UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

OR

For the fiscal year ended

OR

OR

Date of the event requiring this shell company report _________________

Commission file number:

(Exact name of Registrant as specified in its charter) |

Not Applicable |

(Translation of Registrant’s name into English) |

(Jurisdiction of incorporation or organization) |

(Address of principal executive offices) |

Telephone: +1 ( E-mail: |

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) |

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class | Trading symbol(s) | Name of each exchange on which |

*Not for trading, but only in connection with the listing on the NYSE American

**Effective on February 20, 2024, the ratio of ADSs to our Class A Ordinary Shares was changed from one ADS representing two Class A Ordinary Shares to one ADS representing twenty Class A Ordinary Shares.

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None |

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None |

Indicate the number of outstanding shares of each of the issuer’s classes of capital stock as of the close of the period covered by this report.

| par value $0.003 per share, as of December 31, 2023 |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐ Yes ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

☐ Yes ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ |

| Accelerated filer ☐ |

| |

|

|

|

| Emerging Growth Company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive - based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| International Financial Reporting Standards as issued |

| Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

|

| |

5 | ||

5 | ||

5 | ||

32 | ||

42 | ||

42 | ||

55 | ||

65 | ||

66 | ||

66 | ||

67 | ||

76 | ||

76 | ||

|

| |

|

| |

79 | ||

Material Modifications to the Rights of Security Holders and Use of Proceeds | 79 | |

79 | ||

80 | ||

80 | ||

80 | ||

80 | ||

Purchases of Equity Securities by the Issuer and Affiliated Purchasers | 80 | |

80 | ||

80 | ||

80 | ||

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | 81 | |

81 | ||

81 | ||

| ||

| ||

82 | ||

82 | ||

83 |

2

CONVENTIONS THAT APPLY IN THIS ANNUAL REPORT ON FORM 20-F

Except where the context requires otherwise and for purposes of this annual report only:

| ● | “ADSs” refers to our American depositary shares. Prior to February 20, 2024, each of which represents two Class A Ordinary Shares, and “ADRs” refers to the American depositary receipts that evidence our ADSs. |

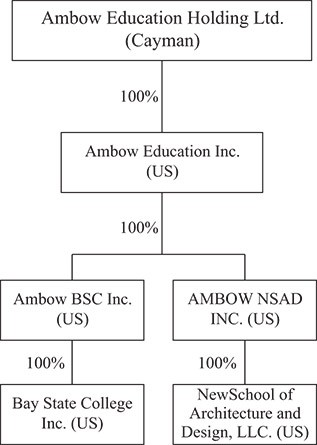

| ● | “Ambow” refers to Ambow Education Holding Ltd., a Cayman Island company; “we,” “us,” “our Company,” “the Company,” “the Group,” “our” or similar terms refer to Ambow Education Holding Ltd., its consolidated subsidiaries unless the context otherwise indicate. |

| ● | “China” or “PRC” refers to the People’s Republic of China, excluding, for the purpose of this annual report, Hong Kong, Macau and Taiwan. |

| ● | “IPO” refers to the initial public offering of our ADSs. |

| ● | “RMB” or “Renminbi” refers to the legal currency of China. |

| ● | “U.S. GAAP” refers to the Generally Accepted Accounting Principles in the United States. |

| ● | “$,” “US$” or “U.S. dollars” refers to the legal currency of the United States. |

3

FORWARD-LOOKING STATEMENTS

This annual report on Form 20-F includes forward-looking statements that relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to differ materially from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Words such as, but not limited to, “believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” “likely,” “will,” “would,” “could,” and similar expressions or phrases identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and future events and financial trends that we believe may affect our financial condition, results of operation, business strategy and financial needs. Forward-looking statements include, but are not limited to, statements about:

| ● | Anticipated trends and challenges in our business and the markets in which we operate; |

| ● | Our ability to anticipate market needs or develop new or enhanced services and products to meet those needs; |

| ● | Our ability to compete in our industry and innovation by our competitors; |

| ● | Our ability to protect our confidential information and intellectual property rights; |

| ● | Risks associated with opening new learning centers and other strategic plans; |

| ● | Our need to obtain additional funding and our ability to obtain funding in the future on acceptable terms; |

| ● | The impact on our business and results of operations arising from the defects in our real properties; |

| ● | Our ability to create and maintain our positive brand awareness and brand loyalty; |

| ● | Our ability to manage growth; |

| ● | Risks associated with school closures. |

All forward-looking statements involve risks, assumptions and uncertainties. You should not rely upon forward-looking statements as predictors of future events. The occurrence of the events described, and the achievement of the expected results, depend on many events, some or all of which are not predictable or within our control. Actual results may differ materially from expected results. See the information under “Item 3.D Key Information—Risk Factors” and elsewhere in this annual report for a more complete discussion of these risks, assumptions and uncertainties and for other risks and uncertainties. These risks, assumptions and uncertainties are not necessarily all of the important factors that could cause actual results to differ materially from those expressed in any of our forward-looking statements. Other unknown or unpredictable factors also could harm our results. We undertake no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this annual report might not occur.

4

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

Item 3. Key Information

A. | [Reserved] |

B. | Capitalization and Indebtedness |

Not applicable.

C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

D. | Risk Factors |

Summary of Risks

An investment in our securities involves a high degree of risk. The occurrence of one or more of the events or circumstances described in the section titled “Risk Factors,” alone or in combination with other events or circumstances, may materially adversely affect our business, financial condition and operating results. In that event, the trading price of our securities could decline, and you could lose all or part of your investment. Such risks include, but are not limited to:

| ● | If we are not able to continue to attract students to enroll in our programs, our net revenues may decline, and we may not be able to maintain profitability. |

| ● | If our expansions into new businesses are not successful, our results of operation and growth prospects may be materially and adversely affected. |

| ● | We face significant competition in each major program we offer and each geographic market in which we operate, and if we fail to compete effectively, we may lose our market share and our profitability may be adversely affected. |

| ● | NYSE may delist our securities from trading on its exchange, which could limit investors’ ability to make transactions in our securities and subject us to additional trading restrictions. |

| ● | We may not be able to successfully integrate businesses that we acquire, which may cause us to lose anticipated benefits from such acquisitions and to incur significant additional expenses. |

| ● | We face risks related to natural disasters or other extraordinary events and public health epidemics, such as the global coronavirus outbreak experienced, in the locations in which we, our students, faculty, and employees live, work, which could have a material adverse effect on our business and results of operations. |

| ● | If we are not able to continually enhance our online programs, services and products and adapt them to rapid technological changes and student needs, we may lose market share and our business could be adversely affected. |

