UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM |

(Mark One)

For the fiscal year ended

or

For the transition period from ________ to _________

Commission File Number:

(Exact name of registrant as specified in its charter)

| ||

(State or other jurisdiction | (I.R.S. Employer | |

of incorporation or organization) | Identification No.) |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: ( |

Securities registered pursuant to section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Securities registered pursuant to section 12(g) of the Act: None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

☒ | Accelerated filer | ☐ | |

Non-accelerated filer | ☐ | Smaller reporting company | |

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes

Based on the registrant’s closing price of $11.08 as quoted on the Nasdaq on December 31, 2022, the aggregate market value of the voting and nonvoting common equity held by non-affiliates of eXp World Holdings, Inc. was approximately $

DOCUMENTS INCORPORATED BY REFERENCE The registrant intends to file a definitive proxy statement pursuant to Regulation 14A within 120 days after the end of the fiscal year ended December 31, 2022. Portions of such proxy statement are incorporated by reference into Part III of this Form 10-K. Portions of the Registrant’s Annual Report on Form 10-K for the fiscal year ended December 31,2021 are incorporated into Part I, Item 1 and Part II, Item 7, of this Form 10-K.

TABLE OF CONTENTS

i

FORWARD-LOOKING STATEMENTS

This Annual Report and our other public filings contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not based on historical facts but rather represent current expectations and assumptions of future events. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

Many of these risks and other factors are beyond our ability to control or predict. Forward-looking statements can be identified by words such as “believe,” “expect,” “anticipate,” “estimate,” “project,” “plan,” “should,” “intend,” “may,” “will,” “could,” “can,” “would,” “potential,” “seek,” “goal” and similar expressions. These risks and uncertainties, as well as other risks and uncertainties that could cause our actual results to differ significantly from management’s expectations, are described in greater detail in Item 1A, “Risk Factors”, Item 3, “Legal Proceedings,” Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” and Item 9A. “Controls and Procedures – Inherent Limitations on Effectiveness of Controls.”

Forward-looking statements are based on currently available operating, financial and market information and are inherently uncertain. Investors should not place undue reliance on forward-looking statements, which speak only as of the date they are made and are not guarantees of future performance. Actual future results and trends may differ materially from such forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statements whether as a result of new information, future developments or otherwise, except as may be required by law.

1

PART I

Item 1. | BUSINESS |

General

eXp World Holdings, Inc. (“eXp,” or, collectively with its subsidiaries, the “Company,” “we,” “us,” or “our”) owns and operates a diversified portfolio of service- based businesses whose operations benefit substantially from utilizing our enabling technology platform. We strategically prioritize our efforts to grow our real estate brokerage by strengthening our agent value proposition, developing immersive and cloud-based technology to enable our model and providing affiliate and media services supporting those efforts.

The following are changes in our business in the most recent fiscal year:

Real Estate Brokerage Expansion – In addition to maintaining operations in all locations, in 2022 the Company continued its international growth with expansion into the Dominican Republic, Greece, New Zealand, Chile and Poland. In addition, in late 2022, we announced operations in Dubai, which is expected to be fully operational in 2023. Except for certain employees who hold active real estate licenses, virtually all our real estate professionals are independent contractors.

Recent Acquisition – On July 1, 2022, the Company acquired Zoocasa Realty Inc. –, an Ontario, Canada company (“Zoocasa”). Zoocasa’s key product is a consumer real estate research portal that offers proprietary home search tools, market insights and a connection to local real estate experts. Zoocasa has been included in the North American Realty segment since its key asset, Zoocasa.com, provides quality real estate referrals for the North American real estate markets.

New Programs and Services – During 2022, the Company launched various new ancillary programs and services to support the development and success of its agents, brokers and customers, including eXp Luxury™, Revenos™, SUCCESS® Health and SUCCESS® Coaching.

Details regarding the development of our businesses prior to 2022 are incorporated by reference herein from Part I of our Annual Report on Form 10-K dated February 25, 2022 (Commission File No. 001-38493).

Business Segments

Due to growth in international operations and changes to the North American markets, the Company began operating and managing the Company as four operating and reportable business segments beginning in December 2022, in order to increase our management effectiveness. The reportable segments are North American Realty, International Realty, Virbela and Other Affiliated Services. Our business segments bring together related eXp technologies and services to support the success and development of agents, entrepreneurs and businesses and provide them remote business solutions.

Both the North American Realty and the International Realty segments generate revenue primarily by serving as a licensed broker for the purpose of processing residential and commercial real estate transactions, from which we earn commissions. The Company in turn pays a portion of the commissions earned to the real estate agents and brokers. eXp offers an innovative cloud-based brokerage model, which reduces costs to our agents and brokers. The model features low entry fees, stock ownership opportunities for agents and brokers and a revenue sharing plan through which agents and brokers can earn commission from transactions conducted by agents and brokers they’ve attracted to eXp.

| ● | North American Realty: Together with our other real estate brokerage subsidiaries, eXp Realty, LLC (“eXp Realty”) is a leading, rapidly growing, cloud-based real estate brokerage company in the United States and Canada. We disrupt the traditional real estate model within the markets in which we operate for the benefit of agents and brokers through innovation, use of cloud-based technology and development of world-class agent and broker attraction and retention practices. In 2022, we devoted significant efforts to the ongoing expansion of eXp Solutions™ for our agents, including the launch of Revenos™ and the development and improvement of proprietary software to source quality leads for agents. Our North American Realty segment also includes lead-generation and other real estate support services in North America and Canada. The United States and Canada operating segments are aggregated into one operating segment due to similarities in the markets, economics and management strategy. |

| ● | International Realty: We expanded our business into Australia and the United Kingdom in 2019, into South Africa, India, Mexico, Portugal and France, during 2020 and into Puerto Rico, Brazil, Italy, Hong Kong, Colombia, Spain, Israel, Panama and Germany in 2021. During 2022 we commenced operations in The Dominican Republic, Greece, New Zealand, Chile and Poland. In addition, in late 2022, we announced operations in Dubai, which are expected to be fully operational in 2023. Throughout our international operations, we disrupt the traditional real estate model for the benefit of agents and brokers through innovation, use of cloud-based technology and development of world-class agent and broker attraction and retention practices. |

2

| ● | Virbela: We operate over the internet and rely on cloud-based technologies to provide our residential real estate brokerage services. Our brokers and agents leverage our technology, services, data, lead generation and marketing tools to represent residential real estate buyers and sellers. Among other technologies we use to operate our business, our proprietary 3D, fully-immersive, cloud office, has virtual conference rooms, training centers and individual offices in which our management, employees, agents and brokers all work on a daily basis learning from, sharing with, transacting business with and socializing with colleagues from different geographic regions by utilizing avatars in the Virbela platform. Virbela is an immersive technology company that specializes in building virtual worlds and environments for work, education and events. Its portfolio of metaverse and virtual reality (VR) offerings includes Virbela® and Frame™. eXp Realty created a virtual campus — called eXp World — using Virbela’s software which provides 24/7 access to collaboration tools, training and social communities for the company’s real estate agents and employees across our many locations. |

| ● | Other Affiliated Services: Includes key assets such as SUCCESS® magazine, SUCCESS® Coaching and SUCCESS® Health, which provide training, classes, resources, and tools to empower our agents, brokers, staff, and customers to excel and empower their professional development. |

Markets and Customers

Real Estate Brokerage: Our clients are primarily residential homeowners and homebuyers in the markets in which we operate as serviced by our international network of independent agents and brokers. These customers are sellers or purchasers of new or existing homes and engage us to aid in the facilitation of the closing of the real estate transaction, including, but not limited to, searching, listing, application processing and other pre- and post-close support. Our experienced agents and brokers are well suited to support our customers’ needs with a high level of professionalism, knowledge and support as they endeavor on one of the largest transactions they will most likely experience.

