UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________

FORM

__________________

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22432

__________________

__________________

8 Sound Shore Drive, Suite 255

Greenwich, CT 06830

(Address of principal executive offices)

Jonathan H. Cohen

Chief Executive Officer

Oxford Lane Capital Corp.

8 Sound Shore Drive, Suite 255

Greenwich, CT 06830

(Name and address of agent for service)

__________________

Registrant’s telephone number, including area code: (203) 983-5275

Date of fiscal year end: March 31

Date of reporting period:

Item 1. Reports to Stockholders.

The semi-annual report to stockholders for the six months ended September 30, 2023 is filed herewith pursuant to Rule 30e-1 under the Investment Company Act of 1940.

Oxford Lane Capital Corp.

Semi-Annual Report

September 30, 2023

oxfordlanecapital.com

OXFORD LANE CAPITAL CORP.

TABLE OF CONTENTS

|

Page |

||

|

Letter to Stockholders and Management’s Discussion of Fund Performance |

1 |

|

|

4 |

||

|

5 |

||

|

6 |

||

|

9 |

||

|

10 |

||

|

30 |

||

|

31 |

||

|

32 |

||

|

33 |

||

|

62 |

||

|

63 |

||

|

64 |

||

|

68 |

||

|

69 |

||

|

70 |

i

Oxford Lane Capital Corp.

Letter to Stockholders and Management’s Discussion of Fund Performance

November 7, 2023

To Our Stockholders:

Company Overview

We are pleased to submit to you the report of Oxford Lane Capital Corp. (“we”, “us”, “our”, the “Fund” or “Oxford Lane”) for the six months ended September 30, 2023. The net asset value (“NAV”) of our shares at that date was $4.81 per common share. The Fund’s common stock is traded on the NASDAQ Global Select Market and its share price can differ from its NAV. The Fund’s closing price at September 30, 2023 was $4.99 compared to $5.23 at March 31, 2023. The total return based on market value for the Fund for the six months ended September 30, 2023, as reflected in the Fund’s financial highlights, was 4.48%. This return reflects the change in market price for the six months ended September 30, 2023, as well as the impact of $0.465 per share in distributions declared and paid for the six months ended September 30, 2023. The total return based on NAV for the six months ended September 30, 2023, as reflected in the Fund’s financial highlights, was 14.43%. Please refer to “Note 13. Financial Highlights” for further details. On November 6, 2023, the last reported sale price of the Fund’s common stock was $5.03.

We note that there may be significant differences between Oxford Lane’s earnings prepared in accordance with generally accepted accounting principles (“GAAP”) in the United States of America and our taxable earnings, particularly related to collateralized loan obligation (“CLO”) equity investments where our taxable earnings are based upon the distributable share of earnings as determined under tax regulations for each CLO equity investment, while GAAP earnings are based upon an effective yield calculation. Additionally, as our taxable earnings are not generally known until after our distributions are made; those distributions may represent a return of capital on a tax basis. While reportable GAAP income from our CLO equity investments for the six months ended September 30, 2023 was approximately $135.5 million, we received or were entitled to receive approximately $213.5 million in distributions from our CLO equity investments.

Investment Objectives

Our investment objective is to maximize our portfolio’s risk adjusted total return, and we currently seek to achieve our investment objective by investing in structured finance investments, specifically the equity and junior debt tranches of collateralized loan obligation (“CLO”) vehicles, which are collateralized primarily by a diverse portfolio of senior secured loans made to companies whose debt is unrated or is rated below investment grade (the “Senior Loans”) and, to a limited extent, subordinated and/or unsecured loans and bonds (together with the Senior Loans, the “CLO Assets”).

Investment Review

We implement our investment objective by investing in equity and junior debt tranches of CLO vehicles(1), which are collateralized primarily by diverse portfolios of Senior Loans, and which generally have very little or no exposure to real estate loans, or mortgage loans or to pools of consumer-based debt, such as credit card receivables or auto loans. Our investment strategy also includes investing in warehouse facilities, which are financing structures intended to aggregate Senior Loans that may be used to form the basis of a CLO vehicle. We may also invest, on an opportunistic basis, in other corporate credits of a variety of types.

____________

1. A CLO vehicle is formed by raising multiple “tranches” of debt (with the most senior tranches being rated “AAA” to the most junior tranches typically being rated “BB” or “B”) and equity. Below investment grade securities, such as the CLO securities in which we primarily intend to invest, are often referred to as “junk.” In addition, the CLO equity and junior debt securities in which we invest are highly levered (with CLO equity securities typically being leveraged between nine and thirteen times), which significantly magnifies our risk of loss on such investments relative to senior debt tranches of CLOs. A CLO itself is highly leveraged because it borrows significant amounts of money to acquire the underlying commercial loans in which it invests. A CLO borrows money by issuing debt securities to investors (including junior debt securities of the type we intend to invest), and the CLO equity (which is also the CLO residual tranche) is the first to bear the risk on the underlying investment.

1

Structurally, CLO vehicles are entities formed to originate and/or acquire a portfolio of loans. The loans within a CLO vehicle are generally limited to loans which meet established credit criteria and are subject to concentration limitations in order to limit a CLO vehicle’s exposure to a single credit.

An investment in us carries with it a significant number of meaningful risks, certain of which are discussed in the notes to our financial statements. Investors should read “Note 14. Risks and Uncertainties”, as well as our prospectus, carefully.

2023 Portfolio Review

As of September 30, 2023, we held equity investments in 225 different CLO structures, and debt investments in 25 different CLO structures.

For the six months ended September 30, 2023, net investment income, calculated in accordance with GAAP, was approximately $86.8 million, or $0.47 per weighted average common share.

For the six months ended September 30, 2023, we recorded a net increase in net assets resulting from operations of approximately $115.2 million, or $0.57 per weighted average common share (inclusive of realized and unrealized gains and losses).

For the six months ended September 30, 2023, we made additional investments of approximately $283.6 million, and received approximately $81.4 million from sales and repayments of our CLO investments.

Market Overview and Opportunity

The broader corporate loan and CLO equity market have demonstrated strong performance during the calendar year 2023, through September 30, 2023. During that period, the Morningstar LSTA US Leveraged Loan Index increased from a price of 92.44% as of December 31, 2022 to 94.24% as of June 30, 2023. From June 30, 2023, the Morningstar LSTA US Leveraged Loan Index increased to 95.92% as of September 19, 2023 before dropping to 95.55% as of September month end. The increase in U.S. loan prices led to an approximate 29 point increase in median U.S. CLO equity net asset values year to date. The default rate began the year at 0.72%, peaked at 1.75% in July 2023, before dropping to 1.27% by principal amount in September 2023. In a year that saw elevated defaults, September was the first month of the year which did not record any defaults amongst the constituents of the Morningstar LSTA US Leveraged Loan Index. CLO new issuance through September 30, 2023 totaled approximately $84 billion as issuance ticked up during the third quarter buoyed momentarily by improved arbitrage conditions, but still trails the $106 billion of issuance for the same period in 2022. With this backdrop, we continue to see compelling opportunities and remain active in both the primary and secondary markets, while remaining cautious of potential headwinds from (i) the impact of a prolonged high interest rate environment, (ii) continued inflationary pressures, and (iii) increased geopolitical tension.

Economic and Market Conditions

From time to time, capital markets may experience periods of volatility and instability for a variety of reasons. We are currently operating in a period of market volatility, as a result of, among other factors, continued concerns about the systemic impact of inflation, energy costs, the Coronavirus pandemic, geopolitical issues, the availability and cost of credit, sovereign debt levels, the mortgage market and a declining real estate market in the United States. Government spending, government policies, including recent increases in certain interest rates by the Federal Reserve, the failure of certain regional banks and disruptions in supply chains in the United States and elsewhere, in conjunction with other factors, have led and could continue to lead to a continued inflationary economic environment that could affect the Fund’s investments, the Fund’s financial condition and the Fund’s results of operations.

