Exhibit (a)(5)(G)

– H ighl y Confident ia l Draf t – Project Pacific Specia l Committe e Discussio n Materials April 25, 2024

1 – H ighl y Confident ia l Draf t – Disclaimer This presentation has been prepared by Centerview Partners LLC (“Centerview”) for use solely by the Special Committee of Board of Directors of Pacific (“Pacific”, the “Company” or the ” Special Committee “) in connection with its evaluation of a proposed strategic alternatives for Pacific and for no other purpose . The information contained herein is based upon information supplied by or on behalf of Pacific and publicly available information, and portions of the information contained herein may be based upon statements, estimates and forecasts provided by Pacific . Centerview has relied upon the accuracy and completeness of the foregoing information, and has not assumed any responsibility for any independent verification of such information or for any independent evaluation or appraisal of any of the assets or liabilities (contingent or otherwise) of Pacific or any other entity, or concerning the solvency or fair value of Pacific or any other entity . The financial analysis in this presentation is complex and is not necessarily susceptible to a partial analysis or summary description . In performing this financial analysis, Centerview has considered the results of its analysis as a whole and did not necessarily attribute a particular weight to any particular portion of the analysis considered . Furthermore, selecting any portion of Centerview’s analysis, without considering the analysis as a whole, would create an incomplete view of the process underlying its financial analysis . Centerview may have deemed various assumptions more or less probable than other assumptions, so the reference ranges resulting from any particular portion of the analysis described above should not be taken to be Centerview’s view of the actual value of Pacific . These materials and the information contained herein are confidential, were not prepared with a view toward public disclosure, and may not be disclosed publicly or made available to third parties without the prior written consent of Centerview . These materials and any other advice, written or oral, rendered by Centerview are intended solely for the benefit and use of the Board of Directors of Pacific (in its capacity as such) in its consideration of the proposed transaction, and are not for the benefit of, and do not convey any rights or remedies for any holder of securities of Pacific or any other person . Centerview will not be responsible for and has not provided any tax, accounting, actuarial, legal or other specialist advice . These materials are not intended to provide the sole basis for evaluating the proposed transaction, and this presentation does not represent a fairness opinion, recommendation, valuation or opinion of any kind, and is necessarily incomplete and should be viewed solely in conjunction with the oral presentation provided by Centerview .

2 – H ighl y Confident ia l Draf t – ▪ Pacific (the “Company”) received an inbound acquisition proposal from Phoenix on February 13, 2024; subsequently formed Special Committee which engaged RLF and Centerview – P hoenix proposal at p r ice of $40.50 per share ▪ In order to assess strategic alternatives, the Special Committee directed Centerview to reach out to a selected group of seven additional financial sponsors about a potential transaction – Phoenix and six of the additional parties signed NDAs and five of the parties participated in a management presentation, including Phoenix – Phoenix is the only party that has indicated an intention to provide an indication of interest for the Company; three other parties (including Goldfinch, an existing investor) have expressed an interest in a potential minority investment ▪ The parties were provided a Round 1 process letter on April 15, 2024 requesting preliminary proposals on April 26, 2024 ▪ In advance of receiving proposal(s) tomorrow, today’s discussion is to review analysis of the Company’s standalone plan Introduction Initial Out r each ( 8 pa r t ies) NDA E x ecuted ( 7 pa r t ies) Managemen t Meeting (5 parties) Expected t o Submit Proposal ( 1 pa r ty)

