Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on September 29, 2017.

Registration Statement No. 333-220495

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1 to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CARGURUS, INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

7389 (Primary Standard Industrial Classification Code Number) |

04-3843478 (IRS Employer Identification Number) |

2 Canal Park

4th Floor

Cambridge, Massachusetts 02141

(617) 354-0068

(Address, including zip code, and telephone number, including

area code, of registrant's principal executive offices)

Langley Steinert

Chief Executive Officer, President, and Chairman

2 Canal Park

4th Floor

Cambridge, Massachusetts 02141

(617) 354-0068

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | ||||

Michael A. Conza, Esq. Gitte J. Blanchet, Esq. Morgan, Lewis & Bockius LLP One Federal Street Boston, Massachusetts 02110 (617) 341-7700 |

Jason Trevisan Chief Financial Officer and Treasurer 2 Canal Park, 4th Floor Cambridge, Massachusetts 02141 (617) 354-0068 |

Mark G. Borden, Esq. Wilmer Cutler Pickering Hale and Dorr LLP 60 State Street Boston, Massachusetts 02109 (617) 526-6000 |

||

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (do not check if a smaller reporting company) |

Smaller reporting company o Emerging growth company ý |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

CALCULATION OF REGISTRATION FEE

|

||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Offering Price Per Share |

Estimated Maximum Aggregate Offering Price(2) |

Amount of Registration Fee(3) |

||||

|---|---|---|---|---|---|---|---|---|

Class A Common Stock, par value $0.001 per share |

10,810,000 | $15.00 | $162,150,000 | $18,794 | ||||

|

||||||||

- (1)

- Includes

shares that the underwriters have the option to purchase to cover over-allotments, if any.

- (2)

- Estimated

solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(a) under the Securities Act of 1933, as

amended.

- (3)

- The registrant previously paid $11,590 of this registration fee in connection with the original filing of this Registration Statement on September 15, 2017.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion. Dated September 29, 2017.

9,400,000 Shares

Class A Common Stock

This is an initial public offering of shares of Class A common stock of CarGurus, Inc.

We are offering 2,500,000 shares of Class A common stock. The selling stockholders identified in this prospectus are offering an additional 6,900,000 shares of Class A common stock. We will not receive any of the proceeds from the sale of the shares being sold by the selling stockholders.

We have two classes of authorized common stock, Class A common stock and Class B common stock. The rights of the holders of Class A common stock and Class B common stock are identical, except with respect to voting and conversion rights. Each share of Class A common stock is entitled to one vote per share. Each share of Class B common stock is entitled to ten votes per share and is convertible into one share of Class A common stock. Outstanding shares of Class B common stock will represent approximately 78.5% of the voting power of our outstanding capital stock immediately following this offering.

Following this offering, our founder, Chief Executive Officer, President, and Chairman, Langley Steinert, will hold or have the ability to control approximately 53% of the voting power of our outstanding capital stock. As a result, we will be a "controlled company" within the meaning of the corporate governance rules for the NASDAQ Stock Market. See the section titled "Management — Controlled Company."

Prior to this offering, there has been no public market for our Class A common stock. It is currently estimated that the initial public offering price of our Class A common stock will be between $13.00 and $15.00 per share. We have applied to list our Class A common stock on the NASDAQ Global Select Market under the symbol "CARG."

We are an "emerging growth company" as defined under the federal securities laws, and as such, we may elect to comply with certain reduced reporting requirements for this prospectus and may elect to do so in future filings. See "Prospectus Summary — Implications of Being an Emerging Growth Company."

See "Risk Factors" on page 17 to read about factors you should consider before buying shares of our Class A common stock.

Neither the Securities and Exchange Commission nor any state securities commission or other regulatory body has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

|

Per Share | Total |

|||

| | | | | | |

Initial public offering price |

$ | $ | |||

Underwriting discount(1) |

$ | $ | |||

Proceeds, before expenses, to CarGurus |

$ | $ | |||

Proceeds, before expenses, to the selling stockholders |

$ | $ |

- (1)

- See the section titled "Underwriting (Conflicts of Interest)" for a description of the compensation payable to the underwriters.

To the extent that the underwriters sell more than 9,400,000 shares of Class A common stock, the underwriters have the option to purchase up to an additional 1,410,000 shares of Class A common stock from us and certain of the selling stockholders at the initial public offering price less the underwriting discount.

The underwriters expect to deliver the shares against payment in New York, New York on or about , 2017.

| Goldman Sachs & Co. LLC | ||||

| Allen & Company LLC | ||||

| RBC Capital Markets |

| JMP Securities | Raymond James | William Blair |

Prospectus dated , 2017

Through and including , 2017 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer's obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

Neither we, the selling stockholders, nor the underwriters have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We, the selling stockholders, and the underwriters take no responsibility for, and provide no assurance about the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the Class A common stock. Our business, financial condition, results of operations, and prospects may have changed since such date.

For investors outside the United States: Neither we, the selling stockholders, nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about, and to observe any restrictions relating to, this offering and the distribution of this prospectus.

i

This summary highlights information appearing elsewhere in this prospectus. This summary does not contain all the information you should consider before investing in our Class A common stock. You should read this entire prospectus carefully, including the sections titled "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and related notes included elsewhere in this prospectus, before making any investment decision. Unless the context otherwise requires, we use the terms "CarGurus," the "company," "we," "us," and "our" in this prospectus to refer to CarGurus, Inc. and, where appropriate, our consolidated subsidiaries.

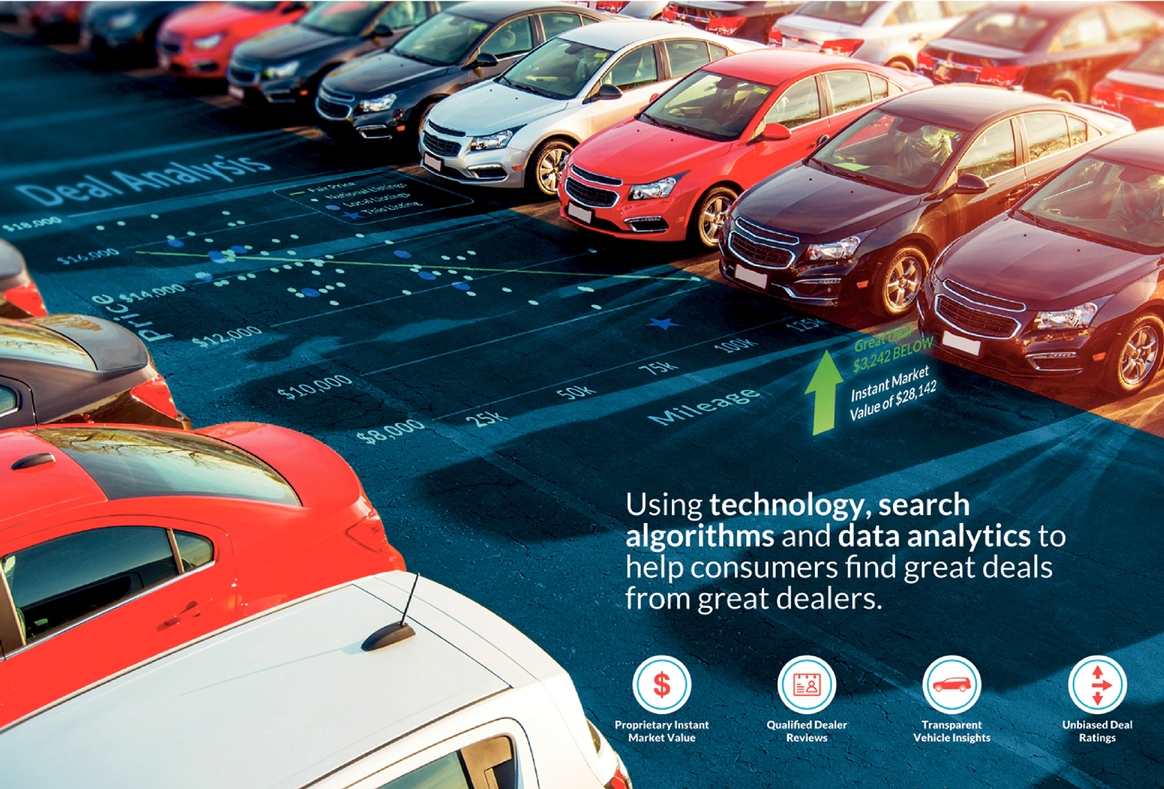

Our Business

CarGurus is a global, online automotive marketplace connecting buyers and sellers of new and used cars. Using proprietary technology, search algorithms, and innovative data analytics, we believe we are building the world's most trusted and transparent automotive marketplace and creating a differentiated automotive search experience for consumers. Our trusted marketplace empowers users with unbiased third-party validation on pricing and dealer reputation as well as other information that aids them in finding "Great Deals from Great Dealers." As of June 30, 2017, we had an active dealer network of over 40,000 dealers, and our selection of over 5.4 million car listings is the largest number of car listings available on any of the major U.S. online automotive marketplaces. In addition to the United States, we operate online marketplaces in Canada, the United Kingdom, and Germany.

