HEAR-2015.3.31-10Q

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark one)

ý QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2015

or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-35465

TURTLE BEACH CORPORATION

(Exact name of registrant as specified in its charter)

|

| |

Nevada | 27-2767540 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

| |

100 Summit Lake Drive, Suite 100 Valhalla, New York | 10595 |

(Address of principal executive offices) | (Zip Code) |

(914) 345-2255

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ý Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ý Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ý Non-accelerated filer ¨ Smaller reporting company ¨

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes ý No

The number of shares of the registrant's Common Stock, par value $0.001 per share, outstanding on April 30, 2015 was 42,147,238.

|

| | |

| | Page |

PART I. FINANCIAL INFORMATION | |

| | |

Item 1. | Financial Statements (unaudited)

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Item 2. | | |

| | |

Item 3. | | |

| | |

Item 4. | | |

| |

PART II. OTHER INFORMATION | |

| | |

Item 1. | | |

| | |

Item 1A. | | |

| | |

Item 6. | | |

| |

SIGNATURES | |

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements.

Turtle Beach Corporation

Condensed Consolidated Balance Sheets

(unaudited)

|

| | | | | | | |

| March 31, 2015 |

| December 31, 2014 |

ASSETS | (in thousands, except par value and share amounts) |

Current Assets: | |

| | |

|

Cash and cash equivalents | $ | 2,141 |

| | $ | 7,908 |

|

Accounts receivable, net | 15,448 |

| | 61,059 |

|

Inventories | 36,201 |

| | 38,400 |

|

Deferred income taxes | 8,343 |

| | 4,930 |

|

Prepaid income taxes | 1,482 |

| | 1,482 |

|

Prepaid expenses and other current assets | 4,106 |

| | 3,818 |

|

Total Current Assets | 67,721 |

| | 117,597 |

|

Property and equipment, net | 5,922 |

| | 6,722 |

|

Goodwill | 80,974 |

| | 80,974 |

|

Intangible assets, net | 39,473 |

| | 39,726 |

|

Deferred income taxes | 1,128 |

| | 1,128 |

|

Other assets | 920 |

| | 821 |

|

Total Assets | $ | 196,138 |

| | $ | 246,968 |

|

LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

|

Current Liabilities: | | | |

|

Revolving credit facilities | $ | 15,538 |

| | $ | 36,863 |

|

Term loan | 2,564 |

| | 1,923 |

|

Accounts payable | 20,112 |

| | 35,546 |

|

Other current liabilities | 9,617 |

| | 14,525 |

|

Total Current Liabilities | 47,831 |

| | 88,857 |

|

Term loan, long-term portion | 5,128 |

| | 5,769 |

|

Series B redeemable preferred stock | 15,212 |

| | 14,916 |

|

Deferred income taxes | 648 |

| | 648 |

|

Other liabilities | 5,582 |

| | 5,592 |

|

Total Liabilities | 74,401 |

| | 115,782 |

|

Commitments and Contingencies | | | |

Stockholders' Equity | |

| | |

|

Common stock, $0.001 par value - 50,000,000 shares authorized; 42,132,551 and 42,027,991 shares issued and outstanding as of March 31, 2015 and December 31, 2014, respectively | 42 |

| | 42 |

|

Additional paid-in capital | 129,555 |

| | 128,084 |

|

Retained earnings (accumulated deficit) | (7,304 | ) | | 3,289 |

|

Accumulated other comprehensive income (loss) | (556 | ) | | (229 | ) |

Total Stockholders' Equity | 121,737 |

| | 131,186 |

|

Total Liabilities and Stockholders' Equity | $ | 196,138 |

| | $ | 246,968 |

|

See accompanying Notes to the Condensed Consolidated Financial Statements (unaudited)

Turtle Beach Corporation

Condensed Consolidated Statements of Operations

(unaudited)

|

| | | | | | | |

| Three Months Ended |

| March 31, 2015 |

| March 31, 2014 |

| (in thousands, except per-share data) |

Net Revenue | $ | 19,689 |

| | $ | 38,288 |

|

Cost of Revenue | 16,573 |

| | 26,012 |

|

Gross Profit | 3,116 |

| | 12,276 |

|

Operating expenses: | | | |

Selling and marketing | 7,746 |

|

| 7,000 |

|

Research and development | 2,854 |

|

| 1,998 |

|

General and administrative | 4,740 |

|

| 3,573 |

|

Business transaction costs | — |

|

| 4,228 |

|

Restructuring charges | 325 |

| | — |

|

Total operating expenses | 15,665 |

|

| 16,799 |

|

Operating loss | (12,549 | ) | | (4,523 | ) |

Interest expense | 784 |

| | 4,240 |

|

Other non-operating expense (income), net | 628 |

| | (25 | ) |

Loss before income tax benefit | (13,961 | ) | | (8,738 | ) |

Income tax benefit | (3,368 | ) | | (5,832 | ) |

Net loss | $ | (10,593 | ) |

| $ | (2,906 | ) |

| | | |

Net loss per share: | | | |

Basic | $ | (0.25 | ) | | $ | (0.09 | ) |

Diluted | $ | (0.25 | ) | | $ | (0.09 | ) |

Weighted average number of shares: | | | |

Basic | 42,039 |

| | 33,715 |

|

Diluted | 42,039 |

| | 33,715 |

|

See accompanying Notes to the Condensed Consolidated Financial Statements (unaudited)

Turtle Beach Corporation

Condensed Consolidated Statements of Comprehensive Income (Loss)

(unaudited)

|

| | | | | | | | |

| | Three Months Ended |

| | March 31, 2015 | | March 31, 2014 |

| (in thousands) |

Net loss | | $ | (10,593 | ) | | $ | (2,906 | ) |

| | | | |

Other comprehensive income (loss):

| | | | |

Foreign currency translation adjustment | | (327 | ) | | 128 |

|

Other comprehensive income (loss)

| | (327 | ) | | 128 |

|

Comprehensive loss | | $ | (10,920 | ) | | $ | (2,778 | ) |

See accompanying Notes to the Condensed Consolidated Financial Statements (unaudited)

Turtle Beach Corporation

Condensed Consolidated Statements of Cash Flows

(unaudited)

|

| | | | | | | |

| Three Months Ended |

| March 31, 2015 | | March 31, 2014 |

| (in thousands) |

CASH FLOWS FROM OPERATING ACTIVITIES | |

| | |

|

Net loss | $ | (10,593 | ) | | $ | (2,906 | ) |

Adjustments to reconcile net loss to net cash provided by operating activities: | | | |

Depreciation and amortization | 1,585 |

| | 1,814 |

|

Amortization of intangible assets | 222 |

| | 237 |

|

Amortization of debt financing costs | 49 |

| | 2,545 |

|

Stock-based compensation | 1,325 |

| | 1,049 |

|

Accrued interest on Series B redeemable preferred stock | 296 |

| | 270 |

|

Paid in kind interest | — |

| | 396 |

|

Deferred income taxes | (3,414 | ) | | (6,331 | ) |

Provision of (Reversal of) sales returns reserve | (2,976 | ) | | (1,265 | ) |

Provision of (Reversal of) doubtful accounts | (55 | ) | | (151 | ) |

Provision for obsolete inventory | 699 |

| | 381 |

|

Changes in operating assets and liabilities: | | | |

Accounts receivable | 48,642 |

| | 21,148 |

|

Inventories | 1,500 |

| | 8,360 |

|

Accounts payable | (14,212 | ) | | (15,845 | ) |

Prepaid expenses and other assets | (360 | ) | | (646 | ) |

Income taxes payable | 65 |

| | 188 |

|

Other liabilities | (5,097 | ) | | (342 | ) |

Net cash provided by operating activities | 17,676 |

| | 8,902 |

|

CASH FLOWS FROM INVESTING ACTIVITIES | | | |

Purchase of property and equipment | (2,007 | ) | | (468 | ) |

Cash acquired in business combination | — |

| | 4,093 |

|

Net cash provided by (used for) investing activities | (2,007 | ) | | 3,625 |

|

CASH FLOWS FROM FINANCING ACTIVITIES | | | |

Borrowings on revolving credit facilities | 46,328 |

| | 44,490 |

|

Repayment of revolving credit facilities | (67,652 | ) | | (49,736 | ) |

Repayment of capital leases | (10 | ) | | (6 | ) |

Repayment of term loan | — |

| | (14,500 | ) |

Proceeds from exercise of stock options | 146 |

| | 559 |

|

Debt financing costs | (75 | ) | | (1,419 | ) |

Proceeds from issuance of subordinated notes | — |

| | 7,000 |

|

Net cash used for financing activities | (21,263 | ) | | (13,612 | ) |

Effect of exchange rate changes on cash and cash equivalents | (173 | ) | | 128 |