3 – H ighl y Confident ia l Draf t – Management Long - Range Plan (“LRP”) Summary 2022A 2023A 2024E 2025E 2026E 2027E 2028E 2029E ’23A - ’27E ’27E - ’29E Presence $597 $704 $874 $974 $1,053 $1,153 +13% Commerce 270 308 342 399 486 587 +17% Total Revenue $867 $1,012 $1,216 $1,374 $1,539 $1,740 $1,932 $2,125 +15% +11% % Growth 11% 17% 20% 13% 12% 13% 11% 10% ( - ) C O G S (153) (208) (305) (327) (346) (365) +15% Gross Profit $714 $805 $911 $1,047 $1,193 $1,375 $1,545 $1,715 +14% +12% % Margin 82% 80% 75% 76% 78% 79% 80% 81% ( - ) M a rke t i n g & S a l e s (322) (350) (411) (445) (481) (523) +11% ( - ) R e s e a r c h & D e v e l o p m e n t (227) (242) (292) (333) (368) (397) +13% ( - ) G e n e r a l & A d m i n i s t r a t i v e (152) (129) (126) (138) (149) (161) +6% ( - ) I m p a i rm e n t C h a r g e (225) – – – – – Operating Income ($212) $84 $82 $131 $194 $294 $357 $412 +37% +18% % Margin (24%) 8% 7% 10% 13% 17% 18% 19% Adjusted EBITDA $147 $235 $291 $371 $446 $537 $627 $709 +23% +15% % Margin 17% 23% 24% 27% 29% 31% 32% 33% Unlevered FCF $166 $241 $331 $392 $448 $527 $616 $696 +22% +15% % Margin 19% 24% 27% 29% 29% 30% 32% 33% SBC $103 $108 $133 $166 $180 $190 $193 $212 % o f R e v e nu e 12% 11% 11% 12% 12% 11% 10% 10% Capex $12 $17 $6 $5 $9 $8 $6 $6 % o f R e v e nu e 1% 2% 0% 0% 1% 0% 0% 0% Historicals P r o j e c tio n s C A G R s Source: LRP, Pacific Management and Company filings. Note: Dollars in millions. Adjusted EBITDA unburdened by stock - based compensation expense.

4 – H ighl y Confident ia l Draf t – Preliminary Indicative Valuation Summary Methodology Relevant Metrics Implied Share Price Range (1) 12 . 50 % - 14 . 50 % W A C C ; 1 5 . 0 x - 1 8 . 0 x N T M u F C F M u l t i p l e L o w : 5 / 4 / 23 High: 4/11/24 Analyst Price Targets 52 - W ee k T r ad i n g R a n g e Discounted Cash Flow Selected Public Trading Comparables $ 40 . 80 $ 37 . 00 $ 26 . 22 $ 2 8 . 00 $ 5 2 . 20 $4 3 . 90 $ 37 . 7 9 $ 45 . 00 L o w : W o l fe (2 / 29 / 24 ) (3) High: JMP (3/18/24) Source: LRP, Pacific Management, Wall Street research, Company filings and FactSet as of April 23, 2024. Note: Balance sheet and share count as of March 31, 2024 as provided by Pacific Management. (1) Implied share price ranges rounded to the nearest $0.05, except 52 - week trading range. (2) NTM uFCF calculated based on time - weighted average of FY24E uFCF of $331 and FY25E uFCF of $392. (3) Reflects low end of Wolfe’s $28.00 - $50.00 price target range. Fo r Referenc e Only 17 . 0 x - 20 . 0 x N T M u F C F o f $ 34 6 (2)

5 – H ighl y Confident ia l Draf t – 2024E 2025E 2026E 2027E 2028E 2029E Revenue $1,216 $1,374 $1,539 $1,740 $1,932 $2,125 % Growth 20% 13% 12% 13% 11% 10% Adj. EBITDA $291 $371 $446 $537 $627 $709 % Growth 24% 27% 20% 20% 17% 13% % Margin 24% 27% 29% 31% 32% 33% ( - ) C a p E x ($6) ($5) ($9) ($8) ($6) ($6) (+) Incr. in Deferred Revenue 71 44 58 65 72 80 (+) Decr. in NWC (excl. deferred revenue) 56 57 61 68 79 91 ( - ) T a x e s & O t h e r (80) (76) (108) (135) (157) (177) Unlevered FCF $331 $392 $448 $527 $616 $696 % Growth 37% 18% 14% 18% 17% 13% % Margin 27% 29% 29% 30% 32% 33% (Less): SBC (133) (166) (180) (190) (193) Unlevered FCF (post - SBC) $198 (1) $226 $268 $337 $423 % Growth 53% 14% 18% 26% 26% % Margin 16% 16% 17% 19% 22% F i s c a l Y e a r E n d i n g D e c e m b e r 3 1 , T e r m i n a l Y e ar Preliminar y Discounte d Cas h Flo w Analysi s $44.27 $46.91 $49.56 $52.20 42.49 45.02 47.56 50.09 40.80 43.23 45.66 48.08 Equity Value Per Share E V / N T M u F C F 1 5 . 0 x 1 6 . 0 x 1 7 . 0 x 1 8 . 0 x 1 2 . 5 % 1 3 . 5 % 1 4 . 5 % WA C C $6,983 $7,381 $7,779 $8,176 6,715 7,096 7,478 7,859 6,460 6,826 7,191 7,557 Enterprise Value ($mm) 1 5 . 0 x E V / N T M u F C F 16 . 0 x 1 7 . 0 x 1 8. 0 x 1 2 . 5 % 1 3 . 5 % 1 4 . 5 % WA C C Sou r ce: L RP an d Pacific Man agem e n t . Note: Dollars in millions except per share amounts. Adjusted EBITDA unburdened by stock - based compensation expense. Assumes mid - period discounting convention. Valuation as of March 31, 2024 through December 31, 2028. Share count and balance sheet as of March 31, 2024 as provided by Pacific Management. (1) Discounted cash flow analysis includes only Q2’24E through Q4’24E.

