Exhibit

Exhibit 99.1

Explanatory Note

As discussed in the Quarterly Reports on Form 10-Q for the quarters ended March 31, 2018 and June 30, 2018 filed by Univar Inc. (the “Company”), we adopted Accounting Standard Update ("ASU") 2017-07 “Compensation - Retirement Benefits” (Topic 715) - “Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost” and ASU 2016-15 “Statement of Cash Flows” (Topic 230) - “Classification of Certain Cash Receipts and Cash Payments” on January 1, 2018 applying the retrospective presentation requirements to the periods presented.

ASU 2017-07 impacted the operating income subtotal presented on the Consolidated Statements of Operations for the years ended December 31, 2017, 2016 and 2015, as well as items within the Annual Report on Form 10-K for the year ended December 31, 2017 (the “2017 Form 10-K”), filed with the United States Securities and Exchange Commission (the “SEC”) on February 28, 2018, referencing operating income. ASU 2016-15 impacted net cash provided by operating activities and net cash used by financing activities on the Consolidated Statements of Cash Flows for the years ended December 31, 2017, 2016 and 2015, as well as items within the 2017 Form 10-K referencing net cash provided by operating activities and net cash used by financing activities.

The Company has also updated the presentation for the following: (i) gross profit from the Consolidated Statements of Operations, the Segments and Quarterly financial information (unaudited) footnotes, Selected Financial Data and Management's Discussion and Analysis of Financial Condition and Results of Operations; (ii) gross margin from Selected Financial Data; and (iii) enhanced disclosures in the Income taxes footnote.

Accordingly, the Company is filing this Exhibit 99.1 to its Current Report on Form 8-K to retrospectively reclassify certain previously reported financial information in its Annual Report on Form 10-K for the year ended December 31, 2017 to reflect these changes. Except the reporting changes described above, the Company has not updated this Exhibit 99.1 to its Current Report for any development or event occurring after February 28, 2018, the date on which the Company’s 2017 Form 10-K was filed with the SEC.

The adoption of this guidance impacts the line item presentation of the Company's results of operations, but does not change income (loss) before income taxes, net income (loss) or income (loss) per common share. This Exhibit 99.1 to the Company's Current Report includes updates only to the extent necessary to reflect reclassifications made to the following items of the Company's Annual Report on Form 10-K for the year ended December 31, 2017:

| |

• | Item 6. Selected Financial Data |

| |

• | Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations |

| |

• | Item 8. Financial Statements and Supplementary Data |

PART I

ITEM 1. BUSINESS

Our Company

We are a leading global chemical and ingredients distributor and provider of specialty services. We purchase chemicals from thousands of chemical producers worldwide and warehouse, repackage, blend, dilute, transport and sell those chemicals to more than 100,000 customer locations across approximately 140 countries. Our specialized services include digital promotion or e-marketing of chemicals for our producers, chemical waste removal and ancillary services, on-site storage of chemicals for our customers, and support services for the agricultural and pest control industries. We derive competitive advantage from our scale, broad product offering, technical expertise, specialized services, long-standing relationships with leading chemical producers and our industry leading safety record.

The global chemical distribution industry is large and fragmented with thousands of distributors but represents a relatively small portion of the total chemical industry. While the total chemical industry is projected to grow at rates about equal to the growth of the gross national product of countries we operate in around the world, the distributed chemicals portion of the market is projected to grow faster as producers and customers increasingly realize the benefits of outsourcing. Chemical producers rely on us to warehouse, repackage, transport and sell their products as a way to expand their market access, enhance their geographic reach, lower their costs and grow their business. Customers who purchase products and services from us benefit from a lower total cost of ownership, as they are able to simplify their chemical sourcing process and outsource functions to us such as just-in-time

availability of the right product, packaging, mixing, blending and technical expertise. They also rely on us for safe delivery and off-loading of chemicals that is fully compliant with increasing local and federal regulations.

In the year ended December 31, 2017, we generated $8.3 billion in net sales, net income of $119.8 million and $593.8 million in Adjusted EBITDA. Adjusted EBITDA has been recast to reflect the retrospective adoption of ASU 2017-07 which reclassified interest cost, expected return on assets and amortization of prior service costs from warehousing, selling and administrative expenses to other expense, net within the Company's consolidated statement of operations. For a reconciliation of Adjusted EBITDA to net income (loss), see “Selected Financial Data” in Item 6 of this Current Report on Form 8-K.

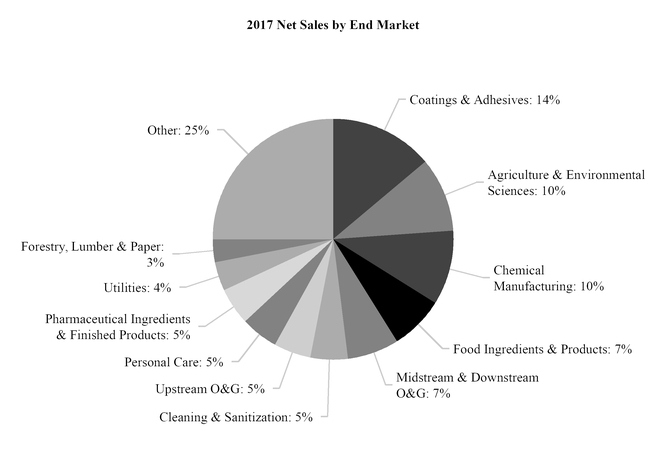

The following charts illustrate the geographical and end market diversity of our 2017 net sales:

We maintain strong, long-term relationships with our producers and our customers, many of which span decades. We source materials from thousands of producers worldwide, including premier global leaders. For the year ended December 31, 2017, our 10 largest producers accounted for approximately 30 percent of our total chemical purchases. Similarly, we sell products to thousands of customers globally, ranging from small and medium-sized businesses to large industrial customers. For the year ended December 31, 2017, our top 10 customers accounted for approximately 10 percent of our consolidated net sales. Globally, we service our customers with on-time delivery rates greater than 96 percent.

Our Segments

Our business is organized and managed in four geographical segments: Univar USA (“USA”), Univar Canada (“Canada”), Univar Europe and the Middle East and Africa (“EMEA”), and Rest of World (“Rest of World”), which is predominantly in Latin America. For additional information on our geographical segments, see “Note 21: Segments” in Item 8 of this Current Report on Form 8-K for additional information.

USA

We supply a broad offering of commodity and specialty chemicals and ingredients, as well as specialized services to a wide range of end markets, touching a majority of the manufacturing and industrial production sectors in the United States. Our close proximity to customers, combined with our deep product knowledge and end market expertise, serves as a competitive advantage.

We repackage and blend bulk chemicals for shipment by our transportation fleet as well as common carriers. Our highly skilled salesforce is deployed by geographic sales district as well as by end-use market and industry, e.g., coatings and adhesives, food ingredients and products, pharmaceutical ingredients and products, personal care, and energy.

Canada

Our Canadian operations are regionally focused, with a highly skilled salesforce supplying a broad offering of commodity and specialty chemicals and ingredients to the local customer base. In Eastern Canada, we primarily focus on industrial markets such as food ingredients, pharmaceutical ingredients, coatings and adhesives, and chemical manufacturing. We also service the cleaning and sanitation, personal care, mining, and energy markets. In Western Canada, we focus on forestry, chemical manufacturing, mining, and energy markets (e.g., midstream gas pipeline, oil sands processing and oil refining). Lastly, due to its

size, we have dedicated resources and expertise serving the agriculture end market. In agriculture, we formulate and distribute crop protection and fertilizer products to independent retailers and specialty applicators servicing the agricultural end markets in both Western Canada and Eastern Canada and we provide support services to agricultural chemical producers throughout the country.

