UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ý | ||||||||

Filed by a Party other than the Registrant o | ||||||||

| Check the appropriate box: | ||||||||

| o | Preliminary Proxy Statement | |||||||

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||||||

| ý | Definitive Proxy Statement | |||||||

| o | Definitive Additional Materials | |||||||

| o | Soliciting Material Pursuant to §240.14a-12 | |||||||

| OptiNose, Inc. | |||||

| (Name of Registrant as Specified In Its Charter) | |||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |||||

| Payment of Filing Fee (Check all boxes that apply): | |||||

| ý | No fee required. | ||||

| o | Fee paid previously with preliminary materials. | ||||

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||||

NOTICE OF 2024 SPECIAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT

______________________________________________________________________________________________________

Meeting Date

December 23, 2024

______________________________________________________________________________________________________

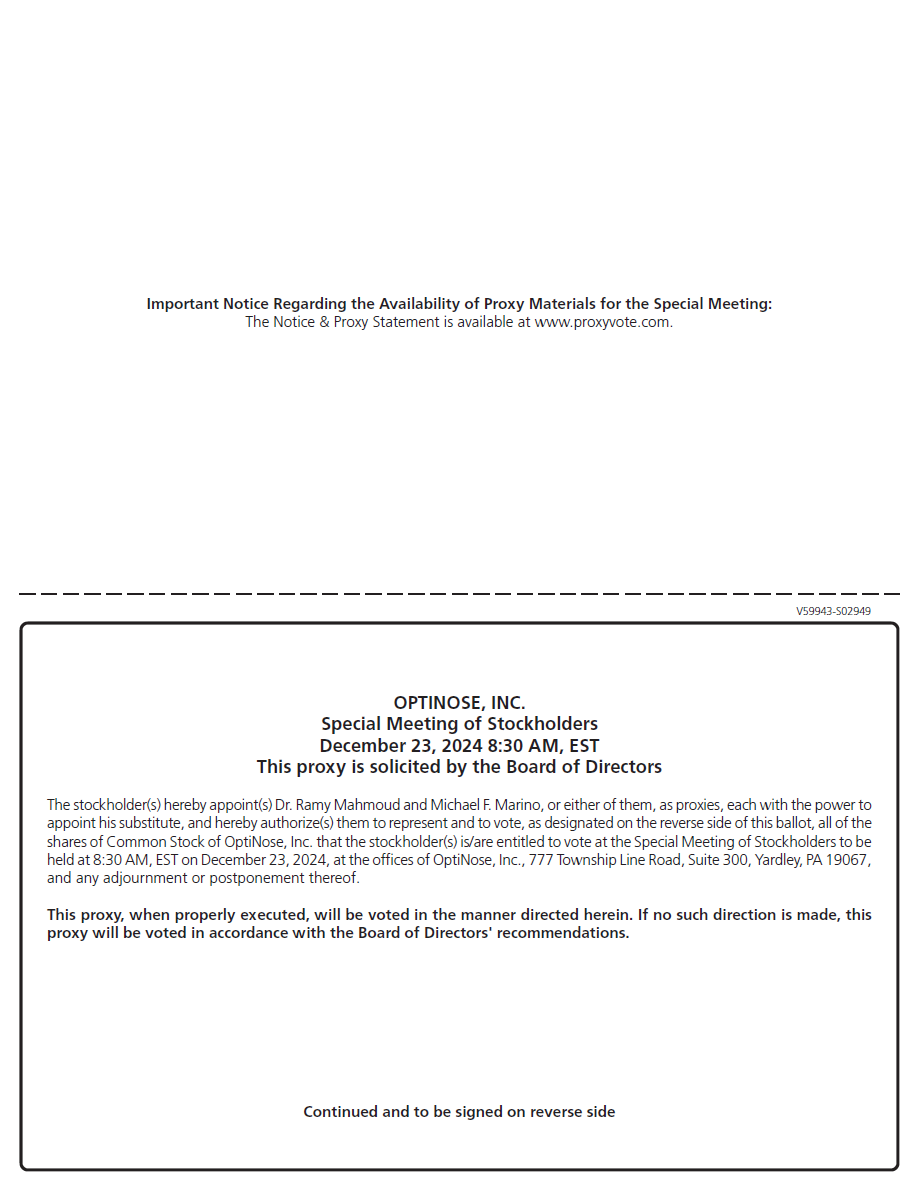

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING TO BE HELD ON DECEMBER 23, 2024:

The proxy materials relating to the 2024 Special Meeting are first being sent to stockholders on or about December 12, 2024. In addition, a complete set of the proxy materials are available on the Internet at www.proxyvote.com.

TABLE OF CONTENTS

| Page | |||||

NOTICE OF 2024 SPECIAL MEETING OF STOCKHOLDERS | |||||

PROPOSAL 1: Reverse Stock Split | |||||

Other Proposed Action | |||||

________________________

In this Proxy Statement, the words “Optinose,” “the Company,” “we,” “our,” “us” and similar terms refer to OptiNose, Inc. and its consolidated subsidiaries, unless the context indicates otherwise.

OPTINOSE®, XHANCE® and the Optinose logo are trademarks of ours in the United States. Other trademarks, trade names and service marks appearing in this Proxy Statement are the property of their respective owners.

777 Township Line Road, Suite 300

Yardley, Pennsylvania 19067

(267) 364-3500

NOTICE OF 2024 SPECIAL MEETING OF STOCKHOLDERS

The 2024 Special Meeting of Stockholders (2024 Special Meeting) of OptiNose, Inc. (Company, we, us, and our) will be held on Monday, December 23, 2024 at 8:30 a.m., Eastern Time, at the offices of OptiNose, Inc., 777 Township Line Road, Suite 300, Yardley, PA 19067, for the following purpose:

To approve an amendment to our Fourth Amended and Restated Certificate of Incorporation to effect a reverse stock split of the Company’s outstanding shares of common stock at a ratio within a range of one-for-ten (1-for-10) to a maximum of one-for-one hundred (1-for-100) split, as determined by the Company’s Board of Directors (the “Board”), and with such reverse stock split to be effected at such time and date, if at all, as determined by the Board in its sole discretion.

Our Board of Directors has fixed the close of business on November 27, 2024 as the record date (Record Date) for determining the stockholders entitled to receive notice of, and to vote at, the 2024 Special Meeting or any adjournments or postponements thereof. The 2024 Special Meeting may be adjourned or postponed from time to time without notice other than by announcement at the 2024 Special Meeting.

Your vote is important. Even if you plan to attend the 2024 Special Meeting, we urge you to submit your proxy or voting instructions as soon as possible so that your shares may be voted at the 2024 Special Meeting. For specific instructions on how to vote your shares, please refer to the “Questions and Answers About the Proxy Materials, Voting and the 2024 Special Meeting” section of this Proxy Statement.

By Order of the Board of Directors,

| Ramy A. Mahmoud, M.D., M.P.H. | |||||

| Chief Executive Officer and member of the Board of Directors | December 12, 2024 | ||||

Optinose - Notice of 2024 Special Meeting of Stockholders

QUESTIONS AND ANSWERS

ABOUT THE PROXY MATERIALS, VOTING AND

THE 2024 SPECIAL MEETING

Proxy Materials

Why are we calling the 2024 Special Meeting?

Our Board of Directors is soliciting your proxy to vote at our 2024 Special Meeting of Stockholders (2024 Special Meeting), which will take place on Monday, December 23, 2024 at 8:30 a.m., Eastern Time, at the offices of OptiNose, Inc., 777 Township Line Road, Suite 300, Yardley, PA 19067. On or about December 12, 2024, we will begin mailing the proxy materials to our stockholders who owned shares of Optinose common stock at the close of business on November 27, 2024 (Record Date), and that entitles you to vote at the 2024 Special Meeting. The proxy materials describe the matters on which our Board of Directors would like you to vote and contain information that we are required to provide to you under the rules of the U.S. Securities and Exchange Commission (SEC) when we solicit your proxy. As many of our stockholders may be unable to attend the 2024 Special Meeting, proxies are solicited to give each stockholder an opportunity to vote on all matters that will properly come before the 2024 Special Meeting. References in this Proxy Statement to the 2024 Special Meeting include any adjournments or postponements of the 2024 Special Meeting.

