united

states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-22447

Equinox Funds Trust

(Exact name of registrant as specified in charter)

17645 Wright Street, Suite 200, Omaha, Nebraska 68130

(Address of principal executive offices) (Zip code)

Rich Malinowski, Gemini Fund Services, LLC.

80 Arkay Drive, Suite 110, Hauppauge, NY 11788

(Name and address of agent for service)

Registrant's telephone number, including area code: 631-470-2619

Date of fiscal year end: 9/30

Date of reporting period: 9/30/19

Item 1. Reports to Stockholders.

EQUINOX ASPECT CORE DIVERSIFIED

STRATEGY FUND

CLASS A SHARES: EQAAX

CLASS C SHARES: EQACX

CLASS I SHARES: EQAIX

ANNUAL REPORT

SEPTEMBER 30, 2019

1-888-643-3431

WWW.EQUINOXFUNDS.COM

This report and the consolidated financial statements contained herein are submitted for the general information of shareholders and are not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus. Nothing herein contained is to be considered an offer to buy shares of the Equinox Aspect Core Diversified Strategy Fund. Such offering is made only by prospectus, which includes details as to offering price and other material information.

Distributed by Northern Lights Distributors, LLC

Member FINRA

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website www.equinoxfunds.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically or to continue receiving paper copies of shareholder reports, which are available free of charge, by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by following the instructions included with paper Fund documents that have been mailed to you.

EQUINOX ASPECT CORE DIVERSIFIED STRATEGY FUND

Annual Letter to Shareholders for the year ended September 30, 2019

The Equinox Aspect Core Diversified Strategy Fund (the “Fund”) was launched on November 5, 2014 (Class I Shares, as shown in the table below; Class A and C shares were launched on August 21, 2015).

The Fund’s investment objective is to seek long-term capital appreciation, which is pursued by investing (a) directly or (b) indirectly through its wholly-owned subsidiary, in a combination of

| (i) | exposure to a managed futures trading program offered by Aspect Capital Limited (the “Aspect program”)1; and |

| (ii) | a fixed-income portfolio. |

PERFORMANCE OF THE FUND

As of 9/30/2019

| NAME | TICKER | 12

MO RETURN (10/1/18-9/30/19) |

ANNUALIZED RETURN SINCE INCEPTION |

CUMULATIVE RETURN SINCE INCEPTION |

INCEPTION DATE |

|||||||||||

| Class A | EQAAX | 2.50% | -1.68% | -6.73% | 8/21/2015 | |||||||||||

| Class A (with 5.75% maximum sales charge) | EQAAX | -3.38% | -3.10% | -12.13% | 8/21/2015 | |||||||||||

| Class C | EQACX | 1.67% | -2.45% | -9.68% | 8/21/2015 | |||||||||||

| Class I | EQAIX | 2.72% | 0.22% | 1.09% | 11/5/2014^ |

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Investments in Managed Futures are speculative, involve substantial risk, and are not suitable for all investors.

| ^ | Start of performance. |

Returns for the Fund’s shares for the fiscal year are shown in the table above. The Fund’s primary investment allocation is to the Aspect program, which is a diversified intermediate to long-term trend-following program. For the year ended September 30, 2019, the Fund’s I shares were up (+2.72%), and performance since inception is now positive.

| 1 | A “Managed Futures program” generally is a trading program that a CTA uses to guide its investments in futures, forwards, options or spot contracts. Please see the Fund’s Prospectus for a detailed description of the Fund’s investment strategy. |

1

In terms of sector attribution, Interest Rates contributed significantly to performance this year. Stock Indices, Commodities and Currencies detracted from performance.

As shown below, the Aspect program’s (and consequently the Fund’s) market exposure is well-diversified across four major sectors. As of year-end, Currencies were the largest gross exposure, followed by Interest Rates, Commodities and Equity Indices, in that order. It is worth noting that the Aspect program has long-term target risk exposures to various sectors. The actual sector risk exposures at any time are a function of the signals generated by the trading models: when there are more trends in markets, whether up or down, actual sector risk exposures will tend to be higher. It is also worth distinguishing between “gross” and “net” risk exposures: for example, a sector that has long positions whose risk exposure is 10% and short positions whose risk exposure is -15% will be shown as having a gross risk exposure of 25%, even though its “net” exposure would be only -5% (short).

SECTOR ALLOCATION

As of 9/30/2019

| COMMODITIES | CURRENCIES | INTEREST RATES | EQUITY INDICES | TOTAL | ||||||||||

| 24.3% | 29.7% | 28.4% | 17.6% | 100.0% |

MARKET COMMENTARY AND FUND PERFORMANCE HIGHLIGHTS

October 2018

The Fund returned -5.44% in October. As global stock markets sold off together with growth-linked assets such as oil, the demand for safe-haven assets increased. Volatility across financial markets increased during the month as investors grappled with concerns about the pace of rate hikes in the US and the late stage of economic expansion. Declines were extended following weaker corporate earnings and economic data inflamed by geopolitical uncertainty such as Brexit, Italy’s budget crisis and ongoing trade frictions.

Against this background, the trading program’s medium-term trend following models struggled to adapt to the changing market conditions within this short time frame. Although the strategy responded entirely systematically, it was mostly affected by trend reversals during the month. Similarly, reversals of established trends across the oils sector and particularly reformulated gasoline also contributed to losses. Furthermore, a flight to safety, meant that short gold exposure was not profitable, although long dollar positions were broadly profitable, except against the Yen and some strengthening emerging markets. The program also benefited from short exposure to the Euro and Canadian dollar which experienced weakness though some gains were offset by reversals in Sterling.

2

In fixed income, short US bond and interest rate positions contributed positively. Unrelated to the market turmoil, a stronger Brazilian Real propelled coffee to reverse a multi-year bear trend, against the established short position.

November 2018

The fund returned -2.42% in November. The month began with US midterm election results coming in as expected, lifting a cloud of uncertainty. However, volatility followed heightened political anxiety in the UK and Italy, sharp stock market drops and ongoing fragility within commodities including one of the worst months in oil price history. This stoked appetite for safer government bonds. Investors also wrestled with mixed signals surrounding both the pace of US rate hikes and the potential for a US-China trade deal ahead of a high-stakes G20 summit.

Rate hike fears eased slightly with the Federal Reserve softening its policy view by suggesting that rates were already nearing neutral. The program experienced reversals within stock indices reflecting conflicting signals across stock markets. In fixed income, short positions in North American bonds and interest rates incurred losses. This outweighed gains from long positions in other bonds after investors demanded less risky assets during market choppiness. The currencies sector made losses as small gains from short Canadian Dollar exposure were eroded by losses from its long Norwegian Krone exposure after both currencies struggled on oil weakness. In commodities, record high global oil production and waning demand resulted in plunging oil prices. Natural gas defied energy sector losses due to low stockpiles and cold weather forecasts. Long natural gas and short coffee positions performed strongly, with losses coming from other commodity markets including oil products.

December 2018

The fund returned 0.24% in December. Initially, relief over the temporary US-China trade truce evaporated as anxieties about tightening monetary policies, slowing global growth and geopolitical uncertainty took hold. Stock market sell-offs were deep and broad, exacerbated by thin trading volumes over the holiday period, with major stock indices entering bear market territory. Notable events included an inversion of the US yield curve, the partial US government shutdown and the Federal Reserve’s expected rate hike accompanied by unexpectedly hawkish forward guidance. Elsewhere, global oil prices continued to plummet, global credit spreads widened and investors fretted over weak economic data from China and the unresolved nature of Brexit.

In stock indices, the US-issued arrest of a top Chinese technology executive initiated some major global stock index declines. The program’s French stock index position was the sector’s worst performer as it also suffered from domestic troubles. In bonds, the long position in the Japanese 10Y profited from safe-haven appeal. This also benefitted the long position in longer-dated North American bonds. In currencies, investor preference for safety adversely affected the net short

3

Japanese Yen exposure, while commodity weakness benefitted the short Canadian Dollar exposure. In energy, short WTI and Brent crude positions were rewarded as oil prices continued to fall amid global economic health concerns and feared oversupply. However, the long natural gas position struggled as anticipated chilly weather failed to materialise. In agriculturals, the short coffee position gained due to ample supplies.

January 2019

The fund returned -1.41% in January. The year began with an attempt by riskier assets such as stocks and energies to recover some of 2018’s losses. Major US stock indices had their best January in three decades, boosted by strong earnings and a moderation of the Federal Reserve’s hawkish stance. Further optimism surrounded the trade talks between Beijing and Washington, and the temporary reopening of the US government. Despite these developments, geopolitical risks and signs of European economic weakness still spurred investor cautiousness as global bond yields were driven lower. In particular, anxieties increased over difficulties involved in overcoming the Brexit impasse ahead of the impending deadline.

The program’s long US stock index positions made gains partly fuelled by US-China trade hopes, but were offset by short Chinese and European stock index positions. In currencies, long US Dollar positions generally suffered after US monetary policy caution. Oil price strength contributed to a surge in the Canadian Dollar to the detriment of the program’s short exposure. Meanwhile, the short Swedish Krona exposure benefitted from weaker inflation. In fixed income, long positions across longer dated global sovereign issuers were mostly profitable. In particular, German bonds rallied as investors sought protection from a cloudy European economic outlook. In energies, despite record high US production, the oil complex saw significant price gains as OPEC sustained its production cuts and the US began sanctions on Venezuela. This adversely affected short crude oil positions. Metals rose amid a weaker US Dollar with losses from the short nickel position also exacerbated by increased alloy-maker demand. In agriculturals, while some short softs positions incurred losses, abundant US supplies helped make the short lean hogs position profitable.

