Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

(Mark One)

|

| | |

þ | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 25, 2016

OR

|

| | |

o | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-35065

WRIGHT MEDICAL GROUP N.V.

(Exact name of registrant as specified in its charter)

|

| | |

The Netherlands | | 98-0509600 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

|

| | |

Prins Bernhardplein 200 1097 JB Amsterdam, The Netherlands | | None (Zip code) |

(Address of Principal Executive Offices) | |

Registrant’s telephone number, including area code: (+31) 20 521 4777

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of each class | | Name of each exchange on which registered |

Ordinary shares, par value €0.03 per share | | NASDAQ Global Select Market |

Contingent Value Rights | | NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. þ Yes o No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. o Yes þ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. þ Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). þ Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | |

Large accelerated filer þ | | Accelerated filer o | | Non-accelerated filer o | | Smaller reporting company o |

| | | | (Do not check if a smaller reporting company) | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). o Yes þ No

The aggregate market value of the ordinary shares held by non-affiliates of the registrant on June 26, 2016 was $1.7 billion based on the closing sale price of the ordinary shares on that date, as reported by the NASDAQ Global Select Market. For purposes of the foregoing calculation only, the registrant has assumed that all executive officers and directors of the registrant, and their affiliated entities, are affiliates.

As of February 17, 2017, there were 103,625,395 ordinary shares outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

WRIGHT MEDICAL GROUP N.V.

ANNUAL REPORT ON FORM 10-K

Table of Contents

|

| |

| Page |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

EX-10.31 | |

EX-10.32 | |

EX-10.33 | |

EX-10.34 | |

EX-10.35 | |

EX-10.36 | |

EX-10.37 | |

EX-10.38 | |

EX-10.67 | |

EX-10.68 | |

EX-10.69 | |

EX-12.1 | |

EX-21.1 | |

EX-23.1 | |

EX-31.1 | |

EX-31.2 | |

EX-32.1 | |

EX-101 INSTANCE DOCUMENT |

EX-101 SCHEMA DOCUMENT |

EX-101 CALCULATION LINKBASE DOCUMENT |

EX-101 LABELS LINKBASE DOCUMENT |

EX-101 PRESENTATION LINKBASE DOCUMENT |

EX-101 DEFINITION LINKBASE DOCUMENT |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Exchange Act of 1934, as amended (Exchange Act), and that are subject to the safe harbor created by those sections. These statements reflect management's current knowledge, assumptions, beliefs, estimates, and expectations and express management's current view of future performance, results, and trends. Forward looking statements may be identified by their use of terms such as anticipate, believe, could, estimate, expect, intend, may, plan, predict, project, will, and other similar terms. Forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to materially differ from those described in the forward-looking statements. The reader should not place undue reliance on forward-looking statements. Such statements are made as of the date of this report, and we undertake no obligation to update such statements after this date. Risks and uncertainties that could cause our actual results to materially differ from those described in forward-looking statements are discussed in our filings with the U.S. Securities and Exchange Commission (SEC) (including those described in "Part I. Item 1A. Risk Factors" of this report). By way of example and without implied limitation, such risks and uncertainties include:

| |

• | future actions of the SEC, the United States Attorney’s office, the U.S. Food and Drug Administration (FDA), the Department of Health and Human Services, or other U.S. or foreign government authorities, including those resulting from increased scrutiny under the U.S. Foreign Corrupt Practices Act and similar laws, that could delay, limit, or suspend our development, manufacturing, commercialization, and sale of products, or result in seizures, injunctions, monetary sanctions, or criminal or civil liabilities; |

| |

• | risks associated with the merger between Tornier N.V. (Tornier or legacy Tornier) and Wright Medical Group, Inc. (WMG or legacy Wright), including the failure to realize intended benefits and anticipated synergies and cost-savings from the transaction or delay in realization thereof; our businesses may not be combined successfully, or such combination may take longer, be more difficult, time-consuming or costly to accomplish than expected; and business disruption after the transaction, including adverse effects on employee retention, our sales and distribution channel, especially in light of territory transitions, and business relationships with third parties; |

| |

• | risks associated with the divestiture of the U.S. rights to certain of legacy Tornier's ankle and silastic toe replacement products; |

| |

• | liability for product liability claims on hip/knee (OrthoRecon) products sold by Wright Medical Technology, Inc. (WMT) prior to the divestiture of the OrthoRecon business; |

| |

• | risks and uncertainties associated with the recent metal-on-metal master settlement agreement and the settlement agreement with the three insurance companies, including without limitation, the final settlement amount and the final number of claims settled under the master settlement agreement, the resolution of the remaining unresolved claims, the effect of the broad release of certain insurance coverage for present and future claims, and the resolution of WMT’s dispute with the remaining carriers; |

| |

• | failure to realize the anticipated benefits from previous acquisitions and dispositions; |

| |

• | adverse outcomes in existing product liability litigation; |

| |

• | new product liability claims; |

| |

• | inadequate insurance coverage; |

| |

• | copycat claims against our modular hip systems resulting from a competitor’s recall of its modular hip product; |

| |

• | the ability of a creditor of any one particular entity within our corporate structure to reach the assets of the other entities within our corporate structure not liable for the underlying claims of the one particular entity, despite our corporate structure which is intended to ring-fence liabilities; |

| |

• | failure to obtain anticipated commercial sales of our AUGMENT® Bone Graft in the United States; |

| |

• | challenges to our intellectual property rights or inability to defend our products against the intellectual property rights of others; |

| |

• | adverse effects of diverting resources and attention to transition services provided to the purchaser of our Large Joints business; |

| |

• | failures of, interruptions to, or unauthorized tampering with, our information technology systems; |

| |

• | failure or delay in obtaining FDA or other regulatory approvals for our products; |

| |

• | the potentially negative effect of our ongoing compliance efforts on our relationships with customers and on our ability to deliver timely and effective medical education, clinical studies, and new products; |

| |

• | the possibility of private securities litigation or shareholder derivative suits; |

| |

• | insufficient demand for and market acceptance of our new and existing products; |

| |

• | recently enacted healthcare laws and changes in product reimbursements, which could generate downward pressure on our product pricing; |

| |

• | potentially burdensome tax measures; |

| |

• | lack of suitable business development opportunities; |

| |

• | inability to capitalize on business development opportunities; |

| |

• | product quality or patient safety issues; |

| |

• | geographic and product mix impact on our sales; |

| |

• | inability to retain key sales representatives, independent distributors, and other personnel or to attract new talent; |

| |

• | inventory reductions or fluctuations in buying patterns by wholesalers or distributors; |

| |

• | inability to generate sufficient cash flow to satisfy our capital requirements, including future milestone payments, and existing debt, including the conversion features of our convertible senior notes, or refinance our existing debt as it matures; |

| |

• | risks associated with our credit, security and guaranty agreement for our senior secured asset based line of credit; |

| |

• | inability to raise additional financing when needed and on favorable terms; |

| |

• | the negative impact of the commercial and credit environment on us, our customers, and our suppliers; |

| |

• | deriving a significant portion of our revenues from operations in certain geographic markets that are subject to political, economic, and social instability, including in particular France, and risks and uncertainties involved in launching our products in certain new geographic markets; |

| |

• | fluctuations in foreign currency exchange rates; |

| |

• | not successfully developing and marketing new products and technologies and implementing our business strategy; |

| |

• | not successfully competing against our existing or potential competitors and the effect of significant recent consolidations amongst our competitors; |

| |

• | the reliance of our business plan on certain market assumptions; |

| |

• | our private label manufacturers failing to provide us with sufficient supply of their products, or failing to meet appropriate quality requirements; |

| |

• | our inability to timely manufacture products or instrument sets to meet demand; |

| |

• | our plans to bring the manufacturing of certain of our products in-house and possible disruptions we may experience in connection with such transition; |

| |

• | our plans to increase our gross margins by taking certain actions designed to do so; |

| |

• | the loss of key suppliers, which may result in our inability to meet customer orders for our products in a timely manner or within our budget; |

| |

• | the incurrence of significant expenditures of resources to maintain relatively high levels of inventory, which could reduce our cash flows and increase the risk of inventory obsolescence, which could harm our operating results; |

| |

• | consolidation in the healthcare industry that could lead to demands for price concessions or the exclusion of some suppliers from certain of our markets, which could have an adverse effect on our business, financial condition, or operating results; |

| |

• | our clinical trials and their results and our reliance on third parties to conduct them; |

| |

• | the compliance of our products and activities with the laws and regulations of the countries in which they are marketed, which compliance may be costly and time-consuming; |

| |

• | the use, misuse or off-label use of our products that may harm our image in the marketplace or result in injuries that may lead to product liability suits, which could be costly to our business or result in governmental sanctions; |

| |

• | pending and future other litigation, which could have an adverse effect on our business, financial condition, or operating results; and |

| |

• | risks in light of the material weakness in our internal control over financial reporting that we have recently identified. |

