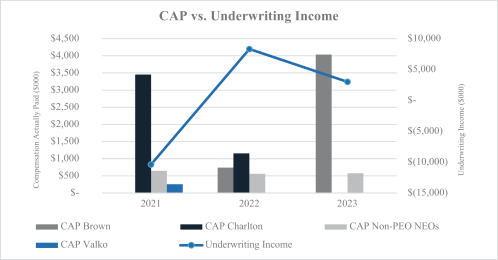

year underwriting income as discussed in “Cash Bonus Opportunity” above. Mr. McGeehan was eligible for an equity bonus between $200,000 and $300,000, with a target of $250,000. Mr. Gibbons was eligible for an equity bonus between $130,000 and $195,000, with a target of $162,500. Mr. Elliott was eligible for an equity bonus between $160,000 and $240,000, with a target of $200,000. Mr. Lam was eligible for an equity bonus between $160,000 and $240,000, with a target of $200,000. Equity bonuses are payable in BVRs.

Performance Results

Messrs. McGeehan, Gibbons, Elliott, and Lam did not qualify for an equity bonus as Global Indemnity’s 2023 underwriting income of $40.4 million was not at least 80% of the 2023 policy year underwriting income goal of $56.268 million.

Other Cash and Equity Awards

Mr. Brown received options on October 21, 2022 to buy 200,000 Class A Common Shares with an exercise price of $20.77. The options vested and became exercisable as follows: 25% on each of November 1, 2022, February 1, 2023, May 1, 2023. Mr. Brown received options on January 2, 2024 to buy 200,000 Class A Common Shares with an exercise price of $32.00. The options vest and become exercisable as follows: 25% each on the first business day of each quarter in 2024 if Mr. Brown is an employee as of each such vesting date. Vesting would accelerate if, prior to vesting, Mr. Brown’s employment with Global Indemnity is terminated by GBLI other than in respect of a Cause Event (as defined in the 2024 CEO Agreement), Mr. Brown’s death or his permanent disability. 25% of the options vested on January 2, 2024 and 25% of the options vested on April 1, 2024. If Mr. Brown is employed by GBLI on January 1st of each year, beginning in 2025, he is eligible to receive 50,000 options to buy Class A Common Shares with an exercise price equal to the closing price of GBLI’s Class A Common Shares on the date of grant. The options, if granted, will vest on December 31, 2028 (subject to Mr. Brown remaining employed with GBLI through each vesting date).

Mr. Oltman received options on January 19, 2021 to buy 140,000 Class A Common Shares with an exercise price of $28.70. One-third of the options will vest on April 1 of each of 2022, 2023 and 2024, subject to the achievement of certain underwriting results for the applicable year as determined by the Board and Mr. Oltman being a Company employee in good standing as of the applicable vesting date. One-third of the options failed to vest on April 1, 2022 as certain underwriting results were not achieved in 2021 and one-third of the options failed to vest on April 1, 2023 as certain underwriting results were not achieved in 2022. One-third of the options failed to vest when Mr. Oltman’s employment with GBLI ended. Mr. Oltman received 26,507 RSUs on June 18, 2019. The RSUs vest 10%, 20%, 30% and 40% on June 18 of each of 2021, 2022, 2023 and 2024, in each case subject to continued service to us through each applicable vesting date. 10% of the RSUs vested on June 18, 2021, 20% of the RSUs vested on June 18, 2022, and 30% of the RSUs vested on June 18, 2023. 40% of the RSUs failed to vest when Mr. Oltman’s employment with GBLI ended.

Mr. Gibbons received 19,181 RSUs on February 9, 2020. The RSUs vest 10%, 20%, 30% and 40% on June 18 of each of 2021, 2022, 2023 and 2024, in each case subject to continued service to us through each applicable vesting date. 10% of the RSUs vested on June 18, 2021, 20% vested on June 18, 2022 and 30% vested on June 18, 2023. Mr. Gibbons received $100,000 of BVRs on March 3, 2022. 16.5% of the BVRs vested on January 1, 2023, 16.5% vested on January 1, 2024 and 17% are scheduled to vest on January 1, 2025. 50% of the BVRs vest if i.) certain combined ratio and premium targets were met in 2022, and ii.) upon the re-measurement of the 2022 combined ratio of GBLI’s insurance operations as of the end of 2025. Mr. Gibbons received $75,000 of BVRs on March 6, 2024. 50% of these BVRs vest on March 6, 2026 and March 6, 2027, respectively.

Mr. Elliott received 17,007 RSUs on February 9, 2020. The RSUs vest 10%, 20%, 30% and 40% on June 18 of each of 2021, 2022, 2023 and 2024, in each case subject to continued service to us through each applicable vesting date. 10% of the RSUs vested on June 18, 2021, 20% vested on June 18, 2022, and 30% vested on June 18, 2023. Mr. Elliott received 50,000 options on March 6, 2024 to purchase Global Indemnity Class A

26