Table of Contents

Filed Pursuant to Rule 424(b)(3)

Registration Statement No. 333-167482

Prospectus of Naugatuck Valley Financial Corporation (a Maryland corporation)

Proxy Statement of Naugatuck Valley Financial Corporation (a Federal corporation)

Conversion Proposed—Your Vote is Important

Dear Shareholder:

You are cordially invited to attend the annual meeting of shareholders of Naugatuck Valley Financial Corporation. The meeting will be held on June 24, 2011 at 9:00 a.m., Eastern Time, at the Community Room located at the main office of Naugatuck Valley Savings and Loan, 333 Church Street, Naugatuck, Connecticut. In addition to the regular business of electing directors and ratifying the appointment of the independent auditors, stockholders will vote on our proposed “second step” conversion.

Naugatuck Valley Financial Corporation, a federal corporation (“Naugatuck Valley Financial”), is soliciting shareholder votes regarding the conversion of Naugatuck Valley Savings and Loan from the partially public mutual holding company form of organization to the fully-public stock holding company structure. The conversion involves the formation of a new holding company for Naugatuck Valley Savings and Loan, which is also called Naugatuck Valley Financial Corporation, a Maryland corporation (“New Naugatuck Valley Financial”), the exchange of shares of New Naugatuck Valley Financial for your shares of Naugatuck Valley Financial, and the sale by New Naugatuck Valley Financial of up to 4,456,250 shares of common stock.

The Proxy Vote—Your Vote Is Very Important

We have received conditional regulatory approval to implement the conversion, however we must also receive the approval of our shareholders. This proxy statement/prospectus describes the proposals before our shareholders. Please promptly vote the enclosed proxy card. Our Board of Directors urges you to vote “FOR” each of the proposals set forth in this proxy statement/prospectus.

The Share Exchange

At the conclusion of the conversion, each share of Naugatuck Valley Financial common stock owned by the public at that time will be exchanged for between 0.7875 and 1.0655 shares of common stock of New Naugatuck Valley Financial so that Naugatuck Valley Financial’s existing public shareholders will own approximately the same percentage of New Naugatuck Valley Financial common stock as they owned of Naugatuck Valley Financial’s common stock immediately before the conversion. The actual number of shares that you will receive will depend on the percentage of Naugatuck Valley Financial common stock held by the public at the completion of the conversion, the final independent appraisal of New Naugatuck Valley Financial and the number of shares of New Naugatuck Valley Financial common stock sold in its offering. The exchange ratio will not depend on the market price of Naugatuck Valley Financial common stock. Based on the exchange ratio, we expect to issue between 2,233,748 and 3,022,130 shares (subject to increase to 3,475,450 shares) of New Naugatuck Valley Financial common stock to the holders of Naugatuck Valley Financial common stock. Shortly after the completion of the conversion, our exchange agent will send a transmittal form to each shareholder of Naugatuck Valley Financial who holds stock certificates. The transmittal form will explain the procedure to follow to exchange your shares. Please do not deliver your certificate(s) before you receive the transmittal form. Shares of Naugatuck Valley Financial that are held in street name (e.g. in a brokerage account) will be converted automatically at the conclusion of the conversion; no action or documentation is required of you.

The Stock Offering

We are offering the shares of common stock of New Naugatuck Valley Financial for sale at $8.00 per share. The shares are being offered in a “subscription offering” to eligible depositors of Naugatuck Valley Savings and Loan. If all shares are not subscribed for in the subscription offering, shares are expected to be available in a “community offering,” with a first preference given to residents of Fairfield and New Haven Counties, Connecticut, and a second preference given to Naugatuck Valley Financial public shareholders as of May 3, 2011. If you are interested in purchasing shares of our common stock, you may request a stock order form and prospectus by calling our Stock Information Center at the phone number in the Questions and Answers section herein. The stock offering period is expected to expire on June 14, 2011.

Naugatuck Valley Financial’s common stock is currently listed on the Nasdaq Global Market under the symbol “NVSL.” We expect that New Naugatuck Valley Financial’s common stock will trade on the Nasdaq Global Market under the trading symbol “NVSLD” for a period of 20 trading days after the completion of the offering. Thereafter, the trading symbol will be “NVSL.”

This document serves as the proxy statement for the annual meeting of shareholders of Naugatuck Valley Financial and the prospectus for the shares of New Naugatuck Valley Financial common stock to be issued in exchange for shares of Naugatuck Valley Financial common stock. We urge you to read this entire document carefully. You can also obtain information about our companies from documents that we have filed with the Securities and Exchange Commission and the Office of Thrift Supervision. This document does not serve as the prospectus relating to the offering by New Naugatuck Valley Financial of its shares of common stock in the stock offering, which will be made pursuant to a separate prospectus.

This proxy statement/prospectus contains information that you should consider in evaluating the plan conversion. In particular, you should carefully read the section captioned “Risk Factors” beginning on page 14 for a discussion of certain risk factors relating to the conversion and offering.

These securities are not deposits or savings accounts and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

None of the Securities and Exchange Commission, the Office of Thrift Supervision or any state securities regulator has approved or disapproved of these securities or determined if this proxy statement/prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

The date of this proxy statement/prospectus is May 13, 2011, and is first being mailed to shareholders

of Naugatuck Valley Financial on or about May 20, 2011.

Table of Contents

| Page | ||||

| i | ||||

| 1 | ||||

| 14 | ||||

| 23 | ||||

| 24 | ||||

| 26 | ||||

| 31 | ||||

| 34 | ||||

| 48 | ||||

| 50 | ||||

| Proposal 4—Ratification of the Independent Registered Public Accounting Firm |

52 | |||

| 53 | ||||

| 54 | ||||

| 56 | ||||

| 57 | ||||

| 58 | ||||

| 59 | ||||

| 60 | ||||

| 64 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

73 | |||

| 97 | ||||

| 98 | ||||

| 103 | ||||

| 104 | ||||

| 109 | ||||

| 110 | ||||

| 111 | ||||

| 118 | ||||

| 120 | ||||

| Restrictions on Acquisition of New Naugatuck Valley Financial |

126 | |||

| 128 | ||||

| 129 | ||||

| 129 | ||||

| 129 | ||||

| 129 | ||||

| 130 | ||||

| Submission of Business Proposals and Shareholder Nominations |

130 | |||

| 130 | ||||

| 131 | ||||

| 131 | ||||

| 132 | ||||

Table of Contents

Naugatuck Valley Financial Corporation

333 Church Street

Naugatuck, Connecticut 06770

(203) 720-5000

Notice of Annual Meeting of Shareholders

On June 24, 2011, Naugatuck Valley Financial Corporation will hold its annual meeting of shareholders at the Community Room located at the main office of Naugatuck Valley Savings and Loan, 333 Church Street, Naugatuck, Connecticut. The meeting will begin at 9:00 a.m., Eastern time. At the meeting, shareholders will consider and act on the following:

| 1. | The approval of a plan of conversion and reorganization pursuant to which: (A) Naugatuck Valley Mutual Holding Company, which currently owns 59.6% of the common stock of Naugatuck Valley Financial Corporation (“Naugatuck Valley Financial”), will merge with and into Naugatuck Valley Financial, with Naugatuck Valley Financial being the surviving entity; (B) Naugatuck Valley Financial will merge with and into Naugatuck Valley Financial, a Maryland corporation recently formed to be the holding company for Naugatuck Valley Savings and Loan (“New Naugatuck Valley Financial”), with New Naugatuck Valley Financial being the surviving entity; (C) the outstanding shares of Naugatuck Valley Financial, other than those held by Naugatuck Valley Mutual Holding Company, will be converted into shares of common stock of New Naugatuck Valley Financial; and (D) New Naugatuck Valley Financial will offer shares of its common stock for sale in a subscription offering and, if necessary, in a community offering and/or syndicated community offering. |

| 2. | The following informational proposals: |

| 2a. | Approval of a provision in New Naugatuck Valley Financial’s articles of incorporation requiring a super-majority vote to approve certain amendments to New Naugatuck Valley Financial’s articles of incorporation; and |

| 2b. | Approval of a provision in New Naugatuck Valley Financial’s articles of incorporation to limit the voting rights of shares beneficially owned in excess of 10% of New Naugatuck Valley Financial’s outstanding voting stock. |

| 3. | The election of three directors for terms of three years each. |

| 4. | The ratification of the appointment of Whittlesey & Hadley, P.C. as independent registered public accountants for the fiscal year ending December 31, 2011. |

| 5. | The approval of the adjournment of the annual meeting, if necessary, to solicit additional proxies in the event that there are not sufficient votes at the time of the annual meeting to approve the plan of conversion. |

| 6. | Such other business that may properly come before the meeting. |

NOTE: The board of directors is not aware of any other business to come before the meeting.

The provisions of New Naugatuck Valley Financial’s articles of incorporation which are summarized as informational proposals 2a and 2b were approved as part of the process in which the board of directors of Naugatuck Valley Financial approved the plan of conversion. These proposals are informational in nature only, because the Office of Thrift Supervision’s regulations governing mutual-to-stock conversions do not provide for votes on matters other than the plan of conversion. While we are asking you to vote with respect to each of the informational proposals listed above, the proposed provisions for which an informational vote is requested will become effective if shareholders approve the plan of conversion, regardless of whether shareholders vote to approve any or all of the informational proposals.

Only shareholders as of May 3, 2011 are entitled to receive notice of the meeting and to vote at the meeting and any adjournments or postponements of the meeting.

Please complete, sign and date the enclosed form of proxy, which is solicited by the board of directors, and mail it promptly in the enclosed envelope. The proxy will not be used if you attend the meeting and vote in person.

| BY ORDER OF THE BOARD OF DIRECTORS |

|

Bernadette A. Mole |

| Corporate Secretary |

Naugatuck, Connecticut

May 20, 2011

Table of Contents

You should read this document for more information about the conversion and offering. The plan of conversion described in this document has been conditionally approved by the Office of Thrift Supervision.

The Proxy Vote

| Q: | What am I being asked to approve? |

| A: | Naugatuck Valley Financial shareholders as of May 3, 2011 are asked to vote on the plan of conversion. Under the plan of conversion, Naugatuck Valley Savings and Loan will convert from the mutual holding company form of organization to the stock holding company form, and as part of such conversion, New Naugatuck Valley Financial will offer for sale, in the form of shares of its common stock, Naugatuck Valley Mutual Holding Company’s 59.6% ownership interest in Naugatuck Valley Financial. In addition to the shares of common stock to be issued to those who purchase shares in the offering, public shareholders of Naugatuck Valley Financial as of the completion of the conversion and offering will receive shares of New Naugatuck Valley Financial common stock in exchange for their shares of Naugatuck Valley Financial common stock. The exchange will be based on an exchange ratio that will result in Naugatuck Valley Financial’s public shareholders owning approximately the same percentage of New Naugatuck Valley Financial common stock as they owned of Naugatuck Valley Financial immediately before the completion of the conversion and offering. |

Shareholders also are asked to vote on the following informational proposals with respect to the articles of incorporation of New Naugatuck Valley Financial:

| • | Approval of a provision in New Naugatuck Valley Financial’s articles of incorporation requiring a super-majority vote to approve certain amendments to New Naugatuck Valley Financial’s articles of incorporation; and |

| • | Approval of a provision in New Naugatuck Valley Financial’s articles of incorporation to limit the voting rights of shares beneficially owned in excess of 10% of New Naugatuck Valley Financial’s outstanding voting stock. |

The provisions of New Naugatuck Valley Financial’s articles of incorporation, which are summarized as informational proposals were approved as part of the process in which the board of directors of Naugatuck Valley Financial approved the plan of conversion. These proposals are informational in nature only, because the Office of Thrift Supervision’s regulations governing mutual-to-stock conversions do not provide for votes on matters other than the plan of conversion. While we are asking you to vote with respect to each of the informational proposals listed above, the proposed provisions for which an informational vote is requested will become effective if shareholders approve the plan of conversion, regardless of whether shareholders vote to approve either or both of the informational proposals. The provisions of New Naugatuck Valley Financial’s articles of incorporation which are summarized as informational proposals may have the effect of deterring or rendering more difficult attempts by third parties to obtain control of New Naugatuck Valley Financial, if such attempts are not approved by the board of directors, or may make the removal of the board of directors or management, or the appointment of new directors, more difficult.

In addition, shareholders will vote on the election of directors, the ratification of the appointment of independent auditors, and a proposal to adjourn the annual meeting, if necessary, to solicit additional proxies if there are not sufficient votes at the time of the annual meeting to approve the plan of conversion.

YOUR VOTE IS IMPORTANT. WE CANNOT COMPLETE THE CONVERSION AND OFFERING UNLESS THE PLAN OF CONVERSION RECEIVES THE AFFIRMATIVE VOTE OF A MAJORITY OF SHARES HELD BY OUR PUBLIC SHAREHOLDERS.

| Q: | What is the conversion and related stock offering? |

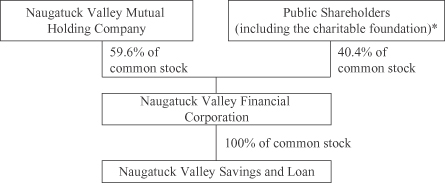

| A: | Naugatuck Valley Savings and Loan is converting from a partially-public mutual holding company structure to a fully-public stock holding company ownership structure. Currently, Naugatuck Valley Mutual Holding Company owns 59.6% of Naugatuck Valley Financial’s common stock. The remaining 40.4% of Naugatuck Valley Financial’s common stock is owned by public shareholders. As a result of the conversion, New Naugatuck Valley Financial will become the parent of Naugatuck Valley Savings and Loan. |

i

Table of Contents

Shares of common stock of New Naugatuck Valley Financial, representing the 59.6% ownership interest of Naugatuck Valley Mutual Holding Company in Naugatuck Valley Financial, are being offered for sale to eligible depositors of Naugatuck Valley Savings and Loan and, possibly, to the public. At the completion of the conversion and offering, public shareholders of Naugatuck Valley Financial will exchange their shares of Naugatuck Valley Financial common stock for shares of common stock of New Naugatuck Valley Financial.

After the conversion and offering are completed, Naugatuck Valley Savings and Loan will be a wholly-owned subsidiary of New Naugatuck Valley Financial, and 100% of the common stock of New Naugatuck Valley Financial will be owned by public shareholders. Our organization will have completed the transition from partial to fully-public ownership. As a result of the conversion and offering, Naugatuck Valley Financial and Naugatuck Valley Mutual Holding Company will cease to exist.

See “Proposal 1—Approval of the Plan of Conversion” for more information about the conversion and offering.

| Q: | What are reasons for the conversion and offering? |

| A: | The primary reasons for the conversion and offering are to increase capital to support our growth, create a more liquid and active market than currently exists for Naugatuck Valley Financial common stock, structure our business in a form that will provide improved access to capital markets and facilitate acquisitions of other financial institutions and eliminate any regulatory uncertainty associated with dividend waivers by our mutual holding company. |

| Q: | Why should I vote? |

| A: | You are not required to vote, but your vote is very important. In order for us to implement the plan of conversion, we must receive the affirmative vote of (1) the holders of at least two-thirds of the outstanding shares of Naugatuck Valley Financial common stock entitled to vote at the annual meeting, including shares held by Naugatuck Valley Mutual Holding Company and (2) the holders of at least a majority of the outstanding shares of Naugatuck Valley Financial common stock entitled to vote at the annual meeting, excluding shares held by Naugatuck Valley Mutual Holding Company. Your board of directors recommends that you vote “FOR” the plan of conversion. |

| Q: | What happens if I don’t vote? |

| A: | Your prompt vote is very important. Not voting will have the same effect as voting “AGAINST” the plan of conversion. Without sufficient favorable votes “FOR” the plan of conversion, we cannot complete the conversion and offering. |

| Q: | How do I vote? |

| A: | You should mark your vote, sign your proxy card and return it in the enclosed pre-paid envelope. Alternatively, you may vote by telephone or via the Internet, by following instructions on your proxy card. PLEASE VOTE PROMPTLY. NOT VOTING HAS THE SAME EFFECT AS VOTING “AGAINST” THE PLAN OF CONVERSION. |

| Q: | If my shares are held in street name, will my broker automatically vote on my behalf? |

| A: | No. Your broker will not be able to vote your shares without instructions from you. You should instruct your broker to vote your shares, using the directions that your broker provides to you. |

| Q: | What if I do not give voting instructions to my broker? |

| A: | Your vote is important. If you do not instruct your broker to vote your shares, the unvoted proxy will have the same effect as a vote against the plan of conversion. |

The Share Exchange

| Q: | I currently own shares of Naugatuck Valley Financial common stock. What will happen to my shares as a result of the conversion? |

| A: | At the completion of the conversion, your shares of Naugatuck Valley Financial common stock will be canceled and exchanged for shares of common stock of New Naugatuck Valley Financial. The number of shares you will receive will be based on an exchange ratio, determined as of the completion of the conversion and offering, that is intended to result |

ii

Table of Contents

| in Naugatuck Valley Financial’s existing public shareholders owning the same percentage interest of New Naugatuck Valley Financial common stock as they currently own of Naugatuck Valley Financial common stock, before giving effect to cash paid in lieu of issuing fractional shares or shares that existing shareholders may purchase in the offering. |

| Q: | Does the exchange ratio depend on the market price of Naugatuck Valley Financial common stock? |

| A: | No, the exchange ratio will not be based on the market price of Naugatuck Valley Financial common stock. Therefore, changes in the price of Naugatuck Valley Financial common stock between now and the completion of the conversion and offering will not effect the calculation of the exchange ratio. |

| Q: | How will the actual exchange ratio be determined? |

| A: | Because the purpose of the exchange ratio is to maintain the ownership percentage of the existing public shareholders of Naugatuck Valley Financial, the actual exchange ratio will depend on the number of shares of New Naugatuck Valley Financial’s common stock sold in the offering and, therefore, cannot be determined until the completion of the conversion and offering. |

| Q: | How many shares will I receive in the exchange? |

| A: | You will receive between 0.7875 and 1.0655 (subject to increase to 1.2253) shares of New Naugatuck Valley Financial common stock for each share of Naugatuck Valley Financial common stock you own on the date of the completion of the conversion and offering. For example, if you own 100 shares of Naugatuck Valley Financial common stock, and the exchange ratio is 0.9265 (at the midpoint of the offering range), you will receive 92 shares of New Naugatuck Valley Financial common stock and $5.20 in cash, the value of the fractional share, based on the $8.00 per share purchase price in the offering. Shareholders who hold shares in street name at a brokerage firm will receive these funds in their accounts. Shareholders who hold stock certificates will receive a check in the mail. |

| Q. | Why did the board of directors base the exchange ratio on an $8.00 per share stock price? |

| A. | In adopting the plan of conversion, the board of directors focused on the value of the shares to be received in the exchange in comparison to the market price of Naugatuck Valley Financial common stock. Because Naugatuck Valley Financial common stock has been trading below $10.00 per share since 2008, the board of directors concluded that an offering price of $8.00 is consistent with the historical trading range of our stock. |

| Q. | Why does the board of directors support the conversion if the value of the shares to be received in the exchange might be less than the current market value of Naugatuck Valley Financial common stock? |

| A. | Over the 30 trading days before April 25, 2011, which is the date on which the board of directors last amended the plan of conversion, the price of Naugatuck Valley Financial common stock traded between $7.91 and $8.95. Based on the offering price of $8.00 per share and the exchange ratio, the value of the shares to be received in exchange for each share of Naugatuck Valley Financial common stock would range from $6.30 to $8.52. In adopting the plan of conversion, the board of directors focused on our prospects for generating shareholder value and on the price of our stock relative to our peers. For the reasons described above, the board of directors concluded that converting to the stock holding company form would provide the best opportunity to generate shareholder value. The board of directors also considered that compared to the peer group used in the independent appraisal of our common stock, our common stock would be priced at a discount of 20.6% to the peer group on a price-to-book basis and at a discount of 22.3% to the peer group on a price-to-tangible book basis, which could make our stock an attractive investment. |

| Q: | Should I submit my stock certificates now? |

| A: | No. If you hold a stock certificate for Naugatuck Valley Financial common stock, instructions for exchanging your certificate will be sent to you after completion of the conversion and offering. Until you submit the transmittal form and certificate, you will not receive your new certificate and check for cash in lieu of fractional shares, if any. If your shares are held in street name at a brokerage firm, the share exchange will occur automatically upon completion of the conversion and offering, without any action on your part. Please do not send in your stock certificate until you receive a transmittal form and instructions. |

iii

Table of Contents

The Stock Offering

| Q: | May I place an order to purchase shares in the offering, in addition to the shares that I will receive in the exchange? |

| A: | Eligible depositors of Naugatuck Valley Savings and Loan have priority subscription rights allowing them to purchase common stock in the subscription offering. Shares not purchased in the subscription offering may be made available for sale in a community offering. Naugatuck Valley Financial shareholders have a preference in the community offering after orders submitted by residents of our communities. If you would like to receive a prospectus and stock order form, please call our Stock Information Center toll-free at 1-(877) 821-5783 from 10:00 a.m. to 4:00 p.m., Eastern time, Monday through Friday. The Stock Information Center will be closed weekends and bank holidays. |

Stock order forms, along with full payment, must be received (not postmarked) no later than 2:00 p.m., Eastern time, on June 14, 2011.

Other Questions?

For answers to questions about the conversion or voting, please read this proxy statement/prospectus. Questions about voting may be directed to our proxy information agent, Phoenix Advisory Partners, by calling toll-free 1-(877) 265-2368, Monday through Friday, from 10:00 a.m. to 8:00 p.m., Eastern Time, or Saturday, from 10:00 a.m. to 6:00 p.m., Eastern Time. For answers to questions about the stock offering, you may call our Stock Information Center, toll-free, at 1-(877) 821-5783 from 10:00 a.m. to 4:00 p.m. Eastern time, Monday through Friday. A copy of the plan of conversion is available from Naugatuck Valley Savings and Loan upon written request to the Corporate Secretary and is available for inspection at the offices of Naugatuck Valley Savings and Loan and at the Office of Thrift Supervision.

iv

Table of Contents

This summary highlights material information from this document and may not contain all the information that is important to you. To understand the conversion and offering fully, you should read this entire document carefully.

Annual Meeting of Shareholders

Date, Time and Place; Record Date

The annual meeting of Naugatuck Valley Financial shareholders is scheduled to be held at the Community Room located at the main office of Naugatuck Valley Savings and Loan, 333 Church Street, Naugatuck, Connecticut at 9:00 a.m., Eastern time, on June 24, 2011. Only Naugatuck Valley Financial shareholders of record as of the close of business on May 3, 2011 are entitled to notice of, and to vote at, the annual meeting of shareholders and any adjournments or postponements of the meeting.

Purpose of the Meeting

Shareholders will be voting on the following proposals at the annual meeting:

| 1. | Approval of the plan of conversion; |

| 2. | The following informational proposals: |

| 2a. | Approval of a provision in New Naugatuck Valley Financial’s articles of incorporation requiring a super-majority vote to approve certain amendments to New Naugatuck Valley Financial’s articles of incorporation; and |

| 2b. | Approval of a provision in New Naugatuck Valley Financial’s articles of incorporation to limit the voting rights of shares beneficially owned in excess of 10% of New Naugatuck Valley Financial’s outstanding voting stock; |

| 3. | The election of three directors for terms of three years each; |

| 4. | The ratification of the appointment of Whittlesey & Hadley, P.C. as independent registered public accountants for the fiscal year ending December 31, 2011; and |

| 5. | The approval of the adjournment of the annual meeting, if necessary, to solicit additional proxies in the event that there are not sufficient votes at the time of the annual meeting to approve the plan of conversion. |

The provisions of New Naugatuck Valley Financial’s articles of incorporation which are summarized as informational proposals 2a and 2b were approved as part of the process in which the board of directors of Naugatuck Valley Financial approved the plan of conversion. These proposals are informational in nature only, because the Office of Thrift Supervision’s regulations governing mutual-to-stock conversions do not provide for votes on matters other than the plan of conversion. While we are asking you to vote with respect to each of the informational proposals listed above, the proposed provisions for which an informational vote is requested will become effective if shareholders approve the plan of conversion, regardless of whether shareholders vote to approve either or both of the informational proposals. The provisions of New Naugatuck Valley Financial’s articles of incorporation which are summarized as informational proposals may have the effect of deterring or rendering more difficult attempts by third parties to obtain control of New Naugatuck Valley Financial, if such attempts are not approved by the board of directors, or may make the removal of the board of directors or management, or the appointment of new directors, more difficult.

Vote Required

Proposal 1: Approval of the Plan of Conversion. Approval of the plan of conversion requires the affirmative vote of holders of at least two-thirds of the outstanding shares of Naugatuck Valley Financial, including shares held by Naugatuck Valley Mutual Holding Company, and the holders of at least a majority of the votes eligible to be cast by shareholders of Naugatuck Valley Financial, excluding shares held by Naugatuck Valley Mutual Holding Company.

1

Table of Contents

Informational Proposals 2a and 2b. While we are asking you to vote with respect to each of the informational proposals listed above, the proposed provisions for which an informational vote is requested will become effective if shareholders approve the plan of conversion, regardless of whether shareholders vote to approve either or both of the informational proposals.

Proposal 3: Election of Directors. Directors are elected by a plurality of the votes cast at the annual meeting. This means that the nominees receiving the greatest number of votes will be elected.

Proposal 4: Ratification of Auditor. Ratification of the selection of Whittlesey & Hadley, P.C. as our independent registered public accounting firm for 2011 requires the affirmative vote of a majority of the shares represented at the annual meeting and entitled to vote.

Proposal 5: Approval of the adjournment of the annual meeting. We must obtain the affirmative vote of the majority of the shares represented at the annual meeting and entitled to vote to adjourn the annual meeting, if necessary, to solicit additional proxies in the event that there are not sufficient votes at the time of the annual meeting to approve the proposal to approve the plan of conversion.

As of the record date, there were 7,018,627 shares of Naugatuck Valley Financial common stock outstanding, of which Naugatuck Valley Mutual Holding Company owned 4,182,407, or 59.6%. The directors and executive officers of Naugatuck Valley Financial (and their affiliates), as a group, beneficially owned 210,603 shares of Naugatuck Valley Financial common stock (excluding shares that they may acquire upon the exercise of outstanding stock options), representing 3.0% of the outstanding shares of Naugatuck Valley Financial common stock and 7.4% of the shares held by persons other than Naugatuck Valley Mutual Holding Company as of such date. Naugatuck Valley Mutual Holding Company and our directors and executive officers intend to vote their shares in favor of each of the proposals set forth in this proxy statement/prospectus.

Our Company

Naugatuck Valley Financial is, and New Naugatuck Valley Financial following the completion of the conversion and offering will be, the unitary savings and loan holding company for Naugatuck Valley Savings and Loan, a federally chartered savings bank. Naugatuck Valley Savings and Loan is headquartered in Naugatuck, Connecticut and has served customers in Connecticut since 1922. In addition to our main office, we operate nine branch offices in the Greater Naugatuck Valley which we consider our market area. Naugatuck Valley Financial’s common stock is traded on the Nasdaq Global Market under the symbol “NVSL.”

At December 31, 2010, Naugatuck Valley Financial had consolidated total assets of $568.3 million, total net loans of $473.6 million, total deposits of $405.9 million and total shareholders’ equity of $52.3 million. At December 31, 2010, Naugatuck Valley Savings and Loan exceeded all regulatory capital requirements and was not a participant in any of the U.S. Treasury’s capital raising programs for financial institutions. Naugatuck Valley Financial’s principal executive offices are located at 333 Church Street, Naugatuck, Connecticut 06770 and its telephone number is (203) 720-5000. Naugatuck Valley Financial’s website address is www.nvsl.com. Information on this website should not be considered a part of this proxy statement/prospectus.

2

Table of Contents

The Conversion

Description of the Conversion (page 34)

In 2004, Naugatuck Valley Savings and Loan reorganized into the mutual holding company structure. As a part of that reorganization, we formed Naugatuck Valley Financial as the mid-tier holding company for Naugatuck Valley Savings and Loan and sold a minority interest in Naugatuck Valley Financial common stock to our depositors and our employee stock ownership plan in a subscription offering. The majority of Naugatuck Valley Financial’s shares were issued to Naugatuck Valley Mutual Holding Company. As a mutual holding company, Naugatuck Valley Mutual Holding Company does not have any shareholders, does not hold any significant assets other than the common stock of Naugatuck Valley Financial, and does not engage in any significant business activity. Our current ownership structure is as follows:

| * | The Naugatuck Valley Savings and Loan Foundation owns approximately 1.8% of the current outstanding shares of Naugatuck Valley Financial common stock. |

The “second-step” conversion process that we are now undertaking involves a series of transactions by which we will convert our organization from the partially public mutual holding company form to the fully public stock holding company structure. In the stock holding company structure, all of Naugatuck Valley Savings and Loan’s common stock will be owned by New Naugatuck Valley Financial, and all of New Naugatuck Valley Financial’s common stock will be owned by the public. We are conducting the conversion and offering under the terms of our plan of conversion and reorganization (which is referred to as the “plan of conversion”). Upon completion of the conversion and offering, the present Naugatuck Valley Financial and Naugatuck Valley Mutual Holding Company will cease to exist.

As part of the conversion, we are offering for sale common stock representing the 59.6% ownership interest of Naugatuck Valley Financial that is currently held by Naugatuck Valley Mutual Holding Company. At the conclusion of the conversion and offering, existing public shareholders of Naugatuck Valley Financial will receive shares of common stock in New Naugatuck Valley Financial in exchange for their existing shares of common stock of Naugatuck Valley Financial, based upon an exchange ratio ranging from 0.7875 to 1.0655. The actual exchange ratio will be determined at the conclusion of the conversion and the offering based on the total number of shares sold in the offering, and is intended to result in Naugatuck Valley Financial’s existing public shareholders owning the same 40.4% interest of New Naugatuck Valley Financial common stock as they currently own of Naugatuck Valley Financial common stock, without giving effect to cash paid in lieu of issuing fractional shares or shares that existing shareholders may purchase in the offering.

3

Table of Contents

After the conversion and offering, our ownership structure will be as follows:

| * | Upon completion of the offering, the Naugatuck Valley Savings and Loan Foundation will continue to own approximately 1.8% of the outstanding shares of New Naugatuck Valley Financial common stock. No stock or cash contribution will be made to the charitable foundation in connection with the conversion and offering. All New Naugatuck Valley Financial common stock owned by the charitable foundation will continue to be voted in the same ratio as all other New Naugatuck Valley Financial shares voted on each proposal considered by New Naugatuck Valley Financial stockholders. |

We may cancel the conversion and offering with the concurrence of the Office of Thrift Supervision. If canceled, orders for common stock submitted will be canceled, subscribers’ funds will be promptly returned with interest calculated at Naugatuck Valley Savings and Loan’s passbook savings rate and all deposit account withdrawal authorizations will be cancelled.

The normal business operations of Naugatuck Valley Savings and Loan will continue without interruption during the conversion and offering, and the same officers and directors who currently serve Naugatuck Valley Savings and Loan in the mutual holding company structure will serve the new holding company and Naugatuck Valley Savings and Loan in the fully converted stock form.

Reasons for the Conversion and Offering (page 35)

Our primary reasons for the conversion and offering are the following:

| • | While Naugatuck Valley Savings and Loan currently exceeds all regulatory capital requirements, the proceeds from the sale of common stock will increase our capital, which will support our continued lending and operational growth. Our board of directors considered current market conditions, the amount of capital needed for continued growth, that the offering will not raise excessive capital, and the interests of existing shareholders in deciding to conduct the conversion and offering at this time. |

| • | The larger number of shares that will be in the hands of public investors after completion of the conversion and offering is expected to result in a more liquid and active market than currently exists for Naugatuck Valley Financial common stock. A more liquid and active market would make it easier for our shareholders to buy and sell our common stock. See “Market for the Common Stock.” |

| • | The stock holding company structure is a more familiar form of organization, which we believe will make our common stock more appealing to investors, and will give us greater flexibility to access the capital markets through possible future equity and debt offerings and to acquire other financial institutions or financial service companies. Our current mutual holding company structure limits our ability to raise capital or issue stock in an acquisition transaction because Naugatuck Valley Mutual Holding Company must own at least 50.1% of the shares of Naugatuck Valley Financial. Currently, however, we have no plans, agreements or understandings regarding any additional securities offerings or acquisitions. |

| • | We are currently regulated by the Office of Thrift Supervision. Recently enacted financial regulatory reform legislation will result in changes to our primary bank regulator and holding company regulator, as well as changes in regulations applicable to us, which may include changes in regulations affecting capital requirements, payment of dividends and conversion to stock form. Specifically, the Federal Reserve Board will become the sole federal |

4

Table of Contents

| regulator of all holding companies, including mutual holding companies, and the Federal Reserve Board historically has not allowed mutual holding companies to waive the receipt of dividends from their mid-tier holding company subsidiaries. Although Naugatuck Valley Mutual Holding Company is still considered a “grandfathered” mutual holding company, it is not clear how the Federal Reserve Board will evaluate dividend waivers by grandfathered mutual holding companies and whether the Federal Reserve Board would require any future waived dividends to be taken into account in determining an appropriate exchange ratio, which would result in dilution to the ownership interests of minority stockholders in the event of a “second-step” conversion to stock form. The reorganization will eliminate our mutual holding company structure and any regulatory uncertainty associated with dividend waivers by our mutual holding company, as well as the treatment of waived dividends in a conversion of our mutual holding company to stock form. The reorganization will also better position us to meet all future regulatory capital requirements. |

Conditions to Completing the Conversion and Offering

We cannot complete the conversion and offering unless:

| • | the plan of conversion is approved by at least a majority of votes eligible to be cast by voting members of Naugatuck Valley Mutual Holding Company (depositors of Naugatuck Valley Savings and Loan); |

| • | the plan of conversion is approved by at least two-thirds of the outstanding shares of Naugatuck Valley Financial, including shares held by Naugatuck Valley Mutual Holding Company; |

| • | the plan of conversion is approved by at least a majority of the votes eligible to be cast by shareholders of Naugatuck Valley Financial, excluding shares held by Naugatuck Valley Mutual Holding Company; |

| • | we sell at least the minimum number of shares offered; and |

| • | we receive the final approval of the Office of Thrift Supervision to complete the conversion and offering. |

Naugatuck Valley Mutual Holding Company, which owns 59.6% of the outstanding shares of Naugatuck Valley Financial, intends to vote these shares in favor of the plan of conversion. In addition, as of May 3, 2011, directors and executive officers of Naugatuck Valley Financial and their associates beneficially owned 210,603 shares of Naugatuck Valley Financial or 3.0% of the outstanding shares. They intend to vote those shares in favor of the plan of conversion.

The Exchange of Existing Shares of Naugatuck Valley Financial Common Stock (page 36)

If you are a shareholder of Naugatuck Valley Financial on the date we complete the conversion and offering, your existing shares will be cancelled and exchanged for shares of New Naugatuck Valley Financial. The number of shares you will receive will be based on an exchange ratio determined as of the completion of the conversion and offering that is intended to result in Naugatuck Valley Financial’s existing public shareholders owning approximately 40.4% of New Naugatuck Valley Financial’s common stock, which is the same percentage of Naugatuck Valley Financial common stock currently owned by existing public shareholders. The following table shows how the exchange ratio will adjust, based on the number of shares sold in our offering. The table also shows how many shares a hypothetical owner of 100 shares of Naugatuck Valley Financial common stock would receive in the exchange, based on the number of shares sold in the offering, and the pro forma tangible book value per exchanged share.

| Exchange Ratio | Shares to be Received for 100 Existing Shares (1) |

Pro Forma Tangible Book Value Per Exchanged Share |

||||||||||

| Minimum |

0.7875 | 78 | $ | 10.50 | ||||||||

| Midpoint |

0.9265 | 92 | 11.08 | |||||||||

| Maximum |

1.0655 | 106 | 11.65 | |||||||||

| Maximum, as adjusted |

1.2253 | 122 | 12.33 | |||||||||

| (1) | Cash will be paid instead of issuing any fractional shares. |

5

Table of Contents

No fractional shares of New Naugatuck Valley Financial common stock will be issued in the conversion and offering. For each fractional share that would otherwise be issued, we will pay cash in an amount equal to the product obtained by multiplying the fractional share interest to which the holder would otherwise be entitled by the $8.00 per share offering price.

We also will convert options previously awarded under the 2005 Equity Incentive Plan into options to purchase New Naugatuck Valley Financial common stock. At December 31, 2010, there were outstanding options to purchase 326,300 shares of Naugatuck Valley Financial common stock. The number of outstanding options and related per share exercise prices will be adjusted based on the exchange ratio. The aggregate exercise price, term and vesting period of the outstanding options will remain unchanged. If any options are exercised before we complete the offering, the number of shares of Naugatuck Valley Financial common stock outstanding will increase and the exchange ratio could be adjusted.

Ownership of New Naugatuck Valley Financial after Completion of the Conversion and Offering

The following table shows the number of shares to be issued, and approximate percentage of the total stock issuance, for each of the shares to be sold in the offering and shares to be received in exchange for existing shares of Naugatuck Valley Financial.

| Shares to be Sold in the Offering |

Shares to be Received in Exchange for Existing Shares of Naugatuck Valley Financial |

Total Shares of Common Stock to be Outstanding |

||||||||||||||||||

| Amount | Percent | Amount | Percent | |||||||||||||||||

| Minimum |

3,293,750 | 59.6 | % | 2,233,748 | 40.4 | % | 5,527,498 | |||||||||||||

| Midpoint |

3,875,000 | 59.6 | 2,627,939 | 40.4 | 6,502,939 | |||||||||||||||

| Maximum |

4,456,250 | 59.6 | 3,022,130 | 40.4 | 7,478,380 | |||||||||||||||

| Maximum, as adjusted |

5,124,688 | 59.6 | 3,475,450 | 40.4 | 8,600,138 | |||||||||||||||

Effect of the Conversion on Shareholders of Naugatuck Valley Financial

The following table compares historical information for Naugatuck Valley Financial with similar information on a pro forma and per equivalent New Naugatuck Valley Financial share basis. The information listed as “per equivalent Naugatuck Valley Financial share” was obtained by multiplying the pro forma amounts by the exchange ratio indicated in the table.

| Naugatuck Valley Financial Historical |

Pro Forma |

Exchange Ratio |

Per Equivalent New Naugatuck Valley Financial Share |

|||||||||||||

| Book value per share at December 31, 2010: |

||||||||||||||||

| Sale of 3,293,750 |

$ | 9.45 | $ | 13.34 | 0.7875 | $ | 10.51 | |||||||||

| Sale of 3,875,000 |

8.04 | 11.97 | 0.9265 | 11.09 | ||||||||||||

| Sale of 4,456,250 |

6.98 | 10.94 | 1.0655 | 11.66 | ||||||||||||

| Sale of 5,124,688 |

6.08 | 10.07 | 1.2253 | 12.34 | ||||||||||||

| Earnings per share for the year ended December 31, 2010: |

||||||||||||||||

| Sale of 3,293,750 |

$ | 0.27 | $ | 0.25 | 0.7875 | $ | 0.20 | |||||||||

| Sale of 3,875,000 |

0.23 | 0.21 | 0.9265 | 0.19 | ||||||||||||

| Sale of 4,456,250 |

0.20 | 0.18 | 1.0655 | 0.19 | ||||||||||||

| Sale of 5,124,688 |

0.18 | 0.16 | 1.2253 | 0.20 | ||||||||||||

| Price per share (1): |

||||||||||||||||

| Sale of 3,293,750 |

$ | 8.99 | $ | 8.00 | 0.7875 | $ | 6.30 | |||||||||

| Sale of 3,875,000 |

8.99 | 8.00 | 0.9265 | 7.41 | ||||||||||||

| Sale of 4,456,250 |

8.99 | 8.00 | 1.0655 | 8.52 | ||||||||||||

| Sale of 5,124,688 |

8.99 | 8.00 | 1.2253 | 9.80 | ||||||||||||

| (1) | At February 4, 2011, which was the date of the appraisal. |

6

Table of Contents

How We Determined the Offering Range and Exchange Ratio (page 37)

Federal regulations require that the aggregate purchase price of the securities sold in the offering be based upon our estimated pro forma market value after the conversion (i.e., taking into account the expected receipt of proceeds from the sale of securities in the offering) as determined by an independent appraisal. We have retained RP Financial, LC., which is experienced in the evaluation and appraisal of financial institutions, to prepare the appraisal. RP Financial has indicated that in its valuation as of February 4, 2011, as amended as of April 29, 2011, our common stock’s estimated full market value ranged from $44.2 million to $59.8 million, with a midpoint of $52.0 million. The pro forma market value of New Naugatuck Valley Financial includes:

| • | the total number of shares that will be sold in the offering (representing the 59.6% ownership interest in Naugatuck Valley Financial currently owned by Naugatuck Valley Mutual Holding Company); and |

| • | the total number of shares to be issued to current Naugatuck Valley Financial stockholders in exchange for their shares of Naugatuck Valley Financial common stock (representing the remaining 40.4% ownership interest in Naugatuck Valley Financial currently owned by current Naugatuck Valley Financial stockholders). |

This valuation and Naugatuck Valley Mutual Holding Company’s ownership interest in Naugatuck Valley Financial, results in an offering range of $26.4 million to $35.7 million, with a midpoint of $31.0 million. RP Financial will receive fees totaling $41,000 for its appraisal report, plus $5,000 for any appraisal updates (of which there will be at least one) and reimbursement of out-of-pocket expenses.

The appraisal was based in part upon Naugatuck Valley Financial’s financial condition and results of operations, the effect of the additional capital we will raise from the sale of common stock in this offering, and an analysis of a peer group of ten publicly traded savings and loan holding companies that RP Financial considered comparable to Naugatuck Valley Financial. The appraisal peer group consists of the companies listed below. Total assets are as of the most recent quarter-end for which data is publicly available (i.e. either September 30, 2010 or December 31, 2010).

| Company Name |

Ticker Symbol | Exchange | Headquarters | Total Assets | ||||||||

| (in millions) | ||||||||||||

| Central Bancorp, Inc. |

CEBK | NASDAQ | Somerville, MA | $ | 526 | |||||||

| Chicopee Bancorp, Inc. |

CBNK | NASDAQ | Chicopee, MA | 574 | ||||||||

| Hampden Bancorp, Inc. |

HBNK | NASDAQ | Springfield, MA | 574 | ||||||||

| Mayflower Bancorp, Inc. |

MFLR | NASDAQ | Middleboro, MA | 249 | ||||||||

| New Hampshire Thrift Bancshares, Inc. |

NHTB | NASDAQ | Newport, NH | 995 | ||||||||

| Newport Bancorp, Inc. |

NFSB | NASDAQ | Newport, RI | 450 | ||||||||

| Ocean Shore Holding Co. |

OSHC | NASDAQ | Ocean City, NJ | 838 | ||||||||

| TF Financial Corporation |

THRD | NASDAQ | Newton, PA | 692 | ||||||||

| United Financial Bancorp, Inc. |

UBNK | NASDAQ | West Springfield, MA | 1,585 | ||||||||

| Westfield Financial, Inc. |

WFD | NASDAQ | Westfield, MA | 1,240 | ||||||||

In preparing its appraisal, RP Financial considered the information in this prospectus, including our financial statements. RP Financial also considered the following factors, among others:

| • | our historical and projected operating results and financial condition, including, but not limited to, net interest income, the amount and volatility of interest income and interest expense relative to changes in market conditions and interest rates, asset quality, levels of loan loss provisions, the amount and sources of non-interest income, and the amount of noninterest expense; |

| • | the economic, demographic and competitive characteristics of our market area, including, but not limited to, employment by industry type, unemployment trends, size and growth of the population, trends in household and per capita income, and deposit market share; |

| • | a comparative evaluation of our operating and financial statistics with those of other similarly-situated, publicly-traded savings associations and savings association holding companies, which included a comparative analysis of balance sheet composition, income statement and balance sheet ratios, credit and interest rate risk exposure; |

| • | the effect of the capital raised in this offering on our net worth and earnings potential, including, but not limited to, the increase in consolidated equity resulting from the offering, the estimated increase in earnings resulting from the |

7

Table of Contents

| investment of the net proceeds of the offering, and the estimated impact on consolidated equity and earnings resulting from adoption of the proposed employee stock benefit plans; and |

| • | the trading market for Naugatuck Valley Financial common stock and securities of comparable institutions and general conditions in the market for such securities. |

Two measures that some investors use to analyze whether a stock might be a good investment are the ratio of the offering price to the issuer’s “book value” and “tangible book value” and the ratio of the offering price to the issuer’s core earnings. RP Financial considered these ratios in preparing its appraisal, among other factors. Book value is the same as total equity and represents the difference between the issuer’s assets and liabilities. Tangible book value is equal to total equity minus intangible assets. Core earnings, for purposes of the appraisal, was defined as net earnings after taxes, excluding the after-tax portion of income from nonrecurring items. RP Financial’s appraisal also incorporates an analysis of a peer group of publicly traded companies that RP Financial considered to be comparable to us. In applying each of the valuation methods, RP Financial considered adjustments to our pro forma market value based on a comparison of Naugatuck Valley Financial with the peer group. RP Financial made slight upward adjustment for profitability, including earnings growth potential. No adjustments were made for financial condition, market area, dividends, trading liquidity, subscription interest, regulatory matters or management. RP Financial made no downward adjustments.

The following table presents a summary of selected pricing ratios for the peer group companies utilized by RP Financial in its appraisal and the pro forma pricing ratios for us as calculated by RP Financial in its appraisal report, based on financial data as of and for the 12 months ended December 31, 2010. The pricing ratios for Naugatuck Valley Financial are based on financial data as of or for the 12 months ended December 31, 2010.

| Price to Book Value Ratio |

Price to Tangible Book Value Ratio |

Price

to Earnings Multiple |

Price to Core Earnings Multiple |

|||||||||||||

| New Naugatuck Valley Financial (pro forma): |

||||||||||||||||

| Minimum |

59.93 | % | 59.97 | % | 32.76 | x | 23.79 | x | ||||||||

| Midpoint |

66.78 | 66.83 | 39.01 | 28.23 | ||||||||||||

| Maximum |

72.99 | 73.06 | 45.41 | 32.75 | ||||||||||||

| Maximum, as adjusted |

79.44 | 79.44 | 52.96 | 38.05 | ||||||||||||

| Pricing ratios of peer group companies as of February 4, 2011: |

||||||||||||||||

| Average |

92.82 | 99.29 | 17.48 | 19.97 | ||||||||||||

| Median |

91.91 | 94.05 | 16.49 | 21.83 | ||||||||||||

Compared to the median pricing ratios of the peer group, at the maximum of the offering range our common stock would be priced at a discount of 20.6% to the peer group on a price-to-book basis, a discount of 22.3% on a price-to-tangible book basis, a premium of 175.4% on a price to earnings basis and a premium of 50.0% on a price to core earnings basis. This means that, at the maximum of the offering range, a share of our common stock would be less expensive than the peer group on a book value and tangible book value basis and more expensive on an earnings and core earnings basis.

Compared to the median pricing ratios of the peer group, at the minimum of the offering range our common stock would be priced at discount of 37.8% to the peer group on a price-to-book basis, a discount of 39.1% on a price-to-tangible book basis, a premium of 79.7% on a price to earnings basis and a premium of 1.6% on a price to core earnings basis. This means that, at the minimum of the offering range, a share of our common stock would be less expensive than the peer group on a book value and tangible book value basis and more expensive on an earnings and core earnings basis.

Our board of directors reviewed RP Financial’s appraisal report, including the methodology and the assumptions used by RP Financial, and determined that the offering range was reasonable and adequate. Our board of directors has decided to offer the shares for a price of $8.00 per share. The purchase price of $8.00 per share was determined by us, taking into account, among other factors, the market price of our stock before adoption of the plan of conversion, the requirement under Office of Thrift Supervision regulations that the common stock be offered in a manner that will achieve the widest distribution of the stock, and desired liquidity in the common stock after the offering. Our board of directors also established the formula for determining the exchange ratio. Based upon such formula and the offering range, the exchange ratio ranged

8

Table of Contents

from a minimum of 0.7875 shares to a maximum of 1.0655 shares of New Naugatuck Valley Financial common stock for each current share of Naugatuck Valley Financial common stock, with a midpoint of 0.9265 shares. Based upon this exchange ratio, we expect to issue between 2,233,748 and 3,022,130 shares of New Naugatuck Valley Financial common stock to the holders of Naugatuck Valley Financial common stock outstanding immediately before the completion of the conversion and offering.

Because of differences in important factors such as operating characteristics, location, financial performance, asset size, capital structure and business prospects between us and other fully converted institutions, you should not rely on these comparative valuation ratios as an indication as to whether or not our common stock is an appropriate investment for you. The appraisal is not intended, and must not be construed, as a recommendation of any kind as to the advisability of purchasing our common stock. The appraisal does not indicate market value. You should not assume or expect that the appraisal described above means that our common stock will trade at or above the $8.00 purchase price after the offering.

Our board of directors makes no recommendation of any kind as to the advisability of purchasing shares of common stock in the offering.

Possible Change in Offering Range

RP Financial will update its appraisal before we complete the conversion and offering. If, as a result of regulatory considerations, demand for the shares or changes in financial market conditions, RP Financial determines that our estimated pro forma market value has increased, we may sell up to 5,124,688 shares, or $41.0 million, without further notice to you. If our pro forma market value at that time is either below $44.2 million or above $68.8 million, then, after consulting with the Office of Thrift Supervision, we may: terminate the offering and promptly return all funds; promptly return all funds, set a new offering range and give all subscribers the opportunity to place a new order; or take such other actions as may be permitted by the Office of Thrift Supervision and the Securities and Exchange Commission.

How We Intend to Use the Proceeds of the Offering (page 54)

The following table summarizes how we intend to use the proceeds of the offering, based on the sale of shares at the minimum and maximum of the offering range.

| Minimum of Offering Range |

Percent of Net Offering Proceeds |

Maximum of Offering Range |

Percent of Net Offering Proceeds |

|||||||||||||

| (In thousands) |

3,293,750 Shares at $8.00 Per Share |

4,456,250 Shares at $8.00 Per Share |

||||||||||||||

| Offering proceeds |

$ | 26,350 | $ | 35,650 | ||||||||||||

| Less: offering expenses |

(2,407 | ) | (2,726 | ) | ||||||||||||

| Net offering proceeds |

23,943 | 100.0 | % | 32,924 | 100.0 | % | ||||||||||

| Less: |

||||||||||||||||

| Proceeds contributed to Naugatuck Valley Savings and Loan |

15,563 | 65.0 | 21,401 | 65.0 | ||||||||||||

| Proceeds used for loan to employee stock ownership plan |

1,581 | 6.6 | 2,139 | 6.5 | ||||||||||||

| Proceeds remaining for New Naugatuck Valley Financial |

$ | 6,799 | 28.4 | % | $ | 9,384 | 28.5 | % | ||||||||

Initially, we intend to invest the proceeds of the offering in short-term investments. In the future, New Naugatuck Valley Financial may use the funds it retains to invest in securities, pay cash dividends, repurchase shares of its common stock, subject to regulatory restrictions, or for general corporate purposes. Over time, Naugatuck Valley Savings and Loan intends to use the portion of the proceeds that it receives to fund new loans, including residential mortgage loans. The amount of time that it will take to deploy the proceeds of the offering into loans will depend primarily on the level of loan demand. We may also use the proceeds of the offering to diversify our business or acquire other companies or expand our branch network, although we have no specific plans to do so at this time.

9

Table of Contents

Benefits of the Conversion to Management

We intend to purchase additional shares of common stock through our employee stock ownership plan and adopt the stock benefit plan as described below. We will recognize additional compensation expense related to the expanded employee stock ownership plan and the new equity incentive plan. The actual expense will depend on the market value of our common stock and will increase as the value of our common stock increases. As reflected under “Pro Forma Data,” based upon assumptions set forth therein, the annual after tax expense related to the employee stock ownership plan and the new equity incentive plan would have been $333,000 for the year ended December 31, 2010, assuming shares are sold at the maximum of the offering range. If awards under the new equity incentive plan are funded from authorized but unissued stock, your ownership interest would be diluted by up to approximately 6.16%. See “Pro Forma Data” for an illustration of the effects of each of these plans.

Employee Stock Ownership Plan. Our employee stock ownership plan intends to purchase 6.0% of the shares sold in the offering using the proceeds from a 20-year loan from New Naugatuck Valley Financial. Alternatively, we reserve the right to purchase shares of common stock in the open market following the offering to fund all or a portion of the employee stock ownership plan. As the loan is repaid and shares are released from collateral, the shares will be allocated to the accounts of employee participants. Allocations will be based on a participant’s individual compensation as a percentage of total plan compensation. Non-employee directors are not eligible to participate in the employee stock ownership plan. The purchase of common stock by the employee stock ownership plan in the offering will comply with all applicable Office of Thrift Supervision regulations except to the extent waived by the Office of Thrift Supervision. We will incur additional compensation expense as a result of this plan. See “Pro Forma Data” for an illustration of the effects of this plan.

New Equity Incentive Plan. We intend to implement a new equity incentive plan no earlier than six months after completion of the conversion and offering. We will submit this plan to our shareholders for their approval. Under this plan, if implemented within 12 months following the completion of the conversion, we intend to grant stock options in an amount up to 7.87% of the number of shares sold in the offering and restricted stock awards in an amount equal to 3.15% of the shares sold in the offering. Stock options will be granted at an exercise price equal to 100% of the fair market value of our common stock on the option grant date. Shares of restricted stock will be awarded at no cost to the recipient. We will incur additional compensation expense as a result of this plan. See “Pro Forma Data” for an illustration of the effects of this plan. If the new equity incentive plan is adopted more than 12 months after the completion of the conversion, restricted stock awards and stock option grants under the plan may exceed the percentage limitations set forth above. The new equity incentive plan will supplement our existing 2005 Equity Incentive Plan, which will continue as a plan of New Naugatuck Valley Financial. The equity incentive plan will comply with all applicable Office of Thrift Supervision regulations except to the extent waived by the Office of Thrift Supervision.

The following table summarizes, at the maximum of the offering range, the total number and value of the shares of common stock that the employee stock ownership plan expects to acquire and the total value of all restricted stock awards and stock options that are expected to be available under the new equity incentive plan. At the maximum of the offering range, we will sell 4,456,250 shares and have 7,478,380 shares outstanding. The number of shares reflected for the benefit plans in the table below assumes that the new equity incentive plan is implemented within 12 months following completion of the conversion and the application of the net proceeds as described under “Use of Proceeds.”

| Number of Shares to be Granted or Purchased | Dilution Resulting from Issuance of Additional Shares |

Total Estimated Value |

||||||||||||||||||

| (Dollars in thousands) |

At Maximum of Offering Range |

As a % of Common Stock Sold |

As a % of Common Stock Outstanding |

|||||||||||||||||

| Employee stock ownership plan (1) |

267,375 | 6.00 | % | 3.58 | % | — | % | $ | 2,139 | |||||||||||

| Restricted stock awards (1) |

140,327 | 3.15 | 1.88 | 1.84 | 1,123 | |||||||||||||||

| Stock options (2) |

350,818 | 7.87 | 4.69 | 4.48 | 624 | |||||||||||||||

| Total |

758,520 | 17.02 | % | 10.14 | % | 6.16 | $ | 3,886 | ||||||||||||

| (1) | Assumes the value of New Naugatuck Valley Financial common stock is $8.00 per share for determining the total estimated value. |

| (2) | Assumes the value of a stock option is $1.78. See “Pro Forma Data.” |

10

Table of Contents

We may fund our plans through open market purchases, as opposed to new issuances of common stock; however, if any options previously granted under our 2005 Equity Incentive Plan are exercised during the first year following completion of the offering, they will be funded with newly-issued shares as Office of Thrift Supervision regulations do not permit us to repurchase our shares during the first year following the completion of this offering except to fund the grants of restricted stock under the equity incentive plan or, with prior regulatory approval, under extraordinary circumstances. The Office of Thrift Supervision has previously advised that the exercise of outstanding options and cancellation of treasury shares in the conversion will not constitute an extraordinary circumstance or a compelling business purpose for satisfying this test.

The following table presents information regarding our existing employee stock ownership plan, options and restricted stock previously awarded or available for future awards under our 2005 Equity Incentive Plan, additional shares purchased by our employee stock ownership plan, and our proposed new equity incentive plan. The table below assumes that 7,478,380 shares are outstanding after the offering, which includes the sale of 4,456,250 shares in the offering at the maximum of the offering range and the issuance of 3,022,130 shares in exchange for shares of Naugatuck Valley Financial using an exchange ratio of 1.0655. It is also assumed that the value of the stock is $8.00 per share. The number of shares reflected for the benefit plans in the table below assumes that the new equity incentive plan is implemented within 12 months following completion of the conversion.

| Existing and New Stock Benefit Plans |

Eligible Participants | Number of Shares at Maximum of Offering Range |

Estimated Value of Shares |

Percentage of Shares Outstanding After the Offering |

||||||||||||

| (Dollars in thousands) |

||||||||||||||||

| Employee Stock Ownership Plan: |

Employees | |||||||||||||||

| Shares purchased in 2004 offering (1) |

317,616 | (2) | $ | 2,541 | 4.25 | % | ||||||||||

| Shares to be purchased in this offering |

267,375 | 2,139 | 3.58 | % | ||||||||||||

| Total employee stock ownership plan |

584,991 | $ | 4,680 | 7.83 | % | |||||||||||

| Restricted Stock Awards: |

Directors and employees | |||||||||||||||

| 2005 Equity Incentive Plan (1) |

158,809 | (3) | $ | 1,270 | (4) | 2.12 | % | |||||||||

| New shares of restricted stock |

140,327 | 1,123 | (4) | 1.88 | % | |||||||||||

| Total shares of restricted stock |

299,136 | $ | 2,393 | 4.00 | % | |||||||||||

| Stock Options: |

Directors and employees | |||||||||||||||

| 2005 Equity Incentive Plan (1) |

397,020 | (5) | $ | 913 | (6) | 5.31 | % | |||||||||

| New stock options |

350,818 | 624 | (7) | 4.69 | % | |||||||||||

| Total stock options |

747,838 | $ | 1,537 | 10.00 | % | |||||||||||

| Total stock benefit plans |

1,631,964 | $ | 8,610 | 21.83 | % | |||||||||||

| (1) | Number of shares has been adjusted for the 1.0655 exchange ratio at the maximum of the offering range. |

| (2) | As of December 31, 2010, of these shares, 132,574 (124,425 before adjustment) have been allocated to the accounts of participants and 185,041 (173,666 before adjustment) remain unallocated. |

| (3) | As of December 31, 2010, of these shares, 155,266 (145,722 before adjustment) have been awarded and 3,542 (3,324 before adjustment) remain available for future awards. As of December 31, 2010, awards covering 142,822 shares have vested and the shares have been distributed. |

| (4) | The actual value of restricted stock grants will be determined based on their fair value as of the date grants are made. For purposes of this table, fair value is assumed to be the same as the offering price of $8.00 per share. |

| (5) | As of December 31, 2010, of these shares, options for 347,928 shares (326,540 shares before adjustment) have been awarded and options for 49,091 shares (46,074 shares before adjustment) remain available for future grants. As of December 31, 2010, 240 options had been exercised. |

| (6) | The fair value of stock options granted and outstanding under the 2005 Equity Incentive Plan has been estimated using the Black-Scholes option pricing model. Before the adjustment for the exchange ratio, there were 326,300 outstanding options with a weighted average fair value of $2.46 per option. Using this value and adjusting for the exchange ratio at the maximum of the offering range, the fair value of stock options granted or available for grant under the 2005 Equity Incentive Plan has been estimated at $2.45 per option. |

11

Table of Contents

| (7) | For purposes of this table, the fair value of stock options to be granted under the new equity incentive plan has been estimated at $1.78 per option using the Black-Scholes option pricing model with the following assumptions: exercise price, $8.00; trading price on date of grant, $8.00; dividend yield, 1.50%; expected life, 7 years; expected volatility, 19.30%; and risk-free interest rate, 3.04%. |

Purchases by Directors and Executive Officers (page 110)

We expect that our directors and executive officers, together with their associates, will subscribe for approximately 65,875 shares, which is 2.0% of the minimum of the offering range. Our directors and executive officers will pay the same $8.00 per share price as everyone else who purchases shares in the offering. Like all of our depositors, our directors and executive officers have subscription rights based on their deposits and, in the event of an oversubscription, their orders will be subject to the allocation provisions set forth in our plan of conversion. Purchases by our directors and executive officers will count towards the minimum number of shares we must sell to close the offering.

All directors and executive officers, together with their associates, are expected to own, upon completion of the offering and the exchange, approximately 4.2% of our outstanding shares at the minimum of the offering range.

Market for New Naugatuck Valley Financial’s Common Stock (page 57)

Naugatuck Valley Financial common stock is listed on the Nasdaq Global Market under the symbol “NVSL.” We expect that New Naugatuck Valley Financial’s common stock will trade on the Nasdaq Global Market under the trading symbol “NVSLD” for a period of 20 trading days after the completion of the conversion and offering. Thereafter, the trading symbol will be “NVSL.” After shares of the common stock begin trading, you may contact a stock broker to buy or sell shares. There can be no assurance that persons purchasing the common stock in the offering will be able to sell their shares at or above the $8.00 offering price, and brokerage firms typically charge commissions related to the purchase or sale of securities.

Naugatuck Valley Financial’s Dividend Policy (page 56)

Naugatuck Valley Financial has paid quarterly cash dividends since the first quarter of 2005. For the quarter ended December 31, 2010, the quarterly cash dividend was $0.03 per share, which equals $0.12 per share on an annualized basis. After the conversion and offering, we expect to pay a quarterly cash dividend of $0.03 per share, or $0.12 per share on an annualized basis, at all levels of the offering range. This represents an annual dividend yield of 1.5% at all levels of the offering range based on a stock price of $8.00 per share. However, the dividend rate and the continued payment of dividends will depend on a number of factors, including our capital requirements and alternative uses for capital, our financial condition and results of operations, tax considerations, statutory and regulatory limitations and general economic conditions. No assurance can be given that we will continue to pay dividends or that they will not be reduced or eliminated in the future.

Dissenters’ Rights

Shareholders of Naugatuck Valley Financial do not have dissenters’ rights in connection with the conversion and offering.

Differences in Shareholder Rights

As a result of the conversion, shareholders of Naugatuck Valley Financial will become shareholders of New Naugatuck Valley Financial. The rights of shareholders of New Naugatuck Valley Financial will be less than the rights shareholders currently have. The decrease in shareholder rights results from differences between the articles of incorporation and bylaws of New Naugatuck Valley Financial and the charter and bylaws of Naugatuck Valley Financial and from distinctions between Maryland and federal law. The differences in shareholder rights under the articles of incorporation and bylaws of New Naugatuck Valley Financial are not mandated by Maryland law but have been chosen by management as being in the best interests of the corporation and all of its shareholders. However, the provisions in New Naugatuck Valley Financial’s articles of incorporation and bylaws may make it more difficult to pursue a takeover attempt that management opposes. These provisions will also make the removal of the board of directors or management, or the appointment of new directors, more difficult.

12

Table of Contents

The differences in shareholder rights include the following:

| • | supermajority voting requirements for certain business combinations and changes to some provisions of the articles of incorporation and bylaws; |

| • | limitation on the right to vote shares; |

| • | a majority of shareholders required to call annual meetings of shareholders; and |

| • | greater lead time required for shareholders to submit business proposals or director nominations. |

Tax Consequences (page 118)

As a general matter, the conversion will not be a taxable transaction for purposes of federal or state income taxes to us or to persons who receive or exercise subscription rights. Existing shareholders of Naugatuck Valley Financial who receive cash in lieu of fractional share interests in shares of New Naugatuck Valley Financial will recognize gain or loss equal to the difference between the cash received and the tax basis of the fractional share. Kilpatrick Townsend & Stockton LLP and Whittlesey & Hadley, P.C. have issued us opinions to this effect.

Questions

Questions about voting may be directed to our proxy information agent, Phoenix Advisory Partners, at 1-(877) 265-2368.

13

Table of Contents

You should consider carefully the following risk factors when deciding how to vote on the conversion and before purchasing shares of New Naugatuck Valley Financial common stock.

Risks Related to Our Business

Our portfolio of loans with a higher risk of loss have increased recently and may increase further as a result of our continued origination of commercial loans.