Form 8K

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

The

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): April 26, 2013

PAN

GLOBAL, CORP.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

333-167130 |

|

27-2473958 |

| (State

or other jurisdiction |

|

(Commission

|

|

(IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

123

W. Nye Lane,

Suite

455

Carson

City, Nevada |

|

89706 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (888) 983-1623

N/A

(Former

name or former address, if changed since last report.)

With

a copy to:

Philip

Magri, Esq.

The

Magri Law Firm, PLLC

11

Broadway, Suite 615

New

York, NY 10004

T:

(646) 502-5900

F:

(646) 826-9200

pmagri@magrilaw.com

www.MagriLaw.com

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

[ ] Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

Current Report on Form 8-K contains forward-looking statements that involve risks and uncertainties, principally in the sections

entitled “Description of Business,” “Risk Factors,” and “Management’s Discussion and Analysis

of Financial Condition and Results of Operations.” All statements other than statements of historical fact contained in

this Current Report on Form 8-K, including statements regarding future events, our future financial performance, business strategy

and plans and objectives of management for future operations, are forward-looking statements. We have attempted to identify forward-looking

statements by terminology including “anticipates,” “believes,” “can,” “continue,”

“could,” “estimates,” “expects,” “intends,” “may,” “plans,”

“potential,” “predicts,” “should,” or “will” or the negative of these terms or

other comparable terminology. Although we do not make forward-looking statements unless we believe we have a reasonable basis

for doing so, we cannot guarantee their accuracy. These statements are only predictions and involve known and unknown risks, uncertainties

and other factors, including the risks outlined under “Risk Factors” or elsewhere in this Current Report on Form 8-K.

Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time and it is not

possible for us to predict all risk factors, nor can we address the impact of all factors on our business or the extent to which

any factor, or combination of factors, may cause our actual results to differ materially from those contained in any forward-looking

statements.

We

have based these forward-looking statements largely on our current expectations and projections about future events and financial

trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term

business operations, and financial needs. These forward-looking statements are subject to certain risks and uncertainties that

could cause our actual results to differ materially from those reflected in the forward-looking statements. Factors that could

cause or contribute to such differences include, but are not limited to, those discussed in this Current Report on Form 8-K, and

in particular, the risks discussed below and under the heading “Risk Factors” and those discussed in other documents

we file with the Securities and Exchange Commission that are incorporated into this Current Report on Form 8-K by reference.

The following discussion should be read in conjunction with our consolidated financial statements and notes thereto included in

this Report. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking

statements. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in

this Current Report on Form 8-K may not occur and actual results could differ materially and adversely from those anticipated

or implied in the forward-looking statements.

You

should not place undue reliance on any forward-looking statement, each of which applies only as of the date of this Current Report

on Form 8-K. Before you invest in our common stock, you should be aware that the occurrence of the events described in the section

entitled “Risk Factors” and elsewhere in this Current Report on Form 8-K could negatively affect our business, operating

results, financial condition and stock price. Except as required by law, we undertake no obligation to update or revise publicly

any of the forward-looking statements after the date of this Current Report on Form 8-K to conform our statements to actual results

or changed expectations.

ITEM

2.01 COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS

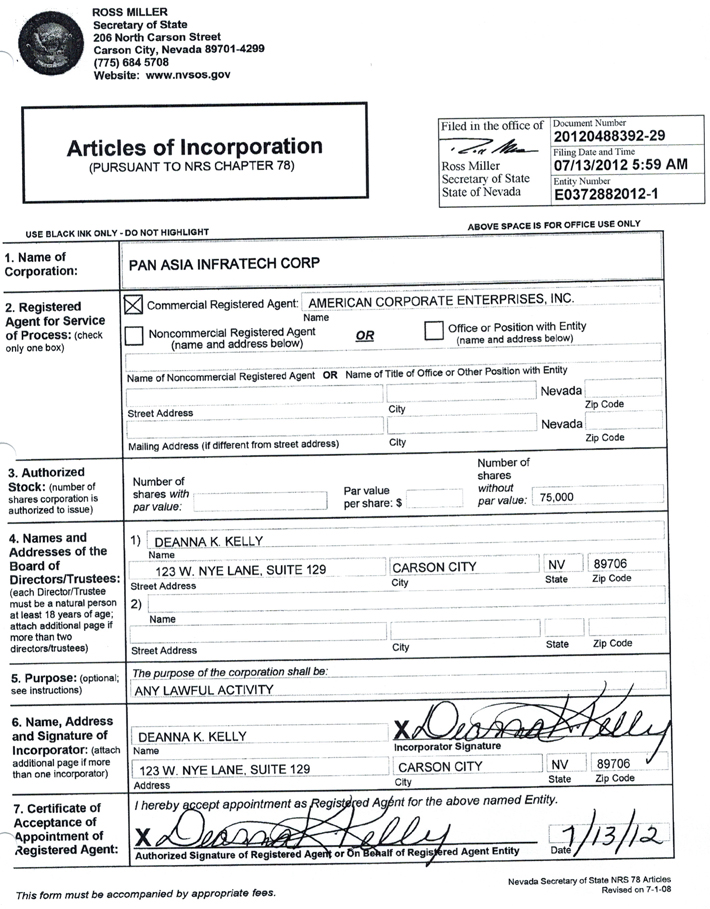

As

previously reported by Pan Global, Corp., a Nevada corporation formerly known as Savvy Business Support, Inc. (the “Company”),

on a Form 8-K filed with the Commission on May 1, 2013, on April 25, 2013, the Company entered into a Stock Exchange Agreement

(the “Agreement”) with Pan Asia Infratech Corp., a Nevada corporation (“Pan Asia”).

Pursuant

to the Agreement, consummated on April 26, 2013, the stockholders of Pan Asia transferred to the Company 100% of the outstanding

capital stock of Pan Asia (consisting of 15,000 shares of common stock, no par value) in exchange for, on a pro rata basis, an

aggregate of 90 million (90,000,000) shares of common stock, par value $0.0001 per share (the “Common Stock”), of

the Company (the “Share Exchange”). As a result of the Share Exchange, Pan Asia became a wholly-owned subsidiary of

the Company and the business of Pan Asia has become the business of the Company.

Pan

Asia is a development stage company incorporated in Nevada on July 13, 2012 and its principal business is the development of projects

and technologies in environmentally sustainable energy and infrastructure markets. Pan Asia intends to generate sales through

consulting and project management fees, project development fees, revenue from operating or investing in energy and infrastructure

facilities, and technology sales.

Pursuant

to Item 201(f) of Current Report on Form 8-K, if any disclosure required by Item 2.01(f) is previously reported by the Company,

the Company may identify the filing in which that disclosure is included instead of including that disclosure in this report.

BUSINESS

General

Pan

Global, Corp. was incorporated in the State of Nevada on April 30, 2010 under the name of Savvy Business Support, Inc. (“Savvy”).