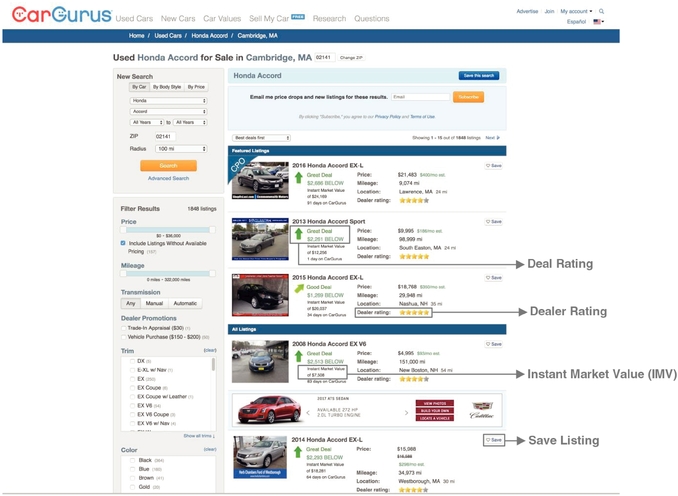

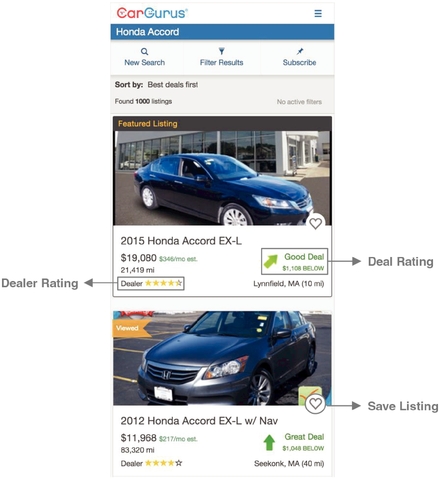

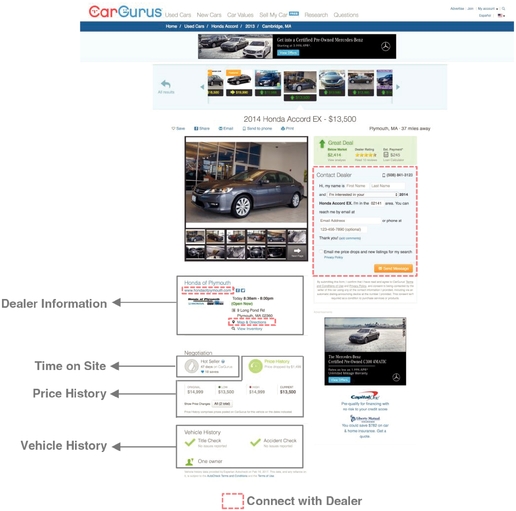

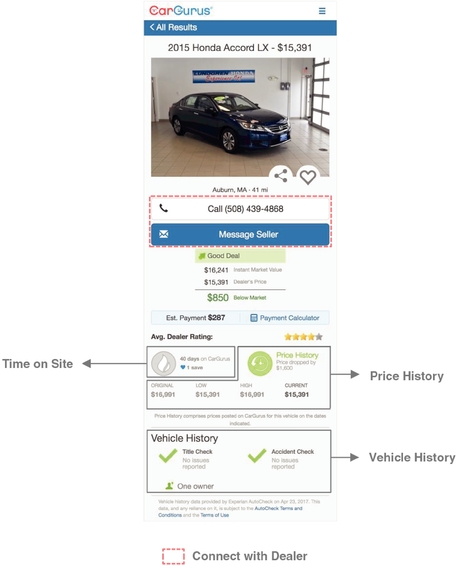

A core principle of our marketplace is unbiased transparency. For consumers considering used vehicles, we aggregate vehicle inventory from dealers and apply our proprietary analysis to generate a Deal Rating as either: Great Deal, Good Deal, Fair Deal, High Priced, or Overpriced. Deal Rating illustrates how competitive a listing is compared to similar cars sold in the same region in recent history. We determine Deal Rating principally on the basis of both our proprietary Instant Market Value, or IMV, algorithm, which determines the market value of any given vehicle in a local market, and Dealer Rating, a measure of a dealer's reputation as determined by reviews of that dealer from our user community. By sorting organic search results based on a used car's Deal Rating, we enable consumers to find the most relevant car for their needs. We also provide our users information historically not widely available, such as Price History, Time on Site, and Vehicle History. We believe this approach brings greater transparency, trust, and efficiency to a consumer's car research and buying process, leading to higher engagement and a more informed consumer who is better prepared to purchase at the dealership.

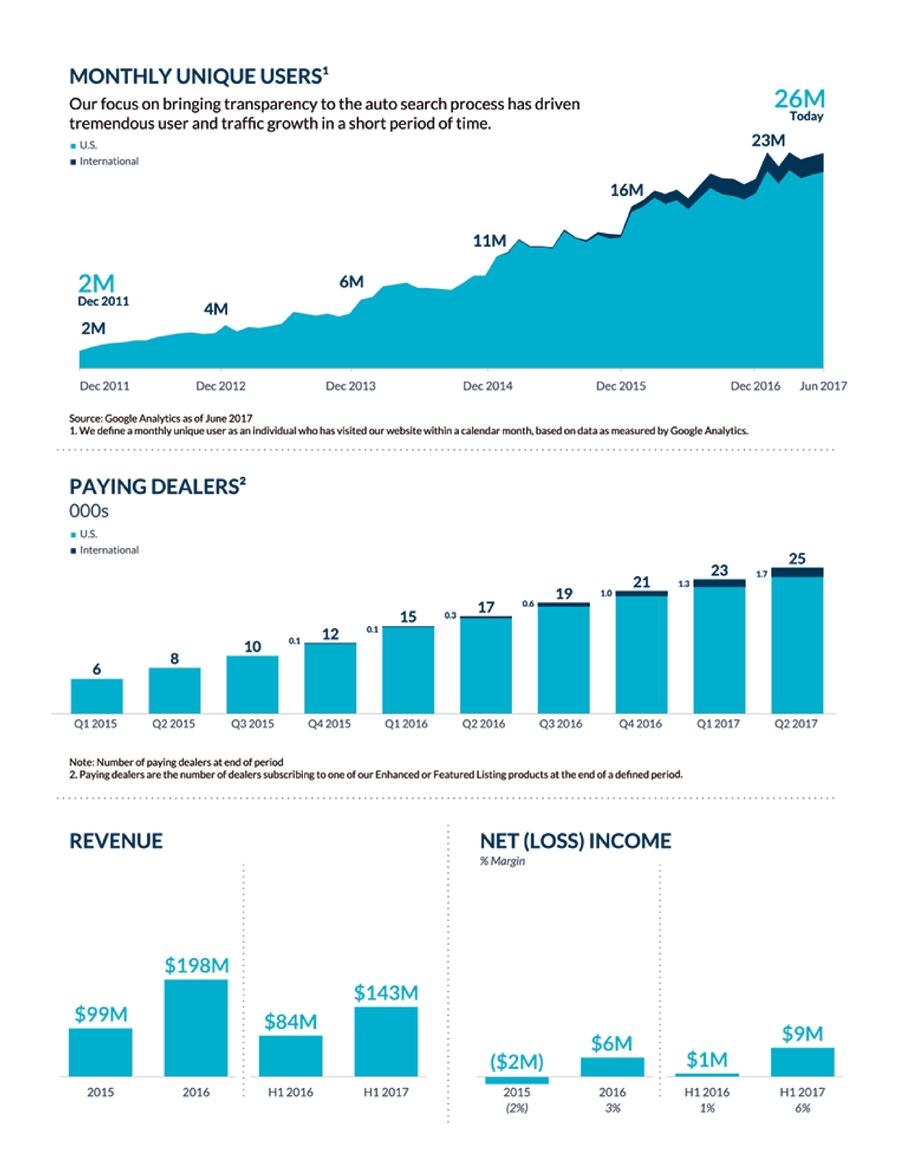

According to Google Analytics, in the second quarter of 2017, we had approximately 61 million average monthly sessions in the United States, up from approximately 45 million during the same period in 2016. According to comScore, we have become the most visited online automotive marketplace in the United States, and we have the largest mobile audience, with over 78% of our second quarter 2017 monthly unique visitors accessing our marketplace from mobile devices. Our focus on providing unbiased transparency for consumers has also created an engaged user community. According to comScore, during the second quarter of 2017, visitors returned to our site 2.4 times as often as any other major U.S. online automotive marketplace, up from 1.8 times as often in the second quarter of 2016.