We are calling the 2024 Special Meeting to seek the approval of our stockholders to approve an amendment to our Fourth Amended and Restated Certificate of Incorporation to effect a reverse stock split of the Company’s outstanding shares of common stock at a ratio within a range of one-for-ten (1-for-10) to a maximum of one-for-one hundred (1-for-100), as determined by the Company’s Board of Directors (the “Board”), and with such reverse stock split to be effected at such time and date, if at all, as determined by the Board in its sole discretion.

What is included in the proxy materials?

The proxy materials include:

•the Notice of the 2024 Special Meeting of Stockholders and this Proxy Statement (Proxy Statement); and

•a proxy or voting instruction card that accompanies these materials.

The information in this Proxy Statement relates to the proposal to be voted on at the 2024 Special Meeting, the voting process, beneficial owners of our common stock and other required information.

How can I access the proxy materials over the Internet?

The proxy or voting instruction card that accompanied these materials contains instructions on how to:

•view the proxy materials for the 2024 Special Meeting on the Internet and vote your shares; and

•instruct us to send our future proxy materials to you electronically by email.

Our proxy materials are also available at www.proxyvote.com.

Choosing to receive your future proxy materials by email will save us the cost of printing and mailing documents to you. If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by email will remain in effect until you revoke it.

Optinose - Proxy Statement for Special Meeting of Stockholders | 1

Voting Information

What items of business will be voted on at the 2024 Special Meeting and how does the Board recommend that I vote on such items?

There is one item of business scheduled to be voted on at the 2024 Special Meeting and the Board's recommendation for voting on such item is set forth below:

Board Recommendation | |||||||||||

| Proposal No. 1: | To approve an amendment to our Fourth Amended and Restated Certificate of Incorporation to effect a reverse stock split of the Company’s outstanding shares of common stock at a ratio within a range of one-for-ten (1-for-10) to a maximum of one-for-one hundred (1-for-100), as determined by the Company’s Board of Directors (the “Board”), and with such reverse stock split to be effected at such time and date, if at all, as determined by the Board in its sole discretion. | FOR | |||||||||

See the "Proposal" section of this Proxy Statement for information on this proposal.

What happens if additional matters are presented at the 2024 Special Meeting?

Other than the item of business described in this Proxy Statement, we are not aware of any other business to be acted upon at the 2024 Special Meeting. If you grant a proxy, the persons named as proxy holders, Dr. Ramy Mahmoud and Michael Marino, or either of them, will have the discretion to vote your shares on any additional matters properly presented for a vote at the 2024 Special Meeting or any adjournments or postponements thereof.

How many votes do I have?

There were 150,829,507 shares of common stock issued and outstanding as of the close of business on the Record Date. Each share of our common stock that you owned as of the Record Date entitles you to one vote on each matter presented at the 2024 Special Meeting.

What is the difference between holding shares as a "stockholder of record" as compared to as a "beneficial owner"?

Most of our stockholders hold their shares as a beneficial owner through a broker, bank, trust or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

•Stockholder of Record: If your shares are registered directly in your name with our transfer agent, Broadridge Corporate Issuer Solutions, Inc., you are considered the stockholder of record with respect to those shares. As the stockholder of record, you have the right to grant your voting proxy directly to us or to vote in person at the 2024 Special Meeting. If you do not wish to vote in person or you will not be attending the 2024 Special Meeting, you may vote by proxy over the Internet, by telephone or by mail by following the instructions contained on the proxy card that accompanied your proxy materials. See “How can I vote my shares without attending the 2024 Special Meeting?” below.

•Beneficial Owner: If your shares are held through a broker, bank, trust or other nominee, like the vast majority of our stockholders, you are considered the beneficial owner of shares held in street name, and certain proxy materials were forwarded to you by that organization. As the beneficial owner, you have the right to direct your broker, bank, trustee, or other nominee how to vote your shares. Since a beneficial owner is not the stockholder of record, you may not vote your shares in person at the 2024 Special Meeting unless you obtain a “legal proxy” from the broker, bank, trustee, or other

Optinose - Proxy Statement for Special Meeting of Stockholders | 2

nominee that holds your shares giving you the right to vote the shares at the 2024 Special Meeting. If you do not wish to vote in person or you will not be attending the 2024 Special Meeting, you may vote by proxy over the Internet, by telephone or by mail by following the instructions on the voting instruction card provided to you by your broker, bank, trustee, or other nominee. See “How can I vote my shares without attending the 2024 Special Meeting?” below.

How can I vote my shares in person at the 2024 Special Meeting?

If you hold your shares held in your name as the stockholder of record, you may vote in person at the 2024 Special Meeting. If you are the beneficial owner of shares held in street name, you may vote your shares in person at the 2024 Special Meeting only if you obtain a legal proxy from the broker, bank, trustee, or other nominee that holds your shares giving you the right to vote the shares. Even if you plan to attend the 2024 Special Meeting, we recommend that you also submit your proxy or voting instructions as described below so that your vote will be counted if you later decide not to attend the 2024 Special Meeting.

How can I vote my shares without attending the 2024 Special Meeting?

Whether you hold shares directly as the stockholder of record or as the beneficial owner of shares held in street name, you may direct how your shares are voted without attending the 2024 Special Meeting.

•Stockholder of Record: If you are a stockholder of record, you may vote by proxy. You can vote by proxy over the Internet, by telephone or by mail by following the instructions on the proxy card that accompanied your proxy materials.

•Beneficial Owner: If you are the beneficial owner of shares held in street name, you may also vote by proxy over the Internet, by telephone or by mail by following the instructions on the voting instruction card provided to you by your broker, bank, trustee, or other nominee.

Can I change my vote or revoke my proxy?

If you are the stockholder of record, you may change your vote at any time prior to the taking of the vote at the 2024 Special Meeting by:

•granting a new proxy bearing a later date by following the instructions provided in the proxy card that accompanied your proxy materials;

•providing a written notice of revocation to our Corporate Secretary at 777 Township Line Road, Suite 300, Yardley, Pennsylvania 19067, which notice must be received by our Corporate Secretary before the 2024 Special Meeting; or

•attending the 2024 Special Meeting and voting in person.

If you are the beneficial owner of shares held in street name, you may change your vote at any time prior to the taking of the vote at the 2024 Special Meeting by:

•submitting new voting instructions to your broker, bank, other trustee, or nominee by following the instructions provided in the voting instruction card provided to you by your broker, bank, trustee, or other nominee; or

•if you have obtained a valid legal proxy from your broker, bank, trustee, or other nominee giving you the right to vote your shares, by attending the 2024 Special Meeting and voting in person using the valid legal proxy.

Note that for both stockholders of record and beneficial owners, attendance at the 2024 Special Meeting will not cause your previously granted proxy or voting instructions to be revoked unless you specifically so request or vote in person at the 2024 Special Meeting.

Optinose - Proxy Statement for Special Meeting of Stockholders | 3

Is my vote confidential?

Proxy instructions, ballots, and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed to third parties, except: (1) as necessary to meet applicable legal requirements, (2) to allow for the tabulation of votes and certification of the vote, and (3) to facilitate a successful proxy solicitation.

What is a "broker non-vote"?

If you are a beneficial owner of shares held by a broker, bank, trust or other nominee and you do not provide your broker, bank trust or other nominee with voting instructions, your shares may constitute “broker non-votes”. Broker non-votes occur on a matter when the broker, bank, trust or other nominee is not permitted under applicable stock exchange rules to vote on that matter without instructions from the beneficial owner and instructions are not given. These matters are referred to as “non-routine” matters. However, Proposal No. 1 is considered a “routine” matter. Therefore, if you are a beneficial owner of shares held in street name and do not provide voting instructions, a broker, bank, trustee or other nominee will be permitted to exercise its discretion on this proposal, which means there will be no broker non-votes on this matter.

How many shares must be present or represented to conduct business at the 2024 Special Meeting?

A “quorum” is necessary to conduct business at the 2024 Special Meeting. A quorum is established if the holders of a majority of all shares issued and outstanding and entitled to vote at the 2024 Special Meeting are present at the 2024 Special Meeting, either in person or represented by proxy. Abstentions and broker non-votes will be counted as present for purposes of determining a quorum at the 2024 Special Meeting. If a quorum is not present, the 2024 Special Meeting will be adjourned until a quorum is obtained.