|

Net decrease in cash and cash equivalents | (5,767 | ) | | (957 | ) |

Cash and cash equivalents - beginning of period | 7,908 |

| | 6,509 |

|

Cash and cash equivalents - end of period | $ | 2,141 |

| | $ | 5,552 |

|

| | | |

SUPPLEMENTAL DISCLOSURE OF INFORMATION | | | |

Cash paid for interest | $ | 299 |

| | $ | 563 |

|

Cash paid for income taxes | $ | — |

| | $ | 14 |

|

Value of shares issued to acquire HyperSound business | $ | — |

| | $ | 113,782 |

|

See accompanying Notes to the Condensed Consolidated Financial Statements (unaudited)

Turtle Beach Corporation

Condensed Consolidated Statement of Stockholders' Equity

(unaudited)

|

| | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional Paid-In Capital | | Retained Earnings (Accumulated Deficit) | | Accumulated Other Comprehensive Income (Loss) | | Total |

| Shares | Amount | | | | |

| (in thousands)

|

Balance at December 31, 2014 | 42,028 |

| $ | 42 |

| | $ | 128,084 |

| | $ | 3,289 |

| | $ | (229 | ) | | $ | 131,186 |

|

Net loss | — |

| — |

| | — |

| | (10,593 | ) | | — |

| | (10,593 | ) |

Other comprehensive income | — |

| — |

| | — |

| | — |

| | (327 | ) | | (327 | ) |

Stock options exercised | 105 |

| — |

| | 146 |

| | — |

| | — |

| | 146 |

|

Stock-based compensation | — |

| — |

| | 1,325 |

| | | | — |

| | 1,325 |

|

Balance at March 31, 2015 | 42,133 |

| $ | 42 |

| | $ | 129,555 |

| | $ | (7,304 | ) | | $ | (556 | ) | | $ | 121,737 |

|

See accompanying Notes to the Condensed Consolidated Financial Statements (unaudited)

Turtle Beach Corporation

Notes to Condensed Consolidated Financial Statements

(unaudited)

Note 1. Background and Basis of Presentation

Organization

Turtle Beach Corporation (“Turtle Beach” or the “Company”), incorporated in the state of Nevada in 2010, merged with VTB Holdings, Inc. (“VTBH”) and its subsidiary, Voyetra Turtle Beach, Inc. (“VTB”), which is headquartered in Valhalla, New York and was incorporated in the state of Delaware in 1975, to form a premier audio innovation company with expertise and experience in developing, commercializing and marketing audio technologies across a range of large addressable markets under the Turtle Beach® and HyperSound® brands. Turtle Beach is a worldwide leading provider of feature-rich headset solutions for use across multiple platforms, including video game and entertainment consoles, handheld consoles, personal computers, Macintosh computers, tablets and mobile devices. HyperSound is a novel patent-protected sound delivery technology that delivers immersive, directional audio offering unique benefits in a variety of commercial and consumer audio devices.

Basis of Presentation

The accompanying interim condensed consolidated financial statements have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”) and, in the opinion of management, reflect all adjustments (which include normal recurring adjustments) considered necessary for a fair presentation of the financial position, results of operations, and cash flows for the periods presented. All intercompany accounts and transactions have been eliminated in consolidation. Certain information and footnote disclosures, normally included in annual financial statements prepared in accordance with U.S. generally accepted accounting principles (“GAAP”), have been condensed or omitted pursuant to those rules and regulations. We believe that the disclosures made are adequate to make the information presented not misleading.

On January 15, 2014, VTBH, which operated the Turtle Beach business, completed the merger (the “Merger”) with the Company (f/k/a Parametric Sound Corporation (“Parametric,”) which operated the HyperSound business. For accounting purposes, the Merger was treated as a “reverse acquisition” and VTBH was considered the accounting acquirer. Accordingly, VTBH’s historical results of operations replace Parametric’s historical results for all periods prior to the Merger, and from the acquisition date forward the results of operations of both companies are included. The results of operations for the interim periods are not necessarily indicative of the results of operations for the entire fiscal year.

The December 31, 2014 Condensed Consolidated Balance Sheet has been derived from the Company's most recent audited financial statements included in its Annual Report on Form 10-K.

These financial statements should be read in conjunction with the annual financial statements and the notes thereto included in our Annual Report on Form 10-K filed with the SEC on March 30, 2015 (“Annual Report”) that contains information useful to understanding the Company's businesses and financial statement presentations.

Immaterial Correction of Statements of Cash Flows

Subsequent to the issuance of its 2014 first quarter condensed consolidated financial statements, the Company determined that the amount for “Reversal of sales returns reserve” was incorrectly reported as an increase, rather than a reduction, in the reconciliation of Net income to Net cash provided by operating activities. This correction also impacted the line item “Accounts receivable,” but had no impact on total Net cash provided by operating activities. The Company has corrected the previously presented Condensed Consolidated Statement of Cash Flows to present “Reversal of sales return reserve” as a reduction to reconcile net income to net cash provided by operating activities and properly state the change in “Accounts receivable” as an increase of $21.1 million (previously reported as an increase of $18.6 million).

Note 2. Summary of Significant Accounting Policies

The preparation of consolidated annual and quarterly financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amount of assets and liabilities, the disclosure of contingent assets and liabilities at the date of our consolidated financial statements, and the reported amounts of revenue and expenses during the reporting periods. The Company can give no assurance that actual results will not differ from those estimates.

Turtle Beach Corporation

Notes to Condensed Consolidated Financial Statements - (Continued)

(unaudited)

There have been no material changes to the critical accounting policies and estimates from the information provided in Note 1 of the notes to our consolidated financial statements in our Annual Report.

Recent Accounting Pronouncements

In May 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2014-09, Revenue from Contracts with Customers, which requires entities to recognize revenue in a way that depicts the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled to in exchange for those goods or services. The new guidance also requires additional disclosure about the nature, amount, timing and uncertainty of revenue and cash flows arising from customer contracts, including significant judgments and changes in judgments and assets recognized from costs incurred to obtain or fulfill a contract. The amendment is effective for annual reporting periods beginning after December 15, 2016 and interim periods within those annual periods. On April 1, 2015, the FASB tentatively agreed to propose a one-year deferral of the effective date, but would permit all entities to adopt the standard as of the original effective date for public business entities. The Company is currently evaluating the impact, if any, this new standard will have on our consolidated financial statements and has not yet determined the method of adoption.

In April 2015, the FASB issued ASU No. 2015-03, Interest—Imputation of Interest (Subtopic 835-30): Simplifying the Presentation of Debt Issuance Costs, which requires that debt issuance costs related to a recognized debt liability be presented in the balance sheet as a direct deduction from the carrying amount of that debt liability, consistent with debt discounts. The amendment is effective for annual reporting periods beginning after December 15, 2015 and interim periods within those annual periods with early adoption permitted. The adoption of this guidance is not expected to have a material impact on our financial condition or results of operations.

Note 3. Business Combination

On January 15, 2014, VTBH completed the Merger with and into a wholly-owned subsidiary of Turtle Beach (f/k/a Parametric) in an all-stock, tax-free reorganization. VTBH entered into the Merger to acquire and commercialize Parametric’s technology and gain access to capital market opportunities as a public company.

Business Transaction Costs

Business transaction costs as a result of the Merger of $4.2 million were recognized for the three months ended March 31, 2014, respectively. The components of business transaction costs are presented below.

|

| | | |

| Three Months Ended |

| March 31, |

| 2014 |

| (in thousands) |

Legal fees | $ | 785 |

|

Accounting fees | 84 |

|

Advisory fees | 2,704 |

|

Termination and severance | 450 |

|

Other | 205 |

|

Total Transaction Costs | $ | 4,228 |

|

Advisory fees include success based fees payable to investment bankers for both merger parties.