February 2019

The fund returned 0.95% in February. The month saw a general spring in the step of riskier financial markets. Global stock markets improved following productive US-China trade developments which included a delay to additional tariffs on China by President Trump. Meanwhile, the oil complex was bolstered by announcements of global supply cuts. Amid global growth slowdown concerns, the European Central Bank recognised weaker-than-expected economic data and the Federal Reserve reaffirmed its more data-dependent and neutral policy stance.

In stock indices, the majority of the program’s long positions contributed positively led by the Australian SPI 200 index which rose after its central bank mulled a potential rate cut. In bonds, a

4

wave of government debt selling in Europe adversely affected predominantly long positions. Long Australian bond positions gained on the possible rate cut while long North American bond positions struggled after selloffs. In currencies, concerns over South Africa’s creditworthiness caused losses for long Rand exposure and expectations for a delayed Brexit caused losses for short Sterling exposure. Elsewhere, investors favoured the Euro over the Swedish Krona Dollar amid weak Swedish inflation data, which benefitted program exposures accordingly. In commodities, most short agricultural positions produced strong gains. Wheat futures faltered on demand concerns, while coffee and lean hog futures struggled with oversupply. Within energy, tightening crude output by OPEC resulted in mixed results from various positions across the oil complex.

March 2019

The fund returned 4.26% in March. The month saw investors preoccupied with the partial US yield curve inversion which came after the Federal Reserve kept rates steady and also signalled that rates could stay lower for longer. Global growth appeared to slow down amid weaker than expected US economic releases and stimulus announcements by the Chinese government to shore up China’s economy. Meanwhile, the European Central Bank’s increasingly accommodative stance helped push longer term German bond yields into negative territory. Brexit uncertainty deepened considerably despite the delay to the UK’s departure date.

In bonds, the program made significant gains from most of its long positions in sovereign longer-term bonds as yields fell. This followed weaker global economic data which fuelled recessionary fears, characterised by the first negative yield spread between US 3-Month bills and the US 10Y Note since 2007. In currencies, the program’s long Sterling exposure made losses amid anxiety over Brexit. In stock indices, many of the program’s long developed markets indices were profitable on the back of dovish central bank action. In agriculturals, the program’s short lean hogs position struggled after China, the world’s largest pork consumer, purchased sizeable quantities from the US amid ongoing African swine fever fears. The program’s short coffee position gained after expectations of oversupply increased. In energies, oil prices continued to surge after a surprise drop in US inventories and ongoing Iranian and Venezuelan sanctions.

April 2019

The fund returned 3.06% in April. The month saw a resurgence of risk appetite across the globe causing demand for safe-haven assets to fade. A series of strong economic data paved the way for major US equity indices to set a succession of record highs. Global government debt yields rose as upbeat economic data eased concerns about a global growth slowdown.

The program’s strongest performing sector was stock indices, with the Swedish OMX Index generating the biggest gain. Most long stock index positions profited from better than expected GDP data from China and the US as well as a batch of well-received earnings reports from both the

5

US and Europe. Losses came from long bond positions as government debt proved less appealing against a backdrop of global growth optimism. In currencies, the long Mexican Peso position was the sector’s best performer helped by higher crude oil prices and President Trump backtracking on his previous threat to shut down the US southern border. In agriculturals, short wheat and Arabica coffee positions were among the top performers. Prices of the soft commodities came under pressure from increasing global supply, with Arabica coffee prices hitting a 13-year low. In energies, the long position in reformulated gasoline profited from price rises in the oil complex due to US sanctions, OPEC output cuts and fears of contamination in Russian shipments.

May 2019

The fund returned -1.65% in May. Major US equity indices suffered their worst month of 2019 with investors flocking into safe-haven assets as global trade tensions worsened and economic growth concerns heightened. Increased speculation that the Federal Reserve will soon have to cut interest rates sent US treasury yields plunging to their lowest level since 2017. The trade spat between the US and China escalated due to tariff hikes and increased threats from both countries. Brexit turmoil continued to remain firmly in focus as the UK witnessed the collapse of cross-party Brexit talks and a long-awaited speech from Prime Minister Theresa May outlining her departure plan for June 2019.

The risk-off environment benefitted the program’s long bond positions. Long-dated US treasuries and the Australian 10Y Bond were among the top performers as yields plummeted to multi-year lows following a bleak global economic outlook. Losses came from long positions in stock indices, particularly in Europe as markets were pressured in part by growing Euro-scepticism following EU parliamentary election results. In currencies, short Sterling position profited from political uncertainty linked to Brexit and many short bets on emerging market currencies gained due to relative US Dollar strength. In energy, long oil and gasoline positions were amongst the worst performers in a month where oil prices suffered as trade tensions compounded recessionary fears. Agricultural markets such as coffee and wheat experienced strong gains amid weather-related supply concerns in the Americas leading to losses from short positions in these markets.

June 2019

The fund returned 2.46% in June. Markets were focused on worldwide economic health after global Purchasing Managers’ Index (PMI) surveys signalled contraction and central banks across the globe unified dovish tones, sending investors once again flocking into safe-haven assets. The Federal Reserve left rates unchanged but sent ripples through financial markets with its surprisingly dovish tone causing investors to expect rate cuts as early as July 2019. The European Central Bank’s (ECB) chief Mario Draghi hinted at the possibility of new rate cuts if inflation remained below targets. Markets also closely watched the month-end G-20 summit where the US and China agreed to resume trade talks and to hold off on further tariffs.

6

Sovereign bonds across the globe benefitted from market unease, making the program’s predominately long positions across the sector profitable. The long position in the German 10Y Bund was one of the program’s best performers as its yield fell to a record low. Stock indices was another profitable sector for the program, led by long positions in major European stock indices as the ECB hinted at further stimulus. In currencies, the program’s long US Dollar positions made losses after market expectations for multiple rate cuts were compounded. The program managed to navigate emerging markets, with gains coming from the program’s short US Dollar positions against these c currencies. In commodities, the program’s short natural gas position was the best performer partly due to mild US temperatures. The program’s gold position gained as the shift in global monetary policy rhetoric alongside political tensions helped the metal break through a six-year high. The program’s short soybean position made losses after futures rallied partly due US weather forecasts turning wetter.

July 2019

The fund returned 2.18% in July. Weakness in the global economy and rumbling trade tensions drove the much anticipated 25bps rate cut from the Federal Reserve - the first since the financial crisis. Among a growing list of countries adopting a more dovish stance, European Central Bank officials hinted that a rate cut could come in September and the UK seemed poised for one too driven by the risk of a no-deal Brexit after the appointment of Boris Johnson as Prime Minister. The net short Sterling exposure took centre stage as the top performer for the program, as it fell to its lowest level since 2017 in the face of an increasingly strong US Dollar, a potential UK rate cut and relentless Brexit turmoil.

The general rise in dovish central bank activity benefited the program’s predominantly long fixed- income positions, while losses came from long US Treasury positions as yields rose in the first half of the month amid stronger than expected inflation data. In stock indices, whilst major US indices hit record highs, the best performance came from long positions in Italy and Australia. In commodities, long gold and silver positions gained on expectations for lower interest rates. In energy, losses occurred in oil positions as tensions in the Persian Gulf heated up. In agricultural markets, while short wheat and soy positions made gains, losses came from lean hogs as prices increased on renewed hopes for pork exports to China.

August 2019

The fund returned 4.27% in August. Concerns about global growth drove markets during the month as the US-China trade war continued and threatened to expand into a currency war. The Chinese Renminbi sank past the key threshold of 7 Renminbi per US Dollar for the first time since the financial crisis, causing speculation that China is allowing its currency to depreciate to counteract President Trump’s tariffs. With record amounts of global debt yields in negative territory, bonds continued to rally as trade tensions intensified. Yields on UK bonds reached record lows, with prices

7

further boosted by no-deal Brexit risk and the prospect of interest rate cuts from the Bank of England. Meanwhile Germany sold 30-year bonds at auction with negative yields for the first time, and in Italy government bonds rallied amid the resignation of Prime Minister Giuseppe Conte.

The program’s variable positions in stock indices led to losses driven by choppy price action in global equities. In currencies, the US Dollar strengthened as fears of a global recession grew, leading to losses from some short US Dollar positions against several emerging market currencies. Positive performance came from commodity markets. The long nickel position was a strong performer as prices soared to 16-month highs amid concerns that Indonesia, which has rich reserves of the metal, may bring forward a ban scheduled for 2022 on nickel exports. Gold also rose on safe-haven appeal, leading to gains. In agriculturals, short meat positions performed positively as prices fell following a fire at a major US beef plant. Meanwhile short positions in WTI crude and other oil markets were profitable as trade concerns weighed on prices.

September 2019

The fund returned -3.18% in September. Frosty relations between the US and China thawed at the start of the month, fuelling a resurgence in risk appetite for equity markets and dampening enthusiasm for government bonds. In a widely anticipated move, the US Federal Reserve cut its interest rate by 25bps, the second cut this year and since the global financial crisis. Brent crude oil prices soared 20% mid-month - their biggest jump on record - following attacks on two of Saudi Arabia’s major oil facilities. In UK politics, a series of developments regarding Brexit led to choppy waters for Sterling, including the UK Supreme Court’s ruling that Boris Johnson’s suspension of Parliament was unlawful. Macro optimism rotated investors out of safe-haven markets, leading to losses in the majority of the program’s long fixed income positions.

In currencies, the program’s short Euro position against the US Dollar profited from weaker-than-expected eurozone PMI data for September, which fell to a six-year low. Gains were offset by losses in the long Japanese Yen position against the US Dollar as demand for safe havens fell. Stock indices incurred losses, predominately from short positions in the sector amid rising risk appetite. In commodities, reversals across agriculturals hurt short positions. Cattle climbed from 10-year lows on expected export demand as the US and Japan signed a limited trade deal that opened markets up to billions worth of US products. In energies, losses came from short positions in oil products and natural gas, as late-season heat drove prices up. Longs in gold and silver led to losses as risk appetite recovered.