For more information regarding these and other uncertainties and factors that could cause our actual results to differ materially from what we have anticipated in our forward-looking statements or otherwise could materially adversely affect our business, financial condition, or operating results, see “Part I. Item 1A. Risk Factors” of this report. The risks and uncertainties described above and in “Part I. Item 1A. Risk Factors” of this report are not exclusive and further information concerning us and our business, including factors that potentially could materially affect our financial results or condition, may emerge from time to time. We assume no obligation to update, amend, or clarify forward-looking statements to reflect actual results or changes in factors or assumptions affecting such forward-looking statements. We advise you, however, to consult any further disclosures we make on related subjects in our future Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K we file with or furnish to the SEC.

PART I

Item 1. Business.

Overview

Wright Medical Group N.V. (Wright or we) is a global medical device company focused on extremities and biologics products. We are committed to delivering innovative, value-added solutions improving quality of life for patients worldwide and are a recognized leader of surgical solutions for the upper extremities (shoulder, elbow, wrist and hand), lower extremities (foot and ankle) and biologics markets, three of the fastest growing segments in orthopaedics. We market our products in over 50 countries worldwide. We believe we are differentiated in the marketplace by our strategic focus on extremities and biologics, our full portfolio of upper and lower extremities and biologics products, and our specialized and focused sales organization.

Our product portfolio consists of the following product categories:

| |

• | Upper extremities, which include joint implants and bone fixation devices for the shoulder, elbow, wrist, and hand; |

| |

• | Lower extremities, which include joint implants and bone fixation devices for the foot and ankle; |

| |

• | Biologics, which include products used to support treatment of damaged or diseased bone, tendons, and soft tissues or to stimulate bone growth; and |

| |

• | Sports medicine and other, which include products used across several anatomic sites to mechanically repair tissue-to-tissue or tissue-to-bone injuries and other ancillary products. |

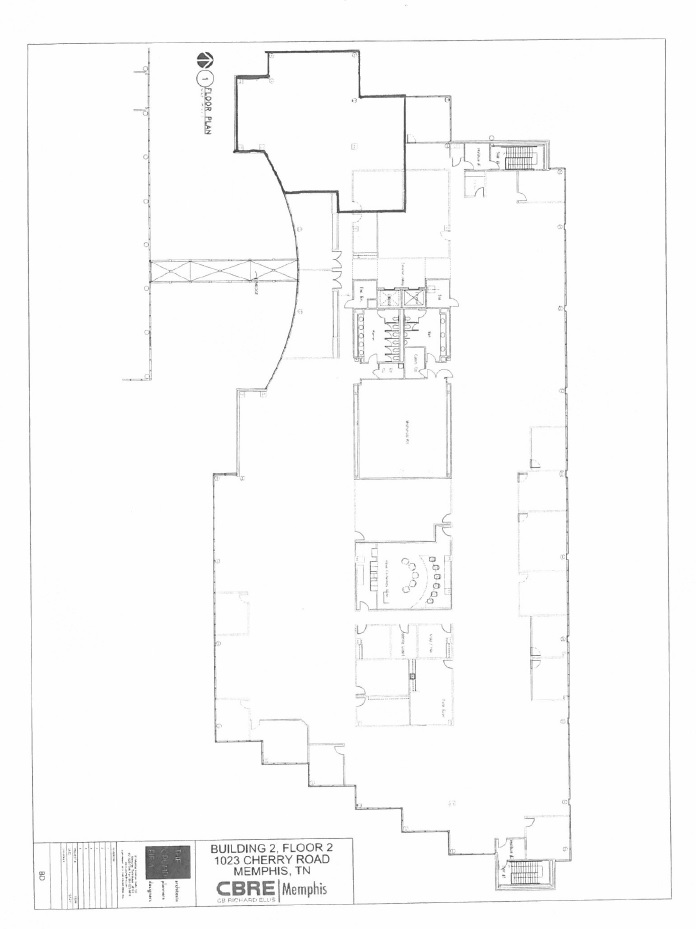

Our global corporate headquarters are located in Amsterdam, the Netherlands. We also have significant operations located in Memphis, Tennessee (U.S. headquarters, research and development, sales and marketing administration, and administrative activities); Bloomington, Minnesota (upper extremities sales and marketing and warehousing operations); Arlington, Tennessee (manufacturing and warehousing operations); Franklin, Tennessee (manufacturing and warehousing operations); Montbonnot, France (manufacturing and warehousing operations); and Macroom, Ireland (manufacturing). In addition, we have local sales and distribution offices in Canada, Australia, Asia, Latin America, and throughout Europe. For purposes of this report, references to "international" or "foreign" relate to non-U.S. matters while references to "domestic" relate to U.S. matters.

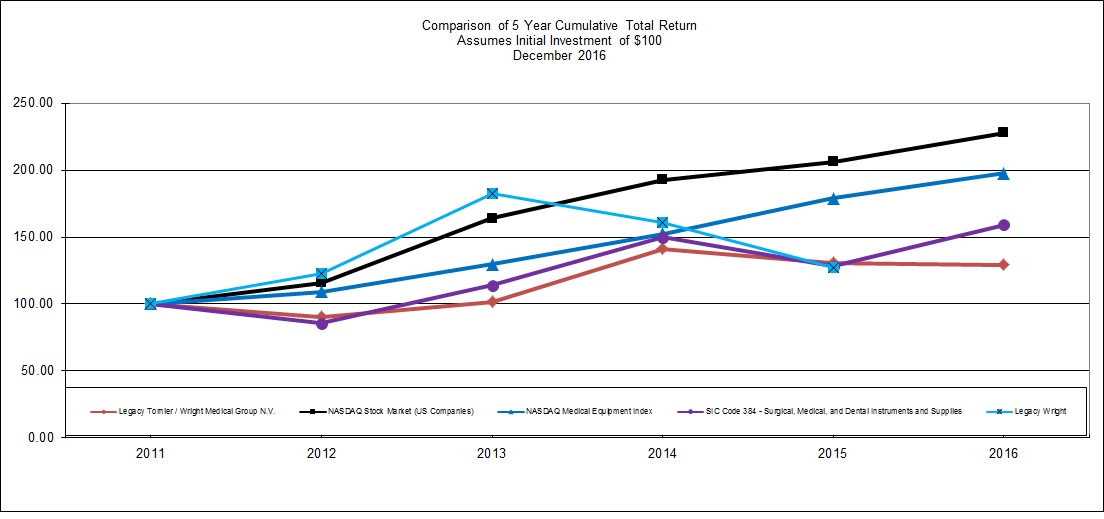

On October 1, 2015, we became Wright Medical Group N.V. following the merger (the Wright/Tornier merger or the merger) of Wright Medical Group, Inc. (WMG or legacy Wright) with Tornier N.V. (Tornier or legacy Tornier). Because of the structure of the merger and the governance of the combined company immediately post-merger, the merger was accounted for as a "reverse acquisition" under generally accepted accounting principles in the United States (US GAAP), and as such, legacy Wright was considered the acquiring entity for accounting purposes. Therefore, legacy Wright’s historical results of operations replaced legacy Tornier’s historical results of operations for all periods prior to the merger. References in this section and certain other sections of Part I of this report to "we," "our" and "us" refer to Wright Medical Group N.V. and its subsidiaries after the Wright/Tornier merger and Wright Medical Group, Inc. and its subsidiaries before the merger.

