UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐

Preliminary Proxy Statement

☐

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐

Definitive Proxy Statement

☒

Definitive Additional Materials

☐

Soliciting Material Pursuant to Rule 14a-12

CORPORATE CAPITAL TRUST, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒

No fee required.

☐

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

1)

Title of each class of securities to which transaction applies:

| 2) | Aggregate number of securities to which transaction applies: | |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| 4) | Proposed maximum aggregate value of transaction: | |

| 5) | Total fee paid: | |

☐ Fee paid previously with preliminary materials:

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

| 1) | Amount Previously Paid: | |

| 2) | Form, Schedule or Registration Statement No.: | |

| 3) | Filing Party: | |

| 4) | Date Filed: | |

On August 10, 2017, at 2:00 p.m., Eastern Time, Corporate Capital Trust, Inc. (the “Company”), a non-traded business development company that provides individuals the opportunity to invest in the debt of privately owned American companies, made the following presentation (the “Presentation”). The following are the Presentation slides and Presentation script, a recording of which will be made available on the Company’s website, CorporateCapitalTrust.com, approximately 48 hours after the presentation.

* * *

© 2017 Corporate Capital Trust, Inc. All Rights Reserved. CNL ® and the Squares Within Squares design trademarks are used under license from CNL Intellectual Properties, Inc. CCT - 0817 - 00272 - 003 - BD Corporate Capital Trust: In Preparation for Listing Aug. 10, 2017

2 Presenters 2 MIKE GAVISER Managing Director KKR Client & Partner Group SEAN HICKHAM Senior Vice President of Fund Management CNL Fund Advisors

3 Disclosures This presentation is for informational purposes only and is neither an offer to sell nor a solicitation of an offer to buy the securities described herein. Investing in Corporate Capital Trust is not suitable for all investors and they should carefully read the information in our Forms 10 - Q and 10 - K filings and in our other public filings before making an investment. Consider the investment objectives, risks, charges and expenses before deciding to invest in our shares of common stock. The information contained herein does not replace or supersede any information contained within the company’s 10 - K, 10 - Qs or other public filings . Corporate Capital Trust closed to new investors who purchase through the independent broker - dealer channel on Feb. 12, 2016. Corporate Capital Trust is advised by CNL Fund Advisors Company (CNL) and subadvised by KKR Credit Advisors (US) LLC (KKR), affiliates of CNL Financial Group and KKR & Co. L.P., respectively. Some of the statements in this presentation constitute “forward - looking statements” because they relate to future events or the future performance or financial condition of the company . These statements are based on the beliefs and assumptions of the company’s management and on the information currently available to management at the time of such statements. Although we believe that the expectations reflected in such forward - looking statements are based upon reasonable assumptions, our actual results could differ materially from those set forth in the forward - looking statements.

4 Disclosures Some factors that might cause such a difference include the following: persistent economic weakness at the global or national level, increased direct competition, changes in government regulations or accounting rules, changes in local, national and global capital market conditions, our ability to obtain or maintain credit lines or credit facilities on satisfactory terms, changes in interest rates, our ability to identify suitable investments, our ability to close on identified investments, our ability to maintain our qualification as a regulated investment company and as a business development company, the ability of our Advisors and their affiliates to attract and retain highly talented professionals, the ability of our Advisors to locate suitable borrowers for our loans, the ability of such borrowers to make payments under their respective loans, our ability to complete the listing of our shares of common stock on the New York Stock Exchange LLC (NYSE), our ability to complete the proposed related tender offer, and the price at which shares of our common stock may trade on the NYSE, which may be higher or lower than the purchase price in the proposed tender offer. Given these uncertainties, we caution you not to place undue reliance on such statements, which apply only as of the date hereof. Forward - looking statements generally can be identified by the words “believes,” “expects,” “intends,” “plans,” “estimates” or similar expressions that indicate future events. Important factors that could cause actual results to differ materially from the company’s expectations include those described above and disclosed in the company’s filings with the SEC, including the company’s annual report on Form 10 - K for the year ended December 31, 2016, which was filed with the SEC on March 20, 2017. The company undertakes no obligation to update such statements to reflect subsequent events.