8

OUTLOOK

We believe that there continues to be much latent uncertainty in the markets. In the US, the outcome of the impeachment proceedings is uppermost on people’s minds. Geopolitical stresses continue in Europe (particularly with respect to Brexit) and the Middle East (Iran, Syria, Saudi Arabia, Yemen). Trade-related issues with China and other trading partners are not yet fully resolved. Climate change remains a concern in the form of more severe weather-related events. The Fed’s policy reversed this year in the face of a slowing economy. Surprisingly, equity markets have continued to scale new heights; however, this has triggered fresh doubts about its sustainability.

Investors should bear in mind that managed futures programs have historically offered useful diversification benefits, with the potential for attractive risk-adjusted returns over the long run. In fact, managed futures have historically tended to perform well in a wide variety of market conditions, perhaps particularly so during periods of equity market turbulence and volatility expansion. We continue to believe that a significant and strategic allocation to the asset class has the potential to serve investors well in the long run.

Although the Fund has been in operation for a short period of time, Aspect Capital has been trading a similar strategy dating back to 1999. Aspect’s program has historically offered useful diversification benefits, along with what we view as attractive risk-adjusted long-term returns over multiple market cycles. In our opinion, the Fund and the managed futures asset class should continue to offer these potential benefits in a market environment that is still challenging and a geopolitical outlook that remains fraught with uncertainty. In fact, managed futures, although not a hedge for equities in the true sense of the word, have historically displayed the ability to earn what has been termed as “crisis alpha:” positive returns during periods when equity markets have fallen and volatility has increased.

Thank you for investing in the Equinox Aspect Core Diversified Strategy Fund.

9

DEFINITIONS

Brexit is the popular term for the prospective withdrawal of the United Kingom from the European Union.

A Commodity Trading Advisor (“CTA”) is a trader who may invest in more than 150 global futures markets. They seek to generate profit in both bull or bear markets, due to their ability to go long (buy) futures positions, in anticipation of rising markets, or go short (sell) futures positions, in anticipation of falling markets.

A Derivative Contract is a financial contract which derives its value from the performance of another entity such as an asset, index, or interest rate, called the “underlying”. Derivatives are one of the three main categories of financial instruments, the other two being equities (i.e. stocks) and debt (i.e. bonds and mortgages).

Long Position refers to the buying of a security such as a stock, commodity or currency, with the expectation that the asset will rise in value.

The Purchasing Managers’ Index (PMI) is an index of the prevailing direction of economic trends in the manufacturing and service sectors. It consists of a diffusion index that summarizes whether market conditions, as viewed by purchasing managers, are expanding, staying the same, or contracting.

Risk-adjusted return is a mesuare of the return on an investment relative to the risk of that investment, over a specific period, which is generally expressed as a number or rating.

Short Position is a position whereby an investor sells borrowed securities in anticipation of a price decline and is required to return an equal number of shares at some point in the future.

A Trend Following strategy generally seeks to identify the general direction of one or more global market segments (either up or down) using indicators such as current market prices and moving average prices, and buy or sell investments based on the assessment of these trade signals as determined before a trade is made. Trend-following generally focuses on the direction an investment or global market segment already has gone and not on the direction it may go.

3858-NLD-11/7/2019

10

| Equinox Aspect Core Diversified Strategy Fund |

| PORTFOLIO REVIEW (Unaudited) |

| September 30, 2019 |

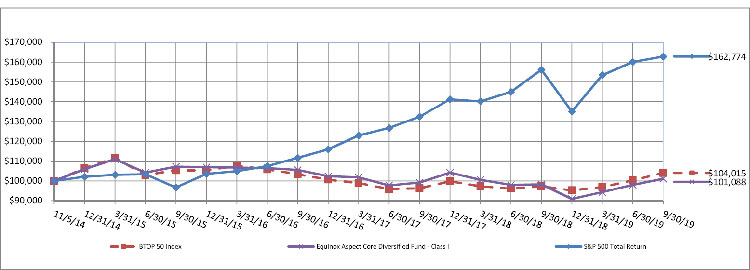

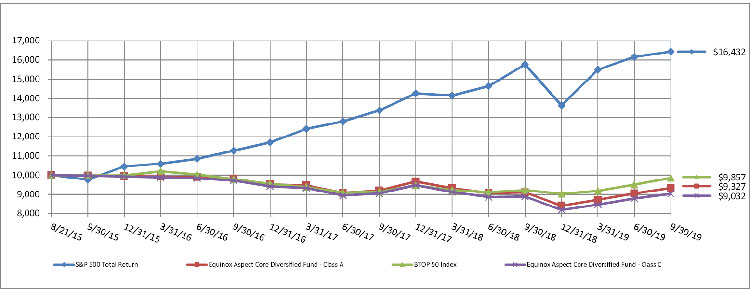

The Fund’s performance figures* for the periods ended September 30, 2019, as compared to its benchmarks:

| Annualized | ||||

| Since Inception | Since Inception | |||

| One Year | Three Years | (8/21/15) | (11/5/14) | |

| Equinox Aspect Core Diversified Strategy Fund | ||||

| Class A with load | (3.38)% | (3.58)% | (3.10)% | N/A |

| Class A | 2.50% | (1.65)% | (1.68)% | N/A |

| Class C | 1.67% | (2.42)% | (2.45)% | N/A |

| Class I | 2.72% | (1.43)% | N/A | 0.22% |

| S&P 500 Total Return Index ^ | 4.25% | 13.39% | 12.85% | 10.45% |

| BTOP 50 Index ** | 6.95% | 0.22% | (0.35)% | 0.81% |

| * | The performance data quoted is historical. The performance comparison includes reinvestment of all dividends and capital gains and has been adjusted for Class A maximum applicable sales charge of 5.75%. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on portfolio distributions or on the redemptions of portfolio shares. Performance figures for periods greater than one year are annualized. The returns would have been lower had Equinox Institutional Asset Management, LP (the “Advisor”) not waived its fees or reimbursed a portion of the Fund’s expenses. Per the fee table in the Fund’s prospectus dated February 1, 2019, the Fund’s “Total Annual Fund Operating Expenses” are 2.14%, 2.89% and 1.89% and the Fund’s “Total Annual Fund Operating Expenses (after Fee Waiver and/or Expense Reimbursement)” are 1.70%, 2.45% and 1.45% for Class A, Class C and Class I shares, respectively, of the Fund’s average daily net assets. These expenses may differ from the actual expenses incurred by the Fund for the period covered by this report. Additional information regarding the Fund’s expense ratios is available in the Financial Highlights. For performance information current to the most recent month-end please call 1-888-643-3431. |

| ^ | The S&P 500 Total Return Index is a widely accepted, unmanaged index of U.S. stock market performance which does not take into account charges, fees and other expenses. Investors cannot invest directly in an index. |

| ** | The Barclay BTOP50 Index (“BTOP50 Index”) seeks to replicate the overall composition of the managed futures industry with regard to trading style and overall market exposure. The BTOP50 Index employs a top-down approach in selecting its constituents. The largest investable trading advisor programs, as measured by assets under management, are selected for inclusion in the BTOP50 Index. In each calendar year the selected trading advisors represent, in aggregate, no less than 50% of the investable assets of the Barclay CTA Universe. For 2019, there are 20 funds in the BTOP50 Index. Investors cannot invest directly in an index. |

Comparison of the Change in Value of a $100,000 Investment

11

| Equinox Aspect Core Diversified Strategy Fund |

| PORTFOLIO REVIEW (Unaudited) (Continued) |

| September 30, 2019 |

Comparison of the Change in Value of a $10,000 Investment

| Holdings by Asset Class | % of Net Assets | |||

| U.S. Treasury Notes | 82.5 | % | ||

| Other Assets Less Liabilities | 17.5 | % | ||

| 100.0 | % | |||

Please refer to the Consolidated Portfolio of Investments in this annual report for a detail of the Fund’s holdings. The value of the Fund’s derivative positions that provide exposure to a managed futures program is included in “other assets less liabilities;” however, the portfolio composition detailed above does not include derivatives exposure. See the accompanying notes for more information on the impact of the Fund’s derivative positions on the consolidated financial statements.

12

| Equinox Aspect Core Diversified Strategy Fund |

| CONSOLIDATED PORTFOLIO OF INVESTMENTS |

| September 30, 2019 |

| Principal | Coupon Rate | |||||||||||

| Amount | (%) | Maturity | Fair Value | |||||||||

| U.S. TREASURY NOTES - 82.5% | ||||||||||||

| $ | 2,330,000 | United States Treasury Note *+ | 1.2500 | 1/31/2020 | $ | 2,324,903 | ||||||

| 3,100,000 | United States Treasury Note *+ | 1.5000 | 10/31/2019 | 3,098,512 | ||||||||

| 5,000,000 | United States Treasury Note | 1.6250 | 11/30/2020 | 4,990,430 | ||||||||

| 3,895,000 | United States Treasury Note *+ | 2.0000 | 7/31/2020 | 3,899,412 | ||||||||

| 5,000,000 | United States Treasury Note | 2.2500 | 2/15/2021 | 5,033,301 | ||||||||

| TOTAL U.S. TREASURY NOTES (Cost - $19,208,561) | 19,346,558 | |||||||||||

| TOTAL INVESTMENTS - 82.5% (Cost - $19,208,561) | $ | 19,346,558 | ||||||||||

| OTHER ASSETS AND LIABILITIES - NET - 17.5% | 4,093,920 | |||||||||||

| TOTAL NET ASSETS - 100.0% | $ | 23,440,478 | ||||||||||

| * | All or a portion of this security is pledged as collateral for futures and forward foreign currency contracts. As of September 30, 2019, $909,527 and $1,499,209 is pledged as collateral for futures and forward foreign currency contracts, respectively. |

| + | A portion of this security is a holding of Equinox Aspect Core Diversified Strategy Fund Limited. |

See accompanying notes to consolidated financial statements.