5

| ● | Our ADSs or Ordinary Shares may be delisted under the Holding Foreign Companies Accountable Act (“HFCA Act”) if the PCAOB is unable to adequately inspect audit documentation located in China. The delisting of our ADSs or Ordinary Shares, or the threat of their being delisted, may materially and adversely affect the value of your investment. Additionally, the inability of the PCAOB to conduct adequate inspections deprives our investors with the benefits of such inspections. Furthermore, on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, which was enacted on December 29, 2022 under the Consolidated Appropriations Act 2023, amends the HFCA Act and requires the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three. |

| ● | The actual or perceived failure by us, our customers, partners or vendors to comply with stringent and evolving laws and regulations, industry standards, policies, and contractual obligations relating to privacy, data protection, information security, and other matters could harm our reputation and business and subject us to significant fines and liability. |

| ● | Our information security measures, and those of third parties upon which we rely, may be compromised in the future. If our information security measures are compromised in the future or if our information technology fails, this could harm our reputation, expose us to significant fines and liability, impair our sales, and harm our business. In addition, our products and services may be perceived as not being secure. This perception may result in customers and users curtailing or ceasing their use of our products, our incurring significant liabilities, and our business being harmed. |

| ● | If we fail to comply with the extensive U.S. regulatory requirements related to operating a U.S. higher education institution, we could face significant monetary liabilities, fines and penalties, including loss of access to federal student loans and grants for our students. |

| ● | Our failure to demonstrate financial responsibility or administrative capability may result in the loss of eligibility to participate in Title IV programs. |

| ● | The ongoing regulatory effort aimed at for-profit post-secondary institutions of higher education could lead to additional legislation or other governmental action that may negatively affect the industry. |

| ● | Insiders have substantial control over us, which could adversely affect the market price of our ADSs. |

6

RISKS RELATED TO OUR BUSINESS AND INDUSTRY

If we are not able to continue to attract students to enroll in our programs, our net revenues may decline, and we may not be able to maintain profitability.

The success of our business largely depends on the number of students who are enrolled in our programs and the amount of fees that our students are willing to pay for our courses. Therefore, our ability to continue to attract students to enroll in our programs without significantly decreasing course fees is critical to the continued success and growth of our business. This will depend on several factors, including our ability to develop new programs and enhance existing programs to respond to changes in market trends and student demands, expanding our geographic reach, managing our growth while maintaining the consistency of our teaching quality, effectively marketing our programs to a broader base of prospective students, developing and licensing additional high-quality educational content and responding to competitive pressures. It also depends on macroeconomic factors like unemployment and the resulting lower confidence in job prospects and many of the regulatory risks discussed below. Our enrollment in future years will be affected by legislative uncertainty, regulatory activity and macroeconomic conditions. It is likely that legislative, regulatory and economic uncertainties will continue for the foreseeable future, and thus it is difficult to assess our long-term growth prospects. If we are unable to continue to attract students to enroll in our programs without significantly decreasing course fees, our net revenues may decline and we may not be able to achieve profitability, either of which could result in a material adverse effect on our business, results of operations and financial condition.

If we are not able to continue to attract and retain qualified education professionals, we may not be able to maintain consistent teaching quality throughout our school, and our brand, business and results of operations may be materially and adversely affected.

Our education professionals are critical to maintaining the quality of our services, software products and programs, and maintaining our brand and reputation, as they interact with our students on a regular basis. We must continue to attract qualified education professionals who have a strong command of the subject areas to be taught and who meet our qualifications. We may not be able to hire and retain enough qualified education professionals to keep pace with our anticipated growth or at acceptable costs while maintaining consistent teaching quality across many different schools and programs in different geographic locations. Shortages of qualified education professionals, or decreases in the quality of our instruction, whether actual or perceived in one or more of our markets, or an increase in hiring costs, may have a material and adverse effect on our business and our reputation. Further, our inability to retain our education professionals may hurt our existing brands and those brands we are trying to develop, and retaining qualified teachers at additional costs may have a material adverse effect on our business and results of operations.

If our expansions into new businesses are not successful, our results of operation and growth prospects may be materially and adversely affected.

As part of our growth strategy, we enter into new businesses from time to time to generate additional revenue streams and through our development of new business lines or strategic investments in or acquisitions of other businesses. Expansions into new businesses may present operating, marketing and compliance challenges that differ from those that we currently encounter.

We have invested resources in the research and development of artificial intelligence (“AI”) technology and have made progress in the commercialization of our AI-driven offering, HybriU. We plan to continue to invest capital and other resources into our AI-driven business operations. However, AI technology is rapidly evolving with significant uncertainties, and we cannot make assurances that our investment and exploration in AI technology and AI-driven products and services will be successful. In addition, our AI-driven business requires very different products and services, sales and marketing channels and internal operational systems and processes. These requirements could disrupt our current operations and harm our financial condition and operating results, especially during the initial stage of investment, development and scaling of our new AI-driven offerings.

It is uncertain whether our strategies will attract users and customers or generate the revenue required to succeed. If we fail to generate sufficient usage of our new products and services, we may not grow revenue in line with the significant resources we invest in these new businesses. This may negatively impact gross margins and operating income.

7

Potential issues in the adoption and use of artificial intelligence in our product offerings may result in reputational harm or liability.

We are building AI into our product offerings and we expect this element of our business to be a driver for our future growth. We envision a future in which AI operates in our services and applications, such as HybriU. As with many disruptive innovations, AI presents risks and challenges that could affect its adoption, and, therefore, our business. Our products and services based on AI may not be adopted by our users or customers. AI algorithms may be flawed. Datasets may be insufficient or contain biased information. Inappropriate or controversial data practices by us or others could impair the acceptance of our AI solutions.

Our business depends on the strength of our brands in the marketplace. We may not be able to retain existing students or attract new students if we cannot continue to use, protect and enhance our brands successfully in the marketplace.

Our operational and financial performance and the successful growth of our business are highly dependent on market awareness of our “Ambow” brand and the regional brands that we have acquired. We believe that maintaining and enhancing the “Ambow” brand is critical to maintaining and enhancing our competitive advantage and growing our business. In order to retain existing students and attract new students, we plan to continue to make expenditures to create and maintain our positive brand awareness and create brand loyalty. The diverse set of services and products that we offer to college students places significant demands on us to maintain the consistency and quality of our services and products to ensure that our brands do not suffer from any actual or perceived decrease in the quality of our services and products. As we grow in size, expand our services and products and extend our geographical reach, maintaining the quality and consistency of our services and products may be more difficult. Any negative publicity about our services, products, or schools, regardless of its veracity, could harm our brand image and have a material adverse effect on our business and results of operations.

