U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year ended May 31, 2013

Commission file number: 000-54452

BUCKEYE OIL & GAS, INC.

(Exact name of registrant as specified in its charter)

|

Florida

|

|

80-0778461

|

|

(State of incorporation)

|

|

(I.R.S. Employer Identification No.)

|

8275 S. Eastern Avenue, Suite 200

Las Vegas, Nevada 89123

(Address of principal executive offices)

(702) 938-0491

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Exchange Act:

None

Securities registered pursuant to Section 12(g) of the Exchange Act:

Common Stock, $0.0001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

|

Non-accelerated filer ¨ (Do not check if a smaller reporting company)

|

Smaller Reporting Company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the average bid and asked price of such common equity as November 30, 2012 was approximately $0.

The number of shares of the issuer’s common stock issued and outstanding as of September 3, 2013 was 620,500 shares.

Documents Incorporated By Reference: None

1

TABLE OF CONTENTS

|

|

Page | ||

|

Oil and Gas Glossary

|

3 | ||

|

PART I

|

|||

|

Item 1

|

Business

|

5 | |

|

Item 1A

|

Risk Factors

|

9 | |

|

Item 1B

|

Unresolved Staff Comments

|

22 | |

|

Item 2

|

Properties

|

22 | |

|

Item 3

|

Legal Proceedings

|

31 | |

|

Item 4

|

Mine Safety Disclosures

|

31 | |

|

PART II

|

|||

|

Item 5

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

32 | |

|

Item 6

|

Selected Financial Data

|

32 | |

|

Item 7

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

33 | |

|

Item 7A

|

Quantitative and Qualitative Disclosures About Market Risk.

|

39 | |

|

Item 8

|

Financial Statements and Supplementary Data.

|

39 | |

|

Item 9

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

56 | |

|

Item 9A

|

Controls and Procedures

|

56 | |

|

Item 9B

|

Other Information

|

57 | |

|

PART III

|

|||

|

Item 10

|

Directors, Executive Officers and Corporate Governance

|

58 | |

|

Item 11

|

Executive Compensation

|

60 | |

|

Item 12

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

61 | |

|

Item 13

|

Certain Relationships and Related Transactions, and Director Independence

|

62 | |

|

Item 14

|

Principal Accountant Fees and Services

|

62 | |

|

PART IV

|

|||

|

Item 15

|

Exhibits, Financial Statement Schedules

|

63 | |

|

SIGNATURES

|

64 | ||

2

Oil and Gas Glossary

Adsorption: The accumulation of gases, liquids, or solutes on the surface of a solid or liquid.

Basin: A depressed area where sediments have accumulated during geologic time and considered to be prospective for oil and gas deposits.

Banff Formation: It is a stratigraphical unit of Devonian age in the Western Canadian Sedimentary Basin.

Coal: A carbon-rich rock derived from plant material (peat).

Development: The phase in which a proven oil or gas field is brought into production by drilling production (development) wells.

Drilling: The using of a rig and crew for the drilling, suspension, production testing, capping, plugging and abandoning, deepening plugging back, sidetracking, re-drilling or reconditioning of a well.

Drilling Logs: Recorded observations made of rock chips cut from the formation by the drill bit, and brought to the surface with the mud, as well as rate of penetration of the drill bit through rock formations. Used by geologists to obtain formation data.

Exploration: The phase of operations which covers the search for oil or gas by carrying out detailed geological and geophysical surveys followed up where appropriate by exploratory drilling. Compare to "Development" phase.

Fracturing: The application of hydraulic pressure to the reservoir formation to create fractures through which oil or gas may move to the wellbore.

Mannville Formation: It is a stratigraphical unit of Cretaceous age in the Western Canadian Sedimentary Basin.

Methane: The simplest of the various hydrocarbons and is the major hydrocarbon component of natural gas, and in fact is commonly known as natural gas. It is colorless, odorless, and burns efficiently without many byproducts.

Milk River Formation: A near- shore to terrestrial sedimentary unit deposited during the Late Cretaceous period in southern Alberta.

Mineral Lease: A legal instrument executed by a mineral owner granting exclusive right to another to explore, drill, and produce oil and gas from a piece of land.

Mississippian Period: The period beginning about 359 million years ago and ending about 318 million years ago.

PN&G: Petroleum and Natural Gas.

Permeability: A measure of the ability of a rock to transmit fluid through pore spaces.

Reserves: Generally the amount of oil or gas in a particular reservoir that is available for production.

Reservoir: The underground rock formation where oil and gas has accumulated. It consists of a porous rock to hold the oil or gas, and a cap rock that prevents its escape.

Stratigraphy: A branch of geology that studies rock layers and layering (stratification). It is primarily used in the study of sedimentary and layered volcanic rocks.

3

Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking information. Forward-looking information includes statements relating to future actions, prospective products, future performance or results of current or anticipated products, sales and marketing efforts, costs and expenses, interest rates, outcome of contingencies, financial condition, results of operations, liquidity, business strategies, cost savings, objectives of management of Buckeye Oil & Gas, Inc. (the “Company”, “Buckeye”, or “we”) and other matters. Forward-looking information may be included in this Annual Report on Form 10-K or may be incorporated by reference from other documents filed with the Securities and Exchange Commission (the “SEC”) by the Company. One can find many of these statements by looking for words including, for example, “believes,” “expects,” “anticipates,” “estimates” or similar expressions in this Annual Report on Form 10-K or in documents incorporated by reference in this Annual Report on Form 10-K. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events.

The Company has based the forward-looking statements relating to the Company’s operations on management’s current expectations, estimates and projections about the Company and the industry in which it operates. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that we cannot predict. In particular, we have based many of these forward-looking statements on assumptions about future events that may prove to be inaccurate. Accordingly, the Company’s actual results may differ materially from those contemplated by these forward-looking statements. Any differences could result from a variety of factors, including, but not limited to general economic and business conditions, competition, and other factors.

4

PART I

Item 1. Description of Business

Buckeye Oil & Gas, Inc. (formerly Benefits Solutions Outsourcing Corp.) (the "Company") is a development stage company, incorporated in the State of Florida on May 11, 2010. The Company was formed to offer small and medium-sized businesses services that reduced invoicing expenses, sped up receipt of monies, and allowed authorization and recovery of paper drafts.

On May 19, 2011 the Board of Directors and majority shareholder of the Company approved a change to the Company’s Articles of Incorporation which affected a 17 for 1 forward stock split of our issued and outstanding common stock, changed the name of the company to “Buckeye Oil & Gas, Inc.”, and changed the business of the Company to oil and gas exploration. The changes became effective at the close of business on June 1, 2011. The forward stock split was distributed to all shareholders of record on March 31, 2011. No cash was paid or distributed as a result of the forward stock split and no fractional shares were issued. There was no change in the par value of our common stock. All share and per share amounts presented in this Form 10-K and the consolidated financial statements have been adjusted for the stock split.

On June 2, 2011, Jamie Mills, the principal shareholder of the Company entered into a Stock Purchase Agreement which provided for the sale of his 380,000 shares of common stock of the Company (the “Shares”) to Ravi Dhaddey (who purchased 329,000 of the Shares) and Pol Brisset (who purchased 51,000 of the Shares). Combined, the Shares acquired by Messrs. Dhaddey and Brisset represented 65.07% of the issued and outstanding share capital of the Company on a fully-diluted basis at that time. In connection with such purchase, Mr. Mills cancelled the other 1,150,000 shares in the Company which he had owned.

Effective as of June 2, 2011, in connection with the acquisition of the Shares, Pol Brisset was appointed a director of the Company upon the resignation of Jamie Mills from his positions as the sole officer and director of the Company. The Board of Directors of the Company then elected Pol Brisset as President, Chief Executive Officer, Chief Financial Officer and Treasurer.