6 – H ighl y Confident ia l Draf t – Preliminar y WAC C Analysi s WACC Calculation Selected Peer Companies Source: Pacific Management, Company filings, U.S. Department of the Treasury, Duff & Phelps, Bloomberg and FactSet as of April 23, 2024. Note: Dollars in millions. Pacific share count and balance sheet as of March 31, 2024 as pr o vided by Paci f i c Managemen t . Total debt divided by total market value of equity. T wo - year, weekly adjusted hi st o r ical beta per Bl o o m berg. Unlevered Beta = Levered Beta / (1 + [(1 – tax rate) * Debt / Equity]). Levered Beta = Unlevered Beta * (1 + [(1 – tax rate) * Debt / Equity]). (1) (2) (3) (4) Company Equity Value Total Debt Debt / Equity (1) Levered Beta (2) Unlevered Beta (3) Intuit $183,170 $6,000 3.3% 1.385 1.350 VeriSign 18,808 1,800 9.6% 1.008 0.937 GoDaddy 18,416 3,876 21.0% 1.200 1.029 Wix 7,602 575 7.6% 1.370 1.293 Bill.com 6,875 1,860 27.1% 1.578 1.300 BigCommerce 484 346 71.4% 1.655 1.058 Mean 23.3% 1.161 Median 15.3% 1.176 Pacific $5,467 $559 10.2% 0.804 0.744 Unlevered Beta 1.176 A s s u m e d D e b t / Equ i t y 15.3% Estimated Levered Beta (4) 1.318 Risk - Free Rate (5) 4.8% Market Risk Premium (6) 7.2% Market Cap Size Premium (7) 0.6% Cost of Equity 14.9% Cost of Debt Calculation Pre - Tax Cost of Debt (8) 6.71% Tax Rate 21.0% After - Tax Cost of Debt 5.3% Cost of Capital Calculation Assumed Equity / Capitalization 86.7% W A CC Analysis Assumed Debt / Capitalization 13.3% Debt / Debt / Unlevered Beta WACC 13.7% Equity Total Cap. 1.000 1.150 1.300 5.0% 4.8% 12.6% 13.6% 14.7% 10.0% 9.1% 12.5% 13.6% 14.6% 15.0% 13.0% 12.4% 13.5% 14.5% Cost of Equity Calculation Peer Median (5) (6) 20 - year Treasury Par Yield, per the U . S . Treasury Dept . Average historical spread between the return on stocks and l o ng - t erm b o nds per Du f f & Phelps . Reflects the size premium ($4.6 - $7.5bn market cap range) per Du f f & Phelps . Reflects average of ICE BofA BB U.S. High Yield Index E ffectiv e Yield. (7) ( 8 )

7 – H ighl y Confident ia l Draf t – Selecte d Publi c Tradin g Comparable s Bill.com Wix Pacific (M g m t. ) Intuit Pacific (Cons. ) Big Com m e r c e Ver i Si g n GoDa d d y 16% 13% 13% 12% 12% 9% 7% 7% Source: LRP, Pacific Management and FactSet as of April 23, 2024. Note: Medians exclude Pacific figures. Gross profit and adjusted EBITDA unburdened by stock - based compensation expense. Pacific balance sheet and share count as of March 31, 2024 as provided by Pacific Management. Pacific NTM metrics calculated as proportional average of FY24E and FY25E figures. (1) Reflects ’24 - ’25E revenue growth + NTM uFCF margin. R e v . G r o w t h NTM Margin NTM EV Multiple 2024E - 2025E UFCF UFCF 62% 34% 32% 28% VeriSign Intuit GoDaddy Pacific (Mgmt.) Pacific (Cons.) Bill.com W i x Big Com m e r c e Intuit Big Com m e r c e 31.1x 29.1x VeriSign Bill.com Pacific (Cons. ) Wix Pacific (Mgmt. ) GoDaddy 19.9x 18.5x 18.0x 17.8x 16.7x 14.8x Adj. EBITDA Bill.com In t u i t Big Commerce Wix Pacific (Co n s. ) Pacific ( M gmt. ) Ver i Si g n Go D a d d y 28.1x 26.5x 25.6x 20.0x 18.7x 18.6x 16.0x 15.8x G r oss P r ofit Bill.com In t u i t Big Com m e r c e Pacific (Cons. ) Pacific (Mgmt. ) W i x GoDa d d y VeriSign 85% 82% 78% 77% 76% 69% 63% n.a. Margin 76% 41% 30% 25% 69% 47% 39% 41% 26% 25% 38% 24% 16% 40% 23% 20% 36% 6% 6% 15% Adj . EBITDA Rule of… (1)

