Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

Sabra Health Care REIT, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Table of Contents

Sabra Health Care REIT, Inc.

18500 Von Karman Avenue, Suite 550

Irvine, California 92612

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On June 9, 2020

To the Stockholders of Sabra Health Care REIT, Inc.:

Notice is hereby given that the 2020 Annual Meeting of Stockholders (the “Annual Meeting”) of Sabra Health Care REIT, Inc., a Maryland corporation (the “Company”), will be held at the Company’s headquarters located at 18500 Von Karman Avenue, Suite 550, Irvine, California 92612 on Tuesday, June 9, 2020, at 9:00 a.m., Pacific time, to consider and vote on the following proposals:

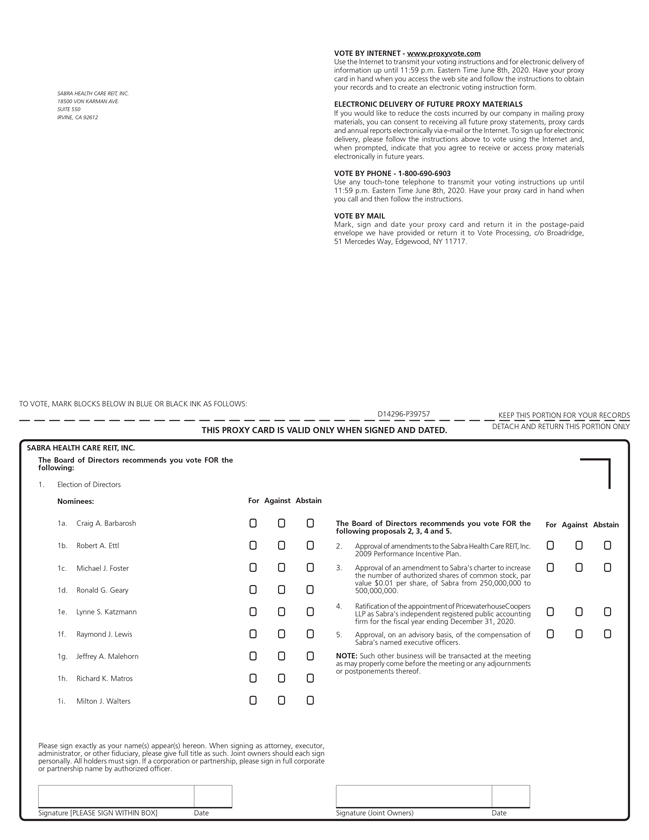

| (1) | The election of nine nominees to the Board of Directors to serve until the Company’s 2021 annual meeting of stockholders and until their respective successors are elected and qualified; |

| (2) | The approval of amendments to the Sabra Health Care REIT, Inc. 2009 Performance Incentive Plan; |

| (3) | The approval of an amendment to the charter of the Company to increase the number of authorized shares of common stock, par value $0.01 per share, of the Company from 250,000,000 to 500,000,000; |

| (4) | The ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2020; and |

| (5) | The approval, on an advisory basis, of the compensation of the Company’s named executive officers as described in the Proxy Statement. |

In addition, at the Annual Meeting, we will transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof.

Only stockholders of record of the Company’s common stock as of the close of business on April 20, 2020 are entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements thereof.

You are cordially invited to attend the Annual Meeting in person. Your vote is important to us. Whether or not you expect to attend the Annual Meeting, please submit your proxy as soon as possible. If you attend the Annual Meeting and vote in person, your proxy will not be used.

Important Notice—Contingent Virtual Meeting: We are closely monitoring the developments regarding the coronavirus (COVID-19). Although we currently intend to hold our Annual Meeting in person, we are sensitive to the public health and travel concerns stockholders may have and the protocols that federal, state, and local governments are imposing. In the event we determine that we need to conduct our Annual Meeting solely by means of remote communication, we will make such a determination in advance and announce the change and provide instructions on how stockholders can attend and participate in the Annual Meeting remotely via press release and by filing additional soliciting materials with the Securities and Exchange Commission. The press release will also be available on the “Investors” section of our website at www.sabrahealth.com. If you currently plan to attend the Annual Meeting in person, please check our website one week prior to the Annual Meeting.

| By Order of the Board of Directors, | ||

| ||

| Harold W. Andrews, Jr. Executive Vice President, Chief Financial Officer and Secretary | ||

| Irvine, California April 27, 2020 |

||

Table of Contents

Table of Contents

SABRA HEALTH CARE REIT, INC.

18500 Von Karman Avenue, Suite 550

Irvine, California 92612

The Board of Directors of Sabra Health Care REIT, Inc., a Maryland corporation (“Sabra,” “we,” “our” and “us”), solicits your proxy for the 2020 Annual Meeting of Stockholders (the “Annual Meeting”) to be held at 9:00 a.m., Pacific time, on Tuesday, June 9, 2020 at our headquarters located at 18500 Von Karman Avenue, Suite 550, Irvine, California 92612 or, if determined necessary, via remote communication as set forth below, and at any and all adjournments or postponements of the Annual Meeting. These proxy materials are first being sent or made available to our stockholders on or about April 27, 2020.

IMPORTANT NOTICE REGARDING INTERNET AVAILABILITY OF PROXY MATERIALS

This Proxy Statement and our Annual Report on Form 10-K for the year ended December 31, 2019 (“2019 Annual Report”) are posted in the Investors—Financials section of our website at www.sabrahealth.com. You can also view these materials at www.proxyvote.com by using the control number provided on your proxy card or Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”). References to our website in this Proxy Statement are provided for convenience only and the content on our website does not constitute part of this Proxy Statement.

Contingent Virtual Meeting

We are closely monitoring the developments regarding the coronavirus (COVID-19). Although we currently intend to hold our Annual Meeting in person, we are sensitive to the public health and travel concerns stockholders may have and the protocols that federal, state, and local governments are imposing. In the event we determine that we need to conduct our Annual Meeting solely by means of remote communication, we will make that determination in advance and announce the change and provide instructions on how stockholders can attend and participate in the Annual Meeting remotely via press release and by filing additional soliciting materials with the SEC. The press release will also be available on the “Investors” section of our website at www.sabrahealth.com. If you currently plan to attend the Annual Meeting in person, please check our website one week prior to the Annual Meeting.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

| Q: | Why did I receive only a Notice of Internet Availability? |

| A: | As permitted by the Securities and Exchange Commission (the “SEC”), Sabra is furnishing to stockholders its Notice of Annual Meeting, Proxy Statement and 2019 Annual Report primarily over the Internet. On or about April 27, 2020, we mailed to each of our stockholders (other than those who previously requested electronic delivery or to whom we are mailing a paper copy of the proxy materials) a Notice of Internet Availability containing instructions on how to access and review the proxy materials via the Internet and how to submit a proxy electronically using the Internet. The Notice of Internet Availability also contains instructions on how to receive, free of charge, paper copies of the proxy materials. If you received the Notice of Internet Availability, you will not receive a paper copy of the proxy materials unless you request one. |

1

Table of Contents

We believe the delivery options that we have chosen will allow us to provide our stockholders with the proxy materials they need, while lowering the cost of the delivery of the materials and reducing the environmental impact of printing and mailing paper copies.

| Q: | What items will be voted on at the Annual Meeting? |

| A: | The items of business scheduled to be voted on at the Annual Meeting are: |

| • | the election of nine nominees to the Board of Directors to serve until the 2021 annual meeting of stockholders and until their respective successors are elected and qualified (Proposal No. 1); |

| • | the approval of amendments to the Sabra Health Care REIT, Inc. 2009 Performance Incentive Plan (Proposal No. 2); |

| • | the approval of an amendment to our charter to increase the number of authorized shares of our common stock from 250,000,000 to 500,000,000 (Proposal No. 3); |

| • | the ratification of the appointment of PricewaterhouseCoopers LLP (“PwC”) as Sabra’s independent registered public accounting firm for the fiscal year ending December 31, 2020 (Proposal No. 4); and |

| • | the approval, on an advisory basis, of the compensation of our Named Executive Officers (as hereinafter defined) (Proposal No. 5). |

