Exhibit 99.1

|

|

[LOGO] |

|

|

FORWARD-LOOKING STATEMENTS AND NON-GAAP MEASURES This presentation contains forward-looking statements. These statements relate to future events or to future financial performance and involve known and unknown risks, uncertainties, and other factors that may cause actual results, levels of activity, or performance to differ from those achievements expressed or implied by these forward-looking statements. The words “possible,” “propose,” “might,” “could,” “would,” “projects,” “plan,” “forecasts,” “anticipates,” “expect,” “intend,” “believe,” “seek,” or “may,” the negative of these terms and other comparable terminology, are intended to identify forward-looking statements, but are not the exclusive means of identifying them. Actual results may differ materially from the results suggested by these forward-looking statements, for a number of reasons, including, but not limited to, our ability to refinance, extend, restructure or repay near and intermediate term debt, our substantial level of indebtedness, our ability to raise capital through equity issuances, asset sales or the incurrence of new debt, retail and credit market conditions, impairments, our liquidity demands, retail and economic conditions and our ability to consummate our anticipated spin-off of Rouse Properties, Inc. Readers are referred to the documents filed by General Growth Properties, Inc. (“GGP”) with the Securities and Exchange Commission (the “SEC”), which further identify important risk factors that could cause actual results to differ materially from the forward-looking statements in this presentation. Except as may be required by law, we disclaim any obligation to update any forward-looking statements, whether as a result of new information, future developments or otherwise. The 2011 and 2012 guidance included in this presentation reflects management’s view of current and future market conditions, including assumptions with respect to rental rates, occupancy levels and the earnings impact of the events referenced in this presentation and previously disclosed. The guidance also reflects management’s view of future capital market conditions, which is generally consistent with the current forward rates for LIBOR and U.S. Treasury bonds. The estimates do not include possible future gains or losses or the impact on operating results from other possible future property acquisitions or dispositions, possible capital markets activity or possible future impairment charges. Earnings per share (“EPS”) estimates may be subject to fluctuations as a result of several factors, including changes in the recognition of depreciation and amortization expense and any gains or losses associated with disposition activity. The 2011 and 2012 guidance are forward-looking statements. This presentation also makes reference to real estate property net operating income (“NOI”), earnings before interest, taxes, depreciation and amortization (“EBITDA”), and funds from operations (“FFO”). NOI is defined as income from property operations after operating expenses have been deducted, but prior to deducting financing, administrative and income tax expenses. EBITDA is defined as NOI less certain property management, administrative expenses and preferred unit distributions, net of management fees and other operational items. FFO is defined as net income (loss) attributable to common stockholders in accordance with GAAP, excluding gains (or losses) from cumulative effects of accounting changes, extraordinary items and sales of properties, plus real estate related depreciation and amortization and including adjustments for unconsolidated partnerships and joint ventures. NOI, EBITDA and FFO are presented in this presentation on a proportionate basis, which includes GGP’s share of consolidated and unconsolidated properties. As GGP conducts substantially all of its business through GGP Limited Partnership (the “Operating Partnership”, which is 99% owned by GGP) and the conversion of non-GGP limited common units of the Operating Partnership are included in total diluted weighted average FFO per share amounts, all FFO amounts in this presentation reflect the FFO of the Operating Partnership. In order to present GGP’s operations in a manner most relevant to its future operations, Core NOI has been presented to exclude certain non-cash and non-recurring revenue and expenses. A reconciliation of NOI to Core NOI has been included in Appendix A, along with other reconciliations. NOI is not an alternative to GAAP operating income (loss) or net income (loss) available to common stockholders. For reference, as an aid in understanding management’s computation of NOI, a reconciliation of NOI to consolidated operating income in accordance with GAAP has been included in Appendix A. 2 |

|

|

AGENDA 8:45 Introduction - Sandeep Mathrani, Chief Executive Officer 9:00 Investments - Shobi Khan, Chief Operating Officer Leasing - Alan Barocas, Senior Executive VP, Mall Leasing Development - Richard Pesin, Executive VP, Anchors, Development & Construction Asset Management - Chuck Lhotka, Executive VP, Asset Management Capital Markets - Hugh Zwieg, Executive VP, Capital Markets Financial Overview - Steve Douglas 11:00 Key Takeaways and Q&A - Sandeep Mathrani, Chief Executive Officer 11:30 Lunch 12:30 Depart for Tour of Water Tower Place 2:00 Reception at Water Tower Place (Mity Nice Grill – Green Room) 3:00 Conclusion 3 |

|

|

INTRODUCTION Sandeep Mathrani Chief Executive Officer 4 |

|

|

SENIOR MANAGEMENT TEAM Shobi Khan, Chief Operating Officer Alan Barocas, Senior Executive VP, Mall Leasing Richard Pesin, Executive VP, Anchors, Development & Construction Chuck Lhotka, Executive VP, Asset Management Hugh Zwieg, Executive VP, Capital Markets Michael Berman, Executive VP and Chief Financial Officer(1) Marvin Levine, Senior VP, Chief Legal Officer 5 (1) Effective December 15, 2011. |

|

|

STRATEGIC FOCUS High Quality Shopping Malls Lease, Lease, Lease 6 |

|

|

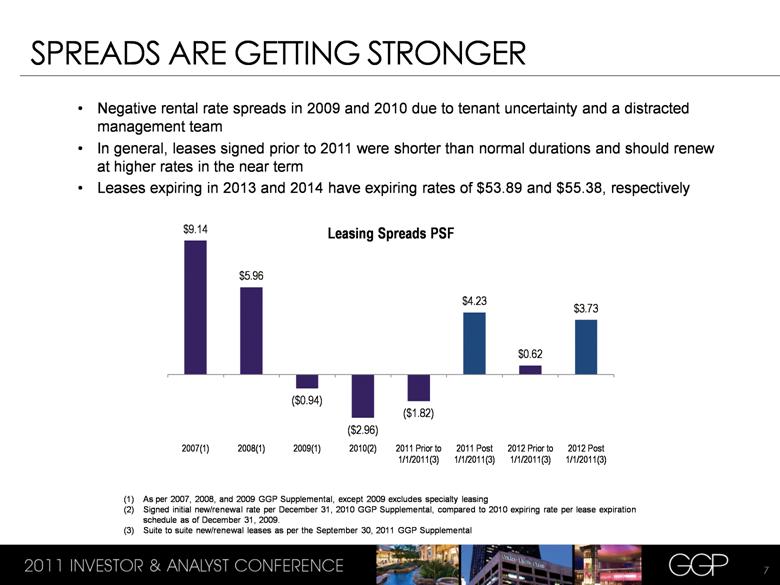

7 SPREADS ARE GETTING STRONGER Negative rental rate spreads in 2009 and 2010 due to tenant uncertainty and a distracted management team In general, leases signed prior to 2011 were shorter than normal durations and should renew at higher rates in the near term Leases expiring in 2013 and 2014 have expiring rates of $53.89 and $55.38, respectively As per 2007, 2008, and 2009 GGP Supplemental, except 2009 excludes specialty leasing Signed initial new/renewal rate per December 31, 2010 GGP Supplemental, compared to 2010 expiring rate per lease expiration schedule as of December 31, 2009. Suite to suite new/renewal leases as per the September 30, 2011 GGP Supplemental |

|

|

STRATEGIC FOCUS High Quality Shopping Malls Lease, Lease, Lease De-Risk and Reduce Leverage Disciplined Capital Investment Asset Management 8 |

|

|

INVESTMENTS Shobi Khan Chief Operating Officer 9 |

|

|

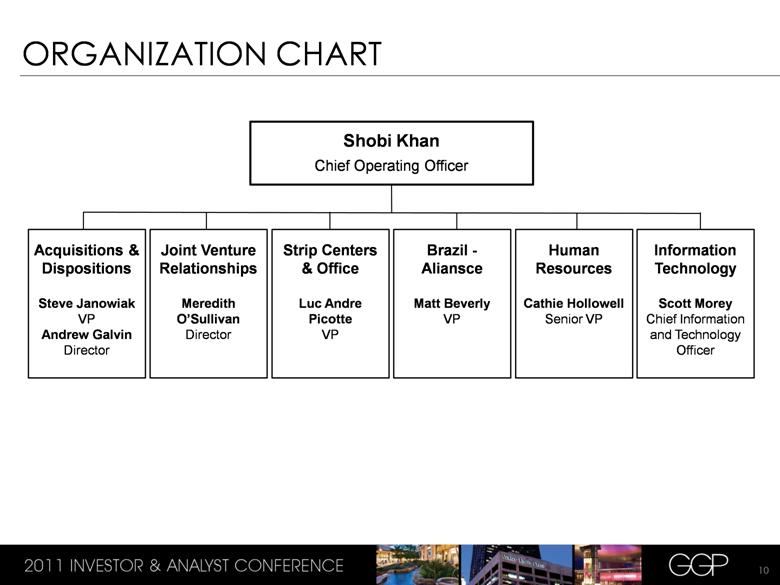

ORGANIZATION CHART 10 Shobi Khan Chief Operating Officer Acquisitions & Dispositions Steve Janowiak VP Andrew Galvin Director Joint Venture Relationships Meredith O’Sullivan Director Strip Centers & Office Luc Andre Picotte VP Brazil - Aliansce Matt Beverly VP Human Resources Cathie Hollowell Senior VP Information Technology Scott Morey Chief Information and Technology Officer |

