Exhibit 4.28

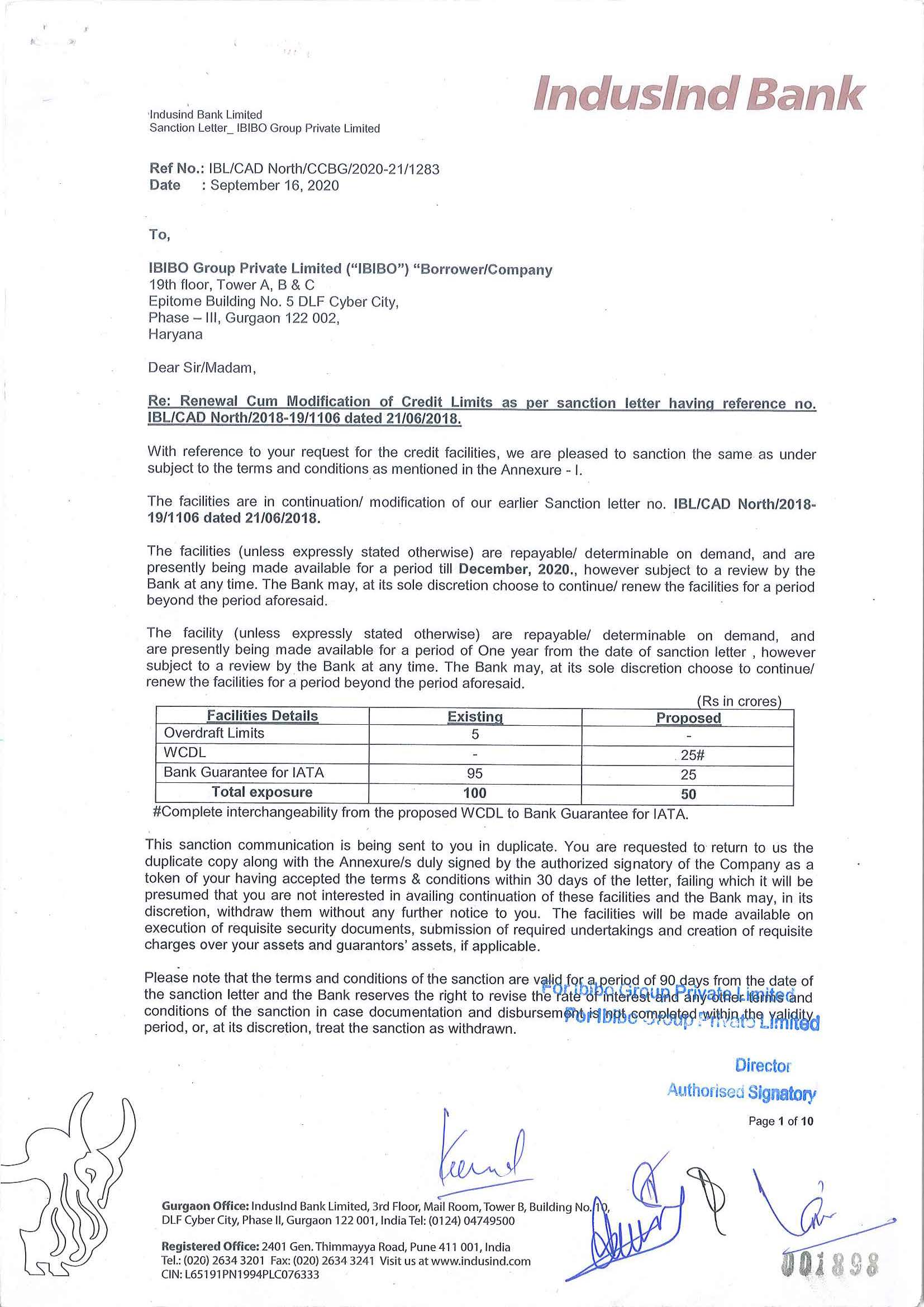

lnduslnd Bank lndusind Bank Limited Sanction letter_IBIB0 Group Private Limited Ref No.: IBL/CAD North/CCBG/2020-21/1283 Date :September 16, 2020 To, IBIBO Group Private Limited ("IBIBO") "Borrower/Company 19th floor, Tower A, B & C Epitome Building No. 5 DLF Cyber City, Phase - Ill, Gurgaon 122 002, Haryana Dear Sir/Madam, Re: Renewal Cum Modification of Credit Limits as per sanction letter having reference no. IBL/CAD North/2018-19/1106 dated 21/06/2018. With reference to your request for the credit facilities, we are pleased to sanction the same as under subject to the terms and conditions as mentioned in the Annexure - I. The facilities are in continuation/ modification of our earlier Sanction letter no. IBL/CAD North/2018- 19/1106 dated 21/06/2018. The facilities (unless expressly stated otherwise) are repayable/ determinable on demand, and are presently being made available for a period till December, 2020., however subject to a review by the Bank at any time. The Bank may, at its sole discretion choose to continue/ renew the facilities for a period beyond the period aforesaid. The facility (unless expressly stated otherwise) are repayable/ determinable on demand, and are presently being made available for a period of One year from the date of sanction letter , however subject to a review by the Bank at any time. The Bank may, at its sole discretion choose to continue/ renew the facilities for a period beyond the period aforesaid. (Rs in crores) Facilities Details Existing Proposed Overdraft Limits 5 - WCDL - . 25# Bank Guarantee for lATA 95 25 Total exposure 100 50 . . #Complete interchangeability from the proposed WCDL to Bank Guarantee for IATA . This sanction communication is being sent to you in duplicate. You are requested to return to us the duplicate copy along with the Annexure/s duly signed by the authorized signatory of the Company as a token of your having accepted the terms & conditions within 30 days of the letter, failing which it will be presumed that you are not interested in availing continuation of these facilities and the Bank may, in its discretion, withdraw them without any further notice to you. The facilities will be made available on execution of requisite security documents, submission of required undertakings and creation of requisite charges over your assets and guarantors' assets, if applicable. Please note that the terms and conditions of the sanction are valid for a period of 90.Days from the date of the sanction letter and the Bank reserves the right to revise the rate of interest and any other terms and conditions of the sanction in case documentation and disbursement is not completed within the validity period, or, at its discretion, treat the sanction as withdrawn. Gurgaon Office: lnduslnd Bank limited, 3rd Floor, Mail Room, Tower B, Building No. 10 , DLF Cyber City, Phase II, Gurgaon 122 001, India Tel: (0124) 04749500 Registered Office: 2401 Gen. Thimmayya Road, Pune 411001, India Tel.: (020) 2634 3201 Fax: (020) 2634 3241 Visit us at www.indusind.com CIN: L65191PN1994PLC076333 For IBIB0 Group Private Limited Director Authorised Signatory Page 1 of 10

lndusind Bank limited Sanction Letter_ IBIBO Group Private limited Assuring you the best of our attentions, Yours faithfully For lnduslnd Bank Ltd. For lnduslnd Bank Ltd. /s/Vishal sikri /s/roopak jain (vishal Sikri-Team Leader MCG) (Roopak jain-Zonal Head MCG) Accepted the above terms and conditions. We hereby confirm execution of the facility and security documents executed in favour of Bank and confirm that the securities created there under will continue for the above mentioned facilities. For IBIBO Group Private Limited /s/Vikas saini /s/Malaya kumar pallai (Authorised Signatory) Name of Authorised Signatory : vikas Saini/ Malaya kumar pallai Designation : vice president finance Place of Execution Date of Execution Corporate Guarantor: For Make My Trip limited ("MMT") (Nasdaq listed entity incorporated in Mauritius) /s/kamal (Authorised Signatory) kamal avutapalli Name of Authorised Signatory kamal avutapalli Designation Authorised Signatory Place of Execution Date of Execution Page 2 of 10