Turtle Beach Corporation

Notes to Condensed Consolidated Financial Statements

(unaudited)

Note 4. Fair Value Measurement

The Company follows a three-level fair value hierarchy that prioritizes the inputs used to measure fair value. This hierarchy requires entities to maximize the use of observable inputs and minimize the use of unobservable inputs. The three levels of inputs used to measure fair value are as follows:

| |

• | Level 1 — Quoted prices in active markets for identical assets or liabilities. |

| |

• | Level 2 — Observable inputs other than quoted prices included in Level 1, such as quoted prices for markets that are not active, or other inputs that are observable or can be corroborated by observable market data. |

| |

• | Level 3 — Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities. This includes certain pricing models, discounted cash flow methodologies and similar techniques that use significant unobservable inputs. |

Financial instruments consist of cash and cash equivalents, accounts receivable, accounts payable, derivative instruments, credit facility and term loans. Cash equivalents are stated at amortized cost, which approximated fair value as of the consolidated balance sheet dates, due to the short period of time to maturity; and accounts receivable and accounts payable are stated at their carrying value, which approximates fair value due to the short time to the expected receipt or payment. The credit facility and term loan are stated at the carrying value as the stated interest rate approximates market rates currently available to the Company, which are considered Level 2 inputs. As of March 31, 2015 and December 31, 2014, there were no outstanding financial assets and liabilities recorded at fair value on a recurring basis and the Company had not elected the fair value option for any financial assets and liabilities for which such an election would have been permitted.

Note 5. Allowance for Sales Returns

The following tables provide the changes in our sales return reserve, which is classified as a reduction of accounts receivable:

|

| | | | | | | | |

| | Three Months Ended |

| | March 31, |

| | 2015 | | 2014 |

| (in thousands) |

Balance, beginning of period | | $ | 4,155 |

| | $ | 6,266 |

|

Reserve accrual | | 1,666 |

| | 3,050 |

|

Recoveries and deductions, net | | (4,642 | ) | | (4,315 | ) |

Balance, end of period

| | $ | 1,179 |

| | $ | 5,001 |

|

The year over year allowance was impacted by a reduction in the return rate and the timing of revenue as the prior year period included the initial sell-in for the new Xbox One compatible headsets, which launched during the first quarter of 2014 as a result of a delay in gaming headset audio, that deferred actual returns.

Note 6. Composition of Certain Financial Statement Items

Inventories

Inventories consist of the following:

|

| | | | | | | |

| March 31, 2015 |

| December 31, 2014 |

| (in thousands) |

Raw materials | $ | 2,511 |

| | $ | 2,065 |

|

Finished goods | 33,690 |

| | 36,335 |

|

Total inventories | $ | 36,201 |

| | $ | 38,400 |

|

Turtle Beach Corporation

Notes to Condensed Consolidated Financial Statements - (Continued)

(unaudited)

Property and Equipment, net

Property and equipment, net consists of the following:

|

| | | | | | | |

| March 31, 2015 |

| December 31, 2014 |

| (in thousands) |

Machinery and equipment | $ | 654 |

| | $ | 599 |

|

Software and software development | 855 |

| | 847 |

|

Furniture and fixtures | 226 |

| | 226 |

|

Tooling | 2,782 |

| | 2,417 |

|

Leasehold improvements | 104 |

| | 104 |

|

Demonstration units and convention booths | 14,059 |

| | 13,702 |

|

Total property and equipment, gross | 18,680 |

| | 17,895 |

|

Less: accumulated depreciation and amortization | (12,758 | ) | | (11,173 | ) |

Total property and equipment, net | $ | 5,922 |

| | $ | 6,722 |

|

Note 7. Goodwill and Other Intangible Assets

At acquisition, the Company estimates and records the fair value of purchased intangible assets. The fair values of these intangible assets are estimated based on our assessment. Goodwill is the excess of the purchase price over the fair value of identifiable net assets acquired in business combinations. Goodwill and certain other intangible assets having indefinite lives are not amortized to earnings, but instead are subject to periodic testing for impairment. Intangible assets determined to have definite lives are amortized over their remaining useful lives.

We assess the impairment of long‑lived assets, intangibles assets and goodwill whenever events or changes in circumstances indicate that full recoverability of net asset balances through future cash flows is in question. Goodwill and indefinite-lived intangible assets are assessed at least annually, but also whenever events or changes in circumstances indicate the carrying values may not be recoverable. Factors that could trigger an impairment review include: (a) significant underperformance relative to historical or projected future operating results; (b) significant changes in the manner of use of the acquired assets or the strategy for our overall business; (c) significant negative industry or economic trends; (d) significant decline in our stock price for a sustained period; and (e) a decline in our market capitalization below net book value. No impairment indicators were noted in the first quarter of 2015 which would trigger the need for testing.

Turtle Beach Corporation

Notes to Condensed Consolidated Financial Statements

(unaudited)

Acquired Intangible Assets

Acquired identifiable intangible assets, and related accumulated amortization, as of March 31, 2015 and December 31, 2014 consist of:

|

| | | | | | | | | | | |

| March 31, 2015 |

| Gross Carrying Value | | Accumulated Amortization | | Net Book Value |

| (in thousands) |

Customer relationships | $ | 5,796 |

| | $ | 2,647 |

| | $ | 3,149 |

|

Non-compete agreements | 177 |

| | 177 |

| | — |

|

In-process Research and Development | 27,100 |

| | — |

| | 27,100 |

|

Developed technology | 8,880 |

| | 118 |

| | 8,762 |

|

Trade names | 170 |

| | 41 |

| | 129 |

|

Patent and trademarks | 525 |

| | — |

| | 525 |

|

Foreign Currency | $ | (452 | ) | | $ | (260 | ) | | $ | (192 | ) |

Total Intangible Assets | $ | 42,196 |

| | $ | 2,723 |

| | $ | 39,473 |

|

| | | | | |

| | | | | |

| December 31, 2014 |

| Gross Carrying Value | | Accumulated Amortization | | Net Book Value |

| (in thousands) |

Customer relationships | $ | 5,796 |

| | $ | 2,458 |

| | $ | 3,338 |

|

Non-compete agreements | 177 |

| | 177 |

| | — |

|

In-process Research and Development | 27,100 |

| | — |

| | 27,100 |

|

Developed technology | 8,880 |

| | 104 |

| | 8,776 |

|

Trade names | 170 |

| | 33 |

| | 137 |

|

Patent and trademarks | 439 |

| | — |

| | 439 |

|

Foreign Currency | $ | (205 | ) | | $ | (141 | ) | | $ | (64 | ) |

Total Intangible Assets | $ | 42,357 |

| | $ | 2,631 |

| | $ | 39,726 |

|

In October 2012, VTB acquired Lygo International Limited, subsequently renamed TB Europe Ltd. The acquired intangible assets relating to customer relationships and non-compete agreements are being amortized over an estimated useful life of thirteen years and two years, respectively, with the amortization being included within sales and marketing expense.

In January 2014, the Merger between VTBH and Turtle Beach (f/k/a Parametric) was completed. The acquired intangible assets relating to developed technology, customer relationships and trade name are subject to amortization. Developed technology is being amortized over an estimated economic useful life of approximately seven years with the amortization being included within cost of revenue. Customer relationships and trade name are being amortized over an estimated useful life of two years and five years, respectively, with the amortization being included within sales and marketing expense. In-process Research and Development (“IPR&D”) is considered an indefinite-lived intangible asset until the completion or abandonment of the associated research and development efforts. Accordingly, during the development period, the IPR&D is not amortized but rather subject to impairment review. As of March 31, 2015, no impairment indicators were noted.

Amortization expense related to definite lived intangible assets of $0.2 million was recognized in the three months ended March 31, 2015 and $0.2 million for the three months ended March 31, 2014.