We will also consider any other business that properly comes before the Annual Meeting or any adjournments or postponements thereof. See “—How will voting on any other business be conducted?” below.

| Q: | How does the Board recommend I vote on these items? |

| A: | The Board of Directors recommends that you vote your shares: |

| • | FOR the election to the Board of Directors of each of the following nine nominees: Craig A. Barbarosh, Robert A. Ettl, Michael J. Foster, Ronald G. Geary, Lynne S. Katzmann, Raymond J. Lewis, Jeffrey A. Malehorn, Richard K. Matros and Milton J. Walters (Proposal No. 1); |

| • | FOR the approval of amendments to the Sabra Health Care REIT, Inc. 2009 Performance Incentive Plan (Proposal No. 2); |

| • | FOR the approval of an amendment to our charter to increase the number of authorized shares of our common stock from 250,000,000 to 500,000,000 (Proposal No. 3); |

| • | FOR the ratification of the appointment of PwC as our independent registered public accounting firm for the fiscal year ending December 31, 2020 (Proposal No. 4); and |

| • | FOR the approval, on an advisory basis, of the compensation of our Named Executive Officers (Proposal No. 5). |

| Q: | Who is entitled to vote at the Annual Meeting? |

| A: | The record date for the Annual Meeting is the close of business on April 20, 2020. Stockholders of record of Sabra’s common stock as of the close of business on the record date are entitled to receive notice of, and to vote at, the Annual Meeting. |

2

Table of Contents

| Q: | What options are available to me to vote my shares? |

| A: | Whether you hold shares directly as the stockholder of record or through a bank, broker or other nominee (that is, in “street name”), your shares may be voted at the Annual Meeting by following any of the voting options available to you below: |

You may authorize a proxy to vote via the Internet.

| (1) | If you received a Notice of Internet Availability or a copy of the proxy materials electronically by email, you can submit your proxy or voting instructions over the Internet by following the instructions provided in the Notice of Internet Availability or the electronic copy of the proxy materials you received; or |

| (2) | If you received a printed set of the proxy materials by mail, including a paper copy of the proxy card or voting instruction form, you may submit your proxy or voting instructions over the Internet by following the instructions on the proxy card or voting instruction form, as applicable. |

You may authorize a proxy to vote via telephone. If you are a stockholder of record, you can submit your proxy by calling the telephone number specified on the paper copy of the proxy card you received if you received a printed set of the proxy materials. You must have the control number that appears on your proxy card available when submitting your proxy over the telephone. Most stockholders who hold their shares in street name may submit voting instructions by calling the telephone number specified on the voting instruction form provided by their bank, broker or other nominee. Those stockholders should check the voting instruction form for telephone voting availability.

You may authorize a proxy to vote by mail. If you received a printed set of the proxy materials, you may submit your proxy or voting instructions by completing and signing the separate proxy card or voting instruction form you received and mailing it in the accompanying prepaid and addressed envelope.

You may vote in person at the Annual Meeting. All stockholders of record may vote in person at the Annual Meeting. Written ballots will be passed out to anyone who wants to vote at the Annual Meeting. However, if you are the beneficial owner of shares held in street name through a bank, broker or other nominee, you may not vote your shares at the Annual Meeting unless you obtain a “legal proxy” from the bank, broker or other nominee that holds your shares giving you the right to vote the shares at the Annual Meeting. Obtaining such a legal proxy may take several days.

Even if you plan to attend the Annual Meeting, we recommend that you submit your proxy or voting instructions in advance to authorize the voting of your shares at the Annual Meeting so that your vote will be counted if you later are unable to attend the Annual Meeting.

| Q: | What is the deadline for voting my shares? |

| A: | If you are a stockholder of record, your proxy must be received by telephone or the Internet by 11:59 p.m. Eastern time on June 8, 2020 in order for your shares to be voted at the Annual Meeting. However, if you are a stockholder of record and you received a copy of the proxy materials by mail, you may instead mark, sign and date the proxy card you received and return it in the accompanying prepaid and addressed envelope so that it is received by Sabra before voting begins at the Annual Meeting in order for your shares to be voted at the Annual Meeting. If you hold your shares in street name, please provide your voting instructions by the deadline specified by the bank, broker or other nominee that holds your shares. |

| Q: | Once I have submitted my proxy, is it possible for me to change or revoke my proxy? |

| A: | Yes. Any stockholder of record has the power to change or revoke a previously submitted proxy at any time before it is voted at the Annual Meeting by: |

| • | submitting to our Secretary, before the voting begins at the Annual Meeting, a written notice of revocation bearing a later date than the proxy; |

3

Table of Contents

| • | properly submitting a proxy on a later date prior to the deadlines specified in “—What is the deadline for voting my shares?” above (only the latest proxy submitted by a stockholder by Internet, telephone or mail will be counted); or |

| • | attending the Annual Meeting and voting in person; attendance at the Annual Meeting will not by itself constitute a revocation of a proxy. |

For shares held in street name, you may revoke any previous voting instructions by submitting new voting instructions to the bank, broker or other nominee holding your shares by the deadline for voting specified in the voting instruction form provided by your bank, broker or other nominee. Alternatively, if your shares are held in street name and you have obtained a legal proxy from the bank, broker or other nominee giving you the right to vote the shares at the Annual Meeting, any previous voting instructions will be revoked, and you may vote by attending the Annual Meeting and voting in person.

| Q: | How many shares are eligible to vote at the Annual Meeting? |

| A: | As of the close of business on the record date of April 20, 2020, there were 205,559,356 shares of Sabra common stock outstanding and eligible to vote at the Annual Meeting. There is no other class of voting securities outstanding. Each share of common stock entitles its holder to one vote at the Annual Meeting. |

| Q: | How is a quorum determined? |

| A: | A quorum refers to the number of shares that must be in attendance at an annual meeting of stockholders to lawfully conduct business. The representation, in person or by proxy, of holders entitled to cast a majority of all of the votes entitled to be cast at the Annual Meeting constitutes a quorum at the Annual Meeting. Your shares will be counted for purposes of determining whether a quorum exists for the Annual Meeting if you returned a signed and dated proxy card or voting instruction form, if you submitted your proxy or voting instructions by telephone or the Internet, or if you vote in person at the Annual Meeting, even if you abstain from voting on any of the proposals. In addition, if you are a street name holder, your shares may also be counted for purposes of determining whether a quorum exists for the Annual Meeting even if you do not submit voting instructions to your broker. See “—How will votes be counted at the Annual Meeting?” below. |

| Q: | What is required to approve each proposal at the Annual Meeting? |

| A: | Election of Directors (Proposal No. 1). Our Amended and Restated Bylaws (“Bylaws”) provide for a majority voting standard for the election of directors. Under this majority voting standard, once a quorum has been established, each director nominee receiving a majority of the votes cast with respect to his or her election (that is, the number of votes cast FOR the nominee exceeds the number of votes cast AGAINST the nominee) will be elected as a director. As required by our Bylaws, each incumbent director has submitted an irrevocable letter of resignation that becomes effective if the director is not elected by stockholders in an uncontested election and the Board of Directors accepts the resignation. The majority voting standard does not apply, however, in a contested election where the number of director nominees exceeds the number of directors to be elected. In such circumstances, directors will instead be elected by a plurality of the votes cast, meaning that the persons receiving the highest number of FOR votes, up to the total number of directors to be elected at the meeting, will be elected. The majority voting standard is discussed further under the section entitled “Election of Directors (Proposal No. 1)—Majority Voting Standard.” |

The election of directors at the Annual Meeting is not contested. Therefore, in accordance with the majority voting standard, director nominees will be elected at the Annual Meeting by a majority of the votes cast. Stockholders are not permitted to cumulate their shares for the purpose of electing directors.

