unvr-20201231false2020FY0001494319--12-31us-gaap:AccountingStandardsUpdate201409Memberus-gaap:AccountingStandardsUpdate201409Memberus-gaap:AccountingStandardsUpdate201409Memberus-gaap:AccountingStandardsUpdate201802MemberP10YP6MP3YP4Yus-gaap:OtherAssetsus-gaap:OtherAssetsus-gaap:AssetsAbstractus-gaap:AssetsAbstractus-gaap:AccountsPayableAndAccruedLiabilitiesCurrentus-gaap:AccountsPayableAndAccruedLiabilitiesCurrentus-gaap:DebtCurrentus-gaap:DebtCurrentus-gaap:OtherLiabilitiesNoncurrentus-gaap:OtherLiabilitiesNoncurrentus-gaap:LongTermDebtNoncurrentus-gaap:LongTermDebtNoncurrent00014943192020-01-012020-12-31iso4217:USD00014943192020-06-30xbrli:shares00014943192021-02-1100014943192019-01-012019-12-3100014943192018-01-012018-12-310001494319us-gaap:ProductMember2020-01-012020-12-310001494319us-gaap:ProductMember2019-01-012019-12-310001494319us-gaap:ProductMember2018-01-012018-12-310001494319us-gaap:ShippingAndHandlingMember2020-01-012020-12-310001494319us-gaap:ShippingAndHandlingMember2019-01-012019-12-310001494319us-gaap:ShippingAndHandlingMember2018-01-012018-12-31iso4217:USDxbrli:shares0001494319us-gaap:AccountingStandardsUpdate201802Member2020-01-012020-12-310001494319us-gaap:AccountingStandardsUpdate201802Member2019-01-012019-12-310001494319us-gaap:AccountingStandardsUpdate201802Member2018-01-012018-12-310001494319us-gaap:AccountingStandardsUpdate201712Member2020-01-012020-12-310001494319us-gaap:AccountingStandardsUpdate201712Member2019-01-012019-12-310001494319us-gaap:AccountingStandardsUpdate201712Member2018-01-012018-12-3100014943192020-12-3100014943192019-12-3100014943192018-12-3100014943192017-12-310001494319us-gaap:CommonStockMember2017-12-310001494319us-gaap:AdditionalPaidInCapitalMember2017-12-310001494319us-gaap:RetainedEarningsMember2017-12-310001494319us-gaap:AccumulatedOtherComprehensiveIncomeMember2017-12-3100014943192017-01-012017-12-310001494319us-gaap:AccountingStandardsUpdate201409Member2018-01-010001494319srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2017-12-310001494319us-gaap:AccumulatedOtherComprehensiveIncomeMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2017-12-310001494319srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2017-12-310001494319us-gaap:RetainedEarningsMember2018-01-012018-12-310001494319us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-01-012018-12-310001494319us-gaap:CommonStockMember2018-01-012018-12-310001494319us-gaap:AdditionalPaidInCapitalMember2018-01-012018-12-310001494319us-gaap:CommonStockMember2018-12-310001494319us-gaap:AdditionalPaidInCapitalMember2018-12-310001494319us-gaap:RetainedEarningsMember2018-12-310001494319us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-310001494319srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2018-12-310001494319us-gaap:AccumulatedOtherComprehensiveIncomeMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2018-12-310001494319us-gaap:RetainedEarningsMember2019-01-012019-12-310001494319us-gaap:AccountingStandardsUpdate201409Member2019-01-012019-12-310001494319us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001494319us-gaap:CommonStockMember2019-01-012019-12-310001494319us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310001494319us-gaap:CommonStockMember2019-12-310001494319us-gaap:AdditionalPaidInCapitalMember2019-12-310001494319us-gaap:RetainedEarningsMember2019-12-310001494319us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001494319us-gaap:RetainedEarningsMember2020-01-012020-12-310001494319us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001494319us-gaap:CommonStockMember2020-01-012020-12-310001494319us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001494319us-gaap:CommonStockMember2020-12-310001494319us-gaap:AdditionalPaidInCapitalMember2020-12-310001494319us-gaap:RetainedEarningsMember2020-12-310001494319us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-31unvr:segment0001494319srt:MinimumMemberus-gaap:BuildingMember2020-01-012020-12-310001494319srt:MaximumMemberus-gaap:BuildingMember2020-01-012020-12-310001494319unvr:MainComponentsOfTankFarmsMembersrt:MinimumMember2020-01-012020-12-310001494319unvr:MainComponentsOfTankFarmsMembersrt:MaximumMember2020-01-012020-12-310001494319us-gaap:ContainersMembersrt:MinimumMember2020-01-012020-12-310001494319srt:MaximumMemberus-gaap:ContainersMember2020-01-012020-12-310001494319srt:MinimumMemberus-gaap:MachineryAndEquipmentMember2020-01-012020-12-310001494319srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2020-01-012020-12-310001494319srt:MinimumMemberus-gaap:FurnitureAndFixturesMember2020-01-012020-12-310001494319srt:MaximumMemberus-gaap:FurnitureAndFixturesMember2020-01-012020-12-310001494319unvr:InformationTechnologyMembersrt:MinimumMember2020-01-012020-12-310001494319unvr:InformationTechnologyMembersrt:MaximumMember2020-01-012020-12-310001494319srt:MinimumMember2020-01-012020-12-310001494319srt:MaximumMember2020-01-012020-12-310001494319unvr:TechiChemMember2020-12-182020-12-180001494319unvr:TechiChemMember2020-12-180001494319us-gaap:CustomerRelationshipsMemberunvr:TechiChemMember2020-01-012020-12-31xbrli:pure0001494319unvr:NexeoSolutionsInc.Member2019-02-280001494319unvr:NexeoSolutionsInc.Member2019-02-282019-02-280001494319unvr:NexeoSolutionsInc.Member2019-02-2700014943192019-02-282019-12-310001494319unvr:NexeoSolutionsInc.Member2020-03-310001494319unvr:NexeoPlasticsMember2019-03-290001494319country:USunvr:NexeoSolutionsInc.Member2019-02-280001494319country:CAunvr:NexeoSolutionsInc.Member2019-02-280001494319srt:LatinAmericaMemberunvr:NexeoSolutionsInc.Member2019-02-280001494319unvr:NexeoSolutionsInc.Member2020-12-310001494319us-gaap:CustomerRelationshipsMemberunvr:NexeoSolutionsInc.Member2020-01-012020-12-3100014943192019-02-282019-02-2800014943192019-02-280001494319unvr:NexeoSolutionsInc.Member2019-03-012019-12-310001494319unvr:NexeoSolutionsInc.Member2020-10-012020-12-310001494319unvr:NexeoSolutionsInc.Member2019-10-012019-12-310001494319unvr:NexeoSolutionsInc.Member2020-01-012020-12-310001494319unvr:NexeoSolutionsInc.Member2019-01-012019-12-310001494319srt:MinimumMemberunvr:NexeoPlasticsMember2019-03-292019-03-290001494319srt:MaximumMemberunvr:NexeoPlasticsMember2019-03-292019-03-29unvr:renewal00014943192019-03-292019-03-290001494319unvr:NexeoPlasticsMember2019-03-292019-03-290001494319unvr:CanadianAgriculturalServicesBusinessMember2020-11-302020-11-300001494319unvr:CanadianAgriculturalServicesBusinessMember2020-01-012020-12-310001494319unvr:CanadianAgriculturalServicesBusinessMember2019-01-012019-12-310001494319unvr:CanadianAgriculturalServicesBusinessMember2018-01-012018-12-310001494319us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberunvr:IndustrialServicesBusinessMember2020-09-012020-09-010001494319unvr:IndustrialServicesBusinessMember2020-09-302020-09-300001494319us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberunvr:IndustrialServicesBusinessMember2020-12-310001494319unvr:IndustrialServicesBusinessMember2020-01-012020-12-310001494319unvr:IndustrialServicesBusinessMember2019-01-012019-12-310001494319unvr:IndustrialServicesBusinessMember2018-01-012018-12-310001494319us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberunvr:EnvironmentalSciencesBusinessMember2019-12-312019-12-310001494319us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberunvr:EnvironmentalSciencesBusinessMember2020-12-310001494319us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberunvr:EnvironmentalSciencesBusinessMember2019-12-310001494319unvr:EnvironmentalSciencesBusinessMember2019-10-012019-12-310001494319us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberunvr:EnvironmentalSciencesBusinessMember2020-03-310001494319unvr:EnvironmentalSciencesBusinessMember2019-01-012019-12-310001494319unvr:EnvironmentalSciencesBusinessMember2018-01-012018-12-310001494319unvr:ChemicalDistributionMemberunvr:UnivarUnitedStatesofAmericaMember2020-01-012020-12-310001494319unvr:ChemicalDistributionMemberunvr:UnivarEuropetheMiddleEastandAfricaMember2020-01-012020-12-310001494319unvr:UnivarCanadaMemberunvr:ChemicalDistributionMember2020-01-012020-12-310001494319unvr:UnivarRestOfWorldMemberunvr:ChemicalDistributionMember2020-01-012020-12-310001494319unvr:ChemicalDistributionMember2020-01-012020-12-310001494319unvr:UnivarUnitedStatesofAmericaMemberunvr:CropSciencesMember2020-01-012020-12-310001494319unvr:UnivarEuropetheMiddleEastandAfricaMemberunvr:CropSciencesMember2020-01-012020-12-310001494319unvr:UnivarCanadaMemberunvr:CropSciencesMember2020-01-012020-12-310001494319unvr:UnivarRestOfWorldMemberunvr:CropSciencesMember2020-01-012020-12-310001494319unvr:CropSciencesMember2020-01-012020-12-310001494319unvr:UnivarUnitedStatesofAmericaMemberunvr:ServicesMember2020-01-012020-12-310001494319unvr:UnivarEuropetheMiddleEastandAfricaMemberunvr:ServicesMember2020-01-012020-12-310001494319unvr:UnivarCanadaMemberunvr:ServicesMember2020-01-012020-12-310001494319unvr:UnivarRestOfWorldMemberunvr:ServicesMember2020-01-012020-12-310001494319unvr:ServicesMember2020-01-012020-12-310001494319unvr:UnivarUnitedStatesofAmericaMember2020-01-012020-12-310001494319unvr:UnivarEuropetheMiddleEastandAfricaMember2020-01-012020-12-310001494319unvr:UnivarCanadaMember2020-01-012020-12-310001494319unvr:UnivarRestOfWorldMember2020-01-012020-12-310001494319unvr:ChemicalDistributionMemberunvr:UnivarUnitedStatesofAmericaMember2019-01-012019-12-310001494319unvr:ChemicalDistributionMemberunvr:UnivarEuropetheMiddleEastandAfricaMember2019-01-012019-12-310001494319unvr:UnivarCanadaMemberunvr:ChemicalDistributionMember2019-01-012019-12-310001494319unvr:UnivarRestOfWorldMemberunvr:ChemicalDistributionMember2019-01-012019-12-310001494319unvr:ChemicalDistributionMember2019-01-012019-12-310001494319unvr:UnivarUnitedStatesofAmericaMemberunvr:CropSciencesMember2019-01-012019-12-310001494319unvr:UnivarEuropetheMiddleEastandAfricaMemberunvr:CropSciencesMember2019-01-012019-12-310001494319unvr:UnivarCanadaMemberunvr:CropSciencesMember2019-01-012019-12-310001494319unvr:UnivarRestOfWorldMemberunvr:CropSciencesMember2019-01-012019-12-310001494319unvr:CropSciencesMember2019-01-012019-12-310001494319unvr:UnivarUnitedStatesofAmericaMemberunvr:ServicesMember2019-01-012019-12-310001494319unvr:UnivarEuropetheMiddleEastandAfricaMemberunvr:ServicesMember2019-01-012019-12-310001494319unvr:UnivarCanadaMemberunvr:ServicesMember2019-01-012019-12-310001494319unvr:UnivarRestOfWorldMemberunvr:ServicesMember2019-01-012019-12-310001494319unvr:ServicesMember2019-01-012019-12-310001494319unvr:UnivarUnitedStatesofAmericaMember2019-01-012019-12-310001494319unvr:UnivarEuropetheMiddleEastandAfricaMember2019-01-012019-12-310001494319unvr:UnivarCanadaMember2019-01-012019-12-310001494319unvr:UnivarRestOfWorldMember2019-01-012019-12-310001494319unvr:ChemicalDistributionMemberunvr:UnivarUnitedStatesofAmericaMember2018-01-012018-12-310001494319unvr:ChemicalDistributionMemberunvr:UnivarEuropetheMiddleEastandAfricaMember2018-01-012018-12-310001494319unvr:UnivarCanadaMemberunvr:ChemicalDistributionMember2018-01-012018-12-310001494319unvr:UnivarRestOfWorldMemberunvr:ChemicalDistributionMember2018-01-012018-12-310001494319unvr:ChemicalDistributionMember2018-01-012018-12-310001494319unvr:UnivarUnitedStatesofAmericaMemberunvr:CropSciencesMember2018-01-012018-12-310001494319unvr:UnivarEuropetheMiddleEastandAfricaMemberunvr:CropSciencesMember2018-01-012018-12-310001494319unvr:UnivarCanadaMemberunvr:CropSciencesMember2018-01-012018-12-310001494319unvr:UnivarRestOfWorldMemberunvr:CropSciencesMember2018-01-012018-12-310001494319unvr:CropSciencesMember2018-01-012018-12-310001494319unvr:UnivarUnitedStatesofAmericaMemberunvr:ServicesMember2018-01-012018-12-310001494319unvr:UnivarEuropetheMiddleEastandAfricaMemberunvr:ServicesMember2018-01-012018-12-310001494319unvr:UnivarCanadaMemberunvr:ServicesMember2018-01-012018-12-310001494319unvr:UnivarRestOfWorldMemberunvr:ServicesMember2018-01-012018-12-310001494319unvr:ServicesMember2018-01-012018-12-310001494319unvr:UnivarUnitedStatesofAmericaMember2018-01-012018-12-310001494319unvr:UnivarEuropetheMiddleEastandAfricaMember2018-01-012018-12-310001494319unvr:UnivarCanadaMember2018-01-012018-12-310001494319unvr:UnivarRestOfWorldMember2018-01-012018-12-310001494319us-gaap:EmployeeSeveranceMembercountry:CAunvr:RestructuringPlan2020Member2020-07-012020-09-300001494319us-gaap:EmployeeSeveranceMembercountry:CAunvr:RestructuringPlan2020Member2020-10-012020-12-310001494319us-gaap:EmployeeSeveranceMemberunvr:RestructuringPlan2020Membercountry:US2020-01-012020-12-310001494319us-gaap:EmployeeSeveranceMemberunvr:RestructuringPlan2020Membercountry:US2020-12-310001494319us-gaap:EmployeeSeveranceMembercountry:CAunvr:RestructuringPlan2020Member2020-01-012020-12-310001494319us-gaap:EmployeeSeveranceMembercountry:CAunvr:RestructuringPlan2020Member2020-12-310001494319us-gaap:EmployeeSeveranceMemberunvr:RestructuringPlan2020Memberus-gaap:NonUsMember2020-01-012020-12-310001494319us-gaap:EmployeeSeveranceMemberunvr:RestructuringPlan2020Memberus-gaap:NonUsMember2020-12-310001494319unvr:RestructuringPlan2020Member2020-01-012020-12-310001494319unvr:RestructuringPlan2020Member2020-12-310001494319us-gaap:EmployeeSeveranceMembercountry:CAunvr:CanadianAgricultureRestructuringMember2020-01-012020-12-310001494319us-gaap:EmployeeSeveranceMembercountry:CAunvr:CanadianAgricultureRestructuringMember2020-12-310001494319country:CAunvr:CanadianAgricultureRestructuringMemberus-gaap:OtherRestructuringMember2020-01-012020-12-310001494319country:CAunvr:CanadianAgricultureRestructuringMemberus-gaap:OtherRestructuringMember2020-12-310001494319country:CAunvr:CanadianAgricultureRestructuringMember2020-01-012020-12-310001494319country:CAunvr:CanadianAgricultureRestructuringMember2020-12-310001494319unvr:RestructuringPlan2018Member2020-10-012020-12-310001494319us-gaap:EmployeeSeveranceMemberunvr:RestructuringPlan2018Membercountry:US2020-01-012020-12-310001494319us-gaap:EmployeeSeveranceMemberunvr:RestructuringPlan2018Membercountry:US2020-12-310001494319unvr:RestructuringPlan2018Membercountry:USus-gaap:OtherRestructuringMember2020-01-012020-12-310001494319unvr:RestructuringPlan2018Membercountry:USus-gaap:OtherRestructuringMember2020-12-310001494319unvr:RestructuringPlan2018Membercountry:US2020-01-012020-12-310001494319unvr:RestructuringPlan2018Membercountry:US2020-12-310001494319us-gaap:EmployeeSeveranceMemberunvr:RestructuringPlan2018Memberus-gaap:NonUsMember2020-01-012020-12-310001494319us-gaap:EmployeeSeveranceMemberunvr:RestructuringPlan2018Memberus-gaap:NonUsMember2020-12-310001494319us-gaap:EmployeeSeveranceMemberunvr:RestructuringPlan2018Member2020-01-012020-12-310001494319us-gaap:EmployeeSeveranceMemberunvr:RestructuringPlan2018Member2020-12-310001494319unvr:RestructuringPlan2018Memberus-gaap:OtherRestructuringMember2020-01-012020-12-310001494319unvr:RestructuringPlan2018Memberus-gaap:OtherRestructuringMember2020-12-310001494319unvr:RestructuringPlan2018Member2020-01-012020-12-310001494319unvr:RestructuringPlan2018Member2020-12-310001494319us-gaap:EmployeeSeveranceMember2019-12-310001494319us-gaap:EmployeeSeveranceMember2020-01-012020-12-310001494319us-gaap:EmployeeSeveranceMember2020-12-310001494319us-gaap:FacilityClosingMember2019-12-310001494319us-gaap:FacilityClosingMember2020-01-012020-12-310001494319us-gaap:FacilityClosingMember2020-12-310001494319us-gaap:OtherRestructuringMember2019-12-310001494319us-gaap:OtherRestructuringMember2020-01-012020-12-310001494319us-gaap:OtherRestructuringMember2020-12-310001494319us-gaap:EmployeeSeveranceMember2018-12-310001494319us-gaap:EmployeeSeveranceMember2019-01-012019-12-310001494319us-gaap:FacilityClosingMember2018-12-310001494319us-gaap:FacilityClosingMember2019-01-012019-12-310001494319us-gaap:OtherRestructuringMember2018-12-310001494319us-gaap:OtherRestructuringMember2019-01-012019-12-310001494319unvr:TaxYearBetweenTwoTwentyOneAndTwoThousandTwentySevenMember2020-12-310001494319unvr:TaxYearUnlimitedLifeMember2020-12-310001494319us-gaap:EmployeeStockOptionMemberus-gaap:CommonStockMember2020-01-012020-12-310001494319us-gaap:EmployeeStockOptionMemberus-gaap:CommonStockMember2019-01-012019-12-310001494319us-gaap:EmployeeStockOptionMemberus-gaap:CommonStockMember2018-01-012018-12-310001494319us-gaap:EmployeeStockOptionMemberus-gaap:RestrictedStockMember2020-01-012020-12-310001494319us-gaap:EmployeeStockOptionMemberus-gaap:RestrictedStockMember2019-01-012019-12-310001494319us-gaap:EmployeeStockOptionMemberus-gaap:RestrictedStockMember2018-01-012018-12-310001494319us-gaap:PensionPlansDefinedBenefitMembercountry:US2019-12-310001494319us-gaap:PensionPlansDefinedBenefitMembercountry:US2018-12-310001494319us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2019-12-310001494319us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2018-12-310001494319us-gaap:PensionPlansDefinedBenefitMember2019-12-310001494319us-gaap:PensionPlansDefinedBenefitMember2018-12-310001494319us-gaap:PensionPlansDefinedBenefitMembercountry:US2020-01-012020-12-310001494319us-gaap:PensionPlansDefinedBenefitMembercountry:US2019-01-012019-12-310001494319us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2020-01-012020-12-310001494319us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2019-01-012019-12-310001494319us-gaap:PensionPlansDefinedBenefitMember2020-01-012020-12-310001494319us-gaap:PensionPlansDefinedBenefitMember2019-01-012019-12-310001494319us-gaap:PensionPlansDefinedBenefitMembercountry:US2020-12-310001494319us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2020-12-310001494319us-gaap:PensionPlansDefinedBenefitMember2020-12-310001494319us-gaap:PensionPlansDefinedBenefitMembercountry:US2018-01-012018-12-310001494319us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2018-01-012018-12-310001494319us-gaap:PensionPlansDefinedBenefitMember2018-01-012018-12-310001494319us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-12-310001494319us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-12-310001494319us-gaap:DefinedBenefitPlanEquitySecuritiesUsMemberus-gaap:PensionPlansDefinedBenefitMembercountry:US2020-12-310001494319us-gaap:DefinedBenefitPlanEquitySecuritiesUsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2020-12-310001494319us-gaap:DefinedBenefitPlanDebtSecurityMemberus-gaap:PensionPlansDefinedBenefitMembercountry:US2020-12-310001494319us-gaap:DefinedBenefitPlanDebtSecurityMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2020-12-310001494319us-gaap:OtherDebtSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMembercountry:US2020-12-310001494319us-gaap:OtherDebtSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2020-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DefinedBenefitPlanCashMemberus-gaap:PensionPlansDefinedBenefitMembercountry:US2020-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DefinedBenefitPlanCashMemberus-gaap:PensionPlansDefinedBenefitMembercountry:USus-gaap:FairValueInputsLevel1Member2020-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DefinedBenefitPlanCashMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Membercountry:US2020-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DefinedBenefitPlanCashMemberus-gaap:PensionPlansDefinedBenefitMembercountry:US2019-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DefinedBenefitPlanCashMemberus-gaap:PensionPlansDefinedBenefitMembercountry:USus-gaap:FairValueInputsLevel1Member2019-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DefinedBenefitPlanCashMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Membercountry:US2019-12-310001494319unvr:DefinedBenefitPlanInvestmentFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMembercountry:US2020-12-310001494319unvr:DefinedBenefitPlanInvestmentFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMembercountry:USus-gaap:FairValueInputsLevel1Member2020-12-310001494319unvr:DefinedBenefitPlanInvestmentFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Membercountry:US2020-12-310001494319unvr:DefinedBenefitPlanInvestmentFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMembercountry:US2019-12-310001494319unvr:DefinedBenefitPlanInvestmentFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMembercountry:USus-gaap:FairValueInputsLevel1Member2019-12-310001494319unvr:DefinedBenefitPlanInvestmentFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Membercountry:US2019-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMembercountry:US2020-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMembercountry:USus-gaap:FairValueInputsLevel1Member2020-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Membercountry:US2020-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMembercountry:US2019-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMembercountry:USus-gaap:FairValueInputsLevel1Member2019-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Membercountry:US2019-12-310001494319us-gaap:PensionPlansDefinedBenefitMemberunvr:DomesticEquitySecuritiesMembercountry:US2020-12-310001494319us-gaap:PensionPlansDefinedBenefitMemberunvr:DomesticEquitySecuritiesMembercountry:US2019-12-310001494319unvr:ForeignEquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMembercountry:US2020-12-310001494319unvr:ForeignEquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMembercountry:US2019-12-310001494319us-gaap:PensionPlansDefinedBenefitMembercountry:USus-gaap:DomesticCorporateDebtSecuritiesMember2020-12-310001494319us-gaap:PensionPlansDefinedBenefitMembercountry:USus-gaap:DomesticCorporateDebtSecuritiesMember2019-12-310001494319us-gaap:OtherDebtSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMembercountry:US2020-12-310001494319us-gaap:OtherDebtSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMembercountry:US2019-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DefinedBenefitPlanCashMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2020-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DefinedBenefitPlanCashMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ForeignPlanMember2020-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DefinedBenefitPlanCashMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ForeignPlanMember2020-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DefinedBenefitPlanCashMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ForeignPlanMember2020-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DefinedBenefitPlanCashMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2019-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DefinedBenefitPlanCashMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ForeignPlanMember2019-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DefinedBenefitPlanCashMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ForeignPlanMember2019-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DefinedBenefitPlanCashMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ForeignPlanMember2019-12-310001494319unvr:DefinedBenefitPlanInvestmentFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2020-12-310001494319unvr:DefinedBenefitPlanInvestmentFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ForeignPlanMember2020-12-310001494319unvr:DefinedBenefitPlanInvestmentFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ForeignPlanMember2020-12-310001494319unvr:DefinedBenefitPlanInvestmentFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ForeignPlanMember2020-12-310001494319unvr:DefinedBenefitPlanInvestmentFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2019-12-310001494319unvr:DefinedBenefitPlanInvestmentFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ForeignPlanMember2019-12-310001494319unvr:DefinedBenefitPlanInvestmentFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ForeignPlanMember2019-12-310001494319unvr:DefinedBenefitPlanInvestmentFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ForeignPlanMember2019-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberunvr:DefinedBenefitPlansInsuranceContractsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2020-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberunvr:DefinedBenefitPlansInsuranceContractsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ForeignPlanMember2020-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberunvr:DefinedBenefitPlansInsuranceContractsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ForeignPlanMember2020-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberunvr:DefinedBenefitPlansInsuranceContractsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ForeignPlanMember2020-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberunvr:DefinedBenefitPlansInsuranceContractsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2019-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberunvr:DefinedBenefitPlansInsuranceContractsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ForeignPlanMember2019-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberunvr:DefinedBenefitPlansInsuranceContractsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ForeignPlanMember2019-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberunvr:DefinedBenefitPlansInsuranceContractsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ForeignPlanMember2019-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberunvr:DefinedBenefitPlanInvestmentsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2020-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberunvr:DefinedBenefitPlanInvestmentsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ForeignPlanMember2020-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberunvr:DefinedBenefitPlanInvestmentsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ForeignPlanMember2020-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberunvr:DefinedBenefitPlanInvestmentsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ForeignPlanMember2020-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberunvr:DefinedBenefitPlanInvestmentsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2019-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberunvr:DefinedBenefitPlanInvestmentsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ForeignPlanMember2019-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberunvr:DefinedBenefitPlanInvestmentsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ForeignPlanMember2019-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberunvr:DefinedBenefitPlanInvestmentsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ForeignPlanMember2019-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2020-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ForeignPlanMember2020-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ForeignPlanMember2020-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ForeignPlanMember2020-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2019-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ForeignPlanMember2019-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ForeignPlanMember2019-12-310001494319us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ForeignPlanMember2019-12-310001494319us-gaap:PensionPlansDefinedBenefitMemberunvr:DomesticEquitySecuritiesMemberus-gaap:ForeignPlanMember2020-12-310001494319us-gaap:PensionPlansDefinedBenefitMemberunvr:DomesticEquitySecuritiesMemberus-gaap:ForeignPlanMember2019-12-310001494319unvr:ForeignEquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2020-12-310001494319unvr:ForeignEquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2019-12-310001494319us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignCorporateDebtSecuritiesMemberus-gaap:ForeignPlanMember2020-12-310001494319us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignCorporateDebtSecuritiesMemberus-gaap:ForeignPlanMember2019-12-310001494319us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2020-12-310001494319us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2019-12-310001494319us-gaap:OtherDebtSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2020-12-310001494319us-gaap:OtherDebtSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2019-12-310001494319us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ForeignPlanMember2019-12-310001494319us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ForeignPlanMember2018-12-310001494319us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ForeignPlanMember2020-01-012020-12-310001494319us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ForeignPlanMember2019-01-012019-12-310001494319us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ForeignPlanMember2020-12-31unvr:locationunvr:facility0001494319unvr:CentralStatesSoutheastAndSouthwestAreasPensionPlanMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001494319srt:MinimumMemberunvr:CentralStatesSoutheastAndSouthwestAreasPensionPlanMember2020-12-310001494319srt:MaximumMemberunvr:CentralStatesSoutheastAndSouthwestAreasPensionPlanMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001494319srt:MinimumMemberunvr:CentralStatesSoutheastAndSouthwestAreasPensionPlanMember2020-01-012020-12-310001494319unvr:WesternConferenceOfTeamstersPensionPlanMember2020-01-012020-12-310001494319unvr:WesternConferenceOfTeamstersPensionPlanMember2019-01-012019-12-310001494319unvr:WesternConferenceOfTeamstersPensionPlanMember2018-01-012018-12-310001494319unvr:CentralStatesSoutheastAndSouthwestAreasPensionPlanMember2020-01-012020-12-310001494319unvr:CentralStatesSoutheastAndSouthwestAreasPensionPlanMember2019-01-012019-12-310001494319unvr:CentralStatesSoutheastAndSouthwestAreasPensionPlanMember2018-01-012018-12-310001494319unvr:NewEnglandTeamstersAndTruckingIndustryPensionFundMember2020-01-012020-12-310001494319unvr:NewEnglandTeamstersAndTruckingIndustryPensionFundMember2019-01-012019-12-310001494319unvr:NewEnglandTeamstersAndTruckingIndustryPensionFundMember2018-01-012018-12-310001494319us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001494319srt:MaximumMemberus-gaap:EmployeeStockOptionMember2020-01-012020-12-310001494319us-gaap:EmployeeStockOptionMember2020-12-310001494319us-gaap:RestrictedStockMembersrt:DirectorMember2020-01-012020-12-310001494319us-gaap:RestrictedStockMember2019-12-310001494319us-gaap:RestrictedStockMember2020-01-012020-12-310001494319us-gaap:RestrictedStockMember2020-12-310001494319us-gaap:RestrictedStockMember2019-01-012019-12-310001494319us-gaap:RestrictedStockMember2018-01-012018-12-310001494319srt:MinimumMemberus-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310001494319srt:MaximumMemberus-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310001494319us-gaap:RestrictedStockUnitsRSUMember2019-12-310001494319us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310001494319us-gaap:RestrictedStockUnitsRSUMember2020-12-310001494319us-gaap:PerformanceSharesMember2020-01-012020-12-310001494319us-gaap:PerformanceSharesMember2019-12-310001494319us-gaap:PerformanceSharesMember2020-12-310001494319unvr:UnivarEmployeeStockPurchasePlanMember2020-12-310001494319unvr:UnivarEmployeeStockPurchasePlanMember2020-01-012020-12-31unvr:offeringPeriod0001494319us-gaap:EmployeeStockOptionMember2019-01-012019-12-310001494319us-gaap:EmployeeStockOptionMember2018-01-012018-12-310001494319us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2017-12-310001494319us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2017-12-310001494319us-gaap:AccumulatedTranslationAdjustmentMember2017-12-310001494319us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2017-12-310001494319us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2017-12-310001494319us-gaap:AccumulatedTranslationAdjustmentMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2017-12-310001494319us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2018-01-012018-12-310001494319us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2018-01-012018-12-310001494319us-gaap:AccumulatedTranslationAdjustmentMember2018-01-012018-12-310001494319us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2018-12-310001494319us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2018-12-310001494319us-gaap:AccumulatedTranslationAdjustmentMember2018-12-310001494319us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2018-12-310001494319us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2018-12-310001494319us-gaap:AccumulatedTranslationAdjustmentMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2018-12-310001494319srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2018-12-310001494319us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-01-012019-12-310001494319us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-01-012019-12-310001494319us-gaap:AccumulatedTranslationAdjustmentMember2019-01-012019-12-310001494319us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-12-310001494319us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-12-310001494319us-gaap:AccumulatedTranslationAdjustmentMember2019-12-310001494319us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-01-012020-12-310001494319us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-01-012020-12-310001494319us-gaap:AccumulatedTranslationAdjustmentMember2020-01-012020-12-310001494319us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-12-310001494319us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-12-310001494319us-gaap:AccumulatedTranslationAdjustmentMember2020-12-310001494319us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMembercountry:GB2020-01-012020-12-310001494319us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001494319us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001494319us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2018-01-012018-12-310001494319us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:InterestRateSwapMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001494319us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:InterestRateSwapMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001494319us