Destra Investment Trust

Destra Investment Trust II

901 Warrenville Road, Suite 15

Lisle, Illinois 60532

Important Information for Fund Shareholders

October 3, 2014

Destra Dividend Total Return Fund

Destra Preferred and Income Securities Fund

Destra Focused Equity Fund

(each, a “Fund” and collectively, the “Funds”)

While we encourage you to read the full text of the enclosed Joint Proxy Statement, we are also providing you with a brief overview of the proposals in the Questions & Answers (“Q&A”) below. The Q&A contains limited information. It should be read in conjunction with, and is qualified by reference to, the more detailed information contained elsewhere in the Joint Proxy Statement.

|

Q.

|

Why am I receiving this Joint Proxy Statement?

|

|

A.

|

You are being asked to vote on several important matters affecting your Fund:

|

(1) Approval of a New Investment Management Agreement.

Destra Capital Advisors LLC (“Destra” or the “Adviser”) serves as your Fund’s investment adviser. On August 25, 2014, Arrowpoint Asset Management LLC and its affiliates agreed to acquire additional units in Destra Capital Management LLC, the parent company of Destra (the “Transaction”). Upon the closing of the Transaction (the “Closing”), the current investment management agreement under which Destra serves as investment adviser to your Fund will automatically terminate. In order to permit Destra to continue to serve as investment adviser to your Fund once the Closing occurs, securities laws require your Fund’s shareholders to approve a new investment management agreement. The Closing is contingent upon, among other things, the approval of each Fund’s new investment management agreement by shareholders, which means that the Closing will not occur unless shareholders of each Fund approve its new investment management agreement.

(2) Approval of a New Investment Sub-Advisory Agreement.

Destra has retained a sub-adviser to manage the assets of your Fund. The sub-adviser to each Fund is identified in the enclosed Joint Proxy Statement. Upon the Closing, the current investment sub-advisory agreements under which the sub-advisers serve the Funds will automatically terminate. In order to permit your Fund’s sub-adviser to continue to serve as sub-adviser to your Fund once the Closing occurs, securities laws require your Fund’s shareholders to approve a new investment sub-advisory agreement. The Closing is contingent upon, among other things, the approval of each Fund’s new investment sub-advisory agreement by shareholders, which means that the Closing will not occur unless shareholders of each Fund approve its new investment sub-advisory agreement.

(3) Election of Trustees.

In connection with the Transaction, the current Boards of Trustees of Destra Investment Trust and Destra Investment Trust II (each, a “Board” and collectively, the “Boards”) have determined that it is appropriate for the Funds to have Boards comprised of predominantly new Trustees, including new “Independent Trustees” (i.e., Trustees who are not “interested persons” of the Funds or of the Adviser within the meaning of the Investment Company Act of 1940, as amended (the “1940 Act”).

Accordingly, the current Independent Trustees will resign from their positions and a new slate of Trustees, if elected, will serve the Funds, as described in Proposal 3. In addition, you are also being asked to approve the re-election to your Fund’s Board of Nicholas Dalmaso, a current Trustee who, by reason of his positions with and ownership of the Adviser and its affiliates, is referred to as an “Interested Trustee.”

Your Fund’s Board, including the Independent Trustees, unanimously recommends that you vote FOR each proposal applicable to your Fund.

Your vote is very important. We encourage you as a shareholder to participate in your Fund’s governance by returning your vote as soon as possible. If enough shareholders do not cast their votes, your Fund may not be able to hold its meeting or to obtain the vote on each issue. Your immediate response will prevent the inconvenience of further solicitations for a shareholder vote.

|

Q.

|

How will I as a Fund shareholder be affected by the Transaction?

|

|

A.

|

Your Fund investment will not change as a result of Destra’s change of ownership. You will still own the same Fund shares and the underlying value of those shares will not change as a result of the Transaction. Destra and your Fund’s sub-adviser will continue to manage your Fund according to the same objectives and policies as before, and it is not anticipated that there will be any significant changes to your Fund’s operations.

|

|

Q.

|

Will there be any important differences between my Fund’s new investment management agreement and sub-advisory agreement and the current agreements?

|

|

A.

|

No. The terms of the new and current agreements are substantially identical. There will be no change in the contractual management fees you pay.

|

|

Q.

|

What will happen if shareholders of my Fund do not approve the new investment management agreement or sub-advisory agreement?

|

|

A.

|

Completion of the Transaction is contingent upon, among other things, approval of Proposals 1 and 2, as set forth above, by shareholders of each Fund. If the Closing does not occur, the current investment management agreements and sub-advisory agreements will not automatically terminate, and, therefore, it will not be necessary to enter into new agreements. The proposal to elect Trustees, however, is not contingent on the completion of the Transaction or the approval of the new investment management agreements and the new sub-advisory agreements.

|

|

Q.

|

How do the Boards recommend that I vote on the proposals?

|

|

A.

|

After careful consideration, each Board unanimously recommends that shareholders vote FOR the proposals.

|

|

Q.

|

Whom do I call if I have questions?

|

|

A.

|

If you need any assistance, or have any questions regarding the proposals or how to vote your shares, please call AST Fund Solutions, LLC, your Fund’s proxy solicitor, at (800) 341-6292.

|

|

Q.

|

Will my Fund pay for this proxy solicitation?

|

|

A.

|

No. Destra or its affiliates will bear all costs and expenses associated with the preparation, printing and mailing of the Joint Proxy Statement, the solicitation of proxy votes and the costs of holding the meetings.

|

|

Q.

|

How do I vote my shares?

|

|

A.

|

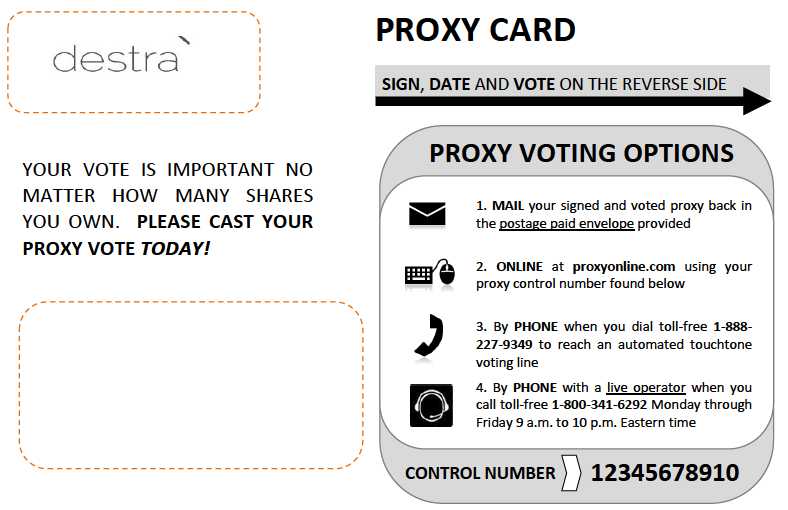

You can vote your shares by completing and signing the enclosed proxy card, and mailing it in the enclosed postage-paid envelope. Alternatively, you may vote by telephone by calling the toll-free number found on your proxy card or by going to the Internet site found on your proxy card.

|

|

Q.

|

Will anyone contact me?

|

|

A.

|

You may receive a call from AST Fund Solutions, LLC, the proxy solicitor, to verify that you received your proxy materials, to answer any questions you may have about the proposals and to encourage you to vote your proxy.

|

901 Warrenville Road, Suite 15

Lisle, Illinois 60532

Notice of Joint Special Meeting

of Shareholders

to be held on November 6, 2014

|

Destra Investment Trust

|

Destra Investment Trust II

|

|

Destra Dividend Total Return Fund

|

Destra Focused Equity Fund

|

| |

Destra Preferred and Income Securities Fund

|

| |

|

October 3, 2014

To the Shareholders of the Above Funds:

Notice is hereby given that a Joint Special Meeting of Shareholders (the “Meeting”) of each of Destra Investment Trust and Destra Investment Trust II (each, a Massachusetts business trust and each trust, individually, a “Trust” and collectively, the “Trusts”), on behalf of each series of each Trust (each series of each Trust, as identified above and on Appendix A to the enclosed Joint Proxy Statement, individually a “Fund,” and collectively, the “Funds”), will be held in the offices of Chapman and Cutler LLP, 111 West Monroe Street, Chicago, Illinois 60603, on Thursday, November 6, 2014, at 10:00 a.m., Central time, for the following purposes:

|

• Proposal 1:

|

To approve a new investment management agreement between each Trust and Destra Capital Advisors LLC (“Destra”), each Fund’s investment adviser, applicable to series of the Trust.

|

|

|

• Proposal 2:

|

To approve a new investment sub-advisory agreement as follows:

|

|

|

a.

|

To approve a new investment sub-advisory agreement among Destra, Miller/Howard Investments, Inc. and Destra Investment Trust, on behalf of the Destra Dividend Total Return Fund;

|

|

|

b.

|

To approve a new investment sub-advisory agreement among Destra, WestEnd Advisors LLC and Destra Investment Trust II, on behalf of the Destra Focused Equity Fund; and

|

|

|

c.

|

To approve a new investment sub-advisory agreement among Destra, Flaherty & Crumrine Incorporated and Destra Investment Trust II, on behalf of the Destra Preferred and Income Securities Fund.

|

|

• Proposal 3:

|

To elect four (4) Trustees (one of whom is a current Trustee).

|

|

|

To transact such other business as may properly come before the Meeting.

|

Please see the table contained on page 1 of the enclosed Joint Proxy Statement, which indicates which proposals shareholders of each Fund are being asked to approve.

Shareholders of record at the close of business on September 12, 2014 are entitled to notice of and to vote at the Meeting.

The Board of Trustees of each Trust recommends that shareholders vote “FOR” each proposal above.

All shareholders are cordially invited to attend the Meeting. In order to avoid delay and additional expense and to assure that your shares are represented, please vote as promptly as possible, regardless of whether or not you plan to attend the Meeting. You may vote by mail, telephone or over the Internet. To vote by mail,

please mark, sign, date and mail the enclosed proxy card. No postage is required if mailed in the United States. To vote by telephone, please call (800) 341-6292 and follow the recorded instructions, using your proxy card as a guide. To vote over the Internet, go to www.proxyonline.com and follow the instructions, using your proxy card as a guide.

By Order of the Boards of Trustees,

/s/ Nicholas Dalmaso

Nicholas Dalmaso

Chief Executive Officer

Destra Investment Trust

Destra Investment Trust II

901 Warrenville Road, Suite 15

Lisle, Illinois 60532

Joint Proxy Statement

October 3, 2014

This Joint Proxy Statement is first being mailed to shareholders on or about October 6, 2014.

|

Destra Investment Trust

|

Destra Investment Trust II

|

|

Destra Dividend Total Return Fund

|

Destra Focused Equity Fund

|

| |

Destra Preferred and Income Securities Fund

|

This Joint Proxy Statement is furnished in connection with the solicitation by the board of trustees (each, a “Board” and collectively, the “Boards,” and each trustee, a “Trustee” and collectively, the “Trustees”) of each of Destra Investment Trust and Destra Investment Trust II (each trust individually, a “Trust” and collectively, the “Trusts”), on behalf of each series of each Trust (each series of each Trust, as identified above and on Appendix A, individually, a “Fund,” and collectively, the “Funds”), of proxies to be voted at the Special Meeting of Shareholders to be held in the offices of Chapman and Cutler LLP, 111 West Monroe Street, Chicago, Illinois 60603, on Thursday, November 6, 2014, at 10:00 a.m., Central time (for each Fund, a “Meeting” and collectively, the “Meetings”), and at any and all adjournments, postponements or delays thereof. Appendix A sets forth the abbreviated name of each Fund by which such Fund is referred to in this Joint Proxy Statement.

Proposals

|

1.

|

To approve a new investment management agreement between each Trust and Destra Capital Advisors LLC (“Destra” or the “Adviser”), each Fund’s investment adviser, applicable to series of the Trust.

|

|

2.

|

To approve a new investment sub-advisory agreement as follows:

|

|

|

a.

|

To approve a new investment sub-advisory agreement among Destra, Miller/Howard Investments, Inc. and Destra Investment Trust, on behalf of the Destra Dividend Total Return Fund;

|

|

|

b.

|

To approve a new investment sub-advisory agreement among Destra, WestEnd Advisors LLC and Destra Investment Trust II, on behalf of the Destra Focused Equity Fund; and

|

|

|

c.

|

To approve a new investment sub-advisory agreement among Destra, Flaherty & Crumrine Incorporated and Destra Investment Trust II, on behalf of the Destra Preferred and Income Securities Fund.

|

|

3.

|

To elect four (4) Trustees (one of whom is a current Trustee) to each Board.

|

The following table indicates which shareholders are solicited with respect to each Proposal. The enclosed proxy card(s) indicate the Fund(s) in which you hold shares and the Proposals on which you are being asked to vote.

| |

Proposal(*)

|

| |

1

|

2(a)

|

2(b)

|

2(c)

|

3

|

|

Destra Investment Trust

|

|

|

|

|

|

|

Destra Dividend Total Return Fund

|

X

|

X

|

|

|

X

|

|

Destra Investment Trust II

|

|

|

|

|

|

|

Destra Focused Equity Fund

|

X

|

|

X

|

|

X

|

|

Destra Preferred and Income Securities Fund

|

X

|

|

|

X

|

X

|

|

(*)

|

Shareholders of all classes of each Fund or, in the case of the election of Trustees, of each Trust, vote together on each Proposal. The classes of shares that each Fund has outstanding are identified on Appendix A.

|

Voting Information

On the Proposals coming before each Meeting as to which a choice has been specified by shareholders on the proxy, the shares will be voted accordingly. If a properly executed proxy is returned and no choice is specified, the shares will be voted:

|

|

•

|

FOR the approval of the applicable new investment management agreement,

|

|

|

•

|

FOR the approval of the applicable new sub-advisory agreement, and

|

|

|

•

|

FOR the election of a new slate of Trustees to the Board of Trustees as described in this Joint Proxy Statement.

|

Shareholders who execute proxies may revoke them at any time before they are voted by filing a written notice of revocation, by delivering a duly executed proxy bearing a later date, or by attending the Meeting and voting in person. A prior proxy can also be revoked by voting again through the toll-free number or the Internet address listed in the proxy card. Merely attending the Meeting, however, will not revoke any previously submitted proxy.

A quorum of shareholders is required to take action at each Meeting. Thirty percent of the shares entitled to vote at each Meeting, represented in person or by proxy, will constitute a quorum of shareholders at that Meeting. Votes cast by proxy or in person at each Meeting will be tabulated by the inspectors of election appointed for that Meeting. The inspectors of election will determine whether or not a quorum is present at the Meeting. The inspectors of election will treat abstentions and “broker non-votes” (i.e., shares held by brokers or nominees, typically in “street name,” as to which (i) instructions have not been received from the beneficial owners or persons entitled to vote and (ii) the broker or nominee does not have discretionary voting power on a particular matter) as present for purposes of determining a quorum.

Broker-dealer firms holding shares of a Fund in “street name” for the benefit of their customers and clients may request the instructions of such customers and clients on how to vote their shares before the Meeting. We urge you to provide instructions to your broker or nominee so that your votes may be counted.

The details of the Proposals to be voted on by the shareholders of each Fund and the vote required for approval of the Proposals are set forth under the description of the Proposals below.

The Boards have determined that the use of this Joint Proxy Statement for each Meeting is in the best interest of each Fund in light of the similar Proposals being considered and voted on by the shareholders. Shareholders of each Fund or, in the case of the election of Trustees, of each Trust, will vote separately on the respective Proposals relating to their Fund or Trust.

Shares Outstanding

Those persons who were shareholders of record at the close of business on September 12, 2014 (the “Record Date”), will be entitled to one vote for each share held and a proportionate fractional vote for each fractional share held. Appendix A lists the shares of each class of each Fund that were issued and outstanding as of the Record Date.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting To Be Held on November 6, 2014. This Joint Proxy Statement is available on the Internet at http://destracapital.com. The Funds’ most recent annual and semi-annual reports are also available on the Internet at http://destracapital.com/investors/literature. In addition, the Funds will furnish, without charge, copies of their most recent annual and semi-annual reports to any shareholder upon request. To request a copy, please write to Destra Capital Advisors LLC, 901 Warrenville Road, Suite 15, Lisle, Illinois 60532, or call 877-287-9646.