|

|

One Year Ago Today(1) HIGH-QUALITY, NATIONALLY DIVERSIFIED PORTFOLIO 11 (1) Reflects portfolio after anticipated Rouse Properties, Inc. spinoff. (2) Figures include mall and freestanding gross leasable area (GLA). 168 shopping malls 68 million square feet(2) 137 shopping malls 58 million square feet(2) |

|

|

Transactions GLA (sf in 000s) Gross Amount (in millions) Debt (in millions) Net Amount (in millions) Dispositions Malls(2) 6 2,015 $427 $210 $217 Strip Centers 9 906 97 24 73 Office 2 1,415 240 - 240 Total 17 4,336 $764 $234 $530 Acquisitions Big Box 12 1,744 $99 $6 $93 Mall 1 265 75 29 46 Total 13 2,009 $174 $35 $139 2011 YTD INVESTMENT ACTIVITY(1) 12 All figures represent GGP’s share. Includes five partial sales. |

|

|

2011 – YEAR IN TRANSITION(1) Regional Malls International Office Strip Centers Properties GLA (sf in 000s) % of Core NOI 168 68,000 95.3% 15 5,250 1.5% 28 3,680 1.9% 23 3,940 1.3% Properties GLA (sf in 000s) % of Core NOI 137 57,600 96.3% 16 5,480 1.8% 26 2,270 1.0% 14 2,750 1.0% 13 One Year Ago Today(2) All figures represent GGP’s share. Reflects portfolio after anticipated Rouse Properties, Inc. spinoff. |

|

|

Highlights Joint Venture GGP Malls(1) Sales psf $522 Occupancy 95.0% % of Core NOI 18.9% JOINT VENTURE RELATIONSHIPS The New York State Common Retirement Fund (CRF) Teachers' Retirement System of the State of Illinois JPMorgan (Strategic Property Fund) Canada Pension Plan Investment Board (CPPIB) Morgan Stanley (Prime Property Fund) Abu Dhabi Investment Authority (ADIA) California Public Employees' Retirement System (CalPERS) USAA 14 |

|

|

GGP BRAZIL – ALIANSCE SHOPPING CENTERS GGP Share 2011E 2012E FFO (in 000s) $23,300 $28,500 FFO % Growth 23% Operating Highlights Q3 YoY Same Store Sales psf +11% Same Store Rent psf +12% Occupancy as of Q311 98% 15 +47% Increase in Owned GLA by 2013 (est.) Figures as of September 30, 2011. |

|

|

ROUSE PROPERTIES, INC. 30 malls 9 million SF Mall and Freestanding GLA 19 states 16 Vista Ridge Collin Creek Sikes Senter Southland Center Newpark Mall Silver Lake West Valley Southland Center Lansing Mall Pierre Bossier Colony Square Birchwood Westwood Steeplegate Mall Spring Hill Knollwood Mall St. Vincent Cache Valley Mall Lakeland Square Valley Hills Mall North Plains Washington Park Gateway Mall The Mall at Sierra Vista White Mountain The Boulevard Mall Three Rivers Mall Animas Valley Mall Bayshore Mall Chula Vista |

|

|

Estimated Timing Late December Record Date for Spinoff Mid January Rouse Property Spinoff February Anticipated Rights Offering ROUSE PROPERTIES, INC. SPINOFF 17 GATEWAY MALL Springfield, OR THE BOULEVARD MALL Las Vegas, NV SPRING HILL MALL West Dundee, IL CACHE VALLEY MALL Logan, UT |

|

|

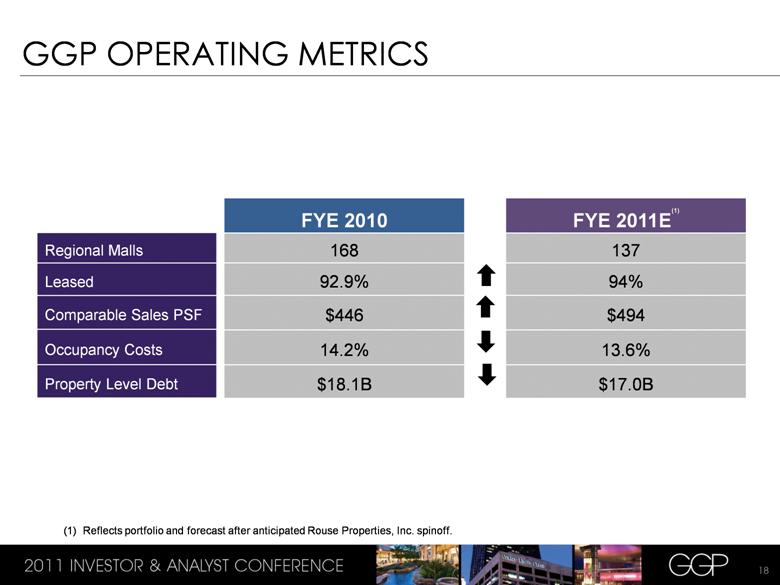

GGP OPERATING METRICS Regional Malls Leased Comparable Sales PSF Occupancy Costs Property Level Debt FYE 2010 168 92.9% $446 14.2% $18.1B FYE 2011E(1) 137 94% $494 13.6% $17.0B 18 (1) Reflects portfolio and forecast after anticipated Rouse Properties, Inc. spinoff. |

|

|

Continue to focus on non-core asset sales Complete Rouse Properties spin-off Recycle non-core malls, strip centers and office Maintain / expand Brazilian retail platform Focus near term on redevelopment opportunities Selectively pursue mall acquisition opportunities Plaza Frontenac Neiman Marcus Box at Fashion Show Sales PSF ~$1,000 Occupancy 98.1% Sales PSF ~$1,200 Occupancy 98.2% Sales PSF ~$750 Occupancy 98.8% FASHION SHOW Las Vegas, NV NORTH STAR MALL San Antonio, TX KEY TAKEAWAYS ALA MOANA CENTER Honolulu, HI 19 |

|

|

LEASING Alan Barocas Senior Executive Vice President, Mall Leasing 20 |

|

|

ENTERPRISE APPROACH TO LEASING Alan Barocas Senior Executive VP, Mall Leasing Events The Club Social Media Retailer Partnerships Traffic Short term leasing New concepts Alternative Revenue Strategic Partnerships Revenue Tenants Merchandise Mix Deals Portfolio Management Execution Demographics Psychographics Projections Retailer Support Opportunities Strategy & Research Tom Bernier Senior VP Marketing Susan Houck Senior VP Leasing Troy Benson Senior VP, West Christopher Bruck Senior VP, East Steven Weiss Senior VP, Central Business Development Melinda Holland Senior VP 21 |

|

|

Retailers expanding footprints Mature retailers developing new concepts “Fast Fashion” continues to grow International brands emerging in U.S. markets RETAIL LANDSCAPE 22 |

|

|

E-commerce as an incubator for new concepts Social media and mobile technology to communicate with customers Brand websites to streamline and enhance in-store experience E-COMMERCE: FRIEND, NOT FOE 23 |

|

|

GREAT CENTERS GETTING STRONGER Comparable mall productivity up 8% from 2010 24 Malls GLA (in millions) % of Mall NOI(1) Average Productivity(2) 20 9.0 28% $800+ 50 23.5 54% $650+ 67 31.8 68% $600+ 92 41.9 83% $550+ 137 57.6 100% $494 For the nine months ended September 30, 2011. TTM ended September 30, 2011. |

|

|

OCCUPANCY RATES IMPROVING Occupancy growth and temporary-to-permanent conversion drive revenue 25 |

|

|

LONG-TERM LEASING FOCUS: INCREASE PRODUCTIVITY AND REVENUE Focus on new tenants, thorough merchandise plans, and right-sizing tenants to increase productivity and drive rents (1) Data includes all approved deals commencing in 2011 and 2012 26 |

|

|

Deal Approval Opening Date Possession Date Legal Process ~ 90 Days Permit Approvals & Construction 4-6 Months 3-4 Months 7-10 Months LEASE LIFECYCLE 27 7 to 10 months generally elapse from deal approval to store opening |

|

|

# of Leases SF (000S) Term (years) Initial Rent PSF Average Rent PSF Expiring Rent PSF Initial Cash Rent Spread Average Rent Spread New Leases Prior to January 1, 2011 28 177 7.5 $46.79 $52.56 $43.84 $2.95 6.7% $8.72 19.9% Post January 1, 2011 206 784 9.7 $62.70 $70.60 $57.34 $5.36 9.3% $13.27 23.1% Renewal Leases Prior to January 1, 2011 113 532 5.7 $50.35 $53.72 $49.97 $0.38 0.8% $3.74 7.5% Post January 1, 2011 350 1,046 6.0 $61.70 $66.74 $57.40 $4.30 7.5% $9.34 16.3% New/Renewal Leases Prior to January 1, 2011 141 709 6.2 $49.43 $53.42 $48.38 $1.05 2.2% $5.03 10.4% Post January 1, 2011 556 1,830 7.6 $62.14 $68.43 $57.37 $4.77 8.3% $11.06 19.3% Total 697 2,539 7.2 $58.69 $64.36 $54.93 $3.76 6.8% $9.43 17.2% Suite-to-suite spread on all deals with 2012 commencement approved through 10/31/11: RENTAL RATE SPREADS 28 2012 Commencement |

|

|

SEIZING OPPORTUNITIES: BORDERS & THE GAP The Gap Recycling the 29 identified stores should increase productivity and revenue Borders More productive, higher paying tenants have leased the space 29 Stores SF (000s) Gross Rent (000s) Capital (000s) Gross Rent Spread (000s) % Spread Cash-on- Cost Return Borders 20 330 $7,425 New Tenant 13 260 $8,250 $13,475 $1,260 18% 9.4% Stores SF (000s) Annual Sales (000s) Occupancy Cost % Mall Avg vs. Gap Occupancy Cost PSF Identified “At Risk” Stores 29 250 $43,900 11% +$20 |