Effective July 8, 2013, the Board of Directors and a majority of the Company’s shareholders approved a reverse split of the Company’s issued and outstanding shares of common stock on the basis of 1 post consolidation share for each 100 pre-consolidation shares. No cash was paid or distributed as a result of the reverse stock split and no fractional shares were issued. All fractional shares which would otherwise be required to be issued as a result of the stock split were rounded up to the nearest whole share. There was no change in the par value of our common stock. All share and per share amounts presented in this Form 10-K and the consolidated financial statements have been adjusted for the stock split.

The Company is principally a company engaged in the acquisition and exploration of oil and gas properties. The Company currently has earned a 28% working interest in two properties located in Alberta, Canada.

5

Farmout and Participation Agreement with Luxor

On June 23, 2011 the Company entered into a Stock Purchase Agreement to acquire all of the issued and outstanding shares of Buckeye Oil & Gas (Canada) Inc., a private Canadian company incorporated in Alberta, Canada and owned by the Company’s principal executive officer (“Buckeye Canada”). The purchase price paid for the shares of Buckeye Canada was $400,000, which was paid by the issuance to Pol Brisset, the Company’s principal officer and a director, of 10,000 shares of common stock of the Company. As a result of the acquisition, Buckeye Canada became a wholly-owned subsidiary of the Company. Buckeye Canada’s sole asset is rights granted pursuant to a Farmout and Participation Agreement (“Farmout Agreement”) with Luxor Oil & Gas, Inc. (“Luxor”) dated May 12, 2011. Under the Farmout Agreement, Buckeye Canada has agreed to incur 80% of the cost of drilling a well on one of Luxor’s properties in exchange for a 56% working interest in said well. On May 16, 2011 Buckeye Canada entered into a participation agreement (“Participation Agreement”) whereby Buckeye Canada agreed to share its obligations and rights under the Farmout Agreement with Pioneer Marketing Group, Ltd., a privately owned Canadian company (“Pioneer”) on a 50% basis. The Participation Agreement requires Buckeye Canada and Pioneer to equally fund Buckeye Canada’s obligations under the Luxor Farmout Agreement and to participate equally in the working interest in the well. Accordingly, Buckeye Canada and Pioneer will each pay a net 40% of the initial capital costs and earn a 28% interest in any wells drilled by Luxor, as long as Pioneer continues to fund its half of the required expenses.

In the event that Pioneer does not fund its share of exploration and development costs under its agreement with Buckeye Canada, Buckeye Canada would then be required to fund Pioneer’s portion, in addition to its own obligations to Luxor. As a result, should Pioneer not meet its funding obligations, Buckeye Canada would have to fund an additional 40% (prior to earning-in under the agreement) or 28% (after earning-in under the agreement) of any cash calls that came from Luxor. Pioneer would then be put into penalty whereby Buckeye Canada would be entitled to recover an amount equaling 300% of any delinquent funding owed from Pioneer before payouts from revenue, if any, would be made to Pioneer.

The first well drilled under the Farmout Agreement is located in the Valhalla area of Alberta (“Valhalla Well”), Canada and was drilled in July 2011. The Valhalla Well was completed in August, 2011 and oil production from the Valhalla Well commenced at the end of September 2011. However, due to sand build-up, the well was taken off-line after only limited production. A new pump was installed and the well was brought back on-line on October 18, 2011. Production since October 2011 has been minimal as production problems relating to water build-up continue to be encountered and currently the Valhalla Well is shut in and is not currently producing. Buckeye Canada has now earned its 28% interest in the Valhalla Well as well as the entire property on which the Valhalla Well is located. The Valhalla Property does not currently contain any assigned resources or reserves of oil or natural gas.

6

Buckeye Canada also has the right of first refusal to participate on two additional properties if Luxor determines that it desires to pursue drilling on those properties. If Buckeye Canada exercises this right, it will need to pay 40% of such expenses in exchange for a 28% working interest, subject to Pioneer paying its half of the costs. On July 26, 2011 Buckeye Canada exercised its rights to participate in a second well to be drilled by Luxor. The second well drilled under the Company’s agreement with Luxor is on the Spirit Rycroft Property (the “SR Well”). The drilling of the SR Well commenced in August, 2011 and was brought on-line in April 2012 after the completion of the construction of a 2.5 kilometer pipeline. The SR Well has intermittently produced small quantities of gas, oil and liquids along with significant amounts of water. It is not known at this time if the gas, oil and liquid content will rise to a significant enough level to operate the SR Well in the future. Currently the SR Well is shut in and is not currently in production. The Spirit Rycroft Property does not currently contain any assigned resources or reserves of oil or natural gas.

The Farmout Agreement with Luxor provides for Buckeye Canada to earn its working interest on the entire respective property where a well is located and not just on the respective well. As a result, now that Buckeye Canada has earned its interest in the Valhalla Well and the SR Well, we have earned-in on the whole Valhalla and Spirit Rycroft Properties. Buckeye Canada will now pay 28% of the capital costs on any new wells drilled on either of the Valhalla or Spirit Rycroft Properties and earn a 28% working interest. The drilling of any future wells on either property will be determined in conjunction with Luxor.

In summary, on the potentially three properties that are part of the Luxor agreement, Buckeye Canada initially pays 40% of the capital costs to earn a 28% working interest on the first well drilled on the respective property but will pay 28% of the capital costs to earn a 28% working interest on all subsequent wells drilled on the respective property. Luxor has indicated that they will not be proceeding on a third property. As a result, the Farmout Agreement with Luxor will include only the two properties currently under the Farmout Agreement.

Neither the Valhalla nor the Spirit Rycroft Properties currently contain any assigned resources or reserves of oil or natural gas. Production from both properties has not been significant to date.

Competition

The oil and gas exploration industry is intensely competitive, highly fragmented and subject to rapid change. We may be unable to compete successfully with our existing competitors or with any new competitors. We compete with many exploration companies that have significantly greater personnel, financial, managerial, and technical resources than we do. This competition from other companies with greater resources and reputations may result in our failure to maintain or expand our business.

7

Government Regulation

Development, production and sale of oil and natural gas in Canada are subject to extensive laws and regulations, including environmental laws and regulations. The oil and gas properties in which the Company has an interest are owned by the Province of Alberta and are managed by the Department of Energy of Alberta. We may be required to make large expenditures to comply with environmental and other governmental regulations. In Alberta, the legislated mandate for the responsible development of the Province’s oil and gas resources is set out in the Mines and Minerals Act that provides the Minister with the responsibility for the exploration, development, management and conservation of non-renewable resources. The Oil Sands Conservation Act establishes a regulatory regime and scheme of approvals for the development of oil sands resources and related facilities in Alberta. Matters subject to regulation include:

|

|

• location and density of wells;

|

|

|

• the handling of drilling fluids and obtaining discharge permits for drilling operations;

|

|

|

• accounting for and payment of royalties on production from state, federal and Indian lands;

|

|

|

• bonds for ownership, development and production of natural gas and oil properties;

|

|

|

• transportation of natural gas and oil by pipelines;

|

|

|

• operation of wells and reports concerning operations; and

|

|

|

• taxation.

|

Under these laws and regulations, we could be liable for personal injuries, property damage, oil spills, discharge of hazardous materials, remediation and clean-up costs and other environmental damages. Failure to comply with these laws and regulations also may result in the suspension or termination of our operations and subject us to administrative, civil and criminal penalties. Moreover, these laws and regulations could change in ways that substantially increase our costs. Accordingly, any of these liabilities, penalties, suspensions, terminations or regulatory changes could materially adversely affect our financial condition and results of operations enough to possibly force us to cease our business operations.

