Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22426

Name of Fund: BlackRock Build America Bond Trust (BBN)

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Build America

Bond Trust, 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 882-0052, Option 4

Date of fiscal year end: 07/31/2014

Date of reporting period: 01/31/2014

Table of Contents

Item 1 – Report to Stockholders

Table of Contents

JANUARY 31, 2014

|

SEMI-ANNUAL REPORT (UNAUDITED)

|

|

BlackRock Build America Bond Trust (BBN)

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

Table of Contents

| Table of Contents |

| Page | ||||

| 3 | ||||

| Semi-Annual Report: |

||||

| 4 | ||||

| 5 | ||||

| 5 | ||||

| 6 | ||||

| Financial Statements: | ||||

| 8 | ||||

| 14 | ||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 19 | ||||

| 25 | ||||

| 26 | ||||

| 2 | BLACKROCK BUILD AMERICA BOND TRUST | JANUARY 31, 2014 |

Table of Contents

| Dear Shareholder |

One year ago, US financial markets were improving despite a sluggish global economy, as loose monetary policy beckoned investors to take on more risk in their portfolios. Slow but positive growth in the US was sufficient to support corporate earnings, while uncomfortably high unemployment reinforced expectations that the Federal Reserve would continue its aggressive monetary stimulus programs. International markets were not as fruitful in the earlier part of the year given uneven growth rates and more direct exposure to macro risks such as the resurgence of political instability in Italy, the banking crisis in Cyprus and a generally poor outlook for European economies. Additionally, emerging markets significantly lagged the rest of the world due to slowing growth and structural imbalances.

Global financial markets were rattled in May when Fed Chairman Bernanke mentioned the possibility of reducing (or “tapering”) the central bank’s asset purchase programs — comments that were widely misinterpreted as signaling an end to the Fed’s zero-interest-rate policy. US Treasury yields rose sharply, triggering a steep sell-off across fixed income markets. (Bond prices move in the opposite direction of yields.) Equity prices also suffered as investors feared the implications of a potential end of a program that had greatly supported the markets. Markets rebounded in late June, however, when the Fed’s tone turned more dovish, and improving economic indicators and better corporate earnings helped extend gains through most of the summer.

The fall was a surprisingly positive period for most asset classes after the Fed defied market expectations with its decision to delay tapering. Higher volatility returned in late September when the US Treasury Department warned that the national debt would soon breach its statutory maximum. The ensuing political brinksmanship led to a partial government shutdown, roiling global financial markets through the first half of October, but equities and other so-called “risk assets” resumed their rally when politicians engineered a compromise to reopen the government and extend the debt ceiling, at least temporarily.

The remainder of 2013 was generally positive for stock markets in the developed world, although investors continued to grapple with uncertainty about when and how much the Fed would scale back on stimulus. When the long-awaited taper announcement ultimately came in mid-December, the Fed reduced the amount of its monthly asset purchases but at the same time extended its time horizon for maintaining low short-term interest rates. Markets reacted positively, as this move signaled the Fed’s perception of real improvement in the economy and investors were finally relieved from the tenacious anxiety that had gripped them for quite some time.

Investors’ risk appetite diminished in the new year. Heightened volatility in emerging markets and mixed US economic data caused global equities to weaken in January while bond markets found renewed strength. While tighter global liquidity was an ongoing headwind for developing countries, financial troubles in Argentina and Turkey launched a sharp sell-off in a number of emerging market currencies. Unexpectedly poor economic data out of China added to the turmoil. In the US, most indicators continued to signal a strengthening economy; however, stagnant wage growth raised concerns about the sustainability of the overall positive momentum. US stocks underperformed other developed equity markets as a number of disappointing corporate earnings reports prompted investors to take advantage of lower valuations abroad.

While accommodative monetary policy was the main driver behind positive market performance over the period, it was also the primary cause of volatility and uncertainty. Developed market stocks were the strongest performers for the six- and 12-month periods ended January 31. In contrast, emerging markets were weighed down by uneven growth, high debt levels and severe currency weakness. Rising interest rates pressured US Treasury bonds and other high-quality fixed income sectors, including tax-exempt municipals and investment grade corporate bonds. High yield bonds, to the contrary, benefited from income-oriented investors’ search for yield in the low-rate environment. Short-term interest rates remained near zero, keeping yields on money market securities near historical lows.

At BlackRock, we believe investors need to think globally and extend their scope across a broader array of asset classes and be prepared to move freely as market conditions change over time. We encourage you to talk with your financial advisor and visit www.blackrock.com for further insight about investing in today’s world.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

“While accommodative monetary policy was the main driver behind positive market performance over the period, it was also the primary cause of volatility and uncertainty.”

Rob Kapito

President, BlackRock Advisors, LLC

| Total Returns as of January 31, 2014 | ||||||||

| 6-month | 12-month | |||||||

| US large cap equities |

6.85 | % | 21.52 | % | ||||

| US small cap equities |

8.88 | 27.03 | ||||||

| International equities |

7.51 | 11.93 | ||||||

| Emerging market equities |

(0.33 | ) | (10.17 | ) | ||||

| 3-month Treasury bill |

0.03 | 0.08 | ||||||

| US Treasury securities |

0.77 | (2.97 | ) | |||||

| US investment grade |

1.78 | 0.12 | ||||||

| Tax-exempt municipal |

3.13 | (1.10 | ) | |||||

| US high yield bonds (Barclays US Corporate High Yield 2% Issuer Capped Index) |

4.70 | 6.76 | ||||||

| Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | ||||||||

| THIS PAGE NOT PART OF YOUR FUND REPORT | 3 |

Table of Contents

| Build America Bond Overview | ||||

| For the Reporting Period Ended January 31, 2014 |

Build America Bonds (“BABs”) typically trade at a spread or extra yield to US Treasury bonds with similar maturities as they are taxable municipal securities. During the reporting period, yields on US Treasury bonds spent most of the period probing higher yields but ultimately ended the period without significant change. The yield curve flattened as yields on 30-year maturities dropped slightly while yields on 10-year and shorter maturities increased. The Barclays Aggregate Eligible Build America Bond Index returned 5.79% for the six-month period ended January 31, 2014. Given that BABs are no longer issued and demand has remained strong (more so for index-eligible BABs), the relative scarcity of the bonds contributed positively to performance as credit spreads for BABs generally tightened. California general obligation BABs, in particular, continued to benefit from the state’s improving credit quality. Additionally, Illinois general obligation bonds benefited significantly from the passage of pension reform legislation in late 2013, which the market viewed as positive for the issuer’s credit strength.

Additionally, during the reporting period, the BABs market faced the ongoing headwind of federal sequestration (a series of automatic spending cuts resulting from the fiscal cliff deal). As sequestration was triggered, the federal subsidy used to pay the coupon on BABs (previously 35%) has been reduced. Since the federal government now pays a smaller proportion of the coupon, the issuer’s cost of borrowing has increased. While most issuers should be able to absorb this higher cost, some may face more of a challenge. Additionally, most BABs were issued with an Extraordinary Redemption Provision (“ERP”) intended to give issuers the ability to call their bonds prior to maturity in the event the federal subsidy was lowered. Some issuers have already exercised their ERP and called their bonds out of the market, although, the volume has been small relative to the overall size of the market. However, the longer sequestration continues, the greater the likelihood that additional issuers will consider exercising this provision to call bonds. At present, though, for most BABs issuers there are no cost savings to be generated by exercising the ERP. Thus far, general concerns around the sequestration and the potential for bond calls through ERPs have not materially impacted the overall BABs market.

Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

| 4 | BLACKROCK BUILD AMERICA BOND TRUST | JANUARY 31, 2014 |

Table of Contents

| The Benefits and Risks of Leveraging |

The Trust may utilize leverage to seek to enhance the yield and net asset value (“NAV”). However, these objectives cannot be achieved in all interest rate environments.

The Trust may utilize leverage by entering into reverse repurchase agreements. In general, the concept of leveraging is based on the premise that the financing cost of assets to be obtained from leverage, which will be based on short-term interest rates, will normally be lower than the income earned by the Trust on its longer-term portfolio investments. To the extent that the total assets of the Trust (including the assets obtained from leverage) are invested in higher-yielding portfolio investments, the Trust’s shareholders will benefit from the incremental net income.

The interest earned on securities purchased with the proceeds from leverage is paid to shareholders in the form of dividends, and the value of these portfolio holdings is reflected in the per share NAV. However, in order to benefit shareholders, the yield curve must be positively sloped; that is, short-term interest rates must be lower than long-term interest rates. If the yield curve becomes negatively sloped, meaning short-term interest rates exceed long-term interest rates, income to shareholders will be lower than if the Trust had not used leverage.

To illustrate these concepts, assume a Trust’s capitalization is $100 million and it borrows for an additional $30 million, creating a total value of $130 million available for investment in long-term securities. If prevailing short-term interest rates are 3% and long-term interest rates are 6%, the yield curve has a strongly positive slope. In this case, the Trust pays borrowing costs and interest expense on the $30 million of borrowings based on the lower short-term interest rates. At the same time, the securities purchased by the Trust with assets received from the borrowings earn income based on long-term interest rates. In this case, the borrowing costs and interest expense of the borrowings is significantly lower than the income earned on the Trust’s long-term investments, and therefore the Trust’s shareholders are the beneficiaries of the incremental net income.