13

| Equinox Aspect Core Diversified Strategy Fund |

| CONSOLIDATED PORTFOLIO OF INVESTMENTS (Continued) |

| September 30, 2019 |

| Unrealized | ||||||||||||||

| Number of | Notional Value at | Appreciation/ | ||||||||||||

| Description | Contracts | Counterparty | Expiration Date | September 30, 2019 | (Depreciation) | |||||||||

| SHORT FUTURES CONTRACTS | ||||||||||||||

| Australian Dollar Future | 31 | Morgan Stanley | Dec-19 | 2,098,080 | $ | 24,930 | ||||||||

| Brent Crude Future + | 1 | Morgan Stanley | Dec-19 | 59,250 | 2,170 | |||||||||

| British Pound Future | 19 | Morgan Stanley | Dec-19 | 1,464,425 | 7,963 | |||||||||

| Canadian Dollar Future | 3 | Morgan Stanley | Dec-19 | 226,890 | 235 | |||||||||

| Coffee Future + | 2 | Morgan Stanley | Dec-19 | 75,863 | (1,688 | ) | ||||||||

| Coffee Future + | 1 | Morgan Stanley | Mar-20 | 39,263 | (2,287 | ) | ||||||||

| Coffee Future + | 1 | Morgan Stanley | May-20 | 40,125 | (1,594 | ) | ||||||||

| Copper Future + | 4 | Morgan Stanley | Dec-19 | 257,850 | 1,113 | |||||||||

| Corn Future + | 3 | Morgan Stanley | Dec-19 | 58,200 | (3,213 | ) | ||||||||

| Corn Future + | 3 | Morgan Stanley | Mar-20 | 59,925 | (2,725 | ) | ||||||||

| Euro FX Future | 26 | Morgan Stanley | Dec-19 | 3,562,813 | 39,856 | |||||||||

| FTSE/JSE Top 40 Future | 4 | Morgan Stanley | Dec-19 | 130,116 | 2,870 | |||||||||

| Gasoline RBOB Future + | 1 | Morgan Stanley | Nov-19 | 65,793 | (3,427 | ) | ||||||||

| Hang Seng Index Future | 2 | Morgan Stanley | Oct-19 | 332,194 | 102 | |||||||||

| Hard Red Winter Wheat Future + | 12 | Morgan Stanley | Dec-19 | 249,000 | (6,988 | ) | ||||||||

| HSCEI Future | 5 | Morgan Stanley | Oct-19 | 325,599 | 1,506 | |||||||||

| Lean Hogs Future + | 3 | Morgan Stanley | Dec-19 | 87,120 | (8,900 | ) | ||||||||

| Lean Hogs Future + | 2 | Morgan Stanley | Feb-20 | 62,400 | (3,550 | ) | ||||||||

| Live Cattle Future + | 5 | Morgan Stanley | Dec-19 | 220,600 | (8,070 | ) | ||||||||

| Live Cattle Future + | 4 | Morgan Stanley | Feb-20 | 186,600 | (7,970 | ) | ||||||||

| Live Cattle Future + | 3 | Morgan Stanley | Apr-20 | 142,890 | (8,450 | ) | ||||||||

| LME Copper Future + | 2 | Morgan Stanley | Dec-19 | 286,188 | (1,695 | ) | ||||||||

| LME Primary Aluminum Future + | 2 | Morgan Stanley | Dec-19 | 86,400 | 1,565 | |||||||||

| LME Zinc Future + | 3 | Morgan Stanley | Dec-19 | 179,363 | (3,120 | ) | ||||||||

| Low Sulfur Gas Oil Future + | 2 | Morgan Stanley | Nov-19 | 117,300 | (725 | ) | ||||||||

| Low Sulfur Gas Oil Future + | 1 | Morgan Stanley | Dec-19 | 57,975 | 750 | |||||||||

| MSCI Emerging Market Future | 4 | Morgan Stanley | Dec-19 | 200,380 | 2,750 | |||||||||

| Natural Gas Future + | 4 | Morgan Stanley | Nov-19 | 93,200 | 2,270 | |||||||||

| Natural Gas Future + | 2 | Morgan Stanley | Dec-19 | 50,080 | 1,290 | |||||||||

| New Zealand Dollar Future | 42 | Morgan Stanley | Dec-19 | 2,635,080 | 54,780 | |||||||||

| NY Harbor ULSD Future + | 1 | Morgan Stanley | Nov-19 | 79,682 | (3,847 | ) | ||||||||

| NY Harbor ULSD Future + | 1 | Morgan Stanley | Dec-19 | 79,313 | 1,352 | |||||||||

| Soybean Future + | 3 | Morgan Stanley | Nov-19 | 135,900 | (5,200 | ) | ||||||||

| Soybean Meal Future + | 7 | Morgan Stanley | Dec-19 | 210,700 | 2,490 | |||||||||

| Wheat (CBT) Future + | 1 | Morgan Stanley | Dec-19 | 24,788 | (1,025 | ) | ||||||||

| Wheat (CBT) Future + | 2 | Morgan Stanley | Mar-20 | 50,250 | (2,112 | ) | ||||||||

| World Sugar #11 Future + | 14 | Morgan Stanley | Mar-20 | 198,352 | (5,824 | ) | ||||||||

| World Sugar #11 Future + | 12 | Morgan Stanley | May-20 | 171,360 | (6,227 | ) | ||||||||

| WTI Crude Oil Future + | 1 | Morgan Stanley | Nov-19 | 54,070 | 4,180 | |||||||||

| 63,535 | ||||||||||||||

| LONG FUTURES CONTRACTS | ||||||||||||||

| 3 Month Euro (EURIBOR) | 1 | Morgan Stanley | Dec-21 | 274,008 | 577 | |||||||||

| 3 Month Euro (EURIBOR) | 2 | Morgan Stanley | Mar-22 | 547,935 | (510 | ) | ||||||||

| 90 Day Bank Bill Future | 11 | Morgan Stanley | Mar-20 | 7,404,712 | 56 | |||||||||

| 90 Day Bank Bill Future | 11 | Morgan Stanley | Jun-20 | 7,405,623 | (262 | ) | ||||||||

| 90 Day Bank Bill Future | 8 | Morgan Stanley | Sep-20 | 5,386,305 | (194 | ) | ||||||||

| 90 Day Bank Bill Future | 5 | Morgan Stanley | Dec-20 | 3,366,109 | (239 | ) | ||||||||

| 90 Day Bank Bill Future | 5 | Morgan Stanley | Mar-21 | 3,366,275 | 350 | |||||||||

| 90 Day Bank Bill Future | 3 | Morgan Stanley | Jun-21 | 2,019,715 | (89 | ) | ||||||||

| 90 Day Euro Future | 2 | Morgan Stanley | Mar-20 | 491,650 | 213 | |||||||||

See accompanying notes to consolidated financial statements.

14

| Equinox Aspect Core Diversified Strategy Fund |

| CONSOLIDATED PORTFOLIO OF INVESTMENTS (Continued) |

| September 30, 2019 |

| Unrealized | ||||||||||||||

| Number of | Notional Value at | Appreciation/ | ||||||||||||

| Description | Contracts | Counterparty | Expiration Date | September 30, 2019 | (Depreciation) | |||||||||

| LONG FUTURES CONTRACTS (Continued) | ||||||||||||||

| 90 Day Euro Future | 6 | Morgan Stanley | Jun-20 | 1,476,675 | $ | (838 | ) | |||||||

| 90 Day Euro Future | 4 | Morgan Stanley | Sep-20 | 985,250 | (350 | ) | ||||||||

| 90 Day Euro Future | 4 | Morgan Stanley | Dec-20 | 985,250 | 238 | |||||||||

| 90 Day Euro Future | 4 | Morgan Stanley | Mar-21 | 986,050 | 1,700 | |||||||||

| 90 Day Euro Future | 4 | Morgan Stanley | Jun-21 | 986,250 | (1,400 | ) | ||||||||

| 90 Day Euro Future | 3 | Morgan Stanley | Sep-21 | 739,725 | 488 | |||||||||

| 90 Day Euro Future | 3 | Morgan Stanley | Dec-21 | 739,538 | 1,388 | |||||||||

| 90 Day Euro Future | 3 | Morgan Stanley | Mar-22 | 739,650 | (1,125 | ) | ||||||||

| 90 Day Sterling Future | 1 | Morgan Stanley | Mar-20 | 153,075 | (47 | ) | ||||||||

| 90 Day Sterling Future | 8 | Morgan Stanley | Jun-20 | 1,225,215 | (96 | ) | ||||||||

| 90 Day Sterling Future | 16 | Morgan Stanley | Sep-20 | 2,451,415 | (216 | ) | ||||||||

| 90 Day Sterling Future | 15 | Morgan Stanley | Dec-20 | 2,297,970 | (356 | ) | ||||||||

| 90 Day Sterling Future | 12 | Morgan Stanley | Mar-21 | 1,839,301 | 659 | |||||||||

| 90 Day Sterling Future | 15 | Morgan Stanley | Jun-21 | 2,299,357 | 1,148 | |||||||||

| 90 Day Sterling Future | 14 | Morgan Stanley | Sep-21 | 2,146,174 | 1,388 | |||||||||

| 90 Day Sterling Future | 13 | Morgan Stanley | Dec-21 | 1,992,676 | 1,377 | |||||||||

| 90 Day Sterling Future | 13 | Morgan Stanley | Mar-22 | 1,992,676 | (735 | ) | ||||||||

| AEX Index (Amsterdam) Future | 3 | Morgan Stanley | Oct-19 | 379,488 | 2,611 | |||||||||

| Australian 3 Year Bond Future | 58 | Morgan Stanley | Dec-19 | 4,525,608 | 7,849 | |||||||||

| Australian 10 Year Bond Future | 10 | Morgan Stanley | Dec-19 | 993,798 | 3,617 | |||||||||