Our North American Realty segment is comprised of operations in the U.S. and Canadian residential real estate markets. Through our network of independent agents and brokers, we have brokerages in all 50 states in the U.S. residential real estate market and residential real estate markets in most of the Canadian provinces. The U.S. residential real estate market for existing homes, seasonally adjusted, accounted for approximately 4.02 million homes sold with a median existing home sales price of $0.4 million in 2022, based on data released by the National Association of Realtors.

Our International Realty segment operates in the U.K., Australia, South Africa, India, Mexico, Portugal, France, Puerto Rico, Brazil, Italy, Hong Kong, Colombia, Spain, Israel, Panama and Germany, the Dominican Republic, Greece, New Zealand, Chile and Poland. In late 2022, we announced operations in Dubai, which is expected to be fully operational in 2023. Our International Realty segment represented 0.8% of total consolidated revenues in 2022.

Virbela: Our innovative technologies are used primarily by our brokerage real estate agents and their clients within our U.S., Canadian and international markets. Additionally, eXp World Technologies, LLC ("World Tech") has continued to innovate the Virbela portfolio, expanding the product offering to agents, teams and other global companies and organizations who can benefit from having their own, always-on virtual environment for workplace collaboration.

Other Affiliated Services: We provide affiliated services to our agents, brokers and customers that support their professional efforts and personal betterment. Under its ownership, the Company has built upon SUCCESS® magazine and its related media properties to develop a robust SUCCESS® brand of innovative personal and professional development tools, including SUCCESS® Health, SUCCESS® Coaching and SUCCESS® Space.

Competition

Our real estate brokerage competes with local, regional, national and international residential real estate brokerages with respect to the sale of homes and to attract and retain agents, teams of agents, brokers and consumers — both home sellers and buyers. We compete primarily on the basis of our service, culture, collaboration, utilization of cloud-based systems and technologies that reduce costs, while providing relevant and substantial professional development opportunities for our agents and brokers with an opportunity to generate more business and participate in the growth of our company.

Residential real estate brokerage companies typically realize revenues in the form of a commission based on a percentage of the price of each home purchased or sold, which can vary based on industry standards, geographical location and specific customer-agent negotiations, among other factors. Therefore, variability in the commissions earned in the real estate industry exists based on general economic and market factors, as well as price and volume of homes sold. When home prices and the volume of home sale transactions increase (decrease), commissions generally will also increase (decrease). However, we are positioned to earn commissions on either — or both — of the buy side or sell side of residential real estate transactions, as well as the ability to receive other fees for complementary services provided during the close process.

3

We believe that we are the only international real estate brokerage presently using a 3D immersive office environment in place of physical brick-and-mortar offices. Additionally, this innovative operational structure coupled with our distribution model allows us to effectively enter new markets with speed and flexibility and without much of the investment and cost associated with establishing a traditional brokerage. We also believe our compensation and incentive programs to attract and retain highly productive agents is one of the most compelling in the industry. As such, we believe that we are well-positioned in our competitive landscape.

Resources

Software Development

Our Company continues to increase our investment in the development of our own cloud-based transaction processing platforms and further expand our products and service offerings. We continue to create process efficiencies and provide our agents and brokers with mobile applications designed to facilitate transactions in an efficient and consumer friendly way. To further expand our products and service offerings, we offer an on-demand, home tour mobile application that enables home shoppers to request immediate access to properties exclusive to eXp Realty agents in certain markets.

Our operational model and growth strategies necessitate the proprietary technologies used to support our operations now and in the future, as well as requiring us to, at times, consider existing and emerging technology companies for acquisition, partnerships and other collaborative relationships.

Intellectual Property

Our cloud-based real estate brokerage is highly dependent on the proprietary technology that we employ and the intellectual property that we create. “eXp Realty” is one of our registered trademarks in the United States. We have also placed the marks “3D MLS”, “3D Listing Service” and “RE Tech Campus” on the United States Patent and Trademark Office’s Supplemental Register, among others. We also own the rights to key domain names used by our domestic and international brokerages: (e.g., https://exprealty.com and https://exprealty.ca). Additionally, we own registered trademarks and the rights to domain names which are leveraged in our other business segments and in connection with services that complement our real estate brokerage, such as the “SUCCESS” registered trademark and https://success.com. Other proprietary brands key to our suite of services include Revenos, eXp Luxury, SUCCESS Coaching and SUCCESS Health. We have also engaged various third parties to extend enterprise licenses for critical transaction management, CRM and other proprietary software.

While there can be no assurance that registered trademarks and other intellectual property rights will protect our proprietary information, we intend to assert our intellectual property rights against any infringement. Although any assertion of our rights could result in a substantial cost and diversion of management effort, we believe the protection and defense against infringement of our intellectual property rights are essential to our business.

Seasonality of Business

Seasons and weather traditionally impact the real estate industry in the markets in which we operate. Spring and summer seasons historically reflect greater sales periods and, in turn, higher revenues and operating results in comparison to fall and winter seasons. The Company has historically experienced higher revenue during the second and third quarters of its fiscal year due in part to seasonal industry patterns. By contrast, our technology and affiliate services segments experience generally consistent revenue during the year, with some increased adoption around the Company’s spring and fall events.

Government Regulation

Real Estate Regulation

We primarily serve the residential real estate industry, which is regulated by federal, international, state, provincial and local authorities as well as private associations or state sponsored associations or organizations. We are required to comply with federal, state, provincial and local laws, as well as private governing bodies’ regulations, which combined results in a highly-regulated industry.

We are also subject to federal, international, state and provincial regulations relating to employment, contractor and compensation practices. Except for certain employees who have an active real estate license, virtually all real estate professionals in our brokerage operations have been retained as independent contractors, either directly or indirectly through third-party entities formed by these independent contractors for their business purposes. With respect to these independent contractors, like most brokerage firms, we are subject to the Internal Revenue Service regulations, foreign regulations and applicable state and provincial law guidelines regarding independent contractor classification. These regulations and guidelines are subject to judicial and agency interpretation.

