Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22421

iShares MSCI Russia Capped ETF, Inc.

(Exact name of Registrant as specified in charter)

c/o: State Street Bank and Trust Company

200 Clarendon Street, Boston, MA 02116

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

351 West Camden Street, Baltimore, MD 21201

(Name and address of agent for service)

Registrant’s telephone number, including area code: 415-670-2000

Date of fiscal year end: August 31, 2013

Date of reporting period: August 31, 2013

Table of Contents

Item 1. Reports to Stockholders.

Table of Contents

AUGUST 31, 2013

|

2013 ANNUAL REPORT

|

|

iShares MSCI Russia Capped ETF, Inc.

| Ø | iShares MSCI Russia Capped ETF | ERUS | NYSE Arca |

Table of Contents

| 5 | ||||

| 8 | ||||

| 8 | ||||

| 9 | ||||

| 10 | ||||

| 13 | ||||

| 14 | ||||

| 20 | ||||

| 21 | ||||

| 22 | ||||

| 26 | ||||

| 27 |

Table of Contents

Management’s Discussion of Fund Performance

iSHARES® MSCI RUSSIA CAPPED ETF

EMERGING MARKETS OVERVIEW

Stocks in emerging markets posted mixed results for the 12-month period ended August 31, 2013 (the “reporting period”), but produced relatively flat returns overall. Emerging markets stocks experienced significant volatility during the reporting period, including a substantial rally during the first four months of the reporting period, followed by a sharp decline over the subsequent six months before recovering somewhat during the final two months of the reporting period.

Emerging markets stocks posted strong gains during the last four months of 2012 amid improving global economic conditions. In the fall of 2012, central banks around the world took aggressive actions to stimulate economic growth. Most notably, central banks in the U.S. and U.K. increased their quantitative easing activity, while the Bank of Japan introduced quantitative easing measures for the first time. In addition, a temporary resolution to the “fiscal cliff” in the U.S. (the expiration of certain federal tax cuts and the implementation of automatic U.S. government spending reductions set to take place in early 2013) and positive signs in Europe regarding its sovereign debt crisis helped lift investor confidence. As a result, emerging markets stocks advanced by approximately 15% as a group for the last four months of 2012.

Market conditions changed in early 2013 as evidence of a slowdown in several major emerging economies appeared, driven in part by lower exports to developed countries. In particular, the four largest emerging markets — China, India, Russia and Brazil — all experienced weaker economic growth during the reporting period. The slowdown in emerging economies led to a sharp reversal in emerging markets stocks; from their peak in early January 2013 through their trough in late June 2013, emerging markets stocks fell by more than 17%.

Although they remained volatile, emerging markets stocks rebounded over the final two months of the reporting period. Promising economic news in Europe and Japan led to optimism regarding a recovery in exports from emerging markets to developed economies. For the reporting period, emerging markets stocks advanced by less than 1%.

Emerging markets in Asia held up the best, posting gains of more than 6% as a group for the reporting period. Despite a continued slowdown in the Chinese economy, China’s stock market generated double-digit gains thanks to a robust property market and better economic data late in the reporting period. Other strong performers in this region included the Philippines and Taiwan. On the downside, stock markets in India and Indonesia produced the most significant declines as both economies slowed markedly during the reporting period.

Emerging markets in Latin America faced the largest declines, falling by more than 11% for the reporting period. Brazil, the largest market in the region, declined by approximately 16% for the reporting period. The Brazilian economy nearly slipped into recession in late 2012, and although it recovered somewhat in the first half of 2013, its growth rate for the 12 months ended June 30, 2013 was just a third of its peak growth rate three years earlier. Chile, whose economy slowed as global demand for commodities eased, and Peru posted the largest declines among Latin American stock markets, while Mexico was the only market in the region to deliver a positive return for the reporting period.

Eastern European stock markets generated modestly negative returns for the reporting period. Stock markets in Hungary, where the economy emerged from recession during the reporting period, and Poland posted the best returns, while Turkey and the Czech Republic declined the most. Russia, the largest market in the region, declined slightly for the reporting period.

| MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE |

5 |

Table of Contents

Management’s Discussion of Fund Performance

iSHARES® MSCI RUSSIA CAPPED ETF

Performance as of August 31, 2013

| Average Annual Total Returns | Cumulative Total Returns | |||||||||||||||||||||||||

| NAV | MARKET | INDEX | NAV | MARKET | INDEX | |||||||||||||||||||||

| 1 Year |

(3.40)% | (3.71)% | (2.63)% | (3.40)% | (3.71)% | (2.63)% | ||||||||||||||||||||

| Since Inception |

(5.70)% | (5.84)% | (5.16)% | (15.22)% | (15.55)% | (13.82)% | ||||||||||||||||||||

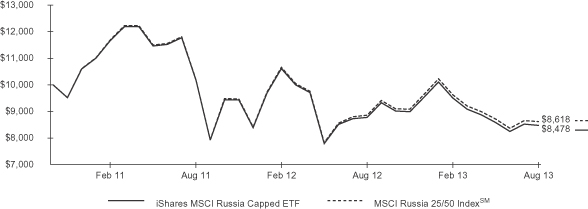

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was 11/9/10. The first day of secondary market trading was 11/10/10.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” on page 8 for more information.

| Shareholder Expenses | ||||||||||||||||||||||||||

| Actual | Hypothetical 5% Return | |||||||||||||||||||||||||

| Beginning Account Value (3/1/13) |

Ending Account Value (8/31/13) |

Expenses Paid During Period a |

Beginning Account Value (3/1/13) |

Ending Account Value (8/31/13) |

Expenses Paid During Period a |

Annualized Expense Ratio |

||||||||||||||||||||

| $ | 1,000.00 | $ | 892.00 | $ | 2.91 | $ | 1,000.00 | $ | 1,022.10 | $ | 3.11 | 0.61% | ||||||||||||||

| a | Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (184 days) and divided by the number of days in the year (365 days). See “Shareholder Expenses” on page 8 for more information. |

The iShares MSCI Russia Capped ETF (the “Fund”), formerly the iShares MSCI Russia Capped Index Fund, seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI Russia 25/50 IndexSM (the “Index”). The Index is a free float-adjusted market capitalization-weighted index designed to measure the performance of equity securities listed on stock exchanges in Russia. The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index. For the 12-month reporting period ended August 31, 2013, the total return for the Fund was -3.40%, net of fees, while the total return for the Index was -2.63%.

| 6 | 2013 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

Management’s Discussion of Fund Performance (Continued)

iSHARES® MSCI RUSSIA CAPPED ETF

As represented by the Index, the Russian stock market declined by nearly 3% for the reporting period, trailing the fractional gain of the broad emerging markets index. The Russian economy slowed markedly during the reporting period, growing by just 1.2% for the 12 months ended June 30, 2013, down from a 4.3% growth rate for the prior 12 months. Russia’s economy is driven primarily by commodities, as it is the world’s largest oil producer, the biggest natural gas exporter and a major producer of metals such as nickel and palladium. Reduced global demand for energy and other commodities, along with falling commodity prices, contributed to the decline in Russia’s economy. This trend was a key factor behind the negative returns for the Russian equity market during the reporting period.

In addition, exports to Europe — Russia’s largest trading partner — are an important component of Russia’s economy, and recessions across much of Europe during the reporting period led to lower export demand. This further weakened the Russian economy. Despite the economic slowdown, the Russian central bank held interest rates steady as inflation remained elevated at 6.5%, up from 5.9% at the beginning of the reporting period.