Because Savvy had nominal operations and minimal assets since its inception on April 30, 2012, it had been considered to be a

“shell company,” as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”). Upon the consummation of the Share Exchange on April 26, 2013, Pan Asia became a wholly-owned subsidiary of Savvy,

and the Company ceased being a “shell company.”

On

April 26, 2013, Savvy amended its Articles of Incorporation with the Secretary of State of Nevada thereby changing the name of

the Company from Savvy Business Support, Inc. to Pan Global, Corp.

On

May 2, 2013, the OTCBB symbol of the Company’s Common Stock was changed from SVYB to PGLO.

Unless

otherwise defined herein, the terms “Pan Global,” the “Company,” “we,” “us,” “our,”

and similar terms shall refer to Pan Global, Corp. and its wholly-owned subsidiary, Pan Asia Infratech Corp., a Nevada corporation.

Business

Overview

Pan

Global is focused on developing environmentally sustainable energy and infrastructure projects and technologies. Our aim is to

invest in green energy technology and infrastructure around the world. We incubate and fund investments in renewable energy and

energy efficiency technology and “green” projects that comprise innovative solutions for basic infrastructure. We

have a significant, but not exclusive, focus on developing investment opportunities in India.

The

Company has formulated a business model that management believes can help it grow and achieve scale over time. We have undertaken

the necessary due diligence and prepared a business plan that will enable us to compete in the market for environmentally sustainable

energy and infratech solutions.

Business

Development

We

are investigating business opportunities in the market segments in which we operate, and we intend to pursue these opportunities

by securing rights to technologies and projects. These opportunities are identified through our management’s network of

contacts in India and around the world.

During

the next three years, we intend to pursue opportunities in the following areas:

| ● | | Energy Efficiency. We

have identified opportunities in energy efficiency consulting and innovation in India, where energy demand and prices are increasing

rapidly. We believe Indian businesses and households are seeking energy solutions that can assist them with increasing the efficiency

of their energy usage as well as seeking to adopt innovative green energy technologies that supplement or substitute for their

reliance on fossil fuels and traditional grid-based electricity. We seek to provide such solutions to customers through consulting

services, project implementation and project management. We envision such solutions to cover areas such as alternative energy

technology implementation, building retrofits to reduce energy usage, installation of electrical control system technology and

other similar items. |

| ● | | Alternative Energy Projects.

We seek to invest in alternative energy projects, such as the development of power generation projects using solar photovoltaic

(“PV”), mini-hydro, geothermal and wind energy technologies. Several countries, including India, provide certain electric

power generation incentives for the development of these and other alternative energy technologies. Pan Global seeks to provide

development funding for such projects. We may sell these projects at the time of commissioning or hold them for the long term,

depending on the financial return to the Company on a case by case basis. |

| ● | | Infrastructure. The Company

also seeks to invest in non-energy infrastructure technology and projects that provide environmentally sustainable solutions in

place of conventional technology. We are seeking opportunities to develop projects in the field of agriculture, building technology

and water distribution, amongst others. Management believes the Indian agriculture sector is ripe for adopting technologies that

significantly reduce environmental footprints, such as by improving the efficiency of water use and intensity of land use. We

believe there are existing technologies in the building sector that are widely used in Europe and North America which significantly

improve resource efficiency and which can be adapted to the Indian market. We also believe there are opportunities in the Indian

market for water purification and waste-water treatment. The Company seeks to introduce such technologies in the Indian context.

In some cases we may license these technologies from the patentholder. In other cases, the technology is available for general

use, so we will seek to develop projects directly. |

Business

Model

Our

business model is based on three prospective revenue streams: consulting fees; sales of equipment and technology in connection

with energy efficiency projects; and revenue from operating projects such as power generation, agricultural operations and other

infrastructure related projects. Our revenue from operating projects may be derived from projects in which we hold a majority

equity position or where we hold an investment as a minority partner. Generally, we anticipate that our sales will be derived

from business and commercial customers, as follows:

| |

1. |

Consulting

Fees: We are in the process of building an energy efficiency audit and consulting team in India that will conduct energy

audits for commercial and other business customers and advise them on how they can implement energy savings technologies to

reduce their energy usage. The audit and consulting team may also manage project implementation, equipment procurement and

provide installation services. |

| |

2. |

Power

generation projects: We are investigating opportunities to develop electric power generation projects from renewable energy

sources such as solar, mini-hydro, geothermal and wind. While our main focus is on potential projects in India, it is not

exclusively so. Within the Indian market there are available various government backed incentives programs, including those

which provide direct tariff subsidies as well as market based tariff support through renewable energy credits that can be

sold in established trading markets. We intend to pursue both types of opportunities and to assess the project viability on

a case by case basis, and to invest in such projects both as owner-developers and/or as partners with other developers. Our

investments may be made as equity level investments or as mezzanine funding. These projects earn revenue from the sale of

power generated and sold to either government owned electricity companies or from the direct sale of power to private buyers.

|

| |

3. |

Infrastructure:

We are investigating opportunities to develop sustainable projects in the Indian infrastructure industry, including but not

limited to, investments in agriculture, the building construction industry and water purification and treatment. We intend

to pursue the development of agricultural growing operations using more modern technology and equipment than is currently

in use in India. One of the areas we are focusing on is the establishment of greenhouse facilities for growing certain crops,

which is a young but growing industry in India. We also intend to identify and pursue other infrastructure related opportunities

including in the construction industry, where we seek to introduce sustainable building technologies to the Indian market,

and water management technologies to improve water quality and usage efficiency. Some of these opportunities may overlap in

one project, such as in the case of water management in the context of greenhouse growing operations. Since this business

segment is broad, our revenue from it will be derived in varying ways: |

| |

a. |

In

the agricultural production component we intend to establish relationships with wholesalers to distribute our produce under

a branded label that is characterized by a marketing strategy that establishes us as a grower of natural, organic and pesticide

free environmentally sustainable premium produce. We may also sell product directly to large retail buyers. |

| |

|

|

| |

b. |

In

the building construction, water management and other component of this segment we expect to generate license revenue and

revenue from the sale of equipment and technology. We may also earn revenue, in the case of water management, from operating

facilities or distribution of water. Our customers may include commercial businesses, government entities, as well as retail

clients. |

Industry

Analysis

The

market for environmentally sustainable products and services in alternative energy, infrastructure and similar areas, is highly

competitive and broad. Although numerous established companies offer a variety of services to various different industry space’s

in which we operate, the Company believes our business model should enable us to establish and maintain a niche but growing presence

in areas such as project development for alternative energy facilities and energy efficiency consulting services; and, with respect

to our infrastructure space strategy, we believe our business model should enable us to establish operations based on the early

use of superior and more efficient technology that provides a more compelling value proposition to potential customers compared

to our competitors.