EMEA

We maintain a strong presence in the United Kingdom and Continental Europe with sales offices in 20 countries. We also have five sales offices in the Middle East and Africa.

We execute primarily on a pan-European basis, leveraging centralized or shared information technology systems, raw materials procurement, logistics, route operations and the management of producer relationships where possible to benefit from economies of scale and improve cost efficiency. We have strong end market expertise and key account management capability across Europe to better support sales representatives in each country and for serving our key customer end markets, namely pharmaceutical ingredients and finished products, food ingredients, coating and adhesives, and personal care.

Rest of World

We operate sales offices and distribution sites in Mexico, Brazil and to a lesser extent the Asia-Pacific region. We continue to expand our footprint in Latin America through strategic acquisitions, most recently through our 2017 acquisition of Tagma, a leading provider of customized formulation and packaging services for crop protection chemicals in the Brazilian agriculture market.

Our Competitive Strengths

We derive strength and competitive advantage from our scale, broad product offering, high levels of service and expertise, long-standing relationships with producers, and our industry leading safety record.

Scale

We operate one of the most extensive chemical distribution networks in the world, comprising more than 600 distribution facilities, approximately 90 million gallons of chemical storage tank capacity and hundreds of tractors, railcars, tankers and trailers operating daily through our facilities. We purchase thousands of different chemicals, some in large quantities, from over thousands of producers. Our purchasing power and global procurement relationships provide us with advantages over local and regional competitors due to economies of scale and our ability to manage our working capital.

Product breadth and market reach

We offer a wide range of chemical products and services across nearly all end-use markets. This enables us to present to customers a “one-stop-shop” approach that simplifies their procurement process and lowers their total cost of ownership, and provides suppliers with the opportunity to achieve growth by accessing new end markets through us.

Service and expertise

Globally, we provide our customers with greater than 96 percent on-time delivery from our nearby facilities. This highly responsive service level enables our customers to lower their inventory levels and avoid production interruptions from lack of chemical ingredients.

To complement our extensive product portfolio, we offer to our customers specialized services, such as our chemical waste removal and environmental response services, chemical storage, and specialty product blending and formulation services. These services provide efficiency gains to our customers and deepen our relationships with them.

We also provide, through our highly skilled sales force, in-depth product technical knowledge and end market expertise to our customers, as well as valuable market and customer insights to our producers about how their products are performing in the market.

Long-standing producer and customer relationships

We have developed strong, long-term relationships, many spanning several decades, with the world's premier global chemical producers and distribute products to more than 100,000 customer locations around the globe, from small and medium sized businesses to global industrial customers. The strength of our relationships has provided opportunities for us to integrate our service and logistics capabilities into our customers’ and producers’ business processes and to promote collaboration on supply chain optimization, marketing and other revenue enhancement strategies.

Safety and regulatory compliance

At Univar we are Serious about Safety. Our safety culture is embedded into our global operations. Safety is foundational in planning for operations, products, processes and facilities. Specific initiatives include:

| |

• | Data driven and causality-based accident prevention work; |

| |

• | Improved process and facility controls; |

| |

• | Mandatory general education and role specific safety training; |

| |

• | Joint management-worker Health and Safety Committees; and |

| |

• | Safety audits, incident investigation and improvement measures. |

Our efforts have resulted in improvements in global safety metrics during the last 6 years. We track worker injuries using the U.S. Occupational Safety & Health Administration (OSHA) standardized methodology of Total Case Incident Rate (TCIR), which is the rate of recordable injuries per 200,000 hours worked. We have reduced our TCIR from 1.69 in 2011 to 0.71 in 2017, an improvement of 58.0%.

We believe that being Serious about Safety results in a competitive advantage by:

| |

• | Maintaining and improving relationships with our customers, who view safety performance as a key criterion for vendor selection; |

| |

• | Improving employee recruitment and retention; and |

| |

• | Reducing the likelihood of incidents and enabling our employees to focus on their contributions. |

While we believe being Serious about Safety improves our service, productivity and financial performance, that is not why safety is important to us. At Univar, we believe it is our responsibility to provide safe working conditions and challenge ourselves to continually improve.

Our Growth Strategy

We believe that we are well positioned to drive profitable growth, increase our market share, and capitalize on industry outsourcing trends by focusing on our key initiatives of Commercial Greatness, Operational Excellence and One Univar.

Drive profitable growth

Commercial Greatness. We seek to increase the value we provide our customers and our producers by improving our customers’ experience and driving additional growth for our producers. We seek to:

| |

• | further develop a highly skilled and well-equipped sales force utilizing a value-based consultative sales approach that is aligned to customer and end market needs by geography, product and service, and industry specialization; |

| |

• | continue to increase our technical and industry-specific product and market expertise; |

| |

• | develop a world-class marketing capability to dynamically identify and align resources with high-growth, high value opportunities; and |

| |

• | cultivate and maintain long-term producer relationships through deep market and product knowledge, value-based selling, reduced complexity in distribution channels, and offering complementary products and services as a total solution for our customers. |

Operational Excellence. We are committed to continuously improving our operating performance and lowering our costs per transaction. We seek to:

| |

• | align our business teams with identified growth opportunities in customer end markets, product markets, services, and industries in a way that narrows focus and increases accountability; |

| |

• | increase our use of digital tools to simplify tasks, lower costs and improve customer experience; |

| |

• | continue to use Lean Six Sigma methodologies to deliver project-by-project productivity gains; |

| |

• | increase the cost efficiency of our warehouses, terminals, tank farms and logistics, and improve our net working capital efficiency; |

| |

• | deliver a compelling customer value proposition by providing simplified sourcing, cost effective just-in-time delivery and managed inventory along with value-added services; and |

| |

• | continue to build on our industry leading safety performance as a differentiator with both customers and producers. |

One Univar. We are committed to developing a healthy, high-performance culture through the selection, recognition and development of engaged employees. We aspire to build an environment where the best people want to work and add value for our customers, producers and shareholders. We will strengthen the overall governance and efficiency of our global business operations with integrated, disciplined operating processes and by leveraging best practices.

Expand our market share

We believe our Commercial Greatness, Operational Excellence and One Univar initiatives will allow us to outperform competitors, leading to market share gains. We will continue to streamline and enhance our customer experience in order to be the easiest distributor to do business with and to increase customer preference for Univar. In addition, we believe our industry-focused go-to-market strategy combined with innovative sales and marketing support and strong customer preference will lead to winning additional product authorizations from producers. Finally, we are also pursuing selective acquisitions to increase our presence and develop competitive advantage in attractive end markets and whose products and service capabilities can benefit from our scale advantages. As a result, Univar is positioned well to gain market share.

Capitalize on industry outsourcing trends

We are well positioned to benefit from the growing trend of chemical producers and customers to outsource key tasks to chemical distributors. As a full-line distributor with a strong supply-chain-network across a broad geographic region, we are well suited to help customers and producers consolidate their distributor relationships and lower their total costs of ownership or service. Finally, as a leader in chemical distribution, we believe we can accelerate this trend by increasing the attractiveness of our total value proposition to both customers and our producers.

Through our Commercial Greatness, Operational Excellence and One Univar initiatives and by reinforcing our “one-stop-shop” provider capability, we will build on and increase the economic value we create in the global supply chain.