Employees

We have commenced only limited operations. Therefore, we have no full time employees. Our sole officer and two directors provide planning and organizational services for us on a part-time basis. The Company’s oil and gas properties are being operated by Luxor. To date, Luxor has been responsible for assigning their employees or hiring contractors to undertake the required work on the properties.

Subsidiaries

We have one wholly-owned subsidiary, Buckeye Oil & Gas (Canada), Inc. which is incorporated in the province of Alberta, Canada.

8

Item 1A. Risk Factors

An investment in our common stock involves a high degree of risk. You should carefully consider the following factors and other information in this prospectus before deciding to invest in our company. If any of the following risks actually occur, our business, financial condition, results of operations and prospects for growth would likely suffer. As a result, you could lose all or part of your investment.

Risk Factors Relating to Our Company

|

1.

|

Our independent auditor has issued a going concern opinion after auditing our May 31, 2013 financial statements. Our ability to continue is dependent on our ability to raise additional capital and our operations could be curtailed if we are unable to obtain required additional funding when needed.

|

We will be required to expend substantial amounts of working capital in order to continue to explore and develop the properties subject to our agreement with Luxor. Our operations to date were funded entirely from capital raised from our private offering of securities from May 2010 through February 2013. We will continue to require additional financing to execute our business strategy. We are currently totally dependent on external sources of financing for the foreseeable future, of which we have no commitments. Our failure to raise additional funds in the future will adversely affect our business operations, and may require us to suspend our operations, which in turn may result in a loss to the purchasers of our common stock. We are entirely dependent on our ability to attract and receive additional funding from either the sale of securities or outside sources such as private investment or a strategic partner. We currently have no firm agreements or arrangements with respect to any such financing and there can be no assurance that any needed funds will be available to us on acceptable terms or at all. The inability to obtain sufficient funding of our operations in the future could restrict our ability to grow and reduce our ability to continue to conduct business operations. As of May 31, 2013, we incurred a net loss of $256,921 from inception and used cash in operations from inception of $217,789. After auditing our May 31, 2013 financial statements, our independent auditor issued a going concern opinion and our ability to continue is dependent on our ability to raise additional capital. If we are unable to obtain necessary financing, we will likely be required to curtail our development plans which could cause us to become dormant. Any additional equity financing may involve substantial dilution to our then existing stockholders.

9

|

2.

|

We are an exploration stage company, with limited operating history in oil and gas exploration and we have focused primarily on establishing our operations, all of which raises substantial doubt as to our ability to successfully develop profitable business operations and makes an investment in our common shares very risky.

|

We are an oil and gas exploration stage company and we have not yet produced any significant amounts of oil or gas. Our prospects must be considered in light of the risks, expenses and difficulties frequently encountered in establishing a business in the oil and natural gas industries. We have yet to generate any significant revenues from operations and have been focused on organizational, start-up, property acquisition, and fund raising activities. Since we have not generated any revenues, we will have to raise additional capital to fund our operations for the next twelve months, which we may do through loans from existing shareholders, the sale of our equity securities or a strategic arrangement with a third party in order to continue our business operations. There is nothing at this time on which to base an assumption that our business operations will prove to be successful or that we will ever be able to operate profitably. Our future operating results will depend on many factors, including:

|

|

• our ability to raise adequate working capital;

|

|

|

• success of our exploration and development;

|

|

|

• demand for natural gas and oil;

|

|

|

• the level of our competition;

|

|

|

• our ability to attract and maintain key management and employees; and

|

|

|

• our ability to efficiently explore, develop and produce sufficient quantities of marketable natural gas or oil in a highly competitive and speculative environment while maintaining quality and controlling costs.

|

To achieve profitable operations, we must, alone or with others, successfully execute on the factors stated above. If we are not successful in executing any of the above stated factors, our business will not be profitable and may never even generate any revenue, which make our common stock a less attractive investment and may harm the trading of our common stock, if a market ever develops.

|

3.

|

The field of oil and gas exploration is difficult to predict because of technological advancements and market factors, which factors our management may not correctly assess and it may make it difficult for investors to sell their our common stock.

|

Because the nature of our business is expected to change as a result of shifts in the market price of oil and natural gas, competition, and the development of new and improved technology, management forecasts are not necessarily indicative of future operations and should not be relied upon as an indication of future performance.

Our management may incorrectly estimate projected occurrences and events within the timetable of our business plan, which would have an adverse effect on our results of operations and, consequently, make our common shares a less attractive investment and harm the future trading of our common shares trading on the OTC Bulletin Board. Investors may find it difficult to sell their shares on the OTC Bulletin Board should a market ever develop for our shares.

10

|

4.

|

Because we have no plan to generate revenue unless and until our exploration program is successful in finding productive wells, we will need to raise a substantial amount of additional capital in order to fund our operations for the next twelve months and in order to develop our properties and acquire and develop new properties. If the prospects for our properties are not favorable or the capital markets are tight, we would not be able to raise the necessary capital and we will not be able to pursue our business plan, which would likely cause our common shares to become worthless.

|

Cash on hand is insufficient to fund our anticipated operating needs of approximately $59,600 for the next twelve months. As we have no plan to generate revenue unless and until our exploration program is successful in finding productive wells, we will require substantial additional capital to fund our operations for the next twelve months and in order to explore our properties which have not had any production of oil or natural gas, as well as for the future acquisition and/or development of other properties. Because we currently do not have any cash flow from operations we need to raise additional capital, which may be in the form of loans from current shareholders and/or from public and private equity offerings. Our ability to access capital will depend on our success in participating in properties that are successful in exploring for and producing oil and gas at profitable prices. It will also be dependent upon the status of the capital markets at the time such capital is sought. Should sufficient capital not be available, the development of our business plan could be delayed and, accordingly, the implementation of our business strategy would be adversely affected. In such event it would not be likely that investors would obtain a profitable return on their investments or a return of their investments at all.

|

5.

|

We are heavily dependent on contracted third parties. The inability to identify and obtain the services of third party contractors would harm our ability to execute our business plan and continue our operations until we found a suitable replacement.

|

We are dependent on the continued contributions of Luxor’s employees and third party contractors whose knowledge and technical expertise is critical for future of the Company. Our success is also heavily dependent on our ability to retain and attract experienced engineers, geoscientists and other technical and professional staff. We do not currently have any long-term consulting agreements in place with third parties under which we can ensure that we will have sufficient expertise to undertake our planned exploration program. If we were unable to obtain the services of third party contractors our ability to execute our business plan would be harmed and we may be forced to cease operations until such time as we could hire suitable contractors.

|

6.

|

Volatility of oil and gas prices and markets, over which we have no control, could make it difficult for us to achieve profitability and investors are likely to lose their investment in our common shares.

|

Our ability to achieve profitability is substantially dependent on prevailing prices for oil and natural gas. The amounts of, and price obtainable for, any oil and gas production that we achieve will be affected by market factors beyond our control. If these factors are not favorable over time to our financial interests, it is likely that owners of our common shares will lose their investments. Such factors include:

11

|

|

• worldwide or regional demand for energy, which is affected by economic conditions;

|

|

|

• the domestic and foreign supply of natural gas and oil;

|

|

|

• weather conditions;

|

|

|

• domestic and foreign governmental regulations;

|

|

|

• political conditions in natural gas and oil producing regions;

|

|

|

• the ability of members of the Organization of Petroleum Exporting Countries to agree upon and maintain oil prices and production levels; and

|

|

|

• the price and availability of other fuels.

|

|

7.

