Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________________________________________________________________________________________

FORM 10-Q

___________________________________________________________________________________________________________________

ý QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2017

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-35007

___________________________________________________________________________________________________________________

Swift Transportation Company

(Exact name of registrant as specified in its charter)

___________________________________________________________________________________________________________________

|

| | |

Delaware | | 20-5589597 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

2200 South 75th Avenue

Phoenix, AZ 85043

(Address of principal executive offices and zip code)

(602) 269-9700

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

___________________________________________________________________________________________________________________

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

| | | | | | |

| | | | | | |

Large accelerated filer | | ý | | Accelerated filer | | o |

| | | | | | |

Non-accelerated filer | | o (Do not check if a smaller reporting company) | | Smaller reporting company | | o |

| | | | | | |

| | | | Emerging growth company | | o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The number of outstanding shares of the registrant’s Class A common stock as of April 25, 2017 was 83,539,116 and the number of outstanding shares of the registrant’s Class B common stock as of April 25, 2017 was 49,741,938.

SWIFT TRANSPORTATION COMPANY

|

| |

QUARTERLY REPORT ON FORM 10-Q |

| |

TABLE OF CONTENTS |

| |

PART I FINANCIAL INFORMATION | PAGE |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

PART II OTHER INFORMATION | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

SWIFT TRANSPORTATION COMPANY

|

| | |

QUARTERLY REPORT ON FORM 10-Q |

|

GLOSSARY OF TERMS |

The following glossary provides definitions for certain acronyms and terms used in this Quarterly Report on Form 10-Q. These acronyms and terms are specific to our company, commonly used in our industry, or are otherwise frequently used throughout our document. |

|

Term | | Definition |

Swift/the Company/Management/We/Us/Our | | Unless otherwise indicated or the context otherwise requires, these terms represent Swift Transportation Company and its subsidiaries. Swift Transportation Company is the holding company for Swift Transportation Co., LLC (a Delaware limited liability company) and Interstate Equipment Leasing, LLC. |

2007 Transactions | | In April 2007, Jerry Moyes and his wife contributed their ownership of all of the issued and outstanding shares of IEL (defined below) to Swift Corporation in exchange for additional Swift Corporation shares. In May 2007, the Moyes Affiliates (defined below), contributed their shares of Swift Transportation Co., Inc. common stock to Swift Corporation in exchange for additional Swift Corporation shares. Swift Corporation then completed its acquisition of Swift Transportation Co., Inc. through a merger on May 10, 2007, thereby acquiring the remaining outstanding shares of Swift Transportation Co., Inc. common stock. Upon completion of the 2007 Transactions, Swift Transportation Co., Inc. became a wholly-owned subsidiary of Swift Corporation. At the close of the market on May 10, 2007, the common stock of Swift Transportation Co., Inc. ceased trading on NASDAQ (defined below). |

2013 RSA | | Second Amended and Restated Receivables Sale Agreement, entered into in 2013 by SRCII (defined below), with unrelated financial entities, "The Purchasers." The 2013 RSA was later replaced by the 2015 RSA. |

2015 RSA | | Third Amendment to Amended and Restated Receivables Sale Agreement, entered into in 2015 by SRCII (defined below), with unrelated financial entities, "The Purchasers" |

2015 Agreement | | The Company's Fourth Amended and Restated Credit Agreement |

ASC | | Accounting Standards Codification |

ASU | | Accounting Standards Update |

Board | | Swift's Board of Directors |

CSA | | Compliance Safety Accountability |

Deadhead | | Tractor movement without hauling freight (unpaid miles driven) |

DLC | | Deferred Loan Cost |

DOE | | United States Department of Energy |

EBITDA | | Earnings Before Interest, Taxes, Depreciation, and Amortization (a non-GAAP measure) |

EPS | | Earnings Per Share |

FASB | | Financial Accounting Standards Board |

FLSA | | Fair Labor Standards Act |

GAAP | | United States Generally Accepted Accounting Principles |

IEL | | Interstate Equipment Leasing, LLC (formerly Interstate Equipment Leasing, Inc.) |

IPO | | Initial Public Offering |

LIBOR | | London InterBank Offered Rate |

SWIFT TRANSPORTATION COMPANY

|

| | |

GLOSSARY OF TERMS — CONTINUED |

The following glossary provides definitions for certain acronyms and terms used in this Quarterly Report on Form 10-Q. These acronyms and terms are specific to our company, commonly used in our industry, or are otherwise frequently used throughout our document. |

|

Term | | Definition |

Moyes Affiliates | | Jerry Moyes, Vickie Moyes, The Jerry and Vickie Moyes Family Trust dated December 11, 1987, and various Moyes children’s trusts |

NASDAQ | | National Association of Securities Dealers Automated Quotations |

NLRB | | National Labor Relations Board |

Quarter or QTD | | Quarter-to-date, or three months ended |

Revenue xFSR | | Revenue, Excluding Fuel Surcharge Revenue |

Revolver | | Revolving line of credit under the 2015 Agreement |

SEC | | United States Securities and Exchange Commission |

SRCII | | Swift Receivables Company II, LLC |

Term Loan A | | The Company's first lien term loan A under the 2015 Agreement |

The Purchasers | | Unrelated financial entities in the 2013 RSA and 2015 RSA, which were accounts receivable securitization agreements entered into by SRCII |

Year or YTD | | Year-to-date, or twelve months ended |

SWIFT TRANSPORTATION COMPANY

|

| | | | |

PART I FINANCIAL INFORMATION |

|

| |

ITEM 1. | FINANCIAL STATEMENTS |

CONSOLIDATED BALANCE SHEETS

(UNAUDITED) |

| | | | | | | |

| March 31, 2017 | | December 31, 2016 |

| (In thousands, except share data) |

ASSETS | | | |

Current assets: | | | |

Cash and cash equivalents | $ | 61,770 |

| | $ | 89,391 |

|

Cash and cash equivalents – restricted | 54,945 |

| | 57,046 |

|

Restricted investments, held to maturity, amortized cost | 22,859 |

| | 22,717 |

|

Accounts receivable, net | 396,251 |

| | 408,593 |

|

Equipment sales receivable | 2,243 |

| | — |

|

Income tax refund receivable | 272 |

| | 206 |

|

Inventories and supplies | 16,663 |

| | 16,630 |

|

Assets held for sale | 5,333 |

| | 6,969 |

|

Prepaid taxes, licenses, insurance, and other | 48,557 |

| | 47,038 |

|

Current portion of notes receivable | 6,414 |

| | 6,961 |

|

Total current assets | 615,307 |

| | 655,551 |

|

Property and equipment, at cost: | | | |

Revenue and service equipment | 2,229,531 |

| | 2,266,137 |

|

Land | 132,335 |

| | 132,084 |

|

Facilities and improvements | 283,949 |

| | 281,390 |

|

Furniture and office equipment | 109,189 |

| | 113,880 |

|

Total property and equipment | 2,755,004 |

| | 2,793,491 |

|

Less: accumulated depreciation and amortization | (1,271,973 | ) | | (1,244,890 | ) |

Net property and equipment | 1,483,031 |

| | 1,548,601 |

|

Other assets | 23,511 |

| | 21,953 |

|

Intangible assets, net | 262,101 |

| | 266,305 |

|

Goodwill | 253,256 |

| | 253,256 |

|

Total assets | $ | 2,637,206 |

| | $ | 2,745,666 |

|

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

Current liabilities: | | | |

Accounts payable | $ | 114,147 |

| | $ | 115,063 |

|

Accrued liabilities | 163,033 |

| | 132,712 |

|

Current portion of claims accruals | 86,191 |

| | 80,866 |

|

Current portion of long-term debt | 5,946 |

| | 8,459 |

|

Current portion of capital lease obligations | 60,060 |

| | 72,473 |

|

Total current liabilities | 429,377 |

| | 409,573 |

|

Revolving line of credit | 10,000 |

| | 130,000 |

|

Long-term debt, less current portion | 470,932 |

| | 493,346 |

|

Capital lease obligations, less current portion | 151,468 |

| | 161,463 |

|

Claims accruals, less current portion | 174,662 |

| | 165,726 |

|

Deferred income taxes | 408,795 |

| | 427,722 |

|

Accounts receivable securitization | 304,374 |

| | 279,285 |

|

Other liabilities | 5,804 |

| | 6,296 |

|

Total liabilities | 1,955,412 |

| | 2,073,411 |

|

Commitments and Contingencies (Notes 10 and 11) |

| |

|

Stockholders’ equity: | | | |

Preferred stock, par value $0.01 per share; authorized 10,000,000 shares; none issued | — |

| | — |

|

Class A common stock, par value $0.01 per share; authorized 500,000,000 shares; 83,518,819 and 83,299,118 shares issued and outstanding as of March 31, 2017 and December 31, 2016, respectively | 835 |

| | 833 |

|

Class B common stock, par value $0.01 per share; authorized 250,000,000 shares; 49,741,938 shares issued and outstanding as of March 31, 2017 and December 31, 2016 | 497 |

| | 497 |

|

Additional paid-in capital | 688,234 |

| | 701,065 |

|

Accumulated deficit | (7,874 | ) | | (30,242 | ) |

Noncontrolling interest | 102 |

| | 102 |

|

Total stockholders’ equity | 681,794 |

| | 672,255 |

|

Total liabilities and stockholders’ equity | $ | 2,637,206 |

| | $ | 2,745,666 |

|

See accompanying notes to consolidated financial statements.