Company History

Our history dates back to 1924 when we were founded as a brokerage business. In 1986, we acquired McKesson Chemical Corporation, then the third largest US chemical distributor, solidifying our presence throughout the United States and making us the largest chemical distributor in North America. In 2001, we continued our expansion into Europe through the acquisition of Ellis & Everard, which specialized in the distribution of chemicals in the United Kingdom and Ireland and had additional facilities in Europe and the Eastern United States. In 2007, we acquired ChemCentral, which enabled us to improve our market share and operational efficiencies in North America.

In 2007, we were acquired by investment funds advised by CVC Capital Partners Advisory (US), Inc. (“CVC”) as well as investment funds associated with Goldman, Sachs & Co. and Parcom. In November 2010, investment funds associated with Clayton, Dubilier & Rice, LLC (“CD&R”) acquired a 42.5 percent ownership interest in us. In December 2010, we acquired Basic Chemicals Solutions, a global distributor and trader of commodity chemicals, which strengthened our ability to provide value in the supply chain between chemical producers and end-users and reinforced our global sourcing capabilities. In January 2011, we completed the acquisition of Quaron, a chemical distributor operating in Belgium and the Netherlands, which complemented our strong European foothold in specialty chemicals with expanded product portfolio and increased logistical capability. We continued our expansion into the emerging markets in 2011 through our acquisition of Eral-Protek, a leading chemical distributor in Turkey, and the acquisition of Arinos, a leading chemical distributor of specialty and commodity chemicals and high-value services in Brazil. In December 2012, we acquired Magnablend, whose specialty chemical and manufactured products broadened our energy offerings. In May 2013, we expanded our Mexican presence with the acquisition of Quimicompuestos, making us a leading chemical distributor in the Mexican market. In November 2014, we acquired D’Altomare Quimica Ltda., a Brazilian distributor of specialty chemicals and ingredients, which expanded our geographic footprint and market presence in Brazil. In April 2015, we acquired Key Chemical, Inc., one of the largest distributors of fluoride to municipalities in the United States, which expanded our offerings into the municipal and other industrial markets.

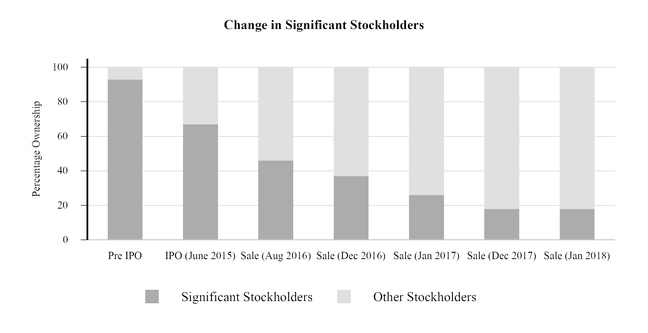

On June 23, 2015, we closed our initial public offering (“IPO”) in which we issued and sold 20.0 million shares of common stock at a public offering price of $22.00 per share. In addition, we completed a concurrent private placement of $350.0 million for shares of common stock (17.6 million shares) to Dahlia Investments Pte. Ltd., an indirect wholly owned subsidiary of Temasek Holdings (Private) Limited (“Temasek”). We received total net proceeds of approximately $760.0 million from the IPO and the private placement after deducting underwriting discounts and commissions and other offering expenses of approximately $30.0 million. These expenses were recorded against the proceeds received from the IPO. Certain selling stockholders sold an additional 25.3 million shares of common stock in the IPO and concurrent private placement. We did not receive any proceeds from the sale of these shares.

In July 2015, we acquired the assets of Chemical Associates, Inc., a marketer, manufacturer, and distributor of oleochemicals, many of which are based on renewable and sustainable resources, thereby enhancing the value Univar brings to a number of our key markets such as personal care, food, cleaning and sanitization, lubricants, and coatings and adhesives. In October 2015, we entered into the agrochemical formulation market and expanded our capabilities in the third-party agriculture logistics market in Canada with the acquisition of the Future Group. In November 2015, we acquired Arrow Chemical, Inc., adding a complementary portfolio of active pharmaceutical ingredients (“APIs”) and other specialty ingredients essential to the formulation of generic and over-the-counter pharmaceuticals. In December 2015, we acquired Weaver Town Oil Services, Inc., and Weavertown Transport Leasing, Inc., operating as the Weavertown Environmental Group, which strengthened our ChemCare waste management service offering with a broad range of complementary services, including industrial cleaning, waste management and transportation, site remediation, and 24/7 emergency response services. In December 2015, we also acquired Polymer Technologies Ltd., a U.K.-based developer and distributor of unique ultraviolet/electron beam curable chemistries used to formulate environmentally responsible paints, inks, and adhesives.

In March 2016, we acquired Bodine Services of the Midwest, further strengthening our ChemCare waste management, environmental maintenance and response service offering in key geographic markets. That same month, we acquired the assets of Nexus Ag Business, Inc., enhancing our existing macronutrient and crop protection inputs through a proprietary line of micronutrients, macronutrients and specialty fertilizers. Together with our leading distribution and services network in the region, this acquisition further strengthens our agriculture group’s ability to provide customers in Canada with a complete product service offering that covers the entire growing cycle from start to finish.

In September 2017, we acquired Tagma Brasil Ltda., expanding our agriculture business in one of the world's fastest-growing agricultural markets. That same month, we acquired the assets of PVS Minibulk, Inc., strengthening our MiniBulk business in the West Coast market.

During 2016 and 2017, we engaged in a series of secondary registrations of our stock. As a result, CVC divested its ownership interest in our company and both CD&R and Temasek continued to reduce their ownership stakes in our company. As of January 31, 2018, CD&R and Temasek owned 8.2% and 9.9%, respectively, of our issued and outstanding shares.

The below chart illustrates the change in our Significant Stockholders since the IPO date.

Products and End Markets

The focus of our marketing approach is to identify attractive end-user markets and provide customers in those markets all of their commodity and specialty chemical or ingredient needs. We also offer value-added services as well as procurement solutions that leverage our chemical, supply chain and logistics expertise, networked inventory sourcing and producer relationships. We provide our customers with a “one-stop shop” for their commodity and specialty chemical needs and offer a reliable and stable source of quality products and services.

We buy and inventory chemicals and ingredients in large quantities such as barge loads, railcars or full truck loads from chemical producers and sell and distribute smaller quantities to our customers. Approximately 40 percent of the chemicals and ingredients we purchase are in bulk form, and we repackage them into various size containers for sale and distribution.

Commodity chemicals and ingredients represent the largest portion of our business by sales and volume. Our commodity portfolio includes acids and bases, surfactants, glycols, inorganic compounds, alcohols and general chemicals used extensively throughout most end markets. Our specialty chemicals and ingredient sales represent an important, high-value, higher-growth portion of the chemical distribution market. We typically sell specialty products in lower volumes but at a higher profit than commodity products and our intent is to increase our presence in the specialty market. While many producers supply specialty products directly to customers, there is an increasing trend toward outsourcing the distribution of these specialized, lower volume products and ingredients. We believe that customers and producers value Univar’s ability to supply both commodity and specialty products, particularly as the markets continue to consolidate.

We focus on sourcing high-volume products that we distribute to our customers. We buy products globally at attractive pricing. Generally, we sell chemicals and ingredients via our industry-focused salesforce. However, a small proportion of the chemicals that we source are sold directly to certain high-volume customers through a dedicated sales team who handles these unique products and transactions. Our global sourcing capabilities enhance our global market presence, ensure safety of supply and competitive pricing, and provide product expertise across all market segments.

We serve a diverse set of end markets and regions, with no end market accounting for more than 14 percent of our net sales over the past year.