What are the voting requirements to approve the proposal discussed in this Proxy Statement?

Proposal No. 1: Reverse Stock Split Amendment. Votes may be cast: FOR, AGAINST or ABSTAIN. The approval of this proposal requires that the votes cast for the proposal exceed the votes cast against the proposal. Broker non-votes will not occur in connection with this proposal because brokers, banks, trustees and other nominees have discretionary voting authority to vote shares on this proposal under stock exchange rules without specific instructions from the beneficial owner of such shares. Abstentions will have no effect on the outcome of this proposal.

Who will bear the cost of soliciting votes for the 2024 Special Meeting, and how will proxies be solicited?

We will pay the entire cost of preparing, assembling, printing, mailing and distributing the these proxy materials, as well as for soliciting votes. Our directors, officers and employees may solicit proxies or votes in person, by telephone or by electronic communication. We will not pay our directors, officers or employees any additional compensation for these services. We will ask banks, brokers and other institutions, nominees and fiduciaries to forward the applicable proxy materials to their principals and to obtain authority to execute proxies and will reimburse them for certain costs in connection with such activities.

Who will count the votes?

Votes will be counted by the inspector of election appointed for the 2024 Special Meeting.

Where can I find the voting results of the 2024 Special Meeting?

We will announce preliminary voting results at the 2024 Special Meeting and disclose the final voting results in a Current Report on Form 8-K that we will file with the SEC within four business days of the 2024 Special Meeting.

Optinose - Proxy Statement for Special Meeting of Stockholders | 4

Attending the 2024 Special Meeting

How can I attend the 2024 Special Meeting?

You are entitled to attend the 2024 Special Meeting only if you were an Optinose stockholder as of the Record Date (November 27, 2024), or you hold a valid legal proxy from a stockholder of record for attending or voting at the 2024 Special Meeting. You must present valid government-issued photo identification, such as a driver’s license or passport, for admittance. If you are not a stockholder of record but hold shares as a beneficial owner in street name, you must also provide proof of beneficial ownership as of the Record Date, such as your most recent account statement prior to November 27, 2024, or a copy of the voting instruction card provided by your broker, bank, trustee, or other nominee, or other similar evidence of ownership. If you do not provide photo identification or comply with the other procedures outlined above, you will not be admitted to the 2024 Special Meeting.

Please let us know if you plan to attend the 2024 Special Meeting by indicating your plans when prompted if you vote by Internet or telephone or, if you vote by mail, by marking the appropriate box on your proxy or voting instruction card.

The 2024 Special Meeting will begin promptly at 8:30 a.m., Eastern Time. Check-in will begin at 8:00 a.m., Eastern Time, and you should allow ample time for the check-in procedures. The offices of OptiNose, Inc. are located at 777 Township Line Road, Suite 300, Yardley, PA 19067.

PROPOSAL

Proposal 1: Reverse Stock Split Amendment

General

The Board has approved, and recommends that our stockholders approve, an amendment to our Fourth Amended and Restated Certificate of Incorporation in substantially the form attached hereto as Annex A (the “Reverse Split Amendment”), to combine outstanding shares of our common stock into a lesser number of outstanding shares, or a “reverse stock split,” at a specific ratio within a range of one-for-ten (1-for-10) to a maximum of one-for-one hundred (1-for-100), with the exact ratio to be determined by our Board of Directors in its sole discretion. This proposal is referred to below as the “Reverse Stock Split Proposal.” If the stockholders approve the reverse stock split and the Board decides to implement it, the reverse stock split will become effective at the effective time set forth in the Reverse Split Amendment to be filed with the Secretary of State of the State of Delaware.

The Reverse Split Amendment will not change the number of authorized shares of common stock or the relative voting power of such holders of our outstanding shares of common stock. Because the Reverse Split Amendment does not include a proportionate decrease to the number of authorized shares of common stock, the relative number of authorized but unissued

shares of our common stock will materially increase and will be available for issuance by us if the Reverse Split Amendment is

implemented. The reverse stock split, if implemented, will not change the par value of the common stock, which will remain at

$0.001 per share. The number of authorized shares of preferred stock will also remain the same. The reverse stock split will be realized simultaneously for all outstanding shares of common stock and the ratio will be the same for all outstanding shares of common stock. The reverse stock split will affect all holders of our common stock uniformly and each stockholder will hold the same percentage of common stock outstanding immediately following the reverse stock split as that stockholder held

Optinose - Proxy Statement for Special Meeting of Stockholders | 5

immediately prior to the reverse stock split, except for adjustments that may result from the treatment of fractional shares as described below.

The Board approved and recommended seeking stockholder approval of this Reverse Stock Split Proposal on November 26, 2024. The Board may determine in its discretion not to effect any reverse stock split and not to file the Reverse Split Amendment. Subject to approval of the Reverse Split Amendment through the approval of this Reverse Stock Split Proposal, no further action on the part of our stockholders will be required to either implement or abandon the reverse stock split. As detailed below, if the Board does not effect the reverse stock split by filing the Reverse Split Amendment within one year of the date that the proposal is approved by stockholders, the Board will no longer be permitted to effect the reverse stock split as the Board's authority to effect the reverse stock split will expire on such date.

The Board’s determination as to whether and when to effect a reverse stock split will be based on a number of factors, including the closing bid price for our common stock, prevailing market conditions, existing and expected trading prices for our common stock, actual or forecasted results of operations, and the likely effect of such results on the market price of our common stock.

The reverse stock split is not being proposed in response to any effort of which we are aware to accumulate shares of our common stock or obtain control of the Company, nor is it a plan by management to recommend a series of similar actions to our Board or our stockholders.

There are certain risks associated with a reverse stock split, and we cannot accurately predict whether, or assure that, the reverse stock split will produce or maintain the desired results (for more information on the risks, see the section below entitled “Certain Risks Associated with the Reverse Stock Split”). However, our Board believes that the benefits to the Company and our stockholders outweigh the risks and recommends that you vote in favor of the Reverse Stock Split Proposal.

Reasons for the Proposed Reverse Stock Split

Our Board is seeking stockholder approval of the Reverse Stock Split with the primary intent of increasing the price of our common stock in order to meet the Nasdaq’s minimum price per share criteria for continued listing on that exchange. Our common stock currently is publicly traded and listed on the Nasdaq Global Select Market under the symbol “OPTN.” On October 16, 2024, we received a written notice from The Nasdaq Stock Market, LLC (“Nasdaq”) notifying us that for the previous 30 consecutive business days, the bid price for our common stock had closed below the $1.00 minimum bid price requirement for continued inclusion on The Nasdaq Global Select Market as set forth in Nasdaq Listing Rule 5450(a)(1) (the “Minimum Bid Price Requirement”). We have until April 14, 2025 (the “Compliance Date”) to regain compliance with the Minimum Bid Price Requirement. To regain compliance with the Minimum Bid Price Requirement, the closing bid price of our common stock must be at least $1.00 per share for a minimum of 10 consecutive business days prior to the Compliance Date.

If we do not regain compliance with the Minimum Bid Price Requirement by the Compliance Date, we may be eligible for a second 180 calendar day compliance period. If we do not regain compliance within the allotted compliance period(s), including any extensions that may be granted by Nasdaq, Nasdaq will provide notice that our common stock will be subject to delisting. At such time, we would have an opportunity to appeal the delisting determination to a Nasdaq Listing Qualifications Panel (the “Panel”), but there can be no assurance that the Panel would grant our request for continued listing.

If we are delisted from The Nasdaq Global Select Market and we are not able to list our common stock on another exchange, our common stock could be quoted on the OTC Bulletin Board or in the “pink sheets.” As a result, we could face significant adverse consequences including, among others:

•a limited availability of market quotations for our securities;

•a determination that our common stock is a “penny stock” which will require brokers trading in our common stock to adhere to more stringent rules and possibly result in a reduced level of trading activity in the secondary trading market for our securities;

•a limited amount of news and no analyst coverage for us;

Optinose - Proxy Statement for Special Meeting of Stockholders | 6

•we would no longer qualify for exemptions from state securities registration requirements, which may require us to comply with applicable state securities laws; and

•a decreased ability to issue additional securities (including pursuant to short-form registration statements on Form S-3) or obtain additional financing in the future.