| CAC 40 10 Euro Future | 8 | Morgan Stanley | Oct-19 | 495,038 | 6,580 | |||||||||

| Canadian 10 Year Bond Future | 10 | Morgan Stanley | Dec-19 | 1,077,039 | (13,778 | ) | ||||||||

| Canadian Bank Acceptance Future | 3 | Morgan Stanley | Jun-20 | 555,759 | (1,883 | ) | ||||||||

| Canadian Bank Acceptance Future | 3 | Morgan Stanley | Sep-20 | 556,071 | (1,638 | ) | ||||||||

| Canadian Bank Acceptance Future | 3 | Morgan Stanley | Dec-20 | 556,269 | (2,045 | ) | ||||||||

| Canadian Bank Acceptance Future | 2 | Morgan Stanley | Mar-21 | 371,054 | (1,241 | ) | ||||||||

| Canadian Bank Acceptance Future | 2 | Morgan Stanley | Jun-21 | 371,186 | (1,109 | ) | ||||||||

| Cocoa Future + | 1 | Morgan Stanley | Dec-19 | 24,420 | 40 | |||||||||

| Cocoa Future + | 1 | Morgan Stanley | Mar-20 | 24,560 | (90 | ) | ||||||||

| DAX Index Future | 1 | Morgan Stanley | Dec-19 | 338,262 | (1,260 | ) | ||||||||

| DJIA Index E-Mini Future | 2 | Morgan Stanley | Dec-19 | 269,010 | (1,620 | ) | ||||||||

| Euro-BOBL Future | 18 | Morgan Stanley | Dec-19 | 2,661,942 | (14,405 | ) | ||||||||

| Euro-BTP Italian Government Bond Future | 4 | Morgan Stanley | Dec-19 | 635,979 | 4,001 | |||||||||

| Euro-BUND Future | 11 | Morgan Stanley | Dec-19 | 2,089,642 | (13,486 | ) | ||||||||

| Euro-BUXL 30 Year Bond Future | 1 | Morgan Stanley | Dec-19 | 237,119 | (4,207 | ) | ||||||||

| Euro OAT Future | 3 | Morgan Stanley | Dec-19 | 557,016 | (3,339 | ) | ||||||||

| Euro-SCHATZ Future | 4 | Morgan Stanley | Dec-19 | 489,849 | (1,593 | ) | ||||||||

| Euro STOXX 50 Future | 12 | Morgan Stanley | Dec-19 | 465,080 | 5,025 | |||||||||

| FTSE 100 Index Future | 2 | Morgan Stanley | Dec-19 | 181,974 | 1,058 | |||||||||

| FTSE/MIB Index Future | 5 | Morgan Stanley | Dec-19 | 601,409 | 8,250 | |||||||||

| Gold 100 Oz. Future + | 3 | Morgan Stanley | Dec-19 | 441,870 | 9,960 | |||||||||

| ICE ECX Emission Future + | 1 | Morgan Stanley | Dec-19 | 26,950 | (4,029 | ) | ||||||||

| Japan 10 Year Bond Future | 1 | Morgan Stanley | Dec-19 | 1,434,374 | 1,118 | |||||||||

| Japanese Yen Future | 15 | Morgan Stanley | Dec-19 | 1,743,375 | (7,888 | ) | ||||||||

| LME Nickle Future + | 3 | Morgan Stanley | Dec-19 | 307,170 | 13,156 | |||||||||

| Long Gilt Future | 10 | Morgan Stanley | Dec-19 | 1,654,240 | 6,193 | |||||||||

| Mexican Peso Future | 8 | Morgan Stanley | Dec-19 | 200,240 | (2,745 | ) | ||||||||

| Mini MSCI EAFE Index Future | 1 | Morgan Stanley | Dec-19 | 94,920 | 285 | |||||||||

| Nasdaq 100 E-Mini Future | 1 | Morgan Stanley | Dec-19 | 155,410 | (1,293 | ) | ||||||||

| NIKKEI 225 (CME) Future | 1 | Morgan Stanley | Dec-19 | 109,475 | (425 | ) | ||||||||

See accompanying notes to consolidated financial statements.

15

| Equinox Aspect Core Diversified Strategy Fund |

| CONSOLIDATED PORTFOLIO OF INVESTMENTS (Continued) |

| September 30, 2019 |

| Unrealized | ||||||||||||||

| Number of | Notional Value at | Appreciation/ | ||||||||||||

| Description | Contracts | Counterparty | Expiration Date | September 30, 2019 | (Depreciation) | |||||||||

| LONG FUTURES CONTRACTS (Continued) | ||||||||||||||

| NIKKEI 225 (SGX) Future | 1 | Morgan Stanley | Dec-19 | 100,578 | $ | (323 | ) | |||||||

| OMXS30 Index Future | 23 | Morgan Stanley | Oct-19 | 385,452 | 174 | |||||||||

| Platinum Future + | 2 | Morgan Stanley | Jan-20 | 88,920 | (5,890 | ) | ||||||||

| S&P 500 E-Mini Future | 2 | Morgan Stanley | Dec-19 | 297,850 | (1,220 | ) | ||||||||

| S&P/TSX 60 IX Future | 4 | Morgan Stanley | Dec-19 | 601,873 | (1,692 | ) | ||||||||

| Short Euro-BTP Future | 14 | Morgan Stanley | Dec-19 | 1,719,966 | 1,753 | |||||||||

| Silver Future + | 3 | Morgan Stanley | Dec-19 | 254,970 | (24,280 | ) | ||||||||

| SPI 200 Future | 6 | Morgan Stanley | Dec-19 | 676,002 | 1,092 | |||||||||

| Swiss Franc Future | 3 | Morgan Stanley | Dec-19 | 378,075 | (2,288 | ) | ||||||||

| TOPIX Index Future | 1 | Morgan Stanley | Dec-19 | 146,935 | (1,804 | ) | ||||||||

| US 2 Year Note (CBT) Future | 10 | Morgan Stanley | Dec-19 | 2,155,000 | (3,984 | ) | ||||||||

| US 5 Year Note (CBT) Future | 16 | Morgan Stanley | Dec-19 | 1,906,375 | (6,547 | ) | ||||||||

| US 10 Year Note (CBT) Future | 17 | Morgan Stanley | Dec-19 | 2,215,313 | (17,063 | ) | ||||||||

| US Long Bond (CBT) Future | 5 | Morgan Stanley | Dec-19 | 811,563 | (9,383 | ) | ||||||||

| US Ultra Bond (CBT) Future | 2 | Morgan Stanley | Dec-19 | 383,813 | (5,563 | ) | ||||||||

| (82,224 | ) | |||||||||||||

| NET UNREALIZED DEPRECIATION ON FUTURES CONTRACTS | $ | (18,689 | ) | |||||||||||

| + | This investment is a holding of Equinox Aspect Core Diversified Strategy Fund Limited. |

See accompanying notes to consolidated financial statements.

16

| Equinox Aspect Core Diversified Fund |

| CONSOLIDATED PORTFOLIO OF INVESTMENTS (Continued) |

| September 30, 2019 |

Schedule of Forward Foreign Currency Contracts

| Settlement | Currency Units to | Unrealized Appreciation | ||||||||||||

| Date | Counterparty | Receive/Deliver | In Exchange For | (Depreciation) | ||||||||||

| 12/18/2019 | Morgan Stanley | 2,598,197 | CZK | 100,000 | EUR | $ | 218 | |||||||

| 12/18/2019 | Morgan Stanley | 1,295,880 | CZK | 50,000 | EUR | (27 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 50,000 | EUR | 1,302,556 | CZK | (255 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 200,000 | EUR | 65,722,000 | HUF | 4,439 | ||||||||

| 12/18/2019 | Morgan Stanley | 100,000 | EUR | 33,080,316 | HUF | 1,502 | ||||||||

| 12/18/2019 | Morgan Stanley | 100,000 | EUR | 33,626,956 | HUF | (285 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 250,000 | EUR | 2,501,706 | NOK | (1,474 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 175,000 | EUR | 1,751,195 | NOK | (1,032 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 75,000 | EUR | 750,541 | NOK | (445 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 50,000 | EUR | 499,978 | NOK | (255 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 50,000 | EUR | 502,521 | NOK | (535 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 50,000 | EUR | 503,579 | NOK | (652 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 50,000 | EUR | 505,083 | NOK | (817 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 50,000 | EUR | 499,665 | NOK | (220 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 50,000 | EUR | 498,204 | NOK | (59 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 50,000 | EUR | 498,593 | NOK | (102 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 50,000 | EUR | 501,580 | NOK | (431 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 50,000 | EUR | 499,032 | NOK | (151 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 50,000 | EUR | 497,464 | NOK | 22 | ||||||||

| 12/18/2019 | Morgan Stanley | 50,000 | EUR | 499,038 | NOK | (151 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 50,000 | EUR | 496,797 | NOK | 96 | ||||||||

| 12/18/2019 | Morgan Stanley | 25,000 | EUR | 251,974 | NOK | (346 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 25,000 | EUR | 251,977 | NOK | (346 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 50,000 | EUR | 219,872 | PLN | (64 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 50,000 | EUR | 218,408 | PLN | 301 | ||||||||

| 12/18/2019 | Morgan Stanley | 50,000 | EUR | 219,822 | PLN | (52 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 50,000 | EUR | 220,288 | PLN | (168 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 50,000 | EUR | 219,973 | PLN | (90 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 500,000 | EUR | 5,400,678 | SEK | (3,843 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 500,000 | EUR | 5,413,026 | SEK | (5,105 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 100,000 | EUR | 1,066,723 | SEK | 603 | ||||||||

| 12/18/2019 | Morgan Stanley | 175,096 | ILS | 50,000 | USD | 590 | ||||||||

| 12/18/2019 | Morgan Stanley | 174,916 | ILS | 50,000 | USD | 538 | ||||||||

| 12/18/2019 | Morgan Stanley | 174,539 | ILS | 50,000 | USD | 429 | ||||||||

| 12/18/2019 | Morgan Stanley | 174,538 | ILS | 50,000 | USD | 429 | ||||||||

See accompanying notes to consolidated financial statements.