lndusind Bank Limited Sanction Letter_ IBIBO Group Private Limited Annexure I Terms and Conditions IBIBO Group Private Limited Bank Guarantee -1 for lATA Type of Facilitv Nature Financial/ Performance Guarantees. Limit Guarantee Rs. 25 crores. Purpose To be submitted to lATA for guarantying the payment obligations. Period of Sanction 12 months Cash Margin Nil Commission 0.50% p. a. plus applicable taxes. Tenor (including claim period) Up-to 36 months including claim period of 12 months Security As mentioned in the security template. Guarantee As mentioned in the security template. Special Covenants for Bank Guarantee: 1. Guarantees will be issued only after submission and examination and appraisal of documentary evidence of the underlying obligation. 2. A separate Counter Guarantee of the company is to be submitted prior to issue of each Bank Guarantee, unless an omnibus counter guarantee has been submitted. 3. The Bank will not normally issue any guarantee that: a) Does not contain a clause limiting the liability and the period for honoring claims, in a form approved by the Bank b) Contains any onerous clause or places a undue liability, or is required in a format not acceptable to the Bank. c) Requires the Bank to automatically renew I extend the guarantee d) Relates to performance of an obligation not related to borrower's normal business e) Purports to guarantee direct/indirect borrowings. This does not apply to 'Advance Payment Guarantees in connection with contract execution. f) The Bank has not received, to its satisfaction, documentary evidence of the underlying obligation and of the Borrowers ability to fulfill the same. 4. Payment will be made on an invoked Bank Guarantee, immediately on receipt of a valid claim, without reference to you, under intimation to you, by debit to your operative cash credit/ current account, for which you are obliged to make good the funds, forthwith. 5. The company and the guarantor shall undertake to provide full margin when demanded by the Bank with 7 days prior notice in the event the bank does want to renew the Bank Guarantee. In the event of an invocation, if the Bank had to pay to the beneficiary upon invocation of the bank guarantee, company to pay the amount of guarantee to the Bank immediately when demanded by the Bank. 6. The Bank, may at its discretion permit issue of guarantees on behalf of The Bank, may at its discretion permit issue of guarantees on behalf of MakeMyTrip India Private Limited: a) A Board Resolution stating, "the Borrowers are responsible for any risk and liability arising out of the BGs issued on behalf of the SPV/ JVs/ consortia and the securities offered by the company can be appropriated towards such liabilities. b) A request letter from the company authorizing the Bank to issue the BG on behalf of consortium, from out of the limit sanctioned to the borrower. c) BGs on behalf of consortium/JVs will be issued only after approval of such consortium arrangements (names, capabilities, liabilities, etc. of foreign and Indian partners) d) A counter guarantee authorized by a Board resolution from the subsidiary/ JV entity, if required. 7. The borrower should submit a quarterly certificate from a practicing CA I statutory auditor that all payments I settlements to lATA were done promptly, supported by details of instrument and proof of payment to lATA (Bank statement), listing out delays, beyond 3 days if any. Also no certificate is required if payment has been made through lnduslnd Bank Account. 8. The company/ Borrower should undertake to inform the Bank immediately, by means of a special letter, in case of any adverse event as regards performance of the underlying obligation such as claims, counterclaims, dispute, cost and time overruns Court I Arbitration proceedings and the like. Page 3 of 10

lndusind Bank limited Sanction Letter_ IBIBO Group Private limited Type of Facility Working Capital Demand Loan (Fresh) Purpose To meet working capital requirements/ Short term cash flow mismatches. Rate of interest Minimum: One Year MCLR plus 1.05% spread presently, 10.0% p.a. at yearly rest. Currently one month MCLR is 8.95% p.a. The bank has the right to substitute/change MCLR with any alternate rate or change the spread over MCLR or over such rate as per policy of the bank or as may be requested by RBI/statutory directives. Period of Sanction Repayable on demand, subject to review at annual intervals or as may be decided by the Bank. The Bank reserves the right at its sole discretion without assigning any reason whatsoever, to terminate the said Banking Facilities concerned, at any time, and to recall any or all of the amounts due under the said Banking Facilities. All amounts due in respect of the said Banking Facilities shall become payable forthwith on such demand. As regards the un-utilized limits if any under the facility, Bank reserves the right at any point of time, to revoke or cancel and/or vary, alter or modify the said un-utilized limits, at Bank's discretion