We face significant competition in each major program we offer and each geographic market in which we operate, and if we fail to compete effectively, we may lose our market share and our profitability may be adversely affected.

Competition could result in loss of market share and revenues, lower profit margins and limit our future growth.

We face competition from many different companies that focus on one area of our business and are able to devote all of their resources to that business line. These companies may be able to more quickly adapt than we can to changing technology, student preferences and market conditions in these markets. Therefore, these companies may have a competitive advantage over us with respect to these business areas.

Post-secondary education in the United States is highly competitive. Our U.S. colleges, Bay State College Inc. (“Bay State College”), which closed at the end of August 2023, and NewSchool of Architecture & Design, LLC (“NewSchool”), compete with traditional public and private two-year and four-year colleges, other for-profit schools, and alternatives to higher education. Some of our competitors in both the public and private sectors have substantially greater financial and other resources than we do. These competitors may be able to devote greater resources than we can to the development, promotion and sale of their services and products, and respond more quickly than we can to changes in student needs, testing materials, admissions standards, market needs or new technologies. Some of our competitors, both public and private, may offer programs similar to ours at a lower tuition level as a result of government subsidies, government and foundation grants, tax-deductible contributions, and other financial sources not available to proprietary institutions, or by providing fewer student services or larger class sizes. While we believe that our U.S. colleges provide valuable education to their students, we may not always accurately predict the drivers of a student’s or potential students’ decisions to choose among the range of educational and other options available to them. Our student enrollment may decrease due to intense competition, and we may be required to reduce course fees or increase spending in response to competition in order to retain or attract students or pursue new market opportunities. As a result, our net revenues and profitability may decrease. We cannot make assurances that we will be able to compete successfully against current or future competitors. If we are unable to maintain our competitive position or otherwise respond to competitive pressures effectively, we may lose our market share and our profitability may be materially adversely affected.

8

We may not be able to successfully integrate businesses that we acquire, which may cause us to lose anticipated benefits from such acquisitions and to incur significant additional expenses.

It is challenging to integrate the business operations, infrastructure and management philosophies of acquired schools and companies. The benefits of our past and future acquisitions depend in significant part on our ability to integrate technology, operations and personnel. The integration of acquired schools and companies is a complex, time-consuming and expensive process that, without proper planning and implementation, could significantly disrupt our business and operations. The main challenges involved in integrating acquired entities include the following:

| ● | Ensuring and demonstrating to our students that the acquisitions will not result in adverse changes in service standards or business focus; |

| ● | Consolidating and rationalizing corporate IT and administrative infrastructures; |

| ● | Retaining qualified education professionals for our acquired entities; |

| ● | Consolidating service and product offerings; |

| ● | Coordinating and rationalizing research and development activities to enhance the introduction of new products and technologies with reduced costs; |

| ● | Preserving strategic, marketing or other important relationships of the acquired entity and resolving potential conflicts that may arise with our key relationships; and |

| ● | Minimizing the diversion of senior management attention from day-to-day operations. |

We may not successfully integrate our operations and the operations of entities we acquire in a timely manner, or at all, and we may not realize the anticipated benefits or synergies of the acquisitions to the extent or in the timeframe anticipated, which would have a material adverse effect on our results of operations.

Our results of operations may fluctuate, which makes our financial results difficult to forecast, and could cause our results to fall short of expectations.

Our results of operations may fluctuate as a result of a number of factors, many of which are outside of our control. Our net revenues from continuing operations decreased from $17.8 million in 2021 to $14.8 million in 2022, and further decreased to $9.2 million in 2023. Comparing our results of operations on a period-to-period basis may not be meaningful, and past results should not be relied on as an indication of our future performance. Our quarterly and annual net revenues and costs and expenses as a percentage of net revenues may be significantly different from our historical or projected rates. Our quarterly and annual net revenues and gross margins may fluctuate due to a number of factors, including:

| ● | The increase of costs associated with our strategic expansion plans; |

| ● | The revenue and gross margin profiles of our acquisitions in a given period; |

| ● | Our ability to successfully integrate our acquisitions and the timing of our post-integration activities; |

| ● | Our ability to reduce our costs as a percentage of our net revenues; |

| ● | Increased competition; and |

| ● | Our ability to manage our financial resources, including administration of bank loans and bank accounts. |

9

As a result of these and other factors, we may not sustain our past growth rates in future periods, and we may not sustain profitability on a quarterly or annual basis in the future.

We face risks related to natural disasters or other extraordinary events and public health epidemics, such as the global coronavirus outbreak experienced, in the locations in which we, our students, faculty and employees live and work, which could have a material adverse effect on our business and results of operations.

Our business could be severely disrupted and materially adversely affected by natural disasters, inclement weather, or the outbreak of health epidemics in the locations in which we, our students, faculty and employees live, work and attend classes. Any future natural disasters or health epidemics could also severely disrupt our business operations and have a material adverse effect on our business and results of operations.

Our business depends on the continuing efforts of our senior management team and other key personnel, and our business may be harmed if we lose their services.

Our future success depends heavily upon the continuing services of the members of our senior management team and, in particular, upon retaining the services of our founder, Chairman, Chief Executive Officer and acting Chief Financial Officer, Dr. Jin Huang. If one or more of our senior executives or other key personnel are unable or unwilling to continue in their present positions, we may not be able to replace them easily or at all. As a result, our business may be disrupted, and our financial condition and results of operations may be materially and adversely affected. In addition, if any member of our senior management team or any of our other key personnel joins a competitor or forms a competing company, we may lose teachers, students, key professionals and staff members. Competition for experienced management personnel in the private education sector is intense. The pool of qualified candidates is very limited, and we may not be able to retain the services of our senior executives or key personnel or attract and retain high-quality senior executives or key personnel in the future, which could have a material adverse effect on our business and results of operations.

If we are not able to continually enhance our online programs, services and products and adapt them to rapid technological changes and student needs, we may lose market share and our business could be adversely affected.

Our online programs, services and products are vital to the success of our business. The market for such programs, services and products is characterized by rapid technological changes and innovation, as well as unpredictable product life cycles and user preferences. We must quickly modify our online programs, services and products to adapt to changing student needs and preferences, technological advances and evolving Internet practices. Ongoing enhancement of our online offerings and related technologies may entail significant expense and technical risk. We may use new technologies ineffectively or fail to adapt our online services or products and related technologies on a timely and cost-effective basis. If our improvements to our online offerings and the related technology are delayed, if they result in systems interruptions or are not aligned with market expectations or preferences, we may lose market share and our business could be materially adversely affected.

Failure to adequately and promptly respond to industry changes in curriculum, testing materials and standards could cause our services and products to be less attractive to our students.