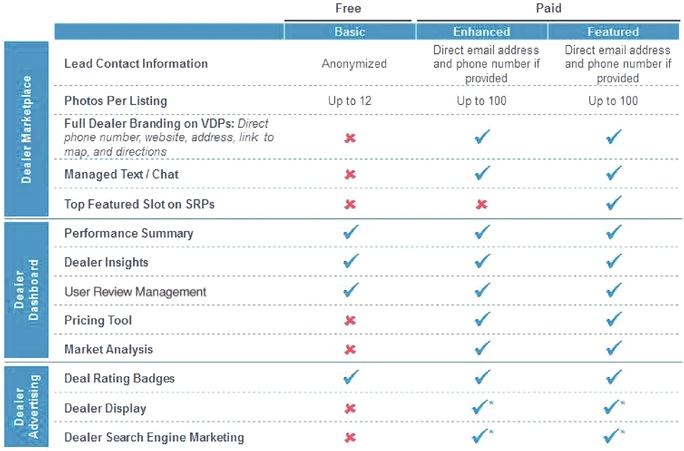

Our large, engaged, and predominantly mobile user base presents an attractive audience of in-market consumers for our dealers. By connecting dealers with more informed consumers, we believe we provide dealers with an efficient customer acquisition channel and attractive returns on their marketing spend with us. Dealers can list their inventory in our marketplace for free with our Basic Listing product or with a paid subscription to our Enhanced or Featured Listing products.

1

Dealers with free listings receive anonymized email connections and access to a subset of the tools on our Dealer Dashboard at no cost. Dealers with a paid subscription receive connections to consumers that are not anonymous and can be made through a wider variety of methods, including phone calls, email, managed text and chat, links to the dealer's website, and map directions to dealerships. In addition, dealers subscribed to our Enhanced and Featured Listing products gain full access to our Dealer Dashboard and are also able to display their dealership information to gain brand recognition, which promotes walk-in traffic to the dealer. Our success with dealers is evidenced by the 66% growth in the number of paying dealers in our U.S. marketplace from 2015 to 2016.

Our scaled online marketplace model drives powerful network effects. The industry-leading inventory selection offered by our dealers attracts a large and engaged consumer audience. The value of robust connections to this audience incentivizes dealers to purchase our Enhanced or Featured Listing products. Having more paying dealers provides consumers with more dealer information and methods to contact them. More consumers and connections drives greater value to paying dealers on our platform. Driven by these network effects, we continue to amass more data, which we use to continuously improve our search algorithms, the accuracy of Deal Ratings, our user experience, and, ultimately, the quality of the connections between consumers and dealers.

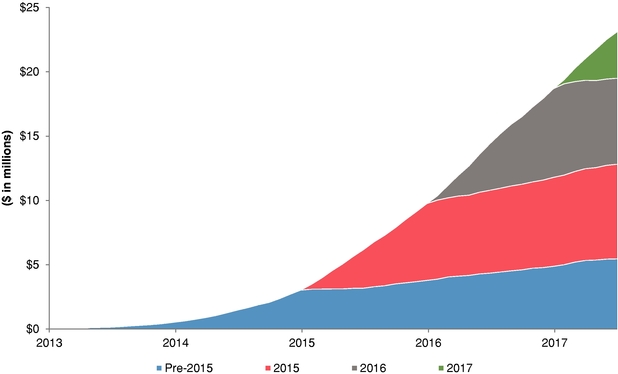

We generate marketplace subscription revenue from dealers through listing and display advertising subscriptions and advertising revenue from auto manufacturers and other auto-related brand advertisers. Our rapid revenue growth and financial performance over the last several years exemplifies the strength of our marketplace. In 2016, we generated revenue of $198.1 million, a 101% increase from $98.6 million of revenue in 2015. Our revenue for the six months ended June 30, 2017 was $143.3 million, a 70% increase from $84.2 million of revenue in the six months ended June 30, 2016. In 2016, we generated net income of $6.5 million and our Adjusted EBITDA was $11.0 million, compared to a net loss of $1.6 million and Adjusted EBITDA of $(0.4) million in 2015. For the six months ended June 30, 2017, we generated net income of $8.6 million and Adjusted EBITDA of $14.1 million, compared to net income of $0.5 million and Adjusted EBITDA of $1.7 million for the six months ended June 30, 2016. See "Selected Consolidated Financial and Other Data — Adjusted EBITDA" for more information regarding our use of Adjusted EBITDA and a reconciliation of Adjusted EBITDA to our net income (loss).

Industry Dynamics and Market Opportunity

Significant Purchasing Decision for Consumers. A car is often the second largest purchase a consumer will make, second only to his or her home. Traditionally, the process of finding the right car to buy, selecting the right dealer or seller to buy it from, and deciding how much to spend, has been complex and intimidating.

Massive U.S. Automotive Market. The automotive industry is one of the largest in the United States. Borrell Associates estimates that U.S. retail automotive sales reached $1.3 trillion in 2016, with dealers accounting for over 85% of all cars sold. According to these estimates, there are approximately 43,000 dealers in the United States, including over 16,000 franchise dealers affiliated with an automotive brand that often sell both new and used cars, and over 26,000 independent dealers that sell only used cars. These U.S. dealers sold approximately 17 million new cars and 44 million used cars in 2016, while peer-to-peer transactions by individuals accounted for approximately 11 million used cars sold. The same report estimates that the U.S. automotive industry spent over $37 billion on advertising in 2016, $23 billion of which was spent by dealers.

Shift from Offline to Online. Consumers are increasingly using the Internet to search for cars before entering a dealership. According to JD Power & Associates, the average car buyer spends 14 hours researching cars online prior to making a purchase. To respond to this trend, the

2

U.S. automotive industry has increasingly allocated more marketing spend to online channels. According to Borrell Associates estimates, 57% of the U.S. automotive marketing spend was on online channels in 2016, up from 32% in 2011, and it is expected to increase to 70% by 2021.

Increasing Importance of Mobile Devices. Consumers are increasingly using their mobile devices to search for vehicles. A 2017 Google study estimates that as much as 71% of a consumer's interactions with dealers, brands, and third-party sites during the car buying process occurred on mobile devices.

Highly Fragmented, Local Market. The market for new and used car sales is highly fragmented and local, making it competitive for dealers to find local buyers. A dealer's inventory may change daily and the speed at which a dealer turns its inventory is a key driver of its profitability. Additionally, unlike new cars, no two used cars are alike, making it challenging for dealers to find the right buyer for a specific vehicle in a cost-efficient manner.

Large International Automotive Markets with Similar Dynamics as the United States. Much like in the United States, dealers represent a critical part of international automotive markets. It is estimated that in 2016, there were approximately 5,800 dealers in Canada and 4.9 million new and used cars sold; 11,700 dealers in the United Kingdom and 10.9 million new and used cars sold; and 21,000 dealers in Germany and 10.8 million new and used cars sold.

Consumer and Dealer Challenges

Consumer Challenges. Historically, the lack of unbiased, transparent information has made it difficult for consumers to effectively compare vehicles and find the vehicle that best suits their needs. For consumers searching for used cars, every car is unique, and it is difficult to aggregate the relevant inventory of available used cars across dealers. Generally, dealers also have had more information about car prices than consumers do, as consumers have had limited resources to determine an appropriate price. Selecting the right dealer has also been challenging for consumers as dealer reputations have historically been based primarily on word-of-mouth.