without prior notice & without assigning any reasons therefore. Margin Receivables - 25% Cover period - 180 days. Drawings & Exclusions Drawing Power will be computed by applying the above margins to outstanding receivables. Security As mentioned in the security template. Guarantee As mentioned in the security template. Documentation As per Bank's internal policies/ guidelines. Other conditions Working Capital Demand Loans (WCDL) will be disbursed subject to the following terms: • Drawings will be permitted on the basis of average floats/cash flow routing in the account or the drawing power as calculated above. • Permitted in foreign currency out of FCNR funds (subject to availability) or in Rupees. • Disbursement will be permitted in single tranche of maximum up-toRs. 10 crores with cooling period of 1 day before the 2nd tranche disbursement. • Each loan will be for a maximum duration of 45 days at a time with a cooling period of 1 day. • Disbursement/ rollover of WCDL will be strictly as per the sanction terms. • Notwithstanding a specified term, the WCDL will become immediately due and payable on occurrence of an event of default or on expiry of the period of sanction or if the Bank, in its absolute discretion has asked for the loan to be so repaid. • Rate of interest is liable to change in case of any RBI I statutory directive, or in case of major volatility in money markets. • The facility should not be used for any speculative purposes or for any activity not permitted under RBI and/or statutory directives. • Utilization of funds must be in compliance with end use guidelines of RBI. Interchangeability One Way interchangeable with lATA BG to the extent of Rs. 22 crores. Other terms • FD margin (50% under lien as FD and 12.5% unencumbered FD) is to be held in the name of the borrower. • 1-day cooling period on WCDL facility will not be waived. For IBIBO Group Private Limited authorised Signatory page 4 of 10

lndusind Bank limited Sanction Letter_ IBIBO Group Private limited For WCDL: Drawings under these facilities will be subject to "Drawing Power" computation based on monthly stock statements/ cash flow routing in the account. While calculating drawing power value of primary securities would be determined in the same manner as arrived by the company in its annual audited accounts and should ordinarily be as follows: Raw Materials & Stores-Lowest of cost/ market/ control price Stock in process-At cost of production Finished goods-Lower of cost of Sales/ market price Receivables & Book Debts- At billing price Any deviation should have Bank's consent. Stock Statements It is essential that the outstanding borrowings at all times are fully covered by the value of the hypothecated security less the stipulated margins and less value of stocks purchased I imported against usance letters of credit outstanding. The value of the security to be taken at market value/actual value whichever is less. If, at any time, the drawing power yielded by the stocks, stores etc., held by the borrower falls below the amount borrowed, the borrower should forthwith adjust such excess under advice to us. In order to ensure compliance with this requirement, it is necessary that appropriate books and records (e.g. a control ledger/register) are maintained by the borrower showing the relevant particulars on a periodic basis. It should be possible for the borrower to watch the extent of the outstanding borrowings I liability vis-a-vis the stock position and for the Bank to verify at any future date the declarations and statements required to be submitted to it under the arrangements, on the basis of books and records maintained by the borrower. The stocks/book-debts statement as on the last day of each month should be submitted to the bank within 15 days from the last day of the preceding month. Boards mentioning that the stocks are hypothecated to the Consortium/ Bank are to be displayed at a prominent place at the factories and warehouses. Security template applicable for all the facilities: Facilities: All. 1. Security: Exclusive charge over all the assets (as per annexure II, define below) of the company as mentioned in the sanction letter and further listed in the Schedule II of the Deed of Hypothecation (and any modifications thereafter or any fresh deed of hypothecations executed thereafter.) signed between the Bank and the Company, and vehicles which are purchased or will be purchased by the Company under hypothecation to lnduslnd Bank Ltd, but excluding vehicles which are purchased or will be purchased by the Company under hypothecation to other financing Bank(s). 2. FD margin for the WCDL facility: 1. 50% in the form of lien marked FD. Complete documents to be executed for the 50% cash margin. 2. 12.5% in the form of unencumbered FD. Company to give a letter stating that these deposits can be used towards adjusting WCDL's. 3. FD (encumbered and unencumbered) to the extent of 0.625x of WCDL facility and the remaining, i.e. 0.375x in the form of FD/Fioat, availed in MMT and IBIBO, be maintained with IBL at all points in time during the currency of the WCDL. 4. Guarantee: Corporate Guarantee of MakeMy Trip Limited (Nasdaq listed entity incorporated in Mauritius) For IBIBO Group Private Limited Authorised Signatory Page 5 of 10