Other Items (Proposal Nos. 2, 3, 4 and 5). Once a quorum has been established, pursuant to our Bylaws, approval of each of the other items to be submitted for a vote of stockholders at the Annual Meeting requires the affirmative vote of a majority of all of the votes cast on the proposal at the Annual Meeting.

4

Table of Contents

Notwithstanding this vote standard required by our Bylaws, Proposal No. 4 (ratification of the appointment of PwC as our independent registered public accounting firm for the fiscal year ending December 31, 2020) and Proposal No. 5 (advisory approval of named executive officer compensation) are advisory only and are not binding on Sabra. In addition, stockholder approval is not required to amend our charter to increase the authorized number of shares of common stock (Proposal No. 3). However, the Board of Directors has determined to submit this amendment for stockholder approval. Our Board of Directors will consider the outcome of the vote on each of these items in considering what action, if any, should be taken in response to the vote by stockholders.

| Q: | How will votes be counted at the Annual Meeting? |

| A: | In the election of directors (Proposal No. 1), you may vote FOR, AGAINST or ABSTAIN with respect to each director nominee. For the proposals to approve amendments to the Sabra Health Care REIT, Inc. 2009 Performance Incentive Plan (Proposal No. 2), to approve an amendment to our charter to increase the number of authorized shares of our common stock (Proposal No. 3), to ratify the appointment of PwC as our independent registered public accounting firm for the fiscal year ending December 31, 2020 (Proposal No. 4) and the advisory vote on executive compensation (Proposal No. 5), you may vote FOR, AGAINST or ABSTAIN. Abstentions with respect to any proposal at the Annual Meeting will be counted as present and entitled to vote for purposes of determining the presence of a quorum, but will not be counted as a vote cast on the proposal and therefore will not be counted in determining the outcome of the proposal. |

If you hold your shares in street name through a brokerage account and you do not submit voting instructions to your broker, your broker may generally vote your shares in its discretion on routine matters. However, a broker cannot vote shares held in street name on non-routine matters unless the broker receives voting instructions from the street name holder. The proposal to amend our charter to increase the number of authorized shares of our common stock (Proposal No. 3) and the proposal to ratify the appointment of PwC as our independent registered public accounting firm for the fiscal year ending December 31, 2020 (Proposal No. 4) are each expected to be considered routine under applicable rules, while each of the other items to be submitted for a vote of stockholders at the Annual Meeting is considered non-routine. Accordingly, if you hold your shares in street name through a brokerage account and you do not submit voting instructions to your broker, your broker may exercise its discretion to vote your shares on Proposal No. 3 and Proposal No. 4, but will not be permitted to vote your shares on any of the other items at the Annual Meeting. If your broker exercises this discretion, your shares will be counted as present for the purpose of determining the presence of a quorum at the Annual Meeting and will be voted on Proposal No. 3 and Proposal No. 4 in the manner directed by your broker, but your shares will constitute “broker non-votes” on each of the other proposals at the Annual Meeting. Broker non-votes will not be counted as a vote cast with respect to these other proposals and therefore will not be counted in determining the outcome of those proposals. You should instruct your broker or nominee how to vote your shares by following the voting instructions provided by your broker or nominee.

| Q: | How will my shares be voted if I do not give specific voting instructions in the proxy or voting instructions I submit? |

| A: | If you properly submit a proxy or voting instructions but do not indicate your specific voting instructions on one or more of the items listed above in the Notice of Annual Meeting, your shares will be voted as recommended by the Board of Directors on those items. See “—How does the Board recommend I vote on these items?” above. |

| Q: | How will voting on any other business be conducted? |

| A: | Although the Board of Directors does not know of any business to be considered at the Annual Meeting other than the items described in this Proxy Statement, if any other business properly comes before the Annual Meeting, a stockholder’s properly submitted proxy gives authority to the proxy holders named in the proxies solicited by the Board of Directors to vote on those matters in their discretion. |

5

Table of Contents

| Q: | Who will bear the costs of the solicitation of proxies? |

| A: | The cost of preparing the Notice of Annual Meeting of Stockholders, this Proxy Statement, the Notice of Internet Availability and the form of proxy, the cost of mailing such materials to stockholders or making them available on the Internet and the cost of soliciting proxies will be paid by Sabra. In addition to solicitation by mail, certain officers, regular employees and directors of Sabra, without receiving any additional compensation, may solicit proxies personally or by telephone. Sabra will request brokerage houses, banks and other custodians or nominees holding stock in their names for others to forward proxy materials to their customers or principals who are the beneficial owners of shares of our common stock and will reimburse them for their expenses in doing so. |

| Q: | Where can I find the voting results of the Annual Meeting? |

| A: | We intend to announce preliminary voting results at the Annual Meeting and disclose final voting results in a Current Report on Form 8-K to be filed with the SEC within four business days following the Annual Meeting. |

6

Table of Contents

SECURITY OWNERSHIP OF PRINCIPAL STOCKHOLDERS, DIRECTORS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of Sabra common stock as of March 31, 2020 for the following: (i) each of Sabra’s directors and each executive officer of Sabra identified as a “Named Executive Officer” in this Proxy Statement, (ii) all persons who are directors and executive officers of Sabra as a group and (iii) any person who is known by Sabra to be the beneficial owner of more than 5% of Sabra’s outstanding common stock. This table is based on information supplied to us by our executive officers, directors and principal stockholders or included in a Schedule 13G filed with the SEC.

| Name of Beneficial Owner |

Sabra Shares Beneficially Owned (1) |

Percent of Sabra Shares (1) |

||||||

| Directors and Named Executive Officers: |

||||||||

| Richard K. Matros |

1,070,280 | (2) | * | |||||

| Harold W. Andrews, Jr. |

322,637 | (3) | * | |||||

| Talya Nevo-Hacohen |

317,466 | (3) | * | |||||

| Craig A. Barbarosh |

78,226 | (4) | * | |||||

| Robert A. Ettl |

85,455 | (5) | * | |||||

| Michael J. Foster |

84,741 | (6) | * | |||||

| Ronald G. Geary |

33,656 | (7) | * | |||||

| Lynne S. Katzmann |

8,012 | (8) | * | |||||

| Raymond J. Lewis |

201,109 | (7) | * | |||||

| Jeffrey A. Malehorn |

36,299 | (7) | * | |||||

| Milton J. Walters |

50,897 | (9) | * | |||||

| All persons who are directors and executive officers of Sabra as a group (11 persons, each of whom is named above) |

2,288,778 | (10) | 1.1 | % | ||||

| 5% Stockholders: |

||||||||

| The Vanguard Group, Inc. and affiliates 100 Vanguard Blvd. Malvern, PA 19355 |

31,061,572 | (11) | 15.1 | % | ||||

| BlackRock, Inc. 55 East 52nd Street New York, NY 10055 |

27,721,095 | (12) | 13.5 | % | ||||

| Cohen & Steers, Inc. and affiliates 280 Park Avenue, 10th Floor New York, NY 10017 |

12,158,105 | (13) | 5.9 | % | ||||

| * | Less than 1.0% |

| (1) | Beneficial ownership is determined in accordance with the rules of the SEC. Except as otherwise noted below, applicable percentage ownership is determined based on 205,559,356 shares of Sabra common stock outstanding as of March 31, 2020. Restricted stock units vesting within 60 days of March 31, 2020 and shares of common stock subject to restricted stock units that have vested but the payment of which has been deferred until (i) in the case of Named Executive Officers, the fifth calendar year following the grant date (subject to earlier payment in connection with the executive’s death, disability, termination of employment and certain change in control transactions) or (ii) in the case of directors, the earlier of the fifth anniversary of the grant date, a change in control or the director’s separation from service from the Board of Directors, are considered outstanding for purposes of computing the share amount and percentage ownership of the person holding such restricted stock units, but Sabra does not deem them outstanding for purposes of computing the percentage ownership of any other person. Except as indicated in the footnotes to this table and pursuant to applicable community property laws, the persons named in the table have sole voting and investment power with respect to all shares of common stock beneficially owned. |

| (2) | Consists of (i) 42,516 vested restricted stock units, the payment of which has been deferred, that are payable in shares of common stock and (ii) 1,027,764 shares held by the R&A Matros Revocable Trust, with respect to which Mr. Matros shares voting and investment power. |