Various social and political circumstances in the U.S. and around the world (including wars and other forms of conflict, including rising trade tensions between the United States and China, and other uncertainties regarding actual and potential shifts in the U.S. and foreign, trade, economic and other policies with other countries, terrorist acts, security operations and catastrophic events such as fires, floods, earthquakes, tornadoes, hurricanes and global health epidemics), may also contribute to increased market volatility and economic uncertainties or deterioration in the United States and worldwide. Specifically, the Israel-Hamas war and conflict between Russia and Ukraine,

2

and resulting market volatility, could adversely affect our business, financial condition or results of operations. In response to the conflict between Russia and Ukraine, the United States and other countries have imposed sanctions or other restrictive actions against Russia. Any of the above factors, including sanctions, export controls, tariffs, trade wars and other governmental actions, could have a material adverse effect on our business, financial condition, cash flows and results of operations and could cause the market value of our common shares and/or debt securities to decline. These market and economic disruptions could also negatively impact the operating results of our investments.

The Fund’s ability to pay distributions might be adversely affected by the impact of one or more of the risks discussed in this section. The Fund cannot assure investors that it will achieve investment results that will allow the Fund to make a specified level of cash distributions or year-to-year increases in cash distributions.

Jonathan H. Cohen

Chief Executive Officer

This letter is intended to assist stockholders in understanding the Fund’s performance during the six months ended September 30, 2023. The views and opinions in this letter were current as of November 7, 2023. Statements other than those of historical facts included herein may constitute forward-looking statements and are not guarantees of future performance or results and involve a number of risks and uncertainties. Actual results may differ materially from those in the forward-looking statements as a result of a number of factors. The Fund undertakes no duty to update any forward-looking statement made herein. Information contained on our website is not incorporated by reference into this stockholder letter and you should not consider information contained on our website to be part of this stockholder letter or any other report we file with the Securities and Exchange Commission.

3

Important Information

This report is transmitted to the stockholders of the Fund and is furnished pursuant to certain regulatory requirements. This report and the information and views herein do not constitute investment advice, or a recommendation or an offer to enter into any transaction with the Fund or any of its affiliates. This report is provided for informational purposes only, does not constitute an offer to sell securities of the Fund and is not a prospectus. From time to time, the Fund may have a registration statement relating to one or more of its securities on file with the U.S. Securities and Exchange Commission (“SEC”).

An investment in the Fund is not appropriate for all investors. The investment program of the Fund is speculative, entails substantial risk and includes investment techniques not employed by traditional mutual funds. An investment in the Fund is not intended to be a complete investment program. Shares of closed-end investment companies, such as the Fund, may frequently trade at a discount from their NAV, which may increase investors’ risk of loss. Past performance is not indicative of, or a guarantee of, future performance. The performance and certain other portfolio information quoted herein represents information as of September 30, 2023. Nothing herein should be relied upon as a representation as to the future performance or portfolio holdings of the Fund. Investment return and principal value of an investment will fluctuate, and shares, when sold, may be worth more or less than their original cost. The Fund’s performance is subject to change since the end of the period noted in this report and may be lower or higher than the performance data shown herein.

About Oxford Lane Capital Corp.

Oxford Lane Capital Corp. is a publicly-traded registered closed-end management investment company. It currently seeks to achieve its investment objective of maximizing risk-adjusted total return by investing in debt and equity tranches of CLO vehicles. The Fund’s investment strategy also includes warehouse facilities, which are financing structures intended to aggregate loans that may be used to form the basis of a CLO vehicle.

Forward-Looking Statements

This report may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements other than statements of historical facts included in this report may constitute forward-looking statements (including statements containing words such as “anticipates,” “expects,” “intends,” “plans,” “will,” “may,” “continue,” “believes,” “seeks,” “estimates,” “would,” “could,” “should,” “targets,” “projects,” and variations of these words and similar expressions are intended to identify forward-looking statements) and are not guarantees of future performance or results and involve a number of risks and uncertainties. Actual results may differ materially from those in the forward-looking statements as a result of a number of factors, including those described in the Fund’s filings with the SEC. The Fund undertakes no duty to update any forward-looking statement made herein. All forward-looking statements speak only as of the date of this report.

4

OXFORD LANE CAPITAL CORP.

TOP TEN HOLDINGS

AS OF SEPTEMBER 30, 2023

(Unaudited)

|

Investment |

Maturity |

Fair Value |

% of |

||||

|

Regatta XXII Funding Ltd. – CLO subordinated notes |

July 20, 2035 |

$ |

32,611,320 |

3.27% |

|||

|

Wind River 2023-1 CLO Ltd. – CLO subordinated notes |

April 25, 2036 |

$ |

29,610,000 |

2.97% |

|||

|

Milford Park CLO, Ltd. – CLO subordinated notes |

July 20, 2035 |

$ |

28,345,600 |

2.84% |

|||

|

Carlyle US CLO 2021-8, Ltd. – CLO subordinated notes |

October 20, 2034 |

$ |

28,287,438 |

2.83% |

|||

|

Octagon 60, Ltd. – CLO subordinated notes |

October 20, 2035 |

$ |

25,740,000 |

2.58% |

|||

|

Rockford Tower CLO 2022-1, Ltd. – CLO subordinated notes |

July 20, 2035 |

$ |

24,188,813 |

2.42% |

|||

|

Nyack Park CLO, Ltd. – CLO subordinated notes |

October 20, 2034 |

$ |

22,500,000 |

2.25% |

|||

|

CIFC Funding 2021-VII, Ltd. – CLO income notes |

January 23, 2035 |

$ |

21,948,000 |

2.20% |

|||

|

Elmwood CLO 14 Ltd. – CLO subordinated notes |

April 20, 2035 |

$ |

21,746,000 |

2.18% |

|||

|

Kings Park CLO, Ltd. – CLO income notes |

January 21, 2035 |

$ |

21,386,750 |

2.14% |

|||

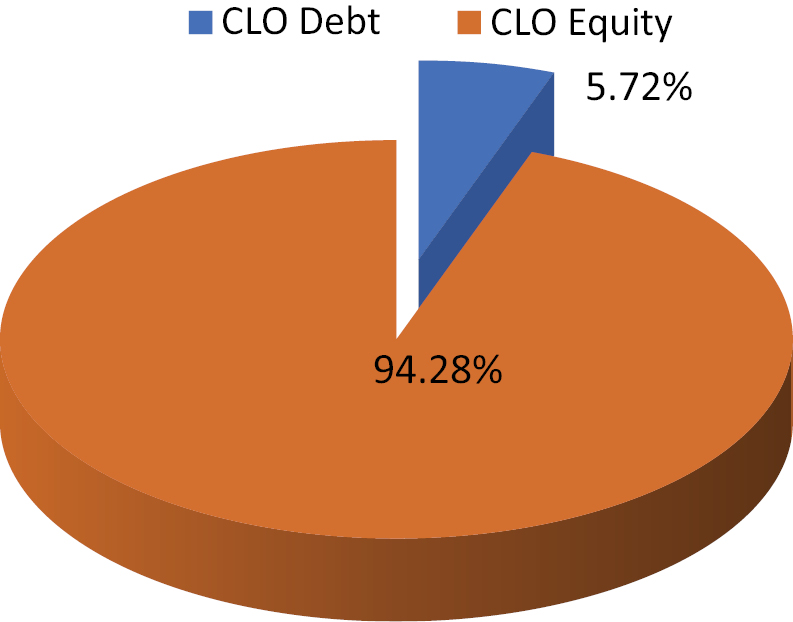

Portfolio Investment Breakdown as of September 30, 2023

(Excludes cash equivalents and other assets)

(Unaudited)

5

FEES AND EXPENSES

The following table is intended to assist you in understanding the costs and expenses that you will bear directly or indirectly. We caution you that some of the percentages indicated in the table below are estimates and may vary. Except where the context suggests otherwise, whenever this report contains a reference to fees or expenses paid by “us” or “Oxford Lane Capital,” or that “we” will pay fees or expenses, you will indirectly bear such fees or expenses as an investor in Oxford Lane Capital Corp.

| Stockholder transaction expenses: |

| ||

Sales load (as a percentage of offering price) |

| (1) | |

Offering expenses borne by us (as a percentage of offering price) |

| (2) | |

Distribution reinvestment plan expenses |

| (3) | |

Total stockholder transaction expenses ( |

| ||

| Annual expenses (estimated as a percentage of net assets attributable to common stock): |

| ||

Base management fee | %(4)(5) | ||

Incentive fees payable under our investment advisory agreement (20% of net investment income) | %(6) | ||

Interest payments on borrowed funds | %(7)(8) | ||

Other expenses | %(9) | ||

Total annual expenses | %(10) |

Example

The following example demonstrates the projected dollar amount of total cumulative expenses that would be incurred over various periods with respect to a hypothetical investment in our common stock. In calculating the following expense amounts, we have assumed that our annual operating expenses would remain at the levels set forth in the table above.