lndusind Bank limited Sanction Letter_ IBIBO Group Private limited 5. Guarantee undertaking: An undertaking from the borrowing company as well as the guarantors shall be obtained that no consideration whether by way of commission, brokerage fees or any other form , would be paid by the former or received by the latter, directly or indirectly. Security creation timelines: 1. Facility documentation to be completed upfront. 2. ROC charge to filed upfront. 3. ROC charge on cash margin to be fi led upfront. 4. Lien to be marked on the FD's upfront. 5. Cor orate Guarantee to be obtained u front. General Covenants applicable to all facilities Others Terms and Conditions Processing Fee 0.25% plus applicable taxes to be payable. Penal interest rate Applicable rate+2%: For non-submission of any information desired by the Bank. Applicable Rate+2%: For other irregularities rendering the account overdue, invocation of BG, non-servicing of OD interest timely, non-payment of bank dues timely, etc. Inspection Quarterly cost to be borne by the company. Insurance All assets charged I financed by the Bank to be fully insured for 100% of the value in the name of the borrower with the Bank Clause. Other conditions During FY21 Company should route at-least 20% of group turnover through IBL counters. From FY22 onwards Company should route at-least Rs. 1000 crores of turnover through IBL counters annually. Company's performance and cash position as well as the unencumbered cash position of the parent company should be monitored on a quarterly basis and a brief report comprising revenues, cash deposits and turnover routed through IBL counters shall be submitted to Bank within 7-days of the quarterly earnings release for the concerned quarter. CA certified undertaking/letter should be obtained from the company stating that it has been a standard asset in the books of its existing lenders (if any) and that it has never been under the purview of CDR/ BIFR in preceding 3 years, and that it has not entered into an OTS with any bank/FI in last 3 years. A written confirmation to be obtained from the company that it! its directors do not appear on RBI/CIBIL defaulter list or SAL of ECGC. (Pre-disbursement condition). Un-hedged Foreign Currency Exposure Company to submit information on un-hedged foreign currency exposure on a quarterly basis on self-certification basis. However, at-least on annual basis, UFCE information should be audited and certified by the statutory auditors of the Company or a Chartered Accountant. First such information to be provided before disbursement/release. UFCE data statement to be submitted within 30 days of the quarter. Where client is not having any foreign currency exposure following declaration to be submitted by the company on their letter head that they have no unhedged exposure in foreign currency as on the date of declaration. Other Compliance The facility/ enhanced facilities should be released only after obtaining a declaration from the borrowers about the credit facilities already enjoyed by them from other banks as specified in Annex I to RBI's circular no., DBOD.No.BP.BC.94/08.12.001/2008-09 dated December 8, 2008 read with circular RBI/2008-2009/183/DBOD. No. BP .BC.46/08.12.001/2008-09 dated September 19, 2008. No deferrals will be permitted for this. Quarterly information in the format specified in the above circulars is passed on to the other banks, and information called for likewise from them. Cases of protracted refusal of other banks to supply information should be escalated. For IBIBO Group Private Limited Authorised Signatory Page 6 of 10