|

|

Innovative Revenue-Generating Strategies in 2011 Over 230 kiosks opened Over 700 sky banners displayed New strategic partnerships formed Digital technology deployment Converting Temporary Tenants to Permanent Tenants Anticipate converting ~500 vacant spaces comprising 750,000 square feet in 2012 Increase revenue from $20psf to $55psf BUSINESS DEVELOPMENT 30 |

|

|

MARKETING: SOCIAL EVENTS 31 |

|

|

MARKETING: SOCIAL MEDIA “The Club” 32 |

|

|

MARKETING: SOCIAL MEDIA “The Club” 33 |

|

|

CONCLUSION Enterprise Approach + Great Team + Focused Leasing Sales Productivity Occupancy Occupancy Costs 34 |

|

|

DEVELOPMENT Richard Pesin Executive Vice President, Anchors, Development and Construction 35 |

|

|

ORGANIZATION CHART 36 Richard Pesin Executive VP, Anchors, Development & Construction Anchor Leasing John Bergstrom Senior VP Big Box Leasing Chris Pine Senior VP Development & Construction John Cournoyer Senior VP |

|

|

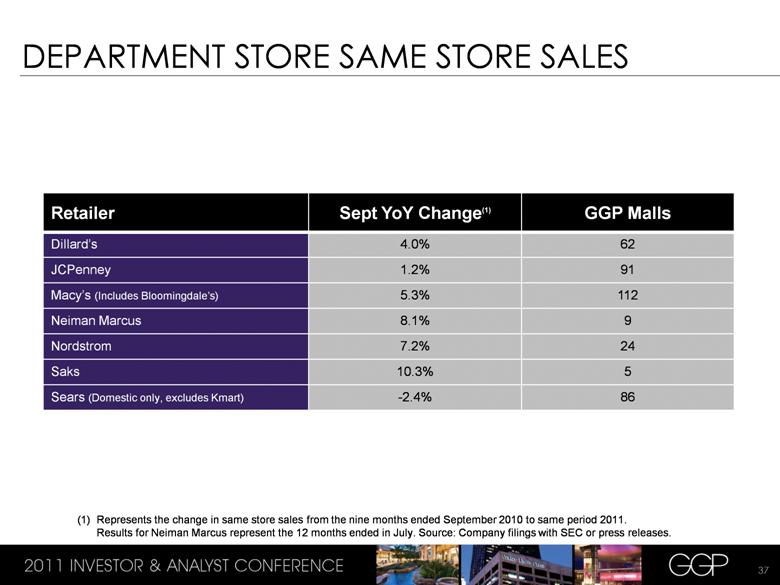

DEPARTMENT STORE SAME STORE SALES 37 Retailer Sept YoY Change(1) GGP Malls Dillard’s 4.0% 62 JCPenney 1.2% 91 Macy’s (Includes Bloomingdale’s) 5.3% 112 Neiman Marcus 8.1% 9 Nordstrom 7.2% 24 Saks 10.3% 5 Sears (Domestic only, excludes Kmart) -2.4% 86 Represents the change in same store sales from the nine months ended September 2010 to same period 2011. Results for Neiman Marcus represent the 12 months ended in July. Source: Company filings with SEC or press releases. |

|

|

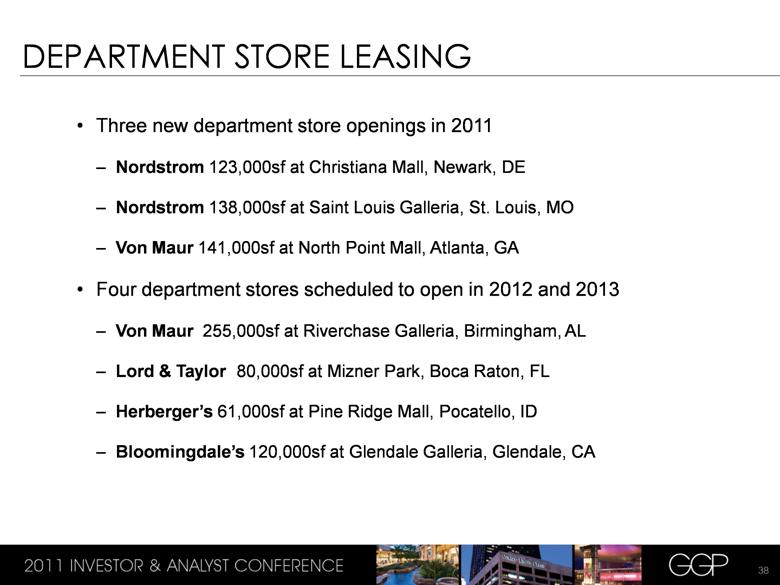

Three new department store openings in 2011 Nordstrom 123,000sf at Christiana Mall, Newark, DE Nordstrom 138,000sf at Saint Louis Galleria, St. Louis, MO Von Maur 141,000sf at North Point Mall, Atlanta, GA Four department stores scheduled to open in 2012 and 2013 Von Maur 255,000sf at Riverchase Galleria, Birmingham, AL Lord & Taylor 80,000sf at Mizner Park, Boca Raton, FL Herberger’s 61,000sf at Pine Ridge Mall, Pocatello, ID Bloomingdale’s 120,000sf at Glendale Galleria, Glendale, CA DEPARTMENT STORE LEASING 38 |

|

|

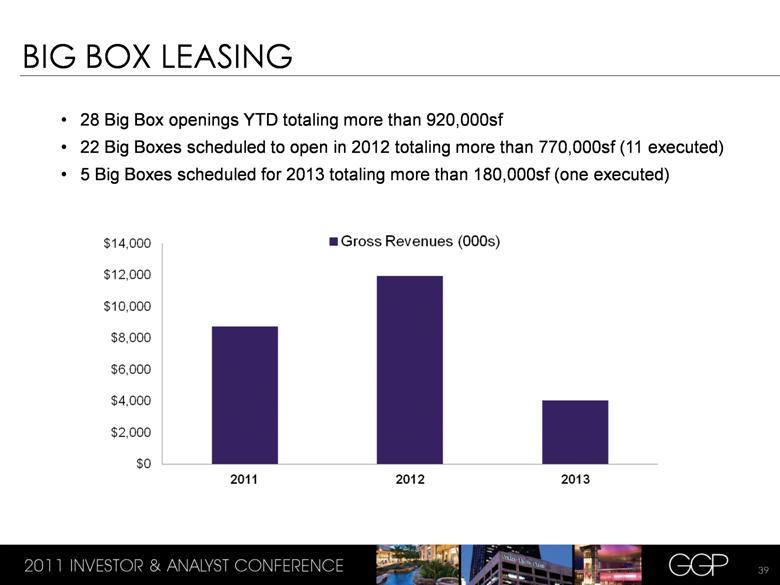

28 Big Box openings YTD totaling more than 920,000sf 22 Big Boxes scheduled to open in 2012 totaling more than 770,000sf (11 executed) 5 Big Boxes scheduled for 2013 totaling more than 180,000sf (one executed) BIG BOX LEASING 39 |

|

|

DEVELOPMENT = REDEVELOPMENT Baybrook Mall - TX Burlington Town Center - TX Christiana Mall – DE Four Seasons Mall – NC Glendale Galleria – CA Mall St. Matthews – KY Mondawmin Mall – MD Neshaminy Mall – PA North Point Mall – GA Oakbrook Center – IL Oakwood Center – LA Pioneer Place – OR Willowbrook Mall – TX Woodbridge Center – NJ 40 |

|

|

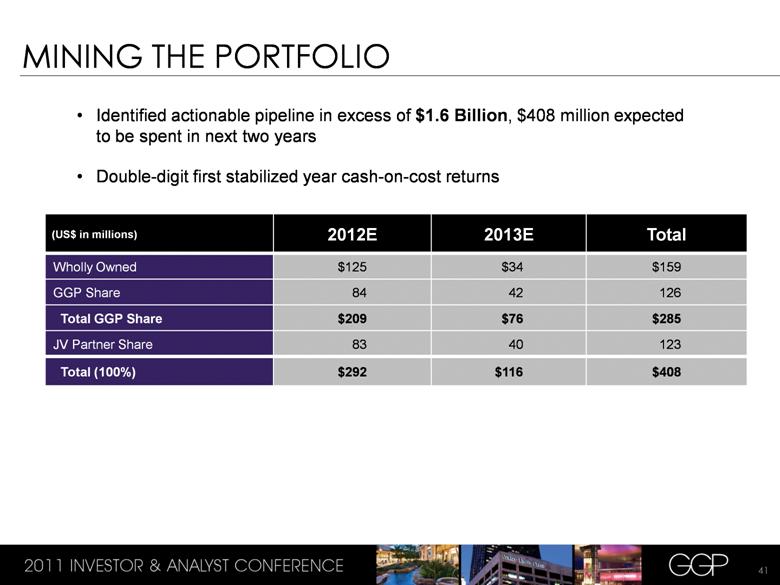

Identified actionable pipeline in excess of $1.6 Billion, $408 million expected to be spent in next two years Double-digit first stabilized year cash-on-cost returns MINING THE PORTFOLIO 41 (US$ in millions) 2012E 2013E Total Wholly Owned $125 $34 $159 GGP Share 84 42 126 Total GGP Share $209 $76 $285 JV Partner Share 83 40 123 Total (100%) $292 $116 $408 |