SWIFT TRANSPORTATION COMPANY

CONSOLIDATED INCOME STATEMENTS

(UNAUDITED)

|

| | | | | | | |

| Quarter Ended March 31, |

| 2017 | | 2016 |

| (In thousands, except per share data) |

Operating revenue: | | | |

Revenue, excluding fuel surcharge revenue | $ | 871,090 |

| | $ | 906,913 |

|

Fuel surcharge revenue | 92,741 |

| | 60,910 |

|

Operating revenue | 963,831 |

| | 967,823 |

|

Operating expenses: | | | |

Salaries, wages, and employee benefits | 283,338 |

| | 288,633 |

|

Operating supplies and expenses | 104,119 |

| | 90,215 |

|

Fuel | 94,961 |

| | 74,987 |

|

Purchased transportation | 265,511 |

| | 267,309 |

|

Rental expense | 55,694 |

| | 56,252 |

|

Insurance and claims | 50,176 |

| | 47,710 |

|

Depreciation and amortization of property and equipment | 67,769 |

| | 66,951 |

|

Amortization of intangibles | 4,204 |

| | 4,204 |

|

Gain on disposal of property and equipment | (4,195 | ) | | (6,326 | ) |

Communication and utilities | 8,503 |

| | 6,900 |

|

Operating taxes and licenses | 18,166 |

| | 18,505 |

|

Total operating expenses | 948,246 |

| | 915,340 |

|

Operating income | 15,585 |

| | 52,483 |

|

Other expenses (income): | | | |

Interest expense | 7,521 |

| | 8,594 |

|

Interest income | (488 | ) | | (751 | ) |

Merger transaction costs | 2,157 |

| | — |

|

Other income, net | (1,183 | ) | | (776 | ) |

Total other expenses (income), net | 8,007 |

| | 7,067 |

|

Income before income taxes | 7,578 |

| | 45,416 |

|

Income tax expense | 2,371 |

| | 13,511 |

|

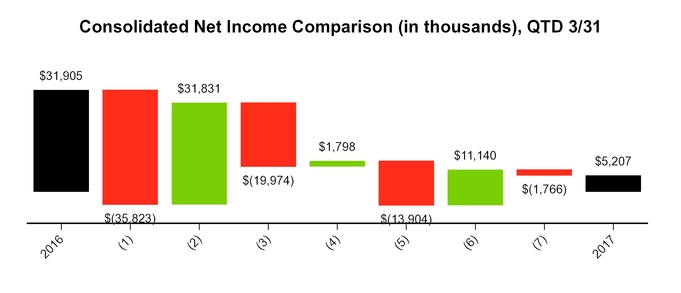

Net income | $ | 5,207 |

| | $ | 31,905 |

|

Basic earnings per share | $ | 0.04 |

| | $ | 0.23 |

|

Diluted earnings per share | $ | 0.04 |

| | $ | 0.23 |

|

Shares used in per share calculations: | | | |

Basic | 133,147 |

| | 136,519 |

|

Diluted | 134,089 |

| | 137,655 |

|

See accompanying notes to consolidated financial statements.

SWIFT TRANSPORTATION COMPANY

CONSOLIDATED STATEMENT OF STOCKHOLDERS' EQUITY

(UNAUDITED)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class A

Common Stock | | Class B

Common Stock | | Additional

Paid-in Capital | | Accumulated Deficit | | Noncontrolling Interest | | Total

Stockholders’ Equity |

| Shares | | Par Value | | Shares | | Par Value | | | | |

| (In thousands, except share data) |

Balances, December 31, 2016 | 83,299,118 |

| | $ | 833 |

| | 49,741,938 |

| | $ | 497 |

| | $ | 701,065 |

| | $ | (30,242 | ) | | $ | 102 |

| | $ | 672,255 |

|

Common stock issued under stock plans | 206,532 |

| | 2 |

| |

|

| |

|

| | 1,581 |

| |

|

| |

|

| | 1,583 |

|

Stock-based compensation expense |

|

| |

|

| |

|

| |

|

| | 2,076 |

| | 368 |

| |

|

| | 2,444 |

|

Excess tax benefit from stock-based compensation |

|

| |

|

| |

|

| |

|

| | (16,793 | ) | | 16,793 |

| |

|

| | — |

|

Shares issued under employee stock purchase plan | 13,169 |

| | — |

| |

|

| |

|

| | 305 |

| |

|

| |

|

| | 305 |

|

Net income |

|

| |

|

| |

|

| |

|

| |

|

| | 5,207 |

| |

|

| | 5,207 |

|

Balances, March 31, 2017 | 83,518,819 |

| | $ | 835 |

| | 49,741,938 |

| | $ | 497 |

| | $ | 688,234 |

| | $ | (7,874 | ) | | $ | 102 |

| | $ | 681,794 |

|

See accompanying notes to consolidated financial statements.

SWIFT TRANSPORTATION COMPANY

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

|

| | | | | | | |

| Quarter Ended March 31, |

| 2017 | | 2016 |

| (In thousands) |

Cash flows from operating activities: | | | |

Net income | $ | 5,207 |

| | $ | 31,905 |

|

Adjustments to reconcile net income to net cash provided by operating activities: | | | |

Depreciation and amortization of property, equipment, and intangibles | 71,973 |

| | 71,155 |

|

Amortization of debt issuance costs, and other | 336 |

| | 351 |

|

Gain on disposal of property and equipment, less write-off of totaled tractors | (2,969 | ) | | (5,763 | ) |