You may call (800) 341-6292 for information on how to obtain directions to be able to attend the Meeting and vote in person.

|

|

PROPOSAL 1: APPROVAL OF NEW INVESTMENT MANAGEMENT AGREEMENTS

|

Background and Reason for Vote

Under investment management agreements between Destra and each Trust (each, an “Original Investment Management Agreement” and collectively, the “Original Investment Management Agreements”), Destra serves as each Fund’s investment adviser and is responsible for each Fund’s overall investment strategy and its implementation. The date of each Trust’s Original Investment Management Agreement and the date on which it was last approved by shareholders and approved for continuance by the Board are provided in Appendix B.

On August 25, 2014, Arrowpoint Asset Management LLC and its affiliates (“Arrowpoint”) agreed to acquire additional units in Destra Capital Management LLC (“Destra Capital”), the parent company of Destra (the “Transaction”). Nicholas Dalmaso, the Chief Executive Officer, President and General Counsel of the Trusts, has agreed to sell all of his outstanding units in Destra Capital to Arrowpoint, and as a result, Arrowpoint will own a majority stake in Destra Capital. In addition, Arrowpoint has agreed to purchase interests in Destra Capital from two other holders. As a result of such purchases, Arrowpoint will own in the aggregate approximately 79% of Destra Capital following the consummation of the Transaction. The closing of the Transaction (“Closing”) is subject to certain conditions, including among others, approval of the New Investment Management Agreements and the New Sub-Advisory Agreements (as defined below), by the Boards and the shareholders of each Fund. Assuming satisfaction of all required closing conditions, the Closing is expected to occur by November 15, 2014.

Each Original Investment Management Agreement, as required by Section 15 of the Investment Company Act of 1940, as amended (the “1940 Act”), provides for its automatic termination in the event of its “assignment” (as defined in the 1940 Act). Any change in control of the Adviser is deemed to be an assignment. The Closing will result in a change in control of the Adviser and therefore cause the automatic termination of each Original Investment Management Agreement, as required by the 1940 Act.

In anticipation of the Transaction, the Board of each Trust met in person at a joint meeting on August 5, 2014 for purposes of, among other things, considering whether it would be in the best interests of each Fund to approve a new investment management agreement between the Trust and Destra on behalf of each Fund in substantially the same form as the Original Investment Management Agreement to take effect upon the Closing (each a “New Investment Management Agreement” and collectively, the “New Investment Management Agreements”). The form of the New Investment Management Agreements is attached hereto as Appendix N.

The 1940 Act requires that each New Investment Management Agreement be approved by the Fund’s shareholders in order for it to become effective. At the August 5, 2014 Board meeting, and for the reasons discussed below (see “Board Considerations” after Proposal 2), each Board, including the Trustees who are not parties to the Original Investment Management Agreements, New Investment Management Agreements or any sub-advisory agreement entered into by the Adviser with respect to any Fund or who are not “interested persons,” as defined in the 1940 Act (the “Independent Trustees”), of the Fund or the Adviser, unanimously approved the New Investment Management Agreements on behalf of each Fund and unanimously recommended their approval by shareholders.

The Transaction is not expected to result in any change in the portfolio management of the Funds or in the Funds’ investment objectives or policies. In addition, as described below, there are no material differences between the Original Investment Management Agreements and the corresponding New Investment Management Agreements. In this regard, the Original Investment Management Agreements and the corresponding New Investment Management Agreements contain the same terms, conditions, and fee rates, and provide for the same management services.

Information Concerning Arrowpoint

Arrowpoint, located at 100 Fillmore Street, Denver, Colorado 80206, was founded in 2007 and is 100% privately held by its principals, David Corkins, Minyoung Sohn and Karen Reidy. Arrowpoint provides investment management services to high-net-worth individuals and associated trusts, estates, endowments, foundations (“separate accounts”) and privately offered limited partnerships and corporate vehicles (“private funds”). As of August 31, 2014, Arrowpoint managed $6.2 billion of assets on a discretionary basis.

Information Concerning Destra

Destra, located at 901 Warrenville Road, Suite 15, Lisle, Illinois 60532, is a Delaware limited liability company and is a wholly-owned subsidiary of Destra Capital, a holding company. It is an affiliate of Destra Capital Investments LLC, the principal underwriter of each Fund’s shares. Destra Capital Investments LLC is also located at 901 Warrenville Road, Suite 15, Lisle, Illinois 60532. Destra was organized in 2008 to provide investment management, advisory, administrative and asset management consulting services.

Additional Information. Certain information regarding the principal executive officers and members of Destra is set forth in Appendix G.

Comparison of Original Investment Management Agreements and New Investment Management Agreements

The terms of each New Investment Management Agreement, including fees payable to the Adviser by the Fund thereunder, are identical to those of the corresponding Original Investment Management Agreement, except for the date of effectiveness. There is no change in the fee rate payable by each Fund to the Adviser. If approved by shareholders of a Fund, the New Investment Management Agreement for such Fund will expire on November 15, 2016, unless continued. Each New Investment Management Agreement will continue in effect from year to year thereafter if such continuance is approved for the Fund at least annually in the manner required by the 1940 Act and the rules and regulations thereunder. Below is a comparison of certain terms of the Original Investment Management Agreements to the terms of the corresponding New Investment Management Agreements. For a more complete understanding of the New Investment Management Agreements, please refer to the form of the New Investment Management Agreements provided in Appendix N. The summary below is qualified in all respects by the terms and conditions of the form of New Investment Management Agreements.

Investment Management Services. The investment management services to be provided by the Adviser to each Fund under the New Investment Management Agreements will be identical to those services currently provided by the Adviser to each Fund under the Original Investment Management Agreements. Both the Original Investment Management Agreements and New Investment Management Agreements provide that the Adviser shall manage the investment and reinvestment of the Fund’s assets in accordance with the Fund’s investment objectives and policies and limitations and administer the Fund’s affairs to the extent requested by, and subject to the supervision of, the Fund’s Board.

Sub-Advisers. Both the Original Investment Management Agreements and the New Investment Management Agreements authorize Destra to retain one or more sub-advisers at Destra’s own cost and expense for the purpose of providing investment management services to the Funds.

Brokerage. Both the Original Investment Management Agreements and New Investment Management Agreements with Destra authorize Destra to select the brokers or dealers that will execute the purchases and sales of portfolio securities for the Funds, subject to its obligation to obtain best execution under the circumstances, which may take account of the overall quality of brokerage and research services provided to Destra.

Fees. Under both the Original Investment Management Agreements and New Investment Management Agreements each Fund pays Destra an investment management fee equal to the annual rate of each Fund’s average daily net assets as set forth on Appendix C. The investment management fee rate payable by each Fund to Destra will be the same under the Original Investment Management Agreements and New Investment Management Agreements.

Expense Agreements. In addition, under the terms of an expense reimbursement, fee waiver and recovery agreement between Destra and the applicable Trust (each, an “Original Expense Agreement”), Destra previously agreed, in general terms, to waive fees and/or reimburse management fees and certain expenses for a specified term to the extent necessary to prevent a Fund’s annual investment management fees and expenses (excluding taxes, interest, all brokerage commissions, other normal charges incident to the purchase and sale of portfolio securities, distribution and service fees payable pursuant to a Rule 12b-1 plan, if any, and extraordinary expenses) from exceeding a specified annual percentage, also set forth in Appendix C, of a Fund’s average daily net assets (each, an “Annual Expense Cap”); however, expenses borne and fees waived by Destra were subject to recovery by Destra from a Fund

as provided in the applicable Original Expense Agreement. Upon termination of the Original Investment Management Agreements, the corresponding Original Expense Agreements shall also terminate in accordance with their terms. Destra will enter into new, substantially similar expense reimbursement, fee waiver and recovery agreements with the Trusts (each, a “New Expense Agreement”), which include the same Annual Expense Caps for each Fund as those set forth in the Original Expense Agreements, and which will expire on November 15, 2016. In addition, under each New Expense Agreement, Destra has retained the ability to recover eligible amounts waived or reimbursed under the corresponding Original Expense Agreement.