Our success depends, in part, on our ability to continually update and expand the content, curriculum and test preparation materials of our academic programs, develop new programs and teaching methods in a cost-effective manner, and meet students’ needs in a timely manner. Any inability to track and respond to industry changes in a timely and cost-effective manner would make our services and products less attractive to students, which may materially and adversely affect our reputation and ability to continue to attract students without a significant decrease in course fees.

10

If we are unable to obtain new loans, at all or on terms that are acceptable to us, our growth will be impacted.

We may seek to obtain additional bank loans in the future. We cannot assure you that we will be able to obtain new loans or credit facilities, at all or on terms that are acceptable to us. Our ability to obtain financing may be affected by our financial position and leverage, our credit rating and investor perception of the education industry, as well as by prevailing economic conditions and the cost of financing in general. In addition, factors beyond our control, such as recent global market and economic conditions and the tightening of credit markets may result in a diminished availability of financing and increased volatility in credit and equity markets, which may materially adversely affect our ability to secure financing at reasonable costs or at all. If we were unable to obtain financing in the future on terms acceptable to us, our business operations and our growth plans would be materially harmed.

Our business is subject to seasonal fluctuations, which may cause our operating results to fluctuate from quarter to quarter.

We have experienced, and expect to continue to experience, seasonal fluctuations in our revenues and results of operations, primarily due to seasonal changes in service days and student enrollment. Historically, the number of days in which our students attend our courses is lower in the third quarter due to school closures for summer break. Because our colleges recognize revenues based on the number of service days in each quarter, we expect our third-quarter revenues to be lower than the first, second and fourth quarters. Our costs and expenses, however, do not necessarily correspond with changes in our student enrollment, service days or net revenues. We make investments in marketing and promotion, teacher recruitment and training, and product development throughout the year. We expect quarterly fluctuations in our revenues and results of operations to continue. As the revenues grow in our colleges, these seasonal fluctuations may become more pronounced.

We may not be able to adequately protect our intellectual property, which could adversely impact our competitiveness.

Our brand, copyrights, patents, trade secrets, trade names and other intellectual property rights are important to our success. Unauthorized use of any of our intellectual property may adversely affect our business and reputation. We rely on a combination of copyright, trademark and trade secrets laws and confidentiality agreements with our employees, consultants and others, including our partner schools, to protect our intellectual property rights. Nevertheless, it may be possible for third parties to obtain and use our intellectual property without authorization. Moreover, litigation may be necessary in the future to enforce our intellectual property rights. Future litigation could result in substantial costs and diversion of our management’s attention and resources and could disrupt our business. If we are unable to enforce our intellectual property rights, it could have a material adverse effect on our financial condition and results of operations. Failure to adequately protect our intellectual property could materially adversely affect our competitive position, our ability to attract students and our results of operations.

We may be exposed to infringement and misappropriation claims by third parties, which, if successful, could cause us to pay significant damage awards.

Third parties may initiate litigation against us alleging infringement upon their intellectual property rights.

In the event of a future successful claim of infringement or misappropriation and our failure or inability to develop non-infringing technology or license the infringed or misappropriated or similar technology on a timely basis, our business could be harmed. In addition, even if we are able to license the infringed or misappropriated or similar technology, license fees could be substantial and may adversely affect our results of operations.

Unexpected network interruptions, security breaches or computer virus attacks and system failures could have a material adverse effect on our business, financial condition and results of operations.

Any failure to maintain satisfactory performance, reliability, security or availability of our network infrastructure may cause significant damage to our reputation and our ability to attract and maintain students. Major risks involving our network structure include:

| ● | Breakdowns or system failures resulting in a prolonged shutdown of our servers, including failures attributable to power shutdowns, or attempts to gain unauthorized access to our systems, which may cause loss or corruption of data, including customer data, or malfunctions of software or hardware; |

11

| ● | Disruption or failure in the national backbone network, which would make it impossible for visitors and students to log on to our websites; |

| ● | Damage from fire, flood, power loss and telecommunications failures; and |

| ● | Any infection by or spread of computer viruses. |

Any network interruption or inadequacy that causes interruptions in the availability of our websites or deterioration in the quality of access to our websites could reduce customer satisfaction and result in a reduction in the number of students using our services. If sustained or repeated, these performance issues could reduce the attractiveness of our online and offline programs. In addition, we may be subject to a security breach caused by a computer hacker, which could involve attempts to gain unauthorized access to our systems or personal information stored in our systems or to cause intentional malfunctions or loss or corruption of data, software, hardware or other computer equipment. A user who circumvents our security measures could misappropriate proprietary information or cause interruptions or malfunctions in our operations. As a result, we may be required to expend significant resources to protect against the threat of these security breaches or to alleviate problems caused by these breaches.

Furthermore, increases in the volume of traffic on our websites could also strain the capacity of our existing computer systems, which could lead to slower response times or system failures. This would cause a disruption or suspension in our online course programs, which would hurt our brand and reputation, and thus negatively affect our net revenue growth. We may need to incur additional costs to upgrade our computer systems in order to accommodate increased demand if we anticipate that our systems cannot handle higher volumes of traffic in the future; or to protect against system errors, failures or disruptions, or to repair or otherwise mitigate problems.

The actual or perceived failure by us, our customers, partners or vendors to comply with stringent and evolving laws and regulations, industry standards, policies, and contractual obligations relating to privacy, data protection, information security, and other matters could harm our reputation and business and subject us to significant fines and liability.

In the ordinary course of business, we collect, receive, store, process, generate, use, transfer, disclose, make accessible, protect, secure, dispose of, transmit, and share confidential, proprietary, and sensitive information, including personal data, customer and user content, business data, trade secrets, intellectual property, third-party data, business plans, transactions, financial information. Our data processing activities subject us to numerous privacy, data protection and information security obligations, such as various laws, regulations, guidance, industry standards, external and internal privacy and security policies, and contractual requirements.

Laws in the United States

In the United States, federal, state, and local governments have enacted numerous privacy, data protection and information security laws, including data breach notification laws, personal data privacy laws, consumer protection laws (e.g., Section 5 of the Federal Trade Commission Act), and other similar laws (e.g., wiretapping laws). For example, the California Consumer Privacy Act of 2018, as amended by the California Privacy Rights Act of 2020 (“CPRA”) (collectively, “CCPA”) applies to the personal information of consumers, business representatives and employees, and requires businesses to provide specific disclosures in privacy notices and honor requests of California residents to exercise certain privacy rights, such as those noted below. The CCPA provides for fines of up to $7,500 per intentional violation and allows private litigants affected by certain data breaches to recover significant statutory damages. Similar laws are being considered in several other states, as well as at the federal and local levels and we expect more states to pass similar laws in the future. These developments may further complicate compliance efforts and increase legal risk and compliance costs for us and the third parties upon whom we rely. Under various laws and other obligations related to privacy, data protection, and information security, we may be required to obtain certain consents to process personal information. For example, some of our data processing practices may be challenged under wiretapping laws if we obtain consumer information from third parties through various methods. These practices may be subject to increased challenges by class action plaintiffs. Our inability or failure to obtain consent for these practices could result in adverse consequences, including class action litigation and mass arbitration demands.

