UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

(Exact Name of Registrant as Specified in its Charter)

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

(Address of Principal Executive Offices; Zip Code)

Registrant’s telephone number, including area code:

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| Pre-commencement communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

| None | N/A | N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 | Regulation FD Disclosure. |

On or around March 9, 2023, CNL Healthcare Properties, Inc. (the “Company”) sent a letter to its stockholders notifying them of the Company’s estimated net asset value (“NAV”) per share as of December 31, 2022 and related matters, and sent an e-mail correspondence to financial professionals notifying them of the same matters. A copy of the letter is filed as Exhibit 99.1 and a copy of the e-mail correspondence is filed as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated herein by reference solely for the purposes of this Item 7.01 disclosure.

Pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”), the information contained in this Item 7.01 disclosure, including Exhibits 99.1 and 99.2, is deemed to have been furnished and shall not be deemed to be “filed” under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of such section, nor shall any of such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

By furnishing the information contained in this Item 7.01 disclosure, including Exhibits 99.1 and 99.2, the Company makes no admission as to the materiality of such information.

| Item 8.01 | Other Events. |

Background and Conclusion

On March 8, 2023, the Board unanimously approved $6.92 per share as the Company’s estimated NAV as of December 31, 2022 (the “2022 NAV”). The Company prepares and announces an estimated net asset value per share of its common stock and provides such information to its stockholders and to members of the Financial Industry Regulatory Authority (“FINRA”) and their associated persons who participated in the Company’s public offerings to assist them in meeting their customer account statement reporting obligations under National Association of Securities Dealers Conduct Rule 2340. For a summary of all of the Company’s previously announced NAVs, please see “Historical NAVs” in this Current Report below.

To assist the Board and the Company’s valuation committee, which is comprised solely of the Company’s independent directors (the “Valuation Committee”), in establishing a new estimated NAV per share of the Company’s common stock as of December 31, 2022 (the “Valuation Date”), the Company engaged Robert A. Stanger & Co., Inc., an independent third-party valuation firm (“Stanger”), to provide a net asset valuation analysis of the Company. Stanger developed a net asset valuation analysis of the Company and provided the analysis to the Valuation Committee in a report dated March 8, 2023 that contained, among other information, a range of per share net asset values for the Company’s common stock as of the Valuation Date (the “Valuation Report”).

The Valuation Committee and the Board reviewed the Valuation Report and considered the material assumptions and valuation methodologies applied and described therein. Upon due consideration, on March 8, 2023, the Valuation Committee determined that the range of per share values for the Company’s common stock was reasonable as of the Valuation Date and recommended the Board approve $6.92 per share as the estimated NAV as of the Valuation Date. Thereafter, also on March 8, 2023, the Board accepted the recommendation of the Valuation Committee and unanimously approved $6.92 per share as the Company’s estimated NAV as of the Valuation Date. The 2022 NAV is the midpoint of the range of per share net asset values, adjusted for estimated transaction costs, for the Company’s common stock that Stanger provided in the Valuation Report.

Other than the adjustment for estimated property-level transaction costs, the Board’s determination of the 2022 NAV was undertaken in accordance with the Company’s valuation policy and the recommendations and methodologies of the Institute for Portfolio Alternatives, a trade association for non-listed direct investment vehicles (“IPA”), as set forth in the Investment Program Association Practice Guideline 2013-01 “Valuations of Publicly Registered Non-Listed REITs” dated April 29, 2013 (“IPA Practice Guideline”).

The 2022 NAV represents a snapshot in time as of December 31, 2022, will likely change, and does not represent the amount a stockholder would receive now or in the future for his or her shares of the Company’s common stock. The 2022 NAV is based on a number of assumptions, estimates and data that are inherently imprecise and susceptible to uncertainty and changes in circumstances. Please see “Valuation Methodologies and Major Assumptions,” “Valuation Summary,” and “Additional Information Regarding the Valuation, Limitations of the 2022 NAV and Stanger” in this Current Report, below.

The Company will hold a webinar on March 21, 2023, at 2:30 p.m., Eastern Time, to review the 2022 NAV.

Valuation Methodologies and Major Assumptions

As of the Valuation Date, the Company’s real estate portfolio consisted of interests in 70 properties, including 69 seniors housing communities and one vacant land parcel (the “Appraised Properties” or “Appraised Property”). The Appraised Properties were valued using valuation and appraisal methodologies consistent with real estate industry standards and practices, as described further below.