7

Table of Contents

| (3) | Includes 19,131 vested restricted stock units, the payment of which has been deferred, that are payable in shares of common stock. |

| (4) | Includes (i) 33,822 vested restricted stock units, the payment of which has been deferred, that are payable in shares of common stock, (ii) 1,042 shares of common stock subject to restricted stock units that vest within 60 days of March 31, 2020 and (iii) 43,362 shares that are held by the Barbarosh Family Trust, with respect to which Mr. Barbarosh shares voting and investment power. |

| (5) | Includes (i) 33,728 vested restricted stock units, the payment of which has been deferred, that are payable in shares of common stock, (ii) 1,042 shares of common stock subject to restricted stock units that vest within 60 days of March 31, 2020 and (iii) 50,685 shares that are held by the Ettl Family Trust, with respect to which Mr. Ettl shares voting and investment power. |

| (6) | Includes (i) 15,972 vested restricted stock units, the payment of which has been deferred, that are payable in shares of common stock and (ii) 1,042 shares of common stock subject to restricted stock units that vest within 60 days of March 31, 2020. |

| (7) | Includes (i) 16,131 vested restricted stock units, the payment of which has been deferred, that are payable in shares of common stock and (ii) 1,042 shares of common stock subject to restricted stock units that vest within 60 days of March 31, 2020. |

| (8) | Consists of (i) 6,970 vested restricted stock units, the payment of which has been deferred, that are payable in shares of common stock and (ii) 1,042 shares of common stock subject to restricted stock units that vest within 60 days of March 31, 2020. |

| (9) | Includes (i) 15,972 vested restricted stock units, the payment of which has been deferred, that are payable in shares of common stock, (ii) 1,042 shares of common stock subject to restricted stock units that vest within 60 days of March 31, 2020 and (iii) 10,000 shares of common stock that are held by Tri-River Capital, an entity with respect to which Mr. Walters has sole voting and investment power. |

| (10) | Includes (i) 1,121,811 shares held by family trusts, with respect to which the officer or director shares voting and investment power, (ii) 235,635 vested restricted stock units, the payment of which has been deferred, that are payable in shares of common stock, (iii) 8,336 shares of common stock subject to restricted stock units that vest within 60 days of March 31, 2020 and (iv) 10,000 shares held by an entity with respect to which the director has sole voting and investment power. |

| (11) | Beneficial share ownership information is given as of December 31, 2019 and was obtained from a Schedule 13G/A filed with the SEC on February 11, 2020 by The Vanguard Group, Inc. (“Vanguard”). According to the Schedule 13G/A, Vanguard has sole voting power over 387,602 shares, shared voting power over 210,027 shares, sole dispositive power over 30,689,837 shares and shared dispositive power over 371,735 shares of our common stock. The Schedule 13G/A states that Vanguard Fiduciary Trust Company, a wholly owned subsidiary of Vanguard, is the beneficial owner of 161,708 shares as a result of serving as investment manager of collective trust accounts. The Schedule 13G/A also states that Vanguard Investments Australia, Ltd., a wholly owned subsidiary of Vanguard, is the beneficial owner of 435,921 shares as a result of serving as investment manager of Australian investment offerings. Vanguard has represented to us that no Vanguard entity, trust or fund has a direct or indirect ownership in our common stock in excess of 9.9%. |

| (12) | Beneficial share ownership information is given as of December 31, 2019 and was obtained from a Schedule 13G/A filed with the SEC on February 4, 2020 by BlackRock, Inc. (“BlackRock”). According to the Schedule 13G/A, BlackRock has sole voting power over 27,183,161 shares and sole dispositive power over 27,721,095 shares of our common stock. The Schedule 13G/A states that BlackRock is a parent holding company and that various persons have the right to receive or the power to direct the receipt of dividends from or the proceeds from the sale of Sabra’s common stock but that no one person’s interest in our common stock is more than five percent of the total outstanding common shares. |

8

Table of Contents

| (13) | Beneficial share ownership information is given as of December 31, 2019 and was obtained from a Schedule 13G/A filed with the SEC on February 14, 2020 by Cohen & Steers, Inc. (“Cohen & Steers”). According to the Schedule 13G/A, Cohen & Steers has sole voting power over 11,111,219 shares and sole dispositive power over 12,158,105 shares of our common stock. The Schedule 13G/A also states that Cohen & Steers Capital Management, Inc., a wholly-owned subsidiary of Cohen & Steers, is the beneficial owner of 12,126,098 of these shares, representing 5.9% of our outstanding common stock, and has sole voting power over 11,111,219 of such shares and sole dispositive power over all 12,126,098 of such shares, and that Cohen & Steers UK Limited, a wholly-owned subsidiary of Cohen & Steers, is the beneficial owner of 32,007 of these shares, with sole dispositive power over all of such shares. |

9

Table of Contents

BOARD OF DIRECTORS AND EXECUTIVE OFFICERS

Directors of the Company

Set forth below is a brief biographical description of each of our directors, all of whom have been nominated for election to the Board of Directors at the Annual Meeting. Sabra believes that its directors should be of high character and integrity, be accomplished in their respective fields, have relevant expertise and experience and collectively represent a diversity of backgrounds and experiences. The disclosure below identifies and describes the key experience, qualifications and skills that are important for persons who serve on the Board of Directors in light of its business and structure. The specific experiences, qualifications and skills that led to the conclusion that each of our directors should serve on the Board of Directors is also included in the table and in the biographical description for each director provided below.

| • | Leadership experience. The Board of Directors believes that directors with experience in significant leadership positions, such as having served as chief executive officer of another entity, will provide the Board with special insights. These individuals generally possess extraordinary leadership qualities and the ability to identify and develop those qualities in others. They demonstrate a practical understanding of organizations, processes, strategy, risk management and the methods to drive change and growth. |

| • | Finance experience. The Board of Directors believes that an understanding of finance and financial reporting processes is important for its directors and therefore it seeks directors who are financially knowledgeable. Sabra measures its operating and strategic performance primarily by reference to financial measures. In addition, accurate financial reporting and robust auditing are critical to Sabra’s success. |

| • | Industry experience. Sabra seeks directors with experience as executives or directors or in other leadership positions in the industries in which it operates. The Board of Directors believes that such experience is important to the director’s understanding of Sabra’s operations, risks and opportunities. |

| • | Public company experience. The Board of Directors believes that directors with experience as executives or directors in publicly owned corporations, including as members of the key standing board committees of those corporations, will be more familiar with the securities laws and other issues faced by public companies that do not affect privately owned corporations. |

| • | Other experience. Sabra seeks directors who bring diverse, yet relevant experience to the Board of Directors. |

| Matros | Barbarosh | Ettl | Foster | Geary | Katzmann | Lewis | Malehorn | Walters | ||||||||||||||||||||||||||||

| Leadership experience | ||||||||||||||||||||||||||||||||||||

| CEO / Business Head | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||

| Senior Management | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||

| Finance experience | ||||||||||||||||||||||||||||||||||||

| Financial Literacy / Accounting | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||

| Financial / Capital Markets | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||

| Investment Expertise | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||

| Industry experience | ||||||||||||||||||||||||||||||||||||

| REIT / Real Estate | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||||

| Healthcare | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||

| Portfolio and Operations Management | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||||

| Public company experience | ||||||||||||||||||||||||||||||||||||

| Executive | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||||||

| Board / Committee | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||

| Other experience | ||||||||||||||||||||||||||||||||||||

| Risk Oversight / Management | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||

| Legal / Regulatory | ✓ | ✓ | ||||||||||||||||||||||||||||||||||

| Professional Accreditation / Education | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||||