A stronger U.S. dollar lowered international equity returns for U.S. investors and had a negative impact on Index performance for the reporting period, as the U.S. dollar appreciated by 3% against the Russian ruble.

| MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE |

7 |

Table of Contents

Past performance is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end is available at www.iShares.com. Performance results assume reinvestment of all dividends and capital gain distributions and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. The investment return and principal value of shares will vary with changes in market conditions. Shares may be worth more or less than their original cost when they are redeemed or sold in the market. Performance for certain funds may reflect a waiver of a portion of investment management fees. Without such waiver, performance would have been lower.

Net asset value or “NAV” is the value of one share of a fund as calculated in accordance with the standard formula for valuing mutual fund shares. The price used to calculate market return (“Market Price”) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of a fund are listed for trading, as of the time that such fund’s NAV is calculated. Since shares of a fund may not have traded in the secondary market until after the fund’s inception, for the period from inception to the first day of secondary trading, the NAV of the fund is used as a proxy for the Market Price to calculate market returns. Market and NAV returns assume that dividends and capital gain distributions have been reinvested at Market Price and NAV, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower.

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of fund shares and (2) ongoing costs, including management fees and other fund expenses. The expense example, which is based on an investment of $1,000 invested on March 1, 2013 and held through August 31, 2013, is intended to help you understand your ongoing costs (in dollars and cents) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds.

Actual Expenses — The table provides information about actual account values and actual expenses. To estimate the expenses that you paid on your account over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number for your Fund under the heading entitled “Expenses Paid During Period.”

Hypothetical Example for Comparison Purposes — The table also provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of fund shares. Therefore, the hypothetical examples are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| 8 | 2013 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

iSHARES® MSCI RUSSIA CAPPED ETF

August 31, 2013

| SCHEDULE OF INVESTMENTS |

9 |

Table of Contents

Statement of Assets and Liabilities

iSHARES® MSCI RUSSIA CAPPED ETF

August 31, 2013

| ASSETS |

||||

| Investments, at cost: |

||||

| Unaffiliated |

$ | 354,968,684 | ||

| Affiliated (Note 2) |

2,702,811 | |||

|

|

|

|||

| Total cost of investments |

$ | 357,671,495 | ||

|

|

|

|||

| Investments in securities, at fair value (Note 1): |

||||

| Unaffiliated |

$ | 306,643,610 | ||

| Affiliated (Note 2) |

2,702,811 | |||

|

|

|

|||

| Total fair value of investments |

309,346,421 | |||

| Receivables: |

||||

| Investment securities sold |

6,089,873 | |||

| Due from custodian (Note 4) |

536,251 | |||

| Dividends |

1,388,721 | |||

|

|

|

|||

| Total Assets |

317,361,266 | |||

|

|

|

|||

| LIABILITIES |

||||

| Payables: |

||||

| Investment securities purchased |

6,699,177 | |||

| Investment advisory fees (Note 2) |

151,291 | |||

|

|

|

|||

| Total Liabilities |

6,850,468 | |||

|

|

|

|||

| NET ASSETS |

$ | 310,510,798 | ||

|

|

|

|||

| Net assets consist of: |

||||

| Paid-in capital |

$ | 369,151,766 | ||

| Undistributed net investment income |

681,247 | |||

| Accumulated net realized loss |

(10,954,931 | ) | ||

| Net unrealized depreciation |

(48,367,284 | ) | ||

|

|

|

|||

| NET ASSETS |

$ | 310,510,798 | ||

|

|

|

|||

| Shares outstandinga |

15,650,000 | |||

|

|

|

|||

| Net asset value per share |

$ | 19.84 | ||

|

|

|

|||

| a | $0.001 par value, number of shares authorized: 1 billion. |

See notes to financial statements.

| 10 | 2013 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

Statement of Operations

iSHARES® MSCI RUSSIA CAPPED ETF

Year ended August 31, 2013

| NET INVESTMENT INCOME |

||||

| Dividends — unaffiliateda |

$ | 7,876,195 | ||

| Interest — affiliated (Note 2) |

145 | |||

|

|

|

|||

| Total investment income |

7,876,340 | |||

|

|

|

|||

| EXPENSES |

||||

| Investment advisory fees (Note 2) |

1,378,297 | |||

|

|

|

|||

| Total expenses |

1,378,297 | |||

|

|

|

|||

| Net investment income |

6,498,043 | |||

|

|

|

|||

| NET REALIZED AND UNREALIZED GAIN (LOSS) |

||||

| Net realized gain (loss) from: |

||||

| Investments — unaffiliated |

(10,650,600 | ) | ||

| In-kind redemptions — unaffiliated |

7,466,156 | |||

| Foreign currency transactions |

(271,118 | ) | ||

|

|

|

|||

| Net realized loss |

(3,455,562 | ) | ||

|

|

|

|||

| Net change in unrealized appreciation/depreciation on: |

||||

| Investments |

(24,794,367 | ) | ||

| Translation of assets and liabilities in foreign currencies |

(28,838 | ) | ||

|

|

|

|||

| Net change in unrealized appreciation/depreciation |

(24,823,205 | ) | ||

|

|

|

|||

| Net realized and unrealized loss |

(28,278,767 | ) | ||

|

|

|

|||

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS |

$ | (21,780,724 | ) | |

|

|

|

|||

| a | Net of foreign withholding tax of $1,389,917. |

See notes to financial statements.

| FINANCIAL STATEMENTS |

11 |

Table of Contents

Statements of Changes in Net Assets

iSHARES® MSCI RUSSIA CAPPED ETF

| Year ended August 31, 2013 |

Year ended August 31, 2012 |

|||||||

| INCREASE (DECREASE) IN NET ASSETS |

||||||||

| OPERATIONS: |

||||||||

| Net investment income |

$ | 6,498,043 | $ | 2,489,928 | ||||

| Net realized loss |

(3,455,562 | ) | (3,090,218 | ) | ||||

| Net change in unrealized appreciation/depreciation |

(24,823,205 | ) | (14,535,510 | ) | ||||

|

|

|

|

|

|||||

| Net decrease in net assets resulting from operations |

(21,780,724 | ) | (15,135,800 | ) | ||||

|

|

|

|

|

|||||

| DISTRIBUTIONS TO SHAREHOLDERS: |

||||||||

| From net investment income |

(5,545,678 | ) | (2,641,795 | ) | ||||

|

|

|

|

|

|||||

| Total distributions to shareholders |

(5,545,678 | ) | (2,641,795 | ) | ||||

|

|

|

|

|

|||||

| CAPITAL SHARE TRANSACTIONS: |

||||||||

| Proceeds from shares sold |

384,012,350 | 90,887,177 | ||||||

| Cost of shares redeemed |

(193,201,247 | ) | (37,918,790 | ) | ||||

|

|

|

|

|

|||||

| Net increase in net assets from capital share transactions |

190,811,103 | 52,968,387 | ||||||

|

|

|

|

|

|||||

| INCREASE IN NET ASSETS |

163,484,701 | 35,190,792 | ||||||

| NET ASSETS |

||||||||

| Beginning of year |

147,026,097 | 111,835,305 | ||||||

|

|

|

|

|

|||||

| End of year |

$ | 310,510,798 | $ | 147,026,097 | ||||

|

|

|

|

|

|||||

| Undistributed net investment income included in net assets at end of year |

$ | 681,247 | $ | — | ||||

|

|

|

|

|

|||||

| SHARES ISSUED AND REDEEMED |

||||||||

| Shares sold |

17,850,000 | 4,250,000 | ||||||

| Shares redeemed |

(9,150,000 | ) | (1,750,000 | ) | ||||

|

|

|

|

|

|||||

| Net increase in shares outstanding |

8,700,000 | 2,500,000 | ||||||

|

|

|

|

|

|||||

See notes to financial statements.