|

Drilling wells is speculative, often involving significant costs that are difficult to project and may be more than our estimates, unsuccessful drilling of wells or successful drilling of wells that are, nonetheless, unprofitable, any one of which is likely to reduce the profitability of our business and negatively affect our results of operations.

|

Exploration and the development of oil and natural gas properties involves a high degree of operational and financial risk, which precludes definitive statements as to the time required and costs involved in reaching certain objectives. The budgeted costs of drilling, completing and operating wells are often exceeded and can increase significantly when drilling costs rise due to a tightening in the supply of various types of oilfield equipment and related services. Drilling may be unsuccessful for many reasons, including title problems, weather, cost overruns, equipment shortages and mechanical difficulties. Moreover, the successful drilling of a natural gas or oil well does not ensure a profit on investment. Exploratory wells bear a much greater risk of loss than development wells. A variety of factors, both geological and market-related, can cause a well to become uneconomical or only marginally economic and the results of our operations will be negatively affected as well.

|

8.

|

The oil and natural gas business involves numerous uncertainties and operating risks that can prevent us from realizing profits and can cause substantial losses.

|

Our exploration, development, and exploitation activities may be unsuccessful for many reasons, including weather, cost overruns, equipment shortages and mechanical difficulties. Moreover, the successful drilling of a natural gas and oil well does not ensure a profit on investment. A variety of factors, both geological and market-related, can cause a well to become uneconomical or only marginally economical.

12

The natural gas and oil business involves a variety of operating risks, including:

|

|

• fires;

|

|

|

• explosions;

|

|

|

• blow-outs and surface cratering;

|

|

|

• uncontrollable flows of oil, natural gas, and formation water;

|

|

|

• natural disasters, such as hurricanes and other adverse weather conditions;

|

|

|

• pipe, cement, or pipeline failures;

|

|

|

• casing collapses;

|

|

|

• embedded oil field drilling and service tools;

|

|

|

• abnormally pressured formations; and

|

|

|

• environmental hazards, such as natural gas leaks, oil spills, pipeline ruptures and discharges of toxic gases.

|

If we experience any of these problems, it could affect well bores, gathering systems and processing facilities, which could adversely affect our ability to conduct operations. We could also incur substantial losses as a result of:

|

|

• injury or loss of life;

|

|

|

• severe damage to and destruction of property, natural resources and equipment;

|

|

|

• pollution and other environmental damage;

|

|

|

• clean-up responsibilities;

|

|

|

• regulatory investigation and penalties;

|

|

|

• suspension of our operations; and

|

|

|

• repairs to resume operations.

|

|

9.

|

We are reliant on Luxor’s ability to locate equipment providers and we may face the unavailability or high cost of drilling rigs, equipment, supplies, personnel and other services which could adversely affect our ability to execute on a timely basis our development, exploitation and exploration plans within our budget and, as a result, negatively impact our financial condition and results of operations.

|

Luxor is the operator of the Company’s properties and as such is responsible for locating drill rigs and other operating equipment. Shortages or an increase in cost of drilling rigs, equipment, supplies or personnel could delay or interrupt our operations and could negatively impact our financial condition and results of operations. Drilling activity in the geographic areas in which we conduct drilling activities may increase, which would lead to increases in associated costs, including those related to drilling rigs, equipment, supplies and personnel and the services and products of other vendors to the industry. Increased drilling activity in these areas may also decrease the availability of rigs. Therefore, our drilling and other costs may increase further and necessary equipment and services may not be available to us at economical prices.

13

|

10.

|

We are subject to complex laws and regulations, including environmental regulations, which can significantly increase our costs and possibly force our operations to cease.

|

If we experience any leakage of crude oil and/or gas from the subsurface portions of a well, our gathering system could cause degradation of fresh groundwater resources, as well as surface damage, potentially resulting in suspension of operation of a well, fines and penalties from governmental agencies, expenditures for remediation of the affected resource, and liabilities to third parties for property damages and personal injuries. In addition, any sale of residual crude oil collected as part of the drilling and recovery process could impose liability on us if the entity to which the oil was transferred fails to manage the material in accordance with applicable environmental health and safety laws.

Drilling operations generally involve a high degree of risk. Hazards such as unusual or unexpected geological formations, power outages, labor disruptions, blow-outs, sour gas leakage, fire, inability to obtain suitable or adequate machinery, equipment or labor, and other risks are involved. We may become subject to liability for pollution or hazards against which it cannot adequately insure or which it may elect not to insure. Incurring any such liability may have a material adverse effect on our financial position and operations.

Development, production and sale of natural gas and oil in Canada are subject to extensive laws and regulations, including environmental laws and regulations. We may be required to make large expenditures to comply with environmental and other governmental regulations. Matters subject to regulation include:

|

|

• location and density of wells;

|

|

|

• the handling of drilling fluids and obtaining discharge permits for drilling operations;

|

|

|

• accounting for and payment of royalties on production from state, federal and Indian lands;

|

|

|

• bonds for ownership, development and production of natural gas and oil properties;

|

|

|

• transportation of natural gas and oil by pipelines;

|

|

|

• operation of wells and reports concerning operations; and

|

|

|

• taxation.

|

Under these laws and regulations, we could be liable for personal injuries, property damage, oil spills, discharge of hazardous materials, remediation and clean-up costs and other environmental damages. Failure to comply with these laws and regulations also may result in the suspension or termination of our operations and subject us to administrative, civil and criminal penalties. Moreover, these laws and regulations could change in ways that substantially increase our costs. Accordingly, any of these liabilities, penalties, suspensions, terminations or regulatory changes could materially adversely affect our financial condition and results of operations enough to possibly force us to cease our business operations.

14

|

11.

|

The potential profitability of oil and gas ventures depends upon various factors beyond the control of our company, which may materially affect our financial performance.

|

The potential profitability of oil and gas properties is dependent upon many factors beyond our control. For instance, world prices and markets for oil and gas are unpredictable, highly volatile, potentially subject to governmental fixing, pegging, controls, or any combination of these and other factors, and respond to changes in domestic, international, political, social, and economic environments. Additionally, due to worldwide economic uncertainty, the availability and cost of funds for production and other expenses have become increasingly difficult, if not impossible, to project. These changes and events may materially affect our financial performance.

|

12.

|

If we do not maintain the property capital payments on our properties, we will lose our interests in the Properties or have to incur penalties.

|

Our agreement with Luxor requires us to fund our proportion of the capital costs on the properties. If we do not continue to make the capital payments as they are requested then we may lose our interest in that property or fall into a penalty situation on the respective property. Alberta law provides for penalty provisions when a company that has earned an interest in a property fails to pay its proportion of capital costs. In general, the penalty provisions allow the operator to recover up to 300% of the delinquent capital payments before any revenue form the well subject to the penalty is paid out to the delinquent party. If we fail to make a capital payment prior to earning its interest the Company may lose its interest in the respective property.

|

13.

|

We may not be able to compete with current and potential exploration companies, some of whom have greater resources and experience than we do in locating and commercializing oil and natural gas reserves and, as a result, we may fail in our ability to maintain or expand our business.

|

The oil and natural gas market is intensely competitive, highly fragmented and subject to rapid change. We may be unable to compete successfully with our existing competitors or with any new competitors. We compete with many exploration companies which have significantly greater personnel, financial, managerial, and technical resources than we do. This competition from other companies with greater resources and reputations may result in our failure to maintain or expand our business.

|

14.

|

We expect losses to continue in the next 12 months because we have no oil or gas reserves and, consequently, no revenue to offset losses.

|

Based upon the fact that we currently do not have any oil or gas reserves, we expect to incur operating losses in next 12 months. The operating losses will occur because there are expenses associated with the acquisition of, and exploration of natural gas and oil properties which do not have any income-producing reserves. Failure to generate revenues may cause us to go out of business. We will require additional funds to achieve our current business strategy and our inability to obtain additional financing will interfere with our ability to expand our current business operations.