10

Table of Contents

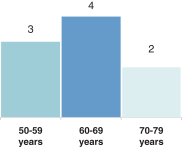

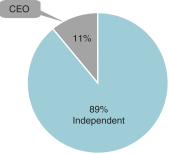

In addition to the diversity of experiences illustrated above, our Board of Directors also represents a mix of tenures and ages and is highly independent, as illustrated below:

| DIRECTOR TENURE | AGE | INDEPENDENCE | ||

|

|

| ||

Craig A. Barbarosh. Mr. Barbarosh, 52, has served on our Board of Directors since November 2010. Mr. Barbarosh also currently serves as a director, as Vice Chairman of the Board, as chair of the compensation committee and as a member of the special transaction and the nominating and governance committees, of NextGen Healthcare, Inc. (formerly known as Quality Systems, Inc.), a developer and marketer of healthcare information systems, and as a director and a member of the compensation committee of Landec Corporation, a diversified health and wellness company. From January 2016 until October 2016, Mr. Barbarosh served as a director, and as chair of the nominating and governance committee and member of the audit and compensation committees, of BioPharmX, Inc., a specialty pharmaceutical company. From September 2017 until its sale in February 2018, Mr. Barbarosh served as a director, and as a member of the compensation committee, of Bazaarvoice, Inc., a SaaS-based provider of consumer engagement software to the retail sector. From May 2018 until its sale in July 2019, Mr. Barbarosh served as a director, and as a member of the compensation committee and as chair of the strategic review committee, of Aratana Therapeutics, Inc., a specialty pharmaceutical company. Mr. Barbarosh has been a partner at the law firm of Katten Muchin Rosenman (“Katten”) since June 2012 and is a nationally recognized restructuring expert. Mr. Barbarosh serves on Katten’s Board of Directors. From 1999 until joining Katten, Mr. Barbarosh was a partner at the law firm of Pillsbury Winthrop Shaw Pittman LLP where he served in several leadership positions including on the firm’s Board of Directors, as the Chair of the firm’s Board Strategy Committee, as a co-leader of the firm’s national Insolvency & Restructuring practice section and as the Managing Partner of the firm’s Orange County office. Additionally, Mr. Barbarosh has completed certificated executive education programs at University of Pennsylvania, The Wharton School, in Corporate Valuation (2019), Harvard Business School in Effective Corporate Boards (2015), Strategic Business Valuation (2010) and Private Equity/Venture Capital (2007) and Carnegie Mellon University in Cybersecurity Oversight (2019).

Director Qualifications:

| • | Public company experience—current and former director of several public companies, including as a chair and member of various board committees; and |

| • | Other experience as a practicing attorney specializing in the area of financial and operational restructuring and related mergers and acquisitions, including in the real estate industry, and through completion of certificated executive education programs. |

Robert A. Ettl. Mr. Ettl, 60, has served on our Board of Directors since November 2010. He served as Chief Operating Officer of Harvard Management Company (HMC) from October 2008 to June 2019 and continued to serve as an advisor until December 2019. HMC manages the endowment for Harvard University. Previously, he was a Managing Director with Allianz Global Investors from 2001 to 2008, where he was most recently Chief Executive Officer for the Alpha Vision hedge fund subsidiary from 2003 to 2007 and served as an

11

Table of Contents

internal management consultant from 2007 to 2008. He was also the firm’s Global Chief Technology and Operations Officer from 2001 to 2003. Prior to its acquisition by Allianz, Mr. Ettl held various roles at Pacific Investment Management Co. (“PIMCO”) from 1995 to 2000. He joined PIMCO in 1995 as Chief Operations Officer, later focusing on PIMCO’s international expansion as Chief Operating Officer of PIMCO’s Global unit in 1998 and became Executive Vice President and Chief Information Officer in 1999. Mr. Ettl has previously held management positions in Salomon Brothers’ government arbitrage trading analytics, technology and operations divisions. He also was associated with Arthur Andersen & Co. (now Accenture) as a senior consultant. Mr. Ettl served as a director of Advent Software, Inc., a formerly publicly traded provider of software and services for the investment management industry, from November 2007 until November 2009.

Director Qualifications:

| • | Leadership experience—expertise managing operations of financial services companies in a variety of officer positions including chief executive officer, chief operating officer, and chief technology officer; |

| • | Finance experience—former chief operating officer of Harvard Management Company responsible for managing Harvard University’s endowment and related assets and previously chief executive officer of a hedge fund; |

| • | Industry experience—management consulting in the healthcare field; and |

| • | Public company experience—former director and a member of the audit committee of a public company. |

Michael J. Foster. Mr. Foster, 66, has served on our Board of Directors since November 2010. He served as a member of the predecessor Sun Healthcare Group, Inc.’s (“Old Sun”) board of directors from 2005 until our 2010 separation from Old Sun (the “Separation”) and as a member of Sun Healthcare Group, Inc.’s (“Sun”) board of directors from the Separation until Sun’s acquisition by Genesis HealthCare LLC in December 2012. Mr. Foster is a managing director of RFE Management Corp. of New Canaan, Connecticut, where he has been employed since 1989. RFE Management Corp. is the investment manager for RFE Investment Partners VII L.P., RFE Investment Partners VIII, L.P. and RFE Investment Partners IX L.P. (collectively referred to as “RFE”) and other private equity investment funds. Mr. Foster was a director of several publicly held healthcare companies more than five years ago, including Res-Care, Inc. (“Res-Care”), a formerly publicly held provider of residential training and support services for persons with developmental disabilities and certain vocational training services, from 2001 to 2005. Mr. Foster is also, and has been previously, a director of several privately held portfolio companies of RFE, including Peak Medical Corporation, an operator of long-term care inpatient centers, from 1998 to 2005.

Director Qualifications:

| • | Leadership experience—managing director of a financial services company; |

| • | Finance experience—managing director of a financial services company; |

| • | Industry experience—former director of a long-term care company; |

| • | Public company experience—former director of several public companies; and |

| • | Other experience as director of multiple privately held companies. |

Ronald G. Geary. Mr. Geary, 72, has served on our Board of Directors since our August 2017 acquisition of Care Capital Properties, Inc. (“CCP”). He served as a member of CCP’s board of directors from 2015 until the closing of our acquisition of CCP, as the chairman of CCP’s audit committee and as a member of its investment committee. Previously, he served as a member of the board of directors of Ventas, Inc. (“Ventas”) from 1998 until the spin-off of CCP from Ventas in 2015. Mr. Geary served as President of Ellis Park Race Course, Inc., a thoroughbred racetrack in Henderson, Kentucky from 2006 until July 2018. He previously served as President of Res-Care, a formerly publicly held provider of residential training and support services for persons with

12

Table of Contents

developmental disabilities and certain vocational training services, from 1990 to 2006 and as Chief Executive Officer of Res-Care from 1993 to 2006. Before that, Mr. Geary was Chief Operating Officer of Res-Care from 1990 to 1993.