| 12 | 2013 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

iSHARES® MSCI RUSSIA CAPPED ETF

(For a share outstanding throughout each period)

| Year ended Aug. 31, 2013 |

Year ended Aug. 31, 2012 |

Period from to Aug. 31, 2011 |

||||||||||

| Net asset value, beginning of period |

$ | 21.15 | $ | 25.13 | $ | 25.00 | ||||||

|

|

|

|

|

|

|

|||||||

| Income from investment operations: |

||||||||||||

| Net investment incomeb |

0.62 | 0.50 | 0.45 | |||||||||

| Net realized and unrealized gain (loss)c |

(1.35 | ) | (4.00 | ) | 0.03 | |||||||

|

|

|

|

|

|

|

|||||||

| Total from investment operations |

(0.73 | ) | (3.50 | ) | 0.48 | |||||||

|

|

|

|

|

|

|

|||||||

| Less distributions from: |

||||||||||||

| Net investment income |

(0.58 | ) | (0.48 | ) | (0.35 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Total distributions |

(0.58 | ) | (0.48 | ) | (0.35 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net asset value, end of period |

$ | 19.84 | $ | 21.15 | $ | 25.13 | ||||||

|

|

|

|

|

|

|

|||||||

| Total return |

(3.40 | )% | (13.75 | )% | 1.76 | %d | ||||||

|

|

|

|

|

|

|

|||||||

| Ratios/Supplemental data: |

||||||||||||

| Net assets, end of period (000s) |

$ | 310,511 | $ | 147,026 | $ | 111,835 | ||||||

| Ratio of expenses to average net assetse |

0.61 | % | 0.61 | % | 0.58 | % | ||||||

| Ratio of net investment income to average net assetse |

2.87 | % | 2.22 | % | 1.99 | % | ||||||

| Portfolio turnover ratef |

14 | % | 16 | % | 22 | % | ||||||

| a | Commencement of operations. |

| b | Based on average shares outstanding throughout each period. |

| c | The amounts reported for a share outstanding may not accord with the change in aggregate gains and losses in securities for the fiscal period due to the timing of capital share transactions in relation to the fluctuating market values of the Fund’s underlying securities. |

| d | Not annualized. |

| e | Annualized for periods of less than one year. |

| f | Portfolio turnover rates exclude portfolio securities received or delivered as a result of processing capital share transactions in Creation Units. |

See notes to financial statements.

| FINANCIAL HIGHLIGHTS |

13 |

Table of Contents

iSHARES® MSCI RUSSIA CAPPED ETF

iShares MSCI Russia Capped ETF, Inc. (the “Company”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Company was incorporated under the laws of the State of Maryland on May 21, 2010 pursuant to amended and restated Articles of Incorporation. Prior to July 1, 2013, the Company’s name was the iShares Russia Capped Index Fund, Inc.

These financial statements relate only to the following fund (the “Fund”):

| iShares ETF | Diversification Classification | |

| MSCI Russia Cappeda |

Non-diversified |

| a | Formerly the iShares MSCI Russia Capped Index Fund. The Fund changed its name effective July 1, 2013. |

The investment objective of the Fund is to seek investment results that correspond generally to the price and yield performance, before fees and expenses, of its underlying index. The investment adviser uses a “passive” or index approach to try to achieve the Fund’s investment objective.

Non-diversified funds generally hold securities of fewer issuers than diversified funds and may be more susceptible to the risks associated with these particular issuers, or to a single economic, political or regulatory occurrence affecting these issuers.

The Fund invests in securities of non-U.S. issuers that trade in non-U.S. markets. This involves certain considerations and risks not typically associated with securities of U.S. issuers. Such risks include, but are not limited to: generally less liquid and less efficient securities markets; generally greater price volatility; exchange rate fluctuations and exchange controls; imposition of restrictions on the expatriation of funds or other assets of the Fund; less publicly available information about issuers; the imposition of withholding or other taxes; higher transaction and custody costs; settlement delays and risk of loss attendant in settlement procedures; difficulties in enforcing contractual obligations; less regulation of securities markets; different accounting, disclosure and reporting requirements; more substantial governmental involvement in the economy; higher inflation rates; greater social, economic and political uncertainties; the risk of nationalization or expropriation of assets; and the risk of war. These risks are heightened for investments in emerging market and frontier market countries.

Pursuant to the Company’s organizational documents, the Fund’s officers and directors are indemnified against certain liabilities that may arise out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred.

| 1. | SIGNIFICANT ACCOUNTING POLICIES |

The following significant accounting policies are consistently followed by the Fund in the preparation of its financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The preparation of financial statements in conformity with U.S. GAAP requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

SECURITY VALUATION

The Fund’s investments are valued at fair value each day that the Fund’s listing exchange is open and, for financial reporting purposes, as of the report date should the reporting period end on a day that the Fund’s listing exchange is not open. U.S. GAAP

| 14 | 2013 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

Notes to Financial Statements (Continued)

iSHARES® MSCI RUSSIA CAPPED ETF

defines fair value as the price a fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. The BlackRock Global Valuation Methodologies Committee (the “Global Valuation Committee”) provides oversight of the valuation of investments for the Fund. The investments of the Fund are valued pursuant to policies and procedures developed by the Global Valuation Committee and approved by the Board of Directors of the Company (the “Board”).

| • | Equity investments traded on a recognized securities exchange are valued at that day’s last reported trade price or the official closing price, as applicable, on the exchange where the stock is primarily traded. Equity investments traded on a recognized exchange for which there were no sales on that day are valued at the last traded price. |

| • | Open-end U.S. mutual funds are valued at that day’s published net asset value (NAV). |

In the event that application of these methods of valuation results in a price for an investment which is deemed not to be representative of the fair value of such investment or if a price is not available, the investment will be valued based upon other available factors deemed relevant by the Global Valuation Committee, in accordance with policies approved by the Board. These factors include but are not limited to (i) attributes specific to the investment; (ii) the principal market for the investment; (iii) the customary participants in the principal market for the investment; (iv) data assumptions by market participants for the investment, if reasonably available; (v) quoted prices for similar investments in active markets; and (vi) other factors, such as future cash flows, interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and/or default rates. Valuations based on such factors are reported to the Board on a quarterly basis.

The Global Valuation Committee employs various methods for calibrating valuation approaches for investments where an active market does not exist, including regular due diligence of the Company’s pricing vendors, a regular review of key inputs and assumptions, transactional back-testing or disposition analysis to compare unrealized gains and losses to realized gains and losses, reviews of missing or stale prices, reviews of large movements in market values, and reviews of market related activity.

Fair value pricing could result in a difference between the prices used to calculate the Fund’s net asset value and the prices used by the Fund’s underlying index, which in turn could result in a difference between the Fund’s performance and the performance of the Fund’s underlying index.

Various inputs are used in determining the fair value of financial instruments. Inputs may be based on independent market data (“observable inputs”) or they may be internally developed (“unobservable inputs”). These inputs are categorized into a disclosure hierarchy consisting of three broad levels for financial reporting purposes. The level of a value determined for a financial instrument within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement in its entirety. The categorization of a value determined for a financial instrument within the hierarchy is based upon the pricing transparency of the instrument and is not necessarily an indication of the risk associated with investing in the instrument. The three levels of the fair value hierarchy are as follows:

| • | Level 1 — Unadjusted quoted prices in active markets for identical assets or liabilities; |

| • | Level 2 — Inputs other than quoted prices included within Level 1 that are observable for the asset or liability either directly or indirectly, including quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not considered to be active, inputs other than quoted prices that are observable for the asset or liability (such as exchange rates, financing terms, interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market-corroborated inputs; and |

| • | Level 3 — Unobservable inputs for the asset or liability, including the Global Valuation Committee’s assumptions used in determining the fair value of investments. |

| NOTES TO FINANCIAL STATEMENTS |

15 |

Table of Contents

Notes to Financial Statements (Continued)

iSHARES® MSCI RUSSIA CAPPED ETF

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. In accordance with the Company’s policy, transfers between different levels of the fair value hierarchy are deemed to have occurred as of the beginning of the reporting period.