If short-term interest rates rise, narrowing the differential between short-term and long-term interest rates, the incremental net income pickup will be reduced or eliminated completely. Furthermore, if prevailing short-term interest rates rise above long-term interest rates, the yield curve has a negative slope. In this case, the Trust pays higher short-term interest rates whereas the Trust’s total portfolio earns income based on lower long-term interest rates.

Furthermore, the value of the Trust’s portfolio investments generally varies inversely with the direction of long-term interest rates, although other factors can influence the value of portfolio investments. As a result, changes in interest rates can influence the Trust’s NAV positively or negatively in addition to the impact on Trust performance from leverage.

The use of leverage may enhance opportunities for increased income to the Trust, but as described above, it also creates risks as short- or long-term interest rates fluctuate. Leverage also will generally cause greater changes in the Trust’s NAV, market price and dividend rate than comparable portfolios without leverage. If the income derived from securities purchased with assets received from leverage exceeds the cost of leverage, the Trust’s net income will be greater than if leverage had not been used. Conversely, if the income from the securities purchased is not sufficient to cover the cost of leverage, the Trust’s net income will be less than if leverage had not been used, and therefore the amount available for distribution to shareholders will be reduced. The Trust may be required to sell portfolio securities at inopportune times or at distressed values in order to comply with regulatory requirements applicable to the use of leverage or as required by the terms of leverage instruments, which may cause the Trust to incur losses. The use of leverage may limit the Trust’s ability to invest in certain types of securities or use certain types of hedging strategies. The Trust will incur expenses in connection with the use of leverage, all of which are borne by shareholders and may reduce income.

Under the Investment Company Act of 1940, as amended (the “1940 Act”), the Trust is permitted to issue senior securities representing indebtedness up to 33 1/3% of its total managed assets (the Trust’s net assets plus the proceeds of any outstanding borrowings used for leverage). If the Trust segregates or designates on its books and records cash or liquid assets having a value not less than the repurchase price (including accrued interest), such reverse repurchase agreement will not be considered a senior security for 1940 Act purposes and therefore will not be subject to this limitation. The Trust, however, voluntarily limits its aggregate economic leverage to 50% of its managed assets. As of January 31, 2014, the Trust had economic leverage of 33% from reverse repurchase agreements as a percentage of its total managed assets.

| Derivative Financial Instruments |

The Trust may invest in various derivative financial instruments, including financial futures contracts as specified in Note 4 of the Notes to Financial Statements, which may constitute forms of economic leverage. Such derivative financial instruments are used to obtain exposure to a market without owning or taking physical custody of securities or to hedge market and/or interest rate risks. Derivative financial instruments involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the derivative financial instrument. The Trust’s ability to use a derivative financial instrument successfully depends on the investment advisor’s ability to predict pertinent market movements accurately, which cannot be assured. The use of derivative financial instruments may result in losses greater than if they had not been used, may require the Trust to sell or purchase portfolio investments at inopportune times or for distressed values, may limit the amount of appreciation the Trust can realize on an investment, may result in lower dividends paid to shareholders and/or may cause the Trust to hold an investment that it might otherwise sell. The Trust’s investments in these instruments are discussed in detail in the Notes to Financial Statements.

| BLACKROCK BUILD AMERICA BOND TRUST | JANUARY 31, 2014 | 5 |

Table of Contents

| Trust Summary as of January 31, 2014 |

| Trust Overview |

BlackRock Build America Bond Trust’s (BBN) (the “Trust”) investment objective is to seek high current income, with a secondary objective of capital appreciation. The Trust seeks to achieve its investment objectives by investing primarily in a portfolio of taxable municipal securities known as BABs issued by state and local governments to finance capital projects such as public schools, roads, transportation infrastructure, bridges, ports and public buildings, among others, pursuant to the American Recovery and Reinvestment Act of 2009. Unlike investments in most other municipal securities, interest received on BABs is subject to federal income tax and may be subject to state income tax. Issuers of direct pay BABs, however, are eligible to receive a subsidy from the US Treasury of up to 35% of the interest paid on the bonds, which allows such issuers to issue bonds that pay interest rates that are expected to be competitive with the rates typically paid by private bond issuers in the taxable fixed income market. Under normal market conditions, the Trust invests at least 80% of its assets in BABs and invests 80% of its assets in securities that at the time of investment are investment grade quality. While the US Treasury subsidizes the interest paid on BABs, it does not guarantee the principal or interest payments on BABs, and there is no guarantee that the US Treasury will not reduce or eliminate the subsidies for BABs in the future. As of the date of this report, the subsidy that issuers of direct payment BABs receive from the US Treasury has been reduced as the result of budgetary sequestration, which may result in early redemptions of BABs at par value. See Build America Bond Overview on page 4.

The BABs program expired on December 31, 2010 and was not renewed. Accordingly, there have been no new issuances of BABs since that date. The Trust has a contingent term provision stating that if there are no new issuances of BABs or similar US government subsidized taxable municipal bonds for any 24-month period ending on or before December 31, 2014, the Board of Trustees (the “Board”) of the Trust would undertake an evaluation of potential actions with respect to the Trust, which may include, among other things, changes to the non-fundamental investment policies of the Trust to broaden its primary investment policies to taxable municipal securities generally or the termination of the Trust (the “Contingent Review Provision”). In November 2013, the Board approved an extension of the Contingent Review Provision until on or before December 31, 2016, during which time the Board will continue to monitor the Trust on an ongoing basis and evaluate potential actions with respect to the Trust. See Note 9 of Notes to Financial Statements for additional information.

No assurance can be given that the Trust’s investment objectives will be achieved.

| Performance |

For the six-month period ended January 31, 2014, the Trust returned 5.63% based on market price and 6.42% based on NAV. For the same period, the closed-end Lipper General Bond Funds category posted an average return of 3.66% based on market price and 5.11% based on NAV. All returns reflect reinvestment of dividends. The Trust’s discount to NAV, which widened during the period, accounts for the difference between performance based on price and performance based on NAV. The following discussion relates to performance based on NAV. Contributing positively to performance was the Trust’s income generated from coupon payments on its portfolio of mostly taxable municipal bonds. The Trust’s holdings of BABs had a positive impact on returns as credit spreads generally tightened in these and other taxable municipal securities during the period. Exposure to longer-dated bonds added to returns as the yield curve flattened (i.e., long-term rates fell while short- and intermediate-term rates rose slightly) (Bond prices rise when rates fall. BABs are taxable municipal bonds; yield movements on these bonds tend to correlate with moves in US government interest rates.). Detracting from performance was security selection as certain credits, such as the Chicago Illinois Board of Education and Wayne County, Michigan, declined in market value due to credit rating downgrades during the period.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| Trust Information | ||||

| Symbol on New York Stock Exchange (“NYSE”) |

BBN | |||

| Initial Offering Date |

August 27, 2010 | |||

| Current Distribution Rate on Closing Market Price as of January 31, 2014 ($19.52)1 |

8.10% | |||

| Current Monthly Distribution per Common Share2 |

$0.1318 | |||

| Current Annualized Distribution per Common Share2 |

$1.5816 | |||

| Economic Leverage as of January 31, 20143 |

33% | |||

| 1 | Current Distribution Rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate may consist of income, net realized gains and/or a return of capital. See the Additional Information — Section 19(a) Notice for estimated sources and character of distributions. Past performance does not guarantee future results. |

| 2 | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain at fiscal year end. |

| 3 | Represents reverse repurchase agreements as a percentage of total managed assets, which is the total assets of the Trust, including any assets attributable to reverse repurchase agreements, minus the sum of accrued liabilities. For a discussion of leveraging techniques utilized by the Trust, please see The Benefits and Risks of Leveraging on page 5. |

| 6 | BLACKROCK BUILD AMERICA BOND TRUST | JANUARY 31, 2014 |

Table of Contents

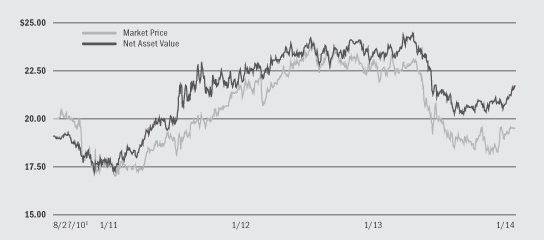

| Market Price and Net Asset Value Per Share Summary | ||||||||||||||||||||

| 1/31/14 | 7/31/13 | Change | High | Low | ||||||||||||||||

| Market Price |

$19.52 | $19.26 | 1.35% | $19.70 | $18.15 | |||||||||||||||

| Net Asset Value |

$21.74 | $21.29 | 2.11% | $21.74 | $20.26 | |||||||||||||||

| Market Price and Net Asset Value History Since Inception |

| 1 | Commencement of operations. |

| Overview of the Trust’s Long-Term Investments |

| Sector Allocation | 1/31/14 | 7/31/13 | ||||||

| Utilities |

30 | % | 31 | % | ||||

| County/City/Special District/School District |

23 | 23 | ||||||

| Transportation |

21 | 20 | ||||||

| State |

11 | 11 | ||||||

| Education |

11 | 11 | ||||||

| Housing |

2 | 2 | ||||||

| Health |

1 | 1 | ||||||

| Corporate |

1 | 1 | ||||||

| Credit Quality Allocation2 | 1/31/14 | 7/31/13 | ||||||

| AAA/Aaa |

5 | % | 5 | % | ||||

| AA/Aa |

49 | 49 | ||||||

| A |

43 | 43 | ||||||

| BBB/Baa |

2 | 3 | ||||||

| BB/Ba |

1 | — | ||||||

| 2 | Using the higher of Standard & Poor’s or Moody’s Investors Service ratings. |