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:InterestRateSwapMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2018-01-012018-12-310001494319us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:CurrencySwapMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001494319us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:CurrencySwapMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001494319us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:CurrencySwapMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2018-01-012018-12-310001494319us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001494319us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001494319us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2018-01-012018-12-310001494319us-gaap:LandAndBuildingMember2020-12-310001494319us-gaap:LandAndBuildingMember2019-12-310001494319unvr:TankFarmsMember2020-12-310001494319unvr:TankFarmsMember2019-12-310001494319us-gaap:MachineryAndEquipmentMember2020-12-310001494319us-gaap:MachineryAndEquipmentMember2019-12-310001494319country:US2018-12-310001494319us-gaap:EMEAMember2018-12-310001494319country:CA2018-12-310001494319srt:LatinAmericaMember2018-12-310001494319country:US2019-01-012019-12-310001494319us-gaap:EMEAMember2019-01-012019-12-310001494319country:CA2019-01-012019-12-310001494319srt:LatinAmericaMember2019-01-012019-12-310001494319country:US2019-12-310001494319us-gaap:EMEAMember2019-12-310001494319country:CA2019-12-310001494319srt:LatinAmericaMember2019-12-310001494319country:US2020-01-012020-12-310001494319us-gaap:EMEAMember2020-01-012020-12-310001494319country:CA2020-01-012020-12-310001494319srt:LatinAmericaMember2020-01-012020-12-310001494319country:US2020-12-310001494319us-gaap:EMEAMember2020-12-310001494319country:CA2020-12-310001494319srt:LatinAmericaMember2020-12-3100014943192019-01-010001494319us-gaap:CustomerRelationshipsMember2020-12-310001494319us-gaap:CustomerRelationshipsMember2019-12-310001494319us-gaap:OtherIntangibleAssetsMember2020-12-310001494319us-gaap:OtherIntangibleAssetsMember2019-12-3100014943192020-04-012020-06-300001494319us-gaap:FiniteLivedIntangibleAssetsMember2020-04-012020-06-300001494319us-gaap:PropertyPlantAndEquipmentMember2020-04-012020-06-3000014943192020-07-012020-09-3000014943192020-10-012020-12-310001494319us-gaap:PropertyPlantAndEquipmentMembercountry:US2020-01-012020-12-310001494319unvr:TermB3LoanDueTwentyTwentyFourMember2020-12-310001494319unvr:TermB3LoanDueTwentyTwentyFourMember2019-12-310001494319unvr:TermB5LoanDueTwentyTwentySixMember2020-12-310001494319unvr:TermB5LoanDueTwentyTwentySixMember2019-12-310001494319unvr:NorthAmericanABLDueTwentyTwentyFourMember2020-12-310001494319unvr:NorthAmericanABLDueTwentyTwentyFourMember2019-12-310001494319unvr:CanadianABLFacilityDueTwentyTwentyTwoMember2020-12-310001494319unvr:CanadianABLFacilityDueTwentyTwentyTwoMember2019-12-310001494319unvr:UnsecuredNotesDueTwentyTwentySevenMember2020-12-310001494319unvr:UnsecuredNotesDueTwentyTwentySevenMember2019-12-310001494319unvr:TermB4LoanDueTwentyTwentyFourMember2020-03-31iso4217:EUR0001494319unvr:EuroTermB2LoanDueTwentyTwentyFourMember2020-03-310001494319us-gaap:BaseRateMemberunvr:TermB5LoanDueTwentyTwentySixMember2020-10-012020-12-310001494319unvr:TermB5LoanDueTwentyTwentySixMemberunvr:EurocurrencyRateMember2020-10-012020-12-310001494319unvr:TermB4LoanDueTwentyTwentyFourMember2020-01-012020-12-310001494319unvr:TermB3LoanDueTwentyTwentyFourMember2020-01-012020-03-310001494319unvr:TermB3LoanDueTwentyTwentyFourMember2020-01-012020-12-310001494319unvr:RevolvingLoanTrancheMemberunvr:NewSeniorABLFacilityMember2020-01-012020-12-310001494319unvr:UnitedStatesSubsidiariesMemberunvr:RevolvingLoanTrancheMemberunvr:NewSeniorABLFacilityMember2020-12-310001494319unvr:CanadianSubsidiariesMemberunvr:RevolvingLoanTrancheMemberunvr:NewSeniorABLFacilityMember2020-12-310001494319unvr:CanadianABLFacilityDueTwentyTwentyTwoMemberunvr:NewSeniorABLFacilityMember2020-01-012020-12-310001494319unvr:CanadianABLFacilityDueTwentyTwentyTwoMemberunvr:NewSeniorABLFacilityMember2020-12-310001494319unvr:NewSeniorABLFacilityMember2019-01-012019-12-310001494319unvr:NorthAmericanABLFacilityDueTwoThousandTwentyThreeInterestRateOfSixPointSevenFivePercentMember2019-01-012019-12-310001494319unvr:UnsecuredNotesDueTwentyTwentyThreeFixedInterestRateOfSixPointSevenFivePercentMember2019-12-310001494319unvr:SeniorTermLoanFacilityMember2019-01-012019-12-310001494319unvr:NewNorthAmericanABLFacilityMember2020-01-012020-12-310001494319unvr:NewNorthAmericanABLFacilityMember2019-01-012019-12-310001494319unvr:EuroTermB2LoanDueTwentyTwentyFourMember2020-12-310001494319unvr:EuroABLDueTwoThousandNineteenMember2020-01-012020-12-310001494319unvr:EuroABLDueTwoThousandNineteenMember2019-01-012019-12-310001494319us-gaap:CashAndCashEquivalentsMember2020-12-310001494319us-gaap:CashAndCashEquivalentsMember2019-12-310001494319us-gaap:AccountsReceivableMember2020-12-310001494319us-gaap:AccountsReceivableMember2019-12-310001494319us-gaap:InventoriesMember2020-12-310001494319us-gaap:InventoriesMember2019-12-310001494319us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2020-12-310001494319us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2019-12-310001494319us-gaap:PropertyPlantAndEquipmentMember2020-12-310001494319us-gaap:PropertyPlantAndEquipmentMember2019-12-310001494319us-gaap:FairValueInputsLevel2Member2020-12-310001494319us-gaap:FairValueInputsLevel2Member2019-12-310001494319us-gaap:WarrantMember2019-12-310001494319us-gaap:WarrantMember2018-12-310001494319unvr:ContingentConsiderationMember2019-12-310001494319us-gaap:WarrantMember2020-01-012020-12-310001494319us-gaap:WarrantMember2019-01-012019-12-310001494319unvr:ContingentConsiderationMember2020-01-012020-12-310001494319us-gaap:WarrantMember2020-12-310001494319unvr:ContingentConsiderationMember2020-12-310001494319us-gaap:WarrantMemberus-gaap:MeasurementInputExpectedTermMember2020-12-310001494319srt:MinimumMemberus-gaap:WarrantMemberus-gaap:MeasurementInputPriceVolatilityMember2020-12-310001494319srt:MaximumMemberus-gaap:WarrantMemberus-gaap:MeasurementInputPriceVolatilityMember2020-12-310001494319us-gaap:WarrantMemberus-gaap:MeasurementInputPriceVolatilityMember2020-12-310001494319us-gaap:WarrantMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2020-12-310001494319us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2019-12-170001494319us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2019-12-172019-12-170001494319us-gaap:InterestRateSwapMember2020-03-170001494319unvr:TermB5LoanDueTwentyTwentySixMemberus-gaap:CrossCurrencyInterestRateContractMember2020-12-310001494319us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-12-310001494319us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2019-12-310001494319us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CrossCurrencyInterestRateContractMember2020-12-310001494319us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CrossCurrencyInterestRateContractMember2019-12-310001494319us-gaap:NondesignatedMemberus-gaap:InterestRateSwapMember2020-12-310001494319us-gaap:NondesignatedMemberus-gaap:InterestRateSwapMember2019-12-310001494319us-gaap:CurrencySwapMemberus-gaap:NondesignatedMember2020-12-310001494319us-gaap:CurrencySwapMemberus-gaap:NondesignatedMember2019-12-310001494319us-gaap:NondesignatedMemberus-gaap:CrossCurrencyInterestRateContractMember2020-12-310001494319us-gaap:NondesignatedMemberus-gaap:CrossCurrencyInterestRateContractMember2019-12-310001494319us-gaap:InterestRateSwapMemberus-gaap:InterestExpenseMember2020-01-012020-12-310001494319us-gaap:InterestRateSwapMemberus-gaap:InterestExpenseMember2019-01-012019-12-310001494319us-gaap:InterestRateSwapMemberus-gaap:InterestExpenseMember2018-01-012018-12-310001494319us-gaap:InterestExpenseMemberus-gaap:CrossCurrencyInterestRateContractMember2020-01-012020-12-310001494319us-gaap:InterestExpenseMemberus-gaap:CrossCurrencyInterestRateContractMember2019-01-012019-12-310001494319us-gaap:InterestExpenseMemberus-gaap:CrossCurrencyInterestRateContractMember2018-01-012018-12-310001494319us-gaap:OtherNonoperatingIncomeExpenseMember2020-01-012020-12-310001494319us-gaap:OtherNonoperatingIncomeExpenseMember2019-01-012019-12-310001494319us-gaap:OtherNonoperatingIncomeExpenseMember2018-01-012018-12-310001494319us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:CrossCurrencyInterestRateContractMember2020-01-012020-12-310001494319us-gaap:CurrencySwapMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-12-310001494319us-gaap:CurrencySwapMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMember2019-12-310001494319us-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherNoncurrentLiabilitiesMember2020-12-310001494319us-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherNoncurrentLiabilitiesMember2019-12-310001494319us-gaap:InterestRateSwapMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-12-310001494319us-gaap:InterestRateSwapMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMember2019-12-310001494319us-gaap:AccruedLiabilitiesMemberus-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-12-310001494319us-gaap:AccruedLiabilitiesMemberus-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2019-12-310001494319us-gaap:InterestRateSwapMemberus-gaap:OtherAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-12-310001494319us-gaap:InterestRateSwapMemberus-gaap:OtherAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMember2019-12-310001494319us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherNoncurrentLiabilitiesMember2020-12-310001494319us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherNoncurrentLiabilitiesMember2019-12-310001494319us-gaap:DesignatedAsHedgingInstrumentMember2020-12-310001494319us-gaap:DesignatedAsHedgingInstrumentMember2019-12-310001494319us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2020-12-310001494319us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2019-12-310001494319us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMemberus-gaap:AccruedLiabilitiesMember2020-12-310001494319us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMemberus-gaap:AccruedLiabilitiesMember2019-12-310001494319us-gaap:CurrencySwapMemberus-gaap:NondesignatedMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2020-12-310001494319us-gaap:CurrencySwapMemberus-gaap:NondesignatedMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2019-12-310001494319us-gaap:CurrencySwapMemberus-gaap:NondesignatedMemberus-gaap:OtherNoncurrentLiabilitiesMember2020-12-310001494319us-gaap:CurrencySwapMemberus-gaap:NondesignatedMemberus-gaap:OtherNoncurrentLiabilitiesMember2019-12-310001494319us-gaap:NondesignatedMemberus-gaap:InterestRateSwapMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2020-12-310001494319us-gaap:NondesignatedMemberus-gaap:InterestRateSwapMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2019-12-310001494319us-gaap:NondesignatedMemberus-gaap:AccruedLiabilitiesMemberus-gaap:InterestRateSwapMember2020-12-310001494319us-gaap:NondesignatedMemberus-gaap:AccruedLiabilitiesMemberus-gaap:InterestRateSwapMember2019-12-310001494319us-gaap:NondesignatedMemberus-gaap:InterestRateSwapMemberus-gaap:OtherAssetsMember2020-12-310001494319us-gaap:NondesignatedMemberus-gaap:InterestRateSwapMemberus-gaap:OtherAssetsMember2019-12-310001494319us-gaap:NondesignatedMemberus-gaap:InterestRateSwapMemberus-gaap:OtherNoncurrentLiabilitiesMember2020-12-310001494319us-gaap:NondesignatedMemberus-gaap:InterestRateSwapMemberus-gaap:OtherNoncurrentLiabilitiesMember2019-12-310001494319us-gaap:NondesignatedMember2020-12-310001494319us-gaap:NondesignatedMember2019-12-310001494319us-gaap:AccruedLiabilitiesMember2020-12-310001494319us-gaap:AccruedLiabilitiesMember2019-12-31unvr:claim0001494319srt:MaximumMember2020-12-31unvr:site0001494319unvr:ProjectsWithUncertainTimingMember2020-12-310001494319us-gaap:ForeignCountryMemberus-gaap:SecretariatOfTheFederalRevenueBureauOfBrazilMember2020-10-012020-12-310001494319us-gaap:ForeignCountryMemberus-gaap:SecretariatOfTheFederalRevenueBureauOfBrazilMember2020-04-012020-06-300001494319us-gaap:InterestIncomeMemberus-gaap:ForeignCountryMemberus-gaap:SecretariatOfTheFederalRevenueBureauOfBrazilMember2020-10-012020-12-310001494319us-gaap:ForeignCountryMemberus-gaap:InterestExpenseMemberus-gaap:SecretariatOfTheFederalRevenueBureauOfBrazilMember2020-10-012020-12-310001494319us-gaap:CostOfSalesMember2020-01-012020-12-310001494319us-gaap:CostOfSalesMember2019-01-012019-12-310001494319us-gaap:ShippingAndHandlingMember2020-01-012020-12-310001494319us-gaap:ShippingAndHandlingMember2019-01-012019-12-310001494319us-gaap:SellingGeneralAndAdministrativeExpensesMember2020-01-012020-12-310001494319us-gaap:SellingGeneralAndAdministrativeExpensesMember2019-01-012019-12-3100014943192020-12-102020-12-100001494319us-gaap:RealEstateMember2020-12-100001494319us-gaap:OperatingSegmentsMembercountry:US2020-01-012020-12-310001494319us-gaap:EMEAMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001494319country:CAus-gaap:OperatingSegmentsMember2020-01-012020-12-310001494319us-gaap:OperatingSegmentsMembersrt:LatinAmericaMember2020-01-012020-12-310001494319us-gaap:OperatingSegmentsMember2020-01-012020-12-310001494319country:USus-gaap:IntersegmentEliminationMember2020-01-012020-12-310001494319us-gaap:EMEAMemberus-gaap:IntersegmentEliminationMember2020-01-012020-12-310001494319country:CAus-gaap:IntersegmentEliminationMember2020-01-012020-12-310001494319srt:LatinAmericaMemberus-gaap:IntersegmentEliminationMember2020-01-012020-12-310001494319us-gaap:IntersegmentEliminationMember2020-01-012020-12-310001494319us-gaap:OperatingSegmentsMembercountry:US2020-12-310001494319us-gaap:EMEAMemberus-gaap:OperatingSegmentsMember2020-12-310001494319country:CAus-gaap:OperatingSegmentsMember2020-12-310001494319us-gaap:OperatingSegmentsMembersrt:LatinAmericaMember2020-12-310001494319us-gaap:IntersegmentEliminationMember2020-12-310001494319us-gaap:OperatingSegmentsMembercountry:US2019-01-012019-12-310001494319us-gaap:EMEAMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001494319country:CAus-gaap:OperatingSegmentsMember2019-01-012019-12-310001494319us-gaap:OperatingSegmentsMembersrt:LatinAmericaMember2019-01-012019-12-310001494319us-gaap:OperatingSegmentsMember2019-01-012019-12-310001494319country:USus-gaap:IntersegmentEliminationMember2019-01-012019-12-310001494319us-gaap:EMEAMemberus-gaap:IntersegmentEliminationMember2019-01-012019-12-310001494319country:CAus-gaap:IntersegmentEliminationMember2019-01-012019-12-310001494319srt:LatinAmericaMemberus-gaap:IntersegmentEliminationMember2019-01-012019-12-310001494319us-gaap:IntersegmentEliminationMember2019-01-012019-12-310001494319us-gaap:OperatingSegmentsMembercountry:US2019-12-310001494319us-gaap:EMEAMemberus-gaap:OperatingSegmentsMember2019-12-310001494319country:CAus-gaap:OperatingSegmentsMember2019-12-310001494319us-gaap:OperatingSegmentsMembersrt:LatinAmericaMember2019-12-310001494319us-gaap:IntersegmentEliminationMember2019-12-310001494319us-gaap:OperatingSegmentsMembercountry:US2018-01-012018-12-310001494319us-gaap:EMEAMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-310001494319country:CAus-gaap:OperatingSegmentsMember2018-01-012018-12-310001494319us-gaap:OperatingSegmentsMembersrt:LatinAmericaMember2018-01-012018-12-310001494319us-gaap:OperatingSegmentsMember2018-01-012018-12-310001494319country:USus-gaap:IntersegmentEliminationMember2018-01-012018-12-310001494319us-gaap:EMEAMemberus-gaap:IntersegmentEliminationMember2018-01-012018-12-310001494319country:CAus-gaap:IntersegmentEliminationMember2018-01-012018-12-310001494319srt:LatinAmericaMemberus-gaap:IntersegmentEliminationMember2018-01-012018-12-310001494319us-gaap:IntersegmentEliminationMember2018-01-012018-12-310001494319country:US2018-01-012018-12-310001494319us-gaap:EMEAMember2018-01-012018-12-310001494319country:CA2018-01-012018-12-310001494319srt:LatinAmericaMember2018-01-012018-12-310001494319us-gaap:OperatingSegmentsMembercountry:US2018-12-310001494319us-gaap:EMEAMemberus-gaap:OperatingSegmentsMember2018-12-310001494319country:CAus-gaap:OperatingSegmentsMember2018-12-310001494319us-gaap:OperatingSegmentsMembersrt:LatinAmericaMember2018-12-310001494319us-gaap:IntersegmentEliminationMember2018-12-3100014943192020-01-012020-03-3100014943192019-01-012019-03-3100014943192019-04-012019-06-3000014943192019-07-012019-09-3000014943192019-10-012019-12-310001494319us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberus-gaap:SubsequentEventMemberunvr:DistrupolBusinessMember2021-01-012021-03-310001494319unvr:CentralStatesSoutheastAndSouthwestAreasPensionPlanMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:SubsequentEventMember2021-12-310001494319unvr:CentralStatesSoutheastAndSouthwestAreasPensionPlanMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:SubsequentEventMember2021-01-012021-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________________________