15

|

15.

|

Since one of our directors, is a geologist and works for an environmental consulting company which may deal with natural resource exploration companies, his other activities for this other companies may involve a conflict of interest with regard to business opportunities to our Company.

|

Our officers and directors are not required to work exclusively for us. Mr. Michal Gnitecki, our secretary and one of our directors, works full-time for an environmental consulting firm. Therefore, it is possible that a conflict of interest with regard to him presenting business opportunities to our Company may occur. Also, due to the competitive nature of the exploration business, the potential exists for conflicts of interest to occur from time to time that may adversely affect our business interests. Mr. Gnitecki may have a conflict of interest in helping us identify and obtain rights to properties, personnel, investments or other business opportunities that the environmental company for which he consults may have an interest or a client with an interest. As a result, a business opportunity that may benefit our business may not be brought to our attention as that opportunity may be presented to other companies.

|

16.

|

Since our directors works full-time for other companies, their other activities for those other companies may involve a conflict of interest with regard to the amount of time they dedicate to our business.

|

Our officers and directors are not required to work exclusively for us and do not devote all of their time to our operations. Therefore, it is possible that a conflict of interest with regard to his time may arise based on their work for such other companies. Their other activities may prevent them from devoting full-time to our operations which could slow our operations and may reduce our financial results because of the slowdown in operations. It is expected that each of our directors will devote approximately two hours per week to our operations on an ongoing basis, and when required will devote whole days and even multiple days at a stretch when property visits are required or when extensive analysis of information is needed.

|

17.

|

Because we have not yet adopted a code of ethics, our stockholders may have limited protections against wrongdoing and unethical conduct by our senior officers.

|

We have not as yet adopted a code of ethics applicable to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions as required by the Sarbanes-Oxley Act of 2002 due to our small size and limited resources.

16

A “code of ethics" is a written standard that are reasonably designed to deter wrongdoing and to promote:

|

·

|

honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships;

|

|

·

|

full, fair, accurate, timely and understandable disclosure in reports and documents that the public company files with, or submits to, the SEC and in other public communications made by the company;

|

|

·

|

compliance with applicable governmental laws, rules and regulations;

|

|

·

|

prompt internal reporting of violations of the code to an appropriate person or persons identified in the code; and

|

|

·

|

accountability for adherence to the code.

|

The absence of such code of ethics may result in less protection against unethical conduct, conflicts of interest, compliance, reporting and similar matters that could adversely affect our business and operations..

|

18.

|

Our principal shareholder owns a controlling interest in our voting stock and investors will not have any voice in our management, which could result in decisions adverse to our general shareholders.

|

Our principal shareholder beneficially owns approximately 53.0% of our outstanding common stock and our principal executive officer who is also a director owns 9.8% of our outstanding common stock. As a result, these shareholders will have the ability to control substantially all matters submitted to our stockholders for approval including:

|

|

· election of our board of directors;

|

|

|

· removal of any of our directors;

|

|

|

· amendment of our Articles of Incorporation or bylaws; and

|

|

|

· adoption of measures that could delay or prevent a change in control or impede a merger, takeover or other business combination involving us.

|

As a result of their ownership, our principal shareholder and principal executive officer are able to influence all matters requiring shareholder approval, including the election of directors and approval of significant corporate transactions. In addition, it is possible for our principal shareholder and principal executive officer to sell or otherwise dispose of all or a part of their shareholdings could affect the market price of our common stock if the marketplace does not orderly adjust to the increase in shares in the market and the value of your investment in the Company may decrease. The controlling shareholder’s stock ownership may discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of us, which in turn could reduce our stock price or prevent our stockholders from realizing a premium over our stock price.

17

|

19.

|

We have no employees and our officers and directors each work two hours per week on our business. Consequently, we may not be able to monitor our operations and respond to matters when they arise in a prompt or timely fashion. Until we have additional capital or generate revenue, we will have to rely on consultants and service providers, which will increase our expenses and increase our losses.

|

We do not have any employees, our officers and directors each work on our business two hours per week. With practically no personnel, we have a limited ability to monitor our operations, such as the progress of oil and gas exploration, and to respond to inquiries from third parties, such as regulatory authorities or potential business partners. Though we may rely on third party service providers, such as accountants and lawyers, to address some of our matters, until we raise additional capital or generate revenue, we will have to rely on consultants and third party service providers to monitor our operations, which will increase our expenses and have a negative effect on our results of operations.

RISK FACTORS RELATING TO OUR COMMON STOCK

20. We may, in the future, issue additional common shares, which would reduce investors’ percent of ownership and may dilute our share value.

Our Articles of Incorporation authorizes the issuance of 500,000,000 shares of common stock, par value $.0001 per share, of which 620,500 shares are currently issued and outstanding. The future issuance of common stock may result in substantial dilution in the percentage of our common stock held by our then existing shareholders. We may value any common stock issued in the future on an arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common stock.

21. Our principal shareholder may decide to sell his shares in our Company, reducing the price you may receive upon a sale.

Our principal shareholder beneficially owns approximately 53.0% of our outstanding common stock. If and when he is able to sell his shares in the market, such sales by our principal shareholder within a short period of time could adversely affect the market price of our common stock if the marketplace does not orderly adjust to the increase in the number of shares in the market. This will result in a decrease in the value of your investment in the Company.

18

22. Our common stock is subject to the "penny stock" rules of the SEC and the trading market in our securities is limited, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

The SEC has adopted Rule 15g-9 which establishes the definition of a "penny stock," for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require: (i) that a broker or dealer approve a person's account for transactions in penny stocks; and (ii) the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. In order to approve a person's account for transactions in penny stocks, the broker or dealer must: (i) obtain financial information and investment experience objectives of the person; and (ii) make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to the penny stock market, which, in highlight form: (i) sets forth the basis on which the broker or dealer made the suitability determination; and (ii) that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

Generally, brokers may be less willing to execute transactions in securities subject to the "penny stock" rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

Because we do not intend to pay any cash dividends on our shares of common stock, our stockholders will not be able to receive a return on their shares unless they sell them.

We intend to retain any future earnings to finance the development and expansion of our business. We do not anticipate paying any cash dividends on our common stock in the foreseeable future. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless they sell them at a price higher than that which they initially paid for such shares.

23. Because we do not intend to pay any cash dividends on our shares of common stock, our stockholders will not be able to receive a return on their shares unless they sell them.

We intend to retain any future earnings to finance the development and expansion of our business. We do not anticipate paying any cash dividends on our common stock in the foreseeable future. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless they sell them at a price higher than that which they initially paid for such shares.

19

24. Currently there is no public market for our securities, and there can be no assurances that any public market will ever develop and if a market develops it is likely to be subject to significant price fluctuations.

There has not been any established trading market for our common stock, and there is currently no public market whatsoever for our securities. There can be no assurances as to whether:

|

·

|

any market for our shares will develop;

|

|

·

|

the prices at which our common stock will trade; or

|

|

·

|

the extent to which investor interest in us will lead to the development of an active, liquid trading market. Active trading markets generally result in lower price volatility and more efficient execution of buy and sell orders for investors.

|

In addition, our common stock is unlikely to be followed by any market analysts, and there may be few institutions acting as market makers for our common stock. Either of these factors could adversely affect the liquidity and trading price of our common stock. Prices for our common stock will be determined in the marketplace, are likely to fluctuate significantly and may be influenced by many factors, including the depth and liquidity of the market for shares of our common stock, developments affecting our business, including the impact of the factors referred to elsewhere in these Risk Factors, investor perception of our company and general economic and market conditions. No assurances can be given that an orderly or liquid market will ever develop for the shares of our common stock.

