certainly in the breakouts, we've talked about that, each brand, the opportunities we see it, but it's also in the integration and creating this what we think is a unique model, and I'll talk more about that as well.

So for Ascena, what we present is a diversified portfolio. We've got five niche brands. We don't represent just a certain segment of price point or of consumer, and I think this diversification helps the investors by saying, hey, we may not have all of them hitting perfectly at once, but you can be sure that they're all going to do pretty well over a long period of time. And we have.

| THOMSON

REUTERS STREETEVENTS | www.streetevents.com | Contact Us |

|

| JANUARY 16, 2013 / 07:50PM GMT, ASNA - Ascena Retail Group, Inc. at ICR XChange Conference |

We think we've got significant growth opportunities, whether it's e-commerce, which last year grew 30%; whether it's going into Canada; whether it's developing new categories, such as we've done at Justice with our Brothers line or with Lane Bryant with their very strong Cacique intimate apparel line. We think there's a lot of opportunity with shared services to reduce our overhead and drive synergies, and we'll talk a little bit more about that.

We've got a strong balance sheet, very strong cash flow, and that creates future opportunities. So as people have heard me say before, the infrastructure that we are building is going to allow us to plug and play future acquisitions, should we be so fortunate to find one. But also with that strong cash flow, it enables us to use that cash not just for an acquisition, but to be an aggressive buyer of our stock, as we have traditionally and historically.

I think most of you know that back in June, we closed on our Charming transaction. We think we paid a reasonable price. We didn't steal it, but we didn't pay too much, I don't think. We did about two-thirds cash, one-third debt. So we think the financing is very reasonable and we're very comfortable with the leverage structure.

We have a plan for each division. So quickly, Figi's, we have announced the sale of Figi's. Barclays, represented here, has been given the mandate to sell it. That's a very small business, but we think it's the right time after the Christmas holiday to move that out. The Lane Bryant -- I'm sorry, the Fashion Bug division is being liquidated, and we're in the process now of finishing our GOBs and that will be done by the end of the month.

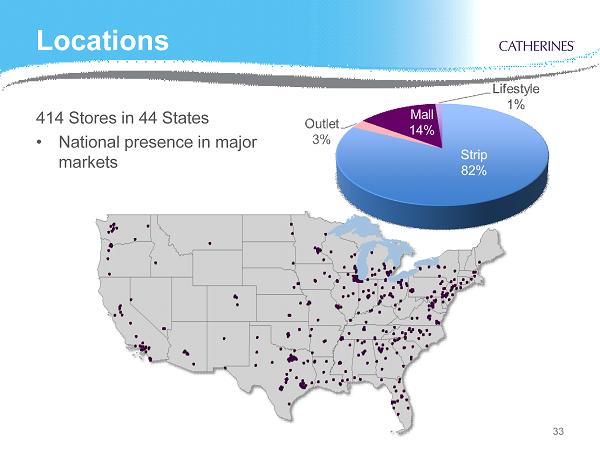

The Catherines business has started regaining some of the ground that they lost since the recession, and we'll see. We're not really putting any capital in that business. It is cash flow positive and we think it's on the right track.

And clearly, the big kahuna is Lane Bryant. We are searching for a president there. We think we have made some good mid-course corrections, but there still needs to be a lot of refinement to that business and I think it's a two- or three-year project. But I do think that that business is certainly capable of 10%-plus operating margins.

Just as an aside, we think there's some unseen assets that have real value to us. Selling Figi's and one of our DCs is probably worth $50 million or so. The NOL is worth about $50 million in cash. And then, we have a DC that we're in the process of repurposing from brick-and-mortar distribution to e-commerce fulfillment. So some good values there that's maybe not as clearly seen.

So Charming, again, we're getting two niche brands. We're working on ways to transfer the Fashion Bug sales. So if you went in there today, you would be given a bounceback to go to the other brands, and we're working -- now we can already accept the Fashion Bug credit card at all four of our other brands, as well.