5 Disclosures In connection with the matters described in this communication, the company has filed relevant materials with the Securities and Exchange Commission (the “SEC”), including a definitive proxy statement on Schedule 14A. The company has mailed the definitive proxy statement and a proxy card to each shareholder entitled to vote at the shareholder meeting relating to such matters. SHAREHOLDERS OF THE COMPANY ARE URGED TO READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO), AND ANY OTHER RELEVANT DOCUMENTS THAT THE COMPANY WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE, BECAUSE THESE MATERIALS WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY AND THE MATTERS DESCRIBED IN THIS COMMUNICATION. The definitive proxy statement and other relevant materials (when they become available), and any other documents filed by the company with the SEC, may be obtained free of charge at the SEC’s website (sec.gov ), at the company’s website (corporatecapitaltrust.com/investor - resources) , or by writing to the company at 450 S. Orange Avenue, Orlando, Florida 32801 (telephone number 866 - 650 - 0650). The company and its directors and officers may be deemed to be participants in the solicitation of proxies from the company’s stockholders with respect to the matters described in this communication. Information about the company’s directors and officers, as well as the identity of other potential participants, and their respective direct or indirect interests in such matters, by security holdings or otherwise, are set forth in the definitive proxy statement and other materials filed with SEC.

6 Disclosures The information in the slide titled Share Repurchase Program and Listing - Related Tender Offer” is for informational purposes only and is not an offer to buy or the solicitation of an offer to sell any securities of the company. Each tender offer referred to therein will be made only pursuant to an offer to purchase, letter of transmittal and related materials (the “Tender Materials”). The full details of each tender offer, including complete instructions on how to tender shares of common stock, will be included in the Tender Materials, which the company will distribute to shareholders and file with the SEC upon the commencement of each tender offer. Shareholders are urged to carefully read the Tender Materials when they become available because they will contain important information, including the terms and conditions of each tender offer. The Tender Materials (when they become available), and any other documents filed by the company with the SEC, may be obtained free of charge at the SEC’s website ( sec.gov ), at the company’s website ( corporatecapitaltrust.com/investor - resources ), or by writing to the company at 450 S. Orange Avenue, Orlando, Florida 32801 (telephone number 866 - 650 - 0650).

7 Risk Factors Investing in Corporate Capital Trust may be considered speculative and involves a high degree of risk, including the risk of a substantial loss of investment. Other risks include a limited operating history, reliance on the advisors of the company, conflicts of interest, payment of substantial fees to the advisors of the company and its affiliates, limited liquidity, and liquidation at less than the original amount invested. Corporate Capital Trust is a long - term investment. Investing for short time periods makes losses more likely. See the Risk Factors section in our Forms 10 - K, 10 - Q and other public filings to read about the risks an investor should consider before buying shares of Corporate Capital Trust. There is no assurance the investment objectives will be met. Corporate Capital Trust may extend loans to those with low credit quality and there may be limited information about those companies, which involves interest rate risk and financial market risk. Leverage can increase expenses and also volatility, which may magnify gains and losses. Distributions are not guaranteed and subject to change. Future distributions may include a return of principal or borrowed funds, which may lower overall returns to the investor and may not be sustainable. We have borrowed funds to make investments, which increases the risks of investing in our shares. An investment in Corporate Capital Trust is illiquid, which means that an investor will have limited ability to sell shares and should not expect to be able to sell their holdings until a liquidity event such as the proposed listing described herein. The board of directors must consider a liquidity event on or before Dec. 31, 2018, but there is no guarantee that any liquidity event will take place. It is anticipated that the board of directors will terminate the share repurchase program following the regular quarterly tender offer scheduled to begin in July 2017. However, there can be no assurance the board will terminate the current plan.