Limitation on Liability. The Original Investment Management Agreements and New Investment Management Agreements provide that Destra shall not be liable for any loss sustained by reason of the purchase, sale or retention of any security, whether or not such purchase, sale or retention shall have been based upon the investigation and research made by any other individual, firm or corporation, if such recommendation shall have been selected with due care and in good faith, except loss resulting from willful misfeasance, bad faith, or gross negligence on the part of Destra in the performance of its obligations and duties, or by reason of its reckless disregard of its obligations and duties thereunder.

Continuance. The Original Investment Management Agreement of each Fund originally was in effect for an initial term and could be continued thereafter for successive one-year periods if such continuance was specifically approved at least annually in the manner required by the 1940 Act. If the shareholders of a Fund approve the New Investment Management Agreement for that Fund, the New Investment Management Agreement will expire on November 15, 2016, unless continued. The New Investment Management Agreement may be continued for successive one-year periods if approved at least annually in the manner required by the 1940 Act.

Termination. The Original Investment Management Agreement and New Investment Management Agreement for each Fund provide that the Agreement shall automatically terminate in the event of its assignment, and may be terminated at any time with respect to a Fund without the payment of any penalty by the Fund or Adviser on sixty (60) days’ written notice to the other party. A Fund may effect termination by action of the Board or by vote of a majority of the outstanding voting securities of the Fund, accompanied by appropriate notice.

Section15(f)

Destra and Arrowpoint have represented that they have agreed to take certain actions to comply with Section 15(f) of the 1940 Act. Section 15(f) provides a non-exclusive “safe harbor” for an investment adviser or any affiliated persons to receive any amount or benefit in connection with a change in control of the investment adviser as long as two conditions are met. First, for a period of three years after the change of control, at least 75% of the Trustees of the Trusts must not be “interested persons” of Destra as defined in the 1940 Act. As of the date of this Joint Proxy Statement, 75% of the Board of each Trust is comprised of Independent Trustees and, assuming approval by shareholders of Proposal 3, 75% of the Board of each Trust will continue to be comprised of Independent Trustees. Accordingly, the Trusts will initially meet the first condition for compliance with Section 15(f) discussed above. Second, an “unfair burden” must not be imposed on a Fund as a result of the closing of the Transaction or any express or implied terms, conditions, or understandings applicable thereto or within a two-year period after the Closing. The term “unfair burden” is defined in Section 15(f) to include any arrangement during the two-year period after the Closing whereby an investment adviser or any interested person of any such adviser receives or is entitled to receive any compensation, directly or indirectly, from the investment company or its security holders (other than fees for bona fide investment advisory or other services) or from any person in connection with the purchase or sale of securities or other property to, from, or on behalf of the investment company (other than bona fide ordinary compensation as principal underwriter for such investment company). Each Board has been advised that Destra, after due inquiry, does not believe that there will be, and is not aware of, any express or implied term, condition, arrangement, or understanding that would impose an “unfair burden” on the Funds as a result of the change of control of Destra. Destra and Arrowpoint have agreed not to impose an “unfair burden” on any Fund within the two-year period after the Closing. Destra shall bear the expenses related to obtaining the approvals of the Funds related to the Closing, including proxy solicitation, printing, mailing, vote tabulation, and other proxy soliciting expenses, legal fees, and out-of-pocket expenses.

Shareholder Approval

To become effective with respect to a particular Fund, the New Investment Management Agreement must be approved by a vote of a majority of the outstanding voting securities of the Fund, with all classes of shares voting together as a single class. The “vote of a majority of the outstanding voting securities” is defined in the 1940 Act as the lesser of the vote of (i) 67% or more of the shares of the Fund entitled to vote thereon present at the meeting if the holders of more than 50% of such outstanding shares are present in person or represented by proxy; or (ii) more than 50% of such outstanding shares of the Fund entitled to vote thereon. For purposes of determining the approval of each New Investment Management Agreement, abstentions and broker non-votes will have the same effect as shares voted against the proposal.

Each New Investment Management Agreement was approved by the Board of the respective Fund after consideration of all factors that it determined to be relevant to its deliberations, including those discussed in “Board Considerations” after Proposal 2 below. The Board of each Fund also determined to submit the Fund’s New Investment Management Agreement for consideration by the shareholders of such Fund.

The Boards unanimously recommend that shareholders of each Fund vote FOR approval of the Fund’s New Investment Management Agreement.

PROPOSAL 2: APPROVAL OF NEW INVESTMENT SUB-ADVISORY AGREEMENTS

Background and Reason for Vote

Destra and the applicable Trust have entered into investment sub-advisory agreements (each, an “Original Sub-Advisory Agreement” and collectively, the “Original Sub-Advisory Agreements”) with respect to each Fund with the investment sub-advisers (each, a “Sub-Adviser” and collectively, the “Sub-Advisers”), as set forth below:

|

|

•

|

Miller/Howard Investments, Inc. (“Miller/Howard”): Destra Dividend Total Return Fund (“Dividend Total Return Fund”)

|

|

|

•

|

WestEnd Advisors LLC (“WestEnd”): Destra Focused Equity Fund (“Focused Equity Fund”)

|

|

|

•

|

Flaherty & Crumrine Incorporated (“Flaherty & Crumrine”): Destra Preferred and Income Securities Fund (“Preferred and Income Fund”)

|

The date of each Original Sub-Advisory Agreement and the date it was last approved by shareholders and approved for continuance by the applicable Board are provided in Appendix D.

As with the Original Investment Management Agreements, each Original Sub-Advisory Agreement, as required by Section 15 of the 1940 Act, provides for its automatic termination in the event of its assignment. As a result, the Closing will result in the termination of each Original Sub-Advisory Agreement.

In anticipation of the Transaction, the Board of each Trust met in person at a joint meeting on August 5, 2014 for purposes of, among other things, considering whether it would be in the best interests of each Fund to approve a new sub-advisory agreement among the applicable Trust, Destra and the respective Sub-Adviser in substantially the same form as the Original Sub-Advisory Agreement to take effect immediately after the Closing (each a “New Sub-Advisory Agreement” and collectively, the “New Sub-Advisory Agreements”). The form of each New Sub-Advisory Agreement is attached hereto as Appendix O.

The 1940 Act requires that each New Sub-Advisory Agreement be approved by that Fund’s shareholders in order for it to become effective. At the August 5, 2014 Board meeting, and for the reasons discussed below (see “Board Considerations”), the Board of each Trust, including a majority of the Independent Trustees, unanimously approved the applicable New Sub-Advisory Agreement on behalf of each Fund and unanimously recommended its approval by shareholders in order to assure continuity of investment sub-advisory services to the Fund after the Closing. As indicated above, the Closing will not occur unless shareholders of each Fund approve its New Sub-Advisory Agreement.

Comparison of Original Sub-Advisory Agreements and New Sub-Advisory Agreements

The terms of each New Sub-Advisory Agreement, including fees payable to the Sub-Adviser by Destra thereunder, are identical to those of the corresponding Original Sub-Advisory Agreement, except for the date of effectiveness. There is no change in the fee rate payable by Destra to the Sub-Adviser. If approved by shareholders of a Fund, the New Sub-Advisory Agreement for the Fund will expire on November 15, 2016, unless continued. Each New Sub-Advisory Agreement will continue in effect from year to year thereafter if such continuance is approved for the Fund at least annually in the manner required by the 1940 Act and the rules and regulations thereunder. Below is a comparison of certain terms of the Original Sub-Advisory Agreements to the terms of the corresponding New Sub-Advisory Agreements. For a more complete understanding of the New Sub-Advisory Agreements, please refer to the form of the New Sub-Advisory Agreements provided in Appendix O. The summary below is qualified in all respects by the terms and conditions of the form of New Sub-Advisory Agreements.