Our key global end markets include:

| |

• | Agricultural and Environmental Sciences. We are a leading wholesale distributor of crop protection products to independent retailers and specialty applicators in Canada. To support this end market, we distribute herbicides, fungicides, insecticides, seed, micronutrients, macronutrients, horticultural products, fertilizers and feed, among other products. In addition, we provide storage, packaging and logistics services for major crop protection companies, for whom we store chemicals, feed-grade materials, seed and equipment. We supply pest control products and equipment to the structural pest control, public health, vegetation management, turf and ornamental, food processing and post-harvest storage, animal health and hay production markets. We operate a network of approximately 70 Univar ProCenter distribution centers in North America to serve this end market. |

| |

• | Chemical Manufacturing. We distribute a full suite of chemical products in support of the chemical manufacturing industry (organic, inorganic and polymer chemistries). Our broad warehousing and delivery resources permit us to assure our chemical manufacturing customers efficient inventory management, just-in-time delivery, and custom blends and packages. Our industry expertise also assists our customers in both selecting products that best suit their objectives and addressing chemical waste and wastewater issues. |

| |

• | Cleaning and Sanitization. The cleaning and sanitization industry is made up of thousands of large and small formulators that require a multitude of chemical ingredients to make cleaning products and detergents for home and industrial use. We distribute chemicals manufactured by many of the industry’s leading producers of enzymes, surfactants, solvents, dispersants, thickeners, bleaching aides, builders, sealants, acids, alkalis and other chemicals that are used as ingredients and processing aids in the manufacturing of cleaning products. |

| |

• | Coatings and Adhesives. The coatings and adhesives industry is one of our largest customer end markets. We sell resins, pigments, solvents, thickeners, dispersants and other additives used to make paints, inks, and coatings. We have a large, dedicated team of industry and product specialists with market expertise that enables us to work closely with formulators and producers to offer new technologies, new and improved formulations and to scale-up support. Our product line includes epoxy resins, polyurethanes, titanium dioxide, fumed silica, esters, plasticizers, silicones and specialty amines. |

| |

• | Food Ingredients and Products. For the food and beverage industry, we distribute a diverse portfolio of commodity and specialty products that are sold as food additives or processing aids. We sell food ingredients such as thickeners, emulsifiers, sweeteners, preservatives, leavening agents and humectants, as well as texturizer and fat replacement products that include xanthan gum, locust bean gum, cellulosics and guar gum. We also distribute acidulants such as citric acid, lactic acid and malic acid, as well as alkalis. Additional offerings include supplements and products such as proteins, vitamins and minerals. The major food and beverage markets we serve are meat processing, baked goods, dairy, grain mill products, processed foods, carbonated soft drinks, fruit drinks and alcoholic beverages. We carefully manage our product portfolio to ensure quality standards, security of supply and cost competitiveness. We continuously refresh our product offering with products that meet key trends impacting the food industry. Our industry experts have developed marketing tools that simplify the ingredient selection process for our customers and provide valuable product performance information and technical solutions. |

| |

• | Energy. We provide chemicals and service to midstream pipeline and downstream refinery operators primarily in the US and Canada. We offer an expansive product line with a team of highly skilled and uniquely dedicated specialists to stay on top of the latest trends, technologies and regulations. We also service the upstream oil and gas production |

market, including the US shale hydraulic-fracturing sector, by providing a variety of bulk chemicals to drill sites, as well as specialty blended products used to fracture rock and stimulate oil and gas production from the well. Other markets served to a lesser extent include Mexico, Europe’s North Sea and parts of Africa.

| |

• | Personal Care. We are a full-line distributor in the personal care industry providing a wide variety of specialty and basic chemicals and ingredients used in skin care products, shampoos, conditioners, styling products, hair color, body washes, sun care, color cosmetics, and pet care products. The products that we distribute include surfactants, emollients, emulsifiers, rheology modifiers, active ingredients, color, preservatives and processing aids. Our dedicated team of industry experts and technical marketers work with our customers to formulate traditional and cutting-edge products that address key trends in the personal care end markets. |

| |

• | Pharmaceutical Ingredients and Finished Products. We are uniquely positioned in the highly-regulated pharmaceutical ingredients industry due to the combination of our product portfolio, logistics footprint and customized solutions. We represent some of the world’s leading excipient, process, solvent and active pharmaceutical ingredient producers, as well as producers of chemicals used to support water treatment, filtering and purification systems, thus offering our customers a very broad product selection in the pharmaceutical industry. We sell active ingredients such as aspirin, ascorbic acid, caffeine and ibuprofen, and excipients that include phosphates, polyethylene glycols, polysorbates, methylcellulose, stearyl alcohol and stearates. We also make and sell certain finished pharmaceutical products. |

Services

In addition to selling and distributing chemicals, we use our transportation and warehousing infrastructure, along with our broad knowledge of chemicals and hazardous materials handling to provide important distribution and specialized services for our producers and our customers. This intermediary role Univar plays is increasingly important, in particular due to the recent trend of increased outsourcing of distribution by chemical producers to satisfy their need for supply chain efficiency. These services include:

Distribution and specialized services

| |

• | Inventory Management. We manage our inventory in order to meet customer demands on short notice whenever possible. Our value as channel partners of chemical producers also enables us to obtain access to chemicals in times of short supply, when smaller chemical distributors may not be able to obtain or maintain stock. Further, our global distribution network permits us to stock products locally to enhance “just-in-time” delivery, providing outsourced inventory management to our customers in a variety of end markets. |

| |

• | Product Knowledge and Technical Expertise. We partner with our customers in their production processes. For example, we employ teams of food technologists, chemical engineers and petroleum engineers who have the technical expertise to assist in the formulation of products to meet specific customer performance requirements as well as provide customers with after-market support and consultation. |

| |

• | Mixing, Blending and Repackaging. We provide a full suite of blending and repackaging services for our customers across diverse industries. Additionally, we can fulfill small orders through our repackaging services, enabling customers to maintain smaller inventories. |

| |

• | Digital Promotion or E-marketing. ChemPoint is our unique distribution business that provides digital promotion or e-marketing channels for specialty and fine chemicals. ChemPoint operates principally in North America and EMEA and is primarily focused on expanding market share of high-value and highly specialized chemicals for partnered producers. |

| |

• | Chemical Waste Removal and Environmental Response Services. Our ChemCare waste management service collects both hazardous and non-hazardous waste products at customer locations in the United States and Canada, and then works with select vendors in the waste disposal business to safely transport these materials to licensed third party treatment, storage and disposal facilities. ChemCare reviews each waste profile, recommends disposal alternatives to the customer and offers transportation of the waste to the appropriate waste disposal company. Hazardous and non-hazardous waste management technologies provided from our approved treatment storage and disposal facility vendors include recycling, incineration, fuels blending, lab packing, landfill, deep well injection and waste-to-energy. Through our acquisitions of Bodine and Weavertown Environmental Group, we are also able to provide our customers with industrial cleaning, site remediation and emergency environmental response services. |

| |

• | Specialized Formulation and Blending. Leveraging our technical expertise, we are able to utilize our blending and mixing capabilities to create specialty chemical formulations to meet specific customer performance demands for agriculture and energy products through our Future Group, Tagma, and Magnablend blending services. |

Producers

Maintaining strong relationships with producers is important to our overall success, and we source chemicals and ingredients from many of the premier global chemical and ingredient manufacturers. Our relationships with some of the world’s largest commodity and specialty chemical and ingredient producers have been in place for decades. We typically maintain relationships with multiple producers in order to protect against disruption in supply and distribution logistics, as well as to ensure competitive pricing of our supply. Our scale, geographic reach, diversified distribution channels and industry expertise enable us to develop strong, long-term relationships with producers, and integrate our service and logistics capabilities into their business processes. This promotes collaboration on supply chain optimization, marketing and other revenue enhancement strategies. The producers we work with also benefit from the insight we provide into customer buying patterns and trends. More and more, chemical and ingredient producers are depending on the sales forces and infrastructure of large distributors to efficiently market, warehouse and deliver their chemicals and ingredients to end users.