17

| Equinox Aspect Core Diversified Fund |

| CONSOLIDATED PORTFOLIO OF INVESTMENTS (Continued) |

| September 30, 2019 |

Schedule of Forward Foreign Currency Contracts (Continued)

| Settlement | Currency Units to | Unrealized Appreciation | ||||||||||||

| Date | Counterparty | Receive/Deliver | In Exchange For | (Depreciation) | ||||||||||

| 12/18/2019 | Morgan Stanley | 174,395 | ILS | 50,000 | USD | $ | 388 | |||||||

| 12/18/2019 | Morgan Stanley | 87,236 | ILS | 25,000 | USD | 205 | ||||||||

| 12/18/2019 | Morgan Stanley | 87,234 | ILS | 25,000 | USD | 204 | ||||||||

| 12/18/2019 | Morgan Stanley | 7,286,968 | INR | 100,000 | USD | 1,968 | ||||||||

| 12/18/2019 | Morgan Stanley | 3,639,369 | INR | 50,000 | USD | 926 | ||||||||

| 12/18/2019 | Morgan Stanley | 3,624,884 | INR | 50,000 | USD | 724 | ||||||||

| 12/18/2019 | Morgan Stanley | 3,591,384 | INR | 50,000 | USD | 255 | ||||||||

| 12/18/2019 | Morgan Stanley | 1,784,767 | INR | 25,000 | USD | (25 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 1,784,672 | INR | 25,000 | USD | (27 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 59,558,140 | KRW | 50,000 | USD | (93 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 30,166,385 | KRW | 25,000 | USD | 278 | ||||||||

| 12/18/2019 | Morgan Stanley | 30,139,000 | KRW | 25,000 | USD | 255 | ||||||||

| 12/18/2019 | Morgan Stanley | 29,540,370 | KRW | 25,000 | USD | (246 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 29,534,968 | KRW | 25,000 | USD | (251 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 499,637 | NOK | 50,000 | EUR | 217 | ||||||||

| 12/18/2019 | Morgan Stanley | 497,279 | NOK | 50,000 | EUR | (43 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 497,067 | NOK | 50,000 | EUR | (66 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 496,807 | NOK | 50,000 | EUR | (95 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 495,437 | NOK | 50,000 | EUR | (246 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 7,877,212 | PHP | 150,000 | USD | 1,493 | ||||||||

| 12/18/2019 | Morgan Stanley | 2,613,187 | PHP | 50,000 | USD | 256 | ||||||||

| 12/18/2019 | Morgan Stanley | 2,597,937 | PHP | 50,000 | USD | (37 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 217,229 | PLN | 50,000 | EUR | (596 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 6,685,610 | RUB | 100,000 | USD | 1,933 | ||||||||

| 12/18/2019 | Morgan Stanley | 6,490,726 | RUB | 100,000 | USD | (1,038 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 3,264,978 | RUB | 50,000 | USD | (220 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 3,225,377 | RUB | 50,000 | USD | (824 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 1,653,636 | RUB | 25,000 | USD | 212 | ||||||||

| 12/18/2019 | Morgan Stanley | 1,653,429 | RUB | 25,000 | USD | 209 | ||||||||

| 12/18/2019 | Morgan Stanley | 1,633,658 | RUB | 25,000 | USD | (92 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 1,633,608 | RUB | 25,000 | USD | (93 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 1,632,475 | RUB | 25,000 | USD | (110 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 1,631,877 | RUB | 25,000 | USD | (119 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 1,629,046 | RUB | 25,000 | USD | (163 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 1,627,274 | RUB | 25,000 | USD | (190 | ) | |||||||

See accompanying notes to consolidated financial statements.

18

| Equinox Aspect Core Diversified Fund |

| CONSOLIDATED PORTFOLIO OF INVESTMENTS (Continued) |

| September 30, 2019 |

Schedule of Forward Foreign Currency Contracts (Continued)

| Settlement | Currency Units to | Unrealized Appreciation | ||||||||||||

| Date | Counterparty | Receive/Deliver | In Exchange For | (Depreciation) | ||||||||||

| 12/18/2019 | Morgan Stanley | 1,626,998 | RUB | 25,000 | USD | $ | (194 | ) | ||||||

| 12/18/2019 | Morgan Stanley | 1,626,145 | RUB | 25,000 | USD | (207 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 1,625,079 | RUB | 25,000 | USD | (223 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 1,624,592 | RUB | 25,000 | USD | (230 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 1,623,989 | RUB | 25,000 | USD | (240 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 1,623,622 | RUB | 25,000 | USD | (245 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 1,623,295 | RUB | 25,000 | USD | (250 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 1,622,882 | RUB | 25,000 | USD | (257 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 1,621,997 | RUB | 25,000 | USD | (270 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 1,620,263 | RUB | 25,000 | USD | (296 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 1,617,930 | RUB | 25,000 | USD | (332 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 1,615,013 | RUB | 25,000 | USD | (377 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 1,614,589 | RUB | 25,000 | USD | (383 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 1,614,270 | RUB | 25,000 | USD | (388 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 1,613,986 | RUB | 25,000 | USD | (392 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 1,613,212 | RUB | 25,000 | USD | (404 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 1,611,420 | RUB | 25,000 | USD | (431 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 1,611,050 | RUB | 25,000 | USD | (437 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 1,068,992 | SEK | 100,000 | EUR | (371 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 1,067,785 | SEK | 100,000 | EUR | (494 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 1,065,715 | SEK | 100,000 | EUR | (706 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 68,834 | SGD | 50,000 | USD | (180 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 68,672 | SGD | 50,000 | USD | (297 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 10,709,943 | THB | 350,000 | USD | 706 | ||||||||

| 12/18/2019 | Morgan Stanley | 1,531,447 | THB | 50,000 | USD | 148 | ||||||||

| 12/18/2019 | Morgan Stanley | 1,526,597 | THB | 50,000 | USD | (10 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 1,816,974 | TRY | 300,000 | USD | 13,734 | ||||||||

| 12/18/2019 | Morgan Stanley | 591,916 | TRY | 100,000 | USD | 2,205 | ||||||||

| 12/18/2019 | Morgan Stanley | 585,681 | TRY | 100,000 | USD | 1,129 | ||||||||

| 12/18/2019 | Morgan Stanley | 578,915 | TRY | 100,000 | USD | (40 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 1,559,693 | TWD | 50,000 | USD | 501 | ||||||||

| 12/18/2019 | Morgan Stanley | 1,546,293 | TWD | 50,000 | USD | 67 | ||||||||

| 12/18/2019 | Morgan Stanley | 1,534,843 | TWD | 50,000 | USD | (304 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 1,534,143 | TWD | 50,000 | USD | (327 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 762,946 | TWD | 25,000 | USD | (297 | ) | |||||||

See accompanying notes to consolidated financial statements.

19

| Equinox Aspect Core Diversified Fund |

| CONSOLIDATED PORTFOLIO OF INVESTMENTS (Continued) |

| September 30, 2019 |

Schedule of Forward Foreign Currency Contracts (Continued)

| Settlement | Currency Units to | Unrealized Appreciation | ||||||||||||

| Date | Counterparty | Receive/Deliver | In Exchange For | (Depreciation) | ||||||||||

| 12/18/2019 | Morgan Stanley | 762,546 | TWD | 25,000 | USD | $ | (310 | ) | ||||||

| 12/18/2019 | Morgan Stanley | 50,000 | USD | 203,312 | BRL | 1,413 | ||||||||

| 12/18/2019 | Morgan Stanley | 50,000 | USD | 205,495 | BRL | 891 | ||||||||

| 12/18/2019 | Morgan Stanley | 50,000 | USD | 210,232 | BRL | (241 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 50,000 | USD | 204,872 | BRL | 1,040 | ||||||||

| 12/18/2019 | Morgan Stanley | 50,000 | USD | 206,712 | BRL | 600 | ||||||||

| 12/18/2019 | Morgan Stanley | 50,000 | USD | 209,280 | BRL | (13 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 25,000 | USD | 105,135 | BRL | (125 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 25,000 | USD | 105,168 | BRL | (133 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 25,000 | USD | 104,396 | BRL | 52 | ||||||||

| 12/18/2019 | Morgan Stanley | 25,000 | USD | 104,410 | BRL | 48 | ||||||||

| 12/18/2019 | Morgan Stanley | 150,000 | USD | 108,486,975 | CLP | 768 | ||||||||

| 12/18/2019 | Morgan Stanley | 150,000 | USD | 107,865,975 | CLP | 1,622 | ||||||||

| 12/18/2019 | Morgan Stanley | 100,000 | USD | 72,354,650 | CLP | 471 | ||||||||

| 12/18/2019 | Morgan Stanley | 25,000 | USD | 18,123,250 | CLP | 70 | ||||||||

| 12/18/2019 | Morgan Stanley | 25,000 | USD | 18,150,413 | CLP | 33 | ||||||||

| 12/18/2019 | Morgan Stanley | 25,000 | USD | 17,997,913 | CLP | 243 | ||||||||

| 12/18/2019 | Morgan Stanley | 25,000 | USD | 17,998,913 | CLP | 241 | ||||||||

| 12/18/2019 | Morgan Stanley | 25,000 | USD | 18,100,663 | CLP | 101 | ||||||||

| 12/18/2019 | Morgan Stanley | 25,000 | USD | 18,118,750 | CLP | 76 | ||||||||

| 12/18/2019 | Morgan Stanley | 25,000 | USD | 18,107,413 | CLP | 92 | ||||||||

| 12/18/2019 | Morgan Stanley | 25,000 | USD | 18,113,250 | CLP | 84 | ||||||||

| 12/18/2019 | Morgan Stanley | 25,000 | USD | 18,149,250 | CLP | 34 | ||||||||

| 12/18/2019 | Morgan Stanley | 25,000 | USD | 18,158,750 | CLP | 21 | ||||||||

| 12/18/2019 | Morgan Stanley | 200,000 | USD | 700,385,700 | COP | (603 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 100,000 | USD | 343,432,850 | COP | 1,635 | ||||||||