| Call/Maturity Schedule3 | ||||

| Calendar Year Ended December 31, |

||||

| 2014 |

— | |||

| 2015 |

— | |||

| 2016 |

1 | % | ||

| 2017 |

— | |||

| 2018 |

— | |||

| 3 | Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

| BLACKROCK BUILD AMERICA BOND TRUST | JANUARY 31, 2014 | 7 |

Table of Contents

| Schedule of Investments January 31, 2014 (Unaudited) | (Percentages shown are based on Net Assets) |

| Municipal Bonds | Par (000) |

Value | ||||||

| Arizona — 3.0% |

| |||||||

| City of Phoenix Arizona Civic Improvement Corp., RB, Sub-Series C (NPFGC), 6.00%, 7/01/35 |

$ | 10,000 | $ | 10,371,900 | ||||

| Salt River Project Agricultural Improvement & Power District, RB, Build America Bonds, Series A, 4.84%, 1/01/41 (a) |

25,000 | 26,968,500 | ||||||

|

|

|

|||||||

| 37,340,400 | ||||||||

| California — 32.4% |

| |||||||

| Bay Area Toll Authority, RB, Build America Bonds: |

|

|||||||

| Series S-1, 6.92%, 4/01/40 |

13,700 | 17,512,573 | ||||||

| Series S-3, 6.91%, 10/01/50 |

14,000 | 18,277,980 | ||||||

| California Infrastructure & Economic Development Bank, RB, Build America Bonds, 6.49%, 5/15/49 |

2,500 | 2,855,850 | ||||||

| California State Public Works Board, RB, Build America Bonds, Series G-2, 8.36%, 10/01/34 (a) |

18,145 | 22,784,676 | ||||||

| City of San Francisco Public Utilities Commission, RB, Build America Bonds, Sub-Series E, 6.00%, 11/01/40 (a) |

21,255 | 25,591,658 | ||||||

| City of San Jose California, Refunding ARB, Series B (AGM), 6.60%, 3/01/41 |

10,000 | 10,376,400 | ||||||

| County of Alameda California Joint Powers Authority, RB, Build America Bonds, Recovery Zone, Series A, 7.05%, 12/01/44 (a) |

13,300 | 15,416,030 | ||||||

| County of Orange California Local Transportation Authority, Refunding RB, Build America Bonds, Series A, 6.91%, 2/15/41 |

5,000 | 6,472,300 | ||||||

| County of Sonoma California, Refunding RB, Series A, 6.00%, 12/01/29 |

14,345 | 15,048,192 | ||||||

| Los Angeles Community College District California, GO, Build America Bonds, 6.60%, 8/01/42 (a) |

10,000 | 12,951,100 | ||||||

| Los Angeles Department of Water & Power, RB, Build America Bonds: |

||||||||

| 6.17%, 7/01/40 (a) |

37,500 | 40,707,750 | ||||||

| 7.00%, 7/01/41 |

17,225 | 19,318,699 | ||||||

| Metropolitan Water District of Southern California, RB, Build America Bonds, Series A, 6.95%, 7/01/40 (a) |

12,000 | 13,641,720 | ||||||

| Palomar Community College District, GO, Build America Bonds, Series B-1, 7.19%, 8/01/45 |

7,500 | 8,430,150 | ||||||

| Rancho Water District Financing Authority, RB, Build America Bonds, Series A, 6.34%, 8/01/40 (a) |

20,000 | 21,422,600 | ||||||

| California (concluded) |

| |||||||

| Riverside Community College District, GO, Build America Bonds, Series D-1, 7.02%, 8/01/40 |

$ | 11,000 | $ | 12,227,270 | ||||

| San Diego County Regional Airport Authority, Refunding RB, Build America Bonds, Sub-Series C, 6.63%, 7/01/40 |

32,100 | 33,750,582 | ||||||

| San Diego Tobacco Settlement Revenue Funding Corp., RB, Asset-Backed, 7.13%, 6/01/32 |

1,615 | 1,504,179 | ||||||

| State of California, GO, Build America Bonds, Various Purpose: |

||||||||

| 7.55%, 4/01/39 |

9,035 | 12,608,071 | ||||||

| 7.63%, 3/01/40 |

8,950 | 12,401,836 | ||||||

| 7.60%, 11/01/40 |

15,000 | 21,143,100 | ||||||

| University of California, RB, Build America Bonds (a): |

||||||||

| 5.95%, 5/15/45 |

24,000 | 28,234,560 | ||||||

| 6.30%, 5/15/50 |

27,010 | 29,232,653 | ||||||

|

|

|

|||||||

| 401,909,929 | ||||||||

| Colorado — 3.6% |

| |||||||

| City & County of Denver Colorado School District No. 1, COP, Refunding, Series B, 7.02%, 12/15/37 |

6,000 | 7,265,880 | ||||||

| Regional Transportation District, COP, Build America Bonds, Series B, 7.67%, 6/01/40 |

28,000 | 32,225,480 | ||||||

| State of Colorado, COP, Build America Bonds, Series E, 7.02%, 3/15/31 |

5,000 | 5,484,750 | ||||||

|

|

|

|||||||

| 44,976,110 | ||||||||

| Connecticut — 1.0% |

| |||||||

| Town of Stratford Connecticut, GO, 6.00%, 8/15/38 |

12,000 | 12,945,720 | ||||||

| District of Columbia — 2.3% |

| |||||||

| Metropolitan Washington Airports Authority, RB, Build America Bonds, Series D, 8.00%, 10/01/47 |

10,750 | 12,656,728 | ||||||

| Washington Convention & Sports Authority, Refunding RB, Series C, 7.00%, 10/01/40 |

15,000 | 15,695,400 | ||||||

|

|

|

|||||||

| 28,352,128 | ||||||||

| Florida — 2.6% |

| |||||||

| City of Sunrise Florida Utility System, RB, Build America Bonds, Series B, 5.91%, 10/01/35 (a) |

25,000 | 27,420,500 | ||||||

| County of Pasco Florida Water & Sewer, RB, Build America Bonds, Series B, 6.76%, 10/01/39 |

1,500 | 1,646,565 | ||||||

| Portfolio Abbreviations | ||||||||

| To simplify the listings of portfolio holdings in the Schedule of Investments, the names and descriptions of many of the securities have been abbreviated according to the following list: | AGM | Assured Guaranty Municipal Corp. | ISD | Independent School District | ||||

| AMT | Alternative Minimum Tax (subject to) | M/F | Multi-Family | |||||

| ARB | Airport Revenue Bonds | NPFGC | National Public Finance Guarantee Corp. | |||||

| COP | Certificates of Participation | PSF-GTD | Permanent School Fund Guaranteed | |||||

| EDA | Economic Development Authority | Q-SBLF | Qualified School Bond Loan Fund | |||||

| GO | General Obligation Bonds | RB | Revenue Bonds | |||||

| HFA | Housing Finance Agency |

See Notes to Financial Statements.

| 8 | BLACKROCK BUILD AMERICA BOND TRUST | JANUARY 31, 2014 |

Table of Contents

| Schedule of Investments (continued) |

(Percentages shown are based on Net Assets) |

| Municipal Bonds | Par (000) |

Value | ||||||

| Florida (concluded) |

| |||||||

| Town of Davie Florida Water & Sewer, RB, Build America Bonds, Series B (AGM), 6.85%, 10/01/40 |

$ | 2,500 | $ | 2,728,050 | ||||

|

|

|

|||||||

| 31,795,115 | ||||||||

| Georgia — 5.5% |

| |||||||

| Municipal Electric Authority of Georgia Plant Vogtle Units 3 & 4, Refunding RB, Build America Bonds, Series A: |

||||||||

| 6.64%, 4/01/57 (a) |

32,084 | 35,685,108 | ||||||

| 6.66%, 4/01/57 |

20,665 | 22,476,907 | ||||||

| 7.06%, 4/01/57 |

10,000 | 10,483,600 | ||||||

|

|

|

|||||||

| 68,645,615 | ||||||||

| Hawaii — 2.6% |

| |||||||

| University of Hawaii, RB, Build America Bonds, Series B-1, 6.03%, 10/01/40 |

30,500 | 32,623,410 | ||||||

| Illinois — 21.3% |

| |||||||

| Chicago Board of Education, GO, Build America Bonds, 6.52%, 12/01/40 |

25,000 | 24,385,000 | ||||||

| Chicago Transit Authority, RB: |

||||||||

| Build America Bonds, Series B, 6.20%, 12/01/40 |

16,015 | 17,422,078 | ||||||

| Series A, 6.90%, 12/01/40 (a) |

4,075 | 4,762,167 | ||||||

| Series B, 6.90%, 12/01/40 |

4,900 | 5,726,287 | ||||||

| City of Chicago Illinois, GO, Build America Bonds: |

||||||||

| Recovery Zone, Series D, 6.26%, 1/01/40 |

27,180 | 26,375,200 | ||||||

| Series B, 7.52%, 1/01/40 |

12,665 | 14,354,384 | ||||||

| City of Chicago Illinois, Refunding ARB, O’Hare International Airport, General 3rd Lien, Build America Bonds, Series B: |

||||||||

| 6.85%, 1/01/38 (a) |

30,110 | 32,539,576 | ||||||

| 6.40%, 1/01/40 |

1,500 | 1,729,935 | ||||||

| City of Chicago Illinois Wastewater Transmission, RB, Build America Bonds, Series B, 6.90%, 1/01/40 (a) |