Form 10-K

__________________________________________________________

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2020

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-37443

_________________________________________________________

Univar Solutions Inc.

(Exact name of registrant as specified in its charter)

__________________________________________________________

| | | | | |

| Delaware | 26-1251958 |

(State or other jurisdiction of

incorporation or organization) | (I.R.S. Employer

Identification No.) |

| | | | | | | | | | | | | | |

| 3075 Highland Parkway, Suite 200 | | Downers Grove, | Illinois | 60515 |

| (Address of principal executive offices) | | | | (Zip Code) |

Registrant’s telephone number, including area code: (331) 777-6000

__________________________________________________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Common Stock ($0.01 par value) | | UNVR | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

Warrants to acquire 0.1525 shares of common stock, $0.01 par value per share, of Univar Solutions Inc. and $1.51 in cash

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | ☐ | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

Aggregate market value of common stock held by non-affiliates of registrant on June 30, 2020: $2.8 billion (see Item 12, under Part III hereof), based on a closing price of registrant’s Common Stock of $16.86 per share.

At February 11, 2021, 169,388,143 shares of the registrant’s common stock, $0.01 par value, were outstanding.

Documents Incorporated by Reference

Certain portions of the registrant’s Proxy Statement for the Annual Meeting of Stockholders to be held May 6, 2021 and to be filed within 120 days after the registrant’s fiscal year ended December 31, 2020 (hereinafter referred to as “Proxy Statement”) are incorporated by reference into Part III.

Univar Solutions Inc.

Form 10-K

TABLE OF CONTENTS

| | | | | | | | |

| | Page |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| | |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| | |

| | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| |

| |

| Item 15. | | |

| Item 16. | | |

| |

SUPPLEMENTAL INFORMATION

In this Annual Report on Form 10-K, “Univar Solutions,” “Company,” “we,” “our” and “us” refer to Univar Solutions Inc., a Delaware corporation, and its subsidiaries included in the consolidated financial statements, except as otherwise indicated or as the context otherwise requires.

Our fiscal year ends on December 31, and references to “fiscal” when used in reference to any twelve month period ended December 31, refer to our fiscal years ended December 31.

The term “GAAP” refers to accounting principles generally accepted in the United States of America.

____________________________________

Forward-looking statements and information

Certain parts of this annual report on Form 10-K contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are generally accompanied by words such as “believes,” “expects,” “may,” “will,” “should,” “could,” “seeks,” “intends,” “plans,” “estimates,” “anticipates” or other comparable terms. All forward-looking statements made in this Annual Report on Form 10-K are qualified by these cautionary statements.

Any forward-looking statements represent our views only as of the date of this report and should not be relied upon as representing our views as of any subsequent date, and we undertake no obligation, other than as may be required by law, to update any forward-looking statement. We caution you that forward-looking statements are not guarantees of future performance and that our actual performance may differ materially from those made in or suggested by the forward-looking statements contained in this Annual Report on Form 10-K. Forward-looking statements include, but are not limited to, statements about:

•the impact of the coronavirus (COVID-19) pandemic and economic conditions on our end markets, operations, financial condition and operating results;

•our expense control and cost reduction plans and other strategic plans and initiatives;

•our ability to solve customer technical challenges and accelerate product development cycles;

•demand for products, systems and services that meet growing customer sustainability standards, expectations and preferences and our ability to provide such products, systems and services to maintain our competitive position;

•our ability to sell specialty products at higher profit;

•our human capital management strategies;

•the continuation of the trend of outsourcing of chemical distribution by chemical manufacturers;

•significant factors that may adversely affect us and our industry;

•the outcome and effect of ongoing and future legal proceedings;

•market conditions and outlook;

•our liquidity outlook and the funding thereof, and cash requirements and adequacy of resources to fund them;

•future contributions to, and withdrawal liability in connection with, our pension plans and cash payments for postretirement benefits;

•future capital expenditures and investments; and

•the impact of ongoing tax guidance and interpretations.

Potential factors that could affect such forward-looking statements include, among others:

•general economic conditions, particularly fluctuations in industrial production and consumption and the timing and extent of economic downturns;

•the sustained geographic spread of the COVID-19 pandemic, the duration and severity of the COVID-19 pandemic, current and new actions that may be taken by governmental authorities to address or otherwise mitigate the impact of the COVID-19 pandemic, the potential negative impacts of COVID-19 on the global economy and our employees, customers, vendors and suppliers, and the overall impact of the COVID-19 pandemic on our business, results of operations and financial condition;

•significant changes in the business strategies of producers or in the operations of our customers;

•increased competitive pressures, including as a result of competitor consolidation;

•significant changes in the pricing, demand and availability of chemicals;

•our indebtedness, the restrictions imposed by, and costs associated with, our debt instruments, and our ability to obtain additional financing;

•the broad spectrum of laws and regulations that we are subject to, including extensive environmental, health and safety laws and regulations;

•potential business disruptions and security breaches, including cybersecurity incidents;

•an inability to generate sufficient working capital;

•increases in transportation and fuel costs and changes in our relationship with third party providers;

•accidents, safety failures, environmental damage, product quality issues, delivery failures or hazards and risks related to our operations and the hazardous materials we handle;

•potential inability to obtain adequate insurance coverage;

•ongoing litigation, potential product liability claims and recalls, and other environmental, legal and regulatory risks;

•challenges associated with international operations;

•exposure to interest rate and currency fluctuations;

•risks associated with integration of legacy business systems;

•possible impairment of goodwill and intangible assets;

•an inability to integrate the business and systems of companies we acquire, including failure to realize the anticipated benefits of such acquisitions;

•negative developments affecting our pension plans and multi-employer pensions;

•labor disruptions associated with the unionized portion of our workforce; and

•the other factors described in “Risk Factors” in Item 1A of this Annual Report on Form 10-K.

PART I

ITEM 1. BUSINESS

General

We are a leading global chemical and ingredient distributor and provider of value-added services to customers across a wide range of diverse industries. We purchase chemicals and ingredients from thousands of chemical producers worldwide to warehouse, repackage, blend, dilute, transport and sell those chemicals to more than 100,000 customer locations across approximately 125 countries. We operate an extensive worldwide chemical and ingredient distribution network, comprised of more than 600 facilities and serviced by hundreds of tractors, railcars, tankers and trailers operating daily through our facilities.

Chemical and ingredient producers rely on us to warehouse, repackage, transport, and sell their products as a way to expand their market access, enhance their geographic reach, lower their cost to serve, and grow their business. Customers who purchase products and services from us benefit from a lower total cost of ownership, as they are able to simplify their chemical sourcing process by outsourcing functions to us such as “just-in-time delivery,” product availability and selection, packaging, mixing, blending and technical expertise. They also rely on us for safe and secure delivery and off-loading of chemicals compliant with increasing local and federal regulations.

Originally formed in 1924 as a brokerage business and through the continued expansion with various acquisitions, we were acquired in 2007 by investment funds advised by CVC Capital Partners Advisory (US), Inc. and in 2010 by investment funds controlled by Clayton, Dubilier & Rice, LLC. We closed our initial public offering on June 23, 2015. As of September 30, 2019, all of the foregoing investment funds had fully divested or reduced ownership in the Company and are no longer considered significant stockholders.

On February 28, 2019, we acquired Nexeo Solutions, Inc. (“Nexeo”), a leading global chemicals and plastics distributor. The acquisition expanded and strengthened our presence in North America and provides expanded opportunities to create the largest North American sales force in chemical and ingredients distribution coupled with a broad and deep product offering. See “Note 3: Business combinations” in Item 8 of this Annual Report on Form 10-K for additional information.

The effects of market conditions on our operations are discussed in Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Recent Developments

On September 1, 2020, we sold our industrial spill and emergency response businesses to EnviroServe Inc. and on November 30, 2020, we sold our Canadian Agriculture services business.

On December 18, 2020, we acquired a business of Zhuhai Techi Chem Silicone Industry Corporation (“Techi Chem”), a leading distributor of specialty silicone solutions used primarily for the coatings, adhesives, sealants, and elastomers (CASE) market within the China marketplace.

At the beginning of the fourth quarter of 2020, the Company decided to wind down its Canadian Agriculture wholesale distribution business, which was operationally completed by December 31, 2020 when all of the inventory had been sold.

See “Note 3: Business combinations” and “Note 4: Discontinued operations and dispositions” in Item 8 of this Annual Report on Form 10-K for additional information.