As of August 31, 2013, the value of each of the Fund’s investments was classified as Level 1. The breakdown of the Fund’s investments into major categories is disclosed in its schedule of investments.

SECURITY TRANSACTIONS AND INCOME RECOGNITION

Security transactions are accounted for on trade date. Dividend income is recognized on the ex-dividend date, net of any foreign taxes withheld at source. Any taxes withheld that are reclaimable from foreign tax authorities as of August 31, 2013 are reflected in dividends receivable. Non-cash dividends received in the form of stock in an elective dividend, if any, are recorded as dividend income at fair value. Distributions received by the Fund may include a return of capital that is estimated by management. Such amounts are recorded as a reduction of the cost of investments or reclassified to capital gains. Interest income is accrued daily. Realized gains and losses on investment transactions are determined using the specific identification method.

FOREIGN CURRENCY TRANSLATION

The accounting records of the Fund are maintained in U.S. dollars. Foreign currencies, as well as investment securities and other assets and liabilities denominated in foreign currencies, are translated into U.S. dollars using exchange rates deemed appropriate by the investment adviser. Purchases and sales of securities, income receipts and expense payments are translated into U.S. dollars on the respective dates of such transactions.

The Fund does not isolate the effect of fluctuations in foreign exchange rates from the effect of fluctuations in the market prices of securities. Such fluctuations are reflected by the Fund as a component of realized and unrealized gains and losses from investments for financial reporting purposes.

FOREIGN TAXES

The Fund may be subject to foreign taxes (a portion of which may be reclaimable) on income, stock dividends, capital gains on investments, or certain foreign currency transactions. All foreign taxes are recorded in accordance with the applicable foreign tax regulations and rates that exist in the foreign jurisdictions in which the Fund invests. These foreign taxes, if any, are paid by the Fund and are reflected in its statement of operations as follows: foreign taxes withheld at source are presented as a reduction of income, foreign taxes on securities lending income are presented as a reduction of securities lending income, foreign taxes on stock dividends are presented as “other foreign taxes,” and foreign taxes on capital gains from sales of investments and foreign taxes on foreign currency transactions are included in their respective net realized gain (loss) categories. Foreign taxes payable as of August 31, 2013, if any, are disclosed in the Fund’s statement of assets and liabilities.

DISTRIBUTIONS TO SHAREHOLDERS

Dividends and distributions paid by the Fund are recorded on the ex-dividend dates. Distributions are determined on a tax basis and may differ from net investment income and net realized capital gains for financial reporting purposes. Dividends and distributions are paid in U.S. dollars and cannot be automatically reinvested in additional shares of the Fund.

| 16 | 2013 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

Notes to Financial Statements (Continued)

iSHARES® MSCI RUSSIA CAPPED ETF

FEDERAL INCOME TAXES

It is the policy of the Fund to qualify as a regulated investment company by complying with the provisions applicable to regulated investment companies, as defined under Subchapter M of the Internal Revenue Code of 1986, as amended, and to annually distribute substantially all of its ordinary income and any net capital gains (taking into account any capital loss carryforwards) sufficient to relieve it from all, or substantially all, federal income and excise taxes. Accordingly, no provision for federal income taxes is required.

RECENT ACCOUNTING STANDARD

In December 2011, the Financial Accounting Standards Board issued guidance to enhance current disclosure requirements on offsetting of certain assets and liabilities and enable financial statement users to compare financial statements prepared under U.S. GAAP and International Financial Reporting Standards (IFRS). The new disclosures are required for investments and derivative financial instruments subject to master netting agreements or similar agreements and require an entity to disclose both gross and net information about such investments and transactions eligible for offset in the statement of assets and liabilities. The scope of the disclosure requirements for offsetting will be limited to certain derivative instruments and securities lending transactions. In addition, the standard requires disclosure of collateral received and posted in connection with master netting agreements or similar agreements. The guidance is effective for financial statements for fiscal years beginning after January 1, 2013, and interim periods within those fiscal years. Management is evaluating the impact of this guidance on the Fund’s financial statements and disclosures.

| 2. | INVESTMENT ADVISORY AGREEMENT AND OTHER TRANSACTIONS WITH AFFILIATES |

Pursuant to an Investment Advisory Agreement with the Company, BlackRock Fund Advisors (“BFA”) manages the investment of the Fund’s assets. BFA is a California corporation indirectly owned by BlackRock, Inc. (“BlackRock”). Under the Investment Advisory Agreement, BFA is responsible for substantially all expenses of the Fund, except interest, taxes, brokerage commissions and other expenses connected with the execution of portfolio transactions, distribution fees, litigation expenses and any extraordinary expenses.

For its investment advisory services to the Fund, BFA is entitled to an annual investment advisory fee based on the Fund’s allocable portion of the aggregate of the average daily net assets of the Fund and certain other iShares funds, as follows:

| Investment Advisory Fee | Aggregate Average Daily Net Assets | ||||

| 0.74 | % | First $2 billion | |||

| 0.69 | Over $2 billion, up to and including $4 billion | ||||

| 0.64 | Over $4 billion, up to and including $8 billion | ||||

| 0.57 | Over $8 billion, up to and including $16 billion | ||||

| 0.51 | Over $16 billion, up to and including $32 billion | ||||

| 0.45 | Over $32 billion | ||||

BlackRock Investments, LLC, an affiliate of BFA, is the distributor for the Fund. Pursuant to the distribution agreement, BFA is responsible for any fees or expenses for distribution services provided to the Fund.

The Fund may invest its positive cash balances in certain money market funds managed by BFA or an affiliate. The income earned on these temporary cash investments is included in “Interest – affiliated” in the statement of operations.

| NOTES TO FINANCIAL STATEMENTS |

17 |

Table of Contents

Notes to Financial Statements (Continued)

iSHARES® MSCI RUSSIA CAPPED ETF

The PNC Financial Services Group, Inc. is the largest stockholder of BlackRock and is considered to be an affiliate of the Fund for 1940 Act purposes.

Certain directors and officers of the Company are also officers of BlackRock Institutional Trust Company, N.A. and/or BFA.

| 3. | INVESTMENT PORTFOLIO TRANSACTIONS |

Purchases and sales of investments (excluding in-kind transactions and short-term investments) for the year ended August 31, 2013, were $37,098,880 and $31,709,243, respectively.

In-kind purchases and sales (see Note 4) for the year ended August 31, 2013, were $374,947,461 and $191,018,540, respectively.

| 4. | CAPITAL SHARE TRANSACTIONS |

Capital shares are issued and redeemed by the Fund only in aggregations of a specified number of shares or multiples thereof (“Creation Units”) at net asset value. Except when aggregated in Creation Units, shares of the Fund are not redeemable. Transactions in capital shares for the Fund are disclosed in detail in the statements of changes in net assets.

The consideration for the purchase of Creation Units of a fund in the Company generally consists of the in-kind deposit of a designated portfolio of securities and a specified amount of cash. Certain funds in the Company may be offered in Creation Units solely or partially for cash in U.S. dollars. Investors purchasing and redeeming Creation Units may pay a purchase transaction fee and a redemption transaction fee directly to State Street Bank and Trust Company, the Company’s administrator, to offset transfer and other transaction costs associated with the issuance and redemption of Creation Units, including Creation Units for cash. Investors transacting in Creation Units for cash may also pay an additional variable charge to compensate the relevant fund for certain transaction costs (i.e., stamp taxes, taxes on currency or other financial transactions, and brokerage costs) and market impact expenses relating to investing in portfolio securities.