Deferred income taxes | (19,196 | ) | | (4,473 | ) |

Reduction of losses on accounts receivable | (540 | ) | | (1,233 | ) |

Stock-based compensation expense | 2,673 |

| | 1,417 |

|

Increase (decrease) in cash resulting from changes in: | | | |

Accounts receivable | 12,882 |

| | 14,885 |

|

Inventories and supplies | (33 | ) | | (52 | ) |

Prepaid expenses and other current assets | (1,585 | ) | | 8,226 |

|

Other assets | (797 | ) | | 2,332 |

|

Accounts payable, and accrued and other liabilities | 50,947 |

| | 13,365 |

|

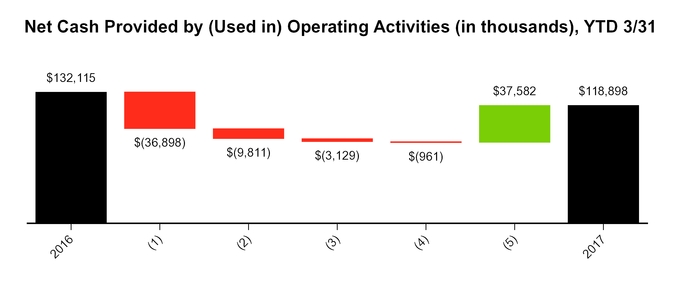

Net cash provided by operating activities | 118,898 |

| | 132,115 |

|

Cash flows from investing activities: | | | |

Decrease (increase) in cash and cash equivalents – restricted | 2,101 |

| | (2,115 | ) |

Proceeds from maturities of investments | 4,790 |

| | 6,386 |

|

Purchases of investments | (5,003 | ) | | (6,429 | ) |

Proceeds from sale of property and equipment | 27,124 |

| | 34,271 |

|

Capital expenditures | (35,566 | ) | | (34,450 | ) |

Payments received on notes receivable | 663 |

| | 1,127 |

|

Expenditures on assets held for sale | (4,355 | ) | | (6,960 | ) |

Payments received on assets held for sale | 5,092 |

| | 5,620 |

|

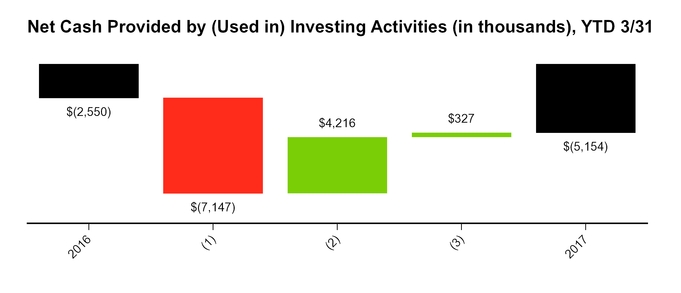

Net cash used in investing activities | (5,154 | ) | | (2,550 | ) |

Cash flows from financing activities: | | | |

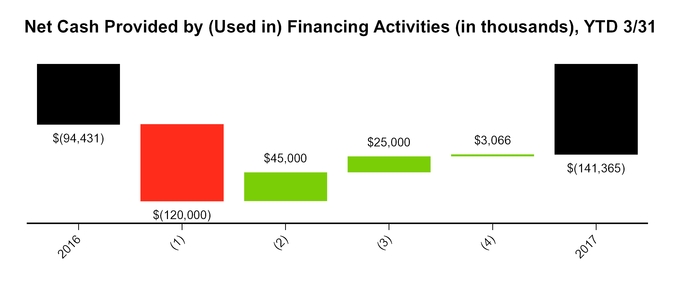

Repayment of long-term debt and capital leases | (47,427 | ) | | (50,535 | ) |

Net repayments on revolving line of credit | (120,000 | ) | | — |

|

Borrowings under accounts receivable securitization | 25,000 |

| | — |

|

Proceeds from common stock issued | 1,888 |

| | 1,411 |

|

Repurchases of Class A common stock | — |

| | (45,000 | ) |

Share withholding for taxes due on equity awards | (826 | ) | | (307 | ) |

Net cash used in financing activities | (141,365 | ) | | (94,431 | ) |

Net (decrease) increase in cash and cash equivalents | (27,621 | ) | | 35,134 |

|

Cash and cash equivalents at beginning of period | 89,391 |

| | 107,590 |

|

Cash and cash equivalents at end of period | $ | 61,770 |

| | $ | 142,724 |

|

See accompanying notes to consolidated financial statements.

SWIFT TRANSPORTATION COMPANY

CONSOLIDATED STATEMENTS OF CASH FLOWS — CONTINUED

(UNAUDITED)

|

| | | | | | | |

| Quarter Ended March 31, |

| 2017 | | 2016 |

| (In thousands) |

Supplemental disclosures of cash flow information: | | | |

Cash paid during the period for: | | | |

Interest | $ | 7,346 |

| | $ | 8,081 |

|

Income taxes | 136 |

| | 944 |

|

Non-cash investing activities: | | | |

Equipment purchase accrual | $ | 4,543 |

| | $ | 593 |

|

Notes receivable from sale of assets | 919 |

| | 520 |

|

Equipment sales receivables | 2,261 |

| | 6,710 |

|

See accompanying notes to consolidated financial statements.

SWIFT TRANSPORTATION COMPANY

|

|

Notes to Consolidated Financial Statements (Unaudited) |

Note 1 — Introduction and Basis of Presentation

Certain acronyms and terms used throughout this Quarterly Report on Form 10-Q are specific to our company, commonly used in our industry, or are otherwise frequently used throughout our document. Definitions for these acronyms and terms are provided in the "Glossary of Terms," available in the front of this document.

Description of Business

Swift is a transportation solutions provider, headquartered in Phoenix, Arizona. As of March 31, 2017, the Company's fleet of revenue equipment included 18,656 tractors (comprised of 14,017 company tractors and 4,639 owner-operator tractors), 63,207 trailers, and 9,130 intermodal containers. The Company’s four reportable segments are Truckload, Dedicated, Refrigerated (formerly "Swift Refrigerated"), and Intermodal.

Subsequent Events

Merger

On April 10, 2017, Swift announced an all-stock merger agreement with Knight Transportation, Inc. ("Knight"), which was unanimously approved by the boards of directors of Swift and Knight and is expected to close during the quarter ended September 30, 2017. The combined company will be named Knight-Swift Transportation Holdings Inc. ("Knight-Swift"). Knight is expected to be the accounting acquirer. Under the terms of the definitive agreement each Swift share will convert into 0.72 shares of Knight-Swift by means of a reverse stock split. Each share of Knight will be exchanged for one Knight-Swift share. Based on the $30.65 closing price of Knight shares on April 7, 2017, the last trading day prior to the announcement, the implied value per share of Swift is $22.07. Upon closing of the transaction, Swift stockholders will own approximately 54.0% and Knight stockholders will own approximately 46.0% of the combined company. Based on Knight’s closing share price on April 7, 2017, the number of combined company shares expected to be outstanding after closing and the combined net debt of Swift and Knight as of December 31, 2016, the combined company would have an implied enterprise value of approximately $6.0 billion.

The merger agreement provides for certain termination rights for both Knight and the Company. Upon termination of the merger agreement under certain specified circumstances, the Company may be required to pay Knight a termination fee of $89.1 million and Knight may be required to pay the Company a termination fee of $75.3 million. In addition, if the merger agreement is terminated because of a failure of either Knight’s or the Company’s stockholders to approve the transactions contemplated by the merger agreement, the other party may be required to reimburse transaction expenses up to $10.0 million.

Legal Settlement

On April 13, 2017, the Company proposed a tentative settlement arrangement with regard to certain litigation in the Refrigerated segment, which was finalized on April 28, 2017, subject to final court approval. As such, the Company increased its legal accrual by $11.7 million for the quarter ended March 31, 2017.

Seasonality

In the truckload industry, results of operations generally show a seasonal pattern. As customers ramp up for the year-end holiday season, the late third quarter and fourth quarter have historically been the Company's strongest volume periods. As customers reduce shipments after the winter holiday season, the first quarter has historically been a lower-volume quarter than the other three quarters. In recent years, the macro consumer buying patterns combined with shippers’ supply chain management, which historically contributed to the fourth quarter "peak" season, continued to evolve. As a result, the Company's fourth quarter 2016, 2015, and 2014 volumes were more evenly distributed throughout the quarter, rather than peaking early in the quarter. In the eastern and mid-western United States, and to a lesser extent in the western United States, the Company's equipment utilization typically declines and operating expenses generally increase during the winter season. This tends to be attributed to declines in fuel efficiency from engine idling and increases in accident frequency, claims, and equipment repairs from severe weather. The Company's revenue is directly related to shippers' available working days. As such, curtailed operations and vacation shutdowns around the holidays may affect the Company's revenue. From time to time, the Company also suffers short-term impacts from severe weather and similar events, such as tornadoes, hurricanes, blizzards, ice storms, floods, fires, earthquakes, and explosions that could add volatility to, or harm, the Company's results of operations.

Basis of Presentation

The consolidated financial statements and footnotes included in this Quarterly Report on Form 10-Q should be read in conjunction with the consolidated financial statements and footnotes included in the Company's Annual Report on Form 10-K for the year ended December 31, 2016. The consolidated financial statements include the accounts of Swift Transportation Company and its wholly-owned subsidiaries. In management's opinion, these consolidated financial statements were prepared in accordance with GAAP and include all adjustments necessary for the fair presentation of the periods presented.

SWIFT TRANSPORTATION COMPANY

Changes in Presentation

Segment Reorganization — During the quarter ended March 31, 2017, the Company reorganized its reportable segments to reflect management’s revised reporting structure of its Dedicated and Refrigerated (formerly “Swift Refrigerated”) reportable segments. In association with the reorganization, the operations of the Company's dedicated grocery line of business, which were previously reported within the Company’s Dedicated segment, are now reported within the Company's Refrigerated segment. This resulted in all temperature-controlled lines of business reporting under the Refrigerated segment. Prior periods have been retrospectively adjusted to align with the current period presentation.

Recently Adopted Accounting Pronouncement — In March 2016, FASB issued ASU 2016-09, Improvements to Employee Share-based Payment Accounting, which amended ASC 718, Compensation – Stock Compensation. The amendments in this ASU are intended to simplify various aspects of accounting for stock-based compensation, including income tax consequences, classification of awards as equity or liability, as well as classification of activities within the statement of cash flows. For public business entities, the amendments in this ASU are effective for financial statements issued for fiscal years beginning after December 15, 2016, and the interim periods within those fiscal years.