Our Board believes that the proposed reverse stock split is a potentially effective means for us to maintain compliance with the Nasdaq listing rules and to avoid, or at least mitigate, the likely adverse consequences of our common stock being delisted from The Nasdaq Global Select Market by producing the immediate effect of increasing the bid price of our common stock.

We also believe that the reverse stock split could enhance the appeal of our common stock to the financial community, including institutional investors, and the general investing public. We believe that a number of institutional investors and investment funds are reluctant to invest in lower-priced securities and that brokerage firms may be reluctant to recommend lower-priced securities to their clients, which may be due in part to a perception that lower-priced securities are less promising as investments, are less liquid in the event that an investor wishes to sell its shares, or are less likely to be followed by institutional securities research firms and therefore more likely to have less third-party analysis of the company available to investors. We believe that the reduction in the number of issued and outstanding shares of our common stock caused by the reverse stock split, together with the anticipated increased stock price immediately following and resulting from the reverse stock split, may encourage interest and trading in our common stock and thus possible promote greater liquidity for our stockholders, thereby resulting in a broader market for our common stock than that which currently exists.

Even if this proposal is approved, the Board will have complete discretion as to whether or not to consummate the reverse stock split. We cannot assure you that all or any of the anticipated beneficial effects on the trading market for our common stock will occur. The Board cannot predict with certainty what effect the reverse stock split will have on the market price of our common stock, particularly over the longer term. Some investors may view a reverse stock split negatively, which could result in a decrease in our trading price and market capitalization. Additionally, any improvement in liquidity due to increased institutional or brokerage interest or lower trading commissions may be offset by the lower number of outstanding shares.

Determination of Ratio

The ratio of the reverse stock split, if approved and implemented, will be within a range of one-for-ten (1-for-10) to a maximum of one-for-one hundred (1-for-100), with the exact ratio within this range to be determined by our Board of Directors in its sole discretion. In determining the specific reverse stock split ratio within this range, the Board intends to considers numerous factors, including:

•our ability to maintain the listing of our common stock on The Nasdaq Global Select Market;

•the historical and projected performance of our common stock;

•prevailing market conditions;

•general economic and other related conditions prevailing in our industry and in the marketplace;

•the projected impact of the selected reverse stock split ratio on trading liquidity in our common stock;

•our capitalization (including the number of shares of our common stock issued and outstanding);

•the prevailing trading price for our common stock and the volume level thereof;

•the continued listing requirements of Nasdaq; and

•potential devaluation of our market capitalization as a result of a reverse stock split.

Principal Effects of the Reverse Stock Split

A reverse stock split refers to a reduction in the number of outstanding shares of a class of a corporation’s capital stock, which may be accomplished, as in this case, by reclassifying and combining all of our outstanding shares of common stock into a proportionately smaller number of shares. After the effective date of the proposed reverse stock split, each stockholder will own a reduced number of shares of common stock. For example, if the Board decides to implement a 1-for-10 reverse stock split, then a shareholder holding 10,000 shares of our common stock before the reverse stock split would instead hold 1,000 shares of

Optinose - Proxy Statement for Special Meeting of Stockholders | 7

our common stock immediately after the reverse stock split. Importantly, the proposed reverse stock split will affect all stockholders uniformly and will not affect any stockholder’s percentage ownership interest in our company (except to the extent that the reverse stock split would result in any stockholders receiving cash in lieu of fractional shares) or proportionate voting power as described below. All shares of common stock will also remain validly issued, fully paid and non-assessable.

By reducing the number of shares of common stock without reducing the number of authorized shares of common stock, the

reverse stock split would effectively increase the relative number of authorized but unissued shares, which the Board may use in connection with future financings or other issuances.

The proposed reverse stock split will also reduce the number of shares of common stock reserved for future awards under our 2010 Stock Incentive Plan and our 2017 Employee Stock Purchase Plan. The per share exercise price of all outstanding option awards will be increased proportionately and the number of shares of common stock issuable upon the exercise of all outstanding option awards will be reduced proportionately. These adjustments will result in approximately the same aggregate exercise price being required to be paid for all outstanding option awards upon exercise, although the aggregate number of shares issuable upon exercise of such option awards will be reduced proportionately following the reverse stock split. The number of shares of outstanding restricted stock units subject to outstanding awards will be reduced proportionately in the same ratio as applicable to our issued and outstanding shares of common stock.

The proposed reverse stock split will also reduce the number of shares of common stock issuable upon exercise of outstanding warrants to purchase shares of our common stock. The exercise price applicable to the outstanding warrants will be increased proportionately, which will reduce the aggregate number of shares of common stock issuable upon any such exercise proportionately with the reduction to the total number of shares of outstanding common stock.

As of November 25, 2024, we were authorized to issue up to 350,000,000 shares of our common stock, par value $0.001 per share, 150,829,507 of which were issued and outstanding, 8,982,814 of which were reserved for future grants under our 2010 Stock Incentive Plan, 1,136,144 of which were reserved for future issuance under our 2017 Employee Stock Purchase Plan, 12,998,730 of which were reserved for issuance upon vesting of outstanding restricted stock units (“RSUs”) and exercise of outstanding stock options, and 56,468,000 of which were reserved for issuance upon exercise of outstanding warrants. If we effect the proposed reverse stock split and file the Reverse Stock Split Amendment, the number of shares of our authorized common stock and our preferred stock will remain unchanged. Further, the Reverse Split Amendment will not affect the par value of our common stock, which, will remain at $0.001 per share, or our preferred stock, which will remain at $0.001 per share.

The following table illustrates the effects of the reverse stock split at various ranges, without giving effect to any adjustments for fractional shares of common stock, on our outstanding shares of common stock as of November 25, 2024:

Optinose - Proxy Statement for Special Meeting of Stockholders | 8

| Before Reverse Stock Split | After Assumed 1-for-10 Reverse Stock Split | After Assumed 1-for-25 Reverse Stock Split | After Assumed 1-for-50 Reverse Stock Split | After Assumed 1-for-100 Reverse Stock Split | |||||||||||||||||||

| Shares of Common Stock Issued and Outstanding | 150,829,507 | 15,082,951 | 6,033,180 | 3,016,590 | 1,508,295 | ||||||||||||||||||

| Shares Reserved for Future Grants of Awards under the 2010 Stock Incentive Plan | 8,982,814 | 898,281 | 359,313 | 179,656 | 89,828 | ||||||||||||||||||

| Shares Reserved for Issuance Upon Vesting of Outstanding RSUs and Exercise of Outstanding Options to Purchase Common Stock | 12,998,730 | 1,299,873 | 519,949 | 259,975 | 129,987 | ||||||||||||||||||

| Shares Reserved for Future Issuance under the 2017 Employee Stock Purchase Plan | 1,136,144 | 113,614 | 45,446 | 22,723 | 11,361 | ||||||||||||||||||

| Shares Reserved for Issuance Upon Exercise of Outstanding Warrants to Purchase Common Stock | 56,468,000 | 5,646,800 | 2,258,720 | 1,129,360 | 564,680 | ||||||||||||||||||

| Total Number of Shares of Common Stock Authorized to be Issued | 350,000,000 | 350,000,000 | 350,000,000 | 350,000,000 | 350,000,000 | ||||||||||||||||||

| Total Number of Shares of Preferred Stock Authorized to be Issued | 5,000,000 | 5,000,000 | 5,000,000 | 5,000,000 | 5,000,000 | ||||||||||||||||||

Because no fractional shares will be issued, holders of our common stock could be eliminated in the event that the proposed reverse stock split is implemented. As of November 25, 2024 we had approximately 1 record holder who held fewer than 100 shares of our common stock, out of a total of approximately 21 record holders. Therefore, we believe that a reverse stock split, even if implemented and approved at a ratio of 1-for-100, would not have a significant effect on the number of holders of our common stock.

Although the number of our outstanding shares of common stock would decrease as a result of the reverse stock split, the Board does not intend to use the reverse stock split as a part of, or a first step in, a “going private” transaction within the meaning of Rule 13e-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). There is no plan or contemplated plan by the Company to take itself private as of the date of this Proxy Statement. Further, the Board is aware that the relative increase in the number of authorized but unissued shares of common stock may have a potential anti-takeover effect, as the Company’s ability to issue additional shares of common stock could be used to thwart persons, or otherwise dilute the stock ownership of stockholders, seeking to control the company. However, the reverse stock split is not being recommended by the Board as part of an anti-takeover strategy.