8 – H ighl y Confident ia l Draf t – E V / NT M Unlevere d FC F Multipl e Ove r Las t Yea r 1 5 . 0 x 2 0 . 0 x 30.0x 27.1x 27.1x 25.0x Apr - 23 11.9x 10.0x Ju n - 23 Aug - 23 O c t - 2 3 D e c - 23 F e b - 2 4 Apr - 24 Source: Pacific Management, Company filings and FactSet as of April 23, 2024. Note: Figures based on consensus estimates. (1) Peers include GoDaddy, Wix, Intuit, Bill.com, Verisign and BigCommerce. Excludes multiples greater than 100x or less than 0x. Pacific Consensus Pee r Media n (1) 21.7x 14.8x LTM Summary Mean Median Pacific 17.5x 16.7x GoDaddy 12.4x 11.9x Wix 19.3x 19.4x Peer Median 22.1x 21.8x 19.2x 18.0x 17.8x

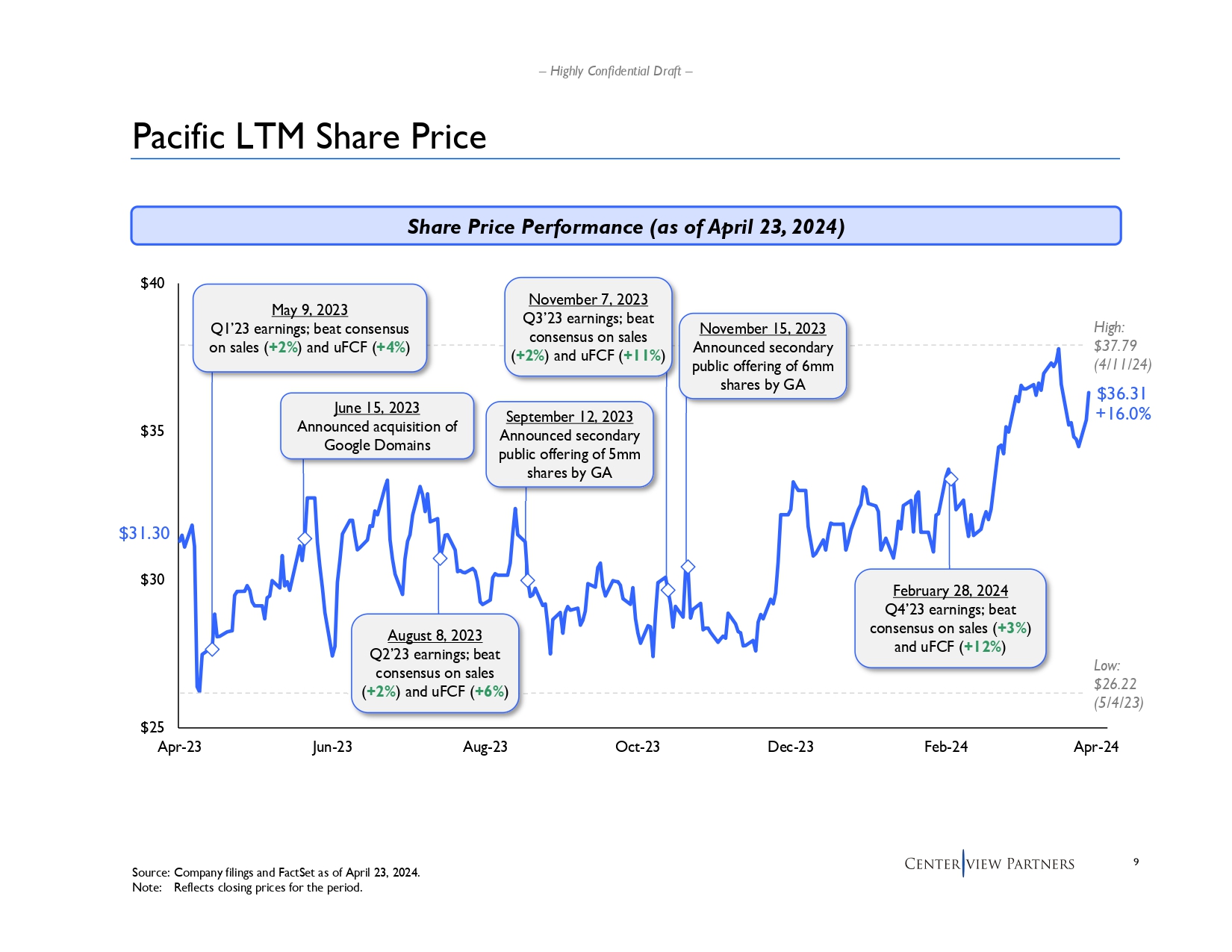

9 – H ighl y Confident ia l Draf t – Pacifi c LT M Shar e Pric e $ 2 5 $ 3 0 $ 3 5 $ 4 0 Apr - 23 Ju n - 23 Aug - 23 O c t - 2 3 D e c - 23 F e b - 2 4 Apr - 24 High: $37.79 (4/11/24) $36.31 +16.0% $31.30 Low: $26.22 (5/4/23) Source: C ompany filings and FactSet as of April 23, 2024. Note: Reflects closing prices for the period. M a y 9 , 2023 Q 1 ’23 earnings; beat consensus on sales ( +2 % ) and uFC F ( +4 % ) Jun e 15 , 2023 Annou n ced acquisition of Google Domains A ugus t 8 , 2023 Q 2 ’23 earnings; beat consensus on sales ( +2 % ) and uFC F ( +6 % ) N ovembe r 7 , 2023 Q 3 ’23 earnings; beat consensus on