From time to time, settlement of securities related to in-kind contributions or in-kind redemptions may be delayed. In such cases, securities related to in-kind contributions are reflected as “Due from custodian” and securities related to in-kind redemptions are reflected as “Securities related to in-kind transactions” in the statement of assets and liabilities.

| 5. | INCOME TAX INFORMATION |

U.S. GAAP requires that certain components of net assets be adjusted to reflect permanent differences between financial and tax reporting. These reclassifications have no effect on net assets or net asset values per share. The following permanent differences as of August 31, 2013, attributable to foreign currency transactions and realized gains (losses) from in-kind redemptions, were reclassified to the following accounts:

| Paid-in Capital |

Undistributed Net Investment Income/Distributions in Excess of Net Investment Income |

Undistributed Net Realized Gain/Accumulated Net Realized Loss |

||||||

| $2,218,428 | $ | (271,118) | $ | (1,947,310) | ||||

| 18 | 2013 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

Notes to Financial Statements (Continued)

iSHARES® MSCI RUSSIA CAPPED ETF

The tax character of distributions paid during the years ended August 31, 2013 and August 31, 2012 was as follows:

| 2013 | 2012 | |||||||

| Ordinary income |

$ | 5,545,678 | $ | 2,641,795 | ||||

|

|

|

|

|

|||||

As of August 31, 2013, the tax components of accumulated net earnings (losses) were as follows:

| Undistributed Ordinary Income |

Capital Loss Carryforwards |

Net Unrealized Gains (Losses)a |

Qualified Late-Year Lossesb |

Total | ||||||||||||

| $681,247 | $ | (1,855,427) | $ | (51,062,009) | $ | (6,404,779) | $ | (58,640,968) | ||||||||

| a | The difference between book-basis and tax-basis unrealized gains (losses) was attributable primarily to tax deferral of losses on wash sales. |

| b | The Fund has elected to defer certain qualified late-year losses and recognize such losses in the year ending August 31, 2014. |

As of August 31, 2013, the Fund had non-expiring capital loss carryforwards in the amount of $1,855,427 available to offset future realized capital gains.

The Fund may own shares in certain foreign investment entities, referred to, under U.S. tax law, as “passive foreign investment companies.” The Fund may elect to mark-to-market annually the shares of each passive foreign investment company and would be required to distribute to shareholders any such marked-to-market gains.

As of August 31, 2013, the cost of investments for federal income tax purposes was $360,366,220. Net unrealized depreciation was $51,019,799, of which $4,603,226 represented gross unrealized appreciation on securities and $55,623,025 represented gross unrealized depreciation on securities.

Management has reviewed the tax positions as of August 31, 2013, inclusive of the open tax return years, and has determined that no provision for income tax is required in the Fund’s financial statements.

| 6. | SUBSEQUENT EVENTS |

Management has evaluated the impact of all subsequent events on the Fund through the date the financial statements were available to be issued and has determined that there were no subsequent events requiring adjustment or disclosure in the financial statements.

| NOTES TO FINANCIAL STATEMENTS |

19 |

Table of Contents

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Directors of

iShares MSCI Russia Capped ETF, Inc.:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of the iShares MSCI Russia Capped ETF (the “Fund”) at August 31, 2013, the results of its operations, the changes in its net assets and its financial highlights for each of the periods presented, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at August 31, 2013 by correspondence with the custodian, transfer agent and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

San Francisco, California

October 23, 2013

| 20 | 2013 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

iSHARES® MSCI RUSSIA CAPPED ETF

For the fiscal year ended August 31, 2013, the Fund earned foreign source income of $9,266,112 and paid foreign taxes of $1,365,684 which it intends to pass through to its shareholders pursuant to Section 853 of the Internal Revenue Code (the “Code”).

Under Section 854(b)(2) of the Code, the Fund hereby designates the maximum amount of $6,911,362 as qualified dividend income for purposes of the maximum rate under Section 1(h)(11) of the Code for the fiscal year ended August 31, 2013.

In February 2014, shareholders will receive Form 1099-DIV which will include their share of qualified dividend income distributed during the calendar year 2013. Shareholders are advised to check with their tax advisers for information on the treatment of these amounts on their income tax returns.

| TAX INFORMATION |

21 |

Table of Contents

Board Review and Approval of Investment Advisory

Contract

iSHARES® MSCI RUSSIA CAPPED ETF

Under Section 15(c) of the Investment Company Act of 1940 (the “1940 Act”), the Company’s Board of Directors (the “Board”), including a majority of Directors who are not “interested persons” of the Company (as that term is defined in the 1940 Act) (the “Independent Directors”), is required annually to consider and approve the Investment Advisory Contract between the Company and BFA (the “Advisory Contract”) on behalf of the Fund. The Independent Directors requested, and BFA provided, such information as the Independent Directors, with advice from independent counsel, deemed reasonably necessary to evaluate the Advisory Contract. A committee of Independent Directors (the “15(c) Committee”), with independent counsel, met with management on March 7, 2013, April 23, 2013, and May 3, 2013, to discuss the types of information the Independent Directors required and the manner in which management would organize and present such information. At a meeting held on May 16, 2013, management presented preliminary information to the Board relating to the continuance of the Advisory Contract, and the Board, including the Independent Directors, reviewed and discussed such information at length. The Independent Directors requested from management certain additional information, and the 15(c) Committee met with management on June 5, 2013, to discuss the additional requests. At a meeting held on June 10-11, 2013, the Board, including the Independent Directors, reviewed the additional information provided by management in response to these requests. The Board, including a majority of the Independent Directors, approved the continuance of the Advisory Contract for the Fund, based on a review of qualitative and quantitative information provided by BFA, including the supplemental information management provided at the request of the Independent Directors. The Board noted its satisfaction with the extent and quality of information provided and its frequent interactions with management, as well as the detailed responses and other information provided by BFA. The Independent Directors were advised by their independent counsel throughout the process. In approving the Advisory Contract for the Fund, the Board, including the Independent Directors, considered the following factors, no one of which was controlling, and reached the following conclusions:

Expenses and Performance of the Fund — The Board reviewed statistical information prepared by Lipper Inc. (“Lipper”), an independent provider of investment company data, regarding the expense ratio components, including actual advisory fees, waivers/reimbursements, and gross and net total expenses of the Fund in comparison with the same information for other registered investment companies objectively selected by Lipper as comprising the Fund’s applicable peer group pursuant to Lipper’s proprietary methodology, and any registered funds that would otherwise have been excluded from Lipper’s comparison group because of the size, sponsor, inception date, or other differentiating factors included in Lipper’s proprietary selection methodology, but that were nonetheless included at the request of BFA (the “Lipper Group”). Because there are few, if any, exchange traded funds or index funds that track an index similar to that tracked by the Fund, the Lipper Group included in part mutual funds, closed-end funds, exchange traded funds, and/or funds with differing investment objective classifications, investment focuses and other characteristics (e.g., actively managed funds and funds sponsored by “at cost” service providers), as applicable. In support of its review of the statistical information, the Board was provided with a detailed description of the methodology used by Lipper to determine the applicable Lipper Groups and to prepare this information. The Board also received a detailed explanation from BFA regarding its rationale for including funds that had been excluded from Lipper’s consideration due to Lipper’s methodology parameters, as well as information showing the effect of including these additional funds in the analysis. The Board further noted that due to the limitations in providing comparable funds in the various Lipper Groups, the statistical information provided in the Lipper Report may or may not provide meaningful direct comparisons to the Fund.

The Board also noted that the investment advisory fee rate and overall expenses for the Fund compared favorably to the investment advisory fee rates and overall expenses of the funds in its respective Lipper Group.