Director Qualifications:

| • | Leadership experience—former president of a private company and former president, chief executive officer and chief operating officer of a publicly traded provider of residential training and support services; |

| • | Finance experience—certified public accountant (inactive) and former chairman of audit committee of a public company; |

| • | Industry experience—former executive in the healthcare industry; |

| • | Public company experience—former director, committee chair and committee member of public companies and former executive officer of a public company; and |

| • | Other experience as a practicing attorney with strong skills in corporate finance, mergers and acquisitions, strategic planning, government relations, and corporate governance. |

Lynne S. Katzmann. Ms. Katzmann, 63, has served on our Board of Directors since March 2019. She currently serves as President and Chief Executive Officer of Juniper Communities (“Juniper”), a national seniors housing company that Ms. Katzmann founded in 1988 and that invests in, develops and operates senior living and long-term care communities. Prior to founding Juniper, Ms. Katzmann was a Vice President of JMK Associates, Inc. from 1986 to 1987 and held positions at Metrocare, Inc. from 1984 to 1986 and at HealthChoice, Inc. in 1983. Ms. Katzmann has held memberships and leadership roles in various professional and community organizations, including currently serving on the Board of Directors of the Elder Care Alliance, the Executive Board of the American Seniors Housing Association, the Advisory Board of Senior Living 100, the Board of Trustees of Partners for Health, the Board of Advisors of Tufts University Medical School, and as the Secretary and Treasurer on the Board of Trustees of Naropa University. Ms. Katzmann holds a doctorate in health policy from the London School of Economics. In March 2019, Ms. Katzmann was selected as the inaugural recipient of the McKnight’s Women of Distinction Lifetime Achievement Award for her outstanding contributions to senior living and skilled care. In January 2020, Ms. Katzmann was inducted into the American Senior Housing Hall of Fame, Class of 2020.

Director Qualifications:

| • | Leadership experience—current president and chief executive officer of a national seniors housing company; and |

| • | Industry experience—founder and current president and chief executive officer of a national seniors housing company that is spearheading an industry-wide initiative in managed care to improve outcomes and drive new revenues to seniors housing for preventative care and lifestyle management. |

Raymond J. Lewis. Mr. Lewis, 55, has served on our Board of Directors since our August 2017 acquisition of CCP. He was CCP’s Chief Executive Officer and a member of its board of directors from the August 2015 spin-off of CCP from Ventas until the closing of our acquisition of CCP, and was a member of its executive committee and investment committee. Mr. Lewis has served as President and Chief Executive Officer and a member of the board of directors of Treehouse REIT, Inc., a privately held real estate investment trust (“REIT”) that owns a net leased portfolio of cannabis-related real estate, since September 2019. From 2002 to 2015, he held various executive positions of increasing responsibility at Ventas, most recently serving as President from 2010 to 2015. Before that, he was Managing Director of Business Development for GE Capital Healthcare Financial Services, a division of General Electric Capital Corporation (“GECC”), where he led a team focused on mergers and portfolio acquisitions of healthcare assets, and Executive Vice President of Healthcare Finance for

13

Table of Contents

Heller Financial, Inc., which was acquired by GECC in 2001, where he had primary responsibility for healthcare lending. He is Chairman Emeritus of the National Investment Center for the Seniors Housing & Care Industry, a former member of the Advisory Board of Governors of Nareit, and former Vice Chairman of the American Seniors Housing Association.

Director Qualifications:

| • | Leadership experience—former executive of publicly traded healthcare REITs and current chief executive officer of a privately held REIT; |

| • | Finance experience—former executive of financial services companies with responsibility for healthcare lending and mergers and portfolio acquisitions, and experience in financing operations, including by accessing capital markets, as an executive of publicly traded healthcare REITs; |

| • | Industry experience—former director and executive of publicly traded healthcare REITs with strong skills in real estate finance, mergers and acquisitions, portfolio management, capital markets, and strategic planning; and |

| • | Public company experience—former director and executive of publicly traded healthcare REITs. |

Jeffrey A. Malehorn. Mr. Malehorn, 59, has served on our Board of Directors since our August 2017 acquisition of CCP. He served as a member of CCP’s board of directors from 2015 until the closing of our acquisition of CCP, and as a member of its compensation, executive and investment committees. Mr. Malehorn has served as Principal at L3.0 Ventures, LLC since January 2019. Mr. Malehorn was the President and Chief Executive Officer of World Business Chicago, a public-private, non-profit, partnership between the City of Chicago and the business community focused on economic development, from 2013 until November 2017 and now serves as a board member. He previously spent 28 years in various capacities at General Electric Corporation, most recently serving as President and CEO of GE Capital, Commercial Distribution Finance, from 2009 to 2012, President and CEO of GE Capital Healthcare Financial Services from 2004 to 2008, and President and CEO of GE Commercial Finance’s Global Financial Restructuring Business from 2002 to 2004. Additionally, Mr. Malehorn was Corporate Citizenship Leader for GE Chicago and the Co-Leader for GE Capital America’s Commercial Council. He was named a GE Company Officer in 2001. From 1991 through 2001, Mr. Malehorn was a Leader at GE Capital Real Estate, where he founded and led the Senior Living & Hospitality Financing business unit from 1993 to 1995, led the debt and equity origination business nationally from 1997 to 1998, and was the European Platform Leader from 1999 to early 2002. Mr. Malehorn is the former Chairman of the Board of the Metropolitan Chicago American Heart Association, serves as a Board member of mHub and the Greater Chicago Food Depository and was a founding Midwest Board member for BuildOn.

Director Qualifications:

| • | Leadership experience—variety of officer positions including president and chief executive officer; |

| • | Finance experience—variety of officer and other positions in the financial services industry; |

| • | Industry experience—executive experience and strong skills in portfolio and operations management and other areas; and |

| • | Public company experience—former director and committee member of a publicly traded healthcare REIT. |

Richard K. Matros. Mr. Matros, 66, has served as Sabra’s President and Chief Executive Officer and as a director since May 2010, and he has served as Chairman of the Board since November 2010. He was Chairman of the board of directors and Chief Executive Officer of Old Sun from 2001 until the Separation. Mr. Matros founded and served as Chief Executive Officer and President of Bright Now! Dental from 1998 to 2000 and as a director from 1998 until its sale in December 2010. From 1998 until the sale of its operations in 2006, Mr. Matros was also a member of, and served on the management committee of, CareMeridian, LLC

14

Table of Contents

(“CareMeridian”), a healthcare company that specialized in offering subacute and skilled nursing for patients suffering from traumatic brain injury, spinal cord injury and other catastrophic injuries. Previously, from 1994 to 1997, he served Regency Health Services, Inc., a publicly held long-term care operator, holding the positions of Chief Executive Officer, President, director and Chief Operating Officer. Prior to that time, from 1988 to 1994, he served Care Enterprises, Inc., holding the positions of Chief Executive Officer, President, Chief Operating Officer, director and Executive Vice President—Operations. Mr. Matros currently serves on the executive board for RFE Investment Partners and is the Executive Producer of Sabra Films, LLC.

Director Qualifications:

| • | Leadership experience—current and former chief executive officer; |

| • | Finance experience—experience in financing operations, including by accessing capital markets, as an executive of publicly held companies; |

| • | Industry experience—chief executive officer of Sabra since the Separation and executive of long-term care companies for over 25 years and experience in long-term care companies for 35 years; and |

| • | Public company experience—current and former chief executive officer of publicly held companies. |

Milton J. Walters. Mr. Walters, 77, has served on our Board of Directors since November 2010. He served as a member of Old Sun’s board of directors from 2001 until the Separation and as a member of Sun’s board of directors, the chairman of Sun’s audit committee and a member of its compensation committee from the Separation until Sun’s acquisition by Genesis HealthCare LLC in December 2012. Mr. Walters’s background includes 25 years of investment banking in leadership roles primarily focused on financial company clients. Included were specialty finance, bank, thrift, leasing company, and captive finance companies of major industrial and energy companies. Services provided included commercial paper issuance, debt and equity financing, both public and private, mutual to stock conversions, strategy consulting and merger and acquisition advice. He led banking professions at Warburg Paribas Becker, formerly A.G. Becker, from 1968 to August 1984, rising to Managing Director, and Smith Barney, as Managing Director, from October 1984 to May 1988. With both organizations, his responsibilities encompassed all operations including staffing, P&L management, transaction management, client maintenance, new business development, and strategy. Since then, with the exception of 1997 to 1999 when he served in a senior new business role of Managing Director at Prudential Securities, Mr. Walters has provided financial consulting services to corporate clients as President through his wholly owned company, Tri-River Capital. Additionally, from 2008 until its sale in June 2014, Mr. Walters served as a director, as chair of the audit committee, and as a member of the nominating and governance committee of Frederick’s of Hollywood Group, Inc., a former publicly held company that designed, manufactured and sold women’s clothing. Leading into its sale, he also served as the lead director and sole member of the independent Board committee. Mr. Walters also serves on the board of directors and as the vice president and a member of the executive committee of Lyme Land Conservation Trust, a non-profit organization, and formerly served as chairman of the board of directors of the Southeast Connecticut World Affairs Council, also a non-profit organization.