36,000 | 41,900,040 | ||||||

| City of Chicago Illinois Waterworks Transmission, RB, Build America Bonds, 2nd Lien, Series B, 6.74%, 11/01/40 |

15,250 | 17,710,435 | ||||||

| County of Cook Illinois, GO, Build America Bonds, Series D, 6.23%, 11/15/34 (a) |

7,900 | 8,389,642 | ||||||

| Illinois Finance Authority, RB, Carle Foundation, Series A, 5.75%, 8/15/34 |

5,000 | 5,402,350 | ||||||

| Illinois Municipal Electric Agency, RB, Build America Bonds, Series A, 7.29%, 2/01/35 |

15,000 | 16,940,250 | ||||||

| Northern Illinois Municipal Power Agency, RB, Build America Bonds, Prairie State Project, Series A, 7.82%, 1/01/40 |

5,000 | 5,769,850 | ||||||

| State of Illinois, GO, Build America Bonds, 7.35%, 7/01/35 (a) |

34,295 | 40,422,831 | ||||||

|

|

|

|||||||

| 263,830,025 | ||||||||

| Indiana — 2.6% |

| |||||||

| Indiana Finance Authority, RB, Build America Bonds, Series B, 6.60%, 2/01/39 |

7,900 | 9,140,142 | ||||||

| Indiana Municipal Power Agency, RB, Build America Bonds, Direct Payment, Series A, 5.59%, 1/01/42 |

22,290 | 23,472,707 | ||||||

|

|

|

|||||||

| 32,612,849 | ||||||||

| Municipal Bonds | Par (000) |

Value | ||||||

| Iowa — 0.5% |

| |||||||

| Iowa Finance Authority, Refunding RB, Midwestern Disaster Area, Iowa Fertilizer Co. Project, 5.25%, 12/01/25 |

$ | 6,595 | $ | 6,121,545 | ||||

| Kentucky — 1.6% |

| |||||||

| City of Wickliffe Kentucky, RB, MeadWestvaco Corp., 7.67%, 1/15/27 (b) |

9,400 | 9,389,942 | ||||||

| Kentucky State Property & Building Commission, RB, Build America Bonds, Series C, 5.92%, 11/01/30 |

10,000 | 11,111,200 | ||||||

|

|

|

|||||||

| 20,501,142 | ||||||||

| Louisiana — 0.8% |

| |||||||

| Administrators of the Tulane Educational Fund, Refunding RB, Tulane University of Louisiana, Series D, 5.25%, 2/15/48 |

10,100 | 9,793,768 | ||||||

| Maine — 0.4% |

| |||||||

| Maine Health & Higher Educational Facilities Authority, RB, Maine General Medical Center, 6.75%, 7/01/36 |

5,000 | 5,264,250 | ||||||

| Maryland — 0.1% |

| |||||||

| Maryland Community Development Administration, RB, Residential, Series I, 6.50%, 3/01/43 |

1,000 | 1,005,460 | ||||||

| Massachusetts — 1.5% |

| |||||||

| Commonwealth of Massachusetts, RB, Build America Bonds, Recovery Zone, |

5,000 | 6,049,150 | ||||||

| Massachusetts HFA, Refunding RB, Series D, 7.02%, 12/01/42 |

12,000 | 12,557,400 | ||||||

|

|

|

|||||||

| 18,606,550 | ||||||||

| Michigan — 1.7% |

| |||||||

| County of Wayne Michigan, RB, Build America Bonds, Recovery Zone, Economic Development Bonds, 10.00%, 12/01/40 |

3,500 | 3,416,385 | ||||||

| Detroit City School District, GO, Build America Bonds (Q-SBLF), 6.85%, 5/01/40 |

10,000 | 9,232,200 | ||||||

| Michigan State University, RB, Build America Bonds, General, Series A, 6.17%, 2/15/50 |

5,500 | 6,070,900 | ||||||

| State of Michigan, RB, Build America Bonds, Series B, 7.63%, 9/15/27 |

2,000 | 2,392,540 | ||||||

|

|

|

|||||||

| 21,112,025 | ||||||||

| Minnesota — 1.2% |

| |||||||

| Southern Minnesota Municipal Power Agency, Refunding RB, Build America Bonds, Series A, 5.93%, 1/01/43 |

8,000 | 8,224,480 | ||||||

| Western Minnesota Municipal Power Agency, RB, Build America Bonds, Series C, 6.77%, 1/01/46 |

5,000 | 6,116,350 | ||||||

|

|

|

|||||||

| 14,340,830 | ||||||||

| Mississippi — 0.5% |

| |||||||

| Mississippi Development Bank, RB, Build America Bonds, Desoto County Highway Contruction Project, Series B, 6.41%, 1/01/40 |

5,000 | 5,814,500 | ||||||

See Notes to Financial Statements.

| BLACKROCK BUILD AMERICA BOND TRUST | JANUARY 31, 2014 | 9 |

Table of Contents

| Schedule of Investments (continued) |

(Percentages shown are based on Net Assets) |

| Municipal Bonds | Par (000) |

Value | ||||||

| Missouri — 1.7% |

| |||||||

| Missouri Joint Municipal Electric Utility Commission, RB, Build America Bonds, Plum Point Project, |

$ | 11,000 | $ | 13,026,970 | ||||

| University of Missouri, RB, Build America Bonds, Series A, 5.79%, 11/01/41 (a) |

7,000 | 8,603,910 | ||||||

|

|

|

|||||||

| 21,630,880 | ||||||||

| Nevada — 1.3% |

| |||||||

| County of Clark Nevada, ARB, Build America Bonds: |

||||||||

| Series B, 6.88%, 7/01/42 |

10,000 | 10,976,700 | ||||||

| Series C, 6.82%, 7/01/45 (a) |

2,000 | 2,624,100 | ||||||

| Las Vegas Valley Water District Nevada, GO, Limited Tax, Build America Bonds, Series C, |

2,265 | 2,484,614 | ||||||

|

|

|

|||||||

| 16,085,414 | ||||||||

| New Jersey — 15.2% |

| |||||||

| County of Camden New Jersey Improvement Authority, RB, Build America Bonds, Cooper Medical School of Rowan University Project, Series A, 7.75%, 7/01/34 |

5,000 | 5,290,300 | ||||||

| New Jersey EDA, RB: |

||||||||

| Build America Bonds, Series CC-1, 6.43%, 12/15/35 (a) |

15,000 | 16,263,600 | ||||||

| Series A (NPFGC), 7.43%, 2/15/29 |

20,974 | 25,981,333 | ||||||

| New Jersey State Housing & Mortgage Finance Agency, RB, M/F Housing, Series C (AGM), |

19,800 | 19,476,666 | ||||||

| New Jersey State Turnpike Authority, RB, Build America Bonds: |

||||||||

| Series A, 7.10%, 1/01/41 (a) |

34,000 | 46,121,000 | ||||||

| Series F, 7.41%, 1/01/40 |

6,790 | 9,517,611 | ||||||

| New Jersey Transportation Trust Fund Authority, RB, Build America Bonds: |

||||||||

| Series B, 6.88%, 12/15/39 |

8,500 | 9,175,750 | ||||||

| Series C, 5.75%, 12/15/28 |

5,000 | 5,633,650 | ||||||

| Series C, 6.10%, 12/15/28 (a) |

42,500 | 47,097,650 | ||||||

| South Jersey Port Corp., RB, Build America Bonds, Marine Terminal, Series P-3, 7.37%, 1/01/40 |

3,215 | 3,553,378 | ||||||

|

|

|

|||||||

| 188,110,938 | ||||||||

| New York — 14.8% |

| |||||||

| City of New York, New York, GO, Build America Bonds, Sub-Series C-1, 5.82%, 10/01/31 |

15,000 | 16,108,050 | ||||||

| City of New York, New York Municipal Water Finance Authority, RB, Build America Bonds, 2nd General Resolution, Series DD, 6.45%, 6/15/41 |