Our Segments

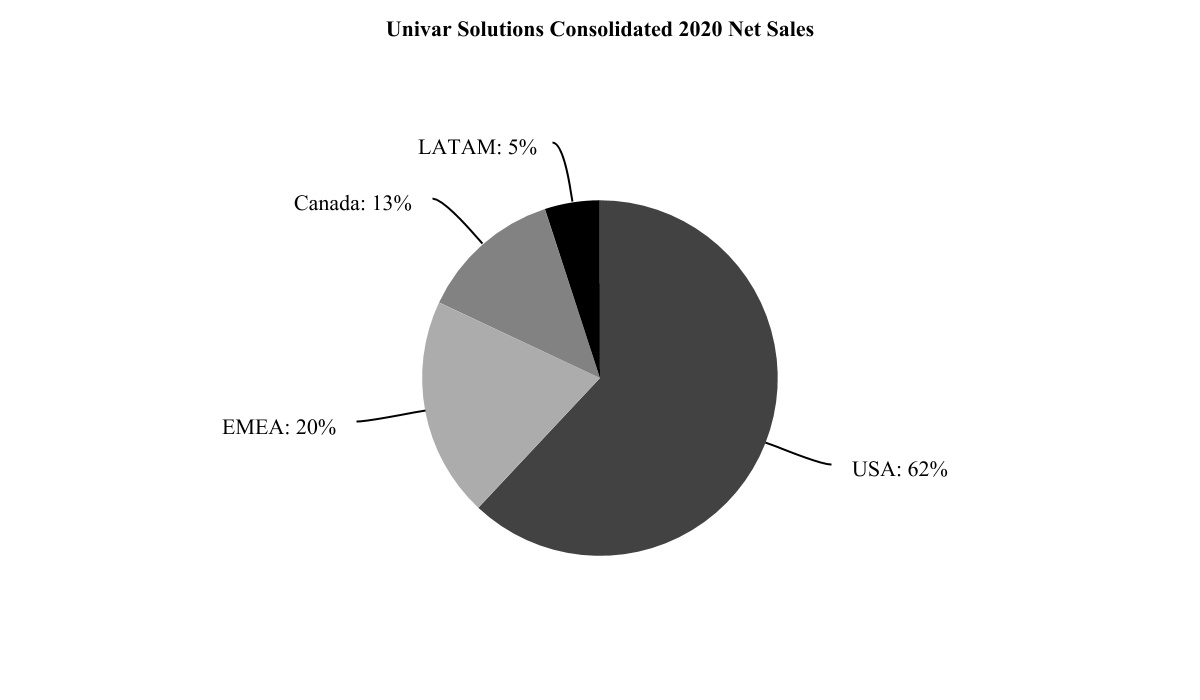

Our business is organized and managed in four geographical segments: Univar Solutions USA (“USA”), Univar Solutions Europe and the Middle East and Africa (“EMEA”), Univar Solutions Canada (“Canada”), and Univar Solutions Latin America (“LATAM”), which includes developing businesses in Latin America (including Brazil and Mexico) and the Asia-Pacific region. For additional information on our geographical segments, see “Note 23: Segments” in Item 8 of this Annual Report on Form 10-K.

The following graph reflects the breakdown by segment of our 2020 consolidated net sales of $8.3 billion.

USA

We are the largest distributor of commodity and specialty chemicals and ingredients with a centralized network in the US. With locations spanning the US, our personnel are strategically located where customers and suppliers need them and are ready to provide agile, reliable support for our customers' business needs. In addition to our broad chemical and ingredients offering, we offer specialized services to a wide range of end markets, touching a majority of the manufacturing and industrial production sectors in the US and all of the Company's end markets. Our Solution Centers provide value-added laboratory services and blending, mixing and packaging capabilities.

Our sales force is deployed through specialized account management across the US to serve our focused customer end markets and through a geographic sales district model to support the local and bulk chemical distribution and services end markets. We repackage and blend bulk chemicals for shipment by our transportation fleet as well as common carriers and utilize our network of terminal and supply locations to optimize bulk shipment deliveries. We believe our close proximity to customers, combined with our extensive product knowledge and end market expertise, serve as a competitive advantage.

EMEA

We maintain a strong presence in the United Kingdom and continental Europe with sales offices in 20 countries. We also have two sales offices in the Middle East and Africa and maintain Solution Centers throughout the EMEA region.

We execute primarily on a pan-European basis, leveraging centralized or shared information technology systems, raw materials procurement, logistics, route operations and the management of producer relationships where possible to benefit from economies of scale and improve cost efficiency. We have strong end market expertise and key account management capability across Europe to better support sales representatives in each country and for serving our key customer end markets, in industrial production, pharmaceutical ingredients, food ingredients, coating and adhesives and personal care.

Canada

Our Canadian operations are regionally focused through sales offices, Solution Centers and distribution sites with a sales force supplying a broad offering of commodity and specialty chemicals and services across a wide range of end markets. In Eastern Canada, we have deep product knowledge in end markets such as food ingredients, beauty and personal care, pharmaceutical ingredients, coatings and adhesives, and chemical manufacturing as well as homecare and industrial cleaning, energy and mining. In Western Canada, our deep end market expertise in forestry and energy (e.g., midstream gas pipeline, oil sands processing and oil refining) complements our offerings across other end markets. While we wound down our agriculture wholesale distribution business at the end of the 2020 season, we remain active in the agriculture end market developing biological crop nutrition solutions for Canadian growers via NexusBioAg.

LATAM

We offer generic and specialty chemicals and ingredients, as well as technical and market expertise, specialized services and key account management to a wide range of end markets including industrial production, personal care, coatings and adhesives, energy and agriculture through sales offices, Solution Centers and distribution sites in Mexico, Brazil, Colombia and to a lesser extent the Asia-Pacific region. With the acquisition of Tagma Brasil Ltda. in 2017, we started to provide formulation services for crop protection manufacturers in Brazil.

Product and End Markets

We source and inventory chemicals and ingredients in large quantities such as barge loads, railcars or full truck loads from chemical and ingredient producers and break down the bulk quantities to repackage, sell and distribute smaller quantities to our customers.

In addition to selling and distributing chemicals, we use our transportation and warehousing infrastructure, along with our broad knowledge of chemicals and hazardous materials handling to provide important distribution and specialized services for our producers and our customers.

We have state-of-the-art Solutions Centers at locations across the globe, consisting of formulation labs, development and research centers, and test kitchens, with specialized industry expertise and innovative technical capabilities to solve our customer's technical challenges and accelerate product development cycles.

In the first quarter of 2020, we organized our product portfolio offering into the following end markets: Industrial Solutions, Consumer Solutions, General Industrial, Refining & Chemical Processing and Services and Other Markets. A further description of these end markets is as follows:

Industrial Solutions

•Coatings and Adhesives. We sell resins, pigments, solvents, thickeners, dispersants and other additives used to make paints, inks, and coatings. Our product line includes epoxy resins, polyurethanes, titanium dioxide, fumed silica, esters, plasticizers, silicones and specialty amines.

•Homecare & Industrial Cleaning. We offer an extensive range of quality ingredients for cleaners, detergents, and disinfectant products. We distribute chemicals manufactured by many of the industry’s leading producers of enzymes, surfactants, solvents, dispersants, thickeners, bleaching aides, builders, sealants, acids, alkalis and other chemicals that are used as ingredients and processing aids in the manufacturing of cleaning and sanitation products.

•Metalworking & Lubricants. Our broad and diverse range of products include base stocks, performance-enhancing additives for both lubricants and metalworking fluids.

Consumer Solutions

•Pharmaceutical Ingredients and Finished Products. Our portfolio includes products along the medicinal production chain, where we offer a broad portfolio of excipients, solvents, reactants, active pharmaceutical ingredients and intermediates to pharmaceutical ingredient producers.

•Beauty and Personal Care. We are a full-line distributor in the beauty and personal care industry, providing a wide variety of specialty and basic chemicals and ingredients used in skin and hair care products.

•Food Ingredients and Products. We distribute a diverse portfolio of commodity and specialty products that are sold into the food industry. The major food and beverage markets we serve are meat processing, baked goods, dairy, grain mill products, processed foods, carbonated soft drinks, fruit drinks and alcoholic beverages.

General Industrial

•Chemical Manufacturing. We distribute a full suite of chemical products in support of the chemical manufacturing industry (organic, inorganic and polymer chemistries).

•Agricultural. During 2020, in Canada we were a wholesale distributor of crop protection products to independent retailers and specialty applicators. In addition, we provided storage, packaging and logistics services for major crop protection companies. However, in the fourth quarter of 2020, we sold the Canadian Agriculture services business and shut down the Canadian Agriculture wholesale distribution business. This will allow us to focus our efforts in the Canadian agriculture end market on serving growers' crop nutrition needs with inoculants, micronutrients, nitrogen stabilizers and foliar products.

•Industrial and Municipal Water Treatment. We provide the chemistries and products used to sanitize, balance and supplement municipal and industrial water.

•Forestry, Lumber, Paper. We serve the forest industry in the US and Canada, supplying a complete range of chemical products for use at all stages of production, from sap stain prevention to pulp and paper manufacturing.

•Mining. Within the mining industry in the US and Canada we provide the chemistries necessary to leach ore body as well as balance and manage tailing ponds and mining water sources.

Refining & Chemical Processing

•Energy (up, mid and downstream). We provide chemicals and service to offshore production, midstream pipeline and downstream refinery operators primarily in the US and Canada, including oil sands production. We also service the upstream US shale hydraulic-fracturing sector by providing bulk chemicals to drill sites.

Services & Other Markets

•Chemical Waste Removal. Our ChemCare waste management business collects both hazardous and non-hazardous waste products at customer locations in the US and Canada, and then works with select vendors in the waste disposal business to safely transport these materials to licensed third party treatment, storage and disposal facilities.