Sub-Advisory Services. The sub-advisory services to be provided by the Sub-Adviser to each Fund under the New Sub-Advisory Agreements will be identical to those sub-advisory services currently provided by the Sub-Adviser to each Fund under the Original Sub-Advisory Agreements. Moreover, the same personnel will continue to provide sub-advisory services to the Funds. Both the Original Sub-Advisory Agreements and New Sub-Advisory Agreements provide that the Sub-Adviser will furnish an investment program in respect of, make investment decisions for and place all orders for the purchase and sale of securities for the Fund’s investment portfolio, all on

behalf of the Fund and subject to the supervision of the Fund’s Board and the Adviser. In performing its duties under both the Original Sub-Advisory Agreement and the corresponding New Sub-Advisory Agreement, a Sub-Adviser will monitor the Fund’s investments and will comply with the provisions of the Trust’s Declaration of Trust and By-laws and the stated investment objectives, policies and restrictions of the Fund.

Brokerage. Both the Original Sub-Advisory Agreements and New Sub-Advisory Agreements authorize the Sub-Adviser to select the brokers or dealers that will execute the purchases and sales of portfolio securities for the Funds.

Fees. Under both the Original Sub-Advisory Agreements and New Sub-Advisory Agreements, the Adviser pays the Sub-Adviser a portfolio management fee out of the investment management fee it receives from the Fund. The rate of the portfolio management fees payable by the Adviser to the Sub-Adviser under the New Sub-Advisory Agreements is identical to the rate of the fees paid under the Original Sub-Advisory Agreements. The annual rate of portfolio management fees payable to the Sub-Adviser under the Original Sub-Advisory Agreements and the New Sub-Advisory Agreements and the fees paid by the Adviser to the Sub-Adviser with respect to each Fund during each Fund’s last fiscal year are set forth in Appendix E to this Joint Proxy Statement.

Payment of Expenses. Under each Original Sub-Advisory Agreement and New Sub-Advisory Agreement, the Sub-Adviser agrees to pay all of its own operating expenses incurred by it in connection with providing sub-advisory services under the Agreement other than the cost of securities and other assets (including brokerage commissions, if any) purchased for the Fund.

Limitation on Liability. The Original Sub-Advisory Agreements and New Sub-Advisory Agreements provide that the Sub-Adviser will not be liable for, and the Adviser will not take any action against the Sub-Adviser to hold the Sub-Adviser liable for, with respect to Flaherty & Crumrine and WestEnd only, any breach thereunder, and with respect to each Sub-Adviser, any error of judgment or mistake of law or for any loss suffered by the Fund in connection with the performance of the Sub-Adviser’s duties under the Agreement, except for a loss resulting from willful misfeasance, bad faith or gross negligence on the part of the Sub-Adviser in the performance of duties under the Agreement, or by reason of its reckless disregard of its obligations and duties under the Agreement.

Continuance. The Original Sub-Advisory Agreement of each Fund originally was in effect for an initial term and could be continued thereafter for successive one-year periods if such continuance was specifically approved at least annually in the manner required by the 1940 Act. If the shareholders of a Fund approve the New Sub-Advisory Agreement for that Fund, the New Sub-Advisory Agreement will expire on November 15, 2016, unless continued. Thereafter, the New Sub-Advisory Agreement may be continued for successive one-year periods if approved at least annually in the manner required by the 1940 Act.

Termination. The Original Sub-Advisory Agreement and New Sub-Advisory Agreement for each Fund provide that the Agreement shall automatically terminate in the event of its assignment and may be terminated at any time without the payment of any penalty by either party on sixty (60) days’ written notice. The Original Sub-Advisory Agreement and New Sub-Advisory Agreement may also be terminated by action of the Fund’s Board or by a vote of a majority of the outstanding voting securities of that Fund, accompanied by 60 days’ written notice.

Information About Sub-Advisers

Miller/Howard. Miller/Howard, located at 324 Upper Byrdcliffe Road, Woodstock, New York 12498, is an asset manager specializing in dividend stocks, listed infrastructure, and MLPs. Miller/Howard was founded in 1984 as an institutional research boutique providing quantitative and technical research to Fortune 500 companies. Miller/Howard has been managing long-only equities since 1991, and had approximately $8.3 billion of assets under management as of June 30, 2014.

WestEnd. WestEnd, located at Two Morrocroft Centre, 4064 Colony Road, Suite 130, Charlotte, North Carolina 28211, is a boutique investment management firm. WestEnd had approximately $2.1 billion of assets under management as of June 30, 2014.

Flaherty & Crumrine. Flaherty & Crumrine, located at 301 East Colorado Blvd., Suite 720, Pasadena, California 91101, has specialized in the management of preferred securities portfolios since 1983 and has managed U.S.-

registered closed-end funds since 1991. Flaherty & Crumrine had approximately $5.1 billion of assets under management as of June 30, 2014.

Additional Information. Included in Appendix F are the advisory fee rates and net assets of registered investment companies advised by each Sub-Adviser with similar investment objectives as the Funds the Sub-Adviser sub-advises. Certain information regarding the principal executive officers and directors of each Sub-Adviser is set forth in Appendix G. Information regarding each Sub-Adviser’s ownership by control persons is set forth in Appendix H.

Affiliated Brokerage and Other Fees

No Fund paid brokerage commissions within the last fiscal year to (i) any broker that is an affiliated person of such Fund or an affiliated person of such person, or (ii) any broker an affiliated person of which is an affiliated person of such Fund, the Adviser or any Sub-Adviser of such Fund.

During each Fund’s last fiscal year, no Fund paid any amounts to the Adviser or Sub-Adviser to such Fund or any affiliated person of the Adviser or Sub-Adviser to such Fund for services provided to the Fund (other than pursuant to the Original Investment Management Agreement or Original Sub-Advisory Agreement or for brokerage commissions).

Shareholder Approval

To become effective with respect to a particular Fund, the New Sub-Advisory Agreement must be approved by a vote of a majority of the outstanding voting securities of the Fund, with all classes of shares voting together as a single class. The “vote of a majority of the outstanding voting securities” is defined in the 1940 Act as the lesser of the vote of (i) 67% or more of the shares of the Fund entitled to vote thereon present at the meeting if the holders of more than 50% of such outstanding shares are present in person or represented by proxy; or (ii) more than 50% of such outstanding shares of the Fund entitled to vote thereon. For purposes of determining the approval of each New Sub-Advisory Agreement, abstentions and broker non-votes will have the same effect as shares voted against the proposal.

Each New Sub-Advisory Agreement was approved by the Board of the respective Fund after consideration of all factors that it determined to be relevant to its deliberations, including those discussed below under “Board Considerations.” The Board of each Fund also determined to submit the Fund’s New Sub-Advisory Agreement for consideration by the shareholders of such Fund.

The Boards unanimously recommend that shareholders of each Fund vote FOR approval of the

Fund’s New Sub-Advisory Agreement.

BOARD CONSIDERATIONS

Each Board, including the Independent Trustees, is responsible for approving the New Investment Management Agreements with Destra and the New Investment Sub-Advisory Agreements with each Sub-Adviser (together, the New Investment Management Agreements and New Investment Sub-Advisory Agreements will be referred to as the “Agreements”) for each Fund.

In anticipation of the Transaction, the Boards met at a Regular Meeting on August 5, 2014 and Special Meetings on July 16, 2014, August 25, 2014 and September 25, 2014 for purposes of, among other things, considering whether it would be in the best interests of each Fund and its shareholders to approve the New Investment Management Agreements and the New Investment Sub-Advisory Agreements. The Nominating Committees of the current Boards also met on July 28, 2014, August 12, 2014 and September 25, 2014.