Our supplier community is well diversified, with our largest producer representing approximately 9% of our 2017 chemicals expenditures, and no other chemical producer accounting for more than 5% of the total. Our 10 largest producers accounted for approximately 30% of our total chemical purchases in 2017.

We typically purchase our chemicals and ingredients through purchase orders rather than long-term contracts, although we have exclusive supply arrangements for certain chemicals and ingredients. We normally enter into framework supply contracts with key producers. These framework agreements generally operate on an annual basis either with pricing items fixed to an index or without fixed pricing terms, although they often include financial incentives if we meet or exceed specified purchase volumes. We also have a limited number of longer term agreements with certain producers of commodity chemicals. For all of these chemicals, once we purchase the products, we ship them either directly to a customer or, more commonly, to one of our distribution centers.

Sales and Marketing

We organize our business to align with our customers and end markets needs by geography, product and service, and industry specialization, including high-focus industries such as coatings and adhesives, food ingredients, pharmaceutical ingredients and products, personal care, agricultural and environmental sciences, and energy. We train our sales personnel so that they develop expertise in the industries that they serve. Our sales force leverages our strong producer relationships to provide superior product insight and expertise supporting the delivery of critical-use specialty, organic and inorganic chemicals and ingredients to customers. Aligning our business to customers and end markets enables our sales force and supply chain to deliver valuable market insights to both our customers and producers.

Distribution Channels

We continue to refine our distribution business model to provide producers and our customers with the highest level of service, reliability and timeliness of deliveries while offering cost competitive products. We have multiple channels to market, including both warehouse delivery, and direct-to-consumer delivery. The principal determinants of the way a customer is serviced include the size, scale and level of customization of a particular order, the nature of the product and the customer, and the location of the product inventories. For the year ended December 31, 2017, warehouse distribution accounted for approximately 79% of our net sales while direct distribution accounted for approximately 18% of our net sales, with the remaining approximate 3% of net sales derived primarily from our waste management services.

Warehouse distribution

Our warehouse distribution channel is the core of our operations. We purchase chemicals and ingredients in truck load or larger quantities from producers based on contracted demands of our customers and our estimates of anticipated customer purchases. Once received, products are stored in one or more of our distribution facilities, for sale and distribution in smaller, less-than-truckload quantities to our customers. Our warehouses have various facilities for services such as repackaging, blending and mixing to create specialized solutions needed by our customers in ready-to-use formulations.

Our warehouse network connects large producers with smaller volume customers whose consumption patterns tend to make them uneconomical to be served directly by producers. Thus, the core customer serviced via our warehouses is a small or medium-volume consumer of chemicals and ingredients. Since chemicals and ingredients comprise only a fraction of the input costs for many of our customers’ products, our warehouse customers typically value quality, reliability of supply and ease of service. Our breadth of product offerings also allows us to provide customers with complete management solutions for their chemical needs as they are able to obtain small volumes of many different products from us more efficiently and economically than if they dealt directly with multiple chemical producers. Our network of warehouses allows us to service most customers from multiple locations and also enables us to move products efficiently and economically throughout our own warehouse system to service customers on a real-time basis. Further, by leveraging our geographic footprint and logistics platform, we are able to combine multiple

customer orders along the same distribution routes to reduce delivery costs and facilitate customer inventory management. For example, we combine multiple less-than-truckload deliveries for different customers along the same route to better utilize our delivery assets while at the same time minimizing our customers’ inventories.

Our network of warehouses allows us to offer a delivery system that increases inventory visibility and improves plant safety and productivity. MiniBulk is a safe and efficient handling and use system for customers receiving less than full truckload quantities of chemicals. Our trained specialists deliver products to on-site storage containment systems that minimize employee exposure to hazardous chemicals. In addition, the need for drum storage and disposal are eliminated, thereby saving costs and improving access to product inventory. Our remote telemetry systems used in conjunction with MiniBulk storage solutions permit around-the-clock access to inventory information. The result is better inventory management, elimination of manual measurement and better assurance of timely replenishment.

With the leading market position in North America, our operations are capable of serving customers throughout the United States, including Hawaii and Alaska, and all major provinces and major manufacturing centers within Canada including remote areas such as the oil sands regions of Northern Canada. Our close proximity to major transportation arteries allows us to service customers in the most remote locations throughout the United States, particularly those markets that chemical producers are not able to serve profitably. In the USA, we rely on a combination of our own fleet of distribution vehicles and third-party carriers, while we primarily use third parties for the transportation of chemicals and ingredients in Canada, EMEA and Rest of World.

Direct distribution

Our direct distribution channel provides point-to-point logistics for full truckloads or larger quantities of chemicals between producers and customers. In direct distribution, we sell and service large quantity purchases that are shipped directly from producers through our logistics infrastructure, which provides our customers with sourcing and logistics support services for inventory management and delivery, in many cases far more economically than the producer might provide. We believe that producers view us not as competitors, but as providers of a valuable service, supporting these large orders through the utilization of our broad distribution network. We typically do not maintain inventory for direct distribution, but rather use our existing producer relationships and marketing expertise, ordering and logistics infrastructure to serve this demand, resulting in limited working capital investment for these sales. Our direct distribution service is valuable to major chemical producers as it allows them to deliver larger orders to customers utilizing our existing ordering, delivery and payment systems.

Insurance

The nature of our business exposes us to operational risk, including damages to the environment and property, and injury to employees or the general public. Although we focus on operating safely and prudently, we occasionally receive claims, alleging damages, negligence or other wrongdoing in the planning or performance of our services. Our liabilities resulting from these claims can be significant. Accruals for deductibles are based on claims and actuarial estimates of claims development and claims incurred but not recorded.

We maintain policies of insurance that provide coverage for these types of claims (subject to limitations, exclusions, or deductibles) for our worldwide facilities and activities. To mitigate aggregate loss potential above these retentions and deductibles, the company purchases insurance coverage from highly rated insurance companies. The company does not currently operate or participate in any captive insurance companies or other non-traditional risk transfer alternatives.

In the normal course of business, as a financial guarantee of our performance, we also purchase surety bonds or issue letters of credit in connection with municipal contracts, import and export activities, environmental remediation, and environmental permits.

Competition

The chemical and ingredient production, distribution and sales markets are highly competitive. Most of the products that we distribute are made to standard specifications and are either produced by or available from multiple sources.

Chemical and ingredient distribution itself is a fragmented market in which only a small number of competitors have substantial international operations. Our principal large international competitor is Brenntag, which has a particularly strong position in Europe.

Many other chemical distributors operate on a regional, national or local basis and may have a strong relationship with local producers and customers that may give them a competitive advantage in their local market. Some of our competitors are either local or regional distributors with a broad product portfolio, while others are niche players which focus on a specific end market, either industry or product-based.

Chemical and ingredient producers may also sell their products through a direct sales force or through multiple chemical distributors, limit their use of third party distributors, particularly with respect to higher margin products, or to partner with other chemical and ingredient producers for distribution. Each of which could increase our competition.