Environmental Regulation

4

The Company operates in a cloud-based model which, gives us an insignificant physical geographical footprint. Due to this, we are not materially impacted by any environmental regulation.

Other Regulation

Our technology and affiliate services businesses operate in multiple geographies and industries which subject them to various governmental and non-governmental rules and regulations, including without limitation, franchising, fair trade, health and data privacy rules. As we expand into new businesses and markets, we assign and/or engage appropriate personnel to manage and comply with such requirements.

Environmental, Social and Governance Initiatives

As a company dedicated to disrupting the traditional industry model, eXp understands the importance of ingraining environmental, social and governance (ESG) best practices across the organization.

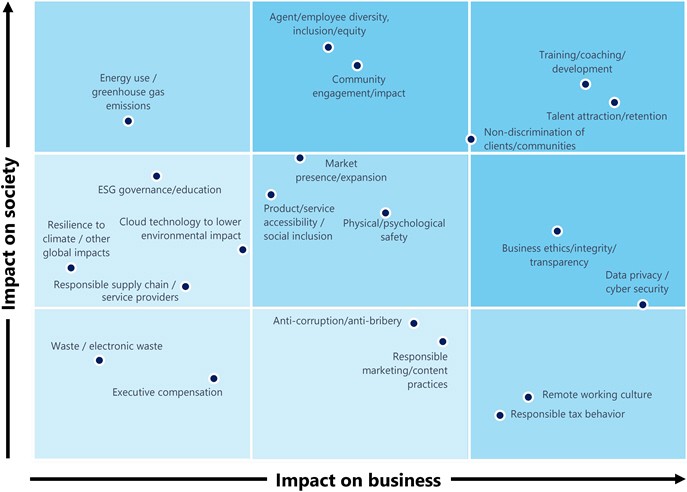

In 2022, we conducted an ESG materiality assessment with the assistance of an external consultant, GlobeScan, to identify the material ESG topics that have the greatest impact on the Company’s success. Our approach included extensive desk research to identify the range of potential environmental, social, governance and economic issues that eXp might face. To refine and prioritize the issues, a series of 16 in-depth interviews were conducted with key internal and external stakeholders to understand their expectations and perceptions of eXp’s business and environmental and social impacts. These interviews included a range of constituents such as eXp executives, agents, industry associations, investors, customers, academics and sustainability experts. Additionally, we conducted a data-driven analysis of issue areas through a structured online questionnaire. The company-wide survey was delivered in January 2023 to our leadership team, employees and agents. The objective of the survey was to assess and prioritize issues influencing eXp's business success.

The results of the materiality assessment were provided to the Company’s Board and management to identify our key focus areas and to develop a strategy to address the material ESG topics identified in the assessment.

| Impact on society Agent / employee diversity, inclusion / equity Anti-corruption / anti-bribery Business ethics / integrity / transparency Community engagement/impact Data privacy / cyber security Energy use / greenhouse gas emissions ESG governance / education Executive compensation Market presence / expansion Non-discrimination of clients / communities Physical/psychological safety Cloud technology to lower environmental impact Remote working culture Responsible marketing/content practices Responsible tax behavior Product / service accessibility / social inclusion Talent attraction / retention Training/coaching / development Waste / electronic waste Resilience to climate / other global impacts Responsible supply chain / service providers Impact on business |

5

During 2022, the Company had various social initiatives, including the following:

| ● | Community Involvement: Our employees, agents and brokers are our best embodiment of the Company’s commitment to community as a core value. Many of our employees, agents and brokers are involved in their own communities to support the betterment of lives. The Company also sponsors many community initiatives which are well attended by our employees, agents and brokers. The first week of October of each year is designated “I Heart eXp” week and employees, agents and brokers across the U.S. mobilize to take part in community charity initiatives. Beginning in May 2021, the Company entered into a joint initiative with New Story, an international nonprofit that pioneers solutions to end global homelessness, to build 100 homes in the Morelos region of Mexico after it suffered damages from a 7.1 magnitude earthquake. Many employees and agents donated directly to New Story as part of this effort and donations were matched by our founder and CEO Glenn Sanford up to $300,000. Additionally, in 2021, eXp’s affiliated nonprofit, eXtend-a-Hand, was granted 501(c)(3) status by the Internal Revenue Service. eXtend-a-Hand’s mission is to provide financial assistance to independent agents of the Company who suffer catastrophic events, including, without limitation, natural disasters, illness and accidents and in the case of dependents or designated beneficiaries, the death of their independent agent family member. The Company is devoted to agent well-being and continued to expand the reach of eXtend-a-Hand during 2022. |

| ● | Diversity and Inclusiveness: We are committed to creating an equitable, diverse and inclusive culture for our employees, agents and brokers. Our Employee Experience team operates under the human resources department and supports this mission with diversity, equity and inclusion practices to support employee engagement and global collaboration. In 2019, we formed the ONE eXp initiative, which is an internal group available to our agents, brokers and employees to discuss, promote and propose business actions that encourage diversity, equity, belonging and inclusion. ONE eXp is also an important vehicle by which we connect diverse agents and brokers with clients identifying as and/or seeking out diverse representation in their home purchase or selling journey. Since its inception, ONE eXp has formed many dedicated subgroup networks, including networks for agents, brokers and employee promoting and/or identifying as Latino, South Asian, Asian, Middle Eastern, Black, LGBTQIA+, Women, senior, young professional and/or person with disabilities and new groups are being added regularly. |

Human Capital

Our employees, including our brokers and our independent contractor real estate agents, represent the human capital investments imperative to our operations. As of December 31, 2022, the Company had approximately 2,016 full-time equivalent employees and 86,203 real estate agents. Our employees are not members of any labor union and we have never experienced business interruptions due to labor disputes. We also utilize part-time and temporary employees and consultants when necessary; in many of our foreign markets we rely on the use of indirect employment structures where personnel providing certain services to the foreign entities are employed by a contractor of the Company and are not employed by the Company.

Management: Our operations are overseen directly by management. Our management oversees all responsibilities in the areas of corporate administration, business development and technological research and development. We have successfully expanded our current management to retain skilled employees with experience relevant to our business and intend to continue with this initiative. Our management’s relationships with agents, brokers, technology providers and customers will provide the foundation through which we expect to grow our business in the future. We believe the skill set of our management team will be a primary asset in the development of our brands and trademarks.

Talent and Culture: Our business is driven by nine core values of community, sustainability, integrity, service, collaboration, innovation, transparency, agility and fun. At eXp, these core values are manifested throughout everything we do and support the Company’s overall vision and shape our culture. We believe that our ongoing success is attributable in large part to our eXp employees who work across the U.S. and internationally in the cloud environment to support our agent-centric business model and core values. Attracting and retaining employee talent is a high priority for us and we look to hire passionate and driven individuals who want to be a part of our mission to continue to grow the brokerage and our related suite of services. We also value transparency and are committed to an open and accountable workplace where employees are empowered to raise issues. The Company provides multiple channels to speak up, ask for guidance and report concerns. eXp has been named one of the Best Places to Work on Glassdoor for each of the years 2019 through 2022. In 2021 and 2022, we were named as one of the Top 100 Companies to Watch for Remote Jobs by FlexJobs.