The Company adopted this guidance during the quarter ended March 31, 2017. The amendments that affected the Company's financial statements are discussed below.

| |

• | Accounting for Income Tax Benefits/Deficiencies: All excess tax benefits and tax deficiencies (including tax benefits of dividends on share-based payment awards) should be recognized as income tax expense or benefit in the income statement. The tax effects of exercised or vested awards should be treated as discrete items in the reporting period in which they occur. An entity should also recognize excess tax benefits regardless of whether the benefit reduces taxes payable in the current period. Modified retrospective application is required, by means of a cumulative-effect adjustment to equity. |

Upon adoption, the Company reclassified approximately$16.8 million in historical net tax benefit/deficiency amounts previously recorded within "Additional paid-in capital" into "Accumulated deficit." Starting January 1, 2017, tax benefit/deficiency amounts are recorded in "Income tax expense" in the consolidated income statements.

| |

• | Classification of Excess Tax Benefits on the Statement of Cash Flows: Excess tax benefits should be classified along with other income tax cash flows as an operating activity. Application is permitted to be prospective or retrospective. |

GAAP previously required classification within cash flows from financing activities. The Company retrospectively adjusted the statement of cash flows for the quarter ended March 31, 2016 to align with the current period presentation by increasing cash flows from operating activities by $0.1 million and correspondingly decreasing cash flows from financing activities by $0.1 million, reflecting the amount of excess tax benefits previously presented for that period.

| |

• | Forfeitures: An entity can make an entity-wide accounting policy election to either estimate the number of awards that are expected to vest (prior GAAP) or account for forfeitures when they occur. Modified retrospective application is required, by means of a cumulative-effect adjustment to equity. |

Upon adoption, the Company transitioned to accounting for forfeitures when they occur. This resulted in approximately a $0.4 million (net of income tax) cumulative-effect adjustment to retained earnings/accumulated deficit to catch-up the previously unrecognized stock-based compensation associated with historical assumed forfeiture rates. Starting January 1, 2017, forfeitures are recorded as adjustments to stock-based compensation as they occur.

| |

• | Classification of Employee Taxes Paid on the Statement of Cash Flows When an Employer Withholds Shares for Tax-withholding purposes: Cash paid by an employer when directly withholding shares for tax-withholding purposes should be classified as a financing activity. Retrospective application is required. |

In 2016, the Company began allowing certain members of management to have shares withheld for taxes when their restricted stock awards and performance units vest. As such, upon adopting the amendments in this ASU, the Company reclassified the amounts out of cash flows from operating activities and into cash flows from financing activities for the quarter ended March 31, 2016 to align with the current period presentation. For the quarter-ended March 31, 2016, the amount was approximately $0.3 million.

SWIFT TRANSPORTATION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) — CONTINUED

Note 2 — Recently Issued Accounting Pronouncements, Not Yet Adopted

|

| | | | | | | | |

Date Issued | | Reference | | Description | | Expected Adoption Date and Method | | Financial Statement Impact |

May 2016 | | 2016-12: Revenue from Contracts with Customers (Topic 606) – Narrow-scope Improvements and Practical Expedients | | The amendments in this ASU clarify certain aspects regarding the collectibility criterion, sales taxes collected from customers, noncash consideration, contract modifications, and completed contracts at transition. It additionally clarifies that retrospective application only requires disclosure of the accounting change effect on prior periods presented, not on the period of adoption. | | January 2018, Modified retrospective | | Currently under evaluation (1) |

April 2016 | | 2016-10: Revenue from Contracts with Customers (Topic 606) – Identifying Performance Obligations and Licensing | | The amendments in this ASU clarify the following two aspects of Topic 606: identifying performance obligations and the licensing implementation guidance, while retaining the related principles for those areas. The amendments do not change the core principle of the guidance. | | January 2018, Modified retrospective | | Currently under evaluation (1) |

March 2016 | | 2016-08: Revenue from Contracts with Customers (Topic 606) – Principal versus Agent Considerations (Reporting Revenue Gross versus Net) | | The amendments in this ASU are intended to improve the operability and understandability of the implementation guidance on principal versus agent considerations, but do not change the core principle of the guidance. | | January 2018, Modified retrospective | | Currently under evaluation (1) |

February 2016 | | 2016-02: Leases (Topic 842) | | The new standard requires lessees to recognize assets and liabilities arising from both operating and financing leases on the balance sheet. Lessor accounting for leases is largely unaffected by the new guidance. | | January 2019, Modified retrospective | | Currently under evaluation; expected to be material, but not yet quantifiable. |

August 2015 | | 2015-14: Revenue from Contracts with Customers (Topic 606) – Deferral of the Effective Date | | This ASU deferred the effective date of ASU 2014-09 (Topic 606) to annual reporting periods beginning after December 15, 2017. | | January 2018, Modified retrospective | | Currently under evaluation (1) |

____________

| |

(1) | Management is in the diagnostic phase of assessing the financial and business impacts of implementing ASC Topic 606, Revenue from Contracts with Customers, including identifying revenue sources within the Company's lines of business, reviewing a sample of contracts, and developing a preliminary assessment. Based upon these preliminary procedures, management anticipates that the following key considerations will impact the Company's accounting and reporting under the new standard: |

| |

• | identification of what constitutes a contract in Swift's business practices, |

| |

• | variability in individual contracts, such as customer-specific terms that may vary from the master agreement, |

| |

• | principal versus agent determinations, |

| |

• | timing of revenue recognition (for example, point-in-time versus over time and/or accelerated versus deferred), |

| |

• | single versus multiple performance obligations, |

| |

• | new/changed estimates and management judgments (for example, system estimation of in-transit accruals versus manual estimation), |

| |

• | disaggregation of revenue by category within segments, and |

Management expects that there will also be changes in sales, contracting, accounting, reporting, tax, debt covenants, and other business processes, policies, and controls, as a result of implementing ASC Topic 606. The Company is currently implementing a new ERP system and transacting a merger (as discussed in Note 1), which will also affect the implementation process.

SWIFT TRANSPORTATION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) — CONTINUED

Based on the information currently available from the diagnostic phase, management cannot yet determine the quantitative impact on the financial statements; however, the impact is expected to be immaterial (potentially with changes only to the timing of revenue recognition between reportable periods, as well as changes in the requirements for accounting policy and other new disclosures). The financial impact has not yet been quantified. The Company is transitioning into the design and planning phase of implementing ASC Topic 606. Since management is continuing to evaluate the impact of ASC Topic 606, disclosures around their preliminary assessments are subject to change.

Note 3 — Restricted Investments

The following table presents the cost or amortized cost, gross unrealized gains and temporary losses, and estimated fair value of the Company’s restricted investments:

|

| | | | | | | | | | | | | | | |

| March 31, 2017 |

| | | Gross Unrealized | | |

| Cost or Amortized

Cost | | Gains | | Temporary

Losses | | Estimated Fair Value |

| (In thousands) |

United States corporate securities | $ | 16,403 |

| | $ | — |

| | $ | (14 | ) | | $ | 16,389 |

|

Municipal bonds | 4,931 |

| | — |

| | (2 | ) | | 4,929 |

|

Negotiable certificate of deposits | 1,525 |

| | — |

| | — |

| | 1,525 |

|

Restricted investments, held to maturity | $ | 22,859 |

| | $ | — |

| | $ | (16 | ) | | $ | 22,843 |

|

| | | | | | | |

| December 31, 2016 |

| | | Gross Unrealized | | |

| Cost or Amortized

Cost | | Gains | | Temporary

Losses | | Estimated Fair Value |

| (In thousands) |

United States corporate securities | $ | 16,432 |

| | $ | — |

| | $ | (23 | ) | | $ | 16,409 |

|

Municipal bonds | 4,760 |

| | — |

| | (6 | ) | | 4,754 |

|

Negotiable certificate of deposits | 1,525 |

| | — |

| | — |

| | 1,525 |

|

Restricted investments, held to maturity | $ | 22,717 |

| | $ | — |

| | $ | (29 | ) | | $ | 22,688 |

|

Refer to Note 14 for additional information regarding fair value measurements of restricted investments.

As of March 31, 2017, the contractual maturities of the restricted investments were one year or less. There were 40 securities and 42 securities that were in an unrealized loss position for less than twelve months as of March 31, 2017 and December 31, 2016, respectively. The Company did not recognize any impairment losses for the quarter ended March 31, 2017 or 2016.