Turtle Beach Corporation

Notes to Condensed Consolidated Financial Statements

(unaudited)

As of March 31, 2015, estimated annual amortization expense related to definite lived intangible assets in future periods is as follows:

|

| | | |

| (in thousands) |

2015 | $ | 2,415 |

|

2016 | 2,049 |

|

2017 | 1,882 |

|

2018 | 1,802 |

|

2019 | 1,709 |

|

Thereafter | 2,183 |

|

Total | $ | 12,040 |

|

Goodwill

Changes in the carrying values of goodwill for the three months ended March 31, 2015 are as follows:

|

| | | |

| (in thousands) |

Balance as of January 1, 2015

| $ | 80,974 |

|

| $ | — |

|

Balance as of March 31, 2015 | $ | 80,974 |

|

Note 8. Credit Facilities and Long-Term Debt

|

| | | | | | | |

| March 31, 2015 | | December 31, 2014 |

| (in thousands) |

Revolving credit facility, maturing March 2019 | $ | 15,538 |

| | $ | 36,863 |

|

Term loans | 7,692 |

| | 7,692 |

|

Total outstanding debt | 23,230 |

| | 44,555 |

|

Less: current portion of revolving line of credit | (15,538 | ) | | (36,863 | ) |

Less: current portion of term loan | (2,564 | ) | | (1,923 | ) |

Less: current portion of subordinated notes | — |

| | — |

|

Total noncurrent portion of long-term debt | $ | 5,128 |

| | $ | 5,769 |

|

Total interest expense, inclusive of amortization of deferred financing costs, on long-term debt obligations was $0.4 million and $3.8 million for the three months ended March 31, 2015 and 2014, respectively.

Amortization of deferred financing costs was $49,000 and $2.5 million for the three months ended March 31, 2015 and 2014, respectively. The amount for the three months ended March 31, 2014 includes the write-off of $2.2 million in deferred financing costs associated with the repayment of the Company's former loan and security agreement.

Revolving Credit Facility

On March 31, 2014, Turtle Beach and certain of its subsidiaries entered into a new asset-based revolving credit agreement (“Credit Facility”) with Bank of America, N.A., as Agent, Sole Lead Arranger and Sole Bookrunner, which replaced the then existing loan and security agreement. The Credit Facility, which expires on March 31, 2019, provides for a line of credit of up to $60 million inclusive of a sub-facility limit of $10 million for TB Europe, a wholly owned subsidiary of Turtle Beach. The Credit Facility may be used for working capital, the issuance of bank guarantees, letters of credit and other corporate purposes.

The maximum credit availability for loans and letters of credit under the Credit Facility is governed by a borrowing base determined by the application of specified percentages to certain eligible assets, primarily eligible trade accounts receivable and inventories, and is subject to discretionary reserves and revaluation adjustments.

Turtle Beach Corporation

Notes to Condensed Consolidated Financial Statements

(unaudited)

Amounts outstanding under the Credit Facility bear interest at a rate equal to either a rate published by Bank of America or the LIBOR rate, plus in each case, an applicable margin, which is between 1.00% to 1.50% for U.S. base rate loans and between 2.00% to 2.50% for U.S. LIBOR loans and U.K. loans. As of March 31, 2015, interest rates for outstanding borrowings were 4.75% for base rate loans and 2.67% for LIBOR rate loans. In addition, Turtle Beach is required to pay a commitment fee on the unused revolving loan commitment at a rate ranging from 0.25% to 0.50%, and letter of credit fees and agent fees.

If certain availability thresholds are not met, meaning that the Company does not have receivables and inventory which are eligible to borrow on under the Credit Facility in excess of amounts borrowed, the Credit Facility requires the Company and its restricted subsidiaries to maintain a fixed charge coverage ratio. The fixed charge ratio is defined as the ratio, determined on a consolidated basis for the most recent four fiscal quarters, of (a) EBITDA minus capital expenditures, excluding those financed through other instruments, and cash taxes paid, and (b) Fixed Charges defined as the sum of cash interest expense plus scheduled principal payments.

The Credit Facility also contains affirmative and negative covenants that, subject to certain exceptions, limit our ability to take certain actions, including our ability to incur debt, pay dividends and repurchase stock, make certain investments and other payments, enter into certain mergers and consolidations, engage in sale leaseback transactions and transactions with affiliates and encumber and dispose of assets. Obligations under the Credit Facility are secured by a security interest and lien upon substantially all of the Company's assets.

In March 2015, Bank of America notified the Company that certain events of default had occurred and were continuing under the Credit Facility, including (i) the Company’s failure to deliver in a timely matter certain monthly financial statements in accordance with the Credit Facility, (ii) the Company’s failure to deliver in a timely matter certain financial projections in accordance with the Credit Facility, (iii) the Company’s failure to repay an over-advance of approximately $100,000 that existed between March 6, 2015 and March 9, 2015, and (iv) the Company’s failure to satisfy the fixed charge coverage ratio under the Credit Facility for certain measurement dates during the fourth quarter of 2014 (in part as a result of certain retroactive changes to the calculation of such ratio pursuant to the December Amendment, as defined below) (the “Existing Events of Default”).

On March 16, 2015, the Company entered into a third amendment (the “Third Amendment”) to the Credit Facility pursuant to which Bank of America and the lenders under the Credit Facility agreed to waive the Existing Events of Default. In addition, the Third Amendment amends certain other provisions of the agreement and requires that we maintain an EBITDA ratio at the end of each month beginning April 30, 2015 on a cumulative basis through the remainder of 2015 and thereafter on a trailing twelve-month basis, our EBITDA (as defined under the Credit Facility) must be in an amount equal to at least 75% of our monthly projected EBITDA as set forth in projections delivered pursuant to the Credit Facility. The current fixed charge coverage ratio of at least 1.15 to 1.00 on the last day of each month while a Covenant Trigger Period (as defined in the Credit Facility) is in effect will become effective again after the Company has complied with such ratio for six consecutive months.

As of March 31, 2015, the Company was in compliance with all financial covenants, and excess borrowing availability was approximately $1.5 million, net of the outstanding Term Loan (as defined below) that is considered to be an additional outstanding amount under the Credit Facility.

Term Loan

On December 29, 2014, the Company amended the Credit Facility (the “December Amendment”) to permit the repayment of $7.7 million of then existing subordinated debt and accrued interest with the proceeds of an additional loan (the “Term Loan”). The Term Loan will result in modified financial covenants while it is outstanding, will bear interest at a rate of LIBOR for the applicable interest period plus 5% and will be repaid in equal monthly installments beginning on April 1, 2015 and ending on April 1, 2018. Amounts so repaid are recognized by lowering the balance of the term loan tranche and increasing the lower interest rate base revolver amount, with no net impact on borrowing availability.

Subordinated Note - Related Party

On April 23, 2015, the Company issued a $5.0 million Subordinated Note (the “Subordinated Note”) to SG VTB Holdings, LLC, the Company’s largest stockholder (“SG VTB”). The Subordinated Note bears interest at a rate of (i) 10% per annum for the first year and (ii) 20% per annum for all periods thereafter, with interest accruing and being added to the principal amount of the the note quarterly. The Subordinated Debt is subordinated to all senior debt of the Company, including the Company’s obligations under the Credit Facility.

Turtle Beach Corporation

Notes to Condensed Consolidated Financial Statements

(unaudited)

SG VTB is an affiliate of Stripes Group LLC (“Stripes”), a private equity firm focused on internet, software, healthcare IT and branded consumer products businesses. Kenneth A. Fox, one of our directors, is the managing general partner of Stripes and the sole manager of SG VTB and Ronald Doornink, our Chairman of the Board, is an operating partner of Stripes.

Note 9. Income Taxes

In order to determine the quarterly provision for income taxes, we use an estimated annual effective tax rate, which is based on expected annual income and statutory tax rates in the various jurisdictions. However, to the extent that application of the estimated annual effective tax rate is not representative of the quarterly portion of actual tax expense expected to be recorded for the year, we determine the quarterly provision for income taxes based on actual year-to-date income (loss). Certain significant or unusual items are separately recognized in the quarter during which they occur and can be a source of variability in the effective tax rates from quarter to quarter.

The following table presents our income tax benefit and effective income tax rate:

|

| | | | | | | |

| Three Months Ended |

| March 31, |

| 2015 | | 2014 |

| (in thousands) |

Income tax benefit | $ | (3,368 | ) | | $ | (5,832 | ) |

Effective income tax rate | 24.1 | % | | 66.7 | % |

Income tax benefit for the three months ended March 31, 2015 was $3.4 million at an effective tax rate of 24.1%. The effective tax rate for the three months ended March 31, 2015 was impacted by interest on the Series B Redeemable Preferred Stock and foreign entity taxable loss.