On October 21, 2016, we sold legacy Tornier’s Large Joints business to Corin Orthopaedics Holdings Limited (Corin) allowing us to devote our full resources and attention on accelerating growth opportunities in the high-growth extremities and biologics markets. Legacy Wright sold its hip and knee (OrthoRecon) business to MicroPort Scientific Corporation (MicroPort) on January 9, 2014. The financial results of legacy Tornier’s Large Joints business and the OrthoRecon business are reflected within discontinued operations for all periods presented.

For the year ended December 25, 2016, we had net sales of $690.4 million and a net loss from continuing operations of $164.9 million. As of December 25, 2016, we had total assets of $2,291 million. During the first quarter of 2016, our management began managing our operations as four operating business segments: U.S. Lower Extremities & Biologics, U.S. Upper Extremities, International Extremities & Biologics, and Large Joints, based on management's change to the way it monitors performance, aligns strategies, and allocates resources. As a result of the sale of our Large Joints business to Corin, the Large Joints reportable segment is presented in our consolidated statements of operations as discontinued operations and is not included in segment results for all periods presented. U.S. Lower Extremities & Biologics, U.S. Upper Extremities, and International Extremities & Biologics are our remaining three reportable segments as of December 25, 2016. Detailed information on our net sales by product category and operating business segment and our net sales and long-lived assets by segment and geographic region can be found in Note 20 to our consolidated financial statements contained in “Item 8. Financial Statements and Supplementary Data.” Orthopaedic Industry

The total worldwide orthopaedic industry is estimated at approximately $47.3 billion in 2016. Five multinational companies currently dominate the orthopaedic industry, each with approximately $2 billion or more in annual sales. The size of these companies often allows them to concentrate their marketing and research and development efforts on products they believe will have a relatively high minimum threshold level of sales. As a result, there is an opportunity for a mid-sized orthopaedic company, such as us, to focus on less contested, higher-growth sectors of the orthopaedic market.

We have focused our efforts into growing our position in the high-growth extremities and biologics markets. We believe a more active and aging patient population with higher expectations regarding “quality of life,” an increasing global awareness of extremities and biologics solutions, improved clinical outcomes as a result of the use of such products, and technological advances resulting in specific designs for such products that simplify procedures and address unmet needs for early interventions, and the growing need for revisions and revision related solutions will drive the market for extremities and biologics products.

The extremities market is one of the fastest growing market segments within orthopaedics, with annual growth rates of 7-10%. We believe the extremities market will continue to grow by approximately 7-10% annually. We currently estimate the market for all surgical products used by extremities-focused surgeons to be approximately $3 billion in the United States. We believe major trends in the extremities market include procedure-specific and anatomy-specific devices, locking plates, and an increase in total ankle replacement or arthroplasty procedures.

Upper extremities reconstruction involves implanting devices to replace, reconstruct, or fixate injured or diseased joints and bones in the shoulder, elbow, wrist, and hand. It is estimated that approximately 60% of the upper extremities market is in total shoulder replacement or arthroplasty implants. We believe major trends in the upper extremities market include next-generation joint arthroplasty systems, bone preserving solutions, virtual planning systems, and revision of failed previous shoulder replacements in older patients.

Lower extremities reconstruction involves implanting devices to replace, reconstruct, or fixate injured or diseased joints and bones in the foot and ankle. A large segment of the lower extremities market is comprised of plating and screw systems for reconstructing and fusing joints or repairing bones after traumatic injury. We believe major trends in the lower extremities market include the use of external fixation devices in diabetic patients, total ankle arthroplasty, advanced tissue fixation devices, and biologics. According to various customer and market surveys, we are a market leader in foot and ankle surgical products. New technologies have been introduced into the lower extremities market in recent years, including next-generation total ankle replacement systems. Many of these technologies currently have low levels of market penetration. We believe that market adoption of total ankle replacement, which currently represents approximately 8% of the U.S. foot and ankle device market, will result in significant future growth in the lower extremities market.

The field of biologics employs tissue engineering and regenerative medicine technologies focused on remodeling and regeneration of tendons, ligaments, bone, and cartilage. Biologic products use both biological tissue-based and synthetic materials to allow the body to regenerate damaged or diseased bone and to repair damaged or diseased soft tissue. These products aid the body’s natural regenerative capabilities to heal itself. Biologic products provide a lower morbidity solution to “autografting,” a procedure that involves harvesting a patient’s own bone or soft tissue and transplanting it to a different site. Following an autografting procedure, the patient typically has pain, and at times, complications result at the harvest site after surgery. Biologically or synthetically derived soft tissue grafts and scaffolds are used to treat soft tissue injuries and are complementary to many sports medicine applications, including rotator cuff tendon repair and Achilles tendon repair. Hard tissue biologics products are used in many bone fusion or trauma cases where healing potential may be compromised and additional biologic factors are desired to enhance healing, where the surgeon needs additional bone, or in cases where the surgeon wishes to use materials that are naturally incorporated by the body over time. We estimate that the worldwide orthobiologics market to be over $3.5 billion, and with annual growth rates of 3-5%. Three multinational companies currently dominate the orthobiologics industry.

The newest addition to our biologics product portfolio is AUGMENT® Bone Graft, which is based on recombinant human platelet-derived growth factor (rhPDGF-BB), a synthetic copy of one of the body’s principal healing agents. We obtained FDA approval of AUGMENT® Bone Graft in the United States for ankle and/or hindfoot fusion indications during the third quarter of 2015. We estimate the U.S. market opportunity for AUGMENT® Bone Graft for ankle and/or hindfoot fusion indications to be approximately $300 million. The main competitors for AUGMENT® Bone Graft are autologous bone grafts, allograft, and synthetic bone growth substitutes. Autologous bone grafts, which account for a significant portion of total graft volume, are taken directly from the patient. This generally necessitates an additional procedure to obtain the graft, which in turn creates added expense, and increased pain and recovery time. Allografts, which are currently the second most commonly used bone grafts, are taken from human cadavers and processed by either bone banks or commercial firms. Although an obvious advantage to allografts is the fact that a second-site harvesting operation is not required, they carry a slight risk of transmitting pathogens and can also cause immune system reactions. Synthetic grafts are derived from numerous materials, including polymers, calcium sulfate, calcium phosphate, bovine collagen, and coral.

Product Portfolio

We offer a broad product portfolio of approximately 180 extremities products and over 20 biologics products that are designed to provide solutions to our surgeon customers, with the goal of improving clinical outcomes and the “quality of life” for their patients. Our product portfolio consists of the following product categories:

| |

• | Upper extremities, which include joint implants and bone fixation devices for the shoulder, elbow, wrist, and hand; |

| |

• | Lower extremities, which include joint implants and bone fixation devices for the foot and ankle; |

| |

• | Biologics, which include products used to support treatment of damaged or diseased bone, tendons, and soft tissues or to stimulate bone growth; and |

| |

• | Sports medicine and other, which include products used across several anatomic sites to mechanically repair tissue-to-tissue or tissue-to-bone injuries and other ancillary products. |

Upper Extremities

The upper extremities product category includes joint implants and bone fixation devices for the shoulder, elbow, wrist, and hand. Our global net sales from this product category was $288.1 million, or 41.7% of total net sales, for the year ended December 25, 2016, as compared to $83.5 million, or 20.6% of total net sales, for the year ended December 27, 2015. Our net sales in upper extremities increased significantly as a result of the Wright/Tornier merger.