Dealer Challenges. The economics of dealerships depend largely on sales volume, gross margin, and customer acquisition efficiency. To achieve a high return on their marketing investments, dealers must find in-market consumers. Traditional marketing channels, including television, radio, and newspaper, can effectively target locally but are inefficient in reaching the small percentage of consumers who are actively in the market to buy a car. In addition, dealers need to find ways to manage constantly changing inventory and adjust pricing strategies to adapt to frequently changing market conditions.

Our Approach

Why Consumers Choose Us

We believe that our marketplace offers the best online automotive marketplace experience for consumers, distinguished by the following:

- •

- Largest Inventory Selection. As of June 30, 2017, we had an active

dealer network of over 40,000 dealers, and our selection of over 5.4 million car listings is the largest number of car listings available on any of the major U.S. online automotive

marketplaces. We define our active dealer network as consisting of all dealers to which we connected a user about a listing during the ninety-day period ending on the applicable measurement date.

- •

- Trust and Unbiased Transparency. Used cars identified through searches in our marketplace are sorted by, and shown with, a Deal Rating, which is determined principally by our proprietary IMV and Dealer Rating. These features, coupled with information historically not

3

- •

- Intuitive Search Results. For used car shoppers, our organic search

function prioritizes results by a car's Deal Rating, which we believe is most relevant to a consumer's decision. In contrast, paid-inclusion automotive marketplaces award dealers preferential listing

placement based on how much a dealer pays.

- •

- Robust, Mobile-Focused Experience. We have designed our marketplace to appeal to mobile users by developing our products with a mobile-first mindset. This approach has resulted in over 78% of our monthly unique visitors accessing our marketplace from mobile devices in the second quarter of 2017, and a 43% growth in our average monthly mobile visits from 2015 to 2016, according to comScore.

widely available, provide consumers with unbiased, transparent information with which to make their purchasing decision.

Why Dealers Choose Us

We believe that dealers choose us for the following reasons:

- •

- Attractive Return on Investment. We believe we offer dealers an efficient

customer acquisition channel driven by the volume of connections to our users, the quality of those connections, and the brand exposure to our engaged audience in relation to our subscription cost.

- •

- Large and Engaged Audience. We are the most visited online automotive

marketplace in the United States; according to comScore, in the second quarter of 2017 we had 2.3 times as many visits to our U.S. website as any other major U.S. online automotive marketplace, up

from 1.8 times as many during the same period in 2016. In addition, we believe our audience is more engaged than users of other major U.S. online automotive marketplaces; in the second quarter of

2017, our visitors returned to our site more than 2.4 times as often as any other major U.S. online automotive marketplace.

- •

- Volume of Connections. Our marketplace enables consumers to easily connect

with dealers through a variety of channels. In 2016, we provided over 42 million connections to our dealers in the United States.

- •

- Broad Suite of Products and Tools. We offer products that help dealers acquire customers and build their brands. Additionally, we provide tools to help dealers market and sell their cars more efficiently.

Why Auto Manufacturers Choose Us

We believe that auto manufacturers choose to advertise in our marketplace for the following reasons:

- •

- Unique Non-Overlapping Audience of In-Market Consumers. Based on comScore

estimates, in the second quarter of 2017, 62% of our monthly unique visitors did not visit any of the other major U.S. online automotive marketplaces during the same period. This creates a compelling

value proposition to auto manufacturers, as they would have difficulty reaching these users at scale elsewhere.

- •

- Clean, Uncluttered Pages. We provide a clean and uncluttered user interface as part of our commitment to creating the best consumer experience. By limiting the number of advertisements on any given page, we help advertisers' messages better resonate when compared to other online automotive marketplaces that display significantly more ads.

4

Our Strengths

We believe that our competitive advantages are based on the following key strengths:

- •

- Trusted Marketplace for Consumers. We believe that

providing an unbiased and transparent consumer experience has instilled greater trust in us among our users, helping us become the most visited major U.S. online automotive marketplace. In the second

quarter of 2017, we experienced over 61 million average monthly sessions. We define average monthly sessions as the number of distinct visits to our website that take place each month within a

given time frame, as measured and defined by Google Analytics.

- •

- Proprietary Search Algorithms and Data-Driven

Approach. We have built an extensive repository of data that is the result of over seven years of data aggregation and regression modeling. We

calculate IMV using complex algorithms and data analytics that apply more than 20 ranking signals and more than 100 normalization rules to millions of data points. Our proprietary search

algorithms and data analytics allow us to use this data to bring greater transparency to our platform through Deal Rating, as well as build new products and launch marketplaces in new countries.

- •

- Strong Value Proposition to Dealers. We believe

that our marketplace offers an efficient customer acquisition channel for dealers, helping them achieve attractive returns on their marketing spend with us. Our strong value proposition to the dealer

community is evidenced by the 66% growth in the number of our paying U.S. dealers, and 18% growth in average annual revenue per subscribing dealer, or AARSD, in the United States from 2015 to 2016.

- •

- Network Effects Driven by Scale. Having reached the

majority of dealers and built one of the largest consumer audiences in the United States, we believe that our scale creates powerful network effects that reinforce the competitive strength of our

business model. Our large consumer audience incentivizes more dealers to convert to paid usage of our listing products, which in turn provides consumers with more dealer information and methods to

contact them. More consumers and connections drive greater value to our paying dealers.

- •

- Attractive Financial Model. We have a strong track

record of revenue growth, profitability, and capital efficiency. Our subscription model results in revenue that is recurring among a diversified customer base.

- •

- Founder-Led Management Team with Culture of Innovation. Building upon our founder's previous experience in using technology to provide transparent information to consumers, we have fostered a culture of data-driven innovation that we expect will drive continued growth.

Our Growth Strategies

We intend to continue to grow our business by pursuing the following strategies:

- •

- Grow Our Paying U.S. Dealer Base. We plan to

convert more dealers to paying dealers in the United States by demonstrating the value proposition of our marketplace and by introducing new features and services.

- •

- Increase Our Share of Dealer Marketing Spend From Existing Products. We intend to continue to grow our AARSD by increasing the volume of connections we provide to dealers and demonstrating the value of our large, engaged, and predominantly mobile audience.

5

- •

- Offer Additional Dealer Products. We plan to offer

new products to help dealers acquire customers, build relationships with prospects, and better manage their inventories, websites, and dealerships.

- •

- Grow the Size and Engagement of Our Consumer

Audience. We intend to continue investing in, and improving the efficiency of, our algorithmic traffic acquisition. We also intend to add new

features to assist consumers with more aspects of the car ownership lifecycle.

- •

- Invest in Our Brand. We plan to further expand our

marketing efforts to drive greater brand recognition, trust, and loyalty from consumers and dealers.

- •

- Expand into International Markets. We plan to grow our marketplaces in Canada, the United Kingdom, and Germany and launch new marketplaces in other countries which have attractive industry dynamics.

You should consider carefully the risks described under the "Risk Factors" section beginning on page 17 and elsewhere in this prospectus. These risks, which include the following, could materially and adversely affect our business, financial condition, operating results, cash flow, and prospects, which could cause the trading price of our Class A common stock to decline and could result in a partial or total loss of your investment:

- •

- Our business is substantially dependent on our relationships with dealers, and our subscription agreements with these dealers do not contain

long-term contractual commitments. If a significant number of dealers terminate their subscription agreements with us, our business and financial results would be materially and adversely affected.

- •

- If we fail to maintain or increase the number of dealers that pay subscription fees to us, or fail to maintain or increase the fees paid to us

for subscriptions, our business and financial results would be harmed.

- •

- If dealers or other advertisers reduce their advertising spend with us and we are unable to attract new advertisers, our business would be

harmed.

- •

- If we are unable to provide a compelling vehicle search experience to consumers through both our web and mobile platforms, the number of

connections between consumers and dealers using our marketplace may decline and our business and financial results would be materially and adversely affected.

- •

- We rely on Internet search engines to drive traffic to our website, and if we fail to appear prominently in the search results, our traffic

would decline and our business would be adversely affected.

- •

- Any inability by us to develop new products, or achieve widespread consumer adoption of those products, could negatively impact our business

and financial results.

- •

- We may be unable to maintain or grow relationships with data providers, or may experience interruptions in the data they provide, which may

create a less valuable or less transparent shopping experience and negatively affect our business and operating results.

- •

- The failure to build and maintain our brand would harm our ability to grow our audience and to expand the use of our marketplace by consumers

and dealers.

- •

- Our recent, rapid growth is not indicative of our future growth, and our revenue growth rate will decline in the future.

6

- •

- If we fail to expand effectively into new markets, both domestically and abroad, our revenue, business, and financial results will be harmed.