Our common stock is currently registered under Section 12(b) of the Exchange Act, and the Company is subject to the periodic reporting and other requirements of the Exchange Act. The proposed reverse stock split will not affect the registration of our common stock under the Exchange Act. If the proposed reverse stock split is implemented, our common stock will continue to be reported on The Nasdaq Global Select Market under the symbol “OPTN,” although it would receive a new CUSIP number.

Certain Risks Associated with the Reverse Stock Split

Before voting on the Reverse Stock Split Proposal, you should consider the following risks associated with the implementation of the reverse stock split:

•Although we expect that the reverse stock split will result in an increase in the market price of our common stock, we cannot assure you that the reverse stock split, if implemented, will increase the market price of our common stock in proportion to the reduction in the number of shares of our common stock outstanding or result in a permanent increase in the market price. Accordingly, the total market capitalization of our common stock after the proposed reverse stock split may be lower than the total market capitalization before the proposed reverse stock split and, in the future, the market price of our common stock following the reverse stock split may not exceed or remain higher than the market price prior to the proposed reverse stock split.

•The effect the reverse stock split may have upon the market price of our common stock cannot be predicted with any certainty, and the history of similar reverse stock splits for companies in similar circumstances to ours is varied. The market price of our common stock is dependent on many factors, including our business and financial performance,

Optinose - Proxy Statement for Special Meeting of Stockholders | 9

general market conditions, prospects for future success and other factors detailed from time to time in the reports we file with the SEC. If the reverse stock split is implemented and the market price of our common stock declines, the percentage decline as an absolute number and as a percentage of our overall market capitalization may be greater than would occur in the absence of the reverse stock split.

•Although the reverse stock split would not have any dilutive effect on our stockholders, the reduction in outstanding shares that would result from the reverse stock split would reduce the proportion of shares owned by our stockholders relative to the number of shares authorized for issuance, resulting in there being relatively more authorized shares of common stock available for issuance after the reverse stock split, which shares may be issued by the Board in its discretion. The Board from time to time may deem it to be in the best interests of the Company and its stockholders to enter into transactions and other ventures that may include the issuance of shares of our common stock. If the Board authorizes the issuance of additional shares of common stock subsequent to the reverse stock split, the dilution to the ownership interest of our existing stockholders may be greater than would occur had the reverse stock split not been effected.

•The reverse stock split may result in some stockholders owning “odd lots” of less than 100 shares of our common stock on a post-split basis. These odd lots may be more difficult to sell, or require greater transaction costs per share to sell, than shares in “round lots” of even multiples of 100 shares.

•While the Board believes that a higher stock price may help generate investor interest, there can be no assurance that the reverse stock split will result in a per share price that will attract institutional investors or investment funds or that such share price will satisfy the investing guidelines of institutional investors or investment funds. As a result, the trading liquidity of our common stock may not necessarily improve.

•Although the Board believes that the decrease in the number of shares of our common stock outstanding as a consequence of the reverse stock split and the anticipated increase in the market price of our common stock could encourage interest in our common stock and possibly promote greater liquidity for our stockholders, such liquidity could also be adversely affected by the reduced number of shares outstanding after the reverse stock split.

Treatment of Fractional Shares

Stockholders will not receive fractional post-reverse stock split shares in connection with the reverse stock split. Instead, we will pay to each registered stockholder, in cash, the value of any fractional share interest in our common stock arising from the reverse stock split. The cash payment would equal the fraction to which the stockholder would otherwise be entitled multiplied by the closing sales price of the common stock as reported on The Nasdaq Global Select Market (or other market on which the Company’s common stock is listed), as of the effective date of the reverse stock split. This cash payment may be subject to applicable U.S. federal, state and local income tax.

No transaction costs will be assessed on stockholders for the cash payment. Stockholders will not be entitled to receive interest for the period of time between the effective date of the reverse stock split and the date payment is made for their fractional share interest in our common stock. You should also be aware that, under the escheat laws of certain jurisdictions, sums due for fractional interests that are not timely claimed after the funds are made available may be required to be paid to the designated agent for each such jurisdiction. Thereafter, stockholders otherwise entitled to receive such funds may have to obtain the funds directly from the state to which they were paid.

If you believe that you may not hold sufficient shares of our common stock at the effective date of the reverse stock split to receive at least one share in the reverse stock split and you want to continue to hold our common stock after the split, you may do so by either:

•purchasing a sufficient number of shares of our common stock; or

Optinose - Proxy Statement for Special Meeting of Stockholders | 10

•if you have shares of common stock in more than one account, consolidating your accounts, so that in each case you hold a number of shares of our common stock in each of your accounts prior to the reverse stock split that would entitle you to receive at least one share of our common stock on a post-reverse stock split basis. Common stock held in registered form (that is, shares held by you in your own name on the Company’s share register maintained by its transfer agent) and common stock held in “street name” (that is, shares held by you through a bank, broker or other nominee) for the same investor would be considered held in separate accounts and would not be aggregated when implementing the reverse stock split. Also, shares of common stock held in registered form but in separate accounts by the same investor would not be aggregated when implementing the reverse stock split.

After the reverse stock split, then-current stockholders would have no further interest in the Company with respect to their fractional shares. A person otherwise entitled to a fractional share interest would not have any voting, dividend or other rights in respect of his or her fractional interest except to receive the cash payment as described above. Such cash payments would reduce the number of post-split stockholders to the extent that there are stockholders holding fewer than that number of pre-split

shares within the exchange ratio that is determined by the Board as described above. Reducing the number of post-split stockholders, however, is not the purpose of this proposal or the reverse stock split.

Effect on Beneficial Stockholders

Stockholders holding our common stock through a bank, broker or other nominee should note that such banks, brokers or other nominees may have different procedures for processing the reverse stock split than those that would be put in place by the Company for registered stockholders that hold such shares directly, and their procedures may result, for example, in differences in the precise cash amounts being paid by such nominees in lieu of a fractional share. If you hold your shares with such a

bank, broker or other nominee and if you have questions in this regard, you are encouraged to contact your bank, broker or nominee.

Effect on Registered Book-Entry Holders

The Company's shares of common stock are uncertificated. Therefore, the Company’s registered stockholders hold their shares electronically in book-entry form under the direct registration system for securities.

These stockholders will not have stock certificates evidencing their ownership of our common stock. They are, however, provided with a statement reflecting the number of shares registered in their accounts.

If you hold shares in a book-entry form, you do not need to take any action to receive your post-split shares or your cash payment in lieu of any fractional share interest, if applicable. If you are entitled to post-split shares, a transaction statement will automatically be sent to your address of record indicating the number of shares you hold.

If you are entitled to a payment in lieu of any fractional share interest, a check will be mailed to you at your registered address as soon as practicable after the Company’s transfer agent completes the aggregation and sale described above in “Treatment of Fractional Shares.” By signing and cashing this check, you will warrant that you owned the shares for which you receive a cash payment.

Procedure for Effecting the Reverse Stock Split

If our stockholders approve this proposal, and the Board elects to effect the reverse stock split, we will effect the reverse stock split by filing the Reverse Split Amendment with the Secretary of State of the State of Delaware. The reverse stock split will become effective, and the combination of, and reduction in, the number of our outstanding shares as a result of the reverse stock split will occur automatically, at the effective time set forth in the Reverse Split Amendment, without any action on the part

of our stockholders. Beginning at the effective time of the reverse stock split, each pre-reverse stock split share will be deemed for all corporate purposes to evidence ownership of post-reverse stock split shares. The text of the Reverse Split Amendment is

Optinose - Proxy Statement for Special Meeting of Stockholders | 11

subject to modification to include such changes as may be required by the office of the Secretary of State of the State of Delaware and as the Board deems necessary and advisable to effect the reverse stock split.

The Board reserves the right, notwithstanding stockholder approval and without further action by the stockholders, to elect not to proceed with the reverse stock split if, at any time prior to filing the Reverse Split Amendment, the Board, in its sole discretion, determines that it is no longer in the best interests of the Company and its stockholders to proceed with the reverse stock split. By voting in favor of the reverse stock split, you are expressly also authorizing the Board to delay (until one year from stockholder approval of this proposal) or abandon the reverse stock split. If the Reverse Split Amendment has not been filed with the Secretary of State of the State of Delaware by the close of business on the one-year anniversary of stockholder approval of this proposal, the Board will abandon the reverse stock split.