Our shoulder products are used to treat painful shoulder conditions due to arthritis, irreparable rotator cuff tendon tears, bone disease, fractured humeral heads, or failed previous shoulder replacement surgery. Our shoulder products include the following:

| |

• | Total Shoulder Joint Replacement. Our total shoulder joint replacement products have two components-a humeral implant consisting of a metal stem or base attached to a metal head, and a plastic implant for the glenoid (shoulder socket). Together, these two components mimic the function of a natural shoulder joint. Our total shoulder joint replacement products include the AEQUALIS ASCEND®, AEQUALIS® PRIMARY™, AEQUALIS® PERFORM™ and SIMPLICITI® shoulder systems. Our recently introduced BLUEPRINT™ 3D Planning Software can be used with our AEQUALIS® PERFORM™ Glenoid System to assist surgeons in accurately positioning the glenoid implant and replicating the pre-operative surgical plan. In addition, we received FDA 510(k) clearance in June 2016 of our AEQUALIS® PERFORM™+ Glenoid System, the first anatomic augmented glenoid. This system was designed to specifically address posterior glenoid deficiencies and deliver bone preservation. |

| |

• | Hemi Shoulder Joint Replacement. Our hemi shoulder joint replacement products replace only the humeral head and allow it to articulate against the native glenoid. These products include our PYC HUMERAL HEAD™ and INSPYRE™. PYC stands for pyrocarbon, which is a biocompatible material that has low joint surface friction and a high resistance to wear. The PYC HUMERAL HEAD™ is currently available in certain international markets. The product received FDA approval in 2015 for its investigational device exemption to conduct a clinical trial in the United States. We anticipate that this single arm study will enroll and implant 157 patients from up to 20 centers across the United States and will evaluate the safety and effectiveness of the device in patients with a primary diagnosis of partial shoulder replacement or hemi-arthroplasty. The study design uses a primary endpoint that is measured at two years. |

| |

• | Reversed Shoulder Joint Replacement. Our reversed shoulder joint replacement products are used in arthritic patients lacking rotator cuff function. The components are different from a traditional “total” shoulder in that the humeral implant has the plastic socket and the glenoid has the metal head. This design has the biomechanical impact of shifting the pivot point of the joint away from the body centerline and recruiting the deltoid muscles to enable the patient to elevate the arm. Our reversed joint replacement products include the AEQUALIS® REVERSED II™ shoulder. We received FDA 510(k) clearance in December 2016 of our AEQUALIS® PERFORM™ REVERSED Glenoid System, our first reverse augmented glenoid. This system was designed to specifically address posterior glenoid deficiencies and deliver bone preservation. |

| |

• | Convertible Shoulder Joint Replacement. Our convertible shoulder joint replacement products are modular implants that can be converted from a total or hemi shoulder implant to a reversed implant at a later date if the patient requires it. Our convertible joint replacement products include the AEQUALIS ASCEND® FLEX™ convertible shoulder system, which provides anatomic and reversed options within a single system and is designed to offer precise intra-operative implant-to-patient fit and easy conversion to reversed if necessary. |

| |

• | Shoulder Resurfacing Implants. An option for some patients is shoulder resurfacing where the damaged humeral head is sculpted to receive a metal “cap” that fits onto the bone, functioning as a new, smooth humeral head. This procedure can be less invasive than a total shoulder replacement. Our shoulder resurfacing implants are designed to preserve bone, which may benefit more active or younger patients with shoulder arthritis. Our resurfacing implants include the AEQUALIS® RESURFACING HEAD™. |

| |

• | Shoulder Trauma Devices. Our shoulder trauma devices, such as plates, pins, screws, and nails, are non-articulating implants used to help stabilize fractures of the humerus. Our shoulder trauma products include the AEQUALIS® IM NAIL™, AEQUALIS® PROXMILA HUMERAL PLATE™, AEQUALIS® FRACTURE™ shoulder and AEQUALIS® REVERSED FRACTURE™ shoulder. |

In addition to our shoulder products, our upper extremities product portfolio consist of implants, plates, pins, screws, and nails that are used to treat the elbow, wrist, and hand, and include the following:

| |

• | Total Elbow and Radial Head Replacement. Our total elbow and radial head replacement products address the need for modularity in the anatomically highly-variable joint of the elbow and give surgeons the ability to reproduce the natural flexion/extension axis and restore natural kinematics of the elbow. Our total elbow replacement products include our LATITUDE® EV™ total elbow prosthesis. Our radial head replacement products include our EVOLVE® modular radial head device, which is a market leading radial head prosthesis that provides different combinations of heads and stems allowing the surgeon to choose implant heads and stems to accommodate the unpredictable anatomy of each patient. |

| |

• | Elbow Fracture Repair. We have several plating and screw products designed to repair a fractured elbow. Our radial head plating systems and screws are for surgeons who wish to repair rather than replace a damaged radial head and include our EVOLVE® TRIAD™ fixation system. Our EVOLVE® Elbow Plating System addresses fractures of the distal humerus and proximal ulna. Composed of polished stainless steel, this system was designed to accurately match the patient anatomy to reduce the need for intra-operative bending while providing a low profile design to minimize post-operative irritation. Both of these products and several of our other products incorporate our ORTHOLOC® 3Di Polyaxial Locking Technology to enable optimal screw placement and stability. |

| |

• | Wrist Fracture Repair. We have several plating and screw products designed to repair a fractured wrist. Our MICRONAIL® II Intramedullary Distal Radius System is a next-generation minimally invasive treatment for distal radius fractures that is designed to provide immediate fracture stabilization with minimal soft tissue disruption. Also, as the nail is implanted within the bone, it has no external profile on top of the bone, thereby reducing the potential for tendon irritation or rupture, which is an appreciable problem with conventional plates designed to lie on top of the bone. In addition, our RAYHACK® system is comprised of a series of precision cutting guides and procedure-specific plates for ulnar and radial shortening procedures and the surgical treatment of radial malunions and Keinbock’s Disease. |

| |

• | Hand Fixation. Our hand fixation products include our FUSEFORCE® Hand Fixation System, which is a shape-memory compression-ready fixation system that can be used in fixation for fractures, fusions, or osteotomies of the bones in the hand. |

| |

• | Thumb and Finger Joint Replacement. Our Swanson finger joints are used in finger joint replacement for patients suffering from rheumatoid arthritis of the hand. With nearly 45 years of clinical success, Swanson digit implants are a foundation in our upper extremities business and are used by a loyal base of hand surgeons worldwide. Our ORTHOSPHERE® implants are used in thumb joint replacement procedures. |

Lower Extremities

The lower extremities product category includes joint implants and bone fusion and fixation devices, including plates, pins, screws, and nails, for the foot and ankle. Our global net sales from this product category for the year ended December 25, 2016 was $285.6 million, or 41.4% of total net sales, as compared to $238.3 million, or 58.8% of total net sales, for the year ended December 27, 2015.