lndusind Bank Limited Sanction Letter_ IBIBO Group Private Limited Banks are required to obtain regular certification by a professional Company Secretary, Chartered Accountants or Cost Accountants regarding compliance of various statutory prescriptions that are in vogue, as per specimen given in Annex Ill to the circular DBOD.No.BP.BC.110/08.12.001/2008-09 February 10, 2009. MFN Clause Borrower shall, during the currency of the facilities, keep the Bank informed about the covenants, representation, undertaking, event of default, and securities stipulated by other Lenders (existing indebtedness , refinancing of existing debt and incremental new debt). Borrower agrees that if any better terms relating to any of covenants, representation , undertaking, event of default, and I or securities are offered to or agreed with any other Lenders by the Borrower, then the same covenants, representation, undertaking, event of default, and I or securities shall be offered to the Bank within 10 days of accepting such terms, and sanctions terms of the Facility from the Bank shall suitably modified and Borrower shall execute all necessary supplemental/ amendatory documents in the form ats acceptable to Bank. The decision of Bank in this behalf shall be final and binding upon Borrower. Non Compliance of such requirement shall be an Event of Default of the Facility. Ownership covenant Bank reserves the right to demand prepayment of the facilities in the event of reduction in share-holding of MMT Limited (Mauritius entity) (direct/indirect) in the company to less than 51%. Events of Default The following will constitute an event of default under the facility: The Borrower is in default to the Bank in this or any other facility, or is in default to any other bank or financial institution. The Borrower has not complied with any loan covenant applicable for this facility or for any other facility. The Borrower ceases to carry on operations/ prolonged strike/ lock outs. Any material adverse change, which in the opinion of the Bank impairs the ability of the borrower to make timely repayments. Consequences of Events of Default If an Event of Default has occurred, the Lender may exercise any one or more of the following actions including but not limited to: Accelerate the maturity of the Facility and declare all amounts outstanding in respect of the Facility to be due and payable immediately; Enforce Security; Appointment of Nominee Director on board of the Company; Call for committed unsubscribed/uncalled equity/Parent contribution; Commitment and obligations of the Lender to make disbursement shall be terminated; Conversion at its option the whole or part of its outstanding Facility along with outstanding interest/overdue into equity shares of the Borrower at par; Exercise any other right that the Lender may have under the Financing Documents or under the Indian Law including reprising of the facility. Quarterly cash flow Company to provide a quarterly statement of results clearly mentioning the position of its cash profit/loss. This statement should be provided within one month of the results of the concerned quarter. In case of any significant increase (>5%) in the cash losses incurred by the Company in any fiscal quarter after the Sanction letter dated mentioned above, as compared to the immediately preceding quarter, then the Bank reserves the right to seek cash collateralization of the entire exposure. If the company continues to make cash losses quarter on quarter, bank reserves the right to seek cash collateralization of the entire exposure. For IBIBO Group Private Limited Authorised Signatory Page 7 of10

lndusind Bank Limited Sanction Letter_ IBIBO Group Private Limited Other General Covenants: The borrowing arrangements would be subject to the following terms and conditions: 1. The Bank will have the right to examine the books of accounts of the borrower from time to time with 1 0 days prior notice by officers of the Bank and/or outside consultants and the expenses incurred by the Bank in this regard will be borne by the borrower. 2. The Bank may at its sole discretion disclose such information to such institution(s) in connection with the credit facilities granted to the borrower. 