In connection with the Boards’ review of the Agreements, the Independent Trustees requested, and the Adviser and Arrowpoint provided the Boards with, information about a variety of matters. The Boards considered, among other things, the following information:

|

·

|

the anticipated enhanced financial strength and resources of the Adviser and Distributor following the Transaction and Arrowpoint’s commitment to provide financial support to the Adviser for the next five years;

|

|

·

|

that the Adviser has no present intention to alter the advisory fee rates and expense arrangements currently in effect for the Funds;

|

|

·

|

the potential for changes in the employees and staff of the Adviser following the Transaction;

|

|

·

|

that it is currently expected that, except for two individuals, the current key employees of the Adviser primarily responsible for portfolio management and compliance services for the Funds will remain employees of the Adviser or be retained as a consultant and will continue to provide services to the Funds following the Transaction;

|

|

·

|

that sub-advisory services currently provided to the Funds will not be affected by the Transaction;

|

|

·

|

that the Adviser or one of its affiliates has agreed to pay all expenses of the Funds in connection with the Boards’ consideration of the Agreements and all costs of seeking shareholder approval of the Agreements;

|

|

·

|

Arrowpoint’s statement to the Boards that the manner in which the Funds’ assets are managed will not change as a result of the Transaction;

|

|

·

|

the assurance from the Adviser and Arrowpoint that following the Transaction there will not be any diminution in the nature, quality and extent of services provided to the Funds;

|

|

·

|

the Adviser’s current financial condition and anticipated positive impact of the Transaction;

|

|

·

|

the impact of the Transaction on the Adviser’s day-to-day operations; and

|

|

·

|

the long-term business goals of Arrowpoint and the Adviser with regard to the business and operations of the Adviser.

|

At a meeting held on August 5, 2014, each Board and the Independent Trustees, voting separately, determined that the Agreements for each Fund are in the best interests of that Fund in light of the services, expenses and such other matters as the Board considered to be relevant in the exercise of its reasonable business judgment and approved them for an initial two-year term.

To reach this determination, each Board considered its duties under the 1940 Act, as well as under the general principles of state law in reviewing and approving advisory contracts; the requirements of the 1940 Act in such matters; the fiduciary duty of investment advisers with respect to advisory agreements and compensation; the standards used by courts in determining whether investment company boards have fulfilled their duties; and the factors to be considered by the Board in voting on such agreements. To assist each Board in its evaluation of the Agreements, the Independent Trustees received materials in advance of Board meetings from Destra and Arrowpoint. The Independent Trustees also met with senior executives of Destra and Arrowpoint. The Independent Trustees also met separately with their independent legal counsel to discuss the information provided by Destra and Arrowpoint. Each Board applied its business judgment to determine whether the arrangements between each Trust, Destra and each Sub-Adviser are reasonable business arrangements from the Funds’ perspective as well as from the perspective of shareholders.

Nature, Extent and Quality of Services Provided to the Funds.

In connection with the investment advisory services to be provided under the New Investment Management Agreements, the Boards took into account detailed discussions with representatives of the Adviser and Arrowpoint regarding the management of each Fund. The Boards noted that, except for two individuals, key management personnel servicing the Funds are expected to remain with the Adviser following the Transaction or be retained as a consultant and that the level and quality of the services to be provided to the Funds by the Adviser are not expected to change. The Board was made aware of contingency plans of the Adviser in the event key management personnel were to leave the firm prior to or following the Transaction, which could readily be implemented should the need arise. The Boards also considered the Adviser’s and Arrowpoint’s representations to the Boards that Arrowpoint intends for the Adviser to continue to operate following the Closing of the Transaction in much the same manner as it operates today, and that the impact of the Transaction on the day-to-day operations of the Adviser would be positive. The Boards also discussed the Adviser’s anticipated financial condition following the completion of the Transaction and Arrowpoint’s commitment to provide financial support to the Adviser for the next five years. The Boards also considered Destra’s statement that its compliance policies and procedures, disaster recovery plans, information security controls and insurance program would not change following the consummation of the Transaction. Based on this review, the Boards concluded that the range and quality of services provided by the Adviser to the Funds were expected to continue under the New Investment Management Agreement at the same or improved levels. There was no expected impact on the services to be provided by the Sub-Advisers as a result of the Transaction.

Investment Performance of the Funds.

The Boards considered the Adviser’s investment philosophy and experience and its history in managing the Funds. The Boards also reviewed Fund performance information, which it reviewed at regular quarterly meetings and at the most recent annual contract review. The Boards noted that, except for one individual, the Adviser’s key personnel currently responsible for the portfolio management and oversight of the Funds were expected to continue to provide those services following the Closing of the Transaction. The Boards also considered that the Adviser has delegated responsibility for the day-to-day management of the Funds to the Sub-Advisers, which would continue to manage the Funds in the same manner following the Closing of the Transaction.

Costs of Services Provided and Profits Realized by the Adviser.

In evaluating the costs of the services to be provided by the Adviser under the Agreements, the Boards considered, among other things, whether advisory fee rates or other expenses would change as a result of the Transaction. The Boards noted that the New Investment Management Agreement for each Fund is substantially identical to the current Agreement, including the fact that the fee rates under the agreements are identical and that representatives of the Adviser represented that there is no present intention due to the Transaction to alter the advisory fee rates, expense waiver or expense reimbursements currently in effect for the Funds. The Boards noted that it was too early to predict how the Transaction may affect the Adviser’s future profitability from its relationship with the Funds. The Boards also noted that each Sub-Adviser fee rate under the New Investment Sub-Advisory Agreement is the same as that assessed under the current Sub-Advisory Agreement.

Economies of Scale and Fee Levels Reflecting Those Economies.

The Boards considered any potential economies of scale that may result from the Transaction. The Boards noted that any change in economies of scale resulting from the Transaction would be speculative at present.

Other Benefits to the Adviser.

The Boards noted their prior determinations that the fees under the current Agreements were reasonable, taking into consideration other benefits to the Adviser. The Boards also considered other benefits to the Adviser, Arrowpoint and their affiliates expected to be derived from their relationships with the Funds as a result of the Transaction and noted that no additional benefits were reported by the Adviser or Arrowpoint as a result of the Transaction. The Boards also noted that the Sub-Advisers would not be affected by the Transaction.

Each Board considered that Destra had identified as a fall out benefit to Destra and Destra Capital Investments LLC the raising of its stature in the investment management industry. Each Board also noted that Destra, WestEnd and Flaherty & Crumrine have not utilized soft dollars in connection with their management of the Funds’ portfolios. Based on their review, the Independent Trustees concluded that any indirect benefits received by Destra or a Sub-Adviser as a result of its relationship with each Fund were reasonable and within acceptable parameters.

Board Determination. After discussion, each Board and the Independent Trustees, voting separately, concluded that, based upon such information as they considered necessary to the exercise of their reasonable business judgment, it was in the best interests of the Funds to approve the Agreements for an initial two-year term. No single factor was identified as determinative in each Board’s analysis or any Independent Trustee’s analysis.

PROPOSAL 3: ELECTION OF TRUSTEES TO A POST-TRANSACTION BOARD

Background and Reason for Vote

For each Trust, the Board of Trustees oversees the management of the applicable Funds, including general supervision of each Fund’s investment activities. Among other things, the applicable Board generally oversees the portfolio management of each Fund and reviews and approves each Fund’s advisory and sub-advisory contracts and other principal contracts.

Under this Proposal 3, four nominees (each, a “Nominee” and collectively, the “Nominees”) are being proposed for election to the Board of Trustees for each Trust. As one element of the change of control Transaction, Arrowpoint and Destra proposed that the members of the current Boards resign in favor of certain persons who currently serve on the Board of Meridian Fund, Inc., a mutual fund family for which Arrowpoint serves as investment adviser. Given the change of control of the Adviser and the controlling position of Arrowpoint after the Transaction, the current Boards considered the potential benefits to shareholders of having a board composed of qualified persons familiar both with Arrowpoint and the oversight of mutual funds in general, in addition to the potential benefits to shareholders of the Transaction generally. The current Boards also considered the skills and experience, time availability and other attributes of each candidate. The current Boards have determined that, in connection with the Transaction, it will be appropriate for each Fund to have a Board comprised of the “Independent Trustees” and “Interested Trustee” set forth below. Accordingly, you are being asked to elect three new Independent Trustees and one Interested Trustee. The individuals nominated to serve as Independent Trustees met with and were nominated by each Trust’s Nominating and Governance Committee. In addition, you are also being asked to approve the re-election of Nicholas Dalmaso, who currently serves on each Trust’s Board as an Interested Trustee. If elected, the Nominees will serve as trustees for the Trusts and, other than Mr. Dalmaso, the current members of the Boards (i.e., the current Independent Trustees), will resign from their positions.