We are a recognized leader in the United States for foot and ankle surgical products. Our lower extremities product portfolio includes:

| |

• | Total Ankle Joint Replacement. Total ankle joint replacement, also known as total ankle arthroplasty, is a surgical procedure that orthopaedic surgeons use to treat ankle arthritis. Our total ankle joint replacement products include implants for the ankle that involve replacing the joint with an articulating multi-component implant. These joint implants may be mobile bearing, in which the plastic component is free to slide relative to the metal bearing surfaces, or fixed bearing, in which this component is constrained. Our INBONE® Total Ankle Systems, including our third-generation INBONE® II Total Ankle System, are modular prostheses that allow the surgeon to tailor the fixation stems for the tibial and talar components in order to maximize stability of the implant. The INBONE® II Total Ankle System is the only ankle replacement that offers surgeons multiple implant options with different articular geometry. Our INFINITY® Total Ankle System is the newest addition to our total ankle replacement portfolio and features a distinctive talar resurfacing option for preservation of talar bone. The combination and interchangeability of both the INBONE® and INFINITY® systems provide the surgeon with an implant continuum of care concept, allowing the surgeon to address a more bone conserving implant option with INFINITY® all the way to addressing a more complex ankle deformity with INBONE®. Our INBONE® and INFINITY® Total Ankle Systems can be used with our PROPHECY® Preoperative Navigation Guides, which combine computer imaging with a patient’s CT scan, and are designed to provide alignment accuracy while reducing surgical steps. Physician testing of our most recent total ankle replacement product, the INVISIONTM Total Ankle Revision System, began in 2016 and is expected to reach full commercial launch in the third quarter of 2017. |

| |

• | Ankle Fusion. We have several products used in ankle fusion procedures, which fuse together the tibia, fibula, and talus bones into one bone, and are intended to treat painful, end-stage arthritis in the ankle joint. These products include our ORTHOLOC® 3Di Ankle Fusion System, which legacy Wright launched successfully in July 2013, VALOR® TTC fusion nail, and the legacy Tornier Maxlock ExtremeTM Plate and Screws System. |

| |

• | Ankle Fixation and Fracture Repair. We sell a broad range of anatomically designed plates, screws, and nails used to stabilize and heal fractured ankle bones, including our ORTHOLOC® 3Di Ankle Fracture System, which is a comprehensive single-tray ankle fracture solution designed to address a wide range of fracture types by providing the surgeon with multiple anatomically-contoured plates and a comprehensive set of instrumentation. |

| |

• | Foot Fusion. We have several products used in foot fusion procedures, which fuse together three bones in the back of the foot into one bone and are used to treat a wide range of conditions, including arthritis, flat feet, rheumatoid arthritis, and previous injuries, such as fractures caused by wear and tear to bones and cartilage. Our foot fusion products include our ORTHOLOC® 3Di Midfoot Plating System, VALOR® TTC fusion nail and the legacy Tornier Maxlock ExtremeTM Plate and Screws System. |

| |

• | Foot Fixation and Fracture Repair. Our foot fixation and fracture repair products include plates, screws, and nails used to stabilize and heal foot deformities and fractures. Our CHARLOTTE® CLAW® Compression Plate is the first ever locking compression plate designed for corrective foot surgeries. Our next-generation CLAW® II Compression Plating System expands our plate and screw offering by introducing anatomic plates specifically designed for fusions of the midfoot, and the CLAW® II Polyaxial Compression Plating System incorporates variable-angle locking screw technology and our ORTHOLOC® 3Di Reconstruction Plating System utilizes our 3Di polyaxial locking technology. In April 2016, we further expanded the ORTHOLOC® 3Di portfolio with the launch of the ORTHOLOC® 3Di CROSSCHECK® Plating System. This modular addition is comprised of five uniquely designed plates which offer an inter-fragmentary solution. Our SALVATION™ limb salvage portfolio, which is designed to address the unique demands of advanced midfoot reconstruction, was also commercially launched in the first half of 2016. Other foot products include the MAXLOCK®, MINIMAX LOCK™ and MINIMAX LOCK EXTREME™ plate and screw systems, BIOFOAM® Wedge System, BIOARCH® Subtalar Arthroereisis Implant, MDI Metatarsal Resurfacing Implant, and TENFUSE® Nail Allograft. |

| |

• | Hammertoe Correction. Hammertoe is a contracture (bending) of one or both joints of the second, third, fourth, or fifth (little) toes. Our hammertoe correction products include the PRO-TOE® VO Hammertoe Fixation System, PRO-TOE® C2 Hammertoe Implant, PHALINX® Hammertoe Fixation System, Cannulink Intraosseous Fixation System (IFS), and TENFUSE® PIP Hammertoe Allograft. |

| |

• | Toe Joint Replacement. We also sell our Swanson line of toe joint replacement products. |

Biologics

The biologics product category includes a broad line of biologic products that are used to support treatment of damaged or diseased bone, tendons, and soft tissues and other biological solutions for surgeons and their patients or to stimulate bone growth. These products focus on supporting biological musculoskeletal repair by utilizing synthetic and human tissue-based materials. Our biologic products are primarily used in extremities-related procedures as well as in trauma-induced voids of the long bones and some spine procedures. Internationally, we offer a bone graft product incorporating antibiotic delivery. Our global net sales from this product category for the year ended December 25, 2016 was $93.5 million, or 13.5% of total net sales, compared to $70.2 million, or 17.3% of total net sales, for the year ended December 27, 2015.

Our biologics products include the following:

| |

• | AUGMENT® Bone Graft. The newest addition to our biologics product portfolio is AUGMENT® Bone Graft. Our AUGMENT® Bone Graft product line is based on recombinant human platelet-derived growth factor (rhPDGF-BB), a synthetic copy of one of the body’s principal healing agents. We obtained FDA approval of AUGMENT® Bone Graft for ankle and/or hindfoot fusion indications in the United States during third quarter of 2015. Prior to FDA approval, this product was available for sale in Canada for foot and ankle fusion indications and in Australia and New Zealand for hindfoot and ankle fusion indications. We acquired the AUGMENT® Bone Graft product line from BioMimetic Therapeutics, Inc. (BioMimetic) in March 2013. |

| |

• | Hard Tissue Repair. Our other bone or hard tissue repair products include our PRO-DENSE® Injectable Regenerative Graft. PRO-DENSE® is a composite graft composed of surgical grade calcium sulfate and calcium phosphate, and in animal studies, has demonstrated excellent bone regenerative characteristics, forming new bone that is over three times stronger than the natural surrounding bone at the 13-week time point. Beyond 13 weeks, the regenerated bone gradually remodels to natural bone strength. Our PRO-STIM® Injectable Inductive Graft is built on the PRO-DENSE® material platform, but adds demineralized bone matrix (DBM), and has demonstrated accelerated healing compared to autograft in pre-clinical testing. Our other hard tissue repair products, including our IGNITE® Power |

Mix Injectable Stimulus, FUSIONFLEX™ Demineralized Moldable Scaffold, ALLOMATRIX® Injectable Putty, OSTEOSET® Resorbable Bead Kit, MIIG® Injectable Graft, CANCELLO-PURE® bone wedge line, and ALLOPURE® Allograft Bone Wedges.

| |

• | Soft Tissue Repair. Our soft tissue repair products include our GRAFTJACKET® Regenerative Tissue Matrix, which is a human-derived soft tissue graft designed for augmentation of tendon and ligament repairs, such as those of the rotator cuff in the shoulder and Achilles tendon in the foot and ankle. GRAFTJACKET® Maxforce Extreme is our thickest GRAFTJACKET® matrix, which provides excellent suture holding power for augmenting challenging tendon and ligament repairs. We procure our GRAFTJACKET® product through an exclusive distribution agreement that expires December 31, 2018. Other soft tissue repair products include our CONEXA™ Reconstructive Tissue Matrix, ACTISHIELD™ and ACTISHIELD™ CF Amniotic Barrier Membranes, VIAFLOW™ and VIAFLOW™ C Flowable Placental Tissue Matrices, BIOFIBER® biologic absorbable scaffold products, and PHANTOM FIBER™ high strength, resorbable suture products. |

Sports Medicine and Other

The sports medicine and other product category includes products used across several anatomic sites to mechanically repair tissue-to-tissue or tissue-to-bone injuries and other ancillary products. Because of its close relationship to extremities joint replacement and bone fixation, our sports medicine portfolio is comprised of products used to complement our upper and lower extremities product portfolios, providing surgeons a variety of products that may be used in upper and lower extremities surgical procedures. Our global net sales from this product category for the year ended December 25, 2016 was $23.2 million, or 3.4% of total net sales, compared to $13.3 million, or 3.3% of total net sales, for the year ended December 27, 2015.