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||

| You would pay the following expenses on a $1,000 investment, assuming a 5% annual return | $ | | $ | | $ | | $ | | ||||

The example and the expenses in the tables above should not be considered as a representation of our future expenses, and actual expenses may be greater or less than those shown. While the example assumes, as required by the SEC, a 5.0% annual return, our performance will vary and may result in a return greater or less than 5.0%. The incentive fee under the investment advisory agreement (the “Investment Advisory Agreement”) with Oxford Lane Management, LLC (“Oxford Lane Management” or the “Adviser”), which, assuming a 5.0% annual return, would either not be payable or would have an insignificant impact on the expense amounts shown above, is included in the example. Also, while the example assumes reinvestment of all distributions at NAV, participants in our distribution reinvestment plan will receive a number of shares of our common stock, determined by dividing the total dollar amount of the distribution payable to a participant by the market price per share of our common stock at the close of trading on the distribution payment date, which may be at, above or below NAV. See “Distribution Reinvestment Plan” in this report for additional information regarding our distribution reinvestment plan.

____________

(1)

(2)

(3)

(4)

6

(5)

(6)

The incentive fee, which is payable quarterly in arrears, equals 20.0% of the excess, if any, of our “Pre-Incentive Fee Net Investment Income” that exceeds a 1.75% quarterly (7.0% annualized) hurdle rate, which we refer to as the “Hurdle”, subject to a “catch-up” provision measured at the end of each calendar quarter. The incentive fee is computed and paid on income that may include interest that is accrued but not yet received in cash. The operation of the incentive fee for each quarter is as follows:

• no incentive fee is payable to Oxford Lane Management in any calendar quarter in which our Pre-Incentive Fee Net Investment Income does not exceed the Hurdle of 1.75%;

• 100% of our Pre-Incentive Fee Net Investment Income with respect to that portion of such Pre-Incentive Fee Net Investment Income, if any, that exceeds the Hurdle but is less than 2.1875% in any calendar quarter (8.75% annualized) is payable to our investment adviser. We refer to this portion of our Pre-Incentive Fee Net Investment Income (which exceeds the Hurdle but is less than 2.1875%) as the “catch-up.” The “catch-up” is meant to provide our investment adviser with 20.0% of our Pre-Incentive Fee Net Investment Income, as if a Hurdle did not apply when our Pre-Incentive Fee Net Investment Income exceeds 2.1875% in any calendar quarter; and

• 20.0% of the amount of our Pre-Incentive Fee Net Investment Income, if any, that exceeds 2.1875% in any calendar quarter (8.75% annualized) is payable to Oxford Lane Management (once the Hurdle is reached and the catch-up is achieved, 20.0% of all Pre-Incentive Fee Investment Income thereafter is allocated to Oxford Lane Management)

No incentive fee is payable to Oxford Lane Management on realized capital gains. For a more detailed discussion of the calculation of this fee, see “Note 5. Related Party Transactions.”

(7)

(8)

(9)

(10)

Principal Risks

For a description of the principal risk factors associated with an investment in the Fund, please refer to “Note 14. Risks and Uncertainties” in the Unaudited Notes to the Financial Statements.

Conflicts of Interest

Oxford Lane Management’s investment team manages the portfolios of Oxford Square Capital Corp., a publicly-traded business development company that invests principally in the debt of U.S.-based companies and CLOs and Oxford Park Income Fund, Inc., a non-traded closed-end investment management company that investments primarily in CLO debt and equity tranches. Additionally, Oxford Lane Management’s investment team also manages the portfolio of Oxford Gate Master Fund, LLC, Oxford Gate, LLC and Oxford Gate (Bermuda),

7

LLC (collectively, the “Oxford Gate Funds”) and Oxford Bridge II, LLC, limited liability companies that invest principally in the equity of CLOs. In certain instances, the Fund may co-invest on a concurrent basis with affiliates of Oxford Lane Management, subject to compliance with applicable regulations and regulatory guidance and our written allocation policies. On June 14, 2017, the Securities and Exchange Commission (the “SEC”) issued an exemptive order (the “Order”) permitting us and certain of our affiliates to complete negotiated co-investment transactions in portfolio companies, subject to certain conditions. Subject to satisfaction of certain conditions to the Order, the Fund and certain of its affiliates are now permitted, together with any future business development companies, registered closed-end funds and certain private funds, each of whose investment adviser is Oxford Lane Management or an investment adviser controlling, controlled by, or under common control with Oxford Lane Management, to co-invest in negotiated investment opportunities where doing so would otherwise be prohibited under the Investment Company Act of 1940, as amended (the “1940 Act”) providing the Fund’s stockholders with access to a broader array of investment opportunities. Pursuant to the Order, the Fund is permitted to co-invest in such investment opportunities with our affiliates if a “required majority” (as defined in Section 57(o) of the 1940 Act) of its independent directors (as defined in Section 2(a)(19) of the 1940 Act) make certain conclusions in connection with a co-investment transaction, including, but not limited to, that (1) the terms of the potential co-investment transaction, including the consideration to be paid, are reasonable and fair to the Fund and its stockholders and do not involve overreaching in respect of the Fund or its stockholders on the part of any person concerned, and (2) the potential co-investment transaction is consistent with the interests of the Fund’s stockholders and is consistent with its then-current investment objective and strategies.

8

OXFORD LANE CAPITAL CORP.

STATEMENT OF ASSETS AND LIABILITIES

(Unaudited)

| September 30, | ||||

| ASSETS |

|

| ||

| Investments, at fair value (cost: $1,859,803,816) | $ | 1,442,843,274 |

| |

| Cash and cash equivalents |

| 27,105,794 |

| |

| Distributions receivable |

| 26,851,283 |

| |

| Interest receivable, including accrued interest purchased |

| 3,141,035 |

| |

| Prepaid expenses and other assets |

| 176,120 |

| |

| Deferred offering costs on common stock |

| 97,304 |

| |

| Fee receivable |

| 86,880 |

| |

| Total assets |

| 1,500,301,690 |

| |

|

|

| |||

| LIABILITIES |

|

| ||

| Mandatorily redeemable preferred stock, net of unamortized deferred issuance costs of $5,398,577 ( |

| 281,769,448 |

| |

| Notes payable – 6.75% unsecured notes, net of unamortized deferred issuance costs of $2,667,340 |

| 97,332,660 |

| |

| Notes payable – 5.00% unsecured notes, net of unamortized deferred issuance costs of $2,252,592 |

| 97,747,408 |

| |

| Securities purchased not settled |

| 2,295,000 |

| |

| Incentive fees payable to affiliate |

| 11,212,156 |

| |

| Base management fee payable to affiliate |

| 7,062,173 |

| |

| Excise tax payable |

| 3,229,219 |

| |

| Accrued expenses |

| 1,089,212 |

| |

| Interest payable |

| 32,639 |

| |

| Directors’ fees payable |

| 70,000 |

| |

| Administrator expense payable |

| 51,860 |

| |

| Total liabilities |

| 501,891,775 |

| |

|

|

| |||

| COMMITMENTS AND CONTINGENCIES (Note 11) |

|

| ||

|

|

| |||

| NET ASSETS applicable to common stock, $0.01 par value, | $ | 998,409,915 |

| |

|

|

| |||

| NET ASSETS consist of: |

|

| ||

| Common stock, $0.01 par value | $ | 2,074,034 |

| |

| Capital in excess of par value |

| 1,384,631,314 |

| |

| Total distributable earnings/(accumulated losses) |

| (388,295,433 | ) | |

| Total net assets | $ | 998,409,915 |

| |

| Net asset value per common share | $ | 4.81 |

| |

| Market price per share | $ | 4.99 |

| |

| Percentage of market price premium to net asset value per share |

| 3.74 | % | |

See Accompanying Notes.