|

|

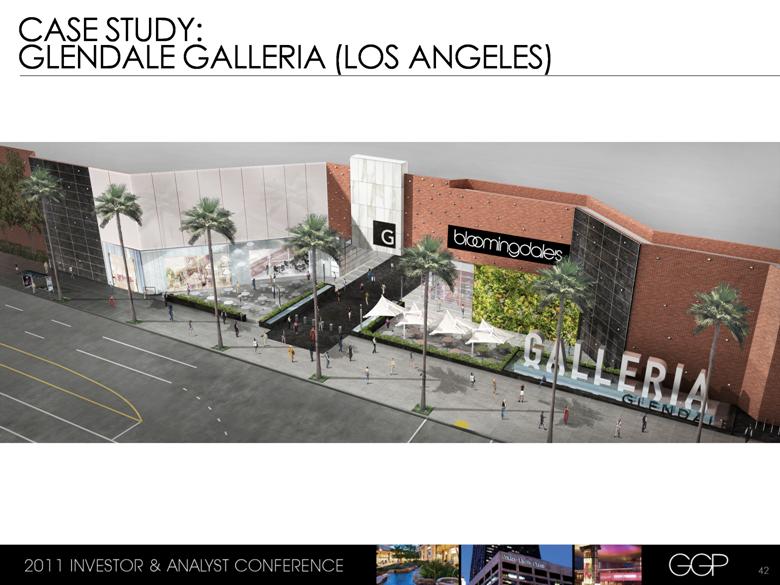

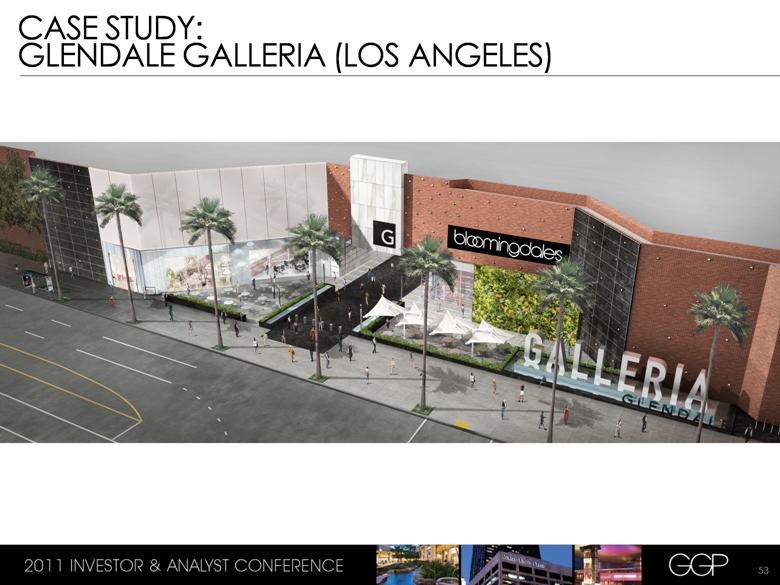

CASE STUDY: GLENDALE GALLERIA (LOS ANGELES) 42 |

|

|

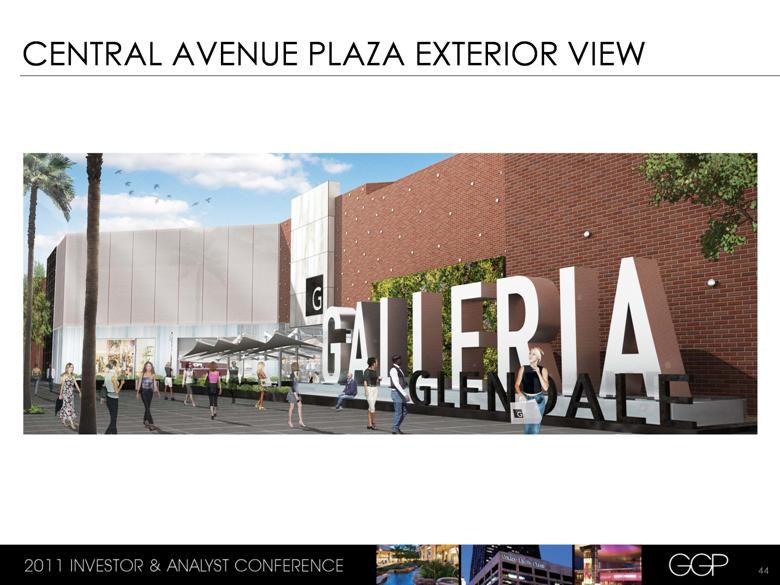

1.4 million square-foot, enclosed super-regional center Acquired by GGP in 2002 November 2011 – Bloomingdale’s fall 2013 opening announced In-line sales of $674 PSF (TTM September 2011) Approximately 37% of in-line leases expire in 2012 and 2013 Comprehensive mall renovation CASE STUDY: GLENDALE GALLERIA 43 Deal Economics Amount (in millions) Total Project Costs $115 Incremental NOI $12 Cash-on-Cost Return 10% |

|

|

CENTRAL AVENUE PLAZA EXTERIOR VIEW 44 |

|

|

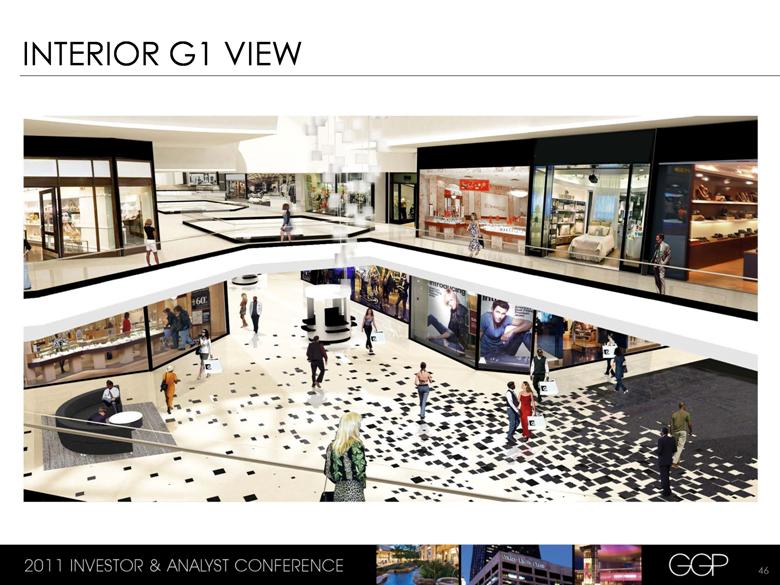

INTERIOR G1 VIEW 45 |

|

|

INTERIOR G1 VIEW 46 |

|

|

INTERIOR G1 VIEW AND CHANDELIER 47 |

|

|

G1 – G2 INTERIOR VIEW 48 |

|

|

G1 – G2 INTERIOR VIEW 49 |

|

|

INTERIOR G2 VIEW 50 |

|

|

INTERIOR G2 VIEW – BLOOMINGDALE’S COURT 51 |

|

|

INTERIOR G2 VIEW – BLOOMINGDALE’S COURT 52 |

|

|

53 CASE STUDY: GLENDALE GALLERIA (LOS ANGELES) |

|

|

CONCLUSION Organizational Streamlining + Department Store / Big Box Drivers + Mining The Portfolio Long-Term Value Creation 54 |

|

|

ASSET MANAGEMENT Chuck Lhotka Executive Vice President, Asset Management 55 |

|

|

ORGANIZATION CHART 56 Chuck Lhotka Executive VP, Asset Management Asset Management Cathie Bryant Senior VP, East Paul Chase Senior VP, West Brian McCarthy Senior VP, Central Property Tax Michael Kolling VP National Operations Josh Burrows Senior VP Eric Almquist VP Tenant Coordination Dennis Gavelek VP |

|

|

Efficient use of internal resources focused on managing operating expenses Economies of scale provided by national platform leads to efficiency/cost savings OPERATING EXPENSES(1) 57 Amounts shown in millions and represents estimates for 2011 and 2012. Excluding marketing costs, property operating expenses are estimated to increase approximately 1.5%. |

|

|

Ordinary Capital - Improvements to maintain the building and site Refresh Capital - Common area renovation OPERATING CAPITAL(1) 58 (1) Amounts shown in millions and represent estimates for 2011 and 2012. |

|

|

Total project cost of $6 million Scope included flooring, painting, signage, amenities, food court improvements, lighting, exterior enhancements, restroom upgrades and energy management system Completed in only five months CASE STUDY: HULEN MALL – FORT WORTH, TX Before After 59 |

|

|

Demand response programs LED lighting High-efficiency HVAC units Energy Management Systems White Roofs Hybrid security vehicles Cardboard recycling SUSTAINABILITY 60 |

