Fundamentally, we bring together foundational real estate and innovative technology expertise around the world to deliver a comprehensive, dedicated product suite to meet customers’ data and connectivity needs. We represent an important part of the digital economy that we believe will benefit from powerful, long-term growth drivers.

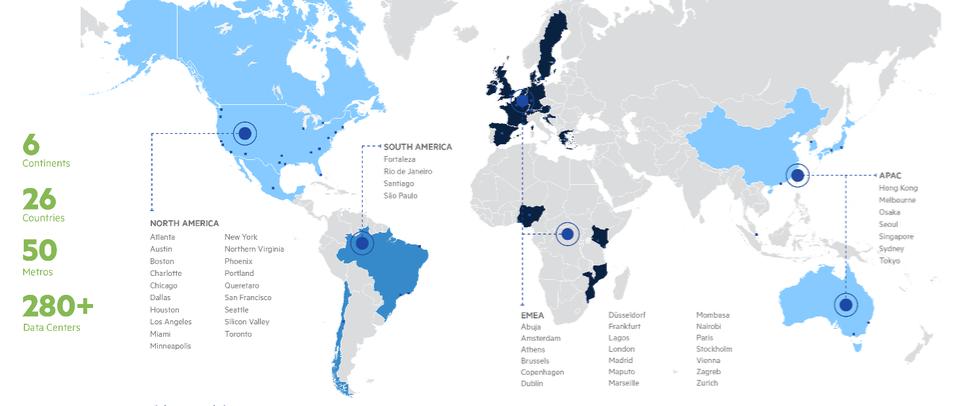

We believe that the growth trends in the data center market, technology, the cloud, internet traffic and internet-based services, combined with cost advantages in outsourcing data center requirements, provide attractive growth opportunities for us as a data center solutions provider. Leveraging deep expertise in technology and real estate, we have an expansive global footprint, impressive scale and a full-spectrum fit-for-purpose product offering in key metropolitan areas around the world. These advantages simplify the contracting process for multinational enterprises, eliminating their need to negotiate with multiple local data center solutions providers. In addition, in areas where high data center construction and operating costs and long time-to-market prohibit many of our customers from building their own data centers, our global footprint and scale allow us to meet our customers' needs quickly and efficiently.

Our Data Center Portfolio

Our portfolio of high-quality data centers provides secure, highly connected and continuously available environments for the exchange, processing and storage of critical data. Data centers are used for digital communication, disaster recovery purposes, transaction processing and housing mission-critical corporate IT applications. Our internet gateway data centers are highly connected, network-dense facilities that serve as hubs for internet and data communications within and between major metropolitan areas. We believe internet gateways are extremely valuable, and a high-quality, highly interconnected global portfolio such as ours could not be easily replicated today on a cost-competitive basis.

We are diversified across major metropolitan areas characterized by a high concentration of connected end-users and technology companies. At December 31, 2021, we owned or had investments in properties, on a wholly-owned basis or through unconsolidated entities, in the following geographies:

Our portfolio contains a total of approximately 45.5 million square feet, including approximately 7.2 million square feet of space under active development and approximately 2.7 million square feet of space held for future development. The 50 data centers held as investments in unconsolidated entities have an aggregate of approximately 35.6 million rentable square feet. The 27 parcels of developable land we own comprise approximately 849 acres. A significant component of our current and future growth is expected to be generated through the development of our existing space held for development and acquisition of new properties. As of December 31, 2021, our portfolio, including the 50 data centers held as investments in unconsolidated entities and excluding space under active development and space held for future development, was approximately 83.6% leased. From time to time we may look to sell individual assets or portfolios of assets that we do not consider to be core to our business and growth strategy.

3