9

OXFORD LANE CAPITAL CORP.

SCHEDULE OF INVESTMENTS

September 30, 2023

(Unaudited)

|

COMPANY/INVESTMENT(1)(13)(14) |

ACQUISITION |

PRINCIPAL |

COST |

FAIR |

% OF |

||||||||

|

Collateralized Loan Obligation – Debt Investments |

|

|

|

||||||||||

|

Structured Finance – Debt Investments |

|

|

|

||||||||||

|

Allegro CLO II-S, Ltd. |

|

|

|

||||||||||

|

CLO secured notes – Class E(3)(6), 13.42% (LIBOR + 7.82%, due October 21, 2028) |

06/24/2020 |

$ |

5,500,000 |

$ |

4,789,474 |

$ |

3,796,650 |

||||||

|

|

|

|

|||||||||||

|

Allegro CLO II-S, Ltd. |

|

|

|

||||||||||

|

CLO secured notes – Class D(3)(6), 11.35% (LIBOR + 5.75%, due October 21, 2028) |

05/09/2023 |

|

8,950,000 |

|

7,199,077 |

|

7,629,875 |

||||||

|

|

|

|

|||||||||||

|

Anchorage Capital CLO 4-R, Ltd. |

|

|

|

||||||||||

|

CLO secured notes – Class E(3)(6)(11), 11.13% (LIBOR + 5.50%, due January 28, 2031) |

11/04/2022 |

|

900,000 |

|

740,603 |

|

807,030 |

||||||

|

|

|

|

|||||||||||

|

Ares XXXVII CLO Ltd. |

|

|

|

||||||||||

|

CLO secured notes – Class ER(3)(6), 12.84% (LIBOR + 7.27%, due October 15, 2030) |

06/23/2022 |

|

6,000,000 |

|

4,257,437 |

|

4,039,800 |

||||||

|

|

|

|

|||||||||||

|

BlueMountain CLO 2015-4 Ltd. |

|

|

|

||||||||||

|

CLO secured notes – Class ER(3)(6), 11.54% (LIBOR + 5.95%, due April 20, 2030) |

01/19/2022 |

|

837,000 |

|

801,744 |

|

709,358 |

||||||

|

|

|

|

|||||||||||

|

BlueMountain CLO 2018-1 Ltd. |

|

|

|

||||||||||

|

CLO secured notes – Class F(3)(6), 13.84% (LIBOR + 8.21%, due July 30, 2030) |

11/18/2019 |

|

8,500,000 |

|

6,683,788 |

|

4,850,950 |

||||||

|

|

|

|

|||||||||||

|

BlueMountain Fuji US CLO II Ltd. |

|

|

|

||||||||||

|

CLO secured notes – Class D(3)(6), 11.74% (LIBOR + 6.15%, due October 20, 2030) |

11/09/2022 |

|

4,750,000 |

|

3,865,503 |

|

4,074,075 |

||||||

|

|

|

|

|||||||||||

|

Elevation CLO 2017-6, Ltd. |

|

|

|

||||||||||

|

CLO secured notes – Class F(3)(6), 13.97% (LIBOR + 8.40%, due July 15, 2029) |

08/03/2022 |

|

2,500,000 |

|

1,993,590 |

|

1,458,250 |

||||||

|

|

|

|

|||||||||||

|

Highbridge Loan Management 5-2015, Ltd. |

|

|

|

||||||||||

|

CLO secured notes – Class FRR(3)(6), 13.57% (LIBOR + 8.00%, due October 15, 2030) |

08/03/2021 |

|

4,375,000 |

|

3,815,873 |

|

3,072,125 |

||||||

|

|

|

|

|||||||||||

|

Highbridge Loan Management 2013-2, Ltd. |

|

|

|

||||||||||

|

CLO secured notes – Class ER(3)(6), 13.84% (LIBOR + 8.25%, due October 20, 2029) |

04/20/2022 |

|

2,500,000 |

|

2,172,953 |

|

1,833,250 |

||||||

|

|

|

|

|||||||||||

|

Highbridge Loan Management 5-2015, Ltd. |

|

|

|

||||||||||

|

CLO secured notes – Class ERR(3)(6), 11.57% (LIBOR + 6.26%, due October 15, 2030) |

09/18/2023 |

|

2,500,000 |

|

2,185,097 |

|

2,183,750 |

||||||

|

|

|

|

|||||||||||

|

Longfellow Place CLO, Ltd. |

|

|

|

||||||||||

|

CLO secured notes – Class FRR(3)(6)(20), 14.07% (LIBOR + 8.50%, due April 15, 2029) |

03/26/2019 |

|

4,515,461 |

|

3,655,264 |

|

674,158 |

||||||

|

|

|

|

|||||||||||

|

Midocean Credit CLO VI |

|

|

|

||||||||||

|

CLO secured notes – Class F(3)(6), 13.60% (LIBOR + 8.01%, due April 20, 2033) |

03/12/2021 |

|

4,000,000 |

|

3,363,176 |

|

2,895,600 |

||||||

(Continued on next page)

See Accompanying Notes.

10

OXFORD LANE CAPITAL CORP.

SCHEDULE OF INVESTMENTS – (continued)

September 30, 2023

(Unaudited)

|

COMPANY/INVESTMENT(1)(13)(14) |

ACQUISITION |

PRINCIPAL |

COST |

FAIR |

% OF |

|||||||||

|

Collateralized Loan Obligation – Debt Investments (continued) |

|

|

|

|

||||||||||

|

Structured Finance – Debt Investments (continued) |

|

|

|

|

||||||||||

|

Milford Park CLO, Ltd. |

|

|

|

|

||||||||||

|

CLO secured notes – Class F(3)(17), 14.65% (SOFR + 9.32%, due July 20, 2035) |

05/12/2022 |

$ |

1,000,000 |

$ |

963,895 |

$ |

971,100 |

|

||||||

|

|

|

|

|

|||||||||||

|

Nassau 2017-II Ltd. |

|

|

|

|

||||||||||

|

CLO secured notes – Class E(3)(6), 11.82% (LIBOR + 6.25%, due January 15, 2030) |

01/07/2022 |

|

7,030,000 |

|

6,539,996 |

|

3,385,648 |

|

||||||

|

|

|

|

|

|||||||||||

|

Octagon Investment Partners 36, Ltd. |

|

|

|

|

||||||||||

|

CLO secured notes – Class F(3)(17), 13.32% (SOFR + 8.01%, due April 15, 2031) |

09/08/2023 |

|

600,000 |

|

393,525 |

|

394,140 |

|

||||||

|

|

|

|

|

|||||||||||

|

OFSI BSL VIII, Ltd. |

|

|

|

|

||||||||||

|

CLO secured notes – Class E(3)(6), 11.96% (LIBOR + 6.39%, due August 16, 2029) |

07/12/2022 |

|

4,000,000 |

|

3,105,143 |

|

3,377,200 |

|

||||||

|

|

|

|

|

|||||||||||

|

OZLM IX, Ltd. |

|

|

|

|

||||||||||

|

CLO secured notes – Class ERR(3)(6), 13.93% (LIBOR + 8.34%, due October 20, 2031) |