Health & Safety: Our employees operate in a fully remote environment and are located across the U.S. and internationally. During 2022, our human resources department expanded on our existing health and safety benefit offerings to support the health and safety of our employees in their remote work environments.

6

Independent Agent and Broker Support: We provide entrepreneurial business opportunities and a competitive compensation structure to our agents and brokers. Additionally, our agents and brokers have a unique choice to attain a greater vested interest in eXp through the acceptance of equity awards in eXp stock as part of their compensation packages. These programs and our agent support platforms — including training, back-office support and communications — allow agents and brokers to successfully operate their own businesses that are aligned with our strategies and goals, creating synergies across our distribution network. We believe it is critical to our success that agent voices are heard at every level of the Company, including management, whose mission is supported by our Agent Advisory Council. Refer to our Agent Advisory Council section of our website at https://expworldholdings.com/agent-advisory-council/ for information on agent participation in the management of eXp. Information contained on our website is not incorporated by reference into this report.

As the Company grows, management continually researches new directives and implementation efforts for the long-term success of the Company.

Available Information

The Company’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (as amended, the “Exchange Act”), are filed with the U.S. Securities and Exchange Commission (the “SEC”). Such reports and information for the previous twelve-months are available free of charge through our website at www.expworldholdings.com/investors/sec-filings/. Additionally, the SEC maintains an internet website that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. The public can obtain any documents that we file with the SEC at www.sec.gov.

Our Company also uses the following channels as a means of disclosing information about the Company on a broad, non-exclusionary basis, including information about our brokerage, upcoming investor and industry conferences, our planned financial and other announcements and other matters and for complying with our disclosure obligations under Regulation FD:

eXp website (www.expworldholdings.com)

eXp Realty Twitter Account (https://twitter.com/eXpRealty)

eXp World Holdings Twitter Account (https://twitter.com/eXpWorldIR)

eXp Realty Facebook Page (https://www.facebook.com/eXpRealty)

eXp World Holdings Facebook Page (https://www.facebook.com/eXpWorldHoldings)

eXp Realty Instagram Page (https://www.instagram.com/eXpRealty_)

eXp World Holdings Instagram Page (https://www.instagram.com/eXpWorldHoldings)

Please note that this list may be updated from time to time. The contents of any website referred to in this Annual Report on Form 10-K are not intended to be incorporated into this Annual Report on Form 10-K or in any other report or document we file with the SEC and any references to our websites are intended to be inactive textual references only.

Item 1A. | RISK FACTORS |

In addition to the other information set forth in this report, you should carefully consider the following factors, which could materially affect our business, financial condition or results of operations in future periods. The risks described below are not the only risks facing our Company. Additional risks not currently known to us or that we currently deem to be immaterial also may materially adversely affect our business, financial condition or results of operations in future periods. You should carefully consider the risk factors described below, together with all of the other information in this Annual Report on Form 10-K, including our consolidated financial statements and notes thereto and the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7 of the Company’s Annual Report on Form 10-K. Certain statements in this Annual Report on Form 10-K are forward-looking statements. See the section of this Annual Report on Form 10-K titled “Forward-Looking Statements.”

Risks Related to Our Industries

Our profitability is tied to the strength of the residential real estate market, which is subject to a number of general business and macroeconomic conditions beyond our control.

Our profitability is closely related to the strength of the residential real estate market, which is cyclical in nature and typically is affected by changes in national, state and local economic conditions, which are beyond our control. Macroeconomic conditions that could adversely impact the growth of the real estate market and have a material adverse effect on our business include, but are not limited to, economic slowdown or recession, increased unemployment, increased energy costs, reductions in the availability of credit or higher interest rates, increased costs of obtaining mortgages, an increase in foreclosure activity,

7

inflation, disruptions in capital markets, declines in the stock market, adverse tax policies or changes in other regulations, lower consumer confidence, lower wage and salary levels, war or terrorist attacks, natural disasters or adverse weather events, or the public perception that any of these events may occur. Unfavorable general economic conditions, such as a recession or economic slowdown, in the U.S., Canada, or other markets we enter and operate within, could negatively affect the affordability of and consumer demand for, our services, which could have a material adverse effect on our business and profitability. In addition, international, federal and state governments, agencies and government-sponsored entities such as Fannie Mae, Freddie Mac and Ginnie Mae could take actions that result in unforeseen consequences to the real estate market or that otherwise could negatively impact our business.

Monetary policies of the U.S. federal government and its agencies may have a material adverse impact on our operations.

The U.S. real estate market is substantially reliant on the monetary policies of the U.S. federal government and its agencies and is particularly affected by the policies of the Federal Reserve Board, which regulates the supply of money and credit in the U.S., which, in turn impacts interest rates. Our business could be negatively impacted by any rising interest rate environment. As mortgage rates rise, the number of home sale transactions may decrease as potential home sellers choose to stay with their lower mortgage rate rather than sell their home and pay a higher mortgage rate with the purchase of another home. Similarly, in higher interest rate environments, potential home-buyers may choose to rent rather than pay higher mortgage rates. Changes in the interest rate environment and mortgage market are beyond our control and are difficult to predict and, as such, could have a material adverse effect on our business and profitability.

General changes in consumer attitudes and behaviors could negatively impact homesale transaction volume.

The real estate market is affected by changes in consumer attitudes and behaviors, including as a result of changing attitudes toward and behaviors related to home ownership. Certain real estate markets have or may experience a decline in homeownership based on changing social behaviors, including as a result of declining marriage and birth rates. Because of these changing attitudes and behaviors, consumers may be more or less likely to prefer renting a home versus purchasing a home. In the event consumer attitudes and behaviors in any of our markets cause a declining interest in home purchasing, it may adversely impact the volume of home sale transactions closed by our brokers and agents and, as such, could have a material adverse effect on our business and profitability.

Home inventory levels may result in excessive or insufficient supply, which could negatively impact home sale transaction growth.

Home inventory levels have been meaningfully declining or increasing in certain markets and price points in recent years. In both instances, homeowners are more likely to retain their homes for longer periods of time resulting in a negative impact on home sale volume growth. Insufficient home inventory levels can cause a reduction in housing affordability, which can result in potential home buyers deferring entry or reentry into the residential real estate market. Alternatively, excessive home inventory levels can contribute to a reduction in home values, which can result in some potential home sellers deferring entry into the residential real estate market. These inventory trends are caused by many pressures outside of our control, including slow or accelerated new housing construction, macroeconomic conditions, real estate industry models that purchase homes for long-term rental or corporate use and other market conditions and behavioral trends discussed herein. In January 2022, the U.S. reported a record low for home inventory levels, which remained low through the remainder of 2022. Continuing constraints on home inventory levels may adversely impact the volume of home sale transactions closed by our brokers and agents and, as such, could have a material adverse effect on our business and profitability.