In addition, the Board reviewed statistical information prepared by Lipper regarding the performance of the Fund for the one-, three-, five-, ten-year, and since inception periods, as applicable, and the “last quarter” period ended December 31, 2012, and a comparison of the Fund’s performance to its performance benchmark index for the same periods. To the extent that any of the comparison funds included in the Lipper Group track the same index as the Fund, Lipper also provided, and the Board reviewed, a comparison of the Fund’s performance to that of such relevant comparison funds for the same periods. The Board noted that

| 22 | 2013 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

Board Review and Approval of Investment Advisory

Contract (Continued)

iSHARES® MSCI RUSSIA CAPPED ETF

the Fund generally performed in line with its performance benchmark index over the relevant periods. In considering this information, the Board noted that the Lipper Group may include funds that are not exchange traded funds or index funds, and that may have different investment objectives and/or benchmarks from the Fund. In addition, the Board noted that the Fund seeks to track its own benchmark index and that, during the prior year, the Board received periodic reports on the Fund’s performance in comparison with its relevant benchmark index. Such periodic comparative performance information, including detailed information on certain specific iShares funds requested by the Board, was also considered.

Based on this review, the other factors considered at the meeting, and their general knowledge of mutual fund pricing, the Board concluded that the investment advisory fee rate and expense level and the historical performance of the Fund supported the Board’s approval of the continuance of the Advisory Contract for the coming year.

Nature, Extent and Quality of Services Provided by BFA — Based on management’s representations, including information about recent and proposed enhancements to the iShares business, including with respect to shareholder servicing and support, the Board expected that there would be no diminution in the scope of services required of or provided by BFA under the Advisory Contract for the coming year as compared to the scope of services provided by BFA during prior years. In reviewing the scope of these services, the Board considered BFA’s investment philosophy and experience, noting that BFA and its affiliates have committed significant resources over time, including during the past year, to supporting the Fund and its shareholders. The Board acknowledged that resources to support the iShares funds and their shareholders have been added or enhanced since BlackRock’s acquisition of BFA in December 2009, including in such areas as investor education, product management, customized portfolio consulting support, and capital markets support. The Board also considered BFA’s compliance program and its compliance record with respect to the Fund. In that regard, the Board noted that BFA reports to the Board about portfolio management and compliance matters on a periodic basis in connection with regularly scheduled meetings of the Board, and on other occasions as necessary and appropriate, and has provided information and made appropriate officers available as needed to provide further assistance with these matters. The Board also reviewed the background and experience of the persons responsible for the day-to-day management of the Fund. In addition to the above considerations, the Board reviewed and considered detailed presentations regarding BFA’s investment and risk management processes and strategies provided at the June 10-11, 2013 meeting and throughout the previous year, and matters related to BFA’s portfolio compliance policies and procedures. The Board noted that the Fund had met its investment objective consistently since its inception date.

Based on review of this information, and the performance information discussed above, the Board concluded that the nature, extent and quality of services provided by BFA to the Fund under the Advisory Contract supported the Board’s approval of the continuance of the Advisory Contract for the coming year.

Costs of Services Provided to the Fund and Profits Realized by BFA and its Affiliates — The Board reviewed information about the profitability to BlackRock of the Fund based on the fees payable to BFA and its affiliates (including fees under the Advisory Contract), and all other sources of revenue and expense to BFA and its affiliates from the Fund’s operations for the last calendar year. The Board reviewed BlackRock’s profitability methodology for the iShares funds, noting that the 15(c) Committee had focused on the methodology and proposed presentation during its meetings. The Board discussed the sources of direct and ancillary revenue with management, including the revenues to BTC from securities lending by the Fund. The Board also discussed BFA’s profit margin as reflected in the Fund’s profitability analysis and reviewed information regarding economies of scale (as discussed below). Based on this review, the Board concluded that the profits realized by BFA and its affiliates under the Advisory Contract and from other relationships between the Fund and BFA and/or its affiliates, if any, were within a reasonable range in light of the factors considered.

Economies of Scale — The Board reviewed information regarding economies of scale or other efficiencies that may result from increases in the Fund’s assets, noting that the issue of economies of scale had been focused on extensively by the 15(c)

| BOARD REVIEW AND APPROVAL OF INVESTMENT ADVISORY CONTRACT |

23 |

Table of Contents

Board Review and Approval of Investment Advisory

Contract (Continued)

iSHARES® MSCI RUSSIA CAPPED ETF

Committee during its meetings and addressed by management. The Board and the 15(c) Committee reviewed information provided by BFA regarding scale benefits shared with the iShares funds through relatively low fee rates established at inception, breakpoints, waivers, or other fee reductions, as well as through additional investment in the iShares business and the provision of improved or additional infrastructure and services to the iShares funds and their shareholders. The Board and the 15(c) Committee received information regarding BlackRock’s historical profitability, including BFA’s and its affiliates’ costs in providing services. The cost information distinguished between fixed and variable costs, and explained how the nature of such costs may impact the existence of scale benefits. The Board noted that the Advisory Contract for the Fund already provided for breakpoints in the Fund’s investment advisory fee rate as the assets of the Fund, on an aggregated basis with the assets of certain other iShares funds, increase. The Board noted that it would continue to monitor the sharing of economies of scale to determine the appropriateness of adding new or revised breakpoints in the future. Based on this review, as well as the other factors considered at the meeting, the Board, recognizing its responsibility to consider this issue at least annually, concluded that the structure of the investment advisory fee rate reflects appropriate sharing of potential economies of scale with the Fund’s shareholders and supported the Board’s approval of the continuance of the Advisory Contract for the coming year.

Fees and Services Provided for Other Comparable Funds/Accounts Managed by BFA and its Affiliates — The Board received and considered information regarding the investment advisory/management fee rates for other funds/accounts in the U.S. for which BFA (or its affiliates) provides investment advisory/management services, including open-end and closed-end funds registered under the 1940 Act (including sub-advised funds), collective trust funds and institutional separate accounts (together, the “Other Accounts”). The Board noted that BFA and its affiliates do manage Other Accounts with a substantially similar investment objective and strategy as the Fund. The Board further noted that BFA provided the Board with detailed information regarding how the Other Accounts (particularly institutional clients) generally differ from the Fund, including in terms of the different, generally more extensive services provided to the Fund, as well as other significant differences in the approach of BFA and its affiliates to the Fund, on one hand, and to the Other Accounts, on the other. In that regard, the Board considered that the pricing of services to institutional clients is typically based on a number of factors beyond the nature and extent of the specific services to be provided and often depends on the overall relationship between the client and its affiliates and the adviser and its affiliates. In addition, the Board considered the relative complexity and inherent risks and challenges of managing and providing other services to the Fund, as a publicly traded exchange traded fund, as compared to the Other Accounts that are institutional clients in light of differing regulatory requirements and client-imposed mandates. The Board also considered the “all-inclusive” nature of the Fund’s advisory fee structure, and the Fund expenses borne by BFA under this arrangement. The Board noted that the investment advisory fee rate under the Advisory Contract for the Fund was generally higher than the investment advisory/management fee rates for the Other Accounts that are institutional clients of BFA (or its affiliates) and concluded that the differences appeared to be consistent with the factors discussed.