Income tax benefit for the three months ended March 31, 2014 was $5.8 million at an effective tax rate of 66.7%, which was higher than the federal statutory rate primarily due to differences in book and tax treatment of stock based compensation, transaction costs, interest on the Series B Preferred Stock and other non-deductible expenses.

At December 31, 2014, the Company had $29.4 million of net operating loss carryforwards and $12.8 million of state net operating loss carryforwards, which will begin to expire in 2029. An ownership change occurred on January 15, 2014 as a result of the Merger, and $12.7 million of federal net operating losses included in the above are pre-change losses subject to Section 382 of the Internal Revenue Code of 1986, as amended. The Company has not recorded a valuation allowance against the related deferred tax asset because it is considered more-likely-than-not that the Company will have future taxable income sufficient to utilize its deferred tax assets.

The Company is subject to income taxes domestically and in various foreign jurisdictions. Significant judgment is required in evaluating uncertain tax positions and determining its provision for income taxes.

The Company recognizes only those tax positions that meet the more-likely-than-not recognition threshold, and establish tax reserves for uncertain tax positions that do not meet this threshold. Interest and penalties associated with income tax matters are included in the provision for income taxes in the condensed consolidated statement of operations. As of each of March 31, 2015 and December 31, 2014, the Company had uncertain tax positions of $5.6 million, inclusive of $1.6 million of interest and penalties, and does not anticipate any significant events or circumstances that would cause a material change to these uncertainties during the ensuing year.

The Company files U.S., state and foreign income tax returns in jurisdictions with various statutes of limitations, and its consolidated federal tax return for 2012 is currently under examination. The federal tax years open under the statute of limitations are 2011 through 2013, and the state tax years open under the statute of limitations are 2010 through 2013.

Turtle Beach Corporation

Notes to Condensed Consolidated Financial Statements

(unaudited)

Note 10. Stock-Based Compensation

Total estimated stock-based compensation expense for employees and non-employees, related to all of the the Company's stock-based awards, was comprised as follows:

|

| | | | | | | |

| Three Months Ended |

| March 31, |

| 2015 |

| 2014 |

| (in thousands) |

Cost of revenue | $ | 218 |

| | $ | 30 |

|

Selling and marketing | 144 |

| | 120 |

|

Product development | 205 |

| | 206 |

|

General and administrative | 758 |

| | 693 |

|

Total stock-based compensation | $ | 1,325 |

| | $ | 1,049 |

|

The following table presents the stock activity and the total number of shares available for grant as of March 31, 2015:

|

| | |

| (in thousands) |

Balance at December 31, 2014 | 443 |

|

Options granted | (85 | ) |

Forfeited/Expired shares added back | 78 |

|

Balance at March 31, 2015 | 436 |

|

Stock Option Activity

|

| | | | | | | | | |

| Options Outstanding |

| Number of Shares Underlying Outstanding Options | | Weighted-Average Exercise Price | | Weighted-Average Remaining Contractual Term | | Aggregate Intrinsic Value |

| | | | | (In years) | | |

Outstanding at December 31, 2014 | 6,588,097 |

| | 6.95 | | 6.96 | | 1,327,366 |

|

Granted | 85,000 |

| | 3.16 | | | | |

Exercised | (104,560 | ) | | 1.39 | | | | |

Forfeited | (149,535 | ) | | 9.11 | | | | |

Outstanding at March 31, 2015 | 6,419,002 |

| | 6.94 | | 6.53 | | 259,781 |

|

Vested and expected to vest at March 31, 2015 | 6,253,297 |

| | 6.90 | | 6.46 | | 259,781 |

|

Exercisable at March 31, 2015 | 3,589,031 |

| | 5.86 | | 4.99 | | 259,781 |

|

In April 2015, the Company filed a preliminary Information Statement with the Securities and Exchange Commission in connection with a proposed stock option exchange program to eligible participants to exchange certain outstanding eligible stock options for replacement options that will be granted under the 2013 Stock-Based Incentive Compensation Plan (“2013 Plan.”)

Stock options are time-based and the majority are exercisable within 10 years of the date of grant, but only to the extent they have vested. The options generally vest as specified in the option agreements subject, in some instances, to acceleration in certain circumstances. In the event participants in the 2013 Plan cease to be employed or engaged by the Company, then all of the options would be forfeited if they are not exercised within 90 days. Forfeitures on option grants are estimated at 10% for

Turtle Beach Corporation

Notes to Condensed Consolidated Financial Statements

(unaudited)

non-executives and 0% based for executives based on evaluation of historical and expected future turnover. Stock-based compensation expense was recorded net of estimated forfeitures, such that expense was recorded only for those stock-based awards expected to vest. The Company reviews this assumption periodically and will adjust it if it is not representative of future forfeiture data and trends within employee types (executive vs. non-executive).

Aggregate intrinsic value represents the difference between the estimated fair value of the underlying common stock and the exercise price of outstanding, in-the-money options. The aggregate intrinsic value of options exercised was $0.1 million for the three months ended March 31, 2015.

The Company uses the Black-Scholes option-pricing model to estimate the fair value of options granted as of the grant date. The following are assumptions for the three months ended March 31, 2015.

|

| |

Expected term (in years) | 6.1 |

Risk-free interest rate | 1.5% - 1.8% |

Expected volatility | 46.3% - 46.5% |

Dividend rate | 0% |

Each of these inputs is subjective and generally requires significant judgment to determine.

The weighted average grant date fair value of options granted during the three months ended March 31, 2015 was $1.46. The total estimated fair value of employee options vested during the three months ended March 31, 2015 was $2.7 million. As of March 31, 2015, total unrecognized compensation cost related to non-vested stock options granted to employees was $10.2 million, which is expected to be recognized over a remaining weighted average vesting period of 2.8 years.

Restricted Stock Activity

|

| | | | | | |

| Shares | | Weighted Average Grant Date Fair Value Per Share |

Nonvested restricted stock at December 31, 2014 | 6,396 |

| | $ | 15.63 |

|

Granted | — |

| | — |

|

Nonvested restricted stock at March 31, 2015 | 6,396 |

| | 15.63 |

|

As of March 31, 2015 total unrecognized compensation cost related to the nonvested restricted stock awards granted was $0.1 million, which is expected to be recognized over a remaining weighted average vesting period of 2.8 years.

Series B Redeemable Preferred Stock

In September 2010, VTBH issued 1,000,000 shares of its Series B Redeemable Preferred Stock with a fair value of $12.4 million. The Series B Redeemable Preferred Stock is required to be redeemed on the earlier of September 28, 2030, or the occurrence of a liquidation event at its original issue price of $12.425371 per share plus any accrued but unpaid dividends. The redemption value was $15.2 million and $14.9 million as of March 31, 2015 and December 31, 2014, respectively.

On February 18, 2015, the holder of the Series B Redeemable Preferred Stock, filed a complaint in Delaware Chancery Court alleging breach of contract against VTBH. According to the complaint, the Merger purportedly triggered a contractual obligation for VTBH to redeem the stock. Refer to Note 13, “Commitments and Contingencies” for further information/

Phantom Equity Activity

In November 2011, VTBH adopted a 2011 Phantom Equity Appreciation Plan (the “Appreciation Plan”) that covers certain employees, consultants, and directors of VTBH (“Participants”) who are entitled to phantom units, as applicable, pursuant to the provisions of their respective award agreements. The Appreciation Plan is shareholder-approved, which permits the granting of phantom units to VTBH’s Participants of up to 1,500,000 units. These units are not exercisable or convertible into shares of

Turtle Beach Corporation

Notes to Condensed Consolidated Financial Statements

(unaudited)

common stock but give the holder a right to receive a cash bonus equal to the appreciation in value between the exercise price and value of common stock at the time of a change in control event as defined in the plan.