6,300 | 6,934,032 | ||||||

| City of New York, New York Municipal Water Finance Authority, Refunding RB, Build America Bonds, 2nd General Resolution: |

||||||||

| Series AA, 5.79%, 6/15/41 (a) |

25,000 | 26,611,250 | ||||||

| Series CC, 6.28%, 6/15/42 (a) |

20,000 | 21,924,600 | ||||||

| Series EE, 6.49%, 6/15/42 |

2,000 | 2,203,240 | ||||||

| Series GG, 6.12%, 6/15/42 |

2,445 | 2,644,439 | ||||||

| City of New York, New York Transitional Finance Authority, RB, Build America Bonds Future Tax Secured (a): |

||||||||

| Sub-Series B-1, 5.57%, 11/01/38 |

19,000 | 22,083,700 | ||||||

| Sub-Series C-2, 6.27%, 8/01/39 |

14,795 | 16,428,516 | ||||||

| Municipal Bonds | Par (000) |

Value | ||||||

| New York (concluded) |

||||||||

| Metropolitan Transportation Authority, RB, Build America Bonds: |

||||||||

| Series A, 6.67%, 11/15/39 |

$ | 2,220 | $ | 2,789,497 | ||||

| Series C, 7.34%, 11/15/39 (a) |

13,245 | 18,206,709 | ||||||

| Series C-1, 6.69%, 11/15/40 |

13,000 | 16,356,990 | ||||||

| Port Authority of New York & New Jersey, RB, Construction, 182nd Series, 5.31%, 8/01/46 |

14,500 | 14,853,655 | ||||||

| State of New York Dormitory Authority, RB, Build America Bonds, General Purpose, Series H, |

15,000 | 17,026,950 | ||||||

|

|

|

|||||||

| 184,171,628 | ||||||||

| Ohio — 6.1% |

| |||||||

| American Municipal Power, Inc., RB, Build America Bonds, Combined Hydroelectric Projects, Series B, 7.83%, 2/15/41 |

10,000 | 13,528,100 | ||||||

| County of Franklin Ohio Convention Facilities Authority, RB, Build America Bonds, 6.64%, 12/01/42 (a) |

30,365 | 35,784,545 | ||||||

| County of Hamilton Ohio, RB, Sewer System, Build America Bonds, Series B, 6.50%, 12/01/34 |

7,000 | 7,902,020 | ||||||

| Mariemont City School District, GO, Refunding, Build America Bonds, Series B, 6.55%, 12/01/47 (a) |

10,055 | 10,797,059 | ||||||

| Princeton City School District, GO, Refunding, Build America Bonds, Series C, 6.09%, 12/01/40 (a) |

7,340 | 7,491,131 | ||||||

|

|

|

|||||||

| 75,502,855 | ||||||||

| Oklahoma — 0.3% |

| |||||||

| Oklahoma Municipal Power Authority, RB, Build America Bonds, Series B, 6.44%, 1/01/45 |

3,500 | 3,863,300 | ||||||

| Pennsylvania — 1.4% |

| |||||||

| Pennsylvania Economic Development Financing Authority, RB, Build America Bonds, Series B, |

12,250 | 13,465,323 | ||||||

| Pennsylvania Turnpike Commission, RB, Build America Bonds, Sub-Series E, 6.38%, 12/01/37 |

3,625 | 3,810,600 | ||||||

|

|

|

|||||||

| 17,275,923 | ||||||||

| South Carolina — 0.9% |

| |||||||

| South Carolina State Public Service Authority, RB, Build America Bonds, Series C, 6.45%, 1/01/50 |

10,000 | 11,504,300 | ||||||

| Tennessee — 3.7% |

||||||||

| Metropolitan Government of Nashville & Davidson County Convention Center Authority, RB, Build America Bonds: |

||||||||

| Series A2, 7.43%, 7/01/43 (a) |

35,105 | 42,608,694 | ||||||

| Series B, 6.73%, 7/01/43 |

2,500 | 2,897,400 | ||||||

|

|

|

|||||||

| 45,506,094 | ||||||||

| Texas — 10.1% |

| |||||||

| City of Austin Texas, RB, Travis, Williams & Hays Counties, Rental Car Specialty Facilities, |

10,000 | 9,819,600 | ||||||

| City of San Antonio Texas, RB, Build America Bonds, Series A, 6.17%, 2/01/41 |

19,000 | 20,901,710 | ||||||

See Notes to Financial Statements.

| 10 | BLACKROCK BUILD AMERICA BOND TRUST | JANUARY 31, 2014 |

Table of Contents

| Schedule of Investments (continued) |

(Percentages shown are based on Net Assets) |

| Municipal Bonds | Par (000) |

Value | ||||||

| Texas (concluded) |

| |||||||

| City of San Antonio Texas, Refunding RB, Build America Bonds, Junior Lien, Series B, 6.31%, 2/01/37 (a) |

$ | 35,000 | $ | 38,799,250 | ||||

| County of Bexar Texas Hospital District, GO, Build America Bonds, Series B, 5.41%, 2/15/40 (a) |

20,000 | 20,848,400 | ||||||

| Cypress-Fairbanks ISD, GO, Build America Bonds, Schoolhouse, Series B, 6.63%, 2/15/38 |

14,000 | 15,820,980 | ||||||

| Dallas Area Rapid Transit, RB, Build America Bonds, Senior Lien, Series B, 5.02%, 12/01/48 |

2,500 | 2,749,650 | ||||||

| Katy ISD Texas, GO, Build America Bonds, School Building, Series D (PSF-GTD), 6.35%, 2/15/41 (a) |

5,000 | 5,511,750 | ||||||

| North Texas Municipal Water District, RB, Build America Bonds, Series A, 6.01%, 9/01/40 |

10,000 | 11,110,100 | ||||||

|

|

|

|||||||

| 125,561,440 | ||||||||

| Utah — 3.3% |

||||||||

| County of Utah, Utah, RB, Build America Bonds, Recovery Zone, Series C, 7.13%, 12/01/39 |

11,800 | 12,956,990 | ||||||

| Utah Transit Authority, RB, Build America Bond, Subordinated, 5.71%, 6/15/40 |

26,405 | 27,643,130 | ||||||

|

|

|

|||||||

| 40,600,120 | ||||||||

| Virginia — 0.5% |

||||||||

| Virginia Small Business Financing Authority, RB, Senior Lien, Elizabeth River Crossings LLC Project, AMT, 6.00%, 1/01/37 |

$ | 5,865 | $ | 6,128,397 | ||||

| Washington — 1.6% |

||||||||

| Port of Seattle Washington, RB, Series B1, 7.00%, 5/01/36 |

5,000 | 5,658,050 | ||||||

| Washington State Convention Center Public Facilities District, RB, Build America Bonds, Series B, 6.79%, 7/01/40 |

12,350 | 13,846,944 | ||||||

|

|

|

|||||||

| 19,504,994 | ||||||||

| Total Long-Term Investments (Cost — $1,648,574,803) — 146.1% |

1,813,037,654 | |||||||

| Short-Term Securities | Shares | |||||||

| BlackRock Liquidity Funds, TempFund, Institutional Class, 0.03% (c)(d) |

8,148,681 | 8,148,681 | ||||||

| Total Short-Term Securities (Cost — $8,148,681) — 0.6% |

8,148,681 | |||||||

| Total Investments (Cost — $1,656,723,484) — 146.7% | 1,821,186,335 | |||||||

| Liabilities in Excess of Other Assets — (46.7)% | (580,040,501 | ) | ||||||

|

|

|

|||||||

| Net Assets — 100.0% | $ | 1,241,145,834 | ||||||

|

|

|

|||||||

| Notes to Schedule of Investments |

| (a) | All or a portion of security has been pledged as collateral in connection with outstanding reverse repurchase agreements. |

| (b) | Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration to qualified institutional investors. |

| (c) | Investments in issuers considered to be an affiliate of the Trust during the six months ended January 31, 2014, for purposes of Section 2(a)(3) of the 1940 Act, were as follows: |

| Affiliate | Shares Held at July 31, 2013 |

Net Activity |

Shares Held at January 31, 2014 |

Income | ||||||||||||

| BlackRock Liquidity Funds, TempFund, Institutional Class |

2,496,512 | 5,652,169 | 8,148,681 | $ | 2,374 | |||||||||||

| (d) | Represents the current yield as of report date. |

| Ÿ | Reverse repurchase agreements outstanding as of January 31, 2014 were as follows: |

| Counterparty | Interest Rate |

Trade Date |

Maturity Date |

Face Value | Face Value Including Accrued Interest |

|||||||||||||||

| Barclays Capital, Inc. |

0.50 | % | 1/15/13 | Open | $ | 15,186,938 | $ | 15,262,451 | ||||||||||||

| Barclays Capital, Inc. |

0.50 | % | 1/15/13 | Open | 20,671,875 | 20,759,156 | ||||||||||||||

| Barclays Capital, Inc. |

0.50 | % | 1/15/13 | Open | 25,537,500 | 25,645,325 | ||||||||||||||

| Barclays Capital, Inc. |

0.50 | % | 1/15/13 | Open | 5,152,500 | 5,174,255 | ||||||||||||||

| Barclays Capital, Inc. |

0.50 | % | 1/15/13 | Open | 10,417,500 | 10,461,485 | ||||||||||||||

| Barclays Capital, Inc. |

0.50 | % | 1/15/13 | Open | 8,662,500 | 8,699,075 | ||||||||||||||

| Barclays Capital, Inc. |

0.50 | % | 1/15/13 | Open | 28,059,615 | 28,178,089 | ||||||||||||||

| Barclays Capital, Inc. |

0.50 | % | 1/15/13 | Open | 20,565,000 | 20,651,830 | ||||||||||||||

| Barclays Capital, Inc. |

0.50 | % | 1/15/13 | Open | 10,035,000 | 10,077,370 | ||||||||||||||

| Barclays Capital, Inc. |

0.55 | % | 1/15/13 | Open | 24,131,250 | 24,263,235 | ||||||||||||||

| Credit Suisse Securities (USA) LLC |

0.50 | % | 1/15/13 | Open | 39,234,375 | 39,442,535 | ||||||||||||||

See Notes to Financial Statements.