While

we have numerous competitors in the alternative energy and energy efficiency consulting space; many of these are large competitors

who primarily undertake large projects (50 MW or more), whereas we intend to initially focus on small and medium size projects,

where larger, more established competitors have less presence. Part of our strategy to address competitive pressures is to target

projects in early stage markets where there are fewer competitors, such as market-based solar PV projects with private counterparties

or mini-hydro. We will still have to face smaller competitors, but we aim to more efficiently and effectively execute project

funding, which is a key factor for closing and commissioning alternative energy projects that smaller firms often find difficult

to surmount.

Within

the sector of the infrastructure space in which we intend to compete there are many large and small competitors. We intend to

compete by being early stage adopters of emerging technology and methods, which may be available for general use or proprietary

under license to us. The Indian agricultural market is highly competitive, comprised of millions of small-holdings farmers, but

we intend to use greenhouse and other technology to grow superior, more consistent product, artificial pesticide free and with

more efficient water use and intend to charge higher prices. We believe there is a market for such agricultural product, among

India’s budding retail chain store market, international class hotels and similar establishments, which can absorb higher

prices compared to traditionally grown product. In other infrastructure areas we intend to compete with the adoption of superior

technology that management assesses gives it a first-mover advantage, such as by employing and selling technologies that reduce

or re-use inputs and generally provide a more efficient solution to existing products or methods.

Marketing

Our

marketing strategy is focused on using our management’s contact network to establish a pipeline of projects in the energy

and infrastructure sectors in which we operate and to similarly establish a limited number of initial customers for our consulting

services and products.

In

the power generation aspect of our business we need to secure a limited number of projects in the short to medium (3-24 months),

as each project, while small compared to traditional energy generation technologies, still involves multi-million dollar investment

outlays and 6-18 months to commission. The Company intends to target projects and customers where we can execute project expansion

in phases, with a small minimum capacity to begin and room for growth in several phases over time at the same facility. We believe

our potential customers are amenable to such a phased growth approach, as it decreases their risk as well as ours, since they

must sign long term agreements with us to offtake power. We intend to target requests for proposals for small projects from government

and to approach private businesses willing to adopt our energy solutions. In particular, we intend to target those areas where

potential power customers face high power and fuel costs near or exceeding the cost of alternatives we can provide and where customers

face inconsistent power availability.

Similarly,

in our infrastructure segment our initial projects are likely to be small but they will still require multi-million dollar investments

over a period of 1-2 years to complete and bring to the revenue-generating stage. While we intend to grow rapidly, management

believes the best opportunity for the Company’s success lies in executing a phased growth strategy whereby we begin with

small capacity build-outs while allowing for project expansions over time. We intend to establish small operations, such as in

agriculture, to build initial relationships with key customers and distributors who are amenable to make larger purchases from

us over time; in this agriculture segment we intend to market our products to the growing number of food retail chains in India

and wholesale distributors and other retail buyers seeking more consistent product, more consistent delivery and higher quality

product than is generally available from the traditional agriculture sector. In other infrastructure projects, where we may be

introducing new technology to a customer base, we believe our best marketing strategy is to complete a limited number of small

projects which establish confidence and credibility for our product offering; our marketing will be focused on targeting the growing

number of Indian firms, governments and quasi-government entities seeking to elevate their environmental sustainability credentials

and who see value in generally taking a more sustainable approach to their infrastructure needs.

We

have identified potential partners and collaborators for our products and services in power generation and infrastructure. These

are firms that are seeking partners to assist them in commissioning or operating projects by providing funding or who are seeking

partners for management assistance. The Company will consider such opportunities on a case by case basis. Some collaboration may

be one-time; in other cases it may involve situations where the Company believes establishing a longer term relationship with

a potential partner will help us build a pipeline of opportunities over time. We will consider all such opportunities as management

develops them.

Growth

Strategy of the Company

Our

goal is to establish a rational growth strategy that will maximize shareholder value over time by applying a phased growth strategy.

We intend to secure a limited number of consulting engagements in the near term (3-24 months) but to grow this segment over time

in line with our personnel growth, since such services are labor and management intensive. We also intend to initially secure

a limited number of opportunities in our power generation and infrastructure segments during the next 3-24 months, but such that

they can be expanded over time into a pipeline of projects that require commissioning over a period of several years.

We

believe a phased growth strategy is the most rational way for us to execute our vision, as our opportunities, particularly in

power generation and infrastructure, while they may be small projects, still entail multi-million dollar investment outlays per

individual project. Our projects involve complexities, such as coordinating engineering, procurement and construction activities;

therefore, building projects in phases and staging growth over a period of years enables management to reduce execution and financing

risk, while the Company bolsters its management resources to cope with our growth. We believe a phased growth strategy will also

help the Company build a growing and more stable revenue base than an alternative approach that could involve attempts to execute

opportunities that are too difficult to manage and finance given the current scope of our resources.

Competitive

Analysis

The

Company has many potential competitors in the industry segments in which we intend to operate. In providing energy consulting

services we face direct competition from well-capitalized large international firms and a range of regional and small, local firms;

these firms tend to have focus on customers of differing size, with some overlap. Nevertheless, our management believes there

is ample opportunity for the Company to build a successful franchise in India by pro-actively approaching the many small and medium

size companies that have not undergone energy audits or engaged with similar consultants in a country market (India) that as yet

remains in an early stage of development.

In

the power generation segment, we also face competition from firms of all sizes; the competition includes well-capitalized large

firms, some of whom are publicly-traded; it includes many medium size firms, many of which are private and many of which have

a primary focus on just one alternative energy technology (such as solar PV, or wind); it also includes many small firms, often

capitalized by individuals or groups of high net worth investors seeking a limited exposure to one or two projects. We intend

to compete by carefully choosing our opportunities from among those parts of the market that remain early stage, which includes

market based solar PV projects, niche mini-hydro, geothermal and similar opportunities.

With

respect to our infrastructure segment and the agricultural sector, we face competition from the multitude of small plot-holding

farmers in India and other food growing operations. Management believes we can compete by using advanced growing methods and techniques,

such as greenhouses, to provide a premium product that is more consistent, healthier and more environmentally sustainable than

that which comes from traditional farms. As of now, there are a very limited number of greenhouse grow operations in India and

most of these appear to be comprised of small entrepreneurs selling low volumes of produce or who are instead focused factory

style mass market operations. We expect that if we demonstrate the viability of greenhouse operations, as we expect, new and better

capitalized competitors will emerge at some point in the future.

In

other infrastructure areas, such as building construction technology and water management we intend to compete based on adopting

a first mover strategy using new and superior technology, often where we can establish proprietary rights to such technology to

the exclusion of competitors. However, we will still face competition from a range of firms that provide solutions based on their

own proprietary or general use technology. Before proceeding in this area management intends to conduct an assessment of the value

proposition we can establish for any technology we may seek to secure and market. Our competitors in these market segments include

a multitude of large, medium and small firms providing a diverse base of competitive products and solutions.