Certain U.S. Federal Income Tax Consequences of the Reverse Stock Split

The following is a summary of certain U.S. federal income tax consequences of the reverse stock split. It addresses only stockholders who hold our common stock as capital assets for United States federal income tax purposes (generally, property held for investment). It does not purport to be complete and does not address stockholders subject to special rules, such as financial institutions, tax-exempt organizations, insurance companies, dealers in securities, foreign stockholders, stockholders who hold their pre-reverse stock split shares as part of a straddle, hedge or conversion transaction, and stockholders who acquired their pre-reverse stock split shares pursuant to the exercise of employee stock options or otherwise as compensation. This summary is based upon current law, which may change, possibly even retroactively. It does not address tax considerations under state, local, non-U.S. and other laws. The tax treatment of a stockholder may vary depending upon the particular facts and circumstances of such stockholder. Each stockholder is urged to consult with such stockholder’s own tax advisor with respect to the tax consequences of the reverse stock split.

The reverse stock split is intended to constitute a reorganization within the meaning of Section 368 of the Internal Revenue Code of 1986, as amended (the “Code”). Assuming the reverse stock split qualifies as reorganization, a stockholder generally will not recognize gain or loss on the reverse stock split, except to the extent of cash, if any, received in lieu of a fractional share interest, as described below. The aggregate tax basis of the post-reverse stock split shares received will be equal to the aggregate tax basis of the pre-reverse stock split shares exchanged therefor (excluding any portion of the stockholder’s basis allocated to fractional shares), and the holding period of the post-reverse stock split shares received will include the holding period of the pre-reverse stock split shares exchanged. Treasury regulations promulgated under the Code provide detailed rules for allocating the tax basis and holding period of our common stock surrendered to our common stock received pursuant to the reverse stock split. Stockholders holding our common stock acquired on different dates and at different prices should consult their tax advisors regarding the allocation of the tax basis and holding period of such common stock.

A stockholder of the pre-reverse stock split shares who receives cash in lieu of a fractional share interest will generally be treated as having received such fractional share pursuant to the reverse stock split and then as having exchanged such fractional share for cash in a redemption by us. The amount of any gain or loss will be equal to the difference between the portion of the tax basis of the pre-reverse stock split shares allocated to the fractional share interest and the cash received and generally should be capital gain or loss and generally would be a long-term gain or loss to the extent that the stockholder’s holding period

exceeds 12 months. Deductibility of capital losses by stockholders is subject to limitations.

THE PRECEDING DISCUSSION IS INTENDED ONLY AS A SUMMARY OF CERTAIN U.S. FEDERAL INCOME TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT AND DOES NOT PURPORT TO BE A COMPLETE ANALYSIS OR DISCUSSION OF ALL POTENTIAL TAX EFFECTS RELEVANT THERETO. YOU SHOULD CONSULT YOUR OWN TAX ADVISORS AS TO THE PARTICULAR FEDERAL, STATE, LOCAL, NON-U.S. AND OTHER TAX CONSEQUENCES OF A REVERSE SPLIT IN LIGHT OF YOUR SPECIFIC CIRCUMSTANCES.

Effect on Stated Capital

The par value per share of our common stock will remain unchanged at $0.001 per share after the reverse stock split. As a result, our stated capital, which consists of the par value per share of our common stock multiplied by the aggregate number of shares of our common stock issued and outstanding, will be reduced proportionately at the effective time of the reverse stock split. Correspondingly, our additional paid-in capital, which consists of the difference between our stated capital and the aggregate amount paid to us upon the issuance of all currently outstanding shares of our common stock, will be increased by a

Optinose - Proxy Statement for Special Meeting of Stockholders | 12

number equal to the decrease in stated capital. Further, net loss per share, book value per share and other per share amounts will be increased as a result of the reverse stock split because there will be fewer shares of our common stock outstanding.

Because the number of shares of authorized common stock would not be reduced by the reverse stock split the overall effect would be a relative increase in the number of authorized but unissued shares of common stock following the reverse stock split. These shares may be issued by the Board in its discretion. At present the Board has no plans to issue the authorized but unissued shares of common stock that would be made available in the event the stockholders approve the Reverse Stock Split Proposal and the Board elects to implement the reverse stock split. However, if the reverse stock split is implemented the resulting increase in the authorized but unissued shares of common stock may be used for various purposes without further stockholder approval. These purposes may include: raising capital; providing equity incentives to employees, officers, directors or other service providers; in connection with strategic relationships with other companies; expanding our business or product lines through the acquisition of other businesses or products; and other purposes. Any future issuances would have the effect of diluting the percentage of stock ownership and voting rights of the present holders of common stock.

No Appraisal Rights

The Company’s stockholders are not entitled to appraisal rights under Delaware law or the Company’s Certificate of Incorporation with respect to the Reverse Split Amendment, and the Company will not independently provide our stockholders with any such right.

Required Vote and Recommendation of Our Board

Approval of the Reverse Stock Split Proposal requires that the votes cast for the proposal exceed the votes cast against the proposal. Broker non-votes will not occur in connection with the Reverse Stock Split Proposal because brokers, banks, trustees and other nominees have discretionary voting authority to vote shares on this proposal under stock exchange rules without specific instructions from the beneficial owner of such shares. Abstentions will have no effect on the outcome of the Reverse Stock Split Proposal.

Our Board recommends stockholders vote FOR the Reverse Stock Split Proposal.

Other Proposed Action

Our Board of Directors does not intend to bring any other matters before the 2024 Special Meeting, nor does it know of any matters which other persons intend to bring before the 2024 Special Meeting. If, however, other matters not mentioned in this Proxy Statement properly come before the 2024 Special Meeting, the persons named in the accompanying form of proxy will vote on such matters in accordance with the recommendation of our Board of Directors.

Optinose - Proxy Statement for Special Meeting of Stockholders | 13

STOCK OWNERSHIP

Stock Ownership of Directors, Officers and Principal Stockholders

The following table sets forth information known to us concerning the beneficial ownership of our common stock as of November 25, 2024 (unless otherwise indicated by footnote below) for:

•each of our named executive officers;

•each of our directors;

•all of our current directors and executive officers as a group; and

•each person, or group of affiliated persons, known by us to own beneficially more than 5% of our common stock.

Beneficial ownership is determined in accordance with the rules of the SEC as indicated in the footnotes to the table below.

| Name of Beneficial Owner | Common Stock Beneficially Owned (1) | Percent of Class (2) | ||||||||||||

Named Executive Officers and Directors (21) : | ||||||||||||||

Ramy A. Mahmoud, M.D., M.P.H. (3) | 1,413,281 | * | ||||||||||||

Michael F. Marino (4) | 895,049 | * | ||||||||||||

Peter K. Miller (5) | 957,797 | * | ||||||||||||

Paul Spence (6) | 260,417 | * | ||||||||||||

R. John Fletcher (7) | 110,389 | * | ||||||||||||

Wilhelmus Groenhuysen (8) | 172,135 | * | ||||||||||||

Sandra L. Helton (9) | 172,135 | * | ||||||||||||

Tomas Heyman (10) | 128,818 | * | ||||||||||||

Eric Bednarski (11) | 114,379 | * | ||||||||||||

Kyle Dempsey (12) | 114,379 | * | ||||||||||||

All Current Executive Officers and Directors as a Group (11 persons) (13) | 3,473,135 | 2.3% | ||||||||||||

Greater Than 5% Stockholders: | ||||||||||||||

Entities affiliated with FMR LLC (14) | 18,675,561 | 12.4% | ||||||||||||

Nantahala Capital Management, LLC (15) | 15,140,948 | 9.99% | ||||||||||||

Great Point Partners (16) | 15,312,136 | 9.99% | ||||||||||||

MVM Partners (17) | 14,605,263 | 9.5% | ||||||||||||

Acorn Bioventures (18) | 12,042,008 | 7.7% | ||||||||||||

Rosalind Advisors, Inc. (19) | 8,287,503 | 5.4% | ||||||||||||

Stonepine Capital Management, LLC (20) | 8,174,631 | 5.4% | ||||||||||||

_______________

* Represents less than 1% of the outstanding shares of the Company’s common stock.