25. If a market develops for our shares, sales of our shares relying upon Rule 144 may depress prices in that market by a material amount.

The majority of the outstanding shares of our common stock held by present stockholders are "restricted securities" within the meaning of Rule 144 under the Securities Act of 1933, as amended. As restricted shares, these shares may be resold only pursuant to an effective registration statement, such as this one (for the shares registered hereunder) or under the requirements of Rule 144 or other applicable exemptions from registration under the Act and as required under applicable state securities laws. On November 15, 2007, the SEC adopted changes to Rule 144, which, would shorten the holding period for sales by non-affiliates to six months (subject to extension under certain circumstances) and remove the volume limitations for such persons. The changes became effective in February 2008. Rule 144 provides in essence that an affiliate who has held restricted securities for a prescribed period may, under certain conditions, sell every three months, in brokerage transactions, a number of shares that does not exceed 1% of a company's outstanding common stock. The alternative average weekly trading volume during the four calendar weeks prior to the sale is not available to our shareholders being that the Over-the-Counter Bulletin Board is not an "automated quotation system" and, accordingly, market based volume limitations are not available for securities quoted only over the Over-The-Counter Bulletin Board. As a result of the revisions to Rule 144 discussed above, there is no limit on the amount of restricted securities that may be sold by a non-affiliate (i.e., a stockholder who has not been an officer, director or control person for at least 90 consecutive days) after the restricted securities have been held by the owner for a period of six months, if we have filed our required reports. A sale under Rule 144 or under any other exemption from the Act, if available, or pursuant to registration of shares of common stock of present stockholders, may have a depressive effect upon the price of our common stock in any market that may develop.

20

26. We may be exposed to potential risks resulting from new requirements under Section 404 of the Sarbanes-Oxley Act of 2002.

As a public company, we are required, pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, to include in our annual report our assessment of the effectiveness of our internal control over financial reporting We expect to incur significant continuing costs, including accounting fees and staffing costs, in order to maintain compliance with the internal control requirements of the Sarbanes-Oxley Act of 2002. Development of our business will necessitate ongoing changes to our internal control systems, processes and information systems. Currently, we have no employees, and two officers and directors. As we engage in the exploration of our mineral claim, hire employees and consultants, our current design for internal control over financial reporting may not be sufficient to enable management to determine that our internal controls are effective for any period, or on an ongoing basis. Accordingly, as we develop our business, such development and growth will necessitate changes to our internal control systems, processes and information systems, all of which will require additional costs and expenses.

In the future, if we fail to complete the annual Section 404 evaluation in a timely manner, we could be subject to regulatory scrutiny and a loss of public confidence in our internal controls. In addition, any failure to implement required new or improved controls, or difficulties encountered in their implementation, could harm our operating results or cause us to fail to meet our reporting obligations.

27. Because we are not subject to compliance with rules requiring the adoption of certain corporate governance measures, our stockholders have limited protections against interested director transactions, conflicts of interest and similar matters.

The Sarbanes-Oxley Act of 2002, as well as rule changes proposed and enacted by the SEC, the New York and American Stock Exchanges and the Nasdaq Stock Market, as a result of Sarbanes-Oxley, require the implementation of various measures relating to corporate governance. These measures are designed to enhance the integrity of corporate management and the securities markets and apply to securities which are listed on those exchanges or the Nasdaq Stock Market. Because we are not presently required to comply with many of the corporate governance provisions and because we chose to avoid incurring the substantial additional costs associated with such compliance any sooner than necessary, we have not yet adopted these measures.

Because none of our directors are independent, we do not currently have independent audit or compensation committees. As a result, the directors have the ability, among other things, to determine their own level of compensation. Until we comply with such corporate governance measures, regardless of whether such compliance is required, the absence of such standards of corporate governance may leave our shareholders without protections against interested director transactions, conflicts of interest and similar matters and investors may be reluctant to provide us with funds necessary to expand our operations.

21

28. The costs to meet our reporting and other requirements as a public company subject to the Exchange Act of 1934 will be substantial and may result in us having insufficient funds to expand our business or even to meet routine business obligations.

As a public company subject to the reporting requirements of the Exchange Act of 1934, we incur ongoing expenses associated with professional fees for accounting, legal and a host of other expenses for annual reports and proxy statements. We estimate that these costs will range up to $25,000 per year for the next few years and will be higher if our business volume and activity increases. As a result, we may not have sufficient funds to grow our operations.

Item 1B. Unresolved Staff Comments

There are no unresolved staff comments.

Item 2. Description of Properties

Corporate Office

We do not own any real property. We currently maintain our feet of corporate office space on a shared basis at 8275 S. Eastern Avenue, Suite 200, Las Vegas, Nevada, 89123 pursuant to lease for $150 per month which expires March 2014. Management believes that our office space is suitable for our current needs.

Oil and Gas Property Interests

Luxor Properties

22

23

24

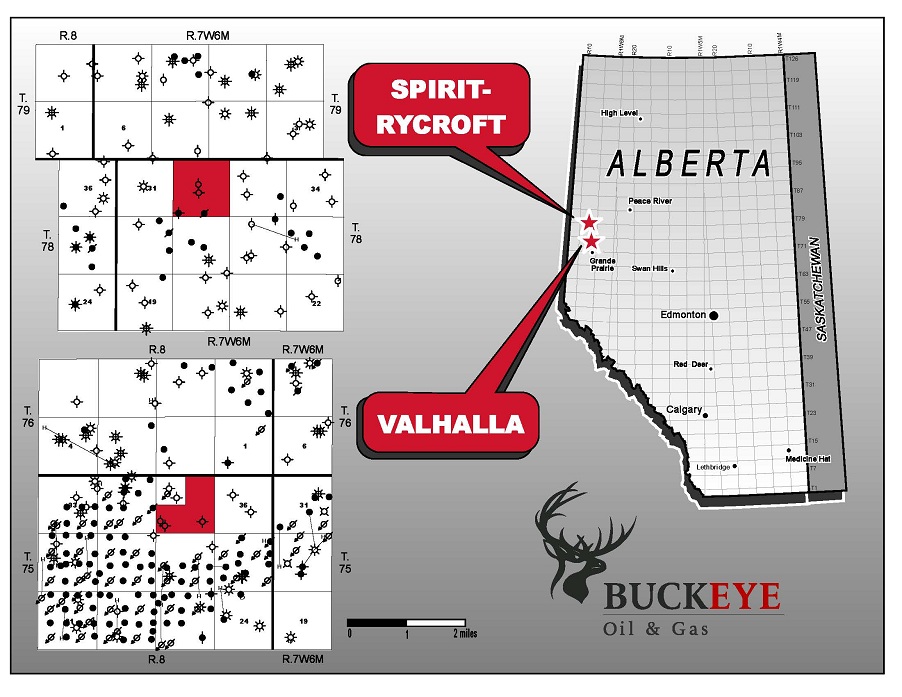

Location Map of the Valhalla and Spirit Rycroft Properties

25

Acquisition of Interests

The following table lists total capitalized costs for the Company’s properties at May 31, 2013. All of the Company’s properties are located in Alberta, Canada.

|

May 31, 2013 (Cumulative)

|

||||||||||||

|

Valhalla

|

Sprit Rycroft

|

Total

|

||||||||||

|

(unproven)

|

(unproven)

|

|||||||||||

|

Property acquisition costs

|

$ | 378,462 | $ | 622,470 | $ | 1,000,932 | ||||||

|

Geological and geophysical

|

2,593 | 2,187 | 4,780 | |||||||||

|

Asset Retirement Obligation

|

4,848 | 4,848 | 9,696 | |||||||||

|

Total expenditures

|

$ | 385,903 | 629,505 | 1,015,408 | ||||||||

On June 23, 2011 the Company entered into a Stock Purchase Agreement to acquire all of the issued and outstanding shares of Buckeye Canada. The purchase price paid for the shares of Buckeye Canada was $400,000, which was paid by the issuance to Pol Brisset, the Company's principal executive officer and a director, of 10,000 shares of common stock of the Company.