We

consider our competition to be, in general, competent and experienced. They are likely to have greater financial and marketing

resources than do we at the present time. Our ability to compete may be adversely affected by the ability of these competitors

to devote greater resources to marketing, research and development, growth of the management team and other employees, amongst

other factors, than are available to our Company. Some of the Company’s competitors in each of our segments also offer a

wider scope of services and have greater name recognition. Our competitors include large firms that also have extensive existing

customer bases and established distribution channels.

Two-Year

Growth Strategy and Milestones

During

the next two years, the Company’s growth strategy is to establish a sales and project base from which we can build out a

project pipeline over subsequent years. We intend to secure a limited number of consulting engagements, power and infrastructure

project opportunities and additional personnel to execute our plans. Within the infrastructure space, we plan to establish an

initial small operation in the agricultural segment from which we can build an experienced team and set the stage for phased growth

of the operations over time as additional financial resources become available to us. Similarly, within the power generation segment

we intend to secure up to three initial projects that we can develop in the short term – within the next 24 months –

so as to establish the base for a phased growth plan and expanding project pipeline over time.

Patents,

Trademarks, Licenses, Franchises, Concessions and Royalty Agreements

At

the present, we do not have any patents or trademarks nor are we a party to any licenses, franchises, concessions or royalty agreements.

Need

for any Government Approval of Products or Services

There

will be instances where we will need to secure various government permits or other authorizations, such as in the power generation

and infrastructure segments, including agreements with grid operators for wheeling power, building permits, securing of water

rights, and land rezoning, among others.

Government

and Industry Regulation

We

will be subject to federal laws and regulations that relate directly or indirectly to our operations including securities laws.

We will also be subject to common business and tax rules and regulations pertaining to the operation of our business. At this

point, we cannot ascertain the effect of existing or probable government relations on our business.

Research

and Development Activities

Other

than time spent researching our proposed business, the Company has not spent any funds on research and development activities

to date. The Company plans to spend funds on research and development in the future, such as for adapting new technologies and

gaining certifications in India and in collaborations with universities or researchers in connection with developing proprietary

technology in one or more of the segments in which we operate.

Environmental

Laws

We

will be subject to federal, state and local environmental laws that relate directly or indirectly to our operations in the jurisdictions

in which we operate. At this time, we cannot ascertain the costs and effects of compliance with environmental laws.

Employees;

Employment Agreements and Labor Contracts

We

currently have one employee (full-time), Bharat Vasandani who serves as our President, Chairman, Chief Executive Officer and Chief

Financial Officer. We do not have an employment agreement with Mr. Vasandani. We do not have any labor contracts.

Dividend

Policy

We

have never paid or declared dividends on our securities. Pursuant to the Certificate of Designation for our Series C Preferred

Stock (effective on April 29, 2013), the holders of shares of Series C Preferred Stock are entitled to a one-time special dividend

of $0.001 per each outstanding share of Series C Preferred Stock payable by the Company to the holders thereof no earlier than

the thirtieth (30th) day after the date of issuance of the Series C Preferred Stock to such holders but no later than the first

anniversary date of the date of issuance of the Series C Preferred Stock to such holders, subject to the approval of the holders

of the Company’s senior securities and satisfaction of the Nevada Revised Statutes. The payment of cash dividends, if any,

in the future is within the discretion of our Board and will depend upon our earnings, our capital requirements, financial condition

and other relevant factors. Other than the one-time dividend for our outstanding Series C Preferred Stock, we do not foresee paying

any dividends on our outstanding securities; but, rather, we intend to retain any future earnings for use in our business.

Principal

Executive Offices

Our

principal executive offices are located at 123 W. Nye Lane, Suite 455, Carson City, NV 89706. Our telephone number is (888) 983-1623.

Our website address is www.panglobalcorp.com. The contents of our website are not incorporated by reference into this Form

8-K.

RISK

FACTORS

An

investment in our Company is extremely risky. You should carefully consider these risks, in addition to the other information

presented in this Report, before deciding to our securities. If any of the following risks actually materialize, our business

and prospects could be seriously harmed, the trading price and value of our securities could decline and you could lose all or

part of your investment. The risks and uncertainties described below are not exclusive and are intended to reflect the material

risks that are specific to us, material risks related to our industry and material risks related to companies that undertake a

public offering or seek to maintain a class of securities that is registered or traded on an exchange or quoted on the over-the-counter

market.

Risks

Related to Our Business

We

are not currently profitable and may not become profitable.

According

to the unaudited pro forma consolidated financial statements of the Company included in Exhibit 99.1 to this Form 8-K, at December

31, 2012, the combined companies had $862 in cash on hand and an accumulated deficit of $53, 0 49 and only generated $9,500

in revenues. In their report for the fiscal year ended September 30, 2012, the auditors of Pan Asia have expressed that there

is substantial doubt as to Pan Asia’s ability to continue as a going concern. We expect that the Company will incur substantial

losses for the foreseeable future and may never become profitable. We also expect to continue to incur significant operating and

capital expenditures for the next several years and anticipate that our expenses will increase substantially in the foreseeable

future. We also expect to experience negative cash flow for the foreseeable future as we fund our operating losses and capital

expenditures. As a result, we will need to generate significant revenues in order to achieve and maintain profitability. We may

not be able to generate these revenues or achieve profitability in the future. Our failure to achieve or maintain profitability

could negatively impact the value of our common stock.

We

are subject to all of the complications and difficulties associated with new enterprises.

The

Company’s operating subsidiary, Pan Asia, was incorporated on July 13, 2012. We have a limited history upon which an evaluation

of our prospects and future performance can be made. Our proposed operations are subject to all business risks associated with

new enterprises. The likelihood of our success must be considered in light of the problems, expenses, difficulties, complications,

and delays frequently encountered in connection with the expansion of a business operation in a competitive industry, and the

continued development of projects, technology and a corresponding customer base. There is a possibility that we could sustain

losses in the future, and there are no assurances that we will ever operate profitably.

We

are focused on “green” initiatives and while our management believes that it can implement our business plan, attract

highly talented personnel and develop a market for its products and services, our plan of operations are subject to changing needs

of target customers, market conditions and various other factors out of our control. For these and other reasons, the purchase

of our common stock should only be made by persons who can afford to lose their entire investment.

The

electric power generation industry is subject to significant technological advancements that may impact our business model

The electricity

industry is undergoing transformative change. Technological advancements such as energy storage and distributed generation may

change the nature of energy generation and delivery. These changes may materially affect our business model as an independent

power producer and our ability to compete with new energy generation and delivery business models.

Weather

and climate related incidents and other natural disasters could materially affect our financial condition and results of operations.