| BLACKROCK BUILD AMERICA BOND TRUST | JANUARY 31, 2014 | 11 |

Table of Contents

| Schedule of Investments (continued) |

Reverse repurchase agreements outstanding as of January 31, 2014 were as follows (concluded):

| Counterparty | Interest Rate |

Trade Date |

Maturity Date |

Face Value | Face Value Including Accrued Interest |

|||||||||||||||

| Credit Suisse Securities (USA) LLC |

0.50 | % | 1/15/13 | Open | $ | 21,850,000 | $ | 21,965,926 | ||||||||||||

| Credit Suisse Securities (USA) LLC |

0.50 | % | 1/15/13 | Open | 23,566,481 | 23,691,514 | ||||||||||||||

| Credit Suisse Securities (USA) LLC |

0.50 | % | 2/7/13 | Open | 37,362,500 | 37,560,729 | ||||||||||||||

| Credit Suisse Securities (USA) LLC |

0.50 | % | 2/7/13 | Open | 26,640,000 | 26,781,340 | ||||||||||||||

| Credit Suisse Securities (USA) LLC |

0.50 | % | 2/28/13 | Open | 15,608,725 | 15,691,538 | ||||||||||||||

| Credit Suisse Securities (USA) LLC |

0.50 | % | 4/2/13 | Open | 17,175,000 | 17,266,123 | ||||||||||||||

| Credit Suisse Securities (USA) LLC |

0.50 | % | 4/2/13 | Open | 6,100,000 | 6,132,364 | ||||||||||||||

| Credit Suisse Securities (USA) LLC |

0.50 | % | 4/2/13 | Open | 15,431,250 | 15,513,121 | ||||||||||||||

| Credit Suisse Securities (USA) LLC |

0.50 | % | 4/2/13 | Open | 10,137,500 | 10,191,285 | ||||||||||||||

| Credit Suisse Securities (USA) LLC |

0.50 | % | 4/2/13 | Open | 2,437,500 | 2,450,432 | ||||||||||||||

| Credit Suisse Securities (USA) LLC |

0.50 | % | 4/2/13 | Open | 13,320,000 | 13,390,670 | ||||||||||||||

| Credit Suisse Securities (USA) LLC |

0.50 | % | 4/2/13 | Open | 21,675,000 | 21,789,998 | ||||||||||||||

| Credit Suisse Securities (USA) LLC |

0.50 | % | 4/2/13 | Open | 10,331,512 | 10,380,013 | ||||||||||||||

| Credit Suisse Securities (USA) LLC |

0.50 | % | 4/30/13 | Open | 18,410,550 | 18,481,379 | ||||||||||||||

| Credit Suisse Securities (USA) LLC |

0.50 | % | 5/23/13 | Open | 4,055,000 | 4,069,305 | ||||||||||||||

| Credit Suisse Securities (USA) LLC |

0.50 | % | 11/25/13 | Open | 7,238,375 | 7,245,211 | ||||||||||||||

| Credit Suisse Securities (USA) LLC |

0.50 | % | 11/29/13 | Open | 6,510,000 | 6,515,787 | ||||||||||||||

| Deutsche Bank Securities, Inc. |

0.50 | % | 12/27/13 | Open | 23,295,000 | 23,305,677 | ||||||||||||||

| Deutsche Bank Securities, Inc. |

0.55 | % | 12/27/13 | Open | 33,882,000 | 33,899,082 | ||||||||||||||

| Deutsche Bank Securities, Inc. |

0.55 | % | 12/27/13 | Open | 27,838,000 | 27,852,035 | ||||||||||||||

| Deutsche Bank Securities, Inc. |

0.55 | % | 12/27/13 | Open | 4,191,000 | 4,193,113 | ||||||||||||||

| RBC Capital Markets LLC |

0.50 | % | 12/27/13 | Open | 6,277,500 | 6,280,290 | ||||||||||||||

| Deutsche Bank Securities, Inc. |

0.20 | % | 12/31/13 | Open | 24,121,000 | 24,125,422 | ||||||||||||||

| RBC Capital Markets LLC |

0.50 | % | 1/30/14 | Open | 19,278,000 | 19,278,536 | ||||||||||||||

| Total |

$ | 604,385,946 | $ | 606,665,696 | ||||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Ÿ | Financial futures contracts outstanding as of January 31, 2014 were as follows: |

| Contracts Sold |

Issue | Exchange | Expiration | Notional Value | Unrealized Depreciation |

|||||||||||

| (1,845 | ) | US Treasury Long Bond | Chicago Board of Trade | March 2014 | $ | 246,480,469 | $ | (7,608,071 | ) | |||||||

| Ÿ | Fair Value Measurements—Various inputs are used in determining the fair value of investments and derivative financial instruments. These inputs to valuation techniques are categorized into a disclosure hierarchy consisting of three broad levels for financial statement purposes as follows: |

| Ÿ | Level 1 — unadjusted price quotations in active markets/exchanges for identical assets or liabilities that the Trust has the ability to access |

| Ÿ | Level 2 — other observable inputs (including, but not limited to, quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market-corroborated inputs) |

| Ÿ | Level 3 — unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are not available (including the Trust’s own assumptions used in determining the fair value of investments and derivative financial instruments) |

The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the fair value hierarchy classification is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy. In accordance with the Trust’s policy, transfers between different levels of the fair value disclosure hierarchy are deemed to have occurred as of the beginning of the reporting period. The categorization of a value determined for investments and derivative financial instruments is based on the pricing transparency of the investment and derivative financial instrument and is not necessarily an indication of the risks associated with investing in those securities. For information about the Trust’s policy regarding valuation of investments and derivative financial instruments, please refer to Note 2 of the Notes to Financial Statements.

See Notes to Financial Statements.

| 12 | BLACKROCK BUILD AMERICA BOND TRUST | JANUARY 31, 2014 |

Table of Contents

| Schedule of Investments (concluded) |

The following tables summarize the Trust’s investments and derivative financial instruments categorized in the disclosure hierarchy as of January 31, 2014:

| Level 1 | Level 2 | Level 3 | Total | |||||||||||

| Assets: |

||||||||||||||

| Investments: | ||||||||||||||

| Long-Term Investments 1 |

— | $ | 1,813,037,654 | — | $ | 1,813,037,654 | ||||||||

| Short-Term Securities |

$ | 8,148,681 | — | — | 8,148,681 | |||||||||

|

|

|

|

|

|

|

|

||||||||

| Total |

$ | 8,148,681 | $ | 1,813,037,654 | — | $ | 1,821,186,335 | |||||||

|

|

|

|

|

|

|

|

||||||||

|

1 See above Schedule of Investments for values in each state or political subdivision. |

||||||||||||||

| Level 1 | Level 2 | Level 3 | Total | |||||||||||

| Derivative Financial Instruments 2 | ||||||||||||||

| Liabilities: |

||||||||||||||

| Interest rate contracts |

$ | (7,608,071 | ) | — | — | $ | (7,608,071 | ) | ||||||

| 2 Derivative financial instruments are financial futures contracts, which are valued at the unrealized appreciation/depreciation on the instrument. |

| |||||||||||||

The carrying amount, or face value, including accrued interest, for certain of the Trust’s assets and/or liabilities approximates fair value for financial statement purposes. As of January 31, 2014, such assets and liabilities are categorized within the disclosure hierarchy as follows:

| Level 1 | Level 2 | Level 3 | Total | |||||||||||

| Assets: |

||||||||||||||

| Cash pledged for financial futures contracts |

$ | 4,808,000 | — | — | $ | 4,808,000 | ||||||||

| Liabilities: |

||||||||||||||

| Reverse repurchase agreements |

— | $ | (606,665,696 | ) | — | (606,665,696 | ) | |||||||

|

|

|

|

|

|

|

|

||||||||

| Total |

$ | 4,808,000 | $ | (606,665,696 | ) | — | $ | (601,857,696 | ) | |||||

|

|

|

|

|

|

|

|

||||||||

There were no transfers between levels during the six months ended January 31, 2014.