The 1940 Act requires that certain percentages of trustees on boards of registered investment companies must have been elected by shareholders under various circumstances. For example, in general, at least a majority of the trustees must have been elected to such office by shareholders. In addition, new trustees cannot be appointed by existing trustees to fill vacancies created by retirements, resignations or an expansion of a board unless, after those appointments, at least two thirds of the trustees have been elected by shareholders. Accordingly, shareholders are being asked to elect the Nominees. It is intended that the enclosed proxy will be voted “FOR” the election of the Nominees, unless such authority has been withheld in the proxy. The proxy cannot be voted for a greater number of persons than the number of Nominees.

The Nominees will be elected for indefinite terms. Each Nominee has indicated a willingness to serve as a member of the Boards if elected. If any of the Nominees should not be available for election, the persons named as proxies may vote for other persons in their discretion. However, there is no reason to believe that any Nominee will be unavailable for election. If the Nominees are not elected, then the current Trustees are expected to continue to remain on the Boards indefinitely.

The following table includes certain important information regarding the Nominees, as well as the officers of the Trusts:

|

Name, Business Address

and Birth Year

|

Position(s) To Be Held with Funds

|

Term of Office and

Length of Time Served

|

Principal Occupation(s)

During Past Five Years

|

Number of

Portfolios in

Fund Complex

To Be

Overseen by

Trustee

|

Other Directorships

Held by Trustee

During Last

Five Years

|

| |

|

Independent Trustees Nominees

|

|

|

|

|

|

|

John S. Emrich, CFA

901 Warrenville Rd.

Suite 15

Lisle, IL 60532

Birth year: 1967

|

Trustee

|

Term—Indefinite Length of

Service—N/A

|

Private Investor, January 2011 to present; Co- Founder and Portfolio Manager, Ironworks Capital Management (an investment adviser), April 2005 to December 2010; Member and Manager, Iroquois Valley Farms LLC, June 2012 to present.

|

3

|

Meridian Fund, Inc. (four portfolios)

|

|

Michael S. Erickson

901 Warrenville Rd.

Suite 15

Lisle, IL 60532

Birth year: 1952

|

Trustee

|

Term—Indefinite Length of

Service—N/A

|

Private Investor, August 2007 to present; Trustee and Treasurer, The Marin School, September 2005 to June 2008.

|

3

|

Meridian Fund, Inc. (four portfolios)

|

|

James Bernard Glavin

901 Warrenville Rd.

Suite 15

Lisle, IL 60532

Birth year: 1935

|

Trustee

|

Term—Indefinite Length of

Service—N/A

|

Retired; previously Chairman of the Board, Orchestra Therapeutics, Inc.

|

3

|

Meridian Fund, Inc. (four portfolios)

|

| |

|

|

|

|

|

|

Interested Trustee Nominee

|

|

|

|

|

|

|

Nicholas Dalmaso

901 Warrenville Rd.

Suite 15

Lisle, IL 60532

Birth year: 1965

|

Trustee

|

Term—Indefinite Length of

Service—Since

2010

|

Co-Chairman, General Counsel and Chief Operating Officer of Destra Capital Management LLC; President, Chief Operating Officer and General Counsel, Destra Capital Advisors LLC; President, Chief Operating Officer and General Counsel, Destra Capital Investments LLC; Chief Executive Officer, Destra Investment Trust and Destra Investment Trust II (2010 to present); General Counsel and Chief Administrative Officer, Claymore Securities, Inc. (2001-2008).

|

3

|

None

|

Name, Business

Address and Birth Year

|

Position(s) Held

with Funds

|

Term of

Office and

Length of

Time Served

with Trust

|

Principal Occupation(s)

During Past Five Years

|

| |

|

|

|

|

Officers:

|

|

|

|

| |

|

|

|

|

Anne Kochevar*

901 Warrenville Rd.

Suite 15

Lisle, IL 60532

Birth year: 1963

|

Chief Compliance Officer

|

Term—Indefinite

Length of

Service—Since

2010

|

Senior Managing Director, Destra Capital Management LLC, Destra Capital Advisors LLC and Destra Capital Investments LLC; Senior Managing Director (2002-2010), Claymore Securities, Inc.

|

Name, Business

Address and Birth Year

|

Position(s) Held

with Funds

|

Term of

Office and

Length of

Time Served

with Trust

|

Principal Occupation(s)

During Past Five Years

|

|

Linda Fryer

901 Warrenville Rd.

Suite 15

Lisle, IL 60532

Birth year: 1973

|

Chief Financial Officer and Treasurer

|

Term—Indefinite

Length of

Service—Since

2012

|

Chief Financial Officer, Destra Capital Investments LLC

|

|

Justin Pfaff

901 Warrenville Rd.

Suite 15

Lisle, IL 60532

Birth year: 1981

|

Secretary

|

Term—Indefinite

Length of

Service—Since

2014

|

Managing Director, Destra Capital Management LLC and Destra Capital Investments LLC; Vice President, Guggenheim Investments

|

|

(*)

|

Ms. Kochevar has advised the Board that she will resign as Chief Compliance Officer of the Funds, the Adviser and Distributor in the near future following the Closing.

|

Set forth in Appendix I to this Joint Proxy Statement is the information regarding the aggregate dollar range of share ownership of each Fund by each current Trustee and Nominee. As of the Record Date, except for Mr. Dalmaso, no Nominee or his immediate family members owned beneficially or of record any securities of Destra or its affiliates. As of the Record Date, the trustees, Nominees and officers of the Funds as a group owned an aggregate of less than 1% of the outstanding shares of each of the Dividend Total Return Fund and the Focused Equity Fund. As of the Record Date, the trustees, Nominees and officers of the Funds as a group owned an aggregate of approximately 1.4% of the outstanding shares of the Preferred and Income Fund.

The Independent Trustees are each paid $4,500 as annual compensation for serving as an Independent Trustee of a Trust, $500 as annual compensation for serving on a committee of the Boards and $1,000 for attendance at each special meeting of the Boards. Such compensation is paid in four equal installments in conjunction with each quarterly Board meeting. In addition, the Independent Trustees are reimbursed by the Trusts for expenses incurred as a result of their attendance at meetings of the Trustees or any committees of the Boards. The Trusts do not have a retirement or pension plan.

Information relating to the amount of compensation paid by the Funds to the current Trustees who are not “interested persons” (as defined in 1940 Act) of the Boards for the last calendar year is set forth in Appendix J to this Joint Proxy Statement.

Board Leadership and Risk Oversight

The Board of Trustees oversees the operations and management of the Funds, including the duties performed for the Funds by Destra. None of the Trustees who are not “interested persons” of a Trust, nor any of their immediate family members, has ever been a director, officer or employee of, or consultant to, Destra, Destra Capital, Destra Capital Investments LLC, or their affiliates.

The Boards oversee the services performed for the Funds under the Original Investment Management Agreements between the Trusts, on behalf of each Fund, and the Adviser. The Trustees approve policies for the Funds, choose the Trusts’ officers, and hire the Funds’ investment advisers, sub-advisers and other service providers. The officers of the Trust manage the day-to-day operations and are responsible to the Trusts’ Board. The applicable provisions regarding the management of the Funds, as outlined above, in the New Investment Management Agreements are identical to those in the Original Investment Management Agreements.

Each Board is currently comprised of three Independent Trustees, Diana S. Ferguson, William M. Fitzgerald, Sr. and Louis A. Holland, and one Interested Trustee, Mr. Dalmaso. The current Independent Trustees will resign upon the

election of the New Trustees. Upon the election of the New Trustees, each Trust’s Board will be composed of three Independent Trustees and one Interested Trustee. The Interested Trustee will be Nicholas Dalmaso, who has served as both the Chief Executive Officer and Chairman of the Boards of the Trusts since 2010.

Annually, the Board will review its governance structure and the committee structures, their performance and functions and reviews any processes that would enhance Board governance over the Funds’ business. The current Board has determined that its leadership structure is appropriate based on the characteristics of the Funds.