As of the Valuation Date, the aggregate estimated value of the Appraised Properties was approximately $1.77 billion. To estimate the value of the Appraised Properties, Stanger conducted an appraisal of each asset. In determining the value of each Appraised Property, Stanger utilized all information that it deemed relevant, including information from the Company’s advisor CNL Healthcare Corp. (the “Advisor”) and its own data sources, which data sources included trends in capitalization rates, leasing rates and other economic factors. In conducting its appraisals of the Appraised Properties, and pursuant to its engagement, Stanger utilized the income approach to valuation, which included a discounted cash flow (“DCF”) analysis and/or direct capitalization analysis to determine value (other than the vacant land parcel). Stanger relied solely on DCF analyses in determining the appraised value of 54 RIDEA seniors housing properties and two leased properties. Stanger utilized direct capitalization analyses for 13 leased seniors housing properties and used a sales comparison approach for the land parcels (which includes one vacant land parcel and excess or surplus land) in the 2022 NAV. Stanger also considered impacts of the COVID-19 pandemic (“COVID-19”) on the Appraised Properties.

For properties in which a DCF analysis was utilized, pro forma statements of operations for such properties including revenues, expenses and capital expenditures, were analyzed and projected over a multi-year period (typically ten years). Projected operating expenses in the DCF analysis included estimated COVID-19 related expenses. A reversion value is estimated after the holding period and then capitalized at an appropriate terminal capitalization rate reflecting the age and anticipated functional and economic obsolescence and competitive position of such properties to determine their reversion value. Net proceeds to owners are determined by deducting appropriate costs of sale in the reversion year. The discount rate selected for the DCF analysis is based upon estimated target rates of return for buyers of similar properties with consideration given to unique property-related factors, lease-up projections, location and age. The discount rate is then applied to the projected cash flows to derive a net present value.

The direct capitalization analysis was performed by applying a market capitalization rate for each applicable Appraised Property to the estimated stabilized forward-year annual net operating income at each such property. In selecting each capitalization rate, Stanger considered, among other factors, prevailing capitalization rates in the applicable property sector, the property’s location, age and condition, the property’s operating trends, the anticipated year of stabilization, the lease coverage ratios and other unique property factors.

As applicable, Stanger adjusted the capitalized value of each Appraised Property for any excess land, deferred maintenance or capital needs and lease-up costs to estimate the “as-is” value of each Appraised Property as of the Valuation Date. Stanger then adjusted the “as-is” property values, as appropriate, for the Company’s allocable ownership interest in the Appraised Properties to account for the interest of any third-party investment partners, including any priority distributions.

In providing a valuation for the land parcels owned by the Company (which includes the one vacant land parcel and excess or surplus land parcels deemed contributory in value within five seniors communities) that are part of the Appraised Properties, actual and/or proposed land sale transactions were identified in each property’s market or region and adjusted to reflect, as appropriate: (i) the property rights conveyed in such transaction; (ii) any extraordinary, special or non-market financing or credits provided by the seller or others which may have influenced the sale price; (iii) adjustments for non-arms-length sale transactions; (iv) improvements or deterioration of market conditions from the reported land sale date through the Valuation Date; (v) listing status versus a consummated sale; (vi) location factors such as area demographics, traffic exposure and access; (vii) land deemed surplus; (vii) zoning factors; and (ix) land size. An index of value (price per square foot) for each land parcel from the land sale comparables was derived and the appropriate index was applied to the Company’s land and excess or surplus land parcels.

Debt: The Company determined the fair market value of its debt liabilities by applying a discounted cash flow analysis over the projected remaining term of each debt liability and reflecting the debt’s contractual agreement and corresponding interest and principal payments. The expected debt payments were then discounted to present value at an interest rate the Company deemed appropriate and reflective of market interest rates as of the Valuation Date for debt instruments with similar collateral, anticipated duration and prepayment terms. While Stanger did not determine the value of the Company’s debt liabilities, Stanger did review the market interest rates used by the Company in determining the debt fair market value and, based upon a summary of the loan terms as provided by the Company, determined that in the aggregate, the market interest rates utilized by the Company were reasonable.

Cash, Other Tangible Assets and Other Liabilities: The fair value of the Company’s cash, other tangible assets and liabilities was estimated by the Company to approximate net realizable value as of the Valuation Date based upon the values of these assets and liabilities on the Company’s balance sheet, and Stanger reviewed and relied upon and utilized such amounts in its Valuation Report.