Sales, Marketing, and Medical Education

Our sales and marketing efforts are focused primarily on orthopaedic, trauma, and podiatric surgeons. Orthopaedic surgeons focused on the extremities in many instances have completed upper or lower extremities fellowship programs. We offer surgeon-to-surgeon education on our products using surgeon advisors in an instructional capacity. We have contractual relationships with these surgeon advisors, who help us train other surgeons in the safe and effective use of our products and help other surgeons perfect new surgical techniques. Together with these surgeon advisors, we provide surgeons extensive “hands on” orthopaedic training and education, including upper and lower extremities fellowships and masters courses that are not easily accessible through traditional medical training programs. We also offer clinical symposia and seminars, and publish advertisements and the results of clinical studies in industry publications. We believe that our history of innovation and focus on quality and improving clinical outcomes and “quality of life” for patients, along with our training programs, allow us to reach surgeons early in their careers and provide on-going value, which includes experiencing the clinical benefits of our products.

Due to the nature of specialized training surrounding podiatric and orthopaedic surgeons focused on extremities and biologics, our target market is well defined. Historically, surgeons are the primary decision-makers in orthopaedic device purchases. While we market our broad portfolio of products to surgeons, our revenue is generated from sales of our products to healthcare institutions and stocking distributors.

United States

As of December 25, 2016, our sales and distribution system in the United States consisted of 68 geographic sales territories that are staffed by approximately 500 direct sales representatives and 24 independent sales agencies or distributors. These sales representatives and independent sales agencies and distributors are generally aligned to selling either our upper extremities products or lower extremities products, but, in some cases, certain agencies or direct sales representatives sell products from both our upper and lower extremities product portfolios in their territories. Our direct sales representatives and independent sales agencies and distributors are provided opportunities for product training throughout the year. We also have working relationships with healthcare dealers, including group purchasing organizations, healthcare organizations, and integrated distribution networks. We believe our success in every market sector is dependent upon having a robust and compelling product offering, and equally as important, a dedicated, highly trained, focused sales organization to service our customers. We plan to continue to strategically focus on and invest in building a competitively superior U.S. sales organization by training and certifying our sales representatives on our innovative product portfolio, continuing to develop and implement strong performance management practices, and enhancing sales productivity. Further, we intend to selectively expand our U.S. sales force by adding about 85 new direct quota-carrying sales representatives, primarily weighted toward the lower extremities business.

International

Internationally, we utilize several distribution approaches that are tailored to the needs and requirements of each individual market. Our international sales and distribution system currently consists of 15 direct sales offices and approximately 90 distributors that sell our products in over 50 countries. We have subsidiaries with direct sales offices in the United Kingdom, France, Germany, Italy, Denmark, Netherlands, Canada, Japan, Australia, Switzerland, and Norway that employ direct sales employees, and in some cases, use independent sales representatives to sell our products in their respective markets. Our products are sold in other countries

in Europe, Asia, Africa, and Latin America using stocking distribution partners. Stocking distributors purchase products directly from us for resale to their local customers, with product ownership generally passing to the distributor upon shipment.

Manufacturing, Facilities, and Quality

We utilize a combination of internal manufacturing and a network of qualified outsourced manufacturing partners to produce our products and surgical instrumentation. We manufacture our internally-sourced products in six locations: Arlington, Tennessee; Franklin, Tennessee; Montbonnot, France; Grenoble, France; Nogent, France; and Macroom, Ireland. We lease the manufacturing facility in Arlington, Tennessee from the Industrial Development Board of the Town of Arlington. Our internal manufacturing operations are focused on product quality, continuous improvement, and efficient production. Our internal manufacturing operations have been practicing lean manufacturing concepts for many years with a philosophy focused on high productivity, flexibility, and capacity optimization. Our operations in France have a long history and deep experience with orthopaedic manufacturing and process innovation. Additionally, we believe we are the only company to have vertically integrated operations for the manufacturing of pyrocarbon orthopaedic products. We believe that this capability gives us a competitive advantage in design for manufacturing and prototyping of this innovative material.

We outsource products to our manufacturing partners when it provides us with cost efficiency, expertise, flexibility, and instances where we need additional capacity. A significant portion of our lower extremities products and surgical instrumentation is produced to our specifications by qualified subcontractors who serve medical device companies. We continuously look for opportunities to optimize our internal manufacturing capacity and insource manufacturing where we believe it makes sense to do so.

We maintain a comprehensive quality system that is certified to the European standards ISO 9001 and ISO 13485 and to the Canadian Medical Devices Conformity Assessment System (CMDCAS). We are accredited by the American Association of Tissue Banks (AATB) and have registrations with the FDA as a medical device establishment and as a tissue establishment. These certifications and registrations require periodic audits and inspections by various global regulatory entities to determine if we have systems in place to ensure our products are safe and effective for their intended use and that we are compliant with applicable regulatory requirements. Our quality system exists so that management has the proper oversight, designs are evaluated and tested, production processes are established and maintained, and monitoring activities are in place to ensure products are safe, effective, and manufactured according to our specifications. Consequently, our quality system provides the way for us to ensure we design and build quality into our products while meeting global requirements. We are committed to meet or exceed customer needs as we strive to improve patient outcomes.

Supply

We use a diverse and broad range of raw materials in the manufacturing of our products. We purchase all of our raw materials and select components used in the manufacturing of our products from external suppliers. In addition, we purchase some supplies from single or limited number of sources for reasons of proprietary know-how, quality assurance, sole source, cost-effectiveness, or constraints resulting from regulatory requirements. We work closely with our suppliers to ensure continuity of supply while maintaining high quality and reliability.

We rely on one supplier for the silicone elastomer used in certain number of our extremities products. We are aware of only two suppliers of silicone elastomer to the medical device industry for permanent implant usage. For certain biologic products, we depend on one supplier of demineralized bone matrix and cancellous bone matrix. We rely on one supplier for our GRAFTJACKET® family of soft tissue repair and graft containment products. We believe we maintain adequate stock from these suppliers to meet market demand. We rely on one supplier for a key component of our AUGMENT® Bone Graft. In December 2013, our supplier notified us of its intent to terminate the supply agreement in December 2015. This supplier was contractually required to meet our supply requirements until the termination date, and to use commercially reasonable efforts to assist us in identifying a new supplier and support the transfer of technology and supporting documentation to produce this component. In April 2016, we entered into a commercial supply agreement with FUJIFILM Diosynth Biotechnologies U.S.A., Inc. pursuant to which Fujifilm agreed to manufacture and sell to us and we agreed to purchase the key component of our AUGMENT® Bone Graft. Pursuant to our supply agreement with Fujifilm, commercial production of the key component is expected to begin in 2019. Although we believe that our current supply of the key component from our former supplier should be sufficient to last until after the component becomes available under the new agreement, no assurance can be provided that it will be sufficient.

Some of our products are provided by suppliers under private-label distribution agreements. Under these agreements, the supplier generally retains the intellectual property and exclusive manufacturing rights. The supplier private labels the products under our brands for sale in certain fields of use and geographic territories. These agreements may be subject to minimum purchase or sales obligations and are terminable by either party upon notice. Our private-label distribution agreements do not, individually or in the aggregate, represent a material portion of our business and we are not substantially dependent on them.

