(Name and address of agent for service)

PARTNERS GROUP PRIVATE EQUITY (INSTITUTIONAL TEI), LLC

(a Delaware Limited Liability Company)

Semi-Annual Report

For the Six Months Ended September 30, 2015

(Unaudited)

(Including the Consolidated Financial Statements of

Partners Group Private Equity (Master Fund), LLC)

Partners Group Private Equity (Institutional TEI), LLC

(a Delaware Limited Liability Company)

Table of Contents

For the Six Months Ended September 30, 2015 (Unaudited)

|

Consolidated Statement of Assets, Liabilities and Members' Equity |

1 |

|

Consolidated Statement of Operations |

2 |

|

Consolidated Statements of Changes in Members' Equity |

3 |

|

Consolidated Statement of Cash Flows |

4 |

|

Consolidated Financial Highlights |

5 |

|

Notes to Consolidated Financial Statements |

6-11 |

|

Other Information |

12 |

|

Consolidated Financial Statements of Partners Group Private Equity (Master Fund), LLC |

Appendix I |

Partners Group Private Equity (Institutional TEI), LLC

(a Delaware Limited Liability Company)

Consolidated Statement of Assets, Liabilities and Members’ Equity –

September 30, 2015 (Unaudited)

|

Assets |

||||

|

Investment in Partners Group Private Equity (Master Fund), LLC, at fair value (cost $116,894,472) |

$ |

135,132,892 |

||

|

Receivable for interests repurchased by Partners Group Private Equity (Master Fund), LLC |

972,676 |

|||

|

Receivable from Adviser |

29,122 |

|||

|

Withholding taxes receivable |

17,882 |

|||

|

Interest receivable |

40 |

|||

|

Prepaid assets |

648 |

|||

|

Total Assets |

$ |

136,153,260 |

||

|

Liabilities |

||||

|

Repurchase amounts payable |

$ |

972,817 |

||

|

Professional fees payable |

10,500 |

|||

|

Accounting and administration fees payable |

5,879 |

|||

|

Custodian fees payable |

800 |

|||

|

Other expenses payable |

1,486 |

|||

|

Total Liabilities |

$ |

991,482 |

||

|

Members' Equity |

$ |

135,161,778 |

||

|

Members' Equity consists of: |

||||

|

Members' Equity Paid-in |

$ |

119,205,074 |

||

|

Accumulated net investment income |

1,302,012 |

|||

|

Accumulated net realized gain on investments, forward foreign currency contracts and foreign currency translation |

11,999,433 |

|||

|

Accumulated net unrealized appreciation on investments, forward foreign currency contracts and foreign currency translation |

4,478,793 |

|||

|

Accumulated Adviser's Incentive Allocation |

(1,823,534 |

) |

||

|

Total Members' Equity |

$ |

135,161,778 |

||

|

Number of Outstanding Units |

9,099,330 |

|||

|

Net Asset Value per Unit |

$ |

14.8540 |

||

The accompanying notes are an integral part of these Consolidated Financial Statements.

1

Partners Group Private Equity (Institutional TEI), LLC

(a Delaware Limited Liability Company)

Consolidated Statement of Operations –

For the Six Months Ended September 30, 2015 (Unaudited)

|

Fund Investment Income |

$ |

129 |

||

|

Fund Operating Expenses |

||||

|

Accounting and administration fees |

32,715 |

|||

|

Professional fees |

7,000 |

|||

|

Custodian fees |

2,400 |

|||

|

Registration fees |

2,198 |

|||

|

Withholding tax |

26,882 |

|||

|

Other expenses |

11,842 |

|||

|

Total Operating Expenses |

83,037 |

|||

|

Investment Income Allocated from Partners Group Private Equity (Master Fund), LLC |

||||

|

Investment Income |

1,081,404 |

|||

|

Expenses |

(729,270 |

) |

||

|

Total Investment Income Allocated from Partners Group Private Equity (Master Fund), LLC |

352,134 |

|||

|

Net Investment Income |

269,226 |

|||

|

Net Realized Gain and Change in Unrealized Depreciation on Investments, Forward Foreign Currency Contracts and Foreign Currency Allocated from Partners Group Private Equity (Master Fund), LLC |

||||

|

Net realized gain from investments and forward foreign currency contracts |

3,301,115 |

|||

|

Net realized gain on foreign currency translation |

8,482 |

|||

|

Net realized gain distributions from primary and secondary investments |

2,269,185 |

|||

|

Net change in accumulated unrealized depreciation on investments, forward foreign currency contracts and foreign currency translation |

(331,049 |

) |

||

|

Net Realized Gain and Change in Unrealized Depreciation on Investments, Forward Foreign Currency Contracts and Foreign Currency Allocated from Partners Group Private Equity (Master Fund), LLC |

5,247,733 |

|||

|

Adviser's Incentive Allocation Allocated from Partners Group Private Equity (Master Fund), LLC |

(559,916 |

) |

||

|

Net Increase in Members' Equity from Operations |

$ |

4,957,043 |

The accompanying notes are an integral part of these Consolidated Financial Statements.

2

Partners Group Private Equity (Institutional TEI), LLC

(a Delaware Limited Liability Company)

Consolidated Statements of Changes in Members’ Equity –

For the Periods Ended March 31, 2015 and September 30, 2015 (Unaudited)

|

Members’ |

||||

|

Members' Equity at March 31, 2014* |

$ |

35,163,730 |

||

|

Capital contributions |

42,056,991 |

|||

|

Capital tenders |

(1,210,996 |

) |

||

|

Net investment income |

574,479 |

|||

|

Net realized gain from investments and forward foreign currency contracts |

1,370,212 |

|||

|

Net realized gain distributions from primary and secondary investments |

3,105,698 |

|||

|

Net change in accumulated unrealized appreciation on investments, forward foreign currency contracts and foreign currency translation |

2,863,231 |

|||

|

Adviser's Incentive Allocation |

(805,833 |

) |

||

|

Members' Equity at March 31, 2015 |

$ |

83,117,512 |

||

|

Capital contributions |

48,314,122 |

|||

|

Capital tenders |

(1,226,899 |

) |

||

|

Net investment income |

269,226 |

|||

|

Net realized gain from investments and forward foreign currency contracts |

3,301,115 |

|||

|

Net realized gain on foreign currency translation |

8,482 |

|||

|

Net realized gain distributions from primary and secondary investments |

2,269,185 |

|||

|

Net change in accumulated unrealized depreciation on investments, forward foreign currency contracts and foreign currency translation |

(331,049 |

) |

||

|

Adviser's Incentive Allocation |

(559,916 |

) |

||

|

Members' Equity at September 30, 2015 |

$ |

135,161,778 |

||

|

Units outstanding at March 31, 2014* |

2,779,208 |

|||

|

Units sold* |

3,192,095 |

|||

|

Units repurchased |

(92,500 |

) |

||

|

Units outstanding at March 31, 2015* |

5,878,803 |

|||

|

Units sold |

3,303,431 |

|||

|

Units repurchased |

(82,904 |

) |

||

|

Units outstanding at September 30, 2015 |

9,099,330 |

|||

|

* |

The item includes a correction of the misstatement for the year ended March 31, 2014. Refer to Note 7 in the Notes to Consolidated Financial Statements. |

The accompanying notes are an integral part of these Consolidated Financial Statements.

3

Partners Group Private Equity (Institutional TEI), LLC

(a Delaware Limited Liability Company)

Consolidated Statement of Cash Flows –

For the Six Months Ended September 30, 2015 (Unaudited)

|

CASH FLOWS FROM OPERATING ACTIVITIES |

||||

|

Net Increase in Members' Equity from Operations |

$ |

4,957,043 |

||

|

Adjustments to reconcile Net Increase in Members' Equity from Operations to net cash used in operating activities: |

||||

|

Purchases of interests in Partners Group Private Equity (Master Fund), LLC |

(47,058,101 |

) |

||

|

Net investment income allocated from Partners Group Private Equity (Master Fund), LLC |

(352,134 |

) |

||

|

Net realized gain from investments and forward foreign currency contracts allocated from Partners Group Private Equity (Master Fund), LLC |

(3,301,115 |

) |

||

|

Net realized gain on foreign currency translation allocated from Partners Group Private Equity (Master Fund), LLC |

(8,482 |

) |

||

|

Net realized gain distributions from primary and secondary investments allocated from Partners Group Private Equity (Master Fund), LLC |

(2,269,185 |

) |

||

|

Net change in accumulated unrealized depreciation on investments, forward foreign currency contracts and foreign currency translation allocated from Partners Group Private Equity (Master Fund), LLC |

451,369 |

|||

|

Adviser's Incentive Allocation allocated from Partners Group Private Equity (Master Fund), LLC |

559,916 |

|||

|

Increase in receivable for interests repurchased by Partners Group Private Equity (Master Fund), LLC |

(972,676 |

) |

||

|

Increase in receivable from Adviser |

(29,122 |

) |

||

|

Increase in withholding taxes receivable |

(17,882 |

) |

||

|

Increase in interest receivable |

(37 |

) |

||

|

Decrease in prepaid assets |

1,299 |

|||

|

Decrease in professional fees payable |

(7,000 |

) |

||

|

Decrease in accounting and administration fees payable |

(9,334 |

) |

||

|

Decrease in withholding taxes payable |

(3,001 |

) |

||

|

Decrease in other expenses payable |

(1,598 |

) |

||

|

Net Cash Used in Operating Activities |

(48,060,040 |

) |

||

|

CASH FLOWS FROM FINANCING ACTIVITIES |

||||

|

Members' capital contributions |

48,314,122 |

|||

|

Members' capital tenders |

(254,082 |

) |

||

|

Net Cash Provided by Financing Activities |

48,060,040 |

|||

|

Net change in cash and cash equivalents |

— |

|||

|

Cash and cash equivalents at beginning of period |

— |

|||

|

Cash and cash equivalents at End of Period |

$ |

— |

||

The accompanying notes are an integral part of these Consolidated Financial Statements.

4

Partners Group Private Equity (Institutional TEI), LLC

(a Delaware Limited Liability Company)

Consolidated Financial Highlights

|

Six Months Ended September 30, (Unaudited) |

Year Ended March 31, 2015 |

Year Ended March 31, |

Year Ended March 31, |

Period from Commencement of Operations - |

||||||||||||||||

|

Per Unit Operating Performance (1) |

||||||||||||||||||||

|

NET ASSET VALUE, BEGINNING OF PERIOD |

$ |

14.1385 |

$ |

12.6524 |

(2) |

$ |

11.21 |

$ |

10.26 |

(3) |

$ |

10.00 |

(3)(4) |

|||||||

|

INCOME FROM INVESTMENT OPERATIONS: |

||||||||||||||||||||

|

Net investment income (loss) |

(0.0326 |

) |

0.0108 |

0.10 |

0.05 |

(3) |

0.01 |

(3) |

||||||||||||

|

Net realized and unrealized gain on investments |

0.7481 |

1.4753 |

1.34 |

* |

0.90 |

(3) |

0.25 |

(3) |

||||||||||||

|

Net Increase in Members' Equity from Operations |

0.7155 |

1.4861 |

1.44 |

* |

0.95 |

(3) |

0.26 |

(3) |

||||||||||||

|

NET ASSET VALUE, END OF PERIOD |

$ |

14.8540 |

$ |

14.1385 |

$ |

12.65 |

* |

$ |

11.21 |

$ |

10.26 |

(3) |

||||||||

|

TOTAL RETURN (5) |

5.06 |

%(6) |

11.75 |

% |

12.85 |

%* |

9.26 |

% |

2.60 |

%(6) |

||||||||||

|

RATIOS AND SUPPLEMENTAL DATA: |

||||||||||||||||||||

|

Net Assets, end of period in thousands (000's) |

135,162 |

83,118 |

35,164 |

* |

12,026 |

5,130 |

||||||||||||||

|

Net investment income to average net assets, excluding Incentive Allocation |

0.54 |

%(7) |

0.94 |

% |

1.59 |

%* |

0.83 |

% |

0.35 |

%(7) |

||||||||||

|

Ratio of gross expenses to average net assets, excluding Incentive Allocation (8) |

1.63 |

%(7) |

1.79 |

% |

2.10 |

% |

2.89 |

% |

3.92 |

%(7)(9) |

||||||||||

|

Ratio of expense recoupment (waiver) to average net assets |

0.00 |

%(7) |

0.00 |

% |

0.28 |

%* |

(0.47 |

)% |

(1.97 |

)% |

||||||||||

|

Ratio of net expenses to average net assets, excluding Incentive Allocation (10) |

1.63 |

%(7) |

1.79 |

% |

2.38 |

%(11)* |

2.42 |

%(11) |

1.95 |

%(7)(9) |

||||||||||

|

Ratio of Incentive Allocation to average net assets |

0.56 |

%(6) |

1.32 |

% |

1.47 |

%* |

1.09 |

% |

0.94 |

%(7) |

||||||||||

|

Portfolio Turnover |

14.19 |

%(6) |

18.25 |

% |

26.84 |

%* |

15.47 |

% |

8.39 |

% |

||||||||||

|

* |

The item includes a correction due to the misstatement for the year ended March 31, 2014. Refer to Note 7 in the Notes to the Consolidated Financial Statements. |

|

(1) |

Selected data for a unit of membership interest outstanding throughout the period. |

|

(2) |

Effective February 28, 2015, the Fund chose to display a four digit net asset value per unit. |

|

(3) |

Adjusted for 100 for 1 change in units, effective October 1, 2012. |

|

(4) |

The net asset value for the beginning period December 1, 2011 (Commencement of Operations) through March 31, 2012 represents the initial contribution per unit of $10. |

|

(5) |

Total return based on per unit net asset value reflects the changes in net asset value based on the effects of the performance of the Fund during the period and assumes distribution, if any, were reinvested. |

|

(6) |

Not annualized. |

|

(7) |

Annualized. |

|

(8) |

Represents the ratio of expenses to average net assets absent fee waivers and/or expense reimbursement by/to the Adviser. |

|

(9) |

The organizational expenses are not annualized for the ratio calculation. |

|

(10) |

Effective September 26, 2011, the Fund’s expense ratio is voluntarily capped at 2.30%. See note 2.e. for a more thorough Expense Limitation Agreement discussion. |

|

(11) |

The Fund’s operating expenses include interest expense allocated from Partners Group Private Equity (Master Fund), LLC, and withholding tax, which are excluded from the Expense Limitation calculation. If interest expense and withholding tax were excluded from operating expenses, the net expense ratio would be 2.30%. |

The accompanying notes are an integral part of these Consolidated Financial Statements.

5

Partners Group Private Equity (Institutional TEI), LLC

(a Delaware Limited Liability Company)

Notes to Consolidated Financial Statements – September 30, 2015 (Unaudited)

1. Organization

Partners Group Private Equity (Institutional TEI), LLC (the “Fund”) invests substantially all of its assets in Partners Group Private Equity (Offshore II), LDC (the “Offshore Fund”). The Offshore Fund is a Cayman Islands limited duration company with the same investment objective as the Fund. The Offshore Fund serves solely as an intermediary entity through which the Fund invests in Partners Group Private Equity (Master Fund), LLC (the “Master Fund”). The Offshore Fund enables tax-exempt Members (as defined below) to invest without receiving certain income in a form that would otherwise be taxable to such tax-exempt Members regardless of their tax-exempt status. The Fund owns 100% of the participating beneficial interest of the Offshore Fund. Where these Notes to Consolidated Financial Statements discuss the Fund’s investment in the Master Fund, it means its investment in the Master Fund through the Offshore Fund.

The Fund was organized as a limited liability company under the laws of the State of Delaware on May 25, 2010 and commenced operations on December 1, 2011. The Fund is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a closed-end, non-diversified management investment company. The objective of the Fund is to seek attractive long-term capital appreciation by investing in a diversified portfolio of private equity investments. To achieve its objective, the Fund invests substantially all of its assets in limited liability company interests (“Interests”) in the Master Fund, a limited liability company organized under the laws of the State of Delaware, which is also registered under the 1940 Act. In addition to the Fund, three other closed-end, non-diversified investment companies also invest substantially all of their respective assets in Interests in the Master Fund (the Fund and each such other investment company, individually a “Feeder Fund” and collectively, the “Feeder Funds”). Collectively, the Feeder Funds own all of Interests in the Master Fund.

The Master Fund is managed by Partners Group (USA) Inc. (the “Adviser”), an investment adviser registered under the Investment Advisers Act of 1940, as amended. A board of managers (the “Board”) has overall responsibility for the management and supervision of the business operations of the Fund. The Board also acts as the board of managers of the Master Fund (the “Master Fund Board”) and of each of the other Feeder Funds. As permitted by applicable law, the Board may delegate any of its rights, powers and authority to, among others, the officers of the Fund, any committee of the Board, or the Adviser. Units of limited liability company interests in the Fund (“Units”) are offered only to investors that represent that they are an “accredited investor” within the meaning of Rule 501 under the Securities Act of 1933, as amended, and a “qualified client” within the meaning of Rule 205-3 under the Investment Advisers Act of 1940, as amended. Holders of Units (“Members”) do not own any direct interest in the Master Fund.

The Fund’s consolidated financial statements should be read in conjunction with the Master Fund’s consolidated financial statements, which are included as Appendix I.

At September 30, 2015, the Fund owned 9.41% of the Interests in the Master Fund.

2. Significant Accounting Policies

The Fund is an investment company. Accordingly, these financial statements have applied the guidance set forth in Accounting Standards Codification (“ASC”) 946, Financial Services—Investment Companies. The following is a summary of significant accounting and reporting policies used in preparing the consolidated financial statements.

a. Basis of Accounting

The Fund’s accounting and reporting policies conform with U.S. generally accepted accounting principles (“U.S. GAAP”).

b. Valuation of Investments

The Fund values its investment in the Master Fund at the net asset value of the Interests in the Master Fund owned by the Fund. The net asset value of the Interests in the Master Fund is determined by the Master Fund. Investments held by the Master Fund include direct equity and debt investments in operating companies (“Direct Investments”) and primary and secondary investments in private equity funds (“Private Equity Fund Investments”; Direct Investments and Private Equity Fund Investments, collectively, “Private Equity Investments”). The Master Fund values interests in Private Equity Investments at fair value in accordance with procedures (the “Valuation Procedures”), which have been approved by the Board and the Master Fund Board. The fair values of Private Equity Investments determined on behalf of the Master Fund by the Adviser in accordance with the Valuation Procedures are estimates. In the case of a Private Equity Fund Investment, the fair value is net of management and performance incentive fees or allocations that may be payable pursuant to the constituent documents of such Private Equity Fund Investments.

6

Partners Group Private Equity (Institutional TEI), LLC

(a Delaware Limited Liability Company)

Notes to Consolidated Financial Statements – September 30, 2015 (Unaudited) (continued)

2. Significant Accounting Policies (continued)

c. Allocations from the Master Fund

In accordance with U.S. GAAP, the Fund, as the holder of Interests in the Master Fund, records in its consolidated financial statements its allocated portion of income, expense, realized gains and losses and unrealized appreciation and depreciation in the Master Fund.

d. Fund Level Income and Expenses

Income, including interest income on any cash or cash equivalents held by the Fund, and expenses are recognized and recorded on an accrual basis. Expenses that are specifically attributed to the Fund are accrued and charged to the Fund. Although the Fund bears its proportionate share of the management fees paid by the Master Fund, the Fund pays no direct management fee to the Adviser.

e. Expense Limitation Agreement

Effective September 26, 2011, the Adviser entered into an expense limitation agreement (the “Expense Limitation Agreement”) with the Fund, whereby the Adviser has agreed to waive fees that it would otherwise be paid, and/or to assume expenses of the Fund (a “Waiver”), if required to ensure the Total Annual Expenses (excluding taxes, interest, brokerage commissions, certain transaction-related expenses, extraordinary expenses, the Incentive Allocation (as defined below) and any acquired fund fees and expenses) do not exceed 2.30% on an annualized basis (the “Expense Limit”). For a period not to exceed three years from the date on which a Waiver is made, the Adviser may recoup amounts waived or assumed, provided it is able to effect such recoupment and remain in compliance with the Expense Limit. The Expense Limitation Agreement may be terminated by the Adviser or the Fund upon thirty days’ written notice to the other party. As of September 30, 2015, there were no amounts waived or assumed that are subject for recoupment by Adviser.

f. Tax Basis Reporting

Because the Master Fund invests primarily in investments that are treated as partnerships for U.S. federal income tax purposes, the tax character of the Fund’s allocated earnings depends on the tax filings of the Private Equity Investments. Accordingly, the tax bases of these allocated earnings and the related balances are not available as of the reporting date.

g. Income Taxes

For U.S. federal income tax purposes, the Fund is treated as a partnership, and each Member is treated as the owner of its allocated share of the net assets, income, expenses, and the realized and unrealized gains (losses) of the Fund. Accordingly, no U.S. federal, state or local income taxes are paid by the Fund on the income or gains of the Fund since the Members are individually liable for the taxes on their allocated share of such income or gains of the Fund.

The Adviser determines whether a tax position of the Fund is more likely than not to be sustained upon examination, including resolution of any related appeals or litigation processes, based on the technical merits of the position. For tax positions meeting the more likely than not threshold, the tax amount recognized in the consolidated financial statements is reduced by the largest benefit that has a greater than fifty percent likelihood of being realized upon ultimate settlement with the relevant taxing authority.

The Fund files tax returns as prescribed by the tax laws of the jurisdictions in which it operates. In the normal course of business, the Fund is subject to examination by U.S. federal, state, local and foreign jurisdictions, where applicable. As of September 30, 2015, the tax years from the year 2011 forward remain subject to examination by the major tax jurisdictions under the statute of limitations.

The Fund, through its investment in the Offshore Fund, may be subject to a withholding of U.S. federal tax at a 30% rate on its allocable share of the Master Fund’s U.S.-source dividend income and other U.S.-source fixed or determinable annual or periodic gains, profits, or income as defined in Section 881(a) of the Internal Revenue Code of 1986, as amended, other than most forms of interest income as disclosed on the Consolidated Statement of Assets, Liabilities and Members’ Equity and the Consolidated Statement of Operations.

7

Partners Group Private Equity (Institutional TEI), LLC

(a Delaware Limited Liability Company)

Notes to Consolidated Financial Statements – September 30, 2015 (Unaudited) (continued)

2. Significant Accounting Policies (continued)

h. Cash and Cash Equivalents

Pending investment in the Master Fund, the Fund holds cash and cash equivalents including amounts held in interest bearing deposit accounts. At times, those amounts may exceed federally insured limits. The Fund has not experienced any losses in such accounts and does not believe that it is exposed to any significant credit risk on such accounts.

i. Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires that management makes estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements, and the reported amounts of increases and decreases in Members’ capital from operations during the reporting period. Actual results can differ from those estimates.

j. Consolidated Financial Statements

The asset, liability and equity accounts of the Fund are consolidated with the Offshore Fund as presented in the Consolidated Statement of Assets, Liabilities and Members’ Equity. All significant intercompany accounts and transactions have been eliminated in consolidation.

k. Recently Issued Accounting Pronouncement

In May 2015, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2015-7, Disclosures for Investments in Certain Entities That Calculate Net Asset Value per Share (or Its Equivalent), modifying ASC 946 Financial Services – Investment Companies. Under the modifications, investments in affiliated and private investment funds valued at NAV are no longer included in the fair value hierarchy. ASU 2015-7 is effective for fiscal years beginning on or after December 15, 2015, and interim periods within those annual periods. Early application is permitted. Management is currently evaluating the implications of ASU 2015-7 and its impact on financial statements disclosures.

3. Fair Value Measurements

The Fund records its investment in the Master Fund at the net asset value of the Interests in the Master Fund owned by the Fund. The Master Fund’s disclosure with respect to investments held by the Master Fund under the three-tier hierarchy is discussed in the Notes to the Master Fund’s consolidated financial statements.

4. Allocation to Members’ Capital Accounts

Net profits or net losses of the Fund for each Allocation Period (as defined below) are allocated among and credited to or debited against the Members’ capital accounts in proportion to the number of Units owned by Members. Each Allocation Period begins on the day after the last day of the preceding Allocation Period and ends at the close of business on the first to occur thereafter of: (1) the last day of a calendar month, (2) the last day of a taxable year, (3) the day preceding a day on which Units are purchased, (4) a day on which Units are repurchased by the Fund pursuant to tenders of Units by Members or (5) a day on which any amount is credited to or debited from the capital account of any Member other than an amount to be credited to or debited from the capital accounts of all Members in accordance with their respective investment percentages.

The Fund maintains a separate capital account in its records for each Member. As of any date, the capital account balance of a Member is equal to the net asset value per Unit as of such date, multiplied by the number of Units held by such Member. Any amounts charged or debited against a Member’s capital account under the Fund’s ability to allocate special items and to accrue reserves (other than among all Members in accordance with the number of Units held by each Member) are treated as a partial repurchase of such Member’s Units for no additional consideration as of the date on which the Board determines such charge or debit is required to be made. Additionally, such Member’s Units are reduced thereby as appropriately determined by the Fund. Any amounts credited to a Member’s capital account under the Fund’s ability to allocate special items and to accrue reserves (other than among all Members in accordance with the number of Units held by each such Member) are treated as an issuance of additional Units to such Member for no additional consideration as of the date on which the Board determines such credit is required to be made. Additionally, such Member’s Units are increased thereby as appropriately determined by the Fund. As of September 30, 2015, there have been no special items or accrued receivables allocated to Members’ capital accounts.

8

Partners Group Private Equity (Institutional TEI), LLC

(a Delaware Limited Liability Company)

Notes to Consolidated Financial Statements – September 30, 2015 (Unaudited) (continued)

5. Subscriptions and Repurchase of Units

Units are generally offered for purchase as of the first day of each calendar month, but may be offered more or less frequently as determined by the Board in its sole discretion.

The Board may, from time to time and in its sole discretion, cause the Fund to repurchase Units from Members pursuant to written tenders by Members at such times and on such terms and conditions as established by the Board. In determining whether the Fund should offer to repurchase Units, the Board considers whether the Master Fund is making a contemporaneous repurchase offer for Interests in the Master Fund, as well as a variety of other operational, business and economic factors. The Adviser anticipates recommending to the Master Fund Board that, under normal circumstances, the Master Fund conduct repurchase offers of no more than 5% of the Master Fund’s net assets quarterly on or about each January 1st, April 1st, July 1st and October 1st. It is anticipated that the Fund will generally conduct repurchase offers contemporaneously with repurchase offers conducted by the Master Fund. A 2.00% early repurchase fee will be charged by the Fund with respect to any repurchase of Units from a Member at any time prior to the day immediately preceding the first anniversary of the Member’s purchase of such Units.

6. Related Party Transactions and Other

An incentive allocation (“Incentive Allocation”) is calculated at the Master Fund and allocated to the Fund based on the Fund’s ownership of Interests in the Master Fund. The Incentive Allocation is equal to 10% of the excess, if any, of (i) the allocable share of the net profits of the Master Fund for the relevant period of each member of the Master Fund, including the Fund, over (ii) the then balance, if any, of that member’s Loss Recovery Account (as defined below). The Incentive Allocation is debited from such member’s capital account and credited to a capital account of the Adviser (or, to the extent permitted by applicable law, of an affiliate of the Adviser) in the Master Fund (the “Incentive Allocation Account”). The Incentive Allocation Account is maintained solely for the purpose of allocating the Incentive Allocation, and thus, the Incentive Allocation Account does not participate in the net profits and losses of the Master Fund.

The Master Fund maintains a memorandum account for each member of the Master Fund, including the Fund (each, a “Loss Recovery Account”). Each member’s Loss Recovery Account has an initial balance of zero and is (i) increased upon the close of each Allocation Period of the Master Fund by the amount of the relevant member’s allocable share of the net losses of the Master Fund for the Allocation Period, and (ii) decreased (but not below zero) upon the close of such Allocation Period by the amount of such member’s allocable share of the net profits of the Master Fund for the Allocation Period. The Incentive Allocation is calculated, charged to each member of the Master Fund and credited to the Incentive Allocation Account as of the end of each Allocation Period. The Allocation Period for a member whose Interest in the Master Fund is repurchased or is transferred in part is treated as ending only for the portion of the Interest so repurchased or transferred. In addition, only the net profits of the Master Fund, if any, and the balance of the Loss Recovery Account attributable to the portion of the Interest being repurchased or transferred (based on the member’s capital account amount being so repurchased or transferred) is taken into account in determining the Incentive Allocation for the Allocation Period then ending. The member’s Loss Recovery Account is not adjusted for such member’s allocable share of the net losses of the Master Fund, if any, for the Allocation Period then ending that are attributable to the portion of the Interest so repurchased or transferred. For the six month period ended September 30, 2015, an Incentive Allocation of $559,916 was credited to the Incentive Allocation Account from the Fund’s capital account in the Master Fund.

UMB Fund Services, Inc. (the “Administrator”) serves as administrator and accounting agent to the Fund and provides certain accounting, record keeping and investor related services. For these services the Administrator receives a fixed monthly fee, based upon average net assets, and a monthly fee based on the number of Member accounts as well as reasonable out of pocket expenses. For the six month period ended September 30, 2015, the Fund paid $32,715 in administration and accounting fees.

9

Partners Group Private Equity (Institutional TEI), LLC

(a Delaware Limited Liability Company)

Notes to Consolidated Financial Statements – September 30, 2015 (Unaudited) (continued)

7. Correction of an Error

During 2015, the Adviser discovered an error at the Master Fund relating to the overstatement in the valuation of one of the Master Fund’s Secondary Investments included in the prior year financial statements. The error impacted the Fund’s investment in the Master Fund in the amount of $202,498 and also impacted the allocations of income and loss from the Master Fund. See Note 11 of the Master Fund’s financial statements for a description of the errors at the Master Fund. The Adviser evaluated the impact of the errors at the Fund and concluded that they were not material to the Fund’s 2014 financial statements taken as a whole. However, the Fund’s management elected to revise the 2014 financial statements of the Fund in order to properly present the amounts in the correct period. As the prior period financial statements are not presented herein, an adjustment to the Fund’s members’ equity at March 31, 2014 in the amount of $202,498 has been recorded to reflect the impact of the errors.

The Fund’s Financial Highlights were impacted by the error as follows:

|

|

Year Ended March 31, 2014 (As Presented) |

Year Ended March 31, 2014 (Revised) |

||||||

|

Net realized and unrealized gain on investments |

1.42 |

1.34 |

||||||

|

Net Increase in Members’ Equity from Operations |

1.52 |

1.44 |

||||||

|

Net Asset Value, End of Period |

$ |

12.73 |

$ |

12.65 |

||||

|

Total Return |

13.56 |

% |

12.85 |

% |

||||

|

Net Assets, end of period in thousands (000's) |

$ |

35,366 |

$ |

35,164 |

||||

|

Net investment income to average net assets, excluding Incentive Allocation |

1.58 |

% |

1.59 |

% |

||||

|

Ratio of expense recoupment (waiver) to average net assets |

.27 |

% |

.28 |

% |

||||

|

Ratio of net expenses to average net assets, excluding Incentive Allocation |

2.37 |

% |

2.38 |

% |

||||

|

Ratio of Incentive Allocation to average net assets |

1.56 |

% |

1.47 |

% |

||||

|

Portfolio Turnover |

26.77 |

% |

26.84 |

% |

||||

Note that the impact of the error on the Financial Highlights ratios has been disclosed in the Fund’s Consolidated Financial Highlights.

8. Risk Factors

An investment in the Fund involves significant risks that should be carefully considered prior to investment and should only be considered by persons financially able to maintain their investment and who can afford a loss of a substantial part or all of such investment. The Master Fund invests substantially all of its available capital in Private Equity Investments. These investments are generally restricted securities that are subject to substantial holding periods and are not traded in public markets. As a result, the Master Fund may not be able to resell some of its holdings for extended periods, which may be several years. No guarantee or representation is made that the Fund’s investment objective will be met.

A further discussion of the risks associated with the Fund’s investment in the Master Fund is provided in Note 12 of the Notes to the Master Fund’s consolidated financial statements, the Fund’s Confidential Private Placement Memorandum and the Fund’s Statement of Additional Information.

10

Partners Group Private Equity (Institutional TEI), LLC

(a Delaware Limited Liability Company)

Notes to Consolidated Financial Statements – September 30, 2015 (Unaudited) (continued)

9. Indemnification

In the normal course of business, the Fund enters into contracts that may provide general indemnification. The Fund’s maximum exposure under these agreements is dependent on future claims that may be made against the Fund under such agreements, and therefore, cannot be established; however, based on management’s experience, the risk of loss from such claims is considered remote.

10. Subsequent Events

Management has evaluated the impact of all subsequent events on the Fund and has determined that there were no subsequent events that require disclosure in the consolidated financial statements

11

Partners Group Private Equity (Institutional TEI), LLC

(a Delaware Limited Liability Company)

Other Information (Unaudited)

Proxy Voting

The Fund is required to file Form N-PX, with its complete proxy voting record for the twelve months ended June 30, no later than August 31. The Fund’s Form N-PX filing is available: (i) without charge, upon request, by calling the Fund at 1-877-748-7209 or (ii) by visiting the SEC’s website at www.sec.gov.

Availability of Quarterly Portfolio Schedules

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q is available, without charge and upon request, on the SEC’s website at www.sec.gov or may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the Public Reference Room may be obtained by calling 1-800-SEC-0330.

12

PARTNERS GROUP PRIVATE EQUITY (MASTER FUND), LLC

(a Delaware Limited Liability Company)

Semi-Annual Report

For the Six Months Ended September 30, 2015

(Unaudited)

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Table of Contents

For the Six Months Ended September 30, 2015 (Unaudited)

|

Consolidated Schedule of Investments |

1-6 |

|

Consolidated Statement of Assets, Liabilities and Members' Equity |

7 |

|

Consolidated Statement of Operations |

8 |

|

Consolidated Statements of Changes in Members' Equity |

9 |

|

Consolidated Statement of Cash Flows |

10 |

|

Consolidated Financial Highlights |

11 |

|

Notes to Consolidated Financial Statements |

12-21 |

|

Other Information |

22 |

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Consolidated Schedule of Investments –

September 30, 2015 (Unaudited)

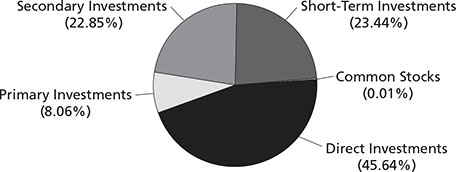

INVESTMENT PORTFOLIO AS A PERCENTAGE OF TOTAL MEMBERS’ EQUITY

Percentages as a percentage of total investments are as follows:

|

Private Equity Investments (73.91%) Direct Investments * (44.07%) Direct Equity (26.29%) |

Investment Type |

Geographic |

Fair |

|||

|

Action Holding BV a |

Common equity |

Western Europe |

$ |

519,470 |

||

|

Apollo Overseas Co-Investors (MHE), L.P. a |

Limited partnership interest |

North America |

8,023,400 |

|||

|

Astorg Co-Invest Kerneos, FCPI a, c |

Common equity |

Western Europe |

11,396,478 |

|||

|

Aurora Products Group, LLC a |

Member interest |

North America |

18,518 |

|||

|

CapitalSpring Finance Company a, c |

Common equity |

North America |

502,367 |

|||

|

Carlyle Retail Turkey Partners, L.P. a, c |

Limited partnership interest |

South America |

5,970,028 |

|||

|

CCM Pharma Debtco Limited a |

Common equity |

Western Europe |

2,199,473 |

|||

|

CD&R Univar Co-Investor, L.P. a, c |

Limited partnership interest |

North America |

2,040,445 |

|||

|

Centauro Co-Investment Fund, L.P. a, c |

Limited partnership interest |

South America |

3,444,759 |

|||

|

CT Holdings (International) Limited a |

Common equity |

Asia - Pacific |

3,886,736 |

|||

|

DLJSAP BookCO, LLC a, c |

Member interest |

South America |

661,041 |

|||

|

EQT Marvin Co-Investment, L.P. a, c |

Limited partnership interest |

Western Europe |

1,978,388 |

|||

|

Eurodrip Co-Investment Fund I, L.P. a, c |

Limited partnership interest |

Western Europe |

8,662,637 |

|||

|

Faster S.p.A. a, c |

Common equity |

Western Europe |

15,400,647 |

|||

|

Fermo Limited a, c |

Common equity |

Asia - Pacific |

7,048,721 |

|||

|

Fermo Limited a, c |

Preferred equity |

Asia - Pacific |

2,825,461 |

|||

|

Gemini Global Holdings Investors, LLC a, c |

Member interest |

North America |

3,588,193 |

|||

|

Genoa Holding Company, Inc. a, c |

Common equity |

North America |

272,184 |

|||

|

Globetrotter Investment & Co S.C.A. a, c |

Common equity |

Western Europe |

3,348,398 |

|||

|

Globetrotter Investment & Co S.C.A. a |

Preferred equity |

Western Europe |

8,537,467 |

|||

|

GTS II Cayman Corporation a, c |

Common equity |

South America |

4,126,095 |

|||

|

Hercules Achievement Holdings, Inc./Hercules VB Holdings, Inc. a |

Common equity |

North America |

13,521,912 |

|||

|

Hogan S.ar.l a, c |

Common equity |

Western Europe |

1 |

|||

|

Hogan S.ar.l a, c |

Preferred equity |

Western Europe |

999,728 |

|||

|

Kahuna Holdco Pty Limited a |

Common equity |

Asia - Pacific |

751,069 |

|||

|

KKBS Group Holdings, LLC a, c |

Member interest |

North America |

10,599 |

|||

|

KKBS Holdings, LLC a, c |

Member interest |

North America |

5,537 |

|||

|

KKR Matterhorn Co-Invest, L.P. a, c |

Limited partnership interest |

Western Europe |

8,752,911 |

|||

|

KLFS Holdings, L.P. a, c |

Limited partnership interest |

North America |

1,688,827 |

|||

|

KOUS Holdings, Inc. a, c |

Common equity |

North America |

10,950,000 |

|||

|

Learning Care Group (US), Inc. a, c |

Warrants |

North America |

12,012 |

|||

|

LTS Group Holdings, LLC a, c |

Member interest |

North America |

19,101,553 |

|||

|

Mauritius (Luxembourg) Investments S.ar.l. a, c |

Common equity |

Western Europe |

1,665,642 |

|||

|

MPH Acquisition Holdco, L.P. a, c |

Limited partnership interest |

North America |

43,058,111 |

|||

|

NDES Holdings, LLC a, c |

Member interest |

North America |

2,996,008 |

|||

|

NTS Holding Corporation, Inc. a, c |

Common equity |

North America |

3,615,583 |

|||

|

Peer I S.A. a, c |

Common equity |

Western Europe |

23,303,856 |

|||

|

QoL Healthcare Company, LLC a, c |

Member interest |

North America |

15,750,000 |

|||

|

QoL meds Holding Company, LLC a, c |

Member interest |

North America |

353,485 |

|||

|

R&R Co-Invest FCPR a, c |

Common equity |

Western Europe |

16,816,044 |

|||

|

Sabre Industries, Inc. a, c |

Common equity |

North America |

1,282,770 |

|||

The accompanying notes are an integral part of these Consolidated Financial Statements.

1

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Consolidated Schedule of Investments –

September 30, 2015 (Unaudited) (continued)

|

Private Equity Investments (continued) Direct Investments * (continued) Direct Equity (continued) |

Investment Type |

Geographic |

Fair |

|||

|

Silver Lake Sumeru Marlin Co-Invest Fund, L.P. a, c |

Limited partnership interest |

North America |

$ |

3,389,667 |

||

|

S-Evergreen Holding Corp. a, c |

Common equity |

North America |

264,977 |

|||

|

Snack Parent Corporation a, c |

Preferred equity |

North America |

25,868 |

|||

|

SPH GRD Acquisition Partners, LLC a, c |

Member interest |

North America |

14,222,528 |

|||

|

Spring Topco, Ltd. a, c |

Common equity |

North America |

434,278 |

|||

|

Strategic Partners, Inc. a |

Common equity |

North America |

7,107,389 |

|||

|

Surgery Center Holdings, Inc. a |

Warrants |

North America |

248,596 |

|||

|

Svensk Utbildning Intressenter Holding AB a, c |

Common equity |

Western Europe |

286,306 |

|||

|

Swissport II Co-Invest FCPR a, c |

Common equity |

Western Europe |

10,260,313 |

|||

|

THL Equity Fund VI Investors (BKFS), L.P. a, c |

Limited partnership interest |

North America |

20,799,910 |

|||

|

Valhalla Co-Invest, L.P. a |

Limited partnership interest |

Western Europe |

2,219,214 |

|||

|

Velocity Holdings L.P. a, c |

Limited partnership interest |

North America |

2,060,215 |

|||

|

Velocity Technologies Solutions, Inc. a, c |

Common equity |

North America |

10,763,074 |

|||

|

Virtuoso Lux I SarL a, c |

Common equity |

Western Europe |

20,390,833 |

|||

|

Virtuoso Lux I SarL a, c |

Shareholder loan |

Western Europe |

17,329,932 |

|||

|

WP Mustang Co-Invest-C L.P. a, c |

Limited partnership interest |

North America |

8,646,563 |

|||

|

$ |

377,536,217 |

|||||

|

Direct Debt (17.78%) |

Interest |

Maturity |

Investment Type |

Geographic |

Fair |

|||

|

Ability Network Inc. a |

Libor (1.00% floor) + 8.25% |

5/16/2022 |

Second Lien |

North America |

$ |

11,442,500 |

||

|

Ability Network Inc. a |

Libor (1.00% floor) + 5.00% |

5/16/2021 |

Senior |

North America |

7,643,559 |

|||

|

Al Alabama B.V. a |

Libor (1.00% floor) + 8.00% |

7/6/2023 |

Second Lien |

Western Europe |

6,374,927 |

|||

|

Astro AB Merger Sub, Inc. a |

Libor (1.00% floor) + 4.50% |

5/22/2022 |

Second Lien |

North America |

7,949,950 |

|||

|

Attendo Care AB a |

Euribor (1.25% floor) + 7.00% + 3.25% PIK |

6/28/2019 |

Mezzanine |

Western Europe |

7,561,344 |

|||

|

Attendo Care AB a |

Euribor (1.25% floor) + 10.25% PIK |

6/28/2019 |

Senior |

Western Europe |

2,967,642 |

|||

|

Biomnis a |

7.00% + 7.00% PIK |

9/3/2019 |

Senior |

Western Europe |

2,500,796 |

|||

|

Biomnis a |

6.55% PIK |

9/3/2019 |

Senior |

Western Europe |

2,366,537 |

|||

|

CapitalSpring Finance Company a |

2.00% + 11.25% PIK |

10/2/2019 |

Mezzanine |

North America |

19,081,011 |

|||

|

CDRH Parent, Inc. a |

Libor (1.00% floor) + 8.00% |

7/1/2022 |

Second Lien |

North America |

9,950,000 |

|||

|

CFS 811 B.V. a |

Euribor (0.75% floor) + 7.25% |

6/12/2021 |

Senior |

Western Europe |

11,940,980 |

|||

|

Evergreen ACQC01, L.P. a |

10.25% |

7/11/2022 |

Mezzanine |

North America |

6,325,000 |

|||

|

Global Tel*Link Corporation a |

Libor (1.25% floor) + 7.75% |

11/23/2020 |

Second Lien |

North America |

9,823,625 |

|||

|

Global Tel*Link Corporation a |

Libor (1.25% floor) + 3.75% |

12/14/2017 |

Senior |

North America |

3,944,588 |

|||

|

Kahuna Bidco Pty Limited a |

BBSY + 5.00% + 3.50% PIK |

12/31/2016 |

Mezzanine |

Asia - Pacific |

4,242,571 |

|||

|

Learning Care Group (US) No. 2, Inc. a |

Libor (1.00% floor) + 4.50% |

5/5/2021 |

Senior |

North America |

6,156,702 |

|||

|

Lightower a |

10.00% |

2/12/2022 |

Mezzanine |

North America |

6,971,692 |

|||

|

Lightower a |

12.00% PIK |

8/12/2025 |

Mezzanine |

North America |

5,208,538 |

|||

|

LIT Holdings, Inc. a |

Libor (1.00% floor) + 9.25% |

5/27/2022 |

Second Lien |

North America |

10,688,255 |

|||

|

National Surgical Hospitals, Inc. a |

Libor (1.00% floor) + 9.00% |

6/1/2023 |

Second Lien |

North America |

9,450,000 |

|||

|

NTS Holding Corporation, Inc. a |

Libor (1.00% floor) + 6.00% |

6/12/2021 |

Senior |

North America |

8,944,317 |

|||

|

Onex Wizard Acquisition Company II S.C.A. a |

Libor (1.00% floor) + 3.25% |

3/27/2022 |

Senior |

Western Europe |

2,391,295 |

|||

|

Onex Wizard Acquisition Company II S.C.A. a |

Euribor (1.00% floor) + 3.25% |

3/19/2022 |

Senior |

Western Europe |

8,072,524 |

|||

|

Photonis Technologies S.A.S a |

Libor (1.00% floor) + 7.50% |

9/18/2019 |

Second Lien |

Western Europe |

8,687,743 |

|||

|

Plano Molding Company, LLC a |

Libor (1.00% floor) + 6.00% |

5/12/2021 |

Second Lien |

North America |

8,559,628 |

|||

|

Sabre Industries, Inc. a |

11.00% |

8/27/2022 |

Mezzanine |

North America |

2,524,011 |

|||

|

Sabre Industries, Inc. a |

11.00% |

8/27/2022 |

Mezzanine |

North America |

4,037,500 |

|||

|

Securitas Direct Holding AB a |

Euribor + 3.75% + 6.75% PIK |

9/2/2019 |

Mezzanine |

Western Europe |

6,386,986 |

|||

The accompanying notes are an integral part of these Consolidated Financial Statements.

2

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Consolidated Schedule of Investments –

September 30, 2015 (Unaudited) (continued)

|

Direct Debt (continued) |

Interest |

Maturity |

Investment Type |

Geographic |

Fair |

|||

|

Ship Luxco 3 S.a.r.l. a |

Libor (1.25% floor) + 3.50% |

11/29/2019 |

Senior |

Western Europe |

$ |

20,054,900 |

||

|

Springer Science+Business Media Deutschland GmbH a |

Libor (1.00% floor) + 3.75% |

8/14/2020 |

Senior |

Western Europe |

9,703,419 |

|||

|

Springer Science+Business Media Deutschland GmbH a |

Libor (1.00% floor) + 3.75% |

8/14/2020 |

Senior |

Western Europe |

10,714,782 |

|||

|

Sun Products Corporation (The) a |

Libor (1.25% floor) + 4.25% |

3/23/2020 |

Senior |

North America |

12,554,501 |

|||

|

255,221,823 |

||||||||

|

Total Direct Investments (44.07%) |

$ |

632,758,040 |

||||||

|

Private Equity Investments (continued) Secondary Investments* (22.06%) |

Geographic |

Fair |

|||

|

3i Europartners Vb, L.P. a |

Western Europe |

$ |

4,548,731 |

||

|

3i Growth Capital B, L.P. a, c |

Western Europe |

1,040,249 |

|||

|

Abingworth Bioventures III, L.P. a, c |

Western Europe |

52,753 |

|||

|

Abingworth Bioventures V Co-Investment Growth Equity Fund, L.P. a, c |

Western Europe |

410,518 |

|||

|

Abingworth Bioventures V, L.P. a |

Western Europe |

534,095 |

|||

|

Advent International GPE VI, L.P. a |

Western Europe |

4,530,855 |

|||

|

Apax Europe VI - A, L.P. a |

Western Europe |

470,212 |

|||

|

Apax Europe VII - B, L.P. a |

Western Europe |

411,294 |

|||

|

Apollo Investment Fund IV, L.P. a, c |

North America |

4,156 |

|||

|

Apollo Investment Fund VI, L.P. a |

North America |

818,801 |

|||

|

Apollo Investment Fund VII, L.P. a |

North America |

576,881 |

|||

|

Apollo Overseas Partners (Delaware) VII, L.P. a |

North America |

242,062 |

|||

|

Ares Corporate Opportunities Fund III, L.P. a |

North America |

315,877 |

|||

|

Astorg V FCPR a, c |

Western Europe |

3,706,584 |

|||

|

Bain Capital Fund X, L.P. a |

North America |

24,592,112 |

|||

|

Bain Capital X Co-Investment Fund, L.P. a |

North America |

919,097 |

|||

|

Baring Asia Private Equity Fund IV, L.P. a |

Asia - Pacific |

419,021 |

|||

|

BC European Capital IX, L.P. a |

Western Europe |

4,145,808 |

|||

|

Bertram Growth Capital II-A, L.P. a, c |

North America |

3,977,077 |

|||

|

Blackstone Capital Partners V/F, L.P. a |

North America |

2,404,665 |

|||

|

Blackstone Capital Partners V-S, L.P. a |

North America |

333,426 |

|||

|

Candover 2005 Fund, L.P. a |

Western Europe |

911,843 |

|||

|

Carlyle Europe Partners II, L.P. a |

Western Europe |

285,678 |

|||

|

Carlyle Europe Partners III, L.P. a |

Western Europe |

10,021,760 |

|||

|

Carlyle Japan International Partners II, L.P. a |

Asia - Pacific |

5,649,808 |

|||

|

Carlyle Partners IV, L.P. a |

North America |

779,769 |

|||

|

Carlyle Partners V, L.P. a |

North America |

991,600 |

|||

|

Carlyle Partners V/B, L.P. a |

North America |

4,775,232 |

|||

|

CCP IX LP No. 2 a |

Western Europe |

2,988,736 |

|||

|

Citigroup Venture Capital International Growth Offshore I, L.P. a |

Asia - Pacific |

47,733 |

|||

|

Citigroup Venture Capital International Growth Offshore II, L.P. a |

Asia - Pacific |

389,002 |

|||

|

Citigroup Venture International Growth Partnership II, L.P. a |

Asia - Pacific |

1,164,827 |

|||

|

Clayton, Dubilier & Rice Fund VII, L.P. a |

North America |

5,292,215 |

|||

|

Clayton, Dubilier & Rice Fund VIII, L.P. a |

North America |

12,853,021 |

|||

|

CVC Capital Partners Asia Pacific III, L.P. a |

Asia - Pacific |

1,687,397 |

|||

|

CVC European Equity Partners Tandem Fund (A), L.P. a |

Western Europe |

101,522 |

|||

|

CVC European Equity Partners V, L.P. a |

Western Europe |

3,608,061 |

|||

|

daVinci Japan Real Estate Partners IV, L.P. a, c |

Asia - Pacific |

9,179 |

|||

|

Duke Street VI US No. 1 Limited Partnership a |

Western Europe |

328,914 |

|||

|

Fourth Cinven Fund, L.P. a |

Western Europe |

346,523 |

|||

|

Frazier Healthcare VI, L.P. a |

North America |

2,019,949 |

|||

|

FS Equity Partners V, L.P. a, c |

North America |

2,979,648 |

|||

|

Galileo III FCPR a, c |

Western Europe |

221,282 |

|||

The accompanying notes are an integral part of these Consolidated Financial Statements.

3

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Consolidated Schedule of Investments –

September 30, 2015 (Unaudited) (continued)

|

Private Equity Investments (continued) Secondary Investments* (continued) |

Geographic |

Fair |

|||

|

Genstar Capital Partners IV, L.P. a, c |

North America |

$ |

153,098 |

||

|

Genstar Capital Partners V, L.P. a, c |

North America |

1,372,600 |

|||

|

Graphite Capital Parners VI, L.P. a, c |

Western Europe |

453,703 |

|||

|

Graphite Capital Parners VII Top-Up a, c |

Western Europe |

75,440 |

|||

|

Graphite Capital Parners VII, L.P. a, c |

Western Europe |

414,189 |

|||

|

Green Equity Investors Side V, L.P. a |

North America |

1,718,882 |

|||

|

Gryphon Partners 3.5, L.P. a |

North America |

3,967,161 |

|||

|

Harvest Partners V, L.P. a |

North America |

267,131 |

|||

|

Hellman & Friedman Capital Partners VI, L.P. a |

North America |

2,852,399 |

|||

|

Hellman & Friedman Capital Partners VII, L.P. a |

North America |

2,094,991 |

|||

|

H.I.G. Bayside Debt & LBO Fund II, L.P. a |

North America |

1,295,540 |

|||

|

Highstar Capital III Prism Fund, L.P. a |

North America |

1,672,888 |

|||

|

Index Ventures II (Jersey), L.P. a, c |

Western Europe |

106,311 |

|||

|

Indigo Capital V, L.P. a, c |

Western Europe |

788,175 |

|||

|

Industri Kapital 1997 Fund a, c |

Western Europe |

158,172 |

|||

|

Industri Kapital 2000, L.P. a, c |

Western Europe |

1 |

|||

|

Investcorp Private Equity 2007 Fund, L.P. a |

North America |

2,897,007 |

|||

|

Investcorp Technology Partners III (Cayman), L.P. a |

North America |

2,706,502 |

|||

|

Irving Place Capital Investors II, L.P. a |

North America |

25,085 |

|||

|

Irving Place Capital Partners III, L.P. a |

North America |

196,150 |

|||

|

Jerusalem Venture Partners IV, L.P. a, c |

Asia - Pacific |

272,369 |

|||

|

KKR European Fund III, L.P. a |

Western Europe |

6,262,591 |

|||

|

Lightyear Fund II, L.P. a |

North America |

5,202,238 |

|||

|

Madison Dearborn Capital Partners V-A and V-B, L.P. a |

North America |

5,855,161 |

|||

|

Madison Dearborn Capital Partners VI-C, L.P. a |

North America |

1,129,867 |

|||

|

MidOcean Partners III, L.P. a |

North America |

2,435,415 |

|||

|

Monomoy Capital Partners II, L.P. a, c |

North America |

643,489 |

|||

|

Montagu III, L.P. a |

Western Europe |

120 |

|||

|

Nexit Infocom 2000 Fund L.P. a, c |

Western Europe |

6,738 |

|||

|

Oak Investment Partners XII, L.P. a |

North America |

1,551,377 |

|||

|

PAI Europe V a, c |

Western Europe |

2,073,031 |

|||

|

Palladium Equity Partners III, L.P. a |

North America |

590,062 |

|||

|

Pamlico Capital GP I, LLC a, c |

North America |

1 |

|||

|

Pamlico Capital GP II, LLC a, c |

North America |

95,476 |

|||

|

Pamlico Capital II, L.P. a, c |

North America |

8,276,915 |

|||

|

Pamlico Capital Secondary Fund, L.P. a, c |

North America |

1 |

|||

|

Permira Europe I, L.P. 1B a, c |

Western Europe |

44,169 |

|||

|

Permira Europe II, L.P. a, c |

Western Europe |

27,869 |

|||

|

Permira Europe III, L.P. a |

Western Europe |

1,024,150 |

|||

|

Permira IV Continuing, L.P. 1 a |

Western Europe |

14,674,980 |

|||

|

Providence Equity Partners IV, L.P. a |

North America |

12,813 |

|||

|

Providence Equity Partners V, L.P. a |

North America |

667,933 |

|||

|

Providence Equity Partners VI, L.P. a |

North America |

15,473,480 |

|||

|

Providence Equity Partners VII-A, L.P. a |

North America |

1,100,459 |

|||

|

Riverside Europe Fund IV, L.P. a, c |

Western Europe |

2,565,637 |

|||

|

Silver Lake Partners II, L.P. a |

North America |

780,141 |

|||

|

Silver Lake Partners III, L.P. a |

North America |

12,580,686 |

|||

|

Silver Lake Sumeru Fund, L.P. a |

North America |

346,618 |

|||

|

Sun Capital Partners V, L.P. a |

North America |

24,004,823 |

|||

|

TA Atlantic and Pacific V, L.P. a, c |

North America |

238,264 |

|||

|

TA Atlantic & Pacific VI, L.P. a, c |

North America |

1,138,708 |

|||

|

TA X, L.P. a, c |

North America |

353,034 |

|||

|

TA XI, L.P. a, c |

North America |

3,435,936 |

|||

|

TCV VI, L.P. a, c |

North America |

990,796 |

|||

|

TCV VII (A), L.P. a, c |

North America |

10,283,556 |

|||

The accompanying notes are an integral part of these Consolidated Financial Statements.

4

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Consolidated Schedule of Investments –

September 30, 2015 (Unaudited) (continued)

|

Private Equity Investments (continued) Secondary Investments* (continued) |

Geographic |

Fair |

|||

|

Terra Firma Capital Partners III, L.P. a, c |

Western Europe |

$ |

11,901,589 |

||

|

Thomas H. Lee Parallel (DT) Fund VI, L.P. a |

North America |

1,888,955 |

|||

|

Thomas H. Lee Parallel Fund VI, L.P. a |

North America |

1,689,892 |

|||

|

TorQuest Partners Fund (U.S.) II, L.P. a, c |

North America |

1,163,730 |

|||

|

TPG Partners V, L.P. a |

North America |

6,616,129 |

|||

|

TPG Partners VI, L.P. a |

North America |

18,844,911 |

|||

|

Tudor Ventures III, L.P. a, c |

North America |

4,333,895 |

|||

|

Warburg Pincus Private Equity IX, L.P. a |

North America |

231,809 |

|||

|

Warburg Pincus Private Equity X, L.P. a |

North America |

10,848,506 |

|||

|

Total Secondary Investments (22.06%) |

$ |

316,781,717 |

|||

|

Primary Investments* (7.78%) |

Geographic |

Fair |

|||

|

Advent International GPE VII-B, L.P. a, c |

North America |

$ |

9,231,739 |

||

|

Advent Latin American Private Equity Fund VI-H, L.P. a, c |

South America |

735,413 |

|||

|

Altra Private Equity Fund II, L.P. a, c |

South America |

1,690,276 |

|||

|

Apollo Investment Fund VIII, L.P. a |

North America |

2,144,231 |

|||

|

Ares Corporate Opportunities Fund IV, L.P. a |

North America |

7,078,475 |

|||

|

Avista Capital Partners II, L.P. a |

North America |

1,348,767 |

|||

|

Avista Capital Partners III, L.P. a |

North America |

7,854,091 |

|||

|

Bain Capital Europe Fund IV, L.P. a, c |

Western Europe |

534,315 |

|||

|

Baring Asia Private Equity Fund V, L.P. a |

Asia - Pacific |

3,190,725 |

|||

|

CapVest Equity Partners III B, L.P. a, c |

Western Europe |

620,631 |

|||

|

Carlyle Europe Partners IV, L.P. a, c |

Western Europe |

244,480 |

|||

|

Clayton, Dubilier & Rice Fund IX, L.P. a |

North America |

4,574,608 |

|||

|

Crescent Mezzanine Partners VIB, L.P. a |

North America |

3,637,239 |

|||

|

CVC Capital Partners VI (A) L.P. a, c |

Western Europe |

885,856 |

|||

|

EQT VI (No.1) Limited Partnership a, c |

Western Europe |

4,122,732 |

|||

|

Genstar Capital Partners VI, L.P. a |

North America |

9,367,359 |

|||

|

Hony Capital Partners V, L.P. a |

Asia - Pacific |

7,653,886 |

|||

|

Index Ventures Growth III (Jersey), L.P. a, c |

Western Europe |

364,624 |

|||

|

KKR North America Fund XI, L.P. a, c |

North America |

7,059,276 |

|||

|

Kohlberg TE Investors VII, L.P. a |

North America |

5,459,240 |

|||

|

Nautic Partners VII-A, L.P. a |

North America |

4,252,026 |

|||

|

New Enterprise Associates 14, L.P. a, c |

North America |

4,883,630 |

|||

|

PAI Europe VI-1, L.P. a, c |

Western Europe |

2,010,414 |

|||

|

Pátria - Brazilian Private Equity Fund IV, L.P. a, c |

South America |

2,644,918 |

|||

|

PennantPark Credit Opportunities Fund, L.P. a |

North America |

12,125,789 |

|||

|

Silver Lake Partners IV, L.P. a |

North America |

4,131,149 |

|||

|

Sumeru Equity Partners Fund, L.P. a, c |

North America |

736,838 |

|||

|

Welsh, Carson, Anderson & Stowe XII, L.P. a, c |

North America |

986,644 |

|||

|

Windjammer Senior Equity Fund IV, L.P. a |

North America |

2,122,102 |

|||

|

Total Primary Investments (7.78%) |

$ |

111,691,473 |

|||

|

Total Private Equity Investments (Cost $903,292,182) (73.91%) |

$ |

1,061,231,230 |

|||

The accompanying notes are an integral part of these Consolidated Financial Statements.

5

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Consolidated Schedule of Investments –

September 30, 2015 (Unaudited) (continued)

|

Common Stocks (0.00%) d Telecommunication Services (0.00%) d |

Shares |

Geographic Region b |

Fair |

||||||

|

Zayo Group Holdings, Inc. c |

2,491 |

North America |

$ |

63,172 |

|||||

|

Total Telecommunication Services (0.00%) d |

63,172 |

||||||||

|

Total Common Stocks (Cost $4,135) (0.00%) d |

$ |

63,172 |

|||||||

|

Short-Term Investments (22.63%) U.S. Government Treasury Obligations (22.63%) |

Principal |

Fair |

||||||

|

U.S. Treasury Bill, 0.035%, 10/15/2015 e |

55,000,000 |

$ |

54,999,222 |

|||||

|

U.S. Treasury Bill, 0.025%, 10/29/2015 e |

30,000,000 |

29,999,417 |

||||||

|

U.S. Treasury Bill, 0.051%, 11/05/2015 e |

30,000,000 |

29,998,542 |

||||||

|

U.S. Treasury Bill, 0.010%, 11/19/2015 e |

55,000,000 |

54,996,171 |

||||||

|

U.S. Treasury Bill, 0.051%, 11/27/2015 e |

30,000,000 |

29,997,601 |

||||||

|

U.S. Treasury Bill, 0.013%, 12/10/2015 e |

30,000,000 |

30,001,380 |

||||||

|

U.S. Treasury Bill, 0.005%, 12/24/2015 f |

55,000,000 |

55,001,100 |

||||||

|

U.S. Treasury Bill, 0.007%, 01/07/2016 f |

40,000,000 |

39,997,960 |

||||||

|

Total U.S. Government Treasury Obligations (22.63%) |

$ |

324,991,393 |

||||||

|

Total Short-Term Investments (Cost $324,991,534) (22.63%) |

$ |

324,991,393 |

||||||

|

Total Investments (Cost $1,228,287,851) (96.54%) |

1,386,285,795 |

|||||||

|

Other Assets in Excess of Liabilities (3.46%) |

49,637,976 |

|||||||

|

Members' Equity (100.00%) |

$ |

1,435,923,771 |

||||||

|

* |

Direct Investments are private investments directly into the equity or debt of selected operating companies, often together with the management of the company. Primary Investments are investments in newly established private equity partnerships where underlying portfolio companies are not known as of the time of investment. Secondary Investments are portfolios of assets on the secondary market. |

|

** |

The Fair Value of any Direct Investment may not necessarily reflect the current or expected future performance of such Direct Investment or the Fair Value of the Master Fund’s interest in such Direct Investment. Furthermore, the Fair Value of any Direct Investment has not been calculated, reviewed, verified or in any way approved by such Direct Investment or its general partner, manager or sponsor (including any of its affiliates). Please see Note 2.b for further detail regarding the valuation policy of the Master Fund. |

|

a |

Private equity investments are generally issued in private placement transactions and as such are generally restricted as to resale. Total cost and fair value of restricted investments as of September 30, 2015 was $903,292,182 and $1,061,231,231, respectively. |

|

b |

Geographic region is based on where a Direct Investment is headquartered and may be different from where such Investment invests or operates. In the case of Primary and Secondary Investments, geographic region generally refers to where the majority of the underlying assets are invested. |

|

c |

Non-income producing. |

|

d |

Rounds to less than 0.005%. |

|

e |

Each issue shows the rate of the discount at the time of purchase. |

|

f |

Each issue shows the rate of the premium at the time of purchase. |

6

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Consolidated Statement of Assets, Liabilities and Members’ Equity –

September 30, 2015 (Unaudited)

|

Assets |

||||

|

Private Equity Investments, at fair value (cost $903,292,182) |

$ |

1,061,231,230 |

||

|

Common stocks, at fair value (cost $4,135) |

63,172 |

|||

|

Short-term investments, at fair value (cost $324,991,534) |

324,991,393 |

|||

|

Cash and cash equivalents |

66,129,283 |

|||

|

Cash denominated in foreign currencies (cost $16,418,537) |

15,349,476 |

|||

|

Interest receivable |

1,357,163 |

|||

|

Dividends receivable |

671,639 |

|||

|

Investment sales receivable |

15,500 |

|||

|

Prepaid assets |

11,386 |

|||

|

Total Assets |

$ |

1,469,820,242 |

||

|

Liabilities |

||||

|

Investment purchases payable |

$ |

2,214,723 |

||

|

Repurchase amounts payable for tender offers |

25,246,765 |

|||

|

Forward foreign currency contracts payable |

2,737,544 |

|||

|

Management fee payable |

2,980,799 |

|||

|

Professional fees payable |

388,608 |

|||

|

Interest expense payable |

209,034 |

|||

|

Accounting and administration fees payable |

54,792 |

|||

|

Board of Managers' fees payable |

31,250 |

|||

|

Custodian fees payable |

18,041 |

|||

|

Other payable |

14,914 |

|||

|