12

Artificial Intelligence

Our development and use of AI technology is subject to privacy, data protection, IP and information security laws, industry standards, external and internal privacy and security policies, and contractual requirements, as well as increasing regulation and scrutiny. Several jurisdictions around the globe, including the EU, the UK and certain U.S. states, have proposed, enacted, or are considering laws governing the development and use of AI. In the EU, regulators have reached a political agreement on the text of the Artificial Intelligence Act, which, when adopted and in force, will have a direct effect across all EU jurisdictions and could impose onerous obligations related to the use of AI-related systems. Obligations on AI may make it harder for us to conduct our business using, or build products incorporating, AI, require us to change our business practices, require us to retrain our algorithms, or prevent or limit our use of AI. Additionally, certain privacy laws extend rights to consumers such as the right to delete certain personal information and regulate automated decision-making, which may be incompatible with our use of AI. If we do not develop or incorporate AI in a manner consistent with these factors and consistent with customer expectations, it may result in an adverse impact on our reputation, our business may be less efficient, or we may be at a competitive disadvantage. Similarly, if customers and users do not widely adopt our new product AI experiences, features and capabilities, or they do not perform as expected, we may not be able to realize a return on our investment.

Industry Standards

In addition to privacy, data protection and information security laws, we are contractually subject to industry standards adopted by industry groups and may become subject to such obligations in the future. We may also have privacy, data protection and information security obligations arising from the practices in our industry or of companies similar to ours. We are also bound by other contractual obligations related to privacy, data protection and information security, and our efforts to comply with such obligations may not be successful. If we fall below such industry standards or cannot comply with such contractual obligations, our reputation and business may be harmed. We also publish privacy policies, marketing materials and other statements, such as compliance with certain certifications or self-regulatory principles, regarding privacy, data protection and information security. If these policies, materials or statements are found to be deficient, lacking in transparency, deceptive, unfair, or misrepresentative of our practices, we may be subject to investigation, enforcement actions by regulators, or other adverse consequences.

Our information security measures, and those of third parties upon which we rely, may be compromised in the future. If our information security measures are compromised in the future or if our information technology fails, this could harm our reputation, expose us to significant fines and liability, impair our sales, and harm our business. In addition, our products and services may be perceived as not being secure. This perception may result in customers and users curtailing or ceasing their use of our products, our incurring significant liabilities, and our business being harmed.

In the ordinary course of our business, we and the third parties upon which we rely collect, receive, store, process, generate, use, transfer, disclose, make accessible, protect, secure, dispose of, transmit and share confidential, proprietary and sensitive data, including data of ours, our customers and our users, the data which includes personal information, customer and user content, health-related data, intellectual property, trade secrets, business plans, and financial information. We and the third parties upon which we rely face a variety of evolving threats, including but not limited to ransomware attacks, which could cause security incidents. Security incidents may occur in the future, resulting in unauthorized access to, loss or unauthorized disclosure of, or inadvertent disclosure of confidential, proprietary, and sensitive information.

13

Cyberattacks, other malicious internet-based activity, online and offline fraud, and other similar activities threaten the confidentiality, integrity, and availability of our proprietary, confidential, and sensitive data and information technology systems, and those of the third parties upon which we rely. Threats are prevalent and continue to rise, are increasingly difficult to detect, and come from a variety of sources, including traditional computer “hackers,” threat actors, “hacktivists,” organized criminal threat actors, personnel such as through theft or misuse, sophisticated nation-state and nation-state supported actors, and advanced persistent threat intrusions. Some actors now engage in and are expected to continue to engage in cyberattacks, including, without limitation, nation-state actors for geopolitical reasons and in conjunction with military conflicts and defense activities. During times of war and other major conflicts, we and the third parties upon which we rely may be vulnerable to a heightened risk of these attacks, which could materially disrupt our systems and operations, supply chain, and ability to provide our services. We may be subject to a variety of evolving threats, including but not limited to social-engineering attacks including through deep fakes, which may be increasingly more difficult to identify as fake, and phishing attacks, malicious code such as viruses and worms, malware including as a result of advanced persistent threat intrusions, denial-of-service attacks, credential stuffing, personnel misconduct or error, supply-chain attacks, software bugs, server malfunctions, software or hardware failures, loss of data or other information technology assets, adware, telecommunications failures, attacks enhanced or facilitated by AI, earthquakes, fires, floods and other similar threats. Ransomware attacks, including those perpetrated by organized criminal threat actors, nation-states, and nation-state-supported actors, are becoming increasingly prevalent and severe and can lead to significant interruptions in our operations or our ability to provide our products or services, loss of data and income, reputational harm, and diversion of funds.

In addition, our reliance on third-party service providers could introduce new cybersecurity risks and vulnerabilities, including supply-chain attacks, and other threats to our business operations. We rely on third-party service providers and technologies to operate critical business systems to process confidential, proprietary, and sensitive data in a variety of contexts, including, without limitation, cloud-based infrastructure, encryption and authentication technology, employee email, content delivery to customers and other functions. We also rely on third-party service providers to provide other products, services and parts, or otherwise to operate our business. Our ability to monitor these third parties’ information security practices is limited, and these third parties may not have adequate information security measures in place. If our third-party service providers experience a security incident or other interruption, we could experience adverse consequences. While we may be entitled to damages if our third-party service providers fail to satisfy their privacy or security-related obligations to us, any award may be insufficient to cover our damages, or we may be unable to recover such award.

If our information security measures are compromised, our reputation could be damaged; our data, information or intellectual property, or that of our customers, may be destroyed, stolen, or otherwise compromised; our business may be harmed; and we could incur significant liability. We take steps designed to detect and remediate vulnerabilities in our information systems and those of third parties upon whom we rely, but we may not detect or remediate all such vulnerabilities or do so in a timely manner. The threats and techniques used to exploit vulnerabilities change frequently, are often sophisticated in nature and may be difficult to detect by security tools. Vulnerabilities could be exploited and result in a security incident. We have limited budgetary and human resources for detecting and remediating vulnerabilities and have experienced difficulties in hiring and retaining qualified security personnel. We may experience delays in developing and deploying remedial measures, including patches, designed to address identified vulnerabilities, and our remedial measures may require action by our customers such as installing patches or updates, which may increase the amount of time a vulnerability remains unremediated. We have not always been able in the past and may be unable in the future to anticipate or prevent threats or techniques used to detect or exploit vulnerabilities in our information systems or third-party software, or obtain unauthorized access to or compromise our systems.