Our business, and the orthopaedic industry in general, is capital intensive, particularly as it relates to inventory levels and surgical instrumentation. Our business requires a significant level of inventory driven by our global footprint, the requirement to provide products within a short period of time, and the number of different sizes of many of our products. In addition, we must maintain

a significant investment in surgical instrumentation as we provide these instruments to healthcare facilities and surgeons for their use to facilitate the implantation of our products.

Competition

Competition in the orthopaedic device industry is intense and is characterized by extensive research efforts and rapid technological progress. Competitors include major and mid-sized companies in the orthopaedic and biologics industries, as well as academic institutions and other public and private research organizations that continue to conduct research, seek patent protection, and establish arrangements for commercializing products that will compete with our products.

The primary competitive factors facing us include price, quality, innovative design and technical capability, clinical results, breadth of product line, scale of operations, distribution capabilities, brand reputation, and strong customer service. Our ability to compete is affected by our ability to accomplish the following:

| |

• | Develop new products and innovative technologies; |

| |

• | Obtain and maintain regulatory clearances or approvals and reimbursement for our products; |

| |

• | Manufacture and sell our products cost-effectively; |

| |

• | Meet all relevant quality standards for our products and their markets; |

| |

• | Respond to competitive pressures specific to each of our geographic markets, including our ability to enforce non-compete agreements; |

| |

• | Protect the proprietary technology of our products and manufacturing processes; |

| |

• | Market and promote our products; |

| |

• | Continue to maintain a high level of medical education for our surgeons on our products; |

| |

• | Attract and retain qualified scientific, management and sales employees and focused sales representatives; and |

| |

• | Support our technology with clinically relevant studies. |

Research and Development

Realizing that new product offerings are a key to our future success, we are committed to a strong research and development program. The intent of our program is to develop new extremities and biologics products and expand our current product offerings and the markets in which they are offered. Our research and development teams are organized and aligned with our product marketing teams and are focused on improving clinical outcomes by designing innovative, clinically differentiated products with improved ease-of-use and by developing new product features and enhanced surgical techniques that can be leveraged across a broader base of surgeon customers. Our internal research and development teams work closely with external research and development consultants and a global network of physicians and medical personnel in hospitals and universities to ensure we have broad access to best-in-class ideas and technologies to drive our product development pipeline. We also have an active business development team that actively evaluates novel technologies and development stage products. In addition, our clinical and regulatory departments are devoted to verifying the safety and efficacy of our products according to regulatory standards enforced by the FDA and other international regulatory bodies. Our research and development expenses totaled $50.5 million, $39.3 million and $25.0 million in 2016, 2015 and 2014, respectively. Our research and development activities are principally located in Memphis, Tennessee; Montbonnot, France; and Warsaw, Indiana, with additional staff in Grenoble, France; and Bloomington, Minnesota.

In the extremities area, our research and development activities focus on building upon our already comprehensive portfolio of surgical solutions for extremities focused surgeons, including procedure and anatomy specific products. With the ultimate goal of addressing unmet clinical needs, we often pursue multiple product solutions for a particular application in order to offer surgeons the ability either to use their preferred procedural technique or to provide options and flexibility in the surgical setting with the understanding that one solution does not work for every case.

In the biologics area, we have research and development projects underway that are designed to provide differentiation of our advanced materials in the marketplace. We are particularly focused on the integration of our biologic product platforms into extremities procedures and potential new applications for our AUGMENT® Bone Graft.

Intellectual Property

Patents, trade secrets, know-how, and other proprietary rights are important to the continued success of our business. We currently own more than 1,500 patents and pending patents throughout the world. We currently have licenses to use approximately 800 patents. We seek to aggressively protect technology, inventions, and improvements that we consider important through the use of patents and trade secrets in the United States and significant foreign markets. We manufacture and market products under both

patents and license agreements with other parties. These patents and license agreements have a defined life and expire from time to time. We are not materially dependent on any one or more of our patents. In addition to patents, our knowledge and experience, creative product development, marketing staff and trade secret information, with respect to manufacturing processes, materials and product design, are as important as our patents in maintaining our proprietary product lines.

Although we believe that, in the aggregate, our patents are valuable, and patent protection is beneficial to our business and competitive positioning, our patent protection will not necessarily deter or prevent competitors from attempting to develop similar products. There can be no assurances that our patents will provide competitive advantages for our products or that competitors will not challenge or circumvent these rights. In addition, there can be no assurances that the United States Patent and Trademark Office (USPTO) or foreign patent offices will issue any of our pending patent applications. The USPTO and foreign patent offices may deny or require a significant narrowing of the claims in our pending patent applications and the patents issuing from such applications. Any patents issuing from the pending patent applications may not provide us with significant commercial protection. We could incur substantial costs in proceedings before the USPTO or foreign patent offices, including opposition and other post-grant proceedings. These proceedings could result in adverse decisions as to the patentability, priority of our inventions, and the narrowing or invalidation of claims in issued patents. Additionally, the laws of some of the countries in which our products are or may be sold may not protect our intellectual property to the same extent as the laws in the United States or at all.

While we do not believe that any of our products infringe any valid claims of patents or other proprietary rights held by others, we are currently subject to patent infringement litigation and there can be no assurances that we do not infringe any patents or other proprietary rights held by them. If our products were found to infringe any proprietary right of another party, we could be required to pay significant damages or license fees to such party and/or cease production, marketing, and distribution of those products. Litigation also may be necessary to defend infringement claims of third parties or to enforce patent rights we hold or to protect trade secrets or techniques we own.

We rely on trade secrets and other unpatented proprietary technology. There can be no assurances that we can meaningfully protect our rights in our unpatented proprietary technology or that others will not independently develop substantially equivalent proprietary products or processes or otherwise gain access to our proprietary technology.

We protect our proprietary rights through a variety of methods. As a condition of employment, we generally require employees to execute an agreement relating to the confidential nature of and company ownership of proprietary information and assigning intellectual property rights to us. We generally require confidentiality agreements with vendors, consultants, and others who may have access to proprietary information. We generally limit access to our facilities and review the release of company information in advance of public disclosure. There can be no assurances, however, that confidentiality agreements with employees, vendors, and consultants will not be breached, adequate remedies for any breach would be available, or competitors will not discover or independently develop our trade secrets. Litigation also may be necessary to protect trade secrets or techniques we own.

Government Regulation

We are subject to varying degrees of government regulation in the countries in which we conduct business. In some countries, such as the United States, Europe, Canada, and Japan, government regulation is significant and, we believe there is a general trend toward increased and more stringent regulation throughout the world. As a manufacturer and marketer of medical devices, we are subject to extensive regulation by the U.S. Food and Drug Administration, other federal governmental agencies, and state agencies in the United States and similar foreign governmental authorities in countries located outside the United States. These regulations generally govern the introduction of new medical devices; the observance of certain standards with respect to the design, manufacture, testing, labeling, promotion, and sales of the devices; the maintenance of certain records; the ability to track devices; the reporting of potential product defects; the import and export of devices; as well as other matters. In addition, as a participant in the healthcare industry, we are also subject to various other U.S. federal, state, and foreign laws.

On September 29, 2010, Wright Medical Technology, Inc. (WMT) entered into a five-year Corporate Integrity Agreement (CIA) with the Office of the Inspector General of the United States Department of Health and Human Services (OIG-HHS). The CIA expired on September 29, 2015 and on January 27, 2016, we received notification from the OIG-HHS that the term of the CIA has concluded. While the term of the CIA has concluded, our failure to continue to maintain compliance with U.S. healthcare laws, regulations and other requirements in the future could expose us to significant liability, including, but not limited to, exclusion from federal healthcare program participation, including Medicaid and Medicare, potential prosecution, civil and criminal fines or penalties, as well as additional litigation cost and expense.