Other Benefits to BFA and/or its Affiliates — The Board reviewed the “fallout” benefits or ancillary revenue received by BFA and/or its affiliates in connection with the services provided to the Fund by BFA, such as payment of revenue to BTC, the Fund’s securities lending agent, for loaning portfolio securities (which was included in the profit margins reviewed by the Board pursuant to BFA’s profitability methodology), and payment of advisory fees and/or administration fees to BFA and BTC (or their affiliates) in connection with any investments by the Fund in other funds for which BFA (or its affiliates) provides investment advisory services and/or administration services. The Board noted that BFA generally does not use soft dollars or consider the value of research or other services that may be provided to BFA (including its affiliates) in selecting brokers for portfolio transactions for the Fund. The Board further noted that any portfolio transactions on behalf of the Fund placed through a BFA affiliate or purchased from an underwriting syndicate in which a BFA affiliate participates, are reported to the Board pursuant to Rule 17e-1 or Rule 10f-3, as applicable, under the 1940 Act. The Board concluded that any such ancillary benefits would not be disadvantageous to the Fund’s shareholders and thus would not alter the Board’s conclusion with respect to the appropriateness of approving the continuance of the Advisory Contract for the coming year.

| 24 | 2013 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

Board Review and Approval of Investment Advisory

Contract (Continued)

iSHARES® MSCI RUSSIA CAPPED ETF

Based on the considerations described above, the Board determined that the investment advisory fee rate under the Advisory Contract does not constitute a fee that is so disproportionately large as to bear no reasonable relationship to the services rendered and that could not have been the product of arm’s-length bargaining, and concluded that it is in the best interest of the Fund and its shareholders to approve the continuance of the Advisory Contract for the coming year.

| BOARD REVIEW AND APPROVAL OF INVESTMENT ADVISORY CONTRACT |

25 |

Table of Contents

Supplemental Information (Unaudited)

iSHARES® MSCI RUSSIA CAPPED ETF

Premium/Discount Information

The table that follows presents information about the differences between the daily market price on secondary markets for shares of the Fund and the Fund’s net asset value. Net asset value, or “NAV,” is the price per share at which the Fund issues and redeems shares. It is calculated in accordance with the standard formula for valuing mutual fund shares. The “Market Price” of the Fund generally is determined using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which the shares of the Fund are listed for trading, as of the time the Fund’s NAV is calculated. The Fund’s Market Price may be at, above or below its NAV. The NAV of the Fund will fluctuate with changes in the fair value of its portfolio holdings. The Market Price of the Fund will fluctuate in accordance with changes in its NAV, as well as market supply and demand.

Premiums or discounts are the differences (expressed as a percentage) between the NAV and Market Price of the Fund on a given day, generally at the time NAV is calculated. A premium is the amount that the Fund is trading above the reported NAV, expressed as a percentage of the NAV. A discount is the amount that the Fund is trading below the reported NAV, expressed as a percentage of the NAV.

The following information shows the frequency distributions of premiums and discounts for the Fund included in this report. The information shown for the Fund is each full calendar quarter completed after the inception date of the Fund through the date of the most recent calendar quarter-end. The specific period covered for the Fund is disclosed in the table.

Each line in the table shows the number of trading days in which the Fund traded within the premium/discount range indicated. The number of trading days in each premium/discount range is also shown as a percentage of the total number of trading days in the period covered by the table. All data presented here represents past performance, which cannot be used to predict future results.

Period Covered: January 1, 2011 through June 30, 2013

| Premium/Discount Range |

Number of Days |

Percentage of Total Days |

||||||

| Greater than 4.0% and Less than 4.5% |

1 | 0.16 | % | |||||

| Greater than 3.5% and Less than 4.0% |

2 | 0.32 | ||||||

| Greater than 3.0% and Less than 3.5% |

5 | 0.80 | ||||||

| Greater than 2.5% and Less than 3.0% |

5 | 0.80 | ||||||

| Greater than 2.0% and Less than 2.5% |

8 | 1.28 | ||||||

| Greater than 1.5% and Less than 2.0% |

12 | 1.92 | ||||||

| Greater than 1.0% and Less than 1.5% |

41 | 6.55 | ||||||

| Greater than 0.5% and Less than 1.0% |

126 | 20.12 | ||||||

| Between 0.5% and –0.5% |

306 | 48.87 | ||||||

| Less than –0.5% and Greater than –1.0% |

57 | 9.11 | ||||||

| Less than –1.0% and Greater than –1.5% |

30 | 4.79 | ||||||

| Less than –1.5% and Greater than –2.0% |

17 | 2.72 | ||||||

| Less than –2.0% and Greater than –2.5% |

6 | 0.96 | ||||||

| Less than –2.5% and Greater than –3.0% |

3 | 0.48 | ||||||

| Less than –3.0% and Greater than –3.5% |

3 | 0.48 | ||||||

| Less than –3.5% and Greater than –4.0% |

1 | 0.16 | ||||||

| Less than –4.0% and Greater than –4.5% |

1 | 0.16 | ||||||

| Less than –4.5% and Greater than –5.0% |

1 | 0.16 | ||||||

| Less than –5.0% |

1 | 0.16 | ||||||

|

|

|

|

|

|||||

| 626 | 100.00 | % | ||||||

|

|

|

|

|

|||||

| 26 | 2013 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

Director and Officer Information

iSHARES® MSCI RUSSIA CAPPED ETF, INC.

The Board of Directors has responsibility for the overall management and operations of the Company, including general supervision of the duties performed by BFA and other service providers. Each Director serves until he or she resigns, is removed, dies, retires or becomes incapacitated. The President, Treasurer and Secretary shall each hold office until their successors are chosen and qualified, and all other officers shall hold office until he or she resigns or is removed. Directors who are not interested persons (as defined in the 1940 Act) are referred to as Independent Directors.

The registered investment companies advised by BFA or its affiliates are organized into one complex of closed-end funds, two complexes of open-end funds and one complex of exchange-traded funds (“Exchange-Traded Fund Complex”) (each, a “BlackRock Fund Complex”). Each Fund is included in the BlackRock Fund Complex referred to as the Exchange-Traded Fund Complex. Each Director of iShares MSCI Russia Capped ETF, Inc. also serves as a Director of iShares, Inc., a Trustee of iShares Trust and a Trustee of iShares U.S. ETF Trust and, as a result, oversees a total of 298 funds within the Exchange-Traded Fund Complex. With the exception of Robert S. Kapito, the address of each Director and Officer is c/o BlackRock, Inc., 400 Howard Street, San Francisco, CA 94105. The address of Mr. Kapito is c/o BlackRock, Inc., Park Avenue Plaza, 55 East 52nd Street, New York, NY 10055. The Board has designated Robert H. Silver as its Independent Chairman. Additional information about the Fund’s Directors and Officers may be found in the Fund’s combined Statement of Additional Information, which is available without charge, upon request, by calling toll-free 1-800-iShares (1-800-474-2737).

Interested Directors and Officers

| Name (Age) | Position(s) (Length of Service) |

Principal Occupation(s) During the Past 5 Years |

Other Directorships Held | |||

| Robert S. Kapitoa (56) |

Director (since 2010). |

President and Director, BlackRock, Inc. (since 2006); Vice Chairman of BlackRock, Inc. and Head of BlackRock’s Portfolio Management Group (since its formation in 1998) and BlackRock’s predecessor entities (since 1988); Trustee, University of Pennsylvania (since 2009); President of Board of Directors, Hope & Heroes Children’s Cancer Fund (since 2002); President of the Board of Directors, Periwinkle Theatre for Youth (since 1983). | Director of BlackRock, Inc. (since 2006); Trustee of iShares Trust (since 2009); Director of iShares, Inc. (since 2009); Trustee of iShares U.S. ETF Trust (since 2011). | |||

| Michael Lathamb (47) |

Director |

Chairman of iShares, BlackRock (since 2011); Global Chief Executive Officer of iShares, BlackRock (2010-2011); Managing Director, BlackRock (since 2009); Head of Americas iShares, Barclays Global Investors (“BGI”) (2007-2009); Director and Chief Financial Officer of Barclays Global Investors International, Inc. (2005-2009); Chief Operating Officer of the Intermediary Investor and Exchange-Traded Products Business, BGI (2003-2007). | Trustee of iShares Trust (since 2010); Director of iShares, Inc. (since 2010); Trustee of iShares U.S. ETF Trust (since 2011). | |||

| a | Robert S. Kapito is deemed to be an “interested person” (as defined in the 1940 Act) of the Trust due to his affiliations with BlackRock, Inc. |

| b | Michael Latham is deemed to be an “interested person” (as defined in the 1940 Act) of the Trust due to his affiliations with BlackRock, Inc. and its affiliates. |

| DIRECTOR AND OFFICER INFORMATION |

27 |

Table of Contents

Director and Officer Information (Continued)

iSHARES® MSCI RUSSIA CAPPED ETF, INC.