As a result of the acquisition, Buckeye Canada became a wholly-owned subsidiary of the Company.

Buckeye Canada’s sole asset is rights granted pursuant to the Farmout Agreement. Under this agreement Buckeye Canada has agreed to incur 80% of the cost of drilling a well on one of Luxor’s properties in exchange for a 56% working interest in said well. On May 16, 2011, Buckeye Canada entered into the Participation Agreement with Pioneer whereby the Company agreed to share its obligations and rights under the agreement with Luxor with Pioneer on a 50% basis. The Participation Agreement requires Buckeye Canada and Pioneer to equally fund Buckeye Canada’s obligations under the Farmout Agreement and to participate equally in the interest in the well. Accordingly, Buckeye Canada and Pioneer will each pay a net 40% of the initial capital costs and earn a 28% interest in any wells drilled by Luxor, as long as Pioneer continues to fund its half of the required amount of expenses.

In the event that Pioneer does not fund its share of exploration and development costs under its agreement with Buckeye, Buckeye would then be required to fund Pioneer’s portion, in addition to its own obligations to Luxor. As a result, should Pioneer not meet its funding obligations, Buckeye would have to fund an additional 40% (prior to earning-in under the agreement) or 28% (after earning-in under the agreement) of any cash calls that came from Luxor. Pioneer would then be put into penalty whereby Buckeye would be entitled to recover an amount equaling 300% of any delinquent funding owed from Pioneer before payouts from revenue, if any, would be made to Pioneer.

26

At the time of the acquisition of Buckeye Canada, Buckeye Canada had paid Luxor an aggregate CDN $152,876 (USD $159,839) in connection with the drilling of the Valhalla Well. In August 2011, Buckeye Canada paid an additional aggregate CDN $175,527 (USD $185,761) to Luxor for the costs to complete the Valhalla Well and acquire surface infrastructure for oil collection. The Valhalla Well was completed in August, 2011 and oil production from the Valhalla Well commenced at the end of September 2011. However, due to sand build-up, the well was taken off-line immediately. A new pump was installed and the well was brought back on-line on October 18, 2011. Production since October 2011 has been minimal as production problems relating to water build-up continue to be encountered and currently the Valhalla Well is shut in and is not currently producing. Buckeye Canada has now earned its 28% interest in the Valhalla Well as well as the entire property on which the Valhalla Well is located. The Valhalla Property does not currently contain any assigned resources or reserves of oil or natural gas.

Buckeye Canada also has the right of first refusal to participate on two additional properties if Luxor determines that it desires to pursue drilling on those properties. If Buckeye Canada exercises this right, it will need to pay 40% of such expenses in exchange for a 28% working interest, subject to Pioneer paying its half of the costs. On July 26, 2011 Buckeye Canada exercised its rights to participate in the SR Well to be drilled by Luxor. The Company paid Luxor an aggregate CDN $202,706 (USD $206,422) for the drilling of the SR Well and an additional CDN $162,383 (USD $158,810) for partial completion of the well. In February 2012, the Company paid CDN $119,540 (USD $119,888) for the construction of a pipeline to tie-in the SR Well to local infrastructure. In April 2012, the Company paid the final amount of CDN $126,150 (USD $125,660) for the surface infrastructure. The SR Well started producing gas, oil and liquids in March 2012 but has only limited production to date. It is not yet known if the SR Well will be economical. The SR Well is shut in and is not currently producing. Buckeye Canada has now earned its 28% interest in the SR Well as well as the entire property on which the SR Well is located.

The Farmout Agreement with Luxor provides for Buckeye Canada to earn its working interest on the entire respective property where a well is located and not just on the respective well. As a result, now that Buckeye Canada has earned its interest in the Valhalla Well and the SR Well, we have earned-in on the whole Valhalla and Spirit Rycroft Properties. Buckeye Canada will now pay 28% of the capital costs on any new wells drilled on either of the Valhalla or Spirit Rycroft Properties and earn a 28% working interest. The drilling of any future wells on either property will be determined in conjunction with Luxor.

On the potentially three properties that are part of the Luxor agreement, Buckeye Canada initially pays 40% of the capital costs to earn a 28% working interest on the first well drilled on the respective property but will pay 28% of the capital costs to earn a 28% working interest on all subsequent wells drilled on the respective property. Luxor has indicated that they will not be proceeding on a third property. As a result, the Farmout Agreement with Luxor will include only the two properties currently under the Farmout Agreement.

Neither the Valhalla nor the Spirit Rycroft Properties currently contain any assigned resources or reserves of oil or natural gas. Production from both properties has not been significant to date.

27

Description and Location of the Luxor Properties

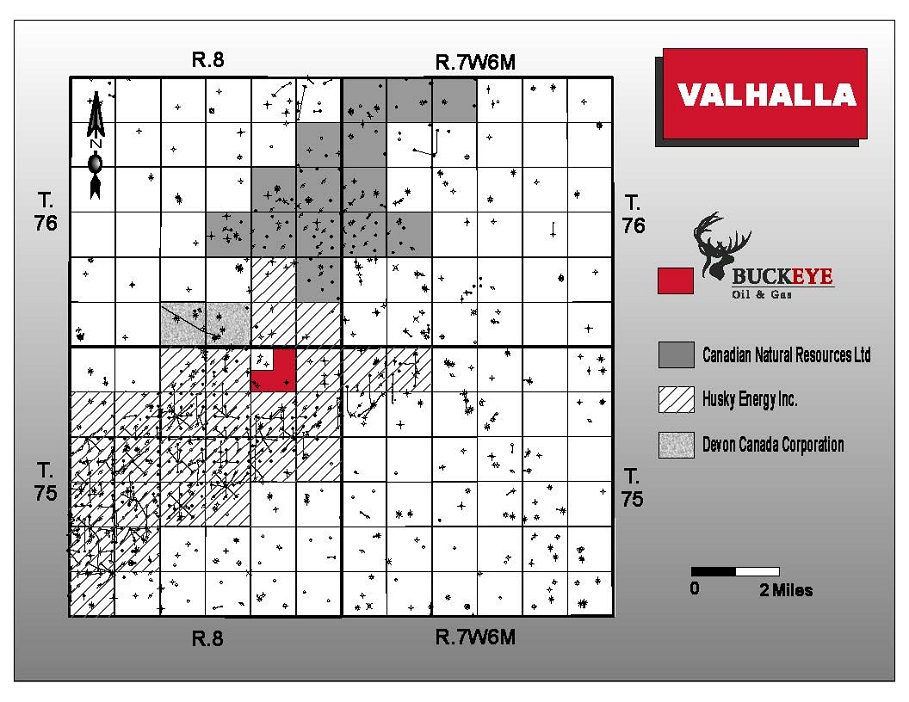

Valhalla

The Valhalla property is located in the Peace River Arch area of northern Alberta, Canada. The Valhalla Property is subject to a Petroleum and Natural Gas Lease with the province of Alberta. Subject to its agreement with Buckeye Canada and royalties payable to the province, Luxor owns 100% of the rights to the underlying lease which is lease No. 0510030702. The lease expires March 25, 2015 but is renewable.

There was no production recorded for the Valhalla property for the year ended May 31, 2013.