Weather-related

incidents, climate factors and other natural disasters, including storms, wildfires and earthquakes and the annual monsoon rains

in India, can disrupt the generation and transmission of electricity, and can seriously damage the infrastructure necessary to

deliver power to customers. These events can lead to lost revenues and increased expenses, including higher maintenance and repair

costs. They can also result in contractual penalties and disallowances, particularly if we encounter difficulties in restoring

power to our customers. These occurrences could materially affect our business, financial condition and results of operations,

and the inability to restore power to our customers could also materially damage the business reputation of the Company. In addition,

renewable power generation projects are subject to weather and climate conditions that impact positively and negatively the amount

of power generated, such as for solar and hydro projects. Renewable power project feasibility is assessed based on historic patterns

of such factors as site-specific solar irradiation or water flows, but these factors can vary significantly from year to year.

Significant deviations of such natural phenomena from levels predicted based on historical data could have a material adverse

impact on project power output and, hence, on revenues and the results of operations. Extended deviations from normal of such

factors could negatively impact our liquidity and solvency.

State-owned

power distribution companies in India are responsible for power transmission and distribution; therefore, we are reliant on them

to deliver power to our customers.

Power distribution

in India is undertaken by state-owned electricity distribution companies. Many are heavily in debt and hard pressed to maintain

their distribution grids at a high level of reliability. Whether we sell power under a contract to the government or directly

to a private electricity buyer, we are reliant on the state-owned electricity distribution companies to deliver our power. If

they are unable to undertake distribution we may suffer revenue losses and we may be unable to recover those losses from the distribution

company or the collection period may be delayed for an extended period of time. Since our power generation projects are a capital

intensive business financed to a significant degree by debt, any losses in revenue or delays in collection would result in significant

financial distress for the company and have a material adverse impact on our liquidity and solvency.

The

generation, transmission and distribution of electricity are dangerous and involve inherent risks of damage to private property

and injury to employees and the general public.

Electricity

is dangerous for employees and the general public should they come in contact with power lines or electrical equipment. Injuries

and property damage caused by such contact can subject to liability that, despite the existence of insurance coverage, can be

significant. Such penalties and liabilities could be significant and can be difficult to predict. The range of possible penalties

and liabilities includes amounts that could materially affect our liquidity and results of operations.

As

a capital intensive company, we rely on access to the capital markets. If we are unable to access the capital markets or the cost

of financing was to substantially increase, our liquidity and operations would be materially affected.

Our power

and infrastructure projects are reliant on access to the capital markets, include both the markets for debt and equity. Electric

power generation projects for renewable energy are typically financed with a significant amount of debt as well as equity. If

we are unable to secure project debt on assumed terms our projects may not be viable. In addition, project debt funding is frequently

sourced from international lenders who, from time to time, may adjust their desired exposure or terms for lending to projects

in India. Market disruptions out of our control could have a material adverse impact on our ability to access such funding.

Our

operations are subject to foreign currency risk.

To

a significant degree, the Company is focusing its efforts on various projects in India. These projects will typically generate

revenue in India rupees. The Indian rupee historically has been subject to significant fluctuations in its value compared to other

currencies over time. Any depreciation in the Indian rupee would result in a decrease in our reported revenues, since the Company

reports in United States dollars. In addition, while our projects will typically generate revenue in Indian rupees, our project

debt funding, whether for infrastructure or power generation projects, may be denominated in a currency other than the Indian

rupee, such as United States dollars or Euros; therefore, we will face a currency mismatch between revenues and the debt funding

obligations we undertake to finance the assets that generate our revenues. While hedging instruments are available to mitigate

currency mismatching risks, hedge instruments are often expensive and also are often unable to offset currency risk with 100%

effectiveness. Therefore, significant currency movements against our liability position and/or hedging ineffectiveness could have

a material adverse impact on our ability to service our debts and to maintain our liquidity and solvency.

We

are dependent on Bharat Vasandani, our Chairman and sole executive officer. The loss of Mr. Vasandani would have a material adverse

effect on our business.

Our

future success depends to a significant extent on Bharat Vasandani and his skills, experience and efforts. We face intense competition

for qualified individuals from numerous companies that offer similar services. The loss of Mr. Vasandani could harm our business

and might significantly delay or prevent the achievement of our business objectives.

As

our business grows, we will need to attract additional employees which we might not be able to do.

In

order to grow and implement our business plan, we would need to add managerial talent to support our business plan. There is no

guarantee that we will be successful in adding such managerial talent.

We

may not be able to compete successfully with current and future competitors.

The

Company has many potential competitors in the market for environmentally sustainable energy and infrastructure products and services.

We will compete, in our current and proposed businesses, with other companies, some of which have far greater marketing and financial

resources and experience than we do. We cannot guarantee that we will be able to penetrate our intended market and be able to

compete profitably, if at all. In addition to established competitors, there is ease of market entry for other companies that

choose to compete with us. Effective competition could result in price reductions, reduced margins or have other negative implications,

any of which could adversely affect our business and chances for success. Competition is likely to increase significantly as new

companies enter the market and current competitors expand their services. Many of these potential competitors are likely to enjoy

substantial competitive advantages, including: larger staffs, greater name recognition, larger and established customer bases

and substantially greater financial, marketing, technical and other resources. To be competitive, we must respond promptly and

effectively to industry dynamics, evolving standards and competitors’ innovations by continuing to enhance our technology,

products, services, sales and marketing channels and customer acquisition. Any pricing pressures, reduced margins or loss of market

share resulting from increased competition, or our failure to compete effectively, could fatally damage our business and chances

for success.

We

may not be able to manage our growth effectively.

We

must continually implement and improve our products and/or services, operations, operating procedures and quality controls on

a timely basis, as well as expand, train, motivate and manage our work force in order to accommodate anticipated growth and compete

effectively in our market segments. Successful implementation of our strategy also requires that we establish and manage a competent,

dedicated work force and employ additional key employees in corporate management, product design, client service and sales. We

can give no assurance that our personnel, systems, procedures and controls will be adequate to support our existing and future

operations. If we fail to implement and improve these operations, there could be a material, adverse effect on our business, operating

results and financial condition.

If

we do not continually update our services, they may become obsolete and we may not be able to compete with other companies.

We

cannot assure you that we will be able to keep pace with advances or that our services and products will not become obsolete.

We cannot assure you that competitors will not develop related or similar services and offer them before we do, or do so more

successfully, or that they will not develop services and products more effective than any that we have or are developing. If that

happens, our business, prospects, results of operations and financial condition will be materially adversely affected.

We

have agreed to indemnify our officers and directors against lawsuits to the fullest extent of the law.

We

are a Nevada corporation. Nevada law permits the indemnification of officers and directors against expenses incurred in successfully

defending against a claim. Nevada law also authorizes Nevada corporations to indemnify their officers and directors against expenses

and liabilities incurred because of their being or having been an officer or director. Our organizational documents provide for

this indemnification to the fullest extent permitted by law.

We

currently do not maintain any insurance coverage. In the event that we are found liable for damage or other losses, we would incur

substantial and protracted losses in paying any such claims or judgments. We have not maintained liability insurance in the past,

but intend to acquire such coverage immediately upon resources becoming available. There is no guarantee that we can secure such

coverage or that any insurance coverage would protect us from any damages or loss claims filed against it.