8 8 Board Pursues Public Listing – On April 3, 2017, the board of directors unanimously approved a recommendation to pursue a public listing Current Status – Four of the 21 proxy proposals were passed at the Aug. 3, 2017 annual shareholder meeting, including the new advisor agreement Expected Timing – Subject to market conditions and final approvals, CCT expects to take final steps so that its shares will begin trading on the NYSE in the period following receipt of approvals for the remaining proposals described in the Proxy Statement Corporate Capital Trust Update Future outcomes may vary.

9 9 Why a listing now? – 2018 charter requirement to consider a liquidity event – CCT has reached sufficient scale – Receptive equity markets Why is a listing potentially good for shareholders? – Reduction in management fee on assets – Increases financial flexibility for CCT – Creates flexibility for shareholders – Potential for CCT to trade above NAV There can be no assurances that an investor will experience a positive outcome in conjunction with a listing event.

10 10 Transition to Sole Advisor – CNL/KKR have agreed to consolidate the existing advisor structure making KKR the sole advisor upon listing – Contingent upon listing on the NYSE Future outcomes may vary.

11 11 Proposed Actions in Preparation for Listing – Distribution changes – Share repurchase & listing - related tender offer – Distribution reinvestment plan

12 12 Distribution Changes – New annualized distribution rate of $0.715 per share as of July 7, 2017, down from $0.805 per share » Change is intended to align the distribution rate to the company’s net investment income and best position the company for the future expected listing – The company also expects, subject to the discretion of the board: » Two additional special distributions totaling $0.090 per share: around Dec. 31, 2017, and within 6 months of listing » To move from monthly to quarterly distribution payments following a listing There is no assurance that the Board’s objectives, as they are stated above, will be met.

13 13 Share Repurchase Program and Listing - Related Tender Offer – Anticipate existing share repurchase to end upon completion of current tender offer (Aug. 21, 2017), subject to a determination by the board – The company expects to conduct a tender offer immediately following a listing and will remain open for a period of at least 20 business days There is no assurance that the Board’s objectives, as they are stated above, will be met.

14 14 Distribution Reinvestment Plan – Expect the board to terminate the current plan just prior to listing – Expect to implement a new plan after the listing - related tender is complete There is no assurance that the Board’s objectives, as they are stated above, will be met.

15 15 Corporate Capital Trust Transition Process S HAREHOLDER MEETINGS LISTING PROXY SOLICITATION PROXY PREPARE FOR LISTING SECURE VOTE DEFINITIVE PROXY Future outcomes may vary.

16 Invest in America. Private Debt Market Update

17 Current Market Opportunity SOURCE: J.P. Morgan and S&P LCD Comps as of March 31, 2017. U . S. Bank L o an Mutua l Fu n d Flows U . S. Hig h - Y i e ld Mutua l Fu n d Flows $ B illi o n s $ B illi o n s (9) 6 5 5 32 13 16 29 (5) (24) (13) 7 (7) (40) (20) -- 20 40 60 80 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 16 YTD 2 4 (1) (6) 5 18 14 12 63 (24) (20) 7 13 (40) (20) -- 20 40 60 80 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 16 YTD