Stanger prepared an appraisal report (the “Appraisal Report”) summarizing key information and assumptions and provided an appraised value on the Appraised Properties in which the Company owned an interest as of the Valuation Date. In accordance with the valuation policy and the IPA Practice Guideline, the appraised value excludes any portfolio premium. The Valuation Report incorporates the appraised value conclusions of the Appraisal Report adjusted for any interests held by third parties in the Appraised Properties. Furthermore, the Valuation Report includes (i) the Company’s fair market value of its debt liabilities; (ii) cash and other tangible assets and liabilities based upon their current net realizable value; (iii) the Advisor’s deductions for estimated property-level transaction costs in a hypothetical orderly sale of the real estate assets of the Company as of the Valuation Date; and (iv) Stanger’s estimate of the Advisor’s subordinated participation in net sales proceeds or incentive fee due upon liquidation of the Company’s portfolio (of which there was none).

Valuation Summary

The following is a summary of the direct capitalization rates, discount rates and terminal capitalization rates used to arrive at the value of the Appraised Properties:

| 2022 Range | ||||||||||||

| Min | Max | W. Avg (a) | ||||||||||

| RIDEA |

||||||||||||

| Direct Capitalization Rate |

Not Utilized | |||||||||||

| Discount Rate |

7.50 | % | 9.50 | % | 8.48 | % | ||||||

| Terminal Capitalization Rate |

6.25 | % | 8.00 | % | 7.04 | % | ||||||

| NNN Leased |

||||||||||||

| Direct Capitalization Rate |

7.00 | % | 7.50 | % | 7.33 | % | ||||||

| Discount Rate |

10.25 | % | 11.25 | % | 10.74 | % | ||||||

| Terminal Capitalization Rate |

8.50 | % | 9.25 | % | 8.87 | % | ||||||

| (a) | The weighted average capitalization rate, discount rates and terminal capitalization rates are weighted on stabilized net operating income. |

In comparison to last year’s valuation, the comparable set of RIDEA properties had an increase in the weighted average discount rate of 44 basis points, to 8.48%, and an increase in the terminal capitalization rate of 9 basis points, to 7.04% in the DCF analyses. The two triple-net leased properties that also utilized DCF had an increase in the weighted average discount rate of 56 basis points, to 10.74%, and a decline in the terminal capitalization rate of 31 basis points, to 8.87%. The thirteen triple-net leased properties utilizing direct cap analyses had an increase in the weighted average direct capitalization rate of 25 basis points, to 7.33%.

The Valuation Report contained a range for the Company’s estimated 2022 NAV of $6.57 to $7.30 per share, including deductions for transaction costs estimated by the Advisor in a hypothetical orderly sale of the assets of the Company, based on a share count of approximately 173.96 million shares issued and outstanding as of the Valuation Date, excluding restricted shares issued to the Company’s Advisor in connection with the Expense Support and Restricted Stock Agreement between the Company and the Advisor, as amended from time to time. Such shares were excluded from the 2022 NAV calculation because the Company and the Advisor do not anticipate the vesting of those shares based on the terms and conditions set forth in the Expense Support and Restricted Stock Agreement.

The valuation range was calculated by varying the direct capitalization rates, discount rates and terminal capitalization rates by 25 basis points in either direction. Stanger also varied the price per square foot value for the one undeveloped land parcel by $0.25 in each direction. The lower end of the capitalization rate and discount rate range, and upper end of the land price per square foot range, has a positive $0.38 impact on NAV per share. The high end of the capitalization rate and discount range, and lower end of the land price per square foot range, has a negative $0.35 impact on NAV per share.

Material Components of the 2022 NAV

The following table summarizes the material components of the Company’s 2022 NAV per share and provides a comparison of such value and the components thereof with the Company’s prior NAV determination as of December 31, 2021 (the “2021 NAV”).