(1)Beneficial ownership is determined in accordance with Rule 13d-3 under the Securities Exchange Act of 1934 (the "Exchange Act"). A person or group is deemed to be the beneficial owner of any shares of our common stock over which such person or group has sole or shared voting or investment power, plus any shares which such person or group has the right to acquire beneficial ownership of within 60 days of November 25, 2024, whether through the exercise of warrants or options, vesting of restricted stock units or otherwise. Unless otherwise indicated in the footnotes, to our knowledge, each person or entity identified in the table has sole voting and investment power with respect to all shares shown as beneficially owned by them, subject to applicable community property laws.

(2)The beneficial ownership percentage is calculated for each person or group separately because shares of our common stock subject to warrants, options, restricted stock units or other rights to acquire our common stock that are currently exercisable or exercisable

Optinose - Proxy Statement for Special Meeting of Stockholders | 14

within 60 days of November 25, 2024 are considered outstanding only for the purpose of calculating the percentage ownership of the person or group holding such warrants, options, restricted stock units or other rights but not for the purpose of calculating the percentage ownership of any other person or group. As a result, the beneficial ownership percentage for each person or group is calculated by dividing (x) the number of shares reported in the table as beneficially owned by such person or group, by (y) 150,829,507 shares (which represents the number of shares of common stock that were outstanding as of November 25, 2024) plus the number of shares that such person or group has the right to acquire beneficial ownership of within 60 days of November 25, 2024 as indicated in the footnotes below.

(3)Consists of (i) 399,344 shares of common stock, (ii) options to purchase 705,004 shares of common stock exercisable within 60 days of November 25, 2024 and 9,950 restricted stock units that vest within 60 days of November 25, 2024, (iii) 172,421 shares of common stock held by The Ramy Mahmoud 2014 Trust for Cynthia Mahmoud, and (iv) options held by The Ramy Mahmoud 2014 Trust for Cynthia Mahmoud to purchase 126,562 shares of common stock exercisable within 60 days of November 25, 2024.

(4)Consists of (i) 247,998 shares of common stock, and (ii) options to purchase 640,171 shares of common stock exercisable within 60 days of November 25, 2024 and 6,880 restricted stock units that vest within 60 days of November 25, 2024.

(5)Mr. Miller’s employment terminated on January 31, 2023. Reported ownership is based on a Statement of Changes in Beneficial Ownership on Form 4 filed by Mr. Miller on January 13, 2023. Consists of (i) 853,384 shares of common stock held directly by Mr. Miller, and (ii) 104,413 shares of common stock hold by the Deed of Trust of Peter K. Miller, dated October 13, 2014.

(6)Consists of options to purchase 260,417 shares of common stock exercisable within 60 days of November 25, 2024.

(7)Consists of options to purchase 110,389 shares of common stock exercisable within 60 days of November 25, 2024.

(8)Consists of options to purchase 172,135 shares of common stock exercisable within 60 days of November 25, 2024.

(9)Consists of options to purchase 172,135 shares of common stock exercisable within 60 days of November 25, 2024.

(10)Consists of options to purchase 128,818 shares of common stock exercisable within 60 days of November 25, 2024.

(11)Consists of options to purchase 114,379 shares of common stock exercisable within 60 days of November 25, 2024.

(12)Consists of options to purchase 114,379 shares of common stock exercisable within 60 days of November 25, 2024.

(13)Includes current executives (Ramy A. Mahmoud, Chief Executive Officer; Terry Kohler, Chief Financial Officer; Michael F. Marino, Chief Legal Officer; Paul Spence, Chief Commercial Officer, and Anthony J. Krick, Chief Accounting Officer) and current members of the Board of Directors (R. John Fletcher, Wilhelmus Groenhuysen, Sandra Helton, Tomas Heyman, Eric Bednarski, and Kyle Dempsey). Consists of (i) 855,010 shares of common stock and (ii) options to purchase 2,601,295 shares of common stock exercisable within 60 days of November 25, 2024 and 16,830 restricted stock units that vest within 60 days of November 25, 2024.

(14)Based on Amendment No. 8 to the Schedule 13G filed by FMR LLC on November 12, 2024. Shares are held by accounts managed by direct or indirect subsidiaries of FMR LLC. Abigail P. Johnson is a Director, the Chairman and the Chief Executive Officer of FMR LLC. Members of the Johnson family, including Abigail P. Johnson, are the predominant owners, directly or through trusts, of Series B voting common shares of FMR LLC, representing 49% of the voting power of FMR LLC. The Johnson family group and all other Series B shareholders have entered into a shareholders' voting agreement under which all Series B voting common shares will be voted in accordance with the majority vote of Series B voting common shares. Accordingly, through their ownership of voting common shares and the execution of the shareholders' voting agreement, members of the Johnson family may be deemed, under the Investment Company Act of 1940, to form a controlling group with respect to FMR LLC. Neither FMR LLC nor Abigail P. Johnson has the sole power to vote or direct the voting of the shares owned directly by the various investment companies registered under the Investment Company Act ("Fidelity Funds") advised by Fidelity Management & Research Company LLC ("FMR Co. LLC"), a wholly owned subsidiary of FMR LLC, which power resides with the Fidelity Funds' Boards of Trustees. FMR Co. LLC carries out the voting of the shares under written guidelines established by the Fidelity Funds' Boards of Trustees. The address for FMR LLC is 245 Summer Street, Boston, MA 02210.

(15)Based on the Schedule 13G filed by Nantahala Capital Management, LLC (“Nantahala”) on November 14, 2024. Represents (i) 14,356,703 shares of common stock and (ii) 784,245 warrants to purchase shares of common stock. Wilmot B. Harkey and Daniel Mack are the managing members of Nantahala and may be deemed to be the beneficial owners of shares held by Nantahala. Blackwell Partners LLC – Series A, a fund advised by Nantahala, has the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of more than five percent of the outstanding shares of common stock beneficially owned by Nantahala reported in the Schedule 13G. The address for each of these individuals and entities is 130 Main St., 2nd Floor, New Canaan, CT 06840.

Optinose - Proxy Statement for Special Meeting of Stockholders | 15

(16)Based on Amendment No. 3 to the Schedule 13G filed by Great Point Partners, LLC on November 14, 2024. Consists of (i) 7,404,490 shares of common stock held by Biomedical Value Fund, L.P., (ii) 5,097,293 shares of common stock held by Biomedical Offshore Value Fund, Ltd., and (iii) 359,353 shares of common stock held by Cheyne Global Equity Fund. In addition to an aggregate of 12,861,136 shares of common stock in the aggregate held outright, the reporting persons hold in the aggregate warrants to purchase 7,894,736 shares of common stock; however, the provisions of such warrants restrict the exercise of such warrants to the extent that, after giving effect to such exercise, the holder of the warrants and its affiliates, together with any other person or entities with which such holder would constitute a group, would beneficially own in excess of 9.99% of the number of shares of Common Stock outstanding immediately after giving effect to such exercise. As a result, an aggregate of 2,451,000 shares underlying such warrants were beneficially owned by the reporting persons based on a total of 150,829,507 shares of common stock outstanding on November 25, 2024 and 2,451,000 shares of common stock issuable upon exercise of warrants held by the reporting persons (subject to the Beneficial Ownership Cap). Dr. Jeffrey R. Jay, M.D. is a senior managing member of Great Point Partners, LLC, and Ms. Lillian Nordahl is a Managing Director of Great Point Partners, LLC.. Dr. Jay and Ms. Nordahl have voting and investment power with respect to the shares listed above, and therefor may be deemed to be the beneficial owner of these shares. The address for each of these individuals and entities is 165 Mason Street, 3rd Floor Greenwich, CT 06830.

(17)Based on Amendment No. 1 to the Schedule 13D filed by MVM Partners LLC on November 22, 2022, and Amendment No. 2 to the Schedule 13D filed by MVM Partners LLC on February 14, 2023. Consists of (i) 16,372,940 shares of common stock (and warrants to purchase shares of common stock) held by MVM V LP, and (ii) 337,586 shares of common stock (and warrants to purchase shares of common stock) held by MVM GP (No. 5) LP. The aggregate amount includes warrants to purchase an aggregate of 2,105,563 shares of common stock. MVM Partners LLC provides investment advisory services to MVM V LP and MVM GP (No. 5) LP, and in such capacity MVM Partners LLP has voting and dispositive power over such shares. Investment decisions for MVM V LP and MVM GP (No. 5) LP are made by an investment committee. The address for each of these entities is Old City Hall, 45 School St., Boston, MA 02108.