See Notes to Financial Statements.

| BLACKROCK BUILD AMERICA BOND TRUST | JANUARY 31, 2014 | 13 |

Table of Contents

| Statement of Assets and Liabilities |

| January 31, 2014 (Unaudited) | ||||

| Assets | ||||

| Investments at value — unaffiliated (cost — $1,648,574,803) |

$ | 1,813,037,654 | ||

| Investments at value — affiliated (cost — $8,148,681) |

8,148,681 | |||

| Cash pledged for financial futures contracts |

4,808,000 | |||

| Interest receivable |

23,546,138 | |||

| Prepaid expenses |

40,999 | |||

|

|

|

|||

| Total assets |

1,849,581,472 | |||

|

|

|

|||

| Liabilities | ||||

| Reverse repurchase agreements |

606,665,696 | |||

| Investment advisory fees payable |

836,649 | |||

| Variation margin payable on financial futures contracts |

576,563 | |||

| Officer’s and Trustees’ fees payable |

214,633 | |||

| Other accrued expenses payable |

142,097 | |||

|

|

|

|||

| Total liabilities |

608,435,638 | |||

|

|

|

|||

| Net Assets |

$ | 1,241,145,834 | ||

|

|

|

|||

| Net Assets Consist of | ||||

| Paid-in capital |

$ | 1,088,757,045 | ||

| Undistributed net investment income |

508,374 | |||

| Accumulated net realized loss |

(4,974,365 | ) | ||

| Net unrealized appreciation/depreciation |

156,854,780 | |||

|

|

|

|||

| Net Assets |

$ | 1,241,145,834 | ||

|

|

|

|||

| Net Asset Value | ||||

| Based on net assets of $1,241,145,834 and 57,103,349 shares outstanding, unlimited number of shares authorized, $0.001 par value |

$ | 21.74 | ||

|

|

|

|||

| See Notes to Financial Statements. | ||||||

| 14 | BLACKROCK BUILD AMERICA BOND TRUST | JANUARY 31, 2014 | ||||

Table of Contents

| Statement of Operations |

| Six Months Ended January 31, 2014 (Unaudited) | ||||

| Investment Income | ||||

| Interest |

$ | 52,543,911 | ||

| Income — affiliated |

2,374 | |||

|

|

|

|||

| Total income |

52,546,285 | |||

|

|

|

|||

| Expenses | ||||

| Investment advisory |

4,962,740 | |||

| Accounting services |

69,419 | |||

| Officer and Trustees |

67,904 | |||

| Professional |

60,458 | |||

| Transfer agent |

60,135 | |||

| Custodian |

53,620 | |||

| Printing |

9,456 | |||

| Registration |

1,586 | |||

| Miscellaneous |

36,397 | |||

|

|

|

|||

| Total expenses excluding interest expense |

5,321,715 | |||

| Interest expense |

1,564,308 | |||

|

|

|

|||

| Total expenses |

6,886,023 | |||

| Less fees waived by Manager |

(3,896 | ) | ||

|

|

|

|||

| Total expenses after fees waived |

6,882,127 | |||

|

|

|

|||

| Net investment income |

45,664,158 | |||

|

|

|

|||

| Realized and Unrealized Gain (Loss) | ||||

| Net realized gain (loss) from: | ||||

| Investments — unaffiliated |

(2,398,450 | ) | ||

| Financial futures contracts |

10,697,454 | |||

|

|

|

|||

| 8,299,004 | ||||

|

|

|

|||

| Net change in unrealized appreciation/depreciation on: | ||||

| Investments |

31,373,463 | |||

| Financial futures contracts |

(14,545,894 | ) | ||

|

|

|

|||

| 16,827,569 | ||||

|

|

|

|||

| Total realized and unrealized gain |

25,126,573 | |||

|

|

|

|||

| Net Increase in Net Assets Resulting from Operations |

$ | 70,790,731 | ||

|

|

|

|||

| See Notes to Financial Statements. | ||||||

| BLACKROCK BUILD AMERICA BOND TRUST | JANUARY 31, 2014 | 15 | ||||

Table of Contents

| Statements of Changes in Net Assets |

| Increase (Decrease) in Net Assets: | Six Months Ended January 31, 2014 (Unaudited) |

Year Ended July 31, 2013 |

||||||

| Operations | ||||||||

| Net investment income |

$ | 45,664,158 | $ | 89,947,193 | ||||

| Net realized gain |

8,299,004 | 7,874,563 | ||||||

| Net change in unrealized appreciation/depreciation |

16,827,569 | (159,827,080 | ) | |||||

|

|

|

|

|

|||||

| Net increase (decrease) in net assets resulting from operations |

70,790,731 | (62,005,324 | ) | |||||

|

|

|

|

|

|||||

| Dividends to Shareholders From | ||||||||

| Net investment income |

(45,157,328 | ) | (90,314,657 | )1 | ||||

|

|

|

|

|

|||||

| Net Assets | ||||||||

| Total increase (decrease) in net assets |

25,633,403 | (152,319,981 | ) | |||||

| Beginning of period |

1,215,512,431 | 1,367,832,412 | ||||||

|

|

|

|

|

|||||

| End of period |

$ | 1,241,145,834 | $ | 1,215,512,431 | ||||

|

|

|

|

|

|||||

| Undistributed net investment income, end of period |

$ | 508,374 | $ | 1,544 | ||||

|

|

|

|

|

|||||

| 1 Determined in accordance with federal income tax regulations. |

|

|||||||

| See Notes to Financial Statements. | ||||||

| 16 | BLACKROCK BUILD AMERICA BOND TRUST | JANUARY 31, 2014 | ||||

Table of Contents

| Statement of Cash Flows |

| Six Months Ended January 31, 2014 (Unaudited) | ||||

| Cash Provided by Operating Activities | ||||

| Net increase in net assets resulting from operations |

$ | 70,790,731 | ||

| Adjustments to reconcile net decrease in net assets resulting from operations to net cash provided by operating activities: | ||||