Material decreases in the average brokerage commission rate, due to conditions beyond our control, could materially adversely affect our financial results.

There are many factors that contribute to average broker commission rates that are beyond our control. Factors that can contribute to a material decrease in brokerage commissions include regulation, a rise in discount brokers and agents, increased adoption of flat fees, commission models with more competitive rates, rebates or lower commission rates on transactions, as well as other competitive factors. The average broker commission rate for a real estate transaction is a key determinant of our profitability and a material decrease in brokerage commission rates could have a material adverse effect on our business and profitability.

Our operating results are subject to seasonality and vary significantly among quarters during each calendar year, making meaningful comparisons of successive quarters difficult.

Seasons and weather traditionally impact the real estate industry. Continuous poor weather or natural disasters negatively impact listings and sales. Spring and summer seasons historically reflect greater sales periods in comparison to fall and winter seasons. We have historically experienced lower revenues during the fall and winter seasons, as well as during periods of unseasonable weather, which reduces our operating income, net income, operating margins and cash flow.

8

Real estate listings precede sales and a period of poor listings activity will negatively impact revenue. Past performance in similar seasons or during similar weather events can provide no assurance of future or current performance and macroeconomic shifts in the markets we serve can conceal the impact of poor weather or seasonality.

Home sales in successive quarters can fluctuate widely due to a wide variety of factors, including holidays, national or international emergencies, the school year calendar’s impact on timing of family relocations, interest rate changes, speculation of pending interest rate changes and the overall macroeconomic market. Our revenue and operating margins each quarter will remain subject to seasonal fluctuations, poor weather and natural disasters and macroeconomic market changes that may make it difficult to compare or analyze our financial performance effectively across successive quarters.

Homesale transaction volume can be impacted by natural disasters and other climate-related interruptions.

Natural disasters are occurring more frequently and/or with more intense effects and may impact general population trends. Areas afflicted by natural disasters may experience a decline in home sale transaction volume due to home destruction and/or general population movement out of the afflicted area. Such events can make it difficult or impossible for home owners and builders to sell their homes and result in slowdowns in home sale transaction volume. Because the real estate industry relies on home sale transactions, climate crises can exacerbate negative financial results for real estate companies operating in particularly affected areas.

Risks Related to our General Business and Operations

We may be unable to effectively manage rapid growth in our business.

We may not be able to scale our business quickly enough to meet the growing needs of our affiliated real estate professionals and if we are not able to grow efficiently, our operating results could be harmed. As the Company adds new real estate professionals, it will need to devote additional financial and human resources to improving its internal systems, integrating with third-party systems and maintaining infrastructure performance. In addition, we will need to appropriately scale our internal business systems and our services organization, including support of our affiliated real estate professionals as our workforce and agent network expand over time. Any failure of or delay in these efforts could cause impaired system performance and reduced real estate professional satisfaction. These issues could reduce the attractiveness of our Company to existing real estate professionals who might leave the Company, as well as resulting in decreased attraction of new real estate professionals. Even if we are able to upgrade our systems and expand our employees, such expansion may be expensive, complex and place increasing demands on our management. We could also face inefficiencies or operational failures as a result of our efforts to scale our infrastructure and we may not be successful in maintaining adequate financial and operating systems and controls as we expand. Moreover, there are inherent risks associated with upgrading, improving and expanding our information technology systems. We cannot be sure that the expansion and improvements to our infrastructure and systems will be fully or effectively implemented on a timely basis, if at all. These efforts may reduce revenue and our margins and adversely impact our financial results.

We may be unable to attract and retain additional qualified personnel.

To execute our business strategy, we must attract and retain highly qualified personnel. In particular, we compete with many other real estate brokerages for qualified brokers who manage our operations in each state. We must also compete with technology companies for developers with high levels of experience in designing, developing and managing cloud-based software, as well as for skilled service and operations professionals and we may not be successful in attracting and retaining the professionals we need. Additionally, in order to realize the potential benefits of acquisitions, we may need to retain employees from the acquired businesses or hire additional personnel to fully capitalize on the opportunities that such acquisitions may offer and we may not be successful in retaining or attracting such individuals following an acquisition. From time to time in the past we have experienced and we expect to continue to experience in the future, difficulty in hiring and retaining highly skilled employees with appropriate qualifications. Many of the companies with which we compete for experienced personnel have greater resources than we do. In addition, in making employment decisions, particularly in the software industry, job candidates often consider the value of the stock options or other equity incentives they are to receive in connection with their employment. If the price of our stock declines or continues to experience significant volatility, our ability to attract or retain key employees may be adversely affected. If we fail to attract new personnel or fail to retain and motivate our current personnel, our growth prospects could be severely harmed.

We have experienced net losses in recent years and, because we have a limited operating history, our ability to fully and successfully develop our business is unknown.

We had a history of operating at losses since our inception in October 2009 until the fourth quarter of 2020 and have had consecutive periods of income since that time. Our ability to realize consistent, meaningful revenues and profit over a sustained period has not been established over the long term and cannot be assured in future periods.

9

While we believe that we have made significant progress in revenue growth and managing our overhead by implementing our cloud-based technology strategy, our services must achieve broad market acceptance by consumers and we must continue to grow our geographical reach, attract more agents and brokers and increase the volume of our residential real-estate transactions. If we are unsuccessful in continuing to gain market acceptance, we will not be able to generate sufficient revenue to continue our business operations and could recognize future operating and net losses.

Despite our ongoing efforts to build revenue growth, both organically and through acquisitions and to control the anticipated expenses associated with the continued development, marketing and provision of our services, we may not be able to consistently generate significant net income and cash flows from operations in the future.

We may not be able to utilize a portion of our net operating loss or research tax credit carryforwards, which may adversely affect our profitability.

As of December 31, 2022, we had federal, state and foreign net operating losses carryforward due to prior years’ losses. The pre-fiscal 2018 federal, certain state and foreign net operating losses will carry forward for a limited number of years. Federal, as well as, some state and foreign net operating losses generated in and after fiscal 2018, do not expire and can be carried forward indefinitely. We also have recorded federal research tax credits for the years 2019, 2020, 2021 and 2022 which will carry forward for 20 years and are expected to be fully utilized before expiration. A nominal portion of our net operating loss may expire, increasing future income tax liabilities which may adversely affect our profitability.

In addition, under Section 382 of the Internal Revenue Code of 1986, as amended, our ability to utilize net operating loss carryforwards or other tax attributes, in any taxable year, may be limited if we experience an "ownership change.” A Section 382 “ownership change” generally occurs if one or more stockholders or groups of stockholders who own at least 5% of our stock increase their ownership by more than 50 percentage points over their lowest ownership percentage within a rolling three-year period. Similar rules may apply under state tax laws. It is possible that an ownership change, or any future ownership change, could have a material effect on the use of our net operating loss carryforwards or other tax attributes, which could adversely affect our profitability.