We strive to comply with regulatory requirements governing our products and operations and to conduct our affairs in an ethical manner. This practice is reflected in our Code of Business Conduct, various other compliance policies and through the responsibility of the nominating, corporate governance and compliance committee of our board of directors, which oversees our corporate compliance program and compliance with legal and regulatory requirements as well as our ethical standards and policies. We devote significant time, effort, and expense to addressing the extensive government and regulatory requirements applicable to our business. Such regulatory requirements are subject to change and we cannot predict the effect, if any, that these changes might have on our business, financial condition, and results of operations. Governmental regulatory actions against us could result in

warning letters, delays in approving or refusal to approve a product, the recall or seizure of our products, suspension or revocation of the authority necessary for the production or sale of our products, litigation expense, and civil and criminal penalties against us and our officers and employees. If we fail to comply with these regulatory requirements, our business, financial condition, and results of operations could be harmed.

United States

In the United States, our products are strictly regulated by the FDA under the U.S. Food, Drug and Cosmetic Act (FDC Act). Some of our products are also regulated by state agencies. FDA regulations and the requirements of the FDC Act affect the pre-clinical and clinical testing, design, manufacture, safety, efficacy, labeling, storage, recordkeeping, advertising, and promotion of our medical device products. Our tissue-based products are subject to FDA regulations, the National Organ Transplant Act (NOTA), and various state agency regulations. We are an accredited member of the American Association of Tissue Banks and an FDA-registered tissue establishment, which includes the packaging, processing, storage, labeling, and distribution of tissue products regulated as medical devices and the storage and distribution of tissue products regulated solely as human cell and tissue products. In addition, we maintain tissue bank licenses in Florida, Maryland, New York, California, Illinois, Delaware, and Oregon.

Generally, before we can market a new medical device, marketing clearance from the FDA must be obtained through either a premarket notification under Section 510(k) of the FDC Act or the approval of a de novo or premarket approval (PMA) application. Most of our products are FDA cleared through the 510(k) premarket notification process. The FDA typically grants a 510(k) clearance if the applicant can establish that the device is substantially equivalent to a predicate device. It usually takes about three months from the date of a 510(k) submission to obtain clearance, but it may take longer, particularly if a clinical trial is required. The FDA may find that a 510(k) is not appropriate or that substantial equivalence has not been shown and, as a result, require a de novo or PMA application.

PMA applications must be supported by valid scientific evidence to demonstrate the safety and effectiveness of the device, typically including the results of human clinical trials, bench tests, and laboratory and animal studies. The PMA application must also contain a complete description of the device and its components, and a detailed description of the methods, facilities, and controls used to manufacture the device. In addition, the submission must include the proposed labeling and any training materials. The PMA application process is expensive and generally takes significantly longer than the 510(k) process. Additionally, the FDA may never approve the PMA application. As part of the PMA application review process, the FDA generally will conduct an inspection of the manufacturer’s facilities to ensure compliance with applicable quality system regulatory requirements, which include quality control testing, documentation control, and other quality assurance procedures. A PMA can include post-approval conditions including, among other things, restrictions on labeling, promotion, sale and distribution, data reporting (surveillance), or requirements to do additional clinical studies post-approval. Even after approval of a PMA, the FDA must grant subsequent approvals for a new PMA or a PMA supplement to authorize certain modifications to the device, its labeling, or its manufacturing process.

One or more clinical trials may be required to support a 510(k) application or a de novo submission and almost always are required to support a PMA application. Clinical trials of unapproved or uncleared medical devices or devices being studied for uses for which they are not approved or cleared (investigational devices) must be conducted in compliance with FDA requirements. If human clinical trials of a medical device are required and the device presents a significant risk, the sponsor of the trial must file an investigational device exemption (IDE) application prior to commencing human clinical trials. The IDE application must be supported by data, typically including the results of animal and/or laboratory testing. If the IDE application is approved by the FDA and one or more institutional review boards (IRBs), human clinical trials may begin at a specific number of institutional investigational sites with the specific number of patients approved by the FDA. If the device presents a non-significant risk to the patient, a sponsor may begin the clinical trial after obtaining approval for the trial by one or more IRBs without separate approval from the FDA. Submission of an IDE does not give assurance that the FDA will approve the IDE. If an IDE is approved, there can be no assurance the FDA will determine that the data derived from the trials support the safety and effectiveness of the device or warrant the continuation of clinical trials. An IDE supplement must be submitted to and approved by the FDA before a sponsor or investigator may make a change to the investigational plan in such a way that may affect its scientific soundness, study indication, or the rights, safety or welfare of human subjects. During the trial, the sponsor must comply with the FDA’s IDE requirements including, for example, investigator selection, trial monitoring, adverse event reporting, and recordkeeping. The investigators must obtain patient informed consent, rigorously follow the investigational plan and trial protocol, control the disposition of investigational devices, and comply with reporting and recordkeeping requirements. We, the FDA and the IRB at each institution at which a clinical trial is being conducted may suspend a clinical trial at any time for various reasons, including a belief that the subjects are being exposed to an unacceptable risk. We are currently conducting a few clinical trials.

After a device is cleared or approved for marketing, numerous and pervasive regulatory requirements continue to apply and we continue to be subject to inspection by the FDA to determine our compliance with these requirements, as do our suppliers, contract manufacturers, and contract testing laboratories. These requirements include, among others, the following:

| |

• | Quality System regulations, which govern, among other things, how manufacturers design, test, manufacture, modify, label, exercise quality control over and document manufacturing of their products; |

| |

• | labeling and claims regulations, which require that promotion is truthful, not misleading, fairly balanced and provide adequate directions for use and that all claims are substantiated, and also prohibit the promotion of products for unapproved or “off-label” uses and impose other restrictions on labeling; |

| |

• | FDA guidance of off-label dissemination of information and responding to unsolicited requests for information; |

| |

• | Medical Device Reporting (MDR) regulation, which requires reporting to the FDA certain adverse experiences associated with use of our products; |

| |

• | complaint handling regulations designed to track, monitor, and resolve complaints related to our products; |

| |

• | Part 806 reporting of certain corrections, removals, enhancements, and recalls of products; |

| |

• | complying with federal law and regulations requiring Unique Device Identifiers (UDI) on devices and also requiring the submission of certain information about each device to FDA’s Global Unique Device Identification Database (GUDID); and |

| |

• | in some cases, ongoing monitoring and tracking of our products’ performance and periodic reporting to the FDA of such performance results. |

The FDA has statutory authority to regulate allograft-based products, processing, and materials. The FDA and other international regulatory agencies have been working to establish more comprehensive regulatory frameworks for allograft-based tissue-containing products, which are principally derived from human cadaveric tissue. The framework developed by the FDA establishes risk-based criteria for determining whether a particular human tissue-based product will be classified as human tissue, a medical device, or a biologic drug requiring premarket clearance or approval. All tissue-based products are subject to extensive FDA regulation, including establishment registration requirements, product listing requirements, good tissue practice requirements for manufacturing, and screening requirements that ensure that diseases are not transmitted to tissue recipients. The FDA has also proposed extensive additional requirements that address sub-contracted tissue services, tracking to the recipient/patient, and donor records review. If a tissue-based product is considered human tissue, the FDA requirements focus on preventing the introduction, transmission, and spread of communicable diseases to recipients. Neither clinical data nor review of safety and efficacy is required before the tissue can be marketed. However, if the tissue is considered a medical device or a biologic drug, then FDA clearance or approval is required.

The FDA and international regulatory authorities periodically inspect us and our third-party manufacturers for compliance with applicable regulatory requirements. These requirements include labeling regulations, manufacturing regulations, quality system regulations, regulations governing unapproved or off-label uses, and medical device regulations. Medical device regulations require a manufacturer to report to the FDA serious adverse events or certain types of malfunctions involving its products.