As of March 31, 2015 and December 31, 2014, 784,661 and 807,578 phantom units at a weighted-average exercise price of $0.89 and $0.88, respectively, have been granted and are outstanding. Because these phantom units are not exercisable or convertible into common shares, said amounts and exercise prices were not subject to the exchange ratio provided by the Merger agreement. As of March 31, 2015, compensation expense related to the Appreciation Plan units remained unrecognized because as of those dates a change in control, as defined in the plan, had not occurred and is not probable to occur.

Note 11. Net Loss Per Share

The following table sets forth the computation of basic and diluted net loss per share of common stock attributable to common stockholders:

|

| | | | | | | |

| Three Months Ended |

| March 31, |

| 2015 |

| 2014 |

| (in thousands, except per-share data) |

Net Loss | $ | (10,593 | ) | | $ | (2,906 | ) |

| | | |

Weighted average common shares outstanding — Basic | 42,039 |

| | 33,715 |

|

Plus incremental shares from assumed conversions: | | | |

Dilutive effect of stock options | — |

| | — |

|

Weighted average common shares outstanding — Diluted | 42,039 |

| | 33,715 |

|

Net loss per share: | | | |

Basic | $ | (0.25 | ) | | $ | (0.09 | ) |

Diluted | $ | (0.25 | ) | | $ | (0.09 | ) |

Incremental shares from stock options and restricted stock awards are computed by the treasury stock method. The weighted average shares listed below were not included in the computation of diluted earnings per share because to do so would have been anti-dilutive for the periods presented or were otherwise excluded under the treasury stock method. The treasury stock method calculates dilution assuming the exercise of all in-the-money options and vesting of restricted stock, reduced by the repurchase of shares with the proceeds from the assumed exercises, unrecognized compensation expense for outstanding awards and the estimated tax benefit of the assumed exercises.

|

| | | | | |

| Three Months Ended |

| March 31, |

| 2015 | | 2014 |

| (in thousands) |

Stock options | 6,615 |

| | 5,664 |

|

Warrants | 31 |

| | 51 |

|

Unvested restricted stock awards | 6 |

| | 4 |

|

Total | 6,652 |

| | 5,719 |

|

Turtle Beach Corporation

Notes to Condensed Consolidated Financial Statements

(unaudited)

Note 12. Geographic Information

The following table represents total net revenues based on where customers are physically located:

|

| | | | | | | |

| Three Months Ended |

| March 31, |

| 2015 |

| 2014 |

| (in thousands) |

United States | $ | 14,057 |

| | $ | 25,513 |

|

United Kingdom | 2,374 |

| | 6,693 |

|

Europe | 1,368 |

| | 3,215 |

|

International | 1,890 |

| | 2,867 |

|

Total net revenues | $ | 19,689 |

| | $ | 38,288 |

|

Note 13. Commitments and Contingencies

Litigation

The Company is subject to various legal proceedings and claims that arise in the ordinary course of its business. Although the amount of any liability that could arise with respect to these actions cannot be determined with certainty, in the Company’s opinion, any such liability will not have a material adverse effect on its consolidated financial position, consolidated results of operations or liquidity.

On August 5, 2013, VTBH and the Company (f/k/a Parametric) announced that they had entered into the Merger Agreement pursuant to which VTBH would acquire an approximately 80% ownership interest and existing shareholders would maintain an approximately 20% ownership interest in the combined company. Following the announcement, several shareholders filed class action lawsuits in California and Nevada seeking to enjoin the Merger. The plaintiffs in each case alleged that members of the Company’s Board of Directors breached their fiduciary duties to the shareholders by agreeing to a Merger that allegedly undervalued the Company. VTBH and the Company were named as defendants in these lawsuits under the theory that they had aided and abetted the Company's Board of Directors in allegedly violating their fiduciary duties. The plaintiffs in both cases sought a preliminary injunction seeking to enjoin closing of the Merger, which, by agreement, was heard by the Nevada court with the California plaintiffs invited to participate. On December 26, 2013, the court in the Nevada cases denied the plaintiffs’ motion for a preliminary injunction. Following the closing of the Merger, the Nevada plaintiffs filed a second amended complaint, which made essentially the same allegations and sought monetary damages as well as an order rescinding the Merger. The California plaintiffs dismissed their action without prejudice, and sought to intervene in the Nevada action, which was granted. Subsequent to the intervention, the plaintiffs filed a third amended complaint, which made essentially the same allegations as prior complaints and sought monetary damages. On June 20, 2014, VTBH and the Company moved to dismiss the action, but that motion was denied on August 28, 2014. That denial is currently under review by the Nevada Supreme Court and briefing was completed on February 23, 2015. The Company believes that the plaintiffs’ claims against it are without merit and intends to vigorously defend itself in the litigation. As of March 31, 2015 and the date of this report, the Company is unable to estimate a possible loss or range of possible loss in regards to this matter; therefore, no litigation reserve has been recorded in the consolidated financial statements.

On February 18, 2015, Dr. John Bonanno, a minority shareholder of VTBH, filed a complaint in Delaware Chancery Court alleging breach of contract against VTBH. According to the complaint, the Merger purportedly triggered a contractual obligation for VTBH to redeem Dr. Bonanno's stock. Dr. Bonanno requests a declaratory judgment stating that he is entitled damages including a redemption of his stock for the redemption value of $15.1 million (equal to the original issue price of his stock plus accrued dividends) as well as other costs and expenses. VTBH maintains that the Merger did not trigger any obligation to redeem Mr. Bonanno's stock and VTBH intends to vigorously defend itself in the litigation.

Turtle Beach Corporation

Notes to Condensed Consolidated Financial Statements

(unaudited)

Warranties

We warrant our products against certain manufacturing and other defects. These product warranties are provided for specific periods of time depending on the nature of the product. Warranties are generally fulfilled by replacing defective products with new products. The following table provides the changes in our product warranties, which are included in accrued liabilities:

|

| | | | | | | |

| Three Months Ended |

| March 31, |

| 2015 | | 2014 |

| (in thousands) |

Warranty, beginning of period | $ | 493 |

| | $ | 139 |

|

Warranty costs accrued | — |

| | 154 |

|

Settlements of warranty claims | (113 | ) | | (161 | ) |

Warranty, end of period

| $ | 380 |

| | $ | 132 |

|

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of our operations should be read together with our unaudited condensed consolidated financial statements and the related notes included in Part I of this Quarterly Report on Form 10-Q and with our audited consolidated financial statements and the related notes included in our Annual Report on Form 10-K filed with the Securities Exchange Commission on March 30, 2015 (the "Annual Report.")

This Report on Form 10-Q contains forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements in this Report are indicated by words such as “anticipates,” “expects,” “believes,” “intends,” “plans,” “estimates,” “projects,” “strategies” and similar expressions. Caution should be taken not to place undue reliance on any such forward-looking statements because they involve risks, uncertainties and other factors that could cause actual results to differ materially from those expressed or implied in, or reasonably inferred from, such statements. Forward-looking statements are based on the beliefs, as well as assumptions made by, and information currently available to, its management and are made only as of the date hereof. The Company undertakes no obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from the Company's historical experience and its present expectations or projections.

On January 15, 2014 , VTB Holdings, Inc. (“VTBH”), which operated the Turtle Beach business, completed the merger (the “Merger”) with the Company (f/k/a Parametric Sound Corporation), which operated the HyperSound business. For accounting purposes, the Merger was treated as a “reverse acquisition” and VTBH was considered the accounting acquirer. Accordingly, VTBH’s historical results of operations replace Parametric’s historical results for all periods prior to the Merger, and from the acquisition date forward the results of operations of both companies are included.

Business Overview

Turtle Beach Corporation (herein referred to as the “Company,” “we,” “us,” or “our”), incorporated in the state of Nevada in 2010, merged with VTB Holdings, Inc. (“VTBH”) and its subsidiary, Voyetra Turtle Beach, Inc. (“VTB”), which is headquartered in Valhalla, New York and was incorporated in the state of Delaware in 1975, to form a premier audio innovation company with expertise and experience in developing, commercializing and marketing audio technologies across a range of large addressable markets under the Turtle Beach® and HyperSound® brands. Turtle Beach is a worldwide leading provider of feature-rich headset solutions for use across multiple platforms, including video game and entertainment consoles, handheld consoles, personal computers, tablets and mobile devices. HyperSound technology is an innovative patent-protected sound technology that delivers immersive, directional audio offering unique potential benefits in a variety of commercial settings and consumer devices. The Company's stock is traded on NASDAQ under the symbol HEAR.