We could be subject to changes in tax laws and regulations that may have a material adverse effect in our business.

We operate and are subject to taxes in the United States and numerous other jurisdictions throughout the world. Changes to federal, state, local, or international tax laws on income, sales, use, indirect, or other tax laws, statutes, rules or regulations may adversely affect our effective tax rate, operating results or cash flows.

Our effective tax rate could increase due to several factors, including: changes in the relative amounts of income before taxes in the various jurisdictions in which we operate that have differing statutory tax rates; changes in tax laws, tax treaties and regulations or the interpretation of them, including the Tax Cuts and Jobs Act of 2017 (the “Tax Act”) which requires research and experimental expenditures attributable to research conducted in the United States to be capitalized as of January 1, 2022 and amortized over a five-year period or expenditures attributable to research conducted outside the United States to be amortized over a 15 year period; the Inflation Reduction Act of 2022 which imposes a 1% non-deductible excise tax on repurchase of stock that are made by U.S. publicly traded corporations after December 31, 2022; changes to our assessment about our ability to realize our deferred tax assets that are based on estimates of our future results, the prudence and feasibility of possible tax planning strategies and the economic and political environments in which we do business; the outcome of current and future tax audits, examinations or administrative appeals; and limitations or adverse findings regarding our ability to do business in some jurisdictions.

In particular, new income, sales and use or other tax laws or regulations could be enacted at any time, which could adversely affect our business operations and financial performance. Further, existing tax laws and regulations could be interpreted, modified or applied adversely to us. For example, the Tax Act enacted many significant changes to the U.S. tax laws. Future guidance from the Internal Revenue Service and other tax authorities with respect to the Tax Act may affect us and certain aspects of the Tax Act could be repealed or modified in future legislation. In addition, it is uncertain if and to what extent various states will conform to the Tax Act or any newly enacted federal tax legislation. Changes in corporate tax rates, the realization of net operating losses and other deferred tax assets relating to our operations, the taxation of foreign earnings and the deductibility of expenses under the Tax Act or future reform legislation could have a material impact on the value of our deferred tax assets and could increase our future U.S. tax expense.

We intend to evaluate acquisitions, mergers, joint ventures or investments in third-party technologies and businesses, but we may not realize the anticipated benefits from and may have to pay substantial costs related to, any acquisitions, mergers, joint ventures, or investments that we undertake.

10

As part of our business and growth strategy, we evaluate acquisitions of, or investments in, a wide array of potential strategic opportunities, including third-party technologies and businesses, as well as other real estate brokerages. If we are not able to effectively integrate acquired businesses and assets or successfully execute on joint venture strategies, our operating results and prospects could be harmed. Since 2019, we have acquired new technology and operations and entered into various joint venture arrangements. We will continue to look for opportunities to acquire technologies or operations that we believe will contribute to our growth and development, including our July 2022 acquisition of Zoocasa. The success of our future acquisition strategy will depend on our ability to identify, negotiate, complete and integrate acquisitions. The success of our future joint venture strategies will depend on our ability to identify, negotiate, complete and successfully manage and grow joint ventures with other parties. In addition, acquisitions and joint ventures could cause potentially dilutive issuances of equity securities or incurrence of debt.

Acquisitions and joint ventures are inherently risky and any we complete may not be successful. Any acquisitions and joint ventures we pursue would involve numerous risks, including the following:

| ● | difficulties in integrating and managing the operations and technologies of the companies we acquire, including higher than expected integration costs and longer integration periods; |

| ● | diversion of our management’s attention from normal daily operations of our business; |

| ● | our inability to maintain the customers, key employees, key business relationships and reputations of the businesses we acquire; |

| ● | our inability to generate sufficient revenue or business efficiencies from acquisitions or joint ventures to offset our increased expenses associated with acquisitions or joint ventures; |

| ● | our responsibility for the liabilities of the businesses we acquire or gain ownership in through joint ventures, including, without limitation, liabilities arising out of their failure to maintain effective data security, data integrity, disaster recovery and privacy controls prior to the acquisition, their infringement or alleged infringement of third-party intellectual property, contract or data access rights prior to the acquisition, or failure to comply with regulatory standards applicable to new business lines; |

| ● | difficulties in complying with new markets or regulatory standards to which we were not previously subject; |

| ● | delays in our ability to implement internal standards, controls, procedures and policies in the businesses we acquire or gain ownership in through joint ventures and increased risk that our internal controls will be ineffective; |

| ● | operations in a nascent state depend directly on utilization by eXp Realty agents and brokers and new and existing customers; |

| ● | adverse effects of acquisition and joint venture activity on the key performance indicators we use to monitor our performance as a business; and |

| ● | inability to fully realize intangible assets recognized through acquisitions or joint ventures and related non-cash impairment charges that may result if we are required to revalue such intangible assets. |

Our failure to address these risks or any other challenges we encounter with our future acquisitions, joint ventures and investments could cause us to not realize all or any of the anticipated benefits of such acquisitions, mergers, joint ventures or investments, incur unanticipated liabilities and harm our business, which could negatively impact our operating results, financial condition and cash flows.

Our international operations are subject to risks not generally experienced by our U.S. operations.

In addition to operating in Canada, we expanded our business into Australia and the United Kingdom in 2019 and into South Africa, India, Mexico, Portugal and France, during 2020 and into Puerto Rico, Brazil, Italy, Hong Kong, Colombia, Spain, Israel, Panama and Germany in 2021. During 2022 we commenced operations in the Dominican Republic, Greece, New Zealand, Chile and Poland and announced the opening of the Dubai market, which is expected to be fully operational in 2023. Our international operations are subject to risks not generally experienced by our U.S. operations. The risks involved in our international operations and relationships that could result in losses against which we are not insured and, therefore, affect our profitability include:

| ● | fluctuations in foreign currency exchange rates; |

| ● | exposure to local economic conditions and local laws and regulations; |

| ● | employment laws that are significantly different that U.S. laws; |

| ● | diminished ability to legally enforce our contractual rights and use of our trademarks in foreign countries; |

| ● | difficulties in registering, protecting or preserving trade names and trademarks in foreign countries; |

| ● | restrictions on the ability to obtain or retain licenses required for operations; |

11

| ● | withholding and other taxes on third-party cross-border transactions as well as remittances and other payments by subsidiaries; |

| ● | onerous requirements, subject to broad interpretation, for indirect taxes and income taxes that can result in audits with potentially significant financial outcomes; |

| ● | changes in foreign taxation structures; |

| ● | compliance with the Foreign Corrupt Practices Act, the U.K. Bribery Act, or similar laws of other countries; |

| ● | uncertainties and effects of the implementation of the United Kingdom’s withdrawal of its membership from the European Union (referred to as Brexit), including financial, legal and tax implications; and |

| ● | regional and country specific data protection and privacy laws including the European Union’s General Data Protection Regulation (“GDPR”). |

In addition, activities of agents and brokers outside of the U.S. are more difficult and more expensive to monitor and improper activities or mismanagement may be more difficult to detect. Negligent or improper activities involving our agents and brokers may result in reputational damage to us and may lead to direct claims against us based on theories of vicarious liability, negligence, joint operations and joint employer liability which, if determined adversely, could increase costs and subject us to incremental liability for their actions.