- •

- We participate in a highly competitive market, and pressure from existing and new companies may adversely affect our business and operating

results.

- •

- Following this offering, our founder and Chief Executive Officer will control a majority of the voting power of our outstanding capital stock, and, therefore, will have control over key decision-making and could control our actions in a manner that conflicts with the interests of other stockholders.

Our Status as a Controlled Company

Mr. Steinert, who after our initial public offering will control approximately 53% of the voting power of our outstanding capital stock, will have the ability to control the outcome of matters submitted to our stockholders for approval, including the election of our directors, as well as the overall management and direction of our company. Because Mr. Steinert controls a majority of our outstanding voting power, we will be a "controlled company" under the corporate governance rules for NASDAQ-listed companies. Because we will qualify as a "controlled company," we will not be required to have a majority of our board of directors be independent, nor will we be required to have a compensation committee consisting entirely of independent directors or having an independent nominating function. Following this offering, we intend to initially avail ourselves of certain of these exemptions and, for so long as we qualify as a "controlled company," we will maintain the option to utilize from time to time some or all of these exemptions. For example, upon the closing of this offering, our compensation committee will not consist entirely of independent directors and we will not have a nominating and corporate governance committee.

In the event of Mr. Steinert's death or voluntary termination of all employment and service on our board of directors, or if the sum of the number of shares of our capital stock held by Langley Steinert, by any Family Member of Langley Steinert, and by any Permitted Entity of Langley Steinert (as such terms are defined in our amended and restated certificate of incorporation), assuming the exercise and settlement in full of all outstanding options and convertible securities and calculated on an as-converted to Class A common stock basis, is less than 9,091,484, then each outstanding share of Class B common stock will convert into one share of Class A common stock. Upon any such conversion, we may no longer be a "controlled company."

Corporate Information

We were originally organized on November 10, 2005 as a Massachusetts limited liability company under the name "Nimalex LLC." Effective July 15, 2006, we changed our name to "CarGurus LLC." On June 26, 2015, we converted into a Delaware corporation and changed our name to "CarGurus, Inc."

Our principal executive offices are located at 2 Canal Park, 4th Floor, Cambridge, Massachusetts 02141, and our telephone number is (617) 354-0068. Our website is www.cargurus.com. Information contained on, or that can be accessed through, our website is not incorporated by reference into this prospectus, and you should not consider information on our website to be part of this prospectus.

CarGurus, the CarGurus logo, and other trademarks or service marks of CarGurus appearing in this prospectus are the property of CarGurus. Trade names, trademarks, and service marks of other companies appearing in this prospectus are the property of their respective holders. We have omitted the ® and ™ designations, as applicable, for the trademarks used in this prospectus.

7

Implications of Being an Emerging Growth Company

We are an emerging growth company as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and are therefore subject to reduced public company reporting requirements. We will remain an emerging growth company until the earliest to occur of: the last day of the fiscal year in which we have more than $1.07 billion in annual revenue; the date we qualify as a "large accelerated filer," with at least $700 million of equity securities held by non-affiliates; the issuance, in any three-year period, by us of more than $1.0 billion in non-convertible debt securities; and the last day of the fiscal year ending after the fifth anniversary of our initial public offering.

As an emerging growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable, in general, to public companies that are not emerging growth companies. These provisions include:

- •

- reduced disclosure about our executive compensation arrangements;

- •

- exemption from the requirements to hold non-binding shareholder advisory votes on executive compensation or golden parachute arrangements;

- •

- exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting; and

- •

- reduced disclosure of financial information in this prospectus, such as being permitted to include only two years of audited financial information and two years of selected financial information in addition to any required unaudited interim financial statements, with correspondingly reduced "Management's Discussion and Analysis of Financial Condition and Results of Operations" disclosure.

We may choose to take advantage of some, or all, of the available exemptions. We have taken advantage of some reduced reporting burdens in this prospectus. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock. The JOBS Act also permits an emerging growth company to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies. We have elected to avail ourselves of this extended transition period and, as a result, while we are an emerging growth company we will not be subject to new or revised accounting standards at the same time that they become applicable to other public companies that are not emerging growth companies.

8

Class A common stock offered by us |

2,500,000 shares | |

Class A common stock offered by the selling stockholders |

6,900,000 shares |

|

Class A common stock to be outstanding after this offering |

77,145,294 shares (or 77,850,294 shares if the underwriters option to purchase additional shares is exercised in full) |

|

Class B common stock to be outstanding after this offering |

28,161,232 shares |

|

Total Class A common stock and Class B common stock to be outstanding after this offering |

105,306,526 shares |

|

Option to purchase additional shares of Class A common stock from us and certain of the selling stockholders |

We and the selling stockholders have granted the underwriters an option, exercisable for 30 days after the date of this prospectus, to purchase up to 705,000 additional shares of Class A common stock from us and up to 705,000 shares of Class A common stock from the selling stockholders. |

|

Use of proceeds |

We estimate that our net proceeds from the sale of our Class A common stock that we are offering will be approximately $28.5 million (or approximately $37.6 million if the underwriters' option to purchase additional shares in this offering is exercised in full), based upon an assumed initial public offering price of $14.00 per share, the midpoint of the estimated offering price range set forth on the cover page of this prospectus, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

9

|

The principal purposes of this offering are to increase our financial flexibility, improve our visibility in the marketplace, create a public market for our Class A common stock, and facilitate our future access to the public capital markets. We currently intend to use the net proceeds from this offering primarily for general corporate purposes, including working capital, operating expenses, and capital expenditures. We may also use a portion of the net proceeds to acquire or invest in complementary technologies, solutions, products, services, businesses, or other assets, although we have no present commitments or agreements to enter into any acquisitions or investments. We will not receive any of the proceeds from the sale of Class A common stock in this offering by the selling stockholders, including any proceeds from the sale of up to 705,000 shares by the selling stockholders if the underwriters' option to purchase additional shares is exercised in full. See "Use of Proceeds" for additional information. |

|

Voting rights |

Following this offering, we will have two classes of authorized common stock, Class A common stock and Class B common stock. Each share of Class A common stock is entitled to one vote per share. Each share of Class B common stock is entitled to ten votes per share and is convertible into one share of Class A common stock. |

|

|

Holders of our Class A common stock and Class B common stock will generally vote together as a single class, unless otherwise required by Delaware law or our amended and restated certificate of incorporation that will become effective upon the closing of this offering. Following this offering, our founder, Chief Executive Officer, President, and Chairman, Langley Steinert, will hold or have the ability to control approximately 53% of the voting power of our outstanding capital stock. As a result, we will be a "controlled company" within the meaning of the corporate governance rules for the NASDAQ Stock Market and Mr. Steinert will have the ability to control the outcome of matters submitted to our stockholders for approval, including the election of our directors and the approval of any change in control transaction. See the sections titled "Principal and Selling Stockholders" and "Description of Capital Stock" for additional information. |

10

Concentration of ownership |

Upon the closing of this offering, the outstanding Class B common stock will represent 26.7% of our outstanding shares and approximately 78.5% of the voting power of our outstanding shares, and our executive officers, directors, and stockholders holding more than 5% of our outstanding shares, together with their affiliates, will beneficially own, in the aggregate, approximately 73.0% of our outstanding shares and 75.3% of the voting power of our outstanding shares. Our founder, Chief Executive Officer, President, and Chairman, Langley Steinert, will hold or have the ability to control approximately 53% of the voting power of our outstanding capital stock following this offering. |

|

Conflicts of Interest |

Allen & Company LLC, an underwriter in this offering, and its associated persons, including Ian Smith, a member of our board of directors, beneficially own 71,685 shares of our outstanding Series A preferred stock, 1,128,994 shares of our outstanding Series B preferred stock, and 163,331 shares of our outstanding Series C preferred stock, collectively representing 13.5% of our outstanding preferred stock, which shares of preferred stock will automatically convert into 8,184,061 shares of Class A common stock upon the closing of this offering. Because Allen & Company LLC is an underwriter in this offering and because Allen & Company LLC and its associated persons beneficially own more than 10% of our outstanding preferred stock, Allen & Company LLC is deemed to have a "conflict of interest" under Rule 5121, which we refer to herein as Rule 5121, of the Financial Industry Regulatory Authority, Inc., or FINRA. Accordingly, this offering will be conducted in accordance with the applicable provisions of Rule 5121, which requires, among other things, that a "qualified independent underwriter" as defined by Rule 5121 has participated in the preparation of, and has exercised the usual standards of "due diligence" with respect to, the registration statement and this prospectus. Goldman Sachs & Co. LLC has agreed to act as qualified independent underwriter within the meaning of Rule 5121 for this offering and to undertake the legal responsibilities and liabilities of an underwriter under the Securities Act of 1933, as amended, or the Securities Act, specifically including those inherent in Section 11 of the Securities Act. See "Underwriting (Conflicts of Interest)." |

|

Risk factors |

You should read the "Risk Factors" section beginning on page 17 and the other information included in this prospectus for a discussion of factors to consider before deciding to invest in shares of our Class A common stock. |

|

Proposed NASDAQ Global Select Market trading symbol |

"CARG" |

11

The number of shares of our Class A common stock and Class B common stock that will be outstanding after this offering is based on 74,645,294 shares of our Class A common stock outstanding and 28,161,232 shares of our Class B common stock outstanding, in each case, as of June 30, 2017 (assuming the automatic conversion of all outstanding shares of our preferred stock into an aggregate of 60,564,678 shares of Class A common stock upon the closing of this offering), and excludes:

- •

- 1,737,056 shares of Class A common stock issuable upon the exercise of options outstanding as of June 30, 2017 with a

weighted-average exercise price of $1.65 per share and 3,474,112 shares of Class B common stock issuable upon the exercise of options outstanding as of June 30, 2017 with a

weighted-average exercise price of $1.65 per share;

- •

- 789,934 shares of Class A common stock and 1,579,868 shares of Class B common stock issuable upon the vesting and settlement of

restricted stock units, or RSUs, outstanding as of June 30, 2017; and

- •

- 8,457,912 shares of Class A common stock reserved for future issuance under our equity compensation plans, consisting of (i) 657,912 shares of Class A common stock reserved for future issuance under our Amended and Restated 2015 Equity Incentive Plan, as amended, or the 2015 Plan, as of June 30, 2017, plus (ii) 7,800,000 additional shares of Class A common stock reserved for future issuance under our Omnibus Incentive Compensation Plan, or our 2017 Plan, which will become effective upon the closing of this offering.

Immediately prior to the closing of this offering, any remaining shares available for issuance under our 2015 Plan will be added to the shares of our Class A common stock reserved for issuance under our 2017 Plan, and we will cease granting awards under the 2015 Plan. In addition, shares of Class A common stock and shares of Class B common stock subject to outstanding grants under our 2015 Plan as of the effective date of our 2017 Plan that terminate, expire, or are cancelled, forfeited, exchanged, or surrendered on or after the effective date of our 2017 Plan without having been exercised, vested, or paid prior to the effective date of the 2017 Plan, including shares tendered or withheld to satisfy tax withholding obligations with respect to outstanding grants under the 2015 Plan, will be added to the shares of Class A common stock reserved for issuance under our 2017 Plan. See the section titled "Executive Compensation — Employee Benefits and Stock Plans" for additional information.

In addition, unless otherwise noted, the information in this prospectus reflects and assumes the following:

- •

- the filing and effectiveness of our amended and restated certificate of incorporation and the adoption of our amended and restated bylaws, each

of which will occur upon the closing of this offering;

- •

- no exercise of outstanding options or settlement of outstanding RSUs after June 30, 2017;

- •

- the retroactive adjustment to all periods herein of all share and per share information to reflect the share recapitalization effected on June 21, 2017, pursuant to which (i) each share of common stock then issued and outstanding was recapitalized, reclassified, and reconstituted into two fully paid and non-assessable shares of outstanding Class A common stock and four fully paid and non-assessable shares of outstanding Class B common stock, (ii) each outstanding common stock option was adjusted such that (a) each share of common stock underlying such option became two shares of Class A common stock and four shares of Class B common stock and (b) the exercise price per share of common stock underlying such option was adjusted to be one-sixth of the exercise price per share in effect immediately prior to the recapitalization, and (iii) each outstanding RSU was adjusted such that (a) each share of common stock issuable upon settlement of such RSU became two

12

- •

- the automatic conversion of all shares of our convertible preferred stock outstanding as of June 30, 2017 into 20,188,226 shares of our

Class A common stock and 40,376,452 shares of our Class B common stock, and the subsequent conversion of such shares of Class B common stock into 40,376,452 shares of our

Class A common stock, which conversions will occur upon to the closing of this offering; and

- •

- no exercise by the underwriters of their option to purchase up to an additional 1,410,000 shares of Class A common stock from us and certain selling stockholders in this offering.

shares of Class A common stock and four shares of Class B common stock and (b) the fair market value per share of common stock issuable upon settlement of such RSU was adjusted to be one-sixth of the fair market value per share in effect immediately prior to the recapitalization;

13

SUMMARY CONSOLIDATED FINANCIAL AND OTHER DATA

The following tables summarize our consolidated financial and other data. We derived the summary consolidated statements of operations data for the years ended December 31, 2015 and 2016 from our audited consolidated financial statements included elsewhere in this prospectus. We derived the summary consolidated statements of operations data for the six months ended June 30, 2016 and 2017 and our consolidated balance sheet data as of June 30, 2017 from our unaudited interim consolidated financial statements included elsewhere in this prospectus. The unaudited interim consolidated financial statements were prepared on a basis consistent with our annual financial statements and include, in the opinion of management, all adjustments, consisting only of normal recurring adjustments, necessary for the fair presentation of the financial information contained in those statements. Our historical results are not necessarily indicative of the results that may be expected in the future, and our interim results are not necessarily indicative of the results to be expected for the full year or any other period. You should read the summary consolidated financial data set forth below in conjunction with the sections titled "Selected Consolidated Financial and Other Data" and "Management's Discussion and Analysis of Financial Condition and

14

Results of Operations" and our consolidated financial statements, the accompanying notes, and other financial information included elsewhere in this prospectus.

|

Year Ended December 31, |

Six Months Ended June 30, |

|||||||||||

| | | | | | | | | | | | | | |

|

2015 | 2016 | 2016 | 2017 |

|||||||||

| | | | | | | | | | | | | | |

|

(in thousands, except share and per share data) | ||||||||||||

Consolidated Statements of Operations Data: |

|||||||||||||

Revenue: |

|||||||||||||

Marketplace subscription |

$ | 75,142 | $ | 171,302 | $ | 71,638 | $ | 127,952 | |||||

Advertising and other |

23,446 | 26,839 | 12,603 | 15,323 | |||||||||

| | | | | | | | | | | | | | |

Total revenue |

98,588 | 198,141 | 84,241 | 143,275 | |||||||||

Cost of revenue(1) |

4,234 | 9,575 | 3,819 | 7,647 | |||||||||

| | | | | | | | | | | | | | |

Gross profit |

94,354 | 188,566 | 80,422 | 135,628 | |||||||||

| | | | | | | | | | | | | | |

Operating expenses: |

|||||||||||||

Sales and marketing |

81,877 | 154,125 | 68,313 | 104,604 | |||||||||

Product, technology, and development |

8,235 | 11,453 | 5,150 | 8,357 | |||||||||

General and administrative |

5,801 | 12,783 | 5,618 | 9,092 | |||||||||

Depreciation and amortization |

969 | 1,634 | 633 | 1,196 | |||||||||

| | | | | | | | | | | | | | |

Total operating expenses |

96,882 | 179,995 | 79,714 | 123,249 | |||||||||

| | | | | | | | | | | | | | |

(Loss) income from operations |

(2,528 | ) | 8,571 | 708 | 12,379 | ||||||||

Other (expense) income, net |

(12 | ) | 374 | 153 | 217 | ||||||||

| | | | | | | | | | | | | | |

(Loss) income before income taxes |

(2,540 | ) | 8,945 | 861 | 12,596 | ||||||||

(Benefit from) provision for income taxes |

(904 | ) | 2,448 | 340 | 4,043 | ||||||||

| | | | | | | | | | | | | | |

Net (loss) income |

$ | (1,636 | ) | $ | 6,497 | $ | 521 | $ | 8,553 | ||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Net (loss) income per share attributable to common stockholders:(2) |

|||||||||||||

Basic |

$ | (0.41 | ) | $ | (0.58 | ) | $ | 0.01 | $ | 0.08 | |||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Diluted |

$ | (0.41 | ) | $ | (0.58 | ) | $ | — | $ | 0.08 | |||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Weighted-average number of shares of common stock used in computing net (loss) income per share attributable to common stockholders: |

|||||||||||||

Basic |

43,141,236 | 44,138,922 | 44,651,235 | 42,122,339 | |||||||||

Diluted |

43,141,236 | 44,138,922 | 48,026,295 | 46,182,359 | |||||||||

Pro forma net (loss) income per share attributable to common stockholders:(2) |

|||||||||||||

Basic |

$ | (0.24 | ) | $ | 0.08 | ||||||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Diluted |

$ | (0.24 | ) | $ | 0.08 | ||||||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Pro forma weighted-average number of shares of common stock used in computing pro forma net (loss) income per share attributable to common stockholders: |

|||||||||||||

Basic |

104,703,600 | 102,687,017 | |||||||||||

Diluted |

104,703,600 | 106,747,037 | |||||||||||

- (1)

- Includes

depreciation and amortization expense for the years ended December 31, 2015 and 2016 and for the six months ended June 30, 2016

and 2017 of $153, $438, $203, and $391, respectively.