Note 4 — Goodwill and Other Intangible Assets

There were no goodwill impairments recorded during the quarter ended March 31, 2017 or 2016. Other intangible asset balances were as follows:

|

| | | | | | | |

| March 31,

2017 | | December 31,

2016 |

| (In thousands) |

Customer Relationships: | | | |

Gross carrying value | $ | 275,324 |

| | $ | 275,324 |

|

Accumulated amortization | (194,260 | ) | | (190,056 | ) |

Customer relationships, net | 81,064 |

| | 85,268 |

|

Trade Name: | | | |

Gross carrying value | 181,037 |

| | 181,037 |

|

Intangible assets, net | $ | 262,101 |

| | $ | 266,305 |

|

SWIFT TRANSPORTATION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) — CONTINUED

The following table presents amortization of intangible assets related to the 2007 Transactions and intangible assets existing prior to the 2007 Transactions:

|

| | | | | | | |

| Quarter Ended March 31, |

| 2017 | | 2016 |

| (In thousands) |

Amortization of intangible assets related to the 2007 Transactions | $ | 3,912 |

| | $ | 3,912 |

|

Amortization related to intangible assets existing prior to the 2007 Transactions | 292 |

| | 292 |

|

Amortization of intangibles | $ | 4,204 |

| | $ | 4,204 |

|

Effective Tax Rate — The effective tax rate for the quarter ended March 31, 2017 was 31.3%, which was lower than management's expectation of 36.0%. The difference was primarily due to certain benefits relating to stock compensation deductions due to the Company's adoption of ASU 2016-09, partially offset by capitalized transaction costs relating to the merger with Knight recognized as discrete items in the quarter. Refer to Note 1 for further details regarding the Company's adoption of ASU 2016-09 and the merger with Knight.

The effective tax rate for the quarter ended March 31, 2016 was 29.8%, which was lower than management's expectation of 38.0%. The difference was primarily due to certain income tax credits received by the Company's foreign subsidiary and a reduction in the uncertain tax position reserve, recognized as discrete items in the quarter.

Interest and Penalties — Accrued interest and penalties related to unrecognized tax benefits as of March 31, 2017 and December 31, 2016 were approximately $0.4 million and $0.4 million, respectively. The Company does not anticipate a decrease of unrecognized tax benefits during the next twelve months.

Tax Examinations — Certain of the Company’s subsidiaries are currently under examination by the Internal Revenue Service and various state jurisdictions for tax years ranging from 2012 through 2015. At the completion of these examinations, management does not expect any adjustments that would have a material impact on the Company’s effective tax rate. Years subsequent to 2012 remain subject to examination.

Note 6 — Accounts Receivable Securitization On December 10, 2015, SRCII, a wholly-owned subsidiary of the Company, entered into the 2015 RSA, which further amended the 2013 RSA. The parties to the 2015 RSA include SRCII as the seller, Swift Transportation Services, LLC as the servicer, the various conduit purchasers, the various related committed purchasers, the various purchaser agents, the various letters of credit participants, and PNC Bank, National Association as the issuing bank of letters of credit and as administrator. Pursuant to the 2015 RSA, the Company's receivable originator subsidiaries sell, on a revolving basis, undivided interests in all of their eligible accounts receivable to SRCII. In turn, SRCII sells a variable percentage ownership interest in the eligible accounts receivable to the various purchasers. The facility qualifies for treatment as a secured borrowing under ASC Topic 860, Transfers and Servicing. As such, outstanding amounts are classified as liabilities on the Company’s consolidated balance sheets. Refer to Note 14 for information regarding the fair value of the 2015 RSA.

As of March 31, 2017 and December 31, 2016, interest accrued on the aggregate principal balance at a rate of 1.5% and 1.3%, respectively. Program fees and unused commitment fees are recorded in "Interest expense" in the consolidated income statements. The Company incurred program fees of $1.4 million and $0.9 million related to the 2015 RSA during the quarter ended March 31, 2017 and 2016, respectively.

The 2015 RSA is subject to customary fees and contains various customary affirmative and negative covenants, representations and warranties, and default and termination provisions. Collections on the underlying receivables by the Company are held for the benefit of SRCII and the Purchasers in the facility and are unavailable to satisfy claims of the Company and its subsidiaries.

SWIFT TRANSPORTATION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) — CONTINUED

Note 7 — Debt and Financing

Other than the Company’s accounts receivable securitization, as discussed in Note 6, and its outstanding capital lease obligations as discussed in Note 9, the Company's long-term debt consisted of the following:

|

| | | | | | | |

| March 31,

2017 | | December 31,

2016 |

| (In thousands) |

2015 Agreement: Term Loan A, due July 2020, net of $1,244 and $1,338 DLCs as of March 31, 2017 and December 31, 2016, respectively (1) | $ | 470,506 |

| | $ | 492,912 |

|

Other | 6,372 |

| | 8,893 |

|

Long-term debt | 476,878 |

| | 501,805 |

|

Less: current portion of long-term debt | (5,946 | ) | | (8,459 | ) |

Long-term debt, less current portion | $ | 470,932 |

| | $ | 493,346 |

|

|

| | | | | | | |

| March 31,

2017 | | December 31,

2016 |

| (In thousands) |

Long-term debt | $ | 476,878 |

| | $ | 501,805 |

|

Revolving line of credit, due July 2020 (1) (2) | 10,000 |

| | 130,000 |

|

Long-term debt, including revolving line of credit | $ | 486,878 |

| | $ | 631,805 |

|

____________

| |

(1) | Refer to Note 14 for information regarding the fair value of long-term debt. |

| |

(2) | The Company also had outstanding letters of credit under the Revolver, primarily related to workers' compensation and self-insurance liabilities of $95.2 million at March 31, 2017 and $97.0 million at December 31, 2016. |

Credit Agreement

On July 27, 2015, the Company entered into the 2015 Agreement, which includes a Revolver and a Term Loan A. The following table presents the key terms of the 2015 Agreement:

|

| | | | |

Description | | Term Loan A | | Revolver (2) |

| | (Dollars in thousands) |

Maximum borrowing capacity | | $680,000 | | $600,000 |

Final maturity date | | July 27, 2020 | | July 27, 2020 |

Interest rate base | | LIBOR | | LIBOR |

LIBOR floor | | —% | | —% |

Interest rate minimum margin (1) | | 1.50% | | 1.50% |

Interest rate maximum margin (1) | | 2.25% | | 2.25% |

Minimum principal payment – amount (3) | | $6,625 | | $— |

Minimum principal payment – frequency | | Quarterly | | Once |

Minimum principal payment – commencement date (3) | | December 31,

2015 | | July 27,

2020 |

____________

| |

(1) | The interest rate margin for the Term Loan A and Revolver is based on the Company's consolidated leverage ratio. As of March 31, 2017, interest accrued at 2.38% on the Term Loan A and 2.39% on the Revolver. As of December 31, 2016, interest accrued at 2.18% on the Term Loan A and 2.18% on the Revolver. |

SWIFT TRANSPORTATION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) — CONTINUED

| |

(2) | The commitment fee for the unused portion of the Revolver is based on the Company's consolidated leverage ratio and ranges from 0.25% to 0.35%. As of March 31, 2017, commitment fees on the unused portion of the Revolver accrued at 0.25% and outstanding letter of credit fees accrued at 1.50%. As of December 31, 2016, commitment fees on the unused portion of the Revolver accrued at 0.25% and outstanding letter of credit fees accrued at 1.50%. |

| |

(3) | Commencing in March 2017, the minimum required quarterly payment amount on the Term Loan A is $12.3 million, at which it would remain until final maturity. However, as of January 2017, the Company has voluntarily prepaid all minimum quarterly principal payments through final maturity. |

The Revolver and Term Loan A of the 2015 Agreement contain certain financial covenants with respect to a maximum leverage ratio and a minimum consolidated interest coverage ratio. The 2015 Agreement provides flexibility regarding the use of proceeds from asset sales, payment of dividends, stock repurchases, and equipment financing. In addition to the financial covenants, the 2015 Agreement includes customary events of default, including a change in control default and certain affirmative and negative covenants, including, but not limited to, restrictions, subject to certain exceptions, on incremental indebtedness, asset sales, certain restricted payments (including dividends and stock repurchases), certain incremental investments or advances, transactions with affiliates, engagement in additional business activities, and prepayment of certain other indebtedness. The anticipated merger with Knight discussed in Note 1 is not expected to be deemed a change in control, as defined in the 2015 Agreement.