|

|

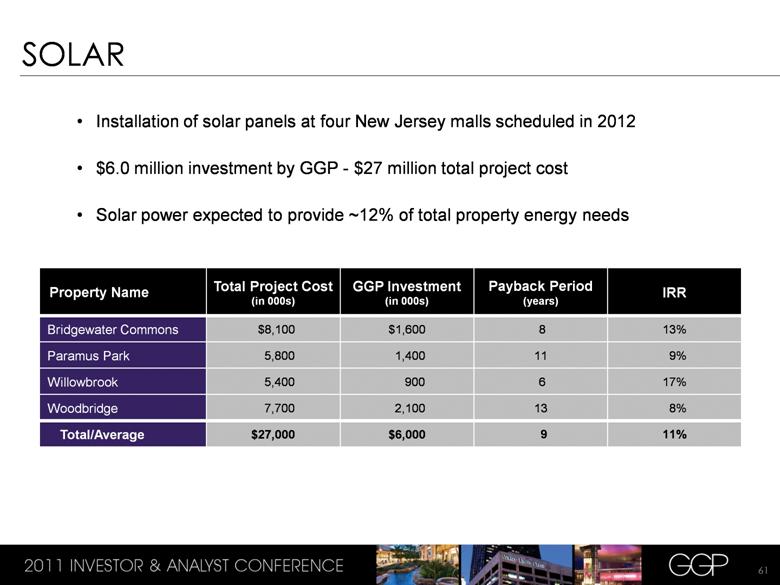

Installation of solar panels at four New Jersey malls scheduled in 2012 $6.0 million investment by GGP - $27 million total project cost Solar power expected to provide ~12% of total property energy needs SOLAR Property Name Total Project Cost (in 000s) GGP Investment (in 000s) Payback Period (years) IRR Bridgewater Commons $8,100 $1,600 8 13% Paramus Park 5,800 1,400 11 9% Willowbrook 5,400 900 6 17% Woodbridge 7,700 2,100 13 8% Total/Average $27,000 $6,000 9 11% 61 |

|

|

Highly experienced and tenured team of asset managers Initiate, strengthen and develop relationships with tenants Prudently manage operating expenses while not compromising quality Lead the retail industry in operating practices and metrics CONCLUSION 62 |

|

|

CAPITAL MARKETS Hugh Zwieg Executive Vice President, Capital Markets 63 |

|

|

ORGANIZATION CHART 64 Hugh Zwieg Executive VP, Capital Markets Capital Markets Heath Fear Senior VP Jason Colton VP Debt Compliance Andrew Oshman Director Business Analysis Jeff Aldridge VP Rajeev Viswanathan VP Enterprise Analytics Michael Fitzmaurice VP Deanne Shanahan VP Lease Management Amy VanSwearingen VP |

|

|

Ensure diverse capital sources and ample liquidity at all times Finance assets on a secured, long-term, non-recourse basis Simplify capital structure, reduce recourse, reduce corporate debt Reduce total debt to achieve investment grade rating CAPITAL MARKETS PHILOSOPHY 65 |

|

|

Interest rates are expected to remain at historic lows Plenty of money for quality real estate Underwriting remains disciplined at investment grade leverage levels Liquidity of CMBS market improving Bank appetite remains healthy across the spectrum of credit products Life insurance companies are a consistent lender for financing our high quality assets CURRENT CAPITAL MARKETS 66 |

|

|

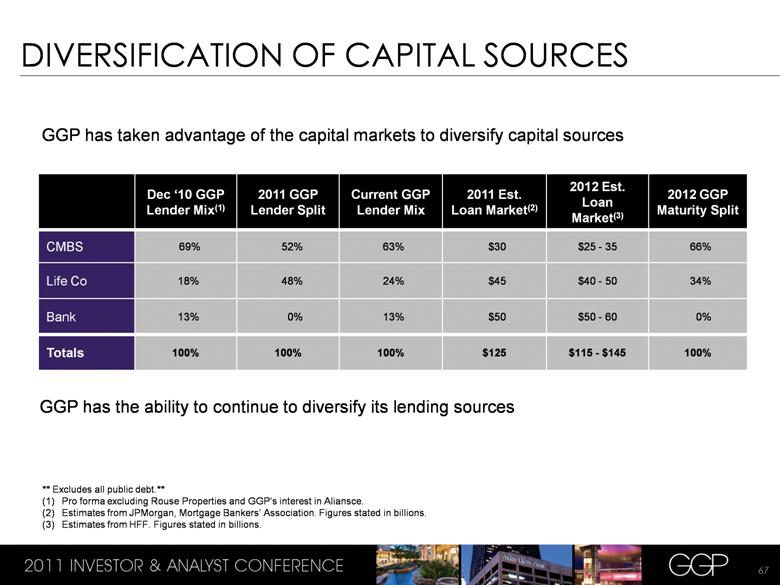

** Excludes all public debt.** Pro forma excluding Rouse Properties and GGP’s interest in Aliansce. Estimates from JPMorgan, Mortgage Bankers’ Association. Figures stated in billions. Estimates from HFF. Figures stated in billions. GGP has the ability to continue to diversify its lending sources DIVERSIFICATION OF CAPITAL SOURCES GGP has taken advantage of the capital markets to diversify capital sources 67 Dec ‘10 GGP Lender Mix(1) 2011 GGP Lender Split Current GGP Lender Mix 2011 Est. Loan Market(2) 2012 Est. Loan Market(3) 2012 GGP Maturity Split CMBS 69% 52% 63% $30 $25 - 35 66% Life Co 18% 48% 24% $45 $40 - 50 34% Bank 13% 0% 13% $50 $50 - 60 0% Totals 100% 100% 100% $125 $115 - $145 100% |

|

|

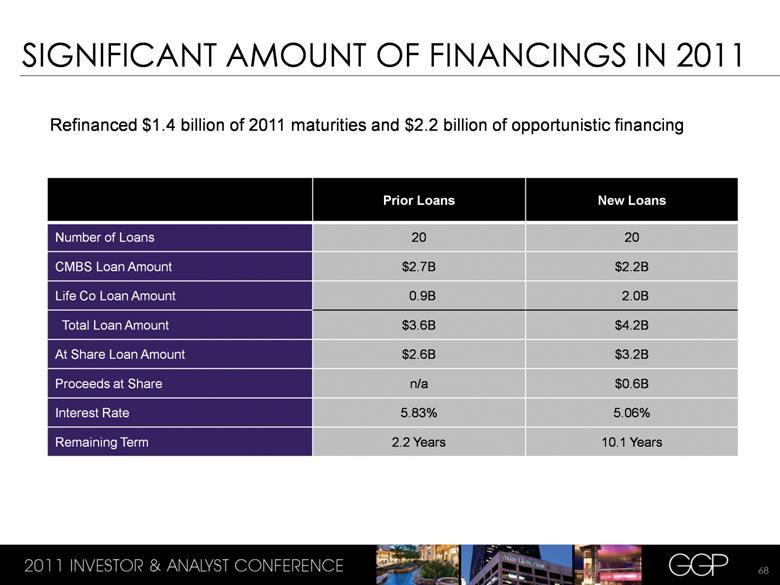

Refinanced $1.4 billion of 2011 maturities and $2.2 billion of opportunistic financing SIGNIFICANT AMOUNT OF FINANCINGS IN 2011 68 Prior Loans New Loans Number of Loans 20 20 CMBS Loan Amount $2.7B $2.2B Life Co Loan Amount 0.9B 2.0B Total Loan Amount $3.6B $4.2B At Share Loan Amount $2.6B $3.2B Proceeds at Share n/a $0.6B Interest Rate 5.83% 5.06% Remaining Term 2.2 Years 10.1 Years |

|

|

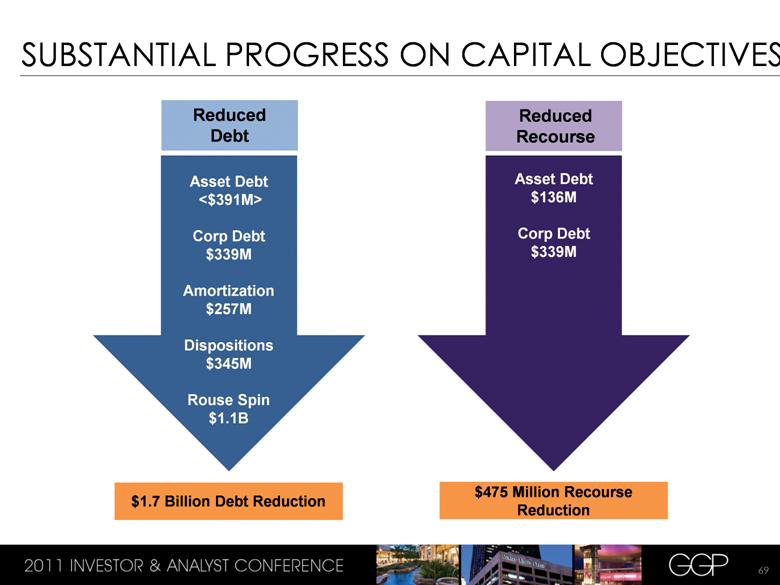

Asset Debt <$391M> Corp Debt $339M Amortization $257M Dispositions $345M Rouse Spin $1.1B Asset Debt $136M Corp Debt $339M SUBSTANTIAL PROGRESS ON CAPITAL OBJECTIVES 69 $1.7 Billion Debt Reduction $475 Million Recourse Reduction Reduced Recourse Reduced Debt |

|

|

Refinanced or Repaid Open-at-Par Debt Above 6.0% Refinanced $4.2B Increased Revolver by $450M to $750M $650M Cash On Hand(1) 70 Interest Rate Lowered from 5.83% to 5.06% $1.4 Billion of Current Liquidity Liquidity Interest Rate POSITIVE ECONOMIC RESULTS (1) As of September 30, 2011. |

|

|

Debt Overview(1) $18.9 billion of debt at 5.25% Appropriate mix of fixed-rate debt (88%) and variable-rate debt (12%) GGP has the option to prepay roughly 50%, or $8.5 billion, of its secured debt at par Early refinancing will be event-driven based on asset and portfolio plans (1) Excludes all Rouse Properties loans and GGP’s interest in Aliansce. Figures as of September 30, 2011. FLEXIBLE DEBT STRUCTURE 71 |

|

|

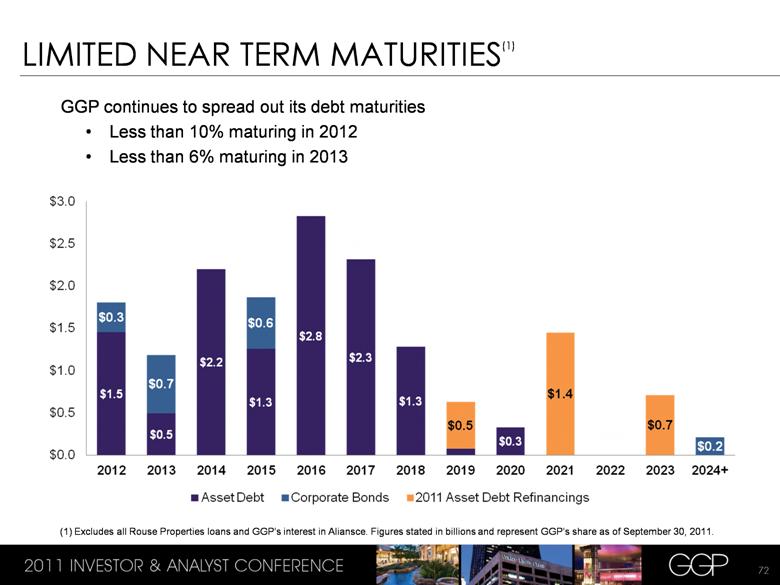

GGP continues to spread out its debt maturities Less than 10% maturing in 2012 Less than 6% maturing in 2013 (1) Excludes all Rouse Properties loans and GGP’s interest in Aliansce. Figures stated in billions and represent GGP’s share as of September 30, 2011. LIMITED NEAR TERM MATURITIES(1) 72 |

|

|

Refinance Asset Secured Debt 2012 maturities = $2.1B ($1.5B at share) at a 5.42% interest rate Monitor $1.6B for early refinance based on market / asset driven events 2012 CAPITAL MARKETS PLAN 73 Portfolio Statistics Number of properties 12 Occupancy 96% Tenant Sales psf ~$500 Occupancy Cost 13% TTM NOI (at share, in millions) $161 The Rouse Company (“TRC”) Bonds - Retire $349 million of TRC bonds at maturity |

|

|

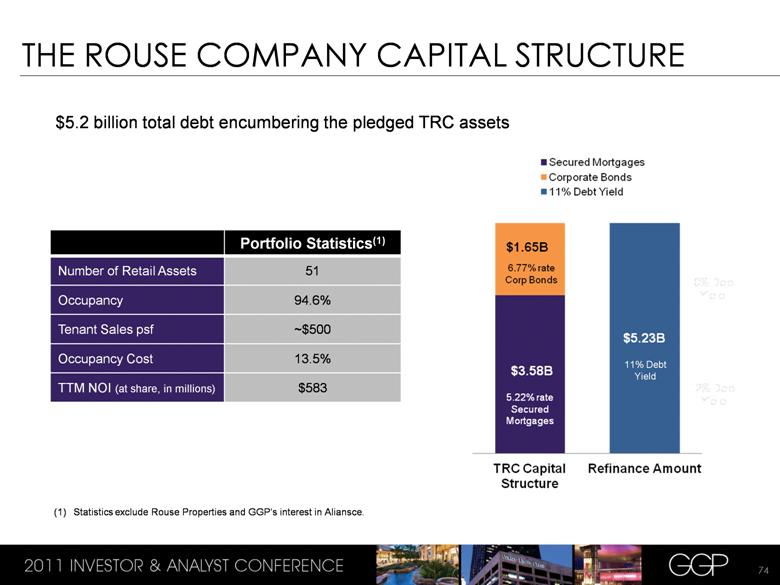

$5.2 billion total debt encumbering the pledged TRC assets Statistics exclude Rouse Properties and GGP’s interest in Aliansce. THE ROUSE COMPANY CAPITAL STRUCTURE 11% Debt Yield 74 Portfolio Statistics(1) Number of Retail Assets 51 Occupancy 94.6% Tenant Sales psf ~$500 Occupancy Cost 13.5% TTM NOI (at share, in millions) $583 $1.65B 6.77% rate Corp Bonds |

|

|

Continued marked progress in diversifying and de-risking capital stack Broaden lending sources Ladder maturities Reduce overall debt Flexibility in debt structure will continue to allow opportunistic financing in sync with asset plans Match investment grade financing with long-term NOI generation strategies in GGP malls CONCLUSION 75 |

|

|

FINANCIAL OVERVIEW 2012 Guidance Steve Douglas |

|

|

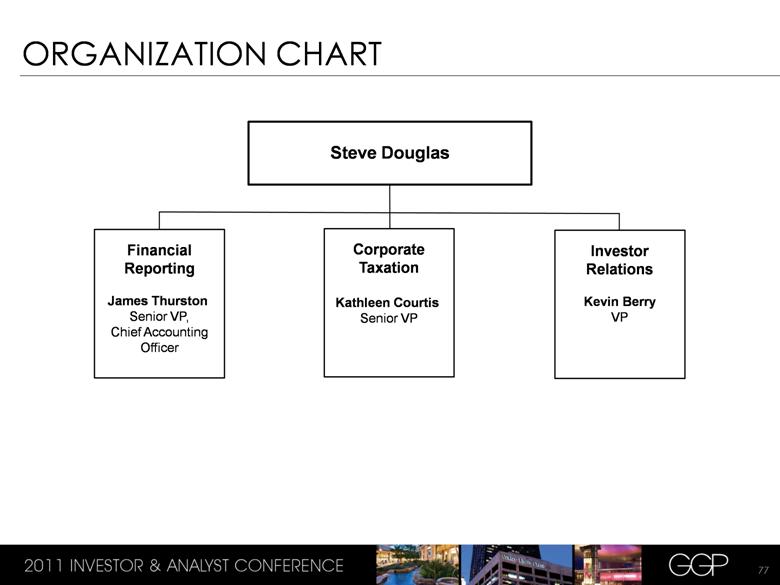

ORGANIZATION CHART 77 Steve Douglas Investor Relations Kevin Berry VP Corporate Taxation Kathleen Courtis Senior VP Financial Reporting James Thurston Senior VP, Chief Accounting Officer |

|

|

Over $3.2 billion of annual revenues Over $2.2 billion of annual Core NOI(2) $1.4 billion of liquidity, including $0.7 billion cash $34 billion total market capitalization 5 million shares traded daily, on average FINANCIAL OVERVIEW(1) Annual revenues and Core NOI are annualized for the nine months ended Sept. 30, 2011. Liquidity is as of Sept. 30, 2011. Market capitalization calculated using total common shares outstanding as of September 30, 2011 multiplied by GGP share price as of Nov. 30, 2011 plus total debt outstanding at share as of Sept. 30, 2011. Average shares traded daily represents the weighted average for nine months ended Sept. 30, 2011. All figures include Rouse Properties, Inc., where applicable. (2) NOI refers to Net Operating Income. 78 |

|

|

Nine months ending September 30, 2011 Total property revenues of $2.4 billion Total Core NOI of $1.6 billion GGP malls Core NOI of $1.4 billion up 2.1%(3) from 2010 Core FFO of $0.66 per fully diluted share REVIEW OF 2011 FINANCIALS(1)(2) (1) At share and includes Rouse Properties, Inc. (2) Refer to the third quarter 2011 GGP earnings release & Supplemental Information package to reconcile Core NOI and Core FFO to the appropriate GAAP measure. The third quarter 2011 GGP earnings release and Supplemental Information package is available in the Investor Relations section of the Company’s website at www.ggp.com. (3) Excludes termination fees. 79 |

|

|

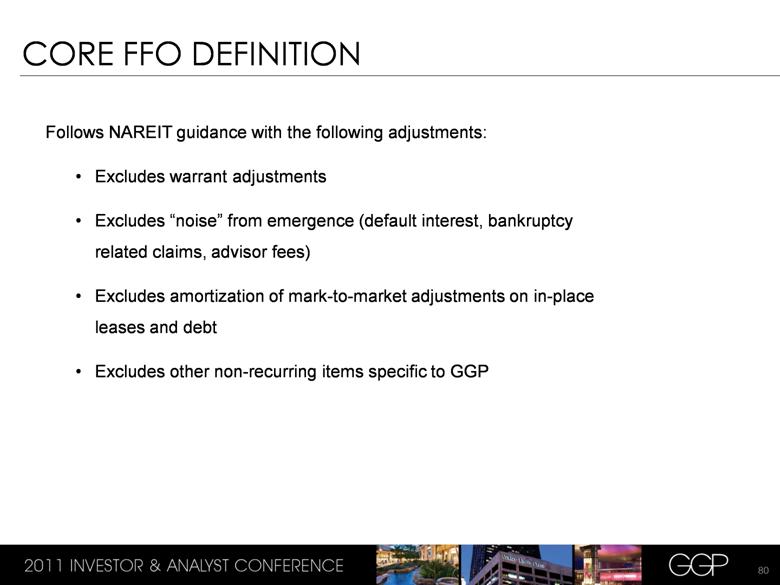

Follows NAREIT guidance with the following adjustments: Excludes warrant adjustments Excludes “noise” from emergence (default interest, bankruptcy related claims, advisor fees) Excludes amortization of mark-to-market adjustments on in-place leases and debt Excludes other non-recurring items specific to GGP CORE FFO DEFINITION 80 |