Overhead reduction is going to be an ongoing challenge. We'll talk more about that in synergies and the creation of best practices among all our divisions, and at our size now we've been able to attract some terrific talent like Dirk and retain some of our best people.

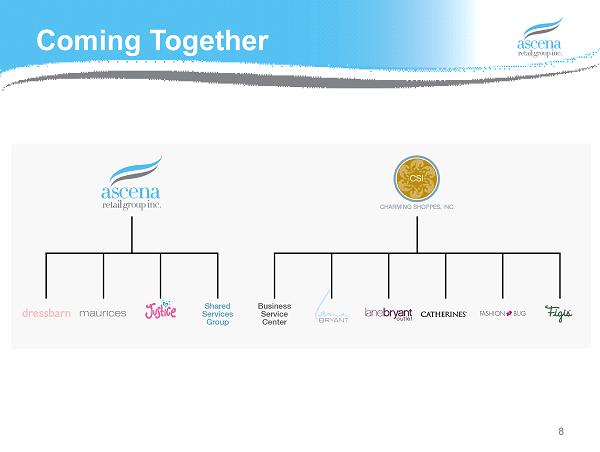

Just quickly, the brands look like -- sorry, the holding companies look like this. So what we did on day one was say, okay, we're going to put the two shared service groups together. We're going to merge Lane Bryant Outlet into Lane Bryant, and eventually we're going to shut down Fashion Bug and sell off Figi's. So go forward, it's a lot simpler. We've got five brands, and shared services becomes our internal brand, servicing the other brands.

So what we think we've done is create this unique business model. So the brands are focusing on the front end. They are driving the traffic. They are creating the energy and excitement about their brands.

What they're not doing is worrying about the back end. They've given that all off to shared services because the customer doesn't care whether or not one group or another group pays payroll or the rent checks or whatever it might be.

So to do this, we've left the teams in place, both physically in Duluth or Columbus or Bensalem, wherever it might be, as well as the management teams, with the exception, as I said, Lane Bryant where Brian retired and now we're trying to fill back that role.

So we think this model looks like this -- customers at the top of the pyramid, the brands support the customer, and then shared services supports the brands. A little different than what you might've seen.

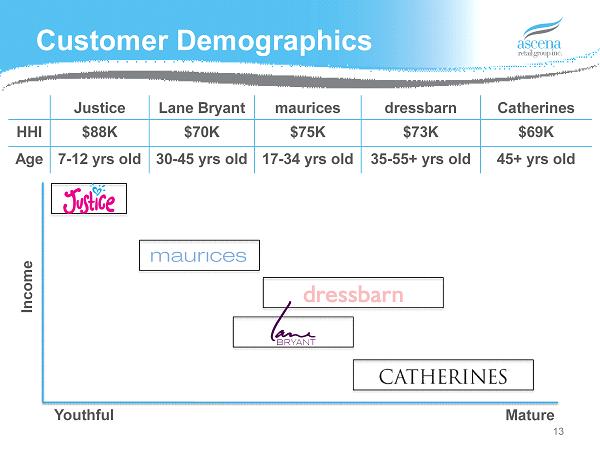

So now, let me switch quickly to our demographics. We believe that each of the brands operates its own unique niche. There is minimal overlap, the slight exception being Lane Bryant and the DBW, dressbarn woman, part of dressbarn. And in that case, there still are some psychographic differences.

| THOMSON

REUTERS STREETEVENTS | www.streetevents.com | Contact Us |

|

| JANUARY 16, 2013 / 07:50PM GMT, ASNA - Ascena Retail Group, Inc. at ICR XChange Conference |

So in general, I would think -- I would say that the Lane Bryant customer is younger, more fashionable, and a little bit more interested in trends. So it's not just the fashion; it's, what's hot now? What's going to make me look sexy? How do I get -- remember, Cacique, what I referred to before, Cacique is 30% of their business. So it's a whole different model than the DBW business. DBW, by the way, is about a third of dressbarn.