If

we engage in any acquisition, we will incur a variety of costs and may never realize the anticipated benefits of the acquisition.

We

may attempt to acquire businesses, technologies, services or products or license technologies that we believe are a strategic

fit with our business. We have limited experience in identifying acquisition targets, and successfully completing and integrating

any acquired businesses, technologies, services or products into our current infrastructure. The process of integrating any acquired

business, technology, service or product may result in unforeseen operating difficulties and expenditures and may divert significant

management attention from our ongoing business operations. As a result, we will incur a variety of costs in connection with an

acquisition and may never realize our anticipated benefits.

If

we fail to establish and maintain an effective system of internal control, we may not be able to report our financial results

accurately or to prevent fraud. Any inability to report and file our financial results accurately and timely could harm our reputation

and adversely impact the trading price of our common stock.

Effective

internal control is necessary for us to provide reliable financial reports and prevent fraud. If we cannot provide reliable financial

reports or prevent fraud, we may not be able to manage our business as effectively as we would if an effective control environment

existed, and our business and reputation with investors may be harmed. As a result, our small size and any current internal control

deficiencies may adversely affect our financial condition, results of operation and access to capital. We have not performed an

in-depth analysis to determine if historical un-discovered failures of internal controls exist, and may in the future discover

areas of our internal control that need improvement.

Public

company compliance may make it more difficult to attract and retain officers and directors.

The

Sarbanes-Oxley Act and new rules subsequently implemented by the SEC have required changes in corporate governance practices of

public companies. As a public company, we expect these new rules and regulations to increase our compliance costs in 2013 and

beyond and to make certain activities more time consuming and costly. As a public company, we also expect that these new rules

and regulations may make it more difficult and expensive for us to obtain director and officer liability insurance in the future

and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or

similar coverage. As a result, it may be more difficult for us to attract and retain qualified persons to serve on our board of

directors or as executive officers.

Compliance

with changing regulation of corporate governance and public disclosure, and our management’s inexperience with such regulations

will result in additional expenses and creates a risk of non-compliance.

Changing

laws, regulations and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act of 2002

and related SEC regulations, have created uncertainty for public companies and significantly increased the costs and risks associated

with accessing the public markets and public reporting. Our management team expects to invest significant management time and

financial resources to comply with both existing and evolving standards for public companies, which will lead to increased general

and administrative expenses and a diversion of management time and attention from revenue generating activities to compliance

activities. Management’s inexperience may cause us to fall out of compliance with applicable regulatory requirements, which

could lead to enforcement action against us and a negative impact on our stock price.

Risks

Relating to Ownership of Our Common Stock

Our

Series B Preferred Stock has 80% voting rights which substantially dilutes and essentially renders the voting power of our Common

Stock meaningless. This may inhibit potential acquisition bids and adversely affect the market price for our Common Stock.

Our

Articles of Incorporation provides our Board of Directors with the authority to issue up to 25,000,000 shares of “blank

check” preferred stock and to determine or alter the rights, preferences, privileges and restrictions granted to or imported

upon these shares without further vote or action by our stockholders. As of the date of this Form 8-K, there were an aggregate

of 2,250,000 shares of Series A Convertible Preferred Stock, 100 shares of Series B Non-Convertible Preferred Stock and 4,800,000

shares of Series C Convertible Preferred Stock designated and outstanding. The outstanding shares of Series B Preferred Stock

shall vote together with the shares of Common Stock and other voting securities of the Company as a single class and, regardless

of the number of shares of Series B Preferred Stock outstanding and as long as at least one of such shares of Series B Preferred

Stock is outstanding, shall represent 80% of all votes entitled to be voted at any annual or special meeting of stockholders of

the Company or action by written consent of stockholders. Each outstanding share of the Series B Non-Convertible Preferred Stock

shall represent its proportionate share of the 80% which is allocated to the outstanding shares of Series B Preferred Stock.

The

80% voting rights of the Series B Preferred Stock substantially dilutes and essentially renders the voting power of our Common

Stock meaningless. According, the 80% voting power of our Series B Preferred Stock could delay or prevent a change in control

transaction without further action by our stockholders. As a result, the market price of our Common Stock may be adversely affected.

In addition, our Series A Preferred Stock and Series C Preferred Stock have preference over our Common Stock with respect to the

payment of dividends or upon our liquidation, dissolution or winding up. The voting power of our Series B Preferred Stock and

liquidation preference of our Series A Preferred Stock, Series B Preferred Stock and Series C Preferred Stock could adversely

affect the market price of our Common Stock.

There

has not historically been an active market for the Company’s common stock, and we cannot assure you that an active trading

market will develop for the Company’s common stock.

Historically,

there has a very limited trading market for the Company’s common stock with limited or no volume and thus the Company cannot

accurately obtain an accurate bid or ask price for a share of its common stock. Any investor who purchases the Company’s

common stock is not likely to find any liquid trading market for the common stock and there can be no assurance that any liquid

trading market will ever develop, or if developed, be maintained. Due to the lack of a trading market for our securities, investors

may have difficulty selling any shares they purchase.

Any

trading market that may develop in the future for our common stock will most likely be very volatile; and numerous factors beyond

our control may have a significant effect on the market.

Our

common stock is deemed a “penny stock,” which could make it more difficult for our investors to sell their shares.

The

Company’s common stock is subject to the “penny stock” rules adopted under Section 15(g) of the Exchange Act.

The “penny stock” rules generally apply to companies whose common stock is not listed on The NASDAQ Stock Market or

other national securities exchange or automated quotation system sponsored by a registered national securities association with

certain listing standards as set forth under Rule 3a51-1 of the Exchange Act, other than companies that have a sales price of

$5.00 or more for its common stock (excluding any broker or dealer commission, commission equivalent, mark-up or mark-down), had

average revenue of at least $6,000,000 for the last three years or that have tangible net worth of at least $5,000,000 ($2,000,000

if the company has been operating for three or more years). These rules require, among other things, that brokers who trade penny

stock to persons other than established customers complete certain documentation, make suitability inquiries of investors and

provide investors with certain information concerning trading in the security, including a risk disclosure document and quote

information under certain circumstances. Many brokers have decided not to trade penny stocks because of the requirements of the

penny stock rules and, as a result, the number of broker-dealers willing to act as market makers in such securities is limited.

If we remain subject to the penny stock rules for any significant period, it could have an adverse effect on the market, if any,

for our securities and investors will find it more difficult to dispose of our securities.

The

price of our shares of common stock in the future may be volatile.