We compete on the basis of service, on-time delivery, product breadth and availability, product and market knowledge and insights, safety and environmental compliance, global reach, product price, as well as our ability to provide certain additional value-added services.

North America

The independent chemical distribution market in North America is fragmented. Our principal competitors in North America include Brenntag, Helm America, Hydrite Chemical, Prinova and Nexeo Solutions. We also compete with a number of smaller companies in certain niche markets.

EMEA

The independent chemical distribution market in Europe historically has been highly fragmented. Consolidation among chemical distributors has increased, mirroring developments within the chemical sector as a whole.

Brenntag is our leading competitor in Europe due to its strong market position in Germany, which is the largest European chemical distribution market. Other regional competitors in Europe include Azelis, Helm and IMCD. We believe that we are the leading chemical distributor in the United Kingdom and Ireland.

Rest of World

In Rest of World, the markets for chemical distribution are much more fragmented and credible competitive information for smaller companies is not available. Our relative competitive position in the Rest of World markets is smaller than in North America or EMEA.

Regulatory Matters

Our business is subject to a wide range of regulatory requirements in the jurisdictions in which we operate. Among other things, these laws and regulations relate to environmental protection, economic sanctions, product regulation, anti-terrorism concerns, management, storage, transport and disposal of hazardous chemicals and other dangerous goods, and occupational health and safety issues. Changes in and introductions of regulations have in the past caused us to devote significant management and capital resources to compliance programs and measures. New laws, regulations, or changing interpretations of existing laws or regulations, or a failure to comply with current laws, regulations or interpretations, may have a material adverse effect on our business, financial condition and results of operations. The following summary illustrates some of the significant regulatory and legal requirements applicable to our business.

Environmental, health and safety matters

We operate in a number of jurisdictions and are subject to numerous foreign, federal, state and local laws and regulations related to the protection of the environment, human health and safety, including laws regulating discharges of hazardous substances into the soil, air and water, blending, managing, handling, storing, selling, transporting and disposing of hazardous substances, investigation and remediation of contaminated properties and protecting the safety of our employees and others. Some of our operations are required to hold environmental permits and licenses and certain of our services businesses are also impacted by these laws. The cost of complying with these environmental, health and safety laws, permits and licenses has, in some instances, been substantial.

Some of our historic operations, including those of companies we acquired, have resulted in contamination at a number of currently and formerly owned or operated sites. We are required to investigate and remediate at many of such sites. Contamination at these sites generally resulted from releases of chemicals and other hazardous substances. We have spent substantial sums on such investigation and remediation and expect to continue to incur such expenditures, or discover additional sites in need of investigation and remediation, until such investigation and remediation is deemed complete. Information on our environmental reserves is included in “Note 19: Commitments and contingencies” to our consolidated financial statements for the year ended December 31, 2017 which are included in Item 8 of this Current Report on Form 8-K.

CERCLA. The US Comprehensive Environmental Response, Compensation, and Liability Act, or CERCLA, also known as Superfund, as well as similar laws in other jurisdictions, governs the remediation of contaminated sites and establishes liability for the release of hazardous substances at such sites. A party that transported waste, or arranged for the shipment of waste, to a waste disposal facility or other third party site that requires remediation can be liable for the cost of cleanup regardless of fault, the lawfulness of the disposal or the actions of other parties. Under CERCLA, the EPA or a delegated state agency can oversee or require remediation of such sites and seek cost recovery from any party whose wastes were disposed at, or who otherwise contributed

to the contamination of, such sites. We are party to consent agreements with the EPA and state regulatory authorities with respect to environmental remediation at a number of such sites. We may be identified as a Potentially Responsible Party at additional third party sites or waste disposal facilities.

RCRA. The EPA regulates the generation, transport, treatment, storage and disposal of hazardous waste under the US Resource Conservation and Recovery Act, or RCRA. RCRA also sets forth a framework for managing non-hazardous waste. Most owners and operators of hazardous waste treatment, storage and disposal facilities must obtain a RCRA permit. RCRA also mandates certain operating, recordkeeping and reporting obligations for owners and operators of hazardous waste facilities. Our facilities generate various hazardous and non-hazardous wastes and we are a hazardous waste transporter and temporary storage facility. As a result of such activities, we are required to comply with RCRA requirements, including the maintenance of financial resources and security to address forced closures or accidental releases.

Clean Air Act. The US Clean Air Act and similar laws in other jurisdictions establish a variety of air pollution control measures, including limits for a number of airborne pollutants. These laws also establish controls for emissions from automobiles and trucks, regulate hazardous air pollutants emitted from industrial sources and address the production of substances that deplete stratospheric ozone. Under the Clean Air Act, we are required to obtain permits for, and report on emissions of, certain air pollutants, or qualify for and maintain records substantiating that we qualify for an exemption. Owners and operators of facilities that handle certain quantities of flammable and toxic substances must implement and regularly update detailed risk management plans filed with and approved by the EPA. Failure to comply with the Clean Air Act may subject us to fines, penalties and other governmental and private actions.

Clean Water Act. Many of the jurisdictions in which we operate regulate water quality and contamination of water. In the United States, the EPA regulates discharges of pollutants into US waters, sets wastewater standards for industry and establishes water quality standards for surface waters, such as streams, rivers and lakes, under the US Clean Water Act. The discharge of any regulated pollutant from point sources (such as pipes and manmade ditches) into navigable waters requires a permit from the EPA or a delegated state agency. Several of our facilities have obtained permits for discharges of treated process wastewater directly to surface waters. In addition, several of our facilities discharge to municipal wastewater treatment facilities and therefore are required to obtain pretreatment discharge permits from local agencies. A number of our facilities also have storm water discharge permits.

Oil Pollution Prevention Regulations. The Oil Pollution Prevention regulations promulgated by the EPA under the authority of the Clean Water Act require that facilities storing oil in excess of threshold quantities or which have the ability to reach navigable water have a spill prevention, control and countermeasure, or SPCC, plan. Many of our facilities have SPCC plans or similar oil storage plans required in non-US jurisdictions.

Storage Requirements. Our warehouse facilities are required to comply with applicable permits and zoning requirements from local regulatory authorities and pursuant to leases. These requirements, which differ based on type of facility and location, define structural specifications and establish limits on building usage. Regulators typically have the authority to address non-compliance with storage requirements through fines, penalties and other administrative sanctions.

EPCRA. The US Emergency Planning and Community Right-To-Know Act, or EPCRA, establishes reporting rules for facilities that store or manage chemicals and requires such facilities to maintain certain safety data. EPCRA is intended to facilitate state and local planning for chemical emergencies. EPCRA requires state and local emergency planning and emergency response authorities to be informed of the presence of specified quantities of “extremely hazardous substances” at a facility and the release of listed hazardous substances above threshold quantities. Facilities that store or use significant amounts of toxic chemicals must also submit annual toxic chemical release reports containing information about the types and amounts of toxic chemicals that are released into the air, water and soil, as well as information on the quantities of toxic chemicals sent to other facilities. We store and handle a number of chemicals subject to EPCRA reporting and recordkeeping requirements.