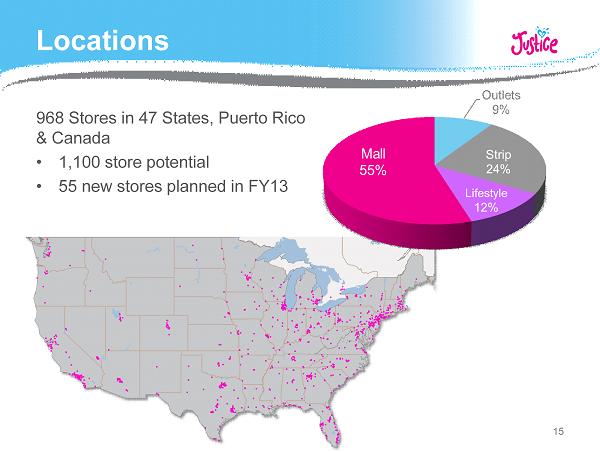

So quickly turning to Justice, I'm just going to be flipping through these pages quickly, and again, they're online, given the time constraints. So Justice still has some runway left on new stores, primarily by building out Canada, as well as building out some of the smaller markets.

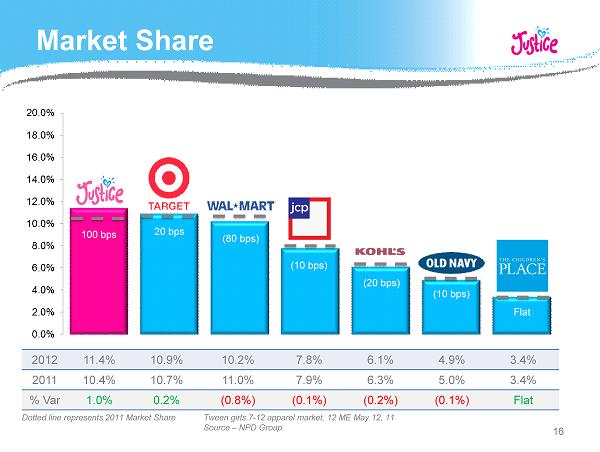

One of the things we're excited about is that we finally took over first place in market share, as you can see here. And if you look at that bottom line, you can see that we actually grew 1% market share and everyone else gave up market share, with the exception of Target that took just a little as well. So very proud of that, and we want to keep taking on more market share and we think that all the strategies we have in place will help us to continue to grow.

One of the strategic initiatives that we think is going to create significant growth opportunity is Brothers. We've got that in about 30 stores. Another 30 are going to open this spring. This is going into the existing stores. It is a shop within the store. It's in a corner. It's got its own tree house feeling.

And it has not, in the 30 stores we have, it is not taken away from the girl sale. So it is plus, it is incremental business, and we think there is significant upside there, both in terms of improving its productivity, as well as rolling it out to more and more stores.

Another driver for Justice has been e-commerce, which continues to do extremely well.

So switching over to Lane Bryant, this is a business that I think was a little bit confused for a number of years. They had many different presidents, many different holding company presidents at the Charming level. And so, one year they might be high fashion, another year they might be career, another year they might be sexy.

So I think it confused the customer. And as we did the research and focus groups last year before we bought it, that's what the customer was telling us.

So we're in the process of rethinking our positioning, thinking about merchandise, thinking about our promos, the cadence, and how we're going to talk to our customers. And I think that we're on the right track. It still needs to be fine-tuned. This is a process. I'm sure we're going to stub our toe and make mistakes, but we're going to test new things and we're going to continue to listen to the customer in response to what it is that she's looking for.