(18)Based on the 13G filed by Acorn Bioventures, L.P. on December 5, 2022 and Amendment No. 1 to Schedule 13G filed by Acorn Bioventures, L.P. on February 13, 2024. Consists of an aggregate of 6,778,851 shares of common stock and warrants to purchase 5,263,157 shares of common stock held by Acorn Bioventures, L.P., Acorn Capital Advisors GP, LLC (“Acorn”), Acorn Capital Advisors HP, LLC (“Acorn GP”), which is the sole general partner of Acorn, Acorn Bioventures 2, L.P. (“Acorn 2”), Acorn Capital Advisors GP 2, LLC (“Acorn GP 2”), which is the sole general partner of Acorn 2, and Anders Hove. Warrants held by the reporting persons are subject to a 9.99% beneficial ownership blocker. Beneficial ownership amounts set forth in the table for these reporting persons gives effect to the blocker as set forth in Amendment No. 1 to Schedule 13G filed by Acorn Bioventures, L.P. on February 13, 2024, and as set forth in such filing is based upon 112,311,984 shares of common stock outstanding as of November 9, 2023 as reported in the Company’s Quarterly Report on Form 10-Q filed with the SEC, and assumes the exercise of the reported warrants subject to the blocker where applicable. Acorn Capital Advisors GP, LLC is the sole general partner of Acorn Bioventures, L.P., and may be deemed to beneficially own the shares of common stock beneficially owned by Acorn Bioventures, L.P. Acorn Capital Advisors GP 2, LLC is the sole general partner of Acorn Bioventures 2, L.P., and may be deemed to beneficially own the shares of common stock beneficially owned by Acorn Bioventures, 2 L.P. Anders Hove is the Manager of Acorn Capital Advisors GP, LLC and Acorn Capital Advisors GP2, LLC, and may be deemed to beneficially own the shares beneficially owned by those entities. The address for each of these individuals and entities is 420 Lexington Ave, Suite 2626 New York, New York 10170.

(19)Based on Amendment No. 5 to the Schedule 13G filed by Rosalind Advisors, Inc. on October 18, 2024. Rosalind Advisors, Inc. (the “Advisor”) is the investment advisor to Rosalind Master Fund L.P. (“RMF”) and may be deemed to be the beneficial owner of shares held by RMF. Represents 8,287,503 shares of common stock, and excludes 1,313,878 warrants to purchase shares of common stock because they contain a blocker provision under which the holder thereof does not have the right to exercise any of the warrants to the extent that such exercise would result in beneficial ownership by the holder in excess of 4.99% of our common stock. Steven Salamon is the portfolio manager of the Advisor and may be deemed to be the beneficial owner of shares held by RMF. Gilad Aharon is the portfolio manager and member of the Advisor which advises RMF. The address of the principal business office of the Advisor, Steven Salamon and Gilad Aharon is 15 Wellesley Street West, Suite 326, Toronto, Ontario, M4Y 0G7 Canada. The address of the principal business offices of RMF is P.O. Box 309, Ugland House, Grand Cayman, KY1-1104, Cayman Island.

(20)Based on the Schedule 13G filed by Stonepine Capital Management LLC (“Stonepine”) on November 20, 2024. Stonepine and Stonepine GP, LLC (“General Partner”) are the investment adviser and general partner, respectively, of Stonepine Capital, L.P. (“Partnership”). Jon M. Plexico is the control person of Stonepine and the General Partner. The reporting persons filed the Schedule 13G jointly, but not as members of a group, and each disclaims membership in a group. Each reporting person also disclaims beneficial ownership of the shares of common stock except to the extent of that person’s pecuniary interest therein. The address of the principal business office for each of these individuals and entities is 919 NW Bond Street, Suite 204, Bend, OR 97703.

(21)The address for each of our executive officers and directors is c/o OptiNose, 777 Township Line Road, Suite 300, Yardley, Pennsylvania 19067.

Optinose - Proxy Statement for Special Meeting of Stockholders | 16

DELIVERY OF DOCUMENTS TO STOCKHOLDERS SHARING AN ADDRESS

We have adopted a procedure, approved by the SEC, called “householding.” Under this procedure, stockholders of record who have the same address and last name will receive only one copy of our proxy materials unless we are notified that one or more of these stockholders wishes to continue receiving individual copies. This procedure will reduce our printing costs and postage fees.

If you are eligible for householding, but you and other stockholders of record with whom you share an address currently receive multiple copies of our proxy materials, or if you hold our stock in more than one account, and in either case you wish to receive only a single copy of each of these documents for your household, please contact our Corporate Secretary by mail, c/o OptiNose, Inc., 777 Township Line Road, Suite 300, Yardley, Pennsylvania 19067 or by phone at (267) 364-3500. If you participate in householding and wish to receive a separate copies of our proxy materials, or if you do not wish to continue to participate in householding and prefer to receive separate copies of these documents in the future, please contact our Corporate Secretary as indicated above.

If you are the beneficial owner of shares held in street name through a broker, bank or other intermediary, please contact your broker, bank or intermediary directly if you have questions, require additional copies of our proxy materials or wish to receive a single copy of such materials in the future for all beneficial owners of shares of our common stock sharing an address.

STOCKHOLDER PROPOSALS AND DIRECTOR NOMINATIONS

If you wish to submit a proposal to be considered for inclusion in next year's proxy materials or nominate a director, your proposal must be in proper form according to SEC Regulation 14A, Rule 14a-8 and received by our Corporate Secretary no later than December 27, 2024. Proposals received after that date will not be included in the proxy materials we send out in connection with our 2025 Annual Meeting of Stockholders. If a proposal is received before that date, the proxies that management solicits for the meeting may still exercise discretionary voting authority on the proposal under circumstances consistent with the proxy rules of the SEC.

In addition, our Bylaws establish an advance notice procedure for nominations for election to our Board of Directors and other matters that stockholders wish to present for action at an annual meeting other than those to be included in our proxy statement. To be timely, stockholder notice of a nomination or a proposal must be delivered to or mailed and received by the Corporate Secretary at our principal offices not later than the close of business on March 8, 2025 and no earlier than the close of business on February 6, 2025; provided, however, that in the event that the date of the 2025 Annual Meeting of Stockholders is held more than thirty (30) days before or more than seventy (70) days after the anniversary date of the 2024 Annual Meeting of Stockholders, notice by the stockholder to be timely must be delivered not earlier than the close of business on the one hundred twentieth (120th) day prior to the 2025 Annual Meeting of Stockholders and not later than the close of business on the later of the ninetieth (90th) day prior to the 2025 Annual Meeting of Stockholders or the tenth (10th) day following the day on which public announcement of the date of such meeting is first made by us. The notice of nomination or proposal also must comply with the content requirements for such notices set forth in our Bylaws. All nominations and stockholder proposals should be sent to the attention of our Corporate Secretary, c/o OptiNose, Inc., 777 Township Line Road, Suite 300, Yardley, Pennsylvania 19067.

In addition to satisfying the foregoing advance notice requirements under our Bylaws, to comply with the universal proxy rules under the Exchange Act, stockholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must provide written notice that sets for the information required by Rule 14a-19 under the Exchange Act no later than April 7, 2025, which is 60 days prior to the anniversary date of the 2024 Annual Meeting of Stockholders.

* * *

Optinose - Proxy Statement for Special Meeting of Stockholders | 17

Your vote is important. Even if you plan to attend the 2024 Special Meeting, we urge you to submit your proxy or voting instructions as soon as possible.

By O

By Order of the Board of Directors of OPTINOSE, INC. | ||||||||

| Chief Executive Officer and member of the Board of Directors | ||||||||

| December 12, 2024 | ||||||||

| Yardley, Pennsylvania | ||||||||

Optinose - Proxy Statement for Special Meeting of Stockholders | 18

ANNEX A

CERTIFICATE OF AMENDMENT OF

FOURTH AMENDED AND RESTATED CERTIFICATE OF INCORPORATION OF

OPTINOSE, INC.

OptiNose, Inc. (the “Corporation”), a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware (the “DGCL”), does hereby certify as follows: