UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22443

Partners Group Private Equity (Institutional TEI), LLC

(Exact name of registrant as specified in charter)

c/o Partners Group (USA) Inc.

1114 Avenue of the Americas, 37th Floor

New York, NY 10036

(Address of principal executive offices) (Zip code)

Brooks Lindberg, CCO

1114 Avenue of the Americas, 37th Floor

New York, NY 10036

(Name and address of agent for service)

registrant's telephone number, including area code: (212) 908-2600

Date of fiscal year end: March 31

Date of reporting period: September 30, 2012

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

The Report to Shareholders is attached herewith.

PARTNERS GROUP PRIVATE EQUITY (INSTITUTIONAL TEI), LLC

(a Delaware Limited Liability Company)

Consolidated Financial Statements

For the Six Months Ended September 30, 2012

(Unaudited)

(Including the Financial Statements of the Partners Group Private Equity (Master Fund), LLC)

PARTNERS GROUP PRIVATE EQUITY (INSTITUTIONAL TEI), LLC

(a Delaware Limited Liability Company)

For the Six Months Ended September 30, 2012

(Unaudited)

Table of Contents

| Consolidated Statement of Assets, Liabilities and Members' Equity | 1 |

| Consolidated Statement of Operations | 2 |

| Consolidated Statements of Changes in Members' Equity | 3 |

| Consolidated Statement of Cash Flows | 4 |

| Consolidated Financial Highlights | 5 |

| Notes to Consolidated Financial Statements | 6-10 |

| Other Information | 11 |

| Financial Statements of Partners Group Private Equity (Master Fund), LLC | Appendix I |

| PARTNERS GROUP PRIVATE EQUITY (INSTITUTIONAL TEI), LLC |

| (a Delaware Limited Liability Company) |

| Consolidated Statement of Assets, Liabilities and Members' Equity - September 30, 2012 (Unaudited) |

| Assets | ||||

| Investment in Partners Group Private Equity (Master Fund), LLC, at fair value (cost $4,906,989) | $ | 5,351,024 | ||

| Receivable for expense waivers | 70,693 | |||

| Prepaid assets | 684 | |||

| Total Assets | $ | 5,422,401 | ||

| Liabilities | ||||

| Professional fees payable | $ | 24,500 | ||

| Organizational fees payable | 13,012 | |||

| Accounting and administration fees payable | 7,016 | |||

| Custodian fees payable | 1,200 | |||

| Other expenses payable | 10,730 | |||

| Total Liabilities | $ | 56,458 | ||

| Members' Equity | $ | 5,365,943 | ||

| Members' Equity consists of: | ||||

| Members' Equity Paid-in | $ | 5,000,000 | ||

| Accumulated net investment income | 10,305 | |||

| Accumulated net realized gain on investments, forward foreign currency contracts and foreign currency translation | 106,580 | |||

| Accumulated net unrealized appreciation on investments, forward foreign currency contracts and foreign currency translation | 293,414 | |||

| Accumulated Adviser's Incentive Allocation | (44,356 | ) | ||

| Total Members' Equity | $ | 5,365,943 | ||

| Number of Outstanding Units | 5,000 | |||

| Net Asset Value per Unit | $ | 1,073.19 |

The accompanying notes are an integral part of these Consolidated Financial Statements.

| 1 |

| PARTNERS GROUP PRIVATE EQUITY (INSTITUTIONAL TEI), LLC |

| (a Delaware Limited Liability Company) |

| Consolidated Statement of Operations |

| For the Six Months Ended September 30, 2012 (Unaudited) |

| Fund Investment Income | $ | - | ||

| Fund Operating Expenses | ||||

| Accounting and administration fees | 21,046 | |||

| Organizational expense | 13,283 | |||

| Professional fees | 9,408 | |||

| Custodian fees | 1,200 | |||

| Registration fees | 1,162 | |||

| Withholding tax | 356 | |||

| Other expenses | 12,574 | |||

| Total Operating Expenses | 59,029 | |||

| Expense Waivers | (37,618 | ) | ||

| Total Fund Net Operating Expenses | 21,411 | |||

| Investment Income Allocated from Partners Group Private Equity (Master Fund), LLC | ||||

| Interest | 66,825 | |||

| Expenses | (41,071 | ) | ||

| Total Investment Income Allocated from Partners Group Private Equity (Master Fund), LLC | 25,754 | |||

| Net Investment Income | 4,343 | |||

| Net Realized Gain and Change in Unrealized Appreciation on Investments, Forward Foreign Currency Contracts and Foreign Currency Allocated from Partners Group Private Equity (Master Fund), LLC | ||||

| Net realized gain from investments and forward foreign currency contracts | 24,901 | |||

| Net realized gain distributions from Private Equity Investments | 58,909 | |||

| Net change in accumulated unrealized appreciation on investments, forward foreign currency contracts and foreign currency translation | 176,277 | |||

| Net Realized Gain and Change in Unrealized Appreciation on Investments, Forward Foreign Currency Contracts and Foreign Currency Allocated from Partners Group Private Equity (Master Fund), LLC | 260,087 | |||

| Adviser's Incentive Fee Allocated from Partners Group Private Equity (Master Fund), LLC | (28,541 | ) | ||

| Net Increase in Members' Equity from Operations | $ | 235,889 |

The accompanying notes are an integral part of these Consolidated Financial Statements.

| 2 |

| PARTNERS GROUP PRIVATE EQUITY (INSTITUTIONAL TEI), LLC |

| (a Delaware Limited Liability Company) |

| Consolidated Statements of Changes in Members' Equity |

| For the Periods Ended March 31, 2012 and September 30, 2012 (Unaudited) |

| Members' | ||||

| Equity | ||||

| Members' Equity at December 1, 2011 * | $ | - | ||

| Capital contributions | 5,000,000 | |||

| Net investment income | 5,962 | |||

| Net realized gain from investments and forward foreign currency contracts | 8,280 | |||

| Net realized loss on foreign currency translation | (4 | ) | ||

| Net realized gain distributions from Private Equity Investments | 14,494 | |||

| Net change in accumulated unrealized appreciation on investments, forward foreign currency contracts and foreign currency translation | 117,137 | |||

| Adviser's Incentive Fee Allocation | (15,815 | ) | ||

| Members' Equity at March 31, 2012 | $ | 5,130,054 | ||

| Net investment income | 4,343 | |||

| Net realized gain from investments and forward foreign currency contracts | 24,901 | |||

| Net realized gain distributions from Private Equity Investments | 58,909 | |||

| Net change in accumulated unrealized appreciation on investments, forward foreign currency contracts and foreign currency translation | 176,277 | |||

| Adviser's Incentive Fee Allocation | (28,541 | ) | ||

| Members' Equity at September 30, 2012 | $ | 5,365,943 | ||

| Units outstanding at December 1, 2011* | - | |||

| Units sold | 5,000 | |||

| Units redeemed | - | |||

| Units outstanding at March 31, 2012 | 5,000 | |||

| Units sold | - | |||

| Units redeemed | - | |||

| Units outstanding at September 30, 2012 | 5,000 | |||

* The Fund commenced operations at December 1, 2011.

The accompanying notes are an integral part of these Consolidated Financial Statements.

| 3 |

| PARTNERS GROUP PRIVATE EQUITY (INSTITUTIONAL TEI), LLC |

| (a Delaware Limited Liability Company) |

| Consolidated Statement of Cash Flows |

| For the Six Months Ended September 30, 2012 (Unaudited) |

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||

| Net Increase in Members' Equity from Operations | $ | 235,889 | ||

| Adjustments to reconcile Net Increase in Members' Equity from Operations to net cash used in operating activities: | ||||

| Net investment income allocated from Partners Group Private Equity (Master Fund), LLC | (25,754 | ) | ||

| Net realized gain from investments and forward foreign currency contracts allocated from Partners Group Private Equity (Master Fund), LLC | (24,901 | ) | ||

| Net realized gain distributions from Private Equity Investments allocated from Partners Group Private Equity (Master Fund), LLC | (58,909 | ) | ||

| Net change in accumulated unrealized appreciation on investments, forward foreign currency contracts and foreign currency translation allocated from Partners Group Private Equity (Master Fund), LLC | (139,113 | ) | ||

| Adviser's Incentive Fee allocated from Partners Group Private Equity (Master Fund), LLC | 28,541 | |||

| Increase in receivable for expense waivers | (37,619 | ) | ||

| Decrease in prepaid assets | 760 | |||

| Increase in organizational fees payable | 4,157 | |||

| Increase in professional fees payable | 7,000 | |||

| Increase in custodian fees payable | 800 | |||

| Increase in other expenses payable | 9,149 | |||

| Net Cash Used in Operating Activities | - | |||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||

| Members' capital contributions | - | |||

| Members' capital tenders | - | |||

| Net Cash Used in Financing Activities | - | |||

| Net change in cash and cash equivalents | - | |||

| Cash and cash equivalents at beginning of period | - | |||

| Cash and cash equivalents at End of Period | $ | - |

The accompanying notes are an integral part of these Consolidated Financial Statements.

| 4 |

| PARTNERS GROUP PRIVATE EQUITY (INSTITUTIONAL TEI), LLC |

| (a Delaware Limited Liability Company) |

| Consolidated Financial Highlights |

| Six Months Ended September 30, 2012 (Unaudited) | Period from Commencement of Operations - December 1, 2011 through March 31, 2012 | |||||||

| Per Unit Operating Performance (1) | ||||||||

| NET ASSET VALUE, BEGINNING OF PERIOD | $ | 1,026.01 | $ | 1,000.00 | (2) | |||

| INCOME FROM INVESTMENT OPERATIONS: | ||||||||

| Net investment income | 0.87 | 1.19 | ||||||

| Net realized and unrealized gain on investments | 46.31 | 24.82 | ||||||

| Net Increase in Members' Equity from Operations | 47.18 | 26.01 | ||||||

| DISTRIBUTIONS TO MEMBERS: | ||||||||

| Net change in Members' Equity due to distributions to Members | - | - | ||||||

| NET ASSET VALUE, END OF PERIOD | $ | 1,073.19 | $ | 1,026.01 | ||||

| TOTAL RETURN (3) | 4.60 | %(4) | 2.60 | %(4) | ||||

| RATIOS AND SUPPLEMENTAL DATA: | ||||||||

| Net Assets, end of period in thousands (000's) | 5,366 | 5,130 | ||||||

| Net investment income to average net assets, excluding Incentive Allocation | 0.16 | %(5) | 0.35 | %(5) | ||||

| Ratio of gross expenses to average net assets, excluding Incentive Allocation (6) | 3.54 | %(5) (8) | 3.92 | %(5)(8) | ||||

| Ratio of expense waiver to average net assets | (1.42 | )%(5) | (1.97 | )% | ||||

| Ratio of net expenses to average net assets, excluding Incentive Allocation (7) | 2.12 | %(5)(8) | 1.95 | %(5) (8) | ||||

| Ratio of Incentive Allocation to average net assets | 0.54 | %(4) | 0.94 | %(5) | ||||

| Portfolio Turnover | 7.89 | %(4) | 8.39 | % | ||||

| (1) | Selected data for a unit of membership interest outstanding throughout the period. |

| (2) | The net asset value for the beginning period December 1, 2011 (Commencement of Operations) through March 31, 2012 represents the initial contribution per unit of $1,000. | |

| (3) | Total return based on per unit net asset value reflects the changes in net asset value based on the effects of the performance of the Fund during the period and assumes distributions, if any, were reinvested. | |

| (4) | Not annualized. |

| (5) | Annualized. |

| (6) | Represents the ratio of expenses to average net assets absent fee waivers and/or expense reimbursement by the Adviser. |

| (7) | Effective December 1, 2011, the Fund is voluntarily capped at 2.30%. See note 2.e. for a more thorough Expense Limitation Agreement discussion. |

| (8) | The Organizational Expenses are not annualized for the ratio calculation. |

The accompanying notes are an integral part of these Consolidated Financial Statements.

| 5 |

Partners Group Private Equity (Institutional TEI), LLC

(a Delaware Limited Liability Company)

Notes to Consolidated Financial Statements – September 30, 2012 (unaudited)

1. Organization

Partners Group Private Equity (Institutional TEI), LLC (the “Fund”) invests substantially all of its assets in Partners Group Private Equity (Offshore II), LDC (the “Offshore Fund”). The Offshore Fund is a Cayman Islands limited duration company with the same investment objective as the Fund. The Offshore Fund serves solely as an intermediary entity through which the Fund invests in Partners Group Private Equity (Master Fund), LLC (the “Master Fund”). The Offshore Fund enables tax-exempt Members (as defined below) to invest without receiving certain income in a form that would otherwise be taxable to such tax-exempt Members regardless of their tax-exempt status. The Fund owns 100% of the participating beneficial interest of the Offshore Fund. Where these Notes to Consolidated Financial Statements discuss the Fund’s investment in the Master Fund, it means its investment in the Master Fund through the Offshore Fund.

The Fund was organized as a limited liability company under the laws of the State of Delaware on May 25, 2010 and commenced operations on December 1, 2011. The Fund is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a closed-end, non-diversified management investment company. The objective of the Fund is to seek attractive long-term capital appreciation by investing in a diversified portfolio of private equity investments. To achieve its objective, the Fund will invest substantially all of its assets in limited liability company interests (“Interests”) in the Master Fund, a limited liability company organized under the laws of the State of Delaware, which is also registered under the 1940 Act. The Master Fund is managed by Partners Group (USA) Inc. (the “Adviser”), an investment adviser registered under the Investment Advisers Act of 1940, as amended. A Board of Managers (the “Board”) has overall responsibility for the management and supervision of the business operations of the Fund. To the fullest extent permitted by applicable law, the Board may delegate any of its rights, powers and authority to, among others, the officers of the Fund, any committee of the Board, or the Adviser. Units of limited liability company interests (“Units”) in the Fund are offered only to investors (“Members”) that represent that they are, an “accredited investor” within the meaning of Rule 501 under the Securities Act of 1933, as amended, and a “qualified client” within the meaning of Rule 205-3 under the Investment Advisers Act of 1940, as amended. The Fund’s consolidated financial statements should be read in conjunction with the Master Fund’s financial statements, which are included as Appendix I.

At September 30, 2012, the Fund owned 1.04% of the Interests in the Master Fund.

2. Significant Accounting Policies

The following is a summary of significant accounting and reporting policies used in preparing the consolidated financial statements.

a. Basis of Accounting

The Fund’s accounting and reporting policies conform with generally accepted accounting principles within the United States (“U.S. GAAP”).

b. Valuation of Investments

The Fund values its investment in the Master Fund at the net asset value of the Interests owned by the Fund in the Master Fund as such net asset value is determined by the Fund. Investments held by the Master Fund include direct, secondary and primary private equity investments (collectively, “Private Equity Investments”). The Master Fund values interests in the Private Equity Investments at fair value in accordance with procedures established by the Board and the Board of Managers of the Master Fund. Private Equity Investments are subject to the terms of their respective Private Equity Investments’ offering documents. Valuations of Private Equity Investments are subject to estimates and are net of management and performance incentive fees or allocations that may be payable pursuant to such offering documents.

c. Allocations from the Master Fund

In accordance with U.S. GAAP, the Fund records its allocated portion of income, expense, realized gains and losses and unrealized appreciation and depreciation allocated from the Master Fund.

d. Fund Level Income and Expenses

Interest income on any cash or cash equivalents held by the Fund is recognized on an accrual basis. Expenses that are specifically attributed to the Fund are accrued and charged to the Fund. Because the Fund bears its proportionate share of the management fees of the Master Fund, the Fund pays no direct management fee to the Adviser. Income and expenses are recorded on an accrual basis.

| 6 |

Partners Group Private Equity (Institutional TEI), LLC

(a Delaware Limited Liability Company)

Notes to Consolidated Financial Statements – September 30, 2012 (unaudited) (continued)

2. Significant Accounting Policies (continued)

e. Expense Limitation Agreement

Effective September 26, 2011, the Adviser has entered into an expense limitation agreement (the “Expense Limitation Agreement”) with the Fund. The Adviser has agreed to waive fees that it would otherwise be paid, and/or to assume expenses of the Fund (a “Waiver”), if required to ensure the Total Annual Expenses (excluding taxes, interest, brokerage commissions, certain transaction-related expenses, extraordinary expenses, the Incentive Allocation (as defined below) and any acquired fund fees and expenses) do not exceed 2.30%, on an annualized basis (the “Expense Limit”). For a period not to exceed three years from the date on which a Waiver is made, the Adviser may recoup amounts waived or assumed, provided it is able to effect such recoupment and remain within the Expense Limit. The Expense Limitation Agreement has an initial two-year term, but it may be terminated by the Adviser or the Fund at any time that the Fund would not exceed the Expense Limit without giving effect to any Waiver. For the six month period ended September 30, 2012, the Adviser waived fees of $37,618. At September 30, 2012, $33,074 is subject for recoupment through March 31, 2015 and $37,618 is subject for recoupment through March 31, 2016.

f. Tax Basis Reporting

Because the Master Fund invests primarily in investments that are treated as partnerships for U.S. federal income tax purposes, the tax character of the Fund’s allocated earnings depends on the tax filings of the Private Equity Investments. Accordingly, the tax bases of these allocated earnings and the related balances are not available as of the reporting date.

g. Income Taxes

For U.S. federal income tax purposes, the Fund is treated as a partnership, and each Member in the Fund is treated as the owner of its allocated share of the net assets, income, expenses, and the realized and unrealized gains (losses) of the Fund. Accordingly, no federal, state or local income taxes are paid by the Fund on the income or gains of the Fund since the Members are individually liable for the taxes on their allocated share of such income or gains of the Fund.

The Fund has adopted the authoritative guidance on accounting for and disclosure of uncertainty in tax positions. The Financial Accounting Standards Board (“FASB”) issued Accounting for Uncertainty in Income Taxes, which requires the Adviser to determine whether a tax position of the Fund is more likely than not to be sustained upon examination, including resolution of any related appeals or litigation processes, based on the technical merits of the position. For tax positions meeting the more likely than not threshold, the tax amount recognized in the financial statements is reduced by the largest benefit that has a greater than fifty percent likelihood of being realized upon ultimate settlement with the relevant taxing authority.

The Fund files tax returns as prescribed by the tax laws of the jurisdictions in which it operates. In the normal course of business, the Fund is subject to examination by federal, state, local and foreign jurisdictions, where applicable. As of September 30, 2012, the tax years from the year 2011 forward remain subject to examination by the major tax jurisdictions under the statute of limitations.

h. Cash and cash equivalents

Pending investment in the Master Fund, the Fund holds cash and cash equivalents including amounts held in interest bearing deposit accounts.

At times, such amounts may exceed federally insured limits. The Fund has not experienced any losses in such accounts and does not believe that it is exposed to any significant credit risk on such accounts.

i. Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements, and the reported amounts of increases and decreases in Members’ capital from operations during the reporting period. Actual results can differ from those estimates.

| 7 |

Partners Group Private Equity (Institutional TEI), LLC

(a Delaware Limited Liability Company)

Notes to Consolidated Financial Statements – September 30, 2012 (unaudited) (continued)

2. Significant Accounting Policies (continued)

j. Consolidated Financial Statements

The asset, liability, and equity accounts of the Partners Group Private Equity (Institutional TEI), LLC are consolidated with its respective Offshore Fund as presented in the Consolidated Statement of Assets, Liabilities, and Members’ Equity. All significant intercompany accounts and transactions have been eliminated in consolidation.

k. Organization Expenses

Costs incurred in connection with the organization of the Fund were $26,566, of which $8,855 was expensed for the fiscal period ended March 31, 2012, and $13,283 was expensed for the six month period ended September 30, 2012.

l. Recently Issued Accounting Pronouncements

In December 2011, FASB issued Accounting Standards Update (“ASU”) No. 2011-11 related to disclosures about offsetting assets and liabilities. The amendments in this ASU require an entity to disclose information about offsetting and related arrangements to enable users of its financial statements to understand the effect of those arrangements on its financial position. The ASU is effective for annual reporting periods beginning on or after January 1, 2013, and interim periods within those annual periods. The guidance requires retrospective application for all comparative periods presented. Management is currently evaluating the impact ASU No. 2011-11 will have on the financial statement disclosures.

3. Fair Value Measurements

The Fund records its investment in the Master Fund at the net asset value of the Interests owned by the Fund in the Master Fund. The Interests in the Master Fund, in which the Fund invests, are considered a Level 3 security as defined under fair valuation accounting standards. The Master Fund’s disclosure with respect to investments held by the Master Fund under the three-tier hierarchy is discussed in the Notes to the Master Fund’s financial statements.

4. Allocation of Members’ Capital

Net profits or net losses of the Fund for each Allocation Period (as defined below) are allocated among and credited to or debited against the capital accounts of the Members. Each Allocation Period begins on the day after the last day of the preceding Allocation Period and ends at the close of business on the first to occur thereafter of: (1) the last day of a calendar month, (2) the last day of a taxable year, (3) the day preceding a day on which interests are purchased, (4) a day on which Units are repurchased by the Fund pursuant to tenders of Units by Members, or (5) a day on which any amount is credited to or debited from the capital account of any Member other than an amount to be credited to or debited from the capital accounts of all Members in accordance with their respective investment percentages.

The Fund maintains a separate capital account on its books for each Member. As of any date, the capital account of a Member shall be equal to the net asset value per Unit as of such date, multiplied by the number of Units held by such Member. Any amounts charged or debited against a Member’s capital account under the Fund’s ability to allocate special items, and to accrue reserves, other than among all Members in accordance with the number of Units held by each Member, shall be treated as a partial repurchase of such Member’s Units for no additional consideration as of the date on which the Board determines such charge or debit is required to be made, and such Member’s Units shall be reduced thereby as appropriately determined by the Fund. Any amounts credited to a Member’s capital account under the Fund’s ability to allocate special items and to accrue reserves, other than among all Members in accordance with the number of Units held by each such Member, shall be treated as an issuance of additional Units to such Member for no additional consideration as of the date on which the Board determines such credit is required to be made, and such Member’s Units shall be increased thereby as appropriately determined by the Fund. As of September 30, 2012, there have been no special items or accrued receivables allocated to Members’ capital accounts.

5. Subscriptions and Repurchase of Members’ Interests

Units are generally offered for purchase as of the first day of each calendar month, but may be offered more or less frequently as determined by the Board in its sole discretion.

| 8 |

Partners Group Private Equity (Institutional TEI), LLC

(a Delaware Limited Liability Company)

Notes to Consolidated Financial Statements – September 30, 2012 (unaudited) (continued)

5. Subscriptions and Repurchase of Members’ Interests (continued)

The Board may, from time to time and in its sole discretion, cause the Fund to repurchase Units from Members pursuant to written tenders by Members at such times and on such terms and conditions as established by the Board. In determining whether the Fund should offer to repurchase Units, the Board considers whether the Master Fund is making a contemporaneous repurchase offer for interests in the Master Fund, as well as a variety of other operational, business and economic factors. The Adviser anticipates recommending to the Master Fund’s Board of Managers that, under normal circumstances, the Master Fund conduct repurchase offers of no more than 5% of the Master Fund’s net assets quarterly on or about each January 1st, April 1st, July 1st and October 1st. It is anticipated that the Fund will generally conduct repurchase offers contemporaneously with repurchase offers conducted by the Master Fund. A 2.00% early repurchase fee will be charged by the Fund with respect to any repurchase of Units from a Member at any time prior to the day immediately preceding the one-year anniversary of the Member’s purchase of such Units.

6. Related Party Transactions and Other

An incentive allocation (“Incentive Allocation”) is calculated at the Master Fund level and allocated to the Fund based on the Fund’s ownership interest in the Master Fund. The Incentive Allocation is equal to 10% of the excess, if any, of (i) the allocable share of the net profits of the Master Fund for the relevant period of each member of the Master Fund, including the Fund, over (ii) the then balance, if any, of that Member’s Loss Recovery Account (as defined below) will be debited from such Member’s capital account and credited to a capital account of the Adviser (or, to the extent permitted by applicable law, of an affiliate of the Adviser) in the Master Fund (the “Incentive Allocation Account”). The Incentive Allocation Account is maintained solely for the purpose of allocating the Incentive Allocation.

The Master Fund maintains a memorandum account for each member of the Master Fund, including the Fund (each, a “Loss Recovery Account”). Each member’s Loss Recovery Account has an initial balance of zero and is (i) increased upon the close of each Allocation Period of the Master Fund by the amount of the relevant member’s allocable share of the net losses of the Master Fund for the Allocation Period, and (ii) decreased (but not below zero) upon the close of such Allocation Period by the amount of such member’s allocable share of the net profits of the Master Fund for the Allocation Period. The Incentive Allocation is calculated, charged to each member of the Master Fund and credited to the Incentive Allocation Account as of the end of each Allocation Period. The Allocation Period with respect to a member whose interest in the Master Fund is repurchased or is transferred in part is treated as ending only for the portion of the interest so repurchased or transferred. In addition, only the net profits of the Master Fund, if any, and the balance of the Loss Recovery Account attributable to the portion of the interest being repurchased or transferred (based on the member’s capital account amount being so repurchased or transferred) is taken into account in determining the Incentive Allocation for the Allocation Period then ending. The member’s Loss Recovery Account is not adjusted for such member’s allocable share of the net losses of the Master Fund, if any, for the Allocation Period then ending that are attributable to the portion of the interest so repurchased or transferred. For the six month period ended September 30, 2012, an Incentive Allocation of $28,541 was credited to the Incentive Allocation Account from the Fund.

UMB Bank, N.A. (the “Custodian”) serves as custodian of the Fund’s cash balances and provides custodial services for the Fund. UMB Fund Services, Inc. (the “Administrator”) serves as administrator and accounting agent to the Fund and provides certain accounting, record keeping and investor related services. For these services the Custodian and the Administrator collectively receive a fixed monthly fee, based upon average net assets, and a monthly fee based on the number of Member accounts as well as reasonable out of pocket expenses. For the six month period ended September 30, 2012, the Fund paid $21,046 in administration and accounting fees.

7. Risk Factors

An investment in the Fund involves significant risks that should be carefully considered prior to investment and should only be considered by persons financially able to maintain their investment and who can afford a loss of a substantial part or all of such investment. The Master Fund invests substantially all of its available capital in Private Equity Investments. These investments are generally restricted securities that are subject to substantial holding periods and are not traded in public markets, so that the Master Fund may not be able to resell some of its holdings for extended periods, which may be several years. No guarantee or representation is made that the investment objective will be met. A further discussion of the risks associated with an investment in the Fund is provided in the Master Fund’s Financial Statements, the Confidential Private Placement Memorandum and Statement of Additional Information.

8. Indemnification

In the normal course of business, the Fund enters into contracts that provide general indemnification. The Fund’s maximum exposure under these agreements is dependent on future claims that may be made against the Fund under such agreements, and therefore, cannot be established; however, based on experience, the risk of loss from such claims is considered remote.

| 9 |

Partners Group Private Equity (Institutional TEI), LLC

(a Delaware Limited Liability Company)

Notes to Consolidated Financial Statements – September 30, 2012 (unaudited) (continued)

9. Subsequent Events

Management has evaluated the impact of all subsequent events on the Fund through November 29, 2012, the date the consolidated financial statements were issued, and has determined that the following subsequent event requires disclosure in the consolidated financial statements. Effective November 1, 2012, there were additional capital contributions to the Fund in the amounts of $1,000,000.

The Fund changed its net asset value per Unit such that Members of record as of September 30, 2012 received, effective October 1, 2012, one hundred Units for every one Unit held. This resulted in an increase in Units outstanding from 5,000 to 500,000, and a decrease in net asset value per unit from $1,073.19 to $10.73.

| 10 |

Partners Group Private Equity (Institutional TEI), LLC

(a Delaware Limited Liability Company)

Other Information (unaudited)

Proxy Voting

The Fund is required to file Form N-PX, with its complete proxy voting record for the twelve months ended June 30, no later than August 31. The Fund’s Form N-PX filing is available: (i) without charge, upon request, by calling the Fund at 1-877-748-7209 or (ii) by visiting the SEC’s website at www.sec.gov.

Availability of Quarterly Portfolio Schedules

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q is available, without charge and upon request, on the SEC’s website at http://www.sec.gov or may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the Public Reference Room may be obtained by calling 1-800-SEC-0330.

| 11 |

PARTNERS GROUP PRIVATE EQUITY (MASTER FUND), LLC

(a Delaware Limited Liability Company)

Financial Statements

For the Six Months Ended September 30, 2012

(Unaudited)

PARTNERS GROUP PRIVATE EQUITY (MASTER FUND), LLC

(a Delaware Limited Liability Company)

For the Six Months Ended September 30, 2012

(Unaudited)

Table of Contents

| Schedule of Investments | 1-3 |

| Statement of Assets, Liabilities and Members' Equity | 4 |

| Statement of Operations | 5 |

| Statements of Changes in Members' Equity | 6 |

| Statement of Cash Flows | 7 |

| Financial Highlights | 8 |

| Notes to Financial Statements | 9-16 |

| Other Information | 17 |

| Partners Group Private Equity (Master Fund), LLC |

| (a Delaware Limited Liability Company) |

| Schedule of Investments - September 30, 2012 (Unaudited) |

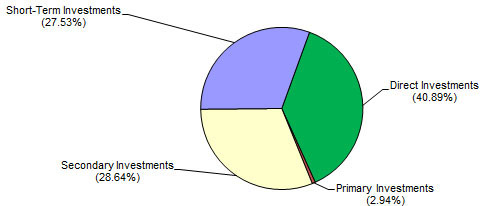

INVESTMENT OBJECTIVE AS A PERCENTAGE OF TOTAL MEMBERS' EQUITY - NET ASSETS

Percentages as a percentage of total investments are as follows:

| Private Equity Investments (73.44%) a | ||||||||

| Direct Investments * (41.44%) | ||||||||

| Direct Equity (16.85%) | Investment Type | Geographic Region b | Fair Value ** | |||||

| ACP Viking Co-Investment, LLC c | Member interest | North America | $ | 2,415,230 | ||||

| AnaCap Calcium, L.P. c | Limited partnership interest | Western Europe | 8,081,500 | |||||

| ATX Networks Holdings, LLC c | Member interest | North America | 95,707 | |||||

| Aurora Products Group, LLC c | Member interest | North America | 425,000 | |||||

| CD&R Univar Co-Investor, L.P. c | Limited partnership interest | North America | 3,703,961 | |||||

| Collins Food Holding Pty, Ltd. | Common equity | Asia - Pacific | 51,837 | |||||

| CT Holdings (International), Ltd. | Common equity | Asia - Pacific | 4,503,070 | |||||

| DLJSAP BookCO, LLC c | Member interest | South America | 728,212 | |||||

| EQT Marvin Co-Investment, L.P. c | Limited partnership interest | Western Europe | 1,396,022 | |||||

| Fermo, Ltd. c | Common equity | Asia - Pacific | 280,000 | |||||

| Fermo, Ltd. c | Preferred equity | Asia - Pacific | 5,320,000 | |||||

| Gemini Global Holdings Investors, LLC c | Member interest | North America | 111,038 | |||||

| Gemini Global Holdings Investors, LLC c | Limited partnership interest | North America | 3,773,057 | |||||

| Globetrotter Investment & Co S.C.A. c | Common equity | Western Europe | 77,154 | |||||

| Globetrotter Investment & Co S.C.A. c | Preferred equity | Western Europe | 7,638,250 | |||||

| HGI Global Holdings, Inc. c | Common equity | North America | 335,440 | |||||

| Hogan S.ar.I c | Common equity | Western Europe | 1,152,002 | |||||

| Hogan S.ar.I c | Preferred equity | Western Europe | 2,475,942 | |||||

| Kahuna Holdco Pty, Ltd. | Common equity | Asia - Pacific | 1,475,567 | |||||

| KKBS Group Holdings, LLC c | Member interest | North America | 125,000 | |||||

| KLFS Holdings, L.P. c | Limited partnership interest | North America | 2,255,690 | |||||

| Mauritius (Luxembourg) Investments S.ar.l. c | Common equity | Western Europe | 1,533,366 | |||||

| MPH Acquisition Holdings, LLC c | Member interest | North America | 3,379,993 | |||||

| NDES Holdings, LLC c | Member interest | North America | 3,999,893 | |||||

| Peer I S.A. c | Common equity | Western Europe | 1,674,977 | |||||

| Peer I S.A. | Preferred equity | Western Europe | 4,040,788 | |||||

| Sabre Industries, Inc. c | Common equity | North America | 570,000 | |||||

| S-Evergreen Holding Corp. c | Common equity | North America | 751,757 | |||||

| Silver Lake Sumeru Marlin Co-Invest Fund, L.P. c | Limited partnership interest | North America | 2,690,377 | |||||

| Spring Topco, Ltd. c | Common equity | North America | 706,828 | |||||

| Strategic Partners, Inc. c | Common equity | North America | 3,469,853 | |||||

| Surgery Center Holdings, LLC c | Warrants | North America | 67,852 | |||||

| Swissport II Co-Invest FCPR c | Common equity | Western Europe | 4,479,012 | |||||

| Valhalla Co-Invest, L.P. c | Limited partnership interest | Western Europe | 4,744,717 | |||||

| Velocity Technologies Solutions, Inc. c | Common equity | North America | 7,800,000 | |||||

| 86,329,092 | ||||||||

| Direct Debt (24.59%) | Interest | Maturity | Investment Type | Geographic Region b | Fair Value ** | |||||||||

| AMC Entertainment, Inc. | Libor + 3.25% | 12/15/2016 | Senior | North America | 2,956,058 | |||||||||

| ATX Networks Corp. | 12.00% + 2.00% PIK | 5/12/2016 | Mezzanine | North America | 962,889 | |||||||||

| Bausch & Lomb, Inc. | Libor + 4.75% (1.00% floor) | 5/18/2019 | Senior | North America | 8,102,027 | |||||||||

| Biomnis | 7.00% + 2.875% PIK (steps up to Euribor + 5.00% + 2.875% PIK) | 6/30/2017 | Mezzanine | Western Europe | 5,134,471 | |||||||||

| BostonMed Acquisition GmbH | Libor (1.25% floor) + 4.75% | 8/28/2020 | Senior | Western Europe | 2,011,000 | |||||||||

| Dynamic Research Corp. | 13.00% | 6/30/2017 | Mezzanine | North America | 10,007,104 | |||||||||

| Diana Ingredients | Euribor + 3.00% + 3.50% PIK | 12/31/2017 | Mezzanine | Western Europe | 6,434,147 | |||||||||

| Evergreen ACQC01, L.P. | 10.50% | 7/11/2022 | Mezzanine | North America | 6,325,000 | |||||||||

| Globetrotter Investment & Co S.C.A. | Euribor + 5.75% | 7/31/2019 | Senior | Western Europe | 9,647,400 | |||||||||

| 1 |

| Partners Group Private Equity (Master Fund), LLC |

| (a Delaware Limited Liability Company) |

| Schedule of Investments - September 30, 2012 (Unaudited)(continued) |

| Direct Debt (24.59%) (continued) | Interest | Maturity | Investment Type | Geographic Region b | Fair Value ** | |||||||||

| Global Tel*Link Corp. | Libor + 4.75% (1.25% floor) | 12/14/2017 | Senior | North America | 4,719,799 | |||||||||

| Greeneden U.S. Holdings II, LLC | Libor + 5.25% (1.50% floor) | 1/31/2019 | Senior | North America | 4,075,952 | |||||||||

| HGI Holdings, Inc. | 12.50% | 10/1/2017 | Mezzanine | North America | 2,100,000 | |||||||||

| KACC Acquisition, LLC | 12% + 1.00% PIK | 6/29/2018 | Mezzanine | North America | 4,263,702 | |||||||||

| Kahuna Bidco Pty, Ltd. | BBSY + 5.00% + 3.50% PIK | 12/31/2016 | Mezzanine | Asia - Pacific | 5,383,036 | |||||||||

| Kinetic Concepts, Inc. | Libor + 5.75% (1.25% floor) | 5/31/2018 | Senior | North America | 4,303,125 | |||||||||

| KKBS Holdings, LLC | 12.00% + 2.00% PIK | 12/17/2016 | Mezzanine | North America | 1,400,482 | |||||||||

| Last Mile Funding Corp. | 12.00% + 2.50% PIK | 6/16/2016 | Mezzanine | North America | 3,108,896 | |||||||||

| Learning Care Group (US), Inc. | 12.00% | 6/30/2016 | Senior | North America | 2,208,171 | |||||||||

| Learning Care Group (US) No. 2, Inc. | 15.00% PIK (2x redemption preference) | 6/30/2016 | Mezzanine | North America | 390,809 | |||||||||

| Newcastle Coal Infrastructure Group Pty, Ltd. | BBSY + 6.50% + (steps up to 9.00%) | 1/22/2023 | Senior | Asia - Pacific | 4,213,705 | |||||||||

| Sabre Industries, Inc. | 12.00% + 2.00% PIK | 2/22/2019 | Mezzanine | North America | 3,854,678 | |||||||||

| Securitas Direct Holding AB | 3.75% + 6.75% PIK | 9/2/2019 | Mezzanine | Western Europe | 7,356,957 | |||||||||

| ServiceMaster Company (The) | Libor + 2.50% | 7/24/2014 | Senior | North America | 2,934,850 | |||||||||

| Surgery Center Holdings, Inc. | 12.00% + 3.00% PIK | 6/24/2015 | Mezzanine | North America | 4,716,859 | |||||||||

| Svensk Utbildning Intressenter Holding AB | Libor(SEK)+5.00%+7.00% PIK (2.00% floor) | 6/30/2018 | Mezzanine | Western Europe | 2,893,038 | |||||||||

| Temple Power Plant | Libor + 13.00% | 7/27/2020 | Mezzanine | North America | 5,427,200 | |||||||||

| Triactor Acquico AB | Euribor + 6.00% + 6.00% PIK (2.00% Euribor floor) | 8/22/2017 | Mezzanine | Western Europe | 644,399 | |||||||||

| Universal Services of America, Inc. | 12.00% + 2.50% PIK | 8/31/2016 | Mezzanine | North America | 3,339,875 | |||||||||

| Wood Mackenzie | Libor + 6.00% (1.25% floor) | 8/31/2019 | Senior | Western Europe | 7,114,352 | |||||||||

| 126,029,981 | ||||||||||||||

| Total Direct Investments (41.44%) | $ | 212,359,073 | ||||||||||||

| Secondary Investments* (29.02%) | Geographic

Region b | Fair Value | ||||

| 3i Europartners Vb, L.P. | Western Europe | $ | 988,385 | |||

| Abingworth Bioventures V Co-Investment Growth Equity Fund, L.P. c | Western Europe | 913,097 | ||||

| Abingworth Bioventures V, L.P. c | Western Europe | 1,016,161 | ||||

| Advent International GPE VI, L.P. | Western Europe | 4,691,794 | ||||

| Apax Europe VI - A, L.P. | Western Europe | 565,237 | ||||

| Apax Europe VII - B, L.P. c | Western Europe | 718,617 | ||||

| Apollo Investment Fund IV, L.P. c | North America | 14,411 | ||||

| Apollo Investment Fund VI, L.P. | North America | 1,918,833 | ||||

| Apollo Investment Fund VII, L.P. | North America | 1,441,008 | ||||

| Apollo Overseas Partners (Delaware) VII, L.P. | North America | 525,334 | ||||

| Ares Corporate Opportunities Fund III, L.P. | North America | 257,523 | ||||

| Bain Capital Fund X, L.P. | North America | 13,870,788 | ||||

| Bain Capital X Co-Investment Fund, L.P. c | North America | 988,158 | ||||

| Baring Asia Private Equity Fund IV, L.P. | Asia - Pacific | 468,324 | ||||

| Blackstone Capital Partners V/F, L.P. | North America | 4,237,448 | ||||

| Blackstone Capital Partners V-S, L.P. | North America | 373,733 | ||||

| Candover 2001 Fund UK No. 2, L.P. c | Western Europe | 167,665 | ||||

| Candover 2005 Fund, L.P. c | Western Europe | 1,030,370 | ||||

| Carlyle Partners IV, L.P. | North America | 3,320,797 | ||||

| Carlyle Partners V, L.P. | North America | 1,017,867 | ||||

| Carlyle Partners V/B, L.P. | North America | 4,306,501 | ||||

| Citigroup Venture Capital International Growth Offshore I, L.P. | Asia - Pacific | 110,397 | ||||

| Citigroup Venture Capital International Growth Offshore II, L.P. | Asia - Pacific | 479,762 | ||||

| Citigroup Venture International Growth Partnership II, L.P. | Asia - Pacific | 1,453,626 | ||||

| Clayton, Dubilier & Rice Fund VII, L.P. | North America | 10,049,635 | ||||

| Clayton, Dubilier & Rice Fund VIII, L.P. c | North America | 6,244,245 | ||||

| CVC European Equity Partners Tandem (A) Fund, L.P. | Western Europe | 873,933 | ||||

| CVC European Equity Partners V, L.P. | Western Europe | 1,529,363 | ||||

| Duke Street Capital V US No. 2, L.P. | Western Europe | 4,763 | ||||

| Duke Street Capital VI US No. 1, L.P. | Western Europe | 408,812 | ||||

| Fourth Cinven Fund, L.P. | Western Europe | 860,521 | ||||

| Frazier Healthcare VI, L.P. c | North America | 1,183,966 | ||||

| FS Equity Partners V, L.P. c | North America | 3,872,103 | ||||

| Green Equity Investors Side V, L.P. | North America | 2,245,260 | ||||

| Harvest Partners V, L.P. | North America | 713,598 | ||||

| H.I.G. Bayside Debt & LBO Fund II, L.P. | North America | 904,333 | ||||

| Highstar Capital III Prism Fund, L.P. | North America | 2,114,193 | ||||

| Investcorp Private Equity 2007 Fund, L.P. c | North America | 4,179,169 | ||||

| Investcorp Technology Partners III (Cayman), L.P.c | North America | 3,875,353 | ||||

| Irving Place Capital Investors II, L.P. | North America | 128,707 | ||||

| Irving Place Capital Partners III, L.P. | North America | 1,218,193 | ||||

| KKR European Fund III, L.P. c | Western Europe | 3,436,811 | ||||

| Madison Dearborn Capital Partners V-A and V-B, L.P. | North America | 8,164,924 | ||||

| Madison Dearborn Capital Partners VI-C, L.P. | North America | 308,651 | ||||

| MidOcean Partners III, L.P. | North America | 2,017,964 | ||||

| 2 |

| Partners Group Private Equity (Master Fund), LLC |

| (a Delaware Limited Liability Company) |

| Schedule of Investments - September 30, 2012 (Unaudited)(continued) |

| Secondary Investments* (29.02%) (continued) | Geographic

Region b | Fair Value | ||||

| Montagu III, L.P. | Western Europe | 240,213 | ||||

| Oak Investment Partners XII, L.P. c | North America | 1,929,567 | ||||

| Palladium Equity Partners III, L.P. | North America | 697,460 | ||||

| Permira IV Continuing, L.P. 1 | Western Europe | 3,050,930 | ||||

| Providence Equity Partners IV, L.P. | North America | 145,945 | ||||

| Providence Equity Partners V, L.P. | North America | 734,993 | ||||

| Providence Equity Partners VI, L.P. | North America | 999,494 | ||||

| Ripplewood Partners II, L.P. c | North America | 8,044,027 | ||||

| Silver Lake Partners III, L.P. | North America | 3,634,198 | ||||

| Silver Lake Sumeru Fund, L.P. | North America | 381,111 | ||||

| Thomas H. Lee Parallel (DT) Fund VI, L.P. c | North America | 2,277,345 | ||||

| Thomas H. Lee Parallel Fund VI, L.P. | North America | 2,034,879 | ||||

| TPG Partners V, L.P. | North America | 6,492,898 | ||||

| TPG Partners VI, L.P. | North America | 365,978 | ||||

| Warburg Pincus Private Equity IX, L.P. | North America | 1,284,007 | ||||

| Warburg Pincus Private Equity X, L.P. | North America | 17,217,244 | ||||

| Total Secondary Investments (29.02%) | $ | 148,740,622 |

| Primary Investments* (2.98%) | Geographic

Region b | Fair Value | ||||

| Advent International GPE VII-B, L.P. c | North America | $ | 737,500 | |||

| Avista Capital Partners II, L.P. | North America | 1,194,899 | ||||

| Avista Capital Partners III, L.P. c | North America | 3,015,765 | ||||

| Baring Asia Private Equity V, L.P. c | Asia - Pacific | 1,178,274 | ||||

| Crescent Mezzanine Partners VIB, L.P. c | North America | 744,324 | ||||

| EQT VI (No.1), L.P. c | Western Europe | 1,232,451 | ||||

| Hony Capital Partners V, L.P. c | Asia - Pacific | 482,282 | ||||

| Kohlberg TE Investors VII, L.P. c | North America | 772,483 | ||||

| New Enterprise Associates 14, L.P. c | North America | 686,225 | ||||

| Pátria - Brazilian Private Equity Fund IV, L.P. c | South America | 198,582 | ||||

| PennantPark Credit Opportunities Fund, L.P. c | North America | 5,000,000 | ||||

| Total Primary Investments (2.98%) | $ | 15,242,785 | ||||

| Total Private Equity Investments (Cost $328,473,076) (73.44%) | $ | 376,342,480 | ||||

| Short-Term Investments (27.90%) | ||||

| U.S. Government Treasury Obligations (27.90%) | ||||

| U.S. Treasury Bill, 0.065%, 10/11/2012 d | $ | 34,999,368 | ||

| U.S. Treasury Bill, 0.05%, 10/25/2012 d | 19,999,333 | |||

| U.S. Treasury Bill, 0.075%, 11/08/2012 d | 29,997,625 | |||

| U.S. Treasury Bill, 0.075%, 11/15/2012 d | 9,999,062 | |||

| U.S. Treasury Bill, 0.09%, 11/29/2012 d | 19,997,050 | |||

| U.S. Treasury Bill, 0.09%, 12/13/2012 d | 27,995,324 | |||

| Total U.S. Government Treasury Obligations (27.90%) | $ | 142,987,762 | ||

| Total Short-Term Investments (Cost $142,987,328) (27.90%) | $ | 142,987,762 | ||

| Total Investments (Cost $471,460,404) (101.34%) | 519,330,242 | |||

| Liabilities in Excess of Other Assets (-1.34%) | (6,848,525 | ) | ||

| Members' Equity (100.00%) | $ | 512,481,717 | ||

| * | Direct private equity investments are private investments directly into the equity or debt of selected operating companies, often together with the management of the company. Primary investments are investments in newly established private equity partnerships where underlying portfolio companies are not known as of the time of investment. Secondary investments involve acquiring single or portfolios of assets on the secondary market. |

| ** | The Fair Value of any Direct Investment may not necessarily reflect the current or expected future performance of such Direct Investment or the Fair Value of the Master Fund's interest in such Direct Investment. Furthermore, the Fair Value of any Direct Investment has not been calculated, reviewed, verified or in any way approved by such Direct Investment or its general partner, manager or sponsor (including any of its affiliates). Please see Note 2.b for further detail regarding the valuation policy of the Master Fund. |

| a | Private equity investments are generally issued in private placement transactions and as such are generally restricted as to resale. Total cost and fair value of restricted portfolio funds as of September 30, 2012 was $328,473,076 and $376,342,480, respectively. |

| b | Geographic region is based on where a Private Equity Investment is headquartered and may be different from where such Private Equity Investment invests or operates. |

| c | Non-income producing. |

| d | Each issue shows the rate of the discount at the time of purchase. |

The accompanying notes are an integral part of these Financial Statements.

| 3 |

| PARTNERS GROUP PRIVATE EQUITY (MASTER FUND), LLC |

| (a Delaware Limited Liability Company) |

| Statement of Assets, Liabilities and Members' Equity - September 30, 2012 (Unaudited) |

| Assets | ||||

| Private Equity Investments, at fair value (cost $328,473,076) | $ | 376,342,480 | ||

| Short-term investments, at fair value (cost $142,987,328) | 142,987,762 | |||

| Cash and cash equivalents | 7,393,679 | |||

| Cash denominated in foreign currencies (cost $1,200,909) | 1,274,732 | |||

| Interest receivable | 1,210,069 | |||

| Transaction fees receivable | 284,939 | |||

| Dividends receivable | 65,286 | |||

| Prepaid assets | 34,678 | |||

| Total Assets | $ | 529,593,625 | ||

| Liabilities | ||||

| Investment purchases payable | $ | 10,152,293 | ||

| Repurchase amounts payable | 5,237,509 | |||

| Forward foreign currency contracts payable | 610,695 | |||

| Management fee payable | 540,143 | |||

| Professional fees payable | 270,218 | |||

| Accounting and administration fees payable | 57,917 | |||

| Board of Managers' fees payable | 45,000 | |||

| Custodian fees payable | 37,138 | |||

| Other expenses payable | 160,995 | |||

| Total Liabilities | $ | 17,111,908 | ||

| Members' Equity | $ | 512,481,717 | ||

| Members' Equity consists of: | ||||

| Members' Equity Paid-in | $ | 445,351,996 | ||

| Accumulated net investment income | 5,141,710 | |||

| Accumulated net realized gain on investments, forward foreign currency contracts and foreign currency translation | 14,654,630 | |||

| Accumulated net unrealized appreciation on investments, forward foreign currency contracts and foreign currency translation | 47,333,381 | |||

| Total Members' Equity | $ | 512,481,717 |

The accompanying notes are an integral part of these Financial Statements.

| 4 |

| PARTNERS GROUP PRIVATE EQUITY (MASTER FUND), LLC |

| (a Delaware Limited Liability Company) |

| Statement of Operations |

| For the Six Months Ended September 30, 2012 (Unaudited) |

| Investment Income | ||||

| Dividends | $ | 675,290 | ||

| Interest | 4,907,377 | |||

| Transaction fee income | 292,755 | |||

| Miscellaneous income | 9,383 | |||

| Total Investment Income | 5,884,805 | |||

| Operating Expenses | ||||

| Management fee | 2,897,589 | |||

| Professional fees | 243,973 | |||

| Accounting and administration fees | 162,563 | |||

| Board of Managers' fees | 45,000 | |||

| Custodian fees | 36,736 | |||

| Insurance expense | 34,109 | |||

| Other expenses | 179,162 | |||

| Net Expenses | 3,599,132 | |||

| Net Investment Income | 2,285,673 | |||

| Net Realized Gain (Loss) and Change in Unrealized Appreciation/(Depreciation) on Investments, Forward Foreign Currency Contracts and Foreign Currency | ||||

| Net realized gain from investments | 1,135,144 | |||

| Net realized gain on forward foreign currency contracts | 1,013,151 | |||

| Net realized loss on foreign currency translation | (36 | ) | ||

| Net realized gain distributions from primary and secondary investments | 5,133,940 | |||

| Net change in accumulated unrealized appreciation/(depreciation) on: | ||||

| Investments | 15,548,563 | |||

| Foreign currency translation | 97,137 | |||

| Forward foreign currency contracts | (392,308 | ) | ||

| Net Realized Gain (Loss) and Change in Unrealized Appreciation/(Depreciation) on Investments, Forward Foreign Currency Contracts and Foreign Currency | 22,535,591 | |||

| Net Increase in Members' Equity From Operations | $ | 24,821,264 |

The accompanying notes are an integral part of these Financial Statements.

| 5 |

| PARTNERS GROUP PRIVATE EQUITY (MASTER FUND), LLC |

| (a Delaware Limited Liability Company) |

| Statements of Changes in Members' Equity |

| For the Periods Ended March 31, 2012 and September 30, 2012 (Unaudited) |

| Total | ||||||||||||

| Members' | Members' | |||||||||||

| Adviser's Equity | Equity | Equity | ||||||||||

| Members' Equity at March 31, 2011 | $ | 609,737 | $ | 165,716,557 | $ | 166,326,294 | ||||||

| Capital contributions | - | 206,634,000 | 206,634,000 | |||||||||

| Capital tenders | (1,747,104 | ) | (10,566,466 | ) | (12,313,570 | ) | ||||||

| Net investment income | - | 3,221,547 | 3,221,547 | |||||||||

| Net realized gain from investments | - | 628,008 | 628,008 | |||||||||

| Net realized gain on forward foreign currency contracts | - | 346,800 | 346,800 | |||||||||

| Net realized gain on foreign currency contracts | - | 99,486 | 99,486 | |||||||||

| Net realized gain distributions from primary and secondary investments | - | 4,330,001 | 4,330,001 | |||||||||

| Net change in accumulated unrealized appreciation on investments, forward foreign currency contracts and foreign currency translation | - | 15,215,542 | 15,215,542 | |||||||||

| Adviser's Incentive Allocation from April 1, 2011 to March 31, 2012 | 2,382,870 | (2,382,870 | ) | - | ||||||||

| Members' Equity at March 31, 2012 | $ | 1,245,503 | $ | 383,242,605 | $ | 384,488,108 | ||||||

| Members' Equity at April 1, 2012 | $ | 1,245,503 | $ | 383,242,605 | $ | 384,488,108 | ||||||

| Capital contributions | - | 118,196,591 | 118,196,591 | |||||||||

| Capital tenders | (2,246,158 | ) | (12,778,088 | ) | (15,024,246 | ) | ||||||

| Net investment income | - | 2,285,673 | 2,285,673 | |||||||||

| Net realized gain from investments | - | 1,135,144 | 1,135,144 | |||||||||

| Net realized gain on forward foreign currency contracts | - | 1,013,151 | 1,013,151 | |||||||||

| Net realized loss on foreign currency contracts | - | (36 | ) | (36 | ) | |||||||

| Net realized gain distributions from primary and secondary investments | - | 5,133,940 | 5,133,940 | |||||||||

| Net change in accumulated unrealized appreciation on investments, forward foreign currency contracts and foreign currency translation | ||||||||||||

| - | 15,253,392 | 15,253,392 | ||||||||||

| Adviser's Incentive Allocation from April 1, 2012 to September 30, 2012 | 2,478,482 | (2,478,482 | ) | - | ||||||||

| Members' Equity at September 30, 2012 | $ | 1,477,827 | $ | 511,003,890 | $ | 512,481,717 | ||||||

The accompanying notes are an integral part of these Financial Statements.

| 6 |

| PARTNERS GROUP PRIVATE EQUITY (MASTER FUND), LLC |

| (a Delaware Limited Liability Company) |

| Statement of Cash Flows |

| For the Six Months Ended September 30, 2012 (Unaudited) |

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||

| Net Increase in Members' Equity from Operations | $ | 24,821,264 | ||

| Adjustments to reconcile Net Increase in Members' Equity from | ||||

| Operations to net cash used in operating activities: | ||||

| Net change in accumulated unrealized appreciation on Investments | (15,548,563 | ) | ||

| Net realized gain from investments | (1,135,144 | ) | ||

| Purchases of Private Equity Investments | (130,748,632 | ) | ||

| Distributions received from Private Equity Investments | 23,488,640 | |||

| Net (purchases) sales of short-term investments | (8,003,275 | ) | ||

| Decrease in interest receivable | 754,364 | |||

| Increase in transaction fees receivable | (284,939 | ) | ||

| Increase in dividends receivable | (65,286 | ) | ||

| Increase in prepaid assets | (34,196 | ) | ||

| Increase in investment purchases payable | 3,630,243 | |||

| Increase in management fee payable | 136,271 | |||

| Decrease in professional fee payable | (13,443 | ) | ||

| Increase in accounting and administration fees payable | 12,692 | |||

| Increase in custodian fees payable | 28,138 | |||

| Increase in managers' fees payable | 22,500 | |||

| Increase in other expenses payable | 145,433 | |||

| Decrease in incentive fees payable | (139,920 | ) | ||

| Increase in forward foreign currency contract payable | 392,308 | |||

| Net Cash Used in Operating Activities | (102,541,545 | ) | ||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||

| Proceeds from Members' capital contributions | 118,196,591 | |||

| Proceeds from Members' capital tenders | (12,608,151 | ) | ||

| Net Cash Provided by Financing Activities | 105,588,440 | |||

| Net change in cash and cash equivalents | 3,046,895 | |||

| Cash and cash equivalents at beginning of period | 5,621,516 | |||

| Cash and Cash Equivalents at End of Period | $ | 8,668,411 |

The accompanying notes are an integral part of these Financial Statements.

| 7 |

| PARTNERS GROUP PRIVATE EQUITY (MASTER FUND), LLC |

| (a Delaware Limited Liability Company) |

| Financial Highlights |

| Period from | ||||||||||||||||

| Commencement | ||||||||||||||||

| Six Months Ended | of Operations - | |||||||||||||||

| September 30, 2012 | Year Ended | Year Ended | July 1, 2009 through | |||||||||||||

| (Unaudited) | March 31, 2012 | March 31, 2011 | March 31, 2010 | |||||||||||||

| Total Return Before Incentive Allocation(1) | 5.60 | %(3) | 9.11 | % | 11.08 | % | 4.30 | %(3) | ||||||||

| Total Return After Incentive Allocation(1) | 5.12 | %(3) | 8.33 | % | 9.95 | % | 3.80 | %(3) | ||||||||

| RATIOS AND SUPPLEMENTAL DATA: | ||||||||||||||||

| Net Assets, end of period in thousands (000's) | $ | 512,482 | $ | 384,488 | $ | 166,326 | $ | 28,214 | ||||||||

| Net investment income (loss) to average net assets before Incentive Allocation | 1.01 | %(4) | 1.17 | % | (0.06 | )% | (3.02 | )%(4) | ||||||||

| Ratio of gross expenses to average net assets, excluding Incentive Allocation(2) | 1.59 | %(4) | 1.63 | % | 2.20 | % | 4.96 | %(5) | ||||||||

| Incentive Allocation to average net assets | 0.55 | %(3) | 0.86 | % | 1.86 | % | 0.99 | %(3) | ||||||||

| Ratio of gross expenses and Incentive Allocation to average net assets (2) | 2.14 | %(4)(5) | 2.49 | % | 4.06 | % | 5.95 | %(4)(5) | ||||||||

| Expense waivers to average net assets | 0.00 | %(4) | 0.00 | % | (0.02 | )% | (1.16 | )%(4) | ||||||||

| Ratio of net expenses and Incentive Allocation to average net assets | 2.14 | %(4)(5) | 2.49 | % | 4.04 | % | 4.79 | %(4) | ||||||||

| Ratio of net expenses to average net assets, excluding Incentive Allocation | 1.59 | %(4) | 1.63 | % | 2.18 | % | 3.79 | %(4)(5) | ||||||||

| Portfolio Turnover | 7.89 | %(3) | 8.39 | % | 5.71 | % | 13.05 | %(3)(5) | ||||||||

| (1) | Total investment return based on per unit net asset value reflects the changes in net asset value based on the effects of the performance of the Master Fund during the period and adjusted for cash flows related to capital contributions or withdrawals during the period. |

| (2) | Represents the ratio of expenses to average net assets absent fee waivers and/or expense reimbursement by the Adviser. |

| (3) | Not annualized. |

| (4) | Annualized. |

| (5) | The Incentive Allocation and/or organizational expenses are not annualized. |

The accompanying notes are an integral part of these Financial Statements.

| 8 |

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Notes to Financial Statements – September 30, 2012 (unaudited)

| 1. | Organization |

Partners Group Private Equity (Master Fund), LLC (the “Master Fund”) was organized as a limited liability company under the laws of the State of Delaware on August 4, 2008 and commenced operations on July 1, 2009. The Master Fund is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a closed-end, non-diversified management investment company. The Master Fund is managed by Partners Group (USA) Inc. (the “Adviser”), an investment adviser registered under the Investment Advisers Act of 1940, as amended. A Board of Managers (the “Board”) has overall responsibility for the management and supervision of the business operations of the Master Fund. To the fullest extent permitted by applicable law, the Board may delegate any of its rights, powers and authority to, among others, the officers of the Master Fund, any committee of the Board, or the Adviser. The objective of the Master Fund is to seek attractive long-term capital appreciation by investing in a diversified portfolio of private equity investments.

The Master Fund is a master investment portfolio in a master-feeder structure. Partners Group Private Equity, LLC, Partners Group Private Equity (Institutional), LLC, Partners Group Private Equity (TEI), LLC, and Partners Group Private Equity (Institutional TEI), LLC, (collectively “the Feeder Funds”) invest substantially all of their assets, directly or indirectly, in the limited liability company interests (“Interests”) of the Master Fund and become members of the Master Fund (“Members”).

| 2. | Significant Accounting Policies |

The following is a summary of significant accounting and reporting policies used in preparing the financial statements.

a. Basis of Accounting

The Master Fund’s accounting and reporting policies conform with generally accepted accounting principles within the United States (“U.S. GAAP”).

b. Valuation of Investments

Investments held by the Master Fund include direct equity and debt investments (“Direct Investments”) and secondary and primary private equity investments (“Private Equity Fund Investments”) (collectively, “Private Equity Investments”).

Direct Investments

In assessing the fair value of non-traded Direct Investments, the Master Fund uses a variety of methods such as the time of last financing, earnings and multiple analysis, discounted cash flow and third party valuation, and makes assumptions that are based on market conditions existing at each end of the reporting period. Quoted market prices or dealer quotes for specific similar instruments are used for long-term debt where appropriate. Other techniques, such as option pricing models and estimated discounted value of future cash flows, are used to determine fair value for the remaining financial instruments.

Private Equity Fund Investments

The Master Fund values Private Equity Fund Investments at fair value, which ordinarily is based on the value determined by their respective investment managers, in accordance with procedures established by the Board. Private Equity Fund Investments are subject to the terms of their respective offering documents. Valuations of Private Equity Fund Investments are subject to estimates and are net of management and performance incentive fees or allocations that may be payable pursuant to such offering documents. If the Adviser determines that the most recent value reported by a Private Equity Investment does not represent fair value or if a Private Equity Investment fails to report a value to the Master Fund, a fair value determination is made under procedures established by and under the general supervision of the Board. Because of the inherent uncertainty in valuation, the estimated values may differ from the values that would have been used had a ready market for the securities existed, and the differences could be material.

The Master Fund has adopted the authoritative guidance under U.S. GAAP for estimating the fair value of investments in investment companies. Accordingly, in circumstances in which net asset value of an investment in an investment company is not determinative of fair value or the net asset value of the investment is determined using accounting guidance other than U.S. GAAP, the Master Fund estimates the fair value of such investment using the net asset value of the investment (or its equivalent) without further adjustment.

| 9 |

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Notes to Financial Statements – September 30, 2012 (unaudited) (continued)

| 2. | Significant Accounting Policies (continued) |

b. Valuation of Investments (continued)

The following is a summary of the inputs used in valuing the Master Fund's Private Equity Investments at fair value. The inputs or methodology used for valuing the Master Fund's Private Equity Investments are not necessarily an indication of the risk associated with investing in those investments. The Master Fund's valuation procedures require evaluation of all relevant factors available at the time the Master Fund values its investments.

Daily Traded Investments

The Master Fund values investments traded (1) on one or more of the U.S. national securities exchanges or the OTC Bulletin Board at their last sales price, and (2) on NASDAQ at the NASDAQ Official Closing Price, at the close of trading on the exchanges or markets where such securities are traded for the business day as of the relevant determination date. If no sale or official closing price of particular securities are reported on a particular day, the securities will be valued at the closing bid price for securities held long, or the closing ask price for securities held short, or if a closing bid or ask price, as applicable, is not available, at either the exchange or system-defined closing price on the exchange or system in which such securities are principally traded. Securities traded on a foreign securities exchange generally will be valued at their closing prices on the exchange where such securities are primarily traded and translated into U.S. dollars at the current exchange rate provided by a recognized pricing service.

Investments for which no prices are obtained under the foregoing procedures, including those for which a pricing service supplies no exchange quotation or a quotation that is believed by the Adviser not to reflect the market value, will be valued at the bid price, in the case of securities held long, or the ask price, in the case of securities held short, supplied by one or more dealers making a market in those securities or one or more brokers. High quality investment grade debt securities (e.g., treasuries, commercial paper, etc.) with a remaining maturity of 60 days or less are valued by the Adviser at amortized cost, which the Board has determined to approximate fair value.

c. Cash and Cash Equivalents

Pending investment in Private Equity Investments and in order to maintain liquidity, the Master Fund holds cash, including amounts held in foreign currency and short-term interest bearing deposit accounts. At times, such amounts may exceed federally insured limits.

The Master Fund has not experienced any losses in such accounts and does not believe that it is exposed to any significant credit risk on such accounts.

d. Foreign Currency Translation

The books and records of the Master Fund are maintained in U.S. Dollars. Generally, assets and liabilities denominated in non-U.S. currencies are translated into U.S. Dollar equivalents using valuation date exchange rates, while purchases, realized gains and losses, income and expenses are translated at the transaction date exchange rates. As of September 30, 2012 the Master Fund has thirty-nine investments denominated in Euros, five investments denominated in Australian Dollars, four investments denominated in British Pounds, two investments denominated in Swedish Kronor, one investment denominated in Norwegian Kronor, and one investment denominated in Hong Kong Dollars. The Master Fund does not isolate the portion of the results of operations due to fluctuations in foreign exchange rates from changes in fair values of the investments during the period.

e. Forward Foreign Currency Exchange Contracts

The Master Fund may enter forward foreign currency exchange contracts as a way of managing foreign exchange rate risk. The Master Fund may enter into these contracts for the purchase or sale of a specific foreign currency at a fixed price on a future date as a hedge or cross hedge against either specific transactions or portfolio positions. The objective of the Master Fund’s foreign currency hedging transactions is to reduce the risk that the U.S. Dollar value of the Master Fund’s foreign currency denominated investments will decline in value due to changes in foreign currency exchange rates. All foreign currency exchange contracts are “marked-to-market” daily at the applicable translation rates resulting in unrealized gains or losses. Realized gains or losses are recorded at the time the foreign currency exchange contract is offset by entering into a closing transaction or by the delivery or receipt of the currency. Risk may arise upon entering into these contracts from the potential inability of counterparties to meet the terms of their contracts and from unanticipated movements in the value of a foreign currency relative to the U.S. Dollar.

| 10 |

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Notes to Financial Statements – September 30, 2012 (unaudited) (continued)

| 2. | Significant Accounting Policies (continued) |

e. Forward Foreign Currency Exchange Contracts (continued)

During the six month period ended September 30, 2012, the Master Fund entered into three short forward foreign currency exchange contracts and one long forward currency exchange contract. As disclosed in the Statement of Operations, the Master Fund had $1,013,151 in net realized gains, and a $392,308 change in net unrealized depreciation on forward foreign currency exchange contracts.

At September 30, 2012, the Master Fund had outstanding short foreign currency exchange contracts:

| Unrealized | |||||||||||||||||||||||

| Contract Amount | Appreciation | ||||||||||||||||||||||

| Settlement Date | Currency | Buy | Sell | Value | (Depreciation) | Counterparty | |||||||||||||||||

| October 19, 2012 | Euro (€) | $ | 12,249,700 | € | 10,000,000 | $ | 12,860,395 | $ | (610,695 | ) | Barclays Capital | ||||||||||||

f. Investment Income

The Master Fund records distributions of cash or in-kind securities from Private Equity Investments at fair value based on the information from distribution notices when distributions are received. Thus, the Master Fund would recognize within the Statement of Operations its share of realized gains or (losses) and the Master Fund’s share of net investment income or (loss) based upon information received regarding distributions from managers of the Private Equity Investments. Unrealized depreciation on investments within the Statement of Operations includes the Master Fund’s share of unrealized gains and losses, realized undistributed gains, and the Master Fund’s share of undistributed net investment income or (loss) from Private Equity Investments for the relevant period.

g. Master Fund Expenses

The Master Fund bears all expenses incurred in the business of the Master Fund on an accrual basis, including, but not limited to, the following: all costs and expenses related to portfolio transactions and positions for the Master Fund’s account; legal fees; accounting, auditing, and tax preparation fees; custodial fees; fees for data and software providers; costs of insurance; registration expenses; managers’ fees; and expenses of meetings of the Board.

h. Income Taxes

For U.S. federal income tax purposes, the Master Fund is treated as a partnership, and each Member in the Master Fund is treated as the owner of its allocated share of the net assets, income, expenses, and the realized and unrealized gains (losses) of the Master Fund. Accordingly, no federal, state or local income taxes are paid by the Master Fund on the income or gains of the Master Fund since the Members are individually liable for the taxes on their allocated share of such income or gains of the Fund.

The Master Fund has adopted the authoritative guidance on accounting for and disclosure of uncertainty in tax positions. The Financial Accounting Standards Board (“FASB”) issued Accounting for Uncertainty in Income Taxes, which requires the Adviser to determine whether a tax position of the Master Fund is more likely than not to be sustained upon examination, including resolution of any related appeals or litigation processes, based on the technical merits of the position. For tax positions meeting the more likely than not threshold, the tax amount recognized in the financial statements is reduced by the largest benefit that has a greater than fifty percent likelihood of being realized upon ultimate settlement with the relevant taxing authority.

The Master Fund files tax returns as prescribed by the tax laws of the jurisdictions in which it operates. In the normal course of business, the Master Fund is subject to examination by federal, state, local and foreign jurisdictions, where applicable. As of September 30, 2012, the tax years from the year 2009 forward remain subject to examination by the major tax jurisdictions under the statute of limitations.

| 11 |

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Notes to Financial Statements – September 30, 2012 (unaudited) (continued)

| 2. | Significant Accounting Policies (continued) |

i. Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires the Master Fund to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in capital from operations during the reporting period. Actual results can differ from those estimates.

j. Recently Issued Accounting Pronouncements