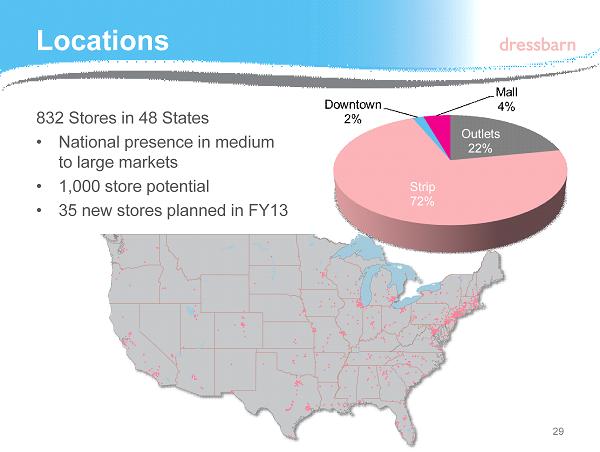

So we've got over 800 stores now. And as you can see, we still have a fair number of mall stores. We're going to be switching most of those mall stores into strips. And when we've done that, we've seen that we can get a little bit of a pickup in sales and even more of a pickup in profitability.

The customer, the large-sized customer, likes the convenience of the strip center where she can drive right up to the store and just walk out. We're also taking the size down a bit from 5,800 prototype to 5,000.

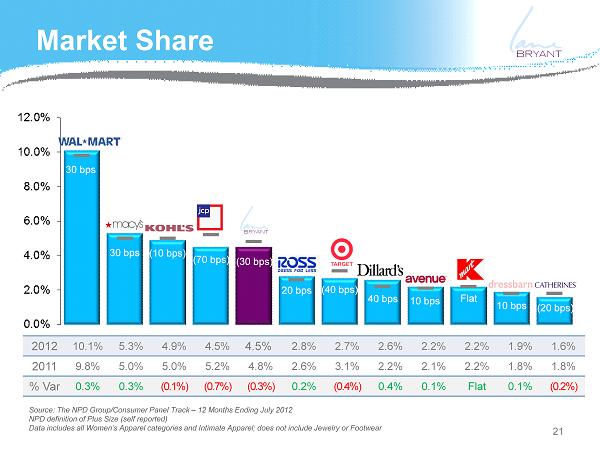

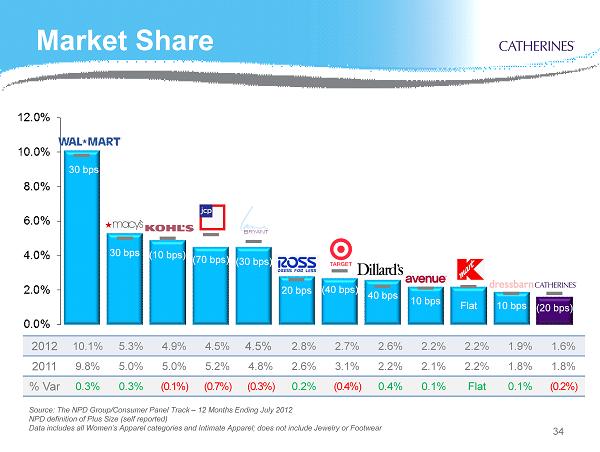

And here, you can see the market share. Right after the big boxes is Lane Bryant. It actually gave up a little bit through some store closings and some weakness in the results, but I think as we look out, the big boxes don't do a terrific job of servicing this customer. The only specialty stores that we compete with would be Avenue, which is much smaller, and, of course, dressbarn woman and Catherines.

So we think the opportunity is there. We just have to execute on it. So I'm still as bullish as I was six months ago when we announced the transaction.

So as we look at some of the growth drivers, clearly e-commerce, refining our mix, and controlling our inventories there is critical.

Also, Cacique. I think Cacique is one of those diamonds in the rough. Even though it's already doing 30% of the business in the stores, actually almost 50% online, this is a business that has legs and I think we can do more with it.

Switching to maurices, we have significant growth potential still here. We like to go into smaller markets. Two-thirds of our -- I'm sorry, 70% of our stores are in markets with populations less than 150,000, so think Walmart Supercenter and we're on the pad. We become the fashion destination. So between Canada and continuing to build out, probably another 50% more stores.

As we look at this business, there is probably two big drivers. Of course, e-commerce. We also think that we can develop sourcing and product development as a strength. Right now, about two-thirds of our goods come from Seventh Avenue, and the stuff that we're sourcing directly, we're doing through agents. So we think that's a big upside, and it allows us at maurices, and dressbarn as well, to tap into the strength that we've developed at Justice and at Charming Shoppes as we merge those sourcing arms together.

| THOMSON

REUTERS STREETEVENTS | www.streetevents.com | Contact Us |

|

| JANUARY 16, 2013 / 07:50PM GMT, ASNA - Ascena Retail Group, Inc. at ICR XChange Conference |

We're calling it Ascena Global Sourcing. And that is going to give us that much more clout with the vendors, and I think we're going to see a win-win there.

Switching to dressbarn, this business is primarily strip dominated. Still some growth. We're testing malls with, frankly, mixed success and we're going to continue to try and refine our approach in malls, which I think is going to be a little different than strips.

And as we look out, I think the big opportunity here is similar to what we said about maurices, is being able to design our own product to cater to our customer. And this is something that is going to be a slow and gradual transition, but creates a lot more opportunity both for margin and for creating that connection with our customer.

So finally on Catherines, this is what I like to call our gift with purchase when we bought Lane Bryant. It's a small business. It is, when we first looked at it, what I would consider to be a dramatic underperformer. The nice thing is -- maybe it's the threat of elimination really focuses the mind and they've really risen to the occasion. They've done a great job. They've had a very good fall.

And as we look out, if they continue to grow at this rate, it will be a very solid, but small, business, but certainly a cash flow producer that would just be another nice niche business to hold onto.

So in this business, we're really not going to be putting any capital against it. And so, we think the opportunity is just for them to continue to strengthen what they're doing, continue to get back to those numbers that they were doing historically prior to the recession, and we'll wait and see.

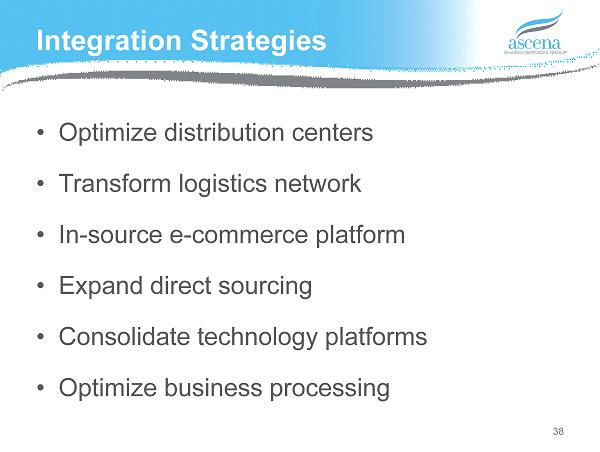

So switching now to our shared service model, you can see that all the stuff that we've got out there is stuff that's back office, it's behind the scenes that doesn't impact the customer. So at a high level, the idea is to again let the brands focus on the customer, let the brands focus on the front end, and also to consolidate all those functions so you can get faster, better, smarter services. You can reduce your costs, greater efficiency, et cetera, et cetera.

So we're getting a lot of this well underway. It's going to take a while, depending on which project. And we've got 19 different teams working on different streams. Some of it is going to finish up next season and some of it is going to take at least two years.

So the big projects, we call the blue chips, is our DCs. We're going from five DCs down to one. Our logistics network, so having everything all brick and mortar in one place, is going to enable us to bring trucks to -- long-haul trucks with five brands' worth of merchandise and then distribute it out from there. So it's going to be much, much more efficient.

We're going to bring e-commerce in house. Right now, all the brands outsource it. That's what we're using that DC for. We're going to convert it to an e-commerce fulfillment center.