In order to streamline communication between Destra and the Independent Trustees and create certain efficiencies, the Boards currently have a Lead Independent Trustee who is responsible for: (i) coordinating activities of the Independent Trustees; (ii) working with Destra, Funds’ counsel and the independent legal counsel to the Independent Trustees to determine the agenda for Board meetings; (iii) serving as the principal contact for and facilitating communication between the Independent Trustees and the Funds’ service providers, particularly Destra; and (iv) any other duties that the Independent Trustees may delegate to the Lead Independent Trustee. The Lead Independent Trustee is selected by the Independent Trustees and serves until his successor is selected. Mr. Holland currently serves as the Lead Independent Trustee and will serve in such capacity until his term of office as a Trustee ends.

Each Board has established three standing committees (as described below) and has delegated certain of its responsibilities to those committees. Each Board and its committees meet frequently throughout the year to oversee Fund activities, review contractual arrangements with and performance of service providers, oversee compliance with regulatory requirements, and review Fund performance. The Independent Trustees are represented by independent legal counsel at all Board and committee meetings. Generally, the Boards act by majority vote of all the Trustees, including a majority vote of the Independent Trustees if required by applicable law.

The three standing committees of the Funds are: the Nominating and Governance Committee, the Valuation Committee and the Audit Committee. The Nominating and Governance Committee is responsible for appointing and nominating persons to the Trust’s Board of Trustees. Ms. Ferguson and Messrs. Fitzgerald and Holland currently serve as members of the Nominating and Governance Committee. If there is no vacancy on a Board of Trustees, the Board will not actively seek recommendations from other parties, including shareholders. When a vacancy on a Board occurs and nominations are sought to fill such vacancy, the Nominating and Governance Committee may seek nominations from those sources it deems appropriate in its discretion, including shareholders of the Funds. To submit a recommendation for nomination as a candidate for a position on a Board of Trustees, shareholders of the Funds shall mail such recommendation to Justin Pfaff, Secretary, at the Trusts’ address, 901 Warrenville Road, Suite 15, Lisle, Illinois 60532. Such recommendation shall include the following information: (i) evidence of Fund ownership of the person or entity recommending the candidate (if a Fund shareholder); (ii) a full description of the proposed candidate’s background, including their education, experience, current employment and date of birth; (iii) names and addresses of at least three professional references for the candidate; (iv) information as to whether the candidate is an “interested person” in relation to the Fund, as such term is defined in the 1940 Act, and such other information that may be considered to impair the candidate’s independence; and (v) any other information that may be helpful to the Nominating and Governance Committee in evaluating the candidate. If a recommendation is received with satisfactorily completed information regarding a candidate during a time when a vacancy exists on a Board or during such other time as the Nominating and Governance Committee is accepting recommendations, the recommendation will be forwarded to the Chairman of the Nominating and Governance Committee and the counsel to the Independent Trustees. Recommendations received at any other time will be kept on file until such time as the Nominating and Governance Committee is accepting recommendations, at which point they may be considered for nomination.

The Valuation Committee is responsible for the oversight of the pricing procedures of the Fund. Ms. Ferguson and Messrs. Fitzgerald and Holland currently serve as members of the Valuation Committee.

The Audit Committee is responsible for overseeing the Funds’ accounting and financial reporting process, the system of internal controls, audit process and evaluating and appointing independent auditors (subject also to Board approval). Ms. Ferguson and Messrs. Fitzgerald and Holland currently serve as members of the Audit Committee.

As part of the general oversight of the Funds, the Boards are involved in the risk oversight of the Funds. The Boards have adopted and periodically review policies and procedures designed to address the Funds’ risks. Oversight of

investment and compliance risk, including oversight of any sub-advisers, is performed primarily at the Board level in conjunction with Destra’s investment oversight group and the Trusts’ Chief Compliance Officer (“CCO”). Oversight of other risks also occurs at the committee level. Destra’s investment oversight group reports to the Board at quarterly meetings regarding, among other things, Fund performance and the various drivers of such performance as well as information related to sub-advisers and their operations and processes. Each Board reviews reports on the Funds’ and the service providers’ compliance policies and procedures at each quarterly Board meeting and receives an annual report from the CCO regarding the operations of the Funds’ and the service providers’ compliance programs. The Audit Committee reviews with Destra the Funds’ major financial risk exposures and the steps Destra has taken to monitor and control these exposures, including the Funds’ risk assessment and risk management policies and guidelines. The Audit Committee also, as appropriate, reviews in a general manner the processes other Board committees have in place with respect to risk assessment and risk management. The Nominating and Governance Committee monitors all matters related to the corporate governance of the Fund. The Valuation Committee monitors valuation risk and compliance with the Fund’s valuation procedures and oversees the pricing agents and actions by Destra’s pricing committee with respect to the valuation of portfolio securities.

Not all risks that may affect the Funds can be identified nor can controls be developed to eliminate or mitigate their occurrence or effects. It may not be practical or cost effective to eliminate or mitigate certain risks, the processes and controls employed to address certain risks may be limited in their effectiveness, and some risks are simply beyond the reasonable control of the Funds, Destra or other service providers. Moreover, it is necessary to bear certain risks (such as investment related risks) to achieve the Funds’ goals. As a result of the foregoing and other factors, the Funds’ ability to manage risk is subject to substantial limitations.

The composition of the Trusts’ committees and overall governance structure of the Trusts will be determined by the new Boards of Trustees, if and when elected.

Board Diversification and Trustee Qualifications

As described above, the Nominating and Governance Committee of each Board oversees matters related to the nomination of Trustees. The Nominating and Governance Committee seeks to establish an effective Board with an appropriate range of skills and diversity, including, as appropriate, differences in background, professional experience, education, vocations, and other individual characteristics and traits in the aggregate. Each Trustee must meet certain basic requirements, including relevant skills and experience, time availability, and if qualifying as an Independent Trustee, independence from Destra, sub-advisers, underwriters or other service providers, including any affiliates of these entities.

For each Nominee, the description of experiences, qualifications and attributes described below have led to the conclusion, as of the date of this Joint Proxy Statement, that each Nominee is qualified to serve as a Trustee. References to the experiences, qualifications, attributes and skills of a Nominee are pursuant to requirements of the Securities and Exchange Commission, do not constitute holding out of the Board, any Trustee or Nominee as having any special expertise or experience and shall not impose any greater responsibility or liability on any such person or on the Board by reason thereof.

The Nominating and Governance Committee initially recommended three additional nominees, two of whom are on the Board of Meridian Fund, Inc., and one of whom is the Chief Executive Officer of Destra. Subsequent to their nomination, those persons withdrew their names from consideration.

Independent Trustees

John S. Emrich has significant experience in the investment management and financial services industry. Mr. Emrich served as a financial analyst or portfolio manager for over 14 years for various investment advisory firms and currently serves as a director of Meridian Fund, Inc. Prior to such positions he also performed business valuations and appraisal analyses at KPMG Peat Marwick, an accounting firm.

Michael S. Erickson has significant leadership and financial management experience, previously serving as Chairman of the Board and Chief Financial Officer of AeroAstro for nearly ten years, and as a Director on the Board of Directors of Decimal, Inc., an online IRA administration company. Mr. Erickson also currently serves as a director of Meridian Fund, Inc. He has served as a certified public accountant for Coopers & Lybrand, an

accounting firm, and has served as Chief Financial Officer for several companies. Mr. Erickson holds a Master of Business Administration degree from Stanford Graduate School of Business.

James Bernard Glavin provides the Board with strong management acumen as he has served as CEO and Chairman of Orchestra Therapeutics, Inc. (formerly known as Immune Response Corp.), a biopharmaceutical company and as a board member for Althea Tech, a privately held biotechnology company. Mr. Glavin also currently serves as a director of Meridian Fund, Inc.

Interested Trustee

Nicholas Dalmaso was the initial Trustee of the Trusts. He has experience as General Counsel and Chief Administrative Officer at Claymore Securities, Inc. His work experience in the mutual fund industry and educational background has prepared him to be a Trustee.

Board Meetings

Appendix K sets forth, for each Trust, the number of Board and committee meetings held during the last fiscal year.

Attendance of Trustees at Annual Meetings