Borrowings under the 2015 Agreement are secured by substantially all of the assets of the Company and are guaranteed by Swift Transportation Company, IEL, Central Refrigerated Transportation, LLC and its subsidiaries, and Swift Transportation Co., LLC and its domestic subsidiaries (other than its captive insurance subsidiaries, driver academy subsidiary, and its bankruptcy-remote special purpose subsidiary).

Note 8 — Deferred Loan Costs

The following table presents the classification of DLCs in the Company's consolidated balance sheets:

|

| | | | | | | |

| March 31,

2017 | | December 31,

2016 |

| (In thousands) |

ASSETS: | | | |

Other assets | $ | 1,087 |

| | $ | 1,169 |

|

LIABILITIES: | | | |

Current portion of long-term debt | — |

| | — |

|

Long-term debt, less current portion | 1,244 |

| | 1,338 |

|

Accounts receivable securitization | 626 |

| | 715 |

|

Total DLCs | $ | 2,957 |

| | $ | 3,222 |

|

The Company finances a portion of its revenue equipment under capital and operating leases and certain terminals under operating leases.

Capital Leases (as Lessee) — The Company’s capital leases are typically structured with balloon payments at the end of the lease term equal to the residual value the Company is contracted to receive from certain equipment manufacturers upon sale or trade back to the manufacturers. If the Company does not receive proceeds of the contracted residual value from the manufacturer, the Company is still obligated to make the balloon payment at the end of the lease term. Certain leases contain renewal or fixed price purchase options. The present value of obligations under capital leases is included under "Current portion of capital lease obligations" and "Capital lease obligations, less current portion" in the consolidated balance sheets. As of March 31, 2017, the leases were collateralized by revenue equipment with a cost of $296.0 million and accumulated amortization of $91.3 million. As of December 31, 2016, the leases were collateralized by revenue equipment with a cost of $319.8 million and accumulated amortization of $97.0 million. Amortization of equipment under capital leases is included in "Depreciation and amortization of property and equipment" in the Company’s consolidated income statements.

Operating Leases (as Lessee) — Rent expense related to operating leases was $55.7 million and $56.3 million for the quarter ended March 31, 2017 and 2016, respectively.

SWIFT TRANSPORTATION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) — CONTINUED

Note 10 — Purchase Commitments As of March 31, 2017, the Company's outstanding commitments to acquire revenue equipment were as follows:

| |

• | remainder of 2017: $277.0 million ($195.4 million of which were tractor commitments), and |

The Company typically has the option to cancel tractor purchase orders with 60 to 90 days' notice prior to the scheduled production, although there is a certain group of tractors we are committed to purchase in 2017 that cannot be canceled (even with advance notice). The notice period to cancel currently committed tractor purchase orders has lapsed for 78.0% of the total tractor commitments outstanding as of March 31, 2017. Purchases are expected to be financed by the combination of operating leases, capital leases, debt, proceeds from sales of existing equipment, and cash flows from operations.

As of March 31, 2017, the Company's outstanding purchase commitments to acquire facilities and non-revenue equipment were as follows:

| |

• | remainder of 2017: $10.7 million |

| |

• | 2018 and 2019: $8.8 million, and |

| |

• | thereafter: $3.9 million. |

Factors such as potential future terminal expansions and changes in information technology infrastructure may change the amount of such expenditures.

Note 11 — Contingencies and Legal Proceedings Accounting Policy

The Company is involved in certain claims and pending litigation primarily arising in the normal course of business. The majority of these claims relate to workers' compensation, auto collision and liability, physical damage, and cargo damage. The Company accrues for the uninsured portion of claims losses and the gross amount of other losses when the likelihood of the loss is probable and the amount of the loss is reasonably estimable. These accruals are based on management's best estimate within a possible range of loss. When there is no amount within the range of loss that appears to be a better estimate than any other amount, then management accrues to the low end of the range. Legal fees are expensed as incurred.

When it is reasonably possible that exposure exists in excess of the related accrual (which could be no accrual), management discloses an estimate of the possible loss or range of loss, unless an estimate cannot be determined.

If the likelihood of a loss is remote, the Company does not accrue for the loss. However if the likelihood of a loss is remote, but it is at least reasonably possible that one or more future confirming events may materially change management's estimate within twelve months from the date of the financial statements, management discloses an estimate of the possible loss or range of loss, unless an estimate cannot be determined.

Legal Proceedings

Information is provided below regarding the nature, status, and contingent loss amounts, if any, associated with the Company's pending legal matters. There are inherent uncertainties in these legal matters, some of which are beyond management's control, making the ultimate outcomes difficult to predict. Moreover, management's views and estimates related to these matters may change in the future, as new events and circumstances arise and the matters continue to develop.

For the matters below, an estimate of the possible loss or range of loss cannot be determined for certain cases because, among other reasons, (1) the proceedings are in various stages that do not allow for assessment; (2) damages have not been sought; (3) damages are unsupported and/or exaggerated; (4) there is uncertainty as to the outcome of pending appeals; and/or (5) there are significant factual issues to be resolved.

Based on currently available information, and in certain cases, advice of outside counsel, management does not believe that loss contingencies arising from pending matters will have a material adverse effect on the Company's overall financial position, after taking into consideration any existing accruals. However, actual outcomes could be material to the Company's operating results or liquidity for any particular period.

|

| | | | | | |

EMPLOYEE COMPENSATION AND PAY PRACTICES MATTERS |

Aggregate information regarding accruals for the below employee compensation and pay practices matters: |

Aggregate accrual | | Aggregate range of loss in excess of accrual | | Explanation if no accrual has been made |

SWIFT TRANSPORTATION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) — CONTINUED

|

| | | | | | |

$1.3 million | | $— | - | $— | | For certain matters, it is not probable that a loss was incurred and/or the amount of loss cannot be reasonably estimated. For those matters, no accrual has been made. |

| | | | | | |

California Private Attorneys General Act ("PAGA") Class Action |

The plaintiff alleges that the Company violated California law by failing to timely pay wages and failing to reimburse employees for business expenses. |

Plaintiff(s) | | Defendant(s) | | Date instituted | | Court or agency currently pending in |

Theron Christopher (1) | | Swift Transportation Co. of Arizona, LLC | | July 8, 2016 | | Superior Court of California, County of Riverside |

Recent Developments and Current Status |

The parties have agreed to a settlement of this matter and are currently seeking court approval of the settlement. The expected settlement amount is not material to the Company's financial statements. |

|

SWIFT TRANSPORTATION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) — CONTINUED

|

| | | | | | |

California Wage, Meal, and Rest: Driver Class Actions |

The plaintiffs generally allege one or more of the following: that the Company 1) failed to pay the California minimum wage; 2) failed to provide proper meal and rest periods; 3) failed to timely pay wages upon separation from employment; 4) failed to pay for all hours worked; 5) failed to pay overtime; 6) failed to properly reimburse work-related expenses; and 7) failed to provide accurate wage statements. |

Plaintiff(s) | | Defendant(s) | | Date instituted | | Court or agency currently pending in |

John Burnell (1) | | Swift Transportation Co., Inc | | March 22, 2010 | | United States District Court for the Central District of California |

| | | | | | |

James R. Rudsell (1) | | Swift Transportation Co. of Arizona, LLC and Swift Transportation Company | | April 5, 2012 | | United States District Court for the Central District of California |

| | | | | | |

Lawrence Peck (1) | | Swift Transportation Co. of Arizona, LLC | | September 25, 2014 | | United States District Court for the Central District of California |

| | | | | | |

Lawrence Peck (1)(2) | | Swift Transportation Co. of Arizona, LLC, et al. | | November 20, 2014 | | Superior Court of California, County of Riverside |

| | | | | | |

Sadashiv Mares (1) | | Swift Transportation Co. of Arizona, LLC | | February 27, 2015 | | United States District Court for the Central District of California |

| | | | | | |

Rafael McKinsty(1) | | Swift Transportation Co. of Arizona, LLC, et al. | | April 15, 2015 | | United States District Court for the Central District of California |

| | | | | | |

Thor Nilsen (1) | | Swift Transportation Co. of Arizona, LLC | | October 15, 2015 | | United States District Court for the Central District of California |