06/16/2023 |

|

1,500,000 |

|

833,853 |

|

1,026,600 |

|

||||||

|

|

|

|

|

|||||||||||

|

Rockford Tower CLO 2022-1, Ltd. |

|

|

|

|

||||||||||

|

CLO secured notes – Class E(3)(17), 12.67% (SOFR + 7.34%, due July 20, 2035) |

05/06/2022 |

|

3,750,000 |

|

3,716,349 |

|

3,472,125 |

|

||||||

|

|

|

|

|

|||||||||||

|

Shackleton 2015-VII-R CLO, Ltd. |

|

|

|

|

||||||||||

|

CLO secured notes – Class E(3)(17), 11.77% (SOFR + 6.20%, due July 15, 2031) |

07/21/2022 |

|

1,000,000 |

|

770,449 |

|

804,800 |

|

||||||

|

|

|

|

|

|||||||||||

|

Sound Point CLO V-R, Ltd. |

|

|

|

|

||||||||||

|

CLO secured notes – Class F(3)(6), 13.67% (LIBOR + 8.10%, due July 18, 2031) |

05/25/2022 |

|

1,250,000 |

|

834,333 |

|

314,625 |

|

||||||

|

|

|

|

|

|||||||||||

|

Venture XXI CLO, Limited |

|

|

|

|

||||||||||

|

CLO secured notes – Class F(3)(6), 12.17% (LIBOR + 6.60%, due July 15, 2027) |

07/28/2021 |

|

8,916,000 |

|

6,893,702 |

|

6,349,084 |

|

||||||

|

|

|

|

|

|||||||||||

|

Venture XXI CLO, Limited |

|

|

|

|

||||||||||

|

CLO secured notes – Class E(3)(6), 10.37% (LIBOR + 4.80%, due July 15, 2027) |

12/08/2022 |

|

11,000,000 |

|

9,730,883 |

|

11,000,000 |

|

||||||

|

|

|

|

|

|||||||||||

|

Venture XXV CLO, Limited |

|

|

|

|

||||||||||

|

CLO secured notes – Class E(3)(6), 12.79% (LIBOR + 7.20%, due April 20, 2029) |

04/21/2022 |

|

4,000,000 |

|

3,487,310 |

|

3,286,400 |

|

||||||

|

|

|

|

|

|||||||||||

|

Wind River 2023-1 CLO Ltd. |

|

|

|

|

||||||||||

|

CLO secured notes – Class E(3)(9)(17), 13.59% (SOFR + 8.52%, due April 25, 2036) |

03/13/2023 |

|

10,000,000 |

|

9,614,065 |

|

10,060,000 |

|

|

|||||

|

Total Structured Finance – Debt Investments |

|

$ |

92,407,084 |

$ |

82,466,593 |

8.26 |

% |

|||||||

|

Total Collateralized Loan Obligation – Debt Investments |

|

$ |

92,407,084 |

$ |

82,466,593 |

8.26 |

% |

|||||||

(Continued on next page)

See Accompanying Notes.

11

OXFORD LANE CAPITAL CORP.

SCHEDULE OF INVESTMENTS – (continued)

September 30, 2023

(Unaudited)

|

COMPANY/INVESTMENT(1)(13)(14) |

ACQUISITION |

PRINCIPAL |

COST |

FAIR |

% OF |

||||||||

|

Collateralized Loan Obligation – Equity Investments |

|

|

|

||||||||||

|

Structured Finance – Equity Investments |

|

|

|

||||||||||

|

522 Funding CLO I Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 27.18%, maturity April 15, 2035) |

03/03/2023 |

$ |

24,300,000 |

$ |

11,063,732 |

$ |

9,571,836 |

||||||

|

|

|

|

|||||||||||

|

AIMCO CLO, Series 2015-A |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7)(11), (Estimated yield 18.93%, maturity October 17, 2034) |

08/25/2021 |

|

13,548,313 |

|

8,117,130 |

|

7,180,606 |

||||||

|

|

|

|

|||||||||||

|

AIG CLO 2018-1, LLC |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 26.90%, maturity April 20, 2032) |

04/25/2023 |

|

9,607,250 |

|

5,734,779 |

|

6,052,568 |

||||||

|

|

|

|

|||||||||||

|

Allegro CLO II-S, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7)(19), (Estimated yield 0.00%, maturity October 21, 2028) |

02/06/2020 |

|

20,800,000 |

|

4,274,918 |

|

832,000 |

||||||

|

|

|

|

|||||||||||

|

ALM XVII, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7)(10)(19), (Estimated yield 0.00%, maturity January 15, 2028) |

03/04/2019 |

|

6,500,000 |

|

— |

|

— |

||||||

|

|

|

|

|||||||||||

|

AMMC CLO XII, Limited |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7)(19), (Estimated yield 0.00%, maturity November 10, 2030) |

09/10/2021 |

|

24,350,000 |

|

3,909,339 |

|

1,948,000 |

||||||

|

|

|

|

|||||||||||

|

AMMC CLO 25, Limited |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 30.76%, maturity April 15, 2035) |

04/27/2022 |

|

19,000,000 |

|

13,926,917 |

|

14,440,000 |

||||||

|

|

|

|

|||||||||||

|

Anchorage Capital CLO 1-R, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 18.29%, maturity April 13, 2031) |

08/13/2020 |

|

12,150,000 |

|

6,119,197 |

|

4,670,914 |

||||||

|

|

|

|

|||||||||||

|

Anchorage Capital CLO 4-R, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7)(11), (Estimated yield 14.73%, maturity January 28, 2031) |

05/20/2019 |

|

9,000,000 |

|

4,691,620 |

|

3,375,000 |

||||||

|

|

|

|

|||||||||||

|

Anchorage Capital CLO 5-R, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7)(10), (Estimated yield 10.97%, maturity January 15, 2030) |

07/16/2019 |

|

27,316,000 |

|

4,057,062 |

|

2,855,077 |

||||||

|

|

|

|

|||||||||||

|

Anchorage Capital CLO 7, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 18.69%, maturity January 28, 2031) |

06/02/2020 |

|

12,750,000 |

|

4,667,015 |

|

4,303,125 |

||||||

|

|

|

|

|||||||||||

|

Anchorage Capital CLO 17, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 17.39%, maturity July 15, 2034) |

06/04/2021 |

|

27,500,000 |

|

20,988,165 |

|

17,050,000 |

||||||

|

|

|

|

|||||||||||

|

Anchorage Capital CLO 25, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 29.13%, maturity April 20, 2035) |

04/24/2023 |

|

10,000,000 |

|

6,680,250 |

|

6,950,000 |

||||||

(Continued on next page)

See Accompanying Notes.

12

OXFORD LANE CAPITAL CORP.

SCHEDULE OF INVESTMENTS – (continued)

September 30, 2023

(Unaudited)

|

COMPANY/INVESTMENT(1)(13)(14) |

ACQUISITION |

PRINCIPAL |

COST |

FAIR |

% OF |

||||||||

|

Collateralized Loan Obligation – Equity Investments (continued) |

|

|

|

||||||||||

|

Structured Finance – Equity Investments (continued) |

|

|

|

||||||||||

|

Apex Credit CLO 2015-II, Ltd. (fka: JFIN CLO 2015-II Ltd.) |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7)(10)(19), (Estimated yield 0.00%, maturity October 17, 2026) |

11/22/2016 |

$ |

5,750,000 |

$ |

2,609,615 |

$ |

933,800 |

||||||

|

|

|

|

|||||||||||

|

Apex Credit CLO 2018 Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7)(19), (Estimated yield 0.00%, maturity April 25, 2031) |

03/14/2018 |

|

12,420,000 |

|

4,403,935 |

|

969,698 |

||||||

|

|

|

|

|||||||||||

|

Apex Credit CLO 2019 Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 20.52%, maturity April 18, 2032) |

05/13/2019 |

|

17,500,000 |

|

12,836,358 |

|

6,486,795 |

||||||

|

|

|

|

|||||||||||

|

Apex Credit CLO 2019-II Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 14.65%, maturity October 25, 2032) |

10/27/2020 |

|

4,500,000 |

|

2,509,655 |

|

1,858,859 |

||||||

|

|

|

|

|||||||||||

|

Apidos CLO XVIII-R |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 24.03%, maturity October 22, 2030) |

06/24/2022 |

|

7,500,000 |

|

3,140,704 |

|

2,925,000 |

||||||

|

|

|

|

|||||||||||

|

Apidos CLO XXIII |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 21.50%, maturity April 15, 2033) |