Director Qualifications:

| • | Leadership experience—current president of a financial consulting firm, former managing director and group leader at investment banking companies and former chairman of a non-profit organization; |

| • | Finance experience—former audit committee chairman of public companies and extensive experience from 40 years of financial consulting and investment banking positions; and |

| • | Public company experience—director, audit committee chairman, lead director and sole independent committee chairman of public companies. |

15

Table of Contents

Executive Officers of the Company

The following sets forth biographical information regarding our executive officers, other than Mr. Matros, whose biographical information is set forth above.

Harold W. Andrews, Jr. Mr. Andrews, 55, served as Sabra’s Treasurer and Secretary from May 2010 to November 2010 and has served as Sabra’s Executive Vice President, Chief Financial Officer and Secretary since November 2010. From 1997 to 2017, Mr. Andrews was a member of, and served on the management committee of, Journey Health Properties, LLC and Journey Lane 5, LLC, two real estate holding entities he organized to own and lease specialized healthcare facilities and a commercial office building. From 1997 to May 2008, Mr. Andrews was also a member, served on the management committee and served as Chief Financial Officer of CareMeridian. Previously, from 1996 to 1997, Mr. Andrews served as the Vice President of Finance for Regency Health Services, Inc., a provider of post-acute care services. Prior to that time, he spent 10 years in public accounting at Arthur Andersen LLP, including serving as senior manager for publicly traded healthcare and real estate companies. Mr. Andrews is also a certified public accountant and a member of the AICPA and Financial Executives International. He also serves on the board of directors of Links Players International, a non-profit organization.

Talya Nevo-Hacohen. Ms. Nevo-Hacohen, 60, has served as Sabra’s Executive Vice President, Chief Investment Officer and Treasurer since November 2010. From September 2006 to August 2008 and from February 2009 to November 2010, Ms. Nevo-Hacohen served as an advisor to private real estate developers and operators regarding property acquisitions and dispositions, corporate capitalization, and equity and debt capital raising. From August 2008 to February 2009, Ms. Nevo-Hacohen was a Managing Director with Cerberus Real Estate Capital Management, LLC, an affiliate of Cerberus Capital Management, L.P., a private investment firm. From 2003 to 2006, Ms. Nevo-Hacohen served as Senior Vice President—Capital Markets and Treasurer for HCP, Inc., a healthcare REIT. Previously, from 1993 to 2003, Ms. Nevo-Hacohen worked for Goldman, Sachs & Co. where she was a Vice President in the investment banking and finance, operations and administration divisions. Prior to her affiliation with Goldman Sachs, she practiced architecture and was associated with several architectural firms in New York.

There are no family relationships among any of our directors or executive officers.

16

Table of Contents

We are committed to effective corporate governance that promotes the long-term interests of our stockholders and strengthens Board and management accountability.

Governance Highlights

| ✓ Annual Election of Directors |

✓ Active Stockholder Engagement Practices | |

| ✓ Highly Independent Board (8 of 9 Directors) and Fully Independent Committees |

✓ Policies and Practices to Align Executive Compensation with Long-Term Stockholder Interests | |

| ✓ Four New Independent Directors in Last Three Years |

✓ Lead Independent Director with a Well-Defined Role and Robust Responsibilities | |

| ✓ Comprehensive New Director Orientation Process |

✓ Annual Review of CEO and Management Succession Plans | |

| ✓ Majority Voting for Directors in Uncontested Elections, with a Director Resignation Policy |

✓ Commitment to Consider Qualified Female and Minority Candidates | |

| ✓ No Supermajority Vote Requirements |

✓ Written Related Person Transaction Policy | |

| ✓ Robust Stock Ownership Requirements for Executives and Directors |

✓ Anti-Hedging and Anti-Pledging Policies | |

| ✓ Annual Board and Committee Evaluations |

✓ Clawback Policy | |

| ✓ Regular Executive Sessions of Independent Directors |

✓ Stockholder Proxy Access Right Reflecting Market Standard Terms | |

| ✓ Stockholder Right to Amend Bylaws by Majority Vote |

✓ No Stockholder Rights Plan |

Corporate Governance Guidelines

The Board of Directors has adopted Corporate Governance Guidelines, which provide the framework for the governance of our company and represent the Board’s current views with respect to selected corporate governance issues considered to be of significance to our stockholders. The Corporate Governance Guidelines direct our Board’s actions with respect to, among other things, Board composition and director qualifications, selection of the Chairman of the Board and the Lead Independent Director, composition of the Board’s standing committees, stockholder communications with the Board, succession planning and the Board’s annual performance evaluation.

Our Corporate Governance Guidelines underscore our focus on diversity, by explicitly stating that the Board of Directors and the Nominating and Governance Committee are committed to actively seeking qualified women and individuals from minority groups to include in the pool from which new Board members or director nominees are selected.

A current copy of the Corporate Governance Guidelines is posted in the Investors—Corporate Governance section of our website at www.sabrahealth.com.

Stockholder Engagement

Our management and our Board of Directors value the input of our stockholders and prioritize engaging with our stockholders to directly receive their feedback. Over the past year, we engaged with our stockholders by various methods, including meetings with stockholders at the 14 investor conferences we attended, direct outreach to stockholders and in connection with stockholder-initiated matters, on a variety of topics, including updates on our business, corporate strategy, industry feedback, corporate governance, executive compensation practices, and ESG issues. Stockholder feedback is shared with our Board of Directors and its committees, which enhances our corporate governance practices and facilitates future dialogue with our stockholders.

17

Table of Contents

Our stockholder engagement is a collaborative process and we regularly seek feedback on whether the information we report, as well as our corporate governance practices and other topics described above, are responsive to investor needs. As examples of this collaborative approach, in recent years, we have made substantial revisions to our quarterly supplemental disclosure package to reflect input from our stockholders and received very positive feedback on those revisions; we amended our Bylaws to provide our stockholders, to the same extent as the Board, the power to amend our Bylaws; we amended our Corporate Governance Guidelines to underscore our commitment to diversity as part of our engagement with our stockholders regarding governance matters; and we upheld that commitment to diversity in the most recent search for a new Board member and resulting appointment of Ms. Katzmann as a new director. In addition, we amended our Bylaws to implement proxy access following engagement on this topic with our stockholders.

Director Independence

Our Corporate Governance Guidelines require that a substantial majority of our Board of Directors qualify as “independent directors” under applicable rules of The Nasdaq Stock Market LLC (the “Nasdaq rules”) and the rules and regulations of the SEC. In considering the independence of each director, the Board of Directors reviews information provided by each director and considers whether any director has a relationship that would interfere with the director’s exercise of independent judgment in carrying out his responsibilities as a director. Our Board of Directors has affirmatively determined that none of Messrs. Barbarosh, Ettl, Foster, Geary, Lewis, Malehorn or Walters nor Ms. Katzmann has a relationship that, in the opinion of the Board of Directors, would interfere with the director’s exercise of independent judgment in carrying out his or her responsibilities as a director and that each such director is an independent director under the Nasdaq rules. Mr. Matros does not qualify as an independent director because he is employed as our President and Chief Executive Officer.

Proxy Access

Our Board of Directors has implemented a proxy access provision in our Bylaws, which permits a stockholder, or group of up to 20 stockholders, owning 3% or more of our outstanding common stock continuously for at least three years, to nominate and require us to include in our proxy materials for an annual meeting of stockholders director candidates constituting up to 25% of the Board of Directors (rounded down to the nearest whole number, but not less than two), provided that the stockholder(s) and the nominee(s) satisfy the eligibility and procedural requirements described in our Bylaws. For more information on using proxy access to nominate directors, see “Stockholder Proposals and Director Nominations for 2021 Annual Meeting of Stockholders.”