Gas production received by the Company has been negligible to date. The following table shows the Company’s share of oil production in aggregate for the year ended May 31, 2012.

Year Ended May 31, 2012

|

Production (1)

|

Sales Price (2)

|

Operating Costs (3)

|

|

(bbls)

|

($/bbl)

|

($/bbl)

|

| 69 | 95.7 | 833 |

|

1.

|

Production is the Company’s 28% working interest in the Valhalla Well.

|

|

2.

|

Average selling price is calculated based on aggregate gross sales proceeds of $6,600 for the year ended May 31, 2012 divided by barrels of oil sold.

|

|

3.

|

Average operating cost is calculated based on aggregate operating costs of $57,460 for the year ended May 31, 2012 divided by barrels of oil produced.

|

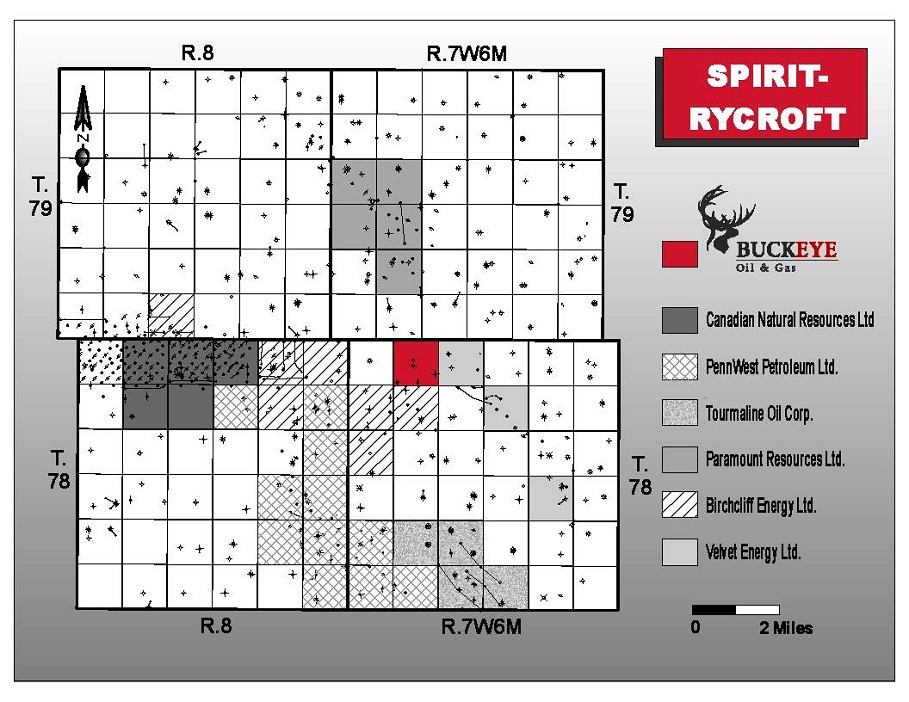

Spirit Rycroft

The Spirit Rycroft property is also located in the Peace River Arch area of northern Alberta, Canada. The Spirit Rycroft Property is subject to a Petroleum and Natural Gas Lease with the province of Alberta. Subject to its agreement with Buckeye Canada and royalties payable to the province, Luxor owns 100% of the rights to the underlying lease which is lease No. 0509080476. The lease expires August 20, 2014 but is renewable.

There was no production recorded for the Spirit Rycroft property for the year ended May 31, 2013.

28

Gas production received by the Company has been negligible to date. The following table shows the Company’s share of oil and liquids production in aggregate for the year ended May 31, 2012.

Year Ended May 31, 2012

|

Production (1)

|

Sales Price (2)

|

Operating Costs (3)

|

|

(bbls)

|

($/bbl)

|

($/bbl)

|

| 23 | 78.3 | 489 |

|

1.

|

Production is the Company’s 28% working interest in the Spirit Rycroft Well.

|

|

2.

|

Average selling price is calculated based on aggregate gross sales proceeds of $1,801 for the year ended May 31, 2013 divided by barrels of oil and liquids sold.

|

|

3.

|

Average operating cost is calculated based on aggregate operating costs of $11,246 for the year ended May 31, 2013 divided by barrels of oil and liquids produced.

|

Regional Geology

The Peace River Arch (“PRA”) is a large, cratonic uplift in northwestern Alberta and northeastern British Columbia. It is one of only a few large-scale tectonic elements in the Western Canada Sedimentary Basin that has significantly disturbed the Phanerozoic cover of the craton. The structure has influenced the location of oil and gas accumulations in strata ranging from the Middle Devonian to the Upper Cretaceous, and has long been a focus of hydrocarbon exploration in the region.

The PRA is an east-northeasterly trending structure that has a total preserved length of approximately 750 km. At its western end, near the Alberta/British Columbia boundary, the arch stands approximately 1,000 m above the regional elevation of the basement. The amplitude of the arch decreases eastward to between 400 and 500 m at the fifth meridian and several tens of metres at its eastern end, near the fourth meridian.

The PRA is an asymmetrical structure with a steeply dipping northern flank and a more gently dipping southern slope. An isopach from the top of the Devonian to the basement shows that total deposition immediately to the south of the arch was several hundred metres thicker than it was to the north.

Exploration History and Geology of the Luxor Properties

Valhalla

Luxor is targeting an on-trend Doe Creek and Dunvegan formations vertical oil well. This well is expected to benefit and possibly be pressurized from the adjacent property water injection program. Sufficient acreage exists for up to five follow up vertical wells or a single horizontal well as may be required.

The primary objective is oil in the Doe Creek sandstone member which lies above the Dunvegan formation. The Doe Creek courses up from an argillaceous base and is well sorted. Secondary objective is the Dunvegan sandstone 25 metres deeper which is oil productive in the Doe Creek pool to the southwest. It is interpreted as the top sandstone of a deltaic system from the west.

29

Spirit Rycroft

Luxor is targeting an on-trend vertical oil well in the Basal Gething and Doe Creek formations offsetting the existing producing oil field. Potential exists for an additional two vertical oil wells or one horizontal well as may be indicated. The primary objective is a stratigraphic trap in a thick, Basal Gething sandstone at 1245 metres which lately has been proven to be oil and natural gas productive in several offsetting wells to the south east. A secondary objective is oil in the Doe Creek sandstone at 270 metres. Thickness is 1-2 metres but not in close proximity to water flooding necessary for good secondary recovery.

Current State of Exploration

Valhalla

The Valhalla Well was completed in August, 2011 and oil production from the Valhalla Well commenced at the end of September 2011. However, due to sand build-up, the well was taken off-line immediately. A new pump was installed and the well was brought back on-line on October 18, 2011. Production since October 2011 has been minimal as production problems relating to water build-up continue to be encountered and currently the Valhalla Well is shut in and is not currently producing. Buckeye Canada has now earned its 28% interest in the Valhalla Well as well as the entire property on which the Valhalla Well is located. The Valhalla Property does not currently contain any assigned resources or reserves of oil or natural gas.

Spirit Rycroft

On July 26, 2011 Buckeye Canada exercised its rights to participate in a second well to be drilled by Luxor. The second well drilled under the Company’s agreement with Luxor is the SR Well. The drilling of the SR Well commenced in August, 2011 and was brought on-line in March 2012 after the completion of the construction of a 2.5 kilometer pipeline. The SR Well initially produced gas, oil and liquids but has had only limited production to date. It is not known at this time if the hydrocarbon content will rise to a significant enough level to operate the SR Well in the future. The SR Well is currently shut in and not in production. The Spirit Rycroft Property does not currently contain any assigned resources or reserves of oil or natural gas.

Geological Exploration Program

Valhalla