Table of Value Estimates for Components of Net Asset Value (1)

(Approximate $ in 000’s, except per share value)

| Net Asset Value as of 12/31/22 |

NAV Per Share as of 12/31/22 |

Net Asset Value as of 12/31/21 |

NAV Per Share as of 12/31/21 |

|||||||||||||

| Total real estate assets, net |

$ | 1,766,060 | $ | 10.15 | $ | 1,846,940 | $ | 10.62 | ||||||||

| Same store real estate assets, net |

1,766,060 | 10.15 | 1,807,280 | 10.39 | ||||||||||||

| Sold real estate assets, net |

— | — | 39,660 | 0.23 | ||||||||||||

| Investment in unconsolidated subsidiaries |

— | — | 20,982 | 0.12 | ||||||||||||

| Cash and cash equivalents(2) |

97,595 | 0.56 | 57,657 | 0.33 | ||||||||||||

| Prepaid expenses and other assets |

11,081 | 0.06 | 10,878 | 0.06 | ||||||||||||

| Fair market value of debt(3) |

(608,790 | ) | (3.50 | ) | (593,411 | ) | (3.41 | ) | ||||||||

| Accounts payable and accrued expenses(4) |

(31,641 | ) | (0.18 | ) | (30,576 | ) | (0.18 | ) | ||||||||

| Other liabilities |

(3,117 | ) | (0.02 | ) | (2,659 | ) | (0.01 | ) | ||||||||

| Noncontrolling Interests |

(1,612 | ) | (0.01 | ) | (3,778 | ) | (0.02 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Asset Value before Est. Transaction Costs |

$ | 1,229,576 | $ | 7.07 | $ | 1,306,033 | $ | 7.51 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Estimated Transaction Costs |

(24,935 | ) | (0.14 | ) | (23,942 | ) | (0.14 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Asset Value after Est. Transaction Costs |

$ | 1,204,641 | $ | 6.92 | $ | 1,282,091 | $ | 7.37 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1) | Balance sheet items reflect management’s audited balance sheet as of Dec. 31, 2022, and Dec. 31, 2021, adjusted for the Company’s ownership share. These are the composite mid-point figures as derived. Per share amounts based on 173,960,541 common shares outstanding for both 2022 and 2021. Numbers may not foot due to rounding. |

| (2) | Includes restricted cash. |

| (3) | 2022 fair market value of debt includes $17.9 million from the consolidation of previously unconsolidated subsidiaries. Total fair market value of debt declined $3.1 million YoY. |

| (4) | Includes amounts due to related parties. |

The decrease in the Company’s 2022 NAV of $0.45 per share, or 6.11%, as compared to the 2021 NAV is due to a decline in the value of the Company’s Appraised Properties, partially offset by an increase in cash and cash equivalents as well as other balance sheet assets. The Seniors Housing industry, and the general market, has faced inflationary pressures and rising interest rates, which have had a resulting impact on margins, discount rates and cap rates. The decline in Appraised Property values was primarily driven by an expansion in discount rates and terminal capitalization rates in conjunction with the impact of macro pressures on the forecasted property level cash flows.

Sensitivity Analysis

Changes to the key assumptions used to arrive at the estimated NAV per share could have a significant impact on the underlying value of the Company’s real estate assets. The following table presents the impact on the estimated NAV per share of the Company’s common stock resulting from a 5.0% increase and decrease to parameters utilized in developing Stanger’s value opinion of the Appraised Properties underlying the concluded NAV per share.

| Value Sensitivity(e) | ||||||||||||

| Low | Concluded | High | ||||||||||

| Estimated Net Asset Value Per Share (a) |

$ | 6.39 | $ | 6.92 | $ | 7.52 | ||||||

| Direct Capitalization Rate Appraised Properties(b) |

7.70 | % | 7.33 | % | 6.96 | % | ||||||

| Terminal Capitalization Rate Appraised Properties(c) |

7.49 | % | 7.13 | % | 6.77 | % | ||||||

| Discount Rate Appraised Properties(c) |

9.02 | % | 8.59 | % | 8.16 | % | ||||||

| Land Value Per Square Foot—Undeveloped Land(d) |

$ | 4.99 | $ | 5.25 | $ | 5.51 | ||||||

| (a) | The estimated NAV per share above is not the range of estimated NAV contained in Stanger’s Valuation Report. Rather, it is only the effect of a 5% increase and decrease in the parameters utilized in the value of the Appraised Properties underlying the concluded NAV per share. As changes in these specific valuation parameters are not material by themselves, we have shown the aggregate value change from moving all parameters up or down by 5%. |

| (b) | Relates to 13 net leased senior housing properties. |

| (c) | Relates to 54 RIDEA properties and two net leased properties. |

| (d) | Relates to the one undeveloped land parcel that was part of the Appraised Properties. |

| (e) | Capitalization rates and discount rates are weighted based on stabilized NOI. |