Committees of the Board of Directors

The standing committees of our Board of Directors include: Audit, Compensation, and Nominating and Governance. The members of these standing committees are appointed by and serve at the discretion of the Board of Directors. Current copies of the charters for each of these committees are posted in the Investors—Corporate Governance section of our website at www.sabrahealth.com.

Our Chief Executive Officer and our Chief Financial Officer and Secretary regularly attend meetings of our Board committees when they are not in executive session and report on matters that are not addressed by other officers. In addition, our directors are encouraged to communicate directly with members of management regarding matters of interest, including matters related to risk, at times when meetings are not being held.

18

Table of Contents

The following table presents the composition of the committees of our Board of Directors as of the date of this Proxy Statement and the number of meetings held by each committee in 2019:

| Name |

Audit Committee | Compensation Committee | Nominating and Governance Committee | |||

| Craig A. Barbarosh |

Chair | ✓ | ||||

| Robert A. Ettl |

Chair | Chair | ||||

| Michael J. Foster |

✓ | ✓ | ||||

| Ronald G. Geary |

✓ | ✓ | ||||

| Lynne S. Katzmann |

||||||

| Raymond J. Lewis |

||||||

| Jeffrey A. Malehorn |

✓ | ✓ | ||||

| Milton J. Walters |

✓ | ✓ | ✓ | |||

| Total Meetings in 2019 |

5 | 4 | 2 |

Audit Committee

The Audit Committee consists of Messrs. Barbarosh (Chair), Foster, Geary, Malehorn and Walters. The Board of Directors has determined that each member of the Audit Committee is an “independent director” under the Nasdaq rules. In addition, each member of the Audit Committee is also “independent” under Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and satisfies the additional financial literacy requirements of the Nasdaq rules. The Board has designated two members of the Audit Committee, Messrs. Foster and Geary, as “audit committee financial experts” as defined by SEC rules. The Board based its determination on the qualifications and business experience of each of Messrs. Foster and Geary described above under “Board of Directors and Executive Officers—Directors of the Company.”

The Audit Committee is responsible for overseeing Sabra’s accounting and financial reporting processes and the audit of Sabra’s financial statements, including the integrity of Sabra’s financial statements, the qualifications and independence of Sabra’s independent registered public accounting firm and the performance of Sabra’s independent registered public accounting firm and internal auditors. Among other things, the Audit Committee is responsible for the appointment, compensation and retention of Sabra’s independent registered public accounting firm; pre-approval of all audit and non-audit services to be performed by the independent registered public accounting firm; review of Sabra’s internal controls and disclosure controls and procedures; oversight of Sabra’s internal audit function; oversight of Sabra’s legal and regulatory compliance and risk assessment and risk management policies; and review and approval of any related party transactions. The Audit Committee is also responsible for preparing the Audit Committee Report included in this Proxy Statement. In performing its responsibilities, the Audit Committee meets regularly with management, Sabra’s independent registered public accounting firm and Sabra’s internal auditors.

Compensation Committee

The Compensation Committee consists of Messrs. Ettl (Chair), Barbarosh, Malehorn and Walters. The Board of Directors has determined that each member of the Compensation Committee is an “independent director” under the Nasdaq rules. In making the determination regarding the independence of each member of the Compensation Committee, the Board of Directors considered whether the director has a relationship with Sabra that is material to the director’s ability to be independent from management in connection with the duties of a member of the Compensation Committee.

The Compensation Committee oversees and determines the compensation of Sabra’s Chief Executive Officer and other executive officers, including salaries, bonuses and awards of equity-based compensation, approves all employment and severance agreements for executive officers, makes recommendations to the Board with respect to the adoption or amendment of incentive compensation plans and stock-based benefit plans,

19

Table of Contents

administers Sabra’s stock-based benefit plans and makes recommendations to the Board of Directors concerning the compensation of directors. The Compensation Committee is also responsible for reviewing the Compensation Discussion and Analysis included in this Proxy Statement and for preparing the Compensation Committee Report included in this Proxy Statement.

The Compensation Committee is solely responsible for making the final decisions on compensation for Sabra’s executive officers. However, the Compensation Committee takes into account recommendations of Sabra’s Chief Executive Officer in determining the compensation (including stock awards) of executive officers other than the Chief Executive Officer. Otherwise, Sabra’s officers do not have any role in determining the form or amount of compensation paid to the executive officers of Sabra. In addition, the Compensation Committee retains the power to appoint and delegate matters to a subcommittee comprised of at least one member of the Compensation Committee, except that the Compensation Committee may not delegate to a subcommittee any power or authority required by any law, regulation or listing standard to be exercised by the Compensation Committee as a whole. The Compensation Committee does not currently intend to delegate any of its responsibilities to a subcommittee.

Pursuant to its charter, the Compensation Committee is authorized to retain compensation consultants to assist in the evaluation of compensation to Sabra’s executive officers. As further described under “Executive Compensation—Compensation Discussion and Analysis” below, since our becoming a separate publicly traded company, the Compensation Committee has retained Frederic W. Cook & Company, Inc. (“FW Cook”) as its independent compensation consultant to assist the Compensation Committee with the design and structure of our executive compensation program and the amounts payable thereunder. The Compensation Committee is directly responsible for the appointment, compensation and oversight of FW Cook’s work, and does not believe FW Cook’s work has raised any conflicts of interest. FW Cook reports only to the Compensation Committee and does not perform services for us, except for executive compensation-related services on behalf of, and as instructed by, the Compensation Committee. All compensation decisions were made solely by our Compensation Committee.

Nominating and Governance Committee

The Nominating and Governance Committee consists of Messrs. Ettl (Chair), Foster, Geary and Walters. The Board of Directors has determined that each member of the Nominating and Governance Committee is an “independent director” under the Nasdaq rules.

As further described below under “—Director Nomination Process,” the Nominating and Governance Committee assists our Board of Directors in identifying individuals qualified to become Board members and selecting the director nominees for each annual meeting of stockholders. The Nominating and Governance Committee also makes recommendations to the Board of Directors concerning the structure and operations of the Board and its committees and is responsible for overseeing the Corporate Governance Guidelines, for developing and recommending to the Board of Directors any changes to the Corporate Governance Guidelines, for overseeing new director orientation and director continuing education and for receiving reports annually from the Chief Executive Officer concerning senior management development and succession plans.

Meetings and Attendance

During 2019, our Board of Directors held four meetings. Each of our directors attended at least 75% of the aggregate meetings of the Board and the committees of the Board on which the director served during 2019. In addition, the independent directors meet regularly in executive session without the presence of management. Mr. Foster, who has been designated by the independent directors as Lead Independent Director, chairs these executive sessions of the independent directors.

20

Table of Contents

Our Board of Directors encourages each director to attend the annual meeting of stockholders. All of our directors attended the 2019 annual meeting of stockholders in person or by telephone.

Board Leadership Structure

Our Corporate Governance Guidelines provide that the Board is free to make its choice for Chairman and Chief Executive Officer in any way that the Board of Directors considers best for Sabra at a given point in time. Accordingly, the Chairman and Chief Executive Officer positions may be filled by one individual or by two different individuals. The Board believes that the most effective leadership structure for Sabra at this time is for Mr. Matros to serve as both our Chairman and Chief Executive Officer, in concert with an independent director serving as our Lead Independent Director.

Our Board of Directors believes that Mr. Matros, our Chief Executive Officer, is best suited to serve as our Chairman because he is the director most familiar with Sabra’s business and industry and most capable of identifying strategic priorities. In the Board’s view, combining the roles of Chairman and Chief Executive Officer facilitates the flow of information between management and the Board, and helps assure that the strategies adopted by the Board will be best positioned for execution by management.