3. During the currency of the Bank's credit facilities, the borrower shall intimate the Bank in writing within 30 days of: a) Effect any change in their capital structure. b) Shall not pledge the shares held by the promoters, group beyond 1 0% of holdings, for raising any loan or for securitizing any loans or advances availed/to be availed by them from any bank/FI/ lender. c) Formulate any scheme of amalgamation/reconstitution. d) Undertake any new project/scheme unless the expenditure on such expansion etc., is covered by the borrower's net cash accruals after providing for dividends, investments, etc., or from long term funds received for financing such new projects or expansion. e) Normal trade credit or security deposits in the usual course of business or advances to employees, etc., are, however, not covered by this covenant. f) Enter into borrowing arrangements either secured or unsecured with any other Bank, financial institution, borrower or otherwise save and except the working capital facilities, granted/to be granted by other consortium /member banks, under consortium/multiple banking arrangement and the term loans proposed to be obtained from financial institutions/banks for completion of the replacement-cum-modernization program. g) Execute any corporate guarantee or bank guarantee as a security in connection with any payment obligation of its group companies. h) Declare dividends for any year except out of the profits relating to that year. 4. The borrower should intimate the bank in writing within 30 days of any material change in their management set up. No material change in the shareholding pattern of the company which has an effect of a possible change in the management control of the company shall be made without prior approval of the Bank. 5. The borrower will keep the Bank informed of the happening of any event, likely to have a substantial effect on their production, sales, profits, etc., such as labor problem, power cut, etc. and the remedial steps proposed to be taken by the borrower. 6. The borrower will inform the Bank if any winding up petition is filed against the borrower. 7. The borrower will keep the Bank advised of any circumstances adversely affecting the financial position of their subsidiaries including any action, taken by any creditor against any of the subsidiaries. 8. The borrower shall submit the declarations as regards: i) Not to use the funds for capital market activities. j) That neither the Company nor the Directors face any litigation, except in the normal course of business. k) The Directors I senior executives of the company, and/or their relatives are not connected with the Bank (IBL) and are not directors in any other bank. I} No commission has been paid to guarantors on extending their guarantee for the advance 9. The Bank would charge the standard service charges in respect of different items of service as in force from time to time. 10. The borrower to furnish to the Bank every year two copies of audited/printed balance sheet and profit and loss account statements of the borrower immediately on being published I signed by the auditors, along with the usual renewal particulars. 11. To forward half-yearly balance sheet and profit and loss account statements within two months from the end of the half-year and annual audited accounts within 3 months. 11. To forward half-yearly balance sheet and profit and loss account statements within two months from the end of the half-year and annual audited accounts within 3 months. For Ibibo Group Private Limited Authorised Signatory Page 8 of 10

lndusind Bank Limited Sanction Letter_ IBIBO Group Private Limited 12. Negative Lien: The borrower should not create, without prior consent of the Bank, charges on their assets as mentioned in sanction letter dated as mentioned above, during the currency of the credit facilities granted by the Bank. 13.1nsurance: All stocks and collateral securities like immovable properties should be kept fully insured against all risks including fire, strikes, riot, malicious damages & natural calamities etc., with the incorporation of Bank's Hypothecation clause and the policies retained by the borrower. A copy of this policy should be submitted to the Bank for their record. 14.0thers: a) Non-fulfillment of above financial and non-financial covenants will trigger an event of default, unless specifically waived in writing. Consequence of an event of default could be levy of penal interest and/or withdrawal of the facility. b) In the event of withdrawal/cancellation of the facility, the borrower accepts to fully cash collateralize any exposure that the Bank has assumed on the client or on behalf of the client, which could not be immediately repaid or unwound. c) Borrower/facilities should conform to guidelines that have been/will be issued by RBI from time to time. d) All interest and cess are exclusive of any taxes and withholdings that may be payable on account of prevailing statutes. e) The Bank has the right to change or modify the rate of interest, or alters the spread, at such intervals or whenever it may deem fit, and a notice of the change to the Borrower will be binding on them. f) In the event of default, The Bank reserves the right at its sole discretion to modify, vary or add to the terms