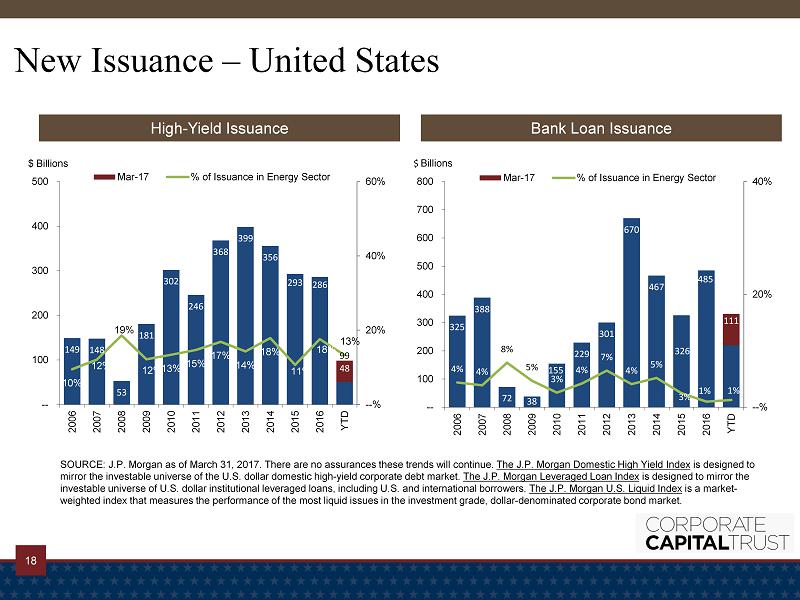

18 New Issuance – United States SOURCE: J.P. Morgan as of March 31, 2017. There are no assurances these trends will continue. The J.P. Morgan Domestic High Yield Index is designed to mirror the investable universe of the U.S. dollar domestic high - yield corporate debt market. The J.P. Morgan Leveraged Loan Index is designed to mirror the investable universe of U.S. dollar institutional leveraged loans, including U.S. and international borrowers. The J.P. Morgan U.S. Liquid Index is a market - weighted index that measures the performance of the most liquid issues in the investment grade, dollar - denominated corporate bon d market. $ Billions $ Billions 149 148 53 181 302 246 368 399 356 293 286 99 48 10% 12% 19% 12% 13% 15% 17% 14% 18% 11% 18% 13% --% 20% 40% 60% -- 100 200 300 400 500 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 YTD Mar-17 % of Issuance in Energy Sector 325 388 72 38 155 229 301 670 467 326 485 331 111 4% 4% 8 % 5% 3% 4% 7% 4% 5% 3% 1 % 1% --% 20% 40% -- 100 200 300 400 500 600 700 800 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 YTD Mar-17 % of Issuance in Energy Sector High - Yield Issuance Bank Loan Issuance