Our legal right to lease certain properties could be challenged by property owners or other third parties, which may cause interruptions to business operations of the affected college campuses and adversely affect our financial results.

We lease the premises used for the operation of our college campuses. As a result, we are dependent on the property rights of these properties held by their owners to enable us to use the premises. We cannot assure you that all lessors of our leased business premises have the relevant land use right certificates or building ownership certificates of the premises they lease to us or otherwise have the right to lease the premises to us.

14

We are not aware of any actions, claims or investigations being contemplated by the relevant governmental entities with respect to the defects in our leased real properties. However, if we are unable to use the existing properties, enter new leases or renew our current leases in a timely basis and on terms favorable to us, our business, results of operations and financial condition could be materially adversely affected. No impairment loss was made against the operating lease right-of-use assets in 2022 and 2023 from the continuing operations.

We may need to record a significant charge to earnings if our goodwill or intangible assets arising from acquisitions become impaired, which would adversely affect our net income.

In accordance with U.S. GAAP, we account for our acquisitions using the acquisition method of accounting, and such acquisitions have resulted in significant goodwill and intangible assets. These assets may become impaired in the future, which could have a material adverse effect on our results of operations following such acquisitions. We are required under U.S. GAAP to review our amortizable intangible assets for impairment when events or changes in circumstances indicate the carrying value may not be recoverable. Goodwill is required to be tested for impairment annually or more frequently if facts and circumstances warrant a review. Factors that may be considered a change in circumstances indicating that the carrying value of our amortizable intangible assets may not be recoverable include a decline in stock price and market capitalization and slower or declining growth rates in our industry. During 2023, we did not recognize any impairment loss. In the future, we may be required to record a significant charge to earnings in our financial statements during the period in which any impairment of our goodwill or amortizable intangible assets is determined, which could have a material adverse effect on our results of operations.

Our grant of employee share options, restricted shares or other share-based compensation and any future grants could have an adverse effect on our net income.

We adopted an equity incentive plan in 2010, the 2010 Equity Incentive Plan, which was amended and restated in November 2018, the Amended and Restated 2010 Plan (the “Amended 2010 Plan”). We have granted options and restricted shares under these plans to our employees and consultants. U.S. GAAP prescribes how we account for share-based compensation, which may have an adverse or negative impact on our results of operations. U.S. GAAP requires us to recognize share-based compensation as a compensation expense in the statement of operations based on the fair value of equity awards on the date of the grant, with the compensation expense recognized over the period in which the recipient is required to provide service in exchange for the equity award. These statements also require us to adopt a fair value-based method for measuring the compensation expense related to share-based compensation. During the year ended December 31, 2023, we did not record any share-based compensation expenses for the restricted stock and the unrecognized share-based compensation expenses amounted to nil as of December 31, 2023. The expenses associated with share-based compensation may reduce the attractiveness of issuing share options or restricted shares under our equity incentive plan. However, if we do not grant share options or restricted shares or reduce the number of share options or restricted shares that we grant, we may not be able to attract and retain key personnel. If we grant more share options or restricted shares to attract and retain key personnel, the expenses associated with share-based compensation may adversely affect our results of operation.

Changes to accounting standards, taxation rules or practices, or greater than anticipated tax liabilities may adversely affect our reported results of operations or how we conduct our business.

A change in accounting standards or taxation rules or practices can have a significant effect on our reported results and may even affect our reporting of transactions completed before the change is effective. New accounting standards or taxation rules, such as accounting for uncertainty in income taxes under ASC 740, and various interpretations of accounting standards or taxation practices have been adopted and may be adopted in the future. These accounting standard and tax regulation changes, future changes and the uncertainties surrounding current practices and implementation procedures may adversely affect our reported financial results or the way we conduct our business. The determination of our provision for income tax and other tax liabilities requires significant judgment, and in the ordinary course of our business, there are many transactions and calculations where the ultimate tax determination is uncertain. Although we believe our estimates are reasonable, the ultimate decisions by the relevant tax authorities may differ from the amounts recorded in our financial statements and may materially affect our financial results in the period or periods for which such determination is made. Moreover, we may lose the tax benefits we are currently receiving, or we may be forced to disgorge prior tax benefits we have enjoyed and pay additional taxes and possibly penalties for prior tax years, any of which would harm our results of operations.

15

RISKS RELATED TO REGULATIONS OF OUR U.S. BUSINESS

If we fail to comply with the extensive U.S. regulatory requirements related to operating a U.S. higher education institution, we could face significant monetary liabilities, fines and penalties, including loss of access to federal student loans and grants for our students.

As a provider of higher education in the United States, we are subject to extensive regulation on both the federal and state levels. These regulatory requirements cover virtually all phases and aspects of our U.S. postsecondary operations, including educational program offerings, facilities, civil rights, safety, public health, privacy, instructional and administrative staff, administrative procedures, marketing and recruiting, financial operations, payment of refunds to students who withdraw, acquisitions or openings of new schools or programs, the addition of new educational programs, and changes in our corporate structure and ownership. In particular, the Higher Education Act and related regulations subject our U.S. colleges that participate in the various Title IV programs to significant regulatory scrutiny.

The Higher Education Act mandates specific regulatory responsibilities for each of the following components of the higher education regulatory triad: (1) the federal government through the Department of Education; (2) the accrediting agencies recognized by the Secretary of Education; and (3) state education regulatory bodies. In addition, other federal agencies such as the Consumer Financial Protection Bureau and Federal Trade Commission, and various state agencies and state attorneys general enforce consumer protection laws applicable to post-secondary educational institutions.

The regulations, standards, and policies of these regulatory agencies frequently change, and changes in, or new interpretations of, applicable laws, regulations, standards, or policies could have a material adverse effect on our accreditation, authorization to operate in various states, permissible activities, receipt of funds under Title IV programs, or costs of doing business.

Title IV requirements are enforced by the Department of Education and, in some instances, by private plaintiffs. If we are found not to be in compliance with these laws, regulations, standards, or policies, we could lose our access to Title IV program funds, which would have a material adverse effect on our U.S. college operations. Findings of noncompliance also could result in our being required to pay monetary damages, or being subjected to fines, penalties, injunctions, restrictions on our access to Title IV program funds, or other censure that could have a material adverse effect on our business.