| Increase in interest receivable |

(16,053 | ) | ||

| Increase in cash pledged for financial futures contracts |

(1,673,000 | ) | ||

| Increase in prepaid expenses |

(27,583 | ) | ||

| Decrease in investment advisory fees payable |

(20,288 | ) | ||

| Increase in interest expense payable |

798,288 | |||

| Decrease in other accrued expenses payable |

(118,601 | ) | ||

| Increase in variation margin payable on financial futures contracts |

413,282 | |||

| Increase in Officer’s and Trustees’ fees payable |

35,519 | |||

| Net realized gain on investments |

2,398,450 | |||

| Net unrealized loss on investments |

(31,373,463 | ) | ||

| Amortization of premium and accretion of discount on investments |

398,794 | |||

| Proceeds from sales of long-term investments |

39,819,952 | |||

| Purchases of long-term investments |

(32,410,984 | ) | ||

| Net payments on purchases of short-term securities |

(5,652,169 | ) | ||

|

|

|

|||

| Cash provided by operating activities |

43,362,875 | |||

|

|

|

|||

| Cash Used for Financing Activities | ||||

| Net borrowing of reverse repurchase agreements |

2,137,104 | |||

| Cash dividends paid to shareholders |

(45,499,979 | ) | ||

|

|

|

|||

| Cash used for financing activities |

(43,362,875 | ) | ||

|

|

|

|||

| Cash | ||||

| Net increase (decrease) in cash |

— | |||

| Cash at beginning of period |

— | |||

|

|

|

|||

| Cash at end of period |

— | |||

|

|

|

|||

| Supplemental Disclosure of Cash Flow Information | ||||

| Cash paid during the period for interest |

$ | 766,020 | ||

|

|

|

|||

| See Notes to Financial Statements. | ||||||

| BLACKROCK BUILD AMERICA BOND TRUST | JANUARY 31, 2014 | 17 | ||||

Table of Contents

| Financial Highlights |

| Six Months Ended 2014 |

Year Ended July 31, | Period August 27, 20101 to July 31, 2011 |

||||||||||||||

| 2013 | 2012 | |||||||||||||||

| Per Share Operating Performance | ||||||||||||||||

| Net asset value, beginning of period |

$ | 21.29 | $ | 23.95 | $ | 20.38 | $ | 19.10 | 2 | |||||||

|

|

|

|||||||||||||||

| Net investment income3 |

0.80 | 1.58 | 1.54 | 1.20 | ||||||||||||

| Net realized and unrealized gain (loss) |

0.44 | (2.66 | ) | 3.57 | 1.30 | |||||||||||

|

|

|

|||||||||||||||

| Net increase (decrease) from investment operations |

1.24 | (1.08 | ) | 5.11 | 2.50 | |||||||||||

|

|

|

|||||||||||||||

| Dividends and distributions from: | ||||||||||||||||

| Net investment income |

(0.79 | )4 | (1.58 | )5 | (1.54 | )5 | (1.18 | )5 | ||||||||

| Net realized gain |

– | – | – | (0.00 | )5,6 | |||||||||||

|

|

|

|||||||||||||||

| Total dividends and distributions |

(0.79 | ) | (1.58 | ) | (1.54 | ) | (1.18 | ) | ||||||||

|

|

|

|||||||||||||||

| Capital charges with respect to issuance of shares |

– | – | – | (0.04 | ) | |||||||||||

|

|

|

|||||||||||||||

| Net asset value, end of period |

$ | 21.74 | $ | 21.29 | $ | 23.95 | $ | 20.38 | ||||||||

|

|

|

|||||||||||||||

| Market price, end of period |

$ | 19.52 | $ | 19.26 | $ | 23.89 | $ | 18.41 | ||||||||

|

|

|

|||||||||||||||

| Total Investment Return7 | ||||||||||||||||

| Based on net asset value |

6.42% | 8 | (4.57)% | 26.22% | 13.84% | 8 | ||||||||||

|

|

|

|||||||||||||||

| Based on market price |

5.63% | 8 | (13.45)% | 39.37% | (1.79)% | 8 | ||||||||||

|

|

|

|||||||||||||||

| Ratios to Average Net Assets | ||||||||||||||||

| Total expenses |

1.15% | 9 | 1.10% | 1.09% | 1.06% | 9 | ||||||||||

|

|

|

|||||||||||||||

| Total expenses after fees waived |

1.15% | 9 | 1.10% | 1.09% | 1.06% | 9 | ||||||||||

|

|

|

|||||||||||||||

| Total expenses after fees waived and excluding interest expense and fees |

0.89% | 9,10 | 0.86% | 10 | 0.85% | 11 | 0.81% | 9,11 | ||||||||

|

|

|

|||||||||||||||

| Net investment income |

7.63% | 9 | 6.75% | 6.88% | 6.99% | 9 | ||||||||||

|

|

|

|||||||||||||||

| Supplemental Data | ||||||||||||||||

| Net assets, end of period (000) |

$ | 1,241,146 | $ | 1,215,512 | $ | 1,367,832 | $ | 1,164,019 | ||||||||

|

|

|

|||||||||||||||

| Borrowings outstanding, end of period (000) |

$ | 606,666 | $ | 603,730 | $ | 584,223 | $ | 515,229 | ||||||||

|

|

|

|||||||||||||||

| Average borrowings outstanding, during the period (000) |

$ | 603,145 | $ | 603,829 | $ | 551,053 | $ | 368,555 | ||||||||

|

|

|

|||||||||||||||

| Portfolio turnover |

2% | 4% | 7% | 13% | ||||||||||||

|

|

|

|||||||||||||||

| Asset coverage, end of period per $1,000 of borrowings |

$ | 3,046 | $ | 3,013 | $ | 3,341 | $ | 3,259 | ||||||||

|

|

|

|||||||||||||||

| 1 | Commencement of operations. |

| 2 | Net asset value, beginning of period, reflects a deduction of $0.90 per share sales charge from the initial offering price of $20.00 per share. |

| 3 | Based on average shares outstanding. |

| 4 | A portion of dividends from net investment income may be deemed a return of capital or net realized gain at fiscal year end. |

| 5 | Determined in accordance with federal income tax regulations. |

| 6 | Amount is greater than $(0.005) per share. |

| 7 | Total investment returns based on market price, which can be significantly greater or less than the net asset value, may result in substantially different returns. Where applicable, excludes the effects of any sales charges and assumes the reinvestment of dividends and distributions. |

| 8 | Aggregate total investment return. |

| 9 | Annualized. |

| 10 | Interest expense and fees related to reverse repurchase agreements. |

| 11 | Interest expense and fees related to tender option bond trusts and reverse repurchase agreements. |

| See Notes to Financial Statements. | ||||||

| 18 | BLACKROCK BUILD AMERICA BOND TRUST | JANUARY 31, 2014 | ||||

Table of Contents

| Notes to Financial Statements (Unaudited) |

1. Organization:

BlackRock Build America Bond Trust (the “Trust”) is registered under the 1940 Act, as a non-diversified, closed-end management investment company. The Trust is organized as a Delaware statutory trust. The Trust determines and makes available for publication the NAV of its Common Shares on a daily basis.

2. Significant Accounting Policies:

The Trust’s financial statements are prepared in conformity with accounting principles generally accepted in the United States of America (“US GAAP”), which may require management to make estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. The following is a summary of the significant accounting policies followed by the Trust:

Valuation: US GAAP defines fair value as the price the Trust would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. The Trust determines the fair value of its financial instruments at market value using independent dealers or pricing services under policies approved by the Board of Trustees of the Trust (the “Board”). The BlackRock Global Valuation Methodologies Committee (the “Global Valuation Committee”) is the committee formed by management to develop global pricing policies and procedures and to provide oversight of the pricing function for the Trust for all financial instruments.

Municipal investments (including commitments to purchase such investments on a “when-issued” basis) are valued on the basis of prices provided by dealers or pricing services. In determining the value of a particular investment, pricing services may use certain information with respect to transactions in such investments, quotations from dealers, pricing matrixes, market transactions in comparable investments and information with respect to various relationships between investments. Financial futures contracts traded on exchanges are valued at their last sale price. Investments in open-end registered investment companies are valued at NAV each business day.

In the event that the application of these methods of valuation results in a price for an investment that is deemed not to be representative of the market value of such investment, or if a price is not available, the investment will be valued by the Global Valuation Committee, or its delegate, in accordance with a policy approved by the Board as reflecting fair value (“Fair Value Assets”). When determining the price for Fair Value Assets, the Global Valuation Committee, or its delegate, seeks to determine the price that the Trust might reasonably expect to receive from the current sale of that asset in an arm’s-length transaction. Fair value determinations shall be based upon all available factors that the Global Valuation Committee, or its delegate, deems relevant consistent with the principles of fair value measurements, which include the market approach, income approach and/or in the case of recent investments, the cost approach, as appropriate. The market approach generally consists of using comparable market transactions. The income approach generally is used to discount future cash flows to present value and is adjusted for liquidity as appropriate. These factors include but are not limited to: (i) attributes specific to the investment or asset; (ii) the principal market for the investment or asset; (iii) the customary participants in the principal market for the investment or asset; (iv) data assumptions by market participants for the investment or asset, if reasonably available; (v) quoted prices for similar investments or assets in active markets; and (vi) other factors, such as future cash flows, interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks, recovery rates, liquidation amounts and/or default rates. Due to the inherent uncertainty of valuations of such investments, the fair values may differ from the values that would have been used had an active market existed. The Global Valuation Committee, or its delegate, employs various methods for calibrating valuation approaches for investments where an active market does not exist, including regular due diligence of the Trust’s pricing vendors, a regular review of key inputs and assumptions, transactional back-testing or disposition analysis to compare unrealized gains and losses to realized gains and losses, reviews of missing or stale prices and large movements in market values and reviews of any market related activity. The pricing of all Fair Value Assets is subsequently reported to the Board or a committee thereof on a quarterly basis.

Segregation and Collateralization: In cases where the Trust enters into certain investments (e.g., financial futures contracts), or certain borrowings (e.g., reverse repurchase transactions) that would be “senior securities” for 1940 Act purposes, the Trust may segregate or designate on its books and records cash or liquid securities having a market value at least equal to the amount of the Trust’s future obligations under such investments or borrowings. Doing so allows the investment or borrowing to be excluded from treatment as a “senior security”. Furthermore, if required by an exchange or counterparty agreement, the Trust may be required to deliver/deposit cash and/or securities to/with an exchange, or broker-dealer or custodian as collateral for certain investments or obligations.

Investment Transactions and Investment Income: For financial reporting purposes, investment transactions are recorded on the dates the transactions are entered into (the trade dates). Realized gains and losses on investment transactions are determined on the identified cost basis. Dividend income is recorded on the ex-dividend dates. Interest income, including amortization and accretion of premiums and discounts on debt securities, is recognized on the accrual basis.

| BLACKROCK BUILD AMERICA BOND TRUST | JANUARY 31, 2014 | 19 |

Table of Contents

| Notes to Financial Statements (continued) |

Dividends and Distributions: Dividends from net investment income are declared and paid monthly. Distributions of capital gains are recorded on the ex-dividend dates. The character and timing of dividends and distributions are determined in accordance with federal income tax regulations, which may differ from US GAAP.

Income Taxes: It is the Trust’s policy to comply with the requirements of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies and to distribute substantially all of its taxable income to its shareholders. Therefore, no federal income tax provision is required.

The Trust files US federal and various state and local tax returns. No income tax returns are currently under examination. The statute of limitations on the Trust’s US federal tax returns remains open for each of the two years ended July 31, 2013 and the period ended July 31, 2011. The statutes of limitations on the Trust’s state and local tax returns may remain open for an additional year depending upon the jurisdiction.

Management has analyzed tax laws and regulations and their application to the Trust’s facts and circumstances and does not believe there are any uncertain tax positions that require recognition of a tax liability.

Deferred Compensation Plan: Under the Deferred Compensation Plan (the “Plan”) approved by the Trust’s Board, the independent Trustees (“Independent Trustees”) may defer a portion of their annual complex-wide compensation. Deferred amounts earn an approximate return as though equivalent dollar amounts had been invested in common shares of certain other BlackRock Closed-End Funds selected by the Independent Trustees. This has the same economic effect for the Independent Trustees as if the Independent Trustees had invested the deferred amounts directly in certain other BlackRock Closed-End Funds.

The Plan is not funded and obligations thereunder represent general unsecured claims against the general assets of the Trust. Deferred compensation liabilities are included in Officer’s and Trustees’ fees payable in the Statement of Assets and Liabilities and will remain as a liability of the Trust until such amounts are distributed in accordance with the Plan.