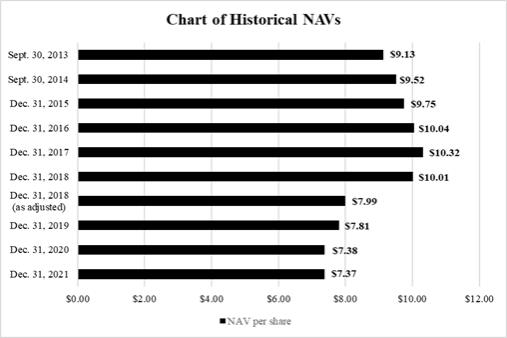

Historical NAVs

Below is a table detailing the Company’s historical NAVs. Beginning with the December 31, 2017 NAV of $10.32 per share, the Company began deducting estimated property-level transaction costs with the commencement of possible strategic alternatives the Company began evaluating in April 2018. Additionally, the December 31, 2018 NAV was adjusted to $7.99 per share after payment of a $2.00 per share special distribution and $0.02 adjustments relating to closing costs from sales of certain of the Company’s assets.

Additional Information Regarding the Valuation, Limitations of the 2022 NAV and Stanger

Throughout the valuation process, the Valuation Committee and the Company reviewed, confirmed and approved the processes and methodologies used by Stanger and their consistency with real estate industry standards and best practices.

Although Stanger considered comments received from the Company or the Advisor during the valuation process, the final appraised values of the Company’s Appraised Properties in the Valuation Report were determined by Stanger. The Valuation Report was based upon market, economic, financial and other information, circumstances and conditions existing at or around the Valuation Date and any material change in such information, circumstances and/or conditions may have a material effect on the Company’s estimated 2022 NAV. Stanger’s valuation materials were addressed solely to the Company to assist the Valuation Committee and the Board in establishing an estimated 2022 NAV. Stanger’s valuation materials were not addressed to the public and should not

be relied upon by any other person to establish an estimated value of the Company’s common stock. The Valuation Report does not constitute a recommendation by Stanger to purchase or sell any shares of the Company’s common stock.

Although Stanger reviewed the information provided by the Company for reasonableness and utilized some of the information in its valuation analyses, Stanger and its affiliates are not responsible for the accuracy of the information. Neither Stanger nor any of its affiliates is responsible for the Board’s determination of the estimated 2022 NAV. While Stanger reviewed for reasonableness publicly available information and the financial information supplied or otherwise made available to it by the Company, Stanger assumed and relied upon the accuracy and completeness of all such information and of all information supplied or otherwise made available to it by any other party, and did not undertake any duty or responsibility to verify independently any of such information.

In performing its analyses, Stanger made numerous assumptions as of various points in time with respect to industry performance, general business, economic and regulatory conditions and other matters, many of which are necessarily subject to change and beyond the control of Stanger and the Company. The analyses performed by Stanger are not necessarily indicative of actual values, trading values or actual future results of the Company’s common stock that might be achieved, all of which may be significantly more or less favorable than suggested by such analyses. The analyses do not purport to reflect the prices at which the properties may actually be sold, and such estimates are inherently subject to uncertainty. The actual value of the Company’s common stock may vary significantly depending on numerous factors that generally impact the price of securities, the financial condition of the Company and the state of the real estate industry more generally. Accordingly, with respect to the estimated 2022 NAV, neither the Company nor Stanger can give any assurance that:

| • | a stockholder would be able to resell his or her shares at this estimated value per share; |

| • | a stockholder would ultimately realize distributions per share equal to the Company’s estimated net asset value per share upon liquidation of the Company’s assets and settlement of the Company’s liabilities or a sale of the Company, as estimated liquidation expenses are not included in the NAV; |

| • | the Company’s shares would trade at a price equal to or greater than the estimated NAV per share if the Company listed them on a national securities exchange; or |

| • | the methodology used to estimate the Company’s NAV per share would be acceptable to FINRA or under the Employee Retirement Income Security Act (“ERISA”) for compliance with its reporting requirements. |

The estimated 2022 NAV was determined by the Board as of the Valuation Date. However, the value of the Company’s shares will fluctuate over time as a result of, among other things, developments related to individual assets, general economic conditions or unanticipated events, and responses to the real estate and capital markets.