TSCA and the Lautenberg Act. The US Toxic Substances Control Act, the recently enacted Lautenberg Act (collectively TSCA) and similar laws in other jurisdictions, are intended to ensure that chemicals do not pose unreasonable risks to human health or the environment. TSCA requires the EPA to maintain the TSCA registry listing chemicals manufactured or processed in the United States. Chemicals not listed on the TSCA registry cannot be imported into or sold in the United States until registered with the EPA. TSCA also sets forth specific reporting, recordkeeping and testing rules for chemicals, including requirements for the import and export of certain chemicals, as well as other restrictions relevant to our business. Pursuant to these laws, the EPA from time to time issues Significant New Use Rules, or SNURs, when it identifies new uses of chemicals that could pose risks to human health or the environment and also requires pre-manufacture notification of new chemical substances that do not appear on the TSCA registry. When we import chemicals into the United States, we must ensure that chemicals appear on the TSCA registry prior to import, participate in the SNUR process when a chemical we import requires testing data and report to the EPA information relating to quantities, identities and uses of imported chemicals.

FIFRA and Other Pesticide and Biocide Regulations. We have a significant operation in the distribution and sale of pesticides and biocides. These products are regulated in many jurisdictions. In the United States, the Federal Insecticide, Fungicide, and

Rodenticide Act, or FIFRA, authorizes the EPA to oversee and regulate the manufacture, distribution, sale and use of pesticides and biocides. We are required to register with the EPA and certain state regulatory authorities as a seller and repackager of pesticides and biocides. The EPA may cancel registration of any pesticide or biocide that does not comply with FIFRA, effectively prohibiting the manufacture, sale, distribution or use of such product in the United States.

The EPA has established procedures and standards for the design of pesticide and biocide containers, as well as the removal of pesticides and biocides from such containers prior to disposal. Applicable regulations also prescribe specific labeling requirements and establish standards to prevent leaks and spills of pesticides and biocides from containment structures at bulk storage sites and dispensing operations. These standards apply to dealers who repackage pesticides, commercial applicators and custom blenders.

REACH. In Europe, our business is affected by legislation dealing with the Registration, Evaluation, Authorization and Restriction of Chemicals, or REACH. REACH requires manufacturers and importers of chemical substances to register such substances with the European Chemicals Agency, or the ECHA, and enables European and national authorities to track such substances. Depending on the amount of chemical substances to be manufactured or imported, and the specific risks of each substance, REACH requires different sets of data to be included in the registration submitted to the ECHA. Registration of substances with the ECHA imposes significant recordkeeping requirements that can result in significant financial obligations for chemical distributors, such as us, to import products into Europe. REACH is accompanied by legislation regulating the classification, labeling and packaging of chemical substances and mixtures.

GHG Emissions. In the US, various legislative and regulatory measures to address greenhouse gas, or GHG, emissions are in various phases of discussion or implementation. At the federal legislative level, Congress has previously considered legislation requiring a mandatory reduction of GHG emissions. Although Congressional passage of such legislation does not appear likely at this time, it could be adopted at a future date. It is also possible that Congress may pass alternative climate change bills that do not mandate a nationwide cap-and-trade program and instead focus on promoting renewable energy and energy efficiency. In the absence of congressional legislation curbing GHG emissions, the EPA is moving ahead administratively under its Clean Air Act authority.

The implementation of additional EPA regulations and/or the passage of federal or state climate change legislation will likely result in increased costs to operate and maintain our facilities. Increased costs associated with compliance with any future legislation or regulation of GHG emissions, if it occurs, may have a material adverse effect on our results of operations, financial condition and ability to make cash distributions.

Internationally, many of the countries in which we do business (but not the US) have ratified the Kyoto Protocol to the United Nations Framework Convention on Climate Change, or the Kyoto Protocol, and we have been subject to its requirements, particularly in the European Union. Many nations entered into the Copenhagen Accord, which may result in a new international climate change treaty in the future. If so, we may become subject to different and more restrictive regulation on climate change to the extent the countries in which we do business implement such a new treaty.

OSHA. We are subject to workplace safety laws in many jurisdictions, including the United States. The US Occupational Safety and Health Act, or OSHA, which addresses safety and health in workplace environments and establishes maximum workplace chemical exposure levels for indoor air quality. Chemical manufacturers and importers must employ a hazard communication program utilizing labels and other forms of warnings, as well as Material Safety Data Sheets, setting forth safety and hazardous materials information to employees and customers. Employers must provide training to ensure that relevant employees are equipped to properly handle chemicals.

We train employees and visitors who have access to chemical handling areas. OSHA requires the use of personal protective equipment when other controls are not feasible or effective in reducing the risk of exposure to serious workplace injuries or illnesses resulting from contact with hazardous substances or other workplace hazards. Employers must conduct workplace assessments to determine what hazards require personal protective equipment, and must provide appropriate equipment to workers.

OSHA operates a process safety management rule, or PSM Rule, that requires employers to compile written process safety information, operating procedures and facility management plans, conduct hazard analyses, develop written action plans for employee participation in safety management and certify every three years that they have evaluated their compliance with process safety requirements. Employees must have access to safety analyses and related information, and employers must maintain and provide process-specific training to relevant employees. We handle several chemicals that are hazardous and listed under the PSM Rule, which imposes extensive obligations on our handling of these chemicals and results in significant costs on our operations.

OSHA’s Hazardous Waste Operations and Emergency Response rules require employers and employees to comply with certain safety standards when conducting operations involving the exposure or potential exposure to hazardous substances and wastes. These standards require hazardous substances preparedness training for employees and generally apply to individuals engaged in cleanup operations, facility operations entailing the treatment, storage and disposal of hazardous wastes, and emergency responses to uncontrolled releases of hazardous substances.

OSHA regulations require employers to develop and maintain an emergency action plan to direct employer and employee actions in the event of a workplace emergency. Under most circumstances, the plan must be maintained in writing, remain accessible at the workplace and be made available to employees for review.

Chemical Facility Anti-Terrorism Standards. The US Department of Homeland Security, or DHS, regulates certain high-risk chemical facilities through its Chemical Facility Anti-Terrorism Standards. These standards establish a Chemical Security Assessment Tool comprised of four elements, including facility user registration, top-screen evaluation, security vulnerability assessment and site security planning. The site security plan must address any vulnerabilities identified in the security vulnerability assessment, including access control, personnel credentialing, recordkeeping, employee training, emergency response, testing of security equipment, reporting of security incidents and suspicious activity, and deterring, detecting and delaying potential attacks. DHS must approve all security vulnerability assessments and site security plans. We handle a number of chemicals regulated by DHS.

FDA. The U.S. Food & Drug Administration, or FDA's, Food Safety Modernization Act, or FSMA, directs FDA to build an integrated national food safety system in partnership with state and local authorities. Univar facilities that handle FDA regulated products are required to implement a written preventive controls plan. This involves evaluating the hazards that could affect food safety and specifying what preventive steps, or controls, will be put in place to significantly minimize or prevent the hazards. Also, when we import FDA regulated products into the United States, we have an explicit responsibility to verify that our foreign suppliers have adequate preventive controls in place. Finally, the rule establishes requirements for companies involved in transporting FDA regulated products to use sanitary practices to ensure the safety of those products.

Other regulations

We are subject to other foreign, federal, state and local regulations. For example, many of the products we repackage, blend and distribute are subject to Food and Drug Administration regulations governing the handling of chemicals used in food, food processing or pharmaceutical applications. Compliance with these regulations requires testing, additional policies, procedures and documentation and segregation of products. In addition, we are subject to a variety of state and local regulations, including those relating to the fire protection standards, and local licensing and permitting of various aspects of our operations and facilities.

Legal Proceedings

In the ordinary course of our business, we are subject to periodic lawsuits, investigations and claims. Although we cannot predict with certainty the ultimate resolution of pending or future lawsuits, investigations and claims asserted against us, we do not believe that any currently pending legal proceeding to which we are a party is likely to have a material adverse effect on our business, results of operations, cash flows or financial condition. See “Note 19: Commitments and Contingencies” in Item 8 of this Current Report on Form 8-K for additional information.