Recent Developments and Current Status |

Before and during 2016, the Rudsell, Peck, Peck PAGA, Mares, McKinsty, and Nilsen complaints were stayed, pending resolution of earlier-filed cases. In May 2016, the Burnell plaintiffs were denied class certification. Their subsequent petition to appeal the decertification order was also denied. Following the Burnell plaintiffs' failure to certify the class, the stays on certain cases were lifted. The Peck case is currently in discovery. The parties in the Mares and McKinsty cases are currently completing class certification briefing. Based on the current procedural nature of the cases, the final disposition of the matter and impact to the Company cannot be determined at this time. The likelihood that a loss has been incurred is remote. |

|

California Wage, Meal, and Rest: Yard Hostler Class Actions |

The plaintiffs, representing yard hostlers employed by the Company in California, generally allege one or more of the following: that the Company 1) failed to pay minimum wage; 2) failed to pay overtime and doubletime wages required by California law; 3) failed to provide accurate, itemized wage statements; 4) failed to timely pay wages upon separation from employment; 5) failed to reimburse for business expenses; and 6) failed to provide proper meal and rest periods. |

Plaintiff(s) | | Defendant(s) | | Date instituted | | Court or agency currently pending in |

Grant Fritsch (1) | | Swift Transportation Company of Arizona, LLC and Swift Transportation Company | | January 28, 2016 | | Superior Court of California, County of San Bernardino |

| | | | | | |

Bill Barker, Tab Bachman, and William Yingling (1)

| | Swift Transportation Company of Arizona, LLC | | April 1, 2016 | | United States District Court for the Eastern District of California |

Recent Developments and Current Status |

The Barker and Fritsch complaints are currently in discovery. The Company retains all of its defenses against liability and damages related to these lawsuits. Additionally, the Company intends to vigorously defend against the merits of the claims and to challenge certification. The final disposition of these matters and the impact on the Company cannot be determined at this time. The likelihood that a loss has been incurred is remote. |

|

SWIFT TRANSPORTATION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) — CONTINUED

|

| | | | | | |

National Customer Service Misclassification Class Action |

The plaintiff, a former Customer Service Representative IV, alleges that the Company failed to pay overtime under the FLSA. Additionally, with respect to California state law, the plaintiff alleges that the Company: 1) failed to pay overtime; 2) failed to pay timely final wages; 3) failed to provide meal and rest periods; and 4) violated the unfair competition law. |

Plaintiff(s) | | Defendant(s) | | Date instituted | | Court or agency currently pending in |

Salvador Castro (1) | | Swift Transportation Co. of Arizona, LLC | | May 11, 2016 | | United States District Court for the Central District of California |

Recent Developments and Current Status |

Castro, along with five other former Customer Service Representative IV employees opted into this collective action lawsuit, which was being pursued under the FLSA. In addition to the Castro collective action, thirteen Customer Service Representative IV employees pursued similar claims in individual arbitrations. The parties conducted three arbitrations regarding the individual claimants. The parties agreed to mediation, which was held in January 2017. The parties have reached a global settlement to the collective action and the individual arbitrations. The individual arbitration claimants have been paid pursuant to this settlement and the parties are seeking court approval of the settlement in the collective action. |

|

Arizona Fair Labor Standards Act Class Action |

The plaintiff alleges that the Company violated the FLSA by failing to pay its trainee drivers minimum wage for all work performed and by failing to pay overtime. |

Plaintiff(s) | | Defendant(s) | | Date instituted | | Court or agency currently pending in |

Pamela Julian (1) | | Swift Transportation Inc., et al. | | December 29, 2015 | | United States District Court for the District of Arizona |

Recent Developments and Current Status |

In March 2016, the Company filed a motion to dismiss the plaintiff's overtime claims, which was granted by the district court in May 2016. The parties recently completed briefing on the plaintiff's Motion for Conditional Class Certification and are awaiting a ruling on the Motion from the Court. The Company retains all of its defenses against liability and damages for the remaining claims. Additionally, the Company intends to vigorously defend against the merits of the claims and to challenge certification. The final disposition of the matter and the impact on the Company cannot be determined at this time. The likelihood that a loss has been incurred is remote. |

|

Washington Overtime Class Actions |

The plaintiffs allege one or more of the following, pertaining to Washington state-based drivers: that the Company 1) failed to pay minimum wage; 2) failed to pay overtime; 3) failed to pay all wages due at established pay periods; 4) failed to provide proper meal and rest periods; 5) failed to provide accurate wage statements; and 6) unlawfully deducted from employee wages. |

Plaintiff(s) | | Defendant(s) | | Date instituted | | Court or agency currently pending in |

Troy Slack (1) | | Swift Transportation Company of Arizona, LLC and Swift Transportation Corporation | | September 9, 2011 | | United States District Court for the Western District of Washington |

| | | | | | |

Julie Hedglin (1)

| | Swift Transportation Company of Arizona, LLC and Swift Transportation Corporation | | January 14, 2016 | | United States District Court for the Western District of Washington |

Recent Developments and Current Status |

The parties in the Slack matter are currently completing dispositive motion briefing. The case is scheduled for trial in September 2017. The Hedglin matter is currently in discovery. The Company retains all of its defenses against liability and damages for both matters. Additionally, the Company intends to vigorously defend against the merits of the claims and to challenge certification. The final disposition of the matter and the impact on the Company cannot be determined at this time. The likelihood that a loss has been incurred is remote. |

___________

| |

(1) | Individually and on behalf of all others similarly situated. |

SWIFT TRANSPORTATION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) — CONTINUED

|

| | | | | | |

OWNER-OPERATOR MATTERS |

Aggregate information regarding accruals for the below owner-operator matters: |

Aggregate accrual | | Aggregate range of loss in excess of accrual | | Explanation if no accrual has been made |

$36.7 million | | $— | - | $— | | For certain matters, it is not probable that a loss was incurred and/or the amount of loss cannot be reasonably estimated. For those matters, no accrual has been made. |

| | | | | | |

Arizona Owner-operator Class Action |

The putative class alleges that the Company improperly compensated owner-operators (later expanding the class to include employee drivers) using the contracted and industry standard remuneration based upon dispatched miles, instead of using a method of calculating mileage that the plaintiffs allege would be more accurate. |

Plaintiff(s) | | Defendant(s) | | Date instituted | | Court or agency currently pending in |

Leonel Garza (1) | | Swift Transportation Co., Inc. | | January 30, 2004 | | Maricopa County Superior Court |

Recent Developments and Current Status |

The original trial court's decision was to deny class certification of the owner-operators, which was reversed and reinstated several times by various courts prior to 2016. The class is currently certified, based on an appellate court's decision from July 2016. The Company filed a petition for review with the Arizona Supreme Court in August 2016, which was denied in January 2017. The matter will now proceed in the Maricopa County Superior Court. The final disposition of the matter and impact to the Company cannot be determined at this time. The likelihood that a loss has been incurred is remote. |

|

Ninth Circuit Owner-operator Misclassification Class Action |

The putative class alleges that the Company misclassified owner-operators as independent contractors in violation of the FLSA and various state laws, and that such owner-operators should be considered employees. The lawsuit also raises certain related issues with respect to the lease agreements that certain owner-operators have entered into with IEL. |

Plaintiff(s) | | Defendant(s) | | Date instituted | | Court or agency currently pending in |

Joseph Sheer, Virginia Van Dusen, Jose Motolinia, Vickii Schwalm, Peter Wood (1) | | Swift Transportation Co., Inc., Interstate Equipment Leasing, Inc., Jerry Moyes, and Chad Killebrew | | December 22, 2009 | | Unites States District Court of Arizona and Ninth Circuit Court of Appeals |

Recent Developments and Current Status |

For several years, the parties have been arguing over the proper venue in which to proceed. The plaintiffs argue that they signed contracts of employment, thus exempting them from arbitration under the Federal Arbitration Act, and claim that their case should be heard in court by a judge. The Company takes the position that these individuals signed independent contractor agreements and therefore can properly be required to submit their claims to arbitration. In January 2017, the district court issued an order finding that the plaintiffs had signed contracts of employment and thus the case could properly proceed in court. The Company has appealed this decision to the Ninth Circuit and the district court stayed the proceedings, pending resolution of the appeal. The Company intends to vigorously defend against any proceedings. The final disposition of the matter and impact to the Company cannot be determined at this time. The likelihood that a loss has been incurred is remote. |

|

SWIFT TRANSPORTATION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) — CONTINUED

|

| | | | | | |

Utah Collective and Individual Arbitration |

The plaintiffs allege that the Central Parties (defined below) misclassified owner-operator drivers as independent contractors and were therefore liable to these drivers for minimum wages and other employee benefits under the FLSA. The complaint also alleges a federal forced labor claim under U.S.C. §1589 and §1595, as well as fraud and other state-law claims. |