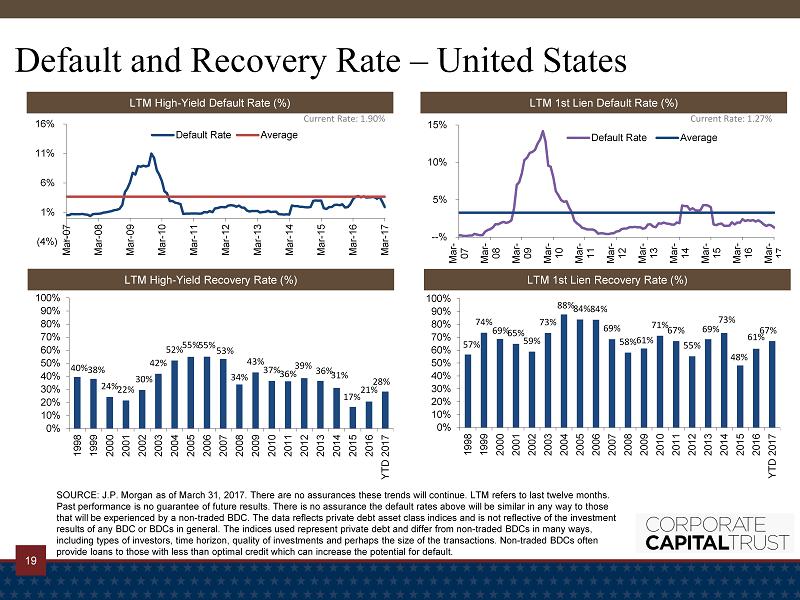

19 --% 5% 10% 15% Mar- 07 Mar- 08 Mar- 09 Mar- 10 Mar- 11 Mar- 12 Mar- 13 Mar- 14 Mar- 15 Mar- 16 Mar- 17 Default Rate Average (4%) 1% 6% 11% 16% Mar-07 Mar-08 Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Default Rate Average Default and Recovery Rate – United States SOURCE: J.P. Morgan as of March 31, 2017. There are no assurances these trends will continue. LTM refers to last twelve months. Past performance is no guarantee of future results. There is no assurance the default rates above will be similar in any way to those that will be experienced by a non - traded BDC. The data reflects private debt asset class indices and is not reflective of the investment results of any BDC or BDCs in general. The indices used represent private debt and differ from non - traded BDCs in many ways, including types of investors, time horizon, quality of investments and perhaps the size of the transactions. Non - traded BDCs often provide loans to those with less than optimal credit which can increase the potential for default. LTM High - Yield Default Rate (%) LTM 1st Lien Default Rate (%) LTM High - Yield Recovery Rate (%) LTM 1st Lien Recovery Rate (%) Current Rate: 1.90% Current Rate: 1.27% 40% 38% 24% 22% 30 % 42% 52% 55% 55% 53% 34% 43% 37 % 36% 39% 36% 31% 17% 21% 28% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 YTD 2017 57 % 74% 69% 65% 59% 73% 88% 84% 84 % 69% 58% 61% 71% 67% 55% 69% 73 % 48% 61% 67% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 YTD 2017

20 Thank you

* * *

Slide 2

| Sean: | Good afternoon and thank you for joining us today. My name is Sean Hickham, and I am a Senior Vice President of Fund Management at CNL and I am joined today by Mike Gaviser, Managing Director at KKR. Mike and I will be focusing on three topics this afternoon. First, we’d like to give you an update and context on the board’s decision to pursue a potential listing. Second, we’ll explain a series of changes to the structure and operations of the Company that have been recently announced. And finally, Mike will give us a short update on the current opportunities in today’s private credit market. |

Before we begin, let me remind you that Corporate Capital Trust’s public offering of its securities is closed. Today’s webinar includes forward-looking statements, which are based on the belief and assumptions of management and information currently available as of August 8th of 2017, and while we believe these to be true, actual results may vary from those set forth in this presentation.

One note at the outset, because Corporate Capital Trust remains in an active proxy solicitation period, we will be unable to take any questions at the end of the presentation.

And with that, we'll get started.

Slide 8 – Corporate Capital Trust Update

| Sean: | As you are all well aware, CCT’s Board of Directors unanimously approved on April the 3rd and empowered CNL and KKR to begin taking steps to pursue a potential listing on the New York Stock Exchange. |

One of these first steps was the process of issuing CCT’s annual proxy to shareholders. The proxy contained 21 different proposals, 2 of which were normal course – director election and auditor appointment – while the remaining 19 relate to changes that would take place, assuming that they are approved by shareholders, and only in conjunction with a future potential listing.

Just last week on August the 3rd, CCT held its annual shareholder meeting. At that meeting, 4 of the proposals were passed. Most notably, shareholders approved the Advisory agreement with KKR, which will make KKR the sole advisor concurrent with CCT’s potential listing. It’s important to point out that this new advisory agreement will reduce the annual asset management fee from 2 percent to 1.5 percent at the time of listing.

The meeting was adjourned until September the 5th in order to allow for additional time to collect the needed votes on the remaining 17 proposals. These proposals have higher voting participation thresholds than the 4 proposals passed last week, and all relating to changes to CCT’s charter that would come into effect upon a listing. If your clients have not yet voted their shares, we ask that you ensure they do so as soon as possible to minimize any potential delays.

So where does that leave us in terms of timing? CCT reaffirmed last week that the movement toward a listing is continuing as planned. Subject to market conditions as well as final board approval and New York Stock Exchange approval, we expect to execute the final required steps so that the shares will begin to trade on the New York Stock Exchange shortly after receipt of approvals for the remaining proxy items.