|

|

(1) Includes the results of Rouse Properties, Inc. for the year ended December 31, 2011. (2) Represents warrant adjustment for the nine months ended September 30, 2011. (3) Refer to page 7 of the third quarter 2011 GGP Supplemental Information package for the nature of adjustments to reconcile FFO to Core FFO. The third quarter 2011 GGP Supplemental Information package is available in the Investor Relations section of the Company’s website at www.ggp.com. 81 Reconfirming 2011 full year guidance Including Rouse Properties, Core FFO estimated to be $0.93 to $0.95 per diluted share For the year ended December 31, 2011(1) Low End Per Share High End Per Share Estimated Net Income Attributable to common shareholders $0.05 $0.07 Depreciation including the Company's share of joint ventures 1.18 1.18 Gain / loss on sales of investment properties (0.01) (0.01) Impact of Dilutive Securities (0.02) (0.02) FFO 1.20 1.22 Warrant Adjustment(2) (0.32) (0.32) Other Core FFO Adjustments(3) 0.05 0.05 Core FFO $0.93 $0.95 2011 FULL YEAR GUIDANCE |

|

|

2012 GUIDANCE(1) 82 FY 2011(1) FY 2012(1) (in millions, except per share amounts) Low High Low High Core NOI $2,070 $2,090 $2,110 $2,140 Core EBITDA $1,865 $1,885 $1,895 $1,930 Core FFO $825 $845 $885 $925 % Change from 2011 (calculated on high end) 9.5% Core FFO per Diluted Share $0.84 $0.86 $0.90 $0.94 Assumed Rouse Proportionate Contribution(2) 0.09 0.09 0.09 0.09 Core FFO per Diluted Share $0.93 $0.95 $0.99 $1.03 (1) See Appendix A for a reconciliation of Core FFO per diluted share to the appropriate GAAP measure. The per share amounts shown assume 985 million weighted average common shares outstanding on a diluted basis. (2) Assumed Rouse Proportionate Contribution for FY 2011 is an estimate. The FY 2012 $0.09 per share is assumed to be the same as FY 2011 and is not intended to represent earnings guidance. The FY 2012 figure does not necessarily reflect anticipated results for Rouse Properties, Inc. under new management and as a stand-alone company. |

|

|

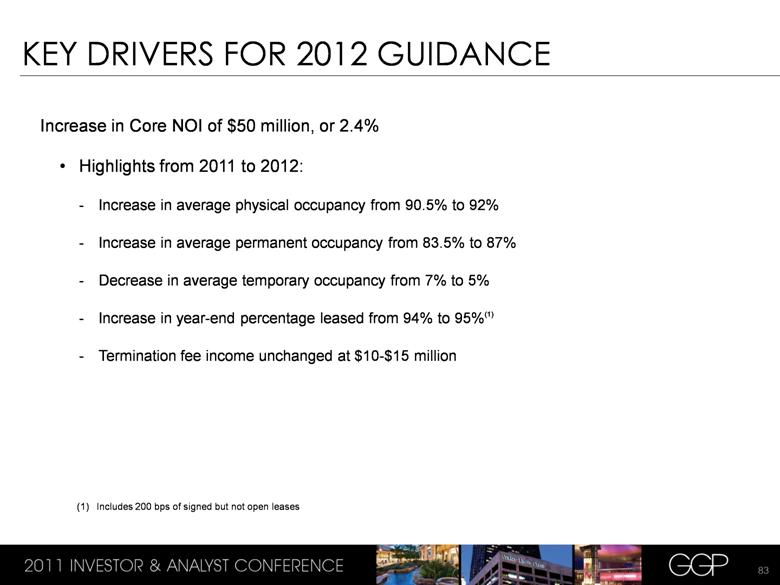

KEY DRIVERS FOR 2012 GUIDANCE Increase in Core NOI of $50 million, or 2.4% Highlights from 2011 to 2012: Increase in average physical occupancy from 90.5% to 92% Increase in average permanent occupancy from 83.5% to 87% Decrease in average temporary occupancy from 7% to 5% Increase in year-end percentage leased from 94% to 95%(1) Termination fee income unchanged at $10-$15 million (1) Includes 200 bps of signed but not open leases 83 |

|

|

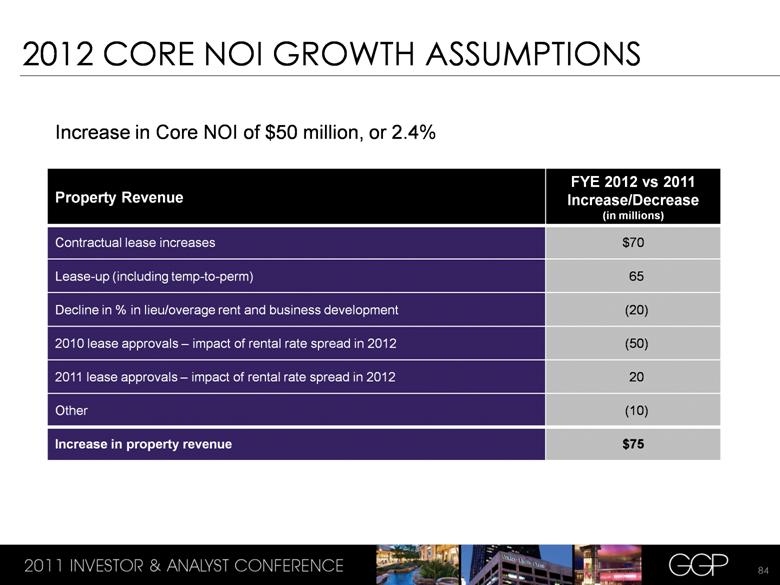

2012 CORE NOI GROWTH ASSUMPTIONS 84 Property Revenue FYE 2012 vs 2011 Increase/Decrease (in millions) Contractual lease increases $70 Lease-up (including temp-to-perm) 65 Decline in % in lieu/overage rent and business development (20) 2010 lease approvals – impact of rental rate spread in 2012 (50) 2011 lease approvals – impact of rental rate spread in 2012 20 Other (10) Increase in property revenue $75 Increase in Core NOI of $50 million, or 2.4% |

|

|

Increase in property operating expenses Real estate taxes (up ~2%) 5 Marketing 10 Property operating and maintenance costs (up ~1.5%) – net of $30 million of organizational savings since 2010 10 Total increase in property operating expenses 25 Increase in Core NOI in 2012 $50 2012 CORE NOI GROWTH ASSUMPTIONS 85 FYE 2012 vs 2011 Increase (Decrease) (in millions) Increase in property revenue $75 |

|

|

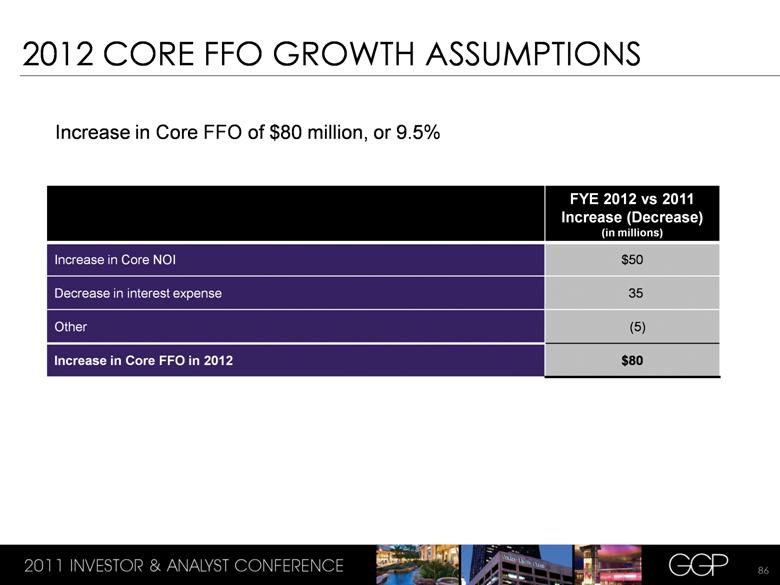

2012 CORE FFO GROWTH ASSUMPTIONS 86 FYE 2012 vs 2011 Increase (Decrease) (in millions) Increase in Core NOI $50 Decrease in interest expense 35 Other (5) Increase in Core FFO in 2012 $80 Increase in Core FFO of $80 million, or 9.5% |

|

|

KEY TAKEAWAYS Sandeep Mathrani Chief Executive Officer 87 |

|

|

KEY TAKEAWAYS Increase Occupancy and Occupancy Cost De-Risk Balance Sheet and Reduce Debt Mine Existing Portfolio for Opportunities Sell Non-Core Assets 88 Identify Complementary Acquisitions |

|

|

Q&A 89 |

|

|

OTHER FINANCIAL SCHEDULES Appendix A 90 |

|

|

2012 ESTIMATED CAPITAL REQUIREMENTS(1) Leasing and maintenance $185 million of leasing costs associated with 10 million sf of leasing $95 million of ordinary capital expenditures Investments $209 million of development capital expenditures (GGP share) $30 million of refresh capital expenditures (1) Excludes Rouse Properties, Inc. 91 |

|

|

BALANCE SHEET REVIEW As of September 30, 2011 (1) Excludes Rouse Properties, Inc. 92 (in millions) As of Sept. 30, 2011 GGP Total Share As of Sept. 30, 2011 GGP Total Share ex-RPI(1) Assets: Net investment in real estate $ 29,222 $ 27,821 Cash & cash equivalents 656 656 Accounts & notes receivable, net 253 238 Deferred & prepaid expenses & other Assets 2,481 2,310 Assets held for disposition 320 320 Total assets $ 32,932 $ 31,345 Liabilities: Mortgages, notes & loans payable $ 19,920 $ 18,840 Accounts payable, accrued expenses & tax liabilities 2,226 2,226 Junior subordinated notes 206 121 Warrant liability 722 722 Liabilities held for disposition 278 278 Total liabilities 23,352 22,187 Total redeemable noncontrolling interests 213 213 Total equity 9,367 8,945 Total liabilities and equity $ 32,932 $ 31,345 |