sales ( +2 % ) and uFC F ( +11% ) N ovembe r 15 , 2023 Announce d secondary public offering of 6mm shares by GA F e bruar y 28 , 2024 Q 4 ’23 earnings; beat consensus on sales ( +3 % ) and uFC F ( +12% ) Sha r e Price Performance (as of April 23, 2024) S e ptembe r 12 , 2023 Announce d secondary public offering of 5mm shares by GA

10 – H ighl y Confident ia l Draf t – Analys t Pric e Target s Pr e m . / ( D i s c . ) B r o k e r P r i c e T a r g e t t o C u rr e n t P r i c e V a l u a t i o n M e t h o d o l o g y Pacific Current $ 36 JMP $45 +24% ~18x 2025E FCF B Riley $43 +18% n.a. B an k o f A m e r i c a $40 +10% 5.5x 2025E Gross Profit Raymond James $40 +10% n.a. UBS $40 +10% ~16x 2025E uFCF Seaport $40 +10% 5.5x 2025E Gross Profit Piper Sandler $40 +10% DCF with 20x terminal FCF multiple Wolfe $28 - 50 n.a. 18x - 25x 2024/25E FCF Barclays $37 +2% 4 x / 18 x 2025 E R e v e nu e / E BI T D A GS $36 (1%) W e i g h te d a v g . u FC F m u l t . r a n g e o f 15 - 25x JPM $36 (1%) DCF, implying 17x 2024E FCF RBC $35 (4%) 14x 2025E uFCF Mizuho $34 (6%) n.a. William Blair n.a. (1) n.a. R e fe re n c e s v a l u a t i o n b a s e d o n r e v . / FC F Oppenheimer n.a. (1) n.a. n.a. Buy H old Source: Wall Street research and FactSet as of April 23, 2024. (1) N o price target pr o v ided.