Slide 9 – Why List Now?

| Sean: | That’s the status of where we’re at in the process. I want to now turn to providing a bit of context on the ‘why’ of this potential listing? In other words, “why now” and “why is this a good time for shareholders”? |

Let’s start with the timing question. There are things to consider.

First, our charter, CCT’s board has an obligation to consider a liquidity event for shareholders no later than the end of 2018. Clearly we are ahead of that timeline, but it’s important to keep in mind that liquidity events like these take time, and it is clearly in the board’s purview to move forward and advance this deadline if they deem it to be in the best interest of shareholders.

Second, CCT, as the third largest BDC in the market by assets, and has reached a sufficient scale and stature such that we believe it will stand out from the crowd in the traded BDC space, assuming it ultimately lists.

Third, today’s equity markets appear receptive to a potential listing. The traded BDC space as a whole is currently trading at an average premium to net asset, or book value. While it’s impossible to accurately predict exactly where CCT may trade, we believe CCT is well positioned relative to many of its listed peers.

Next, and perhaps most important, we will discuss today: why a listing potentially benefits CCT’s shareholders? We see four real advantages for shareholders:

First, as mentioned on the last slide, the new Advisor agreement with KKR that was approved last week will go into effect upon a listing, will reduce annual management fees by 25 percent by reducing the fee rate from 2 percent to 1.5 percent.

Second, having stock listed provides CCT a significant amount of flexibility in the way it finances itself in the future. For example, having listed shares may increase the likelihood of being able to issue a bond publicly or a number of other financing strategies – including convertibles – things that are not presently available to it as a non-traded vehicle.

Third, moving from non-traded to a traded creates flexibility for our shareholders as well. They will now have the ability to determine the future of their holdings. While we hope all shareholders choose to remain in the publicly traded stock, they will now have flexibility.

and finally, there is the potential for listed BDCs – over time – to trade at a premium to net asset value. Like any non-traded fund, CCT essentially is valued at its net asset value, but with the move to the liquid market, and a daily price, there will be potential for those shares to trade at a premium to net asset value as many of its listed BDCs do today. However, I must point out that with the potential upside comes the risk that we could also trade below net asset value at different times.

Slide 10 – Transition to Sole Advisor

| Sean: | As we discussed earlier in the presentation, the shareholders approved last week the new advisory agreement that will go into effect upon the potential listing. And that agreement is with KKR and we would see them take over as the sole advisor going forward. This change will bring CCT in line with the rest of the traded BDC space where all but one company has a single advisor. We believe that this will make the transition to being a listed entity more smooth and will allow us to tell the company’s story in a more simplified manner. |

It’s important to note though, that this only takes effect upon listing. And [CNL] sits in the Advisor seat and still manages the day-to-day operations of the fund, and will do so diligently until the listing. CNL and KKR are working very closely to ensure a smooth transition. In fact, in conjunction with the listing, a number of CNL employees who are involved in the operations of CCT will transition to become KKR employees in order to continue to support CCT after it lists.

Slide 11 – Proposed Actions in Preparation for Listing

| Sean: | Now let’s move to describe some of the structural and operational changes that are expected to be made as we seek to position the fund for the greatest probability of success as a listed BDC. |

A handful of changes are expected to be made to the structure of the ongoing distribution policy, the share repurchase plan, as well as the distribution reinvestment plan. And we’ll touch on each of these in the upcoming slides.

Slide 12 – Distribution Changes

| Sean: | Our board recently fixed a new annualized distribution rate of 71.5 cents per share, down from 80.5 cents per share. Coupled with this change, CCT also announced that it expects to declare and pay two additional special distributions, totaling 9 cents per share, to shareholders in the future. The first 4.5 cent special distribution is expected to be paid around December 31st of 2017 and the second 4.5 cent distribution is expected to be paid within six months following the listing. Note however, that these special distributions are subject to the discretion of the CCT's board. |

The board restructured the ongoing distribution rate in order to align it with certain metrics that are closely tracked in the listed space, some of which are different than those tracked in the non-traded space. Most notably, the restructuring ongoing distribution is expected to be viewed favorably in comparison to CCT’s ongoing net investment income.