- (2)

- See Note 2 of the notes to our consolidated financial statements included elsewhere in this prospectus for an explanation of the calculations of our net (loss) income per share attributable to common stockholders, and pro forma net (loss) income per share attributable to common stockholders.

15

Other Financial Information:

|

Year Ended December 31, |

Six Months Ended June 30, |

|||||||||||

| | | | | | | | | | | | | | |

|

2015 | 2016 | 2016 | 2017 |

|||||||||

| | | | | | | | | | | | | | |

|

(in thousands) | ||||||||||||

Adjusted EBITDA(1) |

$ | (366 | ) | $ | 10,965 | $ | 1,692 | $ | 14,116 | ||||

- (1)

- See "Selected Consolidated Financial and Other Data — Adjusted EBITDA" for more information and for a reconciliation of Adjusted EBITDA to net (loss) income, the most directly comparable financial measure calculated and presented in accordance with U.S. generally accepted accounting principles, or GAAP.

|

At June 30, 2017 |

|||||||||

| | | | | | | | | | | |

|

Actual | Pro forma(1) | Pro forma as adjusted(2)(3) |

|||||||

| | | | | | | | | | | |

|

(in thousands) | |||||||||

Consolidated Balance Sheet Data: |

||||||||||

Cash, cash equivalents, and investments |

$ | 81,309 | $ | 81,309 | $ | 110,064 | ||||

Property and equipment, net |

15,897 | 15,897 | 15,897 | |||||||

Working capital |

61,534 | 61,534 | 91,838 | |||||||

Total assets |

115,606 | 115,606 | 142,507 | |||||||

Total liabilities |

41,852 | 41,852 | 40,303 | |||||||

Convertible preferred stock |

132,698 | — | — | |||||||

Total stockholders' (deficit) equity |

(58,944 | ) | 73,754 | 102,204 | ||||||

- (1)

- Pro

forma amounts reflect (i) the automatic conversion of all of our outstanding shares of preferred stock into shares of Class A common

stock upon the closing of our initial public offering and (ii) the stock-based compensation expense of $1.9 million associated with the vesting of restricted stock units upon closing of

this offering.

- (2)

- Pro

forma as adjusted amounts reflect the pro forma conversion adjustments described in footnote (1) above, as well as the sale by us of

2,500,000 shares of our Class A common stock in this offering at an assumed initial public offering price of $14.00 per share, the midpoint of the estimated offering price range set forth on

the cover page of this prospectus, and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. Additionally, for purposes of the pro forma

as adjusted amounts shown above, the net proceeds to be received by us from the sale of Class A common stock in this offering of $28.5 million have been increased by approximately

$305,000 to reflect the estimated offering expenses that had been paid by us as of June 30, 2017.

- (3)

- Each $1.00 increase or decrease in the assumed initial public offering price of $14.00 per share, the midpoint of the estimated offering price range set forth on the cover page of this prospectus, would increase or decrease, as applicable, each of cash, cash equivalents, and investments, total assets, and total stockholders' (deficit) equity on a pro forma as adjusted basis by $2.3 million, assuming that the number of shares of Class A common stock offered by us, as set forth on the cover page of this prospectus, remains the same, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. Similarly, each increase or decrease of 1.0 million shares in the number of shares of Class A common stock offered by us would increase or decrease as applicable, each of cash, cash equivalents, and investments, total assets, and total stockholders' (deficit) equity on a pro forma as adjusted basis by $13.0 million, assuming the assumed initial public offering price of $14.00 per share, the midpoint of the estimated offering price range set forth on the cover page of this prospectus, remains the same and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us.

16

Investing in our Class A common stock involves a high degree of risk. You should consider carefully the risks and uncertainties described below, together with all of the other information contained in this prospectus, including "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and related notes, before deciding whether to purchase shares of our Class A common stock. Our business, financial condition, operating results, cash flow, and prospects could be materially and adversely affected by any of these risks or uncertainties. In that event, the trading price of our Class A common stock could decline and you could lose part or all of your investment. See "Special Note Regarding Forward-Looking Statements and Industry and Market Data."

Risks Related to Our Business and Industry

Our business is substantially dependent on our relationships with dealers, and our subscription agreements with these dealers do not contain long-term contractual commitments. If a significant number of dealers terminate their subscription agreements with us, our business and financial results would be materially and adversely affected.

Our primary source of revenue consists of subscription fees paid to us by dealers for access to enhanced features on our automotive marketplace. Our subscription agreements with dealers generally may be terminated by us with 30 days' notice and by dealers with 30 days' notice after the initial term. While the majority of our contracts with dealers currently include one-month initial terms, we are in the process of transitioning many of these dealers to contracts with one-year initial terms. The contracts do not contain contractual obligations requiring a dealer to maintain its relationship with us beyond the initial term. Accordingly, these dealers may cancel their subscriptions with us in accordance with the terms of their subscription agreements. If a significant number of our paying dealers terminate their subscriptions with us, our revenue would be materially and adversely affected.

If we fail to maintain or increase the number of dealers that pay subscription fees to us, or fail to maintain or increase the fees paid to us for subscriptions, our business and financial results would be harmed.

If paying dealers do not experience the volume of consumer connections that they expect during their monthly or annual subscription period, or do not experience the level of car sales they expect from those connections, they may terminate their subscriptions or may insist on renewing their subscriptions at a lower level of fees. Even if dealers do experience increased consumer connections or sales, they may not attribute such increases to our marketplace. If we fail to expand our base of paying dealers, or fail to maintain or increase the level of fees that we receive from them, our business and financial results would be materially and adversely affected.

We allow dealers to list their inventory in our marketplace for free; however dealer identity and contact information is not permitted in such free listings and these dealers do not receive access to the paid features of our marketplace. Many dealers start with us on a non-paying basis and then become paid customers in order to take advantage of the features of our Enhanced or Featured Listing products. If dealers using our site do not convert to our paid offerings at the rates we expect, or if a greater than expected number of our paying dealers elect to terminate their subscriptions, our business and financial results would be harmed.

17

If dealers or other advertisers reduce their advertising spend with us and we are unable to attract new advertisers, our business would be harmed.

A significant amount of our revenue is derived from advertising revenues generated primarily through advertising sales to dealers, auto manufacturers, and other auto-related brand advertisers. We compete for this advertising revenue with other online automotive marketplaces and with television, print media, and other traditional advertising channels. Our ability to attract and retain advertisers, and to generate advertising revenue, depends on a number of factors, including:

- •

- our ability to increase the number of consumers using our marketplace;

- •

- our ability to compete effectively for advertising spending with other online automobile marketplaces;

- •

- our ability to continue to develop our advertising products in our marketplace;

- •

- our ability to keep pace with changes in technology and the practices and offerings of our competitors; and

- •

- our ability to offer an attractive return on investment, or ROI, to our advertisers for their advertising spend with us.

Our agreements with dealers for display advertising generally include initial terms ranging from one month to one year and may be terminated by us with 30 days' notice and by dealers with 30 days' notice after the initial term. The contracts do not contain contractual obligations requiring an advertiser to maintain its relationship with us beyond the initial term. Our other advertising contracts, including those with auto manufacturers, are typically for a defined period of time and do not have ongoing commitments to advertise on our site beyond the initial time period. We may not succeed in capturing a greater share of our advertisers' spending if we are unable to convince advertisers of the effectiveness or superiority of our marketplace as compared to alternative channels. If current advertisers reduce or end their advertising spending with us and we are unable to attract new advertisers, our advertising revenue and business and financial results would be harmed.