Plaintiff(s) | | Defendant(s) | | Date instituted | | Court or agency currently pending in |

Gabriel Ciluffo, Kevin Shire, and Bryan Ratterree (1) | | Central Refrigerated Service, Inc., Central Leasing, Inc., Jon Isaacson, and Jerry Moyes (the "Central Parties"), as well as Swift Transportation Company | | June 1, 2012 | | American Arbitration Association |

Recent Developments and Current Status |

In June 2016, mediation commenced, but there was ultimately no settlement of the matter. In October 2016, the arbitrator ruled that approximately 1,300 Central Refrigerated Service, Inc. drivers were improperly classified as independent contractors, when they should have been classified and compensated as employees. The arbitrator ruled that damages could ultimately be assessed in a collective proceeding and denied the Company's motion to decertify the collective proceeding. Based upon the October 2016 arbitration ruling, the Company increased its legal accrual related to this matter for the quarter ended September 30, 2016. On April 14, 2017, the Company proposed a tentative settlement arrangement, which was finalized by and between the parties on April 28, 2017, subject to final court approval. As such, the Company increased its legal accrual again for the quarter ended March 31, 2017. The likelihood that a loss has been incurred is probable. |

___________

| |

(1) | Individually and on behalf of all others similarly situated. |

|

| | | | | | |

EMPLOYEE HIRING PRACTICES MATTERS |

Aggregate information regarding accruals for the below employee hiring practices matters: |

Aggregate accrual | | Aggregate range of loss in excess of accrual | | Explanation if no accrual has been made |

$— | | $— | - | $— | | It is not probable that a loss was incurred and/or the amount of loss cannot be reasonably estimated for these matters. |

| | | | | | |

Indiana Fair Credit Reporting Act Class Action |

The plaintiff alleges that Central Refrigerated Service, Inc. violated the Fair Credit Reporting Act by failing to provide job applicants with adverse action notices and copies of their consumer reports and statements of rights. |

Plaintiff(s) | | Defendant(s) | | Date instituted | | Court or agency currently pending in |

Melvin Banks (1) | | Central Refrigerated Service, Inc. | | March 18, 2015 | | United States District Court for the District of Utah |

Recent Developments and Current Status |

The first phase of discovery, regarding potential for identifying and certifying a class of affected job applicants, has been completed. The parties recently completed class certification briefing and the Company filed a Motion for Summary Judgment. Rulings on these Motions are pending from the court. The Company retains all of its defenses against liability and damages. Additionally, the Company intends to vigorously defend against the merits of the claims and to challenge certification. The final disposition of the matter and the impact on the Company cannot be determined at this time. The likelihood that a loss has been incurred is remote. |

|

SWIFT TRANSPORTATION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) — CONTINUED

|

| | | | | | |

California Class and Collective Action for Pre-employment Physical Testing |

The plaintiff alleges that pre-employment tests of physical strength administered by a third party on behalf of Central Refrigerated Service, Inc. had an unlawfully discriminatory impact on female applicants and applicants over the age of 40. The suit seeks damages under Title VII of the Civil Rights Act of 1964, the age Discrimination Act, and parallel California state law provisions, including the California Fair Employment and Housing Act. |

Plaintiff(s) | | Defendant(s) | | Date instituted | | Court or agency currently pending in |

Robin Anderson (1) | | Central Refrigerated Service, Inc., Workwell Systems, Inc., and Swift Transportation Company | | October 6, 2014 | | United States District Court for the Central District of California |

Recent Developments and Current Status |

Litigation is at a very preliminary stage and no trial date has been set. Additionally, there is a motion for class certification pending, for which the Company is preparing a response. The Company intends to vigorously defend against the merits of the plaintiff's claims and to oppose certification of any class of plaintiffs. The final disposition of this case and the financial impact cannot be determined at this time. The likelihood that a loss has been incurred is remote. |

___________

| |

(1) | Individually and on behalf of all others similarly situated. |

Other Contingencies

Demand for Inspection of Books and Records and Stockholder Derivative Lawsuit — During 2016, the Company received several shareholder demands requesting to inspect the Company's books and records, pursuant to Section 220 of the Delaware General Corporation Law ("Section 220"). The demands relate to the shareholders' alleged investigation pertaining to whether the Board and Jerry Moyes have breached their fiduciary duties with respect to matters that have been publicly disclosed concerning the Company's securities trading policy, limitations on the pledging of Company stock on margin, share repurchases, the status of Board members as independent directors and other related matters. The Company has responded to the shareholders' requests received thus far. On February 9, 2017, a civil lawsuit was filed in the Court of Chancery of the State of Delaware (captioned as: Shiva Stein derivatively on behalf of Swift Transportation Company v. Jerry Moyes et al. and Swift Transportation Company as nominal defendant (the "Complaint")). The Complaint, initially filed as a confidential filing, is a purported derivative action alleging that the individual members of the Company's Board breached their fiduciary duties related to the Company's administration of its Securities Trading Policy and certain compensation actions related to Mr. Moyes.

In February 2017, the Company received a shareholder demand under Section 220 for books and records related to an alleged investigation into whether the Board breached its fiduciary duties in connection with the September 8, 2016 retirement agreement between the Company and Mr. Moyes. The Company is in the process of responding to this request.

Any future disposition or resolution of these matters cannot be determined at this time.

Environmental

The Company's tractors and trailers are involved in motor vehicle accidents, and experience damage, mechanical failures, and cargo issues as an incidental part of its normal course of operations. From time to time, these matters result in the discharge of diesel fuel, motor oil, or other hazardous materials into the environment. Depending on local regulations and who is determined to be at fault, the Company is sometimes responsible for the clean-up costs associated with these discharges. As of March 31, 2017, the Company's estimate for its total legal liability for all such clean-up and remediation costs was approximately $0.3 million in the aggregate for all current and prior year claims.

SWIFT TRANSPORTATION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) — CONTINUED

Note 12 — Share Repurchase Programs The following table presents our repurchases of our Class A common stock under the respective share repurchase programs, net of advisory fees:

|

| | | | | | | | | | | | | | | | | | | | |

| | | | Quarter Ended March 31, | | As of |

Share Repurchase Program | | 2017 | | 2016 | | March 31, 2017 |

Authorized Amount | | Board Approval Date | | Shares | | Amount | | Shares | | Amount | | Amount Remaining |

(In thousands) |

$100,000 | | September 24, 2015 | | — |

| | $ | — |

| | 2,221 |

| | $ | 30,000 |

| | $ | — |

|

$150,000 | | February 22, 2016 | | — |

| | $ | — |

| | 903 |

| | $ | 15,000 |

| | $ | 62,881 |

|

| | | | — |

| | $ | — |

| | 3,124 |

| | $ | 45,000 |

| | $ | 62,881 |

|

Note 13 — Weighted Average Shares Outstanding The following table reconciles basic weighted average shares outstanding to diluted weighted average shares outstanding:

|

| | | | | |

| Quarter Ended March 31, |

| 2017 | | 2016 |

| (In thousands) |

Basic weighted average common shares outstanding | 133,147 |

| | 136,519 |

|

Dilutive effect of stock options | 942 |

| | 1,136 |

|

Diluted weighted average common shares outstanding | 134,089 |

| | 137,655 |

|

Anti-dilutive shares excluded from the dilutive-effect calculation (1) | 153 |

| | 452 |

|

____________

| |

(1) | Shares were excluded from the dilutive-effect calculation because the outstanding options' exercise prices were greater than the average market price of the Company's common shares during the period. |

Note 14 — Fair Value Measurement The following table presents the carrying amounts and estimated fair values of the Company’s financial instruments:

|

| | | | | | | | | | | | | | | |

| March 31, 2017 | | December 31, 2016 |

| Carrying

Value | | Estimated

Fair Value | | Carrying

Value | | Estimated

Fair Value |

| (In thousands) |

Financial Assets: | | | | | | | |

Restricted investments (1) | $ | 22,859 |

| | $ | 22,843 |

| | $ | 22,717 |

| | $ | 22,688 |

|

Financial Liabilities: | | | | | | | |

2015 Agreement: Term Loan A, due July 2020 (2) | 470,506 |

| | 471,750 |

| | 492,912 |

| | 494,250 |

|

2015 RSA, due January 2019 (3) | 304,374 |

| | 305,000 |

| | 279,285 |

| | 280,000 |

|

Revolving line of credit, due July 2020 | 10,000 |

| | 10,000 |

| | 130,000 |

| | 130,000 |

|