| 12/18/2019 | Morgan Stanley | 50,000 | USD | 172,313,925 | COP | 646 | ||||||||

| 12/18/2019 | Morgan Stanley | 25,000 | USD | 86,797,463 | COP | 140 | ||||||||

| 12/18/2019 | Morgan Stanley | 25,000 | USD | 86,846,963 | COP | 125 | ||||||||

| 12/18/2019 | Morgan Stanley | 25,000 | USD | 86,241,963 | COP | 299 | ||||||||

| 12/18/2019 | Morgan Stanley | 25,000 | USD | 86,355,713 | COP | 266 | ||||||||

| 12/18/2019 | Morgan Stanley | 25,000 | USD | 86,709,463 | COP | 165 | ||||||||

| 12/18/2019 | Morgan Stanley | 25,000 | USD | 86,924,750 | COP | 103 | ||||||||

| 12/18/2019 | Morgan Stanley | 50,000 | USD | 3,641,666 | INR | (959 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 50,000 | USD | 3,643,771 | INR | (988 | ) | |||||||

See accompanying notes to consolidated financial statements.

20

| Equinox Aspect Core Diversified Fund |

| CONSOLIDATED PORTFOLIO OF INVESTMENTS (Continued) |

| September 30, 2019 |

Schedule of Forward Foreign Currency Contracts (Continued)

| Settlement | Currency Units to | Unrealized Appreciation | ||||||||||||

| Date | Counterparty | Receive/Deliver | In Exchange For | (Depreciation) | ||||||||||

| 12/18/2019 | Morgan Stanley | 50,000 | USD | 3,630,816 | INR | $ | (807 | ) | ||||||

| 12/18/2019 | Morgan Stanley | 200,000 | USD | 242,120,260 | KRW | (2,887 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 150,000 | USD | 181,432,695 | KRW | (2,033 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 50,000 | USD | 59,536,500 | KRW | 111 | ||||||||

| 12/18/2019 | Morgan Stanley | 50,000 | USD | 59,897,000 | KRW | (191 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 25,000 | USD | 30,252,035 | KRW | (350 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 25,000 | USD | 30,267,893 | KRW | (363 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 25,000 | USD | 29,928,000 | KRW | (78 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 25,000 | USD | 29,930,000 | KRW | (80 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 125,000 | USD | 172,630 | SGD | 54 | ||||||||

| 12/18/2019 | Morgan Stanley | 125,000 | USD | 172,647 | SGD | 42 | ||||||||

| 12/18/2019 | Morgan Stanley | 50,000 | USD | 69,047 | SGD | 25 | ||||||||

| 12/18/2019 | Morgan Stanley | 50,000 | USD | 68,776 | SGD | 221 | ||||||||

| 12/18/2019 | Morgan Stanley | 50,000 | USD | 69,016 | SGD | 48 | ||||||||

| 12/18/2019 | Morgan Stanley | 25,000 | USD | 34,700 | SGD | (115 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 25,000 | USD | 34,703 | SGD | (117 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 200,000 | USD | 6,229,200 | TWD | (1,692 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 150,000 | USD | 4,672,432 | TWD | (1,286 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 50,000 | USD | 1,541,257 | TWD | 96 | ||||||||

| 12/18/2019 | Morgan Stanley | 25,000 | USD | 777,979 | TWD | (190 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 25,000 | USD | 778,029 | TWD | (191 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 150,000 | USD | 2,303,010 | ZAR | (354 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 50,000 | USD | 767,408 | ZAR | (101 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 50,000 | USD | 751,166 | ZAR | 960 | ||||||||

| 12/18/2019 | Morgan Stanley | 50,000 | USD | 760,383 | ZAR | 358 | ||||||||

| 12/18/2019 | Morgan Stanley | 747,170 | ZAR | 50,000 | USD | (1,220 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 743,052 | ZAR | 50,000 | USD | (1,489 | ) | |||||||

| 12/18/2019 | Morgan Stanley | 739,997 | ZAR | 50,000 | USD | (1,689 | ) | |||||||

| Net Unrealized Appreciation on Forward Foreign Currency Contracts | $ | 1,708 | ||||||||||||

| BRL - Brazilian Real | INR - Indian Rupee | SGD - Singapore Dollar |

| CLP - Chilean Peso | KRW - South Korean Won | THB - Thai Baht |

| COP - Colombian Peso | NOK - Norwegian Krone | TRY - Turkish Lira |

| CZK - Czech Koruna | PHP - Philippine Piso | TWD - Taiwan New Dollar |

| EUR - Euro | PLN - Polish Zloty | USD - U.S. Dollar |

| HUF - Hungarian Forint | RUB - Russian Ruble | ZAR - South African Rand |

| ILS - Israeli Shekel | SEK - Swedish Krona |

See accompanying notes to consolidated financial statements.

21

| Equinox Aspect Core Diversified Strategy Fund |

| CONSOLIDATED STATEMENT OF ASSETS AND LIABILITIES |

| September 30, 2019 |

| ASSETS | ||||

| Investment securities: | ||||

| At cost | $ | 19,208,561 | ||

| At fair value | $ | 19,346,558 | ||

| Cash and cash equivalents | 3,403,722 | |||

| Deposits for futures contracts (1) | 488,549 | |||

| Deposits for forward foreign currency contracts (2) | 194,302 | |||

| Net unrealized appreciation on forward foreign currency contracts | 1,708 | |||

| Interest receivable | 82,910 | |||

| Receivable for Fund shares sold | 2,500 | |||

| Prepaid expenses & other assets | 26,006 | |||

| TOTAL ASSETS | 23,546,255 | |||

| LIABILITIES | ||||

| Net unrealized depreciation on futures contracts | 18,689 | |||

| Payable for Fund shares redeemed | 50,000 | |||

| Advisory fee payable | 5,581 | |||

| Distribution (12b-1) fees payable | 2,998 | |||

| Audit and tax fees payable | 23,776 | |||

| Printing fee payable | 909 | |||

| Payable to related parties | 1,186 | |||

| Accrued expenses and other liabilities | 2,638 | |||

| TOTAL LIABILITIES | 105,777 | |||

| NET ASSETS | $ | 23,440,478 | ||

| Net Assets Consist Of: | ||||

| Paid in capital | $ | 26,796,752 | ||

| Accumulated losses | (3,356,274 | ) | ||

| NET ASSETS | $ | 23,440,478 | ||

| Net Asset Value Per Share: | ||||

| Class A Shares: | ||||

| Net Assets | $ | 717,438 | ||

| Shares of beneficial interest outstanding ($0 par value, unlimited shares authorized) | 76,171 | |||

| Net asset value (Net Assets ÷ Shares Outstanding) and redemption price per share | $ | 9.42 | ||

| Maximum offering price per share (maximum sales charges of 5.75%) (a) | $ | 9.99 | ||

| Class C Shares: | ||||

| Net Assets | $ | 3,406,437 | ||

| Shares of beneficial interest outstanding ($0 par value, unlimited shares authorized) | 373,973 | |||

| Net asset value (Net Assets ÷ Shares Outstanding), offering price, and redemption price per share (a) | $ | 9.11 | ||

| Class I Shares: | ||||

| Net Assets | $ | 19,316,603 | ||

| Shares of beneficial interest outstanding ($0 par value, unlimited shares authorized) | 2,044,631 | |||

| Net asset value (Net Assets ÷ Shares Outstanding), offering price and redemption price per share | $ | 9.45 |

| (1) | Segregated in the custodian account as collateral for futures contracts. |

| (2) | Segregated in the custodian account as collateral for forward foreign currency contracts. |

| (a) | A contingent deferred sales charge (“CDSC”) of 1.00% is assessed on certain redemptions of ClassA shares made within 12 months after a purchase of Class A shares where no initial sales charge was paid at the time of purchase as part of an investment of $1,000,000 or more. A CDSC of 1.00% is assessed on redemptions of Class C shares made within one year after a purchase of such shares. |

See accompanying notes to consolidated financial statements.

22

| Equinox Aspect Core Diversified Strategy Fund |

| CONSOLIDATED STATEMENT OF OPERATIONS |

| For the Year Ended September 30, 2019 |

| INVESTMENT INCOME | ||||

| Interest | $ | 625,092 | ||

| EXPENSES | ||||

| Investment advisory fees | 353,862 | |||

| Distribution (12b-1) fees | ||||

| Class A | 1,866 | |||

| Class C | 31,081 | |||

| Registration fees | 48,192 | |||

| Printing and postage expenses | 28,471 | |||

| Audit fees | 13,239 | |||

| Accounting services fees | 11,274 | |||

| Administrative services fees | 30,934 | |||

| Legal fees | 41,547 | |||

| Transfer agent fees | 15,458 | |||

| Compliance officer fees | 2,269 | |||

| Custodian fees | 7,328 | |||

| Trustees fees and expenses | 7,035 | |||

| Third party administrative services fees | 2,911 | |||

| Other expenses | 10,977 | |||

| TOTAL EXPENSES | 606,444 | |||

| Less fees waived by the Advisor | (179,344 | ) | ||

| NET EXPENSES | 427,100 | |||

| NET INVESTMENT INCOME | 197,992 | |||

| REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS | ||||

| Net realized gain/(loss) on: | ||||

| Investments | (12,604 | ) | ||

| Futures contracts | 793,185 | |||

| Futures commissions | (35,171 | ) | ||

| Forward foreign currency contracts | (923,944 | ) | ||

| Foreign currency translations | 18,108 | |||

| (160,426 | ) | |||

| Net change in unrealized appreciation/(depreciation) on: | ||||

| Investments | 194,481 | |||

| Futures contracts | (1,266,121 | ) | ||

| Forward foreign currency contracts | 387,786 | |||

| Foreign currency translations | 32,151 | |||

| (651,703 | ) | |||

| NET REALIZED AND UNREALIZED LOSS ON INVESTMENTS | (812,129 | ) | ||

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | (614,137 | ) |

See accompanying notes to consolidated financial statements.