I should also note that CCT's announced that it expects to move forward from monthly to quarterly distributions following the listing. This is the norm for the traded BDC market, and will bring us in line with our traded peers.

Slide 13 – Share Repurchase Program and Listing-Related Tender Offer

| Sean: | I hope that was a helpful overview of the changes in the structure of the ongoing distribution policy. In addition to those changes, we also announced that we expect the current share repurchase period that is open as we speak to be the final opportunity for shareholders to redeem their shares, prior to the listing. |

However, in conjunction with the listing, CCT has also announced that it expects to conduct a tender offer to shareholders. The purpose of this tender offer is to purchase the shares up to a certain limit from any shareholders who decide to exit their holdings in the period following the listing. The tender is expected to remain open for at least 20 business days after the listing and we’ll make sure shareholders have all of the information they need on this tender offer in advance of its expiration.

Slide 14 – Distribution Reinvestment Plan

| Sean: | And finally, let me touch briefly on the fact that we expect to suspend the current distribution reinvestment plan prior to a listing. If we do list, we will likely need to implement a new or amended plan. We will notify our shareholders of any changes if and when they are approved by the board. |

Slide 15 – Corporate Capital Trust Transition Process

| Sean: | Before we get to an update on the current opportunities in private credit, let me summarize where we are at in the process of moving towards a potential listing. We’ve touched on a few of these points earlier, but I want to make sure that I was clear. |

Following the board’s approval to pursue a listing, we filed a definitive proxy on May the 25th. That proxy included 21 proposals, of which 19 are dependent on the eventual listing of CCT. Broadly, those 19 proposals can be split into three categories: the new Advisory agreement with KKR, the changes to CCT’s company charter, and providing the board with increased flexibility regarding new share issuances, if needed.

In addition to the two normal course proposals – the director election and auditor appointment – the new advisory agreement and the board’s ability to issue shares were approved last week, at the annual shareholder meeting. The remaining 17 proposals will be reconsidered on September 5th, however the meeting may be adjourned again if sufficient shareholder votes have not been received to clear all the proposals by this date.

We still expect that the shares of CCT will begin trading on the New York Stock Exchange, subject to final approvals and market conditions, and we expect this to occur shortly after approvals are received for those remaining 17 proxy proposals.

In the meantime, as we seek to obtain the necessary approvals, we continue to work through the other items required for a successful listing. If the board ultimately makes the definitive decision to list CCT’s shares, we will come back to you with more detail on a variety of topics.

And with that, I'd like to ask Mike to give us a quick update on today’s private credit opportunities.

Slide 17 – Current Market Opportunity

| Mike: |

Great, thanks Sean, and thanks everybody for joining us today. So with these slides here, I'd like to just give you a sense of kind of what we see as the current market opportunity. You know one sign of market health is really to actually track the dollars going into daily liquid investment vehicles like mutual funds. In almost all case these funds allow investors to put money in and take money out every day. Although we have seen modest outflows in high yield mutual funds this past year, investors have added really meaningful capital to loan mutual funds that has more than compensated for the drop. As you can see from the charts on this page, investors have sought out loans as protection from rising rates. It’s important to note that although these pools of capital are large, the required liquidity can sometimes be a challenge for the fund manager. Closed-end funds like Corporate Capital Trust do not need to be positioned for daily redemptions and can take a longer term view. The flexibility the investor gains allows them the advantage of the illiquidity premium that exists in the market. Knowing we won’t have to give back capital on a daily basis allows us to invest in more interesting credits that we believe have better risk/reward potential. |