Asbestos claims

In its 1986 purchase of McKesson Chemical Company from McKesson Corporation, or McKesson, our wholly owned subsidiary, Univar USA Inc., entered into an indemnification agreement with McKesson. Univar USA has an obligation to defend and indemnify McKesson for claims alleging injury from exposure to asbestos-containing products sold by McKesson Chemical Company, or the asbestos claims. Univar USA’s obligation to indemnify McKesson for settlements and judgments arising from asbestos claims is the amount which is in excess of applicable insurance coverage, if any, which may be available under McKesson’s historical insurance coverage. In addition, we are currently defending a small number of claims which name Univar USA as a defendant.

As of December 31, 2017, Univar USA has accepted the tender of, and is defending McKesson in, eight pending separate-plaintiff claims in multi-plaintiff lawsuits filed in the State of Mississippi. These lawsuits have multiple plaintiffs, include a large number of defendants, and provide no specific information on the plaintiffs’ injuries and do not connect the plaintiffs’ injuries to any specific sources of asbestos. Additionally, the majority of the plaintiffs in these lawsuits have not put forth evidence that they have been seriously injured from exposure to asbestos. No new claims in Mississippi have been received since 2010. At the peak there were approximately 16,000 such claims pending against McKesson. To date, the costs for defending these cases have not been material, and the cases that have been finalized have either been dismissed or resolved with either minimal or no payments. Although we cannot predict the outcome of pending or future claims or lawsuits with certainty, we believe the future defense and liability costs for the Mississippi cases will not be material. Univar USA has not recorded a reserve related to these lawsuits, as it has determined that losses are neither probable nor estimable.

As of December 31, 2017, Univar USA was defending fewer than 255 single-plaintiff asbestos claims against McKesson (or Univar USA as a successor in interest to McKesson Chemical Company) pending in 12 states. These cases differ from the Mississippi multi-plaintiff cases in that they are single-plaintiff cases with the plaintiff alleging substantial specific injuries from exposure to asbestos-containing products. These cases are similar to the Mississippi cases in that numerous defendants are named

and that they provide little specific information connecting the plaintiffs’ injuries to any specific source of asbestos. Although we cannot predict the outcome of pending or future claims or lawsuits with certainty, we believe the liabilities for these cases will not be material. In 2017, there were 70 single-plaintiff lawsuits filed against McKesson and 92 cases against McKesson which were resolved. As of December 31, 2017, Univar USA had reserved $125,000 related to pending asbestos litigation.

Environmental remediation

The Company is subject to various federal, state and local environmental laws and regulations that require environmental assessment or remediation efforts (collectively “environmental remediation work”) at approximately 130 locations, some that are now or were previously Company-owned/occupied and some that were never Company-owned/occupied (“non-owned sites”).

The Company’s environmental remediation work at some sites is being conducted pursuant to governmental proceedings or investigations, while the Company, with appropriate state or federal agency oversight and approval, is conducting the environmental remediation work at other sites voluntarily. The Company is currently undergoing remediation efforts or is in the process of active review of the need for potential remediation efforts at approximately 106 current or formerly Company-owned/occupied sites. In addition, the Company may be liable for a share of the cleanup of approximately 24 non-owned sites. These non-owned sites are typically (a) locations of independent waste disposal or recycling operations with alleged or confirmed contaminated soil and/or groundwater to which the Company may have shipped waste products or drums for re-conditioning, or (b) contaminated non-owned sites near historical sites owned or operated by the Company or its predecessors from which contamination is alleged to have arisen.

In determining the appropriate level of environmental reserves, the Company considers several factors such as information obtained from investigatory studies; changes in the scope of remediation; the interpretation, application and enforcement of laws and regulations; changes in the costs of remediation programs; the development of alternative cleanup technologies and methods; and the relative level of the Company’s involvement at various sites for which the Company is allegedly associated. The level of annual expenditures for remedial, monitoring and investigatory activities will change in the future as major components of planned remediation activities are completed and the scope, timing and costs of existing activities are changed. Project lives, and therefore cash flows, range from 2 to 30 years, depending on the specific site and type of remediation project.

Although the Company believes that its reserves are adequate for environmental contingencies, it is possible, due to the uncertainties noted above, that additional reserves could be required in the future that could have a material effect on the overall financial position, results of operations, or cash flows in a particular period. This additional loss or range of losses cannot be recorded at this time, as it is not reasonably estimable.

Customs and international trade laws

In April 2012, the US Department of Justice (“DOJ”) issued a civil investigative demand to the Company in connection with an investigation into the Company’s compliance with applicable customs and international trade laws and regulations relating to the importation of saccharin from 2002 through 2012. The Company also became aware in 2010 of an investigation being conducted by US Customs and Border Patrol (“CBP”) into the Company’s importation of saccharin. Finally, the Company learned that a civil plaintiff had sued the Company and two other defendants in a Qui Tam proceeding, such filing having been made under seal in 2012, and this plaintiff had requested that the DOJ intervene in its lawsuit.

The US government, through the DOJ, declined to intervene in the Qui Tam proceeding in November 2013 and, as a result, the DOJ’s inquiry related to the Qui Tam lawsuit and its initial investigation demand are now finished. On February 26, 2014, the Qui Tam plaintiff also voluntarily dismissed its lawsuit against the Company. CBP, however, continued its investigation on the importation of saccharin by the Company’s subsidiary, Univar USA Inc. On July 21, 2014, CBP sent the Company a “Pre-Penalty Notice” indicating the imposition of a penalty against Univar USA Inc. in the amount of approximately $84.0 million. Univar USA Inc. responded to CBP that the proposed penalty was not justified. On October 1, 2014, the CBP issued a penalty notice to Univar USA Inc. for $84.0 million and has reaffirmed this penalty notice. On August 6, 2015, the DOJ filed a complaint on CBP’s behalf against Univar USA Inc. in the Court of International Trade seeking approximately $84.0 million in allegedly unpaid duties, penalties, interest, costs and attorneys’ fees. The Company continues to defend this matter vigorously. Univar USA Inc. has not recorded a liability related to this investigation as the Company believes a loss is not probable.

Canadian assessment

In 2007, the outstanding shares of Univar N.V., the ultimate public company parent of the Univar group at that time, were acquired by investment funds advised by CVC. To facilitate the acquisition and leveraged financing of Univar N.V. by CVC, a restructuring of some of the companies in the Univar group, including its Canadian operating company, was completed (the “Restructuring”). In February 2013, the Canada Revenue Agency (“CRA”) issued a Notice of Assessment, asserting the General Anti-Avoidance Rule (“GAAR”) against the Company’s subsidiary Univar Holdco Canada ULC (“Univar Holdco”) for withholding tax of $29.4 million (Canadian), relating to this Restructuring. Univar Holdco appealed the assessment, and the matter was litigated in the Tax Court of Canada in June 2015. On June 22, 2016, the Tax Court of Canada issued its judgment in favor of the CRA.

The Company subsequently appealed the judgment and a trial in the Federal Court of Canada occurred on May 10, 2017. On October 13, 2017, the Federal Court Appeals issued its judgment in favor of the Company, ruling that the Canadian restructuring was not subject to the GAAR, reversing the lower court’s decision. The Canadian Ministry of Finance had until December 12, 2017 to appeal the judgment to the Canadian Supreme Court. A $52.1 million (Canadian) Letter of Credit, covering the initial assessment of $29.4 million (Canadian) and interest of $22.7 million (Canadian), was issued.