and conditions, or to terminate the said Banking Facilities concerned, at any time, and to recall any or all of the amounts due under the said Banking Facilities. All amounts due in respect of the said Banking Facilities shall become payable forthwith on such demand. g) As regards the un-utilized limits if any under the facility, Bank reserves the right at any point of time, to revoke or cancel and/or vary, alter or modify the said un-utilized limits, at Bank's discretion without prior notice & without assigning any reasons therefore. h) The company shall pay on demand to the bank the cost between the solicitors/ advocates/ company secretaries/ inspectors and clients incurred by them or any of them in connection with the registration of the securities and clarifications/ charges thereof with the Registrar of Companies, compilation of search/ status reports and/ or any other matter incidental to or in connection .with transactions of the Company with the Bank and also reimburse the Bank for all out-of-pocket expenses including legal, stamping, documentation, incurred in the negotiation, documentation, and disbursement of the facility i) During FY21 Company should route at-least 20% of group turnover through IBL counters. From FY22 onwards Company should route at-least Rs. 1,000 crores of turnover through IBL counters annually. j) Company should furnish a written confirmation that the company/ its directors in the best of their knowledge and belief are not defaulters with any bank/Fl. and there are no legal proceedings initiated or pending against them for recovery of any borrowings. In case in the opinion of the Bank's there has been a material adverse change in the Borrower's business and financial condition, such as: i. Sale or curtailment or closure of any of the Borrowers main businesses. ii. Any significant increase in the cash losses incurred by the Company in a fiscal quarter after this sanctioned letter with date of issue as compared to the immediately preceding quarter. iii. Adverse action by any Regulatory Authority. iv. Default to the Bank under any other facility or to any other lender v. Action by any class of stakeholders which is likely to significantly impair Borrower's business vi. Filing of winding up petition by any creditor/shareholder against the Borrower. The Bank is entitled to withhold further disbursements and/or recall the loan in part or full. For Ibibo Group Private Limited Authorised Signatory Page 9 of 10

lndusind Bank Limited Sanction Letter_ IBIBO Group Private Limited Annexure -II Exclusive charge over all the assets of the company excluding vehicles which are purchased or will be purchased by the Company under hypothecation to the financing Bank(s). Plant and Machinery and other movable assets : All present and future of the movable properties of the Borrower including without limitation its movable plant and machinery, furniture and fittings, equipment, computers hardware, computer software, machinery spares, tools and accessories and other movables, both whether now lying loose or in cases or which are now lying or stored in or about or shall hereafter from time to time during the continuance of the security of these presents be brought into or upon or be stored or be in or about all the Borrower's premises, warehouses, stockyards and godowns or those of the Borrower's agents, affiliates, associates or representatives or at various worksites or at any up country place or places or wherever else the same may be or be held by any party including, without limitation, Book Debts : All present and future book debts, outstandings moneys receivable, claims and bills which are now due and owing or which may at any time during the continuance of this security become due and owing to the Borrower in the course of its business by any person, firm , company or body corporate or by the Government Department or office or any Municipal or Local or Public or Semi Government body or authority or any body corporate or undertaking or project whatever in the public sector. Stocks : All present and future stock in trade consisting of raw materials, finished goods, goods in process of manufacturing and other merchandise whatsoever, being movable properties, now or at any time after this Deed: i. Belonging to the Borrower; or ii. At the Borrower's disposal; or iii. Stored or be stored or brought in to upon or in course of transit to the Borrower's factory or premises including any other place in the Borrower's possession or occupation or at any other place. For Ibibo Group Private Limited Authorised Signatory Page 10 of 10