Stanger possesses substantial experience in the valuation of assets similar to those owned by the Company and regularly undertake the valuation of securities in connection with public offerings, private placements, business combinations and similar transactions. For the preparation of the Valuation Report, the Company paid Stanger a customary fee for services of this nature, no part of which was contingent relating to the provision of services or specific findings. In the past, certain of the Company’s affiliates have engaged Stanger primarily for various real estate-related and advisory services, and the Company anticipates that Stanger will continue to provide similar real estate-related and advisory services in the future. In addition the Company may in its discretion engage Stanger to assist the Board in future determinations of the Company’s estimated NAV. The Company is not affiliated with Stanger or any of its affiliates. While the Company and affiliates of the Advisor have engaged and may engage Stanger or its affiliates in the future for valuations and commercial real estate-related services of various kinds, the Company believes that there are no material conflicts of interest with respect to the Company’s engagement of Stanger.

COVID-19 Statement: Forces that influence real property values including social trends, economic circumstances, governmental controls and regulations and environmental conditions, such as COVID-19, can significantly affect the Appraised Properties value. The effects and risks of COVID-19 on the Appraised Properties’ operations and financial condition is uncertain as of the Valuation Date. Stanger has discussed with the Company the known and reasonably likely effects and risks to the Appraised Properties due to COVID-19. Stanger has also reviewed

the Company’s current response and projections related to COVID-19 uncertainties. Stanger has considered the known impacts of COVID-19 in its analysis as of the Valuation Date. However, as information regarding COVID-19 is continually being updated, the data upon which the Appraised Properties is based is limited in quantity or quality and affects the reliability of the conclusions and relative reliability of the value opinion. Changes since the Valuation Date in market factors, such as COVID-19, can significantly affect property values.

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits.

| 99.1 | Text of correspondence from the Company to Stockholders regarding the 2022 NAV. | |

| 99.2 | Text of correspondence from the Company to Financial Professionals regarding the 2022 NAV. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |

Caution Concerning Forward-Looking Statements

Statements in this Current Report on Form 8-K that are not statements of historical fact, including statements about the purported value of the Company’s common stock, constitute “forward-looking statements” within the meaning of the Federal Private Securities Litigation Reform Act of 1995. The Company intends that such forward-looking statements be subject to the safe harbors created by Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are statements that do not relate strictly to historical or current facts, but reflect management’s current understandings, intentions, beliefs, plans, expectations, assumptions and/or predictions regarding the future of the Company’s business and its performance, statements of future economic performance, and other future conditions and forecasts of future events and circumstances. Forward-looking statements are typically identified by words such as “believes,” “expects,” “anticipates,” “intends,” “estimates,” “plans,” “continues,” “pro forma,” “may,” “will,” “seeks,” “should” and “could,” and words and terms of similar substance in connection with discussions of future operating or financial performance, business strategy and portfolios, projected growth prospects, cash flows, costs and financing needs, legal proceedings, amount and timing of anticipated future distributions, estimated per share value of the Company’s common stock, and other matters. The Company’s forward-looking statements are not guarantees of future performance. While the Company’s management believes its forward-looking statements are reasonable, such statements are inherently susceptible to uncertainty and changes in circumstances. As with any projection or forecast, forward-looking statements are necessarily dependent on assumptions, data and/or methods that may be incorrect or imprecise and may not be realized. The Company’s forward-looking statements are based on management’s current expectations and a variety of risks, uncertainties and other factors, many of which are beyond the Company’s inability to control or accurately predict. Although the Company believes that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, the Company’s actual results could differ materially from those set forth in the forward-looking statements due to a variety of risks, uncertainties and other factors.

For further information regarding risks and uncertainties associated with the Company’s business, and important factors that could cause the Company’s actual results to vary materially from those expressed or implied in its forward-looking statements, please refer to the factors listed and described under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the “Risk Factors” sections of the Company’s documents filed from time to time with the Securities and Exchange Commission, including, but not limited to, the Company’s quarterly reports on Form 10-Q, and the Company’s annual report on Form 10-K, copies of which may be obtained from the Company’s website at http://www.cnlhealthcareproperties.com.

All written and oral forward-looking statements attributable to the Company or persons acting on its behalf are qualified in their entirety by these cautionary statements. Forward-looking statements speak only as of the date on which they are made; the Company undertakes no obligation to, and expressly disclaims any obligation to, update or revise its forward-looking statements to reflect new information, changed assumptions, the occurrence of subsequent events, or changes to future operating results over time unless otherwise required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: March 9, 2023 | CNL HEALTHCARE PROPERTIES, INC. | |||||

| a Maryland corporation | ||||||

| By: | /s/ Ixchell C. Duarte | |||||

| Ixchell C. Duarte | ||||||

| Chief Financial Officer and Treasurer | ||||||