We've talked about direct sourcing, our technology, and then, finally, the business processing, the stuff behind the scenes.

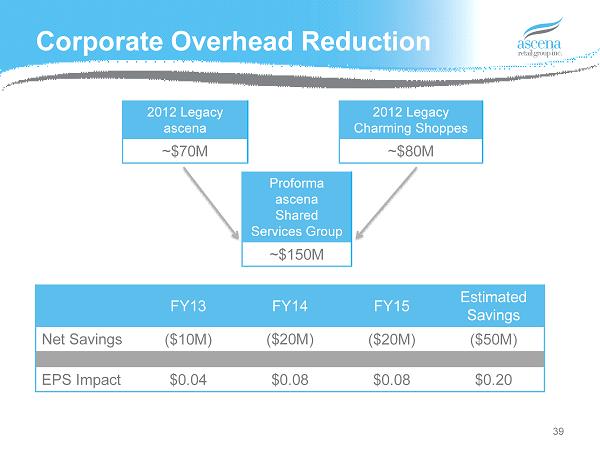

So if you remember, we talked about Charming having about an $80 million overhead structure and Ascena having about a $70 million, so that $150 million needs to come down, we feel, by about $50 million. So we can't get by on the $70 million that we had, but we certainly don't need the $150 million. And here's our best guess as to how long it's going to take to get the $50 million out and to right-size and consolidate.

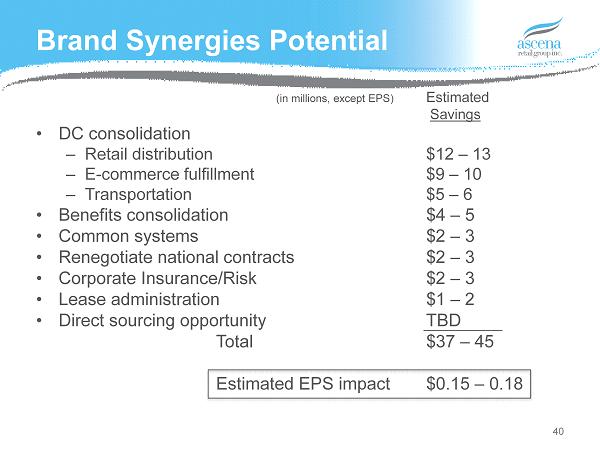

Some of the other savings that we think we're going to see, apart from the overhead reduction, are these synergies. You can go through -- I mentioned some of them already -- the bottom line one, the direct sourcing, is clearly to be determined. And that alone could be bigger than all the other numbers on this page.

So switching to the financials, you can see that our comps, we had a real tough time at dressbarn and Lane Bryant. And that was the primary reason for us taking our guidance down. We don't think it's going to impact spring. Holiday is a different season than spring, and the emphasis where we had problems in sweaters, primarily at dressbarn, obviously we de-emphasized sweaters and dress has become much more important.

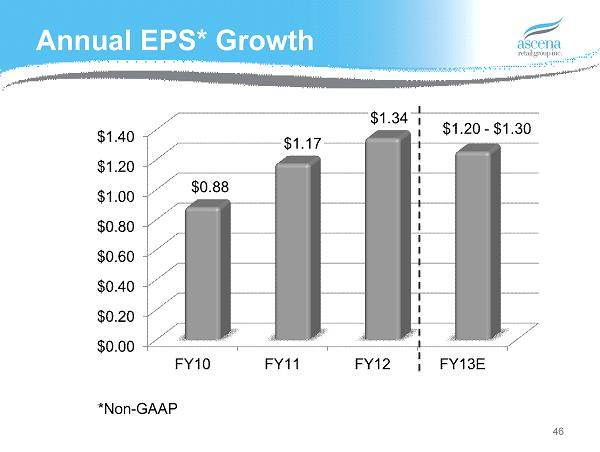

So zipping through, you can see our sales growth. E-commerce growth is very dramatic. Operating income even in a tough year, it's still growing. That shows you the EPS, which is down because of that overhead, that double overhead structure, and the guidance that we just talked about.