Loss of our current executive officers or other key management could significantly harm our business.

We depend on the industry experience and talent of our current executives. We believe that our future results will depend in part upon our ability to retain and attract highly skilled and qualified management. The loss of our executive officers could have a material adverse effect on our operations because other officers may not have the experience and expertise to readily replace these individuals. To the extent that one or more of our top executives or other key management personnel depart from the Company, our operations and business prospects may be adversely affected. In addition, changes in executives and key personnel could be disruptive to our business.

Failure to protect intellectual property rights could adversely affect our business.

Our intellectual property rights, including existing and future trademarks, trade secrets, patents and copyrights, are important assets of the business. We have taken measures to protect our intellectual property, but these measures may not be sufficient or effective. We may bring lawsuits to protect against the potential infringement of our intellectual property rights and other companies, including our competitors, could make claims against us alleging our infringement of their intellectual property rights. There can be no assurance that we would prevail in such lawsuits. Any significant impairment of our intellectual property rights could harm our business.

Our business could be adversely affected if we are unable to expand, maintain and improve the systems and technologies which we rely on to operate.

As the number of agents and brokers in our company grows, our success will depend on our ability to expand, maintain and improve the technology that supports our business operations, including, but not limited to, our cloud office platform. Loss of key personnel or the lack of adequate staffing with the requisite expertise and training could impede our efforts in this regard. If our systems and technologies lack capacity or quality sufficient to service agents and their clients, then the number of agents who wish to use our products could decrease, the level of client service and transaction volume afforded by our systems could suffer and our costs could increase. In addition, if our systems, procedures or controls are not adequate to provide reliable, accurate and timely financial and other reporting, we may not be able to satisfy regulatory scrutiny or contractual obligations with third parties and may suffer a loss of reputation. Any of these events could negatively affect our financial position.

Our business, financial condition and reputation may be substantially harmed by security breaches, interruptions, delays and failures in our systems and operations.

The performance and reliability of our systems and operations are critical to our reputation and ability to attract agents, teams of agents and brokers into our company as well as our ability to service home-buyers and sellers. Our systems and operations are vulnerable to security breaches, interruption or malfunction due to events beyond our control, including natural disasters, such as earthquakes, fire and flood, power loss, telecommunication failures, break-ins, sabotage, computer viruses, intentional acts of vandalism and similar events. In addition, we rely on third-party vendors to provide the cloud office platform and to provide additional systems and related support. If we cannot continue to retain these services on acceptable terms, our access to these systems and services could be interrupted. Any security breach, interruption, delay or failure in our systems and operations could substantially reduce the transaction volume that can be processed with our systems, impair quality of service, increase costs, prompt litigation and other consumer claims and damage our reputation, any of which could substantially harm our financial condition.

12

Cybersecurity incidents could disrupt our business operations, result in the loss of critical and confidential information, adversely impact our reputation and harm our business.

Cybersecurity threats and incidents directed at us could range from uncoordinated individual attempts to gain unauthorized access to information technology systems to sophisticated and targeted measures aimed at disrupting business or gathering personal data of customers. In the ordinary course of our business, we and our agents and brokers collect and store sensitive data, including proprietary business information and personal information about our clients and customers. Our business and particularly our cloud-based platform, is reliant on the uninterrupted functioning of our information technology systems. The secure processing, maintenance and transmission of information are critical to our operations, especially the processing and closing of real estate transactions. Although we employ measures designed to prevent, detect, address and mitigate these threats (including access controls, data encryption, vulnerability assessments and maintenance of backup and protective systems), cybersecurity incidents, depending on their nature and scope, could potentially result in the misappropriation, destruction, corruption, or unavailability of critical data and confidential or proprietary information (our own or that of third parties, including potentially sensitive personal information of our clients and customers) and the disruption of business operations. Any such compromises to our security could cause harm to our reputation, which could cause customers to lose trust and confidence in us or could cause agents and brokers to stop working for us. In addition, we may incur significant costs for remediation that may include liability for stolen assets or information, repair of system damage and compensation to clients, customers and business partners. We may also be subject to legal claims, government investigation and additional state and federal statutory requirements.

The potential consequences of a material cybersecurity incident include regulatory violations of applicable U.S. and foreign privacy and other laws, reputational damage, loss of market value, litigation with third parties (which could result in our exposure to material civil or criminal liability), diminution in the value of the services we provide to our customers and increased cybersecurity protection and remediation costs (that may include liability for stolen assets or information), which in turn could have a material adverse effect on our competitiveness and results of operations.

We are actively and intend to continue, developing new products and services complementary to our brokerage business and our failure to accurately predict their demand or growth could have an adverse effect on our business.

We are actively and intend in the future to continue, investing resources in developing new technology, services, products and other offerings complementary to our brokerage business. New business initiatives are inherently risky and may involve unproven business strategies and markets with which we have limited or no prior development or operating experience. Risks from these new initiatives include those associated with potential defects in the design, ongoing development and maintenance of technologies, reliance on data or user inputs that may prove inadequate or unavailable, failure to design products and services in a way that is more effective or affordable than competing third-party products and services and failure to scale businesses as they grow, among others. As a result of these risks, we could experience increased legal claims, reputational damage, financial loss or other adverse effects, which could be material. We can provide no assurance that we will be able to efficiently or effectively develop, commercialize and achieve market acceptance of new products and services. Additionally, the human and financial capital committed to develop new products and services may either be insufficient or result in expenses that exceed the revenue actually originated from these new products and services. In addition, our efforts to develop new products and services could distract management from current operations and could divert capital and other resources from our existing business, including our brokerage business. Failure to achieve the expected benefits of our investments may occur and could harm our business.

Risks Related to our Real Estate Business

We may be unable to maintain our agent growth rate, which would adversely affect our revenue growth and results of operations.

We have experienced rapid and accelerating growth in our real estate broker and agent base. During the year ended December 31, 2022, our agent and broker base grew to 86,203 agents and brokers, or by 21%, from 71,137 agents and brokers as of December 31, 2021. Because we derive revenue from real estate transactions in which our brokers and agents receive commissions, the amount and rate of growth of our revenue typically correlate to the amount and rate of growth of our agent and broker base, respectively. The rate of growth of our agent and broker base cannot be predicted and is subject to many factors outside of our control, including actions taken by our competitors and macroeconomic factors affecting the real estate industry in general. We cannot assure that we will be able to maintain our recent agent growth rate or that our agent and broker base will continue to expand in future periods. A slowdown in our agent growth rate would have a material adverse effect on revenue growth and could adversely affect our business, results of operations, financial condition and cash flows.