If

an active market ever develops for our common stock, of which no assurances can be given, the market price of our common stock

will likely be volatile and could fluctuate widely in price in response to various factors, many of which are beyond our control,

including: technological innovations or new products and services by us or our competitors; additions or departures of key personnel;

sales of our common stock; our ability to integrate operations, technology, products and services; our ability to execute our

business plan; operating results below expectations; loss of any strategic relationship; industry developments; economic and other

external factors; and period-to-period fluctuations in our financial results. Because we have a very limited operating history

with limited revenues to date, you may consider any one of these factors to be material. Our stock price may fluctuate widely

as a result of any of the above. In addition, the securities markets have from time to time experienced significant price and

volume fluctuations that are unrelated to the operating performance of particular companies. These market fluctuations may also

materially and adversely affect the market price of our common stock.

We

have not paid dividends on our common stock in the past and do not expect to pay dividends in the future. Any return on investment

may be limited to the value of our common stock.

We

have never paid cash dividends on our common stock and do not anticipate doing so in the foreseeable future. The payment of dividends

on our common stock will depend on earnings, financial condition and other business and economic factors affecting us at such

time as our board of directors may consider relevant. If we do not pay dividends, our common stock may be less valuable because

a return on your investment will only occur if our stock price appreciates.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

The following discussion and analysis of

the financial condition and results of operations of the Company for the year ended September 30, 2012 and for the three month

period ended December 31, 2012 and should be read in conjunction with the Selected Consolidated Financial Data, the financial statements,

and the notes to those financial statements that are included elsewhere in this Current Report on Form 8-K. Our discussion includes

forward-looking statements based upon current expectations that involve risks and uncertainties, such as our plans, objectives,

expectations and intentions. Actual results and the timing of events could differ materially from those anticipated in these forward-looking

statements as a result of a number of factors, including those set forth under the Risk Factors, Cautionary Notice Regarding Forward-Looking

Statements and Business sections in this Form 8-K. We use words such as “anticipate,” “estimate,” “plan,”

“project,” “continuing,” “ongoing,” “expect,” “believe,” “intend,”

“may,” “will,” “should,” “could,” and similar expressions to identify forward-looking

statements.

Company Overview

On April 25, 2013,

Savvy Business Support, Inc., a Nevada corporation (“Savvy”), entered into a Share Exchange Agreement (the “Share

Exchange Agreement”), with Pan Asia Infratech Corp., a Nevada corporation (“Pan Asia”). Pan Asia is a

development stage company incorporated in Nevada on July 13, 2012 and its principal business is the development of projects in

renewable energy and energy efficiency technology that comprise innovative solutions for basic infrastructure. Pan Asia intends

to generate revenue through project consulting and development fees, business advisory services, project management fees on operations

of facilities, equity investments in power and infrastructure projects, sales of equipment and operating revenues from power generation

or infrastructure projects.

Pursuant to the

Share Exchange Agreement, on April 26, 2013, the stockholders of Pan Asia transferred to Savvy an aggregate of 15,000 shares of

common stock, no par value, of Pan Asia, constituting 100% of the outstanding capital stock of Pan Asia, in exchange for, on a

pro rata basis, an aggregate of 90,000,000 shares of common stock, par value $0.0001 per share (the “Common Stock”),

of Savvy (the “Share Exchange”). As a result of the Share Exchange, Pan Asia became a wholly-owned subsidiary of Savvy

and Savvy ceased being a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”)).

On the closing date of the Share Exchange,

Brookstone Partners LLC controlled both Savvy and Pan Asia. As a result, the Share Exchange was treated as a combination of entities

under common control.

Effective April 26, 2013, the Company amended

its Articles of Incorporation with the Secretary of State of Nevada therein changing its name from Savvy Business Support, Inc.

to Pan Global, Corp.

On May 2, 2013, the OTCBB symbol of the Company’s

Common Stock was changed from SVYB to PGLO.

Unless otherwise defined herein, the terms

“Pan Global,” the “Company,” “we,” “us,” “our,” and similar terms shall

refer to Pan Global, Corp. and its wholly-owned subsidiary, Pan Asia Infratech Corp., a Nevada corporation.

Plan of Operations

We are investigating business opportunities

in the market segments in which we operate, and we intend to pursue these opportunities by securing rights to technologies and

projects. These opportunities are identified through our management’s network of contacts in India and around the world.

During the next three years, we intend to pursue

opportunities in the following areas:

| ● | Energy Efficiency. We have identified significant opportunities

in energy efficiency consulting and innovation in India, where energy demand and prices are increasing rapidly. We believe Indian

businesses and households are seeking energy solutions that assist can them with increasing the efficiency of their energy usage

as well as seeking to adopt innovative green energy technologies that supplement or substitute for their reliance on fossil fuels

and traditional grid-based electricity. We seek to provide such solutions to customers through consulting services, project implementation

and project management. We envision such solutions to cover areas such as alternative energy technology implementation, building

retrofits to reduce energy usage, installation of electrical control system technology and other similar items. |

| ● | Alternative Energy Projects.

We seek to invest in alternative energy projects, such as the development of solar photovoltaic (“PV”) projects, mini-hydro,

geothermal and wind energy. Several countries, including India, provide certain electric power generation incentives for the development

of these and other alternative energy projects. Pan Global seeks to provide development funding for such projects. We may sell

these projects at the time of commissioning or hold them for the long term, depending on the financial return to the Company on

a case by case basis. |

| ● | Infrastructure.

The

Company

also

seeks

to

invest

in

non-energy

infrastructure

technology

and

projects

that

provide

environmentally

sustainable

solutions

in

place

of

conventional

technology.

We

are

seeking

opportunities

to

develop

projects

in

the

field

of

agriculture,

building

technology

and

water

distribution,

amongst

others.

Management

believes

the

Indian

agriculture

sector

is

ripe

for

technologies

that

significantly

reduce

the

environmental

footprint,

such

as

by

improving

the

efficiency

of

water

use

and

intensity

of

land

use.

We

believe

there

are

existing

technologies

in

the

building

sector

that

are

widely

used

in

Europe

and

North

America

which

significantly

reduce

carbon

footprints

and

which

can

be

adapted

to

the

Indian

market.

We

also

believe

there

are

opportunities

in

the

Indian

market

for

water

purification

and

waste-water

treatment.

The

Company

seeks

to

introduce

such

technologies

in

the

Indian

context.

In

some

cases

we

may

license

these

technologies

from

the

patentholder.