On January 19, 2023, Bay State College was informed its accreditation is considered to be withdrawn by The New England Commission of Higher Education (“NECHE”). On April 11, 2023, the Board of Trustees voted to permanently close Bay State College at the end of the 2022-2023 academic year, and this permanent closure was completed on August 31, 2023. For details, please refer to “Risks related to regulations of our U.S. Business - Our failure to demonstrate financial responsibility or administrative capability may result in the loss of eligibility to participate in Title IV programs.”

The ongoing regulatory effort aimed at for-profit post-secondary institutions of higher education could lead to additional legislation or other governmental action that may negatively affect the industry.

The proprietary post-secondary education sector has at times experienced scrutiny from federal legislators, agencies, and state legislators and attorneys general. An adverse disposition of these existing inquiries, administrative actions, or claims, or the initiation of other inquiries, administrative actions, or claims, could, directly or indirectly, have a material adverse effect on our business, financial condition, result of operations, and cash flows and result in significant restrictions on us and our ability to operate.

On January 19, 2023, Bay State College was informed its accreditation is considered to be withdrawn by The New England Commission of Higher Education (“NECHE”). For details, please refer to “Risks related to regulations of our U.S. Business - Our failure to demonstrate financial responsibility or administrative capability may result in the loss of eligibility to participate in Title IV programs.”

16

If we fail to maintain our institutional accreditation or if our institutional accrediting body loses recognition by the Department of Education, we will lose our ability to participate in Title IV programs.

The loss of institutional accreditation by any of our U.S. colleges would render any of our U.S. colleges ineligible to participate in Title IV programs and would have a material adverse effect on our business, financial condition, results of operations, and cash flows and result in the imposition of significant restrictions on us and our ability to operate. In addition, an adverse action by our institutional accreditors other than loss of accreditation, such as the issuance of a warning, could have a material adverse effect on our business.

If we fail to obtain recertification by the Department of Education when required, we will lose our ability to participate in Title IV programs.

Each institution participating in Title IV programs must enter into a Program Participation Agreement with the Department of Education. Under the agreement, the institution agrees to follow the Department of Education’s rules and regulations governing Title IV programs. An institution generally must seek recertification from the Department of Education at least every six years and possibly more frequently depending on various factors, such as whether it is provisionally certified. The Department of Education may also review an institution’s continued eligibility and certification to participate in Title IV programs, or scope of eligibility and certification, in the event the institution undergoes a change in ownership resulting in a change of control or expands its activities in certain ways, such as the addition of certain types of new programs, or, in certain cases, changes to the academic credentials that it offers. In certain circumstances, the Department of Education must provisionally certify an institution. The Department of Education may withdraw our certification if it determines that we are not fulfilling material requirements for continued participation in Title IV programs. If the Department of Education does not renew, or withdraws our certification to participate in Title IV programs, our students will no longer be able to receive Title IV program funds. Alternatively, the Department of Education could (1) renew the certifications for an institution, but restrict or delay receipt of Title IV funds, limit the number of students to whom an institution could disburse such funds, or place other restrictions on that institution, or (2) delay recertification after an institution’s PPA expires, in which case the institution’s certification would continue on a month-to-month basis, any of which would have a material adverse effect on our business, financial condition, results of operations, and cash flows.

On October 13, 2020, the Department of Education and Bay State College executed a Provisional Program Participation Agreement, approving Bay State College’s continued participation in Title IV programs with full certification through September 30, 2023. On January 16, 2022, the Department of Education and NewSchool executed a Program Participation Agreement, approving NewSchool’s continued participation in Title IV programs with full certification through December 31, 2024.

Student loan defaults could result in the loss of eligibility to participate in Title IV programs.

In general, under the Higher Education Act, an educational institution may lose its eligibility to participate in some or all Title IV programs if, for three consecutive federal fiscal years, 30% or more of its students who were required to begin repaying their student loans in the relevant federal fiscal year default on their payment by the end of the second federal fiscal year following that fiscal year. Institutions with a cohort default rate equal to or greater than 15% for any of the three most recent fiscal years for which data are available are subject to a 30-day delayed disbursement period for first-year, first-time borrowers.

If we lose eligibility to participate in Title IV programs because of high student loan default rates, it will have a material adverse effect on our business, financial condition, results of operations, and cash flows and result in the imposition of significant restrictions on us and our ability to operate.

17

Our U.S. colleges could lose their eligibility to participate in federal student financial aid programs or be provisionally certified with respect to such participation if the percentage of our revenues derived from those programs were too high.

A proprietary institution may lose its eligibility to participate in the federal Title IV student financial aid program if it derives more than 90% of its revenues, on a cash basis, from Title IV programs for two consecutive fiscal years. A proprietary institution of higher education that violates the 90/10 Rule for any fiscal year will be placed on provisional status for up to two fiscal years. Using the formula specified in the Higher Education Act, Bay State College and NewSchool derived approximately 58% and 55% of their cash-basis revenues from these programs in the year of 2022, respectively. Percentages of NewSchool for the year of 2023 are in process of audits as of the date of this report, which we estimate will be in compliance with the 90/10 Rule. If any of our U.S. colleges lose eligibility to participate in Title IV programs because they are unable to comply with 90/10 Rule, it could have a material adverse effect on our business, financial condition, results of operations, and cash flows and result in the imposition of significant restrictions on us and our ability to operate.

Our failure to demonstrate financial responsibility or administrative capability may result in the loss of eligibility to participate in Title IV programs.

All U.S. colleges are subject to meeting financial and administrative standards. These standards are assessed through annual compliance audits, periodic renewal of institutional PPAs, periodic program reviews and ad hoc events which may lead the Department of Education to evaluate an institution’s financial responsibility or administrative capability. The administrative capability criteria require, among other things, that our institution (1) has an adequate number of qualified personnel to administer Title IV programs, (2) has adequate procedures for disbursing and safeguarding Title IV funds and for maintaining records, (3) submits all required reports and consolidated financial statements in a timely manner, and (4) does not have significant problems that affect the institution’s ability to administer Title IV programs.

A financial responsibility test is required for continued participation by an institution’s students in U.S. federal financial assistance programs. The test is based upon a composite score of three ratios: an equity ratio that measures the institution’s capital resources; a primary reserve ratio that measures an institution’s ability to fund its operations from current resources; and a net income ratio that measures an institution’s ability to operate profitably. A minimum score of 1.5 is necessary to meet the financial standards. Institutions with scores of less than 1.5 but greater than or equal to 1.0 are considered financially responsible, but require additional oversight. These schools are subject to heightened cash monitoring and other participation requirements. An institution with a score of less than 1.0 is considered not financially responsible. However, a school with a score of less than 1.0 may continue to participate in the Title IV programs under provisional certification. In addition, this lower score typically requires that the school be subject to heightened cash monitoring requirements and post a letter of credit (equal to a minimum of 10% of the Title IV aid it received in the institution’s most recent fiscal year). For the fiscal year of 2022, the composited score of NewSchool was 1.6. The audits to calculate the composited scores of NewSchool for the fiscal year of 2023 are in process as of the date of this report. We estimate NewSchool will meet the required minimum of 1.5.