04/01/2022 |

|

5,000,000 |

|

3,236,539 |

|

3,045,300 |

||||||

|

|

|

|

|||||||||||

|

Apidos CLO XXIV |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 20.98%, maturity October 20, 2030) |

02/10/2022 |

|

5,000,000 |

|

1,696,202 |

|

1,500,000 |

||||||

|

|

|

|

|||||||||||

|

Apidos CLO XXXIV |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 19.25%, maturity January 20, 2035) |

01/13/2022 |

|

9,950,000 |

|

7,294,651 |

|

6,965,000 |

||||||

|

|

|

|

|||||||||||

|

Arcadia Warehouse 2022, Ltd. |

|

|

|

||||||||||

|

CLO subordinated warehouse notes(4)(5)(7)(11)(19), (Estimated yield 0.00%, maturity July 20, 2023) |

01/31/2022 |

|

584,375 |

|

584,375 |

|

35,998 |

||||||

|

|

|

|

|||||||||||

|

Ares XXVII CLO, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 12.04%, maturity October 28, 2034) |

03/06/2019 |

|

27,871,690 |

|

12,706,251 |

|

8,511,652 |

||||||

|

|

|

|

|||||||||||

|

Ares XXXIV CLO Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 20.59%, maturity April 17, 2033) |

08/30/2021 |

|

26,500,000 |

|

9,700,143 |

|

7,525,422 |

||||||

|

|

|

|

|||||||||||

|

Ares XXXVR CLO Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 14.53%, maturity July 15, 2030) |

09/13/2022 |

|

7,000,000 |

|

2,553,115 |

|

1,447,796 |

||||||

|

|

|

|

|||||||||||

|

Ares XXXVII CLO Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 0.41%, maturity October 15, 2030) |

02/12/2019 |

|

25,000,000 |

|

8,461,873 |

|

4,451,115 |

||||||

(Continued on next page)

See Accompanying Notes.

13

OXFORD LANE CAPITAL CORP.

SCHEDULE OF INVESTMENTS – (continued)

September 30, 2023

(Unaudited)

|

COMPANY/INVESTMENT(1)(13)(14) |

ACQUISITION |

PRINCIPAL |

COST |

FAIR |

% OF |

||||||||

|

Collateralized Loan Obligation – Equity Investments (continued) |

|

|

|

||||||||||

|

Structured Finance – Equity Investments (continued) |

|

|

|

||||||||||

|

Ares XL CLO Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 7.51%, maturity January 15, 2029) |

11/30/2017 |

$ |

31,683,000 |

$ |

6,252,400 |

$ |

3,614,382 |

||||||

|

|

|

|

|||||||||||

|

Ares XLII CLO Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7)(19), (Estimated yield 0.00%, maturity January 22, 2028) |

06/23/2021 |

|

21,910,000 |

|

7,428,090 |

|

3,101,713 |

||||||

|

|

|

|

|||||||||||

|

ARES XLVI CLO Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 16.23%, maturity January 15, 2030) |

01/25/2022 |

|

6,400,000 |

|

2,981,441 |

|

1,921,695 |

||||||

|

|

|

|

|||||||||||

|

Ares XLIX CLO Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 21.01%, maturity July 22, 2030) |

08/19/2022 |

|

7,600,000 |

|

2,582,928 |

|

2,004,369 |

||||||

|

|

|

|

|||||||||||

|

Ares LVII CLO Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 18.66%, maturity January 25, 2035) |

08/22/2022 |

|

21,200,000 |

|

12,812,954 |

|

10,181,052 |

||||||

|

|

|

|

|||||||||||

|

Ares LXI CLO Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 14.26%, maturity October 20, 2034) |

08/25/2021 |

|

13,000,000 |

|

10,601,405 |

|

7,800,000 |

||||||

|

|

|

|

|||||||||||

|

Ares LXVII CLO Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 19.68%, maturity January 25, 2036) |

10/31/2022 |

|

9,180,000 |

|

7,385,474 |

|

6,923,132 |

||||||

|

|

|

|

|||||||||||

|

Ares LXIV CLO Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7)(11), (Estimated yield 26.69%, maturity April 15, 2035) |

06/08/2023 |

|

7,200,000 |

|

4,773,389 |

|

4,904,053 |

||||||

|

|

|

|

|||||||||||

|

Atlas Senior Loan Funding XVII, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 17.42%, maturity October 20, 2034) |

09/20/2021 |

|

6,000,000 |

|

4,745,072 |

|

3,720,000 |

||||||

|

|

|

|

|||||||||||

|

Atlas Senior Loan Fund XVIII, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 18.10%, maturity January 18, 2035) |

04/21/2022 |

|

6,000,000 |

|

3,994,851 |

|

2,940,000 |

||||||

|

|

|

|

|||||||||||

|

Atrium XV |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7)(11), (Estimated yield 17.44%, maturity January 23, 2048) |

09/17/2019 |

|

21,000,000 |

|

13,507,872 |

|

12,180,000 |

||||||

|

|

|

|

|||||||||||

|

Bain Capital Credit CLO 2023-1, Limited |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7)(9), (Estimated yield 24.38%, maturity April 16, 2036) |

06/27/2023 |

|

6,100,000 |

|

4,509,586 |

|

4,880,000 |

||||||

|

|

|

|

|||||||||||

|

Battalion CLO VII Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7)(10)(19), (Estimated yield 0.00%, maturity July 17, 2028) |

07/03/2018 |

|

26,900,000 |

|

2,748,141 |

|

— |

||||||

(Continued on next page)

See Accompanying Notes.

14

OXFORD LANE CAPITAL CORP.

SCHEDULE OF INVESTMENTS – (continued)

September 30, 2023

(Unaudited)

|

COMPANY/INVESTMENT(1)(13)(14) |

ACQUISITION |

PRINCIPAL |

COST |

FAIR |

% OF |

||||||||

|

Collateralized Loan Obligation – Equity Investments (continued) |

|

|

|

||||||||||

|

Structured Finance – Equity Investments (continued) |

|

|

|

||||||||||

|

BlueMountain Fuji US CLO II Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 10.55%, maturity October 20, 2030) |

02/13/2020 |

$ |

27,980,000 |

$ |

11,844,052 |

$ |

7,834,400 |

||||||

|

|

|

|

|||||||||||

|

BlueMountain CLO 2015-4 Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 24.09%, maturity April 20, 2030) |

07/22/2020 |

|

9,644,700 |

|

3,519,564 |

|

2,073,611 |

||||||

|

|

|

|

|||||||||||

|

BlueMountain CLO 2016-3 Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 30.73%, maturity November 15, 2030) |

08/18/2020 |

|

9,897,500 |

|

4,056,377 |

|

2,820,788 |

||||||

|

|

|

|

|||||||||||

|

BlueMountain CLO 2018-1 Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7)(19), (Estimated yield 0.00%, maturity July 30, 2030) |

01/14/2020 |

|

9,000,000 |

|

2,098,494 |

|

1,012,500 |

||||||

|

|

|

|

|||||||||||

|

BlueMountain CLO 2018-3 Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 19.00%, maturity October 25, 2030) |

06/11/2020 |

|

23,825,000 |

|

7,826,148 |

|

5,956,250 |

||||||

|

|

|

|

|||||||||||

|

BlueMountain CLO XXXIV Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 19.55%, maturity April 20, 2035) |

03/23/2022 |

|

10,700,000 |

|

10,219,237 |

|

9,095,000 |

||||||

|

|

|

|

|||||||||||

|

Carlyle Global Market Strategies CLO 2013-2, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7)(10)(11)(19), (Estimated yield 0.00%, maturity January 18, 2029) |

03/19/2013 |

|

16,098,067 |

|

1,174,342 |

|

1,610 |

||||||

|

|

|

|

|||||||||||

|

Carlyle Global Market Strategies CLO 2013-4, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 3.60%, maturity January 15, 2031) |

09/29/2021 |

|

14,500,000 |

|

4,411,567 |

|

2,320,000 |

||||||

|

|

|

|

|||||||||||

|

Carlyle Global Market Strategies CLO 2014-5, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 16.24%, maturity July 15, 2031) |

03/27/2019 |

|

7,134,333 |

|

2,362,170 |

|

1,248,508 |

||||||

|

|

|

|

|||||||||||

|

Carlyle Us CLO 2020-1, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 22.69%, maturity July 20, 2034) |

08/04/2023 |

|

23,500,000 |

|

12,904,167 |

|

12,925,000 |

||||||

|

|

|

|

|||||||||||

|

Carlyle US CLO 2020-2, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7)(11), (Estimated yield 20.75%, maturity January 25, 2035) |

10/21/2020 |

|

14,558,333 |

|

10,139,942 |

|

9,317,333 |

||||||

|

|

|

|

|||||||||||

|

Carlyle US CLO 2021-8, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 17.48%, maturity October 20, 2034) |

08/24/2021 |

|

42,537,500 |

|

31,493,450 |

|

28,287,438 |

||||||

|

|

|

|

|||||||||||

|

Cathedral Lake CLO 2013, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7)(11)(19), (Estimated yield 0.00%, maturity October 15, 2029) |

05/31/2018 |

|

21,350,000 |

|

4,104,830 |

|

427,000 |

||||||

(Continued on next page)

See Accompanying Notes.