In

other

cases,

the

technology

is

available

for

general

use,

so

we

will

seek

to

develop

projects

directly.

|

Business Model

Our business model is based on three prospective

revenue streams: consulting fees; sales of equipment and technology in connection with energy efficiency projects; and revenue

from operating projects such as power generation, agricultural operations and other infrastructure related projects. Our revenue

from operating projects may be derived from projects in which we hold a majority equity position or where we hold an investment

as a minority partner. Generally, we anticipate that our sales will be derived from business and commercial customers, as follows:

| 1. | Consulting Fees: We are in the process of building an energy

efficiency audit and consulting team in India that will conduct energy audits for commercial and other business customers and advise

them on how they can implement energy savings technologies to reduce their energy usage. The audit and consulting team may also

manage project implementation, equipment procurement and provide installation services. |

| 2. | Power generation projects: We are investigating opportunities

to develop electric power generation projects from renewable energy sources such as solar, mini-hydro, geothermal and wind. While

our main focus is on potential projects in India, it is not exclusively so. Within the Indian market there are available various

government backed incentives programs, including those which provide direct tariff subsidies as well as market based tariff support

through renewable energy credits that can be sold on established trading markets. We intend to pursue both types of opportunities

and to assess the project viability on a case by case basis, and to invest in such projects as owner-developers and/or as partners

with other developers. Our investments may be made as equity level investments or as mezzanine funding. These projects earn revenue

from the sale of power generated and sold to either government owned electricity companies or from the direct sale of power to

private buyers. |

| 3. | Infrastructure: We are investigating opportunities to develop

sustainable projects in the Indian infrastructure industry, including but not limited to, investments in agriculture, the building

construction industry and water purification and treatment. We intend to pursue the development of agricultural growing operations

using more modern technology and equipment than is currently in use in India. One of the areas we are focusing on is the establishment

of greenhouse facilities for growing certain crops, which is a young but growing industry in India. We also intend to identify

and pursue other infrastructure related opportunities including in the construction industry, where we seek to introduce sustainable

building technologies to the Indian market, and water management technologies to improve water quality and usage efficiency. Some

of these opportunities may overlap in one project, such as in the case of water management in the context of greenhouse growing

operations. Since this business segment is broad, our revenue from it will be derived in varying ways: |

| a. | In the agricultural production component we intend to establish relationships

with wholesalers to distribute our produce under a branded label that is characterized by a marketing strategy that establishes

us a grower of natural, organic and pesticide free environmentally sustainable premium produce. We may also sell product directly

to large retail buyers. |

| b. | In the building construction, water management and other component

of this segment we expect to generate license revenue and revenue from the sale of equipment and technology. We may also earn revenue,

in the case of water management, from operating facilities or distribution of water. Our customers may include commercial businesses,

government entities, as well as retail clients. |

Growth Strategy of the

Company

Our goal is to establish

a rational growth strategy that will maximize shareholder value over time by applying a phased growth strategy. We intend to secure

a limited number of consulting engagements in the near term (3-24 months) but to grow this segment over time in line with our personnel

growth, since such services are labor and management intensive. We also intend to initially secure a limited number of opportunities

in our power generation and infrastructure segments during the next 3-24 months, but such that they can be expanded over time into

a pipeline of projects that require commissioning over a period of several years.

We believe a phased growth

strategy is the most rational way for us to execute our vision, as our opportunities, particularly in power generation and infrastructure,

while they may be small projects, still entail multi-million dollar investment outlays per individual project. Our projects involve

complexities, such as coordinating engineering, procurement and construction activities; therefore, building projects in phases

and staging growth over a period of years enables management to reduce execution and financing risk, while the company bolsters

its management resources to cope with our growth. We believe a phased growth strategy will also help the Company build a growing

and more stable revenue base than an alternative approach that could involve attempts to execute opportunities that are too difficult

to manage and finance given the current scope of our resources.

Results of Operations of Pan Asia

Pan Asia’s fiscal year end is September

30.

At September 30, 2012, Pan Asia had no assets

and $1,100 in total liabilities consisting of $1,100 owed to the Treasurer of Pan Asia for expenses paid by the Treasurer on behalf

of Pan Asia. At December 31, 2012, Pan Asia had $6,362 in total assets, consisting of $862 in cash and $5,500 in prepaid expenses.

At December 31, 2012, Pan Asia had $1,125 in total liabilities, consisting of $25 in accounts payable and accrued liabilities and

$1,100 owed to the Treasurer of Pan Asia for expenses.

From July 13, 2012 (inception) to September

30, 2012, Pan Asia did not generate any revenues. For the three months ended December 31, 2012, Pan Asia had $9,500 in revenues.

The increase in revenues was due to a consulting engagement for evaluating solar technology.

From July 13, 2012 (inception) to September

30, 2012, Pan Asia had $1,100 in total expenses, consisting of $1,050 in general and administrative expenses and $50 in professional

fees. For the three months ended December 31, 2012, Pan Asia had $8,663 in total expenses, consisting of $163 in general and administrative

expenses, $1,000 in management fees and $7,500 in professional fees. The increase in management fees and professional fees was

due to higher expenses for audit, accounting and legal services as Pan Asia ramped up its startup operations.

Liquidity and Capital Resources

At December 31, 2012, Pan Asia had $862 in

cash.

We believe that our current levels of cash

will not be sufficient to meet our liquidity needs for the next 12 months. We will need additional cash resources in the future

if we pursue opportunities for investment, acquisition, strategic cooperation or other similar actions. To satisfy future cash

requirements, we expect to seek funding through the issuance of debt or equity securities and the obtaining of a credit facility.

Any future issuance of equity securities could cause dilution for our shareholders. Any incurrence of indebtedness will increase

our debt service obligations and may cause us to be subject to restrictive operating and financial covenants. It is possible that

financing may be available to us in amounts or on terms that are not favorable to the Company or not available at all.

Our operations are subject to foreign currency risk.

To a significant degree the Company is focusing

its efforts on various projects in India. These projects will typically generate revenue in India rupees. The Indian rupee historically

has been subject to significant fluctuations in its value compared to other currencies over time. Any depreciation in the Indian

rupee would result in a decrease in our reported revenues, since the Company reports in United States dollars. In addition, while

our projects will typically generate revenue in Indian rupees, our project debt funding, whether for infrastructure or power generation

projects, may be denominated in a currency other than the Indian rupee, such as United States dollars or Euros; therefore, we will

face a currency mismatch between revenues and the debt funding obligations we undertake to finance the assets that generate our

revenues. While hedging instruments are available to mitigate currency mismatching risks, hedge instruments are often expensive

and also are often unable to offset currency risk with 100% effectiveness. Therefore, significant currency movements against our

liability position and/or hedging ineffectiveness, could have a material adverse impact on our ability to service our debts and

to maintain our liquidity and solvency.

Recent Accounting Pronouncements

As of the date of this report, there are no

accounting pronouncements that had not yet been adopted by the Company that we believe would have a material impact on our financial

statements.

Significant Accounting Policies

Use of Estimates

The preparation of financial statements in conformity with US generally

accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets

and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts

of revenues and expenses during the reporting period. The Company regularly evaluates estimates and assumptions related to deferred

income tax asset valuation allowances. The Company bases its estimates and assumptions on current facts, historical experience

and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making

judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent

from other sources. The actual results experienced by the Company may differ materially and adversely from the Company’s

estimates. To the extent there are material differences between the estimates and the actual results, future results of operations

will be affected.

Revenue Recognition

The Company recognizes revenue when persuasive evidence of an arrangement