Slide 18 – New Issuance – United States

| Mike: |

Now if we look at new issuance in the United States, we show the data related to new issuance which is another good barometer of the health of the market. As you can see, we continue to see strong issuance of loans and bonds this year. Similar to the previous slide, loans are a little bit stronger from an issuance perspective. But the bottom line is: there are lots of new opportunities for us to evaluate, as many of our clients are looking for capital to grow sales, expand their footprint and acquire new businesses. We continue to be quite cautious about the percentage of energy investments we make. Energy issues are a large percentage of the high yield category and are frequently bought by open ended funds because of their size and liquidity. One of the benefits of a closed-end structure like Corporate Capital Trust is that one isn’t forced to buy the largest and most liquid names which are sometimes the most indebted companies. |

Slide 19 – Default and Recovery Rate – United States

| Mike: |

Unlike buying stocks, lending is a business where your best case scenario is really to generally get your coupon and principle back. So picking the right loans to make is really important. As a lender, you want to make investments that are unlikely to default (which essentially means, companies that stop paying interest) and even more important if they do default, one wants to recover as much of the original loan as possible. As you can see from the charts on top, defaults are running below average as the credit environment continues to be quite good. Recoveries in the high yield category have dipped recently largely due to significant amount of energy in the category, as we discussed on previous pages. This is one more reason we are attracted to loans where recoveries are much higher and specifically in originated loans where we control the terms. The rates you see here are for the industry but it is important to note that KKR’s defaults are lower than the market as a whole and our recoveries are even higher. This success is largely due to our robust diligence process combined with the management tools that were are able to leverage across our entire firm. With that I’d like to turn it back to Sean to go over some closing remarks. |

Slide 20 – Thank You

| Sean: | Mike, thank you very much. As you can see we still have some things to accomplish, including passing the remaining 17 proposals. Thank you for informing your clients about the proxy materials and the importance of voting their shares as quickly as possible. |

On behalf of Corporate Capital Trust and our board of directors, I want to thank you again for joining us today. We look forward to updating you in the near future. A copy of this webinar will be posted on corporatecapitaltrust.com within 48 hours. Thanks again and have a great day everybody!

* * *

Additional Information and Where to Find It

In connection with the matters described in this communication, the Company has filed relevant materials with the Securities and Exchange Commission (the “SEC”), including a definitive proxy statement on Schedule 14A. The Company has mailed the definitive proxy statement and a proxy card to each stockholder entitled to vote at the stockholder meeting relating to such matters. STOCKHOLDERS OF THE COMPANY ARE URGED TO READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO), AND ANY OTHER RELEVANT DOCUMENTS THAT THE COMPANY WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE, BECAUSE THESE MATERIALS WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY AND THE MATTERS DESCRIBED IN THIS COMMUNICATION. The definitive proxy statement and other relevant materials (when they become available), and any other documents filed by the Company with the SEC, may be obtained free of charge at the SEC’s website (http://www.sec.gov), at the Company’s website (http://www.corporatecapitaltrust.com/investor-resources), or by writing to the Company at 450 S. Orange Avenue, Orlando, Florida 32801 (telephone number 866-650-0650).

Participants in the Solicitation

The Company and its directors and officers may be deemed to be participants in the solicitation of proxies from the Company’s stockholders with respect to the matters described in this communication. Information about the Company’s directors and officers, as well as the identity of other potential participants, and their respective direct or indirect interests in such matters, by security holdings or otherwise, are set forth in the definitive proxy statement and other materials filed with the SEC.

Forward Looking Statements

The information in this communication may include “forward-looking statements.” These statements are based on the beliefs and assumptions of the Company’s management and on the information currently available to management at the time of such statements. Forward-looking statements generally can be identified by the words “believes,” “expects,” “intends,” “plans,” “estimates” or similar expressions that indicate future events. Important factors that could cause actual results to differ materially from the Company’s expectations include those disclosed in the Company’s filings with the SEC on March 20, 2017. The Company undertakes no obligation to update such statements to reflect subsequent events.