|

|

RECONCILIATION TO GAAP 93 FY 2011 (1) FY2012 (1) Low High Low High Core NOI $ 2,070 $ 2,090 $ 2,110 $ 2,140 Core NOI adjustments (2) (25) (25) (51) (51) NOI Pro Rata basis $ 2,045 $ 2,065 $ 2,059 $ 2,089 NOI Unconsolidated properties (364) (364) (386) (386) NOI Consolidated Properties 1,681 1,701 1,673 1,703 Management fees and other corporate revenues, property management and general and administrative costs and noncontrolling interest in NOI (159) (159) (149) (149) Depreciation and amortization (888) (888) (730) (730) Operating income $ 634 $ 654 $ 794 $ 824 Core EBITDA $ 1,865 $ 1,885 $ 1,895 $ 1,930 Core NOI Adjustments (25) (25) (51) (51) Core EBITDA adjustments (2) (9) (9) (14) (14) EBITDA Pro Rata Basis $ 1,831 $ 1,851 $ 1,830 $ 1,865 EBITDA Unconsolidated Properties (337) (337) (360) (360) Preferred unit distributions 9 9 9 9 Depreciation and amortization (888) (888) (730) (730) Interest expense, net (881) (881) (852) (852) Warrant Adjustment (3) 319 319 - - Provision for income taxes, equity in income of Unconsolidated Real Estate Affiliates and other (11) (11) 53 58 Estimated net income attributable to common shareholders $ 42 $ 62 $ (50) $ (10) Core FFO $ 825 $ 845 $ 885 $ 925 Core EBITDA Adjustments (34) (34) (65) (65) Warrant Adjustment (3) 319 319 Other Core FFO adjustments (2) 9 9 19 19 FFO $ 1,119 $ 1,139 $ 839 $ 879 Depreciation including the Company's share of joint ventures (1,080) (1,080) (889) (889) Gain/loss on sales of investment properties 3 3 - - Estimated net income attributable to common shareholders $ 42 $ 62 $ (50) $ (10) Estimated Net Income Attributable to common shareholders $ 0.05 $ 0.08 $ (0.05) $ (0.01) Depreciation including the Company's share of joint ventures 1.10 1.10 0.92 0.92 Gain / loss on sales of investment properties (0.01) (0.01) - - Impact of Dilutive Securities (0.02) (0.02) (0.02) (0.02) FFO per share $ 1.12 $ 1.15 $ 0.85 $ 0.89 Warrant Adjustment (2) (0.31) (0.32) - - Other Core FFO Adjustments (3) 0.03 0.03 0.05 0.05 Core FFO per share $ 0.84 $ 0.86 $ 0.90 $ 0.94 (1) Excludes Rouse Properties, Inc. (2) Refer to page 7 of the third quarter 2011 GGP Supplemental Information package for the nature of Core adjustments. The third quarter 2011 GGP Supplemental Information package is available in the Investor Relations section of the Company's website at www.ggp.com. (3) Represents warrant adjustment for the nine months ended September 30, 2011. |

|

|

BIOS Appendix B 94 |

|

|

BIOS SANDEEP MATHRANI Chief Executive Officer Sandeep Mathrani is chief executive officer of General Growth Properties, the country’s second largest shopping mall owner/developer and real estate investment trust (REIT). Prior to GGP, Mr. Mathrani was president of retail for Vornado Realty Trust, one of the largest REITs in the country, with a total capitalization of more than $31 billion. At Vornado, Mr. Mathrani oversaw U.S. retail real estate and its India operations. Prior to Vornado, he spent eight years with Forest City Ratner, where he was executive vice president, responsible for their retail development and leasing in the New York City metropolitan area. Mr. Mathrani is a real estate industry veteran with more than 20 years of experience and holds a Master of Engineering, Master of Management Science and Bachelor of Engineering from Stevens Institute of Technology. 95 SHOBI KHAN Chief Operating Officer Prior to GGP, Mr. Khan served as U.S. chief investment officer at Bentall Kennedy, one of North America’s largest real estate investment advisors, where he held direct responsibility for U.S. investment activity and served on the company’s management group and investment committees. Prior to Bentall Kennedy, Mr. Khan was senior vice president of investments at Equity Office Properties Trust. During his 11 years at EOP, he led the underwriting of $16 billion in office REIT mergers and was involved with EOP’s $39 billion sale to Blackstone in 2007. Prior to joining EOP in 1996, Mr. Khan served with Katz Hollis, Inc. in Los Angeles, where he completed more than $5 billion in tax allocation bond transactions and public/private-financing assignments throughout the United States. Before joining Katz Hollis, he was with Arthur Andersen in San Francisco, where he was responsible for various real estate consulting engagements. Mr. Khan holds an MBA from the University of Southern California and a bachelor’s degree from the University of California at Berkeley. He is an active member of the Urban Land Institute and other industry organizations. |

|

|

BIOS ALAN BAROCAS Senior Executive VP, Mall Leasing Prior to joining GGP, Mr. Barocas was the principal of Alan J. Barocas and Associates, a retail real estate consulting group he founded in May of 2006, specializing in assisting retailers, developers and investment groups with growth and investment strategies. His client list included Under Armour, Calvin Klein, Fossil, New York & Company, Vornado Realty Trust, Advent International and Abbell Financial Investments. Prior to May of 2006, Mr. Barocas spent 25 years with Gap Inc., where he was instrumental in leading its three divisions (Gap, Banana Republic and Old Navy) in developing and executing their real estate growth strategies. In January of 2007, Mr. Barocas was named to the board of directors of Stage Stores Inc., Houston, Texas. Mr. Barocas is a past trustee of ICSC and a graduate of University at Albany with a Bachelor of Science in Business Administration. 96 RICHARD PESIN Executive VP, Anchors, Development and Construction Prior to GGP, Mr. Pesin was executive vice president and director of Retail Development for Forest City Ratner Companies where he oversaw all aspects of retail development and leasing. With more than 25 years of experience in retail site acquisition, development and leasing, Mr. Pesin led the company’s program to bring innovative shopping centers to underserved urban markets. During his 15 year tenure with Forest City, Mr. Pesin was directly responsible for more than 4.5 million square feet with a cost of more than $1.5 billion of new development. In his executive role, he remained closely involved with the ongoing operation and leasing of the company’s retail portfolio. He is a graduate of Duke University with a Bachelor of Economics and Political Science. |

|

|

BIOS CHUCK LHOTKA Executive Vice President, Asset Management Mr. Lhotka oversees the management and maximization of GGP’s operations. Throughout his tenure at the company, Mr. Lhotka has held various positions, including chief administrative officer, senior vice president of development and senior vice president of operations. Prior to joining General Growth, Mr. Lhotka worked for Homart Development Co., where he began working in 1972 as a staff assistant in the corporate personnel department. At Homart, he went on to serve in many capacities within corporate and mall management, including general manager of Northbrook Court and vice president of asset management. A native of Chicago, Mr. Lhotka received his Bachelor of Arts from DePaul University. He is an honoree of GGP’s distinguished Founder’s Award; member of the International Council of Shopping Centers; has served as an ICSC CSM committee member; and holds the designation of Senior Certified Shopping Center Manager. 97 HUGH ZWIEG Executive Vice President, Capital Markets Mr. Zwieg is responsible for capital markets. He came to GGP in March 2010, bringing 25 years of experience in property investment, portfolio management, finance and operations. Previously he was CEO of Wind Realty Partners. From 1989 to 2006 he held various positions at CMD Realty Investors, L. P., including president and chief operating officer. Prior to joining CMD, he held positions at The Balcor Company, Laventhol & Horwath and the First National Bank of Chicago. He is member of the board and executive committee of The James Graaskamp Real Estate Center at the University of Wisconsin. Mr. Zwieg holds a Bachelor of Business Administration in Accounting and a MBA in Finance from the University of Wisconsin. |

|

|

BIOS 98 MICHAEL BERMAN Michael Berman will assume the role of chief financial officer for General Growth Properties on December 15, 2011. He will oversee GGP’s treasury, finance, accounting and investor relations functions. Mr. Berman brings more than 25 years of combined experience in the real estate and financial industries. Prior to his role as CFO for GGP, Mr. Berman served as executive vice president and chief financial officer of Equity LifeStyle Properties. During 2003, Mr. Berman was an associate professor at the New York University Real Estate Institute. He was a managing director in the investment banking department at Merrill Lynch & Co. from 1997 to 2002. Mr. Berman holds an MBA from Columbia University Graduate School of Business; a law degree from Boston University School of Law; and a bachelor's degree from Binghamton University in New York. Mr. Berman is a director of Lotsa Helping Hands, a private provider of social networking web-based tools for caregiving and volunteer coordination. Mr. Berman is a member of the Columbia Business School Real Estate Advisory Board. |

|

|

CONTACT INFORMATION GGP Investor Relations Contact: Kevin J. Berry Vice President, Investor Relations General Growth Properties (NYSE: GGP) 110 North Wacker Drive Chicago, IL 60606 kevin.berry@ggp.com Office: (312) 960-5529 Mobile: (708) 308-5999 99 |