15

OXFORD LANE CAPITAL CORP.

SCHEDULE OF INVESTMENTS – (continued)

September 30, 2023

(Unaudited)

|

COMPANY/INVESTMENT(1)(13)(14) |

ACQUISITION |

PRINCIPAL |

COST |

FAIR |

% OF |

||||||||

|

Collateralized Loan Obligation – Equity Investments (continued) |

|

|

|

||||||||||

|

Structured Finance – Equity Investments (continued) |

|

|

|

||||||||||

|

Catskill Park CLO, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7)(19), (Estimated yield 0.00%, maturity April 20, 2029) |

02/10/2022 |

$ |

7,942,500 |

$ |

2,754,331 |

$ |

992,813 |

||||||

|

|

|

|

|||||||||||

|

CBAM 2021-14, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 12.31%, maturity April 20, 2034) |

03/24/2022 |

|

20,050,000 |

|

14,968,630 |

|

10,626,500 |

||||||

|

|

|

|

|||||||||||

|

Cedar Funding IV CLO, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 24.34%, maturity July 23, 2034) |

02/10/2022 |

|

42,847,225 |

|

19,838,827 |

|

18,852,779 |

||||||

|

|

|

|

|||||||||||

|

Cedar Funding VIII CLO, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 14.00%, maturity October 17, 2034) |

01/28/2022 |

|

19,126,500 |

|

11,181,947 |

|

8,224,395 |

||||||

|

|

|

|

|||||||||||

|

Cedar Funding XII CLO, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 15.16%, maturity October 25, 2034) |

03/23/2022 |

|

20,008,575 |

|

16,124,547 |

|

12,205,231 |

||||||

|

|

|

|

|||||||||||

|

Cedar Funding XV CLO, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 17.76%, maturity April 20, 2035) |

02/16/2022 |

|

29,235,000 |

|

22,830,500 |

|

19,879,800 |

||||||

|

|

|

|

|||||||||||

|

CIFC Fenway Warehouse II Ltd. |

|

|

|

||||||||||

|

CLO subordinated warehouse notes(4)(5)(7), (Estimated yield 15.17%, maturity October 05, 2023) |

01/27/2022 |

|

296,595 |

|

296,595 |

|

1,138,080 |

||||||

|

|

|

|

|||||||||||

|

CIFC Funding 2014-III, Ltd. |

|

|

|

||||||||||

|

CLO income notes(5)(7)(11)(19), (Estimated yield 0.00%, maturity October 22, 2031) |

03/06/2018 |

|

18,225,000 |

|

6,089,739 |

|

3,462,750 |

||||||

|

|

|

|

|||||||||||

|

CIFC Funding 2021-VII, Ltd. |

|

|

|

||||||||||

|

CLO income notes(5)(7), (Estimated yield 18.28%, maturity January 23, 2035) |

10/18/2021 |

|

27,435,000 |

|

23,373,100 |

|

21,948,000 |

||||||

|

|

|

|

|||||||||||

|

Columbia Cent CLO 28 Limited |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7)(19), (Estimated yield 0.00%, maturity November 07, 2030) |

01/14/2022 |

|

40,000,000 |

|

9,220,962 |

|

400,000 |

||||||

|

|

|

|

|||||||||||

|

Crestline Denali CLO XVI, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7)(19), (Estimated yield 0.00%, maturity January 20, 2030) |

06/10/2021 |

|

22,000,000 |

|

10,422,744 |

|

4,070,000 |

||||||

|

|

|

|

|||||||||||

|

Dryden 33 Senior Loan Fund |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7)(10)(11)(19), (Estimated yield 0.00%, maturity April 15, 2029) |

11/18/2020 |

|

9,600,000 |

|

— |

|

2,496 |

||||||

|

|

|

|

|||||||||||

|

Dryden 38 Senior Loan Fund |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 4.27%, maturity July 15, 2030) |

09/23/2021 |

|

13,100,000 |

|

5,587,755 |

|

2,620,000 |

||||||

(Continued on next page)

See Accompanying Notes.

16

OXFORD LANE CAPITAL CORP.

SCHEDULE OF INVESTMENTS – (continued)

September 30, 2023

(Unaudited)

|

COMPANY/INVESTMENT(1)(13)(14) |

ACQUISITION |

PRINCIPAL |

COST |

FAIR |

% OF |

||||||||

|

Collateralized Loan Obligation – Equity Investments (continued) |

|

|

|

||||||||||

|

Structured Finance – Equity Investments (continued) |

|

|

|

||||||||||

|

Dryden 53 CLO, LLC |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7)(19), (Estimated yield 0.00%, maturity January 15, 2031) |

02/10/2022 |

$ |

9,640,783 |

$ |

3,392,500 |

$ |

2,313,788 |

||||||

|

|

|

|

|||||||||||

|

Dryden 75 CLO, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 17.52%, maturity April 14, 2034) |

08/17/2022 |

|

2,120,000 |

|

1,654,093 |

|

1,270,654 |

||||||

|

|

|

|

|||||||||||

|

Dryden 78 CLO, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7)(11), (Estimated yield 26.19%, maturity April 17, 2033) |

07/25/2023 |

|

7,250,000 |

|

4,429,214 |

|

4,277,500 |

||||||

|

|

|

|

|||||||||||

|

Dryden 86 CLO, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 16.27%, maturity July 17, 2030) |

03/23/2022 |

|

35,350,000 |

|

24,450,774 |

|

18,735,500 |

||||||

|

|

|

|

|||||||||||

|

Dryden 106 CLO, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 18.19%, maturity October 15, 2035) |

10/18/2022 |

|

29,477,500 |

|

22,365,837 |

|

17,746,841 |

||||||

|

|

|

|

|||||||||||

|

Dryden 108 CLO. Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 28.46%, maturity July 18, 2035) |

06/15/2023 |

|

18,600,000 |

|

12,778,748 |

|

13,020,000 |

||||||

|

|

|

|

|||||||||||

|

Elevation CLO 2020-11, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7)(11), (Estimated yield 3.96%, maturity April 15, 2033) |

02/21/2020 |

|

24,000,000 |

|

17,951,800 |

|

11,040,000 |

||||||

|

|

|

|

|||||||||||

|

Elevation CLO 2021-12, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 10.50%, maturity April 20, 2032) |

02/11/2021 |

|

27,190,000 |

|

18,359,989 |

|

10,604,100 |

||||||

|

|

|

|

|||||||||||

|

Elevation CLO 2021-14, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 10.29%, maturity October 20, 2034) |

09/21/2021 |

|

32,000,000 |

|

25,479,876 |

|

16,960,000 |

||||||

|

|

|

|

|||||||||||

|

Elmwood CLO 14 Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 20.64%, maturity April 20, 2035) |

07/24/2023 |

|

26,200,000 |

|

21,131,475 |

|

21,746,000 |

||||||

|

|

|

|

|||||||||||

|

Elmwood CLO V Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 17.82%, maturity October 20, 2034) |

01/25/2022 |

|

10,400,000 |

|

10,561,838 |

|

10,608,000 |

||||||

|

|

|

|

|||||||||||

|

Elmwood CLO XII Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7)(11), (Estimated yield 22.76%, maturity January 20, 2035) |

07/24/2023 |

|

10,750,000 |

|

8,143,161 |

|

8,425,850 |

||||||

|

|

|

|

|||||||||||

|

Fillmore Park CLO, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7)(11), (Estimated yield 34.70%, maturity July 15, 2030) |

07/13/2023 |

|

5,950,000 |

|

2,408,930 |

|

2,499,000 |

||||||

(Continued on next page)

See Accompanying Notes.