Business Trends

The video game industry is a global and growing market. Sales in the console accessories market, which includes gaming headsets and other peripherals such as gamepads and specialty controllers, adapters, batteries, memory and interactive gaming toys are significantly influenced by the launch and sales of new game consoles. In 2013, the gaming industry experienced a cyclical event as Microsoft and Sony each announced new consoles for the first time in eight years, and the strong consumer response to the Xbox One and PlayStation®4 (the “next generation consoles”) has created a growing installed base of gamers and a market for next generation headsets.

With the introduction of the next generation consoles, the gaming industry is now entering its seventh console cycle. As with past console transitions, total industry revenue declined in 2013 as software developers launched fewer new games and shifted development efforts to the new console platforms, and consumers slowed spending in anticipation of the introduction of new hardware and software.

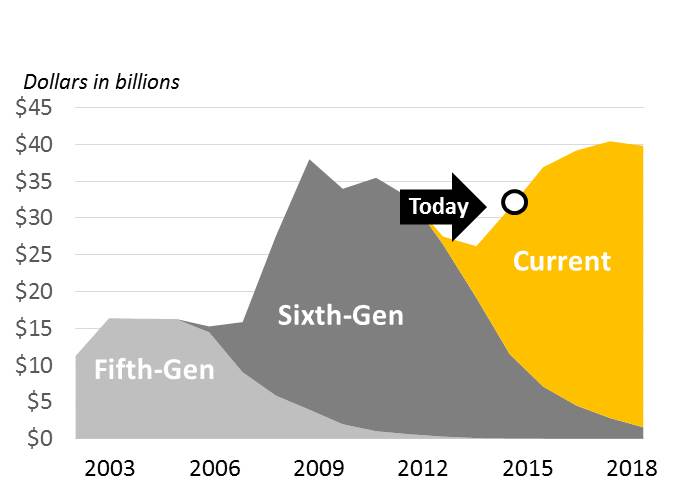

The following chart shows the projected global console hardware and software sales and current stage of the console transition based on estimates from the April 2015 Intelligence: Worldwide Console Forecast report by DFC Intelligence Forecasts, or “DFC.”

(1) Graph as of March 31, 2015

Based on the above, total industry revenue is expected to reach new highs within three years of the launch of new consoles. DFC has forecasted that unit sales of the next generation consoles will be 67% higher in the first three years than in the same period in the previous cycle. At the end of 2014, only 20% of the anticipated five-year cumulative sales are projected to have been made. As such, the console transition is at the front end what we believe will be a strong growth period for the industry, and in 2014, Turtle Beach was the number one console gaming headset manufacturer in the U.S. with a 46% dollar share of the market according to market research company NPD Group's Retail Tracking Service.

Products

Xbox One

In 2014, we expanded our Xbox One compatible headset portfolio with the launch of the XO FOUR, XO SEVEN, XO ONE and Stealth 500X and developed headsets that included many new and unique features including DTS Headphone:X, full wireless integration with Xbox One, and Superhuman Hearing™. In 2015, continuing with our strategy to deliver innovative, high quality console gaming headsets that incorporate advanced audio and wireless technology, we launched two upgraded versions of market-leading Xbox One headsets – the XO SEVEN Pro and the XO FOUR Stealth and introduced the Elite 800X, expected to launch at retail in the Spring of 2015, that brings several more firsts to Xbox One gaming, including active noise cancellation and invisible, boom-free microphones.

PlayStation®4

In January 2014, we announced an agreement with Sony Computer Entertainment Inc. to make officially licensed headsets for the PlayStation®4. During 2014, we added three wireless headsets -- the ELITE 800, Stealth 500P and Stealth 400 -- and the P12, a new entry-level headset for the PlayStation®4 which expanded our core portfolio of headsets for the PlayStation®4.

PC Gaming Accessories

Our new line of PC gaming accessories being produced by Nordic Game Supply in an exclusive licensing agreement offers six models, including the Impact 700 and Impact 500 mechanical keyboards, the Grip 500 programmable laser mouse, the Grip 300 optical mouse, and the Drift and Traction gaming mousepads.

Seasonality

Our gaming headset business is seasonal with a significant portion of sales and profits typically occurring around the holiday period. Historically, more than 50% of headset business revenues are generated during the period from September through December as new headsets are introduced and consumers engage in holiday shopping.

Geographic Expansion

In addition to the traditional markets of the United States and United Kingdom, we have pursued growth in countries such as Germany and France, and have begun to support long-term growth efforts in Asia Pacific and Latin America. In September 2014, sales of our XO Four and XO Seven officially-licensed Xbox One gaming headsets began in China. The launch of the gaming headsets coincided with the launch of the Xbox One console, which debuted in China on September 29, 2014. We believe China offers a growth opportunity over the next several years and therefore, in concert with the introduction of our officially-licensed Xbox One headsets, we created a Chinese language version of the Turtle Beach brand and logo; phonetically pronounced “Huan Jing,” the Chinese language version of the brand name translates as “Fantasy Space.”

Key Performance Indicators and Non-GAAP Measures

Management routinely reviews key performance indicators including revenue, operating income and margins, earnings per share, among others. In addition, we consider other certain measures to be useful to management and investors evaluating our operating performance for the periods presented, and believe these additional measures provide a tool for evaluating our ongoing operations, liquidity and management of assets. These metrics, however, are not measures of financial performance under accounting principles generally accepted in the United States of America (“GAAP”) and should not be considered a substitute for net income (loss) or other consolidated income statement data as determined in accordance with GAAP. These other measures may not be comparable to similarly titled measures employed by other companies. We consider the following non-GAAP measure, which may not be comparable to similarly titled measures reported by other companies, to be key performance indicators:

Adjusted EBITDA is defined as net income (loss) before interest, taxes, depreciation and amortization, stock-based compensation (non-cash) and, certain special items that we believe are not representative of core operations. We believe this measure provides useful information to investors about us and our financial condition and results of operations for the following reasons: (i) it is one of the measures used by our board of directors and management team to evaluate our operating performance; (ii) it is one of the measures used by our management team to make day-to-day operating decisions; (iii) the adjustments made in our calculation of Adjusted EBITDA are often viewed as either non-recurring or not reflective of ongoing financial performance or have no cash impact on operations; and (iv) it is used by securities analysts, investors and other interested parties as a common operating performance measure to compare results across companies in our industry by backing out potential differences caused by variations in capital structures (affecting relative interest expense), and the age and book value of facilities and equipment (affecting relative depreciation and amortization expense).

Adjusted EBITDA has limitations as an analytical tool, and when assessing our operating performance, it should not be considered in isolation or as a substitute for net income (loss) or other consolidated income statement data. Some of these limitations include, but are not limited to (i) it does not reflect changes in, or cash requirements for, our working capital needs; (ii) it does not reflect interest expense, or the cash requirements necessary to service interest or principal payments, on our debt; and (iii) it does not reflect income taxes or the cash requirements for any tax payments; and

Adjusted EBITDA (and a reconciliation to Net loss, the nearest GAAP financial measure) for the three months ended March 31, 2015 and 2014 are as follows:

|

| | | | | | | |

| Three Months Ended |

| March 31, |

| 2015 |

| 2014 |

| (in thousands) |

Net loss | $ | (10,593 | ) | | $ | (2,906 | ) |

Interest expense | 784 |

| | 4,240 |

|

Depreciation and amortization | 1,807 |

| | 2,051 |

|

Stock-based compensation | 1,325 |

| | 1,049 |

|

Income tax benefit | (3,368 | ) | | (5,832 | ) |

Restructuring charges | 325 |

| | — |

|

Business transaction costs | — |

| | 4,228 |

|

Adjusted EBITDA | $ | (9,720 | ) | | $ | 2,830 |

|

Adjusted EBITDA decreased for the three months ended March 31, 2015 as compared to the prior year period which included the initial sell-in of the Company's and the industry’s first ever Xbox One compatible headsets resulting from a delay in gaming headset audio for the Xbox One console. In addition to the lower sales volume, 2015 was negatively impacted by $1.5 million of reserves for products associated with certain discontinued legacy license agreements and $0.6 million of foreign currency expense due to a decline in the British Pound exchange rate.

Results of Operations

The following table sets forth the Company’s statement of operations for the periods presented:

|

| | | | | | | |

| Three Months Ended |

| March 31, |

| 2015 | | 2014 |

| (in thousands) |

Net Revenue | $ | 19,689 |

| | $ | 38,288 |

|

Cost of Revenue | 16,573 |

| | 26,012 |

|

Gross Profit | 3,116 |

| | 12,276 |

|

Operating expenses | 15,665 |

| | 16,799 |

|

Operating loss | (12,549 | ) | | (4,523 | ) |

Interest expense | 784 |

| | 4,240 |

|

Other non-operating expense (income), net | 628 |

| | (25 | ) |

Loss before income tax benefit | (13,961 | ) | | (8,738 | ) |

Income tax benefit | (3,368 | ) | | (5,832 | ) |

Net loss | $ | (10,593 | ) | | $ | (2,906 | ) |

Net Revenue

Despite continued strong consumer response to our 2014 holiday headset assortment, the introduction of new Xbox One compatible headsets, the XO FOUR Stealth and XO SEVEN Pro, and the initial sales of a new line of PC accessories; net revenues for the three months ended March 31, 2015 decreased 48.6% over the comparable 2014 period to $19.7 million. The decrease reflects lower Xbox compatible headset revenue as the prior year period included the initial sell-in for the new Xbox One compatible headsets, which launched during the first quarter of 2014 as a result of a delay in gaming headset audio. PlayStation® compatible headset revenues, which decreased 8.2%, continued to be negatively impacted by the decline of

previous generation console headset sales, partially offset by PlayStation®4 headset revenues that more than doubled over the comparable 2014 period on the continued success of the Stealth 400 and Stealth 500P.

Cost of Revenue and Gross Profit

Gross profit as a percentage of net revenues for the three months ended March 31, 2015 was 15.8% versus 32.1% in the comparable 2014 period. We experienced a year-over-year decrease in gross margin rate performance primarily due to unfavorable manufacturing variances due to lower production volumes as compared to the prior year period which included the highly anticipated launch of new Xbox One headsets following the chat adapter delay as well as the negative impact of $1.5 million of reserves for products associated with certain discontinued legacy license agreements.

Operating Expenses

|

| | | | | | | |

| Three Months Ended |

| March 31, |

| 2015 | | 2014 |

| (in thousands) |

Selling and marketing | $ | 7,746 |

| | $ | 7,000 |

|

Research and development | 2,854 |

| | 1,998 |

|

General and administrative | 4,740 |

| | 3,573 |

|

Business transaction costs | — |

| | 4,228 |

|

Restructuring charges | 325 |

| | — |

|

Total operating expenses | $ | 15,665 |

| | $ | 16,799 |

|

Selling and Marketing

Selling and marketing expense for the three months ended March 31, 2015 totaled $7.7 million, or 39.3% as a percentage of net revenues, compared to $7.0 million, or 18.3% as a percentage of net revenues, for the three months ended March 31, 2014. The 10.7% increase was primarily due to severance and other related costs in connection with strategic enhancement of the leadership team and additional HyperSound sales force.

Research and Development

The increase in research and development expenses for the three months ended March 31, 2015 versus the comparable prior year period was primarily due to the new product development initiatives including increased staffing levels to support the development of the HyperSound Hearing Solutions product.

General and Administrative

The increase in general and administrative expenses for the three months ended March 31, 2015 versus the comparable prior year period was primarily due to additional headcount ($0.5 million), higher legal fees ($0.2 million), and an ongoing investment in information services and technology.

Business Transaction

Business transaction expenses for the three months ended March 31, 2014 related to investment banker success fees of $2.7 million as well as associated legal and accounting fees in connection with the acquisition of the HyperSound business.

Restructuring Charges

During 2014, we began to focus on company-wide overhead and operating expense cost reduction activities, such as closing excess facilities and reducing redundancies. In connection with our efforts to improve our operating efficiency and reduce costs, we started the closure of certain production operations at one of our contract manufacturing operations in China. The wind down is expected to be completed by June 2015.

Interest Expense

Interest expense decreased by $3.5 million for the three months ended March 31, 2015 as compared to March 31, 2014, primarily due to the prior year impact of a $2.2 million write-off of unamortized debt issuance costs related to the refinancing of our then existing credit facility on March 31, 2014 and $0.4 million of additional interest related to the now extinguished subordinated notes as well as a $0.5 million benefit from lower average overall borrowings on our credit facility.

Income Taxes

Income tax benefit for the three months ended March 31, 2015 was $3.4 million at an effective tax rate of 24.1%. The effective tax rate for the three months ended March 31, 2015 was impacted by the interest on the Series B Redeemable Preferred Stock and foreign entity taxable loss.

Income tax benefit for the three months ended March 31, 2014 was $5.8 million at an effective tax rate of 66.7%, which was higher than the federal statutory rate primarily due to differences in book and tax treatment of transaction costs, interest on the Series B Redeemable Preferred Stock and other non-deductible expenses.

Liquidity and Capital Resources

Our primary source of working capital is cash flow from operations. We have funded operations and acquisitions in recent periods with operating cash flows, and proceeds from debt and equity financings.

The following table summarizes our sources and uses of cash:

|

| | | | | | | |

| Three Months Ended |

| March 31, |

| 2015 | | 2014 |

| (in thousands) |

Cash and cash equivalents at beginning of period | $ | 7,908 |

| | $ | 6,509 |

|

Net cash provided by operating activities | 17,676 |

| | 8,902 |

|

Net cash provided by (used for) investing activities | (2,007 | ) | | 3,625 |

|

Net cash used for financing activities | (21,263 | ) | | (13,612 | ) |

Effect of foreign exchange on cash | (173 | ) | | 128 |

|

Cash and cash equivalents at end of period | $ | 2,141 |

| | $ | 5,552 |

|

Operating activities

Cash provided by operating activities for the three months ended March 31, 2015 was $17.7 million, an increase of $8.8 million as compared to $8.9 million for the three months ended March 31, 2014. The year-over-year increase is primarily the result of timing of cash receipts and release of inventory as a result of the full availability of headsets for the holiday season compared to the deferral of headset sales from the 2013 holiday season into the first half of 2014, partially offset by a $10.5 million decrease in net income adjusted for non-cash expenses.

Investing activities

Cash used for investing activities was $2.0 million during the three months ended March 31, 2015 compared to cash provided by investing activities of $3.6 million during the three months ended March 31, 2014, as a result of $4.1 million of cash acquired in the merger. Capital expenditures increased $1.5 million compared to the prior year period to $2.0 million for the three months ended March 31, 2015.

Financing activities

Net cash used for financing activities was $21.3 million during the three months ended March 31, 2015 compared to net cash used of $13.6 million during the three months ended March 31, 2014. Financing activities during the three months ended included net payments on our revolving credit facilities of $21.4 million with cash from operations. The net cash used in

the three months ended March 31, 2014 was primarily due to the draw down on the new revolving line of credit of $34.4 million, net payments to close out the legacy term loan and revolving line of credit of $54.2 million as well as the issuance of $7.0 million of additional subordinated debt.

Management assessment of liquidity

Management believes that its current cash and cash equivalents and the amounts available under its asset-based credit facility and its cash flows derived from operations will be sufficient to meet anticipated cash needs for working capital and capital expenditures for at least the next 12 months. Significant assumptions underlie this belief, including, among other things, that there will be no material adverse developments in our business, liquidity or capital requirements.

We may explore additional financing sources to fund expansion, to respond to competitive pressures, to acquire or to invest in complementary products, businesses or technologies, or to lower our cost of capital, which could include equity and debt financings. There can be no guarantee that any additional financing will be available on acceptable terms, if at all. If additional funds are raised through the issuance of equity or convertible debt, existing stockholders could suffer significant dilution, and if we raise additional funds through the issuance of debt securities or other borrowings, these securities or borrowings could have rights senior to common stock and could contain covenants that could restrict operations.

Foreign cash balances at March 31, 2015 and December 31, 2014 were $1.5 million and $2.5 million, respectively.

Revolving Credit Facility