23

| Equinox Aspect Core Diversified Strategy Fund |

| CONSOLIDATED STATEMENTS OF CHANGES IN NET ASSETS |

| Year Ended | Year Ended | |||||||

| September 30, | September 30, | |||||||

| 2019 | 2018 | |||||||

| FROM OPERATIONS | ||||||||

| Net investment income/(loss) | $ | 197,992 | $ | (142,376 | ) | |||

| Net realized loss on futures contracts, forward foreign currency contracts and foreign currency transactions | (160,426 | ) | (1,187,665 | ) | ||||

| Net change in unrealized appreciation/(depreciation) on investments, futures contracts, forward foreign currency contracts and foreign currency transactions | (651,703 | ) | 831,059 | |||||

| Net decrease in net assets resulting from operations | (614,137 | ) | (498,982 | ) | ||||

| FROM SHARES OF BENEFICIAL INTEREST | ||||||||

| Proceeds from shares sold: | ||||||||

| Class A | 231,593 | 688,553 | ||||||

| Class C | 581,887 | 2,993,950 | ||||||

| Class I | 8,901,314 | 4,770,963 | ||||||

| Payments for shares redeemed: | ||||||||

| Class A | (151,141 | ) | (174,487 | ) | ||||

| Class C | (226,219 | ) | (372,057 | ) | ||||

| Class I | (22,697,256 | ) | (2,593,750 | ) | ||||

| Net increase/(decrease) in net assets from shares of beneficial interest | (13,359,822 | ) | 5,313,172 | |||||

| TOTAL INCREASE/(DECREASE) IN NET ASSETS | (13,973,959 | ) | 4,814,190 | |||||

| NET ASSETS | ||||||||

| Beginning of Period | 37,414,437 | 32,600,247 | ||||||

| End of Period* | $ | 23,440,478 | $ | 37,414,437 | ||||

| SHARE ACTIVITY | ||||||||

| Class A: | ||||||||

| Shares Sold | 25,558 | 71,024 | ||||||

| Shares Redeemed | (16,166 | ) | (18,320 | ) | ||||

| Net increase in shares of beneficial interest outstanding | 9,392 | 52,704 | ||||||

| Class C: | ||||||||

| Shares Sold | 68,788 | 319,253 | ||||||

| Shares Redeemed | (25,653 | ) | (40,955 | ) | ||||

| Net increase in shares of beneficial interest outstanding | 43,135 | 278,298 | ||||||

| Class I: | ||||||||

| Shares Sold | 1,011,176 | 504,552 | ||||||

| Shares Redeemed | (2,646,492 | ) | (276,318 | ) | ||||

| Net increase/(decrease) in shares of beneficial interest outstanding | (1,635,316 | ) | 228,234 | |||||

| * | Net Assets - End of Year includes accumulated net investment loss of $(2,935,329) as of September 30, 2018. |

See accompanying notes to consolidated financial statements.

24

| Equinox Aspect Core Diversified Strategy Fund |

| CONSOLIDATED FINANCIAL HIGHLIGHTS |

Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout Each Period

| Class A | ||||||||||||||||||||

| Year Ended | Year Ended | Year Ended | Year Ended | Period Ended | ||||||||||||||||

| September 30, | September 30, | September 30, | September 30, | September 30, | ||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 (1) | ||||||||||||||||

| Net asset value, beginning of period | $ | 9.19 | $ | 9.29 | $ | 9.98 | $ | 10.73 | $ | 10.75 | ||||||||||

| Activity from investment operations: | ||||||||||||||||||||

| Net investment income/(loss) (2) | 0.06 | (0.04 | ) | (0.12 | ) | (0.15 | ) | (0.02 | ) | |||||||||||

| Net realized and unrealized gain/(loss) on investments | 0.17 | (0.06 | ) | (0.49 | ) | (0.04 | ) | 0.00 | (3,8) | |||||||||||

| Total from investment operations | 0.23 | (0.10 | ) | (0.61 | ) | (0.19 | ) | (0.02 | ) | |||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net investment income | — | — | (0.08 | ) | (0.13 | ) | — | |||||||||||||

| Net realized gains | — | — | — | (0.43 | ) | — | ||||||||||||||

| Total distributions | — | — | (0.08 | ) | (0.56 | ) | — | |||||||||||||

| Net asset value, end of period | $ | 9.42 | $ | 9.19 | $ | 9.29 | $ | 9.98 | $ | 10.73 | ||||||||||

| Total return (4) | 2.50 | % | (1.08 | )% | (6.18 | )% | (1.77 | )% | (0.19 | )% | ||||||||||

| Net assets, at end of period (000’s) | $ | 717 | $ | 614 | $ | 131 | $ | 734 | $ | 2 | ||||||||||

| Ratio of net expenses to average net assets (6) | 1.70 | % | 1.70 | % | 1.70 | % | 1.70 | % | 1.89 | % (7) | ||||||||||

| Ratio of net investment income/(loss) to average net assets | 0.63 | % | (0.44 | )% | (1.23 | )% | (1.44 | )% | (1.51 | )% (7) | ||||||||||

| Portfolio Turnover Rate | 59 | % | 20 | % | 0 | % | 0 | % | 0 | % (5) | ||||||||||

| (1) | The Equinox Aspect Core Diversified Strategy Fund Class A commenced operations on August 21, 2015. |

| (2) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the period. |

| (3) | Realized and unrealized gains per share in this caption are balancing amounts necessary to reconcile the change in net asset value per share for the period, and may not reconcile with the aggregate gains and losses in the statement of operations due to the timing of share transactions for the period. |

| (4) | Total returns are historical and assume changes in share price and reinvestment of dividends and distributions. Total returns for periods of less than one year are not annualized. Total returns would be lower absent fee waivers. Total returns shown exclude the effect of the maximum appreciable sales charge of 5.75% and, if applicable, wire redemption fees. |

| (5) | Not annualized. |

| (6) | Represents the ratio of expenses to average net assets net of fee waivers and/or expense reimbursements by the Advisor. Had these waivers not been in place,the expense ratio would have been: | 2.42 | % | 2.14 | % | 2.47 | % | 2.29 | % | 2.26 | % (7) |

| (7) | Annualized. |

| (8) | Amount is less than $0.005. |

See accompanying notes to consolidated financial statements.

25

| Equinox Aspect Core Diversified Strategy Fund |

| CONSOLIDATED FINANCIAL HIGHLIGHTS |

Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout Each Period

| Class C | ||||||||||||||||||||

| Year Ended | Year Ended | Year Ended | Year Ended | Period Ended | ||||||||||||||||

| September 30, | September 30, | September 30, | September 30, | September 30, | ||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 (1) | ||||||||||||||||

| Net asset value, beginning of period | $ | 8.96 | $ | 9.12 | $ | 9.89 | $ | 10.72 | $ | 10.75 | ||||||||||

| Activity from investment operations: | ||||||||||||||||||||

| Net investment loss (2) | (0.01 | ) | (0.11 | ) | (0.18 | ) | (0.22 | ) | (0.03 | ) | ||||||||||

| Net realized and unrealized gain/(loss) on investments | 0.16 | (0.05 | ) | (0.51 | ) | (0.04 | ) | 0.00 | (3,8) | |||||||||||

| Total from investment operations | 0.15 | (0.16 | ) | (0.69 | ) | (0.26 | ) | (0.03 | ) | |||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net investment income | — | — | (0.08 | ) | (0.14 | ) | — | |||||||||||||

| Net realized gains | — | — | — | (0.43 | ) | — | ||||||||||||||

| Total distributions | — | — | (0.08 | ) | (0.57 | ) | — | |||||||||||||

| Net asset value, end of period | $ | 9.11 | $ | 8.96 | $ | 9.12 | $ | 9.89 | $ | 10.72 | ||||||||||

| Total return (4) | 1.67 | % | (1.75 | )% | (6.99 | )% | (2.52 | )% | (0.28 | )% | ||||||||||

| Net assets, at end of period (000’s) | $ | 3,406 | $ | 2,963 | $ | 479 | $ | 261 | $ | 2 | ||||||||||

| Ratio of net expenses to average net assets (6) | 2.45 | % | 2.45 | % | 2.45 | % | 2.45 | % | 2.64 | % (7) | ||||||||||

| Ratio of net investment loss to average net assets | (0.12 | )% | (1.24 | )% | (1.96 | )% | (2.19 | )% | (2.26 | )% (7) | ||||||||||

| Portfolio Turnover Rate | 59 | % | 20 | % | 0 | % | 0 | % | 0 | % (5) | ||||||||||

| (1) | The Equinox Aspect Core Diversified Strategy Fund Class C commenced operations on August 21, 2015. |

| (2) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the period. |

| (3) | Realized and unrealized gains per share in this caption are balancing amounts necessary to reconcile the change in net asset value per share for the period, and may not reconcile with the aggregate gains and losses in the statement of operations due to the timing of share transactions for the period. |

| (4) | Total returns are historical and assume changes in share price and reinvestment of dividends and distributions. Total returns for periods of less than one year are not annualized. Total returns would be lower absent fee waivers. Total returns shown exclude the effect of the maximum appreciable sales charge and, if applicable, wire redemption fees. |

| (5) | Not annualized. |