If we are unable to provide a compelling vehicle search experience to consumers through both our web and mobile platforms, the number of connections between consumers and dealers using our marketplace may decline and our business and financial results would be materially and adversely affected.

If we fail to continue to provide a compelling vehicle search experience to consumers, the number of connections between consumers and dealers facilitated through our marketplace could decline, which in turn could lead dealers to stop listing their inventory in our marketplace, cancel their subscriptions, or reduce their advertising spend with us. If dealers stop listing their inventory in our marketplace, we may not be able to maintain and grow our consumer traffic, which may cause other dealers to stop using our marketplace. This reduction in the number of dealers using our marketplace would likely adversely affect our marketplace and our business and financial results. As consumers increasingly use their mobile devices to access the Internet and our marketplace, our success will depend, in part, on our ability to provide consumers with a robust and user-friendly experience through their mobile devices. We believe that our ability to provide a compelling vehicle search experience, both on the web and through mobile devices, is subject to a number of factors, including:

- •

- our ability to maintain an attractive marketplace for consumers and dealers, including on mobile platforms;

18

- •

- our ability to continue to innovate and introduce products for our marketplace on mobile platforms;

- •

- our ability to launch new products that are effective and have a high degree of consumer engagement;

- •

- our ability to maintain the compatibility of our mobile application with operating systems, such as iOS and Android, and with popular mobile

devices running such operating systems; and

- •

- our ability to access a sufficient amount of data to enable us to provide relevant information to consumers, including pricing information and accurate vehicle details.

If use of our marketplace, particularly on mobile devices, does not continue to grow, our business and operating results would be harmed.

We rely on Internet search engines to drive traffic to our website, and if we fail to appear prominently in the search results, our traffic would decline and our business would be adversely affected.

We depend, in part, on Internet search engines such as Google, Bing, and Yahoo! to drive traffic to our website. The number of consumers we attract to our marketplace from search engines is due in part to how and where our websites rank in unpaid search results. These rankings can be affected by a number of factors, many of which are not under our direct control and may change frequently. For example, when a consumer searches for a vehicle in an Internet search engine, we rely on a high organic search ranking of our webpages to refer the consumer to our website. Our competitors' Internet search engine optimization efforts may result in their websites receiving higher search result rankings than ours, or Internet search engines could change their methodologies in a way that would adversely affect our search result rankings. If Internet search engines modify their search algorithms in ways that are detrimental to us, or if our competitors' efforts are more successful than ours, overall growth in our traffic could slow or our traffic could decline. In addition, Internet search engine providers could provide dealer and pricing information directly in search results, align with our competitors, or choose to develop competing products. Search engines may also adopt a more aggressive auction-pricing system for keywords that would cause us to incur higher advertising costs or reduce our market visibility to prospective users. Our website has experienced fluctuations in search result rankings in the past, and we anticipate similar fluctuations in the future. Any reduction in the number of consumers directed to our website through Internet search engines could harm our business and operating results.

Any inability by us to develop new products, or achieve widespread consumer adoption of those products, could negatively impact our business and financial results.

Our success depends on our continued innovation to provide products and services that make our marketplace, website, and mobile application useful for consumers. These new products must be widely adopted by consumers in order for us to continue to attract dealers to our subscription products and services. Accordingly, we must continually invest resources in product, technology, and development in order to improve the attractiveness and comprehensiveness of our marketplace and its related products and effectively incorporate new Internet and mobile technologies into them. These product, technology, and development expenses may include costs of hiring additional personnel and of engaging third-party service providers and other research and development costs. In addition, revenue relating to new products is typically unpredictable and our new products may have lower gross margins and higher marketing and sales costs than our existing products. We may also change our pricing models for both existing and new products so that our prices for our offerings reflect the value those offerings are providing to consumers and

19

dealers. Our pricing models may not effectively reflect the value of products to consumers and dealers, and, if we are unable to provide a marketplace and products that consumers and dealers want to use, they may become dissatisfied and instead use our competitors' websites and mobile applications. Without an innovative marketplace and related products, we may be unable to attract additional, unique consumers or retain current consumers, which could affect the number of dealers that become paying dealers and the number of advertisers who want to advertise in our marketplace, which could, in turn, harm our business and financial results.

We may be unable to maintain or grow relationships with data providers, or may experience interruptions in the data they provide, which may create a less valuable or transparent shopping experience and negatively affect our business and operating results.

We obtain data regarding available cars from many third-party data providers, including inventory management systems, automotive websites, customer relationship management systems, dealer management systems, and third-party data licensors. Our business relies on our ability to obtain data for the benefit of consumers and dealers using our marketplace. The large amount of inventory and vehicle information available in our marketplace is critical to the value we provide for consumers. The loss or interruption of such inventory data and other vehicle information, such as vehicle history, could decrease the number of consumers using our marketplace. We could experience interruptions in our data access for a number of reasons, including difficulties in renewing our agreements with data providers, changes to the software used by data providers, efforts by industry participants to restrict access to data, and increased fees we may be charged by data providers. While we believe we have identified other providers in the event any of our current providers terminate their relationships with us, or our service is interrupted, there may be a delay while we transition to new providers, which could disrupt our marketplace. If there is a material disruption in the data provided to us, the information that we provide to consumers and dealers using our marketplace may be limited. In addition, the quality, accuracy, and timeliness of this information may suffer, which may lead to a less valuable and less transparent shopping experience for consumers using our marketplace and could materially and adversely affect our business and financial results.

The failure to build and maintain our brand would harm our ability to grow our audience and to expand the use of our marketplace by consumers and dealers.

While we are focused on building our brand recognition, maintaining and enhancing our brand will depend largely on the success of our efforts to maintain the trust of consumers and dealers and to deliver value to each consumer and dealer using our marketplace. If consumers were to believe that we are not focused on providing them with a better automobile shopping experience, our reputation and the strength of our brand may be adversely affected.

Complaints or negative publicity about our business practices, our marketing and advertising campaigns, our compliance with applicable laws and regulations, the integrity of the data that we provide to consumers, data privacy and security issues, and other aspects of our business, irrespective of their validity, could diminish consumers' and dealers' confidence and participation in our marketplace and could adversely affect our brand. There can be no assurance that we will be able to maintain or enhance our brand, and failure to do so would harm our business growth prospects and operating results.

The "Questions" section of our website enables consumers and dealers using our site to communicate with one another and other persons seeking information or advice on the Internet. Although all such information or feedback is generated by users and not by us, claims of defamation or other injury could be made against us for content posted on our website. In addition, negative publicity and user sentiment generated as a result of fraudulent or deceptive conduct by

20

users of our marketplace could damage our reputation, reduce our ability to attract new users or retain our current users, and diminish the value of our brand.

While we have historically focused our marketing efforts on Internet and mobile channels, we are beginning brand-focused campaigns using television and radio and these efforts may not be successful.

As a consumer brand, it is important for us to increase the visibility of our brand with potential users of our marketplace. While we have historically focused our marketing efforts on Internet and mobile channels, we are beginning to advertise through television, radio, and other channels we have not used previously, with the goal of driving greater brand recognition, trust, and loyalty from a broader consumer audience. If our brand-focused campaigns are not successful and we are unable to recover our marketing costs through increases in user traffic and increased subscription and advertising revenue, or if we discontinue our brand marketing campaigns, it could have a material adverse effect on our business and financial results.

Our recent, rapid growth is not indicative of our future growth, and our revenue growth rate will decline in the future.

Our revenue grew from $98.6 million in 2015 to $198.1 million in 2016, representing a 101% increase between such periods, and grew from $84.2 million for the six months ended June 30, 2016 to $143.3 million for the six months ended June 30, 2017, representing a 70% increase between such periods. In the future, our revenue growth rates will inevitably decline as we achieve higher market penetration rates, as our revenue increases to higher levels, and as we experience increased competition. As our revenue growth rates decline, investors' perceptions of our business may be adversely affected and the market price of our Class A common stock could decline. In addition, we will not be able to grow as expected, or at all, if we do not accomplish the following:

- •

- increase the number of consumers using our marketplace;

- •

- maintain and expand the number of dealers that subscribe to our marketplace;

- •

- attract and retain advertisers placing advertisements in our marketplace;

- •

- further improve the quality of our marketplace, and introduce high quality new products; and

- •

- increase the number of connections between consumers and dealers using our marketplace.

If we fail to expand effectively into new markets, both domestically and abroad, our revenue, business, and financial results will be harmed.