17

OXFORD LANE CAPITAL CORP.

SCHEDULE OF INVESTMENTS – (continued)

September 30, 2023

(Unaudited)

|

COMPANY/INVESTMENT(1)(13)(14) |

ACQUISITION |

PRINCIPAL |

COST |

FAIR |

% OF |

||||||||

|

Collateralized Loan Obligation – Equity Investments (continued) |

|

|

|

||||||||||

|

Structured Finance – Equity Investments (continued) |

|

|

|

||||||||||

|

Highbridge Loan Management 3-2014, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7)(19), (Estimated yield 0.00%, maturity July 18, 2029) |

06/19/2020 |

$ |

25,500,000 |

$ |

6,327,059 |

$ |

1,785,000 |

||||||

|

|

|

|

|||||||||||

|

Highbridge Loan Management 5-2015, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 12.54%, maturity October 15, 2030) |

08/03/2021 |

|

23,125,000 |

|

5,639,830 |

|

3,848,231 |

||||||

|

|

|

|

|||||||||||

|

HPS Loan Management 10-2016, Ltd. |

|

|

|

||||||||||

|

CLO income notes(5)(7), (Estimated yield 16.42%, maturity January 20, 2028) |

10/21/2021 |

|

24,460,380 |

|

11,604,310 |

|

8,438,831 |

||||||

|

|

|

|

|||||||||||

|

HPS Loan Management 2021-16, Ltd. |

|

|

|

||||||||||

|

CLO income notes(5)(7), (Estimated yield 16.01%, maturity January 23, 2035) |

11/12/2021 |

|

24,174,000 |

|

21,010,357 |

|

16,438,320 |

||||||

|

|

|

|

|||||||||||

|

ICG US CLO 2014-1, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 26.38%, maturity October 20, 2034) |

03/01/2023 |

|

28,687,500 |

|

5,852,746 |

|

5,594,063 |

||||||

|

|

|

|

|||||||||||

|

ICG US CLO 2018-2, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 17.35%, maturity July 22, 2031) |

05/24/2022 |

|

17,950,000 |

|

7,624,699 |

|

5,564,500 |

||||||

|

|

|

|

|||||||||||

|

Kings Park CLO, Ltd. |

|

|

|

||||||||||

|

CLO income notes(5)(7), (Estimated yield 18.08%, maturity January 21, 2035) |

12/07/2021 |

|

30,552,500 |

|

22,967,857 |

|

21,386,750 |

||||||

|

|

|

|

|||||||||||

|

KVK CLO 2013-1, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7)(19), (Estimated yield 0.00%, maturity January 14, 2028) |

09/22/2020 |

|

3,950,000 |

|

991,513 |

|

592,500 |

||||||

|

|

|

|

|||||||||||

|

LCM 35 Ltd. |

|

|

|

||||||||||

|

CLO income notes(5)(7), (Estimated yield 18.50%, maturity October 15, 2034) |

10/28/2021 |

|

28,000,000 |

|

20,634,368 |

|

15,092,043 |

||||||

|

|

|

|

|||||||||||

|

LCM 40 Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 31.83%, maturity January 15, 2036) |

04/20/2023 |

|

17,000,000 |

|

12,456,691 |

|

14,145,630 |

||||||

|

|

|

|

|||||||||||

|

Longfellow Place CLO, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7)(19), (Estimated yield 0.00%, maturity April 15, 2029) |

01/11/2018 |

|

19,640,000 |

|

5,309,310 |

|

1,964 |

||||||

|

|

|

|

|||||||||||

|

Madison Park Funding XI, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 7.36%, maturity July 23, 2047) |

01/21/2022 |

|

11,000,000 |

|

2,765,376 |

|

2,145,000 |

||||||

|

|

|

|

|||||||||||

|

Madison Park Funding XIII, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7)(11), (Estimated yield 3.15%, maturity April 19, 2030) |

09/17/2019 |

|

21,500,000 |

|

7,644,794 |

|

5,375,000 |

||||||

(Continued on next page)

See Accompanying Notes.

18

OXFORD LANE CAPITAL CORP.

SCHEDULE OF INVESTMENTS – (continued)

September 30, 2023

(Unaudited)

|

COMPANY/INVESTMENT(1)(13)(14) |

ACQUISITION |

PRINCIPAL |

COST |

FAIR |

% OF |

||||||||

|

Collateralized Loan Obligation – Equity Investments (continued) |

|

|

|

||||||||||

|

Structured Finance – Equity Investments (continued) |

|

|

|

||||||||||

|

Madison Park Funding XV, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7)(10)(19), (Estimated yield 0.00%, maturity January 27, 2026) |

03/07/2019 |

$ |

34,300,000 |

$ |

— |

$ |

44,590 |

||||||

|

|

|

|

|||||||||||

|

Madison Park Funding XIX, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7)(11), (Estimated yield 23.86%, maturity January 22, 2028) |

04/06/2023 |

|

12,093,750 |

|

4,825,890 |

|

6,046,875 |

||||||

|

|

|

|

|||||||||||

|

Madison Park Funding XXI, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 20.93%, maturity October 15, 2032) |

01/26/2022 |

|

7,000,000 |

|

4,789,132 |

|

4,060,000 |

||||||

|

|

|

|

|||||||||||

|

Madison Park Funding XXIV, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 10.26%, maturity October 20, 2029) |

03/28/2019 |

|

3,568,750 |

|

1,694,869 |

|

1,320,438 |

||||||

|

|

|

|

|||||||||||

|

Madison Park Funding XXVIII, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 18.47%, maturity July 15, 2030) |

02/01/2022 |

|

4,267,000 |

|

2,436,119 |

|

2,096,277 |

||||||

|

|

|

|

|||||||||||

|

Madison Park Funding XXX, Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7)(11), (Estimated yield 28.64%, maturity April 15, 2047) |

02/23/2018 |

|

17,550,000 |

|

9,531,679 |

|

8,147,487 |

||||||

|

|

|

|

|||||||||||

|

Madison Park Fund XLI, Ltd. (fka: Atrium XII CLO) |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 11.32%, maturity April 22, 2027) |

10/08/2015 |

|

39,075,000 |

|

16,984,469 |

|

15,630,000 |

||||||

|

|

|

|

|||||||||||

|

Man GLG US CLO 2018-2 Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7)(10)(19), (Estimated yield 0.00%, maturity October 15, 2028) |

02/18/2021 |

|

32,000,000 |

|

— |

|

89,600 |

||||||

|

|

|

|

|||||||||||

|

Marble Point CLO XVII Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 25.29%, maturity April 20, 2033) |

05/09/2023 |

|

12,000,000 |

|

5,957,102 |

|

6,000,000 |

||||||

|

|

|

|

|||||||||||

|

Marble Point CLO XVIII Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 16.61%, maturity October 15, 2050) |

01/25/2022 |

|

25,500,000 |

|

19,894,509 |

|

15,300,000 |

||||||

|

|

|

|

|||||||||||

|

Marble Point CLO XXIV Ltd. |

|

|

|

||||||||||

|

CLO subordinated notes(5)(7), (Estimated yield 22.80%, maturity April 20, 2035) |

01/24/2023 |

|

21,690,000 |

|

16,029,366 |

|

14,966,100 |

||||||

|

|

|

|

|||||||||||

|

Medalist Partners Corporate Finance CLO VI Ltd. |

|

|

|

||||||||||

|