If the Department of Education determines, in its judgment, that Bay State College and NewSchool have failed to demonstrate either financial responsibility or administrative capability, we could be subject to sanctions, including, among other things, a requirement to post a letter of credit, fines, suspension or termination of our eligibility to participate in Title IV programs or repayment of funds received under Title IV programs, any of which could have a material adverse effect on our business, financial condition, results of operation and cash flows and result in the imposition of significant restrictions on us and our ability to operate. The Department of Education has considerable discretion under the regulations to impose the foregoing sanctions and, in some cases, such sanctions could be imposed without advance notice or any prior right of review or appeal.

18

On January 19, 2023, The New England Commission of Higher Education (“NECHE”) informed Bay State College of its intention to withdraw Bay State College’s accreditation as of August 31, 2023. The determination was based on NECHE’s opinion that the College could not come into compliance with Institutional Resources (Accreditation Standard 7) within three years. The decision has no bearing on the quality of the Bay State College’s educational program or outcomes. On March 20, 2023, the appeal panel of NECHE affirmed NECHE’s decision to withdraw Bay State College’s accreditation. Without NECHE accreditation, Bay State College will not be able to disburse Title IV funding to its students for classes after August 2023, and will not be able to disburse VA funding to its students for classes after the Spring semester ends. On April 11, 2023, the Board of Trustees voted to permanently close Bay State College at the end of the 2022-2023 academic year, and this permanent closure was completed on August 31, 2023.

Our failure to comply with the Borrower Defense to Repayment Regulations could result in sanctions and other liability.

Under the Higher Education Act, The Department of Education is authorized to specify in regulations, which acts or omissions of an institution of higher education a borrower may assert as a defense to repayment of a Direct Loan made under the Direct Loan Program. On July 1, 2020, new Defense to Repayment regulations went into effect that include a higher threshold for establishing misrepresentation, provides for a statute of limitation for claims submission, narrows the current triggers allowed for letter of credit requirements, and eliminates provisions for group discharges. The new regulations are effective with claims on loans disbursed on or after July 1, 2020.

Management is unable to predict how regulations will be revised, the result of any other current or future rulemaking, or the impact of such rulemaking on our business. The outcome of any legal proceeding instituted by a private party or governmental authority, facts asserted in pending or future lawsuits, and/or the outcome of any future governmental inquiry, lawsuit, or enforcement action could serve as the basis for claims by students or The Department of Education under the Defense to Repayment regulations, the posting of substantial letters of credit, or the termination of eligibility of our institutions to participate in the Title IV program based on The Department of Education’s institutional capability assessment, any of which could, individually or in the aggregate, have a material adverse effect on our business, financial condition, results of operations, and cash flows.

Our business operations could be harmed if we experience a disruption in our ability to process student loans under the Federal Direct Loan Program.

Any processing disruptions by the Department of Education may affect our students’ ability to obtain student loans on a timely basis. If we experience a disruption in our ability to process student loans through the Federal Direct Loan Program, either because of administrative challenges on our part or the inability of the Department of Education to process the volume of direct loans on a timely basis, our business, financial condition, results of operations, and cash flows related to our U.S. colleges could be adversely and materially affected.

Our business operations could be harmed if Congress makes changes to the availability of Title IV funds.

We collected approximately 41.3% and 45.6% of the consolidated net revenues in our revenue from receipt by Bay State College and NewSchool of Title IV financial aid program funds in the year of 2023, respectively, principally from federal student loans under the Federal Direct Loan Program. Changes in the availability of these funds or a reduction in the amount of funds disbursed may have a material adverse effect on our enrollment, financial condition, results of operations, and cash flows. Action by the U.S. Congress to revise the laws governing the federal student financial aid programs or reduce funding for those programs could reduce our student enrollment and/or increase costs of operation. Political and budgetary concerns significantly affect Title IV programs. Any action by the U.S. Congress that significantly reduces Title IV program funding or the ability of our U.S. colleges or students to participate in Title IV programs could have a material adverse effect on our business, financial condition, results of operations, and cash flows.

19

RISKS RELATED TO OWNERSHIP OF OUR ADSS

We have disposed of our China business and currently do not conduct any business activities in China, which could negatively impact the price of our ADSs.

As a result of the 2021 Implementing Rules, which prohibited foreign investments into or foreign parties from controlling private schools in China, on November 23, 2022, we entered a share purchase agreement to dispose all of our equity interest in Ambow China for a cash consideration of $12.0 million (the “Sale of Ambow China”). The Sale of Ambow China was completed on December 31, 2022. After the Sale of Ambow China, we have sold all our assets and operations in China and have ceased control of all the VIEs.

We cannot assure you that the ADSs will not be delisted from the NYSE American, which could negatively impact the price of the ADSs and our ability to access the capital markets.

Our ADSs are currently listed on the NYSE American. We cannot give you any assurance that a broader or more active public trading market for the ADSs will develop on the NYSE American or be sustained, or that current trading levels in ADSs will be sustained. In addition, if we fail to meet the criteria set forth in SEC regulations, by law, various requirements would be imposed on broker-dealers who sell our securities to persons other than established customers and accredited investors. Consequently, such regulations may deter broker-dealers from recommending or selling the ADSs, which may further affect the liquidity of the ADSs.

We are subject to the continued listing standards of the NYSE American and our failure to satisfy these criteria may result in delisting of our ADSs. In order to maintain this listing, we must maintain a certain share price, financial and share distribution targets, including maintaining a minimum amount of shareholders’ equity and a minimum number of public shareholders. In addition to these objective standards, the NYSE American may delist the securities of any issuer (i) if, in its opinion, the issuer’s financial condition and/or operating results appear unsatisfactory; (ii) if it appears that the extent of public distribution or the aggregate market value of the security has become so reduced as to make continued listing on the NYSE American inadvisable; (iii) if the issuer sells or disposes of principal operating assets or ceases to be an operating company; (iv) if an issuer fails to comply with the NYSE American’s listing requirements; (v) if an issuer’s securities sell at what the NYSE American considers a “low selling price” which the exchange generally considers $0.20 per share and the issuer fails to correct this via a reverse split of shares after notification by the NYSE American; or (vi) if any other event occurs or any condition exists which makes continued listing on the NYSE American, in its opinion, inadvisable.