Independent Directors

| Name (Age) | Position(s) (Length of Service) |

Principal Occupation(s) During the Past 5 Years |

Other Directorships Held | |||

| Robert H. Silver (58) |

Director (since 2010); Independent Chairman (since 2012). |

President and Co-Founder of The Bravitas Group, Inc. (since 2006); Director and Vice Chairman of the YMCA of Greater NYC (2001-2011); Broadway Producer (2006-2011); Co-Founder and Vice President of Parentgiving Inc. (since 2008); Director and Member of the Audit and Compensation Committee of EPAM Systems, Inc. (2006-2009); President and Chief Operating Officer of UBS Financial Services Inc. (formerly Paine Webber Inc.) (2003-2005) and various executive positions with UBS and its affiliates (1988-2005); CPA and Audit Manager of KPMG, LLP (formerly Peat Marwick Mitchell) (1977-1983). | Trustee of iShares Trust (since 2007); Director of iShares, Inc. (since 2007); Trustee of iShares U.S. ETF Trust (since 2011); Independent Chairman of iShares, Inc., iShares Trust and iShares U.S. ETF Trust (since 2012). | |||

| Cecilia H. Herbert (64) |

Director (since 2010); Nominating and Governance Committee Chair and Equity Plus Committee Chair (since 2012). |

Trustee and Member (since 2011) of the Investment Committee, WNET, the New York public broadcasting company; Director (since 1998) and President (2007-2011) of the Board of Directors, Catholic Charities CYO; Trustee (2002-2011) and Chair of the Finance and Investment Committee (2006-2010), the Thacher School; Member (since 1994) and Chair (1994-2005) of the Investment Committee, Archdiocese of San Francisco. |

Trustee of iShares Trust (since 2005); Director of iShares, Inc. (since 2005); Trustee of iShares U.S. ETF Trust (since 2011); Director of Forward Funds (34 portfolios) (since 2009). | |||

| Charles A. Hurty (69) |

Director (since 2010); Audit Committee Chair (since 2006). |

Retired; Partner, KPMG LLP (1968-2001). |

Trustee of iShares Trust (since 2005); Director of iShares, Inc. (since 2005); Trustee of iShares U.S. ETF Trust (since 2011); Director of GMAM Absolute Return Strategy Fund (1 portfolio) (since 2002); Director of SkyBridge Alternative Investment Multi-Adviser Hedge Fund Portfolios LLC (2 portfolio) (since 2002). | |||

| John E. Kerrigan (58) |

Director (since 2010); Fixed Income Plus Committee Chair (since 2012). |

Chief Investment Officer, Santa Clara University (since 2002). | Trustee of iShares Trust (since 2005); Director of iShares, Inc. (since 2005); Trustee of iShares U.S. ETF Trust (since 2011). | |||

| 28 | 2013 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

Director and Officer Information (Continued)

iSHARES® MSCI RUSSIA CAPPED ETF, INC.

Independent Directors (Continued)

| Name (Age) | Position(s) (Length of Service) |

Principal Occupation(s) During the Past 5 Years |

Other Directorships Held | |||

| John E. Martinez (52) |

Director (since 2010); Securities Lending Committee Chair (since 2012). |

Director of FirstREX Agreement Corp. (formerly EquityRock, Inc.) (since 2005). | Trustee of iShares Trust (since 2003); Director of iShares, Inc. (since 2003); Trustee of iShares U.S. ETF Trust (since 2011). | |||

| George G.C. Parker (74) |

Director (since 2010). |

Dean Witter Distinguished Professor of Finance, Emeritus, Stanford University Graduate School of Business (Professor since 1973; Emeritus since 2006). | Trustee of iShares Trust (since 2000); Director of iShares, Inc. (since 2002); Trustee of iShares U.S. ETF Trust (since 2011); Director of Tejon Ranch Company (since 1999); Director of Threshold Pharmaceuticals (since 2004); Director of Colony Financial, Inc. (since 2009); Director of First Republic Bank (since 2010). | |||

| Madhav V. Rajan (49) |

Director (since 2011); 15(c) Committee Chair (since 2012). |

Robert K. Jaedicke Professor of Accounting and Senior Associate Dean for Academic Affairs and Head of MBA Program, Stanford University Graduate School of Business (since 2001); Professor of Law (by courtesy), Stanford Law School (since 2005); Visiting Professor, University of Chicago (Winter 2007-2008). |

Trustee of iShares Trust (since 2011); Director of iShares, Inc. (since 2011); Trustee of iShares U.S. ETF Trust (since 2011). | |||

| DIRECTOR AND OFFICER INFORMATION |

29 |

Table of Contents

Director and Officer Information (Continued)

iSHARES® MSCI RUSSIA CAPPED ETF, INC.

Officers

| Name (Age) | Position(s) (Length of Service) |

Principal Occupation(s) During the Past 5 Years | ||

| Edward B. Baer (44) |

Vice President and Chief Legal Officer (since 2012). |

Managing Director of Legal & Compliance, BlackRock (since 2006); Director of Legal & Compliance, BlackRock (2004-2006). | ||

| Eilleen M. Clavere (61) |

Secretary (since 2010). |

Director of Global Fund Administration, BlackRock (since 2009); Director of Legal Administration of Intermediary Investor Business, BGI (2006-2009); Legal Counsel and Vice President of Atlas Funds, Atlas Advisers, Inc. and Atlas Securities, Inc. (2005-2006); Counsel of Kirkpatrick & Lockhart LLP (2001-2005). | ||

| Jack Gee (53) |

Treasurer and Chief Financial Officer (since 2010). |

Managing Director, BlackRock (since 2009); Senior Director of Fund Administration of Intermediary Investor Business, BGI (2009); Director of Fund Administration of Intermediary Investor Business, BGI (2004-2009). | ||

| Scott Radell (44) |

Executive Vice President (since 2012). |

Managing Director, BlackRock (since 2009); Head of Portfolio Solutions, BlackRock (since 2009); Head of Portfolio Solutions, BGI (2007-2009); Credit Portfolio Manager, BGI (2005-2007); Credit Research Analyst, BGI (2003-2005). | ||

| Amy Schioldager (50) |

Executive Vice President (since 2007). |

Senior Managing Director, BlackRock (since 2009); Global Head of Index Equity, BGI (2008-2009); Global Head of U.S. Indexing, BGI (2006-2008); Head of Domestic Equity Portfolio Management, BGI (2001-2006). | ||

| Ira P. Shapiro (50) |

Vice President (since 2007). | Managing Director, BlackRock (since 2009); Head of Strategic Product Initiatives for iShares (since 2012); Chief Legal Officer, Exchange-Traded Fund Complex (2007-2012); Associate General Counsel, BGI (2004-2009). | ||

| 30 | 2013 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

|

For more information visit www.iShares.com or call 1-800-474-2737

This report is intended for the Fund’s shareholders. It may not be distributed to prospective investors unless it is preceded or accompanied by the current prospectus.

Investing involves risk, including possible loss of principal.

The iShares Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by MSCI Inc., nor does this company make any representation regarding the advisability of investing in the iShares Funds. BlackRock is not affiliated with the company listed above.