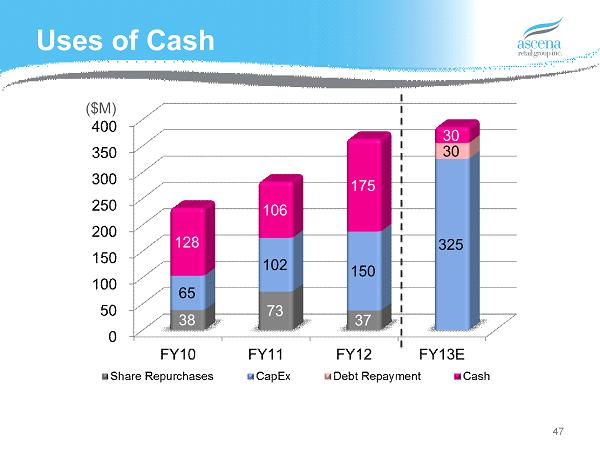

Uses of cash, we'll have a little more cash, we think. It's primarily going into CapEx. And the CapEx is for all that infrastructure that I mentioned a few slides ago. And that will go on for about two years at a similar level, and then it should drop back down to more historical levels with Lane Bryant. Maybe the number gets back to about $200 million.

| THOMSON

REUTERS STREETEVENTS | www.streetevents.com | Contact Us |

|

| JANUARY 16, 2013 / 07:50PM GMT, ASNA - Ascena Retail Group, Inc. at ICR XChange Conference |

So we should have a nice piece of change, both to pay back our debt and, as I said earlier, possibly to either build a war chest, build up our cash position, or possibly to buy back stock.

So long term, our economic model, we think we can continue to grow our top line through comps; through new stores; new categories, like Brothers; e-commerce, which is growing very nicely. We think we can drive our business, once the synergies and overhead reductions are in place, to an operating income percent of about 12% or more. And that should lead us to a consistent 10% EPS growth.

So we're back to investor highlights, and I'm out of time. Thank you very much.

Thomson Reuters reserves the right to make changes to documents, content, or other information on this web site without obligation to notify any person of such changes.

In the conference calls upon which Event Transcripts are based, companies may make projections or other forward-looking statements regarding a variety of items. Such forward-looking statements are based upon current expectations and involve risks and uncertainties. Actual results may differ materially from those stated in any forward-looking statement based on a number of important factors and risks, which are more specifically identified in the companies' most recent SEC filings. Although the companies may indicate and believe that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate or incorrect and, therefore, there can be no assurance that the results contemplated in the forward-looking statements will be realized.

THE INFORMATION CONTAINED IN EVENT TRANSCRIPTS IS A TEXTUAL REPRESENTATION OF THE APPLICABLE COMPANY'S CONFERENCE CALL AND WHILE EFFORTS ARE MADE TO PROVIDE AN ACCURATE TRANSCRIPTION, THERE MAY BE MATERIAL ERRORS, OMISSIONS, OR INACCURACIES IN THE REPORTING OF THE SUBSTANCE OF THE CONFERENCE CALLS. IN NO WAY DOES THOMSON REUTERS OR THE APPLICABLE COMPANY ASSUME ANY RESPONSIBILITY FOR ANY INVESTMENT OR OTHER DECISIONS MADE BASED UPON THE INFORMATION PROVIDED ON THIS WEB SITE OR IN ANY EVENT TRANSCRIPT. USERS ARE ADVISED TO REVIEW THE APPLICABLE COMPANY'S CONFERENCE CALL ITSELF AND THE APPLICABLE COMPANY'S SEC FILINGS BEFORE MAKING ANY INVESTMENT OR OTHER DECISIONS.

© 2013 Thomson Reuters. All Rights Reserved. |

| THOMSON

REUTERS STREETEVENTS | www.streetevents.com | Contact Us |

|