Inflation and rising interest rates have and may continue to contribute to declining real estate transaction volumes, which have and may continue to materially impact operating results, profits and cash flows.

13

Inflation and rising interest rates have generally impacted real estate transaction volumes in the U.S., Canada and other international markets. During 2022, the Company has experienced declining transaction volume, which has had an impact on operating results in the last few months of 2022. If we are not able to organically grow our market share, to offset the declining transactions, our operating results, profits and cash flow may be materially impacted in the event interest rates stay level or continue to rise. The Company believes that it continues to be well positioned for growth in the current economic climate, due to our strong base of agent support, along with our efficient operating model, with lower fixed costs and no brick-and-mortar locations.

If we fail to grow in the various local markets that we serve or are unsuccessful in identifying and pursuing new business opportunities our long-term prospects and profitability will be harmed.

To capture and retain market share in the various local markets that we serve, we must compete successfully against other brokerages for agents and brokers and for the consumer relationships that they bring. Our competitors could lower the fees that they charge to agents and brokers or could raise the compensation structure for those agents. Our competitors may have access to greater financial resources than us, allowing them to undertake expensive local advertising or marketing efforts. In addition, our competitors may be able to leverage local relationships, referral sources and strong local brand and name recognition that we have not established. Our competitors could, as a result, have greater leverage in attracting new and established agents in the market and in generating business among local consumers. Our ability to grow in the local markets that we serve will depend on our ability to compete with these local brokerages.

We may implement changes to our business model and operations to improve revenues that cause a disproportionate increase in our expenses or reduce profit margins. For example, we may allocate resources to acquiring lower margin brokerage models and have invested in the development of a mortgage servicing division, a commercial real estate division, a title and escrow company, a mortgage lending company, a personal development company and a continuing education division. Expanding our service offerings could involve significant up-front costs that may only be recovered after lengthy periods of time. The barrier to entry in new real estate markets is low given our cloud-based operating model; however, attempts to pursue new business opportunities could result in a disproportionate increase in our expenses and in reduced profit margins. In addition, expansion into new markets and business lines, including internationally, could expose us to additional compliance obligations and regulatory risks. If we fail to continue to grow in the local markets we serve or if we fail to successfully identify and pursue new business opportunities, our long-term prospects, financial condition and results of operations may be harmed and our stock price may decline.

Our value proposition for agents and brokers includes allowing them to participate in the revenues of our Company and is not typical in the real estate industry. If agents and brokers do not understand our value proposition, we may not be able to attract, retain and incentivize agents.

Participation in our revenue sharing plan represents a key component of our agent and broker value proposition. Agents and brokers may not understand or appreciate its value due to the intricacies of our programs. In addition, agents may not appreciate other components of our value proposition, including the cloud office platform, the mobility it affords, the systems and tools that we provide to agents and brokers and the professional development opportunities we create and deliver. If agents and brokers do not understand the elements of our agent value proposition, or do not perceive it to be more valuable than the models used by most competitors, we may not be able to attract, retain and incentivize new and existing agents and brokers to grow our revenues.

Risks Related to our Virbela Business

The utilization of a 3D cloud-based immersive office as a suitable substitute for a physical brick-and-mortar location is a new and unproven strategy and we cannot guarantee that we will be able to operate and grow within its confines.

Currently, our cloud office adequately supports the needs of our agent population located across the markets we serve. We cannot guarantee that our cloud office platform will continue to support our agent population and meet our business needs as we grow. The effectiveness of our cloud office platform is tied to a number of variables at any given time, including server capacity and concurrent users. In addition, the use of the cloud office platform and the use generally of 3D immersive office environments as an acceptable substitute among agents and brokers for physical office locations is unproven. We cannot guarantee that industry rank and file will adopt or accept cloud-based 3D office environments as a substitute for a physical office environment in a sustainable, long-term manner.

14

If we do not remain an innovative leader in the real estate industry, we may not be able to grow our business and leverage our costs to achieve profitability.

Innovation has been critical to our ability to compete against other brokerages for clients and agents. For example, we have pioneered the utilization of a 3D immersive online office environment in the real estate market, which reduces our need for office space and facilitates the transaction of business away from an office. If competitors follow our practices or develop innovative practices, our ability to achieve profitability may diminish or erode. For example, certain other brokerages could develop or license cloud-based office platforms that are equal to or superior to ours. If we do not remain on the forefront of innovation, we may not be able to achieve or sustain profitability.

The market for internet products and services including, without limitation, 3D immersive experiences, virtual reality and augmented reality is characterized by rapid technological developments, evolving industry standards and consumer demands and frequent new product introductions and enhancements. The Company’s future success will depend in significant part on its ability to continually improve the performance, features and reliability of its internet-based virtual environment, its tools and other properties in response to both evolving demands of the marketplace and competitive product offerings and there can be no assurance that the Company will be successful in doing so. In addition, the widespread adoption of new virtual reality and augmented reality applications through new technology developments could require fundamental changes in the Company’s services.

Risks Related to Legal and Regulatory Matters

We offer our independent agents the opportunity to earn additional commissions through our revenue sharing plan, which pays under a multi-tiered compensation structure similar in some respects to network marketing. Network marketing is subject to intense government scrutiny and regulation and changes in the law, or the interpretation and enforcement of the law, might adversely affect our business.

Various laws and regulations in the United States and other countries regulate network marketing. These laws and regulations exist at many levels of government in many different forms, including statutes, rules, regulations, judicial decisions and administrative orders. Network marketing regulations are inherently fact-based and often do not include "bright line" rules. Additionally, we are subject to the risk that the regulations, or a regulator's interpretation and enforcement of the regulations, could change. From time to time, we have received requests to supply information regarding our revenue sharing plan to regulatory agencies. We could potentially in the future be required to modify our revenue sharing plan in certain jurisdictions in order to comply with the interpretation of the regulations by local authorities.

In the United States, the Federal Trade Commission (“FTC”) has entered into several highly publicized settlements with network marketing companies that required those companies to modify their compensation plans and business models. Those settlements resulted from actions brought by the FTC involving a variety of alleged violations of consumer protection laws, including misleading earnings representations by the companies' independent distributors, as well as the legal validity of the companies' business model and distributor compensation plans. FTC determinations such as these have created an ambiguity regarding the proper interpretation of the law and regulations applicable to network marketing companies in the U.S. Although a consent decree between the FTC and a specific company does not represent judicial precedent, FTC officials have indicated that the network marketing industry should look to these consent decrees and the principles contained therein, for guidance. Additionally, following the issuance of these consent decrees, the FTC issued non-binding guidance to the network marketing industry, suggesting it was intending to reinforce the principles contained in the consent decrees and provide other operational guidance to the network marketing industry.