Appendix

12 – H ighl y Confident ia l Draf t – Public Trading Metrics and Financia l Outloo k vs. Peers Source: LRP, Pacific Management and FactSet as of April 23, 2024. Note: Dollars in millions unless otherwise noted. Gross profit and adjusted EBITDA unburdened by stock - based compensation expense. Pacific balance sheet and share count as of March 31, 2024 as provided by Pacific Management. (1) (2) Reflects ’24 - ’25E revenue growth + NTM uFCF margin. NTM metrics calculated as proportional average of FY24E and FY25E figures. Selected Peers Intuit $183.2 $187.6 $17,480 $7,086 $6,026 12% 82% 41% 34% 47% 10.7x 26.5x 31.1x VeriSign 18.8 19.7 1,607 1,228 989 7% n.a. 76% 62% 69% 12.2x 16.0x 19.9x GoDaddy 18.4 21.7 4,619 1,375 1,474 7% 63% 30% 32% 39% 4.7x 15.8x 14.8x Wix 7.6 7.4 1,823 369 414 13% 69% 20% 23% 36% 4.0x 20.0x 17.8x Bill.com 6.9 6.2 1,377 220 334 16% 85% 16% 24% 40% 4.5x 28.1x 18.5x BigCommerce 0.5 0.6 341 22 19 9% 78% 6% 6% 15% 1.6x 25.6x 29.1x Median 11% 78% 25% 28% 40% 4.6x 22.8x 19.2x Pacific (Cons.) $5.5 $5.8 $1,227 $309 $321 12% 77% 25% 26% 38% 4.7x 18.7x 18.0x Pacific (Mgmt.) (2) 1,256 311 346 13% 76% 25% 28% 41% 4.6x 18.6x 16.7x NTM Metrics ’24 - 25E N T M M a r g in NTM EV Multiple Market Adjusted Revenue Gross Adjusted Adjusted Company Cap. ($bn) E V ( $ b n ) Revenue EBITDA uFCF Growth Profit EBITDA uFCF Rule of… (1) Revenue EBITDA uFCF

13 – H ighl y Confident ia l Draf t – Publi c Floa t Ove r Las t 2 Year s % Owne r s hip (Q1’22 v s . Cur r ent) Source: Pacific Management, Company filings and FactSet as of April 23, 2024. Note: Pacific share count as of March 31, 2024 as provided by Pacific Management. Publi c Float Insiders Founde r / CEO Pacific 34% 33% 35% 45% 30% G A & Accel 22% G A & Accel Q 1 ’22 Current ~90 % o f voting shar e owne d by CEO, G A an d Accel Value of Public Float ($bn) Wix 4% 4% 5% 96% 91% Q 1 ’22 Current 1% 5% 5% 95% 94% Q 1 ’22 Current GoDaddy ~ 5 % owne d by Starboar d Ca p i tal VeriSign Intuit 1% 1% 99% 99% Q 1 ’22 Current 3% 3% 97% 97% Q 1 ’22 Current Bill.com BigCommerce 7% 5% 93% 95% Q 1 ’22 Current 9% 10% 12% 5% 78% 85% Q 1 ’22 Current ~ $ 1.3 ~ $ 2.2 ~ $ 5.7 ~ $ 6.8 ~ $ 14.0 ~ $ 17.5 ~ $ 24.2 ~ $ 18.5 ~ $ 131.2 ~ $ 171.6 ~ $ 21.9 ~ $ 6.1 ~ $ 1.2 ~ $ 0.4

14 – H ighl y Confident ia l Draf t – Pacific Public Market Overview and Fully - Diluted Share Count Public Market Overview Share Price ($) Basic Shares Outstanding (mm) Plus: Options + RSUs + PSUs (1) Current $36.31 137.5 13.0 Diluted Shares Outstanding (mm) 150.6 Equity Value ($mm) $5,467 (Less): Cash (242) Plus: Debt 559 Memo: Net Debt 317 Enterprise Value $5,784 Capitalization Table S h a r e s % O w n . Anthony Casalena 45.7 33% General Atlantic 15.6 11% Accel Partners 14.6 11% Other Shares 61.7 45% Total Basic Shares 13 7 . 5 1 0 0 % Source: Pacific Management, Company filings and FactSet as of April 23, 2024. Note: Pacific balance sheet and share count as of March 31, 2024 as provided by Pacific Management. (1) (2) R eflect s dilution utilizi n g treasury stock method. Excludes 2.75mm RSUs associated with the CEO’s Long - Term Performance Award, which vests at stock prices between $105 and $420, based on guidance from Pacific Management. Number of Shares Under TSM Type Price Shares (000s) Current Price Stock Options $2.89 697 642 RSUs 11,838 (2) 11,838 PSUs 542 542 Options + RSUs + PSUs 13,078 13,022